Nov 19 Market Update

Weekly sales numbers courtesy of the VREB.

| November 2018 |

Nov

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 62 | 179 | 276 | 671 | |

| New Listings | 123 | 313 | 477 | 843 | |

| Active Listings | 2405 | 2377 | 2370 | 1764 | |

| Sales to New Listings | 50% | 57% | 58% | 80% | |

| Sales Projection | — | 570 | 495 | ||

| Months of Inventory | 2.6 | ||||

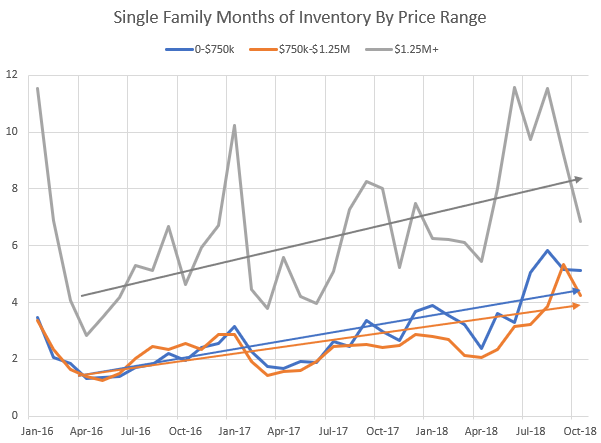

The further we get into November, the bigger the year over year declines. The first week was about on par, the second down 15%, and now we’re down 26% from last November. 26% decline would put us around the 10 year average for November sales, but I wouldn’t be surprised if we end up even lower than that with the current sluggish pace of sales.

The province is taking credit for putting a damper on high end home prices, and it is true that the high end has been the most weakened recently. However all segments are weakening, and provincial regulatory changes are likely not the primary drivers in the market cooling off this year. I’ve been preparing better seasonally adjusted data and it’s pretty clear that the stress test was the primary factor that hit the market this year, with the regulatory changes by the province merely nibbling a little bit around the edges. More on this later in the week.

It’s been interesting to see the fight over in Vancouver with the new municipal government. Right before the election, the Vision Vancouver candidates voted to rezone most single family areas to allow duplexes. Despite the new councilors running on housing affordability, many of them are pushing to reverse that decision and put it back to consultation. Seems like the NIMBYs are still out in full force like in many progressive cities. However I thought Vancouver’s new mayor Kennedy Stewart’s comments at a housing conference in Vancouver were good, where he said “We’ve gone as far as we can go in terms of having the market provide our housing here”. We’ve seen what happens with the current model, and it would be silly to expect different results by doing more of the same. Stewart’s push is on co-op and non-profit housing, and while I’m hesitant about the municipalities being able to deliver on these projects, I’m hopeful that this and other new approaches will emerge over here as well.

.

Fusion powered houses?

New post: https://househuntvictoria.ca/2018/11/22/de-seasonalized-sales/

LeoM

Fusion is where a sustainable energy future lies, IMO. While what the Chinese have just achieved is an important first step, I kinda doubt it’ll be a Chicago pile moment for energy research. Having said that, I think humanity should put its energy research there for now. Everything else we have is either totally crude or lacks energy density.

Anti matter is much better still, but that’s way, way into the future. Heh, you think Fukushima or Chernobyl was bad when they went sideways…try a magnetic field collapse in a chamber full of positrons. At least there wouldn’t be any nuclear fallout afterwards.

Sorry, now about real estate

Fusion is still many decades away from adding anything to the energy mix. The fusion breakthrough has been ‘imminent’ as far back as the 1950s.

Nov 16, 2018

https://www.scmp.com/news/china/science/article/2173666/chinas-artificial-sun-galaxies-away-solving-earths-energy-needs

All this talk about different methods of energy production such as wind, solar, fission, all became passé earlier this week when the Chinese Fusion scientists announced a major breakthrough in finally achieving a sustained fusion temperature. The Chinese surpassed every other country by several orders of magnitude by maintaining a 100 million degree plasma for over 100 seconds. Next steps are clearly defined for the Chinese and rumours are swirling in the physics community that they have even bigger announcements coming over the next 24 months.

Fusion reactors will instantly convert water to high pressure steam and the steam will drive huge turbines to create unlimited electricity. So I suppose the Site C dam just became redundant, but don’t expect your BC Hydro bills to decrease.

@ Grant

Yeah, but being rude and irritable doesn’t make your argument more compelling — just so you know.

Maybe. But you don’t know that. The economics are complicated, and there are many ways to skin a cat. The most recent contract for nuclear power in Europe was the 20-billion pound sterling plant at Hinckley Point in Somerset, England. It is estimated that the plant will produce power at a cost of around 92 pounds sterling per MWh, versus a current cost of power generation with a combined cycle gas turbine of around 35 pounds sterling per MWh.

But then the British government underwrote additional costs related to the project that will total about 50 billion pounds, or two and half times the nominal cost of construction, so the actual cost of power will be astronomical. Gas turbines combined with carbon capture and sequestration by deep underground storage would likely have been vastly cheaper.

And the French contractor building the Hinckley Point reactor has been building a similar unit in France for the last dozen years and has yet to get it into production. At at last report they were battling a major fire at the site!

I suppose Russia’s state company, RosAtom would have done the job more efficiently and cheaply, but we seem to be more or less at war with Russia so that’s not an option. In any case it was Russia that gave us the world’s first disastrous nuclear accident at Chernobyl. Then there’s Westinghouse, you know, the folks who built the Fukushima reactors, But anyhow they just went broke.

In fact, there is a vast number of options other than nuclear, and if anyone is certain that nuclear is the only option, they probably never heard of the alternatives.

I recall a bit on Alice Kluge’s youtube a couple weeks ago where she said she has noticed a sudden increase in people she knows who make $90K a year (not counting the spouse income), who are taking on second jobs to help meet the bill payments, and not for some side hustle to buy a new toy etc.

Toss in agents BS’ing about how the world has discovered Victoria, and agents duking it out over deals gone bad. All adds up to a very dark couple of years ahead. But keep on the rose colored glasses and ear buds in, and you won’t see the train barreling down on you.

Famous last words. Did you miss the HELOC debt charts posted earlier ? Victorians are up to their ass in debt like everyone else. It’s been a consumer and real estate gong show the last 10 years that with rising rates will continue to squeeze the bejeezus out of them.

Even big shot Chip Wilson said you’d have to be crazy to buy real estate in Vancouver with so much coming on line and rising rates. That would go for here too. Misleading info everyone is rolling in dough in Victoria is utter bullshit.

Why are people getting financing turned down at increasing rates ? Why are Westshore developers cutting back projects 50% ? Because this turkey is cooked.

Businesses started cutting back on borrowing a year ago but homeowners keep blowing their brains out.

Canada’s HELOC Debt Is Growing Just As Fast As Last Year, Even With Higher Rates

https://betterdwelling.com/canadas-heloc-debt-is-growing-just-as-fast-as-last-year-even-with-higher-rates/

I just consider that area Alberta…. It’s not really BC.

NE BC is ideal and is also close to the giant “battery” of the Peace River reservoirs

“Why are people so afraid of change? The current system really sucks. ProRep will not even be that big of a change – just a bit of forcing politicians to find compromise to solve problems, rather than giving them carte blanche based on phony gaming the system.”

Since 1952, the socreds/BC Liberals formed a majority government 14 times while the NDP has done so just 3 times. The BC Liberals have a lot to lose, hence the hysterical propaganda coming from their side.

Maybe tidal (if that doesn’t annihilate ocean habitat)….

Wind is not for BC. It takes a lot of land preferably without trees and hills and other obstructions.

I look at Switzerland as one of the best governed countries in the world. They literally never have “majority” government and their seven member Federal Council is essentially government by national consensus. Their National council is elected by Prop rep.

People seem to worry that prop rep will produce radical leftist government. The practical effect in Switzerland has been to produce relatively conservative stable government.

Great post Grant. If we are going to get serious about climate change nuclear has got to be part of the picture in some places. Not likely in BC where we could easily have a surplus in base load power due to hydro, but in many other places.

BC should be aggressively into wind, because our hydro is pretty much the worlds best/cheapest energy storage device/load balancer.

Really if we are going to slow down the increase in CO2 emissions we need an “all of the above” approach: more renewables, more non fossil fuel baseload power, more research into storage, more efficiency, better urban design…..

Also less stupidity would be good.

Biggest disasters in power history haven’t been nuclear. They’ve been hydro dams (like the Banqiao Dam flood). Most deaths by far have been by pollution. Coal being the worst.

[quote]Since implementing PR in 1996, NZ had between 5 and 8 parties represented in govt at once, Never a party with more than 50% of the vote, and always a coalition like we have with the GreeNDP. [/quote]

What in the world is wrong with that? When people or parties are forced to cooperate, they do so, and find compromise. This is how you avoid civic breakdown, the currently polarizing phenom in the US, where half the country rabidly despises the other half (or thinks they do, due to partisanship). When you bring people together, you realize they actually have a lot in common. It’s the ‘winner takes all’ aspect of FPTP that is so poisonous, a large part of what fuels cynicism and disengagement from current affairs.

Why are people so afraid of change? The current system really sucks. ProRep will not even be that big of a change – just a bit of forcing politicians to find compromise to solve problems, rather than giving them carte blanche based on phony gaming the system.

I don’t think the apocalypse is nigh, no. That doesn’t really matter much though, it wasn’t the point I was making. I was more just harping on your track record matters. It does until it doesn’t.

Likely the worst forest fires on record are related to things like getting rid of Alder & Aspen (spraying them with glyphosate – actually!) after previous forest fires, so that only more commercially valuable species (pine/douglas fir) survive, as well as fire suppression which leads to massive build ups of wood just ready to burn.

Based on this:

https://services.pacificclimate.org/weather-anomaly-viewer

It looks like it was hotter than average in BC in July and August, but well under in September this year. 2015 looks significantly worse in the May through August period, but there wasn’t massive forest fires in those years. I don’t know what the correlation is between hot summers and massive fires, or if there is any.

edit: Just checked out some previous fires, like the Junction of Smith and Liard River Wildfire, and it isn’t any hotter than normal leading up to the fire in June in that area. Where as the Lava Canyon fire it was slightly hotter through August and September of 2009 in that area (about 1-1.5 degrees C).

As I get older I find I have less and less tolerance for BS on important issues. Cutting through the ignorance and blatant dishonesty gets tiring. I’m not going to change, I’ll likely just get grumpier. 🙂

For places like BC and Quebec, or any region blessed with a lot of hydro options, nuclear isn’t required. (The hydro options of course have their own warts.) But in the grand scheme of things, nuclear is vital. As for nuclear costs, there is much debate about the economic costs for nuclear, as the costs vary a lot between the countries implementing it, a lot of that due to regulatory issues. But cost is secondary to climate change and what I find hilarious, is to on the one hand discuss how carbon taxes are necessary to combat climate change and then at the same time ignore how carbon taxes are going to necessarily make carbon fuel sources much more expensive! Many nuclear projects which are getting cancelled due to costs are because of – surprise – the comparison of electrical generation costs with fuels like coal and natural gas.

So, if you believe that the carbon we are pumping into the atmosphere must come down, then the next thing to discuss is how we do that without creating a massive energy gap. In conjunction with that, the discussion needs to include practical matters like how we replace carbon fueled base-load generation because it is completely taken for granted.

I used to consult for the AESO (Alberta Electric System Operator). Working in a company like that you get to understand just how complex modern day electrical grids are. They (and every other ISO in the world) have many controllers who constantly monitor the electrical demand and dispatch to electricity providers to either ramp up, or ramp down, on electrical generation. This has to happen immediately or you get brownouts or blackouts. There’s no “Hey, can you give us some time mate, the wind isn’t blowing right at the moment.” Now, in Alberta the way they accomplish stability is they have a fairly steady base load of generation that comes from coal and natural gas fired plants. As demand ramps up, they dispatch to other generators who can easily come online, such as wind farms, or to other natural gas plants (peakers), or by pulling more energy across the transmission lines from BC. But that carbon fueled base load is always there. The key is there are very real limits as to how you get that base load generation. Wind farms can’t do it all and neither can solar. (*You can mitigate this somewhat by building really extensive and wide ranging transmission networks, and that’s how some places in Europe which have high density have been able to integrate more renewable into their grids then other regions). But, short of completely throwing out our centralized electrical grids, we need stable base load generation. Again, if that base load generation doesn’t come from carbon based fuel sources, it needs to come from somewhere else. If your region isn’t fortunate to have hydro (and with low enough demand for hydro to meet needs), then they’re going to need nuclear, or a breakthrough in storage technology so that wind and solar energy can be effectively stored. Tesla batteries or similar are not the right technology and aren’t going to scale like we need it – this type of scaling requires super capacitors because they typically store 10 to 100 times more energy per unit volume or mass than electrolytic capacitors, they can accept and deliver charge much faster than batteries, and they tolerate many more charge and discharge cycles than rechargeable batteries.

So yeah, if we want to tackle climate change but like having stable electricity, there’s no getting around the fact that world wide nuclear is needed at least as a bridge until there are major advances in super capacitors. A Manhattan like project on super capacitors is sorely needed.

The Queen’s Diamond Debt Jubilee!

@ Caveat Emptor

“Probably safer to live beside a nuclear plant than under one of BC Hydro’s big earth fill dams.”

Yes, but greater energy efficiency is a better bet than ever more power, safe or unsafe, green or otherwise. And the primary means to greater energy efficiency is redesigning and reconstructing cities for: (a) higher density, and hence less commuter travel and fewer new roads, bridges and rapid transit systems, (b) more energy efficient buildings, and (c) greater livability, thereby reducing the impulse to travel to some place else.

https://twitter.com/leyneles/status/1065687794952024064?s=21

Things are unraveling quickly in the legislating building If those 2 guys did nothing. We will see the mother of all lawsuits.

Probably safer to live beside a nuclear plant than under one of BC Hydro’s big earth fill dams. Not trying to be alarmist but there are various failure scenarios (earthquake, landslide into lake causing overtopping wave). Failure of an earth fill dam usually takes time so downstream communities would likely have time to evacuate, but the destruction would be epic

It won’t. But it won’t give them absolute power.

@ Grant

Try to be less emotional and more rational. Nuclear power is simply not economic. The Brits will be paying multiple times the cost of thermal power for electricity from the new Hinkley Point nuke plant that Theresa May signed onto as soon as she became PM. (And that’s assuming the French contractor building the thing can figure out how to make it work, something they are having trouble with at another site using the same design.) And beside the cost, a Fukushima type melt down at Hinkley Point would make Bristol, Oxford and London, not to mention a large number of other towns, uninhabitable.

We don’t need a storage breakthrough, we just need the Site C dam which is now on track.

As for James Hansen, if he has a design for a cost effective nuke power plant and plans for locating it where it won’t destroy large areas of human habitation if it blows up, then sure lets go with it. But, in fact, there appears to be no such design available.

What Hansen does say is that the key to cutting atmospheric carbon dioxide concentrations is the carbon tax, and on that the economists agree. One consequence of the tax will be to kill cars with high carbon emissions or a high embodied energy content, e.g., a Tesla electric car battery. This, in turn, will drive a demand for urban densification . We are already a generation behind the Asians in building efficient, livable, high density cities, where ordinary folks can afford a home (however small and high off the ground it may be) without borrowing their brains out. It’s time for Canada’s mentally geriatric urban planners and city councils to get on with planning the necessary transition before we are too poor to handle it.

Because of the Dams? Wrong Bennett dude. Also, nuclear in Canada has a 100% success rate because of the type of reactor we use (CANDU). It can use un-enriched uranium (so doesn’t promote proliferation of nuclear weapons) and will shutdown on a loss of power (so will never ended up with a Fukushima type incident.) The main reason that we have issues with nuclear power plants currently is because of uneducated people who stopped the building of new plants, so they continue to use old ones well past their expiry date. Still need to get the power from somewhere. Germany is the dumbest since they replaced all of theirs with mostly coal after Fukushima.

Oh man, the anti nuclear stance really gets my ire up. It’s like you finally make that breakthrough with one group in getting them to understand how big a problem climate change is and then you have to turn around and scale another wall getting those who are against nuclear to understand how incredibly difficult it’ll be to deal with climate change without nuclear power.

Solar, wind etc. are fantastic and need to continue to be rolled out as much as possible, but we need breakthroughs in storage (super capacitors etc.) to solve the intermittent availability issues with renewables. Without that we can’t rely on renewables for too much of our base electricity load. (stable power grids are near impossible to achieve without reliable base generation which typically comes from coal, natural gas, hydro and nuclear). And more importantly, if carbon fuels finally enter a downward trend in energy contribution, there will be a HUGE gap in energy production. Therefore there is no getting around that we need nuclear as a bridge. I could go on a multi page rant here, but don’t have the time for it (nor does it belong in HVV) so instead here are some links and excerpts:

James Hansen, who brought global warming and climate change to the US congress in 1988, says this of nuclear:

“Nuclear will make the difference between the world missing crucial climate targets or achieving them.”

“It’s unfortunate that environmentalist are assuming renewables will be enough to solve our energy requirements. Soft renewables (not hydro, which is limited in scope) only provide 1-2% of energy… what I find disturbing is that environmentalists who recognize we have a problem with fossil fuels… turn down the potential of nuclear without looking at it.. by shutting down R&D on 4th generation nuclear power. We need authoritative scientific bodies to discuss the relative merits of types of energy production. It is generally agreed that we need more effective and safer uses of nuclear power. Yes there have been accidents but it’s like airplanes. If you have a crash you don’t stop flying. You find and understand the problem and make changes. In nuclear technologies there are approaches that are far superior to existing light water reactors and we should be pursuing those because we don’t have anything on the horizon that will come close to competing with them.”

James Hansen on Nuclear Power

https://www.youtube.com/watch?v=CZExWtXAZ7M

Other TED Talks on nuclear:

https://www.ted.com/talks/michael_shellenberger_how_fear_of_nuclear_power_is_hurting_the_environment

https://www.ted.com/talks/joe_lassiter_we_need_nuclear_power_to_solve_climate_change/discussion

@ Patrick:

Who said anything about mortgage delinquency. Not me, though I love that term: some schmuck get’s sucked in to overburden him or herself with too much debt and he becomes delinquent, i.e., they are among persons “showing or characterized by a tendency to commit crime, particularly minor crime.” I guess we could refer to drug addicts as “chemically delinquent,” or guys who walk out on an aging wife as “maritally delinquent.”

What I was proposing was simply a debt jubilee — for everyone, delinqent or otherwise.

Canadians are more indebted today than they have ever been before and now face rising interests rates which will crush many of them. But apparently, here at HHV, we have no mercy. Free money for corporations, why bless me, of course. And just today, another $14 billion in tax breaks to corporations announced by our very liberal government. Goodoh. But then why not a $14 billion dollar tax break to debtors — for a start, anyhow. Remember, what those folks have borrowed is money created out of thin air. Which means it’s been created by inflating the money supply, creating inflatiion and devaluing your savings. But no, the the faces of the poor should not only be ground, they should be underground.

1 in 200 in Britain now homeless.

167,000 in London alone. Growing.

Nevermind how Brexit will increase the numbers.

Maybe just be thankful and consider giving back to our own community this year and make life for our own homeless a little easier.

I used to think that you travel the world to see how different we all are. As I get older I realize as I travel how similar all of our problems are.

https://www-m.cnn.com/2018/11/22/uk/homelessness-britain-rise-gbr-intl-scli/index.html?r=https%3A%2F%2Fwww.cnn.com%2F

“Hopefully BC votes to keep first-past-the-post and our days of adding one-issue parties like the Greens to govt are over.”

You’ll probably get your wish since old people love fptp and voting. Once the result is confirmed, the old people will be able to rest easy knowing the good old socreds will be back in power soon to resume the important task of ruining housing for posterity.

You mean like a no bid market ? Can’t happen, they said. 😉

https://www.youtube.com/watch?v=vgqG3ITMv1Q

Nonsense.

Plenty of just-as-liquid RE markets have delinquency rates much higher than Victoria or Canada, so Victoria low delinquency is also a sign of healthy mortgages (and not merely a sign of a liquid market) . Obvious example is USA – 3% delinquency in the best of times. That’s a 36x higher rate of mortgage delinquencies in the USA than in Victoria – even during boom times. You can’t explain away a difference like that by saying “our market is more liquid than the American market”.

https://fred.stlouisfed.org/series/DRSFRMACBS

Your idea that overindebted people who can’t pay their mortgage in Victoria sell their house so fast they don’t even miss enough mortgage payments to show up as delinquent doesn’t pass the sniff test, but if you have data to back that rather than a hunch, please post it.

In the meantime, the discussion was about a “debt jubilee” to help our “victims” of over indebtedness. If there are no mortgage delinquencies there’s nothing to talk about. We should instead be talking about the “credit jubilee” taking place in BC, where your GreeNDP friends keep inventing new taxes to take away people’s net worth.

If you want to rephrase the debt jubilee discussion as a “not right now, but what if” .. well sure, but it’s worth pointing out that “right now” we are in great shape debt-wise in Victoria, and the near-zero mortgage delinquency rates are an impressive sign of that.

I vote for a debt jubilee! Please, please please please, Please do a debt jubilee! definitely needed to save the economy. Yep, definitely prudent to do this!

That’s not really telling the whole story. Delinquency rates are quite intertwined with liquidity. While delinquency rates that are stable and in the historical range aren’t really newsworthy, the picture changes when they rapidly drop to almost unseen levels like they have in Ontario and BC. When that occurs, that’s typically a sign of an overly liquid RE market. So, you can expect to see things like rapid price increases, credit growth, very high STL ratios, diddly DOM etc.

You can’t really go bankrupt if you’re in over your head, but can sell your property within days or even hours, for more than you paid. The real test is what happens when the music stops.

A third alternative suggestion is to educate yourself. The delinquency rate on mortgages in Victoria is almost zero (0.08% or 1 in 1200). For Canada as a whole it is also tiny 0.23% (1 in 400).

https://www.cba.ca/mortgages-in-arrears

LF,

It’s been so obvious for last few years this excessive debt borrowing is the blow off top. The pumpers can’t handle the truth that their brethren have borrowed their ass off and will take them all down with them like every other crash.

Attacking and whining about the bears for being right only shows the immaturity and lack of intelligence of the pumpers to not understand basic economics/business cycles. This thing is going to tank for a long time, drip by painful drip.

Spoken like a true capitalist.

A billion or two for Bombardier for planes they cannot sell? Sure. Five billion to Kinder Morgan for a pipeline they cannot build? Absolutely. But heaven forbid that those miserable people struggling to get a place of there own should get a cent of what the bankers printed for themselves out of thin air.

We’re still not done yet…

Canadians continue to pull out HELOC money like no tomorrow – in a market that’s starting to decline.

https://betterdwelling.com/canadas-heloc-debt-is-growing-just-as-fast-as-last-year-even-with-higher-rates/

Since New Zealand PR system is your poster-boy example of the PR movement, I wouldn’t vote for that result either for BC.

Since implementing PR in 1996, NZ had between 5 and 8 parties represented in govt at once, Never a party with more than 50% of the vote, and always a coalition like we have with the GreeNDP. Can’t elect an “independent” to represent you, must be affiliated with a party due to thresholds.

You’re wrong on this point. Israel has a 3.25% threshold. Italy has 3% threshold. BC PR would have a similar one (5%). https://en.m.wikipedia.org/wiki/Election_threshold

Hopefully BC votes to keep first-past-the-post and our days of adding one-issue parties like the Greens to govt are over.

Give a man a fish, he eats for the day. Teach them to fish, he eats for a lifetime.

@CS

1/ Loan forgiveness: someone lives beyond their means and needs a bailout, sure no problem. BUT there should be tons of strings attached because it wouldn’t be fair for the rest of the populace that made prudent decisions + must understand that mommy and daddy can’t bail them out without some severe consequences.

@Sweethome

2/ Education: Call me a capitalist or whatever nasty word that socialist’s can conjure; but all students starting from grade school should be taught financial literacy. I read 20 years ago that the average cost to society of an (with a higher education) educated vs uneducated person is in the magnitude of $500,000 USD over a lifetime. It factors in income taxes paid, social services used etc… It might not be super scientific and too many variables; but it gives you the magnitude. Hence, if I was running the society, I’d focus on education and training kids with real skill sets that they can use.

Many of the homeless are just a result of broken homes, lack of real life skills, substances issues, lack of confidence,….etc… We need to address these issues earlier and identify them at an earlier age. Now they are going to cost the taxpayer $XXX,XXX.

Who doesn’t want to help out our fellow man? But they can only be helped if they seek out assistance. Now back to your regular programming!

There is already a way out for those who borrow money they can’t or won’t pay back. it’s called bankruptcy. Both borrower and lender take a hit and rightly so. For some who have mortgages they can no longer pay, this might not be necessary as long as they can sell the property for more than they paid for it. Being a renter is not the end of the world.

What I cannot countenance is the government making gifts to debtors. There is only one place those gifts can come from and that’s from people like me.

Not to be one of “those people” who gives an opinion on something without trying to understand it, I just read the article @cs linked to about debt forgiveness. I do agree largely with the last lines, although I think borrowers have to take part of the responsibly:

“The basic moral financial principal should be that creditors should bear the hazard for making bad loans that the debtor couldn’t pay — like the IMF loans to Argentina and Greece. The moral hazard is their putting creditor demands over the economy’s survival.”

The article is a review of an apparently dense book, so it doesn’t really say how this would work in the current day with individuals rather than countries. It would be nice if the government would have been quicker with their policies to prevent debt from getting so out-of-hand. If everything is “fair” along the way, then wealth stays more evenly distributed and you don’t need debt forgiveness unless some unforeseen disaster strikes.

Also, teach financial literacy in schools so people don’t get in over their heads.

@Leo S

Not sure the people of California would agree with you…

That was my original observation that got all this started.

In the interest of consistency, I wonder whether Local Fool will also accuse caveat emptor of “simplistic, petty mudslinging.” Something tells me he won’t.

The insufferable ship has sailed long ago.

Rock-solid prediction.

Yes. This is what gives rise to movements like populism and why that’s becoming (arguably) dangerously popular. Human history is replete with examples of social unrest and war occurring whenever wealth becomes excessively concentrated in the hands of a few.

In the modern context, it isn’t any different. The thing I would say over the 20th and 21st century market economies is that large scale corrections (or more globally, war) tend to rebalance that disparity to an extent, but the process of getting to that rebalancing almost always nails the lower rung of the socioeconomic fabric harder than anyone else. Nevertheless, the end result tends to be greater equality.

In the context of free markets, this is why expansions are critical (encourages productivity, and/or innovation) and corrections are just as so (cleanses excess capacity, obsolescence or other imbalances including malinvestment in asset classes like housing). This is also why IMO, reducing these principles to individual expressions of “vengeance” or “punishment” completely misses the mark in terms of how free markets (at least theoretically, haha) provide prosperity and how that prosperity is sustained or clawed back by mathematical or physical necessity.

The real problem comes when the dynamics contributing to the rot are paved over and left to fester. Excessively low interest rates, gutting Dodd-Frank and excess financialization of the economy are recent examples, but history provides others as well.

That is IMO, precisely correct. Wishing for a huge housing crash occurring within the economy you participate in, is a perfect example of “careful what you wish for”. I do understand the frustration of some, though. You can feel that way without concurrently wanting to see families obliterated as a result.

@ Grant:

You have smart friends, Grant.

And yes, under PR you do, in effect, lose control of “WHO those representatives are,” because you probably didn’t vote for them and you may well wish to see them in Hell before they represent you in Parliament.

@ Patriotz

Rubbish. The currency is already being destroyed by inflation. Haven’t you noticed, it’s lost a couple of cents in just the last month: a couple of cents, that is, against the obviously unsound greenback.

The money that has been borrowed has already been spent and thus has had its inflationary impact. What a debt jubilee achieves if combined with much tougher borrowing restrictions is divert income from usurious banks to families, i.e., from the share-holding one per cent to the rest.

@ James Soper

Good list James, but why would you think that Prop Rep will give us more honest politicians?

Anyhow, corruption is not a guarantee of bad government. Bill Vander Zalm may have had a weakness for a well-stuffed brown paper bag, but he did halt logging in the Carmanah watershed, and as for trying to stop public funding for abortions, some people, Catholics for example, think that was a good idea.

Bill Bennett may have had a weakness for insider trading, but it is due to him that BC has no nuclear power plants, a fact for which I for one am glad.

John A. Macdonald was notoriously corrupt, buying votes on a massive scale. But he did it to good effect, not only bringing about confederation but building the CPR, a totally insane proposition economically, yet essential to creating a country from coast to coast to coast that was not American.

“CS where are you getting your pro rep info from?

The guy with the most votes under PR still gets the seat at the legislature… and then a few other candidates go too, so that the representation is proportional to the vote.”

Yeah and a lot of guys who didn’t get the most votes get into the leg. too. Depending on how the vote was split, a majority of those elected could be also rans. Greens for instance, with 17% of the vote would get around 15 seats in the legislature instead of three at present. Well that’d be great provided you don’t mind freezing in the dark as the pipelines bringing the gas and the black stuff from Alberta are shut down.

Furthermore, PropRep will encourage all kinds of new parties. After all, you only need ten of 15% of the vote overall and you’re guaranteed ten of 15% of the seats in the parliament, and probably a place in the government too.

Come to think of it, I propose starting my own free mortgage party right now. Borrow up to a million bucks interest free direct from the Free Mortgage Bank of BC. The money would of course be printed out of thin air, but so is the money you borrow from CIBC, so what’s the difference except that with my party in power, you’d neither pay interest nor repay the principal.

@ Leo M

Lucrative child tax benefit? Really? I never noticed.

No I am talking about a really lucrative tax break, say $50,000 per child beyond the second child, this to be paid in cash to the mother for life.

For high income individuals that would provide, in effect, a lifetime stream of income that would compensate for the damage that child rearing does to a woman’s life-time earnings.

At the same time, welfare mothers should be required to identify their partners or lose all benefits, while the partners should be required to make support payments or spend time in debtors jail.

Some such scheme would have two important consequences.

First, it would reduce the pressure on women to put career before family, thereby tending to correct Canada’s progressively more severe reproductive dysfunction as reflected in a below replacement and declining fertility rate.

Second, by providing the greatest incentive to larger families to those in higher income brackets and hence of presumed higher ability, it would tend to reverse the negative relationship that currently exists between intelligence and fertility.

For a free market economy to function without restraint on the freedom of those who are rich and powerful to exploit those who are poor and weak, then yes, those who make bad economic decisions have to pay the price. The result of such a state of affairs is the accumulation of virtually all wealth in the hands of a very few.

But like most states, Canada has many restrictions on the freedom of the rich and powerful to deal as they would like with the poor and weak. That is why, for example, I am not free to sell heroin to my neighbors kids. Would we really have things otherwise?

Generally it seems the bears want to see those who have benefitted from the run-up in prices suffer a bit.

If/when prices actually do fall a bit prepare for Hawk to be both insufferable and gleeful. I predict:

(1) Hawk and other bears will claim they were right all along

(2) If the stats show a 5-10 % decline they will post “evidence” that it is actually a 20-30% decline

@ Intro:

Seems kind of silly to argue that way. Conditions of all kinds are continually changing, so how can you possibly relate the last two fire seasons in BC to global climate change? Scientifically, there is almost certainly no way you can. In the early part of the last century, something like one third of the interior forests were reported by one observer to have been burned. Whether such widespread burning was due to climate, the practice of Indians to burn forest to create browse for game and room for berry bushes, or just a lack of any effective system of fire control seems impossible to say.

As for

, what has this to do with climate? Obviously deforestation in the Amazon, perhaps the most species-rich area of the world will have causes species extinctions and reductions in animal population numbers. But that’s primarily a reflection of increased demand for soybeans to to feed the animals that feed the increasing appetite for meat in Asia and other places where standards of living are rising.

Just like all the bankers that went to jail after the 2008 financial crisis? Oh but there stock options went down so they suffered greatly, right?

Seriously though, the economy is not an Aesop’s fable, so don’t go applying your simple morality to it. If a sufficiently large chunk of people “pay the price” we get a recession and then everybody pays the price.

We bought for the first time in the last two years at nearly the price peak but had a large downpayment that we sacrificed immensely for. Wiping out debt is the exact opposite of what I would like to see. Low interest rates already made easy money for people less fiscally responsible than we were.

I actually would like to see them suffer a bit (only a bit). I’m not sure how to do that without interest rates going up and possibly tanking house prices. This sounds scary as a homeowner, but, assuming we can eventually sell our house, it means transaction fees drop and other houses drop proportionately. Our equity would still be worth something, and those conditions would allow for some movement within the housing market, which wasn’t possible with a strong seller’s market and rapidly escalating prices.

@ Local Fool

Had you looked at the article I linked to, you would have seen there are grounds for the view that when it comes to debt, the majority of ordinary folk never show great prudence and if not protected by the state from their own miscalculation are likely to finish up as debt slaves.

What I’m saying is that that’s what appears to have happened to many, many young families in Canada today who are spending half or more of their income on a mortgage.

It is a fact, furthermore, that the present condition allowing borrowing virtually unlimited except by the lender’s calculation of what he can gouge back again is relatively new in Canada and will do harm that is yet to be calculated.

On the topic of suite rental and a possible deemed disposition upon change of use, what’s one to do when taking back their suite? Assuming rental income had been declared in the first place it seems to me like there are only two options:

1) Do nothing and let reported rental income dry up, or

2) Report the capital gain and pay the tax.

From what I’ve read there is no deferral mechanism available on a partial change of use from income producing to personal, so there is no election that can be filed.

I assume most people choose option one.

Soper, you don’t think climate breakdown is happening and getting worse? So the last few Victoria summers featuring apocalyptic smoky skies (with Beijing-level air quality) are just a fluke? Humanity hasn’t wiped out 60% of animal populations since 1970? And on and on.

No.

Both very poor comparisons with BC. Italy is a country of 60 million with diverse regional interests. Israel has a pure party based PR system with no constituencies and no voting threshold. A much better comparison is New Zealand with the same population as BC, and interesting much the same party breakdown at the moment.

For a free market economy to function those who make bad economic decisions have to pay the price.

Dear readers, tell me how the following statement from Local Fool isn’t a fine example of a renter wishing “punishment” upon “those whom they deem greedy and reckless” (my original observation):

Prices did, in fact, keep going up. Anyone who bought at almost any time during “the better part of [the last] decade” has done pretty well—and some, very well.

First, prices haven’t even started going down yet! (Not saying they won’t, but still.)

Second, where did I say that I want to hold renters responsible for a future price decline?

CS said: “How about a tax bonus of several hundred thousand dollars to families having a third child”

Be careful what you wish for CS.

Canada already has a lucrative child tax benefit that rewards large families. For example my accountant has more than one immigrant/refugee client with 8+ children. Dad works for less than $50k per year and mom stays home with the kids. They collect almost $50,000 per year in child benefits. That’s our tax dollars at work and that’s why so many people want to move to Canada.

Good post introvert, and that’s right on. If you notice, James Sofer attempted to rebut it, but didn’t challenge the truth of your statement.

That was a great post cs.

I agree completely. We will get a bunch of special-interest-one-issue parties with the same faces elected each time. Pro-life, Northern party, ultra-right etc. etc. Check out Italy or Israel’s cobbled together govt.

It’s first-past-the-post for me. At least we can clear-the-decks when we want a change.

You’ve been going on about this for a decade… you know track record matters. Also doesn’t count if you’re right eventually because you’ve been wrong for so long. #amIdoingItRight?

—

People on this site have been saying for the better part of a decade that you’re crazy to buy, it’s too much money, don’t get yourself into a debt hole. The response has been, don’t worry it’ll keep going up. Now that it’s coming down, you want to hold those same people responsible. Sorry, but no.

CS where are you getting your pro rep info from?

The guy with the most votes under PR still gets the seat at the legislature… and then a few other candidates go too, so that the representation is proportional to the vote.

The parties already decide which hacks get a safe seat… under PR they’ll actually have to work to get elected into it though. And with open party lists (ALL of our parties in BC have said they support open lists) we get to pick the secondary candidates, it’s transparent.

We also will not lose local representation under any of the 3 PR systems… we will gain it as we may have additional candidates in our own personal ridings. So if you’re a Liberal supporter in Victoria you’ll have a lower island liberal MLA to go to with your concerns. Or if you’re an NDP supporter in the interior. We don’t have anything like that right now… 60% of BC voters are not represented by a local candidate who aligns with their values.

Since 1980, First past the post has given BC:

Bill Bennett – convicted of securities fraud, responsible for the British Columbia Resources Investment Corporation

Bill Vander Zalm – forced to resign because of conflict of interest rules while selling his business, tried to get the province to not pay for abortions

Mike Harcourt – resigned because of the bingo charity thing, was personally responsible for BC losing a $156 million dollar lawsuit against Carrier Lunber. Quote from the supreme court – “It is difficult to conceive of a more compelling and cynical example of duplicity and bad faith.”

Glen Clark – Responsible for fast ferries debacle, also approved Casino licenses for free renos on his house, resigned over breach of trust charges

Gordon Campbell – drunk driver – to put it lightly, bribery and other stuff related to BC Rail sale, HST controversy, imposed contracts on teachers.

Christy Clark – Not everything has come out, but the casino money laundering seems to be a major deal.

Hard to know if BC politics just engenders corruption, but personally I don’t want anyone from any party having sole power in this province.

It’s antagonism without a positive cause, like a horror movie that tries to scare you with sudden frights rather than a really scary story. The former takes no talent. Implying that those antagonistic contributions are virtuous because they add some kind of readership value is analogous in the physical world to saying,

“I’m socially repressed, awkward and isolated and want to be recognized by society, but instead of using my intellectual capital to grow, work and gain that recognition positively, I’ll just take the lowest common denominator of my abilities and commit some act of public violence or infamy to do the same.” And indeed, both work. Your call.

No further response.

Something to keep an eye on for the next year. If Mike’s guaranteed hot pick last year GE at $30 (currently $7) blows up, this could get uglier much sooner.

A $9 trillion corporate debt bomb is ‘bubbling’ in the US economy

https://www.cnbc.com/2018/11/21/theres-a-9-trillion-corporate-debt-bomb-bubbling-in-the-us-economy.html

1574 Pear St with a $30K slash to $769K at $47K below assessment . When the reno flippers or young couples starting out with a project house won’t pay under assessment in a prime Mt Tolmie/Cedar Hill hood, you know this market is showing some serious cracks.

A continued predilection for something is the opposite of caprice, so I don’t really see the irony.

Adults sling mud, too, so let’s stop slamming kids when we slam adults, shall we?

Lastly, some occasional simplistic, petty mudslinging adds some spiciness to the blog and often stimulates conversation. Without it, it’d be a real snoozefest.

I can’t.

8 years of posts on this site suggest otherwise.

The irony in calling LeoS capricious, is your continued predilection to take an honestly debatable topic – and turn it into a simplistic, petty, childlike mudslinging contest. You can do better.

Reasons renters want a crash (in no particular order):

Yes side which is predominately left leaning. They are forgetting about the conservatives and them holding the balance of power with the liberals. Fun times with those 2.

My hope is zero gets done if we see PR and a shit show transpires with a bunch of different parties.

What I don’t get is why the NDP wants this… IMHO they are in the same boat as the liberals.

That is just a nice way of saying you are going to destroy the currency though inflation.

No that’s not true. First all of the PR options include locally elected MLA’s as we have now. Second the government has promised “open list” for the other ones, in which voters get to select the candidates on the party list that they like. I know a lot of people are getting this wrong and I think part of the blame has to go to the pro-PR campaign for not getting this across.

Yes in BC that’s correct. I think the reason is if they weren’t that would create a bias in taxation among properties with the same use, that is renters in multiple unit buildings or their owners would be subsidizing other renters or owner-occupiers. You also have the situation, now very common, where a single property has an owner-occupied unit and rental unit(s). Or just a SFH that gets rented. How does that assessment process handle that?

That’s a highly polarizing question that has no inherently right or wrong answer, but I’ll answer as though it does.

If you are going to make the largest purchase of your life and pay no attention to the effect of overextending on your finances or the market happenstance around you, consequences may follow. You cannot avoid these consequences; you can only shift their burden to someone else.

As painful as a nasty correction is, a debt jubilee would be worse IMO and encourage even more financially reckless behavior. What’s the point in fiscal prudence when a nanny has your back, ready to bail you out? Ugh.

Pay attention to what you’re doing with your life, don’t expect others to compensate you for making a poorly informed or impulsive choice. The hubris must be wiped clean, and that inevitably involves some really tough lessons for those that chose to get in over their head. I don’t want you or anyone else to pay gratuitously for their mistakes.

The housing market looks to be entering what could be a period of substantial decline. Indeed, at the high end of the market a substantial decline has already occurred. A severe correction will be extremely painful to those who entered the market for the first time recently, many of whom are indebted to the limit. What to do? Let them suffer?

I have two alternative suggestions. First, a debt jubilee. Here’s an article that explores that subject. In practice, the cancellation of debt could be achieved by the BoC taking over a percentage of all household debt, say 50%, from private lenders, compensating banks and other lenders with printed money. At the same time the BoC would then jack up its base rate to several percentage points above the inflation rate, i.e., around five or six percent, thereby preventing an inflationary regrowth of debt.

An alternative approach that would work well for most young families is the Hungarian solution to national suicide by contraception. This would entail large, and I mean really large, incentives to larger family creation. How about a tax bonus of several hundred thousand dollars to families having a third child? Enough, that is, to pay down a big chunk of the mortgage.

What about the old-fashioned idea that the guy with the most votes gets to win the seat in the legislature?

PropRep means that every party of any significance will be part of every government for ever more. Great if you love “Nobel Prize winner” Weaver, I suppose. On the other hand, if you like to vote those Green bastards totally out of government, PropRep ain’t a good idea at all.

Prop Rep also means that, by dictating who gets the party nomination, the party leadership can ensure the most reliable party hacks are always elected. Does that not remind you of how Communists operate? A small cabal able to exact total subservience from those who are supposed to be representing your community’s interests.

Then there’s the loonie idea of having mixed urban/rural ridings, which totally destroys the Westminster model of government whereby each community has its own representative who’s primary responsibility it is to represent that community’s interests. Instead you may find your representative for, say, Oak Bay weighing your interests against those of folks in the backwoods of Sooke. Yeah, you interests already count for little, under prop-rep your interests will count for damn all.

That was (is? not sure..) my viewpoint as well. But I was at a dinner party this last weekend and out of the 4 couples, 2 votes were for status quo, 1 abstained because they felt they weren’t up to speed on the ProRep options. (And I can’t yet vote as I haven’t been in the province for 6 months.) The other’s argument was not so much again ProRep, but rather that the devil is in the details. They had 2 main points, the first one I didn’t find compelling and wont cover, but the second argument was that ProRep, as presented here in BC, will result in too much party politics. i.e. You will no longer be voting for Barb Smith of Party ABC, rather if party ABC gets 10% of the vote, THE PARTY will put in 10% of the representatives. WHO those representatives are, you lose control of. (Is that true?)

These folks argued that each election they look at who the individual candidates are and what they say with the point being, they aren’t beholden to a party but look for the best individual to represent them.

TSX hasn’t really done anything in 10 years…

Unless gold takes off the TSX is in serious trouble. Take away liquidity with corporate debt tanking with high rates and what happens ? 2008 and worse.

:large

:large

:large

:large

I been told that rental buildings are not assessed for property tax as commercial? Is this correct and if so why are they not treated as any other business?

@guest_52191 The upswing or the downswing?

I know LeoM doesn’t, but does anyone else think we’re in for something similar to early ’16?

Looks like a disaster about to hit Seattle. Slashes exploding. Funny how when slashes increase, prices drop eh gwac ?

Bubble Trouble: Seattle-Bellevue Metro Housing Market Goes South

“In King County, the median listing price peaked in May at $742,000. This means half of the properties listed for more and half listed for less. The median asking price has since dropped every month, falling to $675,000 in October. This marks a 9%, or $67,000 drop from the peak.”

https://wolfstreet.com/2018/11/17/housing-market-downturn-seattle-bellevue-king-county-active-listings-price-reductions/

Underachiever,

“eclectic character home” indeed. Nice layout but I wouldn’t want to take a bath there, lol.

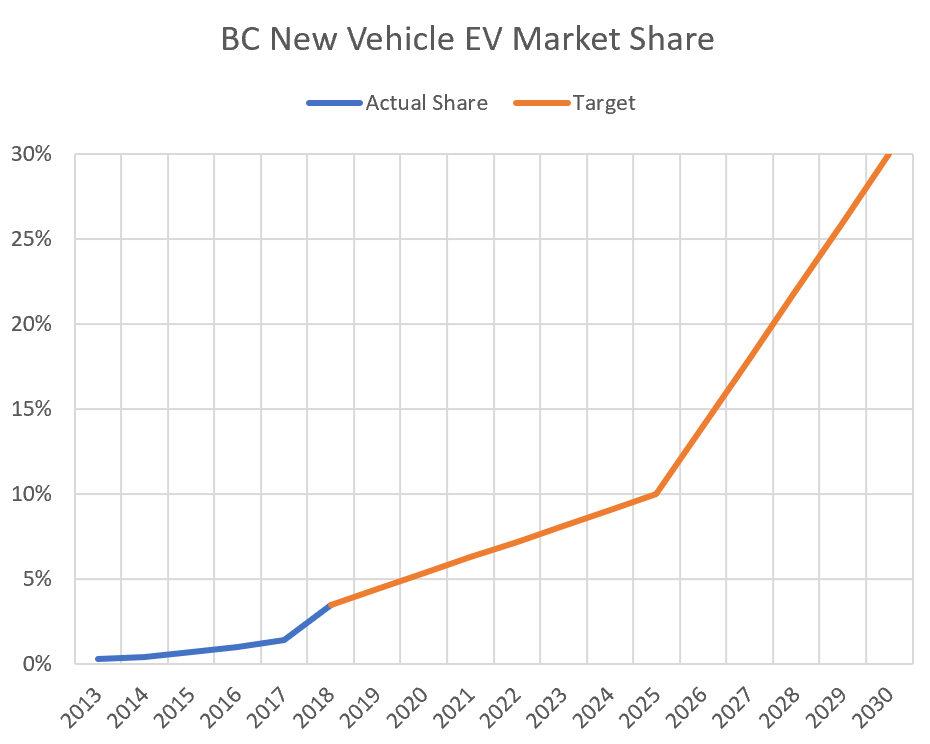

I’d want to know the underlying reasons for their extrapolation. To be clear, I’m not extrapolating the EV trend based on past adoption, there are many fundamental reasons why they will be adopted quickly in the future, but I don’t want to drive the thread too far off topic.

Unless there is an earthquake to scare people away, climate change likely will increase Victoria’s house prices. Victoria’s weather has looked really good compared to a lot of places in the past few years. We did get the forest fire smoke, but there will be very few areas that avoid that. Once 100-year floods, fires, storms, and heatwaves start becoming the norm in some regions, there are definitely going to be climate refugees. The US will be coming after BC’s water, though.

This just simply baffles me. In the early days no-one knew which technology would win out, but the horse has left the barn now. Hydrogen might be useful for some niche applications but they should just give up on the passenger vehicle market. Battery EVs are so far ahead it is pretty obvious where things will end up.

LF, you are absolutely right. For now.

There will be a tipping point soon where the purchase cost of an EV is the same as an equivalent ICE car. There will be a huge shift at that point, for the reasons Marko gave. Reliability and ease of maintenance is a big one for anyone in the market for a Corolla.

I figure when the tipping point hits (2 or 3 years?) all these much better looking Nissan Leafs will be selling used for super cheap. That will be my entry point.

Here’s one for Hawk: 1235 Park Terrace. Just

reducedslashed to $679,900 (20% below assessed value) after 41 DOM.I had a fascinating conversation with a colleague over lunch today. We were talking about RE, and his own experiences. He owns a few properties, his first one being a parcel up island. He was 18, in his early 50’s now. He has obviously seen enormous appreciation of his RE assets, and has previously told me, “get into the market, you can’t go wrong.”

Now he sees what’s happening, but the funny thing he says, is despite the data staring him in the face, the whole experience of a decades long, one way trip down with interest rates and apparently non stop appreciation is ingrained in him to the point where there is a real conflict with his emotions vs his brain. And he knows it, too. He would oscillate between “It’s the worst time to buy in 40 years”, to, “just do it, you only live once” and then back again. He said his assets had never lost value, despite that clearly not being true, and again, he knew the “never lost value” was wrong but still felt otherwise. It’s hard to describe here in text. Like a, “Ya I know, buuuuut…” when “but” doesn’t really have logical substance.

Just interesting to see human psychology operating in this kind of situation. He’s an intelligent, well spoken man that I have a great deal of time for. But there it was, cognitive dissonance still operating even when he knows exactly what he’s doing but can’t seem to help himself. Only human, I guess. At least he’s a long term holder and not planning to buy anything at the moment. He’ll do fine, IMO.

That’s the thing with RE – holding it a long time makes a difference. Flipping it like penny stocks is a very temporary and dangerous game, which many people in the most overvalued markets are already discovering.

Not generally, but as they say, it often rhymes with uncanny repetition.

As a data junkie, if someone extrapolated a trend like that with the housing market, what would you say to them?

Good to know.

I like it!

If buying EVs was about the environment, then we will never get to 10% let alone 30%. They would top out where the prius topped out on market share. Luckily the product is just better so the masses will buy them for other reasons..

As for climate change, that might be another argument for you to take up. As the world warms more people will move to coastal climates where temperatures are more moderate. House prices to the moon!

Sign of the times?

Monopoly for millennials

https://www.theguardian.com/lifeandstyle/shortcuts/2018/nov/19/monopoly-for-millennials-trolling-about-my-generation

“Forget real estate. You can’t afford it anyway”

My guideline for vehicles is they should cost 1/10 of gross income. Sooooo. Once we make half a million per year or never, whichever comes first

Leo, I asked this earlier but maybe you missed it:

Slope already steeper than target to 2025.

The DOW is falling, the DOW is falling…

Is this a Chicken Little moment, or are investors spooked? The DOW dropped again, over 550 points today, so a few investors must be spooked.

As 2018 slowly comes to a close, it looks like my 3% high interest saving account outperforms the stock market this year.

Lemmings?

Some stock investors, it seems, are starting to panick and have begun liquidating their stocks.

Will real estate investors follow in the spring?

One thing is true about every bubble. They are created by lemmings and they are crashed by lemmings.

Oh yea, one more point for the history buffs.

John J. Phelan, president of the New York Stock Exchange, said of 1980:

“This was probably the most profitable year in the history of Wall Street.”

That sounds like 2017/18.

Then came 1981 when house prices crashed and the DOW dropped like a rock.

But we all know history doesn’t repeat itself.

Not right now maybe, but soon. At some point, climate breakdown is going to pop everyone’s cozy little bubble.

What about people who constantly look 37 years behind? Oh yeah, they’re in your position, which ain’t good.

Very good point.

Pretty sure Pro Rep is going to win healthily. The problem is probably going to be low “turnout.” The No side will point to that and say the results aren’t legitimate.

Just wait for it. Wee Wilkie is already drafting the press release and practising the talking points.

DuranDuran:

You must be Hungry Like the Wolf for prorep…..not to worry, we have been canvassing in our neighbourhood and across family groups in support. Fingers crossed.

@LeoS

Personally, I hate heat pumps. I know there’s apparently quiet ones, but our neighbors have one and it’s fairly new and noisy as heck. We’ve passed on buying a few homes (brand new) because of the noisy heat pumps located both next to the house and at the neighbors homes (again, brand new homes, brand new heat pumps), close neighbors.

gwac, at the end of the day there are more houses selling/listing below/near assessment than they did a couple weeks ago. The more it increases , just like the slashes the past few months, the lower prices go down, that’s how markets work ICYMI. 81 took two years.

Those who look 3 months behind miss the new trend and get burnt badly, just like the oil bulls who just received a beatdown.

Hey people – send in your ProRep cards! Need to be mailed by this Friday to arrive on time.

And yes, you should vote Pro ProRep. Because that’s what democracy should be – everyone gets equal (proportional) representation. And then vote for RUP. That is all. Or, you know, one of the other systems if you prefer.

Doesn’t matter if you’re a capitalist or socialist; a renter, condo-dweller, sfh owner, bear, bull, halibut, or mongoose – ProRep loves everyone.

If you believe in rapid adoption of EV’s from here, you should consider natural gas investments (eg. Clark’s $40Billion LNG investment). Gas will slowly replace coal in power generation and eventually produce more than half the world’s electricity.

But keep in mind, it’s a slow transition at times as EV’s have been around since the 1800s.

By 2040 is easy. Shoot look at the release of the first iphone to now and that is simply ten years later. The uptick in EVs is exponential which will be reinforced once they start to come down in price and used ones become more available.

This is just an EU example… China is crazy!

Tend to agree. I can’t do a drive of any distance in Victoria without seeing at least 5 Leafs and 1 Tesla. When EVs really start to take off, the growth is going to be exponential.

There’s a very good chance our next car will be an EV. Still a few years away, but I’m lusting…

BTW, saw a charcoal grey Ferrari behind me at Shelbourne and Feltham this morning. Now there’s an internal combustion vehicle I could still get behind, money being no object!

Most people have no idea what is going on with electric cars and how fast they are improving.

People approach me in parking lots all the time and its not that they have no idea, but they have incorrect info. The amount of mis-information is puzzling.

James yep forgot about the coal. Thanks for reminding me.

Just like the market was not convinced about digital cameras from 1970 to 2000. It’s all about the technology.

Or that we have the biggest coal port in NA.

Marko you are talking your book. Victoria and Vancouver may see some good % by 2040. The rest of the province forget it. More political garbage to make the tree huggers happy. In the mean time less talk about LNG and that environmental issue. In the end is BC going to be less of a polluter. All talk and BS,

It could be, but clearly the market is not presently convinced what you’re saying is true. I know I’m not – I’d say a 3 y/o base Corolla beats an electric on economics hands down. Anyways, whatever. Car sales are overwhelmingly fossil fuel – electrics are still a very small component of the market. We should get away from it though. Burning dead plants and animals for energy isn’t a long term option for our species.

Yeah these targets are comfortably achievable. Most people have no idea what is going on with electric cars and how fast they are improving. We are already at about 4% of sales in BC in recent months

Has no one owned a car with 112,000 km on the clock without a service and 8 mm still left on the original brakes 🙂 Battery at 99% of new but why would I care as it comes with a 8 year unlimited mileage warranty 🙂

What the hell is going on at the BC legislation. Always fun when the NDP are in power…

Otherwise these hard targets in practice end up being aspirational – say Kyoto, Paris etc. Shame really, but humans are humans

The difference here is electric cars, environment completely aside, are a much better consumer product (safer, quieter, faster, much cheaper to operate). If you own a garage also a lot more convenient; 3-5 seconds to plug in versus a trip to a gas station once a week. People won’t be buying them because of environmental reasons.

In my opinion the current obstacles are price (going down slowly), availability (improving slowly), and long distance trips (Tesla has solved this, others will follow).

lol Marko dream on..

I wonder if most people who think that are owners of electric cars. I’m sure it’ll get more uptake, especially if gasoline costs become prohibitive. Otherwise these hard targets in practice end up being aspirational – say Kyoto, Paris etc. Shame really, but humans are humans.

Guarantee 100% that 2040 goal will not happen. Maybe 15% if they are lucky.

Will easily be 15% by 2025 and 90%+ by 2040. On my Wednesday night basketball team, I already have two referral codes I’ve given out (Model X and Model 3). The people that go electric including myself are extremely unlikely to go back to an IC car. IC would be a 100% no go for me at this point and time. Even if Tesla went under I would go with a Bolt or the new gen Leaf.

Once the 45.5k Model 3 is available next year sales will really start taking off. Bye bye 3 series, Audi A4, C-Class, etc, and you will get a lot of 30k car buyers that will spend the extra 10k to jump into a Model 3.

And by 2022-2023 undoubtably the Model 3 will have a stiff competitor as well.

Guarantee 100% that 2040 goal will not happen. Maybe 15% if they are lucky.

Leo, how long before you sell that Leaf and buy a (used) Tesla 3?

Such a sick burn:

ZEV mandate is good news. Will bring more inventory in. Also more chargers so I can more easily drive to the interior. Still a bit of an adventure right now.

The government will beef-up its incentive programs by $20 million this year, bringing the value of the program to $57 million. Electric vehicle buyers who are eligible can receive up to $5,000 in incentives for battery-powered vehicles and $6,000 for hydrogen-fueled vehicles, under the Clean Energy Vehicles for British Columbia program.

The government will also leverage federal funding and private partnerships to more than double the number of direct-current fast-chargers available to the public from 71 to 151.

https://vancouversun.com/news/local-news/vehicle-sales-to-be-100-per-cent-zero-emission-by-2040-under-b-c-s-electrification-plan

If after this much time and hindsight you’re still happy, then you’ve obviously made the right choice. Whether or not it’s the “right” time to buy really is influenced by the particulars of that buyer. There’s almost never a “perfect” time anyways…

@Leo S

I literally yelled out loud “Wow” when I read that closing price. And then I made a snarly face and cursed the selling realtor. That’s because back in May we offered a little bit more: $790K. (This wasn’t an official offer, it was more of a fishing expedition to see what the reaction would be before moving forward.) The builder said No, and the realtor said we should decide soon because of the interest in the house. The house was at the drywalling stage and I decided to have a small inspection done on it; the inspector noticed some issues with the backing used in the tile shower, so between this and the price rejection I really cooled on the house. And shortly after that our house came on the market and we preferred it.

As for why the smaller 2487 sold for a similar price, I’d say there’s probably several reasons. First that smaller house was an “Executive” home – take what you will with that marketing fluff, but it does have more upgrades and is nicer inside. Plus the smaller one had fencing and more landscaping complete. The larger house is ultra basic – just really big although it’s a bit of an odd layout (based on the floorplan it would have been great to run a B&B in it, but it didn’t have plumbing for another kitchen so it wasn’t functional for an official suite).

But the bigger reason, IMO, is the market is clearly softer now and with the seasonal slowdown the developer probably wanted to move on. He’d originally wanted the house off his hands in June, it didn’t reach lock up until August and now it’s November so he was carrying those costs. He had another house he just finished building a few doors down (979 Dorey Way) and it too recently finally went after being finished since August.

Back in May I figured we probably bought at the peak of the market. But we’re super happy with the house and so thrilled to be out of Alberta winters. You win some you lose some.

Yeah, suuuuuure.

Everything except eliminating restrictive zoning laws that prevent densification.

In fact, cities in Canada seem to do everything they can to maximize house prices. I suppose since that is to the advantage of those who already own a home, it’s kind of democratic. But when politicians talk about “going as far as we can” to facilitate the market providing housing, they are simply lying.

Hawk

At the end of the day the average sale over assessment will be 10%. Weird how that works. Same with all those slashes…

Active listings should be around 2k soon.

Forgot about 2051 Granite St in Oak Bay, slashed twice for $78K total to $942K only $13K over assessment, it will be going under most likely.

Oak Bay now selling below assessment, that’s a first at 973 Runnymede Pl. slashed $60K down to $999K, $70K below assessment even after a big reno job and you still get a cracked driveway. Very telling.

2060 Beach Dr slashed $200K to just $30K above assessment of $1.366 million, needs a reno but still it’s Oak Bay, the pride of the HHV pumpers.

Over off Blenkinsop we have 1287 Lonsdale Place just listed $699K, for $53K below assessment.

thanks Bingo

Not worth it for me. My Insert does a good job and I get free wood and the summer only has 1 to 2 weeks above 20 at night.

Do you have a GVPL library card? If so, you have access to Consumer Reports online. I use this service often – it is a bit clunky but works. Last researched a used car for daughter and am happy with the info I found in CR.

True. The more interest rates rise the bigger the potential to drop them when the recession inevitably hits.

Will it be enough? Impossible to tell but I think best case our debt levels will be a huge drag on the economy for many years.

SweetHome

If you are buying a Maax do yourself a favour and find someone with an account at B&G.

What it sold at Home Depot and Costco etc is NOT the same product as what is sold at a plumbing store. They look the same, and maybe use the same molds, but the plumbing store unit will be free-standing fibreglass (i.e. self supporting) so it won’t require a bunch of labour to frame it for support and will be less problematic long term.

Ask any plumber. They hate box store tubs and hate having to educate their customers. “Well the Maax at Home Depot is on sale for $399…” “IT’S NOT THE SAME TUB”

My one piece I just bought was around $400. A simple clean looking Hytec that they have tons of in stock. There was a Maax we liked as well, but it was a 2 piece and we wanted to go one piece, since we could. Any of the ones we like were around $400 with an account.

Of course if you walk off the street into B&G they’ll quote you closer to $800.

Gwac

3 head ductless? Depending on size of the units and outdoor unit I’d say closer to 15K including install tax etc, then subtract any rebate.

We did a mixed system (ducted and ductless) and I’d recommend ducted to anyone that can run it (open crawlspace or attic). I’d do as few zones as possible. Our place was pusing the limit to have all our upstairs as one zone, so we have two in attic units with brand new insulated ducting running to ceiling vents. We tend to run the two zones at the same temp, so having two is kind of pointless.

Less units means less cost.

Have you done a calculation of how many BTUs you’ll need total? First step is the correct size outdoor unit. You’ll need significantly less than your average house the same size.

Not true. We could even go into the negative!

Personally I think they are scrambling to hike rates to prepare for the next downturn. It’s a pickle though because wage inflation is happening which is usually when rates rise. In part because people can afford to pay more. Usually wage inflation goes hand in hand with a booming economy. We have a booming economy ish but based on real-estate which is now over the crest and looking downwards. There will most likely be a combination of interest rate drops, wage inflation, and price declines to get to a new affordability trough. I predict 47% of household income for mortgage payment. There is certainly less political will to prop up the market (or inflate it) but if it starts tanking too hard it’s like a sinking ship that sucks everything else down with it. Action will need to be taken and there are other tools that were taken away that would compensate for less room on the rates department. Like longer amortization periods, lower down payments. You know, all the stuff that inflated us to this point! One of the reasons I’ve been a Halibut is the people working the levers of the economy don’t want crashing prices. They want inflation to inflate debt away. The system is chugging ahead to slowly increase the cost of everything. The blow-back from the QE to recover from the great recession wasn’t planned however and this large spike in asset prices due to all the free money in the system is causing a bit of a glitch in the matrix. Unfortunately the next few years will be interesting times…..

Actually about 100x since 1960. Also note how the majority of that appreciation always occurs as rates go up (periods of inflation).

I have a question about the affordable housing initiative. How is the price of the 15% of affordable units in new downtown condos calculated and does the developer take a loss on those units? Anyone?….anyone?…..(Save Ferris).

Yeah the upcoming correction will be interesting. Previously we have been able to improve affordability without major price drops (81/82 excepted) due to interest rate drops. That isn’t really an option this time, so affordability will have to improve due to wage gains (this is much slower than interest rate dropping) or price drops, or affordability stays permanently poor and breaks the trend.

Hey Dasmo, welcome to the bear’s lair!

Very interesting. Thanks for the personal experience!

It is amazing how much you can actually do, with some careful study and hard work. Good friends with skills often help as well.

Why not post a graph of the 50X appreciation in house prices since 1960. That’ll make your point that there is no true market flat lining 🙂

Thanks, Leo. That’s helpful.

Yeah single family will get worse over time. More on the decade time frame but in the long run it gets worse as single family makes up a lesser and lesser percentage of available housing stock.

And all things being equal you are better off under that scenario. Less interest rate risk, higher reward from additional payments, faster payoff time.

Heat pump would be very similar, except there’s a unit outside which is the compressor. Heating uses about half the energy compared to your electric furnace

Instead of just turning the electricity into heat, it “pumps” heat from outside the house into your house via compressing a gas, which is more efficient.

Can someone please briefly explain to me, a total idiot on this topic, what the advantages of a heat pump are?

I have an electric forced-air furnace, which I’m fairly happy with. But, again, I know nothing.

Question on this. The previous owner did some electrical work without permit. If I take out homeowner permit, would the inspector look around and force you to fix other subpar work or just look at the job that was done?

You do. You can buy the vacuum pump yourself but need a professional install for the warranty to be valid. Thanks to @guest_52172 for the tip last time it came up.

Got a lead on an HVAC guy that will do the charging of the lines.

Best thing is that you can still get the rebate on DIY according to @guest_52172