The battling trends

This post is a bit of a history of my research into single family house prices in Victoria and two of the most powerful trends I’ve seen in the market. About a decade ago I was discussing the housing market on another forum and had recently gotten access to long term historical average price data for Victoria. Naturally I charted the data and added a linear trend line because that’s what I saw everyone else doing in other markets.

Obvious bubble right? The average single family house in 2008 was almost $600,000 and yet based on the trend line, it seems like it should have been closer to $350,000! Clearly a 40% crash in prices was inevitable.

Then someone pointed out that if you expect house prices to increase at a fixed percentage per year, then that trend line should not be flat, but rather exponential. And the thing is, exponential trend lines change the picture quite a bit. Here we have the inflation adjusted single family house price with a 1%, 2%, and 3.5% annual inflation line (which is close to the best fit).

Now the trend line that fit the data was only 30% below current prices. It still seemed on the surface of it that prices in 2008 were a bubble, but once you extend the trend line out a few years with exponential appreciation, it catches up to those 2008 prices quite quickly.

That was my first big aha moment in analyzing the housing market. At the time, I felt that this new insight fundamentally changed the argument when talking about the housing market. The argument that “this time it’s different” was always used by housing bears to discount the bull argument that prices could be maintained at high levels. However when using the correct trend line, the rapid price appreciation from 2000 to 2008 was in fact not very different from previous runups in Victoria. In fact the burden to prove that this time it was different had shifted into the bear camp and it was now up to the bears to explain why this time prices would crash.

I ran this by a prominent housing analyst – Ben Rabidoux – who responded that while he saw my point, he didn’t think it was reasonable to assume that house prices could continue to expand at such high rates forever. While I agree with that, at the time I didn’t really have a good reason why they wouldn’t other than it felt unsustainable. For the real estate bulls out there, this is probably your favourite chart.

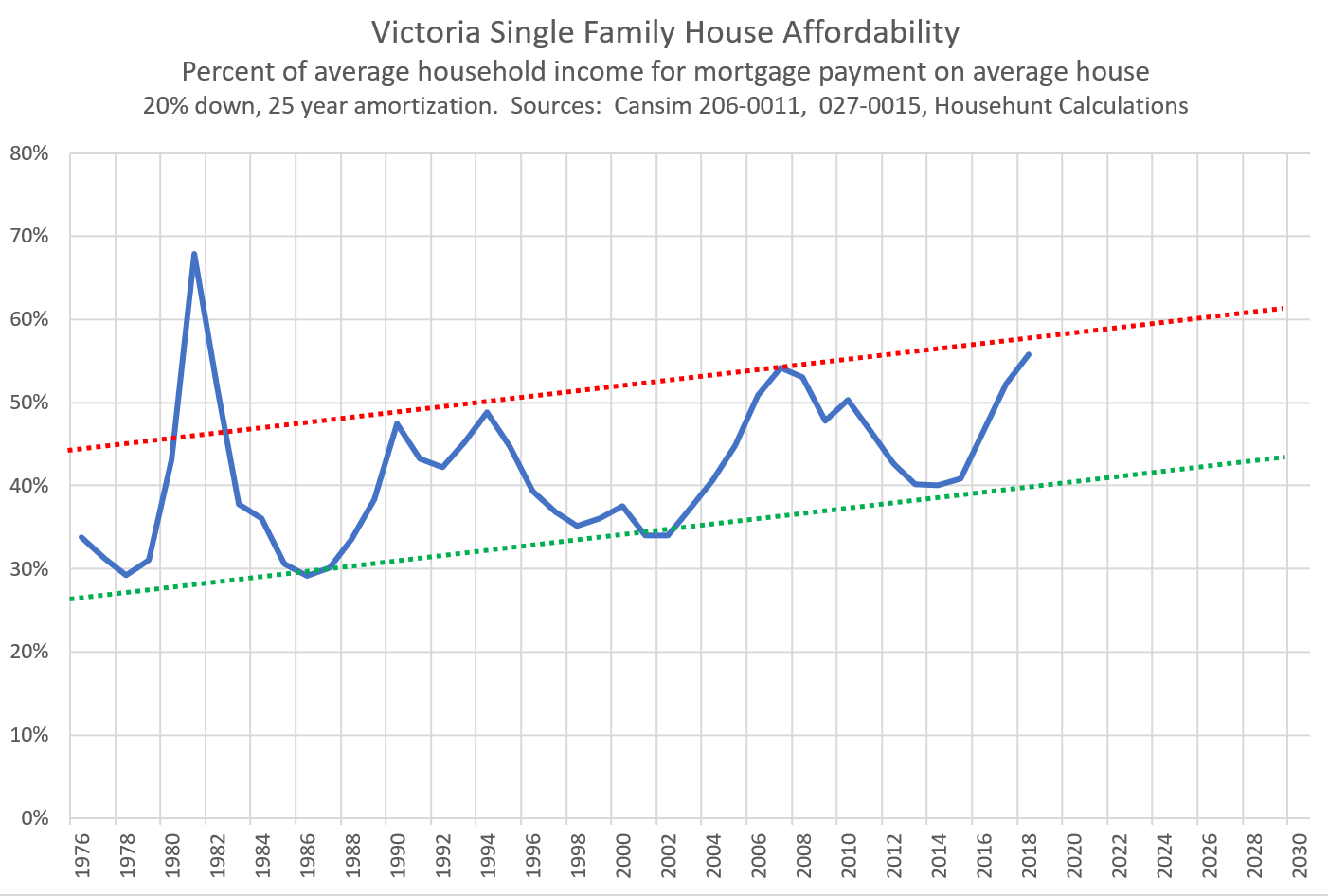

A little while later I had my second aha moment when I discovered the pattern of affordability and how increasing incomes and declining interest rates had enabled that 3.5% appreciation for so long while keeping affordability ratios within a fairly narrow band. This finally explained the pattern of strong house price appreciation to me in a way that did not rely on dogmatic beliefs like “house prices always go up” or “Victoria is a desirable place”. So far my bet is that affordability is one of the most powerful factors in the market and one of the most useful in assessing the level of risk in current prices.

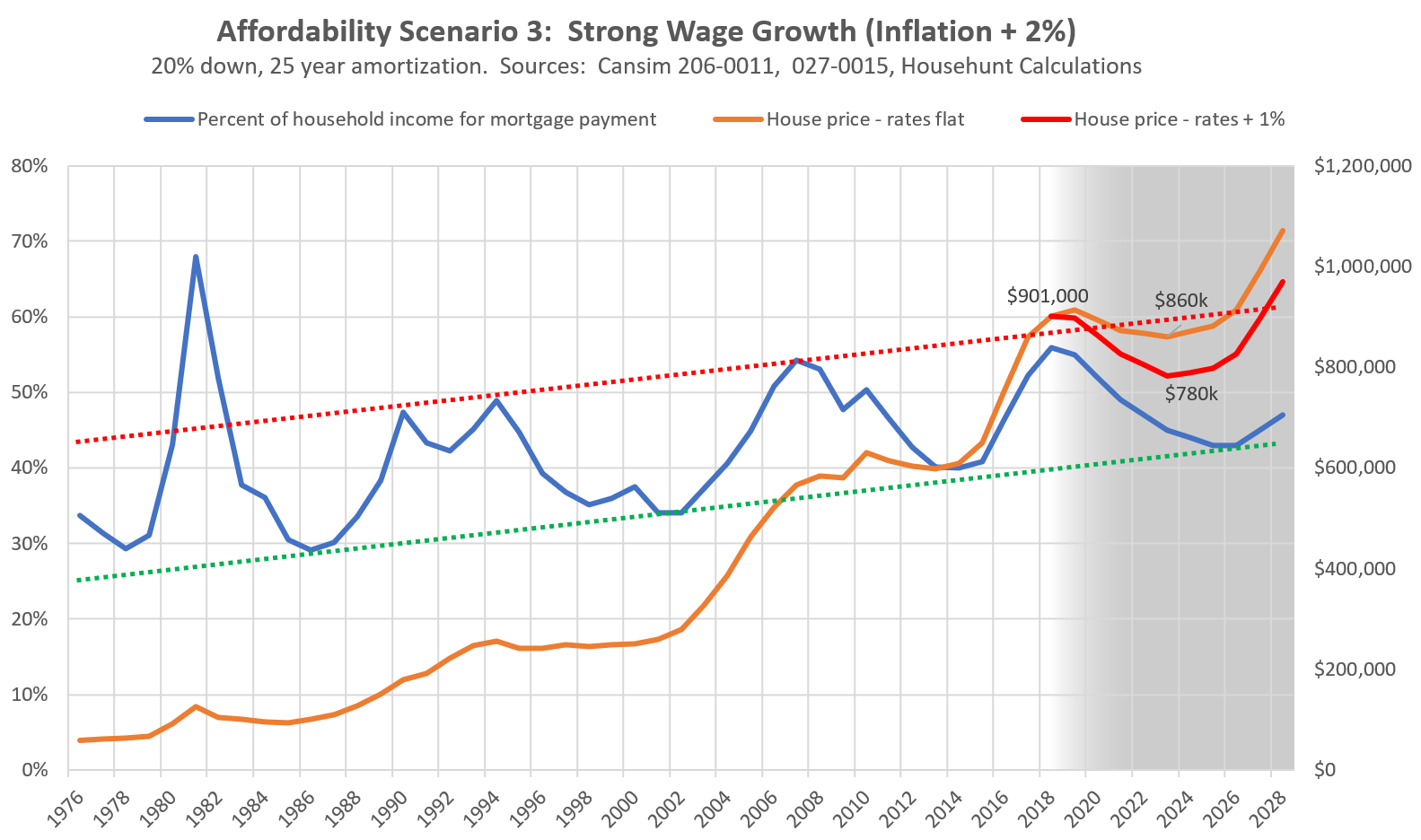

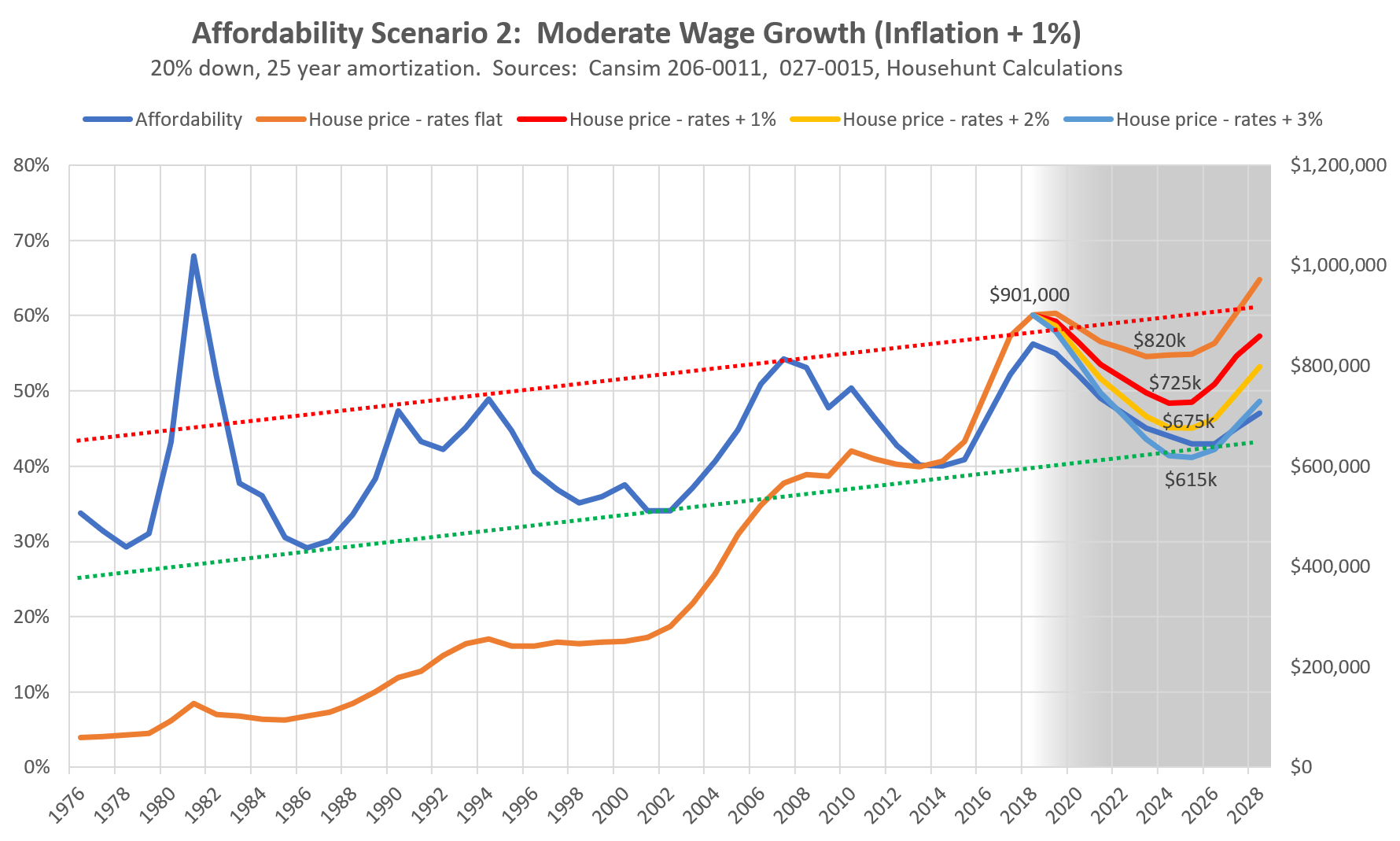

A few months ago I modelled some possible impacts on house prices under various wage growth and interest rate scenarios if the pattern of affordability continues as it has for the past few decades. The result was a range of outcomes for prices in the next 5 years from roughly flat to a 30% decline depending on what happens with wages and interest rates. Of course I shouldn’t have to point out that these are just projections, no one has a crystal ball, and you should not use this to make any purchasing decisions.

The real acid test will be in the next few years. Up until now, the trend of inflation adjusted single family house prices increasing at about 3.5% per year and the trend of affordability staying in a relatively tight range have been able to coexist primarily due to dropping mortgage rates. Going forward that cannot happen, and one of these two trends will break.

Will house prices continue their historical rate of appreciation and thus detach completely from local incomes? Or will prices continue to be bound by incomes and thus no longer be able to appreciate at historical rates?

New high mark set for an Oaklands bungalow – 862K for 2841 Shakespeare, 30k above asking. And this one is just a 4600 square ft. lot…

Grace:

That just sounds so sad. Might be time to ban all foreign buyers in BC.

Just back from aday in Vancouver with my sister. We drove through their previous neighbourhood in West Vancouver. On her street alone four houses have been razed and four ugly concrete boxes are going up. Her beautiful character home which they poured their heart and soul into sits empty as it has for two years. The gardens she toiled over are overgrown and the house just looks so sad.

A family bought the house and sold it after about four years. The new foreign buyers put it,on the market for an insane price. Didn’t sell,and now they have just left it.

This makes me sick. A lovely, large family home sits empty

left to deteriorate because of greed.

And yes three of her friends have sold and moved to Victoria.

Please please Victoria don’t let what has happened to West Van happened here.

And icing on the cake my sister showed me a new 16000 square foot house being built across from WV High….four houses torn down to build a monstrous ugly mansion.

My sister said people in WV have vowed to never let this happen again…god I,hope they are right.

As we all wait for the Monday numbers. Anyone care to guess if the sales are up or down; has inventory increased?

Getting nasty out there on world markets, including Canadian indices…

What about the person who bought at $1.5 mil, has lost most of his down payment, and now faces even higher monthly payments?

“Driving around Gordon Head (where I live) reveals a number of unkempt properties with little to no sign of residents.”

Could be old people too. There’s a property down the street from us (in Gordon Head) with no car outside and the lawn looking like a field, but I have seen an old lady tottering around sometimes. If I didn’t go by often, though, I wouldn’t know anyone lived there.

You could probably pick an address and see if it sold in the last 3 years on e-value BC, since that’s when foreign ownership seemed to take off.

Yep. So what to do? Best idea is what you are doing. Invest in yourself.

Driving around Gordon Head (where I live) reveals a number of unkempt properties with little to no sign of residents. I just might drive around the rest of the city to see if this the same in other municipalities. Future spec tax listings?

@guest_45294

The search for yield is absolutely right.

Almost all asset classes are overvalued.

Part of the problem with my “but the fundamentals” argument is that in some ways, they’re being disturbed due to CB manipulation. In my view, their attempt to smooth over 2008 actually made the problems worse. Globally, people are now plowing money into high risk assets in attempt to get yield, debt is being ignored, and everyone thinks now the CB’s have their backs. Hence to some extent it’s tough to look at fundamentals alone. However that doesn’t mean they don’t exist, all debt needs to be paid back, and CB balance sheets cannot expand forever.

On the other hand, RE is a bit different. Human shelter is a national resource so precious it’s second only to food and water. If people can’t afford to live there, either prices come down, or the community shuts down. My understanding of history is that it almost never gets so bad that the latter occurs.

I’m not sure that quote is entirely a New Paradigm™ argument. It is a different time now – but I don’t think it will lead to a different outcome, if that makes sense.

I’m not waiting for any particular % decline before buying, I’m just waiting for something that works which I can afford. I could buy in James Bay now, but the places I can afford are a terrible deal. I would at least like to see where the current slow down is headed before getting serious. That said, a return to late 2016 prices would probably be enough for me to jump if I found a desirable place, which would be a drop of about 15%.

None of that math is relevant to me. I could win the lottery and I still wouldn’t pay $5k/month for rent or mortgage. Housing just isn’t worth that to me regardless of luxury or location. I have enough saved that my investments are paying the rent. So that takes the urgency of owning way, way down.

You’ve successfully demonstrated that overextending to the maximum extent of what’s legal is a dreadful idea, regardless of timing.

See Figure 1, “THE GRAPH”, label “New Paradigm!!!”. It’s different this time™ .

Local Fool,

I agree but we are living in a different time now, hence everything are out of control. Run away housing price, billionaires instead of millionaires, and government corruptions is the new norm.

I think because we live in a relatively stable era (lack of wars locally) for more than 70s years that allows government to become unwieldy, and unscrupulous individuals have time to manipulate the market to accumulate wealth and power.

QT:

Thanks for dropping the fake pidgin. The relief you feel in not having to add that contrivance to your posts is matched by mine at not having to read it.

Correction: $1.275 mil would be a 15% lost for $1.5 mil James Bay SFH.

Posts like this is what makes me think that so many folks have utterly lost touch with the implications of such numbers, almost to the point where they have no meaning at all. Numbers that ludicrous, IMO, highlights the level of risk in the market right now.

We have collectively lost our minds on real estate to the point where we cannot even conceive of the reality that every market eventually faces after a protracted boom, even if it’s starting to unfold right in front of our faces.

People who think the monstrosity we’ve created is sustainable, good for an economy, or promotes prosperity have to have a level of cognitive dissonance I can’t even imagine.

Leo S,

The scenarios in my previous post are unlikely, however it demonstrate that the outcome may not be in favor of those who wait.

Let’s drill down the possibilities of a full 2 points rate increase as many people has predicted in this forum, and hope to God that the market drop of 15%.

$1.275 mil would be a lost for $1.5 mil James Bay SFH.

$342K down payment, at 5.3% mortgage for 25 years fixed = $5587 monthly payment.

Unintended pun there. Anyway what are you referring to apart from Glen Clark’s deck, which had no knockoff effects on anyone else?

That is – surprise – solely because Oak Bay has the most expensive houses of any CRD municipality. In fact for a given house price Oak Bay has just about the lowest taxes.

http://saviifinancial.com/tools/bc-municipalities-property-tax-calculator/

Exactly the reason we need proportional representation. If the liberals didn’t have a majority all the time they wouldn’t have gotten so corrupt/complacent.

If there is an affordability driven downturn then it would/should reduce the monthly payment (at least as a proportion of income if not in absolute terms) as it has in all the other downturns. So I don’t think any of your three scenarios that result in much larger monthly payments are likely.

Yes true should be separated out by SFH vs condo

Leo S,

It is possible that property tax is the most expensive in Oak Bay, but IMHO it could be that the $6K number is skewed by a large number of expensive SFH in Uplands, low number of condos, and municipal services such as garbage/recycling collections, free large garbage and garden waste dumping, environment fees, etc… are included.

IMHO, Langford is shown at $2447 is due to high number of condos and tiny houses. The average SFH property tax is a round $3500, with out garbage/recycling collection, large garbage and garden waste, environment fees, etc… The true total municipality fees and taxes of an average SFH in Langford is closer to $4K to $4.5K per year.

The fact is that property tax in Langford is higher than Oak Bay if the Langford house is assessed at the same price as an Oak Bay house, and that hasn’t factored in the free municipality services that Oak Bay residents enjoys.

BC Municipalities Property Tax Calculator — http://saviifinancial.com/tools/bc-municipalities-property-tax-calculator/

Current Statistic average RE — https://www.vreb.org/pdf/VREBNewsReleaseFull.pdf

Josh: I am curious, roughly how far would the James Bay housing market have to fall before you wold buy. Are we talking 10 or 15% or are you needing a 50% decline.

A seperate question is whether you are still in the same boat if house prices decline by 15% but mortgage rates go up by two full points?

Sweet Home: What is more amazing is that we have managed to convince some many people that being crammed into a small condo at an outrageous price is both virtuous and trendy. Trust me that the rich developers who made millions off of the sky coffins dont actually live in these little boxes.

Actually, I have noticed that good quality pieces of furniture are still demanding top dollar and sell in a blink of an eye. Don’t know about China and silverware though. At some point the millennials might start to wonder why they are poorer than their parents generation. But there is a good chance that we might convince them that being poor is actually being virtuous. Seems to be working so far.

Josh,

IMHO, if the average buyer couldn’t afford a monthly mortgage for a place in James Bay today, then they would have a difficult time buying when rates are high even with RE price drop.

Let say the average detached SFH in James Bay is $1.5 mil.

$300K down payment, 25 year amortized, 5 year fixed at 3.3% = monthly payment of $5860.

RE market price drop of 20% ($1.2 mil) in 2 years.

$342K down payment (with 7% yearly investment gained for 2 years), 25 year amortized, 5 year fixed at 7% = monthly payment of $6010.

RE market price drop of 40% ($900K, 1982 scenario) in 2 years.

$342K down payment (with 7% yearly investment gained for 2 years), 25 year amortized, 5 year fixed at 20% = monthly payment of $9011.

Difficult to see. Always in motion is the future Padawan.

Is there a chart of what the average priced house is for each of these districts? Would be interesting comparison.

Hawk the only reason the NDP has not gone back to their scandaless ways is they have minority. Same old clowns running the gong show from the 90s. They will run this economy into the ground.

Worth it get rid of them.

Oak Bay still by far the most expensive to live as far as taxes go. tax bill on average house is over $6k.

https://infogram.com/vancouver-island-total-taxes-on-an-average-home-for-2018-1hnq41lq1e1x23z

Keep up the liberal facade joke gwac. The NDP could never match your liberal buddies destruction and corruption of our province. They let the worst of the worst waltz in here with tens of billions of dirty money. Keep embarassing yourself defending criminals.

“But Eby said the shady activity in casinos could just be the tip of B.C.’s money-laundering iceberg.

“There is an appearance of a link between casinos, the real estate market, the fentanyl crisis and drug dealing around the province,” Eby said, adding German has also flagged suspicious financial activities in the B.C. horse-racing industry and the sale of expensive luxury cars.

The report coming this week has been sitting on Eby’s desk for months, a delay Eby said was required because B.C. government officials and departments are named in its pages.

“It involves identifiable groups and individuals,” he said.

Those groups include the gaming enforcement branch and the B.C. Lottery Corp.”

@Barrister

Thanks for reply. It sounds like you are leading a lovely life. I think you appreciate that you have lived long enough with enough health to enjoy the fruits of your labour (and luck and circumstance). Also, you make an effort to stay engaged, which is something many retired people neglect.

We have a relative who is downsizing, and I have been doing some investigation into how to get rid of things and whether or not they are worth anything. Apparently there is a glut of used china and traditional furniture worldwide as both Baby Boomers and millennials live more simply in smaller spaces. It’s interesting to think how demographic trends and the increase in price per square foot of housing is affecting consumption patterns of home furnishings.

Hawk that is the funniest post I have ever read by you on here.

Corruption happened in the 90’s under your gang of thieves.

I’d be hanging my head in shame that I supported the money laundering BC liberals but righties have no shame when it comes to corruption. It’s their whole game, that’s about blow up in their faces.

Brutal but true.

Screw the universe! I’ve got another year or two of wait in me and my bank account.

Queue bulls telling me how waiting is financial suicide.

Yes, it is. Very fortunate to have the arrangement we do, actually. We were finishing univ before, so it’s not like we were going to buy then anyways. 🙂

Local you just finished primary and enjoy secondary. Not buying that gone well so far for you?

Prices barely went down at close to 6k listings. All this excitement at 2500 is cute.

Unless there is a dramatic and sustained shift in the provincial sales data, he’s not likely to be the one who’s going to be sent to school…

Every day I read comments from a new I am too smart to buy into this market because I know better.

How is that been working out for you?

Today’s 5m dollar dude brought an extra smile to my face.

You are about to get schooled in how it works on our little island. Enjoy and just like the original person who started this blog. You will eventually hang your head in shame and buy something to be never heard from again on here or turn into Hawk . Lol

Barrister:

My dad owned a number of second hand furniture and antique stores in and around Victoria from the early 90’s to the late 00’s. Reading about the gems you found hidden amongst the junk reminded me of my childhood, and hearing my dad explain the same things to me. Some of my best memories as a child involve sitting around the dinner table on Friday night with my dad as he planned out his Saturday morning garage sale route, cross referencing the TC Classifieds with his map.

You hit the nail on the head: the quality time you share with your partner/parents/kids on the hunt is what makes it so enjoyable. The bakery probably helps too 🙂

Once,

How do we know you and Intorovert aren’t the same? Too much time on your hands.

Thank Christy and gwac’s BC Liberals who allowed this bubble to happen with rampant money laundering.

Eby’s report should be very interesting since liberals abandoned the watchdog agency after the Olympics.

British Columbians should prepare for a “mind-blowing” experience when David Eby releases a bombshell report this week on the extent and scale of criminal money laundering in B.C. casinos.

The report — prepared by former RCMP deputy commissioner Peter German and set for release Wednesday — will explain how B.C. became notorious around the world as a money-laundering hotbed, Eby said.

http://theprovince.com/news/bc-politics/mike-smyth-eby-set-to-tackle-mind-blowing-money-laundering-in-b-c

I went to an open house yesterday and the realtor doing the showing was not the listed realtor. The first question she asked me was if I had a realtor. I was honest and said I was alookielu. She said that realtors aren’t doing open houses on their own listings because there is no point. They can’t

represent anyone who walks in without a realtor.

Is that what is happening now because of the new dual representation rule changes?

Sweet Home:

I dont think that there is any hard and fast rule as to where the best garage sales are to be found. But generally speaking the more upscale neighbourhoods hold out more promise.

Personally I avoid Esquimalt, Fernwood and also James Bay.

The best deals depends on what you are looking for I guess. Recently I suspect the best deal was a solid brass antique umbrella stand for $4.00 that is listed with a couple of US dealers for around $450 US. Also a couple of very high end German chef knifes which sell new for over 200 each for a dollar a piece (both just needed sharpening. A four drawer barristers bookcase with stained glass in perfect condition for forty dollars. A new, unused Cuisinart coffee maker for three dollars. Since we only buy items that we are planning on using I am sure that we passed up on lots of other bargains. For young couples with kids there is a bonaza of great toys for next to nothing.

The real treasure was spending time and having fun with my wife. We tend to start up in Sidney because I love the bakery up there and we tend to grab things for our Sunday night card evenings with our neighbours. What I have noticed is that there seems to be a lot more professional dealers pillaging the garage sales these days.

@guest_45304 (numbershack)

The point of the comment was to illustrate to bearkilla not to confuse can’t buy a property with won’t buy a property

@Barrister

I’m curious about the garage sales. Do you find a difference in the types of items in different neighbourhoods? Are the sellers more likely to be older people downsizing or families just getting rid of extra stuff? What’s the nicest thing/best deal you’ve found?

@Anna Edwards, a few Asian realtors (victoraibbs.com) run side business as property management company without Rental Property Management Licensing. Those home owners are their clients.

Long term rental or flipping is quite common in Gordon Head.

Also, when I went to a pac meeting at lochside elementary school, I have heard parents are so mad about the frequency of changing their neighbours/renters etc in Cordova bay. I asked further about the owners, they said the chinese….

How do we know that Hawk and Bearkilla are not the same person, trolling all of us…

Ahh, we have all been there. Young full of bravado and a little money in the bank we scream it from the mountain top. If you are young and are fortunate to make some money, be grateful of what you have, as many people have not been as fortuitous. However, no need to advertise, as there are as many people who have as well or better!

Wealth is not what you have in the bank, but how you utilize it. In terms of housing, could be a rental, a comfy condo, or a mansion, everyone’s different. But real wealth is your relationships with the people who truly care for you.

FWIW, people who need to track their worth…eh…let say that they are not really that wealthy! Leo S is absolutely right for such a young kid, your networth could be a gazillion dollars, but if it is stuck in inventory in your co…well haha, you can not pay your workers with widgets haha.

Dear Rotten Tomato:

Personally I never thought of a house as anything other than a home. Certainly not as an investment. For me there is an intrinsic value in owning a home. Before everyone jumps on me I wont disagree with the investment and math gurus on this blog who will argue the contrary. I never claimed to be sensible in my buying habits including owning a number of horses. While building a 5 million dollar business in your twenties is an accomplishment it is important to savor that success with quiet modesty.

Bearkilla, Personally I suspect that we may be entering a period of declining house prices. But I dont believe that you can paint me as a bear if for no other reason than that I dont

make predictions. Maybe it is time that we all tone down the rhetoric just a bit. But feel free to beat up on me.

I assume most of the $5M is in the business. Makes it a bit tough to extract for a house. And if you have a $5M business in your 20s, I assume your taste in houses is not some ramshackle Oak Bay bungalow either.

I’ll tell you, if I had 5 million bucks I would be tempted to get what I wanted and say the hell with the market. Have you ever been tempted even a little? I don’t look at my PCS anymore for exactly that reason. It’d be too easy to get into that “got to have it” mode.

Bearkilla, I am in my late 20s, own a business, and my net worth is in excess of 5 million dollars.

I rent because I’m not a moron and I refuse to by into this “irrational exuberance”.

Land has utility, buildings are depreciating assets. Houses are meant to live in plain and simple.

Speculate all you want, but don’t pretend your Warren Buffet because you had some paper gains of 200-400k in the last couple years. That’s nothing who gives a *&@%.

Dummies like bearkilla are in for a rude awakening. It can happen and will.

Why a US-Style Housing Bust & Mortgage Crisis Can Happen in Canada, Australia, and Other Bubble Markets

“So Canada and Australia, with their majestic housing bubbles, face the same scenario that the US faced: when home prices drop sharply, some homeowners will abandon their mortgages because they’re unable or unwilling to make payments on an underwater mortgage or a money-losing investment property. This becomes a huge issue when people they lose their jobs.”

https://wolfstreet.com/2018/06/20/us-style-housing-bust-mortgage-crisis-in-canada-australia-recourse-non-recourse/

Mind the “Directional Shift” in the Housing Bubble in BC, Canada

“However, a recent slowdown in the housing market is beginning to test the province of BC. Fewer full-time positions drove a 0.5%, or 12,000-person dip in total employment from April. Overall, employment has eroded since a December peak, cutting year-over-year growth to 0.1% which was the weakest since 2015.”

https://wolfstreet.com/2018/06/22/mind-the-directional-shift-in-the-housing-bubble-in-bc-canada/

Saw bearkilla collecting bottles on the side of Pat Bay today. I would have tossed him a few but my Ferrari was going too fast. 😉

Ownership is getting tougher by the day with all those slashes stacking up and rates only going way way higher.

Summer is here bears and guess what? You’re still a forenter. Wow just like last summer. Maybe next summer you’ll get a good job and buy but not likely. Just sad.

Federal income tax brackets have been indexed to inflation since 1973. If you mean indexing them to house prices, no of course, but that would be madness. Not sure about provincial but those interested can look it up. In any case I believe BC income tax rates are still lower for everyone than they were under the former NDP government 20 years ago.

https://www.nytimes.com/1981/08/23/business/what-indexing-income-taxes-produced-for-canada.html

Nan makes an excellent point about after tax incomes and that is before accounting for all

other increased taxes being imposed which would reduce the amount of disposable income left for housing.

One of the things to note in my article posting below (and alluded to in the Youtube video) is the context of this 29% drop in sales.

The last time we saw such a precipitous drop in RE activity in 2008, the global economy was on the verge of complete collapse, with panicking central bankers pumping tens of trillions into the global credit markets in an epic effort to get the credit engine moving.

But here we are again – except now, there is no global economic collapse, and BC is at almost record low unemployment, and strong wage growth. What’s going on?

A blip? A quick window of opportunity to buy? Or are we beginning to see the results of billions of dollars of capital being foolishly dumped into an economically unproductive asset class using money we don’t really have, and now have to pay back?

BC Home Sales Fall 29% in May – Largest Drop Since 2008

On the surface the BC economy appears to be humming along, unemployment rates remain low, declining from 5% in April to 4.8% in May. Labour force participation rates and employment rates remain elevated which is helping pump year-over-year growth in average hourly wages from 5.6% in April to a whopping 6.9% in May.

However, a recent slowdown in the housing market is beginning to test the province of BC. Overall, employment has eroded since a December peak, cutting year-over-year growth to 0.1% which was the weakest since 2015.

This might not be surprising considering recent data on the housing front. BC home sales dropped by a head turning 29% year over year in May. This marked the largest percentage decline on a year over year basis since May 2008 when home sales tumbled by 31%.

http://vancitycondoguide.com/bc-home-prices-in-may/

https://www.youtube.com/watch?v=UlEO7VhrnJg

This is one piece I’ve mentioned and never got much of an answer to. I know there are people on here and elsewhere that believe what we have seen will continue, or will resume after a small, short blip. I also suspect that at least some of you people are of means to acquire investment property today if you wanted. So why aren’t you?

I know you aren’t, because sales volumes in BC are presently dropping off a cliff. Why aren’t you going out there, and loading up on every piece of property you can get your hands on? If you’re convinced the mania is going to continue, refusing to buy now (if your aim is to make money) doesn’t seem like a very shrewd choice to make. You could literally make multiple millions, within a decade.

VB is correct – listings are growing, and in some cases, there are relative “deals” to be had. I would suggest exactly the same thing: quit debating, have the courage of your convictions, get out there and buy as much property as you possibly can. You have more choice, fear is growing – why isn’t now the time to strike? Because prices might be a bit lower in a few months? So? What difference could that even make when you stand to reap such huge gains?

…Uh oh. 🙂

@ Victoria Born – Incomes would need to increase more than that unless the government increases the tax brackets which I do not believe they will do. As the average salaries go up so does the average tax rate necessitating even higher incomes for a given house price.

I would say if you are looking for a similar stress level for income earners to house prices at normalized interest rates, at those incomes house prices over 2-3x would be high enough as average tax rates would increase from 25%-30% or whatever they are now to 45-50% at new inflated incomes.

I never understood that metric anyways since it ignores the massive and increasing tax burden at all levels in Canada. What good is 3-4 x when that might be 6-8x what you get after tax?

A multiple of average after tax income is far more valuable I think.

Wonderful day out and I hope you all have enjoyed the sunshine.

Josh: That is interesting about the age restriction with 26 Menzies. Does anyone know if that age restriction is enforceable by the Strata if a owner becomes pregnant after moving into the unit.

Josh, the universe simply does not want you to buy in James Bay. Of coarse by the time that you can afford to buy something you actually want in James Bay you probably wont want to live there anymore.

I am getting the impression that sales may have picked up a little bit; the last of the spring market?

Matters little what BOC does – US fed on course for 4 rate hikes this year (3 in the bag) and 3 to 4 in 2019. David Rosenberg says 100 basis points is needed just to get to neutral on the fed funds rate, which he says will be done by end of next year. Why is this important? Mortgage rates are set in the bond market – as the US Fed tightens, mortgage prices fall and yields rise and our mortgage rates rise – Canada is not an Island, though Victoria may be on one, it is not immune.

As LeoM stated, I too will stick to the exact path he outlined below. To say this is a straight line up (or to the right) by extrapolating from the 3 hottest years (and drawing a straight line to the right upwards) in the rear view mirror, and thereby ignoring new the policies targeting this very excess, is to truly have one’s head in the sand [or up somewhere else]. But, if you believe that the rule of 72 applies to this, you should be buying full speed ahead as prices are being slashed right now – these future multi-million dollar homes are on sale – millions are to be made – you should have the courage of your convictions and buy. But you are not because you know this is over.

It will take decades for incomes to rise sufficiently to be in line with the historical average [median house price divided by median income = 3 to 4]. If your average home is expected to be, as below is suggested, $1.6 million, then the average household income would have to rise to $400,000 to $533,333. Assume 2 income earners in the household making the same amount per household, means an average income of $200,000 to $266,666 per person. Incomes are rising 1.5% per year [even raising minimum wages won’t do anything]. It would take decades or even generations for equilibrium to be restored.

Better to sell short.

The consumer is tapped out, rates still going up, don’t look good pumpers.

Canada’s Economy Just Wobbled But Rate Hikes Are Still In the Cards

https://www.bloomberg.com/news/articles/2018-06-22/canada-economy-falters-as-inflation-stalls-retail-sales-drop

I have 82 slashes on the week, most in prime hoods under $1.3 million.

LeoS.

Why don’t you use 25% downpayment like RBC does ? Is it to make it look more affordable than it really is versus how the banks lend out the money? That’s fudging the numbers. That changes the chart 6% lower. I want to know what the banks use as a lending metric.

“Our standard RBC Housing Affordability Measure captures the proportion of median pre-tax household income required to service the cost of a

mortgage on an existing housing unit at market prices, including principal and interest, property taxes and utilities; the modified measure used here

includes the cost of servicing a mortgage, but excludes property taxes and utilities due to data constraint in the smaller CMAs. This measure is

based on a 25% down payment, a 25-year mortgage loan at a five-year fixed rate, and is estimated on a quarterly basis. The higher the measure, the

more difficult it is to afford a house. “

26 Menzies St is a good example of how BS age restrictions are. It’s not 55+, it’s 19+. You’re not allowed to procreate in the home you own. Places like this only show up once or twice a year. It ticks all my boxes and I could get that place if it wasn’t for the demented no knocking your wife up rule. God that’s infuriating.

Another drop for 255 Government St. It was originally $1,888,888. Guess all that luck wasn’t enticing enough. It was on the market all the way through the 2 hottest years on record, it’s been kind of amazing watching it not sell. They tried 8’s again with $1,588,000 and now it’s $1,525,000.

Looks like another beautiful day and we are off doing garage sales. It is a great excuse to take a nice drive while we are treasure hunting.

With Hawk not here, I don’t think anyone mentioned the word “slash” today. So, this one raised my eyebrow: 945 Woodhall Drive (High Quadra) went from $949K to $839K. That sounds bad, but it is only assessed at $749K. It backs Christmas Hill Sanctuary, so that might make it worth more, but the interior is also quite dated.

Man, the wechat convo’s i watch (group chat 600+) are all mad about the 20% tax they have to pay, and are picking Montreal over Vancouver. Someone mentioned Victoria, but no one else knew where it was.

That’s great!

late30. What are they doing with these several properties that they purchased?

Victoria is small, but now is the 1st choice of many rich immigrants from China. I have been actively watching their wechat activity, group chats( group members of 500+). Some of them are staying their kids for school , but they did purchase several properties.

In the past three years, there are about 4000 immigrants just landed in Victoria area.

I predict the house price will go up about 5% each year( NOT 3.5%)

I meme’d. Bulls be like

Larger cities are more subject to global capital. Vancouver isn’t “world class”, but it is a gateway city that has, and has always had, strong connections with the orient. Toronto basically just has its sheer size, compared to anywhere else in Canada.

Huge price run ups in larger cities can get larger feedback loops than smaller ones. As prices rise, more and more people get into the fray to expose themselves to rising valuations. This in turn attracts money from global sources, who are seeking returns on their moneys.

Victoria is much too small to see a dynamic like this, and is inconsequential in a global sense. So when Victoria has a run up, it’s much more driven by local and nearby sources. This is in a sense a good thing, as any “bubble” is likely to be much smaller.

But this is what makes Vancouver so dangerous, IMO. It has seen this global feedback loop, and in a few short years, is in a severe social crisis because their housing is suddenly completely unmatched by the supporting economy. The problem is foreign capital has no allegiance – it will appear, and disappear at a whim. And the latter will occur at the first sign of trouble, and what happens there, invariably effects here.

By the way, here are the sales volumes for Vancouver real estate from May 21-June 18, 2018:

Detached sales………… – 44%

Townhouse sales……… – 42%

Condo sales……………… – 36%

Remember – falling sales volumes are one of the leading indicators of price declines, if the phenomenon is persistent.

Take a look at this chart

Best fit changes depending on the data range and where we end (top or bottom of the cycle). Either way these are quite close to each other.

I do not anticipate this trend to continue. I believe that affordability constraints will mean much lower appreciation in the next decades.

Had a chat with another realtor the other day, she has seen more people holding off on purchases worried about the market and one deal that collapsed because the buyer got cold feet about potential declines.

The latter I would say is a bad decision. Backing out of a deal is breaking a contract and extremely risky especially if the market declines. People in Toronto doing the same ended up on the hook for tens or hundreds of thousands when the property resold for less and they had nothing to show for it!

LeoS, your latest post is outstanding, in fact there isn’t an worthy adjective in the English language to describe it. Well done. It won’t be long before some wealthy foreign investor makes you an offer you can’t refuse to keep doing your weekly analysis but exclusively for him/her.

However, although I agree with everything you posted about the past trends, I’ll stick to my prediction that the next 20 months will see changes that negatively affect SFH prices, and that will result in an exponential increase in unsold listings, and prices that will decline slowly at first but price drops that will gain momentum as we approach spring 2020.

Excellent post Leo. Best yet.

I’d be curious how this applies (or doesn’t) to other Canadian cities. I remember discussing the RBC report that showed Victoria tended to stick to a fairly narrow band of affordability.. other cities didn’t stick to such a narrow band. What about Vancouver and Toronto, where the claim is they have detached from local wages (and so should be out of their historical affordability band).

I have not mostly because it is quite challenging to find long run house price and income data. However the RBC affordability reports are good for Canada. http://www.rbc.com/newsroom/reports/rbc-housing-affordability.html

http://www.remonline.com/theredpin-closes-down-being-a-tech-disruptor-isnt-easy/

Tech focused and discount commission focused brokerage in Toronto closes down.

King suggests that TheRedPin over-relied on providing discounted services and commissions to buyers and sellers. “A place that markets itself on discounts – when I’m talking about my largest asset, I have trouble with that.”

Interesting how resistant not just the industry but also the consumer is to any change

Doesn’t that seem a little far-fetched? That the trend will continue I mean.

Yes, according to the rule of 72. https://en.m.wikipedia.org/wiki/Rule_of_72

By the way thank you very much to the anonymous someone and kind words below. I appreciate all the readers and commenters.

On Saltspring island this weekend for a big EV show.

http://www.revolutionss.ca

So a decade until doubling then?

Here’s the point where you must start actually questioning your analysis Leo.

Correct

The site needs to consider putting up a warning to readers that it contains graphic content.

Gwac’s probably right if we get the typical 170%. If my math is correct that would put us around 1.6M by 2025. If interest rates & inflation start to soar like the 70s then nominal prices would of course go much higher. People are also underestimating how fast wages are rising.

Btw, great analysis Leo.

Holy crap. Can most of you please remove your collective lips from Leo’s ass? The hyper-fawning is getting weird.

“a 10% drop in SFH average price would be looked at by the bears as proof positive they are right and that Armageddon is imminent”

That is a collective statement. That collective believes Armageddon is imminent. The latter is false, on its face. Yes I know, there’s at least one poster that loves vitriol, but that’s not all or even most posters, despite what you said above.

Now, you’re attempting to support your argument by referring to individual statements that are merely crass, or otherwise just demonstrate an opinion that challenges your own – but both sides do this. Folks enthusiastically posting price changes up or down hardly qualify as support for what was your generalized argument.

The level of emotion coming off your posts makes me wonder if you’re trying to indirectly assure yourself you’ve made the right choice in buying recently. If so, I wouldn’t. Just enjoy your home. You’ll be fine as long as you didn’t overextend yourself or somehow, Armageddon actually strikes. In which case, we’ll all have bigger problems.

So the 3.7% trendline is above and beyond inflation? That’s like a 5.7 to 7.7% increase then each year…

James trying to stay in reality and what is possible in Victoria core. I choose other cities in Canada to get direction, so 1.6m average house price is definitely possible in that time frame .

7.5m is not very likely. 🙂

Except it’s been going up 20% a year. So clearly by 2035, those houses will be worth 7.5 million. I know what you’re thinking gwac, I’m being stupid, but Never say never.

Speaking of hawk, where is our old pal? Police custody (ahem, i mean vacation) like he was this time last year?

Ah, bipedal monsters. You’d think with data that clearly leads up to, and ends on a simple, to be, or not to be premise would be understood to be just that. Nothing more, nothing less.

But no, lol. What would be the fun in that? 😛

Seriously Leo, one of the best analyses I’ve seen you do. I don’t think this site gets the attention it deserves.

Nice work, Leo S. This RE price escalation is a function of lower interest rates – we have had 2 (plus) decades of falling interest rates – a secular trend that is now reversing. If you track the inverse of the falling mortgage rates [just use prime rate] against the SFH graph, you will see what i mean.

Incomes have not kept up with rising asset prices. We have a demographic pattern in play here. The baby boomers sit on over-priced homes and the buyers [millenlials] can’t even afford a picture of the home. So, who is to buy them? Enter the foreign buyer, who is now being called to account and backing away. Speculation tax, income tax [disclosure registry] and foreign buyers tax will all flush them out. Who is left – a millennial earning $50K per year.

Risks rise, negative cash flow for investors, more supply on the horizon……..The cracks get bigger and bigger:

https://bnnbloomberg.ca/toronto-housing-chill-may-soon-extend-to-high-flying-condo-market-1.1097195

Tick tock.

One last point for Leo here.

With that last graph, what is going to suddenly drive this massive wage growth?

We haven’t had inflation +2% in a decade. Even then, from everything I’ve found that was only a couple years, and I have to go back over a decade to see it again.

Can we get a graph that doesn’t incorporate unreasonable wage growth?

And it just so happens that prices in Toronto started falling last year.

@Leo

Markets are demand/supply driven and the common metric has been sales/listings and it doesn’t tell me a whole lot.

Don’t know if data is available but:

1/ Sales or Listings to absolute supply

– can find out the % of the supply being turned over YoY

– more interesting is the delta value YoY of % being turned over

– be very interesting to see the correlation with affordability (% of income) + rates

@Grant

You can quote Hawk over and over again.

Just like I can quote others on the board being ridiculous when prices were going up 20% a year. So if ridiculous people are a spade then…

You’re a spade.

James

Never say never. Toronto core hit that last year. Their median family income is very comparable. This will never happen argument just holds no water when populations grow and land stays constant. Anything is possible.

Victoria core the possibilities are endless on how far price can go. Governments with their changes have not changed demand they have delayed it which is not good to any large decrease and increases the chances of a further large increases after the rest we are going to see for 2 to 4 years.

why does your one chart show 3.7% increases when 3.5% is the best fit apparently?

How do you honestly see this going forward when there’s no lever for local people to continue to afford the 3.5-3.7% increases? Most people aren’t getting wage increases of anything near that, and interest rates going up are going to contract the affordability instead of what we’ve had over the last decade. At 3.7% increases, it’s under 20 years to double. No first time home buyers are going to be even close to the 1.6 million dollar average that this would be in the 2035 range.

On another note:

https://betterdwelling.com/canada-has-a-subprime-real-estate-problem-you-just-dont-know-it/

33% of people who got into the condo market in toronto in the last year are paying over 9% interest. Something is definitely wrong there. I can’t imagine that Vancouver is in better straights in that regard…

Grant you need to be gentle with the doomsayers. 🙂 Leo`s analysis has really thrown a bulldozer (wrench to small) into the argument of over valuation of the Victoria market.

Uhm, LF, are we reading the same comments? All one needs to do is look back even at just a few:

Post #43076

Post #43063

There’s LOADS of these. I’ll gladly take ownership of having a dishonest tactic if it is applicable, but I’m sorry it’s simply not. The board’s comments are overwhelming negative/bear. There is a steady undercurrent of anticipatory glee from what bears perceive as an impending market crash. Constant posts “New price reduction!” “Interest rates heading up!” “Pumpers are going to get it good!”

Let’s call a spade a spade, shall we?

All the house prices are inflation adjusted already except the first and last chart. The 3.7% is after inflation.

@Leo,

If you ever want to quit your day job or want some project work on the side PM me.

Your train of thought with different scenario analysis + the being able to present it succinctly, (whether it is right or wrong) should be commended.

Keep up the good work!

Nice work Leo. I’m curious what the affordability curve would look like under the hypothetical of a flat long-term historical average interest rate, but keeping house prices the same. Perhaps this wouldn’t yield anything interesting. What I still find shocking is that as late as the early 90’s, the average Canadian’s personal debt was something like 85-90% (I think) relative to income. Today it’s pushing around 175%.

Very good … but! Inflation has not been flat since 1970’s, or ever. That’s why they use inflation adjusted prices over time periods. It solves the problem of whether 1% or 2% or whatever is the right rate of appreciation. For what it’s worth, I would argue that 3.7 is a bit too high for the last 20 years, when inflation has been at or below 2%.

Grant, I don’t think you’re giving credence to everything Leo actually said there. It really does boil down to – do you think the market will detach from incomes here on in, or, will it continue to be constrained by affordability? The historical data says the latter. True, that’s no guarantee of anything looking forward. Will interest rates be on another 30 year down trend from here? I don’t know, but I wouldn’t count on it.

Incidentally, collectively framing your opponent’s arguments as extremists who all shriek little more than Armageddon is a cheap, intellectually dishonest tactic on your part that doesn’t really demonstrate strength of position. Few people on here are actually that far over, one side or another.

Leo:

I was curious as to what your chart looks like with an increase of 2.5 points on interest rates?

What’s pretty darn clear: Victoria is an “appreciation market.”

Thanks, Local Fool. That’s interesting.

I think Leo just “dropped the mic” – those graphs really say it all. Major props to Leo for continuing to provide content that really is objective and free of bias.

For all the lurkers out there who may be looking to buy (for principle residence) and are wondering what to do, don’t let the repetitive bombastic rhetoric in some of the comments on this forum blind you to what data like this really shows. The takeaways are:

1) Long term trends show the market is not in a bubble. Instead the recent multi-year run-up is the market coming back inline with the 3.7% trend.

2) However the market does appear to be slightly over-valued at this particular point in time (5-10% according to Leo’s chart)

3) As the market cycles up and down, over the next few years a swing under the 3.7% appreciation line would not be shocking either. (Also happened in 1996-2005)

Nevertheless, even with this data I’ll bet dollars to doughnuts that a 10% drop in SFH average price would be looked at by the bears as proof positive they are right and that Armageddon is imminent. It’s undeniable that even a broken clock is right twice daily. So if you can buy and hold, plus ensure you are able to weather any small increases in interest rates, you are very likely to be satisfied you got into the market. SweetHome’s comment illustrates this pretty clearly.

The latest Canadian econ data coming out is a bit of a stinker. Inflation is lower than expected, and retail sales are beginning to contract contrary to previous forecasts. StatsCan is suspecting that “inclement weather” is playing a role. Maybe, though I’d also suspect that folks diverting outsized portions of their income to housing might…just might…have something to do with it.

May challenge the notion of a July rate hike.

https://www.bnnbloomberg.ca/inflation-retail-sales-soft-patch-tame-expectations-for-rate-hike-1.1097272

Wow that was an amazing analysis. We will one day lose you to bigger and better things.

IMHO the big reasons were falling prices in Vancouver (I don’t think Victoria has ever gone up while Vancouver was falling), and no downward trend in mortgage rates over that period. Opponents of the NDP blamed them, of course.

Great post Leo!

I wish I would have had graphs like these 5 or 6 years ago. They would have helped me accept that spending $600K on a house was not crazy, since it was still “affordable” to many people.

My idea of affordable is an amount that ensures you have your house paid off no later than age 55, especially if you don’t have a defined-benefit pension. However, that’s not how most people do it.

Whatever the majority of buyers want, think they can afford, and can technically afford (in the sense that they at least get the money from somewhere) is what house prices adjust to. So, while we were saving for a larger down payment, several factors combined to produce buyers that would pay $800K by 2016 for the formerly $600K house.

For sure that trend is over for awhile. It would be lovely if it stayed pretty flat like from ’94 to 2002. Why was it flat during those years (I was too young to be watching real estate then)?

I was impressed by the work you have done on this.

Leo, I’m wondering if you’ve looked at the patterns of affordability in major markets across Canada and the US? I’d be curious to see how they compare.

Take a bow. I know a lot of these outcomes can be inferred through discussion and anecdotes but we rarely get to see current local market data sets be modeled so well.

My prediction is that there will be a slowdown, not a precipitous drop, in prices in single family homes throughout the CRD. As more and more people find it unaffordable to stretch their income to keep pace with risings rates, it will thin out the herd at the top of the pile. Though, I don’t have the same confidence in other BC communities that have less diversity in industry and higher instances of non-salaried employment.