CMHC forecast off to a flying start

A month ago CMHC released a bold forecast for real estate: housing starts would plummet in 2020, sales would decline until the end of this year, and average prices would decline by between 9 and 18%.

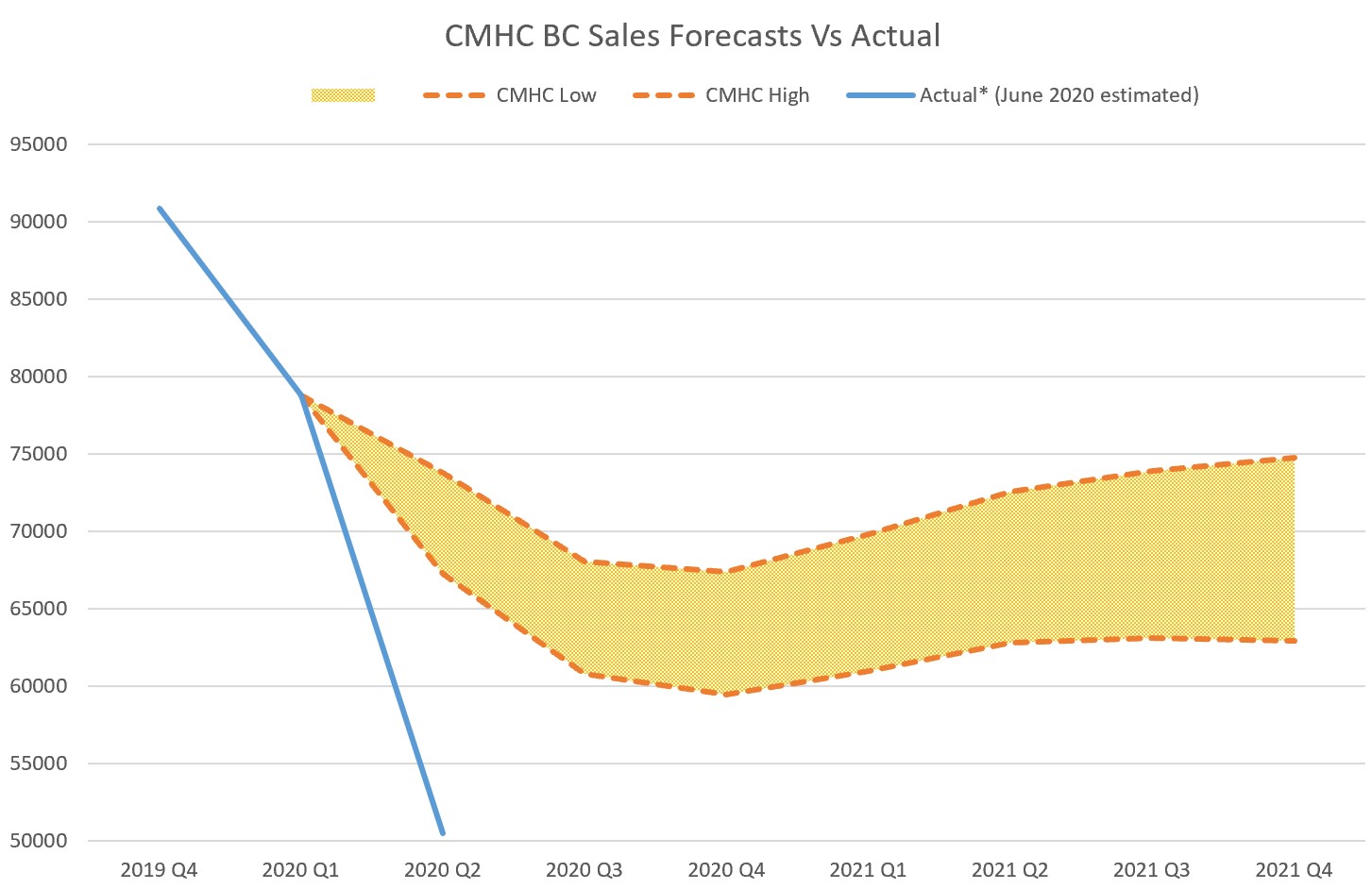

The first thing that jumped out at me about the sales forecast was that it made absolutely no sense. How could sales under an economic lockdown (the second quarter) be higher than when that lockdown is lifted? When sales were down some 58% in April, 46% in May, and perhaps up 10% in June then it’s going to be very hard for that quarter not to be the bottom for sales. Once we burn through the pent up demand we may well go back to year over year sales declines, but it’s not likely to be anywhere close to the magnitude we saw in the current quarter.

We’re getting close to the end of the second quarter now and we pretty much know that in the major markets in BC we will end up matching last June’s sales rate or exceeding it by a bit. That means we can combine the BC sales data for April and May with the estimate for June to get a pretty good read on the sales for the second quarter.

Was the CMHC estimate close? You be the judge.

So in a forecast published nearly two thirds through the second quarter, CMHC’s average projection for that quarter was off by some 20,000 sales or 28%. I suspect the third quarter’s sales won’t fall in their range either because we will get a sharp uptick from the second quarter, but we’ll have to wait and see.

Here’s the thing. I’m not writing this to pick on CMHC. The people working there are great and I really appreciate the insight they’ve given me over the years. I’m also not faulting them for not having a crystal ball about the future housing market. I certainly am not claiming I’m better at predicting the market.

However as a public institution and given how much press their communications get, I certainly hold them to a higher standard. I’ve critiqued their forecasts many times because I think they need to improve.

- If the situation is so uncertain, then don’t publish a specific forecast. CMHC states the housing forecast was subject to “unprecedented uncertainty“, but then they went ahead and published a very specific forecast down to the quarter level with six significant figures. If you don’t know, speak in generalities and leave it at that.

- Forecast ranges give a false sense of certainty. CMHC said “The high uncertainty regarding the path of the pandemic is reflected in our wider forecast ranges“. That implies that forecast lows are the worst case and forecast highs are the best case. But only a month after their forecast it was blown right out of the water, with actuals coming in way below the supposed worst case. Again, if you don’t know, don’t pretend to give certainty with ranges or at least publish some confidence intervals.

- Publish your assumptions and models. These projections are the output of an economic model. CMHC fed it assumptions about unemployment, spending, immigration, and I’m sure many other things and it spit out these results. Problem is the model appears to know nothing about pandemics so it’s not off to a great start. If they published the detailed set of inputs that were assumed, or better yet the entire runnable model, then third parties could verify and improve the results. Right now all we have is a black box, and from a public institution I don’t think that’s good enough.

- Don’t double down. Sales forecasts in the city level outlook published this week are essentially unchanged.

- Empower your employees to speak up. I’m no economist, I only play one on this blog. With all the real economists working at CMHC I’m sure I’m not the only person that looked at those sales forecasts and recognized they were out to lunch. But the forecast got published anyway because either they didn’t dare say anything or they were overruled.

Oh, and a minor thing, but it wouldn’t kill you to put some vertical grid lines in your charts.

To be clear, the big miss on the sales forecast does not mean their projection of a 9 to 18% drop in prices is wrong. It’s quite likely that these temporary gyrations in sales will not be a significant long term factor. However it should give you pause about this and any forecast. They’re only as good as their assumptions, and no one knows what will happen as this all plays out. Be suspicious of certainty. One factor that may confound any attempt to predict the average price is the shift away from condos and towards detached properties that we are seeing. Prices could very well drop but a shift in the mix could keep the average selling prices for the entire market up. Only time will tell.

New post: https://househuntvictoria.ca/2020/07/02/low-inventory-drives-single-family-prices-to-record-high/

Whale Tales – the SFH market is hot all over the world right now as everyone seems to think we’re going to have the same experience as after the 2008 financial crisis. 5 year rates under 2% & unrestrained optimism is more likely the cause than Marko mentioning a few sales.

Marko is just pumping up the market, I suspect he has a hand in it..? Has anyone taken a walk downtown the place is bleeding, it’s really sad in all honesty and yet we still have RE Bulls here it cracks me up. Welcome the the lost decade!

Is a lovely city in Quebec.

Like South Carolina?

I stand corrected, however 20% or more of EU oil and gas life blood come from Norway, a country with a population equivalent to BC that will produce almost as much oil and gas a Canada that is greenwashing its stance with the most EV per capita in the world due to its abundance of hydropower.

LeoM: Interesting to hear that some people are postponing their retirements because of Covid. Makes sense if travelling is at the top of your list.

Marko: I suspect that some of the Lake purchases are for retirement homes and not cottages.

Retirements due to COVID. I know of several people who have postponed their spring/summer 2020 retirement plans due to the COVID travel restrictions. Their rationale is, ‘Why retire now when I’ll be forced to stay around the city, I’ll keep working and collect a full paycheque until the vaccine is available. Can’t get travel insurance either, so there’s no point in retiring now.’

QT, Norway is not part of the EU, never has been, never will be.

Excellent news to go along with Norway sovereign wealth fund that pulled out of Canada citing environmental concerns and diversification from fossil fuels, along with the report on Suncor mention of diversification. That said, the darling of the EU green nation is opening 136 new oil blocks and 125 of that is in the pristine Arctic Barents Sea to increase the country oil output by 43% by 2024.

‘Hypocritical’: After divesting from oilsands companies, Norway expands to untouched Arctic — https://business.financialpost.com/commodities/its-hypocritical-after-divesting-from-oilsands-companies-norway-expands-in-untouched-portion-of-arctic

A notable mention is how environmentalists boast Tesla secured an exclusive cobalt deal with Glencore, a company that have a long laundry list of international environmental and human rights abuse, child slave labour, trading with rouge states, financial and accounting manipulation, and is a king of coal lobbyist.

IMHO, it is only the start.

We will definitely see less foreigner students due to coronavirus and travel restrictions, but China Bre-X moment (counterfeit gold) is about to cause another shock on Canadian equities, farmers, tourism, universities that are expose to China market.

Used to go swimming at Mara lake all the time growing up. Nice place. Also outside spec tax region so no surprise business is up

Yea waterfront property @ Shawinigan over ask yesterday and multiple realtors posting in our private FB group “have buyers looking for waterfront at Shawinigan, contact me if anything coming up:”…..I always thought when there was uncertainty recreational properties would suffer. Guess not.

Interesting…

“We have seen an uptick in people from Vancouver and Albertans flocking to these vacation properties. In the last 45 days I’ve cleaned out most of the listings I had, at least two-thirds of the ones I’d call rare or more difficult to sell. I even had one on the market for 2½ years that got an offer this week.”

https://www.theglobeandmail.com/real-estate/vancouver/article-alberta-family-buys-vacation-property-in-bcs-shuswap-region/

Good news:

Shell plans $22-billion write-down of its assets.

“Shell is giving us a message about stranded assets, just like BP did a few weeks ago.”

https://www.axios.com/shell-write-down-oil-gas-a37cd0a8-8d31-4510-a79c-33c86b9c73f0.html

SFH slowly get more expensive relative to condos.

I happened upon the circumstances of the 1.5M sale and there is more to that story (it was closer to a 1.85M sale). Probably close to 2020 assessed.

There’s definitely been more retirements as some people who were able to retire previously, but thought they’d miss work too much have started to see it the other way around, where they couldn’t actually imagine going back into the office again. That’s BC anyway, don’t know about the rest of the country.

I know a couple people who just lost their jobs at Uvic.

I think Umm..really? may be right about some picking up value buys in June in the above $1.5M range.

Waterfront homes on King George Terr and on Beach Ave sold $500K or more below the land part of their 2020 assessments, another one on King George sold more than $300K below its 2020 land assessment.

Second wave layoffs are coming though. Camosun just laid off 50. Layoffs at UVic are coming. Airlines are laying off thousands. Events business will be bleeding people for a while. Not just students.

It seems to me that so far many people with good jobs are still employed. The only people I know who have lost their employment are university students. Now they have CERB and are less motivated to look for work. Some of them are making more now than they would have working. I don’t know what will happen next, but our government is providing a lot of support and seems likely to extend this. Maybe house prices won’t drop as I thought they might.

Of course for every person jumping into high end real estate one person is jumping out.

2924 Mt. Baker View. “Your own BOATHOUSE.”

Listed $3,999,999 235 days ago.

Sold $3,390,000

Assess: $3,633,000

Exactly.

We walk in our neighborhood often, did notice that there were a few “fro sale” signs in past few months, some were up since March/April. Felt like more than normal in numbers (maybe because they stayed longer than normal?). But started from the past week or two, the “Sold” stickers appeared on those signs one-by-one, and by yesterday, all are sold.

The listing prices of these recently sold houses seemed to be more reasonable than before the pandemic, one of them even dropped a couple times after listing. So I would think the buyers are those who were already in house hunting market before March, and not financially impacted by the pandemic. They felt this is the window of opportunity for them to act, and they did (collectively by chance).

Wait for the forbearance period to end, also I feel that the SNLR with drop below 40 in the next month or so… Signalling a “buyers market”, don’t take this as a buy signal (well at least I am not it’s still a falling knife). I am waiting for the inventory to go through the roof and the banks to start foreclosing on properties although this does take time, housing markets are not the stock market it takes time to unwind.. Rents are tanking in town and I believe the rent will only get lower as the months go on and students and tourism “does not come back”, I am waiting to move into a cheaper unit in the Fall when 2 bedrooms will be $1100.00. Sounds crazy right, well lets see how it goes..

I suspect that most people are buying a home and it has little to do with a flight to hard assets. Perhaps I am wrong but maybe someone who has been dealing with some of the SFH buyers can give us a better insight.

That does look a lot like a flight to hard assets for those with significant liquidity available.

It may seem odd to say this, but the 46 sales above 1.5m in June may have been been the surge in picking up value buys. I do recall discussions here about the significant slippage on prices over a million. As well, those shopping at that level are likely to have different resources available to make such purchases and being able to make make condition free offers. However, it does help explain the jump in average prices during an unstable economic atmosphere.

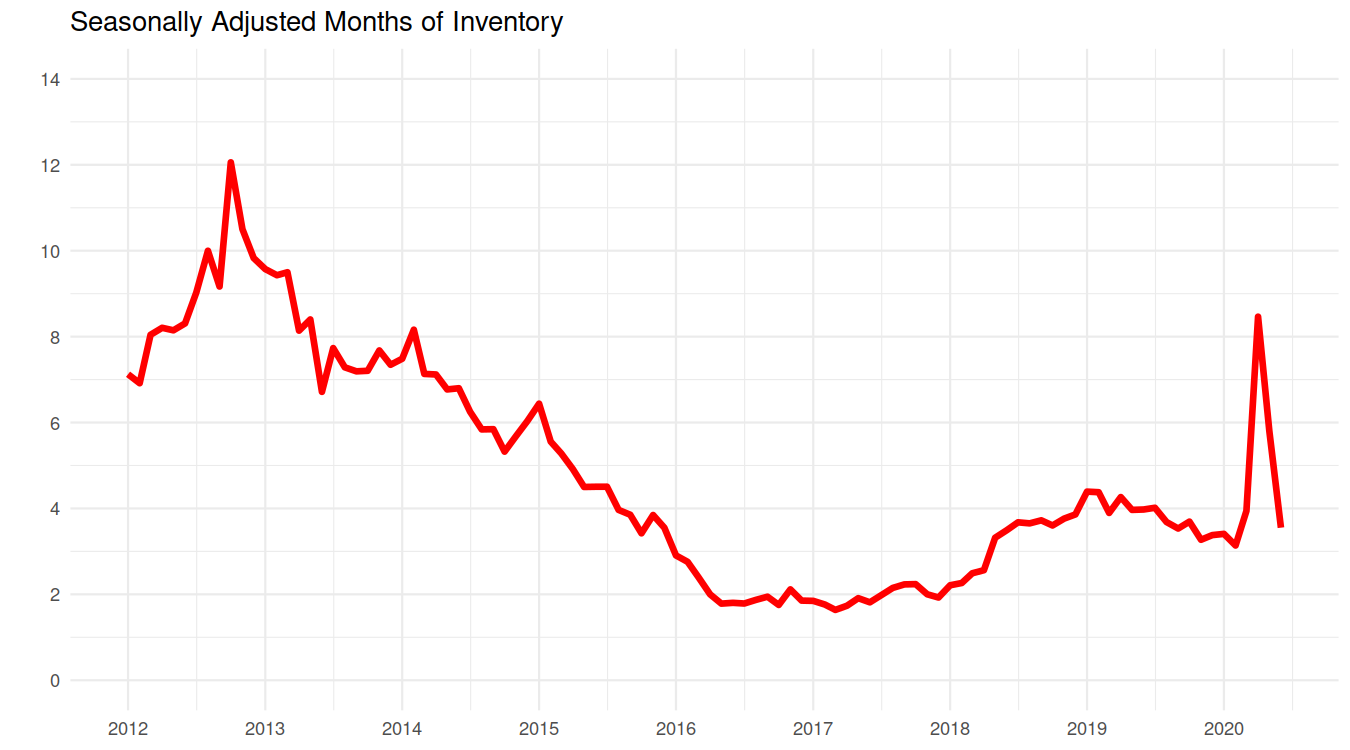

MOI almost back to pre-pandemic levels.

I wonder if Covid has caused some people to retire, perhaps early, and move to the island. No real way of knowing.

In this case it was more than a couple.

Detached sales over $1.5M

June 2019: 20

May 2020: 15

June 2020: 46

Click image to enlarge.

See below for final June Vancouver numbers

MOI 4.7, that’s sellers market territory. True that relative to 10 year average it’s lower than our total.

“Vancouver June sales look to be similar to Victoria (up a bit from last year) ”

But Vancouver saw the lowest sales in 20 years for June 2019 whereas Victoria June 2019 sales were up from the previous year.

https://www.cbc.ca/news/canada/british-columbia/home-sales-june-below-average-vancouver-1.5198669

Can’t really make out that low res chart, but are you seeing this page? https://www.zealty.ca/stats-daily.html

Includes daily detached and attached average pricing as well as daily sales/listings.

Not sure what you are getting from Zealty’s daily stats, I can’t glean much from those charts.

Vancouver June sales look to be similar to Victoria (up a bit from last year) which would likely put them back into seller’s market territory.

Only tech stocks.

Too much money chasing returns.

I’m just spitballing here. But stock market looks wildly overvalued, returns on fixed income near zero. Where to put the money? Could be a reason for the high end strengthening. Low end likely fueled more by low rates.

From what? Aren’t stocks and bonds near record highs?

Let’s hope that isn’t the case or we’re all in pretty serious trouble.

One thing that indicates that probably isn’t the case is that according to Zealty daily stats, the same thing does not appear to be happening in the lower mainland.

Perhaps a flood of out-of-towners moving to the island and very low inventory?

June medians subject to change somewhat based on final sales and because VREB reporting system is based on reported date not pending date. But this should be pretty close.

Sure, monthly numbers are 90% noise and there will be mean reversion in July average, but it’s a milestone and consistent with the other data. Median up, 24% of detached going over ask, inventory down. Detached market is hot.

Condo market is another story. Not sure yet if it’s set to drop or if it will heat up too like detached. Lots more headwinds against the condo side but then again I’ve been saying that for 2 years and hasn’t lead to any price declines. Might just continue to trundle around with roughly flat prices for a while.

That is why the average is not as meaningful/useful as the median.

Which makes me a little doubtful that this isn’t a blip in the average price. Just how many million+ properties sold to push it up that much? It only takes a couple multi million dollar deals to totally skew the data.

Ks112: I am pretty sure he is being sarcastic but you know what they say about sarcasm. On the other hand I am sure that he appreciated my sarcasm regarding his position.

Barrister, I think Marko was being sarcastic about the market crashing…

It is a nice place for sure, but do watch out for “sound from sky”, if you care, when the air traffic recovers from the pandemic.

Note: those loud sounds killed our thought of moving to Sidney two summers ago (when we sat on the little beach at the end of the fifth street enjoying its quaint and charming). Guess we are just super noise-sensitive 😉 , and being retired, home is where we are most time.

Marko: Take it from an old guy who has been around for a while. The market might take a downturn but it is definitely not going to end your career. You have developed a good reputation and houses still will be selling regardless. Maybe a few less sales and a somewhat smaller commission but not enough to end your career or anywhere close to it.

So cheer up and be happy that you dont have a career as a opera singer.

Sorry, I have to admit I am a bit grumpy lately. I have a feeling the market is about to crash hard and my career will end.

That is true, no one has called me out on this blog.

Marko; you were sounding a bit grumpy at James. You repeat yourself constantly as well but no one is calling you on it.

“30 years…

Do they even allow that still? I thought it was pretty well down to 25 no matter what.”

30 years is allowed on uninsured mortgages

It’s not really. Maybe compared to the what people are trying to rent out basements for in gordon head. Regardless… doesn’t change the point.

Encore (two units rented at $1,700 during COVID).

I haven’t seen the Hudson Rentals myself but my friends that were offered for $1,450 with parking ended up renting at Tuscany Village for $1,500 and the other friend paid $1,800 so he could have top floor south facing at the Bosa building on Pandora.

So obviously there is some sort of catch with the Hudson rentals in terms of desirability. Personally I would rather rent in a rental as I don’t like to deal with amateur landlord; however, many people want something nicer and condos offers that over apartments.

30 years…

Do they even allow that still? I thought it was pretty well down to 25 no matter what.

Thanks for bringing up the fact that you have a really good deal for the 5th time.

Excellent, and, much better than downtown!

Marko, which building of yours charges $1700 for a 530 sqft place? That seems on the high side given what the Hudson rentals are charging, if it is 834 Johnson I can’t see anyone paying more to live there next to essentially a large crack house. There is the one in the Astoria below for $1650 with Parking

https://victoria.craigslist.org/apa/d/victoria-1bedroom-1-bath-downtown/7143138132.html

Sarah: I have friends in Sidney and they absolutely love it. The Sidney bakery on Beacon Avenue is just super and very reasonably priced.

“Non-penthouse 1 bedrooms (530 sq/ft) in my building go for $1,700 per month (rented out during COVID19) so at $1,900 per month with current interest rates you can obtain a sizable mortgage.”

Spot on! We’re paying $1705 (with parking) right now for 600sq/ft. We were kind of forced into an expensive apartment because our dogs limited our options.

The new place is in the north part of Sidney, which was at the top of our list since my husband travels on the ferry a lot for work, and I find Sidney super quaint and charming. We’re really excited!

“Biggest swing ($163,000) in one month I’ve ever seen. Of course there’s a large element of chance here, but still that is a crazy change. Median at $877,250 is also at a record high.”

Just curious what the condo median is for June? I know it was down about 10% last month.

This more or less confirms our suspicion that, in Victoria at least, those in the market to buy a SFH are not the same people who have been hammered by COVID-related job loss/reduced income.

“How sizable? Because I pay $1900 a month in rent on a 3 bedroom full house in GH, and I definitely can’t get a sizable enough mortgage to buy a house.”

$500,000@2.39% over 30 years would be $1950 per month.

So you’d have to have a sizable down-payment to go with the sizable mortgage.

Sarah: great news, remember to fill it with joy.

How sizable? Because I pay $1900 a month in rent on a 3 bedroom full house in GH, and I definitely can’t get a sizable enough mortgage to buy a house.

Non-penthouse 1 bedrooms (530 sq/ft) in my building go for $1,700 per month (rented out during COVID19) so at $1,900 per month with current interest rates you can obtain a sizable mortgage.

This makes no sense to me. 1bd penthouse?

Great move! Congrats and may you enjoy the house for many years.

Congrats! What neighborhood did you select?

Congrats Sarah

We bought our first house this month! We’d been looking at condos for the past year but ultimately the uncertainty around strata fees/insurance was the bigger deal-breaker for us than the possibility of catching COVID.

With the interest rates so low, our mortgage will only be $200/month more than rent in our downtown 1bd.

This is my on the ground assessment of the situation.

In early June there were some great value plays in the high-end market and buyers piled in.

For example, spectacular waterfront newer builder I toured in Cordova Bay that was purchased in 2013 for $2.5 million re-sold earlier in June for $2.8 million.

Then on the other hand you have below a million pushing peak prices.

For example, a place in Maplewood purchased in 2011 for $499,000 just went is a bidding war last night over asking at $855,000. In absolute numbers it appreciated more than the $2.5 million dollar purchase which is insane.

Conclusion, value in the luxury market drove a lot of sales and the bottom end is at peak prices and you end up with a record average and record median.

Value in the luxury market has disappeared a bit in the last 14 days as a lot of the good deals were picked off.

Barrister, if your previous 11 comments didn’t convince me now I am convinced….condos are COVID19 deathtraps. Time for me to buy a SFH to stay safe.

Maybe if we get a second wave we’ll get to $1.5M average

Maybe. Depends on what you consider EOL.

If we built better quality buildings (and the step code is pushing things in that direction), then EOL should be well over 100 years. Attempting to update a 40+ year-old building can be quite a challenge given the much stricter code and engineering requirements. It often makes sense (cost, time, and flexibility) to replace a building than attempt to renovate….which sadly is a significant environmental impact.

Entering the realm of speculation, I wonder if Covid has had some impact on buying patterns with a shift from luxury condo to SFH preference. Close friends of ours where initially looking for a luxury downtown condo in the 1.5 range. They shifted their goal to SFH since the thought of social distancing in hallways or being herded like cattle in an elevator (their words not mine) totally scared them.

The other thing that they both brought up was that downtown, especially at night does not feel safe anymore. (Before someone sends me a barrage of crime stats on downtown Victoria, it is not an issue of statistical safety to them, but if you dont feel safe then it is a loss of comfort. In fairness my wife does not feel great downtown either) They decided to focus on a small SFH in Oak Bay. Their other alternative is Sidney.

I am not suggesting that they are typical or that there are vast hoards of buyers like them. But I was wondering if there is one or two hundred couples like them would this have an impact both on sales and prices of SFH? Before I am laughed off this blogg, we have two other sets of friends who have put their condos on the market and are looking for SFH. Again Covid is the motivator.

Just that tearing down a house to build more energy efficient is not worth it unless that house is truly EOL. So in your case made sense, but in the future makes sense to keep it up as long as possible.

Tons of buildings are torn down before EOL with little thought and then the builders trumpet the energy efficiency of the new one.

Average single family price in June in Greater Victoria is $1,038,590.

Over a million for the first time ever.

Biggest swing ($163,000) in one month I’ve ever seen. Of course there’s a large element of chance here, but still that is a crazy change. Median at $877,250 is also at a record high.

Flight to hard assets or irrational exuberance?

@Ash, I agree with everything in this article. It doesn’t really have anything to do with PassiveHouse other than there are probably some certified buildings that have a high construction CO2 footprint. It’s a tricky subject since in Victoria we’re fairly limited to what we can use for foundations (concrete and steel), and under-slab insulation (high-density foam). If you’re not in an area with building inspections then go to town with ‘non-conventional’ options.

Compounding issues within a municipality is that many engineers are not familiar and not particularly comfortable with atypical materials and methods. If you want to do anything out of the ordinary then you’ll have to get it stamped by an engineer. I was frustrating for me personally as there are methods used in other parts of the world that seem to work perfectly well, but aren’t done here.

Leo, maybe I missed something in this article, but doesn’t it just say that we should endevour to use land more wisely (increase density)? I skimmed it and couldn’t really tease out anything interesting from it. Yes, building a new structure is carbon intensive. My house was over 100 years old when it was torn down. It was uncomfortable, an energy pig, and had a crappy layout.

If you are tearing down an end-of-life house and building a new one, try and choose materials with a low embodied carbon footprint and build it to last a long time. Consider deconstructing the house and salvaging some of the wood for other non-structural uses. Maybe the glass can be saved for a greenhouse etc. Maybe don’t use ICF construction since it’s heavy on the concrete and foam.

Google mobility realtime data (June 23) of location of phones show that….

Retail and Recreation (including Restaurants) in many parts of Canada are back to near normal levels – compared to last year (Quebec -2%, Manitoba -2%, New Brunswick +0%). Laggards are Ontario -28%, Alberta (-11%), and BC (-18%).

Data for people returning to workspaces hasn’t improved as much though.. still -42%. Maybe work-from-home is here to stay.

https://www.gstatic.com/covid19/mobility/2020-06-23_CA_Mobility_Report_en.pdf

Good point. A foreigner/speculator owning a multi-unit apartment with a single title here is exempt from spec tax, as long as one unit is rented. That loophole allows them to rent out a tiny portion of their mansion for 6 months, and avoid spec tax. Just the mom-n-pop landlords will be hit with spec tax if they don’t find a renter for 6 months. Likely doesn’t matter, the whole silly spec tax idea will fall apart if vacancy rates rise, and will need to be redone or abolished.

I am confident that “below a million SFH core homes” will never be priced above $999,999.99.

It’s not.

https://www.alternativesjournal.ca/science-and-solutions/debunking-dams

Woot woot!

Landlords will do everything they can to avoid dropping rents, and entice people in using incentives like a couple months of free rent. Tons of those out there right now.

If they get you in on an incentive you are at the higher rent. If they drop rent they are tied to inflation increases every year.

As a renter if you are planning to stay longer you want the lower rent in most cases.

This is pretty rare. I posted the number earlier, I think it was like three or four over asks in a month that were under the original asking price.

Taking all that into account it’s still very low-carbon energy.

https://doodles.mountainmath.ca/blog/2018/05/23/teardowns-and-emissions/

Why is it assumed 10% vacancy? People move out and move in all the time. A posted rental doesn’t mean a vacant rental. Based on the ‘available immediately’ status:

Mews – 3 vacant (2.5%)

Walk 1 – 5 vacant (3.0%)

Walk 2 – 11 vacant (10.4%)

Also Spec tax is for residential properties, probably doesn’t apply to commercial rental buildings.

Sharp drop in immigration threatens Canadian housing prices

Do you mean rentals to businesses or multi unit residential rentals? Spec tax only on residential and only if the unit is individually titled. Spec tax applies to properties (i.e. something with a title), not units per se.

Anything longer than six months vacant in the year, and spec tax will be due on the unit. One of the joys of being a landlord.

Marko I though u had a friend rent at the Hudson mews for 1450 including parking

Ten per cent vacancy rate over the long run in a commercial rental building is not acceptable but they will hold off lower rents for a long time. Likely to do the free month rent lease first to maintain the rental base.

I had a friend wanting to rent here and they asked for an application before they would show just two units.

Prices still haven’t really dropped much. I was anticipating decent newer one bedroom condos downtown to be at $1,500/month (including parking) but that is still hard to find.

Because sellers adjust their expectations when they see 1 in 4 houses going over asking? Don’t think so.

Below a million SFH core homes are at peak prices imo.

If a property ask price drops and then the property goes for over ask, is it still really over ask?

So was June 2019 below average in terms of # of sales?

Slower. SFH sales will be at or somewhat above the 10 year average.

Condo sales down about 10%.

So not that big of a difference there, but I get the feeling SFH sales are inventory constrained while condos aren’t.

LeoS: How are condos doing?

For the whole month (Greater Victoria only), it is 23.6% of detached properties going for over ask.

In the last two weeks it was 24.5%

In the last week it was 24.7%

Pretty steady I would say.

Sure. That is the logical ‘next step’, which is happening in North America right now. Generally, the Europeans have much more selection of low carbon materials from which to build, although it’s getting better. Items like FoamGlass, wood fiber insulation/cladding etc. can be found from more boutique suppliers.

As Leo mentions, wood is having a bit of a renaissance as it has a much better Carbon footprint than Concrete (for example). There are hemp, straw bale, and other interesting materials in the pipeline as well.

What are the parameters here? Are we ripping down a perfectly good SFH just to build more efficient (EnerPHit is the route here)? If a SFH is going to be replaced anyways, the jump to PH is probably a 5-15% cost premium which may have a cost payback of 10 to 20 years. The PH program itself doesn’t take carbon footprint into consideration so it really depends how the building is constructed. For example, an all-wood building with a screw-pile foundation and cellulose insulation would have a very low embodied energy. An all Insulated Concrete Form (ICF) building, not so much.

Only because we don’t count that carbon.

There’s a large carbon footprint in building the dams up north (and accompanying infrastructure), not to mention the massive ecosystem destruction(an Oil spill has nothing on Dam construction, and the footprint of just the dams in Northern BC is the equivalent of the exclusion zone of Chernobyl, and that’s not considering all the mecury poisoning in plenty of tributaries up and down stream). We’re currently building another dam too, for the exact reason that you’re implying here.

Leo are houses still going 1 in 4 over ask? Anecdotally seeing lots of price drops and wondering if that’s being reflected in final sales price. Cheers.

727 sales to date (down 2% on a per day basis, to end the month up ~8%)

1337 new listings (up 10%)

2710 properties on the market (down 11%)

Yes lots. Mass timber structures which BC is now starting to really ramp on could have a negative carbon footprint in the future with very careful lifecycle management and harvest practices).

But it’s true that replacing a single family house with a more energy efficient single family house will never pay back in BC if it’s electrically heated at least. The extra energy you spend on heat has a low enough carbon footprint that you will never make back the embodied carbon.

Would be interesting to know what their assumptions of long term vacancy rates are.

The big purpose built rental will be fine. When students return next year sometime vacancy rates will be back to normal (elevated likely, but not like now)

But many amateur landlords did that calculation (if they did it at all) with essentially zero vacancy because the rental market has been so tight for so long. I think we’ll see some of the more marginal rentals that were losing money before hit the resale market, likely mostly condos. Universe of rentals will likely shift back towards PBR, which I think is a good thing.

Hudson Mews – 120 units

Hudson Walk 1 – 169

Hudson Walk 2 – 106

395 units, so less than 10% in a relatively new complex with regular comings & goings. Doesn’t seem out of line.

Ks112: How are you managing these days? I worry for a number of my neighbours. Once Cerb ends I know of at least three couples who will not be able to pay their mortgage. In addition at least two of the bed and breakfasts here are in dire straits and likely to be on the market soon.

If Covid follows the same pattern as it is in the US with their reopenings I suspect that things might get a little grim.

Personally I miss restaurants and social interactions a lot but being on the vulnerable kill list self quarantine seems to be my future. My wife, being an introvert, has barely noticed. I have to confess that I am glad we are not stuck in a tiny condo like some of our friends.

No idea on that barrister.

KS112: Initially that number of rental units strikes me as a lot but is it actually more than usual for this time of year?

https://petersonrentals.com/find-an-apartment/

Looks like 38 units available for rent in the 3 Hudson rental apartments

Introvert: Read about half the delirium article and it totally reinforced my self quarantine state of mind.

Heard more people today saying how we dont have any Covid on the island. They need to go up to the ferry terminal and just watch them unloading cars from the mainland. Lot more than just one or two Alberta plates.

Afterwards swing by the the airport/ Really, really think about what you are seeing.

https://thewalrus.ca/the-false-promise-of-green-housing/

Thoughts from the passive house crowd? Is there much thought going into the carbon footprint of bldg materials when bldg passive?

“….. I’m talking of course, about existing Assessed Values shown for a great many Victoria region properties for sale.

Assessment values based on July 1st, 2018 (and originally sent out to owners in January 2019) are the assessment values many buyers are STILL being shown when they consider buying a property. ”

Where are the 2019 assessment values still being shown to buyers? I just looked at a wide variety of condo and house listings and don’t follow what you are talking about. None mention 2019 assessment values. As a buyer I can check BC assessment for the July 1, 2019 assessment that owners pay their 2020 property taxes on and the website is up to date as far as I can tell. Where are buyers being misled with old assessments or what am I missing with your post?

The Canada-U.S. border is going to stay closed for many months to come if this keeps up…

Only two US states are reporting a decline in new coronavirus cases

https://www.cnn.com/2020/06/28/health/us-coronavirus-sunday/index.html

And this is lovely:

They Want to Kill Me’: Many Covid Patients Have Terrifying Delirium

https://www.nytimes.com/2020/06/28/health/coronavirus-delirium-hallucinations.html

Just finished a pleasant afternoon with friends who are looking for a new home. Like me they are older and while a condo has a lot of appeal they are really worried that sharing an elevator these days is a really bad idea. Anyone has any thoughts on this?

You are all cordially invited to a Very Special Birthday Celebration for a special toddler!

That’s right, in a couple of days, on July 1st, the little guy turns 2 years old!

I’m talking of course, about existing Assessed Values shown for a great many Victoria region properties for sale.

Assessment values based on July 1st, 2018 (and originally sent out to owners in January 2019) are the assessment values many buyers are STILL being shown when they consider buying a property. TWO. FRIKKIN. YEARS. OLD.

Leo, has there ever been an entire blog post dedicated to this? How about images of a birthday cake/candle and soiled diapers to commemorate the occasion? Isn’t this unprecedented?

This really stinks, and has stunk for a very, very long time. There is no room for opinion here, or questions about things like modeling assumptions — it is 100% clear that the wrong assessed values have been shown for a long time , AND “coincidentally” in a great many cases they have been much higher assessed values than reality.

It’s completely unacceptable, yet all I’ve ever seen is tantamount to collective whispers and shrugs about it.

A shame the CMHC wasn’t involved, because then we might have actually seen some outrage. 😉

Barrister said, “In fairness to Leo he has often mentioned the obvious that projections or analysis by the various Real Estate Boards are little more than sound and fury”

Has there ever been a dedicated blog post here dedicated to examining why any particular projection by a real estate board, big bank, or real estate firm is out to lunch? Maybe I just missed it, but if not why not?

The single recent controversial CMHC report is barely a drop in the bucket compared to the tidal wave of other private sector reports that have made headlines for several decades.

A lot of people who read the local papers, watch the local evening news, listen to the local radio interviews with real estate representatives, believe the headlines and talking points . Given those headlines are overwhelmingly sourced from real estate cheerleaders, why is it okay for them to be mostly ignored while it is okay to pile onto the CMHC?

The switch will also fix assessed values for all new listings (existing ones will not be updated)

Yes I have all the data but the stats package is pretty broken on the new system so all results questionable. The switchover is sometime in July for all VREB members so I assume it will be fixed by then

Any visibility to the rest of the Island yet Leo?

By the way, sales are down 3% over last June. The only reason we will exceed last June’s total is because there are 2 additional business days this June.

Tilt still towards single family.

Definite drop from the week before.

Asymptomatic COVID-19 findings dim hopes for ‘herd immunity’ and ‘immunity passports’

https://www.cbc.ca/news/health/asymptomatic-covid-19-1.5629172

Pretty strong last few days….we will clear 800 sales for the month.

It is also important to note that the current CMHC board is probably the first board that wasn’t comprised, by majority, of people with a very strong vested interest in Real Estate. The previous president was extremely popular with the housing industry.

https://www.superbrokers.ca/library/cmhc-karen-kinsley.phtm

I honestly believe that the “pent up demand” in Canada has probably been fulfilled and every province will see an increasing amount of listings. The new normal will not be pleasant for way too many people, especially those that are heavily mortgage indebted.

It seems like sales have slowed down again? What are people seeing on the ground?

In fairness to Leo he has often mentioned the obvious that projections or analysis by the various Real Estate Boards are little more than sound and fury. I think it is fair to say that few if any people reading this blog consider the real estate boards as little more than sales pimps.

Factor in, too, a likely second wave in the fall (one that could be worse than the first wave) and a return to full lockdown — and the unemployment that goes with it.

One important CMHC projection that I haven’t seen challenged here is the current and projected number of CMHC insured mortgage deferrals in Canada. Currently it is 12% and CMHC is projecting it to rise to 20% In Canada by September.

I don’t find it hard to connect the dots …

– 20% of people deferring their CMHC insured mortgages In September leading to

– a “deferral cliff” by early 2021 (no more deferral allowed, have to pay) leading to

– forced sales in 2021 leading to

– a 9-19% drop in RE prices by June 2021 (which is what CMHC is projecting)

IMO, the only thing stopping that would be a treatment/vaccine.

/////========————

May 21, 2020 https://www.cbc.ca/news/canada/calgary/mortgage-deferral-cmhc-housing-covid-canada-insured-1.5578816

“Siddall [CMHC] said the escalating number of deferrals could spell big trouble for the economy. Roughly 12 per cent of mortgage holders have elected to defer payments so far, Evan Siddall, the chief executive officer at Canada Mortgage and Housing Corporation, told the House of Commons standing committee on finance in Ottawa on Tuesday.

Not only that, Siddall warned: almost 20 per cent of Canadians who have CMHC insured mortgages could be forced to defer payments by September because of the economic crisis sparked by COVID-19.

The CMHC is the Crown corporation that backstops the vast majority of Canada’s housing market by insuring the loans that finance it.

Siddall said the escalating number of deferrals could spell big trouble for the economy.

CMHC is also forecasting a decline in average house prices of nine per cent to 18 per cent over the next 12 months, Siddall said.

He said a team is at work at CMHC to help manage what he termed a looming debt “deferral cliff” — when some unemployed people will need to start paying their mortgages again.

https://www.theglobeandmail.com/canada/investigations/article-canadas-lost-months-when-covid-19s-first-wave-hit-governments-and/

Leo, you are right to wonder about assumptions being made by CMHC’s modeling. In fact you have brought it up a bunch of times in various message posts,etc, before the current blog post devoted to this. In your super nice guy way, beating up on CMHC. 🙂

Let me tell you why your doing this concerns me.

For decades, the vast majority of real estate projections that capture news headlines have come from sources that are overwhelmingly interested in cheerleading real estate, even in bad times. Often laughably so. Those are the “projections” that most people hear about, talk about at the water fountains, and are a big factor for many people going into deep debt. (“It’s always a good to buy, doncha know!”).

You know who provides most of those projections headlines. The Victoria Real Estate Board. The BC Real Estate Association. The various big banks. Colliers and various other real estate companies, Etc, etc, etc. It is not a secret they do not exist with any mandate to help Canadians, they exist to maximize greed and profits. They also spend heavily on advertising in many of the media outlets where – lo and behold! – they are also coincidentally called upon to provide their biased market projections/headlines.

I’ve not always been on this site, but ive never seen you pile on those others’ projections anywhere close to the same you’ve been beating up on the CMHC.(Please correct me if I’m wrong).

Keep in mind, the CMHC’s mandate is to help Canadians. At long last, a major organization that exists to protect Canadian consumers comes out with bold, widespread headline projections, and THAT’S the one organization you have the courage/energy to beat up on?

It would seem to me a bit like beating up on the faults of the first electric car ever produced, after spending many years whistling and smiling at all the gas-guzzling cars with various faults of their own.

Yes, I know that the CMHC is publicly funded. And that is exactly why their mandate is to help Canadians; the two ideas go hand in hand. Is that a good reason for only singling them out to be picked on? So from now on, only the public sector can get all the harsh criticism, and all private sector faults get a pass? In that case, let’s just hand over our entire society to the private sector, since we can no longer criticize them.

What matters most is which headlines are getting the most exposure, whether public or private. It does not make sense to me why you’d be much less inclined to criticize a misleading report being read by everybody, just because it is not taxpayer funded. Data analysis/science is about finding and communicating Truths. Truths don’t discriminate between private or public sector, and neither should you.

Keep in mind, too, the stranglehold on data that the real estate boards and agencies have. You yourself said in a post a few hours ago, “the way the regulations are it’s difficult to continue doing analytics without (being a licensed Realtor).” They have a frickin’ MONOPOLY on real estate transaction data, they produce many (most!) widely viewed projections, but they’re the ones whose bad projections you’d rather not criticize so much?

If you’re going to beat up on CMHC’s projection faults, you should proportionally beat up on the many other widely published projections that also make mistakes. Otherwise, why are you singling out your harshest criticism for an outnumbered minority — the only organization with a big voice that is truly mandated to look out for Canadians?

40% of Manitoba lives outside of Winnipeg though.

My hat off to Leo, for handling new poster’s questioning fairly and very gentlemanly.

We were all new comers to this blog once, and possibly made some off-judgement posts here and there, so give them the benefit of the doubt, even when they made some inaccurate comments.

Note: I am not (nor related with) “Sardarji Khalsa” 😉

That doesn’t even make any sense, and even if it did, the notion that CERB payments are a large part of why RE is holding up are both at odds with the data demonstrating who is buying, who is actually losing their jobs, and who isn’t. Covid could smash the RE market for sure, but there are far larger forces at work distorting asset prices of all types globally including housing. Incidentally, governments in Canada don’t offer “mortgage forbearance”.

For someone who is clearly intelligent and articulate, your assessment of Leo’s content is ironically about as well reasoned as CMHC’s forecasts, which is the subject of this article. I almost wonder if you yourself work at the CMHC. If so, say hi to Evan for me, because I think he’s the best asset they’ve got going. Their economists and data modelers, not so much.

Well said. Perhaps you should stay as far away from this site as possible and anything else Leo has his grubby little weasel-paws in. I would hate to see you or those you care about incur any more injury at the hands of this site’s malicious and treacherous content.

Leo, you ought to be ashamed of yourself. Great article, by the way.

The numbers on that web site indicate to me they really are talking about detached houses. But a “home” can also be a condo or townhouse. Even in metro Vancouver you can buy a condo in the low 200’s.

Frank said :”the house I paid $122,000 in Cloverdale in May, according to my realtor, shot up to $170,000″

You have one story about a single property in Cloverdale (of all places) to back up your original general claim that back in 1989 “BC real estate prices… shot up 40% in one month.” Really?

I’m trying to be polite here, but that’s absolutely ridiculous. Keep in mind the kind of statistical data people post and discuss here on a regular basis. Why should anybody not just laugh at your original assertion?

It would be the same if I took one know Victoria property sale from a few weeks ago — which went at 40% below assessed value and one day said “hey everybody, BC real estate was selling at 40% below assessed value in June 2020!”. Absolutely ridiculous.

Frank said:

“I know quite a few Chinese people in Winnipeg, most of them a glad they are out of China, no one wants to live under a communist regime.”

So what ? Not only do I know quite a few Chinese people too, but the ones I know all actually live in major BC cities, which is the subject of your prediction.

The ones from Hong Kong who have feared communist Chinese govt have been wary since the mid-80s. That’s why many of them already came here in the last 35 years.

None of that convinces anybody that TODAY there is still a huge number of Hong-Kong Chinese that have suddenly woken up just now to the fears that have been around there a long time.

Read the article I linked to with quotes from people with extensive links to people still in Hong Kong. It doesn’t carry quotes from Chinese people that immigrated to Winnipeg X years ago.

I live in Winnipeg, you don’t get much for $250,000. Poor areas of the city pull the average down. You would be shocked that in a lot of better areas of the city, prices rival Victoria’s. A newer good home in a desirable area is $500,000-$1,000,000.

But prices are the highest in provinces with the largest populations:

I do think Alberta could be in big trouble for obvious reasons.

“Lots of Canada with $200K or $300K homes. For example, half of homes in Alberta are less than $353K CAD (= $250K USD). Do they all have “very good jobs” that aren’t affected by CoVid.”

The other thing is that maybe one person has a “very good job” and the other doesn’t. The base case here is always the quasi-professional-couple-with-two-stable-incomes (“she’s a nurse, he’s a police officer”). But things aren’t always equal like that. If the non-breadwinner loses their job, you’d think that would put the squeeze on some households at least.

Lots of Canada with $200K or $300K homes.

Province Average House Price https://www.livingin-canada.com/house-prices-canada.html

British Columbia $736,000

Ontario $594,000

Alberta $353,000 <— e.g. half of homes in Alberta are less than $353K CAD (= $250K USD). Do they all have “amazing jobs” that aren’t affected by CoVid?

Quebec $340,000

Manitoba $295,000

Saskatchewan $271,000

Nova Scotia $266,000

Prince Edward Island $243,000

Newfoundland / Labrador $236,000

New Brunswick $183,000

Sure. Premature judgement not so much.

Looking at options. I was there in 1989, the house I paid $122,000 in Cloverdale in May, according to my realtor, shot up to $170,000. It did settle down to around $150,00 and I sold a few years later for $202,000. By the way interest rates were 12.25%, it took a lot of balls to buy back then.

I know quite a few Chinese people in Winnipeg, most of them a glad they are out of China, no one wants to live under a communist regime.

Canada’s higher home ownership, with lower incomes and higher price/income make for more defaults, not less. This will be apparent in a few months when 7 million people stop getting CERB.

Yeah, lots of cheap houses in many parts of Canada. But overall Canada’s prices seem to be quite a bit higher.

Don’t have time to find the best apples-to-apples comparison, but…

Canada’s average price (Apr 2020): $488K

USA’s median price: $227K

https://www.livingin-canada.com/house-prices-canada.html

https://www.businessinsider.com/cost-to-buy-a-house-in-every-state-ranked-2018-8

Same w/ most of Canada.

It’s only Vancouver/Toronto/Victoria that have NYC/San Fran/Seattle issues.

Because houses in many parts of the U.S. are like $200K or $300K. So it doesn’t take an amazing job to be able to afford a house (and get a mortgage). And it’s those not-amazing-jobs that have mostly been shed.

With Canadian house prices being higher, only those with very good jobs can afford a house, and very good jobs haven’t seen big losses thus far.

The rental listings for Hudson Mews, Hudson Walk 1 and Hudson Walk 2 are all on petersonrentals . com

Looks like there are 40 listings between the 3 buildings

There’s been discussion around here that the “homeowners” are largely unaffected economically by CoVid, are still able to pay mortgages, and so it won’t lead to big defaults and foreclosures. How likely is this to be true, when down south half of US mortgaged homeowners are struggling with mortgages and thinking of selling?

https://www.studyfinds.org/half-of-u-s-homeowners-struggle-with-mortgage-due-to-covid-19-consider-selling-home/

Half of U.S. homeowners struggle with mortgage due to COVID-19, consider selling home

“A survey of 2,000 American homeowners found that 52 percent are constantly concerned about making their mortgage payment on time. Forty-seven percent of the poll say they’re considering selling their home because they can’t afford their mortgage anymore.

Researchers say 35 percent of U.S. homeowners admit they’ve missed a mortgage payment during the pandemic. The same amount of respondents said they worry about losing their home because of the financial situation COVID-19 has put them in.“

Questioning the source of information is a very good thing. Probably something we don’t do enough of as a society. Of course the ideal is somewhere between unquestioning acceptance and unquestioning skepticism

https://www.studyfinds.org/half-of-u-s-homeowners-struggle-with-mortgage-due-to-covid-19-consider-selling-home/

Half of U.S. homeowners struggle with mortgage due to COVID-19, consider selling home

“A survey of 2,000 American homeowners found that 52 percent are constantly concerned about making their mortgage payment on time. Forty-seven percent of the poll say they’re considering selling their home because they can’t afford their mortgage anymore.

Researchers say 35 percent of U.S. homeowners admit they’ve missed a mortgage payment during the pandemic. The same amount of respondents said they worry about losing their home because of the financial situation COVID-19 has put them in.“

Sad when people who are not in possession of facts feel free to judge others. This, not money, is the root of all evil imo.

has this fellow read more than one post on HHV?

Would make a good subtitle for the site though:

House Hunt Victoria:

Unbiased real estate analysis from a sly weasel

Leo is a realtor in name only.

He got his license just to get better access to data.

He’s as independent as you’re ever going to get.

I don’t sell real estate. I’m only licensed in order to access data for analysis. I make some money from this site via referring good realtors for those that want one, occasional freelance writing, custom analytics, and advertising revenue but the direction of the market has zero impact on my income. I would love not to have to be a licensed realtor but currently the way the regulations are it’s difficult to continue doing analytics without it.

You’re right to be suspicious of my biases, but I am not scared by a decline in prices, I would love to see housing more affordable and have written as much many times on this blog for ten years.

Frank – the unrest in Hong Kong has been going on for more than a year. The biggest protests were a year ago. Why would the smart Hong Kong money wait so long if they’re going to leave there?

You’re at least a year behind other people predicting what you are. Those people were wrong a year ago. And according to a recent Vancouver Sun article, there is very little sign that Hong Kongers are currently having any effect on BC markets.

The people saying what you’re saying have apparently been trying to scare local buyers into FOMO (Fear of Missing Out). Some advice – FOMO cheerleading works better if you have at least several anecdotes about local sales to buyers escaping world-class metropolitan Hong Kong for the completely opposite backwoods Vancouver Island lifestyle they’ve always secretly wanted.

As you are somebody with two investment properties of the Island, and you are predicting Island real estate to be influenced by phantom Hong Kong activity, I hope you are not just the same as those in Vancouver trying to create FOMO. On a related note I REALLY believe you when you say prices shot up 40% shot up in one month. It’s just a number you put out there. 40%. No qualifiers whatsoever.. Uh-huh. 😉

Are any of your BC properties for sale at the moment?

…

“But it didn’t amount to anything. The realtors were just trying to scare people into thinking they had to buy in Vancouver. They were trying to create a fear of missing out,” said Wu, who has colleagues, clients and family with links to both Hong Kong and Canada.

Vancouver realtor David Hutchinson is among those who doesn’t see any particular signs of a Hong Kong resurgence in the Metro Vancouver market. He says prospective buyers here are now predominantly local. Hutchinson says many Canadians in Hong Kong already have some sort of housing in Metro.

https://vancouversun.com/opinion/columnists/douglas-todd-little-sign-that-hongkongers-are-buying-vancouver-homes-again/wcm/c44c3562-809d-44aa-9e4c-10dc0b1e0819/amp/

Typical salty realtor, it’s really hard to objectively analyze something when you’re emotionally invested in it.

In your case your livelihood depends on real-estate and it’s unsurprising that even the thoughts of a correction scare you to the core, what say of a crash.

What you fail to tell your readers is why the market is holding up, this is only because of the generous CERB and mortgage forbearance and rental assistance that the federal government and provincial governments are offering. The sad reality is that these benefits won’t be around forever and also the economy won’t rebound with the same speed that it was shut down. As the band aid that the government has applied is ripped, there will be a level of natural correction. What that number will be isn’t something that I can predict but I’m not going around trying to discredit anyone who would be ringing alarm bells to forewarn people of the impending potential crisis.

Instead sly weasels like yourself in the real-estate profession are running around and telling people that all is well and now is the best time to invest. You’ll happily make away with your commission whereas when the shit hits the fan, the poor investors and tax payers are left with the clean up job. So I’d strongly suggest that you do what it is that you do and make as much money as you can; but for the love of god please don’t tell CHMC as to what they should and shouldn’t be doing.

Barrister. Thanks for the acknowledgment. I never wanted to invest in real estate in a foreign country, even the U.S., that’s why I invested in B.C. real estate in 1989, one month before Tienanmen Square, prices shot up 40% in one month. I expect the unrest in Hong Kong to start to influence Canadian real estate, especially on the Island where the virus was kept in check. I still live in Winnipeg and maintain rental properties in Victoria and Ladysmith, smartest investments in my life.

“Apparently there are close to 50 vacancies in the Hudson rentals”

Interesting if true. I noticed on Craigslist that some landlords are offering a free month of rent. Not sure if that was happening before Covid, but it was pretty widespread in the aftermath of the Great Recession.

My only thought is maybe they’re using some kind of rolling data like the Teranet – National Bank HPI. Which is actually several months behind because they use closings, but it still doesn’t make sense w/r to where the bottom is without another shutdown.

Interesting that they could still be right about the Q4 sales levels though still even if it isn’t the bottom.

KS did you get that from a trustworthy source or just rumors? And yes i know asking an internet stranger of whom i’m not sure is a trustworthy source about a trustworthy source is foolish but I don’t care.

32 people in Verve, a newer Calgary condominium building infected with covid – likely from shared high-touch surfaces but knowing that elevator airborne droplets have been a traced source of transmission in Korean apartment buildings not sure that could be ruled out. Residents are still being tested so numbers might rise. Three otherwise healthy people from the building hospitalized.

Condos are going to be a tougher sell for some renters and purchasers for the next bit.

Apparently there are close to 50 vacancies in the Hudson rentals

I feel very strongly that Australia’s trends are leading what we will experience here in B.C. 25-30% down on rents there and I suspect similar patterns will emerge here as well. We will see SNLR outpace demand most certainly, I love RE however you couldn’t pay me to buy anything!

Yes will show the full chart with Victoria specific data at the end of the month. This market isn’t settled yet, plenty of things still to come.

Definitely. Plenty of evidence rents are dropping in major centres across Canada including here. We don’t have great data but it’s impossible to ignore.

All I have to say is watch the Vacancy Rates, I am willing to be they are going to head North in most major cities where tourism and Universities are a large part of the housing structure.. Also there is a 60% chance we will be going back to Stage 1 (Full Out Lock-down) again here in the next 2 months.. Anyone who thinks house prices are going to keep making increases needs to visit a local neurologist ASAP!

LeoS: First, let me once again say how much I appreciate all the hard work that you put into this site.

I know that it would involve a lot mire work but is there any way to separate SFH from condo sales since the market seems to be diverging so much.

Frank: Some interesting thoughts and it would be nice to follow this situation over the year. I expect the border will open before the winter. Health insurance will be an interesting issue particularly for seniors.

You have to feel for any Canadian owning real estate in the U.S. They cannot access their property and are unable to rent them out to anyone. Health insurance will not cover covid-19, so much for snowbirds escaping Canadian winters for this year at least. I wonder how many will try to sell their properties and what effect it will have on real estate prices in Florida, Arizona, and California. Could get ugly. Might also contribute to higher prices on the Island.

Could be. If only they would tell us.

Maybe the CMHC’s Q4 bottoming was influence by the UK’s Covid policy recommendation document which forecast a much larger second wave in Q3/Q4, once strict measures were dropped:

https://imgur.com/a/Bl5qHYw

Report 9: Impact of non-pharmaceutical interventions (NPIs) to reduce COVID-19 mortality and healthcare demand

https://www.imperial.ac.uk/media/imperial-college/medicine/sph/ide/gida-fellowships/Imperial-College-COVID19-NPI-modelling-16-03-2020.pdf

looks like another downtown condo rental deal, $1425 with parking at the union:

https://victoria.craigslist.org/apa/d/victoria-downtown-condo-in-union/7140828723.html

Wonder if the prices will get to the $1200’s by the time fall comes.