A different way to look at affordability

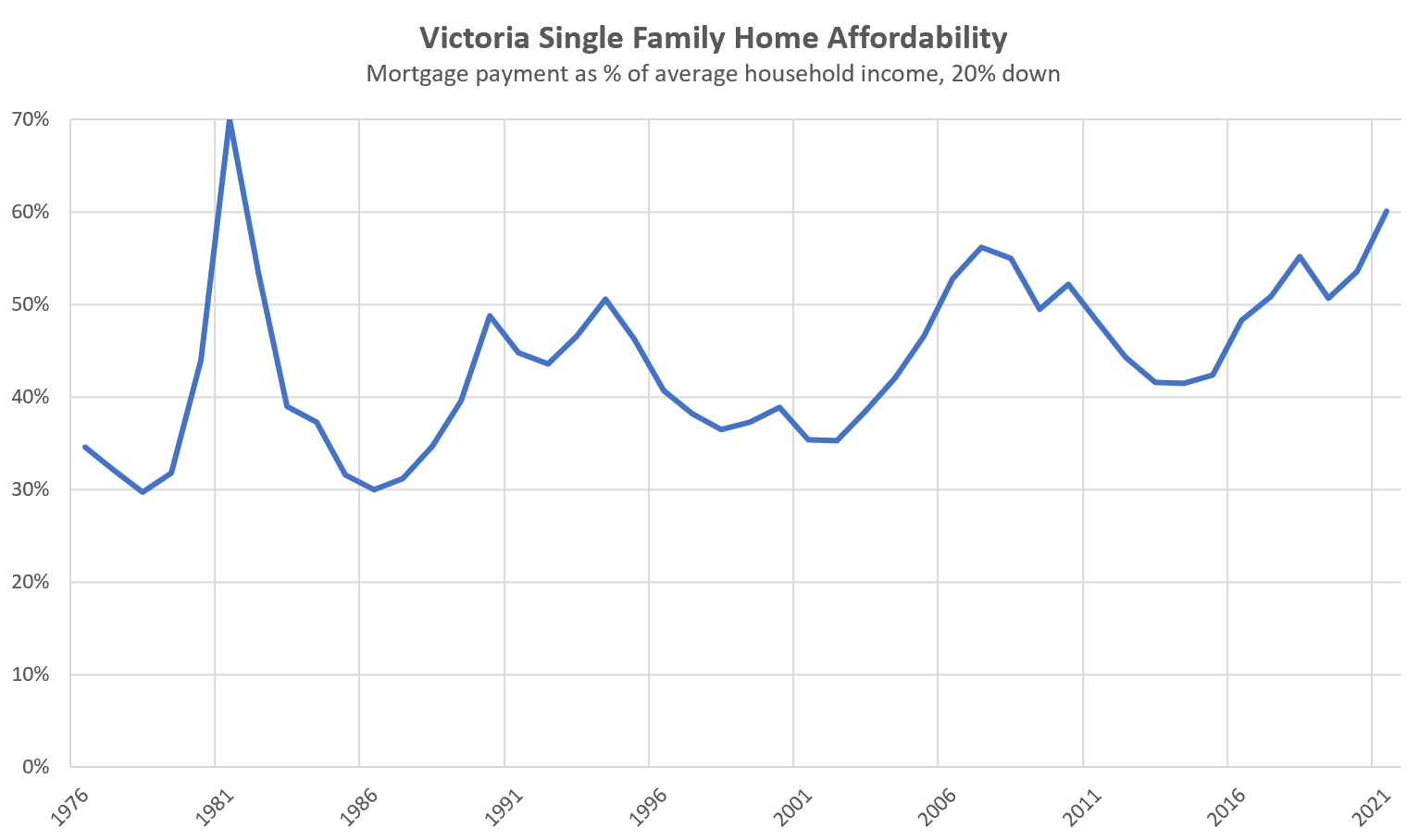

I often talk about and measure affordability on this blog for a few reasons. It’s the one metric that very clearly shows the real estate cycle, and it has proven to be quite correlated with subsequent price changes in the past 40 years. It’s a correlation that happens over many years and incorporates incomes, interest rates, and price movements which means it comes with some pretty large error bars. For that reason it’s not really useful for timing the market, but it has been an indicator of expected future returns.

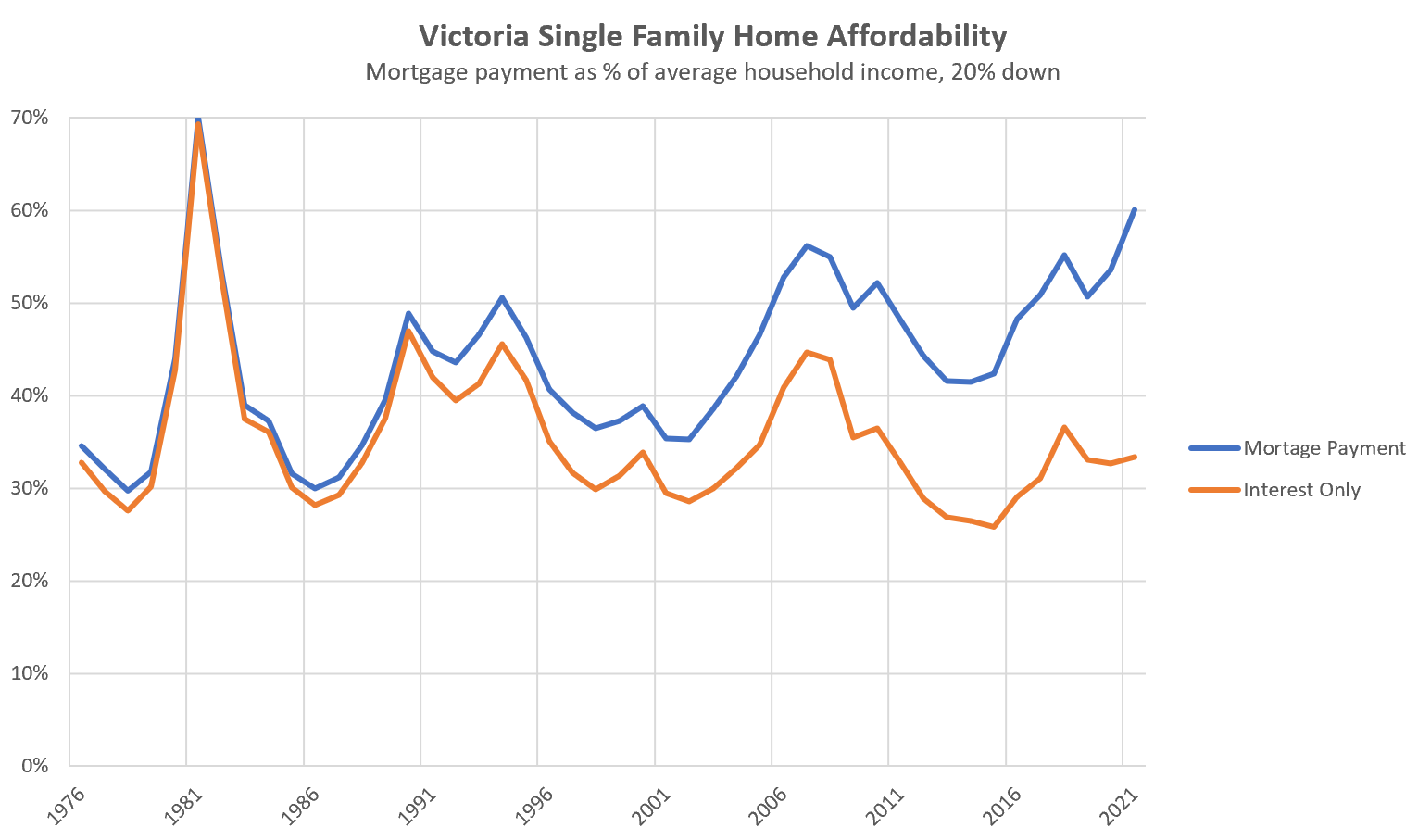

Factoring out the real estate bubble of 1981, affordability of single family homes in Victoria has been steadily deteriorating for decades. That is not surprising in a densifying city, and I don’t expect this long run trend to change anytime soon.

Affordability by that measure is worse now than it’s been since 1982. Not high enough to indicate a bubble by my estimation, but using the historical relationship between prices and affordability it is pointing at roughly flat prices for the next 5 years. There has been some recent evidence that despite continuing ultra-hot market conditions for single family homes, prices have only been increasing slowly in recent months, perhaps due to pressure from affordability.

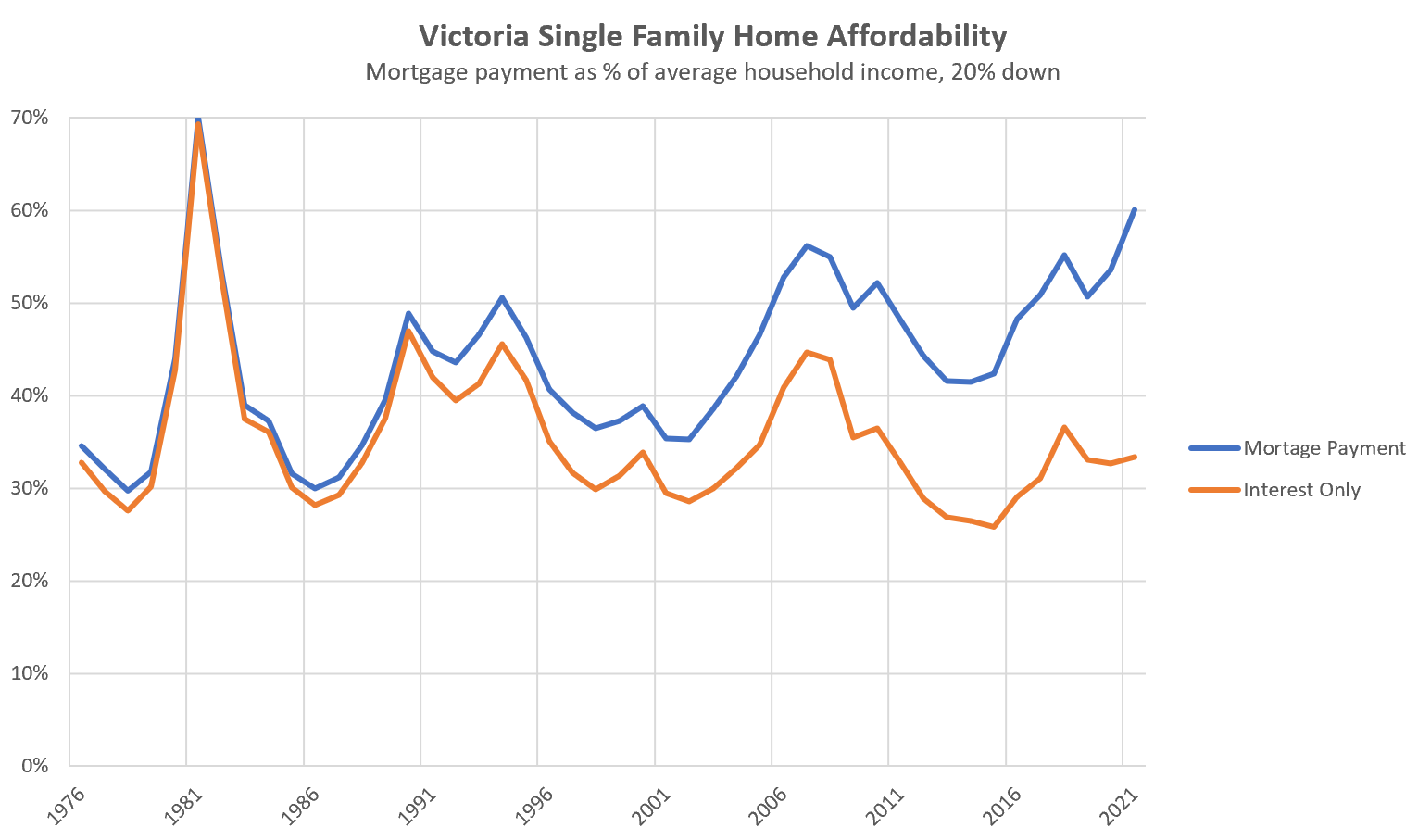

However those market conditions definitely put a ton of upward pressure on prices, and it could take years before inventory builds again. Measuring affordability by the size of the mortgage payment is one approach, but of course with low rates, most of the payments are actually towards principal, a form of forced savings. What does the picture look like if we only use the interest portion of the payment? Note this is interest portion of the first payment as a percentage of income.

It’s quite a different picture. The proportion of income going towards interest payments on an average house is not stretched at all in a historical context, coming in at 33% which is exactly the 20 year average. The chart shows that the barrier to entry for a detached house is getting higher, excluding more and more people as buyers simply cannot afford or be qualified for the very high monthly payments. However for those who do clear that bar, the interest costs are well within historical ranges, while the amount of forced savings are high.

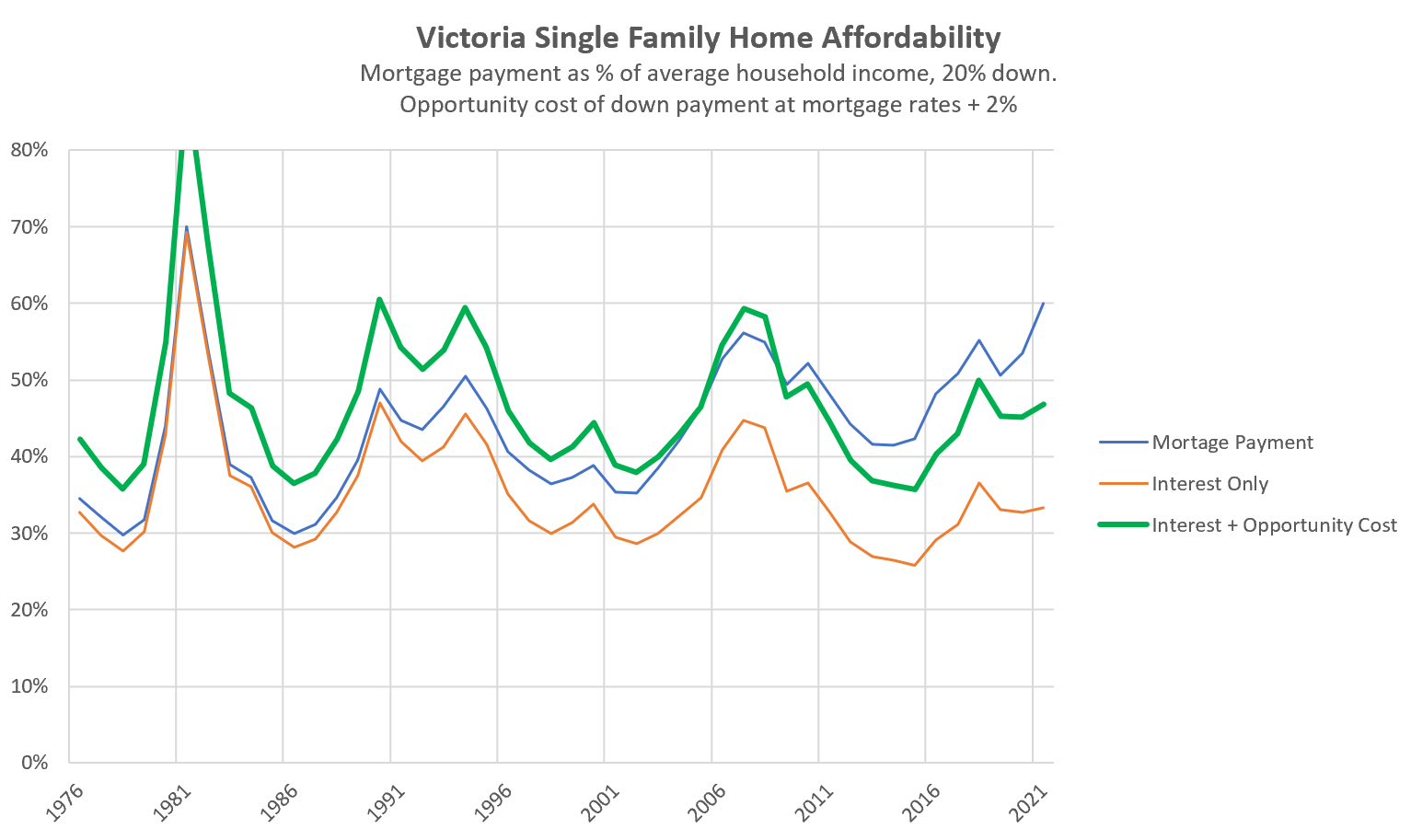

Of course interest on the mortgage is not the only cost. As prices appreciate and require growing down payments, the impact of opportunity cost becomes more and more substantial. We can add that cost back to the equation by estimating the opportunity cost of the down payment along with interest costs. The question here is what to use as the rate on the opportunity cost. Given that mortgage rates should represent something pretty close to the risk free rate, I went with mortgage rates + 2% as a conservative estimate of returns that could be achieved elsewhere without taking on a lot of risk. This is debatable and imperfect, but yields the following.

Again, it paints a very different picture than affordability as measured by the total payment. Rather than costs being historically very stretched, they are middle of the road, and continue to have room on the upside. I think if you wanted to make a bullish argument for single family home prices, this could be a compelling part of such a case. If you can accept that there are enough relatively wealthy buyers out there that can swing the payments, the real costs have room to grow.

At this point I’m undecided as to whether this model has any use in the real world or not. To me the evidence is strong that absolute affordability (using the entire payment) has a correlation with expected returns, and it would take some pretty clear evidence that a pure costs affordability model is more predictive. I’ll take a look at the correlations in a future post and see what comes out.

What are your thoughts? Are we at the top of the cycle and will see detached house prices level out, or is there more room to run? Does it make sense to discount forced savings, even though people need to still pay them?

Also weekly numbers courtesy of the VREB.

| September 2021 |

Sep

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 129 | 271 | 989 | ||

| New Listings | 151 | 383 | 1294 | ||

| Active Listings | 1128 | 1180 | 2389 | ||

| Sales to New Listings | 85% | 71% | 76% | ||

| Sales YoY Change | -23% | -26% | |||

| Months of Inventory | 2.4 | ||||

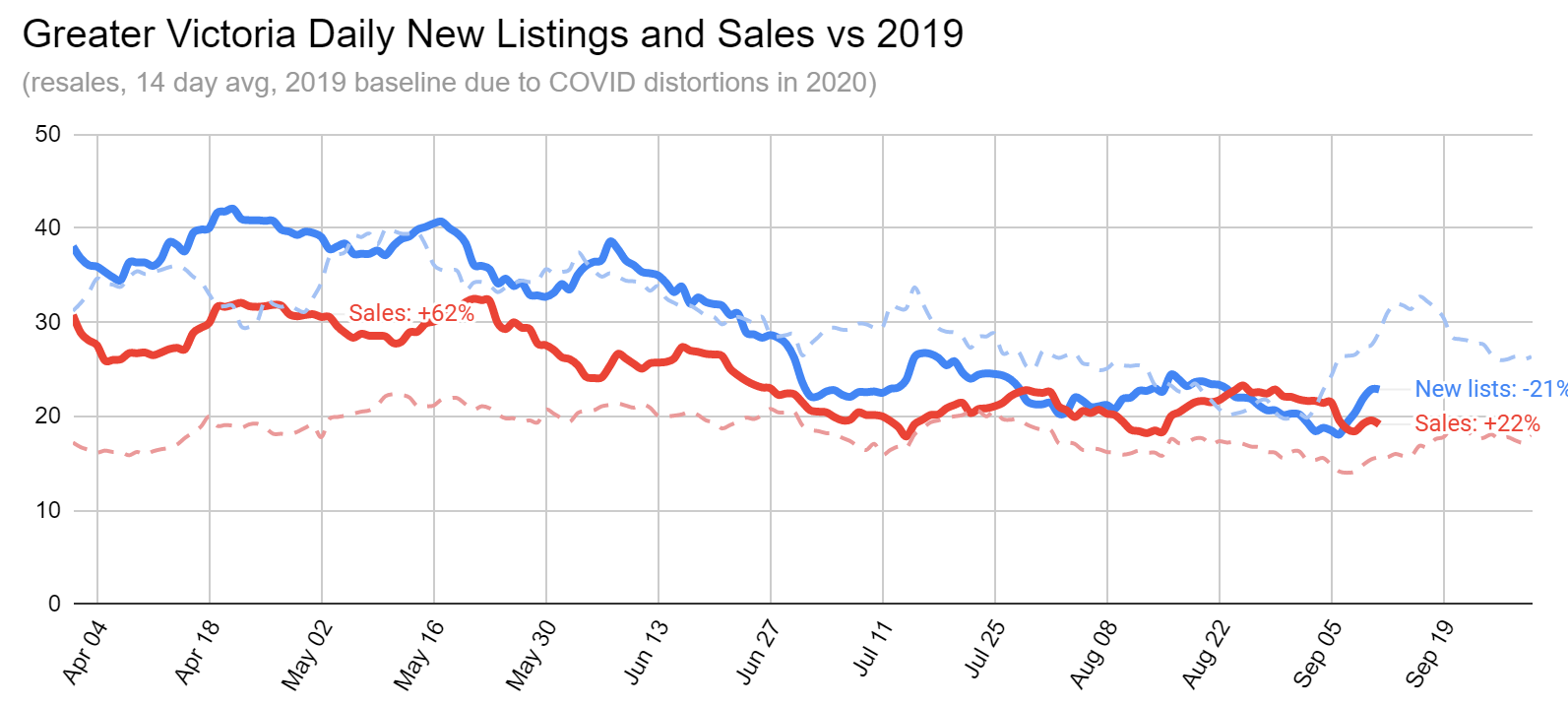

The big question coming into September is if the couple hundred listings that we missed in July and August are going to be gone for good or just delayed into the fall. It’s still too early to tell, but so far no indication of any extraordinary volume of new listings. While there was an increase last week, it was approximately the normal amount we would expect after Labour Day. Note that in the chart below, Labour Day in 2019 was Sept 2nd, so we are running a week behind. In the end we are still 20% ahead of a normal sales pace with record low inventory (down 54% from last year).

Whatever happens with single family prices and the question of affordability, I expect continued upward price pressure on condos. Although prices have made up some ground on the detached market this year, the reality is there is little else available within the price range of many buyers, and the extreme rental shortage is attracting investor back into the market as well.

New post: https://househuntvictoria.ca/2021/09/20/more-on-the-condo-outlook/

A house in Gordon Head.

Sold:

1989: $233,000

1994:$330,000

2004: $425,000

2021: $1,500,00

‘

‘

Sounds about right at around 5.5% after fees. Or inflation plus 2 or 3%.

A house in Gordon Head.

Sold:

1989: $233,000

1994:$330,000

2004: $425,000

2021: $1,500,000

It’s interesting with the TV federal election results. In the run up to the election, almost every poll is on the % popular vote.

Now the election results come in, and there’s not a mention of popular vote with the TV coverage. Just numbers of seats. Maybe they think we will get confused, I checked every network and the same thing.

Too bad, because % popular vote is always interesting and can be compared to the polls for each province etc.

Anyway, there is one site I found that does show popular vote by province https://enr.elections.ca/Provinces.aspx?lang=e

And you can compare it to it to the polls by province here https://newsinteractives.cbc.ca/elections/poll-tracker/canada/

For example, polls had Atlantic Canada as 41 Lib, 27 Con. (Lib =+14) The vote so far in Atlantic Canada is lib 42, Cons 33 (lib=+9) So that’s interesting….

We do in fact have a private health care option in BC. There private MRI clinics as mentioned. Also there is Cambie Clinic and the False Creek Surgical Centre that provide specialist consultations and surgical services. These are heavily utilized by Worksafe, RCMP, Corrections Canada and for a fee, the general public. There is Copeman Health which offers expedited primary care and specialist referrals. Physicians who serve these clinics work in the public system as well. There has been a several year court case which is coming to a decision shortly, in which the government of BC is suing these clinics as contravening the Canada Health Act. The Clinics argue it is unconstitutional to force people onto these long and at times hazardous wait times without choice. If the government wins expect even longer wait times than we currently have and possibly an exodus of some specialists such as Orthopedics who can get only very limited operating time in the public hospitals.

Have a look at how other countries provide health care. We have our head in the sand revering our inefficient, costly, monopolized health care system as sacred and untouchable.

Imagine having furniture and floors nice enough that UV damage is a concern 🙂

I think Titan has the rights to the 3M stuff for Vancouver Island.

It’s a really good product and it’s guaranteed for the life.

Anyone have a reasonable referral for someone to install UV coating on our south facing windows, the back of our house is half glass and its great from Sept to May but I would like to avoid UV damage to floors and furniture, our blinds have UV protection but I would prefer to look outside. I got one quote and it seemed high at around $200 per window, owner said it takes about 10 to 15 mins per window.

There is a no wait private MRI clinic in Vancouver (Richmond) http://www.prioritymri.ca/

You need to pay about $1,000 and have a Doctor referral, and you can typically get the test within a day. That doesn’t help with the surgical referral though. We need private health care options like most other countries have.

‘

‘

I have used the Cambie clinic, if you have the means there is no need to wait. That was over 10 years ago and cost was around $400 for 1 hour apt.

the key issue is equality (but dont forget inclusivity and diversity!)

rich or poor, Canadians are all entited the the same universal mediocre level of health care.

And you thought BC was tough on landlords. Note that Berlin is a state under Germany’s federal system.

Berlin’s bold proposal for surging rents: Evict the landlords

This is what our government doesn’t get, people can’t wait forever and are willing and able to pay for efficient service with results. There are aspects of our system that work, for instance, I had a torn retina and if not treated in a couple weeks, that eye goes blind. I was operated on in a week but the specialist works like a dog and is the highest paid Doctor in the Province. Sometimes I think our system is backed up to ration care, if every problem was treated quickly, our country would be bankrupt. An efficient and free health system is just not realistic, especially when you consider the poor physical condition most Canadians are in.

There is a no wait private MRI clinic in Vancouver (Richmond) http://www.prioritymri.ca/

You need to pay about $1,000 and have a Doctor referral, and you can typically get the test within a day. That doesn’t help with the surgical referral though. We need private health care options like most other countries have.

That one is weird. I showed a GP a mole and he excised right there in his office and sent it for biopsy and the result in 2 days. Getting to a specialist is insane in our system unless you are dying right at that moment. I know a few folks that tried to get to ENTs for vertigo and they had to wait for a year and a half, but at least their vertigo cleared after 6 months of not be able to work a full day or enjoy life. For myself, for knee problem, I was put on a 6 month to year wait list for a MRI, before they would do a surgical referral that was to take up to two years after having the to wait for the MRI. So, I went to Seattle and paid the money and got it all done in one weekend. I couldn’t let myself be useless for a possible 2 to 4 year period of hindered productivity and enjoying life. Health care in Canada is the ultimate red herring of Canadian politics everyone knows the system is broken and knows there is no way for more government funds to go into it (since it already takes up 2/3rds of provincial budgets), but any real discussion on the system just turns into zealots screaming about a slippery slope to the evils of for profit medicine.

Monday numbers:

Sales: 454 (down 27% from last year, up 18% from 2019)

New lists: 616 (down 20% from 2019)

Active listings: 1190 (down 53% from last year)

New post tonight

I had a mole I need to have checked out and it was going to be 6 months for a dermatologist. Went to Croatia and had it checked out same day my flight landed at a private dermatology clinic. If it was melanoma you would be dead before your appointment. For a rich country the healthcare system here sucks.

Kids and pets tend to put a lot more wear on a place. Might be obvious, but I’ve had to learn that over the years.

I agree with having a private health system in conjunction with the public health system. Several European nations have such a system. I think in most countries the private system must provide a percentage of their care to the public system, something like 20%. This takes some pressure off the public system while allowing those who can afford or have private insurance to access the private system. We already have a private system that we can access, it’s called the U.S. health care system. Many wealthy people opt to get their treatment across the border avoiding long , possibly harmful, wait times. My friend knows someone who paid $60,000 for a knee replacement to have it done quickly and not wait for months or years. It was worth it to them. I definitely am not in favour of paying for someone else’s medication, facilitating their dependance. Doctors hand out pills like candy.

If your Schnauzer has a cough you can get same-day treatement in a clean facility with enthused, motivated and well-paid staff. Conversely, if your child experiences a sudden hearing loss you will be told (with a straight face) that it is a nine-month wait to see an ENT specialist in Victoria.

What better marker do you need for a society that lost its’ way? A socialist pipe dream has become a nightmare for any number of Canadians.

No nation yields to the UK in pride for their socialized health care system, yet they also have first-rate private care. The country has had a cradle-to-grave welfare state for 75 years but no one there seems to find private care a moral failing or a capitalist horror.

Privitisation is the only solution so embrace it now, not after your near and dear ones die lingering and pointless deaths.

Great tips Viclandlord and others, thank you

Perhaps because if your job can be done by you at home it could probably be done by someone in India, etc.

Anyway, what’s possible and what the employer wants are not the same thing. Just ask all those people who are being told to come back to the office or find another job.

6/10 job seekers in the US looking for work are intending to find a job where they can work from home. No surprise, as Covid has shown most people that this is possible.

People working outside the home (like an ICU nurse) will need to be paid more to do it, at least relative to the home workers.

Cadborosaurus

First off congrats on the purchase!

Some tips for you becoming a landlord

When did the tenancy start with you?

How much rent was being paid?

Was rent paid the 15 or the 30th?

its mind blowing the amount of people that will give fake references.

Treat it like a business and do not under any circumstances listen to anyone’s sob stories!

These lessons were learned after a 20k loss and 6 months to get them out ( but the rtb favours landlords apparently lol )

Good luck!

Or perhaps believe that what you do is worth it for other reasons? You make a good point if you don’t feel that way though.

I’d like to see a major move to government funded nurse practitioner clinic models with multiple staff members who can cover for each other to address the family doctor shortage. With standardized overhead and set salaries the job is more appealing to a nurse practitioner imo and we should be providing free tuition for those willing to become practitioners.

On topic, I’ve enjoyed the data provided by this free service: https://bchome.ai/

Why not just answer the rental wanted adds? The adds themselves are informative and you usually get to look at future renters.

FYI: A gut-wrenching first person (an MD) story on CBC today (see link below) about doctor shortage, which can happen or/and happens almost everywhere in Canada:

https://www.cbc.ca/news/canada/newfoundland-labrador/opinion-kidd-doctors-leaving-1.6179376

We need to increase the number of both medical and nursing schools here in the province. I also agree with Marko that after a number of years of service that all student loans are forgiven, Better pay is a must.

As a former ICU/Emerg respiratory therapist you would have to be an idiot to be in health care. 90k/year stressful, nightshifts, very high responsibility (I was intubating and doing aertial lines, etc.) take shit from patients, etc. I was on the code team and you would run full speed at 5:30 am (10 hrs into your shift) to resuscitate someone on the ward. Get there shock them, intubate them, etc., and then go home at 7:30 am and it’s not like you would even get a thank you from anyone for your efforts.

Alternative is just get some complete non-sense provincial/municipal/etc. government job with flex fridays or even better take a 6 week course and sell real estate.

There is so much wealth and waste in society that there is plenty of room to train more and pay health care professionals better, but we’ve opted not to do so.

If you made nursing and other health care professions free tuition (or loan forgiveness with a few years of service) and increased pay 30-40% there would be no issues with staffing.

Fyi, number of full time realtors currently are ex ICU nurses…how sad is that.

Thanks Karise for the info and your hard work! It confirms that BC couldn’t take AB Covid ICU patient is purely due to resources shortage, Not about politics. It also confirms that we are facing the same crisis as AB.

If we could get our own crisis under control, of course we should help. So the best we can do now is to ask those around us who haven’t yet vaccinated to get the jab asap. Once BC reaches 75% vaccination rate (of whole population) like Denmark, then we would be in a better position to offer help.

From what I see everyday as a healthcare worker it’s not about having beds it’s about having no staff. There is a critical staffing shortage in all departments and our covid hospitalizations are rising quickly. Victoria hospitals are already bringing in contract workers from other provinces just to get by. Please be careful out there and if you’re not vaccinated stay home. My co workers and I are very nervous for what this fall/winter may bring.

The biggest problem with the health care system is the attrition that has occurred in the nursing profession. Thousands of positions are vacant in most Provinces, they are dropping like flies due to the physical and emotional stress imposed by the pandemic. Even recent graduates are packing it in. This problem can’t be fixed overnight, you don’t want to need medical care nowadays. Maybe that’s why Provinces aren’t able to provide help to Alberta, they may have the beds but lack the staff.

I’d pay Marko to screen tenants

Re: Alberta, we told our family out there to bubble wrap themselves, the ICU crunch is terrifying. I think BC should be helping out if able to do so.

Pending at $899k.

Of course Alberta would also be “footing the bill” for any Albertans treated for COVID-19 in BC, or any BC staff working in Alberta, so I don’t see any relevance to that point.

BC does have ICU space now, and Alberta doesn’t. BC should accept some patients, as lives are at stake.

The BC taxpayer is footing the bill. Helps support the Alberta health care system. And if there were no beds available, no I don’t think there would be outrage from BC if they couldn’t accept out-of-province hospitalizations. The space is there or it isn’t.

Good to know my car gets me in your door. Never would have thought of it that way. I manage our properties – I don’t feel like paying someone for something that is normally extremely low effort. I only rent to people who take their shoes off at the showing. We all have our things…

It look like we are well divided to me, because we no longer stand as one.

The True North strong and free!

From far and wide,

O Canada, we stand on guard for thee.

It doesn’t need to be an earthquake. Even with the pandemic crunch Alberta still accepts the emergency patients from Northern and Eastern BC. I am pretty sure the classy people enthralled with petty politics and looking down with their hubris at our neighbours would let their hypocrisy flow with outrage if Alberta started refusing emergency patients needing care from BC (taking these emergency cases occurs almost every day). The virus doesn’t know politics or borders and BC needs to careful because we might be in the Alberta situation in a matter of weeks (ironically,one of the reasons BC wasn’t willing to accept Alberta cases). It’s best to help all you can, whenever you can.

It has nothing to do with politics nor pointing fingers at anyone at all. I wouldn’t feel bad nor blame on them if they were also hit badly by the same earthquake so they couldn’t help us, even they wanted to.

Reckless, misstep, or whatever you want to call it, we must help our neighbour/team, because we are all in this together at this time of need. This is not the time to point fingers, being selfish, or saying it is NIMBY-NMP (Not In My Back Yard-Not My Problem).

How would your children feels if AB refuse to send relief if we get a major earthquake that we ask for help?

Biggest factor is fewer seniors per capita. Alberta 14% versus BC 19%. That’s 65+, difference is a lot bigger for 75+.

By the same measure, they should have fewer Covid hospitalizations per capita. Should.

Absolutely true.

But BC still could offer “some” beds and “some” staff to help Alberta. Zero is too few.

For example, none of BCs 218 surge ICU beds have been activated. BC have had 18 months of pandemic to prepare for this, and have confidently boasted about those surge beds at press conferences.

They should open up those beds and get the staff for them ready.

What are they waiting for? We may be like Alberta in a few weeks and I wouldn’t want to be Horgan asking other provinces for help.

One thing I don’t understand, AB population is about 86% of that in BC, how come they only have 173 ICU beds normally (note they just added another 113, increased it to 286 last week) while we have 510 ICU beds in BC?

I don’t think it is not about politics at all, but the main reason behind BC’s refusal is that our medical system/resources are running full and under high stress already. You can’t just take a patient in onto an ICU bed without medical resources for care and support. Where would be the extra resource from? Didn’t we just have someone died while waiting in ER and 911 recently? Aren’t there so many people on this island waiting for years but still couldn’t get a family doctor?

Also BC is just a bit, but not that much better than AB wrt Covid crisis, due to the big mistake of removing indoor masking policy and holding-back to re-add it by our PHO. Per IHA report, we had 73 new cases yesterday in south island (great Victoria area) alone, the highest one day ever from 57 cases the day before, and likely higher in the coming days.

In other words, BC is just supposed to forget about Kenney demonizing the province for years on end because he can’t handle the fallout from his idiotic policies?

If BC had so many hospital beds and staff that it could accommodate potential 4th wave demand from both Albertans and its own populace, I would say let bygones be bygones. But it doesn’t nor does any other province.

There’s plenty of times to play politics. This isn’t one of them.

I would prefer not to cancel a bunch of surgeries because of Jason Kenney’s recklessness and ideological stubbornness unless it becomes absolutely necessary. Not offering beds at the moment is the right call.

The only good thing about Kenney’s mismanagement of just about everything in Alberta, is that his dream of becoming Prime Minister one day is likely dead.

Shame on our BC provincial government, for refusing to help out Alberta with ICU beds to help with the Alberta overflow ICU bed crisis.

Alberta has 270 COVID patients in ICU, and their ICU is at 155% of capacity.

BC has 144 COVID patients in ICU, with 282 free ICU beds (64 free beds + 218 available surge beds)

Alberta has specifically asked for help from other provinces with ICU beds and staff. “ ICU space and skilled labour from other jurisdictions”

Thank you to Ontario, Manitoba and Newfoundland, which have offered to help. But not “Beautiful British Columbia”, which has “ stopped short of offering hospital beds or staff.”

What the hell does it mean to be Canadian, when we won’t help out a neighbor province with the help it is asking for in an emergency?

https://globalnews.ca/news/8199554/horgan-alberta-covid-crisis/

“Alberta Health Services head Dr. Verna Yiu said this week the province’s ICUs were operating at 155 per cent over capacity, and that the province has reached out to other jurisdictions for help.

Ontario and Newfoundland and Labrador have offered aid, but British Columbia and Quebec have both said they do not have the capacity to assist.

As of Thursday, B.C. had 134 COVID-19 patients in hospital, 117 of them unvaccinated.

British Columbia’s healthcare system has a total of 510 ICU beds and 218 surge beds, 444 of which were occupied as of Thursday.British Columbia’s premier says the province will do what it can to help Alberta stave off the collapse of its health-care system, but stopped short of offering hospital beds or staff.”

I really don’t have the time to manage my own properties anymore and I totally have no issues paying 10%; however, I feel like I do a better job myself being the owner so I continue to manage. When I was a renter and looking at places I would often show up and there would be a bunch of other perspective tenants and the property manager was just handing out applications. Personally I always book tenants 20 minutes apart so I can chat to them as to me personally a short chat is a 80% of the equation. I would NOT SUGGEST this but I’ve never done a credit check on anyone and between all the properties I own and I have one now that I’ve been renting for 10+ years I’ve never had a late rent payment. Four tenants so far have used me as a realtor to buy places (I have a good relationship with my tenants).

I just go on common sense and my own investigations. For example, if they put down they work for Island Health and make $90k/year I should be able to find them on the list of people making over 75k/year at Island Health that is published every year. I’ll do my own social media research, etc.

I also try to rent to government employees, medical residents, etc.

I have a bunch of other oddball quirks. If they put down on the application that they drive a Mazda3 hatchback (sport) they are pretty much a shoe in. When have you met an asshole that drives a Mazda3 hatchback? Dodge Ram…….not a plus in my books.

From: https://www.cnbc.com/2021/09/17/china-developer-evergrande-debt-crisis-bond-default-and-investor-risks.html

Looks like a real estate debt crisis in the PRC is starting to become concerning as they worry about a market contagion and an economic crisis in China.

Hi Leo could you please give the sale price of 871 Sevenoaks RD. It was listed for only a few days at 899000. Thanks for this.

Bigger problem in the U.S. is the thousands of people crossing the southern border every day. Who knows how many are carrying covid and are not vaccinated. This could eventually affect Canada.

Strange times for housing. The share of people in the US who think it is a good time to buy a house has collapsed from the usual 70%, to 29%. That’s the lowest it’s been since 1982 when mortgage rates were 15% and inflation and unemployment were high. https://finance.yahoo.com/news/americans-haven-t-down-housing-174212114.html?fr=sycsrp_catchall

It’s a different story in Canada, where… “ 61% believe home values will only go up in the immediate future. Four-in-five Canadians also continue to see housing as a good investment (83%) and the majority say it is better to buy than rent (56%). there is a large increase in Canadians who are considering buying a home in the next two years (30%, up 8% from 2020). This rises to 49% for those respondents under 40 years of age and 66% for new Canadians who have been in the country less than five years. ” https://www.newswire.ca/news-releases/are-canadians-dreaming-of-owning-a-home-it-s-complicated-rbc-poll-867206771.html

So it’s strange that there’s lots of housing bears in the US and very few here.

Marko- Being a Real Estate professional you know how to screen potential renters. Which is why I recommend using a professional. Also, having someone manage your property gives you support and expertise when problems with a tenant arise. For some people managing a property is within their capabilities, many people lack the experience and can run into unforeseen problems. I hope he takes my advice.

I add these questions at the bottom of my rental ads and only about 1/10 address them and those are the only perspective tenants I get back to….remainder I don’t reply to.

“To assist with the rental process please provide some information about yourself:

1. Who is your current employer? Or what is your major source of income?

2. How many people will be living in the suite?

3. What is the reason for moving from your previous home?”

Patriotz: Actually good idea from you that we should scale back the tourism industry. Maybe just focus on the high end tourists and forget the mobs off the cruise ships. Langford just got a bunch of well paying jobs there in tech, maybe if we got rid of the druggies downtown and cleaned up the city we might have been able to provide better high paying jobs here.

Try a posting at the hospital renting out to a young doctor doing their residency. They are usually quiet, respectful and almost never home. Often only around a couple of years which lets you bump up the rent on a regular basis. Neighbour has had great success with this arrangement.

If the cruise ship isn’t leaving America, they wouldn’t be allowed to hire foreigners with no American visas, avoid US taxes and alcohol/gambling laws. So yes, that’s why they WANT to stop in Canada (and Caribbean countries) . BC ferries can’t hire foreign workers without Canadian visas, just because they’re a boat.

They have always realized this. Indeed it was well reported when the Alaska cruises really got going from Vancouver a few decades back.

Yes.

Though there is a good reason for the Jones Act, that might end up saving our BC cruise industry. The Jones Act and amendments came about during prohibition, to prevent international cruise ships from having a floating casino and alcohol, which would violate US prohibition and gambling laws, as they are outside the US laws.

The Americans don’t want to allow a cruise ship to travel only within the USA. For example, from San Diego to Seattle. The reason is that these aren’t American flagged ships, and don’t have American workers or need to follow American laws. There is only one American flagged cruise ship (Pride of America), and it needs to have American staff, and it can’t have a casino, or a “drink package” or other flexible alcohol/gambling/labour rules. It putters around the Hawaiian islands, never leaving America.

So the only reason that a cruise ship is allowed to have these things like international workers, casinos, and flexible alcohol rules, is that they have some foreign destination included. That stops an international cruise ship from having floating casinos and tax free alcohol and just parking themselves outside a big American city.

If they were to stick with no Canadian stop on Seattle to Alaska cruises with international (non American crews and laws), then lots of stakeholders in America like labour unions, casinos, hotels etc. would complain because they have to hire Americans and these cruise ships don’t. It’s of course possible that they’d make a special exemption for Alaska, but they don’t do it for Hawai’i (you never see a Seattle to Hawai’i cruise for that reason)

freedom- Where’s your sense of humour? 2009 was a totally different story from today. My property manager has told me that the responses to any ad concerning rentals is insane and the people are quite aggressive. Anyway, you can lead a horse to water…..

The most amusing thing about this that it Governments in Canada don’t realize that the cruise ships never wanted to stop in Canada. It was an anomaly created by the Jones Act that made them stop in Canadian ports. The scenery is the draw up and down the coast. So, they have the situation now where the cruise ships will travel the inside passage where we take on all the pollution risk and etc.. and Canada gets none of the revenue. Before any one says we can kick them out of the inside passage, it is an international strait of navigation and we cannot prohibit innocent passage through it.

Cadboro, I totally agree with everything freedom _2008 and Dad have said.

Here’s another suggestion. Before you post an online ad, put the word out in your social circles (family, friends, work) that you have a suite available to rent.

Acquaintances (a co-worker’s relative, your brother’s friend, etc.) often make for excellent tenants. Advantages: you have a better sense of them (compared to a stranger off the street), and there’s this weird built-in incentive for them not to disappoint you or the person who gave them the tip.

Understand that you are an absent owner and don’t live local here. But neither your property manager nor us locals would post rental ads as you suggested (which were discontinued 20 some years ago), nowadays that almost all rentals are posted on social media. 😉

In a hot rental market, you don’t need to post your phone number in your rental ad, just let people reply via built-in email. You read and filter through the emails, and chose a few that are well written and sound a good fit and with a phone number (request that in your ad) to view the property and see them in person. Once you decide who is the best fit, give him/her/them the application form to fill, and then credit/reference checking … …

We even sold our last house ourselves this way in late 2009, posted in UsedVictoria and Craigslist, received over 100 emails in first 3 days. We called back to 40 well written ones and selected 12 to view the house (30 minutes each all in one day), and set a offer date 3 days later and got 6 offers.

Another thing helps is to be open and honest up front in your ad, e.g. say if you have young children so the tenant can’t be too sensitive on children running/crying sounds upstairs, and it is not good for someone works night shift.

Well I keep hearing on this forum that if people with lower paying jobs (e.g. tourism) find Victoria too expensive, they should just leave.

If you (collectively) won’t support policies that will make the city affordable for tourism workers, why care about having a tourism industry in the first place?

On the cruise ship issue, the Vancouver Sun reports that our Premier “ Horgan shrugs off latest U.S. threat to B.C. cruise ship business. Opinion: Premier showing ‘arrogant overconfidence’ is hoping new U.S. law will not be approved”

https://vancouversun.com/opinion/columnists/vaughn-palmer-horgan-shrugs-off-latest-u-s-threat-to-b-c-cruise-ship-business

I think our BC government may discover that you don’t tug on Superman’s Cape, and that the US doesn’t like to be pushed around.

It’s not looking good for the cruise ship industry in BC, as the Americans like the new system with no Canadian stops, and are considering making it permanent.

The provincial and federal governments mishandling of it may have killed most of it. The “alarm” here is not coming from me, it is from the Canadian cruise ship industry in BC. The US plan is for the ships to stop at native tribal lands in Alaska, and that would qualify as a “foreign” stop.

https://www.cbc.ca/news/canada/british-columbia/b-c-cruise-industry-sounds-alarm-over-proposed-u-s-laws-allowing-ships-to-skip-canadian-ports-1.6177365

“ Cities like Victoria, Nanaimo and Prince Rupert are typically stopover destinations and would see a fraction of the cruise ship traffic they normally do should the legislation pass, Robertson said.”

Dad’s comment is 100% spot on and why you should get a property manager. I like to leave things to the professionals, like dental work, surgery, car repairs, etc….

Cadborosaurus- Managing your suite is totally doable except in this market you will be overwhelmed and the applicants have zero patience these days. Unless you can find someone word of mouth, getting 100 phone calls are impossible to manage. Maybe put up a quaint hand made sign on the bulletin board at a grocery store with the little tear off telephone number tags. I’m just being stupid but I’m sure it would work with a lot less aggravation.

A caveat with reference checks is that sometimes the previous landlord is quite happy to see the tenant go, and will omit certain details when you call for a reference. Credit checks are a must, but not useful as noted below if a person has no credit history.

Don’t go for top dollar. Set the rent a bit below market value and be honest about things like noise transmission. People who feel like they are getting a bit of a break, and have been dealt with honestly tend to be less salty with you.

And do not under any circumstances let someone with shitty credit/sketchy references win you over with a sob story. I’m a sympathetic person but you as a landlord in the private market aren’t providing social housing. I have seen people get burned this way, and a savvy tenant can easily delay an eviction for months while paying zero rent to you.

I managed a rental house with a suite (total 7 bedrooms) for a friend who moved away for work. From my 7 years landlord experience, LandlordBC has been a very valuable resource, especially for a new landlord. They have more detailed rental forms to use, and can do credit check per request (with permission from the potential tenant), and all questions are answered promptly and just a phone call away. Their annual fee ($150?) is totally worth it, and you can deduct it from rental income with other related expenses. And you can stop using them once you have more experience or have a good long term tenant.

Credit check is not that useful for students, but is useful for other types of tenants. As least you should ask permission from the applicant, and it is a red flag If any applicant refuses that. Reference/previous landlord checking can also be useful. I would do online search of all the names/emails including the references given on the application throughly, especially when you will share your home with them. Good luck.

I’d do a property manager if I didn’t live in the same city but I’ll be living right above, and we will do small maintenance jobs ourselves. I’m fixing a door today it’s surprisingly rewarding 🙂

Would be nice to have someone go through the applications though, but I assume after the initial signing we wouldn’t have the same need for a manager as someone living elsewhere. I have a general idea about screening and where to list, just tapping some fellow landlords for tips as many of you have been doing this longer than my peers and probably have great suggestions.

Is there good value in signing up with landlord BC? Do you do credit checks?

I don’t see the appeal in getting a property manager for a suite in your own house. The tenants are going to be in your face anyway. Plus you are going to want to do a lot of minor maintenance yourself, rather than paying someone.

Further to property managers: They collect and deposit the rent for you (that can be a monthly hassle). They have access to all the trades who do the repairs you will ultimately need, and they are probably the most reasonably priced and reliable than someone out of the Yellow pages. They also provide you with an accurate year end statement that will make tax time less stressful. All in all, they basically pay for themselves, depending on how much you value your time. You don’t want to handle the 100+ phone calls you’ll be bombarded with, I hear renters are desperate and can get snarly.

Cadborosaurus- The fact that you are asking these questions tells me you are in need of a property manager. I realize you are renting a suite in your house and this may seem like strange advice, but for 10%, you don’t have to worry about dealing with human beings. They have a long list of renters and will do all the screening for you. They will probably get you a higher rent than you thought possible. Let’s face it, you’re going to get a silly amount of rent anyway, so why give yourself all that hassle. Maybe you should be asking for a good property manager.

Where do you list your place for rent and any tips on screening tenants? Thanks!

Voting statistics for Victoria and Saanich: https://www.homesforliving.ca/voting-record

Work in progress. Victoria stats go back over 2 years, Saanich stats just beginning. Goal is to backfill these to the last municipal election over time but the picture on who votes for housing and who doesn’t is already pretty clear.

Kenny,

As long as COVID remains bad and the economy is sluggish, I think rates will stay low and the stock market will do OK. When COVID and the economy improves I expect rates to rise, inflation to rise and the stock market to fall (not crash).

Thanks for the discussion and good luck with the yard work.

Patrick, I can’t keep track of your predictions, first you say rates will be stable and then you say rates may rise so best to lock in for 10 years and then the stock market may crash so people will be forced to sell but now you say the stock market not at top.

On another matter nothing like a prediction of heavy rain to get me to clean the drains and lube the seals on my hardtop convertible tonight after it has been on my to do list for past 6 months. I would park it in the garage but I have a slight leak in the sun roof of my other car and its in the garage, it seems like every sun roof or sky light eventually leaks.

California just ended restrictive single family zoning statewide. No city can restrict people from lot splits or creating a duplex.

Similar legislation is inevitable for BC. The only question is how long it will take.

No. I’m not calling a top in either of those. Look about 10 posts down, where I said rates are staying steady.

“ With COVID sticking around, and the sluggish economy I think rates will stay steady.”

And you can check out my many posts talking about how houses in Victoria are affordable, and this is the “golden age of affordability”, as house prices should rise in the future.

Patrick, so just to confirm, your calling a top in the bond market and stock market but not the housing market. Good thing you didn’t listen to Poloz when he said to consider a 10 year mortgage rate in 2018 when rates were 4%.

Yes. And Poloz, the Governor of the a bank of Canada agrees with me about getting a ten year term mortgage. I happen to think the governor of the bank of Canada knows more about future interest rates than you do. And he’s lobbying to make ten year and longer terms more available, at lower rates.

https://www.theglobeandmail.com/business/article-bank-of-canada-urges-lenders-to-offer-longer-term-mortgages/

As for the other reasons to get a ten year, here’s a summary …

https://www.alterna.ca/SharedContent/documents/Promotions/10Year-UnScaryMortgageRate.pdf

I don’t think we’re at the top of the market.

Best thing for a HH to do is to hold your nose, buy the biggest house you can afford, get a 10 year term and then just make the payments and forget all about rates, inflation and house prices.

You can come up for air 10 years later and if inflation has or hasn’t arrived your house is probably worth a lot more than it was 10 years ago when you bought it. And you’ve enabled your kids to grow up in a family house that you own, which is a big deal for a family.

‘

‘

So borrowing to invest is a bad thing but borrowing the max and paying a high interest premium to buy a house at the top of the market is a good thing as you say “your home will be worth a lot more in 10 years”, lol

BCGEU members got two wage increases in 1974 (15% and 8%), followed by another 9% in 1975…and then three 8% wage increases in the early 80s. My dad was in a private sector union and mentioned he got some massive wage increases during that time as well.

del

True that household incomes went up but due to both parents entered the work force instead of one income earner, hence the term latchkey kid was coined during that time.

There you have it folks. Housing price would go up substantially even if interest rates climbs.

A pretty sleazy real estate story..

From: https://www.cbc.ca/news/canada/british-columbia/real-estate-predatory-rent-own-1.6177366

On a separate note, from over the years, I do know of a couple real estate agents that purchased properties at a discount from seniors that brought the properties to a realtor to sell, but the realtor just bought it for themselves. One tore down the house in a prime neighborhood to build their own new place and the other that renovated the property and sold later.

I wonder if it’s too late to report?

It provides certainty, if you’re worried about inflation.

Old timers that lived through the 1970s-80s would understand.

“Best thing for a HH to do is to hold your nose, buy the biggest house you can afford, get a 10 year term”

Why bother getting a 10 year fixed?

5-year variable rates are hovering around 1-1.4%. Cheapest bank rate on a 10 year fixed that I see is 3.24%. I’m fairly risk averse, but I’m betting that you would beat the shit out of that 10 year rate by going variable, even with the renewal in 5 years. Plus variable mortgages are cheap to break.

Well rush4life, it seems you’ve talked yourself out of affording a home. As you know, lots of people with incomes less than yours manage to buy, and are happy.

I disagree. Cash in an account you can take our freely. To start with, a HELOC you can only borrow up to 65% of the value of your home – not the full 80%-95% like a mortgage – so if you only have 30% equity you can’t get a HELOC. You also have to qualify – so if you have recently retired and are trying to set up a HELOC through a bank you may not qualify – and if you do its still a process – so no, cash is king in terms of easy access to liquidity.

So you just said that houses are affordable because interest payments are low but now you are recognizing that amortization plays a part – which means really its the size of the total payment – not the interest portion. Just like Leos original affordability graph implies. I agree with this – Whether its a mortgage at 10% interest or a mortgage at 0% interest ultimately for the purpose of what is affordable is the size of the payment compared to my pay If the interest is 0% but is 80% of my take home pay – its not very affordable. if the interest is 12% but the payment is only 20% of my take home pay then its more affordable. There are other considerations that you realistically incorporate but i think the chart gives a pretty good impression of affordability.

So were real household incomes, substantially. Nominal household incomes even more so.

Plus rates really didn’t go up that much. From 7% in 1960 to 11% in mid-1979. They went up a lot afterward, but that baked the 1981 crash into the cake.

https://www.bankofcanada.ca/wp-content/uploads/2010/09/selected_historical_v122497.pdf

Affordable is a relative term, and whenever price jump to 5M that a single or 2 person income can’t pay for it, then perhaps we may have to rethink our term of affordable and strategy as billions of others who aren’t living in North America are facing. Perhaps, we then finally have to join the rest of the world and live in a multi generational dwelling and save the planet.

Not necessary, interest rates was on an upward tear through out the 60s and 70s, and so was the ascending of house price. Even those salary increased was well below the rate of housing.

With COVID sticking around, and the sluggish economy I think rates will stay steady.

Best thing for a HH to do is to hold your nose, buy the biggest house you can afford, get a 10 year term and then just make the payments and forget all about rates, inflation and house prices.

You can come up for air 10 years later and if inflation has or hasn’t arrived your house is probably worth a lot more than it was 10 years ago when you bought it. And you’ve enabled your kids to grow up in a family house that you own, which is a big deal for a family.

Hard to say but I do think it will put a pressure on prices if rates do rise substantially. Even if they don’t, I still think the 40 year drop in rates is wildly underestimated as a factor and a lot of people are still projecting out from those returns as if it can be repeated.

It’s much better than a liquid bank account. Because you can pull funds out whenever you please (HELOC), but unlike a bank account you get to keep the investment.

Kinda tells you that as interest rates go up though, prices have to come down no?

The Pfizer name is Comirnaty, let’s make this pandemic more difficult for everyone. No wonder there are conspiracy theories.

Who comes up with these? You could have a kids contest to name these and they’d come up with better names.

SpikeVax is the equivalent of VaxyMcVaxFace.

They just fully approved the Pfizer and Moderna vaccines in Canada. To confuse everyone even more, they changed the name of both of them. That’ll make things better.

We’ve always been at war with Eastasia.

Yes, houses could still be affordable at $5m, 0% interest , actually more affordable than now if you pay off in 100 years instead of 25 (as they do in Europe)

I’ve said that houses in Victoria (and Canada) are now and have always been affordable. many posters here know that, because they’ve posted on the forum here that they could buy a home but just haven’t found the right one yet. I haven’t said that it’s impossible for houses to become unaffordable, just like peanut butter might become unaffordable, but isn’t now.

The $5m scenario you talk about hasn’t happened and when it does let me know. Maybe mortgages will be paid off in 100 years instead of 25 and then the $5m house @0% interest will be more affordable (lower monthly payment) than a $1m house @2% interest now. And all payments are principal so it is actually much more affordable in your “worst case” scenario

This is the wrong way to look at it – so if prices jump to 5M and interest rates are zero then prices are affordable (despite no one being able to make monthly payments to principal) because 0% is going towards mortgage interest? Just because money is going to principal doesn’t mean its affordable. Its not a liquid bank account where you can just pull funds out whenever you please.

The typical affordability chart is used to show how unaffordable houses are in Victoria. Because, “OMG look at what % of income people need to pay to buy a house!! 60% of income on a mortgage. There is nothing left for food! “ If we are now told that the Y axis is irrelevant and it’s only in relation to historical range…. Then it doesn’t say anything about if houses are unaffordable or not. Because you could show a graph of the cost of peanut butter compared to income, and it would rise up and down, and it doesn’t mean that the cost of peanut butter is at times unaffordable and a “crisis”. The actual amount of your income consumed by peanut butter is relevant here, and a properly labeled Y axis would make it clear how cheap peanut butter is.

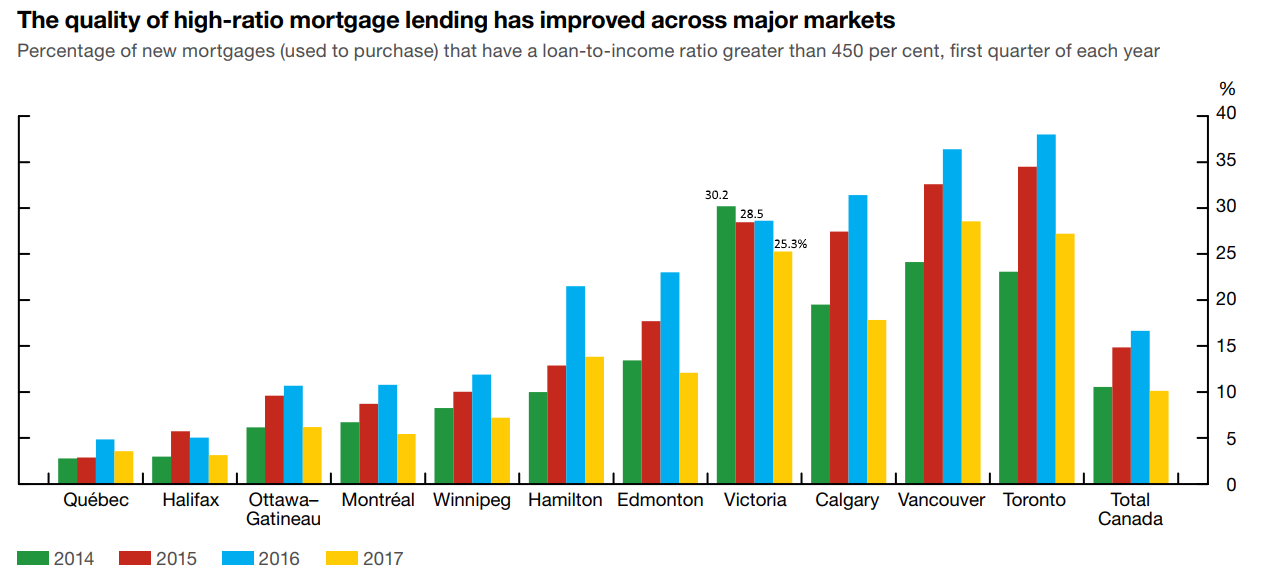

I make the case that homes in Victoria have always been affordable, including now. And a great way to show it is to show how small a % of income is spent by first time buyers on mortgages, with 75% of them spending less than 9% of their income on mortgage interest (as shown on your BOC chart below, assuming 2% mortgage rate). Yet we are told by the “homes are unaffordable” people that even this is too much to pay. And by the way, the 9% is people with new mortgages, and the average mortgage payer is paying much less than that.

Here’s an amazing single piece of data from stats can showing that ‘houses have always been affordable” … The average household in Canada spends a tiny 3% of their income on mortgage interest and that amount has been constant for at least 25 years.

The point is the markets with the highest prices have the highest debt levels.

You’re missing the point of the chart. It’s not meant to reflect any given buyer. The values are irrelevant. Forget the values completely. I’ve made the same chart relative to disposable income and everything gets shifted up to above 100%.

The only thing that matters is the current reading in relation to the historical range.

Looking at the BOC chart showing high ratio mortgages shows an important point about how truly affordable homes are in Victoria. Because Only 25% of Victoria new mortgages are higher than 450% on your chart. It shows that even the most indebted with a mortgage 450% of income @2% rate is only paying 9% of income as interest, not the 33% you show on your “interest only” affordability chart (see yellow line in chart below).

Someone with a “worryingly high” mortgage 450% of income, paying 2% mortgage interest is paying only 450%x2%= 9% of their income per year in mortgage interest. For example, someone with a 100K income borrowing $450K would have a high ratio mortgage.

But they only pay $9k interest (2% mortgage) which is 9% Yet somehow you have an affordability chart (yellow line below) that says the average buyer is paying 33% of income as mortgage interest.

This shows a point that I’ve made previously, that new buyers aren’t buying average SFH homes (which are expensive), they’re buying the 50% of homes that are below average price. And even the ones with 450% “high ratio” mortgages that we are told are dangerously high in debt are only paying a reasonable 9% of their income to mortgage payments. The BOC chart you posted tells us that 75% of new buyers are paying LESS than 9% of income as interest (with a 2% mortgage).

So who are these people that are paying 33% mortgage interest on your chart? At 2% mortgage rate , someone with $100K income would need to have borrowed $1.65m. That isn’t anything close to what people are borrowing, I think the average new mortgage in Victoria is $420k which is 1/4 of that.

More or less my thought as well. Most of what we are seeing is supply chain disruptions still. Could it take off? Sure. I just don’t see the need to panic in the data.

Good thread here from economist Trevor Tombe https://twitter.com/trevortombe/status/1438120602779353090?s=21

DIY-ers benefit from lower prices in aftermath of lumber price correction

https://www.ctvnews.ca/business/diy-ers-benefit-from-lower-prices-in-aftermath-of-lumber-price-correction-1.5586608

An eight-foot-long, two-by-four inch piece of framing lumber that cost $12.65 on June 1 is now selling for $3.95, … basically what it would have sold for before the boom.

I’m not really concerned about vaccinated cases. Risk of hospitalization drops something like 35 times if you’re vaccinated. But it seems inevitable that about 20% of the population will remain unvaccinated and every one of them will get COVID leading to a very long dance with restrictions to prevent our health care system from being overwhelmed. We’re better than Alberta on vaccinations, but the end result remains that it will work through the unvaccinated population sooner or later:

My point on that article was not the specific amounts but that debt is high in high priced cities. Bank of Canada came to the same conclusion. Just to counter the idea that everyone is paying with cash and it’s all just wealthy buyers.

Although BC is a bit better than AB, Removing masking policy on July 2nd was a big mistake made by Dr Henry. I would think it is one of the main reasons for BC high cases numbers in this 4th wave. Blaming the unvaccinated rather than admitting their own big mistakes is pathetic. BC has higher vaccination rate than ON but ON has much lower case rate in the 4th wave and they have kept indoor masking.

A good map below by an MD on Twitter:

“Fear” is the biggest motivation to sell stocks, and people that have taken your advice to buy stocks with truck loads of borrowed money will be the most scared if stocks fall.

The people that will be selling most in a down stock market with rising rates will be people like you that have taken on truck loads of debt to invest in the market.

Because the “no-brainer” reason they took on the debt was “crazy low” rates, and that reason is gone when rates go up. Their Telus shares with a 4% dividend that seemed a good idea when they were paying 2% on the borrowed money, don’t seem like such a smart idea if they’re paying 7% on the borrowed money.

RRSP/RRIF withdrawal can be done in-kind, so no need for seniors to cash out the market other than the tax owing portion.

You mean like the way the title to your house is registered with the government? Face it, if you want to get government out of it you’ll have to put it in gold bars or the like.

Despite all the media re early vaccine rollout 78% of Israel adults are fully vaccinated so it is not spectacular.

Certainly seems that way. I wasn’t anticipating so many breakthrough cases when they announced the vaccine.

What is worse than Alberta is what’s happening in Israel. They had the earliest uptake of the vaccine and vaccinated a high percentage of their population.

,

‘

Actually they have only fully vaccinated 62 % of their population.

The idea of registering my life savings with the government has never been appealing to me. It just gives them more control.

Most people don’t have a TFSA actually, nor do most people make an RRSP contribution every year.

Stock holdings in RRIF’s are tiny compared to the whole stock market. Potential buyers are world wide, particularly for US stocks which anyone can hold in their RRIF without limit. I just don’t see it as an issue.

What is worse than Alberta is what’s happening in Israel. They had the earliest uptake of the vaccine and vaccinated a high percentage of their population. Things are worse than ever there, it appears the vaccine may not remain effective for more than a few months especially when it comes to the new variants.

Umm-The original point was that the selling of RRSP assets would exceed the demand and cause the markets to correct.

What’s happened in Alberta shows us this thing is far from over.

In the end every single person will be exposed to COVID. Either you get it vaccinated and are probably ok or you get it unvaccinated and might not be.

Problem is 30% of the people in Alberta are unvaccinated and that’s several times more than we need in order to overwhelm the hospitals.

It’s gonna be a long haul.

So, what’s the original point? As well, the contribution limit on a RRSP is reduced if you are contributing to a pension other than CPP. So, the RRSP really isn’t a huge part of a retirement plan because of the decreased contribution limit (but still offers exploitation opportunities). Not to mention if there other big income sources in retirement, tax becomes the big battle later in life. Hopefully, people aren’t doing their retirement planning around the mechanisms (such as RRSP) mandates or they will get caught in negative options. Ideally, someone targets the RRSP as a tax deferral in high income years, then actions an early retirement and draws down the RRSP in years their income presents as low and before the other taxable retirement investments start paying out. Of course, many with a big pension don’t want to have the RRIF bumping them into a high tax bracket. Tax is what will eat away at a lot of what people figured they gained in investment growth. The RRSP is an extremely useful tool if not looked at in a simple linear view. It really needs to be customized to the needs of the person now and in their future. I assume that most people use their RRSP tax rebate cash to top up their TFSA every year…… Hopefully, they are also using their TFSAs as an investment account and not just a savings.

Personally I would spring a tad to -> https://reunionatbelmont.com/

Umm- It is mandatory to convert to a RRIF when you turn 71. Many seniors with serious money in RRSPs probably have good pensions and did not need the money. At age 71, their seven figure RRSPs necessitates taking out at least $50,000 a year. The percentage increases every year. I think the government knew what they were doing when they created this “benefit”. Luckily, I stopped contributing to an RRSP in 1998, opting to invest in real estate. I think this forced liquidation will cause the stock markets to fall when the generation who created the demand, becomes the supply.

Seniors could but this money right back into equities (after tax) if they don’t need the cash. If they do need the cash they would have liquidated it anyway. Also, if they are relying on it for income they should have converted most of those equities to fixed income well in advance

Is there a reason those seniors haven moved those RRSPs into a RRIF? Are they worried about dying before annuity is paid out? Or is the RRSP small so it doesn’t warrant going into a RRIF? Then if it’s small the 5% draw down in a down market shouldn’t be an impact. Ideally, the maxed out RRSP was primarily done as a tax deferral mechanism and there is other money located in other vehicles, that mitigates the forced 5% sell in a possible down market.

But if a bunch of equities come up on the cheap that people have to sell, I will probably be buying some…. Especially at a discount. I think everyone did well buying financials in 2009 and who didn’t load up on energy stocks when they crashed at the start of the pandemic?

I worry about a stock market crash. As seniors are forced to liquidate 5% of their RRSPs every year, who is going to buy up all their equities? Certainly not young people with huge mortgages, we could be headed for a perfect storm. Unless the large equity funds can absorb all these assets, a crash might be inevitable. It seems to me that the 21st century is replaying the 20th century, without a world war( some would argue that we are in a silent world war), and we all know what happened in 1929. If this hyperinflation continues, it could happen sooner. Crashes don’t have a time schedule, they can happen tomorrow, that’s why it’s called a crash. By the time you brush your teeth, half your investments could be gone, and there isn’t going to be any government bailouts, they’re broke and the main reason for a crash to occur.

There is no real must buy scenario other than the one people convince themselves to justify purchases; however, there are real must sell scenarios that exist in every market. The must sell occurs in the ups and occurs even more in the down markets.

FYI: interesting site about cost of living in Victoria (or other cities around the world) and in comparison with Halifax (or with other cities):

https://www.numbeo.com/cost-of-living/compare_cities.jsp?country1=Canada&country2=Canada&city1=Halifax&city2=Victoria&tracking=getDispatchComparison

Nothing about stock predictions is “necessarily true.”

My opinion is that the “party will be over” for rising prices of houses, stocks and bonds if there’s significant, sustained inflation. (e.g. 5-7% per year, sustained inflation).

The fed and our BOC will not keep printing money or keep rates low in the face of sustained inflation, that would be economic suicide. Instead they will raise rates, higher than the rate of inflation if necessary.

Currently the fed , BOC and the market believe that inflation is temporary, which is why the party (low rates) continues. I hope they’re right.

Yah it might take years for a crash. But stocks that people are buying for a 5-6% dividend yield will get slaughtered fast if rates rise due to inflation.

Since “homeowners gotta own”, a smart move for homeowners should be to lock in these low mortgage rates for as long as possible, like 10 years. Then inflation might be your friend.

They stop trades for 15 min and restart. During the most recent crash there were some of the biggest drops in history – 10% on a couple days if memory serves. The only time they stop for the day is if its 20% or more on the index. I don’t think that has ever happened even in 2008. This doesn’t prevent a crash it just stalls a daily drop. I mean markets just dropped 30% plus like a year and a half ago – it didn’t prevent that.

You are correct that the stock market and house price will fall if we face hyperinflation, but the effect would take sometime (5-10 years) before the crash similar to the buildup pre 1929 and pre 1982. The government seemed to have figured out that quantitative easing works as a tool for prevent market crash and/or speed up recovery. And, today stock exchanges employ automatic circuit breakers to halt trading to prevent a steep decline/chaos, something that they learn from the 2000s dot com, and 2008 bubble.

So, imo it will be unlikely that we will see steep prolong crashes of the past, unless we go into a global/full on shooting war with China.

If “Inflation is real”, as you say, then future higher rates will also be real. In that scenario, it is likely that both the stock market and house prices will fall.

‘

‘

‘

That’s not necessarily true.

Why would you be selling in a down market?

If “Inflation is real”, as you say, then future higher rates will also be real. In that scenario, it is likely that both the stock market and house prices will fall. It would be painful to be carrying a “truck load of debt” and have invested that in the stock market that falls.

Worse still would be to have invested using a financial planner who convinces you to “stay the course” and “hold for the long term”, because then the losses could be huge.

Marko, what do you think of the development at Whirlaway in Langford? Currently there is a 3bed/2bath, 2 parking spaces condo having 1125 Sq.Ft. Completion is expected in July 2023. Asking price is $619,900 and it can be purchased with 5% to hold. That is a couple of years from now…..? Seems like it may be worth looking at.

“Makes more of a headline when you see it was already up 0.6% in July.”

I just think it’s kind of a silly comparison. CPI can bounce around month-to-month, so year-over-year comparisons don’t really mean that much. No denying that the trend is up over the last 6 months but I’m going to wait a bit longer before getting my laser eyes.

Makes more of a headline when you see it was already up 0.6% in July. Either way seeing near 20 year highs on inflation is nothing to sneeze at. here are some more details:

“Canadian August CPI came in at +4.1% (y/y) vs +3.9% expected and 3.7% in July. CPI grew 0.2% (m/m) after the 0.6% gain in July. This is the highest reading since March 2003.The average of the BoC’s three core CPI measures was 2.6% in July. Durable goods are the main mover for the CPI figure, with passenger vehicles +7.2%, Furniture +8.7% and Household appliances +5.3%. Services inflation has also been picking up, which is what you might expect as reopening’s gain momentum. Prices for services rose for the fifth consecutive month and up to 2.7% y/y from 2.6%. Hotels (+19.3%) are a major reason why.”

https://www.fxstreet.com/analysis/inflation-spikes-in-both-uk-and-canada-202109151405

“CPI up 0.2% over July” doesn’t make for an interesting headline I guess.

I think the perfect place for them to set up shop would be the uplands.

I would say the crazy ones are those who think that today’s rates are going to hold at all time lows in the face of inflation.

https://www.theglobeandmail.com/business/economy/article-canadas-inflation-rates-jumps-to-41-fastest-pace-since-2003/

They should be sheltered in the boonies somewhere, just outside the city, to avoid all this:

Mount Tolmie residents ‘angry, fearful’ over shelter in their midst

https://www.timescolonist.com/news/local/mount-tolmie-residents-angry-fearful-over-shelter-in-their-midst-1.24357949

In Greater Victoria, the average was $477,128

And half owe more than that!

“

“

Like I’ve said before, you’d be crazy not to take on a truck load of debt at these rates and invest the proceeds, at these rates who cares if it ever gets paid off, inflation will eventually pay it off. 500K mortgage carries at less then 2K month. Inflation is real.

LeoS: Absolutely agree that there have always been out of town money. What I wonder is what is the impact of a steady stream of out of town buyers with deep pockets when there is a reduced amount of inventory. At what point do SFH in desirable areas stop reflecting local incomes altogether and price points become set by the pocket books of out of towners.

On a separate note, the cost of groceries have been going through the roof so what about the cost of building new housing? A neighbour owns some property on Shanagan Lake and just had the cost of building a retirement out there priced, The amount was absolutely shocking. The price of everything from material to labour has gone through the roof in the last couple of years. I have no idea if it is true but he was saying that new government regulations have really added to the cost of new construction. What I am wondering is whether the average person is starting to pay for the government printing money by inflation hitting their spending power (Please do not quote the official inflation rate, it amazes me that government officials can actually produce that with a straight face.) In turn, that effects houses prices along with bread and eggs.

Right. So the study is only of homeowners that also have mortgages that show up in a certain type of credit report. One would assume that looking at credit reports would be looking at people who want to borrow more, so are going to be skewed to the more indebted, and not a random sample.

Yet that select group gets reported by the media as simply “homeowners”.. Of course this leads to high indebtedness stats, and misleading statements as were posted here, and also the title of the article “Average Greater Victoria homeowner holds $500,000 in debt”

And yes, the average mortgage among Victoria homeowners with a mortgage would be more like $350k according to government stats. And they pay about $8k mortgage interest per year, an affordable 8% of their $100k household income. But including all homeowners,, the average Victoria homeowner mortgage is $196k, less then half the $477k quoted.

The article headline should have been “average Victorian homeowner is a millionaire”, since net worth of average homeowner household here is well over a $ million. And that’s net worth, after paying off debts like the mortgage.

Not necessarily because most people take “average” to denote “mean average” and not “median average” (the latter usually gets specified as “median”).

As an example, 10 people owe debt. 9 of them owe $100, and the 10th owes $1000. That’s $1900 total, with the average being $190. But 90% of those people owe less than the average.

Never has been

“Nope.”

That borrowell study excludes homeowners who have no mortgage at all. In Victoria that would mean $20b/57k = $350k average using your numbers.

Nope.

In Victoria,

– There are $20 billion in mortgages https://assets.cmhc-schl.gc.ca/sites/cmhc/professional/housing-markets-data-and-research/housing-data-tables/mortgage-debt/total-outstanding-debt-payment-financial-obligation/2021/total-outstanding-debt-payment-financial-obligation-canada-cma-2021-q2-en.xlsx?rev=d131a861-44ed-4a83-b4e2-4b62109ca08d

That’s $20b/102K = $196k average mortgage per homeowner in Victoria.

Same story for Canada. $1.7trillion mortgages, and 10 million homeowners.

That’s $170k average mortgage per homeowner in Canada. Only 60% (6 million) have any mortgage.

Average home equity in Canada now is 76%, which would be having $530k equity and owing $170k mortgage on a $700k value home. If prices fell in half (to $350k), that would on average be still having 51% equity ($180k equity and owing $170k.)

In summary, we are in great shape.

LeoS: What you might factor in the equation is that there is a steady albeit slow stream of new buyers from out of town that are much less constrained by affordability. For example new retirees from Toronto who have no trouble writing a cheque for two or three million.

it is not a closed system dependent upon local incomes alone.

And half owe more than that!

Gil R

Is this sale at a heavy discount to assessment value a reflection of very high condo fees or what? If so, what is the best strategy for a seller dealing with inflated condo fees in a handful of complexes?

316 – 21 Dallas Rd Victoria BC V8V 4Z9Vi James Bay – VictoriaMLS®:879031

Both. The super low months of inventory puts a ton of pressure on prices to go up. But prices haven’t been rising quickly in the last 6 months. Why? Maybe because affordability is so strained and there is opposite downward pressure keeping prices in check.

I’m not super confident in that theory though. If affordability is a serious constraint then I would expect sales to slow and MOI to start rising as buyers are priced out. Hasn’t really happened yet.

“ Compiling data from 874,111 members in August, Borrowell found the average Canadian homeowner held $359,587 in mortgage debt. In Greater Victoria, the average was $477,128, only sitting below Toronto, Vancouver, Burnaby and Surrey.”

Higher prices, higher debt.

https://www.saanichnews.com/news/average-greater-victoria-homeowner-holds-500000-in-debt/?utm_source=dlvr.it&utm_medium=twitter

good one Patrick

Thanks, it’s great to see an article making the case for affordability. Assuming mortgage rates stay the same, it’s also helpful to remember that affordability gets better every year after purchase (since mortgage payments stays the same, but incomes rise with inflation). So year 1 is the worst year, and that’s what is represented on the affordability chart. But for homeowners, it gets better.

in June, we talked about a nice affordable $600k 3bdr “family size” Langford townhouse, that would have a $2,100/month mortgage, with 79% of that forced savings and only average 21% ( $433/month) “down the drain” interest. https://househuntvictoria.ca/2021/06/20/a-brief-history-of-credit-measures/#comment-80739 That $433 per month is $5,200 per year and is only about 5% of a $100k typical household income. Compare that 5% to the “old” way of looking at affordability which has it up near 60% of income! To me, family housing “affordability” should be measuring the first rung of the housing ladder (family 3bdr townhouse) , not the middle rung (average SFH).

For many people, these prices are cheaper than renting, and it’s why so many people are in the market to buy. Affordability will likely get worse, and if it does, this might be the last “golden age” of affordability.

Hey Leo – I think there’s a typo or writing error in your post. There’s a logical inconsistency here:

Well, which is it – prices increasing slowly, or a ton of upward pressure on prices? (I suspect the former.) I think maybe you meant to write a ton of downward pressure on inventory? Otherwise I’m not grasping the meaning of these two sentences together.

Wouldn’t you have to factor in the opportunity cost of all the forced savings as well?

While some discounting for the forced savings effect and opportunity cost is probably in order, you should probably consider mortgages more as form of leveraged investment. Consider: 20% down on a 1.5 million dollar home @2%, with reasonable property tax/insurance gives you a cost of 2500 (ish) per month costs, while tying up 300k capital. The first obvious point is that to RENT a 1.5 million dollar home you’re looking at 4k ish per month, and that’s going to eat most of the capital growth on your 300k investment. So apples to apples, if you’re the kind of person who wants to live in a 1.5 million dollar home, you’re starting to approach break-even to renting. This kind of scaling has issues: to be honest, most people who want to live in a 1.5 million home aren’t willing to rent one for 4k/month, they’ll accept a much worse accommodations for the chance to save up, but it should make clear some of of the effects at play.

But it gets stranger. People worry (or pray for) “flat” housing growth, but “flat” growth still looks like 1-2% yearly. If you pay cash for your home, that’s a problem, but most people are leveraged 5:1 or more. 1% annual growth on our hypothetical property means 15k increase on 300k invested. That’s not spectacular, but it’s more than enough to make it worth the risk since you’re paying for a place to live one way or another. While housing prices might go up or down a bit (especially in real terms), I’d be genuinely surprised if rent decreased anytime soon.

We’ve pretty much tied our interest rate to US interest rate though. I have I hard time seeing the US going negative.

I used the series 027-0015 Canada Mortgage and Housing Corporation, conventional mortgage lending rate, 5-year term.

Those rates are consistently 1 to 1.5% above discounted contract rates (I believe it’s the average of the rates charged on loans in their portfolio), but the big advantage is that it goes back to 1951. The current reading is 3.2%.

Worth remembering that it’s really not the levels that are important (we could set it against after tax income and shift the whole thing up), it’s the relationship to historical ranges.

Yes, good point I forgot to add to the article.

Though it feels like the bottom for rates you could imagine we might see one more leg down. I believe in Germany mortgages are sub 1%.

That’s a far cry from the interest rate drops that previous buyers enjoyed though.