A brief August summary

I’m still out of town and don’t have access to all my usual charts, but here’s a quick summary of the month’s numbers.

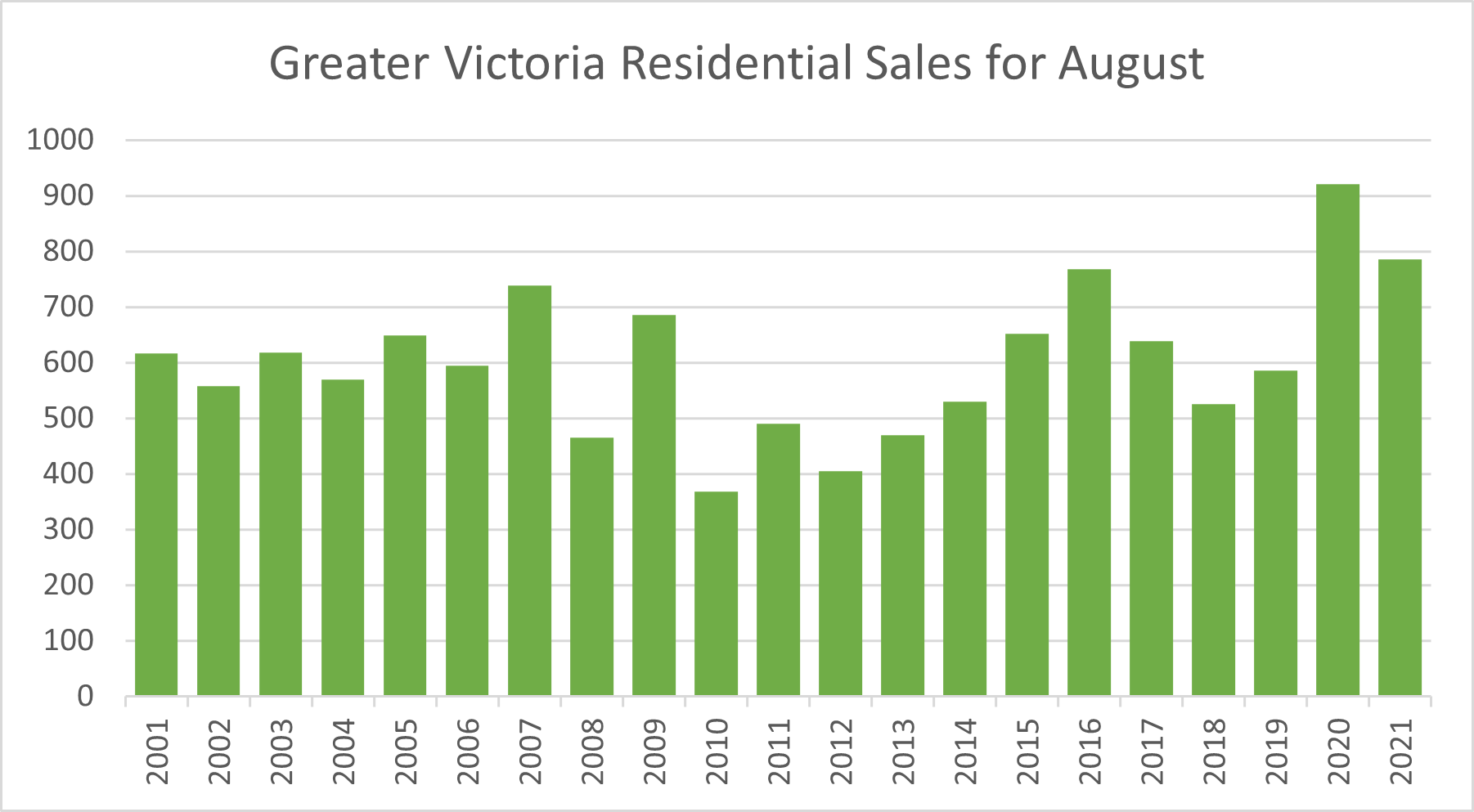

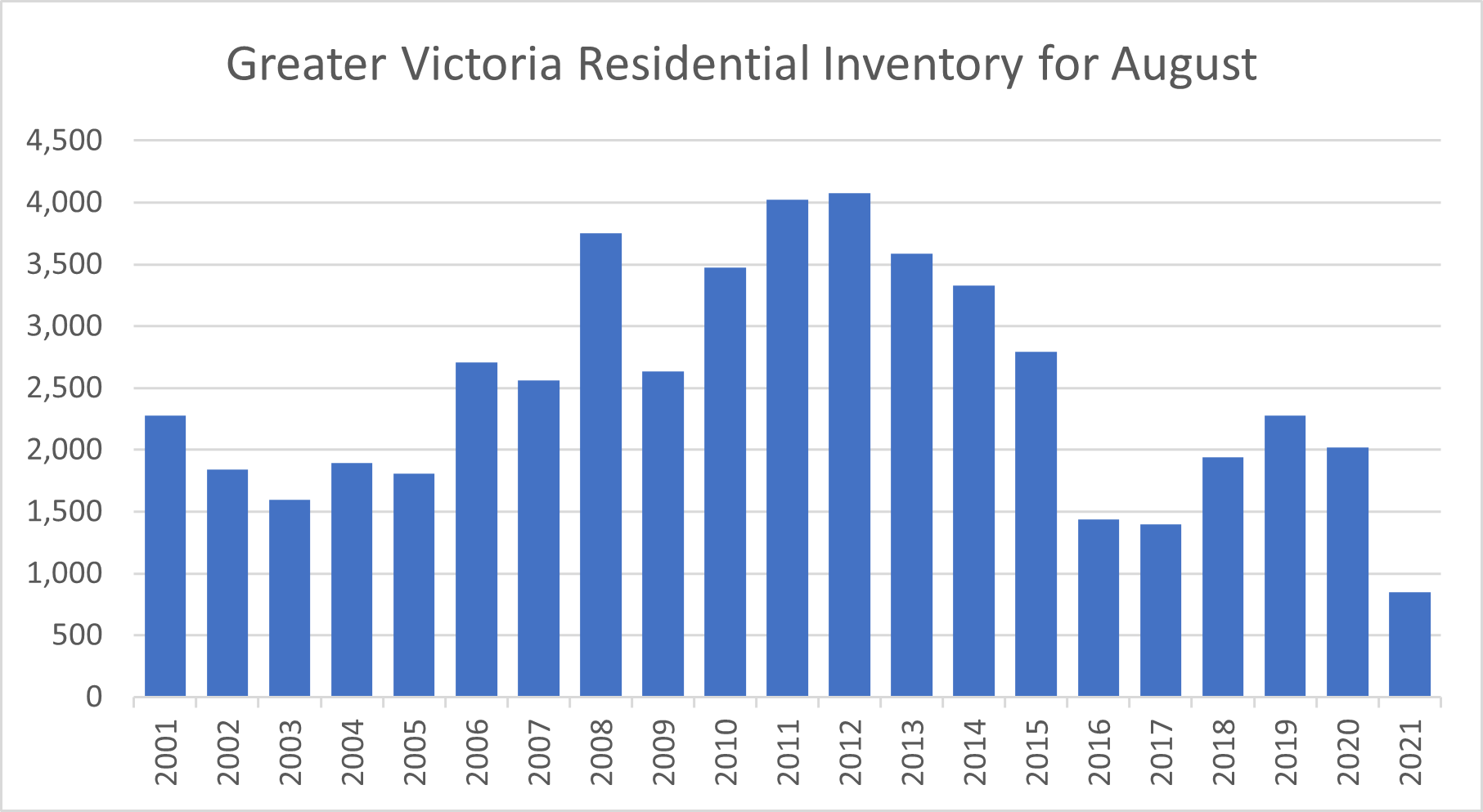

Overall the market was little changed in August from July, with no sign of any more cooling in market conditions. While single family and townhouse sales dropped from July, condos saw a jump in transactions reflecting slightly better availability and of course cheaper prices. We still have record low inventory (only 1120 active listings of all types, down 57% from last August), sales running ahead of the normal pace (though down 19% from last year), and new listings down 11% from “normal” (2019) levels.

In February I observed that overheated markets (with a sales to list ratio of 80% on a seasonally adjusted basis) don’t usually last that long in Victoria. Historically after 6-8 months of super-hot market conditions, things settle down again and so I expected the same to happen mid summer based on previous patterns. While we have seen some relaxation in market conditions since March, it’s not been enough to put a stop to the high rate of over-ask sales or bring any inventory on board. We are now going on 11 months of an overheated market in Victoria, which is charting new territory.

As we’ve seen all year, once prices of single family homes jumped up beyond where most could afford them, price pressure moved to the cheaper options which have been steadily appreciating since January. In August, the median single family home traded hands at 34% above last year’s assessed value, the median townhouse at 27% over, and the median condo at 21% over. Both single family and condos are up from July’s results, but since March we’ve seen a 4% increase in the single family price while condos are up 8%.

Other than perhaps the start of a structural shift in demand patterns, I believe that part of the reason the market remains atypical is that we are still living in fiscal fantasyland. The labour market has roared back in most sectors but government transfers remain high. That has led to persistently high savings rate for Canadians and an unprecedented redirection of travel spending to domestic expenses like real estate and renovations.

The election means we aren’t going back to reality yet either. No one is running on fiscal restraint, with even the Conservatives promising billions in goodies (everything except a puppy). It’s no surprise that the federal election platforms won’t be effective in lowering prices either. What party would risk impacting the value of the biggest asset that Canadians own? Regardless, it’s not a rate of spending that can continue forever, but so far no politician has spent a lot of time talking about how the fiscal ship will be righted other than a vague hope for more jobs.

The problem with high prices is that it’s a zero sum game and they come with increased risk. Every windfall increase delivered to a seller is an increased price that must be born by younger generations wanting to become buyers. A transfer of wealth. Wealth that then can’t be used for other things that life throws at you. It’s not that buyers today can’t afford the prices. They can because mostly our lenders are prudent and jobs are plentiful. But what about if there’s a job loss, a health problem, or even just a few kids with the associated expenses and distractions? If you speak to older folks, it’s an exception to find someone who hasn’t experienced some major setbacks in life. They did OK because they had a buffer, but excessive debt makes for a more fragile state of affairs. I fear we will find it dragging on both individual and the country’s prospects once the euphoria is past.

The problem is: we have no rain when you need them in your barrel.

New post: https://househuntvictoria.ca/2021/09/13/a-different-way-to-look-at-affordability/

Crystalball I was told you can collect rainwater off of a metal roof for gardening vs. asphalt so if that’s your thing, get some barrels

FYI: Starting Oct. 1, Fortis (gas) customers in the Lower Mainland and on Vancouver Island will see a monthly increase of nine per cent

https://bc.ctvnews.ca/fortisbc-price-hike-b-c-natural-gas-customers-about-to-pay-more-1.5583215

Someone we know is not a fan of Phil Smith Roofing:

Needing to replace a roof, and are thinking about metal. Pros and cons of metal vs asphalt? Rough cost for a 2200sqft house? Any contractor recommendations?

I would suspect people are opting to get rid of their suite rentals to avoid being taxed on the sale of their home. With prices escalating like they have , the potential income tax owners may have to pay outweighs the rent they are receiving. Get rid of your renters, live several years in your home, then don’t worry about losing your primary residence exemption. Makes sense to me.

Having a suite and renting it out is not a public service. It is a private service filling a need that really ought to be addressed at the mid to low income levels through public policy and investment. Without private suites people would have even fewer options than they do now because we don’t have enough rentals so complaining about them without another solution is a no win situation for anyone – landlords or tenants. I feel like we need a massive investment in something like co-ops where there is an affordable buy-in and reasonable costs, but government would need to donate land for that to make sense. Maybe that is what should happen.

I don’t judge people choosing to leave suites empty in the same way that I don’t consider renting out a suite some kind of public service.

Yes, and these lousy quality “suite in home” rentals are a reason BC has the highest eviction in Canada.

Nice to see 100+ well paying IT jobs coming to Langford. Nicer still to see the company describing Langford as “ incredibly easy to work.” COV should take note.

https://www.victoriabuzz.com/2021/09/massive-development-and-tech-company-coming-to-langford-will-create-hundreds-of-new-jobs/

“Massive development and tech company coming to Langford will create hundreds of new jobs

Langford was chosen as the best location for the firm’s relocation due to the city’s lifestyle and recreation options, talent opportunities, affordable housing choices and the city’s support to business development.

The city also has proven efficient in development processes and timelines.

“We believe that Langford had the most to offer with respect to lifestyle and amenities for our business and team,” said Plexxis CEO, Chris Loranger.

“The City of Langford has been incredibly easy to work with as we move and build our new headquarters on the West Coast.”

Different risk appetite for different people. If I didn’t have a 5 to 10 yr zero income buffer at this point in my life (mid 30s) it would make me nervous. Shit can happen health wise at any point and the last thing I would want to thinking about is finances.

Also, being a dual citizen it’s nice to have the option of putting all your stuff in the suite and renting out the upstairs or having the suite to crash in when I am here, etc.

I just see so many endless upsides to a suite and essentially zero downsizes especially in new construction where you can design it to function as either. Just because you have a suite does not mean you have to rent it.

Our tenant voluntarily moved out in the spring (a nice fella who never left the house) and the suite is now a nice rec room and an extra bathroom. I won’t say never again, but I am disinclined to rent it out unless I have to for some reason. And yes, being shut in for the winter due to the pandemic was a contributing factor. I just want my own fucking space.

This is an example of why it was bad policy to lean almost entirely on homeowners and small time investors to create new rental housing.

No mystery at all. It’s been well discussed here – it’s the only way they can buy, or at least the only way they can buy and have any disposable income left.

Used to live on top of a suite myself, but after a while said never again. Of course that was in the good old days when interest rates just went down and down and down.

Might be a trend if interest rates never go up.

So…. we all know the price-premium for a detached home when compared to a condominium arrangement. It’s a total mystery to me how anyone would accept that premium and then foul their private oasis with a tenanted suite. If it’s for granny, fine, but if it’s the financial safety net that Marko suggests you can count me out. If you add a notoriously tenant-biased regulatory framework into the mix, the entire notion is deeply unattractive.

Didn’t we work and save to avoid being cheek-by-jowl with the great unwashed?

To me, like Alexandracdn said, aging in place appears a perfectly logical and acceptable choice for a myriad of reasons whether to you have a suite you keep vacant for your visitors or not. How far does it go by the way? Are you allowed a guest room that you don’t rent out? What about a basement you are not fully using that could easily be converted to a suite? And, as Marko said, are you allowed to live in 5000 square feet if you don’t have a suite?

Life is time limited and there is a progression in building a home and a life and attachment to place that has value – including the value of younger generations not needing to subsidize the older generation who has equity to sustain aging costs which older renters do not. Your generation will end up paying the aging costs of low income renters through tax funded subsidies.

It is not up to older folks who have worked hard and saved to own to provide for the next generation by sacrificing the home they value and love.

Affordable housing is a policy issue for government to address in my opinion and this will eventually happen. It won’t be through kicking seniors from their homes.

Your time will come. Your views will probably change. If not, you can downsize for the next generation’s benefit.

This may be hard to process, but when someone or a couple approaches the age of 60, they may still have 35 more years to live. My mom was 93 when she passed. Often, if they keep in good shape and are fortunate enough to have great genes, the first 25 of those years can be spent enjoying a productive and happy retirement.

There are a myriad of reasons why seniors wouldn’t sell their home with a suite and move to one without. Most are not for “selfish” reasons, rather they are practical and logical reasons.

As you said Caddy, the cheapest homes in the CRD area go for at least $750K if they are without a suite. Why would most people ( landlords?) sell their home just because they have a small secondary suite that they no longer wish to rent out? Say they just put on a new 35 year roof at the cost of $10-20K three years ago. Last year they paid $700 for a new hot water tank and they updated their kitchens and baths a few years ago at a cost of over $35K. Now they are mostly set and are able to better financially plan their retirement expenses.

Why would they throw out another $100K to sell their home, move, purchase another home sans a secondary suite that they truly don’t like as much as the old one just because they don’t want to appear selfish to a 35 year old? Give your head a shake. In many cases making that move would simply be called foolish. They may love their current neighborhood, they may enjoy having extra space for storage and the lady of the house can now convince her husband to use the garage for their car as it was meant to. Hallelujah!! Now their daughter and husband can have a place to stay when they come out from Ottawa. And of course, they will still have the option to “age in place,” and use their walkout suite for themselves someday.

The best option for your suite, I think would be to charge a percentage of the electricity and water bill with them. That way they will probably economize just as much as you if they know they are partially responsible for costs. It always worked for me without a hitch. It would appear right now you can’t afford to spend thousands more dollars to upgrade your hot water & heating costs. So, as some have pointed out, get the cheapest hot water tank available from Home Depot. Within the next few years using fossil fuels to heat your home may become extra expensive by the taxing on some environmental fees etc. At least you will have time to think about it.

Cadboro: Is it a housing crisis or do you just have an income crisis. Your employer does not seem to value your work enough to pay you an amount that is enough for you to support your family in the type of house you believe is adequate.

There is a argument to be made that the value of what Canadians produce, on a per capita basis, has been declining over many years and that the standard of living is finally starting to reflect that decline. Most peoples income has not increased a lot over the last few years but the price of groceries is going through the roof, assuming you can afford a roof. A sheet of plywood is following suit. The simple fact may possibly be that the country, on a per capita basis, is simply poorer than it used to be. Is it a housing crisis or really a income crisis. Three of the most recent houses sold in my neighbourhood have all gone to new immigrants and they dont seem to have had a problem in buying nice SFH for themselves.

Someone with a 2200 sqft home and a 800 sqft suite is suppose to feel guilty leaving it vacant while another individual lives in a 5000 sqft home with no suite in the Uplands?

When I had my SFH the last little while I didn’t rent the suite for various reasons but I would never ever buy or build a SFH without a suite. It is such an awesome safety net to have both financially and for family reasons. Also, the difference between a finished basement and a suite is really minimal. Just throw in a linear kitchen with a stove and you basically have a bar for your rec room if not renting it out. Laundry hookups are cheap and exterior entrance and full bathroom for basement are a plus even if not renting.

Must be nice to have the luxury of owning usable rental space and leaving it vacant, especially in a housing crisis. Why don’t these ex-landlords just downsize?

We would have loved just a 3-bedroom starter home for our family, but when they broke the 750k mark in the cheapest corners of the CRD (that’s a 3k/m mortgage at today’s rates) we switched our sights to the new “starter” of a home with a suite. Which after factoring in rental income is more affordable, for the same amount of space for our family.

It’s not about breaking even, I don’t know when that date will be. We paid an additional 100k++ for a house with a suite. It was about getting a 3 bedroom space for us, which was not even attainable without the suite.

The only draw for a suite for me is to have the space for a geriatric farm. However, once that duty is completed, I would probably leave the suit vacant because the point for me of having SFD property is not having to share a wall or to deal with strangers where I live myself. I guess some use the suites for increased borrowing capacity, but I just don’t see it as a draw unless I would be renting out the entire property.

That’s why those caveats are written as occupancy limits and not as specific to a circumstance such as a “baby”. Not mention the very common age restrictions that many rentals and stratas currently have in place. But congrats on working hard to find something out of context and separate from the main point of it actually best to avoid sharing utilities with your rental…. Lol..

Interesting that within the last two months at least three people in the neighborhood have just gotten rid of their basement tenants altogether and taken over the house for themselves. Not worth the aggravation especially during Covid with people working at home. I would expect they are the exception but I wonder if this might be a trend that after a few years of having tenants that the owners simply dont require the income to pay the mortgage.

My wife was wondering how much extra do you pay for a house with a basement suite and how many years of rent to break even for that suite? My immediate neighbour looked at the cost of converting his basement into a rental suite and decided he would likely be dead before he recovered the capital cost. But I have noticed that almost all the new builds have suites in them and this is a selling point.

A quick web search tells me that you are going to run up against human rights issues if you try to evict someone just for having a baby, regardless of what’s in the rental agreement.

$166.57/year before you use any gas (basic charge + taxes)

Ideally, a separate meter with the unit on it’s own hot water tank (unfortunately, up front set costs will be incurred) saves a bunch of headaches because the tenant deals with the utilities own their own. If separate meter is not possible, if you are splitting or including them, make sure you have a limiter on the number of occupants in the unit (extra bodies can blow your budget). It seems mean, but if you rent to a couple and baby comes along or if they are roommates and they have someone crashing there multiple days a week, it will really ramp up your utility bills. Splitting a percentage always seems to end in conflict, maybe consider going with a monthly flat rate spelled out in the lease and then at the annual lease renewal bump it up or down as needed.

Seems to me it was about $100 a month for the coldest months, but we keep the house on the warmer side in the day.

Someone with a heat pump can probably give you an idea of what you’ll pay in hydro costs, but I’m guessing it’ll be comparable.

Baseboard heaters are 100% efficient. I believe in optimal conditions, heat pumps can get up to 300%, so baseboard heating is significantly more expensive.

The upside of including utilities in rent is that it’s easier. The downside is that if your tenant keeps the heat cranked and showers three times a day you’re on the hook for that cost.

I think splitting the utilities (e.g., 60/40, 70/30 or whatever seems fair) is the way to go.

Guess I’m closing the vents! I figured they wouldn’t serve much purpose in the ceiling anyway. What’s your gas bill in the winter if you remember? I’d love to take on some things DIY but the water tank is daunting.

Any suggestions on how to split the utilities for the rental with this setup? Or upside/downside to include them? The heat pump will just be for the upstairs but the basement has baseboard heaters will that be about the same then for electric cost?

Cadbro, we used about $2 worth of gas each of the last two months (furnace has been off so that’s just hot water) but our bill was $22.

Since cost is an issue, the cheapest electric hot water tank you can buy is about $400, and it’s a pretty easy diy job. If you’ve got a bit of money, the hybrid tank seems like it would be the best option. Requires a 30 amp circuit though, and I’m guessing your current set up is 20 amp.

FYI: wrt heating regulation in a secondary suite:

“The secondary suite should be equipped with a method of heating, independent of the main dwelling. In order to prevent the migration of smoke between dwelling units during a fire, duct work is not permitted to interconnect the dwelling units. A separate system, such as electric baseboard heating, may need to be installed in the suite.”

“Air from one dwelling unit cannot be circulated to another suite, so a common forced air furnace cannot serve more than one dwelling. If there is a common furnace, the ducts into one unit will have to be closed off inside the fire separation and a different source of heat provided to that unit.”

Thank you for the responses from each of you, this crew is a wealth of knowledge. To clarify the furnace works, i checked my inspection report and it seems like the oil kicks in only when it’s really cold but otherwise the system is a heat pump. We like a cooler house but maybe need to get through one winter here to see what the bills are. There are vents in the basement suite but only 1 per room and they’re in the ceiling, thus why there’s baseboard heaters in the suite.

For anyone on gas what’s the monthly servicing fee now? I had a gas fireplace in a rental and remember it being cheap.

Interesting idea to have more things run on propane, the fireplace is technically not working ATM I believe we have to bleed the line.

Not sure Fortis chart is accurate, as hydro cost includes lots other things in addition to baseboard heating, e.g. lighting, cooking and laundry, which are not likely be included in oil and gas cost in their chart. So they are comparing apples with oranges.

Our house is hydro only, and our summer hydro bill is less than $50/m, that is mostly just for cooking, as the baseboards are turned off and we use cloth line for cloth drying in summer. So the yearly hydro cost for baseboard heating alone should be at least $600 to $800 less than $2160 as posted by Fortis (which could be biased and misleading).

After adding those cost, electric heat pump is likely the winner.

Fortis have a fuel comparison for the Island and they are a gas and electric provider.

https://www.fortisbc.com/services/natural-gas-services/why-choose-natural-gas/annual-fuel-cost-comparison#tab-1

Heating oil is a slightly heavier grade of diesel that use in furnace and have slightly higher energy density than vehicle diesel, and it can be use in diesel vehicles.

Came from the same place and process as gasoline that your car use but heavier and have higher energy density than gasoline.

I have to agree with your plumber.

A typical 30-40 Gal electric HWT elements run at 3000W, 60 Gal electric HWT up to 4500W, hybrid max pull is the same as electric.

A generic gas HWT run at 30,000~40,000 BTU (8792~11,722W) or 2~2.6 times the recovery rate of a top of the line 60 Gal electric HWT. Therefore gas HWT can serve much higher demand than electric.

And if need be, one can step up to a commercial grade HWT that start at around 150,000 BTUs (max 500,000 BTUs) and cost roughly 65% more than a typical HWT price. Or go for the gusto and get a stainless steel gas HWT that would last a lifetime.

Your insurance company will want you to get rid of the oil tank. I put in natural gas, I suggest the same, you’re not going to save the planet. Stop buying on Amazon if you’re concerned with the environment.

Sorry Cadbro, I think I misread your post. It sounds like you may have a heat pump as your main source, and the oil furnace may be your backup heat? If that is the case, I don’t think there would be any reason to bring gas in.

From what you have said, I would guess that the heat pump is the primary source of heat and that it was installed in the plenum of the original oil furnace which is now the backup heat for when it is too cold outside or you flip the heat up and the heat pump calls for backup. If you keep the thermostat fairly constant you probably won’t burn any oil. If the hot water tank is going to spoil anything if it leaks (ie in a finished part of the house) then you want to change it soon. If it is going to leak into the drain pan which is connected to a drain, then it is a tiny bit less urgent but still should be done. I have a Sandon heat pump hot water tank which is excellent and cheap to run but you will never recover what the installation costs. I did it more on principle than to save money. Don’t forget that if you go for gas there is an ongoing supply cost in addition to the actual gas usage charges. It makes less sense if all you have is a gas hot water heater and they cost a lot more than an electric tank. I second the idea of picking up a tank from home depot and changing it yourself. Shark bites make plumbing a lot like tinker toy (showing my age!) and are dead easy for a beginner. Learning to do simple stuff like that will save you an enormous amount of money over the years. Try pricing a plumber to fix a dripping tap. (another easy job)

Brian

Having the propane already there offers some options. Check with the furnace companies and see if it’s possible for them to put in a propane heating element into existence furnace taking you off the oil (saving a full furnace replacement). You can also do a propane water tank or a propane hot water on demand (checking these options might save you some of those upfront costs). Propane is much more efficient than natgas and since it’s in a tank at your house, it doesn’t shut down with earthquakes or big power outages. But if money is an issue right now, don’t look at the cost of filling the oil tank as the single big payment, figure out what the cost is monthly. If it isn’t too bad, get the system serviced and the ducts cleaned and use it until it suits you to change it. On the environmental side, people tend to forget the environmental impact of tearing out a perfectly functional piece of equipment before the end of it’s lifespan and consuming a new good that took an environmental cost to manufacture and ship (Those trading in 2 year old Audi’s on new Tesla’s thinking it helps the environment..lol). It still comes down to what works best for you and you are your own best advisor. Enjoy the experience!

“What’s it cost to get gas brought into the house? Do I switch other things to gas right away, like what? All appliances are working fine (suite has w/d and dishwasher, as does the upstairs). I assume in the long run its best to be on gas vs. oil, and there are rebates?”

$15 in most cases. A decent high efficiency gas furnace is ~$5,000 installed, and there is a $1,700 rebate when switching from oil.

A 10 year old electric hot water tank is at the end of its useful life. Whatever you do, get rid of it, and get something more efficient. I had a 60 gallon tank and it consumed an insane amount of electricity.

I would get a few quotes for a heat pump and for conversion to gas plus options for the hot water. There are calculators that you can use to estimate operating costs but you have to account for fluctuating gas prices, and as Leo points out, gas is going to get more expensive over time due to the carbon tax. I felt that the quotes I received for a heat pump (even with the rebates), and the additional upgrades that were necessary tipped the scales in favour of converting to gas (the rebate on the furnace was $2,400 at the time), so that’s what I did. But for you it might be different.

I wouldn’t bother with anything other than heat and hot water. Those are the two main energy sucks. I estimate that switching from oil heat and electric hot water to gas will save us ~$1,700 per year in operating expenses (less as the carbon tax increases). Still a pretty quick return on investment.

Buy a cheap electric water heater from home depot and install it yourself. That will give you 6 years to think about something else.

I went to the rebate website and it’s showing only a $1000 rebate. The least expensive hybrid tank at Home Depot seems to be $2472.

And, can’t quite tell, but the feds seem to be only offering a $300 tax credit towards it.

I assume you have an oil furnace, so it’s probably the primary heat source for the house (if it’s working, perhaps it isn’t and they put in the heat pumps and baseboards without removing the furnace?).

The oil comes from the tank I assume you have either outside or in your basement. It has to be refilled by someone like columbia fuels every so often. Very expensive and polluting way to heat.

Cost wise, today it’s roughly equivalent to run a heat pump vs gas based on my calculations. In the future assuming ramping up carbon tax it will be cheaper.

I should add that we’re broke as that probably matters re: cost of these options. So looking for what the most cost efficient system is for the next 5ish yrs and learning what the difference is for environmental friendliness.

Stupid question time but what exactly does oil do, or run? The furnace? And what kind of oil is it where does it come from?

In the long run, it’s best to be on electricity.

If it were me, I’d try to decarbonize my home as much as possible, even if it currently costs a bit more compared to gas.

BTW, we have an 184-litre hot water tank which we’ve found to be large enough for three adults (that includes our tenant) and two kids.

I’m a broken record on this topic, but I would go for a hybrid heat pump tank. Likely to be free with the provincial and federal rebates right now. To me it just makes zero sense to add fossil fuels to a house in 2021.

Hard to say what the heating system is as you seem to have every heating system under the sun, but definitely rebates available. Provincial: https://betterhomesbc.ca/rebate-search-tool/

Federal: https://www.nrcan.gc.ca/energy-efficiency/homes/canada-greener-homes-grant/23441

Only downside is everyone is snowed under due to the rebates so count on at least 6 months to get some of this stuff sorted.

All the utilities

We’re moved in, i have so many questions, wanted anyone’s take on the utilities situation if you want a break from election chat.

House has a furnace with vents on both floors, a heat pump, baseboard heaters in suite, an oil tank, and a propane tank rental for the upstairs fireplace. The hotwater tank is over 10yrs old and my inspector said replace it asap so I think that’s #1 priority. There is gas on the street and it’s $25 to bring it to the house. WWYD?

I’m having a plumber come and quote the tank replacement, thinking we’ll get a large one as it’s for 2 floors. Plumber suggested get gas done then do a gas hot water tank.

What’s it cost to get gas brought into the house? Do I switch other things to gas right away, like what? All appliances are working fine (suite has w/d and dishwasher, as does the upstairs). I assume in the long run its best to be on gas vs. oil, and there are rebates?

Slightly scaled down Telus Ocean building advances, public hearing OK’d

https://www.timescolonist.com/news/local/slightly-scaled-down-telus-ocean-building-advances-public-hearing-ok-d-1.24356894

Further to the value of property managers. My house needed a roof, last year I was getting ridiculous quotes of $10,000-12,000 for crap 20 year shingles ( I don’t know why they even sell such a poor product). My manager found a wonderful roofer who did it for $7000 with higher quality shingles. He sent me pictures of the whole process and kept me up to date from beginning to end. I’m going to get him to do the windows next year. I’m going to keep his name to myself, he’s busy enough, and works primarily up Island.

Introvert- I’m pretty sure it’s 10%, plus GST.

Down payment were a lot higher than the generic 5% first time buyer that you get these days, and there were no such thing as RRSP Home Buyer Plan, nor TSFA that everyone are enjoying. And, there were no need for a stress test because the mortgage rates were above 10% when my siblings got into the market.

5 years amortisation interest rates today is less than half of the current inflation rate, that your interest payment in the next 25 years is practically nothing. A 10% interest rate over 25 years mean that you would pay 2 times the amount of the house principle just in interests, and at 18% would be 3.5 times.

And, yes I still stand with the notion that affordability has always been relatively similar in the past to now that Leos provides in his graphs. Having said that, many of your millennial cohorts don’t agree with the bears on this board and are buying in the last 5~6 years to the present.

Frank, how much do you pay for property management?

Marko- I’m out of province, my property managers are invaluable to me and I could not have gotten where I am without them. They handle all the hassles and I’ve rarely had any worries in the last 32 years. They’re worth every penny as far as I’m concerned.

Seems like a waste to have a property manager if you have zero turnover.

Marko- Obviously I haven’t enjoyed any re-rents. Put a new roof on this year, windows next year. I guess I’m not blessed, but that’s reality.

How on earth are you just breaking even? All the rental properties I own the rents have gone up as much as 50% (on the re-rent, I’ve never once issued an annual rent increase to an existing tenant) and my borrowing costs have dropped with each re-finance. Property taxes, strata fees, and insurance have gone up but nothing compared to rents and borrowing costs.

Just heard from my property manager up Island, the government is allowing rent increases starting January 2022. The amount allowed is 1.5%. I wonder how much property taxes are going to increase, let alone insurance. See how lucrative it is to own rental properties. I bet a lot of tenants will be looking for a new place to live (that doesn’t exist). My tenants are staying put, but I sure won’t be making any money, just breaking even.

From: https://reut.rs/3yY0ACQ

It will be interesting to see what happens when mortgage rates normalize and when banks actually have to market their debt and bonds to something other the BoC or CMHC.

Much better. Though in time the millennials may have to explain that to the GenZers (age 9-24)

In the meantime, this sun deck on the Vic Van ferry is spectacular, and I have nothing left to complain about 🙂

Thanks for the discussion.

Patrick – we had it much better in 2014. Is that better?

Maggie- They sure had it good.

The boomers of HHV reminisce.

https://www.youtube.com/watch?v=VKHFZBUTA4k

Why aren’t the millennials here pointing out how easy fellow millennials had it in 2019? No COVID to deal with, home prices were 25% cheaper, and affordability was reasonable according to Leo’s charts. Maybe as a seasoned millennial you could tell us how easy you had it back then.

Drop me an email let’s put together a letter to the MLAs and see what they say.

I don’t understand the ego of the Gen X / Boomer generation who are dead set on trying to prove that affordability is the same now as always. No one is saying it wasn’t hard to get a home at any point – just that its more difficult now. Instead of looking at logic you choose to point to ‘internet’ or ‘avacado toast’ as the reason people can’t afford today. Its absurd.

Getting into your personal experience so you are saying your brother and sister could barely afford a 1 bdrm in Sooke in 1994? SFH average house price in Sooke was 195K (https://www.vreb.org/media/attachments/view/doc/1994/pdf/1994.pdf). So a crappy 1 bedroom was how much? 125K? 150k? You brother and sister were educated with jobs so making what 12-15 an hour (https://tradingeconomics.com/canada/wages) (http://ccsd.ca/factsheets/fs_avgin.html) – based on average wage. What were their student loans (significantly lower costs for those degrees then today even factoring wages). So on the low end they were making 50gs a year combined, didn’t need to pay for daycare as they had family helped and paid 150K for a house and somehow you think that is similar affordability today? was there a down payment requirement at the time? Was there a stress test? Seems a lot easier to me – but perhaps you can provide some details.

No need to get rude. This is just a friendly economics discussion, not life or death.

For the record, my parents emigrated to Canada from Europe in the 1950s, and never owned a home, as it was too expensive to buy. Remember, people had bigger families and many more mouths to feed back then, which consumed the salaries.

I’m sorry if my personal experienced came off as a sob story. I was simply trying to convey that housing has always been an expensive and difficult endeavour for the majority of the populous, and if you think positively like the majority of the homeowners then you wouldn’t be so stressed.

Over a 1,000 owner-builder study guides I’ve sent out this year…..we have students sleeping in cars and no one has thought about eliminating a 100% useless piece of bureaucracy to encourage people to build/lower the costs/improve timelines.

Nobody cares about your personal sob story. I was talking about ordinary working class / middle class Canadians. Sorry to be blunt but I’m getting tired of it.

First of all I should note that there were almost no condos in 1970. Thus almost all apartment dwellers were renters. Comparing total ownership rates between then and now is invalid just on that point. You should compare ownership rates of detached houses.

Beyond that, historically there tends to be an inverse relationship between housing affordability and ownership rate. As Mr. Spock would put it, it’s not logical, but it’s often true.

The best time to buy – in the RE market or stock market – is when the most people don’t want to. The more people want to buy, the more they drive up prices.

I’m not skirting around anything. It was dual income for my professional siblings to get their first home more than 25 years ago, 3 income for my parents first home in Victoria 38 years ago, and dual income for my first home 18 years ago.

If you play the victim card then you will always see yourself as a victim even those home ownership rate is at an all time high presently.

Canada Home Ownership stayed relatively stable since 1931 to now between 60% to 69% — https://www150.statcan.gc.ca/n1/en/pub/11f0019m/11f0019m2010325-eng.pdf?st=z5qbLbr8

Canada Home Ownership Rate — https://tradingeconomics.com/canada/home-ownership-rate

Homeownership rate in Canada was only 60% in the 1970s, and has been rising slowly ever since, and is at an all time high now (69%). If homeownership was so easy back then, and part of a “normal life”, how come only 60% did it?

Stats Can data https://www12.statcan.gc.ca/nhs-enm/2011/as-sa/99-014-x/2011002/c-g/c-g01-eng.cfm

One measure our government could Implement to motivate people: Make the first $100,000 you earn before the age of 21 tax free. This could be modified to include people who pursue higher education by increasing the age and amount. This is the type of solutions I’d like to see.

One thing I’ve learned is the sooner you start, the sooner you can reach financial independence.

The plain fact that you are trying to skirt is that it was not difficult for a family to buy a house and live a normal life on one income.

In other words, they were starting almost from zero. You get a really big % increase with such a small denominator. At the same time Canada had a fully developed industrial economy which was still insulated from global competition.

Not to deny any credit to the South Koreans for their success, but the comparison from that starting point isn’t very relevant.

To answer my own question: in U.S. dollars, there are a grand total of 45 billionaires in Canada. A certain political party makes it sound that there are loads of billionaires waiting around to pay more taxes. What B.S., they can’t touch their money. Pure rhetoric.

“Socialism is great until you run out of other people’s money to spend “. Heard this on the radio this morning. I think this says it all. In a strong country everyone who is capable must pull their own load.

How many billionaires are there in Canada that they are going to tax to solve all these problems? If I were a billionaire, I certainly wouldn’t live in Canada.

“ Greater Victoria recorded 617 new housing starts, an increase of 72.3 per cent over the previous month. But completions are down almost 80 per cent, pointing to the well-documented mismatch between the supply and demand for housing in the region.”

Well that makes no sense whatsoever https://www.goldstreamgazette.com/news/value-of-building-permits-skyrockets-in-greater-victoria/?fbclid=IwAR1fPkdQYpVlw8tP5OD5nc55i2GTK7vNHOHhb-TDgiu86dHTD2Iax6R_AQw

Capitalists are doing fine. They’re quickly figuring out now how to manage the business with less employees, and more automation.

Perhaps you’ve already noticed when phoning a business expecting a human, you’re getting much longer wait times and advice to self serve online.

Many of these cerb recipients have been out of work for 18 months. These people are referred to as LTU (long term unemployed>12 months). Statistics are dismal for LTU people without marketable skills finding good jobs again. In Europe there is a lost generation of them who’ve never found jobs.

The best thing a long term unemployed CERBer could do is get off CRB and take a job while they are available.

What the shock will be is when the election is over and the country wakes up in a recession and we are at the point where stimulus spending actually is a drag on economic productivity. It will be interesting to see the response of the generation that hasn’t really seen or been impacted by a downturn (especially since they believe they are already cheated). Imagine a world where high wages aren’t easily accessible and employees compete for positions instead of employers competing to hire….Oh, and increasing interest rates on all that debt people choose to take on. It should be something to watch.

Bravo to your mom and dad.

When you were a child, how many new vehicles did he own?

Did he had cellular phones, cable TV, internet?

How often does he eat out or go on vacations?

How many pets did he had?

And, what kind of McMansion did your parents lived in?

Odd that my sister had a degree in bio chem from UVIC, and my brother inlaw a degree in computer science also from UVIC couldn’t afford to put their kids in daycare or a house in town, and with family help they were able to scraped together and stretched their budget to purchase a rundown 1 bed, 1 bath 845 sqf starter home in Sooke 27 years ago.

IMHO, people has always had difficult time.

The recovery of certain European and Asian nations from the rubble of war is/was truly amazing and they should be justifiably proud of that. No reason to be ashamed of Canada or of being Canadian though.

Funny how so many so-called capitalists talk about labour shortages, when what they actually mean is just a shortage of people that want to work at the conditions offered.

You wouldn’t want to expose yourself to any thoughts about Canadian work ethics and ambition.

South Korea started the ’60s recovering from a recent war with a capital city that was a pile of rubble, precisely zero natural resources (including a landscape that had been entirely deforested for hundreds of years) and a topography that resists agriculture. Their incease in GDP per capita since then is about 1200%.

Canada has a staggering proportion of the world’s water, trees, minerals, and arable land and has enjoyed two hundred years of peace to develop them so our increase in GDP per capita during the same period should be about…….?

Look if you dare.

When we travel abroad we should all be wearing paper bags. It’s a national embarassment.

Fair – i agree with this.

rush4 life- I’ve heard and I’m sure others have, that drug use was rampant in the oil sands/Fort McMurray region. Lots of isolated people making lots of money, doing lots of drugs. Somehow many of them kept on working to support their habit. It’s amazing how someone who is high can still operate heavy equipment, until they mess up. Who knows how many were fired, maybe their foremen turned a blind eye because it was hard to get people up there. I still think being chronically idle leads to depression and despair. Lots of people become hooked on prescriptions their doctors give them for depression. I’m convinced the best medicine is keeping yourself busy and productive, interacting with other hard working people. Low self esteem is a major factor leading to drug addiction.

I understand this sentiment and agree about the taxpayer burden but also think its too easy of a scapegoat. My dad raised my sister, brother and I on a labourers income, mom didn’t work and watched us (no daycare needed), and he was able to buy a house without education, family help or the need of having someone live in our house paying rent. Anchoring is a real thing so when today many people come out of school with a good education and student loans, and even with that education need two working parents just to cover basic needs one can appreciate the outrage whether you think its justified or not. My friend couldn’t find a daycare for his kids for the first year so was forced to go with Kids and Co which is $2000 a month for each of his two kids ($4000 all together). If things had raised with inflation including incomes and we were in the same situation as our parents i don’t think you would have people screaming for free things. I think its a symptom of a much bigger problem.

Getting back off topic, isn’t CRB winding down in October? If so and if Patrick is right, then the labour shortage will be resolved shortly.

Yes, though “I stand on the shoulders of giants.” 🙂

What do you expect when the populous want everything for free. And, the Canadian populous is hellbent on destroying the country by demand everything for free, such as free healthy care, free higher education, free daycare, welfare, CERB, free drugs, free housing, etc… So why on earth would anyone want to work to pay taxes so others can live for free?

Patrick is fulfilling his dream of becoming an HHV influencer.

Salary isn’t even listed on many job postings and they don’t get replies either. People have been milking cerb and son-of-cerb (crb) for 18 months now so they’re used to it. Some of them I know are fulfilling their dream of becoming a YouTube influencer.

All this would be fun and games if the Canadian economy was anything but a disaster which it is right now. As posted below, the bank of Canada today admitted that they have to keep printing “extraordinary” amounts of money to prevent economic disaster, namely interest rates rising, our dollar falling and inflation because no one wants to buy our bonds.

There are too many people sitting on the economic wagon and not enough people pulling. Paying able-bodied people to sit on the wagon instead of pulling is foolish.

No degree required on the jobs I’ve seen. General Office type skills like using a computer, data entry of a sales order by phone. The point is, there aren’t even unqualified people applying and no difference if the salary is mentioned or not. Lucky to get 4 applicants and you pick one.

Not really, should pick up next week though.

hey Leo – are some of the listings materializing that you had heard were coming this month?

Again I’d say its more likely the other way around – you have an addiction issue and can’t keep a job and end up on the street. Rather than you being a contributing working class citizen who stopped working and then started doing drugs as a ‘distraction’.

That being said i agree that the money spent during the pandemic seemed a bit much. The CRA $5,000 income screw up was absurd and i think the payments should have been a lot more scrutinized as we got further into the pandemic (I know someone who just quit her job and started getting CERB), and I think they should have been enticing people back to work with a reduced amount of payment for dollars earned rather than all or nothing (not sure if they ended up changing that).

I wonder what the qualifications are for an entry level office job in the private sector. Do you need a degree? Or just a pulse?

Maybe they’re working construction and making money under the table?

They’re getting very few applicants because they aren’t paying enough.

IMO, it’s not boogeymen, foreigners, immigrants, and grumpy old people that drives up housing price. What has to do with the ascending housing price are government policies/answers to the voters demand of ultra low interest rates and free money.

BOC keep steady fast at 0.25% interest rates and buying $2 billions worth of bonds per week.

I find it unusual that prior to the pandemic, restaurants had no problem finding workers. Given that hundreds of restaurants have closed for good, you’d think those workers would be fighting for the fewer remaining positions. I wonder what changed.

Introvert- It’s a big country with time zones. I’ll leave at that , we don’t want to get into mathematics.

Given that Victoria is 1% of Canada population, there are about 6,600 people on CRB in Victoria, and 8,000 job openings.

You’re making the point that some of those 6,600 are looking for work, and I don’t dispute that. But it isn’t very many of them. And they will most likely get an entry level job offer the first day they look.

I’ve talked to businesses offering entry level office jobs, “normal jobs” sitting working at a screen like most of us do all day. And on these jobs they won’t be getting “too hot” or “sexually harassed.” (As “Dad” here has worried about).

And they get very few applicants, indicating not much sign of life from our 6,600 mostly lazy CRBers.

Maybe we will hear from someone else that is hiring, and they can describe what they’re seeing.

rush4life- If you’re working you are occupied doing something productive. When you’re not working, you get bored and tend to look for other distractions like drugs. Isn’t this obvious?

https://tinyurl.com/zasrrz3w ??

Frank I’d wager the larger issue downtown is a disease called addiction rather than people who didn’t want to work at McDonalds so they chose the streets instead.

Why don’t you go downtown and survey them Frank? They’re people, you can talk to them.

You can easily be available for work and looking for work, and not looking for a restaurant job.

You’re certainly not expected to take any job when on unemployment, I’d expect CRB to be similar. I’m not an expert though.

That’s a polite way of saying “there aren’t enough buyers of Canada bonds. So we print money and buy them ourselves. If we didn’t do that, interest rates would rise.”

This is bad economic news. We should expect poor performance for the CAD if they keep this up.

Bank of Canada holds key interest rates steady in cautious approach to economic recovery

“The governing council judges that the Canadian economy still has considerable excess capacity, and that the recovery continues to require extraordinary monetary policy support,” the bank said in its decision.

https://www.cbc.ca/news/business/bank-of-canada-sept-8-1.6167838

Also, Frank, why are you awake at 3:54 a.m.?

As I’m fond of saying, work is so bad they have to pay you to do it.

I wonder how many homeless people never found the “right job”. I can list dozens of crap jobs: personal care home workers changing dirty diapers is one of them. Construction work is physically demanding (heaven forbid you should get tired working), first responders see things that would turn your stomach every day, and so on. That’s why it’s called WORK.

Working in a kitchen sucks. It’s hot, hard work, you’ll earn close to minimum wage, earn next to no tips, probably get stuck with an averaging agreement so no overtime either, and if you’re female, there’s a good chance you’ll be sexually harassed.

These people aren’t lazy. It’s just a shitty fucking job that nobody does unless they have to.

Apparently, “affordable” is no longer adequate. We need “deeply affordable” housing.

Green platform planks on housing (from CBC, haven’t read it myself yet)

Invest in the construction and operation of 50,000 supportive housing units over 10 years.

Build and acquire a minimum of 300,000 units of deeply affordable non-market, co-op and non-profit housing over a decade.

You would be defying the terms of CRB, which are that you must be looking for work, and available. You can be as picky as you like , but not if you expect to get CRB. So if you don’t like the term “lazy”, I’d call it being a “freeloader”, by getting benefits you aren’t entitled to.

A more common scenario is someone in the hospitality industry that has left, that is staying on CRB instead of returning to the same in demand hospitality jobs. Look how many there are… https://www.msn.com/en-ca/news/federal-election-2021/there-are-plenty-of-jobs-out-there-why-arent-canadians-filling-them/ar-AAO2sSa

“ In British Columbia’s hospitality industry, 60 per cent of those who were no longer working in the sector as of June had voluntarily left their positions, according to RBC..”

So many of them aren’t eligible for CRB for two reasons, they left voluntarily and they aren’t looking and available for work. What are we supposed to call people who take a government CRB handout that they’re not entitled to? Fraudsters? Criminals? I think the term “lazy”is being kind.

I mean, would you take a job at a restaurant when you were working in an office doing something that you have a lot of experience in? Or would you stay on CRB and continue to look for a job that actually suited you and probably pays more?

I know my response, and it has nothing to do with being lazy.

https://liberal.ca/housing/afford-a-downpayment-faster/

There are 800,000 jobs available in Canada, unfilled. https://www.google.ca/amp/s/globalnews.ca/news/8158090/canada-job-shortage-election/amp/

There are also 640,000 Canadians still collecting CRB payments. A requirement of CRB is that you are actively seeking work. I have no problem labelling somebody who is capable of work but not seeking work and collecting CRB government handouts to be “lazy”. I assume they are all ages young and old. One thing for sure, this nonsense is all borrowed money and we will all be paying it back for generations.

I know Frank, it’s ridiculous.

The other day I asked a simple math question, prove that no three positive integers a, b, and c satisfy the equation a^n + b^n = c^n for any integer value of n greater than 2, and not a single person could do it. Boggles the mind.

What are they even teaching these days?

It’s true that everyone is busy now, but much of the construction is actually just replacing one single family home with a new one. So basically net zero additional homes is taking up much of the trades. That’s because anything other than a single family home is illegal on the vast majority of our land. If we were allowed to build townhouses then the same labour pool could create a lot more homes.

Also right now is a construction boom. But eventually it will slow down. Land use reform could keep construction levels high even in otherwise slower periods.

Canada simply doesn’t have enough tradespeople to do all the construction needed. Lots of new immigrants could contribute but their qualifications don’t meet our standards, and require years of training.

Only 23% of new housing starts in Canada are detached houses. The other 77% are apartments or duplexes/row/multi-unit . This hardly supports the idea that they are being built for people “already well housed.” We need at least 50% construction to be SFH to maintain the current balance in Canada, anything less than that means less people “well housed”, not more.

The point being, given our population growth and low vacancy rates, we need to spend more on new construction, not less. Especially SFH.

Housing starts : https://www.cmhc-schl.gc.ca/en/professionals/housing-markets-data-and-research/housing-data/data-tables/housing-market-data/housing-starts-completions-units-under-construction

Maybe we are. As seen below, our RE sector is proportionally twice as big as the US and probably one of the biggest in the world.

Perhaps part of the problem is that much of this RE investment is going to people who are already well housed.

It’s a good theory Barrister but my income doesn’t depend on high prices. I am also putting a ton of effort into a community advocacy group to try to make housing more affordable, not less and am very concerned about the economic impacts of high prices.

I think it’s a conversation worth having what the correct level of immigration is. But to me the fact that one of the biggest countries in the world can’t manage to build enough housing to accommodate a modest 1.5% growth rate should be a national embarrassment. Funny how every other country with much less land and much more population managed to figure this out and yet it’s an insurmountable problem for us.

Leo: Your thirty year bear market is obviously intentionally misleading and intended to produce fear. The immigration, and hence demand tap, is very capable of being regulated (it is not simply on or off as you well know), Tone it down to stop the insane house price increases and give our young people a chance to have a proper home. I know that ever increasing population growth is like candy to you real estate guys but maybe it is time to tone down the greed of all the developers and real estate guys.

A recurring feature on HHV since 2008

They are proposing “a two-year trial ban on foreign buyers who don’t plan to live in Canada”, whatever that means.

https://vancouversun.com/news/local-news/conservatives-housing-plan-includes-a-two-year-trial-ban-on-foreign-buyers

I heard O’Toole say that the Conservatives would ban foreigners buying NEW homes. Does this mean they can still buy existing homes? You sure have to listen carefully.

Leo- A 30 year bear market might be better than hyperinflation. Look at the countries that have hyperinflation: African nations, Venezuela, etc… That may be the direction we’re headed. All the election promises that certain parties are making will definitely lead us down that path.

+1, amazing insight as always.

Wouldn’t increase of condo price allow people to climb the real estate ladder to townhouse, and from townhouse to single family house?

And, a homeowner who want to move to Victoria from the lower mainland would easily purchase a SFH here, because the average Vancouver detach SFH is now $1.8 million.

How many days on market for the average condo, townhouse, and SFH at the present?

Vancouver house prices rise in August due to little supply — https://www.citynews1130.com/2021/09/05/vancouver-house-prices-supply/

Sales to assessed value ratios.

Pretty interesting to see the interplay between market conditions, affordability, and house prices. October to March, single family prices increased about 17%.

March to august they only increased 4%, despite hotter market conditions. We’ve got tons of buyers in the sub million dollar or sub $1.2M market, but no matter the conditions it’s not like those buyers can move up to $1.5M.

These market conditions will likely keep detached prices moving up slowly, but in the end people still have to be be able to afford them. I still think condos have some more room to run.

If we cut off immigration that’s what we would get. But I wonder if people would really enjoy a 30 year bear market in housing and equities that would likely result.

Patrick What we need is less population growth.

Just shockingly bad sales ratio right now. Normally we just don’t see sales over new listings for extended periods outside of December.

“Residential investment” contribution to GDP consists of 3 things

– construction of new homes

– renovations of existing homes

– transfer costs of selling/buying (RE commissions)

Of those, construction is by far the biggest.

– Canada’s population growth is at record levels, so it shouldn’t be a surprise that home construction needs to be at record levels so that people have a place to live.

– Canada’s population growth in 2019 was 1.4%, which is 3X higher than USA (0.5%) , so of course our home construction is going to be higher than USA.

– Canada has too few homes ( 3% vacant), the USA has too many homes (9% vacant).

And as most everyone here agrees, Canada’s growing population means that we need even more housing construction.

Canada bet big on real estate. Now, it’s an economic drag

…

…

My wife and I stopped at a open house this Sunday in Oak Bay and were actually shocked that it was priced at over 3,3 million. In all likelihood this may be a simple case of overpricing a property by at least a million but if it goes out at anywhere near asking then there is a serious issue with the market. I will try to keep track of this one and let everyone know what happens.

You’re debt free now, but you’ve mentioned that you’ve had mortgages in the past. And yes, Jim Pattinson wouldn’t have bailed you out. But you owned a house to back it up, so you wouldn’t have needed Jim Pattison’s help, as you could have sold the house. Because banks mostly lend to people with collateral (assets) to lend against.

The point being, you can’t expect Canadians to have $17 trillion of assets and be debt free like you are now. Some of them are like you were 30 years ago, young and working and paying off a mortgage. Nothing wrong with that. The fact that Canadians’ debts are only $2 trillion against $17 trillion of assets is impressive and healthy.

Jim Pattison is not going to come to the rescue if you can’t pay your debts. Nor are people like me, who aren’t billionaires but are debt free and on the creditor side of someone else’s debts. Averaging out the whole population doesn’t give you the right picture.

Another thing to think about. I as an individual can sell my house and pay off the mortgage. But the buyer is going to take out another mortgage to buy it. Thus nothing changes collectively. Ultimately debt servicing ability comes from income, not asset prices.

I will throw one in: At the same time when China doesn’t trust and wants to control gaming time of those under age 18, it trusts and permits legal age of 14 for consensual sex. Makes sense to you? It is a place of no law and no freedom of thinking and speaking. Gaming time limit is just part of new brain control strategy under a cover of “saving young people”.

Congrats, this is one of the best trolling posts I have seen in a while. It will be interesting to see if you draw anyone in… Lol..

A country like China recognizes the damage video game addiction is causing their youth and is taking steps to curb this destructive activity. This obsessive behaviour they are addicted to leads to sleep deprivation, alienation from normal human interaction, and other behavioural abnormalities, eventually leading to mental illness. Maybe it’s time for Canada to recognize this problem, or you can ignore this post.

“don’t you think Dad you are employing a bit of a bullying tactic there?”

No Alexandra, I don’t bully people. And for the most part, I just ignore Frank and Patrick’s comments, but the “young people are lazy, they want everything handed to them!” routine is mighty irritating.

Frank –

I find it a bit silly that you say you dont respond to petty insults, yet almost every post from you is a petty insult or silly conclusion about anyone younger than you. I wish there was a way not to see your posts.

Maybe an ignore button in the future Leo?

sure thing “Big Guy”………..don’t you think Dad you are employing a bit of a bullying tactic there?

$2 trillion of debt sounds scary, until you realize that Canadians have $17 trillion in assets, and so a net worth of (17-2)=$15 trillion.

All airlines are in a giant collusion to suck right now. They are intentionally are keeping staff levels low, but selling tickets for flights they know they can’t crew or have service reps to deal with customers. It’s tough from a business was perspective, alienate customers through bad service delivery or risk starting up again too quickly and get trapped by restrictions and shutdowns. I imagine that many of the qualified staff in that industry might be looking at retraining, so the longer the airlines stay at minimum service, the tougher it will be to get qualified staff back.

Thanks Patrick, I simply don’t respond to petty insults, people can believe what they want to believe.

“Please keep personal insults off the forum.”

Sure thing big guy, but it wasn’t personal. I’m sorry if your perceived it that way.

Please keep personal insults off the forum.

Canadians have record-high mortgage debt. What happens when rates rise?

https://www.cbc.ca/news/business/debt-mortgage-feature-1.6162668

Note to self, never fly Flair. First flight delayed, return flight cancelled.

“…but that doesn’t mean having basic math competency wouldn’t come in handy in other situations.”

I agree, but being able to answer a random question about interest rates asked by a deranged, shouting old man isn’t one of them.

“Private pension assets are a major component of the assets of Canadian family units……..accounting for almost 29% of the value of all assets. They are second to the most valuable asset: a home.”

So, I guess if the family home is 50% of their total assets and their Government pensions are 29%, only 21 % is left. Take away their two SUV’s, Computers, furniture, camping equipment (lol) etc. how much is left in cash and investments?

https://www.timescolonist.com/elections/federal-election-north-island-faces-new-realities-1.24355841

In 1971 Canada’s leading export was – drum roll – “industrial goods and materials”, followed closely by “automotive products”. You’re right about oil – it was pretty cheap back then.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610025001&pickMembers%5B0%5D=2.1&pickMembers%5B1%5D=3.2&cubeTimeFrame.startMonth=01&cubeTimeFrame.startYear=1971&cubeTimeFrame.endMonth=10&cubeTimeFrame.endYear=1971&referencePeriods=19710101%2C19711001

I forgot to mention that, in days of yore, you were actually expected to reach as certain level of competency in school studies. If you didn’t meet them, you were held back and repeated the year. This is unheard of in today’s “education” system. Thanks to technology young people can’t perform simple math without the aid of a calculator, it’s pathetic watching them try to make change in a cash transaction. I know that this is rare in our tap transaction society, but that doesn’t mean having basic math competency wouldn’t come in handy in other situations. Ask any young person: If interest rates went from 2% to 3%, what is the percentage increase? Most would probably say 1%. 100% wrong.

Housing price is running out of control all over the world due to low interest rates.

Singapore 4 bedrooms apartment is over $3 million USD, and their median household income is $7,744 S per month or roughly 86,778 CAD a year.

Aside from RE, Canadians are in great shape for retirement, due to a “wall of wealth” in non RE assets. The average Canadian net worth of Canadians is more than $1 million, and boomers have more than average. And that’s $500k in non RE assets. No prior generation had anything close to that prepared for retirement.

Non RE assets are at all time highs for Canadians. Everything from cash savings, stock holdings and pensions. Net worth of Canadians has tripled since 2000, far ahead of inflation.

If you need to more than that, read about Canadians “wall of wealth” here …

https://financialpost.com/executive/posthaste-canadians-built-a-2-trillion-wall-of-wealth-during-the-pandemic-and-its-not-just-a-housing-story

“Canadians built a $2 trillion ‘wall of wealth’ during the pandemic — and it’s not just a housing story

The average Canadian household now has more than $1 million in total assets.

According to BMO, the average Canadian household now has more than $1 million in total assets, even after accounting for debt.

“Household wealth has more than doubled since the past cycle, and tripled just since the dot-com boom at the start of the century — an amazing outcome in the wake of a deep recession,” Porter noted.

While housing played a big role, other assets also surged during the pandemic. Currency and deposits, for example, rose $210 billion. In addition, Canadians also rode the S&P/TSX Capped Composite Index rally, which has jumped nearly 30 per cent during the past year, while the U.S. markets are also trading at record highs.

Equity, mutual funds and ETFs rode the wave of record global stock markets to a $290 billion increase, Porter said, while life insurance and pension values were up $218 billion during the past year.

“These have combined to boost household financial assets by more than $700 billion, while net new borrowing has risen a much smaller $112 billion, lifting net financial assets to $5.7 trillion, or 4 times disposable income,” according to the BMO note, published Friday.

Finally, non-financial assets rose 21 per cent to rise $1.4 trillion — or at more than 10 times the increase in household debt during that period.“

Yes, because things have been getting better for each generation. Many people realize this, others need to be informed about it. Books like “Abundance” and “The Rational Optimist” should be required reading for young people who think they’re worse off than their parents or prior generations.

“There was no day care plan, health system, CERB, welfare, etc… They did not rely on the government for anything, they were self sufficient. This is the problem today, we’ve lost that self sufficiency, want everything handed to us, and don’t want to work for it.”

I’m pretty sure old men have been telling this tale since the beginning of old men, and yet the sun still comes up every day.

patriotz- What do you think Canada’s main industry and exports were in 1971? It sure wasn’t oil.

As recently as 1971? Get serious.

I mean, what’s Thanksgiving dinner like when the couple passing you the mashed potatoes purchased your house for you?

Yeah, it does make you wonder. I might have to ask some tacky questions next time we hang out 🙂

A lot of baby boomers are also enjoying money that was passed down from their family farm. We forget that Canada was primarily an agrarian society 50-150 years ago. Their ancestors came to Canada, were given farmland and they proceeded to work their asses off. There was no day care plan, health system, CERB, welfare, etc… They did not rely on the government for anything, they were self sufficient. This is the problem today, we’ve lost that self sufficiency, want everything handed to us, and don’t want to work for it.

No kidding. As well as simply being older than the other cohorts – people accumulate wealth as they get older – they also had less expensive post-secondary education, better job opportunities and were able to get into the housing market at far lower prices than today’s. Should say “we” I guess.

The issue is apart from their RE holdings, are they better prepared for retirement compared to the previous cohort. Appears to me that they’re not.

Introvert- Concerning your friend whose in-laws gifted them $850,000, boy would that make for a messy divorce. I bet the house is in his wife’s name.

Pick your stat as I have said before. Here is one: Households led by people aged 55-64 had a median net

worth of $690K in 2019 (so $345K each), down 2.7% from 2016. Households led by people aged 65 or older had a median net worth of $543,200, so $271,600 each, in 2019 down 0.82% from 2016.

Boomers average worth 1.2M. Is that the average Boomer couple or the average Boomer single? If it is a couple then each are worth $600K. I would think as a single person making a decent salary over 35 years, and having a worth of $600K isn’t out of this world for sure.

Boomers are the wealthiest generation in history, and have half of all household wealth. About half of Canadians assets are in RE, the other half is pensions, rsp, stocks etc. i

Since boomers are now ages 57 to 75, many are retired already. If they were unprepared and too house heavy, we’d be hearing that they’re selling the RE to pay the bills, and we don’t. Reverse mortgages make sense to access their equity, and augment retirement income.

https://www.advisor.ca/news/industry-news/boomers-ok-when-it-comes-to-wealth-statscan-says/

Boomers OK when it comes to wealth, StatsCan says

“Baby boomers still hold the most wealth in Canada, and generation X are the biggest consumers, according to a new report from Statistics Canada.

The report examines wealth distribution by demographic cohort — boomers (born 1946 to 1964), gen X (1965 to 1980) and millennials (after 1980) — finding that Boomers remain the wealthiest with an average net worth of $1.2 million, and accounting for about half of all household wealth.”

Correct.

Friend is my age — so late-thirties. Not sure the age of the in-laws. Most likely late-sixties.

Introvert, by in-laws do you mean your friends wife’s parents? How old are your friends and about how old are the in-laws? Just wondering. Thanks

There does seem to be a ton of boomers with money to burn, and also a ton who burn all their money. And, naturally, we tend to make boomer generalizations based on what we’re most familiar with.

For me, my social circle is filled with boomers who aren’t hurting for money.

A recent and pretty extraordinary example:

Some may recall me talking a few of weeks ago about a super nice $830K house in Calgary that my friend recently bought. His in-laws gifted them the cash to buy the house outright — no mortgage.

Kenny- That’s where boomers got the money to buy all the winter vacation properties down south, some even passed down. Canada has only been around 150+ years and look at the wealth some families have accumulated. Granted a lot of fortunes were brought from Europe. I don’t think we fully appreciate or comprehend the vast fortunes real wealthy people have. Meanwhile the NDP want to tax the hell out of people like me who started with zero family wealth, bust my ass and made a few wise investment decisions. The super wealthy know how to get around new taxes, mainly because they own the politicians.

patriotz- There are plenty of struggling boomers out there just as there are struggling young people. But like I said, thousands of boomers, like many of my friends who were professionals, are extremely well off, many with seven figures in savings. I didn’t hang out with losers.

In fact evidence shows that boomers are less prepared for retirement than previous generations, and many are depending on their house as a retirement plan. You wouldn’t see all those CHIP reverse mortgage ads on TV if the market wasn’t there.

https://www.advisor.ca/news/industry-news/half-of-canadians-put-off-retirement-saving-survey-finds/

My neighbor across the street at my cottage just bought a new Cadillac SUV, he told me he turned 71 and doesn’t know what to do with all this extra money he doesn’t really need. I bet there are thousands of seniors with this “problem “

‘

‘

More like hundreds of thousands across Canada like this, today’s seniors benefited from generous DB pensions as well many boomers are the beneficiaries of large inheritances from their parents who grew up during the depression and lived very frugally, and just kept saving money until the day they died, boomers on the other hand have no problem spending the windfall like your friend

“… people in Vancouver are paying many more times than they have to for residential property because the CRA did nothing when it was warned by its own employees about what was going on”

25-year-old internal memo to Canada Revenue Agency predicted foreign money distorting housing market

https://docdro.id/SUC0TAT

https://www.theglobeandmail.com/canada/british-columbia/article-25-year-old-internal-memo-to-canada-revenue-agency-predicted-foreign/

Here’s a source of wealth we may missing: baby boomers over the age of 71 are required to cash in 5% of their RRSP, in some cases that could amount to over $50,000 a year, which is taxable. Nonetheless, for many this is found money and some of them don’t know what to do with it and lend or give it to their grandkids for down payments on ridiculously high priced homes. My neighbor across the street at my cottage just bought a new Cadillac SUV, he told me he turned 71 and doesn’t know what to do with all this extra money he doesn’t really need. I bet there are thousands of seniors with this “problem “.

“ If we have someone that is intelligent, have empathy, and integrity then I’m sure that the populous will be behind he/she and the turnout would be much higher than 60~70% and a landslide standing.”

Stephane Dion, Joe Clark, Adrian Dix, Peter Mackay, Mike Harcourt, etc., might say otherwise.

My friend bought a house in Kelowna in March 2021 for 729k. The house across the street with an assessed value of 639k and almost the same layout/size as hers was just listed for 1.15 million… I guess the fires haven’t had an appreciable impact so far.

Distribution of house values by province (2019)

https://twitter.com/philsmith26/status/1433935846256877569?s=21

They all are money grubbing and power hungry scrounges. If we have someone that is intelligent, have empathy, and integrity then I’m sure that the populous will be behind he/she and the turnout would be much higher than 60~70% and a landslide standing.

Below is a link to Lee Kuan Yew saying that today youth are lazy, and how leaders should be developed/selected.

An absolutely spot on view point from the former Singapore PM – https://www.youtube.com/watch?v=MnlPfvx7Cgg

That actually does mean that the labour market has roared back. Demand outpacing supply, you know.

You’re aware that the Liberals and NDP were not in a coalition over the last 2 years? Now apply that model to the Conservatives and BQ.

Looks like you can still work and get CRB. The federal government is borrowing money from foreigners to pay for this irresponsible giveaway. If they believe in it, they should announce they are increasing taxes to pay for it, and then they’d hear what Canadians think of it.

https://www.canada.ca/en/revenue-agency/services/benefits/recovery-benefit/crb-who-apply.html

“You may earn employment or self-employment income while you receive the CRB. But the CRB has an income threshold of $38,000.

You will have to reimburse $0.50 for every dollar of net income you earn above $38,000 on your income tax return for that year (2020 or 2021). You will not have to pay back more than your benefit amount for that year.”

640,000 people on CRB in august 2021. That would be about 6400 people in Victoria since Victoria is 1% of Canada population

https://www.canada.ca/en/revenue-agency/services/benefits/recovery-benefit/crb-statistics.html