A brief history of credit measures

I’ve been talking about supply quite a bit lately, and the obvious question to raise is what about demand? Supply is great, but it’s going to take at minimum several years for reforms on the supply side to really start affecting prices. Can’t we cut down on excessive demand in the meantime? What if we changed the regulations for now to prevent buyers fueled by FOMO from getting drunk on cheap credit?

Well as so often in real estate, it helps to zoom out. In this case, let’s take a look at what the government has done for the last 15 years on credit availability. The following list is adapted from RateSpy’s History of mortgage rule changes.

| Date | Rule | Credit Effect |

|---|---|---|

| Feb 2006 | Max amortization raised to 30 years | 🔼 |

| Jun 2006 | Max amortization raised to 35 years. | 🔼 |

| Nov 2006 | Max amortization raised to 40 years. Zero down mortgages. | 🔼 |

| Mar 2007 | Insured mortgage for self employed borrowers | 🔼 |

| Jul 2008 | Max amortization reduced to 35 years. Minimum down payment raised to 5% | 🔻 |

| Jul 2008 | Minimum credit score of 620 | 🔻 |

| Apr 2010 | Mortgage stress test for high ratio terms less than 5 years | 🔻 |

| Apr 2010 | Max refinancing LTF lowered to 90% | 🔻 |

| Apr 2010 | Rental property requires at least 20% down | 🔻 |

| Jan 2011 | Max amortization reduced to 30 years | 🔻 |

| Jan 2011 | Max refinancing LTV reduced to 85% | 🔻 |

| Jun 2012 | Max refinancing LTV reduced to 80% | 🔻 |

| Jun 2012 | Max home value for insured mortgages capped at $1M | 🔻 |

| Jun 2012 | Max amortization reduced to 25 years | 🔻 |

| Jun 2012 | Max GDS of 39% and TDS of 44% | 🔻 |

| Aug 2013 | Banks can offload securitized mortgages from their balance sheet | 🔼 |

| Dec 2015 | Minimum down payment of 10% for portion of mortgage above $500,000 | 🔻 |

| Oct 2016 | Stress test for insured mortgages | 🔻 |

| Jan 2018 | Stress test for insured mortgages | 🔻 |

| Mar 2019 | RRSP Home Buyer Plan amount increased to $35,000 & First time Home Buyer Inventive | 🔼 |

| Mar 2020 | Pandemic supports to increase lending capacity | 🔼 |

| Jun 2020 | CMHC lowers GDS to 35% and TDS to 42%. | 🔻 |

| Jun 2021 | Stress test rate increases to 5.25% | 🔻 |

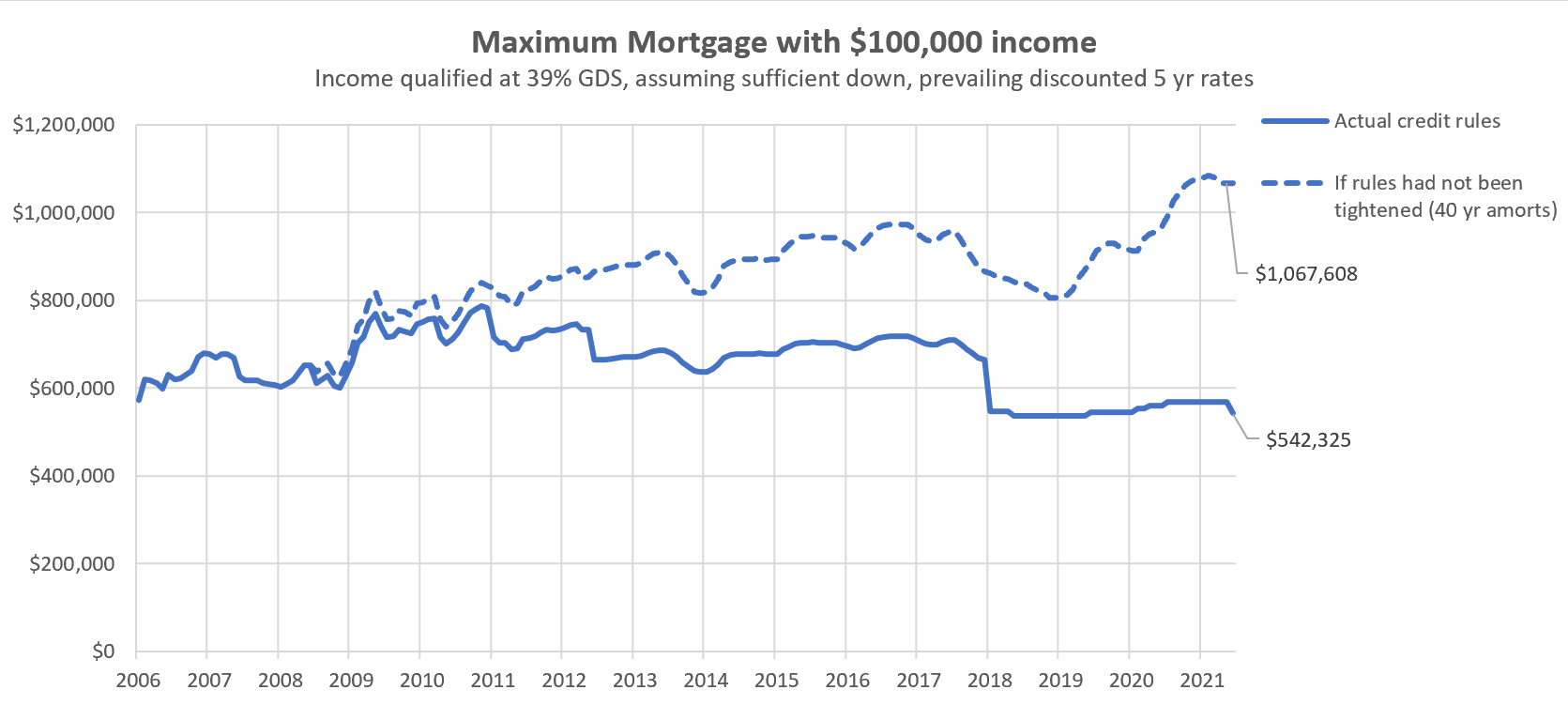

As you can see, temporary pandemic supports and misguided election programs notwithstanding, there’s been quite a lot of credit-restricting moves since 2008 when we had zero down 40 year mortgages for a brief time. It’s impossible to exactly quantify the impact of changes like lowering and then raising down payment requirements or restricting refinancing limits. What we do know is that outside of the stress test which immediately sidelined 20-25% of buyers, none of these changes had sufficient effect to rise above the noise in the sales data. However we can model the impact of changes to maximum amortizations and the mortgage stress test. Below I’ve charted the maximum mortgage for a person making $100,000 over time, along with what it would have been if the government had not started restricting credit availability in 2008.

It’s pretty amazing to see that if we had stuck with 2008 rules, people could qualify for nearly twice as large of a mortgage today as they could with current regulations (and that’s not even including the GDS changes last year, since the private insurers didn’t follow suit). In fact despite much lower rates today, the maximum mortgage under current rules including the mortgage stress test is actually less than it was 15 years ago. On paper, it would seem regulators have already done an excellent job of preventing those lower rates from leading to more leverage.

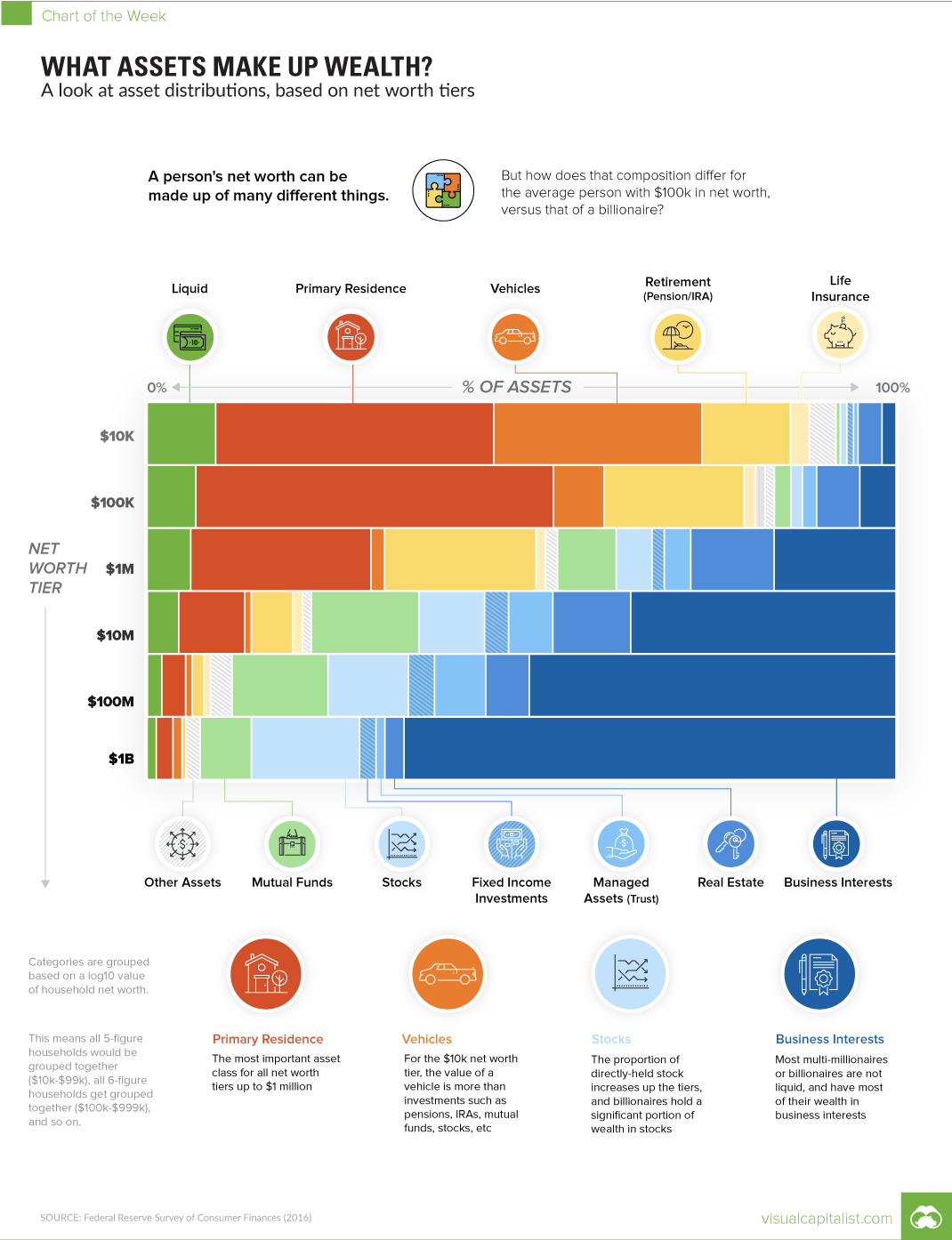

However we know that is not actually the case. House prices have jumped across the country, mortgage debt is increasing at record rates, and we know that there are ways around the stress test available to well qualified borrowers. What this essentially means is that those with a high net worth (often gained through real estate), can often benefit from those incredibly low rates by qualifying for larger mortgages, while those just getting into the market are qualifying at the higher stress tested rates for lower amounts.

It’s a tough problem, because of course the stress test is meant to protect borrowers from rising rates, and it makes no sense to keep increasing amortizations as that simply kicks the affordability can down the road. On the other hand it seems that unless the rules apply to everyone, regulators have created an uneven playing field with the highest barriers for those with the fewest means while those with more can take full advantage of the nearly free money.

However it’s worth remembering that credit availability doesn’t alone lead to higher prices. Under the same credit conditions and despite recent price runups, a house on the east coast still costs less than half of what it does here. It’s when there isn’t enough supply for the demand that prices rise to the limit of purchasing power. The most recent increase to the stress test rate is also a marked departure for regulators. While the stress test rate used to be set by some semblance of the market (big bank posted rates or contract rates + 2%), it is now an arbitrary number that is set annually based on unspecified levels of “risk” in the market. In other words, regulators have a direct finger on the scale and can push it in one direction or the other if they feel prices are too high or too low. With the stated desire by the government to engineer a soft landing and avoid price declines (at least prior to the next election), they may use that finger to increase credit availability if there’s an uncomfortable weakening in the market.

It’s a sticky situation with no easy solutions and I don’t envy the regulators trying to walk this tightrope.

Also the weekly numbers courtesy of the VREB:

| June 2021 |

June

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 168 | 394 | 614 | 808 | |

| New Listings | 279 | 585 | 860 | 1430 | |

| Active Listings | 1495 | 1502 | 1479 | 2698 | |

| Sales to New Listings | 60% | 67% | 71% | 57% | |

| Sales YoY Change | +68% | +54% | +27% | ||

| Months of Inventory | 3.3 | ||||

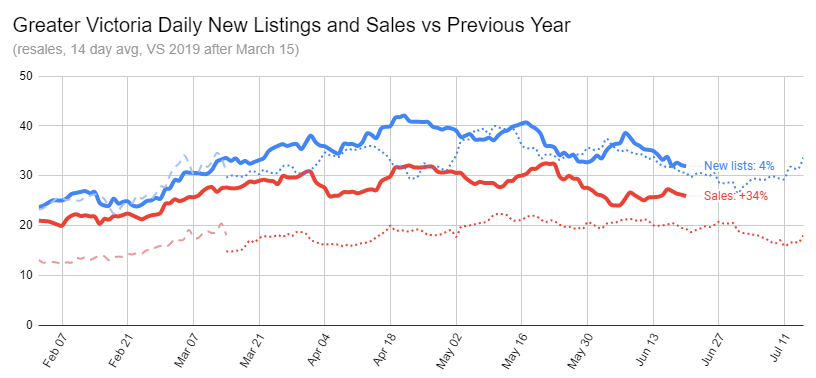

A relatively active sales week as some of those new listings from the start of the month were absorbed. Nevertheless we should expect the sales rate to slowly drift downwards towards more normal levels over the summer. The comparison to 2020 sales levels will not have much meaning for a few more months as we are now comparing to the period of pent up demand. As usual the comparison to 2019 shows how far away we are from more normal levels of market activity. New listings remain unremarkable, tracking 2019 levels quite closely, while sales remain substantially higher.

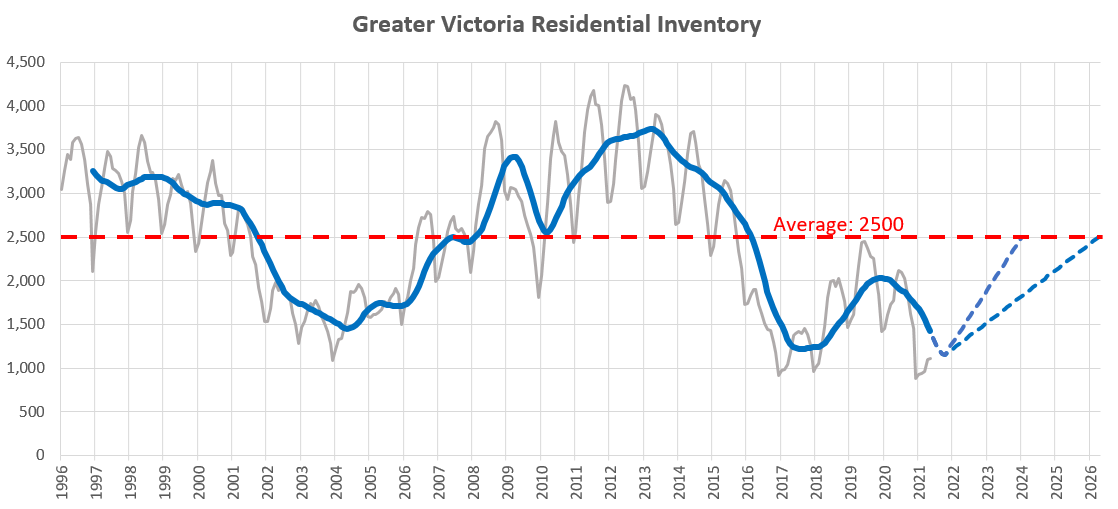

Inventory is still going nowhere fast, and the further we get into the summer, the less likely it gets that we will build any substantial amount of inventory this year. Even once sales cool down, we have to keep in mind that inventory builds very slowly over years. Revisiting an old post topic, we can project based on how the market has built inventory in the past, how long it may take to build it from the current record low levels. Averaging out the seasonal patterns, historically we’ve seen sustained rises of between 25 per month to 50 per month in times of rapid market slowdown. Applying that to current inventory levels (the 12 month average will continue to decline for some months), it will likely take at least 2 years and possibly as long as 4-5 years to get back to just the long run average of about 2500 properties on the market.

Inventory is still going nowhere fast, and the further we get into the summer, the less likely it gets that we will build any substantial amount of inventory this year. Even once sales cool down, we have to keep in mind that inventory builds very slowly over years. Revisiting an old post topic, we can project based on how the market has built inventory in the past, how long it may take to build it from the current record low levels. Averaging out the seasonal patterns, historically we’ve seen sustained rises of between 25 per month to 50 per month in times of rapid market slowdown. Applying that to current inventory levels (the 12 month average will continue to decline for some months), it will likely take at least 2 years and possibly as long as 4-5 years to get back to just the long run average of about 2500 properties on the market.

June numbers https://househuntvictoria.ca/2021/07/02/june-market-eases-slightly-but-remains-hot/

Totoro, I shop almost exclusively at BCL and my drinks are the same price as liquor plus.

Marko, it’s not a lack of construction unions keeping housing here at its bargain basement pricing.

We have minimum wage, EI and CPP. This particular job requires no education or prior training. So this would presumably apply to all entry level workers? The cost of goods and services would rise a lot if everyone unionized and I would suspect a lot of businesses would no longer be viable and the ones that stayed would be looking to automate as much as possible.

Back to housing. The over two million mark properties seem to still be moving briskly and frankly I am surprised at some of the houses that have sold in this price grade. I am beginning to suspect that this is not a bubble but rather the new norm.

Even at these prices there is little to choose from on the market.

Sorry Introvert. Clearly it was someone else looking at investing in Vistra corp. Clearly you missed out. 😉

So you wouldn’t be complaining if the homes you are looking at went up another 100k as all construction workers unionized and measures such as rain/snow/too hot days were introduced to improve working conditions of construction workers?

It’s a zero-sum game out there, Caddy.

Private liquor store workers deserve good pay, benefits and a retirement too- It’s not a race to the bottom. Instead of attacking someone else’s pension (that they pay for out of their government salary I might add, heavily) why not look inwards as to why you’re not getting the same? It’s nice to see that one of our local Starbucks has unionized. Hope more workers follow suit.

https://financialpost.com/pmn/press-releases-pmn/business-wire-news-releases-pmn/victoria-starbucks-workers-brew-up-first-contract

???

I’ve never invested in a stock, bond, ETF, or mutual fund in my entire life.

Anyone know the reason(s) why a group of 5 houses on large lots are all for sale at W. Saanich and Mctavish? I believe one has sold. Cheers.

Also I hope Introvert bought the stock he/she was eyeing up. It has had a nice up tick since. Congrats if so.

Sounds like bullshit to me.

The BC Public Service has less than 40000 people, so that can’t be what he’s talking about. In fact, I can’t find anything on the BC labour market suggesting that the number of “public service employees” has jumped 210000 in 4 years. Probably a short-term boost in health care workers, but I’d argue I’ve seen a service increase there over the past year or so. How do people fall for this BS?

Link to stats: https://www2.gov.bc.ca/gov/content/data/statistics/employment-labour/labour-market-statistics

NOBODY should be subsidized in order for them to purchase a home or to maintain ownership. It just makes prices higher. We should do the reverse – get rid of existing subsidies.

Anyway Cynic, I am glad for many whom work in government positions and get good pay and great perks and benefits. But middle income taxpayers, government employees included, should not be obligated to subsidize families making over $110K per year in order for them to purchase a home. There are just too many other groups that need financial support over them.

Also, when comparing private vs public sector employment, I don’t think most of us, at least not me, think employees working in the professional fields such as Medical, Engineering, Scientific and like categories of the government have it particularly better than they would privately.

It is the rest of the groups such as in administration /administrative support, general labourers, etc. that are top heavy and over compensated in comparison with their privately paid counterparts.

And yes, I think the person behind the till at Walmart does have a more difficult job than the one at the municipal hall re-directing phone calls does.

And no, I never worked at Walmart.

“the private liquor store employee selling liquor, chips n cheezies, baseball caps, pop……….who works harder there?”

Is there a trick to selling cheese balls and hats that I’m not aware of? I’m gonna go out a limb here and guess the work load is comparable.

I should probably just bow out here. This discussion isn’t going anywhere good. Apologies everyone!

Okay, lets compare the government liquor store employee (selling only liquor) & the private liquor store employee selling liquor, chips n cheezies, baseball caps, pop……….who works harder there? Who has the better education?

Cause that is an excellent comparison. Walmart workers with provincial government employees.

I have an idea, lets drag everyone down to the same level just because some people think they work so much harder and better than those lazy government workers.

Here’s an idea, if it really gets your goat that they get “above average salary and pension”, why dont you go and find yourself a government job? You have that opportunity. If you don’t take it, thats your own fault.

“This happens in provinces that the NDP come to power in. They’ve never won a federal election and so they have such a large political machine to feed, they can only do it by moving their allies all over the country wherever people are foolish enough to vote them in.”

Bullshit. Governments of all stripes do this. Remember when the Christy Clark Liberals hired a bunch of ex-Harper government staffers to get the message out?

I’m not at all saying it’s a great idea- just thought it was interesting that so many people can convince themselves that it makes sense, when it clearly doesn’t.

“the number of public service workers has increased from 290,000 to 500,000.”

Lol, and you know what the source is? Liberal MLA Mike Morris! Who the hell is that guy anyway? Never heard of him.

Here’s a crazy thought though…supposin’ that those numbers are actually true: Do ya think that maybe, just maybe, it might have something to do with that whole COVID-19 thinger?

The reason the idea is horrible

Here, here Up and Coming and Stroller re “paid for by the rest of us pensions”.

As Marko said, his basic salary was hugely increased because of all the overtime, shift differentials etc.

Usually pensions are calculated at 2% of your average salary (over your best 3 consecutive years?), times the number of years service.

So, if your “basic” annual pay was $54K per year, your pension would be after 30yrs service $32,400. But if you were to actually make $70K per year because of weekend pay, shift premiums, stat pay and acting pay , your pension would be $42K per year. Usually, overtime, which can really boost your income even more, is not included in pension calculations.

So when you look up what these public service employees are making, you can usually add several thousand on to that because of all the above mentioned. For a real laugh, calculate how many days they actually work per week (or year) considering 4-5-6 weeks annual leave, sick leave, special and family related leave, 12 Stats plus their 2 hour “doctor appointments” a month. I probably missed a few. Annually paid Federal gov’t employees have a 37.5 work week, but I believe the Provincial employees work a 35 hr work week……so they get the “flex Friday” every single Friday. Nice.

I wonder how many people working at Walmart get shift & weekend premiums. Maybe they do, I don’t know.

Marko’s right, this is a horrible idea.

If you’re bullish on RE, invest in a stock – ie) a Canadian REIT.

I don’t advise leverage, but if that’s the attraction to buying your own investment RE, then you can leverage a REIT at 3.3X and pay margin interest of 1.55% at interactivebrokers.ca (which is less than mortgage interest) https://www.interactivebrokers.ca/en/index.php?f=46803

There are lots of REITS,

For example, a “REIT of REITS“ like VRE 3.13% yield. https://ca.finance.yahoo.com/quote/VRE.TO/

REITS are selling for less than they did pre-pandemic, and pre-explosion in house prices.

VRE is going to be a mix of residential and commercial. If you want residential only, choose one of those like https://ca.finance.yahoo.com/quote/IIP-UN.TO/profile?p=IIP-UN.TO

The advantages here is that you need to do absolutely nothing after buying the stock. Unlike what happens when you buy the investment property. For example, no 11pm call from a tenant telling you there are mice in the apartment and what are you going to do! And it’s completely liquid, unlike the plan to flip a unit in 3 years, which involves evicting your tenant, and losing any profit with buying/selling costs and taxes.

Another point, is that these REITS are providing long term quality rentals for Canadian families, so that your investment helps with the problem (especially if you buy a new issue of stock). Unlike your friend’s plan which is to provide a 3 year rental and then “flip” the tenants out of their home.

“Sounds like a horrible idea imo.”

Sounds like another realtor giving financial advice. You’re going to make Mr. Buddy be a bit taken aback again

“Buried away in a newspaper article about the heat wave is a little note about the reign of the NDP here in BC. In the four years since the kleptocracy came to power the number of public service workers has increased from 290,000 to 500,000.”

Sadly, many of these are political hires. The Premier just gave his own office about $3 million more a year and hired a bunch of political allies. This happens in provinces that the NDP come to power in. They’ve never won a federal election and so they have such a large political machine to feed, they can only do it by moving their allies all over the country wherever people are foolish enough to vote them in. Pray they never get elected federally because then you’d really see something terrible. BC had the leanest public service in the country five years ago. Although that probably still wasn’t good enough for some on here by some of the comments I’ve seen.

As yet unconsidered factors in the Victoria SFH price runaway…..

Buried away in a newspaper article about the heat wave is a little note about the reign of the NDP here in BC. In the four years since the kleptocracy came to power the number of public service workers has increased from 290,000 to 500,000.

After you’ve had a little time to quell your nausea, imagine that you yourself were amongst those chosen few. You would have an above average salary which ramped up regularly without any need to increase your performance, be held to no known standards of work productivity or probity, could not lose your job under any circumstance of personal underperformance or economic downturn, and be looking forward to an extravagant pension guaranteed to be funded by your fellow citizens regardless of the future state of the province’s ravaged finances. Would you not think a large mortgage was a triviality?

So….. a 70% increase in the number of people “working” for the rest us out here in the real world. Would anyone like to post examples of the 70% increase in services they have received over the last 48 months?

From: https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-a-financial-shock-is-coming-for-those-who-jumped-into-the-housing/

Well, I guess that’s good news for me compared to the people that out bid me on homes this year. I think I am really going to enjoy Christmas in Hawaii and taking the kids to Disney in March and a few Alpine ski adventures in between. Not buying a home in this nutty market has kept disposable income high. There’s always an upside in any situation and not being financially stretched is one.

Any one know why 1229 St. Patrick St sold for well below ask after 42 days on the market? Looks like a decent character home in south Oak Bay.

Listed 1.65

Sold 1.42

I am surprised the base pay had only increased by ~20% in 14 years. That’s only a cagr of like 1.3%, no wonder you left.

Nightshift differential, weekend differential, pager pay ($30/shift), student preceptor pay ($24/shift), overtime, stats, etc. I think I started at $25.80 so it wasn’t a lot lower 14 year ago. It wasn’t difficult to clear 75k. I worked overtime Christmas/Boxing day two years in a row as most older RTs wanted to be home with their kids.

You could also go to Alberta and the lower and top end increase by $8 and houses are a lot more affordable to boot.

Oh. So by your logic, if it’s the norm now for millennials to not own homes, that’s not a sacrifice?

FYI, the 53% highest tax rate kicked in at $25,000 income in the early 1980s (under Trudeau and the Libs), up to 1986. It got lowered in 1987. (Thank you Brian Mulroney and the PCs). The PCs got rid of the $1,000 interest exemption in 1987, but phased in $100,000 lifetime cap gains exemption, which was better. In those days we didn’t ask the government to increase taxes, like goes on here.

Page 1062 https://www.fcf-ctf.ca/ctfweb/Documents/PDF/1995ctj/1995CTJ5_02_Smith.pdf

I acknowledge that by the 90s affordability was starting to deteriorate. I was thinking of when I was growing up a generation earlier. But back then “No fancy cars, we never got on a plane to go anywhere, had dinner out once every couple weeks” was the norm. It wasn’t a sacrifice.

“But they didn’t really. Owning your own house was part of the normal working/middle class lifestyle. People didn’t have to give anything up.”

I don’t think that’s true. I grew up in a middle-middle class household in the 90s, and we lived modestly in order to live our Suburban Lifestyle Dream. No fancy cars, we never got on a plane to go anywhere, had dinner out once every couple weeks, etc. There were definitely sacrifices made.

Marko, here is a current posting for respiratory therapist at VIHA where the hourly rate range is $30.82 – $38.56 depending on experience (since its a union job). So assuming a 37.5 hour work week you would just crack 75k at the very top end, for anyone not at the top end you would need overtime to crack 75k a year. I don’t know what the exact hourly rate was 15 years ago but obviously it would have been a lot lower.

https://islandhealth.hua.hrsmart.com/hr/ats/Posting/view/136716/0

FYI, until 1988 the first $1000 of interest income was tax free. Beyond that, you needed to have a pretty high taxable income to have a marginal rate of 50%. Over $60K, which in today’s terms is about $135K.

One more thing – there was also something called a Registered Home Ownership Savings Plan. Worked very much like a TFSA – no taxation charged on interest earned or withdrawls provided you used it for a DP.

If you’re comparing affordability, you should be looking at the same % of income as down payment, not the same % of house price. That shows you how bad things have really become.

But they didn’t really. Owning your own house was part of the normal working/middle class lifestyle. People didn’t have to give anything up.

Obviously there were exceptions like newly arrived immigrants or refugees, or someone buying a house on one income after two incomes had become the norm.

Yes, differences in the bank account savings rates between generations would have helped with saving the down payment. FYI, Savings interest was taxed over 50% in the 80s and didn’t keep up with inflation after taxes. As now, it was better to put money into a house or stocks.

Sounds like a horrible idea imo.

@Patrick, monthly affordability is better now but you’ve ignored downpayment, which is much worse these days.

At 20% down with those prices is $60k vs $140k and the former was in a high interest environment so your money compounds more while you’re saving up for a downpayment.

When I invested in real estate, the sellers didn’t give a damn where the money was coming from. When I’ve sold properties, I didn’t give a damn where the money was coming from. If you want to live in a state controlled society move to Venezuela, let me know how that works out for you.

More than a third of boomers are thinking of buying a house in the next five years — and they’re not looking to downsize: survey

https://www.thestar.com/news/gta/2021/06/30/more-than-a-third-of-boomers-are-thinking-of-buying-a-house-in-the-next-five-years-and-theyre-not-looking-to-downsize-survey.html

Yes and no.

At the moment rent doesn’t cover mortgage/maintenance/strata/taxes so the condo owner is betting on the market keep going up at a rate that is greater than the monthly lost and inflation, hence it is more liking using HELOC to buy Options.

It is quite prudent to use HELOC to buy stocks because the current interest rate is 3%, and there are many dividend stocks yield well above 4% therefore the risk is lower.

Are they buying from the realtor listing as well so that he/she can cash in on the double ended deal?

Well CPP was just boosted so that’s essentially it. I wouldn’t be surprised if CPP kept rising to provide that safety net for people

Would it be okay on here if a private investor (wanting to make a pension for himself on retirement as not fortunate enough to be able to pay into DPP), bought an “affordable” investment property after it sat for 30 days on the market without a reasonable offer?

Some friends (early 40s) just told me they are buying a new build condo- as a way of building equity. Idea is to buy it and then flip it in 3-4 years to make equity. They have an existing mortgage on their primary residence, but they believe this is the way to build equity because they don’t have a pension. Not even taking into account transaction costs, isn’t this basically the same as using a line of credit to buy stocks?

These are not sophisticated investors. Wonder if we’d be better off figuring out how to make some kind of defined-benefit pension viable for average folks, rather than encouraging them to look at real estate for better returns? (Although I was a bit taken aback that they are essentially taking investment advice from their realtor)

Strata duplex right in town. B-2511 Vancouver St. Sold: $650K Originally asking $699K. On market for at least 30 days. (So time for inspection)

VERY flexible floor plan with options depending on how big your family is and what you are willing to do to own.

Total of 1500 Sq ft, 3 bedroom, 2 full baths, one main bright kitchen plus kitchenette down. Main living room with F/P, dining room. Separate Garage. Lots of storage in attic.

Easy care vinyl siding. Updated windows and gas furnace in last 15 years. New flooring. Street has sidewalks and boulevards.

“You still gotta have good income to borrow 1M. Ur not getting that mortgage working a union job at government with flexdays.”

That’s true, but you don’t need a million dollar mortgage to buy a house in Victoria. There are areas where houses would still be in reach for a couple with union jobs in the public sector (Mayfair, glanford, parts of esquimalt, Vic west).

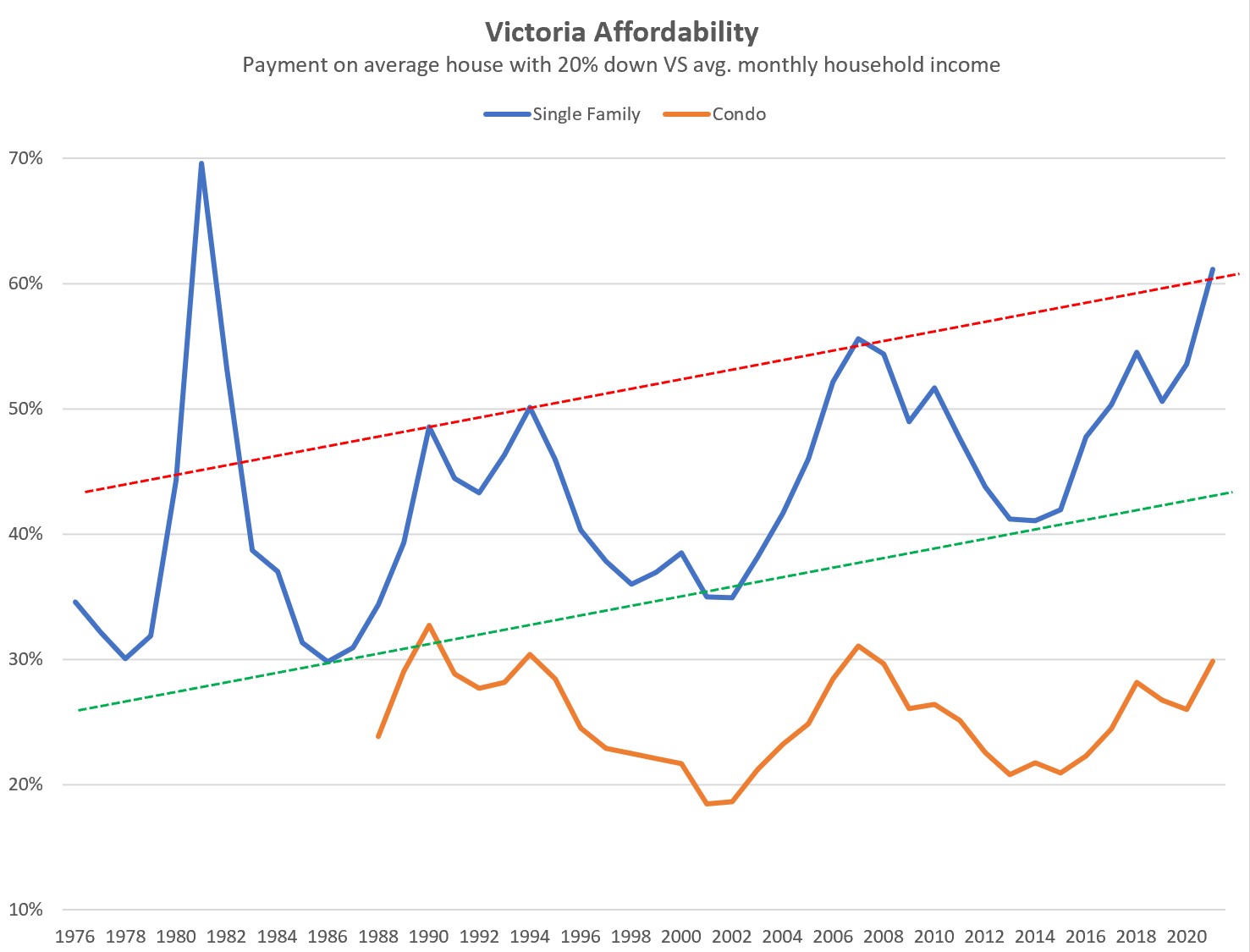

No. They are actually more affordable now at 7X income than they were back then at 3X income. That’s why affordability isn’t measured as price/income, it’s mortgage payment/income

Last time houses were selling at 3X income, was the 1980-1992 period. And mortgage rates were around 11%. (some years were much higher)

You can see from this mortgage calculator https://tools.td.com/mortgage-payment-calculator/ that you pay more per month paying off a $300K mortgage @11% than $700k @ 1.68% (current 5yr term/25 amort discount mortgage rate and other rates from https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

$700k @ 1.68% = $2,857 per month

$300k @ 11% = $2,887 per month. <- ——— they would pay more back then because of huge interest payments

These days, 79% of all mortgage payments you make over a 25 year period (if rates stay the same) are forced savings (equity). only 21% of your mortgage payment is down the drain (interest). Lots of people realize it, and that’s why there are so many buyers now.

Pretty much the scene in most countries around the globe….and that is why people vote with their feet (i.e. they emmigrate) to countries like Canada, New Zeland, Australia, US, etc.

That factor is also almost always ignored when comparing real estate costs/affordability between Canada and European countries.

One smaller factor that is being ignored is the average house these days is just a ton more house. Compared the average 1995 Oaklands SFH sale in terms of square footage/features compared to an average 2021 Oaklands SFH sale. It is not the same.

It is like comparing a 1990 Civic to a 2021 Civic. Similar price but you get 2x car.

I agree with most of what you said except this. lets assume average income is 100k – is it more affordable to buy a home at 400k at 10% interest (payments on 25 year are $3578) or a home at 500K when rates are 5% (payments are $2908). The latter your income to price ratio is 5 to 1 as oppose to 4 to 1 but the payment is $600+ a month cheaper. I think a lot of people would say the latter is more affordable.

Let us face reality here, the majority of the readership of HHV is going to be government/large institutional jobs. People running small businesses don’t have the time to be on HHV. The only people upset with flex days references are those employeed by the government.

It is worse but it is not catastrophic and people have been complaining about timing on HHV whether is was 2007 (prices doubled from 2001), 2016, or 2021. The timing literally always sucks.

This is my first condo I bought (and lived in) in 2009 for $198,900 -> https://www.youtube.com/watch?v=K8unWK-shko&t=102s

Right now I could go to the Haven pre-sale -> https://www.havenbychard.com/ and I could pick up a studio for $292,500 (or 2 bed for $513,000 if a couple). I would be making 95k/year instead of 75k/year I was making in 2009 and interest rates would be way lower.

Yea, but how can one live in a studio without parking….impossible. You have to start somewhere and that start is still not out of reach imo.

I think I understand where Marko is coming from, because I know the type of person he’s describing from my late 20s/early 30s social circle. I know one who complains about not being able to afford property while also spending $1000+/month on food delivery, another that complains while having never worked a full-time job (by choice), and yet another that has been complaining prices are too high for the house they “deserve” for the last 7 years despite having the money to buy something the whole time. Everyone else bought a townhome/half-duplex/SFH within the past 3-4 years either here or in the lower mainland.

Still, that doesn’t mean that more and more people who work hard, save their money, etc. etc. won’t be pushed out every year as affordability continues to decline and the bar for entry increases. I don’t know that the path to real estate that most my age took will still be available to those currently in their early 20s.

More generically, this is a problem that comes up with any type of social policy. Either you help more people (and some people who probably don’t deserve help get a benefit), or you help less people (and some people who probably do deserve help get left out).

https://vancouversun.com/news/local-news/b-c-public-sector-salaries-database-10th-edition

Only 22 pages worth of RTs making over $75k. When I was there you could work as much as you wanted. It wasn’t difficult to clear 75k by picking up a few stats. Not to mention the job is 4 days on, 5 days off….who on earth needs 5 days off in their 20s. I was either studying or on a construction site 4/5 days off.

Not sure what is so difficult about these two concepts.

Ok, I’ve finally had enough of sitting back and reading the following narratives without chiming in:

-“You’re not getting that mortgage working a union job at government with flexdays.” (everyone is really enjoying ragging on flex days here lol)

-Anything less that a 200k+ income is essentially poor and undeserving of home ownership, anyone making less than this needs to step up and get a real job

-People these days aren’t frugal enough and are wasting their money on nice cars, ski trips, avocado toast, and nice cell phones

I think we’re having some difficulties here untangling skill from luck. Personal anecdote: 5 years ago, a coworker of mine who makes just over half of what I do, was bragging about buying his third house. His partner doesn’t work. Instantly my head starts trying to do the math. Really the only stat here that matters is the year the primary residence was bought and what multiple the house price was from income. With that advantage, you pay down the mortgage, build up equity, and most importantly leverage what you have to buy the next residence, now you can profit from renting it out, pay down more debt, etc. Meanwhile the multiple of price to earnings for new people entering the market grows, while your interest rates are going down, and your potential to leverage increases. You can rent out your secondary/tertiary home for more because new entrants to the market have less ability to afford mortgages at the price points.

In short, it is advantage from timing.

We can’t mistake that as the younger generations are too soft, not making enough sacrifices, etc. If houses originally were a 3x multiple from an average income and now they are 7x, in real dollars, then objectively they are less affordable now. Period.

I’m sorry but I can’t sit here and believe that the reason people in higher income brackets today are struggling to afford their first house is due to them wanting to take ski trips or having flex days at their government jobs. Clearly if they downgraded their craft beers for Lucky, they wouldn’t be in this mess and would be able to afford that $1m starter home, am I right?

You still gotta have good income to borrow 1M. Ur not getting that mortgage working a union job at government with flexdays.

Ok Marko, respitory therapists didnt make 75k a year 15 years ago or whatever. Heck they probably don’t make that now without over time.

From the expert panel report on housing supply & affordability

“Demographic projections, produced or commissioned

by governments and statistical agencies, often influence

regional and local land-use and infrastructure planning

decisions, including how much growth to plan for and where.

These projections generally answer the following question:

what should we expect to happen if past trends continue?

Problems with this approach arise when trying to tackle

housing shortages, which by definition involves breaking with

the status quo.”

So what happens if we not only fail to plan to address the shortage, but growth blows past historical projections?

My parents saved and sacrificed for a downpayment, not to pay for the home in cash. You still have to sacrifice to put yourself in a situation where you can purchase a property via borrowing so you can get ahead with the government printing money non-stop. This might mean going back to school or switching careers to increase income, increasing downpayment, working multiple jobs, spending less, etc.

There is nothing wrong with nice things; I drive a $100k car. The problem I see is people execute the sequence poorly. When I was 21 yrs old making $75k @ VIHA I lived with my parents (in 800 sq/ft), had a Telus pre-paid cellphone and I clearly remember the $25 pre-paid card expired every 60 days, used car, etc. Anything I didn’t spend on tuition in an attempt to improve my workplace situation I invested. I still own shares of BMO I purchased in 2009 @ $32/share.

Once I had a property, investment properties, maxed out RRSPs/TSFAs, then I started spending on nice things.

If I didn’t have a property and owning was of important for me I would be working multiple jobs and spending nothing to get into something.

Marko, your folks remind me of another family I know… 🙂

This makes sense to me. People in Canada saw their parents spend money and still afford housing and had nice things. Now, even though they know that homes are much more expensive , they spend money and it’s a hard habit to break.

My friend almost married a woman from mainland China and her family grew up incredibly poor (the dad died when they were kids). The mother came to visit when they were living in vancouver. The mother was as cheap as they come. When they went to the mall she would go to the bathroom and steal the TP – only the rolls are locked so she would unravel the whole thing, put it in her purse, and then roll it back on to a roll at home. She once scolded my friend for opening the door of the fridge too long and wasting energy. One time he came back from a grocery store with name brand bacon and his almost-wife told him to go return it for no name. It impacted every aspect of his life – but he saved more money then ever with her before they broke up. Refugees come here with nothing and so having nothing for years while they save isn’t as difficult from their perspective.

Not stating that all, or even many, refugees would.live like this but that mentality of having nothing and taking whatever you can is less common as we have social nets with minimum guarantees etc.

” You can’t solve a housing shortage through redistribution”

The First Article of Faith in the NDP and Liberal Catechism is that you can solve EVERYTHING by redistribution, all the worse for being “faith” and not demonstrable.

I foresee a problem.

Leo,

Bravo!

That perfectly sums up the housing shortage.

It’s gotta go on the HHV coffee cups and t-shirts!

If we are to be subjected to another near daily dose of your “Glory Days” refrain of buying a house in Vancouver in the 1980s, at least you could get to the good part, and tell us if you sold it before the boom, and did you ever buy again?

That’s nonsense. Maybe true in theory, with flawed assumptions ignoring elasticity, but not in the real world. Victoria is not a closed system.

Rather than me explain it to you, how about you explain it to the class.

Refugees that come to Toronto with absolutely just the shirt only their backs somehow have higher rate of homeownership than Canadian born if family income level is equal that of Canadian born.

https://www150.statcan.gc.ca/n1/pub/11-626-x/11-626-x2019011-eng.htm

I saved close to 50% of my take home pay every month before I bought my first SFH in Vancouver. The point, Marko, is that making this kind of sacrifice doesn’t work any more. The lesson people learn today is that borrowing money gets you ahead, not saving it.

Every investor who buys a SFH and rents it out is outbidding a renting family who wants to own their own home. They are not increasing the net rental supply.

Alexandra, maybe it was something you said 🙂 . Let’s hope someone here bought it…. or buys the twin (3364)

3366 Shelbourne just sold for $600K.

Nothing wrong with this Marko, its ok to want nice things but at the end of the day one needs to have the means to acquire them and achieving the means to acquire them is up to the individual. For all you clients that want those things Marko, please show them the below job postings currently at BCI (both come with DB pensions):

https://careers.bci.ca/res_viewjob.html?optlink-view=view-7728&ERFormID=res_newjoblist&ERFormCode=any

~200k/yr after bonus

https://careers.bci.ca/res_viewjob.html?optlink-view=view-7766&ERFormID=res_newjoblist&ERFormCode=any

~300k/yr after bonus

Realize this is about the impact of the foreign buyer’s tax in Vancouver, before it was extended to Victoria. At the time the concern was that adding it to Vancouver would push buyers to Victoria.

There is no doubt at all in my mind that the foreign buyers tax had a large impact on Vancouver. We had fewer foreign buying but we definitely see the secondary impact of high prices in Vancouver. I support the introduction of it 100%. I also agree that having the FBT and spec tax in place is now allowing us to focus on some of the supply side reforms that are also necessary.

Caddy,

What’s wrong with this place on Shelbourne (Saanich)?

You could buy it and tell your landlord to take his rental unit and shove it up his assets.

—-====================

https://www.rew.ca/properties/3423111/3364-shelbourne-street-saanich-bc#

3364 Shelbourne Street

3 Bed, 2 Bath, 1217 Sqft, Duplex

List Price, $619,900

Gross Taxes for 2020 $2,364

Strata Maintenance Fees $0

“This 3 bed 2 bath ½ duplex checks off all of the boxes, a private yard for the kids or dogs to play in, space for the family, storage, NO strata fees, & separate legal titles. This home offers a perfect layout w/ open kitchen & dining on main, 2 pce bath, storage, generously sized & well-lit living room + den. Hardwood flooring spans much of the home plus thermal windows & forced air high efficiency furnace. Upstairs you will find 3 bedrooms w/ closet space & 4 pce bath w/ full tub. The balcony is accessible off the kitchen w/ outright privacy leading down to the fully fenced back yard. The location is in highly sought out East Saanich minutes from Gordon Head Rec”

And yet that has not happened. In fact, the opposite has occurred as far as I can tell. A far different outcome than predicted by the government. I’m not opposed to these measures if they were effective, but see them as largely ineffective and a way to politically avoid the harder steps needed to address affordable housing as set out in the recent housing affordability report.

Marko may seem non sympathetic and hardened but he is right. My parents were able to purchase a home in Fairfield years ago. They both worked. Mom at slightly over the minimum wage (and it was a tough labor intensive job) and my Dad at a lower than middle income wage. In order to make ends meet, they rented the upstairs. The main floor had one bedroom which my brother and I shared with a curtain down the middle. My parents slept in the living room on a sofa bed. We all shared one closet for clothes plus some hooks for coats hanging by the basement door. We had one small bathroom. It was a nice house inside though and it had a lovely back yard that we shared with our wonderful family dog. We were a very happy family and felt blessed that we could live in such a “beautiful” home. People just didn’t need as much back then. Children were much more self reliant. On my Dads day off he would often help write letters and read and assist in filling out forms for new immigrants that didn’t know the language well enough to read and write in English. On Sundays, because they were both excellent cooks/bakers, they would tend the back garden often canning preserves.

Right now there is a strata titled duplex on Shelbourne having both sides for sale. They have been reduced in price and been on the market I believe for more than one month. (says 11 days but that is after relisting) Asking price: $619K for each side. They are bright units with three beds, 2 baths, den or playroom area and private fenced back yards. Lots of parking but no garage. I realize Shelbourne street isn’t the best. But houses, townhomes & condo’s on the same street certainly get a fair enough price. Good chance same person owns both sides on this one. No takers yet. At one time, because of all the similar duplexes in a row, I would have been thinking of possibilities for the future. Too old now though.

You and others have been posting on this site about how few SFH rentals are available for families. Now you’re concerned that there are too many?

How is that relevant when talking about BC prices?

From that article: “the foreign buyer tax was blunt but incredibly effective. The percentage of foreign buyers in Vancouver is down some 90% from before the tax. ”

So while the change in Victoria was from 3.90% to 3.30% ( a 15% drop) during the given timeframe, the impact on Vancouver was much higher. Just FYI, something doesn’t need to directly impact Victoria for us to be impacted. Vancouver buyers have a big impact on Victoria – especially when prices go up. So just saying this didn’t impact Victoria all that much therefore it had no effect is an incorrect assumption. Again from Leo’s article “A return to more local fundamentals in Vancouver, and a possible stemming of the overflow into Victoria.” So still not sure how you are asserting these items are having no impact on affordability.

How in the world is the act of owning a rental property and renting it at market rate “hoarding” or “exploitative”? You are essentially arguing this is an immoral act. I would suggest it not and that labelling it as “hoarding” is the unethical act and you are complicit in scapegoating which is not excused by current difficult conditions in the housing market which are not, in fact, caused by private landlords.

I would be fine to have further restrictions placed upon second home owners if they ease appreciation, and it is likely that there will be some changes made imo that will make it both more difficult to borrow and require more capital to buy, but there is nothing inherently wrong with with buying a rental property.

Landlords contribute rental housing to a tight market and bear the chance of profit and of loss. I certainly know landlords who have lost from buying investment property, and markets definitely go up and down. Right now we are up – way up. Easy to forget many periods of flat where rents did not cover costs that the Victoria market has had and landlords did not experience the appreciation that has occurred now and would have lost had they sold.

Yeah this is a fair point. Unfortunately I don’t see an obvious way out of it. Capital gains exemption and home owner grant is untouchable politically probably at least for the next 10 to 20 years. Low expected returns in other asset classes means people aren’t so keen to downsize and invest elsewhere.

Easiest way seems like to convert more single family properties to still family-suitable but more compact housing and simply decide to stop listening to existing owners in houses that try to stop it.

Caddy: If they were experienced landlords, they wouldn’t have wasted their time or voluntarily put themselves into a very embarrassing situation by going to RTB. They would have lost. If they did go, any other silly or greedy little ploy against you would have been viewed as harassment. But I do know where you are coming from. I was a very young single parent years ago and landlords wouldn’t rent to me just because of my situation. I was a stable, responsible person with a full time job and had a good credit rating…….but no…..just because I had one child. Those and many other similar experiences toughened me up though.

When my parents came to Canada in the 1990s, we lived in a crappy suite on Roseberry. Both parents worked 6 days a week and on Sundays we delivered fliers for the first two years in Canada. There was no camping, no skiing, no pets, no trips/vacations/grandparent funerals back to Croatia, $1,400 1981 diesel Vovlo, used TV, etc., until a house was purchased. House my parents ended up buying was all original, 801 sq/ft upper floor, 2 bed/1bath. First thing they did was put a two-bed suite in the basement in 15 years later once they paid off their house, they renovated the upstairs.

What I see my in personal day to day business is newer cars, people skipping town every other weekend for various activities, pets, flex Fridays, and big expectations for a 1st home. A lot my first-time buyers want an ensuite, that is just insane imo. I lived with my parents until 25 yrs old with one bathroom never an issue. 2,000 sq/ft for a family of four is kind of a high expectation. No reason 1,200 sq/ft can’t work.

We have a housing problem and prices are insane, but what people define as sacrifice today is kind of a joke imo.

That’s assuming there actually is a shortage. More SFH in Victoria CMA than households with >= 3 persons. Tax policies and subsidies encourage smaller households to stay in SFH in anticipation of capital gains in the future.

Sounds good in theory alexandracdn but we, two university students at the time who had just spent a few bucks moving, were told if we didn’t like it “leave”. Underpaying the rent and the subsequent fight through RTB was considered but also low on the scale of good use of our time and energy. Left right after graduation.

For the “just build more supply” argument, that’s just more supply for landlords hey? I know more and more people buying a new home to live in and just keeping their first home as a rental. You only need 20% down on the the investment property, or 20% as equity in the first house and 5% down on the next one if you move in. IMO that’s why we need to address the demand side more and nail 2nd, 3rd 4th+ properties with heavy taxation, higher downpayments etc. Hording shelter for ever increasing profit is exploitative.

You can’t solve a housing shortage through redistribution.

I’m not saying you should be grateful for what your landlord does. I am saying that without private landlords the vacancy rate would be even worse and when you were evicted for landlord use of property you would have had an even harder time finding a place. If there were more purpose built rentals at least this situation could be eased.

Because of what we do know from the data collected is that foreign buyers make up a very small part of the market in Victoria and, to quote Leo, “they have no appreciable effect on the market in Victoria”. https://househuntvictoria.ca/2016/10/29/foreign-buyers-tax-has-no-appreciable-effect-on-victoria/

And, in terms of the speculation tax, also to quote Leo, “Overall, I think we can conclude that the spec tax is a minor adjustment as far as the market is concerned… the return seems to be relatively low for the administrative and collective effort required to keep it going.

https://househuntvictoria.ca/2019/07/19/spec-tax-little-sign-of-impact-on-victoria-market/

Leo’s views may have changed since, but the data he posted appears reliable.

Guessing instead of asking when it is easy to do is a problem.

One would think that a landlord putting a coin op laundry unit into an already rented apartment where there was free laundry, would constitute an illegal rent increase. I would have told the landlord that I was fine with this as long as I could deduct the coinage used off my rent.

Where is your data on this? because prices are higher? How do you know prices wouldn’t be even higher if we didn’t implement those controls? You can not say things are not more affordable as we don’t have the data showing where BC would be if these controls had not been implemented. I guess you are making unfounded assertions you can’t back up and becoming one of those things you despise so much.

I live in an apartment – not a home that could have been purchased by someone – a purpose built rental which I agree we need a lot more of.

Depends if I get a TH or a house but if i get the latter then yes. And i’ll move out of my rental, free it up for someone to rent at double the price I pay now.

I’m super grateful to my last landlord who renovicted my family so he could move his own kids into my home. What a joke. Really thankful too to a past landlord who switched my laundry machines to coin op 2 weeks after we moved in to gouge us even further. This is not desperately needed, stable rental accommodation, it’s “entrepreneurs” making the best of their own little world until it no longer suits them to provide a home to a tenant.

Patrick the one providing shelter is me with my rent paid, not the multiple property owner who’s taking the rent. With higher downpayment requirements and further regulation to tip the housing stock more towards people who want to buy to live in the homes, my rent money could just be paying my mortgage instead of the investor in the middle.

I disagree. What would stop the government from squandered it away like the rest of the taxes? Just look at the property transfer tax that went straight into general revenue instead of into housing as it was originally sold to the public.

IMO, we must hold the government accountable for their actions or inaction and make sure that they balance the budget, because government can’t keep on running a deficit that will surely destroy our future.

Good post Totoro. Housing in BC has not become more affordable since the foreign buyers tax was implemented. For the most part, all it did was pile on more over paid provincial public service positions to oversee it. Jobs the middle income people are paying for, whilst many of them sit in their rented accommodations because they still can’t afford to buy.

Rush4Life, aren’t you a current renter, and where would you be living today but for the foresight and enterprise of your landlord, who has provided you “shelter” when you needed it?

And your landlord will provide shelter for someone else when you move on to better things. Since your posts here have emphasized the importance of this “shelter” to you, it would seem to me that you should be somewhat grateful to the landlord that provides it for you, at least to acknowledge that they are a “benefit to society.”

And when you do buy your house, I would hope that you will return the favour, by renting out a room/suite in the house to someone in need of shelter. Are you planning to do that?

Sure, his house comes on the market but we still have a vacancy rate of about 2% and probably lower for family-friendly whole homes. My point is not that his buying takes a home out of the rental market. My point is that housing is needed for both renters and buyers and someone buying a home and renting it out is a positive thing for renters and not a net negative given the vacancy rate. If we address the rental housing shortage this should reduce rental rates eventually.

There is only the deal of the day. I’ve heard people virtue signalling from their armchairs about this for the last 20 years whenever there is a hot market without doing the research to back up the assertions – which I personally despise given that type of ignorance is the root of a lot of evil in the form of scapegoating imo and we have good data at our fingertips now. Buyers do not control market conditions, they respond to them. Set your rent too high and you will not get a tenant.

None of the steps taken to date in BC have resulted in improved affordability. That should tell you something.

What creates the conditions for higher rents is scarcity and a severe lack of purpose built rent geared to income housing. This is what we need to address in my opinion and I would pay higher taxes to do so – as I’ve been saying on this board for the last decade. I would support a tax on capital gains from the sale of primary residences for this purposes even though it would affect me because there really is inequity here.

I’d support other effective measures as well but so far we have a largely ineffective foreign buyers tax and empty home tax that we spent a lot of government money on to implement and enforce without the return to show for it or the funds to then spend on affordable housing.

I’m saying that a home buyer who rents the home out is adding to supply and that this is needed in our rental market. This is not to say that this is the best solution to the rental housing shortage, again, purpose built rent-geared-to-income is way more desirable but we don’t have it. Castigating people for making rational choices in response to market conditions is ineffective and really just complaining about effects rather than dealing with causes.

Everyone buying a home (to occupy) in Victoria isn’t a Victoria renter. The non-renters that buy to occupy do lower the supply/demand balance of the rental market, and it’s good that they are balanced by investors buying to rent. That enables us to maintain balance in the supply of rental housing. Especially SFH rentals, which aren’t supplied by purpose built rentals, and only exist because of mom n pop landlords.

This argument has already been refuted multiple times and it still keeps coming. A renter who becomes an owner-occupier is not affecting the supply/demand balance of the rental market.

Is your financial self-interest clouding your logic?

I should have clarified i like the NZ – higher down payment method over taxation. I realize there is a supply issue as well clearly. I’d say attacking from both a supply and demand angle will yield the best results.

Oh yeah – unlike the bulls who clearly care about the betterment of society. Yes Patrick it does benefit me – you know who else that would benefit? every single person who is born and lives here or moves here and needs to buy a house in the future (who isn’t inheriting one). That is the cost of today’s problems which homeowners dont’ seem to care about. “We got ours and don’t care if every person who comes next has to pay for it – as long as I got mine i’m happy”. At least my self-interest benefits future generations. God forbid someone’s 1.5M home that they paid 500K for drop to 1.3million. Whatever will they do!

‘but we have a severe shortage of rental housing as well and they add to supply and the renter could just as well be angry at you for buying up their supply – because the issue is there is not enough of either type of housing.’

Totoro, if Caddy buys a house then the place he is currently renting comes on the market – so no its not him taking a home out of the market, why would the renter care? This idea that investors are doing the lords work is really a stretch. Overpaying for a house, jacking up rents, and forcing people to pay inflated prices just because vacancy rates are low isn’t a benefit to society like you all seem to think (again circling back to the supply issue which I think is number 1 issue).

For PBRs to proliferate there will need to be “less red tape, quicker approvals and improved zoning for density”.

Yes, Patrick and another big one: less pandering to tenants by a notoriously biased Residential Tenancy Branch. A not-very-well-disguised and visceral hatred of the rentier class is another delight you get with an NDP “government”.

Ask me how I know.

The fact that you are impacted by this makes you angry at the competing buyer who is renting the home out, but we have a severe shortage of rental housing as well and they add to supply and the renter could just as well be angry at you for buying up their supply – because the issue is there is not enough of either type of housing. You have to acknowledge based on past performance that it is almost certain that current “hot” market conditions will not last forever, even if this does not mean prices drop. People buying a house and renting it out are making rational choices in the market, not evil ones, and it has a net positive effect for renters.

Overall I’d say this situation is not good for buyers or renters, but it is not caused by “investors” and the market will cool. I don’t think we’ll see housing security and affordability addressed effectively until we deal with ramping up purpose-built rental supply and perhaps the missing middle housing as Leo has pointed out.

We have a supply issue. There is a shortage of rental housing. If someone is buying and renting out a home they are adding to supply and this is needed. I’d say the only effective measure there to make it less attractive and possibly lead to lower appreciation rates would be a huge influx of purpose built rentals along with affordable housing measures.

I don’t see how investors can be encouraged to do this. The price of land plus building is too high here to result in affordable rentals. Purpose built rentals should be run and funded by government/housing societies, perhaps on public lands, and not private investors imo.

Well no, because the househunter might not be leaving a rental when he buys. They may be moving out of parents home, splitting up a marriage, immigrating from another country etc. And there’s more of those cases then the opposite (moving back in with parents, remarrying,emigration). If your remove mom n pop investor-landlords from the equation, rental stock will fall, as all the buyers will be homeowner occupiers.

The only solution to the housing problem is to build more housing. You can’t expect it to “just happen” by some tweak in taxation/rules. Like your naive expectation that purpose built rentals will magically appear because you increase down payment requirements for mon n pop investor properties – that won’t happen! Or that something good will happen to housing by killing the HOG or increasing property taxes.

Government needs to focus on direct measures to build more housing stock. They could start by asking builders what they want to increase building. And the answer from the builders won’t be “increase down payments on investor properties” or “force us to build purpose built rentals”. It will be “less red tape, quicker approvals and improved zoning for density”.

patriotz- There already are thousands of real estate investment opportunities for people to put their money into such as REITS. Every apartment building, hotel, commercial property development looks for investors offering them a potential return on their investment. I wouldn’t touch them with a 10 foot 2×4. My insurance broker invested in a hotel in Saskatchewan that catered to oil field workers, it was costing him more money to maintain with no return. He also invested in a seniors residence that was working well for him at the time. Covid has probably changed that and he may be kicking himself for that brilliant investment. I know he put $300,000 into the hotel, if he would have used that as a downpayment for a house in Victoria several years ago, he’d be laughing. These types of investments are black holes and you have no control of what is going on. The other advantage of buying a rental property is that it can be insured for replacement, in case of most disasters. You can’t do that with any investments I’m aware of.

The househunter is a tenant now. If said househunter buys a house for sale instead of an investor and moves into it, that’s one less tenant and one less rental property, so there is no net change in the rental market. Is that so hard to figure out?

The difference is that if you make it less attractive for investors to buy houses and condos, prices will be lower. Rather than such insecure rentals we should be encouraging investors to put their money into purpose built rentals , which is what we really need.

I’ve just watched a dozen houses I otherwise would have bought near list price get bid up to the moon this year by investors who then put them up for rent on Facebook marketplace using the exact same photos as the for sale listing at incredibly high rent prices. Perhaps requiring 40% downpayments would have curbed a few from being snapped up as cash cows and my family could have bought one to live in, freeing up our own rental house for another renter family. Can someone explain to me how this is a good thing vs. my family just being able to buy these houses without firece competition from landlords?

Investors are just the middleman on housing I still need to live in… It’d be nice to have housing treated as housing 1st and investment 2nd with policy like new Zealand’s new higher downpayment requirements on secondary properties.

A very convenient scapegoat. Already debunked the other ones, so I guess it was just a matter of time. Some people seem to need targets but the real moral issue is the failure to do the work to make sure you are correct before assigning blame.

Ah yes. The latest invisible bogeyman – investment properties.

Perhaps you could explain what the benefit of “increased down payment requirement on investment properties” would be, other than to reduce the supply of much needed rental properties, to allow househunters like you to acquire and occupy the homes instead of tenants.

Your motivation being self-interest – the hope that it might get you a lower buy-in price for a house, but where are the renters supposed to go when they can’t find rentals due to the disincentives to owning rental properties that you’re advocating?

You’re not hearing it from me, and I’m an income tax paying homeowner. Who gets by just fine without a HOG (I’m no longer living in BC).

There really isn’t a “someone else”. You may think you’re winning just because you’d be able to sell your house for more, but that’s not going to help you if there’s a shortage of health care because the workers can’t afford to live in your city.

Could not have said it better myself. As a longtime Vancouver resident I saw the epidemic start there. Now it’s spread to the whole country. I call it “Vancouveritis”.

Thanks Pam,

I appreciate what you saying but i still disagree. To start your daughter isn’t the only person who has made big sacrifices in order to get into the housing market. But when prices are rising faster than your sacrifices add to – it doesn’t always help.

Can i ask at what point would you think we should something about this? it used to be people from Vancouver would just tell people to move – ‘move to Victoria’ Vancouver was the only ‘expensive’ place. Then it came to Victoria – people were told to just move up island – Nanaimo/Comox was still cheap. Now we are literally telling people move out of Ontario and BC – and they are, and guess what – those places are going up too. Places in Atlantic are up over 30% in places in the last year. Prices are projected to rise in AB as well so basically are you wanting to wait until anyone who can’t afford a home is relegated to northern Manitoba before you are willing to accept there is a problem? Why not fix things now before it becomes even more of an issue?

My problem is people your age just assuming that people aren’t willing to sacrifice and we just want our avocado toast and homes in the core and don’t recognize that the problem is much larger than that.

I see you have trouble with this but i’m sure you took no issues with the ever dropping interest rates the government implemented, or CMHC, or the property tax grant, or the munis who shut down builds likes its going out of style – you had no problem with those interventions or any number of government choices that led to this price gain. Now that people are asking to give some of it back via relaxed building requirements, or taxation (personally i like increased down payment requirement on investment properties) you are feeling like they are trying to take something form you without recognizing how much the government have already given you. Seems a bit hypocritical no?

And congrats to your daughter – i hope she does move back – we can use some more doctors.

Over 40 yesterday and today at the Margaret Jenkins station: https://www.victoriaweather.ca/station.php?id=98

Right. And enviro Canada reports that yesterday Victoria hit an official record hottest temp ever.

37.4 degrees at the airport. And we may break it today.

Of course not near the 46.1 degrees all time record for Canada set in Lytten BC yesterday.

The goal for us is not to make the temperature of the upper and lower equal; it’s to make it decently livable downstairs during the coldest months. We have been accomplishing this, when necessary, by turning the thermostat up a bit, which drags the basement temperature up in turn.

Probably, but in 12 years none of my tenants (nor any prospective tenants) has ever mentioned it. I bet that has something to do with Victoria’s rental vacancy rate.

“Thank you for completing the Greener Homes registration process!

Once our program officers have reviewed your application for registration and if you are deemed eligible, an energy advisor who works for a service organization will contact you to schedule a pre-retrofit EnerGuide evaluation.”

Does anybody know how long it takes for them to normally contact you?

Whew, we will never have to live through this again!

We have two sets of curtains, the innermost is lined and insulated – seems like online studies show a 33% reduction in solar gain with this set up. They also help a lot to keep heat in in the winter.

Hey rush4life, thanks for the comment. Clearly had our daughter been able to afford to buy a townhouse in Vic in 2016, that’s what she’d have done. My point entirely was however, that in fact she could NOT afford to buy anything on her income at the time- the very same thing people are complaining about now. However, whereas our daughter dug deep within herself, went back to school, lived in a studio basement suite with a toddler so she could take her BScN and get her RN (and get into med school), what I’m reading from posters here are only suggestions that someone else should fix the affordability issues: make home owners rent out their spare rooms to address rental concerns; remove property tax grants; make home owners pay capital gains tax etc etc. I just have trouble with that; either live where you afford to or make the changes necessary to live where you’d like to (I’d love to live in Tuscany, but I can’t afford it, so I live here. That I can’t afford it isn’t up to the Tuscans to fix.)

The future of real estate, here as in Edmonton, is uncertain, yes. Whatever the future holds, with her basement suite rented out, our daughter will no longer be paying rent and both she and our grand-daughter have their own bedrooms- finally. With her mortgage payments made for her by her tenant, even if her home doesn’t appreciate, our daughter will live ‘free’ during her 4 years at med school and because it’s close to U of A, she can rent the house out til the market appreciates once she moves away for her residency.

As to our daughter’s “great idea” to move to Edmonton, she was accepted to medical school there, so yes, it is a great idea to go to med school wherever you are accepted; each med school in Canada only accepts about 6-10% of its applicant pool, so it’s a privilege in any event, for sure.

This is normally the right thing to do. Even better is to shade your windows on the outside – interior blinds do almost nothing to block heat gain.

My two cents but closing all the windows and curtains at 6am and not opening them until after 8pm has kept it a bit cooler in our house which has no AC on the main living areas.

https://www.cbsnews.com/news/heat-wave-dome-2021-seattle-portland-weather/

“Pacific Northwest bakes under once-in-a-millennium heat dome.

The heat wave baking the U.S. Pacific Northwest and British Columbia, Canada, is of an intensity never recorded by modern humans. By one measure it is more rare than a once in a 1,000 year event — which means that if you could live in this particular spot for 1,000 years, you’d likely only experience a heat dome like this once, if ever.

Portland, Oregon, has already broken its all-time record hottest temperature at 108 degrees on Saturday and the peak of the heat wave has not even been reached yet. Canada is expected to register the nation’s all-time highest temperature before the event is done. These are extremely dangerous numbers, especially in a region not used to heat like this, where many people do not have air conditioning.”

I paid $315 for a post upgrade assessment. Think the pre-assessment was something similar. Most of it was covered via the grants I believe.

There’s definitely a range out there. I was quoted $700-800 from another place.

How much are people paying for Energuide assessments?

Compared to a “normal” year

Sales

Monday sales: 811 (up 17% over last year)

New listings: 1123 (down 13%)

Inventory: 1476 (down 46%)

Thanks late30 – the ‘broker’ i reached out to is specific to one bank. The one i used to work for (big 5). I’m sure every bank is slightly different. That being said for insured mortgages it makes no difference as the insurer needs to sign off on it. This method lines up with what CMHC etc would approve. I used to do mortgages and had ones that were tight with the bank that i put through and were rejected by CMHC.

That being said, and has been noted in the past on this forum, there is some discretion on uninsured mortgages – and with the new B20 some of the banks are adjusting other ratios (TDSR/GDSR) in order to circumvent the B20. I saw an interview with ‘Ron the mortgage guy’ who said there was a percent (can’t remember exacly maybe 10-20%?) of mortgage approvals that the banks could ‘push through’ if they were ‘strong borrowers’ (larger down payments, good credit etc,). And you get into the world of private lenders etc and its a totally different game.

So yes, its not cut and dry but its a good starting point as any.

‘rush4life

I am not sure if the correct question had been asked to the mortgage friend… A mortgage should be a simple qualification issue/process and some mortgage brokers won’t tell you which lenders do not charge heat or property tax etc. Also, there is a strong interest that they will only care about which lender kicks back most amount of commission /rebate/credit/bonus/prepaid visa cards to themselves. I suggest you write your own license and understand what is really under the hood. Some of the lenders /Banks have their own distribution channels and mortgage brokers do not have access to them. Again, it’s frustrating that if your broker are not telling you those facts and viable options.

Of course, they are good decent mortgage brokers out there, too like some are good decent realtors and some bad ones who act in front of their clients too from time to time. you just need to be careful when unexpected shxt happens in the super-fast life where the transaction occurs at a faster speed.

p.s. I was once ditched by one broker and told me just go to your bank as they are already giving you a few mortgages and you asked me to get the best rate and they would match it you are wasting my time. I spoke with another broker and it took her 10 secs to draft the email and I was honest with her and told her that I would need the best rate via the bank. She was fine with it and was hoping me referring her to other friends and I did. and I am thinking to move over my next purchase with her ( I am in the process of writing the UBC mortgage course and want to have a better understanding of what is REALLY going on).

I thank Thumps for resuscitating this crucial heat pump thread!

My 21k quote is from Red Blue. Which, BTW, was before any grant program was announced.

I also tried to get a quote from Island Energy. They had come out to the house to see what was causing our insane energy spikes during the winter season. The tech suggested the heat pump approach, talked with me about alternatives, checked his whatever & said they had actually quoted a heat pump on the house a year or so ago (prior owner) and that he’d get that updated for me. Called them back about a month later to be told, sorry not available yet and oh the guy who does it isn’t always very responsive. So that was now about 3 months ago. I’m sure as heck not going to chase people like that.

So, I guess I will also get a quote from Coastal.

I realize all trades are super busy, though. Frustrating for everyone.

If you are going to go with Red Blue (great company btw) with a 3 ton Fujitsu and 4 heads yes it is going to be over $10k for sure. I’ve had great luck with Fujitsu units. Had Fujitsu in my personal house here and my places in Croatia I run a Fujitsu setup.

I’ve also done it on the super cheap before too. Go to Surrey, pick up one of these https://airlux.ca/12000-btu-dc-inverter-ductless-split-air-conditioner-and-heat-pump/ drill some holes, pull the pipe and then phone a refrigerator tech to fill it up. It isn’t rocket science.

This thread https://twitter.com/mattdellok/status/1409293184660770816?s=21

Except it isn’t. Not Canada wide according to any reliable source, and certainly not in metro Victoria.

https://www150.statcan.gc.ca/n1/daily-quotidien/171025/dq171025c-eng.htm

Good point. Maybe that’s behind the lower numbers of listings. Homeowners may be more reluctant to sell than usual. So they hang on, maybe by staying put or renting out their home while they’re away, instead of selling.

Just pointing out that home prices and rents are correlated and when vacancy rates are low and heading lower when students return it matters – there is a lot to be said around this in regards to affordability (just because people are housed doesn’t mean its affordable to live – a topic for another discussion as you pointed out). Either way, as you know, this wasn’t the focus of that statement which was to say that the thought that people should just pick up and leave the province and will somehow be able to return and own a home hasn’t been the case in the last while.

Patrick you keep coming back to this. It seems to me like you are keep using this number to imply things are affordable when all they show things used to be affordable IMO. When many of these homeowners could not afford the home they live in based on their wages today that is much more telling then the 69%. Its unfortunate we don’t have the stats as maybe that would finally prove to you things are much less affordable then they used to be.

A no brainer with the rebate.

Yup.

Playing ‘whack-a-heat-pump’. You can’t win.

Perhaps, add a stand alone 1 ton unit to the bottom will solve to problem.

It might be cheaper to buy 3 units at 1 ton each, instead of a 3 ton unit with 3 heads. And, you are better off to replace a single 1 ton unit than a single 3 ton unit when it break down.

Prices also depends on brand, efficiency rating, tons, and accessibility of work site.