Spec tax: Little Sign of Impact on Victoria Market

Last year the provincial government introduced what they originally called the Speculation Tax. We could argue endlessly about whether it actually targets speculation, but it seems the government was aware it was broader than that, renaming it the Speculation and Vacancy Tax.

What effect has it had so far on Victoria? Well, first we would have to look at what effect we might expect. Given it taxes empty homes and those occupied by “satellite families“, we might expect:

- Increase in listings as people sell to escape the tax

- Decrease in sales demand from people that had intended to buy units to leave largely empty

- Shift in sales to regions not affected by the spec tax.

- Increase in rental inventory as people rent their units to escape the tax

- Tax revenue from those paying the tax

So let’s take a look at those outcomes more closely.

Increase in listings

I have certainly seen and heard of a few listings that were on the market motivated by the spec tax. I would say most of these are vacation properties not primarily purchased for speculation, but certainly price appreciation factors into these purchases. Very few buy vacation properties that are dropping in price.

However, are there enough spec-tax motivated listings to be noticeable in the data?

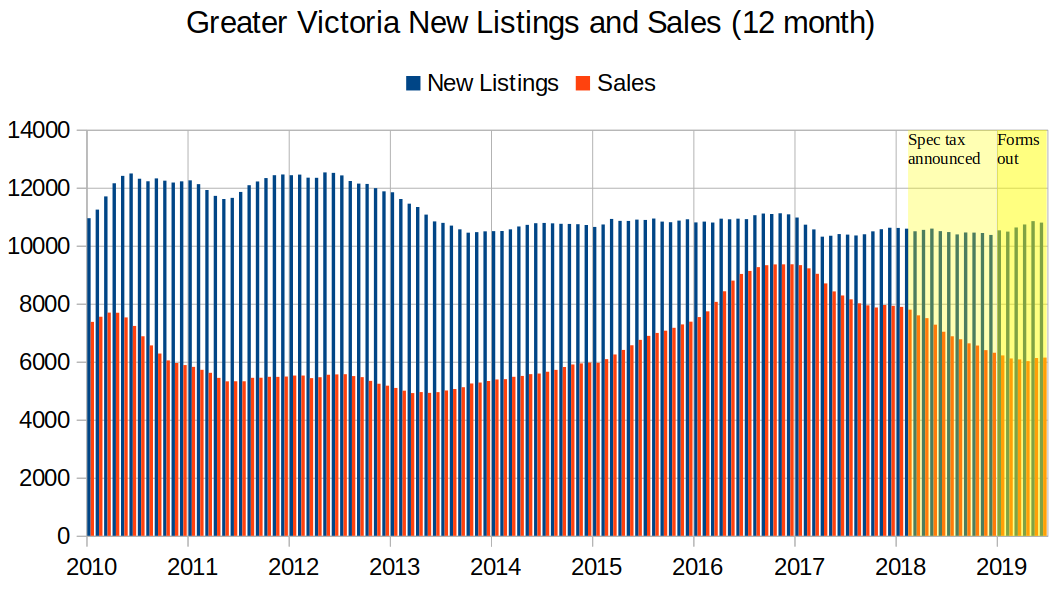

The tax was announced last year but there was no increase in listings then. Smart owners hoping to avoid the tax would have listed right away, but it seems there wasn’t enough of that to move the needle. It’s possible though that people simply weren’t paying attention until they received the declaration forms this year. There was a small bump in listings in 2019 (up 7% Jan-June). Its not what i would call a dramatic increase, but perhaps some of it can be explained by the spec tax. Of course selling this year would not prevent them from paying it for last year.

Decrease or Shift in Sales

So far sales in Greater Victoria this year are down 5% from the first half of 2018. However sales declines stopped in May, and I wouldn’t be surprised if the last half of the year outpaced 2018 to finish at near identical sales levels.

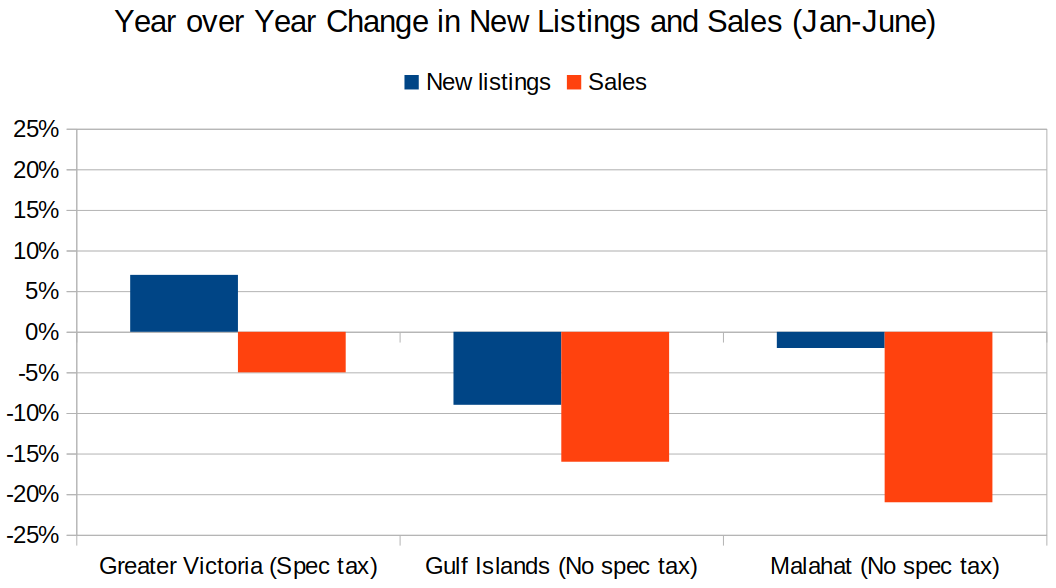

What about non-spec tax regions? We might expect that some vacation property demand has shifted to nearby regions like the Gulf Islands and the Malahat that are both excluded.

However if that happened, it has not been evident in the sales numbers, or it hasn’t happened with enough volume to counter the collapse in sales volume both in the Gulf Islands and on the Malahat this year.

Increase in Rental Inventory

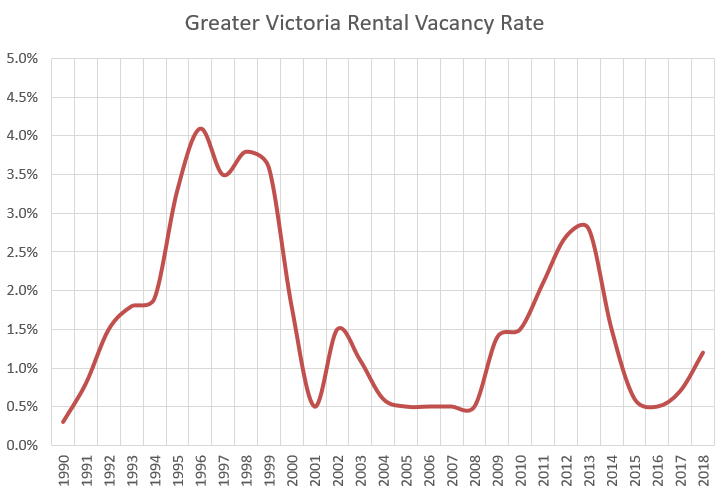

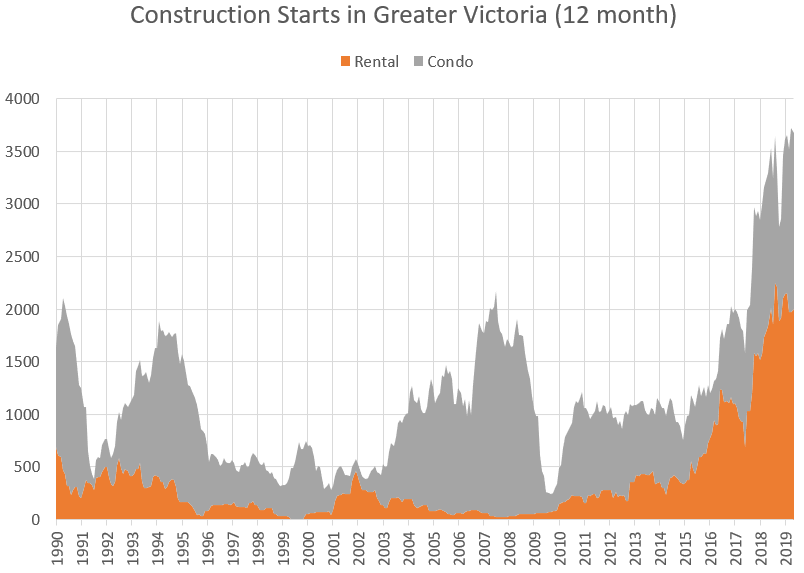

We’ll have to wait for official vacancy data to come out in October to get a sense of this, but again I suspect any effect from the spec tax will be lost in the bigger upcycle of vacancy rates. Even without the spec tax, our vacancy rate in 2019 will have certainly increased, because vacancy rates move in cycles, and we have record rental construction in the area, much of which is completing this year.

Tax Revenue

Those who didn’t find a way to avoid the tax will end up paying it, and the province recently released numbers on how many that has been so far. 12,029 people are paying the tax as of July 4th, bringing in $115 for affordable housing projects. 7826 of those are foreign owners or satellite families that are paying 0.5% for 2018 but their tax rate with quadruple for the 2019 year. Given unfiled declarations, there may be as many as 4500 additional owners paying the tax.

All in all, we are looking at a high estimate of 10,000 properties being subject to the speculation tax in 2018 (based on an the average 1.58 owners/property). I suspect these properties are located disproportionately in Vancouver, but based purely on population that would put us at a max of about 1250 properties paying the speculation tax in Victoria and bringing in perhaps $5-$10M in tax revenue.

Overall, I think we can conclude that the spec tax is a minor adjustment as far as the market is concerned. It may ramp up a bit as tax rates increase this year, but it doesn’t have nearly the effect on Victoria as the mortgage stress test did. I’m of two minds about it, as I absolutely support the fairness aspect of it and the message that it sends (homes are for living in, not to keep empty or speculate with) but the return seems to be relatively low for the administrative and collective effort required to keep it going. It feels like something that is necessary for now to restore some trust in the fairness of the market and curb excesses, but after a couple years and with significant supply side successes I would also support dialing it back to focus mostly on speculation and vacancies in the single family market.

“Time to sell probably and go spend your money somewhere else (lots of really nice places in the US)”

Sure. Have fun dealing with the IRS.

Monday numbers: https://househuntvictoria.ca/latest

Is Calgary considered a core city?

As RBC found, overall 7 come and only 1 leaves. That would include flow from education. Average millennial age is 30, beyond education years, and affecting the housing crisis, due to their large numbers and love of core city, “no commute” living. Nothing wrong with any of that, just trying to explain why I don’t think demand or prices are going to fall in core cities.

Millennials are 22-38 (born 1981-1996) not 20-34. Youngest cohort of millennials SHOULD be in cities getting educated.

RBC has found the same thing in Canada (as the USA studies) , where Canada’s millennials are over-represented in Canadas big cities , and cities are a “millennial magnet”, and millennials are flocking to big cities at a rate of 7 coming for 1 leaving, including the ones with highest prices (Vancouver, Toronto). RBC calls this migration the dominant force for urban demographics. The govt should introduce more incentives to encourage groups that are over-represented (e.g. millennials, immigrants) to live outside the core of big cities, to solve the housing crisis.

http://www.rbc.com/economics/economic-reports/pdf/canadian-housing/housing-millennials-apr2019.pdf

“There’s no evidence to suggest that high housing costs are gutting the ranks of millennials in Canada’s most expensive cities. The number of people aged 20-34 is growing at a healthy clip in Vancouver, Toronto and Montreal.”

“For every millennial leaving a major Canadian city for more affordable digs in the same province, there are between seven and 12 millennials moving in from another country or province. Vancouver, Toronto and Montreal continue to be magnets for young, mobile talent.This is the dominant force shaping the urban demographic make-up, not the loss of millennials priced out of the market. Despite some churn in the prime household-forming population, future housing demand isn’t under threat in Canada’s largest cities.”

Your sources are all from the US. The dynamics of core cities versus the suburbs are completely different in the US than in Canada. Core cities in Canada have always been attractive to young people.

Because Whistler is a resort town which was built from scratch and as such is based on absentee ownership and a largely transient workforce. Sooke is part of metro Victoria.

Note that the BC government initially included other areas which could be considered resort oriented, such as the Gulf Islands, but later excluded them.

i agree mary -ann ; sooke wont make much of impact on affordability .. but the best way (or stupid way) to do things is blanket tax every one .. unless provided more wasted tax money on figuring which municipalities should be omitted

bring clean coal back again ..not related .. but why not

Millennials are flocking to the core of cities, and this is putting pressure in prices, and is a major cause of the housing crisis in the core of cities. I posted more about this in April 2019 comment 58990 https://househuntvictoria.ca/2019/04/23/mitigate-risk-by-holding/#comment-58990

There are also other articles about it…

“Millennials are happiest in cities” https://www.citylab.com/life/2018/06/millennials-are-happiest-in-cities/563999/

“most of the period since 1970, people have been much happier in smaller, less urban places. But that started to change recently—around the year 2010—as the back-to-the-city movement accelerated. Millennials are the only generation that is happier in places with a population of more than 250,000.”

… And it seems they particularly like the Pacific Northwest…

“ Millennials flocking to Pacific Northwest” https://www.bnnbloomberg.ca/millennials-are-flocking-to-the-pacific-northwest-study-finds-1.1289773

Nowhere have I spoke about millennials. Maybe “demographic” was the wrong word for me to use.

Better?

Let take it a fairer and logical step, and have young BCers support less fortunate peers. Tax millennial who chose to live in large dense city centers to discourage people from living in over used high density cities, and use the proceed to support underutilized towns, to create affordable, healthy, livable housing, low crimes, and vibrant lifestyle for the future generation.

If millennial don’t think that is fair then it go to show that millennial believe that pigs are more equal than the rest of the animals.

well .. not many politician has a vacation home in sooke..

Good question and I agree that it should be applied across the province based on some formula involving vacancy rates, median rent, and median income. If there’s an area that doesn’t have a problem with affordability/housing then it shouldn’t have the tax applied.

Mary Ann: Time to sell probably and go spend your money somewhere else (lots of really nice places in the US) You may have noticed that there is an increased demand to tax almost anything to deal with all the “crisis”. We figure that we will be out of here in the next year or less. Victoria remains a nice little city less to our taste than it was six years ago. But each to his own.

Hasn’t someone already tried that in 2016 wrt the foreigner buyer tax? How did that case go?

If the objective is to tax under-used housing, then tax it all, not just selected loacations and use the money to build affordable housing where it is most needed. Why isn’t Whistler taxed, but Sooke is? Also, I would point out that people have owned vacation homes for decades, only in the last 5 years is it suddenly unethical to do so. Like I said, I would be willing to pay a bit more to help, but doubling my property tax in a single year is not fair play.

NAFTA is passed as Canadian law, so the fastest way to challenge it is first within Canadian courts. If that fails, a longer process using NAFTA dispute resolution panels could be done.

I was only speaking about the demographic of people who own underused housing in BC, not any others. Preventing underused housing, or at least taxing it to utilize the money for more affordable housing, is a good goal.

Lol wtf

How’d antifa get in here?

So by your definition only BC young demographic in certain local deserve a place to live in Kelowna, Nanaimo, Vancouver, and Victoria? What about the rest of the province, Canada, or matter of fact the rest of the world unfortunate people, are they not as equal as BC millennial?

Hold on MARY-ANN G, no one here is asking you to give up your dream of vacation home or targeting you to do anything first. People probably just feel a bit surprised by the drastic impact as claimed caused by the spec tax.

We all have our own issues in life (and some even do have real issues with $200/m extra cost), but I (also have worked all my life) always feel very grateful and appreciate for what we have and where we are, with or without having second home (and second car).

From Wiki…

Fascism: is a form of radical right-wing, authoritarian ultra-regionalism characterized by dictatorial power, forcible suppression of opposition and strong regimentation of society and of the economy.

“Vacation might be a necessity, but a vacation home is not”

I would encourage some of you to have a good long look in the mirror and ask yourselves what it is you represent, and who your Clansmates are.

I sympathize with the medical situation, and don’t think you’re illegitimate or didn’t work hard to get where you are. But if we’re talking about what people deserve, it’s a place to live.

Spec/vacancy tax is affecting people who own unused housing. It’s one of the exact demographics that should be hit. Rent it out for 6 mos a year, or pay a small luxury tax. Having a second house that you keep empty almost all of the year so you can fly in every once and a while is the definition of a luxury, especially while people go without stable housing.

Listen folks, I’m not asking for anyone’s pity, but a bit of understanding would be nice. The criticisms that I am pompous, should never have built an expensive vacation home across the country, had no business doing that when medical problems limit use, and shouldn’t consider myself to be “legitimate” or “hardworking,” do nothing to advance the real issues in this tax policy. I have neither stated nor implied that non-homeowners are “illegitimate” or “slackers,” but those of you who think I should be forced to give up what I worked for, or give all my savings to others who have worked half as long as I did, ARE labelling ME as “illegitimate,” which I don’t believe I deserve. When I started out, rental vacancies in Toronto were below 1% and landlords demanded non-refundable key money (among other things, sometimes) just to show an apartment. I was refused rentals because some landlords considered single females a high risk, regardless of actual income. I didn’t buy my first home until I had been working and sharing rental accommodation with 2 others for 15 years, and saving every penny for a down payment. When I married, my husband and I had a small house, no renovations, no vacations, no new cars etc for years while we paid every extra cent to the mortgage. Our mortgage had an interest rate of 8.75%, the lowest we could get then. At no time did I look at other people’s homes or vacation cottages, and demand a piece of that.

Look, everyone isn’t entitled to the same things, and every generation has to find its way according to the challenges of the day. I agree that the current housing market is problematic and needs to be more affordable, but I don’t see how taxing a small number of people like me out of our houses will help. It does, however, feed a convenient narrative that people like me somehow don’t deserve what we have. If you really believe that vacation homes are illegitimate until everyone has one home, then make it illegal for anyone to own a second home. Why just hit on a few people in certain locations? I already pay undiscounted local property taxes, and federal income taxes, which is ok by me, so it isn’t like I’m trying to avoid responsibilities. I would even pay an extra 20-25% on my property tax if that would help Sooke, but 100% more is too much. I’m not asking for handouts, never have, but the spec tax makes people treat me as if I am, and that offends me. No, a vacation home is not a necessity, and I never said it was. But if we are now going to argue necessities vs luxuries, I suggest you take a look at your own life and consider what non-necessities you are willing to give up to eradicate poverty once and for all before you start demanding that I go first.

Just for info, my daughter developed her medical issues just when we were finishing our Sooke house, but we felt that we could manage her ongoing treatments, and still manage some vacation time in between, both for her and us. Hopefully, that’s not “immoral” of us. As for AirBnb, I consider them to be a big part, largely unaddressed, of the housing affordability problem, and I also refuse to impose a revolving door of strangers on our lovely Sooke neighbours.

Hey Patrick,

Doesn’t nafta have it’s own dispute resolution process under chapter 11? If so, wouldn’t that be the place to go to seek costs against the government?

I haven’t read the petition so I don’t really know what the argument against the spec tax is, but you keep talking about how it violates nafta.

Retirees who do worry $200/m additional cost wouldn’t be those who build nice vacation home across country. Vacation might be a necessity, but a vacation home is not.

I lived in Ottawa for 17 years before moving back to Victoria. I was surprised by the low property tax rate we pay here comparing to that in Ottawa, about half for house/lot with similar sizes.

MARY-ANN G, I understand why you complain, because it is a surprise additional cost to you, not because you can’t afford it, you can also rent it out for a few months to cover both property and spec taxes.

Or Airbnb it for a little while to offset the 0.5% of assessed value. Which on a $500k assessed property is $2500/yr.

I know it all adds up especially in retirement but $200/mo makes “sudden and drastic change” a bit hyperbolic, don’t you think?

You asked a question about me, you got an answer about me.

Speaks for itself, so I won’t.

The discussion is about the govt singling out and attacking a group of people via taxes, treating them differently than others. In your B.C. rail example, everyone was treated equally ( the luxury tickets cost the same for anyone). With the spec tax, we have foreigners, satellite families and ROC treated differently for RE than BCers by our provincial govt (perhaps illegally).

Hi Mary-Ann G – I haven’t had any issues with the spec tax thus far but i do feel sympathetic to your scenario. Do you have the option of renting the place for 6 months a year? I’m assuming that’s not an option or you’d be doing it but just curious as to why you can’t if down the road you really want to retire here. The market is pretty good for rentals here and although finding tenants who just want the place for 6 or 7 months is more difficult, from what i’ve seen on the Facebook rentals page I believe you would find some people with an appetite for it if the price was right. Have you considered this?

I sympathize with your family situation, but why would you buy an expensive property on the other side of the country knowing you could never move permanently to it? You’re setting yourself up for a lot of pitfalls beside a change in BC tax policy.

You aren’t helping your argument by labelling non-owners as “envious”. It’s pompous and plainly wrong.

What’s your point? Plenty of people work hard and many of them can’t afford an apartment let alone a second vacation home. What makes you a “legitimate” homeowner with respect to your mostly empty-most-of-the-year vacation home, while others are “illegitimate”?

Well I used to like the passenger service on BC Rail, before Gordo sold it contrary to his promise. Now there’s only a luxury service.

Plenty of people fared worse, but the point is everyone gets affected negatively by some government, and some people by a lot. Plenty of people felt they were under attack when Gordo brought in the HST. Not me, I thought it was the right policy, though dishonestly delivered.

And of course a lot of people, myself included, believe that the housing crisis was in large part created by Gordo and Christy. I myself am not a victim because I was already an owner.

We live in Ontario and cannot relocate permanently to BC because our daughter requires ongoing medical care that is based in Toronto. I have no problem with paying a fair share to help with the BC housing crisis, but people like me should not be made to be the only ones tasked with paying to solve this problem, one that exists in my hometown Toronto as well, by the way. We built our Sooke house after saving for many decades to afford that, and we followed all the rules. Now the game has been so suddenly and drastically changed that we have to reexamine everything we planned so carefully for. I know there are no guarantees in life, but the spec tax just seems especially arbitrary and selective on a relatively small group of people that didn’t cause the problem in the first place, and that don’t have any political influence. Why can’t they put the tax just on second homes going forward, so at least people know what they are getting into? Existing homes could be exempt until they are sold to a new owner.

We are going to try to hang on to our vacation dream as long as we can, but will likely have to give it up at some point if this tax isn’t removed or lowered. At today’s prices and factoring in taxes, we would barely break even if we sold. This wasn’t an investment for us as much as it was a long-held dream for our family.

As for the issue of “envy”, I agree it is a loaded term, and I avoided using it all of last year in the run-up to this tax, but I got tired of being branded as a “greedy freeloader” by people who thought they deserve to have now, what took me 25 extra years of working and saving to acquire.

Tell us how you’ve been attacked by some provincial govt at some time.

As we are constantly being reminded on this forum, BC’s superior climate and lifestyle justify its stratospheric RE prices and life anywhere else is unbearable. Someone with the means to own two personal residences in its most expensive markets is unlikely to leave just because of an extra 0.5% levied on one of them.

More generally, pretty well everyone in BC has been attacked by some provincial government at some time, so if they didn’t stay there would be nobody left.

Thanks for the post Leo. Been waiting for it.

I don’t agree with the base assumptions of analyzing those areas within BC for assessing the effect of the Envy Tax. Why would a group of people who have just been singled out for hatred and attacked by Prov Gov’t stay in the Prov?

Patrick: “Or just somewhere out of Canada, like the USA.”

Bang-on. I would simply say, anywhere outside the Prov..

Interesting proposition for Malahat/Gulf Isd tho. These are obviously statistically small at 7 for Malahat and 17 for the Gulf vs 348 for Victoria. Even so, given the SFH HPI June 2018/19 is up 5.7% Malahat and 12.3% Gulf vs a drop of 1.3% over same period for Vic., I find this more telling. I would also point out the Sales drop from a year long plateau of ~8000 at the announcement precipitously dropping to ~ 6000 today (June 2019) is a 25% drop in sales. I will come on record as saying that the ave homeowner with two homes (primary and vacation) is more financially astute the the ave monkey and would not have rushed to sell at the announcement, but would have waited thru the policy acrobatics that ensued after Feb/18. The larger factor would then be the difficult to assess sign that was hung at the Prov border:

“Not Welcome”

Perhaps ‘Beautiful British Columbia’ no longer accurately reflects the prevailing sentiment. Maybe we have a new BC Lic plate moto?!

Don’t miss Eats & Beats at the Beach today at the Lagoon. Great time.

@guest_61930

Tax hikes this year (EHT, CPP, income tax, income sprinkling, small biz tax etc) have cost me almost 100k more in 2019 than 2018. Do I get to fit into this category as well? Why do so many readers here consider their secondary accommodation sacred relative to all the other areas the government has been hiking.

Should I not have the same “right to enjoy my life because I have worked hard for it”. This isn’t a spec tax problem. This is a tax problem.

Hmm global warming?

So what wrong with people who want to relax in theirs weekend home outside of Victoria? IMO, people should have the right to enjoy their lives the way they see fit, because they work hard and sacrificed for it. And, I’m sorry for not being sensitive to people who just started out with life that do not want to make any sacrifice of their own lifestyle, but cries how unfair it is that they can’t afford top end housing.

Do you really feel for home owners that are harmed by the ideology that you were a strong supporter of?

Like I have said in the past, these taxes that people supports will come back and haunt/harm them directly in the future.

patriotz:

Who said anything about the expenditures showing up as current expense? Once the dividends are paid from ICBC to the province, the province can do whatever they want with the money, whether it be capital or operating. Just like they can issue debt to fund either capital or operating shortfalls. It comes down to a cash-flow issue which affects capital and operating expenditures equally.

@guest_61918

This phrase could literally be used for every tax in existence. I neither agree or disagree with the spec tax but blanket statements like this don’t really help your situation either way.

We all do, but most of us don’t feel the need to own two personal residences in the same metro.

First of all I will correct myself – for anyone earning under $113K or so, BC has the lowest income taxes in Canada. The reason is that BC’s brackets are more progressive than Alberta’s.

California seems to have the highest income taxes of any US state, rates and brackets fairly similar to BC under $113K, then BC is somewhat higher.

There’s also the question of whether federal income taxes are lower in the US, they certainly are for high earners but maybe not at the low end.

https://www2.gov.bc.ca/gov/content/taxes/income-taxes/personal/tax-rates

https://www.alberta.ca/personal-income-tax.aspx

https://www.tax-brackets.org/californiataxtable

Heat kicked in this morning. Well it’s been a nice summer

I do feel for you on that one especially if you built the house yourself which definitely makes for a strong connection.

I’m curious, where do you live primarily? On the island, Mailand, other province? And now that the spec tax is in effect, what do you plan to do with the property other than hope the tax gets cancelled?

Given the govt original estimate of 32,000 subject to the tax that represents about 1/3 of the original plan.

With 70% of the payers being foreigner/satellite, and given their rate for 2019 being 4X higher than Canadians, that likely means 90% of revenue for this misnamed “spec and vacancy tax” is coming from foreigners. And the satellite family members are living in the homes, not leaving them vacant, and they alone will be paying about 40% of all the tax .

Just seems like another ill-advised tax on foreigners. And probably illegal under NAFTA and other treaties. If so, 2/3 of all tax collected would get ultimately refunded to the foreigners.

With numbers under 1% of total homes, foreigners aren’t the cause of the housing crisis, and we should focus elsewhere for solutions (increased housing supply, better transportation for commuting, moving govt jobs out of the core etc).

Is it? Are all the US states lower than the provinces?

A great many businesses were paying the employees’ MSP premiums anyway. They did for every job I had. To characterize the new tax simply as shifting the burden toward employers is off the mark.

Isn’t that the same as saying that BC has the 2nd lowest taxes in Canada? As someone pointed out, you really have to add healthcare expenses in the US to the tax take for a fair comparison between the US and Canada.

The real disincentive to professionals locating in Victoria or Vancouver is the high cost of housing. As if that needed to be pointed out here.

They were using the money to fund current expenses, i.e. day to day expenditures. Building things goes on the capital budget and does not show up as a current expense. That is why the government can run a surplus (under both the current NDP and previous Liberals) yet the debt is increasing. The borrowed money is used for capital projects.

The spec tax on vacation homes will do nothing to solve the housing crisis. As a vacation homeowner in Sooke, my property tax effectively doubled due to this tax. I already pay full property tax (No Homeowner Grant for me), which I am ok with. I would even be willing to pay a little more, even though I contribute lots to the local economy and use precious few public services. But doubling the property tax so selectively is ridiculous. We built our vacation house for our own use, we are not foreigners, satellites or speculators, we pay all our taxes in Canada, and just want to enjoy the retirement we worked 38 years for. The cash grab might make some envious people feel good, but that doesn’t make it fair to legitimate homeowners like me. And I don’t see it “fixing” the housing market, whatever people think that means.

Or just somewhere out of Canada, like the USA.

Parksville maybe?

I am not sure that I agree that one would expect a shift to either the Malahat or the Gulf Islands because of the spec tax. More likely a different location in most cases.

Since the money is to be spent in the spec tax areas anyway, I would like the idea of turning the spec tax over to the municipalities to run as they see fit. Then they can make it a simple one-line checkbox on the property tax renewal, and (for example) charge ANYONE with an empty home 25% higher property tax. I don’t see the appetite from the general public to go through filling out the online declaration each year.

Yes, you have shown a 0.5% rate increase can be small. However a 3% rate increase would have more impact than the minimum wage increase in your example.

I’d argue that increasing costs of employment are more detrimental to business investment than interest rates which are always hit the top of the news pile.

Example. A business that borrowed 500k to build a new location and interest rates increase 0.5%. The monthly impact is $208 a month. Not so bad right?

The same business employs 2 FT cashiers at $12 an hour and the minimum wage increases by $3 in the same period of time. An increase in expenses of $1040 a month.

It is hard to compare the tax burden in the US states to Canada. Part of why they now look even more favourable is of the recent Trump tax cuts. This is adding to US huge debt load. They can get away with that because US bonds are still the goto safe asset due to USD dominance, which keeps their borrowing costs low. If Canada were to run up a similar debt level by giving tax cuts I am not sure our borrowing costs would stay as low. Also US has a lower tax overhead, because Healthcare is mostly privately funded, so Healthcare costs are mostly funded by the employer and/or individual. A typical health plan for a family is $23,000 USD per year, with about 2/3 covered by the employer. This is a a huge additional “tax” on employers and individuals. I know Canadian employers also often provide extended health plans, but these typically cost around $4000 CAD.

Agreed, that must be fixed. Probably bigger changes necessary there to address medical industry issues than just a slight bump in rates though.

Not necessarily a bad thing although I understand the fear associated.

@Leo S

“Business pays, increases prices”

There’s lots of businesses that can’t increase their prices. Most healthcare related businesses have preset rates of remuneration with the province, third parties or feds. Most of the EHT comes straight out of the bottom line for those businesses.

Increasing the “cost” of employing people just improves the value proposition for automation. With CPP, EI, 2 weeks vacation, and EHT is more than 13% over and above an employees hourly wage.

HST should have stayed agree 100%. More efficient. We also had to refund the fed 1b plus and recreate a taxation department. Sometimes you do not let the average person have a say.

The liberals governed in fear about everything under Christie. Non of the provinces issues where dealt with.

Very surprised that the NDP do not call an election. They probably would win a majority. Get ride of the Green and their speaker issues.

EHT is zero sum (after this year) though. Business pays, increases prices, in the end consumer pays with the money they are saving on MSP.

Ironically HST was an excellent idea, thrown under the bus by piss poor marketing, rollout, and response

From that report. Short term is not the issue. Its a long term issue..

BTW I am not saying the liberals did a good job. After the HST shit show, they were a government who did SFA.

Also in 2018, the government significantly increased the province’s top personal income tax rate (B.C. now has the ninth highest income tax rate for entrepreneurs, professionals and business owners of all 60 U.S. states and Canadian provinces). Consequently, skilled workers in the top tax bracket now face a combined federal/provincial tax rate of 49.8 per cent. Compare this to a top rate of 37 per cent in neighbouring Washington State. Evidence shows that such a high tax rate discourages productive activities such as work, savings and investment, which B.C. needs more of—not less.

Add the higher carbon tax, a new employer health tax, higher property transfer tax rates on certain properties, and new or higher excise taxes on high-end items (luxury vehicles, for example) and items purchased predominantly by lower-income folks (cigarettes, for example) and a picture emerges of B.C. as an increasingly high-tax jurisdiction.

Taken together, all these tax hikes have made it more expensive to live and work in B.C. and diminished the province’s attractiveness for entrepreneurship, business investment and skilled professionals. There’s nothing new about B.C.’s tax competitiveness problem—it’s been a problem for a while. But it’s worrying that, instead of taking steps to fix this problem, the government in Victoria seems determined to make matters worse.

On the topic of spec tax it’s incredible watching the NDP touting a budget “win” by massive tax increases on corporations, EHT… 19 new or increased taxes in total.

Average BCer pays 40%+ of all income in taxes (income tax, PST, GST, PTT, EHT, business taxes, cap gains, carbon tax etc).

Definitely discouraging.

https://www.coastreporter.net/updated-1-5-billion-b-c-surplus-for-2018-19-minister-says-1.23889889

https://www.fraserinstitute.org/article/tax-competitiveness-bc-goes-from-bad-to-worse

British tanker seized by Iran. You want something that could blow up the global economy and assets. Look no further.

Great post

Your post about condos Leo was an eye opener for me a few weeks ago and spec taxes. I think you are right on the money about that.