More on the condo outlook

When the pandemic hit, it was clear pretty early that detached house prices would be very resilient to any potential drops. Prices were rising before, and COVID shifted preferences towards more space. The condo market was more uncertain, with sales depressed until last fall and prices unstable. However since last November it was also evident that the condo market was going to see a leg up in prices. Condos have been on a tear since then, jumping about 15% in price.

Now that prices have jumped, you might be asking yourself if it still makes sense to buy a condo or not. Of course there are many factors that go into buying a condo and if you are considering buying one to live in, I encourage you to think through the process based on risks and probabilities. However one important factor is certainly prices as most condo buyers don’t own them forever, and are thus interested in not losing money on resale in 5 years time.

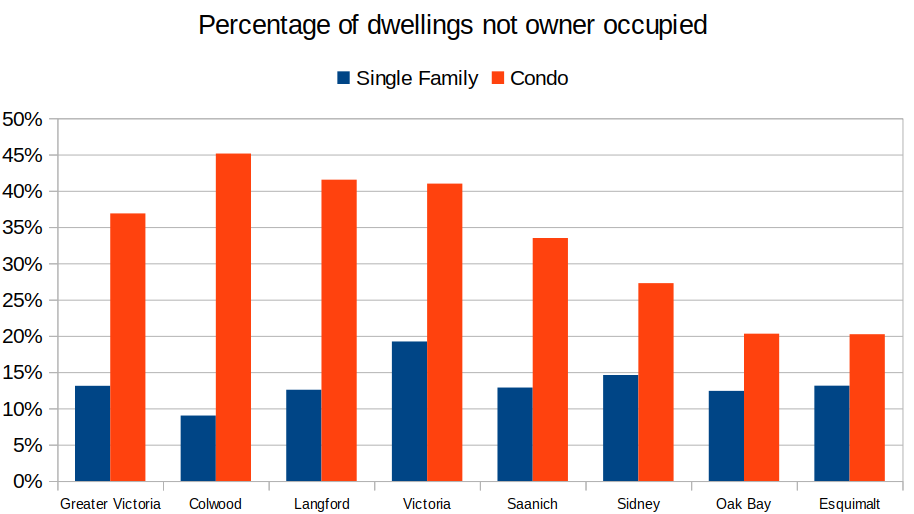

Other than owner-occupiers, the other major purchasers of condos are investors who will rent out the units. Statistics for Greater Victoria show that about 37% of condos are not owner occupied, meaning mostly investment properties. I’ve previously done an analysis on historical returns for condo investors, which showed strong returns due primarily to price appreciation. While no longer dropping interest rates should put drag on long run price appreciation, we’re likely not at the end of the current run yet so it’s worth thinking about where prices could go.

Not too long I ago I looked at the condo outlook from the point of view of affordability and the rent ratio. Not that much has changed from those perspectives, so I’ll just link to that article from April if you missed it. Prices are up somewhat from then, but not enough to change any of the major conclusions. Affordability remains above the historical average, but not yet at levels where we have previously seen price plateaus or declines. That’s assuming that many buyers can bypass the stress test in some way (through a credit union or being otherwise well qualified).

For investors though, there’s a few more things that may come into play, including the competition from purpose built rentals. Though purpose built rental construction has picked up in recent years, it’s not been evenly distributed throughout the region. The big boom has been out in Langford, with Victoria stepping up in starts just in the last year.

Zooming out a bit and putting those on a map, we can clearly show where all those rental starts from the past 5 years ended up.

It’s no surprise that most of the construction has been on the westshore, but it does illustrate a problem when set against the housing crunch for the some 20,000 UVic students not accommodated by on-campus housing: nearly all the new rentals are far away. Purpose built rentals in Langford are great for many people, but it doesn’t do a whole lot for those on the other side of town. Of note: According to the VREB buyer’s agent survey, nearly 9% of buyers in August and September were buying second homes for family. That’s over double the normal average rate. Parents buying condos for their kids when rentals weren’t available? That might be a sound move financially too. Though prices have been rising, low rates means interest costs are down from 3 years ago. It all points to likely higher condo prices to come.

Saanich is starting to step up with rental projects in the pipeline, but it’ll be a few years before those turn into homes. In the meantime for better or worse expect investors to jump in to fill the gap. Next month the CMHC will be gathering rental market data, but we won’t see the results until January. Expect the vacancy rate to drop from the brief reprieve brought by the pandemic last year. As I’ve said before, if we want to make a dent in the rental shortage, we’ll need to keep up this level of building for at least a decade.

Also weekly numbers courtesy of the VREB.

| September 2021 |

Sep

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 129 | 271 | 454 | 989 | |

| New Listings | 151 | 383 | 616 | 1294 | |

| Active Listings | 1128 | 1180 | 1190 | 2389 | |

| Sales to New Listings | 85% | 71% | 74% | 76% | |

| Sales YoY Change | -23% | -26% | -27% | ||

| Months of Inventory | 2.4 | ||||

It seems increasingly clear that the fall market won’t bring any relief from the listings drought that we’ve been suffering from all year but has become particularly acute since July. Reminder that Labour Day was a week delayed this year compared to 2019, so the fall new listings are a week behind as well. However even accounting for that our pace of new listings is lagging. September is really the last month with substantial new listings every year, so if we’re not building inventory now, don’t expect that to happen until next spring.

Sales have been pushed down to even with 2019 levels, but that is due to extremely low supply more than being reflective of actual demand. Expect sales to rise again as the new lists from the past week are absorbed.

Sales have been pushed down to even with 2019 levels, but that is due to extremely low supply more than being reflective of actual demand. Expect sales to rise again as the new lists from the past week are absorbed.

The crazy bidding wars continue, with a $400,000 over ask sale in North Saanich and a $310,000 over ask sale in Saanich so far at the top of the list. Both those listings were deliberately underpriced of course, but it shows the market remains hot enough to pull off this tactic, even if the rate of over asks for detached properties continues to slowly drop (45% selling over ask so far this month). Condos meanwhile have gone the other way, with 42% going over the list price, the highest rate we’ve seen all year.

Totally agree. I think demand has eased somewhat since the spring but it is tough to tell with our super low inventory. Would want to see a sustained rise in inventory before we can really judge demand levels.

Umm your relatives are moving here?

Tough to gauge actual demand with such low listings. Maybe strong demand relative to listings, but I guess it’s always relative.. lol.

Unfortunately this is accurate. No sign of any new list catchup and continued strong demand.

Just write, “Buyers, you’re screwed” and call it done 🙂

Yes, already written, just have to add the market update.

Leo, is a new post coming?

Sales: 650 (down 20% from last year)

New lists: 837 (down 27%)

Inventory: 1166 (down 54%)

All the stories I’ve heard about Berlin is that people are desperately searching for rentals and can’t find them. Seems like that’s the primary issue, with people in housing but paying high rents relative to their income a secondary one. To help the latter, I think a plan like the NDPs to directly support those people with cash is a better one.

Who knows, this whole expropriation thing probably won’t happen, but I don’t see the difference between one company owning 3000 rentals (with 3000 share holders) VS 3000 individual landlords owning one unit each.

Should the government take over old purpose built rentals to protect them from redevelopment? I think there’s a case to be made for that. But if this actually goes through as expropriation (as in, the units are taken at below market value) then I think it absolutely will have a chilling effect on rental investment.

It’s like a bread shortage with high prices. Yes, government can solve the high prices by forcing the prices down. But then you’ll have empty shelves. Either way, you’ll still have a shortage of bread.

So in the Berlin housing example, yes 200,000 lucky people get low rent, and they will rarely move. And the rest fight for a tiny number of available rentals.

Berlin’s housing crisis is the same as ours. Too many people for the available homes. And like us, they’re stuck with a socialist government unable to realize that. So they waste time and energy on dumb redistribution ideas like this. Imagine what would happen to Berlin new home construction numbers if the “expropriation at well below market value” starts.

I don’t think this is redistribution as much as it is the government expropriating 200,000 rental apartments and then dropping the rents on them. Either way you slice it it will help the 200,000 families (or single ppl) in those rentals. Agreed it seems like more housing there would be the better solution but that’s long term and this may help in the interim.

9320/9316 Lochside Dr

Listed $1.1M

Sold $1.5M

Assessed: $761,200

Can’t solve a shortage via redistribution.

That said this is the kind of thing that happens when the population gets angry enough from having their basic needs not met. Governments ignore it at their peril.

Germany: Berlin locals vote to expropriate real estate giants – https://www.google.ca/amp/s/amp.dw.com/en/germany-berlin-locals-vote-to-expropriate-real-estate-giants/a-59315431

What would an expropriation mean?

The vote was the result of a grassroots campaign to “Expropriate Deutsche Wohnen and Co.” A successful vote would open the way for the Berlin Senate to devise a law that would allow for expropriation of real estate companies with more than 3,000 housing units. Companies would be reimbursed for the properties at a rate “well below market value,” according to the campaign.

Ya, it is discouraging. I just renewed my pre-approval for the 4th time in a row. This time with the new stress test applied. I don’t see any relief as long as the inventory stays this low. However, I do think some debt shock is going to start hitting the over-leveraged pretty soon. Especially the ones that tapped every resource possible for a down payment (borrowing from family) and maxed their borrowing based upon their income. Those folks will likely be borrowing (credit cards and HELOCs) to sustain their lifestyles and that won’t end well, especially since their families already floated the cash for the down payment and are now tapped for anything else if the kids end up in trouble with too much debt.

Karisse: On the other hand there are some properties that just dont sell and I am not sure why.

Barrister without a doubt there’s a lot of out of town buyers. Even properties in less than desirable areas sell high making me think the buyer probably doesn’t know Victoria very well. I have noticed properties are sitting longer in the cowichan bay/cobble hill/shawnigan area. Too early to tell if it’s a blip or a slow down up there.

I am guessing that there is more than the usual number of out of town buyers with pretty deep pockets. Combined with really low inventory this makes for a rather difficult market for SFH.

As a buyer I’m very discouraged. The list prices are crazy and the sale prices even crazier. Lots of unprofessional behaviour on the part of realtors as well and sellers playing games. I think a lot of the buyers out there are out of towners and there are still a lot of investors which I don’t get with these prices. Even when a property sits for a month it still sells over asking. Is the art of negotiation dead and everyone comes in over asking? It’s bizzare.

Good interview here with Ben Rabidoux on housing https://www.youtube.com/watch?v=d4RODhiNsxM?t=2901

The low rates support the market at the bottom and middle, and the price differential percolates up to the top.

I suspect that there must be a lot of people that have become totally discouraged in their house hunting. But this price spiral seems to have hit all sort of other areas from grocery stores to pub fare to exercise equipment. A friend of mine pointed out that his ten dollar breakfast suddenly became an eighteen dollar breakfast at his favorite haunt. I wonder if we are starting to pay for Ottawa running the printing presses?

I am still wondering who are the people that are spending two to three million for some pretty ordinary houses. I doubt if the low mortgage rate accounts for the number of sales over two million. There was a recent new build, usual style, not waterfront, that sold for over two million in Sidney.

Sorry, just morning ponderings over my first cup of coffee.

At least you can complain to your friends about your house from hell, you can’t complain about your Tesla.

What would you rather buy?

That house is in Saskatoon. It’s got everything. Bloodstains on the bedroom carpet. Blair Witch death basement. A furnace that may or may not run on coal. And annual property taxes of $206,097.

https://www.realtor.ca/real-estate/23675141/1118-b-ave-n-saskatoon-caswell-hill

From: https://reut.rs/3AFcCD1

It’s interesting to see that the US had an earlier re-opening from Covid than we did and they initially faced an inventory crunch that drove prices higher during the pandemic; however, it appears that inventory has recovered and it’s at highest level since 2008 in the US. Prices have initially maintained the increases from earlier in the year, but it should be interesting to watch to see if the US begins to experience a correction with growing inventory and the possibility of buyers still backing away from high prices with the FED signalling interest rate increases soon down south.

Yeah would need to use assessment data for actual equity gain but avg sale price is an approximation

Yes, Vancouver island prices up $163K CAD in a year looks to be more than any equity gain of the 50 USA states. But equity gain is lowered by new buyers that have little equity, so it’s different than price gains.

Thanks, QT!

Cool resource. Vancouver Island up 31.7% YOY!

Introvert, you are welcome.

https://www.crea.ca/housing-market-stats/national-price-map/

Would love to see the Canada version of this:

https://www.corelogic.com/intelligence/homeowner-equity-insights/

I’m curious- what’s the address of the home that went $400k over ask in North Saanich? What was the final price?

I showed it as well. My client wanted to write 100k above asking I told him it was a waste of time for all of us 🙂

Better deals to be had from GableCraft, but you have to wait a year for the home to be completed.

$1,185,000

Breakeven cost for Canada LNG is between $8.09 to $11.17 per million BTU pending which area it is from, and price could reach $100 this winter is a major win for Canada economy.

Citi Isn’t Ruling Out Natural Gas at $100 in a Frigid Winter — https://tinyurl.com/3k9bunb3

Can anyone tell me what 3474 Curlew St in Royal Bay sold for?

I had the second place offer on the home in North Saanich that went for $400k over ask. When the sale was posted the next day on MLS it was an “unrepresented buyer.” 16 offers in total, definitely one of the most underpriced properties I have had the pleasure of writing on in this market.

@marko – I also feel your pain, as do many others. Not looking forward to submitting a BP just to add some PV.

Geez, what’s the point of dealing with variance boards, community plan sign offs and neighbour consent if you still have to deal with the douches that sit on council.

@marko

I feel your pain, we are finishing our second infill spec off a dp permit and this will be our last, such a joke….

It took about the same amount of time for a bp permit.

we are now in for permit on a small apartment building renovation, we are now at month 3 and just got our second set of comments back, probably be at 5 months before we get it.

The amount of money we have paid architect,mechanical,structural,electrical engineers is sure adding up fast.

we are also trying to legalize two existing illegal units in the building that have been there for over 30 years, we just put that on hold because we need to apply for a dp permit variance for two parking spots, that will take another 6 months at least.

Looks like two rental units will sit empty for another year, actually there’s 4 empty at the moment, because we can’t renovate them until we get our permit.

Maybe Saanich is a bit better, wrt to new build process time?

A friend couple just finished building a side-by-side duplex in Saanich, with each side about 2400sqft. They started to prepare the rezoning – SF (a corner lot) to duplex process in fall of 2018, and passed the Council meeting in Oct 2019, and then the public hearing in Dec 2019. The old house on the lot was moved away May 2020, and the build started June 2020, and the tenants moved in Aug 2021.

We do it to ourselves. Come the next round of municipal elections, we will elect the same or some along the same kind that will just keep putting in the same or variations on the process that will increase cost or time to construct. The goal will be obstruct and it will be hidden under the guise of environmental responsibility. Even folks here that advocate for efficiency of process to build quicker still have their conceptions of what must be in place that will muck up any desired efficiencies to be gained in the process.

A lot of people believe the theory that the market will slow down eventually (it will) and everything will be fine (I doubt it). Problem is when the market slows instead of construction continuing at a lower cost it simply won’t occur due to fixed bureaucratic cost like having to hand deconstruct a tear down. The no construction during a slowdown in the real estate market will restrict inventory and market will be back to inbalanced with limited inventory in no time.

The crap I’ve had to do for a 1,644 sqft is just insane. Like completely replacing completing functioning neighbouring driveways/curbs/etc. where even the neighbour was like why does this need to be repalced.

According to Marko, if it takes 5 years to get a house built due to bureaucratic red tape, the housing shortage will never be addressed. If the prices are too high now, they are only going to get worse. I guess relocation is the only option for some people. Local governments must want to keep the population on the Island down, more people, more problems.

Downtown Victoria can be pretty noisy , that said there are a lot of buildings in the “downtown adjacent” neighborhoods like Fairfield, North Park, & James Bay which are pretty quiet while still being walkable for downtown. If I was looking to buy a condo in Victoria that is where I would be looking, although there isn’t much new construction in those areas.

You’re not going to hear it from the politicians until home owners are in a clear minority. If and when that happens, watch out.

From: https://www.bnnbloomberg.ca/the-global-housing-market-is-broken-and-it-s-dividing-entire-countries-1.1654418

Politicians love wedge issues and using taxes as a policy mechanism. You can already hear the catch phrases morphing from tax the the rich to tax the home owner…..

https://www.cbc.ca/news/canada/british-columbia/vancouver-renter-fights-payment-scheme-1.6171443

Nice to see the coyotes will be OK

Leo’s prediction is happening:

B.C. property insurers tighten rules for homeowners, builders in forest fire regions

https://docdro.id/8n3QLiB

https://www.theglobeandmail.com/business/article-bc-property-insurers-tighten-rules-in-forest-fire-regions/?ref=premium

Map of Vancouver, after all the world’s ice sheets have melted:

https://dailyhive.com/vancouver/vancouver-sea-level-rise-map

I am finishing up a 1,644 sq/ft home in the Oaklands neighborhood. 5 years start to finish and it fit the small lot policy. In any normal world start to finish would take 1.5 years.

Took half a year to get the BP after it tooks years to get the DP -> https://m.youtube.com/watch?v=MocTwO-Kk24

The BP plans were identical to the DP plans.

Useless sidewalk to no where is now well over 50k in bills -> https://m.youtube.com/watch?v=s6aSPG47AQo

First and last time doing an infill in COV.

The architect on a duplex up for public hearing tonight on the costs of all the process.

Hundreds of hours of high priced consultant time to turn a house into a duplex

We have a few in the building like that. They didn’t realize that it’s a junkie apocalypse downtown and there are 5 alarm overdose responses all hours of the day and night (since it’s a small downtown, you hear it all). It’s a bit shocking for folks from quieter spots. The best are the ones that complain about the noise from the patios of restaurants (didn’t you move here to have the services in walking distance?). I wonder why they chose to downsize to Victoria instead of a place like Parksville or Qualicum. The funny thing is, I had friends from downtown Vancouver stay and they were shocked at the street noise in Victoria compared to downtown Vancouver at night.

I had friends downsize from a nice small house to a condo downtown and they are saying it was the dumbest thing they every did. They moved a year ago and the SFH market has made moving back extremely challenging.

In the last two years I’ve also helped quite a few retired folks upsize from their downsize

‘

‘

‘

I’m sure they would have wanted more space when they were younger but may not have been able to afford it. Then you get into your late 40s and 50s and with mortgage paid off and income at peak levels and its hard to spend all the money, then you get a 6 or 7 figure inheritance and you buy the house you always wanted, i see it all the time. I just worked with a son and daughter in their early 50’s, dad died and mom gifting a couple of million each to kids who had modest savings before the gift, daughter moves from condo in the prairies to a 1.5MM home on the island.

Yeah, I think the myth that most retirees are keen to downsize has been thoroughly debunked.

Yup, I would say on average most of my clients relocating here with adult children that don’t live at home anymore are buying the same, or bigger homes compared to where they are coming from (Calgary, Toronto, Ottawa, etc.). In the last two years I’ve also helped quite a few retired folks upsize from their downsize (they previous sold a SFH to buy a condo/townhome and then went back to SFH).

It is not unusual to have single people in their 60s and up buying 2,000 to 3,000 sq/ft homes.

I’ve had single people walk into 1,200 sq/ft condos and run out because they feel claustrophobic and they don’t have TV room and all this other stuff. Best part is they drop lines about their concern for the environment and young families not being able to afford housing.

It’s a good point. Extra bedrooms come in handy when your kids or other people come to visit. You may feel the same way when the time comes.

I find it odd the desire for elderly people to buy home bigger than what they raised their families in, when it’s just two of them, they still want big houses with all the cost and maintenance. I know quite few for some reason bought bigger homes in their 60s and 70s. I am only looking for a big house right now because I need the space. As soon as I don’t need it, I will be looking for something small that I can leave for 3 months at a time without having to worry.

This happened in my situation, also.

As for my partner’s folks, I think they’d like to move here but they dithered too long and now the price delta between Calgary and Victoria is such that all they could buy with the proceeds of their Calgary house is a small condo here.

Makes my (successful) $20K-above-asking bid in 2009 seem tame by comparison.

The most I have gone over ask has been $117k with no conditions without success. From the numbers, it looks like a dream of spring now.. lol.. Oh well, I have the résumés out to see if I can find comparable employment elsewhere. I guess I can claim to be environmentally minded by have a family of 4 in a 2bdrm condo. At least it’s a 90’s build with a fair bit more space than what’s going up now.

Yea it’s pretty brutal out there. Had clients go 95k above asking unconditional on a Westhills home tonight only to be outbid.

Completely anecdotal, but this weekend was showing homes to two sets of out of town parents of my clients (kids moved/bought in Victoria and now parents in 60s following here). Not sure how many parents from Victoria follow their kids/grandkids to Edmonton/Winnipeg/Moncton.