Returns in the investment condo market

There was some interesting discussion about the returns of investing in condos vs in the equities and bond markets on the last article, so I thought I’d take a closer look at historical returns for investment condos in Victoria. We all know that cap rates are poor in high priced markets, and Victoria is no exception. Any investors used to cheaper markets will be disappointed by the 2%-3% cap rates that are common for condos. But does that mean condos have been a bad rental investment in Victoria? Well let’s take a look.

The assumptions

Of course, there are many individual variables in rental investing. To do any kind of assessment of historical returns, we have to make some assumptions. In this case I assumed the following:

- Holding period of 10 years

- Achieved rents are 10% above the CMHC average for the year (CMHC measures rents of occupied units, not vacant ones). Note that CMHC rents are adjusted to the sales mix for condos in order to make the average condo sales price comparable.

- Vacancy set as the CMHC vacancy for that year, plus 2.5% credit loss

- 80% financing on a 25 year amortization, with two 5 year terms at prevailing rates with 1 renewal (estimated at 1% below the 5 year average rate as reported by CMHC)

- Yearly expenses as follows:

- Strata fees at 1% of the current value per year (average of current strata fees)

- Property taxes at 0.5% of the current value per year (average of current taxes)

- Insurance at 0.1% of current value

- Maintenance at 0.1% of current value

- No special assessments

- Existing units increase at same rate as condo average

- Purchase costs at 2% of value (PTT + legal + one time costs)

- Selling costs at typical commission of 6% on first $100k and 3% of remainder (commissions may vary)

- Opportunity cost at 8% (alternate investment for excess rental cashflow)

- All returns are pre-tax

We can debate about each of these assessments, and of course none of them are exactly right for any given condo. However if you feel I am way off on these please leave a comment below.

The results

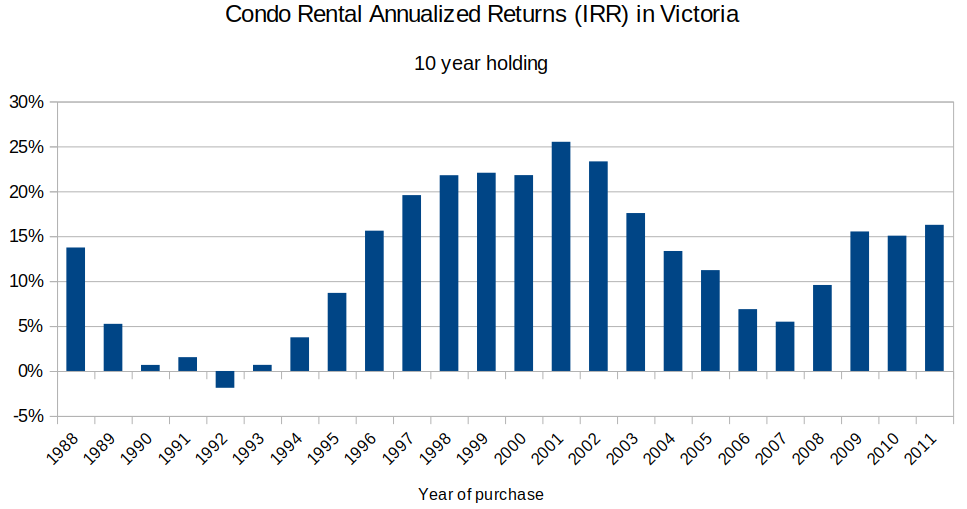

Without further ado, here are the model results for internal rates of return for condo rental investments in Victoria

According to this model, returns from condo investments have generally been good in Victoria, with an average of 12.22% annualized return over the ~25 years, soundly outpacing returns that most people can make in equities. A notable exception is the first half of the 90s, when leaky condos suppressed condo prices for a decade, at the same time as only modest growth in rents.

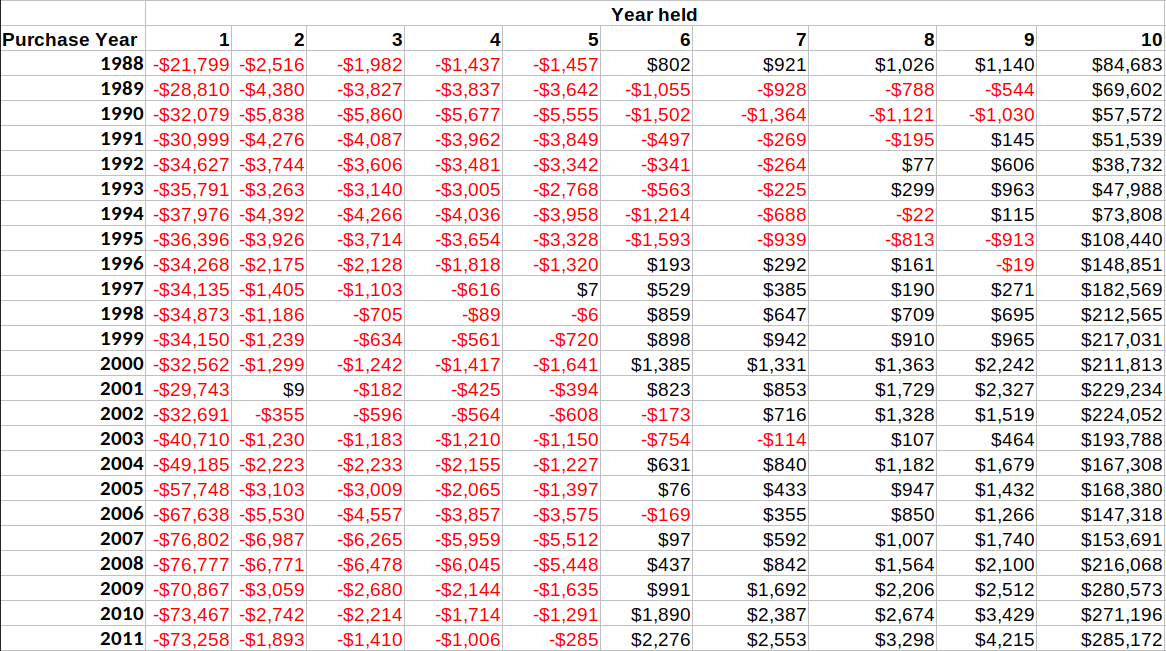

Negative cash flows abound

If you look at the cash flows in the model, red ink flows deep. In nearly every year, investment condos started out with negative cash flows, and only turned positive after about 5 years when a mortgage renewal at a substantially lower rate dropped interest costs while rents increased.

Returns are largely due to capital appreciation and reduced cost of debt

It’s clear then that the excellent returns in condos are largely due to appreciation in condo prices and the reduction in interest rates. In the last 30 years we’ve seen an average appreciation rate of 4.7% in condos, which lags that of the detached market (5.7%) but still soundly outpaces inflation (1.9%). At the same time (of course they are intertwined), the average mortgage rate has fallen by 75%, which means that investors have enjoyed a renewal at substantially lower interest rates than their purchase for nearly every period. That has been enough to turn cash flow negative investments cash flow positive in the second half of a 10 year holding period (and would make them even more cash flow positive for longer holding periods).

Past performance is no guarantee of future results

For condo investors then, it’s been good times in Victoria and in most cases the returns have been substantially higher than in the equities markets. However before projecting this out into the future, you may want to consider the factors at work here and where we stand currently.

- Interest rates: As stated above, a big factor in producing our price appreciation and reducing carrying costs over time has been steadily declining interest rates over decades. It’s not that rates can’t go lower from here, and I doubt we will see a big spike in interest rates given debt levels, but it’s clear we are at or close to the bottom. For almost the first time in 40 years, interest rates are not likely to be lower in 5 years than they are now. Thus lower financing costs won’t be the saviour for cash bleeding investments as they have in the past.

- Rental construction: For decades we had nearly no rental construction, and there was a big shift in the rental market from only purpose built rentals to many people living in rented condos owned by private investors. That changed about 5 years ago, with a 10x increase in the rate of rental unit construction. It used to be that a renter wanting a nicer unit had to go to a condo, but now there are many purpose built rentals of equivalent quality they could choose from. That and temporary COVID impacts have already raised the vacancy rate and seemingly put a stop to previously rapid rent appreciation. In the coming years it is likely to continue to reduce upward pressure on rents.

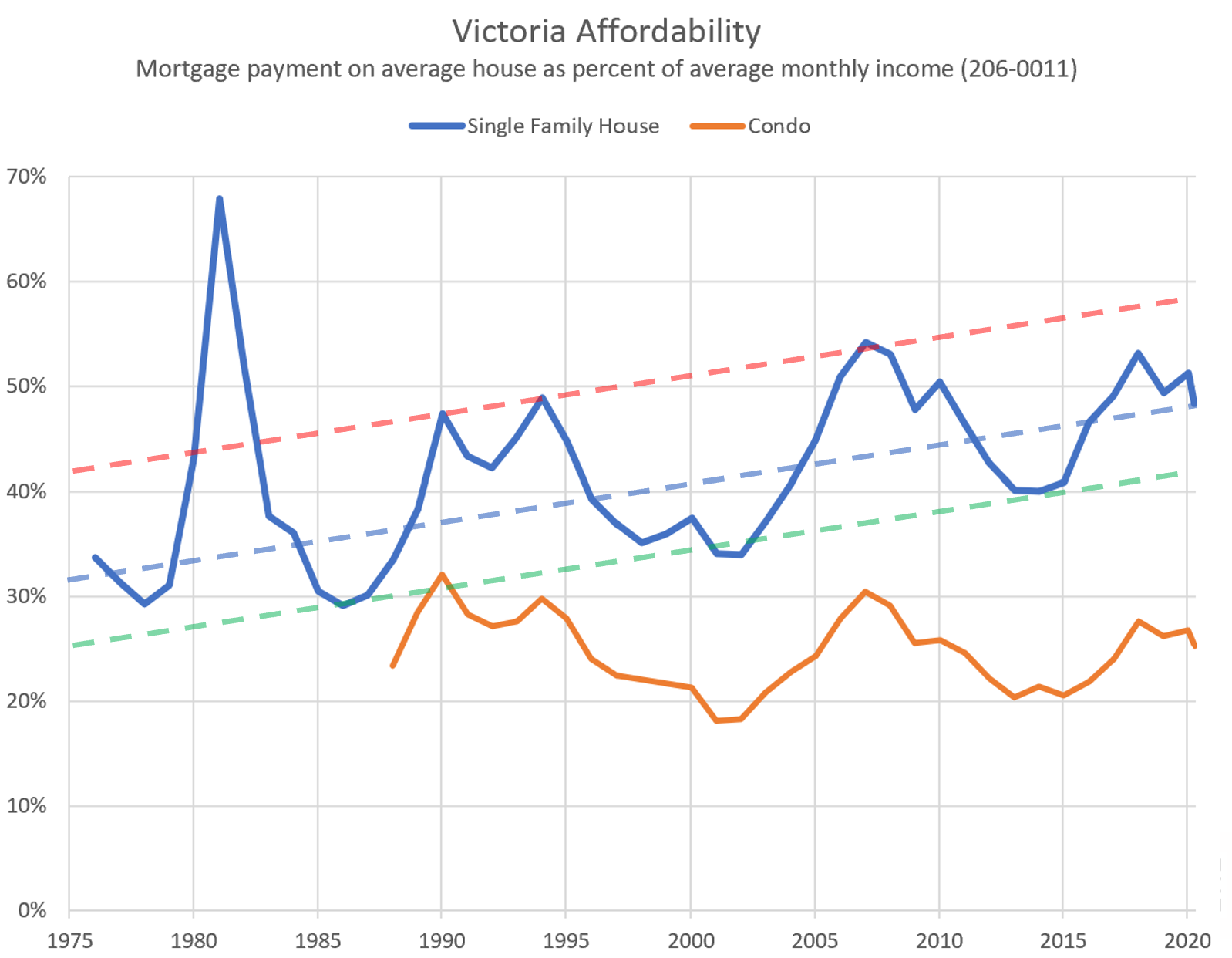

- Affordability: On the positive side, due to our low interest rates and a price stagnation after the stress test, affordability in condos is not that bad right now. This chart is a few months out of date, but it shows that condo affordability has been substantially worse in the past. At this level there is headroom for increasing prices, so I wouldn’t rule that out.

Please check my work!

There’s a fair amount going on in those calculations, so I’d appreciate if there’s any Excel/finance nerds in the audience to check through the spreadsheet and let me know if I’ve made made any mistakes.

What do you think returns will be in the Victoria investment condo market in the future? Are we in for structurally lower returns going forward, or is it still a good time to invest?

Also the weekly numbers, courtesy of the VREB:

| November 2020 |

Nov

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 192 | 398 | 577 | ||

| New Listings | 280 | 462 | 750 | ||

| Active Listings | 2124 | 2033 | 2397 | ||

| Sales to New Listings | 69% | 86% | 77% | ||

| Sales YoY Change | +33% | +36% | |||

| Months of Inventory | 4.2 | ||||

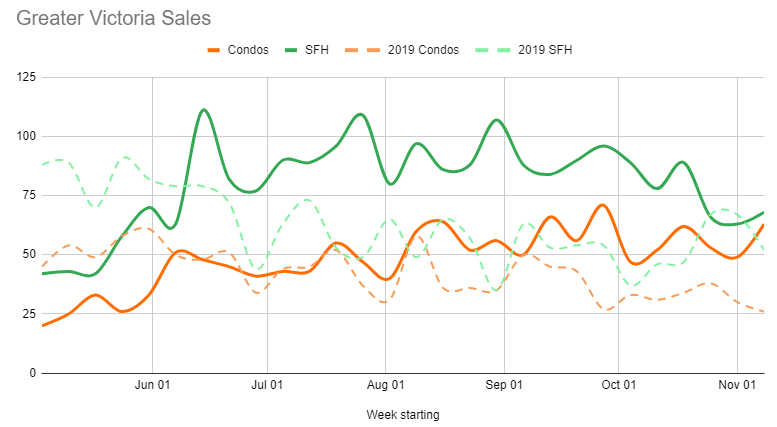

Our bump in new listings to start November was short lived, and they have since dropped precipitously with overall sales to list ratio again higher than this time last year. Inventory continues to drop, now 19% below the same week last year. As usual, this is highly dependent on the market segment, with detached inventory down 28% while there are 53% more one bed condos and 16% more 2 beds on the market.

Weekly detached sales are now down substantially from the summer and even dipped below last year’s levels for a couple weeks, but that may be more due to lacking inventory than lacking demand. In the past two weeks we still had more than one out of every four go over the asking price. Condo sales meanwhile have stayed high but with much less froth and fewer bidding wars. As I’ve said before, both elevated demand and new supply is keeping that market pretty balanced, but it could change direction very rapidly at these activity levels.

LeoS: Amongst other things we are really behind on the restoration of the roof. There has been a lot of structural replacement required before having to replace a new slate roof. The slate delivery is totally behind since it had to be custom cut. I am beginning to suspect the foundation work is actually being carried out by aging turtles or the guys that did the blue bridge. But no complaints, with Covid raging it really does not matter where I am.

Actually we already have cars in Switzerland, the kids in California will get this one. My point is that I tend to keep my cars for twenty to thirty years just like my dad did. Good maintence on a good car is a good investment. But I do believe that electrics have a strong future.

Hope everyone is coping with the new Covid restrictions. My excitement is my new rowing machine which actually seems to be fun.

New post: https://househuntvictoria.ca/2020/11/23/invest-in-heat-pumps-and-solar/

Less gas than a G

I don’t think they’re gonna let you ship that thing over to Switzerland Barrister. Or are you figuring the renos will take another 10 years?

My next car might be an electric but wont buy one until the Benz dies which might be another ten or more years.

I don’t know about 50% unless someone comes out with something decent under 30k and 300km worth of range. However, the above 50k market will be owned by electrics other than sports cars. Who on earth buys a 3 series, A4, c-class over a Model 3 or a q5, x3, whatever benz makes over a Model Y. Tesla will cursh the luxury brands unless they get their s*** together but I think one of Germans will in the next 5 to 8 years.

In BC I mean. It’s currently about 13%

That is a bold prediction.

I think it will be much higher than the current 0.5% yearly light vehicles sales, and it will be very difficult to reach +43 million in 5 years (global light vehicle sales 86 millions per year), because battery production have to be greatly increased and minerals extraction is lagging behind.

by 2025, electric vehicles will make up 7% of all passenger car sales — https://www.cnbc.com/2019/07/26/electric-car-production-rises-supply-crunch-for-battery-metals-looms.html

I agree, electric cars is going to be the future personal transportation for many people, but for now it is out of reach financially for most, and it make total sense for people that drives a lot. As for me, I’ll stick to my 11 year old gas car that still drive like brand new, because I put on less than 10,000 km per year (I commute by bicycle as much as I can).

I also agree. Tesla stock price seems so unrealistic (P/E Ratio of 1,033.23), because it is so far removed from fundamentals. However, Tesla does have a slim chance of making it if somehow the company manage to pull off a Steve Jobs. Apple price (P/E Ratio of 34.85) weren’t any where near out of line like TSLA during its early days, and AAPL was/is a purely tech company with little to no costs on manufacturing/hard assets investment compare to Tesla.

Driving mostly electric for 4 years now. Paid $16k for the car and spent about $600 in fuel to drive it 40,000km. Based current market share of new vehicle sales and pipeline I bet we will be > 50% new vehicle sales as electric by 2025.

Having owned a Tesla for 5 yrs the future is electric for sure. It is amazing getting into a car that is pushing 200,000 km and still drives like brand new.

But the stock…..wtf for a company that produces less than 1% of cars globally.

+1, exactly.

Introvert,

It is great that Tesla is up, perhaps you can buy their stocks as well as GM if you belive in it. Since GM stocks has been down for a long time for financial losts due to poor managements you can pick it up for cheap. GM recently lost a couple of biilions on the Nikola fiasco partnership and management are looking for ways to bail out their failing business plan so they are throwing darts at EV and/or hydrogen hoping something would stick.

And, just for your information, oil and gas is not going away at anytime soon, because Germany the darling of the environmental movement is weeks away from completing a giant gas pipeline from Russia to doulble their gas import to ensure energy security despite the EU enviromentalists and North America alliance protests. We are going to need every souces of energy we can get and it look like nuclear is a good candidate in the near future, because people are not going to stop consumption or stop from having kids. World population is going to hit 8 billions in 2023, and 10 billions by 2055.

I agree,

but people should be allow to make their own decisions based on logical/correct informations, budget, and risk tolerance instead of being forced with missed informations and have to pay for others lifestyle. People shouldn’t be forced by people that are living large with sfh, resource dependant pets, intercontinental travels, having multiple kids, but somehow they can justify their consumptions and looked down on others because they happened to drives EV, installed solar panels, using electric appliances bought with taxpayers money (goverment incentives).

I think gas stoves are worse for nitrogen oxides, wood stoves worse for fine particulate matter. Best thing for indoor air quality is probably not to have ANY combustion sources inside your house.

Also…

https://www.cnbc.com/2020/11/19/gm-accelerating-ev-plans-with-additional-7-billion-announces-new-pickup.html

Tesla stock closes above $500 for first time. Market capitalization of almost half a trillion dollars.

Month to date:

577 sales (up 38%)

656 new listings (up 15%)

1999 active listings (down 19%)

New post later today.

While I agree that fireplaces have no place in the city (and they are polluting), I’d guess wood stoves are less polluting to the indoor air quality than gas appliances (unless you have combustion spillage).

C’mon man – if you’re going to make the argument that heat pumps don’t perform up to their advertised COP due to poor installation, maintenance, etc., then surely you can’t be arguing that indoor air pollution from gas stoves is a non-issue due to hood fans? I mean kitchen exhausts are just about the most poorly implemented appliance in pretty much every house (if they even have one).

It’s rare to find an interlocked make-up supply, and when you do, they’re horribly inefficient. As I previously mentioned, you’re not going to hit step 4 or 5 of the building code with make-up air. Period. Gas is on the way out.

Having said that, cooking is also a major indoor air polluter. In an ideal world, we’d have HRV-like appliances that can handle cooking duties…but those don’t exist in north america (that I’m aware of).

And to relate this back to the blog – for all you house hunters out there – maybe think twice the next time you see a shiny 8 burner wolf stove and a giant hood fan. Instead, go into the mechanical room and check out the HRV (if there is one). Ask to see the spec sheet and find out who commissioned it. A properly commissioned HRV should change the entire air volume of the house every ~4 hours.

Agreed. With a gas appliance at most you are having some impact on indoor air quality. With a wood stove you not only have crappy indoor air quality but you can also inflict poor air quality on multiple neighbours.

The study noted that many homes and apartments, especially in low-income areas (of the U.S.), do not have exhaust hoods. Second, some exhaust hoods are ductless and only recirculate emissions through filters that do little to clean the air.

My stove is electric, so there’s no panic.

No need for the panic. The phenomenon has been known for at least 4 decades, hence active exhaust is required. And, most if not all today gas appliance manufacturers go beyond code by indicated that active exhaust/vent hood are required, and often makeup air must be provided.

What is more damaging to the environment and indoor air quality is wood burning stove and wood burning fireplace (traditional fireplace is only 10% efficient) because active exhaust and/or makeup air is not required (back draft). Wood burning stove can be as high as 6 times more polluting than a diesel truck, and wood fire place is 4 to 7 times more polluting than wood stove.

This is crazy.

Apropos our gas discussion earlier, a recent report examined the impact of gas stoves on indoor air pollution and public health:

https://rmi.org/indoor-air-pollution-the-link-between-climate-and-health/

https://www.businesscouncilab.com/work/covid-19-government-debt-should-we-be-worried/

About $22M in foreign buyer tax has been collected in Victoria since the tax was brought in in mid 2018

Leo, can u provide $ figures for the low, med and high wages?

CCCU, but you are looking at prime+2% or higher.

All these countries had, or have, debts in currencies they don’t control. Euros for the first three and USD for the last. Canada’s debt is in CAD and as a last resort the BoC can buy it. Not saying there won’t be negative impacts, but it’s a different situation.

Got the answer.

That chart is based on Table 14-10-0063, hourly wages by industry from the LFS. The categories are sorted as follows:

Low Wage: <90% of BC Average Wage

Mid Wage : <=90% of Average, <=110% of BC Average Wage

High Wage: >110% of Average Wage

asking for a friend-just curious about any lenders(non-private) out there would provide commercial construction loan for 7 houses project? Thank you

Good news for our forestry sector at least.

Yep constant theme from the builders I talk to. Costs are up both due to materials and lower labour productivity. Productivity will return after the pandemic and some materials are stabilizing like lumber but still net result is likely up after the shock has passed.

Is there such a thing as a construction materials cost index published anywhere?

It’s not the now that issue will be seen, it will be in the 2030’s as the 90’s were the problem from the deficit financing in the 70s and 80s. After the crisis is over there will will be a massive lobby not to reduce deficit spending and that’s where debt to GDP ratios will get out of hand if it carries on perpetually. The problem will be compounded by debt held by the population and by the other levels government. In the end it it is self correcting, but the unfortunate thing is that all services (even needed and expected ones) are rolled back no matter what the public demand is at. Usually at that point, taxes are maxed out to where taxes limit growth and there isn’t any more money to grab. Looks like in Canada we get to see it play out in Newfoundland first. Just ask Greece, Italy, Spain, and Argentina how it went when they were begging for loans, but they were saying they had things they couldn’t cut… the creditors don’t care… So, the the best way to protect social services, autonomy, democratic will and in many ways national sovereignty is to maintain a strong fiscal balance sheet and limiting sovereign debt issues.

Constructions just keep on trucking up….email this morning from company where we usually get our concrete

“Despite our efforts to contain our costs since our price increases 2 years ago, we are unable to continue at those

pricing levels therefore will be implementing a RMX concrete price increase of $5.00/m3 to $8.00/m3, depending on

mix type, effective January 1, 2021. In addition, some value-added products will see a slight increase as well. “

It makes a huge difference to service workers who were exposed to many people daily who were not wearing masks and if they tried to enforce a store-wide mask policy were in fear of dealing with non-compliant customers without a public health order to back them up. The mandatory mask requirement is in part in response to advocacy by the Retail Council of Canada.

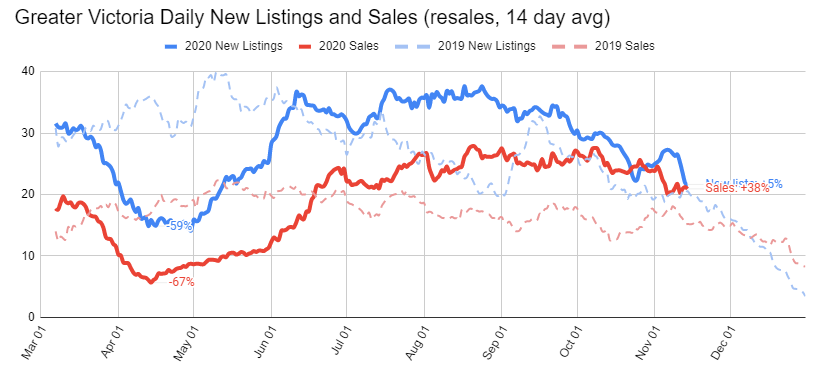

Pent up supply estimate turned out to be surprisingly accurate with new listings leveling out at same as last year.

Meanwhile additional out of town buyers pushed demand much higher than I expected.

CEWS subsidy extended to next June, new rent support for tenants

Not sure but I’ll ask him.

Brendon Bernard an economist at LinkedIn has posted a very similar graph that I’ve reposted here as well

No. “You should only visit a restaurant with people in your household or core bubble. Remember, a maximum of six people at a table”

However if you live alone you can pick a couple friends to include in your household

“People who live alone cannot host gatherings. They can continue to see the same one or two people of their core bubble at each other’s homes.”

It’s all defined here: https://www2.gov.bc.ca/gov/content/safety/emergency-preparedness-response-recovery/covid-19-provincial-support/restrictions

Am I understanding this correct, I can’t have friends over at my place but I can meet my friends at a resturant?

Good moves in my book. I think the hullabaloo over the lack of mask mandates was overblown, but it probably can’t hurt. I see about 90-95% mask wearing when shopping, so realistically a mask mandate is only going to increase wearing by a few percent and won’t make a big difference to spread. But perhaps in some other regions or settings we have substantially lower mask wearing rates and this will help.

New public health order:

Mandatory masks in public places.

Socialize with your household only. (no safe six anymore)

No events or gatherings.

No spectators at sporting events and no travel for sports teams.

Group fitness closed.

Non-essential travel advisory.

Landlords for the most part will be ok on cash flow as when they go refinance their carrying costs will be lower.

Data can always be misconstrued though.

Any idea what’s considered a high wage vs med wage vs. low?

I think it is more likely that rents are flat or up instead of down, because most people don’ts want to deal with moving so they can save $50-100.

I believe the employment data is all from StatsCan

How much do you actually trust jobs data from BCREA?

Thanks rush4life good point. This isn’t my chart it’s from a BCREA presentation, but they are using Rentals.ca data which is asking rents. Not super reliable because it’s a limited dataset but best we have until the CMHC data is released.

So asking rents could be flat/down but CMHC rents could still be up due to turnover

Leo is it fair to assume that flat means down? Anyone who moved that has been living in their place for more than a couple years would likely be paying more – but possibly less then what could have been a year ago? For example i am living in an apartment paying $950 a month but if i moved out and moved back in again i’d be paying $1700 – so i’m up even though if i had timed it wrong i might have been paying 1775 a year ago. So it still brings up the average but doesn’t actually show that prices are down over the last year. Similarly i have a friend who owns at the hudson and the property management co said when his tenant moved out 6 months ago that he had to drop his price (i didn’t ask how much)- in order to guarantee a quick rental. Thoughts?

In BC the shock was record sharp on both the downside and the upside. But recovery from here on out will likely look very different and may reverse temporarily over the winter.

Economic impact still 100% concentrated in the low and mid tiers of employment by income.

Another forecast miss, people were expecting new listings to come online from this shock like they usually do in recessions. So far that hasn’t happened (although condo new listings are up)

Indicators of financial vulnerability low but the data is very lagging so we don’t know what will happen until supports expire and the backlog is processed.

Rents to be about flat this year after multi-year strong increases. Vacancy rate should be up quite a bit in the CMHC report

Josh: Nice to see you online again, it seems like it has been a while.

Point is, a significant number of homeowners now make more $ in equity gains per year than what they earn through employment.

I think that depends a lot on your cash flow. Also, said cash flow depends on the tenants having jobs.

https://globalnews.ca/news/7428631/coronavirus-toronto-condo-apartment-rental-prices

I love it even more that the Canadian government can close down my nonessential business and I have revenue properties to fall back on.

I love that Canadians no longer need jobs as long as they’re invested in real estate!

insert huge unreadable ascii graphic

something something unprecedented never to be repeated interest rate drops

signed,

info.

Not that their forecast was much better. No one got this right.

BCREA economist throws some shade 🙂

Just got some real estate spam in the mail. It’s titled “James Bay Market Watch” and it is packed with cherry picking. They’ve conveniently left out all apartments and only reported duplex, SFH and “split level” whatever that is. It has Average Resale Price as +28.4% in large print but that’s just for September. Year to date is +15.1% in small text. I guess this is normal though. Real Estate professionals have frequently employed more heinous sales tactics.

https://www.theglobeandmail.com/investing/personal-finance/young-money/article-housing-affordability-is-one-more-thing-the-covid-19-pandemic-is/

Pretty interesting to see what happens with all the cash. Will it be spent and lead to inflation, or simply be hoarded (and then the same people will complain when it comes time to raise taxes).

Nice.

Rare Garry oak meadow to become Victoria’s newest park

https://vancouverisland.ctvnews.ca/rare-garry-oak-meadow-to-become-victoria-s-newest-park-1.5194497

https://financialpost.com/news/economy/canadian-households-and-businesses-sitting-on-170-billion-excess-cash-hoard-cibc

+1, have used him on last 3 new builds for structural engineering.

Thanks “Inspector”…..I’ll follow up on that lead. Much appreciated.

Derek, there are lots of good engineers of course but I have dealt with Steve Malkow of Farhill Engineering and found him it be very good, sensible and reasonably priced.

Yes, for the most part.

The reason the developers like “incentives” is then it doesn’t appear like they are dropping prices which can be perceived negatively by purchasers that have previously bought.

Thanks Sidekick…. I agree…… I often wish I had an Amish crew at my elbow.

I like their practical ways and how they hoist a large beamed barn up with such ease and simplicity. Common sense structural integrity and their work lasts for generations.

I’ll watch this posting and see what transpires.

Maybe Marko or someone else can confirm but don’t mortgage incentives – like free strata – actually reduce what the banks will lend on thereby reducing your mortgage similar to if they just dropped the price?

You might not like the reply you get from a structural engineer (they tend to over-engineer by quite a large margin). Might be better to use a good contractor. There are tables which can be used to determine sizing shorter spans.

Thanks former, that makes sense.

Anyone know of a structural engineer who might give straight forward advice on taking out a three foot “very short section” of beam in a typical basement of an older home. ( The width needed would be a bit more than Two joists wide)

The beam is a horizontal support beam on posts. (It’s a Small house…… bungalow.)

I want to do it right and not take any chances.

I’ve seen it done where the joists are cut and an I beam inserted to span the gap and the the joists are hung onto the I beam with proper hangers and a support beam attached below. Seems very doable and logical.

I’d like a suggestion for a structural engineer who might give advice for a reasonable fee. The house is in Victoria.

That house is hideous, they sure built some ugly stuff in the 80’s.

Sales price can be rolled into the mortgage. Saving on Strata can help cashflow and free up money to buy furniture and appliances for example.

That’s putting a good spin on it.

Over 700 new cases today and 11 deaths. Over a hundred active cases on the island. This seems to be picking up speed in a rather worrisome way.

Here is a good SFH investment property for an armature landlord/. https://www.realtor.ca/real-estate/22595460/1560-brodick-cres-saanich-mt-doug

should be cashflow positive with 20% down.

Could be compressor noise that an acoustic isolation jacket and/or heavy insulation can reduce some noise, but most of the time it is not enough to satisfy the customer completely.

I agree, absolutely. Just surprised to see the lower island doing better than central (again, so far), definitely thought it would be more down here before I looked at the numbers.

My daughter is an RN and works at Burnaby General. A large fire broke out there yesterday and something like 16 firetrucks attended.

On Wednesday the 11th, this was her text to me:

The facility here is on outbreak…the worst in the province for the last two and a half weeks. So far 36 patients, 16 staff and four deaths…..

It is extremely chaotic, disorganized and staff are very stressed; often breaking down at work. We are being tested regularly though and I am fine right now.

QT thanks for your suggestion but we have a hedge between the houses but it doesn’t cut the ambient low pitched humming noise. Agree about some people having a noise sensitivity, which my wife may have but I do not, and I’m still am affected by it.

The podium one bedrooms sold out right away but they had one bedrooms in the tower months into the pre-sale at below 300k.

Exactly. If we’re not careful we’ll have hundreds of cases like the lower mainland which will threaten the economic recovery very quickly. Already schools being shut down on the mainland putting many parents out of work temporarily.

James: The numbers are not huge, but the rate of increase is a bit concerning.

Island numbers are actually decent for lower island (so far). Only 30 active cases in lower island, 50 in central, and 19 in the north.

Yes, but it can be expensive and may not be enough, because some people are more sensitive to ambient noise than others. Is there a possibility for you to built/plant your own evergreen shrubs barrier or hedge on your side of the property?

2xx – 70 Saghalie Rd, the Encore, 1 bed 1 bath, 604 sqft askign for 515k, ie.e $852/sqft. I regretted that I did not buy into the pre-sale on this one , it was sold out within day 1-if my memory servces me correctly.

a few realtors brought them I believe per the sales lady.

Yep, rough IRR on your condo presale example was 22% vs the about 16% for the average.

True but that is 100% equities in a 10 year bull run of the markets. Now what’s the 30 year avg return? Condo’s of course at 4.7% have done a lot worse, but leverage is what makes the difference.

Important to point out that not all condos are alike. In my opinion if you want the best return you have to go super small (studios or one bedrooms). For example, $280k studio you can get upwards of $1,400. There is no way you are getting $2,800 per month for a $560k unit. Many other factors favor small condos in terms of return.

Secondly, you’ll get much better return long term out of a SFH with suite, or a triplex, etc. over a condo. The reason I stick to condos knowing the return isn’t as good is I just don’t have time to deal with a house; however, if you are a tradesperson, handy or semi-retired or fully retired SFH investment might be a better way to go.

Thanks Intro for the update.

https://www.cheknews.ca/bc-covid-19-nov-16-718191/

James: I wonder where we will be a month from now on the island? How are the island hospitalizations doing?

40 new cases on the island over the weekend.

Victoria is only 100 km away…

https://finance.yahoo.com/quote/SPY/performance/

SPY trailing last ten years 12.91%

just noticed the total number of foreclosures is increasing per Vancouver court. I wonder when it hits YYJ….