Dusting off the crystal ball

If there’s one thing I’ve learned in a decade of analyzing Victoria’s housing market, it’s that you can’t predict the housing market. If you’re going to try to do that, you better learn to be humble. Similar to the stock market, there’s no shortage of people that will tell you where the market is going with certainty and with many very convincing arguments, but much of that is just our left hemispheres trying to rationalize a highly random process.

That doesn’t mean that there is nothing to learn about the market. One thing we’ve seen fairly consistently in the stock market is a correlation between medium term returns and the price of the market. When stocks are expensive relative to their fundamentals, their returns suffer and vice versa. That’s most famously illustrated with the Case Shiller CAPE ratio, and Brian Chang does some interesting work for the Canadian market.

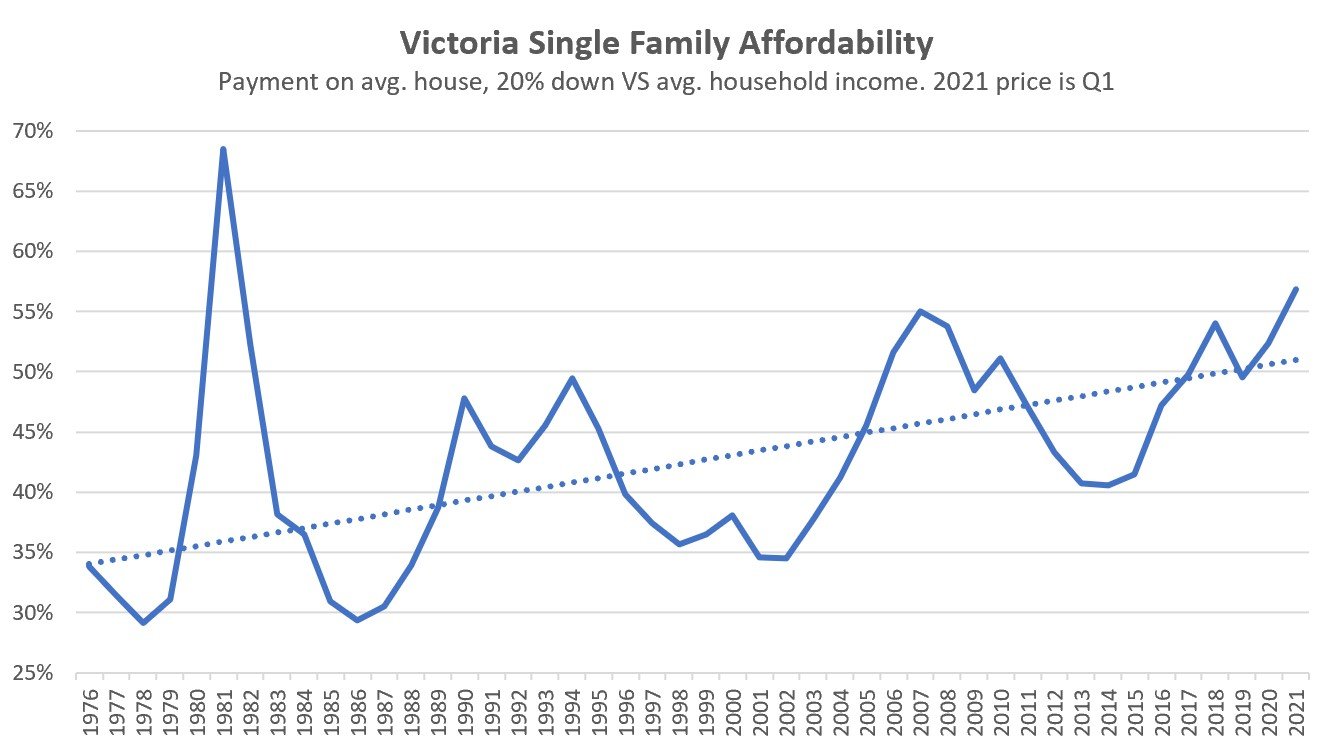

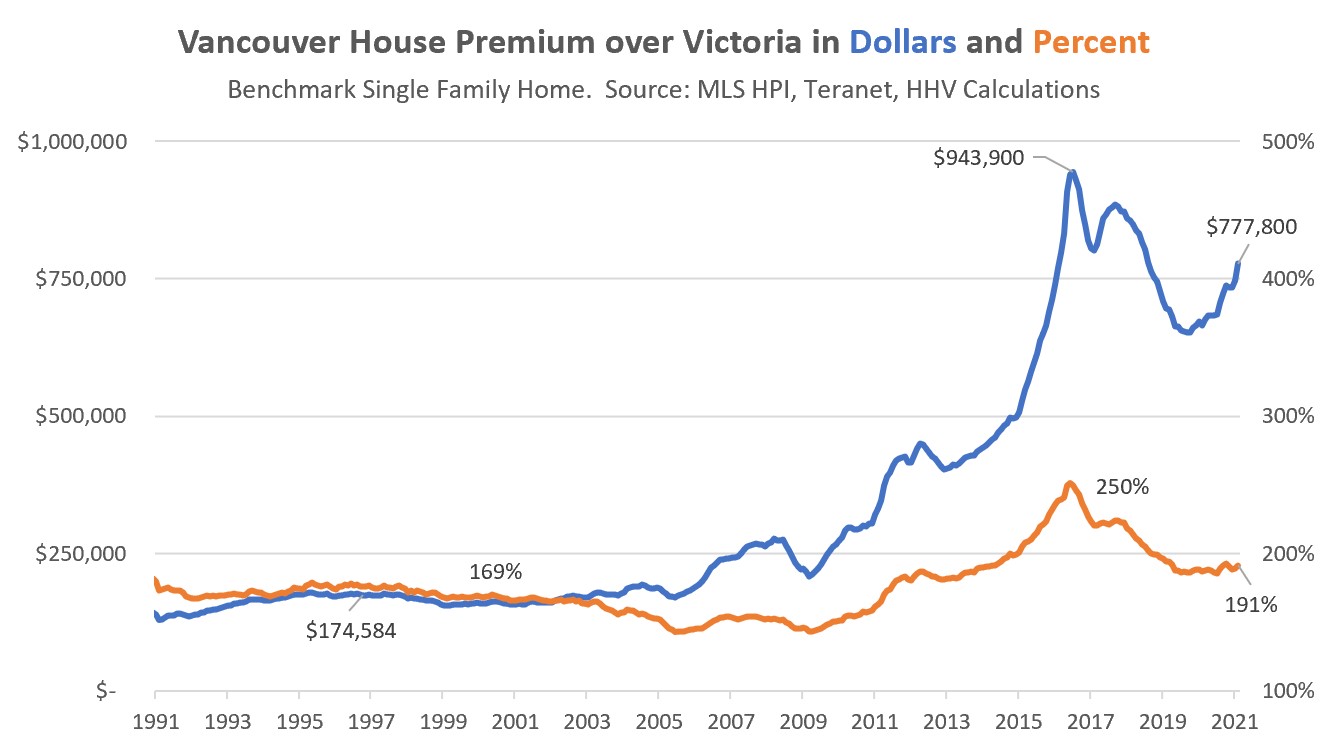

Many people have tried to use price/income or price/rent as real estate fundamentals, but that has failed spectacularly as a method of predicting overvaluation or the direction of prices as those measures have continued to spiral upwards as interest rates dropped. The closest thing to fundamentals that I’ve found is affordability: that is the percentage that the average mortgage payment takes up of the average income. I’ve written about that many times on this blog, most recently to conclude that although current price escalation has pushed affordability to strained levels, it isn’t in what I would call bubble territory thanks to low rates. Here’s the current affordability picture, using the year to date average for prices in 2021.

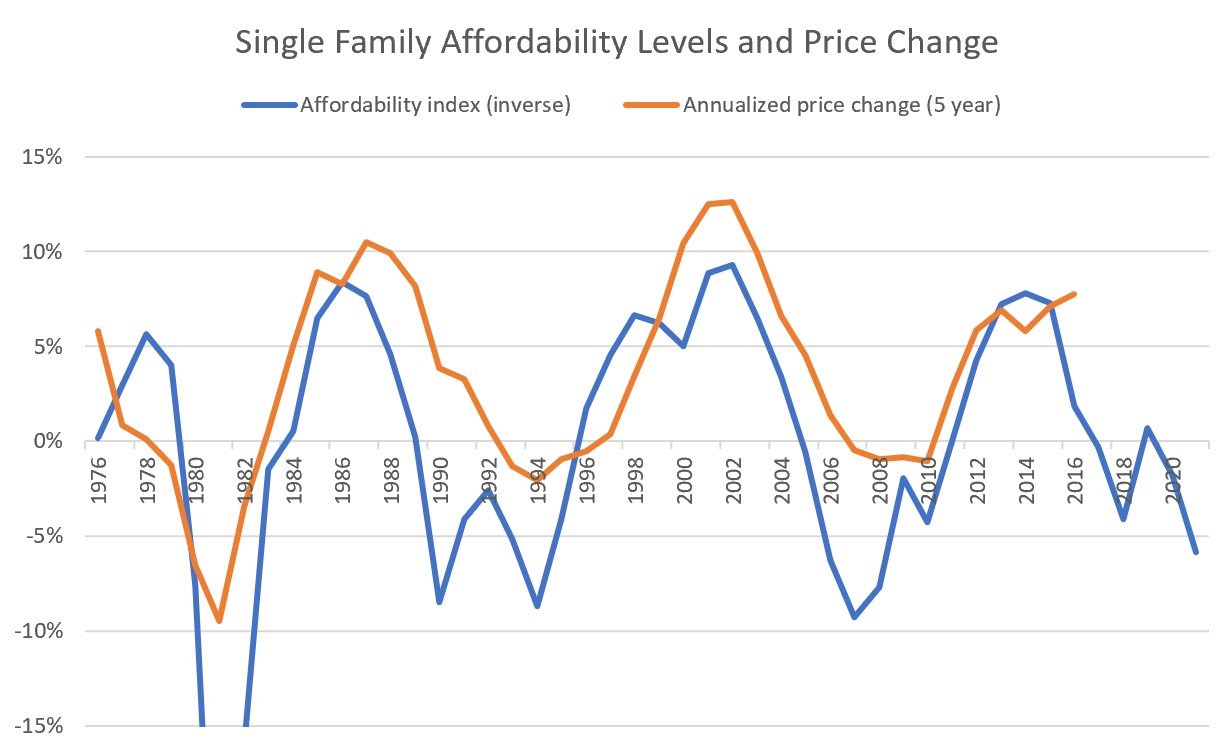

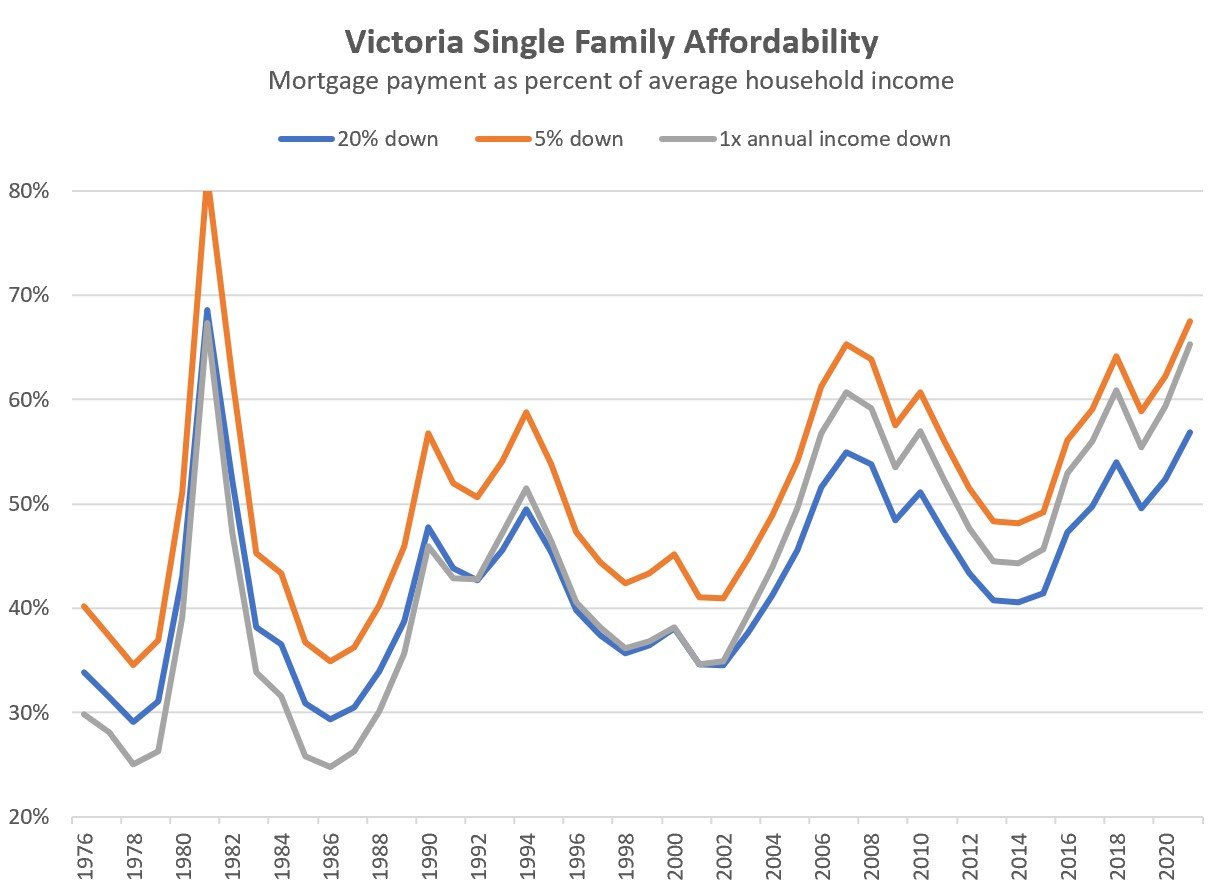

The long term trend of deteriorating affordability (dashed line) is not a fitted linear trendline, but rather an eyeballed overlay and shows the long run deterioration of single family home affordability in the city due to gradual densification. Because of that long term upwards trend, we can’t simply take affordability levels and related them to price changes without subtracting out that trend to create an affordability index. Below I’ve done that and added the 5 year annualized price change for single family houses in Victoria (inflation adjusted).

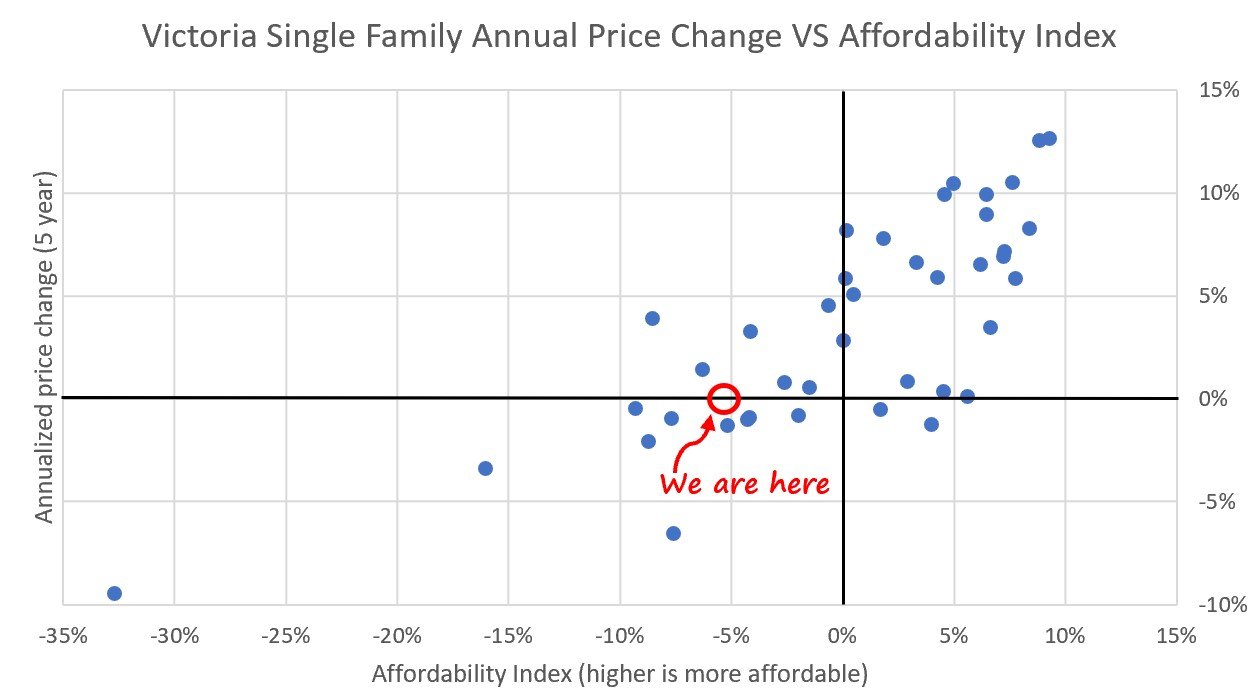

As you can see, when affordability is good (blue line high), we see strong positive price appreciation. When affordability is poor we see flat or negative prices. Another way to look at this is on a scatter plot.

The relationship is not super tight, but given past behavior of prices relative to affordability, it seems like current buyers should expect low medium-term returns. However a few things to keep in mind:

- Past performance does not guarantee future results. This is a pattern from the last 40 years, but that doesn’t mean it will go on forever. Pandemic economics especially are very strange and I’ll bet we aren’t done being surprised yet.

- Data is limited. 40 years may seem like a lot, but it’s only about 3 real estate cycles, so the exact run of any trend is uncertain due to limited data.

- These are medium term returns annualized from a 5 year price change. That is currently we’d be looking ahead to 2026. Prices could very well continue go up in the next year as market conditions are still pointing strongly upwards.

- It all hinges on the inputs. Rates could rise which would deteriorate affordability further, but on the other hand we could see a jump in incomes as well. Between 2016 and 2019 the average BC household income (206-0011) increased by $9000 or 11% which helped affordability.

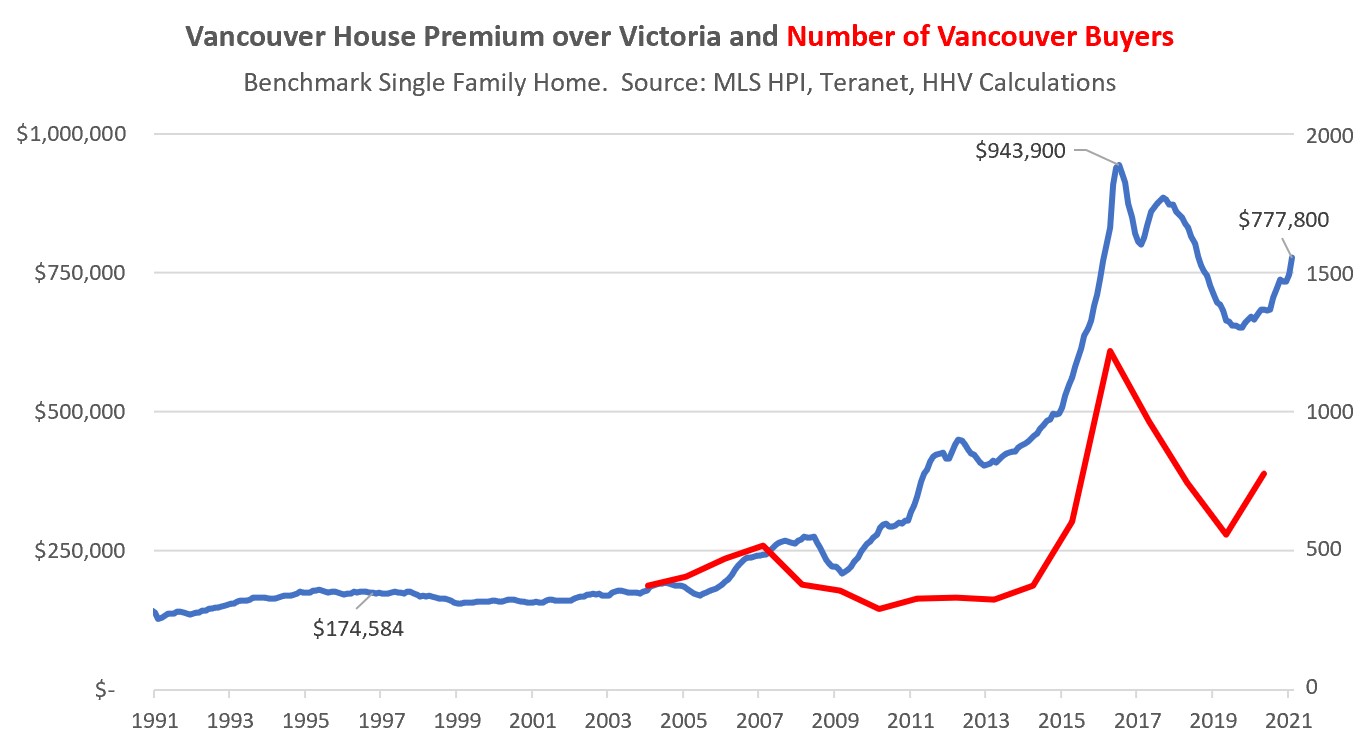

In the last couple downturns, we had lower rates come to the rescue to restore affordability without a substantial price drop. Rates likely won’t be dropping much this time around which could prolong any correction. On the other hand we still have an elevated Vancouver premium that may keep out of town buyers higher and prices more stable.

As usual when we shake the magic 8 ball of housing predictions the answer is at best hazy, but if you’re waiting for clear you’ll be waiting forever.

New post: https://househuntvictoria.ca/2021/04/12/whats-the-outlook-for-condos/

Totoro,

I can’t help but wonder, is there’s a difference between inflation and currency erosion? Are prices really going up or is the value of our money eroding?

It will if you put 200k down on a 1 million dollar home – which now seems to be the average SFH price in the core and 20% is a pretty normal down payment.

In seven years the home will be worth $1,605,781.48 if there is 7% appreciation.

This is 806k in equity rounded up, not including principle paydown which, at 1.7%, would be an additional $238,786.46.

This means that you have turned 200k into over a million in seven years tax free and less expenses that exceed renting and LOC.

This is what has happened to some homeowners over the last seven years.

Doesn’t mean that this is guaranteed to continue.

Your math is way way off here.

It won’t even double in 7 years @ 7%.

Thanks “Umm…really” !

760k

Sure, do the math with whatever rate you feel appropriate. Leo thinks it is going to be 3% going forward. That puts you at 430k plus principle paydown after 7 years on 200k invested. Annualized return of 12% tax free on the appreciation alone after seven years, 23% return if appreciation averages 7%/year..

I said 7-10 years and 7% is the long term average in Victoria.

Totoro, that is a cherry picked 7 years, you could have picked 2007 to 2014 which would show a different result. I would circle back to Leo’s affordability chart as that seems to be the best indicator of how local prices, incomes and interest rates behave together over time.

You are looking back at a period of the largest decline in interest rates ever.

The odds of winning the lottery (lotto max jackpot) are 1 in one in 33,294,800. The odds on missing out on appreciation have been zero if you were able to stay invested for seven to ten years in Victoria and 100% if you never bought.

In fact, the odds are that you would have had 7% compounding appreciation over time had you bought. In seven years at that rate the 200k down payment turns into 806k of equity plus the principal pay down.

If you are looking at odds, I’d add the three bucks to the house down payment.

Judging by the pattern in the graph above, is it not likely that house prices will reduce in the year ahead? Or am I reading these graphs wrong? Or, will the pandemic lead to a steady rise in prices all year?

As a buyer, it would be great to hear some points of view on this question. I am not sure whether buying something mediocre now to avoid paying and addtional $50,000 or more in the months or year ahead.

If you are underwater you are almost certainly negative cash flow on renting out. House price declines rarely happen if renting out is cash flow positive.

Because you don’t have the down payment. Also because the lender has an issue with all the money you owe on the first house.

“you lose all career mobility due to being underwater”

Don’t agree with that, you can be underwater and still rent the place out and make your mortgage payments if you move somewhere else for a new job. You may not be cashflow neutral or positive but I don’t think the economics are that terrible provided the rental market is still in tact. You have a paper loss in the same manner as the paper gains everyone who bough before 2021 currently have, doesn’t mean much until you cash out.

Unless you are talking about not being able to buy another house if you move because you don’t want to sell at a loss on the current house?

It works “If you are in an appreciating market”.

Amongst steep competition that is without a doubt the biggest “IF” seen on the forum to date.

It also “works” if you win the lottery but neither of these are certain. In the case of missing out on the latter you lose three dollars. In the case of missing out on the former you lose all career mobility due to being underwater, lose all your down payment and (as many, many cash- stressed Canadians will tell you) lose your marriage.

Of course it is, my comment was more tied to the excessive consumer debt people are maintaining while pursuing the housing option. As well, the singular focus of all resources on a singular asset class elevating risk.

Unfortunately, the understanding of good and managed debt seems to be disappearing in the belief that a person must get in or miss out forever. The reason and planning part of carrying debt seems to eroding in a belief that all debt is how to get it done.

Shouldn’t be sacrificing your other low tax gain opportunities; housing should not take away from maxing your TFSAs or RRSPs, (these are only small sums annually that can really help down the road) there is a need to keep things balanced.

It depends on the situation. In the end a person is responsible for their failures and successes and nothing else. People love to claim success coming from their innate special abilities and hard work, but love to blame an unfair system or being cheated as the reason for their failures.

The largest intergenerational wealth transfer in human history is already happening. The biggest threat to it will be cash strapped governments wanting to get their cut and that will really give the gaining generation a sense of inequality.

“Hand written full page note in my mailbox. Telling me about themselves and wanting to know if we would sell.”

Hey! I just dropped off a letter yesterday asking if someone would be interested in selling their house! I wonder if it was you GWAC?

Some points for everyone’s consideration:

Professional Flipper – I wish! I’m just looking for a nice family house. I know what areas I want to be in, and if you got a letter from me, you’ve got a nice house! I’m looking for something unique and sadly those kinds of houses are few and far between. The “2.0 kids + dog” was meant to try and demonstrate we’re not professional flippers.

How do we know what it looks like inside? – we don’t. The letter was just to start the discussion in case someone was interested.

Appealing to emotions – No not really, just hoping that selling was something the homeowner was thinking about. I think i’m pretty well informed on what realistic prices would be and looking to buy at market price, a realtor could be brought on at any time to help, but that would just include commissioning.

I know people who have had success with this approach, and i thought why not give it a shot.

Cheers

It is just math. It is odd to me that people don’t do the math. Lots of good spreadsheets and calculators out there make it easy. You need to project forward with various scenarios and then do the same with other times of investments with the capital you have.

Because good debt, well-managed, is.

Not the only, but the lowest cost debt with the most tax advantages and least work required – plus you have to live somewhere and if you are in an appreciating market the math works – or it has historically. Doesn’t everywhere.

Never saw it as a sacrifice, but an opportunity.

Compound interest and appreciation is your friend over the long-term with housing and most other investments. Unfortunately, this has led to intergenerational inequality of access to housing in our market.

https://www.cmhc-schl.gc.ca/en/media-newsroom/speeches/2018/on-housing-wealth-and-intergenerational-inequity

I think you may be attributing some else’s statement to me or just making up something that I didn’t write. There is a huge difference between skilled trades (Red Seal Tradesmen) and and the uncertified labour that work off the certified tradesmen ticket. However, this market is difficult for almost any income level from professionals, trades, labour or anything else. No matter what you do, if you are fit mind and body, there are always ways to find more money, but with the current cost escalation, should home ownership be what you are chasing (in this market)?

What surprises me is that how many people believe that debt is a gateway to wealth and that home ownership is a must or the only to move forward in wealth generation and sacrificing all other venues of wealth generation to do it. It seems an odd mindset that people have by somehow putting themselves further behind, they will somehow end up ahead. I guess it’s a good excuse not to save or do anything else for financial stability, but those people are likely being set up for an even harder long term outcome.

Yes, I would like to own a home in Victoria, but no, I am not going to blow my families finacial planning to do it. So, I will only purchase a home here if it’s workable in my plan. So, because of that, I have a Victoria “out plan” whereby I leave Victoria in 3 years (my work ties me here until then) when my employment becomes more portable. That way, unless the housing situation here becomes workable here in my plan, I can just relocate and gain that SFD lifestyle choice for my family that doesn’t apply too much risk to my financial diversity.

For some reference of pay of federal government trade workers:

Ship Repair Group: 40 hour work week. Monday through Friday.

Trades Helper: $15 – $29 per hour ($60,320 plus extras below)

Most trades: $37.47 to $40.57 per hour $84,386 plus any pay and allowances below

Electronics techs more.

Apprentices: $19 – $39 per hour ($81,120 .. final year) plus allowances below

Lead Hands, Charge Hands & Supervisors: $45 – $50 per hour up to $104,000 per year.

Types of Leave: Annual leave ( 15-30 work days per year), Stats 12 days per year, special leave – death in family 7 consecutive days plus 3 days for travel, Maternity allowances & leave, Parental Leave, Education leave without pay up to 1 yr…can be extended, Career development leave with pay, Examination leave with pay, Overtime, Severance, Coffee Breaks, Overtime Meal Allowance, Call back pay, Dirty Work Allowance, Height Pay (extra $25% of hrly pay pro rated), Sea duty pay, Transfer at sea pay, Instruction allowance pay, Shift premium pay (week ends, nights extra 1/7th – 1/5th of hrly pay, Acting Pay.

Marko, how is the rental market in Croatia? How expensive to rent a one-bedroom or two-bedroom apartment? I guess Croatian have the mentality of owning than renting?

The homes are so unaffordable for the locals. There must be lots of homes owned by foreigners! It is such a beautiful place… The cost of living there seems still lower compared to here or in the rich developed countries.

“The only ones that are trying to get into the public sector, could not hack it in the private sector.”

All I am just saying is that worker bees in private sector trades aren’t paid as much as “Umm really” thinks where they can all afford SFH currently, majority of trades workers working in the private sector won’t become successful entrepreneurs, so they look around and think well maybe I should work for the public sector where the wage are similar but better job security, benefits, vacation and DB pension.

Vic Landord, do you think it is likely that a carpenter (none owner) working on a project for Expansion Properties would turn down a trades job from say the City of Victoria?

In bigger cities, private sector trades could provide a better career path because of large companies like PCL, Ledcor, Graham etc. but Victoria there aren’t that many large players and career paths at smaller shops are limited so I think most worker bees are attracted to the public sector (work the 35 hours and maybe do some cash jobs on the side)

March 16, $1.302M

“I’m confused. According to ks112, some houses in Gordon Head dropped ~$100K in the period after the previous boom and before the current boom.”

Why is it so confusing? Prices dropped from late 2017 until early/mid 2019, Leo already made a chart on that already.

I’m confused. According to ks112, some houses in Gordon Head dropped ~$100K in the period after the previous boom and before the current boom.

That’s the government’s job. And if that’s unaffordable to government then it needs to raise taxes on the person described above.

I co-worker of mine got his house this way. He wanted to move to a specific area (close to inlaws after having kids). There was nothing for sale at the time, so he wrote some letters for the houses he was interested in. Just so happened one of them was close to putting it on the market and they made the deal without Realtors involved.

He is still living there over 10 years later.

“The only ones that are trying to get into the public sector, could not hack it in the private sector.”

Couldn’t hack the low pay and worse working conditions? Hacking it in the private sector means owning your own business. Working for the man isn’t going to get you ahead.

Perhaps a front for a professional flipper? I get lots of these “letters” written in a handwriting style font, maybe the real thing is the next step.

As we’ve discussed previously, even saving over a year’s income like I did won’t make enough difference to get you into the market today.

If saving gets you nowhere, why save? I’m not at all surprised by people following a debt-fueled lifestyle today. And it’s the people buying RE who are leading the pack.

Could you please advise the sold price for 1856 Hillcrest Ave? Thanks!

Monday.

Sales: 327 (up 343% from same week last year 🙂

New lists: 499

Inventory: 1416 (down 38% but finally starting to build)

New post tonight

“Most try to get into public sector trades work (i.e. the city, BC transit, BC Ferries, etc.)“

The only ones that are trying to get into the public sector, could not hack it in the private sector.

I personally think that appreciation rates will slow down dramatically due to no longer dropping rates.

Long term it should still be positive for detached housing though. Just more like 3% a year instead of 7%.

Condos I don’t know. They should remain constant in affordability terms (so basically match income growth with flat rates), but it depends on municipal supply response and construction costs.

What’s the market for a graduate degree in Victoria? Just hunting jobs in the government? Are their degree’s anything useful or just another Humanities MA. I remember going through resumes not that long ago and I had a lot MAs, but surprisingly a large number without applicable experience (to their MA or the job they were applying). For some reason they followed up university with more university instead of getting experience (excluding engineers, doctors lawyers and etc.. from this). Sounds like that lovable dumbass might be the smart one of the bunch. There is a thing of people being educated beyond their intelligence, it tends to give them a sense of arrogance, superiority, elitism and a lack of understanding why other success eludes them.

Yes, it was worth it. No regrets on the investment. It was a 4 year professional degree from UBC ($15K per year in tuition, $10K per year living costs in YVR) and parents weren’t in a position to help. I’ve had good income since I graduated, which is why after paying off debts and trying my hand at a failed business I’m still financially ok. Just without any real estate.

Thanks for sharing. Do posters here still think this will apply moving forward? Max out the mortgage, minimize the down payment, and let central back monetary policy work it’s 2% magic?

Patience, planning, saving and avoiding debt were part of the old ways. If you’re not leveraging up, you’re falling behind. As someone with a healthy bank account and investments but no real estate, it’s soul crushing to see where responsible spending has gotten me.

”

‘

Yup, the rules seemed to have changed in the last 15 years, either out of necessity or by choice. I remember someone telling me over 20 years ago, if you have a solid profession buy as much house as you can and keep extending amortization as long as possible, don’t worry about the mortgage, inflation will take care of it over 30 or 40 years. Although was easier when average home was only 2 or 3x solid house hold income back in early 2000.

and written full page note in my mail box. Telling me about themselves and wanting to know if we would sell. Is this what has become of our housing market?

Sad situation out there for buyers.

‘

‘

This happens in all kinds of markets, I know someone who bought a house this way and someone who received a note and ended up selling this way 15 years ago.

I have some buyers that were waiting last year for prices to drop and that did not materialize. Now they are worried about being priced out and jumping in. Others, just life. Finishing medical residency readying to buy a house, received large inheritance, saved up for downpayment, etc.

“Hand written full page note in my mail box. Telling me about themselves and wanting to know if we would sell. Is this what has become of our housing market? Sad situation out there for buyers.’

How the hell do they even know what your house looks like on the inside or what the lay out is?

Marko, do you every ask your clients why they are buying now instead of last summer or anytime in the previous 2.5 years? Why now?

I know some people in trades and I don’t think the worker bees are getting that much $, maybe 35 bucks to 40 bucks an hour after trade ticket with no pension and probably minimal benefits. Most try to get into public sector trades work (i.e. the city, BC transit, BC Ferries, etc.)

I don’t get the letters/notes etc., on million-dollar homes. Basically, trying to appeal to emotion on something less than 1% of the global population can afford. If I was a seller and I didn’t need the money I would still, try to get top dollar and then I would just donate the money to people who actually need the basics in life. I am sorry but SFH in the core versus townhome on the Westshore is not life or death.

Also, what is up with everyone writing into their letter that they have 2.0 kids. Seller should discriminate against the other couple which may not be able to have kids?

Fair enough! Yes, that was a great World Cup run.

Yet a massive shortage of trades and huge surplus of English degrees. Reality is people would rather be sitting in a cushy government job than risk falling off a three story house installing trusses as a carpenter.

Although, I do want to say I aware of the absolute craziness of talking about the magical median as something put up or sacred.

Median plumbers, electricians, carpenters, and tradespeople all make enough to live in sfh in core victoria. And they can’t be outsourced. And the barrier to entry in most of those fields is not high.

I also have staff who have staff paid $25 an hour for their graduate degrees. But my plumber (who’s a lovable dumbass) definitely makes more then any 4 of them combined.

Oh yes ks. You are completely right. Ultimately times change and what is affordable is not. Median household income 10 years ago could easily have purchased an sfh in core victoria. Today, no more. However no amount of bad advice for out of date housing strategies is gonna help here.

I kinda doubt a 30 something yr old with two kids making 50% more then median is really going to cash in on advice like: have you tried being paid more? Or, did you know banks have checking AND savings accounts? Please, there are reasons people do the jobs that they do.

And re:priced out. No one posting here was worried about being priced out. Leo’s blog commenters are not avg people. People were priced out when a house was 8x median income in 2017. It’s just those people are all poor or working class. No one cares about poor people. Now the list of poor people includes a large percentage of the long term employed and educated as well.

Wow, that is a lot of debt – like five times the average in 2009. Was it worth it?

Hand written full page note in my mail box. Telling me about themselves and wanting to know if we would sell. Is this what has become of our housing market?

Sad situation out there for buyers.

Newhomeowner, I think median/average income is useless now when talking about detached home prices. It is about the absolute number of people with high income jobs here versus the absolute number of SFH’s and one of those numbers is static.

I would caution that sentiment changes pretty fast, just go look back at the posts in late 2018/early 2019 on this forum. no one was scared of getting priced out and everyone was posting examples of bag holders that bought in 2017.

LoL, look at all these boomers telling kids these days to layoff the avocado toast.

I know most of you only know millionaires, but median income in BC for someone between 35 and 44 is $53k and for a 25 to 34 year old is $43k.(statscan 2019).

When an average house is actually 12x the income of your median homebuyers. There’s no planning. Just get into whatever you can as fast as you can and hope appreciation and income work itself out.

What kind of psychopath thinks that diligence will allow someone who makes 53k a year to save a down payment of $200k?

My house makes 160k/yr. my townhouse in colwood and childcare alone accounts for 68% of our take home income. Add in water and electricity and were over 70%.

(Edit: by house I mean my hh income is around 160k per year. My house (physical home) appears to have made $50k in 2018 and 2019, and about 200k in the last 6 months).

I don’t really like to bitch. I’m pretty lucky and upwardly mobile. I have great faith that my best earning days are far ahead of me. But, be real guys. My staff have staff that own homes that are completely unattainable for me. That’s just reality.

As someone who graduated with 100k of debt in 2009, lived like a student for an extra 5 years after starting my career, paid off my debt and delayed gratification but who can’t afford to get into this market… I firmly believe the rules of personal finance have changed.

Patience, planning, saving and avoiding debt were part of the old ways. If you’re not leveraging up, you’re falling behind. As someone with a healthy bank account and investments but no real estate, it’s soul crushing to see where responsible spending has gotten me.

went to a couple of fast food places this weekend for some treats, lol inflation is definitely very apparent there.

Patrick, soccer is the only real sport. Nothing else matters 🙂 Serbia would trade 10 Djokovics for a decent soccer team.

“My point is you would think a poor country where everyone lives in condos would suck at sports, ”

‘

‘

Actually the book The talent code, says more athletes come from places where the conditions are actually poor and where the focus is more on getting the work done rather then on nice new conditions.

I think Canada is a bit of a unique place in that for the most part until recently if you are a talented male athlete you play hockey almost without exception. This has been changing over the past 2 decades, think of the 76 olympics when we won no gold medals to now when Canada places quite high up. I would still say most of Canada’s best young athletes still play hockey though.

In other words, it probably won’t happen in our lifetimes.

Good rant. Lack of self-accountability does have its consequences.

A lot can still afford it, but believe they should be able to afford it all at once. Gone is the patience planning part of it. A lot of the consumer culture has moved a lot away from basic principles of monetary success. Some wonder why they have no cash at end month or end year, but they buy $400 sunglasses, $1500 cell phone (some extra on that smart watch), $500+ a month in subscription services, newest seasonal fashions, 2 vacations in a year, trade a 2 year old car in on a Tesla (convincing themselves it’s the environmental thing to do), only servicing credit card debt instead of paying it off, $8 a day on coffee & $30 on lunch while figuring it’s income inequality keeping them behind. People don’t like looking at themselves and how their own actions/choices contribute to the situation they find themselves in.

Yes. Croatia is a great country in many ways. And a great sports country for its size, especially for men’s soccer and men’s basketball. But it doesn’t come close to outranking Canada for sports world rankings overall.

If we include team sports that both countries play, … soccer, basketball, volleyball, rugby, field hockey, that’s 5 sports for men/women so 10 in all.

On my count, I get Canada higher ranked than Croatia for 8/10 sports and Croatia for 2/10.

And If you add in Summer and Winter Olympics, that becomes 10 higher rankings for Canada vs 2 for Croatia

Croatia is higher ranked than Canada for only these 2 …

– men’s soccer, (Croatia ranked 14th world, Canada 70th)

– men’s basketball (Croatia 14, Canada 21)

Canada has higher ranking than Croatia for the other 8

-women’s soccer (Canada 9th, Croatia 52nd)

-women’s basketball (can 4th, Croatia 31st)

-men’s volleyball (can 10th, Croatia 54th)

– women’s volleyball (Canada 18th, Croatia 45th)

-men’s rugby (23rd vs 44th)

– women’s rugby (3rd vs no ranking)

-men’s field hockey (10ths vs no ranking)

– women’s field hockey (14th vs no ranking)

Canada is also higher medal count for winter and summer Olympics

– Winter Olympics 2018 (Canada 29 medals, Croatia 0)

– Summer Olympics 2016 (Canada 22 vs Croatia 10)

The point being… well no point really, it’s just fun to talk a little sports once in awhile 🙂

——

Sources: Google, type ranking

I don’t know no one in Croatia is starving and government is too corrupt to have substantial $ to promote sports. My personal impression is people in Croatia like sports, myself included, and living in a condo doesn’t prevent kids from excelling at sports or anything else for that matter.

The whole yard thing in my opinion is a north american cultural thing as is tv room, guest bedroom, garage, etc. We’ve had the resources in the past where the average family in north america could afford this stuff, now they can’t and everyone is upset.

I wouldn’t think that actually. To the contrary, economic disadvantage often motivates young people to excel at sports that don’t require a lot of up-front investment. Look where many of the world’s top soccer players come from. And what group in the US produces so many basketball and football stars?

And Eastern Europe has a legacy of communist-era promotion of sport. I don’t know how much that matters in Croatia today, but it certainly does in Russia and some former East Bloc countries.

Well yes, most kids in Canada only speak English or at most two languages, they should be pro at reading. In Croatia it is rare that I meet someone under 30 yrs old that doesn’t speak great English and very common (much more common than someone here speaking French) for people to speak German in addition to Croatian/English.

As for Math that is a baffling one, but I will accept it.

The problem is you can’t afford a condo in Croatia, that is why people leave. A decent condo in Zagreb is 500k CND -> https://www.njuskalo.hr/nekretnine/baboniceva-vmd-novogradnja-luksuzan-3s-stan-loggiom-vrtom-garazom-oglas-33450221

Average salary is $15,000 cnd/year. If people could afford a 700 sq/ft two bed condo no one would be leaving.

Well, I guess the good thing is that OFSI gave us a date for peak madness on June 1st. It should be an insane 6 weeks as people try to get ahead of the new rules. I imagine a few others are in the same boat as me with a climbing rate (my current fixed pre-approval done at the end of May and my broker has said the new approval is a half percent higher) causing some not to want to pass up their lower rates and jumping whatever is out there. The ones that have waited to market their properties might be in for a bit of a surprise as their peak price aspirations might need to be adjusted as we enter June.

Population of Canada 37.59 million, rich country. Population of Croatia 4.076 million, poor country.

Worlds Five Most Popular Spots

i/ Soccer; Croatia>Canada, not even close. It would literally be a 10-0 game.

ii/ Cricket; neither country is big into cricket.

iii/ Basketball; Croatia>Canada, it would be a close game but Croatia has historically performed much better on the global stage.

iv/ Field Hockey; neither country is big into field hockey either.

v/ Tennis; Croatia>Canada, this would be close right now as Cilic is hurt and Canada has Bianca but historically Croatia has been much better (Ivanisevic, Cilic, Iva Mojoli, etc.).

And then everywhere Canada has an advatnage (Ice Hockey) so does Croatia (Waterpolo), etc.

My point is you would think a poor country where everyone lives in condos would suck at sports, but it doesn’t. People aren’t hard done by having to live in a condo, imo. Where is the evidence that kids living with a private yard are healthier, smarter, etc.?

Ks112 oh yes. It’s a bit tricky ATM because we’re sharing a parental leave. The one of us who makes less than the other and has more ability to increase in the short term is on leave with top-up, so cannot work on EI and also can’t change employers but once that’s over will be looking for a salary change. Not a lot of hiring going on where we each work anyways but that’s starting to change as the pandemic drags on.

I hustle kids clothes and toys on varage sale and have stopped eating avocado toast.

Sometimes they say the quiet part out loud. No decrease in prices will be tolerated because that might threaten Property Transfer Tax revenues

Cadbro, have you or your partner been actively trying to look for better paying jobs or additional sources of income? I understand that is hard with kids but hustling to get ahead is a must in a capitalistic society.

Ottawa has been building lots of townhouses for years, and that’s in a market where SFH has been much more affordable than in Victoria. Perhaps one reason is that most of them are individually titled – no strata. I don’t understand why more such townhouses and duplexes aren’t built in Victoria and elsewhere in BC.

https://www.minto.com/ottawa/new-homes-condos/news/Buying-a-Freehold-Home~1257_1483.html

It’s hard to define “professional” athletes to count them, but here’s the results for the “amateur” athletes

Olympic medals by country

Canada 501 (137 Gold)

Croatia 44 (15 Gold)

https://worldpopulationreview.com/country-rankings/olympic-medals-by-country

I appreciate hearing about life in other areas like Marko’s fam in Croatia. It puts a lot of things into perspective here and how it’s pretty standard to want a SFH for a family, probably because many of us grew up in one and want the same for our kids, despite it being more maintenance than a condo and more expensive. Makes me fantasize about what our standard of living would be like outside of Vic/Van/TO as well, I think we’d have ptsd from Victoria’s prices and with a lower cost house we’d spend a lot more on travel.

As a renter we sought out a SFH even before having kids because we wanted our own space and to not be sharing poorly soundproofed walls, due to previous suites and issues. And as a family seeking a rental last year it was an absolute must- my partner had eyes on a brand new 3 bed suite, and we chose a run down 2 bed SFH instead because I didn’t want my occasionally screaming children to cause issues, or others to wake them up.

I think for families to be cool with missing middle housing there’s going to need to be a lot of it built, it built with families in mind so soundproofing and parks nearby (I’m looking at townhouses to buy and if I can’t even put a swing set in the yard it’s a huge turn-off) and a cultural shift to make it a desirable alternative to the SFH.

Croatia became a member of the EU in 2013, which means its citizens can work anywhere in the EU without going through immigration. This is undoubtedly one of the reasons behind the recent population decline. It also might have something to do with housing prices being out of whack with local incomes.

It also has a fertility rate of 1.47 births per woman, notwithstanding the patriotic efforts of Marko’s relatives. 🙂

One of the ways they “manage” living in a condo with 2-5 kids is by leaving Croatia and emigrating to USA and Canada, where they can find better housing.

Croatia population 2005: 4.3m

Croatia population 2019: 4.07m (-5%)

Croatia population 2050: 3.46m (demographic projection)

https://balkaninsight.com/2019/10/31/croatia-faces-long-term-stagnation-of-demographic-decline/

Briefly chatted the other day with a young family at the playground…recently moved here from Ontario…bought a newish house in Gordon Head (= $$$).

Toronto cash-out buyer perhaps?

Cool to see that Victoria is on the radar for folks that far away.

“Croatia, a poor country of 4.1 million people, has more professional athletes than Canada”

‘

‘

Please show me the link for this stat

If you feel the need to slam our math education compared to other countries, you should be aware that there are standardized worldwide tests (PISA) taken every 3 years, by 80 countries that measure each countries performance on math, reading and science. These are tests of students randomly selected in each country.

Canada’s results are near the top in all, maths, science and reading.

FYI, Croatia results are below world average in all three. For example, of the 80 countries, in maths Canada was 7th (score 512) and Croatia was 39th (479). World average maths score 489.

https://www.newswire.ca/news-releases/canadian-students-among-the-highest-achievers-in-reading-according-to-new-oecd-report-817397605.html

“Here are the highlights for Canada from PISA 2018:

*Canadian 15-year-olds placed well above the OECD average and Canadians are among the world’s top performers in reading. Of the 79 countries and economies participating in the assessment, only three—the economies of BSJZ (China) and Macao (China), and the country of Singapore—outperformed Canada. Eighty-six percent of Canadian students performed at or above Level 2 in reading, the baseline level of proficiency required to take advantage of further learning opportunities and participate fully in modern society. The OECD average was only 77 percent.

“

Detailed results: https://www.cmec.ca/Publications/Lists/Publications/Attachments/396/PISA2018_PublicReport_EN.pdf

I think the problem is no cultural appetite for it. Every single cousin I have in Croatia lives in a condo with two to five kids. There are not many public washrooms either in parks but they manage. They go to markets to buy produce instead of Costco so depsite no yards the food is so much better.

I don’t think the kids are by any means hard off having to share rooms and having no yard. Education wise they are doing math three grades ahead of kids here and sports wise Croatia, a poor country of 4.1 million people, has more professional athletes than Canada, a rich country of 36 million. So it’s not like condos are impeding development in any way.

Time is a limited resource and I rather be traveling and doing other stuff versus working on my house. Condo in that sense is easier manage, lock the door and take off and come back whenever and zero maintenance to organize.

If money was literally no object I would buy a SFH and I would hire a manager to deal with all the trades/maintenance people. Obviously that would cost a small fortune.

But because money is an object I would rather retire from real estate in the next 5 yrs and forgo the mansion in the Uplands. The $2-3 million dollar upgrade can be better spent imo.

They can, in Moncton. As for Victoria we need to find a way to create land out of thin air.

Jeremy, more higher income people have come to Victoria and that has pushed prices higher even though the average income may not show it. Because the SFH supply is fixed, the prices have to go up. If say Victoria’s current average income is 70k and a 100 new people move here with 20 of them making 150k while the rest make 50k,

then the average income of all these new people is still 70k, so on paper this doesn’t affect the average income in town but in reality there are now 20 additional higher earners in the market that can outbid the average income person for that fixed SFH supply.

Then you got CIBC doing these types of mortgage promotions…..

There’s no good reason why the average individual, couple, or family cannot own their on house. It’s a failure on many fronts that this continues to happen.

It will be interesting to see what 1340 Bay street sells for. Seems low at $640,000.00 asking price . Please post and let me know what it sells for if anyone finds out. Thanks.

I honestly don’t think there is any need for families to live in apartments. We’re not London or Munich or New York. There is absolutely no shortage of land in Victoria for ground-oriented family-suitable housing.

Rezone all residential areas for townhouses and then go on a massive family rental building spree to allow any families that want to rent or can’t afford to buy access to a purpose built townhouse or duplex/triplex/quadplex/multiplex rental. Private developers will build the townhouses of various sizes and configurations for the resale market. Upzone around arterials and transit for at least 6 floors.

Victoria will never be cheap, but it can remain attainable for a broad spectrum of the population.

“Ha ha of course I would “prefer” a house in the Uplands with a full time maintenance team’

Marko, I thought you would have preferred that two unit connected penthouse at Bayview instead??

We preferred a detached house because after three years with a small child in an apartment we were tired of trying to get our child to be quiet all the time and trying to get outside time out at parks littered with needles and dog faeces, and with unreliable access to washrooms. A detached house means a vegetable garden, safe outdoor play space, and no more stress about the volume of normal childhood life.

I think if we want families to live in apartments and condos we need to completely change how we approach high density living to make it as good for families and kids to live in condos as it is to live in detached houses. That means changing adjacent infrastructure (adding community gardens, washrooms to parks with play structures, and being diligent about park clean up for example) and people’s attitudes. (Our neighbours let us know they didn’t care much for us.)

Ha ha of course I would “prefer” a house in the Uplands with a full time maintenance team. Throw in some views, tennis court, and gym.

It really should be would you prefer a two bed condo in Vic West or a detached home in Sooke.

Detached house is preferred home type of 83% of young Canadian families, and 56% end up buying that type.

http://www.newgeography.com/content/006189-canadian-families-denied-preferred-detached-houses-forced-condos-survey

Canadian Families Want Single-Family Detached Houses

For years, urban core interests, especially urban planners, have claimed that younger households have a preference for higher densities and condominiums:

Sotheby’s notes: “…proponents of urban densification now argue that the desire to live in condominiums, attached homes and duplex/triplex/multiplex units has increased across every demographic group, including a new generation of families who prefer higher-density housing and an urban lifestyle over the traditional single family home ‘dream.’” The Sotheby’s survey findings “reveal a more complex picture.” That picture is of young urban families overwhelmingly preferring detached houses, and decidedly not the condominiums into which planners are driving them. As Sotheby’s puts it, “The report dispels myths about young, urban families’ housing preferences.”

Quite right, that’s the nomenclature in Ottawa and likely elsewhere in Ontario. But not in Vancouver – e.g. “strata duplex” where each side has its own title – and elsewhere in BC.

Which raises the issue of how the census questions get answered across the country. And it would be nice if they just added “suite in detached house.”

so, I would say after looking at Structural Type of building for census purposes, a duplex ( an apartment or flat in a duplex normally would be two in number) given Code 4. Semi-detached are under separate code. I think Code 3. Illustrations are given for each code.

oops been looking in “weather in Victoria” for so long, that I typed “weather” instead of “whether” just so you don’t get too much of a giggle.

Leo: When I lived in Ottawa along time ago a duplex weather up and down or side by side were single titled and semi-detached were separately titled.

Does this also include refinancing? I know some that are poor savers and buy everything on credit have used the increase in house prices to refinance to consolidate their debts.

Short-term this should actually reduce the risk to financial system, because the other debts are higher risk than a mortgage. However, long term they may continue piling on consumer debt.

Right. You could conceivably factor out the flat in a duplex category and assume those are mostly part of the houses.

So you think a house with a suite would be classified as 1 single family house and 1 flat in a duplex?

Thanks for the chart Leo, but keep in mind that a SFH with a suite will be counted by the census as two dwellings. So if every property was a SFH with a suite SFH would only be 50% of all dwellings, even though they were 100% of properties.

I think it’s just self-reported. I do think that the owner-occupier of a SFH with a suite is most likely to report as “fully detached”.

It’s unclear to me exactly how the statscan categories work. There is “Semi-detached” and then there’s “flat in a duplex”. Most “flats in a duplex” are basement suites, but it’s unclear to me whether a traditional side by side duplex goes into semi or “flat in a duplex”

Good question. Here’s the percentages

From an investment and growth perspective, yes I agree, 1 bedrooms are better for that, but not everything in life is about money

JS, I would just buy a one bedroom if u don’t get a roommate assuming you don’t need the space. See Marko’s prior posts, one bedroom condos provides much better flexibility and returns if you end up trying to rent it out later.

Ks112, no it does not include my strata fees or property taxes. However, I am buying a 2 bedroom and could in theory get a roommate if I wanted to reduce my overall cost to lower than what I pay now. If I have over 20% down, then I am certainly not a bad saver 😉

Housing is very expensive, even with 20% down on say a $600k property, that means carrying almost a half a million dollar mortgage, for a condo. What is the average wage in Victoria? Maybe $60k? If the average household income in 2017 made $90k. So in the best of cases individuals are signing up for mortgages, nearly ten times their annual salary, before tax.

JS, was there a reason why you didn’t buy in 2020 or prior?

I have done that before (can’t find the article at the moment) but it’s hard to know what interest rate to use. The 2% contract rate or the 4.79% stress test rate? Technically the latter but it seems like many are bypassing the stress test so not sure how meaningful it would be

Great comment JS. There are only hard choices in this market. Decades of neglect of rentals pushing rents up and governments pushing supply of rentals to the secondary market which provide only insecure tenure. Ultra low rates and sky high valuations pushing down expected returns in all asset classes

Yes, they can’t help themselves so OFSI is stepping in.

An individual bank has the choice of meeting the mortgage market with regard to qualifications and rates or not lending. If it chooses not to lend its existing mortgage portfolio will have the same risk of default but it will lose business. See the problem?

I don’t think everyone in banking over 40 is above 150k or 200k. Victoria banking is limited to retail and lower level commercial banking. Only people over 200k are the market/area VPs and there is probably one per bank. Senior managers doing commercial banking is probably around 135k after bonus in Victoria and retail banking is lower. There are numerous investment advisors making over 200k though but that’s much more like running your business.

The choice the banks have is not to destabilize the financial system by risky lending practices. That’s what OFSI has identified with a big number of uninsured mortgages that went out the door and has decided to step in. Debt is not an asset or liquidity, so if it is purely low interest driving asset inflation and the perception of people’s net worth by cheap access to credit it is not sustainable. If someone needs to be on a payment plan to afford their cellphone, adding credit card debt to pay monthly bills/ buy groceries or decides to go on vacation because the space they have on their credit card instead of cash on hand, they should not be getting approved for a mortgage.

If you’re going to spend it you have to pay it out. So as far as the housing market is concerned it’s the income to the individual that matters.

Guess you’re not making friends with the tellers. “Everyone I know…” is something we hear a lot but it doesn’t show the big picture.

53% of couple families make over $100k.

26% make over $150k

12% make over $200k”

And there is the data!

–

That may be the official data but I don’t believe it resembles the true reality. As someone else mentioned there are thousands of retired people with several million in investments who may only show 50 to 100K in family income, same thing for self employed individuals with Corp, heck even Doctors keep money in a Corp rather then pay out all revenue. Now the sector I work in banking and finance may pay higher then most but I’d be hard pressed to think of anyone I know over 40 who makes under 150K, with most well over 200K

Ok JS, but does it automatically imply that you are a bad saver because the bank is willing to lend that to you at 44 tds? Because that’s what “umm really” is saying. If your mortgage is cheaper than rent then obviously it’s a no brainer, you must have some really expensive rent then…. Are you counting strata and property tax?

And no one is saying TDS should be in the teens, it’s the amount of people with TDS at 44% or higher as a percentage of all mortgages originated should be in the teens where right now it’s over a quarter.

They might be move-up buyers, who are the majority of buyers. But if they are first timers, yes I think the DP is coming from Mom and Dad.

What other choice do banks have? I am above the 44% mark and am currently waiting for a financing approval from my bank. I do have >20% down, on a single income and despite my >44% TDS, my new 25y mortgage will be less than what I currently pay in rent for a one bedroom apartment. TDS in the teens is something we will not be seeing when it is so cheap to borrow and there is absolutely no incentive at the moment to keep money in the bank. You either risk your money in an over valued stock market, risk your money in an over priced house market, invest in a business, or lose ~ 2% a year on your money in the bank, due to inflation. At least if my money is in a mortgage, I have a place to live and at the chance the market goes up, I won’t pay tax on the capital gain.

Lol u gotta ask the bank why they are willing to lend at that high of TDS. How can the bank’s lending decision have anything to do with with the saving habits of the buyer? If anything the buyer probably has excellent credit which gives the bank the comfort to lend them to the max.

Or they have a cosigner and/or other collateral at play.

So, how are these leveraged to max folks getting their 20% down? With that debt ratio, I imagine they are not the best savers. I guess it’s the down payment gifting. Maybe a simple rule “the amount of debt you carry is subtracted from the consideration of your down payment” taking those people out of the uninsured category. Not to mention, their debt servicing is already factored on the amount they can sustain to borrow. It should reduce some of the madness. I believe the point of mustering 20% down was to demonstrate a level of financial discpline and stability to be a better lending risk. But it sounds like a lot have escaped the insured mortgage rules with the gift help and are weaseling up the uninsured bracket for the rest of us.

987 Falkland: $1.495M

2133 Windsor: $1.8M

Leo would you be willing to tell me what 987 Falkland sold for, and also 2133 Windsor road (in the fall). Both of these houses were on corner lots on fairly busy roads, and of a similar size. The former appears to have been substantially renovated with 3 bedrooms 3 bathrooms, and the later a new-build with an astonishing 6 bedrooms and 4 bathrooms in only 2800 square feet! The other major difference between the two- the spring market… I have noticed many of these smaller new builds in Oak Bay have been languishing with almost condo-sized living/dining/kitchen spaces.

Oh I know, I was just thinking outloud. Interesting times we live in right now.

The government doesn’t do up to date data 🙂

Leo, I wonder what the data is for Q1 2021 as that’s when prices really started taking off.

Lots of buyers leveraged to the max.

“25.6% of uninsured mortgages originated between July-December 2020 had a “qualified TDS” above 43%, OSFI says.

44% is the limit and for a healthy market you really want to see that number down in the teens (at most). That makes the housing market’s state of affairs more serious than the data we’ve seen to date suggests.

https://www.ratespy.com/late-breaking-news-from-osfi-on-its-new-stress-test-040918416

1685 Stanhope: $1.278M

Leo – would you be able to share what 1685 Stanhope sold for?

“On the one hand you have highest and best use + decreasing percentage of single family as percentage of housing stock. On the other hand you would have a lot more family-suitable places.”

If you have enough people whom can afford a SFH but would rather live in a townhouse to enjoy more financial freedom then I can see SFH prices going down with this shift as the demand destruction would outpace the supply destruction.

“1) gas forced air furnace; 2) heat pump using existing ducts; or 3) abandon existing ducts (stuff them with insulation?) and install a mini split upstairs, supplemented with some baseboard heaters. The ducts are a source of noise transmission between units, which I’m happy to close off if it means a quieter house.”

Gas is likely going to be your cheapest option to install and operate, but there is an environmental cost.

The basement is on baseboard heat, so there are no registers/return air vents in the suite, correct? I’ve found that insulating around existing ducts helps block noise transfer and dampening the echo chamber qualities. Not sure if that’s an option for you.

I’ve said it before but it’s unknown exactly what the impact will be. On the one hand you have highest and best use + decreasing percentage of single family as percentage of housing stock. On the other hand you would have a lot more family-suitable places. Right now it’s essentially single family or nothing because there just isn’t much else other than condos.

“It’s not a given that replacing one SFH by (i.e.) two individually owned duplex units will make remaining SFH more expensive. It’s an increase in total supply and the 1/2 duplex is a close substitute.”

Sure it will, if right now 160k is the current minimum income required to buy a SFH given current supply/demand characteristics and assuming the current SFH stock for sale is “X”, when you decrease “X” then the $160k minimum goes up all things equal. On the demand side, the only things that will bring the prices down is less people making 160k a year or if SFH goes out of favor for those 160k earners.

I suppose you can also put in polices that discourages multiple home ownership which will also decrease demand while putting more stock on the market, that will also decrease prices.

If interest rate goes up, you get in a situation where current prices are higher than what those making 160k can afford which leads to excess supply and falling prices until a new equilibrium is reached. In the short term the price declines will probably overshoot as those 160k people will probably not all jump in as soon as it is affordable in fear of catching a falling knife but in the medium term $160k will still be the cutoff at the higher interest rates.

It’s not a given that replacing one SFH by (i.e.) two individually owned duplex units will make remaining SFH more expensive. It’s an increase in total supply and the 1/2 duplex is a close substitute.

Yes, and the percentage will drop even faster if Leo’s dream of unencumbered building of “missing middle” housing comes to pass.

To those priced-out of a SFH but who are still dead set on trying to buy one, be careful what you advocate for.

But not all people with high incomes want to live in the core. There are pricey properties all the way out.

Great chart also. Do we know how many “couple families” there are in Victoria?

And what % of housing stock is detached SFH in the core? Whatever it is right now it will just get smaller and smaller as the years go on.

Yes.

Heat pump / renovation question…. I have a 1970s house with a basement suite. The suite has baseboard heating. Upstairs is heated by a central forced air electric furnace. I’d like to upgrade heating system, so should I go with 1) gas forced air furnace; 2) heat pump using existing ducts; or 3) abandon existing ducts (stuff them with insulation?) and install a mini split upstairs, supplemented with some baseboard heaters. The ducts are a source of noise transmission between units, which I’m happy to close off if it means a quieter house.

I don’t foresee the house being repatriated to one unit in the near future- ie., the basement will always be a suite. thanks

LeoS: Do couple families include retired seniors? A lot of seniors I know have low incomes but high net worth.

Could be. But I’ve noticed the pack size of some products has reduced while the price I pay has remained the same. Sure, you’re not paying more at the till. But you might be getting less, dollar for dollar.

LOL. Well done, sir.

Just the other day I was at the grocery store and saw someone elses old receipt and they’d spent $250,000, all from their checking account.

Yes but what about the price of Cadbury cream eggs and pepperoni???? That’s all the proof I need that StatsCan is cooking the books.

Is it? I know people love to say that.

I track my household expenses monthly and am not seeing any noticeable rise.

Leo, it would be interesting if you could combine your affordability graph with that couples income information so that you could see what percentage of the population could afford an average SFH in Victoria over the past decades.

Rob Carrick seems to like the tweak:

How young adults and the whole country win with a tougher mortgage stress test for home buyers

https://docdro.id/cLPBSOE

“53% of couple families make over $100k.

26% make over $150k

12% make over $200k”

And there is the data!

53% of couple families make over $100k.

26% make over $150k

12% make over $200k

“You might be waiting for a long time.”

Its already here, despite what the official stats say daily life is getting more expensive (outside of housing). So unless wages catch up it will get tighter and tighter for people whether they own or rent.

‘Now is the moment’ to act on child care, says Freeland at virtual Liberal convention

https://www.theglobeandmail.com/politics/article-now-is-the-moment-to-act-on-child-care-says-freeland-at-virtual/

You might be waiting for a long time.

Dunno how co-signers are treated in these data. I’d like to see the distribution of loan to income. Fixed cutoffs are always problematic.

Leo, wouldn’t the growth in high ratio to income mortgage be solely attributed to two things?

1 – Cosigner

2 – lenders relaxing lending ratios

Haha, just a mistake in the original listing, it was immediately corrected to $999,999

250 Michigan appears to have sold for $885,001 over ask… Someone correct me if I’m wrong, but this is a good reason to take “over asking” with a grain of salt.

Strong jobs report nationally. +35k jobs, mostly in Vancouver

Victoria unemployment rate still lower than the provincial average but actually up from 5.1% to 5.9%

When was the last time you’ve considered “people on the edge” to be in good enough shape for you to expect an upturn in the housing cycle?

LeoS: You know what they say “90% of politicians make the other 10% look bad”.

Seems to me the stress test has basically stopped working. Not sure if the small tweak to reduce borrowing power by 4% will be noticed. Maybe in the condo market

https://www.bankofcanada.ca/2021/04/staff-analytical-note-2021-4/?utm_source=alert&utm_medium=email&utm_campaign=FSH210409

Banks do almost all of their borrowing (e.g. savings accounts, GIC) at terms of 5 years or less. That means for example they can match their 5 year mortgage rate against the 5 year GIC rate. Beyond that term they are taking on interest rate risk. Sure they have forecasts but future rates are unknown. ISTM the premium on the 10 year term is pretty reasonable. But since almost all buyers buy as much house as they can at the 5 year or shorter rate, few will take advantage.

Consumer prices going up doesn’t mean your income will go up. Hasn’t been the case for decades really.

What it implies is that mortgage debt is increasing and at a record high, which is a documented fact.

It’s true that some people are increasing their savings. But these are the people who were in good shape to start with. It’s the people on the edge who matter to housing market cycles.

“53% of Canadians on the brink of insolvency: MNP survey”

I don’t know what to make of surveys like this. We have house prices exploding, implying Canadians are flush with savings and income, and then this long-running survey, that 53% of Canadians are $200/month away from “insolvency”, 30% are already insolvent, and it’s worsened dramatically (+10%) since December. I get that there are winners and losers in the COVID economy, but it seems to me that both the “rosy” and “gloomy” scenarios can’t be true.

https://www.bnnbloomberg.ca/53-of-canadians-within-200-a-month-of-insolvency-mnp-1.1587379#.YG75o-RgfzA.twitter

I remember houses in the early 1970’s more than doubling. I was a teenager then so the details aren’t too clear, but I recall my older cousin buying a new house for $30,000 and sold it in a couple years for $67,000, to buy a larger place for $90,000. It was rather astonishing, at a time when gas was around 70 cents a gallon. After that, prices did not increase for a long time, he eventually sold that house for around $145,000 about 15-20 years later. This was in Winnipeg.

25% is quite a jump, but it is a far cry from the 80s, and I’m waiting for inflation to catch up from the spending spree and various tax increase.

Hunger for housing

Boom time for homeowners—sad days for the ‘outs’

MARCH 30 1981 THOMAS HOPKINS

https://archive.macleans.ca/article/1981/3/30/hunger-for-housing

“What happens to cities when market value assessment is the financial base for their budget process” (and prices decline) – Adam Vaughan

Scary an MP on the housing file has absolutely no idea how city budgets work. That whole interview is full of nonsense.

Child care is the killer new homeowner. If you tighten the belt until the kid is in school then it should smooth be sailing after (provided interest rates don’t jump). But if you don’t absolutely need the space, is it worth it to jump in right now, that’s the million dollar question….. Literally

Also u could get a house with a basement suite which should get you another $1k atleast in cashflow

I wanted to remind everyone that mortgage insurance stops after $999,999.

The average house in Toronto, vancouver, and Victoria already dont have mortgage insurance.

Also: it was interesting the discussion that was going on about affordability. My partner and I are government with 160k household income and bring home about $8200/4 weeks.

With our current equity(300k) we were approved for a mortgage just above 800k. So an average house.

But we have kids. Childcare ($2500/month)+house($4200/mo just in utilities, mortgage, insurance, tax) would amount to a little over 75% of take home income. It’s next to impossible. Buying an avg sfh in Victoria might’ve been possible on paper, but at 1.7% interest would’ve left us completely broke.

And of course shows that the stress test is far from infallible.

Patrick, I wouldn’t exactly call that cheap insurance. In five years that’s an extra 14k spent on interest. And that’s compared to the 5 year fixed rate, which in all liklihood will end up costing more than a variable option. Banks very obviously price their fixed rates sufficiently high that it’s improbable you’ll come out ahead on interest savings by the end of your term. Effectively, taking a fixed rate (especially a long term fixed rate) is placing a bet against the bank’s ability to make accurate medium-long term economic forecasts.

I’m not claiming the banks are perfect, but if I’m making a financial decision about a product that they price, based on their own forecasts, in order to maximize profit, it seems to make sense to bet with them rather than against.

Liberal Adam Vaughan on housing 36 minutes in.

https://youtu.be/PTDqisgWqd0

“Housing is how Canadians secure their middle class status and their retirement.”

Translation: “we won’t do anything that reduces home values”

Further translation: “We have no plans to improve housing affordability”

How insane is it that after a 25% increase in housing prices anything that might decrease prices even 10% is completely off the table. Seems like they will at best be trying to throw more credit at first time buyers

The more you earn the more tax you pay and the link you posted shows the data:

We are not the US. If you earn more income you will pay more tax and if you are incorporated you are paying corporate tax and delaying some personal tax on money you don’t have access to – and you probably have no pension so you’d better be investing in something.

You also cannot legally claim business expenses that are not real business expenses, and that includes a cell phone bill. What you are talking about is illegal tax evasion. Just like when your tradesperson asks to be paid in cash. You can claim the proportionate share of items used for a legitimate business purpose, but they are often audited, such as automobile expenses, so you’d better have a log or you’ll pay the tax, a penalty and interest on back payments.

https://turbotax.intuit.ca/tips/tax-tip-cell-phone-expenses-for-self-employed-individuals-and-small-business-owners-6204#:~:text=If%20you%20use%20your%20cell,cost%20related%20to%20the%20data.

We were talking about house hold income JS, not single income. So yes, 100k each or 200k HH income is probably what it takes currently to afford a half decent SFH in the core without stretching yourself too thin.

Yes. Though after 5 years, when it’s time to renew, the buyer with the $800k mortgage has paid off $130k principal, which provides a cushion. For example, if rates rise from 2% to 3.6%, he could refinance that 2% 800k mortgage into a new one 25 year, 670k @ 3.6% at the same monthly payment of $3380. Of course if rates rise up to more than 3.6%, he’s going to need to pay more, possible much more.

The only way to protect against big rate rises is to lock in the rates for 10 years. Apparently a 10 year fixed mortgage is available @ 2.59% which would be a good choice IMO. https://www.ratehub.ca/best-mortgage-rates/10-year/fixed going from a 5 year term @ 2% to a 10 year @ 2.59% only increases payment by $232 per month ($3388 to $3620) . Would be cheap insurance against high future rates.

Everyone here seems to think that the top 10% of earners in Canada make $300k + / year. To be in the top 10% you need to earn $100k, in 2018 it was $89k. Let that sink in, if you support a wealth tax on the top 10% of earners If you earn greater than $236k, you are the top 1%. In 2020 there were 14.8m people working full time in Canada. Therefore less than 148k Canadians are making the salaries that are being suggested as required to own a SFH in the Victoria core. Now, how upper income earners and business owners are taxed in comparison to salaried employees is an entirely different discussion. Everyone was shocked to see the small amount of tax that Trump paid per year. But think of the business owners you know who write off expenses (before tax) that every Canadian has to pay, such as a cell phone.

https://themeasureofaplan.com/high-income-canadians/#:~:text=A%20Canadian%20is%20%E2%80%9Cupper%20middle,the%20top%2010%25%20of%20Canadians

https://www12.statcan.gc.ca/nhs-enm/2011/as-sa/99-014-x/99-014-x2011003_2-eng.cfm

I thought you couldn’t get CMHC insurance if your credit score is less than 680 or something?

Yes, but not as good as the feds. 🙂

don’t you need good credit to get mortgage insurance in the first place?

As you pointed out, the banks get a lower rate along with the lower risk. The issue really is whether the buyer is paying CMHC enough to take on that risk.

From my last discussion with my broker I can see why the market really inflates from the impact of the insured mortgages. Without asking, the offer was for me to come off my 20% down and then have almost a .5% drop on my rate and be able to borrow an additional 200k. I said no, but it really erodes the incentive to save a big down payment and have a better credit rating then others when those that don’t have a big down payment or great credit can borrow more at lower rates. As well, it almost forces the situation with bigger offers from the pimping of insured mortgages. I understand the banks and lenders doing it; who wouldn’t want a business model whereby the government takes the risk and you collect the profit.

“For me, the point of buying a house was for family stability/enjoyment, irrespective of making a profit. So if I broke even I wasn’t back to square 1, because we’ve owned and lived in a house.”

I agree with that, life is more so about experiences and not material goods. So if it truly makes one happy to “own” a house then absolutely they should do it. That is why I advocate that if you really want a house then stretch yourself and buy the one you like and will enjoy regardless if it goes up or down in value.

Ya… WTF, going after the qualified buyers to limit their ability doesn’t really make sense. How about limiting what the taxpayer subsidizes for unqualified buyers (the ones needing mortgage insurance) maybe capping insurable mortgages at 600k and take the risk from the taxpayer and getting the ones out of the market that are most vulnerable. The first step should be to eliminate subsidies in a exploding market such as tax exemptions, government backed mortgage insurance and that weird money from the government and put a the government on the title for down payment money thing. With the uninsured mortgage the risk is where it should be, on the borrower and the lender. So, it does not need really need a stress test.

Right, I am only referring to house affordability. Other variables, like “enjoying life” (with extra spending money) and “square 1” (being defined as making money on the house) are individual decisions.

For me, the point of buying a house was for family stability/enjoyment, irrespective of making a profit. So if I broke even I wasn’t back to square 1, because we’ve owned and lived in a house. As it turned out, bought a first house right at the peak of the market, which flatlined for the next several years. I wasn’t even aware of that until I saw the charts many years later. Once you buy a house, most people enjoy it and forget about the housing market. And then they find some thing else to worry about!

I think banks are in a tough spot because given the flurry of articles from them calling for cooling measures it is obvious that they are getting uncomfortable, however, it is classic prisoner’s dilemma where if one raises lending standards above the pack trying to manage risk then they will just lose market share and income and that won’t look good either. So looks like they want a government policy which in a way forces all of them to de-risk.

KS – that is true. Good point.

Rush, but I think this gives the government justification to not bail out the lenders/owners if things go south. They can just say we put the stress test in place trying to protect you so if you guys knowingly skirt around that and things go south then that is on you.

These stress tests are an absolute joke. Now the banks will just up their TDSR approval limits to 55% to offset the impact of the stress test. That’s what is happening now ks112 – so no, people aren’t safe until these rates as a lot of of people aren’t really qualifying at them.

Leo, to me this could make it harder for speculators and landlords to come in the market without a corresponding increase in market rents or their ability to service the debt. I think they are making the assumption that most FTH buyers aren’t putting down 20% so they are not affected.

This also provides additional buffer for lenders/investors as they are holding those loans on the books without insurance.

These stress test rates are also interesting, just playing the devils advocate here but I wonder if rates rise in the future then government can rightfully justify themselves for not bailing out the housing market until at least rates exceed these stress tested levels?

Wow that OSFI proposal is bizarre.

The whole point of the previous consultation was that posted rates made no sense so they would have just gone to contract + 2%. Now they’re pulling a 180 and raising the stress test rate instead of lowering it.

“ The new proposal for the qualifying rate for uninsured mortgages is the higher of the mortgage contract rate plus 2% or 5.25% as a minimum floor.”

https://www.osfi-bsif.gc.ca/Eng/osfi-bsif/med/Pages/b20-nr.aspx

Current stress test rate is 4.79%.

They must be really grasping at straws for what to do about the housing market

Patrick, that would also depend on the other cost of living increases compared to income, I think CPI as currently calculated is misleading. I think it could be done, but if there are kids involved then you almost have to have a suite. I don’t know, just doesn’t seem to be a good way of enjoying life especially if 5 years later there hasn’t been much appreciation and mortgage rates jump to 3.5% then you are almost back at square 1. You could assume higher income in 5 years though if you are confident on your abilities.

Assuming interest rates don’t go up.

Yes, I’m assuming a two income household. If one paycheck pays off the mortgage and house expenses, they live off the other spouse’s salary, and are forced-saving $2,000 per month as they build up equity. Things get better each year, as their salaries increase, but the mortgage payments stay the same.

“You’ve proven time and time again that you don’t really know anything about public service, or public service workers, so just stop talking about it.”

Lol, ok sure bud.

You’ve proven time and time again that you don’t really know anything about public service, or public service workers, so just stop talking about it.

New OSFI ‘proposal’ coming out raising the bar on uninsured mortgages.

Patrick, after property tax, insurance, hydro and routine maintenance you are probably going to be over $4k a month. So for someone making 80k a year at government, that is probably going to be their entire take home pay. So if the partner also makes 80k then you may not need a suite, but if not then a suit is mandatory. If you got kids and day care on top then it is going to be real tight.

Buying a $1m SFH can be done with $200k down and a 2% 25yr 800k mortgage of $3,388 per month. Of the $3,388 per month, on average $1,388 is interest payments and $2,000 is forced savings. That’s not cheap, and doesn’t address the issue of “qualifying” for the mortgage, but still affordable for a lot of households, especially with a suite helper.

I would add that you can see the data with the latest housing boom, when the only people losing jobs are the people who weren’t buying a house anyways, it did not contribute to a crash as all the people whom could afford it piled in with the low rates and drove prices up. So unless Victoria starts getting a constant net influx of higher and higher paying jobs and/or wealthy people moving here (which could happen) then i don’t think it would affect the current percentile of earners (with appropriate savings) that can afford a house.

“synthetic furnished rooms highlighting how fast fire spreads in today’s fire environment. Fire is faster today due to synthetic materials, lighter construction materials and open floor plans. ”

Interesting!

Take away:

Sleep with your bedroom door closed.

Check your smoke alarms every month.