Another record month: pandemic market hits one year

We’re one year into the pandemic really being felt in Victoria’s housing market, and it’s another record month with an all time high sales for March combined with all time low inventory. As the unprecedented disruptions of the pandemic destroyed the Y axes of economic charts forever, it’s now going to destroy the usefulness of year over year comparisons for the remainder of the year. March numbers are the start of that, but April will get exceptionally wacky for comparisons as that was the bottom of the first lockdown’s sales drop.

Sales in March went much the same as sales in February, with anything priced even remotely close to market value selling within the week. Especially in the detached market, the strategy of listing Thursday, a frenzy of showings and pre-inspections, then offers Monday was the dominant one, and for most sellers that worked out beautifully, with 60% of houses going over ask, often in the tens or hundreds of thousands. Only towards the end was there some sign of new listings being able to slightly get away from sales. Too early to call this a turnaround though, it can also just be overly optimistic seller expectations or people testing the market at wishful prices. What’s clear is that our low inventory is not caused by a low rate of new listings as those are up from pre-pandemic. It’s simply that sales are up much more and that has vacuumed up any increase in new listings and then some.

On a monthly basis, sales for all product types remained at or near all time highs.

If there was more inventory, there would have been even higher sales but we are really scraping the bottom of the barrel. Although there was a slight uptick in the final week, end of month expiries dropped that back down to 1310 active listings, lower than both January and February. And of course this is the time of year it should be climbing, so on a seasonally adjusted basis it was a another steep drop.

As mentioned, it’s not a problem with new listings per se. The rate of new listings is actually up in the last year, although still below the levels from 2008 to 2012. That increase is not just on the condo side either, with year to date single family listings up 10%, townhouses up 13%, and condo new listings up 14%.

High sales and low inventory means that the sales to new list ratio remained planted in extreme sellers market territory.

And ultra hot market conditions cause rapid price increases across all product types.

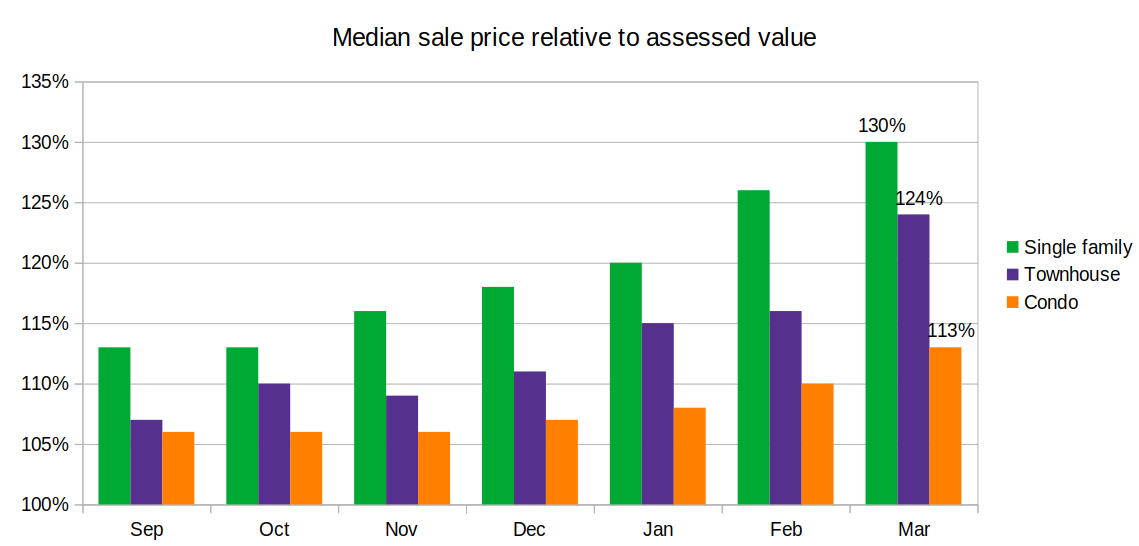

After months of discussing the rapidly heating condo market, we’re seeing that firmly reflected in prices, with the median rising again to $486,250, up from around $425k most of last year. However medians and averages are volatile, and the MLS HPI index has been lagging the market so I’ve really grown to like the median sales to assessed value ratio as a very stable indicator of how fast prices are increasing. In March the median house sold at 30% above it’s valuation from last July, while there was a big jump in townhouse values to +24% and condo prices were up 13%. There is no weak segments or price brackets in this market.

My take

The longer this market (and that in the rest of Canada) remains white hot, the higher the risk that even in a pandemic it becomes impossible for regulators to ignore. It’s nearly all the big banks that have now called on the federal government to do something about runaway house prices, with TD being the latest to predict that the government will probably step in with measures to cool the market if it doesn’t imminently cool itself. What’s missing in all these reports is ideas for what could actually be done. Some have suggested a 40% down payment for investors,and others have called on the government to bring in the capital gains tax for principal residences. However our lead Minister for the National Housing Strategy, Ahmed Hussen, struck down any suggestion of that, stating that they are “neither considering nor implementing” a capital gains tax on homes. Now that may not be entirely true, but the reality remains that the chance of a wildly unpopular new tax being introduced in a year that the Liberals would like to be re-elected is essentially zero.

Much more likely is some measure to cool unspecified “speculation” which would be politically popular. That’s reinforced by this recent tweet from MP Adam Vaughan (also on the housing file), where he states that “it’s the market and the finance side of the ledger which needs action & adjustments”. I have very little faith that any measures on that side will be substantial, although it may be enough to throw cold water on consumer sentiment temporarily. Laughably he claims that Canada is doing what we need to do on supply. Now I’m not claiming that the current boom in prices is directly caused by lacking supply (that’s a problem that has been building for decades), it’s clear that no matter how many demand measures are put in place we have a shortage of homes for people to live in. BC is a good test case here, because we’ve already implemented a foreign buyers tax and a vacancy tax. I support both measures and they both had an impact in cooling home price appreciation, but it’s clear from the market that they are no long term fix. In the end we can’t escape that more homes are needed.

However it seems we will need to try every other possible option before confronting that elephant.

New post: https://househuntvictoria.ca/2021/04/06/dusting-off-the-crystal-ball/

Sidekick- Ask the fire department. Several years ago a couple firemen died in a house fire, and that’s when the information came out. They should be able to give you some data. My favourite are houses built in the 1950’s, or 1960’s. Houses built in the 1970’s should all be torn down. High inflation really affected the quality and the development of cheap building materials flourished. Especially after 1973. Not exactly sure when quality came back, maybe the 1980’s? Buy a sheet of OSB and put it inside your house, the off- gassing will make you sick. Laminate flooring is all chemicals, carpeting is made from recycled plastic pop bottles, etc. Cheap and toxic.

My personal favorite bang for buck is 1990s homes that are in all original condition. They show dated (supressed re-sale) but are relatively easy to renovate. 200 amps panels, modern plumbing/electrical (sans Poly B), for the most part 2×6’‘, windows usually have a few years left, PVC drain tiles, stucco is usually in good shape, etc., etc. Majority of the work that needs to be done is cosmetic versus dealing with asbestos and other issues in older homes.

I have to agree with Sidekick here. When you are building a ton of replica houses most contractors will likely put apprentices on the job site. Code does not deal with things such as is the base under the patio properly compacted, are the floors level, roof material, is the exterior painted properly, etc., etc.

You just don’t see that many nice spec subdivisions on the Westshore. For example, a nice spec subdivision in my opinion would be Polo Village in Saanichton. Super small lots like Westshore but just nice quality/execution (notice the small details like thicker ridge caps, etc.) -> ?v=0&width=844&height=540&mode=scale&quality=80

?v=0&width=844&height=540&mode=scale&quality=80

Personally I would take a new house over most older homes any day of the week, specially over a dozer bait house that is peddled as a quaint character house with good bones that need a bit of TLC.

Here are some of the possible older homes banes. No exhaust fan in bathrooms or kitchen (poor air circulation/black mold/rot), knob and tube wiring, 1/2″ water service, failing foundation, orangeburg/corrugate perimeter drain pipes, etc…

Generally, I would consider the tract housing out there to be poorly built. Do they meet code? Mostly yes, but it’s as cheap as you can build it. Lots of stories of things falling apart after five years. I’d wager lots of “mistakes” are just covered over so the inspector doesn’t see them.

Do you have a reference for that? You may well be right, but fire codes have gotten pretty specific with time-rated assemblies, fire blocking, plenums etc. There was some ra-ra with unprotected I-Joists burning through very quickly but I haven’t heard anything about sheathing.

Leo, I don’t know if you have this info but any idea what the 10 year average is for daily new listings in the spring market?

Let’s be frank, the municipality that has taken the lion’s share of building for all sorts(besides cov) is Langford. And Langford is dramatically better for it. I’ve lived on the border of Langford/colwood for 12 years and the amenities and services have improved dramatically. This might just be rose coloured goggles but I feel the community is becoming more lively and friendly as well.

In 15 years Langford has provided a huge amount of the reasonable priced living space, doubled in population, and done so by building at all levels.

People might think of Langford as ratty houses in Langford proper but it’s much denser then most think. While saanich is 47% sfh, Langford is under 40%.

Has a higher household income too.

I know one thing about new homes, they burn down a hell of a lot faster than older homes. OSB board is held together with 2 types of glue that is highly flammable and has a low combustion point. Older homes with plaster walls or sheeting do not burst into flames like newer building materials. So if you do buy a new house, you better be able to move quickly if a fire starts.

“Hey all, I’m curious as to the second part of Abby’s question. “Is is true that homes are being poorly built on the Westshore?”

No, homes are built to the same code (BC Building Code) everywhere on the lower part of the island (and throughout BC but I don’t have direct experience in the rest of the Province). In the past there were no permissible municipal changes to the code but there are a few choices now, such as the Energy Code requirements where municipalities have some flexibility regards which step they want to have you build to. You may find inspectors in different municipalities differing slightly in their interpretations of some parts of the code but these are usually small items in the general scheme of things.

Leo! Congrats you are officially a YouTuber now! You came off very knowledgeable and trust worthy and u look pretty young! I think you can make a decent career or side gig out of this.

“As well, if only Saanich and the COV pursue aggressive re-zoning and building to meet this social responsibility what incentive is there for the other local municipalities to do the same? Why should one or two municipalities shoulder the responsibility of meeting the housing needs of an entire region?”

I am fine with it. If people want to put up brand new duplexes around me so be it. If it means more people will be housed, go for it. My guess is the community will be more vibrant. What a burden to bear Introvert.

Did I say that you didn’t?

Nope.

“and, here you have it… a dating service for co-ownership”

So all the emotional trauma and humiliation of Tinder with added exposure to fraud and lawsuits.

Tempting.

James Soper- Please read carefully, I specified farmland. Gates also owns tons of other acreage. Farmland is probably the most important land on the planet, without it we all die.

Isn’t this exactly what you want anyway?

and, here you have it… a dating service for co-ownership

https://sharedhomeownershipvictoria.com/?fbclid=IwAR0pPL4LEkymVGQ9qW8vpIMyhaDP-n7TXy1l_o3QtDW-3fzCyb6sCAW67sM

No offense taken. To some extent I agree with the above statement, but the devil is in the details.

For example, will the added density be spread out equally across all neighbourhoods, or will more luxury-class neighbourhoods get a de facto exemption from increased density?

As well, if only Saanich and the COV pursue aggressive re-zoning and building to meet this social responsibility what incentive is there for the other local municipalities to do the same? Why should one or two municipalities shoulder the responsibility of meeting the housing needs of an entire region?

Doesn’t mean he’s the largest land owner.

He owns 242,000 acres of land.

John Malone for instance owns 2.2 million acres.

https://en.wikipedia.org/wiki/John_C._Malone

For living space, sure there is. You could fit them all in Texas. The environmental issues have to do with food and resource production, and pollution. But even those can be greatly reduced in impact.

Has Gates been buying residential RE? Haven’t heard anything about that. Maybe he’s on to what the right investment is.

Speaking of billionaires, I just learned that Bill Gates is the largest owner of farmland in the U.S. He has extensive real estate holdings as do all the other billionaires that the internet created. They are the ones driving up prices putting real estate out of reach for most people. That should be illegal.

This is a geopolitical/cultural issue, not a fundamental resources issue. Empty nesters don’t need 3000sqft on a 1/4acre for two people. We don’t need to eat beef. We don’t need to have billionaires while people live in poverty. Etc.

Monday: 111 sales (up 208% from last year LOL)

176 new listings

1357 active listings (-39%)

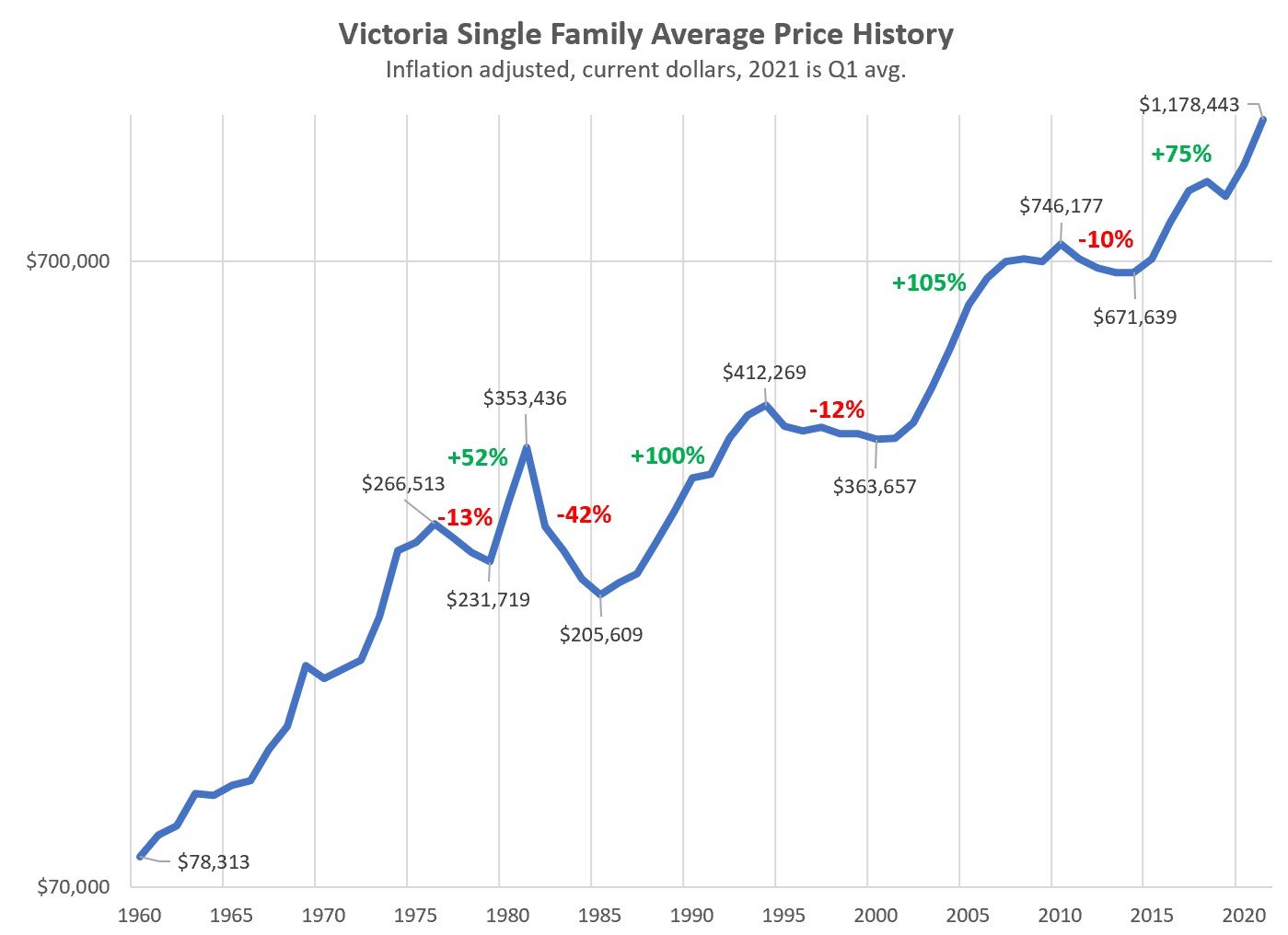

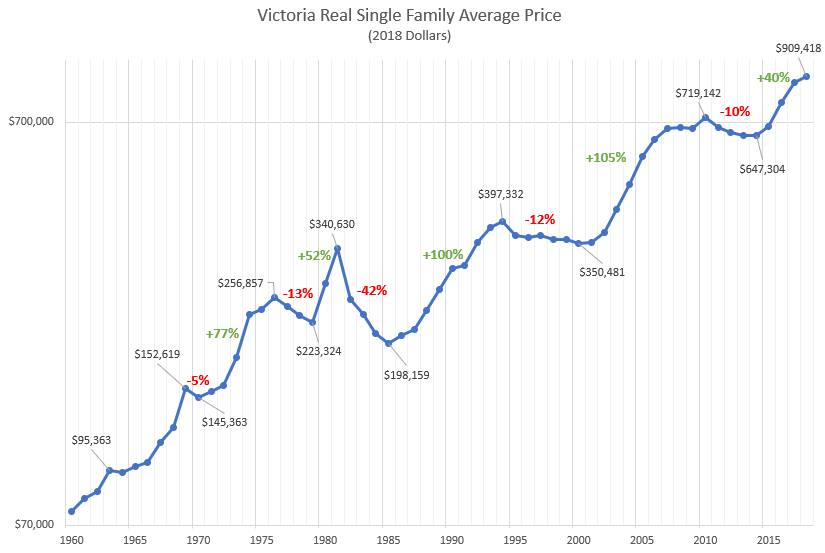

Right. Given that house prices in Victoria are so much higher than the 80s (about 3X in constant $), the effect of those 10-20% mortgage rates seen in the 80s would be catastrophic.

And back then the mortgage rates rose much higher than inflation (e.g. August 1981 BOC Rate 21%, inflation 12%) as the govt attacked inflation by raising rates well above the inflation rate.

A risk of inflation and rising rates as we pull out of COVID is very possible. Hopefully buyers borrowing huge amounts have rates locked in for at least 5 years, preferably 10.

So it appears that it’s not the density they have a problem with, just the residents.

Hey all, I’m curious as to the second part of Abby’s question. “Is is true that homes are being poorly built on the Westshore?”

Buying a new build is appealing to me as I could avoid bidding wars on existing homes, but I’m wondering about the build quality issue. Are there any Westshore developments that are particularly good / particularly bad insofar as construction quality is concerned for SFDs?

I’ll look into it thx

https://www.sookenewsmirror.com/news/residents-petition-against-supportive-housing-project-in-central-saanich/

Hey Leo,

Any chance the comments could be numbered so one could easily find where one last read from?

That’s due to Toronto and other Ontario markets being so dominant in the national average. You can see from Leo’s chart below that Victoria kept going up until the mid-1990’s, and so did Vancouver. They started from a lower bottom in the 1980’s though, as the crash in that decade was much worse in BC.

Not for people with savings. Higher rates and proportionally lower prices make the same property more affordable to someone with a given $ amount of savings.

Leo- I feel that people have the responsibility to not overpopulate the world. There really isn’t land available for 8 billion people to live without destroying forests, jungle, and farmland to the point that we are no longer sustainable. We are there right now, we cannot sustain 10 billion people. I believe global warming is caused by overpopulation. It’s not a supply problem, it’s a demand problem that is not sustainable. Take a look a living conditions in Central and South America, and the catastrophe occurring at the U.S. border. You don’t see government officials trying to stop their citizens from leaving these countries, in fact they hold the gate open for them, glad to see them leave.

Meanwhile, the country’s average home costs even more–over $678,000. That’s a jaw-dropping 25% increase in just 12 months—the biggest nationwide price gain in over three decades, per CREA’s data.

That’s interesting because the last time prices went parabolic to this degree (+25% y/y) was 1989. It was a historical turning point for the market. After a run-up that saw home prices double in just four years, prices sold off 13% nationally following that 1989 peak and then flat-lined for the next decade. Although, they fell far more in places like Toronto.

https://www.ratespy.com/first-time-mortgagors-taking-it-on-the-chin-040518182

Heck and if we treated people for their health problems they might not die, and they might get sick again later and we’ll have to treat them again. And again. And again.

Sorry Introvert not meaning to offend here but I consider building enough housing a basic responsibility of society.

You’re right though that we don’t have any good way to make a detached property in the core less expensive. Unless the feds want to restrict credit substantially the market will do what the market will do.

Updated the chart to current.

Almost. If you keep the same down payment then you are slightly ahead when prices drop as the same down payment takes up a larger percent of the new smaller mortgage (ie 200k down in either scenario). If you choose just to keep the percent the same (ie 20% down) then yes you are no further ahead.

What do the financial models suggest, lets say over the last 15 years, on rates rising and prices falling with respect to the results canceling each other out? Obviously things such as wage inflation also must be factored in. My immediate assumption is that rising rates don’t cancel out price inflation, adjusted for wage inflation to a significant degree. Ks112, you seem like a numbers/modelling type of sort, lets have your figs?

Marko that’s insane. Busy street. Insanity.

My guess is some would, and some wouldn’t.

The irony is that the group of folks who are dying to someday buy a detached house are also advocating hard for missing middle housing, which will only help make detached houses even more expensive and put their goal further out of reach — oops!

It will never be “fixed” because the moment we “fix” it (that is, house everyone), more people will come and there won’t be enough housing for them and we’ll return to crisis.

In fact, if Victoria somehow housed everyone it wanted to house, there would be an absolute wave of newcomers flocking here (way more than normal), all hoping to secure housing like the people just before. Then we’d have to build crazy amounts of housing again. And again. And again.

More and more density, fast, sounds like utopia to Leo and Marko, but it doesn’t to me.

homes will only become more affordable for those priced out if prices go down and rates stay where they are. If we get higher rates and lower prices then they just counteract each other and we are back at square one.

$1.76 million

4486 Emily carr dr. Can someone give me the final sale price. Thanks

Edit : Leo beat me to it haha.

For reference:

in the 90s we had 7 years of flat prices and in the 10s we had 4-5 years of flat prices but 7-8 if you count back to 2007.

The difference is that back then we had dropping interest rates which made houses substantially more affordable in that period which we don’t have this time. On the bullish side we have a larger Victoria/Vancouver price gap which could keep out of town demand higher (assuming Vancouver doesn’t decline).

“In my opinion this is the most likely scenario, but I wouldn’t be surprised if we saw a slow decline/flat market for 5 to 7 years. Then will have to hear from everyone that overpaid for poorly built homes/townhomes on the Westshore about how hard they have been done by the flat/slow declining market.”

I won’t be surprised if there is a flat market for 5 years either. I would be surprised if the market didn’t start to increase again after that. Is is true that homes are being poorly built on the Westshore?

https://www.reddit.com/r/PersonalFinanceCanada/comments/mkug70/just_a_friendly_reminder_that_there_are_other/

I sympathize with people about the cost of housing, but man there is some serious irony in the comments section of this post. It seems like everyone wants a single family house with a yard. so lots of demand? It’s also quite shocking reading people’s response to the posters suggestion to start a small business, how dare they; there is a lot of negativity out there. I wonder if people would be satisfied with the missing middle housing. I hope so because that seems like the only way to fix this housing crisis.

California:

https://ww2.arb.ca.gov/news/latest-ghg-inventory-shows-california-remains-below-2020-emissions-target

1185 Hawthorne: $1.15M

Anyone know what that place on Hawthorne St sold for?

underwater and not being able to pay the mortgage are two different things that could be argued as mutually exclusive for those not directly working in the real estate industry. But given how much real estate is part of the Canadian economy I can see how this may become a problem. Which bust did you buy your house?

I’ve heard that one before. Plenty of people have walked away during busts in Canada, including the owners of one of the houses I bought. If you’re way underwater and you can’t make the payments, what are you going to do?

Also, only a minority of states in the US are non-recourse. Some of the worst states for foreclosures in the 2000’s were full recourse, such as Florida and Nevada.

“another global event that necessitates a drop to the floor in interest rates which causes another RE price spike.”

This only works if the people in the market for houses still have jobs. Covid was unique that it only affected the low income folks. Not sure if this will be the case next time especially since most of the $60k/year union government worker types are already priced out.

Patriotz, Canada is full recourse on mortgage so not many people will walk away from their house just because it is underwater.

It’s not over till it’s over: https://www.bbc.com/news/world-asia-india-56507988

Jobs bouncing back and relaxation of the Covid rules may be just a temporary thing if this double virus takes hold.

You’ve been making that same argument for at least 10 years, always saying that “today’s” average prices were too high for people to afford.

But instead, at least 50% of first time buyers bought below average price homes and now they stay put as happy homeowners or have equity and higher salaries to put towards buying an above average price home.

What explains it in Victoria, and everywhere else, is that the great majority of owners got into the market at prices lower than today’s. Duh.

Seems plausible. And what will end the slow decline/flat market will probably be yet another global event that necessitates a drop to the floor in interest rates which causes another RE price spike.

That “average” home price number doesn’t have any relevance to conclude that all but 20% are shut out of the market.

It is a mistake to use “average” home price as the barrier to entry. Because about 50% of homes sell for less than the average. If you are trying to decide what income is needed to buy a home, instead use the “cheapest” home price. When you do that, you will see that Victoria homes are affordable to a much bigger share of the Victoria population. And this explains why Victoria home ownership rate is 63%, because half of the homes are bought at below average prices.

Not everyone gets to own an above average price home, especially as a first time buyer. But that still leaves them to buy a below average price, that’s 50% of the homes for them to buy.

“Reduction in maximum debt service ratios. Probability: 50%”

What kinds of changes could this be?

The stats people are taking a dig on Canada’s Covid death rates and it looks like Canadian hubris might take a hit.

The BC part:

From: https://www.theglobeandmail.com/canada/article-canadas-covid-19-death-toll-from-first-months-of-pandemic-higher-than/

It will be interesting to see the breakdown and analysis a few years from now to see how the performances during the pandemic really went.

Foreclosures are more a result of falling prices than a cause. People are less willing to keep up payments if the equity is gone, nor are they able to sell. In the US bust of the early 2000’s foreclosures didn’t start rising until over a year after prices started falling, and I think the same applies to past downturns in Canada.

But I don’t see a 40% nominal decline in the major markets. Some of the outlying areas that have seen huge increases, maybe.

“but I wouldn’t be surprised if we saw a slow decline/flat market for 5 to 7 years. ”

I guess that depends on the rate of rising incomes also, regardless, Leo’s affordability graph will be put to test!

In my opinion this is the most likely scenario, but I wouldn’t be surprised if we saw a slow decline/flat market for 5 to 7 years. Then will have to hear from everyone that overpaid for poorly built homes/townhomes on the Westshore about how hard they have been done by the flat/slow declining market.

Further to the solution: owners who house 2 homeless people in their suite, pay no property tax. The government provides food and subsidizes utilities.

Here’s a solution: eliminate income tax on suites (most people aren’t declaring or writing off expenses to 0 profit), and penalize SFH owners on their property tax if they don’t have a suite to rent. Helps owners pay their mortgage, and provides desperately needed rental space. People who want their privacy will have to pay for it. Problem solved, next.

If the land is reserved for SFH and gets built, the price will have to come down enough that every house has a buyer. I not saying that more townhouses, etc., shouldn’t be built though.

Also note that a lot of those SFH will have rental suites.

If you’re talking about SFH affordability, remember “homes” includes condos.

Note that household income stats include single person households who would most likely not be looking for SFH, so it’s not quite that bad. But still bad.

Just do the mortgage qualification on the avg single family house and then see what income you would need to qualify.

That 20% number was pulled out of thin air. Something like 40% of millennials already own homes, and they are the big buyers now. So what age group is the one where only 20% can own a home?

Leo, I wonder how our stats compare with Vancouver. How man sfh do they have versus HH. It could be that given their population, only the top 10% can afford a sfh, which then would explain why they much more expensive

Which really illustrates the absurdity of reserving the majority of the land for 20% of the population.

Well Patrick that doesn’t really matter if they aren’t selling like introvert.

Barrister the article was only comparing those teaser rate mortgages in the u.s. to here, so it may be a fair comparison.

You can add nearly all the “apartment or flat in a duplex” to that number as most of them are not duplexes, but houses with suites. So 25,575 / 2 = 12,787 structures. Maybe 2000 are actual duplexes? The other 10,000 are probably houses so we’re probably around 75,000 SFH or about 46% of the housing stock.

Most of the Victoria homeowners have paid far less and many have their homes entirely paid off. I recall the average mortgage balance in Canada in 2016 is 180k. Also the average new mortgage taken out in Canada in 2020 is $300k, and interest on that is about $6k per year. The big risk is for first time buyers, who might be borrowing $800k on a $1m home.

Thinks patroiz, so as of 2016 there are roughly enough sfh for the top 35% of HH based on income. So after accounting for people that own multiple properties and the ones that bought ages ago, maybe only the top 20% (or less) of HH income folks currently looking can in reality afford a home here.

Yes, and Canada’s economy is now more than 2X dependent (9.43% GDP) on residential RE investment (new construction and major renovation) than the US (4.3%). 50% higher than the USA was at peak of its bubble in 2006. So a RE downturn would be a bigger hit to the Canadian economy.

https://betterdwelling.com/canadas-economy-has-never-been-more-dependent-on-real-estate/#_

“Residential investment [Canada] represents 9.43% of GDP in Q3 2020, up from 7.71% during the same quarter last year. This is not only the highest rate seen in at least 60 years, but it’s also very high for any country. For context, the U.S. residential investment peaked at 6.7% in 2006 during the housing bubble. The current rate in the U.S. is just 4.3%, having also sharply accelerated faster than GDP in the third quarter. Just not nearly as much as Canada. “

In terms of comparison with the US, one needs to take into account that even with 5 year mortgage terms this means that about twenty percent of mortgages renew every year. When one includes variable rate and shorter term mortgages it may be closer to 30% of all mortgages renew every year. The standard mortgage in the US renews over a thirty year term which in many cases means it never renews but rather is paid off.

Our real estate market is definitely more vulnerable to rising rates. I am not suggesting a disaster scenario but rather that there is room for some concern.

Secondly, while the Canadian government certainly has a real impact on mortgage and interest rates they are limited by rates south of the border. While Canada has a little independent wiggle room it is near impossible to ignore any rise in rates in the US. While it is nice to say that the Canadian government cannot afford to have interest rates go up there is the counter balance that it is not completely in their control either.

I don’t think there are widespread signs of slowing. The hot RE market is everywhere in North America. And the recent USA stats show sales being the fastest and highest on record in the week ending March 28. Indicating that if anything it’s getting hotter.

https://www.fox5ny.com/news/homes-selling-faster-than-ever-even-as-prices-rise-to-all-time-highs

“ Homes selling faster than ever even as prices rise to all-time highs. In the week ending on March 28, 61% of homes sold in two weeks or less, according to the data. Meanwhile, just under half of all homes, about 47%, that went under contract accepted an offer within one week, an increase from 33% from a year ago. At the same time, the report revealed that active listings fell 42% from the same period in 2020, which is an all-time low. Still, more than 40% of homes sold above the original asking price, an all-time high, and roughly 16% higher compared to a year earlier, according to the data.”

It’s worse. The early 2000’s bubble in the US missed substantial parts of the country such as Texas and much of the South and Midwest. We are seeing price increases in Canada everywhere, even in areas that have been losing population.

And let us not forget that the US bubble was accompanied by rising employment.

2016 census for Victoria CMA says there are 64,235 SFH out of a total of 162,720 dwellings which is 39% of all dwellings.

There are 60, 660 households with income >= $90K which is 37% of all households.

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CMACA&Code1=935&Geo2=PR&Code2=59&Data=Count&SearchText=victoria&SearchType=Begins&SearchPR=01&B1=All&TABID=1

Newhomeowner, that is the thing about bubbles no one really knows it was one until it bursts. The fact that there are no bears left on this forum anymore and we are at the top of Leo’s affordability chart indicates to me that if this is a bubble then the top is near or already in.

Haha! Caught me before the edit Leo! You’re right, and my first post was wrong. But when 97% of homes in the GVRD were purchased before the run up I still don’t see the risk.

I recently read 2 articles that compared Canada today to the USA of 2006. If this cluster eff runs another 2 years, then we gotta worry. But even then our mortgage and banking sector is far better regulated then the us was then. Honestly, the difference between here now, and there then is totally staggering.

Because when you’re not leveraged to the max you can handle a drop in income.

I don’t know that subprime borrowers working with alt-lenders with a variable rate or fraudsters that don’t get caught are likely to really move the needle.

Most canadians are on a 5-yr fixed and so very few meet the other criteria that I really think that drops into conspiracy territory.

Personally, I don’t really see the risk. The job market in victoria is clearly very healthy. And I disagree with Leo as well. I don’t understand how cancer with a 600k valued house is any less disastrous then cancer with a 900k valued house. In fact, I believe it’s less so. There have been what, 1000 sfh sales at current market rates? The other 100k+ homeowners now have 30% more equity then they did.

Those people are likely to be far more resilient to a personal event today then 4 months ago. Especially if they refinanced at 1.8% like so many others did.

Leo, I wonder how many variable-rate mortgages were used with alternative lenders that don’t do the stress test in the current run-up, along with people lying on mortgage applications? It is one thing for parents to help out with the down payment but will parents actually be willing to chip in on the shortfall month after month? I think demand destruction due to higher rates is the most likely outcome with the fixed 5-year rates going up first. However, if inflation goes up quickly then I can see the BoC raising rates, even if they don’t raise rates things will get awfully tight for people with big mortgages should incomes stay stagnant.

Either way, it looks like your affordability graph is going to be put to the test!

Do you have any stats on how many SFH there are in Victoria in relation to the percentile of local HH income it equates to? For example, are there only enough SFH for the 90th percentile HH incomes or is it maybe 75 percentile?

Another thing about affordability being poor. It’s not that the mortgages can’t be paid, they can. That’s what the stress test is for. But it doesn’t leave much room for error. Shit happens. People get sick, people lose their jobs, people get divorced. At lower valuations that is bad but not catastrophic. When you’ve got a million dollar mortgage there is no room for error.

Well 25%. The other calculations also don’t appear to be entirely correct.

Basically yes. Banks aren’t in the business of torpedoing themselves.

Rates could go up, but I doubt they will by very much. As soon as they start to rise I think we’ll take such a hit to economic growth that they will drop again.

That said I think the impact of flat rates after decades of dropping is still wildly underappreciated. People buying now to jump on this train of house price appreciation I think will be extremely disappointed. We don’t need interest rates to go up much, even if they just stay basically flat that could cause a mild decline or stagnation in prices for a very long period that is unprecedented for Victoria.

Don’t see it falling that much, for that to happen there needs to be mass foreclosures and sky is falling kind of event/sentiment. Given that most people are probably locked into 5 year fixed mortgages and have been stress tested, I just don’t see that transpiring. So what you have are people still making their payments but much less demand since buyers cannot afford current day prices at say 3.5%, but sellers won’t be too desperate that they don’t have to sell so you probably see a slow decline of 10% like what happened in 2012-2014.

One thing that could exacerbate this is I feel like so much of the local economy in Victoria revolves around realestate ( seems like everyone and their dog these days is a realtor, mortgage broker, flipper, investor or developer) so even a mild slowdown could have a real drag on the local economy and puts further downward pressure on prices.

Came across this story sourced from a Vancouver realtor…

https://www.straight.com/news/realtor-warns-canadian-home-prices-could-fall-40-percent-in-major-housing-market-correction

A note, the person is CEO of Zealty.ca and the managing broker of Holywell Properties. Any thoughts from the group on reasons for his angle in the story?

I charge below market rent for a number of reasons.

First…There is nothing more valuable than a good tenant.

By pricing below market value, I get to choose from a larger group of tenants who are eager to rent the place because it is a good deal.

Once I rent the place, they don’t want to move out and they take good care of the place because they don’t feel that they are getting ripped off.

I’ve very rarely had issues with bad tenants or had a missed rent payment over the past thirty five years.

“Every year I ended up doing the same number of deals +/-, expect every year I make more money phasing out discounts.” Mark you are very successful realtor, do you think that by you offering the incentives you were able to build a clientele? Now that you have a clientele you may not have to offer these incentives? Overall it’s pretty unfortunate, I feel like you were one of the last realtors putting up the good fight.

Smaller markets. Very little pressure on commissions in the US in bigger markets, even with Zillow and everything else.

Yeah could be, but why is DIY so common in cheap markets on the east coast?

I disagree, problem with a flat period is the market sucks and then you don’t want to “risk it” with a lower commission brokerage.

My assistant and I once run the numbers on this and this is what happens in a slow market (I am not exaggerating the numbers).

99% of the scenarios

1% of the scenarios

In my opinion, the second scenario is the logical approach but people can’t grasp logic.

I think what will do it in the end is an extended period of flat prices for people that haven’t made money. I’ve said it many times but equity gained through appreciation doesn’t feel like real money. Who cares about spending $40k on the sale when you’ve gained $500k by doing nothing?

But if you bought a $1.2M home and 8 years from now it’s still $1.2M and the only equity you have is from your hard earned dollars then spending $40k starts to look a lot less attractive.

I honestly thought when I started mere postings in 2010 that they would be 10% market share by 2015. I remember having lunch with the original HHV founder in Cook Stree Village summer 2010 being like “I gurantee you 10% of people will want to save 10-15k on selling their house via mere posting and as far as my 50% cash back, that is 100% bulletproof, you would have to be a complete idiot not to use that service on the buying end.”

Two massive factors I overlooked. i/ People have extremely poor common sense and most are so dumb you can’t logically reason with them. ii/ Real estate is extremely emotional.

So, on the FB page where everyone claims to have beat out higher offers with a letter I posted a simple question last night

No one gives me a concrete reply but next comment is….

How do you tackle that with logic? Trying to offer lower fee structures in real estate is like trying to logic with a Trump supporter. There is no winning.

I’ve phased out the mere posting, the 50% cash back, and this is the last year I’ll be doing lower fees for full service. It literally makes zero difference. Every year I ended up doing the same number of deals +/-, expect every year I make more money phasing out discounts. I’ve lost many listings over the years because of the lower fees (people are so incredibly dumb they think lower fees means lower service).

I honestly can’t see real estate fees changing in my lifetime. If anything, they will outpace inflation. For example, SFH prices have almost doubled in the last 10 years which means commissions have doubled, workload has decreased because of technology (i.e. DocuSign), yet the lower commission business models are lmost non-existent. When was the last time you saw a home in Oak Bay listed by “Bob’s discount brokerage?” People are listing with brokerage franchises from Germany and Los Angeles because that makes sense.

Leo probably has a different opinion, but he isn’t on the ground enough to see what I see on a daily basis.

” I see similarities in there to a segment of the population Trump catered to in the US (and I don’t mean that in a derogatory way). It’s people who are being left behind by growing wealth inequality, are angry/distressed about it, and are looking for someone or something to blame. Unfortunately, people in this situation are often manipulated into arguing and acting against their own self-interests.”

I will point out that the net worth of the lower half of Americans increased by more than 70% during the Trump Administration.

“People have basement suites because they need the revenue to pay the mortgage. They are not going to get rid of them because of a potential capital gains hit years into the future.”

Well that’s news to me. I am pretty sure I have a basement suite and don’t need the revenue to pay off the mortgage. It would seem pretty dumb to enact a policy discouraging people from creating and maintaining basement suites when we are already short of rental units.

I was also looking up ownership rates across Canada and it appears Victoria is well below the average, approximately 63%. I think that was 2018 figures. Probably going to stay that way. Might also indicate how important investment properties are to the general population.

Ownership rate is just under 70% in Canada. What is the ideal rate we should be striving for?

I think we need a shopify format so people control their own sale but have easy access to the tech.

I like BAT, but it has its issues as well. I submitted my all original exceptional condition 80s BMW 6 series to be auctioned and they declined it and gave zero explanation. I ended up having to sell it on autotrader.ca.

RE changing house sales methods

Have a look at the Bring A Trailer format. The seller responds to all questions, the bids move upward and the auction closes at a predetermined time. Significant amounts of cash move around in very short periods of time and everyone seems pretty content.

I’ll wait for Marko to chime in but it seems to me that if there is a “profession” which you can enter by getting your teeth whitened, signing a lease on an Audi, and learning how to use the pocket calculator app on your phone and then receive (I almost said “earn”) $50,000 for showing up somewhere on a weekend, that “profession” will be very hard to modify.

Wouldn’t that mean paying the capital gains right now?

You’re currently charging below market rent? How generous of you.

Just do the numbers. Take a typical house with a suite, look at the purchase price, interest component of mortgage, taxes, maintenance. Compare the revenue for the suite with those expenses, pro-rated.

FL has a point that as time progresses the rent vs expenses balance will improve. Back when I was a landlord I started out running at a loss and ended up with a small profit (all duly reported). But it won’t improve if interest rates start going back up.

I think they are probably unaware that it’s the net rental income that’s taxable, not the gross rent.

When we were renting out a suite, we were made a small profit or loss each year. The biggest expense was the interest from mortgage. With the lower interest rates now it would probably be harder to make a loss. Also as you pay off more of your mortgage this expense also becomes smaller.

I still think suite income after expenses are deducted will usually not be all that substantial for most people. The CRA seems to agree since they don’t seem to make this a priority to pursue.

Maybe the market is drunk on the unlimited funds available for real estate. As long as governments create more and more money to keep the party going, more people are going to suffer hangovers.

Say what you like Patriotz… but the first thing I will do is dump the suite….or increase the rent. (Very likely raise the rent.)

Some people will. Some people will not. The fact that “some” will, means there will be less rentals available or available at a higher cost.

We generally rent at below market value. That would not be the case if we were eyeballing a capital gains tax in the future.

By the way…we always declare the income. Anyone who doesn’t is a fool and will get caught eventually.

Lol, not to be cynical, but wouldn’t any community give back just be marketing targeted at the vapid and foolish? The give back I would look for is how much the realtor would be able to save me or gain me leverage because they really know their profession. I wouldn’t say no to the realtor giving me some of the commission % on the deal either. Lol. If it’s my money being spent the only concern I have is how much gets to stay with me, if a realtor is going to give back to the community, it can stay with me instead, enough of the taxes paid on the transaction will be going to the community.

Too funny again: what would that contain? A statement on how you will pay more than anyone else with no conditions? No one will care if it’s your dream home or you really need it for your family, it just comes down to money and ease of transaction. I guess saying your need implicitly states you you will pay more, but not the best negotiation tactic, but in this market there really isn’t negotiation anymore, just bidding. In the end, fairness is relative to perspective and deserve has nothing to with anything.

https://youtu.be/R4pRe8ul7KQ

“The issue is a lot of people with suites are actually running a loss on a net basis, and many others are netting very little.” Do you have stats for this? My guess is that this is not true. The reason why people are not claiming their rental income is because they don’t want to pay tax. However, I do not have the stats to back up how many people don’t claim their rental income, this is just my subjective experience with people I know. I have multiple suites and I deduct as much as possible and I owe tax at the end of the year.

“Note that New Zealand is going to eliminate mortgage interest deductibility for rentals almost across the board. I think however that is not going to apply to purpose built multi unit rentals.” I don’t agree with this, if they want to treat a rental as an investment they should treat it as such.

Mostly happens in hot markets. Not sure if it really makes a difference to house prices. Yes the place is empty during the reno but eventually houses need to be fixed up, and this is one method that the market does it.

Electric sailboat conversion from the eBike wizards at Grin Tech in Vancouver.

Super cool. Potential for totally sustainable cruising solar powered. https://youtu.be/4kAsdIiD8d4

People have basement suites because they need the revenue to pay the mortgage. They are not going to get rid of them because of a potential capital gains hit years into the future. They might consider paying a bit less for the house though.

And let’s not forget capital gains taxation isn’t stopping people from buying and renting out self-contained properties.

Canada’s population growth over the last year was only 0.4%, far below the norm. Population in Newfoundland actually declined. Yet we’ve seen a significant increase in RE prices all across the country, in large and small cities.

It’s not about population growth. It’s a speculative bubble like we’ve seen before in various markets but on an unprecedented scale.

I think one factor driving up prices are people employing the greater fool theory ie. flippers. They battle over properties in the hope that a quick renovation, which a lot of people are capable of doing themselves, will net them more profit than they can make working all year. I’m sure most real estate agents have clients doing this full time. Maybe that’s the segment of the market that should be taxed heavily. Maybe that’s why there is so much demand for property.

If the government wants to crush basement suites out of existence then they should cut back the principal residence exemption for suites.

Of course…..the income received by governments from this windfall would be quickly wiped out by even further homelessness and other social costs.

At the very least, rents would have to go up to cover the costs. If one couldn;t increase the rents (for whatever reason) to cover the cost, then the unit would be taken out of rental market and less rental units would drive up the rents.

I suspect we’ll start hearing the term brain drain again real soon. That was a constant refrain in the 90s with people going to the US. Trump helped us retain our talent and attract it from around the world, but I wouldn’t be surprised if it swings back now.

Salaries have jumped in Vancouver for tech but probably not enough to keep up with prices

Not a real factor though for the overall market. Some people pay too much, and you could even argue that it might increase volatility in the market in hot periods. But every market turns eventually and the market value of a house doesn’t change just because it previously sold for over market.

I do not enjoy watching people pay too much for anything, and current prices in major centers across the country are simply out of reach for most people. I don’t know what the solution is ( maybe slowing immigration?) but a country with such a small population and large amount of available land shouldn’t be this expensive. If I was younger, I’d probably look for another country to live in. Where that is, I have no idea.

‘People aren’t really paying the true value’: How blind bidding helps drive up soaring Canadian home prices

It’s bad for the market because it increases risk of buyers paying more than market value. But it’s not the cause of our high prices. Also note that Australia has a transparent auction system and also sky high prices. A sensible consumer protection change but wouldn’t move the needle on prices

Leo- How is an irrational blind bid not bad for the market? This sets a precedent that other sellers expect to achieve, further driving up prices. Comparative sales are an important tool to determine the value of an asset.

Sellers switch to a bidding war strategy in hot markets. How much of that is due to agent advice and how much is from the seller I don’t know but the advantage for the seller is that there’s a chance of a irrationally high bid from a buyer.

We should definitely have innovation in this area but the blind bids are not a cause for these prices they’re just a symptom of the overheated market

You answered your own question:

I don’t understand why technology hasn’t caught up to the real estate industry. The pandemic has forced all auctions to go online. Since bidding wars are becoming the norm, why not list properties online and have a fully transparent auction. The business I’m in (antiques) has benefited from this format that offers greater exposure, gives people time to think and do more research. Bidders would have to be qualified with a substantial, refundable credit card deposit. Open houses could be conducted at specified times. This would prevent people from overbidding as the auction would increase by increments of $1000, or whatever amount the seller wishes. Realtors might be left out in the cold as commissions for the service could be 1-2% of the selling price. The buyers are usually charged a fee also, splitting the commission between buyer and seller. Not sure what impact this would have on prices, hopefully it would prevent buyers from overpaying. I think this is the future that can easily be implemented today. Maybe a smart realtor should start offering this service and get in on the ground floor before someone else puts them out of business.

The issue is a lot of people with suites are actually running a loss on a net basis, and many others are netting very little.

On the other hand cutting back the principal residence exemption for suites would yield a big tax payoff on a single transaction. Or the government could stop letting suite landlords having it both ways and make the gross rent fully taxable if they want to retain the principal residence exemption on the whole property. That would make it worth going after.

Note that New Zealand is going to eliminate mortgage interest deductibility for rentals almost across the board. I think however that is not going to apply to purpose built multi unit rentals.

This couldn’t be more true when it comes to housing right now. Really well said.

Very hard to tell from a stats standpoint until some months have passed. However 34 sales of houses listed for over $2M in March indicate it’s still very active.

Leo: True enough. The amount of contradictory articles about real estate is staggering, and it’s so easy to manipulate information to support whatever agenda an author has. This is one reason why I have appreciated reading your articles over the past years…you try hard to avoid this.

There are a few voices of reason on there, but mostly it’s just not very useful. I see similarities in there to a segment of the population Trump catered to in the US (and I don’t mean that in a derogatory way). It’s people who are being left behind by growing wealth inequality, are angry/distressed about it, and are looking for someone or something to blame. Unfortunately, people in this situation are often manipulated into arguing and acting against their own self-interests.

Thanks for posting. I’ve offered the Gordon Head Resident’s association to give a presentation to discuss why I raised and supported some of the actions in that report and answer questions from members.

Well I did suggest to sacrifice a goat…

Seems fine to me although I don’t see the point of posting endless random listings and I find FB hard to keep up with. But it does make it clear that there is just so much noise out there about real estate. Hundreds of articles stating everything and its opposite. Hard for people to figure out what is going on.

Also high time we have public sales prices given the dozens of “what did X sell for” posts. Gotta ask Zealty again what’s taking so long to expand here.

The level of discussion on that Vancouver Island Housing FB group is abysmal. I think a grade 7 level is being generous. Ultimately it’s sort of sad. Full of people deluding themselves into believing that housing prices are going to drop to what they were in 1999 because they can’t afford current prices. But at the same time, there also seems to be strong sentiment against plans that might actual help affordability (like those laid out in Lisa Help’s letter).

Marko, I am sure most letters now days are probably just a template downloaded from the internet with some minor modifications 😉

My question is where were all these buyers from May to September? Why does everyone feel the need to follow each other and buy now, never understood the group-think mentality.

Wow….reading some FB group questions and answers.

Dream home….”Any tips on how to make sure that it does not slip by?” 78 replies with approximately 77 being “write a letter.”

“How to choose a realtor”…..”they give back to the community” Yes, they gave $5k back, after grossing well over a million 🙂

It would appear common sense in the general population is at a grade 7 to 8 level. This cannot possibly last, at some point it all must implode.

What are everyone’s thoughts on why all the banks are calling for government cooling measures? Are they just saying this to cover themselves if things do go south (so they can say see I told you so) or are they actually concerned?

I think they are stuck between a rock and a hard place, if any bank scales back mortgage origination right now then they are losing market share to their competitors and will be punished via their earnings and share price, so in essence they have to keep up. On the other hand they are probably getting at least a little uncomfortable with the way prices have gone and their risk management teams are sounding alarm bells when they run their stress tests.

Interesting Frank, I guess it comes down to the kind of business and the assets that come with it. Also, doesn’t BDC exist to help out in these situations?

Mince Meat- Exactly right, you would have to go to a secondary lender and pay 13% interest. In most cases that is the only option. They will even deny you with a principal residence if you do not have the income to cover the mortgage (with the stress test).

In my limited experience attempting to get a business loan, I was denied because I didn’t have a principal residence to put against the loan (RBC and TD). I assumed that this was standard process for a SMB loan across institutions. Is this not the case?

“I do think that they may chip away at the suite exemption for principal residences, which I think is just a CRA guideline rather than tax law. I also think there’s a lot more money that could be brought in simply with better enforcement. For example, lots of triplex “principal residences” these days that don’t qualify under current guidelines in any case.” I am a little confused on why there is so much emphasis on the principal residence exemption. If they got rid of it, they would probably follow the US and let you deduct the carrying cost of the mortgage, which is still very attractive. If the government is going to try and reduce demand, I would be more interested in the government, e.g. the CRA, cracking down on things that are already illegal and making housing attractive. For example, the vast majority of the people I know with suites are not claiming their rental income, but this may be a man power issue.

Leo- Probably will help real estate, fewer people listing, more people liquidating properties south of the border. A lot of money is being repatriated that has to go somewhere.

Perfect time to start underlisting properties by 300k, instead of 200k, to encourage even more buyers that have no chance to book showings.

1000 cases a day for 2 more days. That should give the real estate market a boost

I live in Vic West, doesn’t concern me personally. We already have the tenants in the park and I play basketball and bocce ball there with friends with no concens. I listed one of the Vic West homes in the last week but nothing to do with shelter. My clients had been thinking about selling for a year.

Marko, I have noticed a lot of homes pop up for sale in Vic west in last week, do you think there is any correlation with the two homeless shelters being planted on Catherine and Russel st? I hear there is a lot of concern with the local community and an elementary school being near by.

Depends on the size and the timeframe. FINTRAC requires documentation of large deposits from the banks and separately, the banks ask for a declaration of a gift (from the gifter) if money comes in to support a down payment, without that declaration as a gift it can be considered a loan and thus a repayable liability that impacts the amount of a mortgage approval.

Fatiguedbuyer I have also been getting into housing advocacy lately. Feel free to reach out to me (Leo has my email) – I’d be interested in going to some public hearings or discussing housing ideas in general.

Frank, I am not sure if there are many small business owners that would risk putting their own house up as collateral.

I would be more worried about the properties that have been put up for collateral on all the small businesses that are failing. Difficult, if not impossible to get a loan from a bank( (for a decent rate) to start a business. Don’t know why there hasn’t been more foreclosures.

Umm- I’m not sure how gifts and family loans are declared since I’ve never had that problem. How do the banks know where the money comes from? Do the nanobots they’re injecting into us via the vaccine have listening devices?

I am concerned of the multi-generational debt being built on a single asset class; whereby parents are leveraging their primary asset before retirement to allow their children to become highly leveraged on a single asset as well. It is a significant vulnerability to families as they are chasing the hot market. There is a risk that if modest decline in real estate values occurs or even just a normalization of interest rates happens at a faster pace than expected, some families will have their finances wrecked across generations. I really hope that this doesn’t happen to people, but as I see the “all in” mentality amongst my peers, I think there is going to be negative impact on many boomer’s retirement years and their children’s future financial stability by the singular focus on real estate right now.

It’s the principal residence exemption that’s meddling. In any case, I just don’t see a politically salable way to eliminate it. I do think that they may chip away at the suite exemption for principal residences, which I think is just a CRA guideline rather than tax law. I also think there’s a lot more money that could be brought in simply with better enforcement. For example, lots of triplex “principal residences” these days that don’t qualify under current guidelines in any case.

Yes, and if they grandfather everyone’s principle residence capital gain, what’s the point? The impact will be zero to start off with as no one would have any un-grandfathered taxable capital gains. Homeowners aren’t going to sell because their gains are grandfathered. Buyers aren’t going to be scared off with a cap gains tax down the road either. It’ll just be more government meddling, with extra paperwork and filings for the typical homeowner, accomplishing nothing.

Apologies if this has already been posted here before, but if you haven’t filled out the Saanich housing survey, I encourage you to do so:

https://saanich.ca/housing

Lots of decent strategies here, just hope they can act on them quickly.

I’m doing what I can to organize folks in a similar position to my family (renters and/or currently in a place they have outgrown and desperately needing that missing suitable family housing in the Victoria area). It is frustrating seeing how well organized the NIMBYs can be against new developments (must be nice being retired and having the time to research and create long reports and organize the opposition). Most families I know looking for homes definitely don’t have the cycles to do this in any similar capacity. I definitely plan on getting more involved and attending upcoming public hearings on new developments, mostly so these “65-year-olds-who-moved-here-from-Toronto-in-2010” can look me and my young son in the eye while they say tree canopy and architectural consistency is more important than us having a home.

I guess we agree on something 🙂 I would say my basketball game is much like Kukoc, without the shooting touch. My tennis game much like Ivanisevic without the serve. Both lived on the same street I grew up on, at different times.

I think the states have a cap on gifts towards down payment. Frank, I think there is a cap in Canada on using a loan as down payment regardless of the interest amount. I am sure there are many ways to skirt around those rules regardless. With all these capital gains taxes being talked about, if they just grandfather everyone who bough before then the blowback probably won’t be that bad.

At the end of the day for any of these anti speculation policies to be effective it needs to decrease demand going forward, punishing existing homeowners doesn’t do any good as they will just hunker down and use helocs when they need a liquidity event.

Yes, then the gift has to be declared as a loan to the bank/lender as well, instead of a gift and would go against the amount that would be approved as a mortgage. The bank/lender requires the gift declaration when it is not a loan. So, if it is being declared as a loan for the taxman the paper trail is there and pulls down the overall amount that can be borrowed either way.

Umm- Good idea, unfortunately there is an easy way around it- turn the gift into a loan, 0 interest.

I would not be surprised if the feds decide to attack housing by an indirect approach. Given that the government is going to be cash strapped for years to come and they are going to look hard for revenue sources. I think they might bring in a tax on the in family cash gift (those big funds going from Boomers to Mils to help buy homes). It would likely be a bit of a revenue windfall, give Boomers a second thought on pulling money out on HELOC(to give to their kids) if it was going to to be taxed (cutting some debt the Boomers are adding as well) and likely taking a big chunk of the highly indebted buyers out of the market that were only there because of the down payment gift. Also, at face value, it would not look like an attack on real estate values (home owners like their home values to increase and the majority of Canadians are owners). From a cash grab, impact and political obfuscation standpoint, it really might be considered.

Introvert-Unfortunately, family obligations (elderly mother) prevented me from moving 20 years ago. At least I secured a place in 1994. I knew prices would escalate on the Island as boomers retired, but did not anticipate prices to reach these levels.

Yeah, my partner and I thought we’d get a head start on “retiring” to Vancouver Island by moving here at age 24. I mean, why wait till 65 to enjoy the perks of living here?

Turns out to have been not just a great lifestyle decision but a great financial one too.

’90s NBA basketball was the best.

Regarding an increase in listings, it would be interesting to know what is motivating the current people to list their properties and where they are moving to. I don’t think listings will increase greatly until the pandemic is behind us. I can’t see what would motivate many people to uproot their lives unless absolutely necessary. More seniors are reluctant to enter care homes for obvious reasons. I don’t think many homeowners are considering moving out of Victoria, those who are will be easily replenished by newcomers with a lot of money. The prospect of selling during this mania is tempting, however, trying to buy another property is a nightmare. Investors are the only group of owners that can reap a windfall benefit and, like myself, are not anxious to sell as we are not anticipating a significant drop in price. In my case, and I’m sure others, the reason for purchasing on the Island in the first place, was to one day make it my retirement home. The primary source of new listings would probably come from estate sales, giving the inheritors a ton of cash, which they might use to upgrade their own residence. Can’t see supply increasing much, so the only solution is less demand. How do you decrease demand?

+1 in support of those as well0, just annoying when they spill over to the basketball court and I can’t practice my Tony Kukoc moves.

What about skate parks? Those seem to get there most use, packed with kids on scooters, bikes and skateboards, and have a fairly long useful life with minimal maintenance.

I think as a society we should encourage and provide amenities for ALL for cheap sports like tennis, basketball, soccer so I am 100% in support of tennis courts on prime land. Outdoor tennis has to be the cheapest amenity. Other than resurfacing every few decades and a bit of net maintenance.

I am not in support of people complaining that hockey, golf, whatever is expensive. Your choice.

For those of you keen to increase density, an observation from personal history…..

I used to own a duplex in Fernwood. Every year the assessment would come out showing that each of unist had a land valuation not at 50% of the value of SFH lots to either side and across the street but at a little more than 70%. Only a minor annoyance when looking at the tax bill of course, but if multiple units are to be encouraged shouldn’t the assessments and thus taxes be more rational?

I sort of liked the “bidding ears” for some reason.

Well I guess it really depends how many owners are on the fence about selling. If they start seeing houses going for less than what previous sales go for then it would be motivation to act. I am sure the uncertainties about the upcoming budget has also made buyers gun shy. Why would anyone get into a crazy bidding wars when every day on the news its banks and economists calling for cooling measures.

KS112: An avalanche of listing seems more than a bit optimistic. A few extra sounds a lot more likely.

I wonder if things do start to slow if we will see an avalanche of listings as all the owners who were previously contemplating of selling all jump in trying to cash in.

I have been following the 2mil and up market a bit since a Toronto friend of mine is thinking of buying here. In the last couple of weeks I have had the impression that sales are starting to slow. Absolutely no scientific analysis here to back that up. There are a few properties on the market that I had expected to sell fairly quickly that seem to have sat there now for a couple of weeks. Any thoughts out there?

I agree that financial incentives from senior governments to municipalities for more inclusive zoning would be OK. I do have to say that “offer people substantially lower taxes in their neighborhood” sounds like a payoff to selected individuals for political support. Municipalities are required to tax everyone in the same assessment class at the same rate and I think moving away from that would be a very bad idea.

Re: golf

At least cedar hill has a public trail around and between the front and back 9. Plus prices are reasonable. Malcolm Gladwell is bemoaning the lack of public access to LA’s private courses, despite their very generous tax treatment and the lack of green space options in LA for the general public. Interestingly, in that podcast, he holds up Canada and Scotland as places where some of the nicest golf courses (St. Andrews for example) are at times open to the public.

That said, it’s fair to wonder whether it still makes sense to devote so much prime land to one activity. On a related note, does anyone else find it odd that a ton of prime land is devoted to tennis, which, unlike golf courses, are completely free for those who happen to enjoy that sport?

There would be nothing “illegal” about governments giving tax incentives to encourage neighbourhoods to consider higher density.( I think “pariotz” missunderstands what I am saying.)

At the very least, the golf courses should be “heavily” taxed and if they decide to sell because the cost is not worth it, then the property should be made into a park.

‘

‘

Not going to happen in your lifetime, I agree it’s not fair but its not gonna change anytime soon.

You can listen to Malcolm Gladwell’s podcast on this very subject.

http://revisionisthistory.com/episodes/11-a-good-walk-spoiled

Disclaimer, I am a member of a local private golf club.

Rush4life: Bank of Canada director positions are appointments, not elected positions.

Frank: You can make your own cryptocurrency. You just need people to trust the issuer for it to have any value.

@rush4life seems like you are getting into organizing to advocate for housing solutions. Something I’m increasingly interested in spending time on. Any ideas of best place to do that from? There’s gensqueeze but not really sure they are doing much, and seem to have drifted into too broad of a set of issues, not just housing. Drop me a line on my email if you like.

Here’s a list of supposedly every project in BC: https://www.creativebc.com/crbc-services/provincial-film-commission-services/in-production

Victoria production addresses

AMERICAN DREAMER – Movie

MAID – Season 1. They were filming at the Gordon Head rec centre some time back

BAKER’S SON – TV Movie

WEDDING VEIL WISHES 1

Low rates and uncontrolled “printing “ of money. If they actually printed the money there would probably be no trees left. Makes you wonder if currencies around the world could be considered cryptocurrencies, since they are also being produced digitally. Wish I could do that.

This is why I doubt they will do anything substantial to fix this problem anyway – despite they caused a lot of this problem with low rates.

You think people should be offered money in exchange for political support? Borders on illegal I would think.

Yes, but how many people died of flu over the last year? Why the difference do you think?

https://globalnews.ca/news/7713830/flu-season-2021-low-numbers/

Rush4life- I know it doesn’t make sense, this market doesn’t make sense. Reducing rental property availability to increase inventory isn’t the answer and I believe in some strange way it would not make a dent in prices and create a new set of problems for those people needing a place to live. I would also add that renting is a lot cheaper than owning. No property tax, repairs, etc… In a lot of circumstances, landlords are already subsidizing renters in return for long term capital appreciation. Eventually, the property is sold and capital gains taxes are paid to the government, whereas owners never pay any tax on appreciation. A lot of variables to consider before any major changes should be implemented, things I doubt the government is capable of taking into consideration. They usually make decisions that are popular and will help them get re-elected, not necessarily the best decision.

I don’t think this is put of the blue. UK has vaccinated over half their population now, so they can start thinking about this.

Canada is still under 15%, so we don’t have the luxury of looking that far ahead yet.

Out of the blue, public policy grounded in logic has surfaced in the UK. Let’s hope that, unlike the virus, it spreads here quickly.

As an aside, it appears that it only takes 15 months for career politicians to apply reason and a sense of proportion to a problem. Better than I would have thought….

“No more lockdowns – Britain will treat Covid like flu”, says Chris Whitty

“Accepting some virus deaths is price of allowing people to live a ‘whole life’, says chief medical officerare unlikely to be needed again as Britain learns to treat coronavirus like flu”, Prof Chris Whitty has said.

The chief medical officer said that up to 25,000 people die in a bad flu year without anyone noticing and that accepting some Covid deaths would be the price of keeping schools and business open and allowing people to live a “whole life”.

Prof Whitty, speaking on a Royal School of Medicine webinar, said the Government would only be forced to “pull the alarm cord” if a dangerous variant arrived, against which people had no immunity and which sparked exponential growth.

“Covid is not going to go away,” he said. “You’ve got to work out what’s a rational policy to this and here I would differentiate quite a lot between a pandemic environment and what you get with seasonal flu.

“Every year, somewhere between 7,000 and 9,000 citizens die of flu, most of them very elderly, and every few years you get a bad flu year where 20,000 to 25,000 die of it. The last time we had that was three years ago and no one noticed it.”

From the Telegraph today as reported by Sarah Knapton

Does anyone know what they are filming in a few houses along Beach Drive in Uplands? Seems to be winding down now, but lots of trucks and maybe a hundred people involved in the last few days. Well organized and efficient. Seems like a big budget something.

I believe a lot of this will swing back. Supply / demand mismatch. Our forestry sector will have a field day until this is back in balance.

I believe the US is experimenting with this. Federal government money in exchange for more permissive zoning.

I know it has been mentioned but I purchased a load of lumber yesterday and just about fell out of my chair. In early 2018 I could purchase a 5/8″ 4×8 sheet of OSB for $15. Yesterday I purchased 7/16″ OSB for $60/sheet. And that was only after I complained to Lumberworld that home depot is (loss leader) selling them at $47/sheet (they wanted $65/sheet). Nasty!

I wonder if it would be an encouragement to offer people substantially lower taxes in their neighborhood if they supported increased density? Maybe for a five year period for example?

Many companies already backing away from remote work as the pandemic eases. Methinks that changing your living situation for a once in a generation pandemic was probably a bad idea for most.

Sold for $1,275,000 thought.

Frank this is not a sound theory. How would prices go up even more if renters got in? I mean if renters could afford to buy and they wanted to buy why aren’t they buying now and pushing up the price? The reason is they can’t afford it. If investors/speculators were targeted and they sold and more inventory came to market it could drop prices allowing renters to buy at lower prices but it’s not going to push prices to new highs. That’s why the renter’s aren’t buying now because of prices.

Yeah we need green space so let’s not develop everything, but never made any sense to me to have the vast land of municipal courses reserved for one particular sport. Open it up as a park for all, and upzone around it so more people can enjoy.

“They paint Oak Bay as old fashioned and anti-change”

How incredibly unfair and not at all accurate.

“There is no evidence residents are fleeing Oak Bay because of the price of housing, in fact the opposite is true”

The opposite is true? The city that hasn’t grown in decades is actually exploding in population?

“The test is how are communities that have over-densified making out? Are there fewer or more cars commuting on a daily basis? Is this a plus or minus for climate change?”