Mortgage insights & a new measure of affordability

Every year since 2005, Mortgage Professionals Canada has put out a meaty annual mortgage report summarizing the state of the market in Canada. And while MPC is an industry lobby group, the author Will Dunning has a wealth of experience in mortgage and real estate analytics and always puts out quality analysis of Canadians’ mortgage and housing experience. Generally these reports are based on a survey of both owners and renters as well as other statistical sources and is always worth a read. Here are a few interesting insights from this year’s report that stood out to me.

One common belief floating around out there is that gifts from parents have played a big part in the fueling the housing craze in the last year. That may be true, but the results of this survey indicate otherwise. While 26% of first time buyers indicated that they received gifts from their parents to help with the down payment in 2020, that’s down from over 40% between 2013 and 2015. It’s unclear what’s behind this drop, but part of it may be that refinance rules have been tightened substantially in recent years to make it more difficult to extract equity.

Source: Will Dunning

Overall 14% of down payments funds come from parents’ gifts or loans. I will never understand why loans from financial institutions are a thing, to me that defeats the whole purpose of the down payment, but according to this survey those contribute 14% of down payment funds as well.

Equity extraction exceeds accelerated paydown

The report estimates that the combined effect of lump sum pre-payments and increased monthly payments add up to about $40 Billion for the year. That’s a lot of debt being paid off early, and it seems borrowers were undeterred by record low interest rates, with a consistent third of mortgage holders deciding to take actions to pay down their mortgage early.

However escalating house prices across the entire country continued to fuel the equity extraction party on the other end, and it’s a little bigger. The report estimates that $74 Billion in equity was extracted via HELOCs or refinancing last year. Top uses included debt consolidation, renovation, and investments.

The wealth effect is real. It’s one reason why the central banks have been slow to do anything about a superheated real estate market. Those dollars are helpful to support the battered pandemic economy even if they aren’t sustainable.

However the stories of Canadians extracting all of their gained equity seem to be rare on aggregate. Only 3% of owners have more financing than their original purchase price.

Interest burden going in the opposite direction as affordability

For anyone that had previously bought real estate, the pandemic drop in interest rates was a gift. Their mortgage debt (assuming they had a variable mortgage or refinanced) suddenly got a lot cheaper. New buyers that could get around the stress test also benefited, but prices of detached houses quickly jumped to erase all the advantage and more. That brings us to an odd situation, where existing mortgage holders spend less on mortgage interest now than they have in years, while new buyers face one of the worst affordability pictures in decades.

What explains the difference? Well of course as prices have increased the majority of people’s payments go towards the principal. Some argue that’s not a cost but a savings (including the boffins behind the CPI) and so it can be ignored. However there’s no denying that being forced to save 20% of your income every month to pay for a house is quite different than being forced to save only 10%, even if at the end of it you’re sitting on a bigger pile of equity.

Affordability of family suitable accommodation

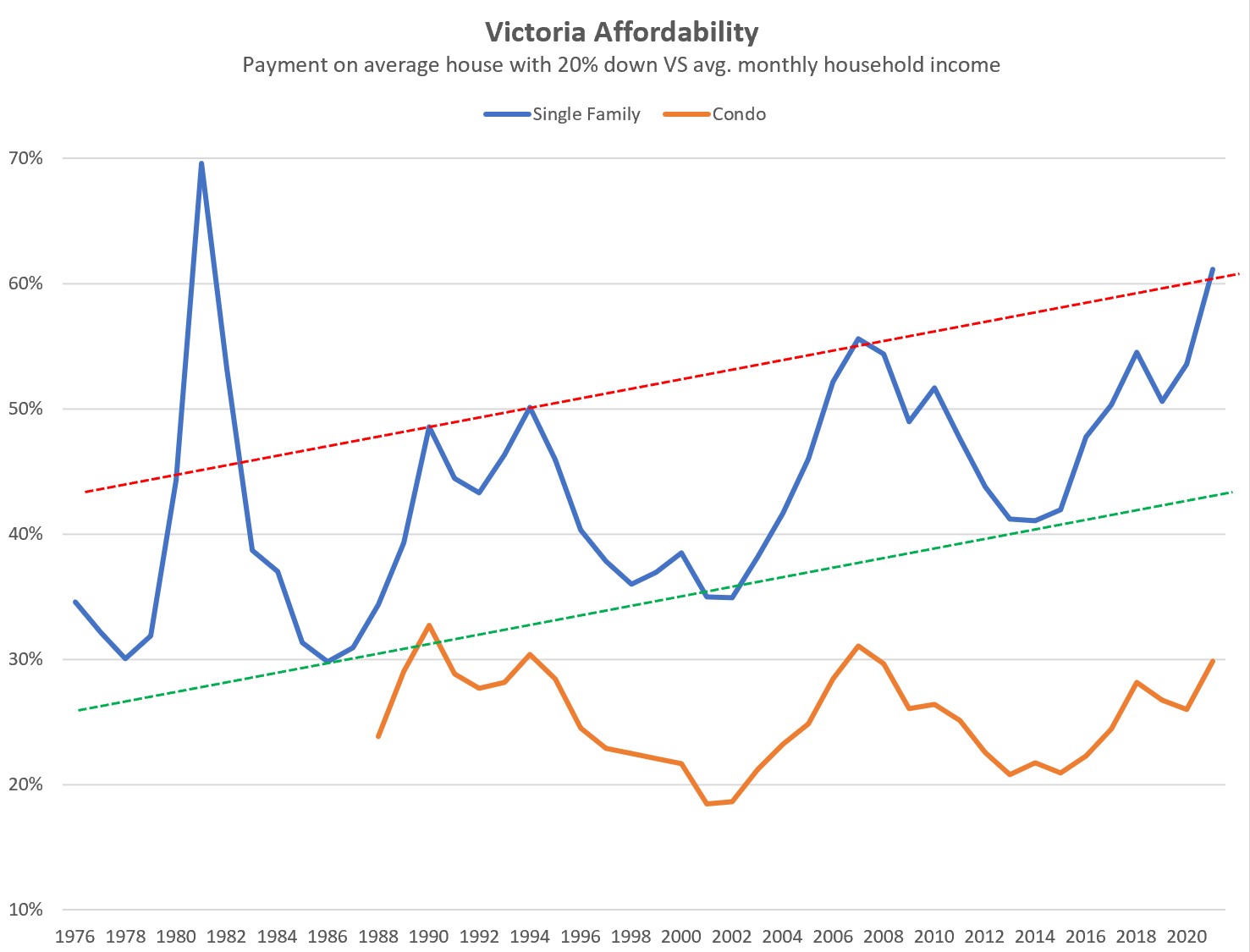

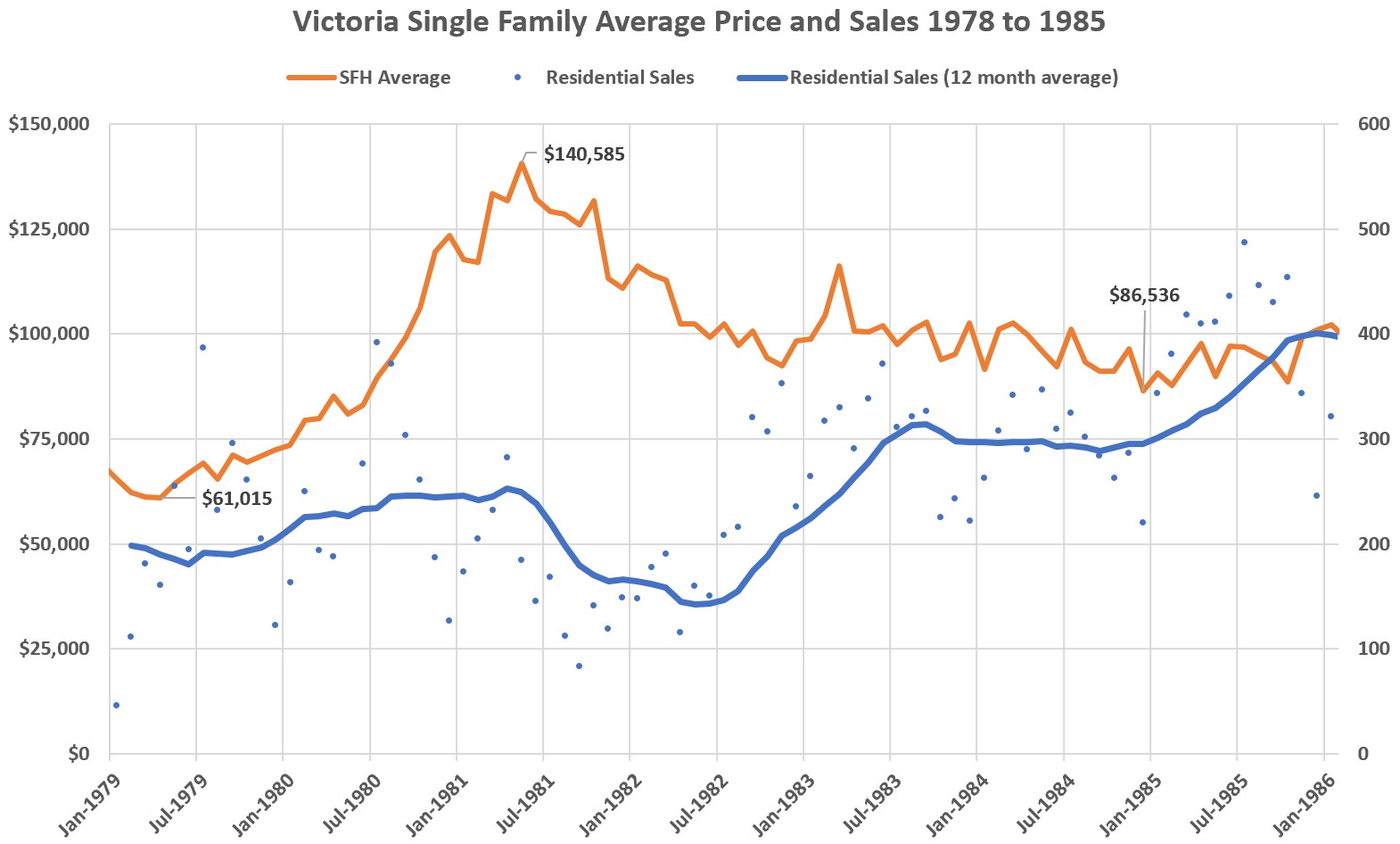

On another topic, I’ve long used affordability as one of the key factors when assessing risk in the market. In the past, when affordability got strained in Victoria, the market corrected, either with large price declines like in the early eighties, or more commonly by a small pullback followed by several years of price stagnation.

Affordability levels with 25% 2021 average price gain.

Despite those cycles, single family affordability has gotten steadily worse over the decades, which makes sense given the densification of the city. Condo affordability meanwhile has stayed in a more fixed range at between about 20 and 30% of average household incomes.

The problem is that this leaves out families. With median house prices above a million it prices out most families without substantial existing assets, while 3 bed condos suitable for families make up less than 5% of condo units. What’s a family suitable house? Well obviously opinions differ, but in my experience and from feedback here it seems 3 bedrooms, 1.5 baths, and a minimum of 1200 sqft is a lower bound for a family of 4.

There’s essentially nothing that our local governments can do about the price of single family homes on full size lots. That price is set by supply, demand, and the availability of credit. For most municipalities in the CRD, there is no more supply of land for building detached housing, whether they are hemmed in by the sea, ALR, or other cities. Langford and Colwood have a few good years left to build on greenfield land, but it too will run out. That’s of course not to say that prices of single family houses can’t go down. They can and will again, but those price movements are almost entirely out of the control of any local influence.

However there is no shortage of land in any of our municipalities to build family suitable housing as per the definition above. The below chart looks at the average price of that minimal family home as well as its affordability relative to incomes. Despite interest rate drops and income gains in recent years, in 2021 the payment on the minimal family home took up 37% of the monthly income of the average household, well above the CMHC’s affordability threshold of 30%.

Not only is that minimal family housing unaffordable, it’s also hard to find, sandwiched as a small part of the market between condos and detached houses, while not being legal to build on the majority of our land which is zoned for only single family homes. That’s something that could be changed, and I believe something for which we should hold our local governments to account.

Turning to current conditions now, here are the weekly numbers courtesy of the VREB:

| Mar 2021 |

Mar

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 254 | 508 | 769 | 1032 | 608 |

| New Listings | 323 | 621 | 939 | 1291 | 1084 |

| Active Listings | 1338 | 1329 | 1334 | 1370 | 2252 |

| Sales to New Listings | 79% | 82% | 82% | 80% | 56% |

| Sales YoY Change | +54% | +51% | +64% | 79% | |

| Months of Inventory | 3.7 | ||||

Another active week of sales, and with three days left we’ll end up nearing double last year’s tally by the end of the month. A more or less meaningless comparison since the baseline was affected by COVID, but comparing to March 2019, we are currently at 64% over that sales pace.

However there are small murmurs of a small shift in the market in Toronto, Vancouver, and Victoria, and that’s starting to be seen in the slight divergence in new listings and sales. After 3 months of sales gobbling up almost all new properties appearing on the market, we’re seeing a slightly larger gap opening up, and a small uptick in active inventory. To be clear it’s a very subtle shift, with the sales to new list ratio still sky high for this time of year, but it’s something worth watching. As I wrote before, I don’t think the super-heated market will be able to hold on much longer.

hi,

I’m sorry for the late reply. The laminates and underlay are already taken.

I was recently getting 2% on a 6mo promo with Tangerine HISA. Not sure if that is still available.

New post: https://househuntvictoria.ca/2021/04/01/another-record-month-pandemic-market-hits-one-year/

Cadborosaurus: High interest savings account(s) for all of it, whether in a tax shelter or not. It should not be in the markets (too volatile, could drop value significantly over the span of 9 mos). GICs lock it up for a set period.

HBP can be of use if you need to pull existing $ out, or if you lined it up with year end so you can deposit $25k in one tax year, and then pull it the next year via the HBP and combine with the refund from the deduction. It’s useful if you’re maxing out available cash for a downpayment.

The Moncton buyer risk.

https://globalnews.ca/news/7721895/nb-brain-syndrome-environmental-exposure/

I recommend consolidating all $230K of it into your chequing account and then leave the transaction receipt sitting on the ATM counter for all to see. 😉

EQ Bank rates: Non registered HISA 1.5%; HISA RRSP’s & TFSA @2.3%.

What did 1542 Wilmot sell for? Thanks

Cadborosaurus – You need 5% (usually) of the total available within a few days of the accepted offer. For us, that meant cash in the bank. Our TFSAs took a week to come through and we didn’t draw any RRSPs but I assume that’s awhile too.

Just thinking about PR and positioning… I wonder how much of the banks making statements is them front-running in anticipation of some sort of economic event that requires intervention by the BoC. You know, the whole “Look Joe Public, we tried to warn the BoC about economic implications of all of our loans. We aren’t liable.”

Benjamin Tal excluded for obvious reasons.

After the two Oaklands recent sold, it starts to make sense why 1542 Wilmot Pl sold for ridiculous high (but still shocked).

1620 Michelle Place back on market. Deal fell through? Anyone know – couldn’t get financing?

Wwyd with a downpayment (want to buy this yr)? Ours is in multiple places incl. RRSP at .6% GIC, EQ bank TFSA 1.5% not locked in, smaller amounts in WS invest and WS trade. One RRSP is up for renewal and some cash on hand, need to decide where to put it. Our RRSPs are not maxed we both have pension when we retire, but will be using all RRSP for HBP. TFSA also not maxed.

I have not made an offer on a house, what’s that like re: cash… I’ve heard you need to have some ready for a deposit. What’s a normal deposit size? How “ready” does it need to be, like cash available asap, with our realtor, or in a bag? I’m new to EQ bank opened the account for the interest rate. It took 2 weeks to put money into my TFSA there will it take a while to pull it out?

Thanks!

Full month end post later today.

As below.

Highest March sales ever, lowest March inventory ever.

$350,000.00 Moncton NB

https://www.point2homes.com/CA/Home-For-Sale/NB/Moncton/146-Church-ST/100472302.html

Detached house owners in Victoria gained about $15B of tax-free equity in a year, and yet at development applications there are endless concerns about greedy developers making a profit on housing.

The problem is that everyone wants the virus contained, but many if not most people, including some very influential special interests, don’t want to cool the housing market.

Get it now?

QT….my son (27years old) is doing his basement and could use some help.

He is looking for something light coloured/imitation wood/barn wood look.

Is the flooring you have moisture proof?

beggers can’t be choosers, but if any of this matches what you have he would be most grateful.

derykhouston@shaw.ca

Thanks

Deryk

Tend to agree. What can they do? Not gonna raise rates just for housing, not gonna make the stress test more stringent, not gonna do capital gains tax.

So what, restrictions on investors? Foreign buyers restrictions and vacancy restrictions we already have.

I think consumer sentiment will need to turn by itself. It always does.

It’s a competitive market. Raise rates and get no business. There are plenty of non-bank mortgage lenders too.

Prisoner’s dilemma.

But people don’t recognize that the status quo constitutes massive intervention in favour of higher prices. Money pumping, mortgage guarantees and tax breaks. They only see changes to the status quo as “intervention”.

The government will be as successful at cooling the housing market as they were containing the virus, including the lack of manufacturing and distribution of a vaccine. We are governed by incompetence.

They all know they’re getting too drunk but no one wants to stop. They would like the feds to take the punch bowl away from everyone at once.

Nothing stopping the banks from cooling the market by increase rates on their own.

Please chime in if your are a cook.

We are getting painted off white wood doors.

Kitchen cabinets, wood or steel for roll-out and drawers?

What system for blind corner cabinets (magic corner or roll-out blind corner)?

Full height cabinets or upper and lower with countertop for pantry?

Modern waterfall quartz countertop end or traditional wainscoat/crown molding?

And, wood or laminate flooring (we already purchased 2800 sqf of AC4 laminate and underlay awhile back, but could donate to a good home)?

Thanks

All the cool banks are getting in on the government intervention talk https://www.straight.com/news/td-economics-sees-government-moving-in-to-cool-down-white-hot-real-estate-market

Yeah Munich prices and all around Germany have really taken off in the past decade.

Every place I’ve visited in Germany I’ve liked prices are insane. My cousin paid 820,000 Euros for a 620 sqft condo in Munich and while in a great location it wasn’t anything spectacular.

Boy, am I ever glad I didn’t invest in Germany. I bet a lot of other people feel the same way.

Germany has stable house prices due to robust rental market and expansive social housing system and no government incentives to buy. Also high transfer taxes are a disincentive to buy.

https://mpra.ub.uni-muenchen.de/43315/

Pre-tax.

“What’s an average person?”

Think he probably meant the average HH income of 90k? I don’t think he meant the average income of a single person.

Leo is your affordability graph based on pre or post tax HH income? I am guessing it is post tax? I can’t see people paying 60% of pre-tax income on housing.

What’s an average person?

Interesting, so now we are comparing Germany to Victoria. Stroller if that is the case then I hope you are out there in bidding wars trying to snatch up as much property as you can afford. Or maybe you already did that back in 2019?

If you look at Leo’s affordability graph, what you are saying is that it will be permanently above the 60% income mark of the average hh income. It’s also interesting that the 80’s crash happened when prices reached 70% of average hh income.

“I wonder what Germany has been doing differently when it comes to real estate. They seem so….. stable!

Anyone any knowledge on what they have done differently?”

Germany has one of the lowest home-ownership rates in the industrialized world at a mere 51%. By observation, part of this is due to a large stock of high-quality rental properties which are available at reasonable prices and in which one can expect to live for a lifetime without fear of eviction, a special assessment, or a three-story stack of mouldy two-by-fours collapsing upon one in one’s James Bay dotage.

Contributing will be the fact that Germany is an exceedingly prosperous nation with fixed assets priced accordingly. An average or even well-above average person there would think it preposterous that they should be able to afford a detached home within thirty minutes of the center of a desirable city.

Earlier I made a shot at suggesting that this is what is happening in Victoria: Going forward, I don’t believe that any set of circumstances will once more place a Victoria-proper home within reach of an average person.

That Schiff has sailed.

James Soper, because that is the central banks job to make sure there is enough liquidity to ensure the economy is functioning. If they didn’t do that then maybe house prices would have crashed along with the rest of the economy and people still wouldn’t be able to buy a house because now they are jobless. I am just saying they should have lowered the rates but at the same time try to keep asset inflation at a minimum.

Duran Duran….that’s a great video clip showing where house prices have risen the most since 2000. Thank you.

I wonder what Germany has been doing differently when it comes to real estate. They seem so….. stable!

Anyone any knowledge on what they have done differently?

Ok …ok Garden suitor……got me there on a technicality…. I was simply trying to point out that Shakespear is within a stones throw” of downtown.

Why is it natural to buy hundreds of billions worth of bonds to decrease interest rates?

The struggle is real. Canada not looking good compared to our OECD brethren.

Do government back mortgages above $1M? I know CHMC doesn’t.

I think the government should remove the 90% backstop from Sagen (formerly Genworth) and Canada Guaranty. They’ve already diverged from CMHC on policy, let’s see what the private sector appetite and cost is for mortgage insurance.

interest rate fluctuations are natural, but just stop/reduce government/tax payer backing for mortgages and stop buying MBS when things go bad. Let the market figure it out, if investor still only demand a 2% return (i don’t actually know what the yield is currently) investing in a 5 year MBS without CMHC backing then that’s where the market is and no one can complain.

So eliminate the interest rate decrease and stop back stopping mortgage companies?

If you go back just one year to any real estate forum, no one said anything about quantitative easing but now everyone is a monetary policy expert lol. If someone is working a fulltime job and managing 26 rental properties then they deserve all the money they are making. my position is to just let this play out naturally with limited government intervention on either side and see how it goes.

in a super simplified example, current mortgage rates are at 2% so if you value equity at 7% then you just need a 3% cap rate to break-even at 80% financing. 3% cap rate for a 1.2M house = 36K per year in NOI, so if you can get that then you are breaking even without any price appreciation.

Too many government, municipal and city officials and employees own their own home and investment properties. Why would they want to tax themselves? I knew of a city of Winnipeg employee who owned 26 rental properties with his brother. Some public sector workers make so much money, investing in real estate is a nice sideline that eventually creates great wealth for themselves. Evil landlords are not the cause of these insane price increases, monetary policy is, and who is manipulating that by printing helicopter money?

Decided to hook a several of townhomes on the portal the last couple of days to see if there was anything interesting to possibly pursue at a less nutty rate than SFD. Today, all 5 that I decided to follow were showing as sold for quite a bit over ask…lol… Oh well..

Come on, what about the metro’s biggest municipality? That and a couple of others are walking distance from downtown.

What I’d like to see and is realistic is not allowing rental operating losses to be deducted against other income. New Zealand is going to disallow deductibility of mortgage interest altogether. Not going to happen here, although you can imagine the rush to the exits by investors if it did.

I think the government should just let the free market function and sort this out naturally, they need to let the market price risk naturally and let it be known that they will not be the backstop to the housing market should things go south. If people really want to buy crack dens in Vancouver for almost $2M when the average HH income is 90k then let them, just don’t use tax payer money to bail them out if things go south.

I’m curious what policy changes will be introduced in the upcoming Federal budget. My guesses are:

Wish the primary residence exemption would be eliminated but doesn’t appear that will happen. Hopefully though they will extend time from 1 yr to 3, 4 or 5 yrs before selling for the exemption to kick in. Also hope they hit those with multiple homes (at the very least people with 3+ properties with additional taxes and other policies to curtail the hoarding of housing).

Are people Air bnbing boats yet? Buy an older 30-40 foot boat, pay the moorage to dock in the inner harbour and airb bnb that thing.

https://victoria.craigslist.org/bod/d/richmond-west-chris-craft-constellation/7281901393.html

Is a condo AirBnB in Langford really a viable business, irrelevant of zoning/strata bylaws?

I have friends that AirBnB a basement suite in Colwood, but they would not rent it to a long-term tenant due to parents/grandparents frequently visiting from out of town.

That’s just CoV I assume. What about the other municipalities?

Agree on the loveliness of the neighbourhood, but google puts a walk from the $1.5MM house to Douglas and Yates at 45 mins.

Now on a bike, that could be as quick as 10-12 mins if you’re zippy, starting out right on the AAA bike route.

Productive oil well in back yard?

Agreed, but Forbes was also an insane reno (Bruce Wilkin Design renovation Goodison Construction built Jason Good Cabinetry in bathrooms and library built ins) imo and that went for $1.3….market has increased even since then.

Re AirBnb….there are only 16 condos with the zoning in place and no new construction is allowed transient zoning.

These 16 buildings will become a smaller and smaller % of supply and essentially non-relevant in terms of overall existing stock.

1) Janion- 1610 Store st/456 Pandora

2) Era- 787 Yates st

3) Union- 517 Fisgard st/528 pandora

4) Falls- 707 Courtney st

5) the Oriental- 562 yate

6) Leiser- 534 Yates

7) Astoria – 751 Fairfield

8) Mermaid wharf- 409 swift

9) 595 Pandora-595 Pandora

10) Leiser- 524 Yates st

11) Vogue -599 Pandora

12) Cityzen- 613 herald

13) Legato-960 Yates

14) Palladian- 1602 quadra

15) Monacco- 610 johnson

16) SoHo- 848 Mason

Twenty minute drive to downtown Vancouver.

1.8million.

(On the other hand you can buy the house on Shakespear, in a lovely neighbourhood, for less and walk to work in twenty minutes)

On the demand side it would discourage many investors from buying. Particularly significant for condos, whether they be pre-sales, new units, or existing units.

Of course that should be “from buying at the current market price”. At some price the properties will be attractive without the possibility of short term rentals.

2809 Shakespeare. No idea what it looked like before so I’d guess 200k for renos and landscaping? I would have painted the outside a different color though.

Fair point about the reno

Well there’s about 2500 active whole-home Airbnbs in the region and 28000 purpose built rentals + 6000 rented condos + who knows how many basement suites.

If AirBnB was banned some would end up in the rental market and some would be sold. I think we would notice maybe an extra 1% vacancy and some more inventory but probably not earth shattering.

https://www.capitaldaily.ca/news/victoria-airbnbs-disappearing-covid-rentals

@2809 Shakespeare

Honest question – what would this house/property sell for if it was in a typical East Vancouver neighborhood? Is this sale approaching E. Van values?

Scammers attempt to steal residential properties

https://www.timescolonist.com/news/local/scammers-attempt-to-steal-residential-properties-1.24301470

Sold January 2019 for $735,000″

Assessed: $860,000

List: $1,198,000

Sold: $1,515,000

Perfectly normal, perfectly healthy.”

Everyone also has to remember when the house sold in 2019, it was all original and a pile of crap, anyone in construction also knows that the renovation that was completed there was not a 100k splash and dash

Leo any ideas on what getting rid of airbnbs would do for Victoria? Would we go from 2-3% rental vacancy? Or is pretty minute in comparison to our needs?

Good lord, $1.5MM is mind boggling. What’s the address of that Shakespeare sale?

More than 100% in 2 years is 1980s bubble level of appreciation. Market overall is not that high but..

I was walking in the Oaklands area from my office to a construction site and randomly ran into an inspector I know that was locked out of the Shakespeare home so he called the realtor who gave me permission to open the lockbox and let him in….if people were preinspecting the home definitively nothing fishy, imo, just a big $ sale.

“I think there is something fishy going on for that Oakland’s house”

nothing fishy about shakespeare house, it ended up selling to a young vancouver couple

“That doesn’t make sense compared to the recent sales anywhere else.”

if you look at it from a price per sq ft, it sold for less then the 1600 sq/ft house on victor, for 1.2 mill

Go Jacinda, https://www.theguardian.com/world/2021/mar/31/new-zealand-raises-minimum-wage-and-increases-taxes-on-the-rich

You can still see some pictures if you google the address. Looks like they put in two meters.

Sanitizing listings is very common (removing documents like title and PDS) once sold. Removing pictures less so.

Didn’t think I’d see something crazier than Victor (1.2M), then Shakespeare happens. Even factoring in the 3 bed main floor plus suite, the renos etc., really hard to understand that one.

Shakespeare has already removed all but one (exterior) photo from the pcs network. Is that unusual?

Lol well Marko, maybe that is the going rate for Oakland’s then….

House in the Westhills just went at $1,325,000……wow.

I think there is something fishy going on for that Oakland’s house. No one in their right mind will pay $1.5M for that thing. My guess is that this some type of tax loss scheme.

Could be one party of a partnership bought this in 2019 as their principal residence, did the reno then flipped to the other party at the inflated price. Now the other party can rent this thing out and collect rent. When it’s time to unload the capital gains tax to pay will be minimized because of the high purchase price.

Well….there was a 1,600 sq/ft home that sold in the Oaklands area today for $1.2 million.

Gifted down-payment – here I am… on my “Early Millennial” high horse, thinking I was special compared to the rest of following cohorts. When I bought my first house, I saved my 5% down payment with my partner. Seemed to be the way then, as I didn’t hear of any gifted down-payments from my friends parents either.

That was early 2000’s… looks like it hasn’t changed much, surprising but now I feel like an old guy assuming I had it harder then the next generation.

Yeah I follow Steve but have the same impression. For Vancouver I prefer Adam and Matt at https://www.vancouverrealestatepodcast.com/

They don’t pretend to be experts in areas they aren’t and they bring on interesting domain experts to their podcast.

Wow, at 20% down that is a nice little return. Why is someone paying 1.5M for that though? That doesn’t make sense compared to the recent sales anywhere else.

Does not compute.

Sold January 2019 for $735,000

Assessed: $860,000

List: $1,198,000

Sold: $1,515,000

Perfectly normal, perfectly healthy.

Lol what are people paying for Oakland’s now Marko?

I don’t put much of weight into what saretsky says personally. Two years ago he was super bearish thinking money laundering and b20 is going to end the Vancouver housing boom. Now he is an expert on modern monetary theory and why prices won’t ever go down.

IMO, this is probably more people hitting the pause button until the budgets are announced as opposed to buyer fatigue. Nobody wants to get caught bidding 500k over ask and bag holding if the government swings the hammer on realestate as it’s been all over the news. It is a wise decision none the less.

Despite my personal love of the Oakland’s area the pending sales today are head scratching!

Steve Saretsky echoing what Leo is saying – on Twitter: “the Vancouver housing market is slowing. Early signs of buyer fatigue. Carry on.” –

Let’s hope it continues.

90% of politicians make the other 10% look bad.

Stroller, Josh, my point is that most people will just look at monthly payments when making a purchase decision, homes included.

Yes Leo, wealth affect is psychological and my example wasn’t really reflective of that. A better example would be that “my house just went up 200k, I should buy my wife that $2k hand bag instead of the $500 one I was originally planning on.”

I just glanced on some of the posts from your Feb 2019 link Leo. Man what a change in sentiment 2 years make. I didn’t see posts about running out of land, lack of supply or any of the current bull thesis. All I saw was barrister going to an open house with no one else there.

That’s a very different pattern than in a normal market.

List thursday offers monday.

“Where else can you get financing on a 100k car with a monthly payments of 400 bucks right now?”

I suppose it’s possible that the statement is meant to be ironical but I suspect it isn’t as I have often heard similar things from adults who to all other appearances are fully functioning. If the idea is offered in wide-eyed wonder as a genuine possibility you could have no more succint proof that personal finances in Canada in general are headed for hell.

I had help. It wasn’t required for the mortgage but it was part of the downpayment.

All I think about in that situation is “first you had a lot of debt for your house, now you have even more for a house + car”. The real winner is the bank.

Wealth effect doesn’t even require extracting equity. People see the value of their house go up, feel richer, then spend more money.

https://househuntvictoria.ca/2019/02/07/the-wealth-effect/

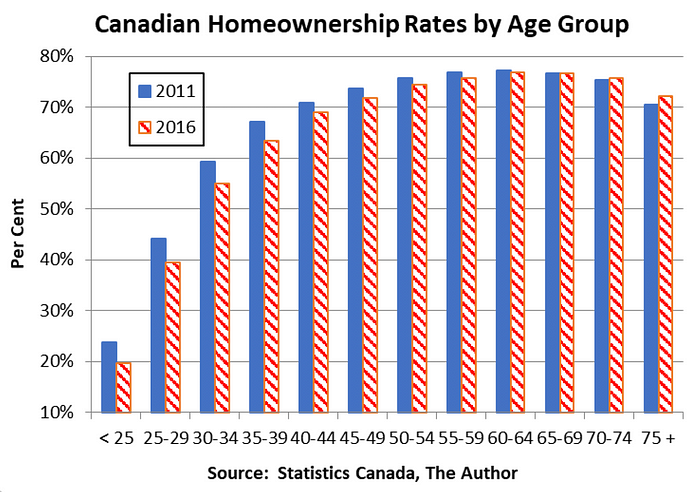

Younger cohort ownership rates over time. 2021 data will be interesting.

Or as Horgan would say “don’t blow this for the rest of us!!”

One interesting thing of note is that every young person here who has posted about their social groups has claimed that while almost everyone they know had help – they themselves did not.

I wonder if that’s bias in how people see ‘help’ or just bias in the type of person to either be on this site or fill out a questionnaire.

Josh, your home would essentially be a bank where you can get loans at super cheap rates. Where else can you get financing on a 100k car with a monthly payments of 400 bucks right now?

I must be weird. I never really considered investments in a home to be “real” wealth, which is part of the reason I scoff so hard at the idea of “forced savings”. Investments into a singular asset which can’t be accessed without paying an interest rate to a financial institution is just.. not wealth. Selling the asset can obviously generate wealth but you generally have to move from urban to not-urban or be downsizing in old age to access any competitive level of wealth when you’re talking about a time-scale of decades. I guess the wealth generator is short-term flipping but that’s super unappealing to me.

Clearly $2300 isn’t enough. Up it to $100k and jail time and see if people start taking it seriously.

I don’t know if I’d say never on the table. Politicians in general and the Liberal party especially doesn’t exactly have a history of not lying to your face.

26% seems very low!

In my experience through my friends and people we know who have bought homes in greater Victoria in the past 10 years almost all of them (about 15 couples) received help from their parents for their down payment. I only know of two friends, myself included, who didn’t receive any help from our parents financially. I find it hard to believe that “26% of first time buyers indicated that they received gifts from their parents to help with the down payment in 2020”. Not sure where that report is getting its data from but 26% it not realistic at all in Victoria. Obviously the amount varies between families and house price etc but it is not uncommon to see friends get $50,000-$150,000 to help with a down payment.

It’s simply because more households are renting and fewer are owner-occupiers. I haven’t seen any evidence that single dwelling rentals (e.g. SFH, condo) are seeing increased interest from corporations. It doesn’t suit their business model – right Marko?

And note that a rental dwelling can be part of the same property as an owner-occupied dwelling. Two separate dwellings.

Was never on the table and there’s the confirmation.

BMO report calls on policymakers to ‘douse the fire’ on rapidly rising real estate prices

The notion that townhouses are “high density” is so absurd to me. I can understand people not wanting a giant glass skyscraper on their block, but the notion that duplexes and townhouses “disrupt neighbourhood character” just shows how many are stuck in a 1950s SFD-or-bust timewarp.

I agree with this 100%. But I’m sure the NIMBYs would come up with elaborate conspiracies about how “evil big developers” are pulling the strings anyways.

One idea I have stems from hearing a woman call in about a infill lot rezoning in the COV. She had an infill home built next to her home and she explained while it caused her distress and anxiety watching the view from her kitchen being block it all changed when the home was completed and a young family moved in with children. She was phoning in SUPPPORT of another infill rezoning knowing there would likely be another family in her neighborhood.

So my idea is why not take super controversial rezonings that have been built and do an end-product story on them? For example, 1008 Pandora by Bosa the pitch forms came out. Check out the product. Added another much needed grocery story downtown with underground parking and free EV charging. Hundreds of people rent/live in the building. The developer allows dogs and has amenities for dogs which has created for an awesome community. If you don’t believe me look it up on Instagram……dogsof1008Pandora!

Saanich homeowners fined after weekend parties

https://vancouverisland.ctvnews.ca/saanich-homeowners-fined-after-weekend-parties-1.5368319

A bit ambiguous: did the homeowner get fined, or the tenants (assuming that the Hartwood house wasn’t owner-occupied)?

Rush, that’s the tradeoff that the investors take to make this trade and that is fine. However, I think the issue is that currently the investors are being bailed out along with the homeowners using it as their primary residence with tax dollars whenever things go south. So their downside risk is protected but are not sharing any of the upside benefits.

Government should only be buying primary residence MBS’s when they need to support the housing market. The MBS yield related to investment properties should be left to the market to price, this will inevitably lead to higher mortgage rates for those properties. Obviously this is way harder to do in practice.

I also think there is lot of tax evasion going on with rentals. I heard of quite a few people buying a property as their primary residence (while they live somewhere else) and not claiming any rental income. I think what the government can do is tell renters that they could be eligible for a rental rebate and get them to send in their proof of rent payment for say the last 5 years via bank records. Then they can cross reference that with the CRA tax filings and go after back taxes, the backed taxes can then pay for the renter rebate and discourage this behavior.

KS112 i’m not opposed to that idea either – clearly not everyone can own and some people prefer to rent – so we need rentals for sure. But agreed – at least until there is a balance in the market – i am all for taking away incentives to buy more homes. As i’m watching both the rental and purchase markets i have seen properties purchased and then almost immediately show up on usedvictoria and with 20% down they have to be losing a couple hundred a month. but they don’t care as the priced will be 200k higher in 5 years when they renew so, in their mind, its worth the trade off.

Marko & Leo: The subject could have been brought up here before, but I don’t remember reading about it. The speculation tax exemption is going to be phased out on 31 Dec 2021 for strata property owners whom own property where their bylaws prohibit rentals. Is this going to impact the market in any substantial way?

they could clamp down on investment properties in certain hot areas with severe affordability challenges. I think people should be able to have 1 investment property without punitive tax repercussions. But scooping up 2,3,4,5 at the expense of people buying it for their primary residence use could be discouraged.

Or government can reduce support or eliminate backing mortgages related to investment properties and let the market price them, that way it eliminates risk to taxpayers in a downturn and also reflect the true risk undertaken by the realestate speculators/investors.

rush 4life- Don’t forget that a lot of government officials and workers probably are long term home owners. Who knows how many own investment properties? I don’t think they want to shoot themselves in the foot. Governments don’t necessarily want to do what’s good for everyone, but focus on what will get them re-elected.

I agree we need more stock but if you can’t produce a large amount of stock all at once then its just going to be investors or companies buying up all the properties anyway and jacking up rents – they are the ones who can make the ‘no conditions’ offers with 100K over asking because even if the appraisal comes in low they have 3 other houses that have all gone up 20% in the last year and can just leverage those. People without that kind of backing can not. Thats why, IMO, along with getting more housing stock we need to make it a lot less attractive to buy investment properties. New Zealand just implemented the 40% down – why can’t we jack up property taxes, or property transfer tax, make gains 75% taxable instead of 50% and make it 40% down as well. The majority of things i see government doing (which i understand they don’t want to anger their voting bases) are talks about making it easier for first time buyers to get in the market. What good is that? It helps the people here and now and then in 5 years prices have been jacked up as they just given people easier access to the market and then you have the same scenario except its worse as prices are up and impacts everyone else going forward. Alternatively they offer something with no teeth – like a spec tax – just to make it look like they are doing something when in reality it has no real impact on the housing market.

Needs to be a two prong approach IMO.

This is why we need an organized YIMBY group in Victoria that is lead by tenants and/or residents not affiliated with the industry. The data is clear in the research that more supply helps affordability, but naturally people are suspicious when that message comes from developers or real estate people. Still trying to figure out how to effectively do this work without a realtor’s license, if I can do that I’d give it up in an instant.

Other than SFHs are 80% of my sales volume and condos are 20% of my sales volume, Leo can verify.

It would be a lot easier if you moved then we wouldn’t have to hear back how strong >$2 million dollar sales are every two weeks.

Marko: The other way to deal with the problem is to stop rezoning everything, make a lot of people in the real estate industry unhappy, and accept the fact that never ending growth is not particularly good for a city. Either cut back on immigration or create the infrastructure for new small cities or a combination of both.

Marko, obviously you love high density with condos everywhere. Be happy and move to Vancouver. I know that selling condo is your bread and butter so excuse me if I have to take your opinion with a large grain salt to counterbalance your self interest.

This has popped up on a few Facebook groups now….and ha ha at the comments. We are screwed. A popular comment seems to be “overpriced condos are not a solution,” but then no one provides a solution. Why is everyone so god damn bitter abouts condos, I love living in a condo!

I agree with Leo, the only way to deal with this is to just somehow blanket rezone the entire city. The battles taking place to rezone one single small infill lot are insane imo.

The interesting thing about the below graph is, unless you are over 65 it seems everyone is taking less market share (more so on the ages below 40 of course) – i wonder if this is because companies are taking more? Leo any insites – i found that here: https://canadahousing.medium.com/five-batshit-crazy-charts-on-canadas-housing-market-7fbe4cd0ab92

no surprise but younger people having less and less market share of housing according to this (sorry if this has been posted before):

Yeah good question. I don’t think it’s early enough to tell. Also I think it isn’t ambitious enough. Often a new duplex will be more money than the old house it replaced due to it being new. That helps because it is still less than a new detached house but it doesn’t look like it. I think you need to allow four plexes or townhouses to move the needle.

I bet all of these measures will take at least 5 years to really be noticed and 10 years to make a substantial impact.

Probably because Canada is running out of land

Something doesn’t really make sense, we have had basically the lowest rate of savings over the last 3 years, and yet the highest rate of first time home buyers are only tapping savings?

Any indication yet of what impact duplex zoning in Vancouver had? Is more infill housing being built there as a result? Has it led to an increase in price for lots in Vancouver relative to neighbouring municipalities (if that sort of comparison is even possible)?

Great article!