March 22 Market Update

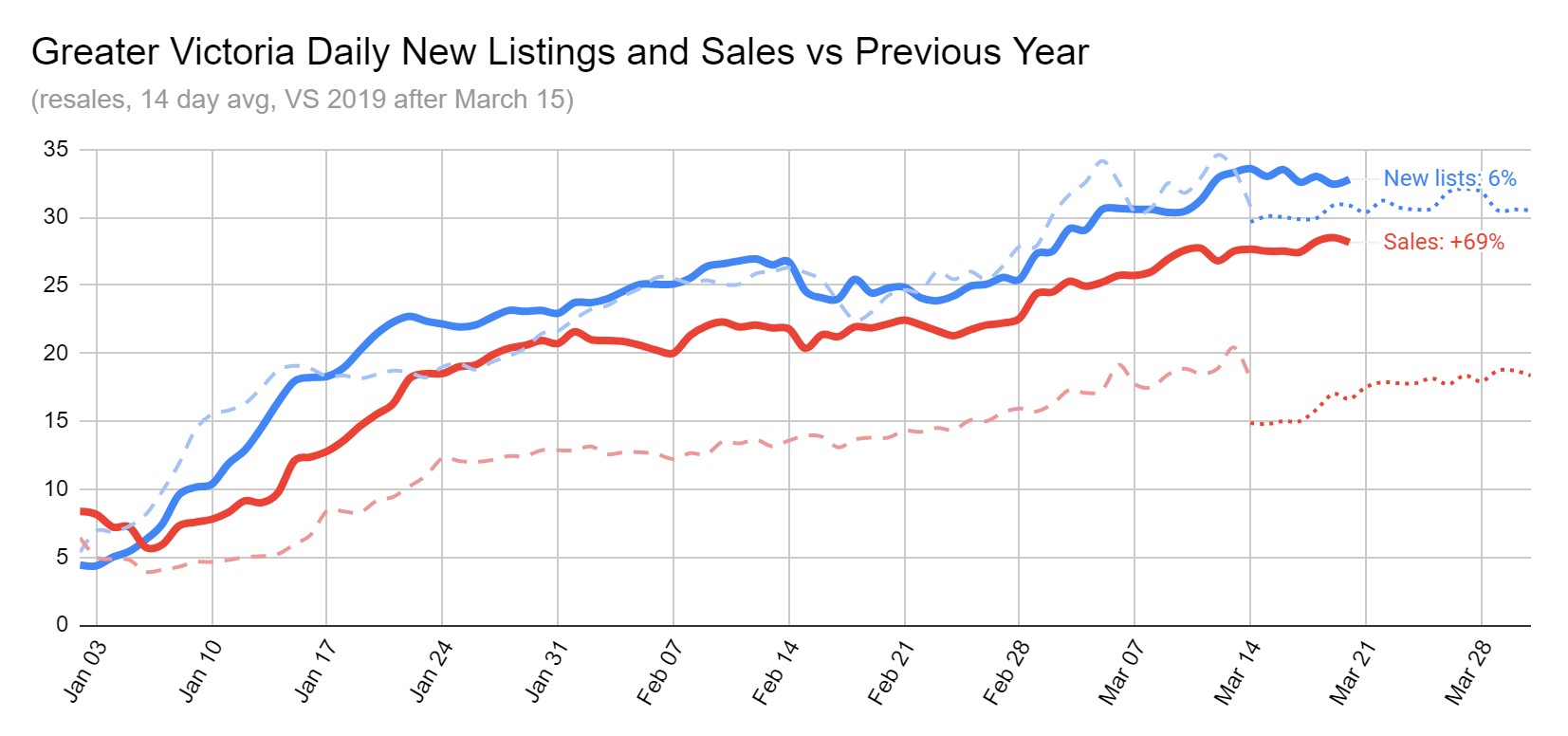

It’s been one year since the pandemic hit the real estate market in Victoria. Few predicted that we would still be in the middle of it 12 months later, and no one predicted an unprecedented economic shock would ignite an ultra hot market across the entire country. Year over year comparisons will be meaningless for the next couple months, because we’ll be comparing to some very depressed March and April 2020 figures, and then comparing against the pent up demand from last summer. For the daily sales chart, I’ll be comparing to 2019 which was a more normal year, but less active than 2020 and so in the last two weeks sales are up 69% from two years ago.

| Mar 2021 |

Mar

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 254 | 508 | 769 | 608 | |

| New Listings | 323 | 621 | 939 | 1084 | |

| Active Listings | 1338 | 1329 | 1334 | 2252 | |

| Sales to New Listings | 79% | 82% | 82% | 56% | |

| Sales YoY Change | +54% | +51% | +64% | ||

| Months of Inventory | 3.7 | ||||

Despite a few more listings coming online late last week which was a hopeful sign, inventory barely budged upwards for the week as sales continue to closely hug new listings and anything priced remotely close to the market sells within the week.

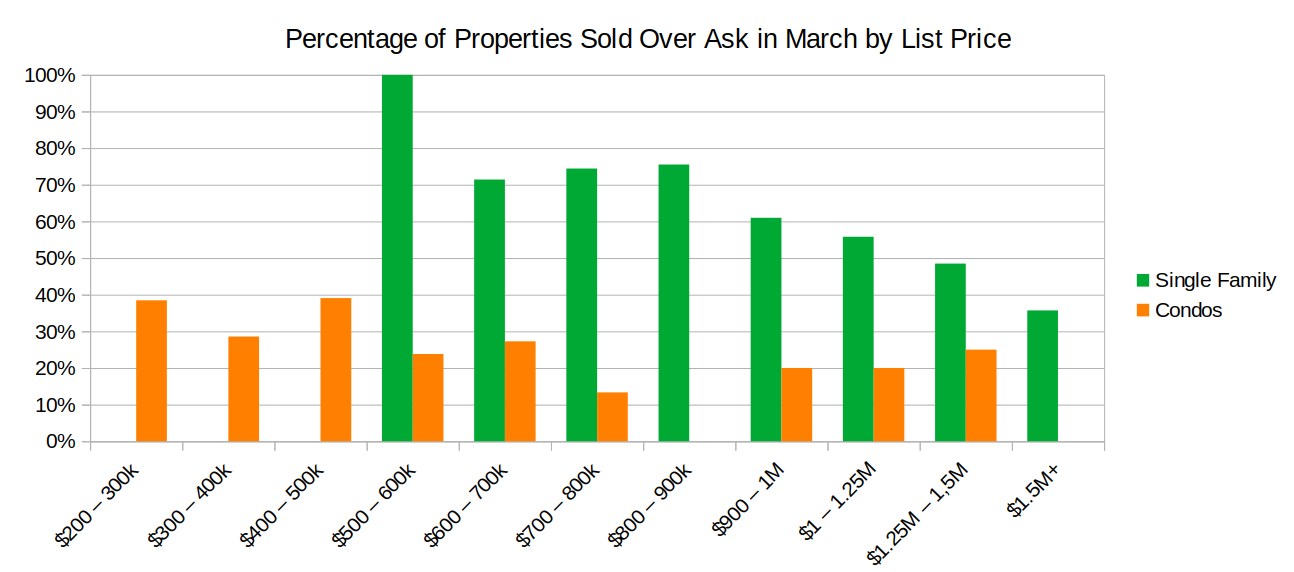

Some 60% of single family properties have gone for 1% or more over the asking price in March. That’s far more than the 28% of condos that did the same, but if you look closer at the most popular (and lower) price bands for condos, it’s starting to get close to 40% there too.

For single family homes under $900,000, over 70% are going over ask, with every one of the few remaining listings under $600k (put there by deliberate underpricing) doing the same.

Price indexes are lagging the market, but outlying areas rose the most

There’s something odd going on with the MLS and Teranet repeat sales home price indexes. Both indicate about a 10% increase in single family prices from last year, when the reality is at least double that. The same is happening in Vancouver, with the indices substantially lagging actual price changes. It’s unclear why this is happening – I’ve found them normally relatively good at tracking price changes – but one potential reason may be that the algorithms reject outliers, and the market is so hot that more sales than normal are being rejected as too high to be reflective of the market. I suspect at some point the MLS HPI will have to make a sizeable jump to catch up to the market, which will be just as irrational as the current lag.

Regardless, the HPI should still be useful in comparing appreciation across our areas, and it’s indicating substantial differences in appreciation rates. In the last year the MLS HPI indicated an increase of 19% in the price of houses around the Malahat and 21% in Central Saanich, while Colwood rose 15% and core areas were up around 8-10%. The higher appreciation areas being primarily further out where there were still more affordable detached homes available to buy. With a return to mostly in-person work looming for most and the associated longer commutes, it remains to be seen whether those areas’ outsized appreciation can be maintained. I’m betting that many of the pandemic living changes will swing back rather quickly when the pandemic is behind us.

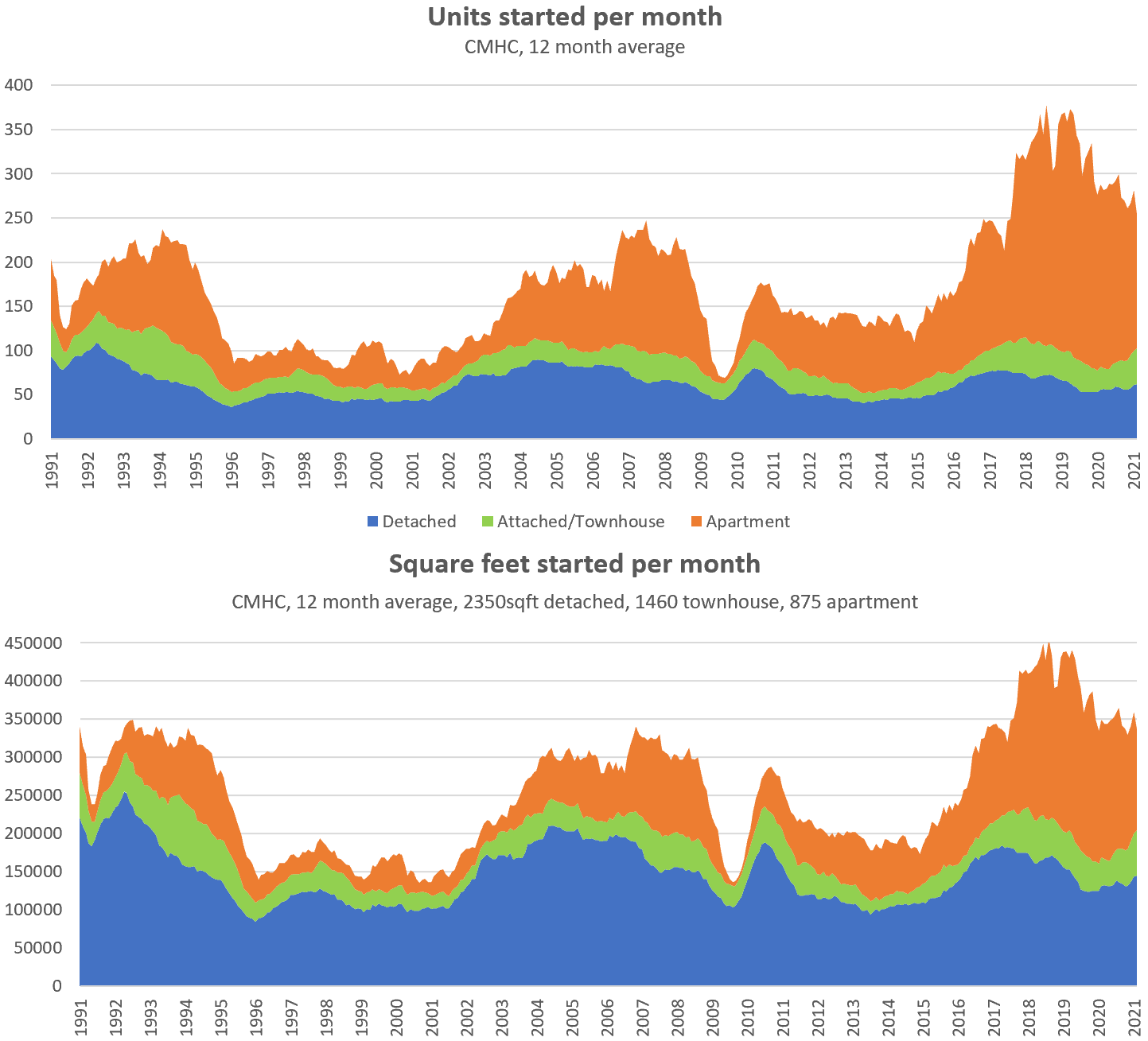

Another look at construction levels

Inspired by Ben Myers’ post about deceivingly high construction levels in Toronto, here’s the same analysis for our rate of construction in Victoria. If you just look at unit starts, it seems our current construction boom dwarfed the previous two in the early 90s and 2000s. But the mix of units has shifted, with much of the current volume made up by apartments rather than detached or semi-detached properties.

Adjusting the construction rate by the typical new home sizes, we see that the current boom, while still impressive, isn’t that much bigger than the previous ones. In the last year, the median new detached house was 2350 sqft with 4 beds, while the median townhouse was 1460 sqft with 3 beds, and the median condo was 875sqft with 2 beds. Holding unit sizes constant (in reality unit sizes have decreased so this is generous) we can estimate the rate of construction in terms of floor space instead of units.

Most of those apartments are new rentals which is great and desperately needed, but if you’re a family, some 75% of the current construction starts won’t be of use to you right off the bat. Then unless you’re relatively wealthy another 15% or so which are single family will be too expensive. That leaves only about 9% of new construction that could be suitable and attainable. Our cities will have to grapple with their failure to create family-suitable housing now and in the future. Right now the westshore is still carrying the region in building net-new detached housing, but we are likely to run out of easily developable greenfield land within the decade. Unless we can figure out how to efficiently build infill by then the housing crisis will get dramatically worse.

“Why not get rid of the elder option and just have the hardship one – that was the ppl who need it get it and the rest don’t.”

Sounds logical to me….but somehow things that land in the lap of politicians seldom are dealt logically.

New post: https://househuntvictoria.ca/2021/03/29/mortgage-insights-a-new-measure-of-affordability/

Why not get rid of the elder option and just have the hardship one – that was the ppl who need it get it and the rest don’t.

R Haysom I understand that – but if you get a reverse MTG you can use that to pay your property taxes. That’s what I’m saying. Also the interest rate is 0.45% for elderly which is what you – and everyone else is referring to – 2.45% is for hardship and families – https://www.google.ca/url?sa=t&source=web&rct=j&url=https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/defer-taxes/interest-fees&ved=2ahUKEwjtnPG1-dbvAhXNop4KHW17DyYQFjAAegQIBBAC&usg=AOvVaw1970IeyeK1OHn37htw3dWP

Good point R Hanson, some elderly people even stop paying insurance on their property, that’s a red flag indicating maybe they should sell their house. That would also disqualify them from a reverse mortgage. Hope I never get into that situation.

I don’t know much about reverse mortgages, other than I would never take one out. I guess other people think the same way.

Rush4life:

All Reverse Mortgage Companies require that you pay your property taxes. If a person doesn’t pay their taxes that is considered a default on the reverse mortgage. For those people that have an outstanding property tax balance it has to paid off from the reverse mortgage funds.

In some cases the mortgage company will hold an amount back to pay the future taxes and charge the owner interest on that money as it is disbursed.

So I’ve done some research on the BC Property Tax Deferral program and can see how it gets under some people’s craw.

It is a very generous program and can easily be abused. It has been around for a long time (1974) so it probably doesn’t make too much impact on the current RE market, as there are probably close to as many people signing up for it, as there are who are passing on. I can see it having had an impact in the early years of its implementation when suddenly a large no. of tax payers were suddenly removed from the tax role. The interest rate of 2.45% is very generous and likely attracts people who otherwise wouldn’t take it if it were higher. The age of 55 likewise is generous especially if those people are gainfully employed.

Otherwise it is a compassionate program especially for the infirmed, persons with disabilities, widowers etc.

Frank as I mentioned they don’t need to get a near free loan from the Province when they qualify for a reverse mortgage.

The property tax deferral system everyone is against could be saving tons of money for the government. Here’s how- instead of keeping seniors in their own home, the only alternative in some cases would be heavily subsidized personal care homes. That could cost the government $100-$200 a day. That could translate into an additional $40,000-$50,000 per year. Makes the tax deferral look really cheap.

I would imagine the majority of elderly could get a reverse mortgage and just finance it themselves rather then relying on the Province to pick up the carrying costs.

Just to be clear, PTD doesn’t reduce municipal revenue. It is a practically-interest-free loan to all old people.

IMO, it is bad policy, but I’d hate to see it eliminated. It is valuable for many old people and it’s a relatively cheap program(the Homeowner Grant costs the province significantly more). The problem is that it isn’t income tested. Slap on an 80k\household income test and we’re done.

It could reduce utilization, could probably be implemented in a few months, and would probably piss off nobody. As far as forcing old people away from home, I mean, I get it. I’m a millenial: screw all boomers. But like, my mom is also 73 and is losing her faculties. She’s already downsized, but if she hadn’t I wouldn’t her to spend her later years worried about a crippling tax bill because she likes living in the house she’s lived in for decades.

Just seems wrong.

I’m against property tax deferral when it’s based on age because it’s not based on need. It’s helping literal millionaires stay in their homes while the city is making cuts due to decreased revenue, and during a housing crisis (that the city talks about regularly) to boot. The interest on deferral is so low that financial planners publically tout doing it and investing the money for larger gains instead. Policy needs to be abolished, if you can’t afford to pay your property tax sell the place imo. Would increase inventory and would move older people into smaller places they could afford.

Patriotz, why are you so anti deferred property taxes? “property tax deferral being the most egregious.”

What is the interest COV charges on deferred property taxes?

In the case of an elderly person being able to stay in their home because of property tax referral surely is a good thing? It is emotionally dramatic for elderly people to move if they don’t have to or want to.

“It was a good week for housing in the city”

It certainly was if you happen to be someone who pays no tax, contributes nothing to society and happen to be in the market for a free new home. On the other hand, If you are a dutiful taxpayer or happen to live near these joyful free houses, not so much.

According to the TC, these free homes are also permanent (!) and have “around-the-clock supports”. Any way I can get some of that for free? I’m a little wan from scraping together my property tax….

“There really is enough housing to go around, it’s just misallocated”. Are you suggesting that investors are purchasing the majority of these homes? At a vacancy rate of sub 2%, I don’t see it.

That’s you assuming property tax deferrals lower housing supply. If you want to make your point, don’t just repeat it, provide some evidence. Such as pointing to some data showing higher housing supplies in provinces without deferrals. I don’t see it.

Also, you declared yesterday that “Of course we’re accommodating them [housing for new arrivals]” but today you say we have a “lack of supply”. Which is it?

Duplexes with suites….I would be in strong support of this!

Surprised nobody has posted this yet

https://lisahelpsvictoria.ca/2021/03/28/community-making-requires-housing-of-all-sorts-three-big-ideas/

But I was talking about stock, which is something different. Stock is the total amount of housing. Supply is the amount of housing for sale.

I do think there is a lack of supply exacerbated by government policies, property tax deferral being the most egregious. There are more SFH in metro Victoria than there are households with 3 or more people. There really is enough housing to go around, it’s just misallocated. Some of that is due to income and wealth inequality which are admittedly hard to address, some is due to wrongheaded government policies, and some is due simply to the attitude that the more house you have the bigger payoff you’ll get.

“Seawood went for 1.3”

hmmm, prob. not that great then unless it is a long term hold.

Seawood went for 1.3

That’s an analytics position. None of your forecasts would be taken into consideration.

Yes. There are still some of those out there for sure. Especially in the west shore.

Can you find a house currently for $1M that has a suite generating enough income which will pass the stress test?

not for a million dollar home anyway.

With those stats you wouldn’t need a co-signor unless you had bad credit or lots of other debt.

Cadbo, I would say to buy a SFH right now, you probably need a minimum of: $200k down payment, $150k HH income, a suite and likely a cosigner. So the real question is how many people fit those categories versus how many houses are for sale.

What kids are you guys talking to? Bootstrap mentality is rare in millenials. I find most of my peers & colleagues resonate with the generation squeeze dialogue and even the privaledged ones recognize the help they’ve had and don’t hide it. Finances and politics are anything but taboo in my social sphere and thats talking to my peers and also parents etc. I know how much my friends paid for their homes and what financing it took to get them there and it’s pretty normal discussion.

Of my friends with a SFH in Victoria area, the only ones who did not buy with parental help had sold another house elsewhere (AB and ON) to get in here. Parental help ranges from: parents built a house then sold it to kid for cost, parents contributed 20% down, inheritance from a grandparent brought savings up to 20% down, parents allowed kid to live at home while in university rent free and then kid bought with the savings, grandparent gave part of a downpayment but kid was still high ratio, parent died and kid moved into their home, parent loaned part of the downpayment (I’ve seen this with 3x friends).

4508 Seawood Terr says waiting for deposit now. Anyone know what it went for? If it was around asking price then I would say there is value there given the current market. Looks like you can build a garden suite pretty easily on that lot plus it has ample parking.

Monday

Sales: 1032 (+79% over last year but this is basically meaningless)

New lists: 1291

Inventory: 1370 (-39%)

Some murmurs of softening. New post later today

I once worked in a company where over the course of a year my boss was replaced twice. 1st guy made 120k/yr, 2nd made 220k, 3rd made 180k. All of them had performance goals that could’ve doubled that.

As far as CMHC goes, I’ve never worked in the public sector outside of the bc government. But for the BCGEU a person with 4 years tenure in a role makes 14% more then a new hire. And someone in a role that requires a professional degree will normally be under implemented one grade lower(10% pay reduction) until they finish their degree.

And in demand degrees actually get paid a premium over their union classification that the trainee wouldn’t get.

So in the bc province if a hiring manager were looking for an entry level accountant to audit taxes but would be willing to hire someone close to completion of their certification the salary range would be $60,998-$80,560.

And that’s straight union negotiated wages for a union negotiated job description.

Pulling yourself up by your own bootstraps is considered more admirable than relying on parental handouts. Ergo most people don’t advertise that the only reason they could buy a house was because they were gifted a boatload of cash.

Bluesman, this is not just government. In any job your best for a good raise is to go somewhere else (assuming it is a decent sized company). It is unfortunate but that’s just how it works.

Yeah, not a public sector, govt type in this corner. Thanks for the insight.

ANY FIRST TIME BUYERS WHO BOUGHT A HOUSE IN 2020 DON’T FORGET THIS TAX DEDUCTION:

Home buyers’ amount (Line 31270) — Value: $750

Bought your first home in 2020? Well, the $5,000 home buyers’ amount may be for you. It’s a 15 per cent non-refundable federal credit on the base amount of $5,000 if you or your spouse or partner were considered a “first time home buyer,” meaning you didn’t live in another home owned by you (or your spouse or partner) in the year or in any of the four preceding calendar years.

Bluesman, this is actually a pretty tight salary range, lots of jobs have ranges that at least double this. Typically if you are a internal promote then likely you will be placed somewhere between the min and the mid point. For an external hire you have the ability to negotiate and should be at the mid-point or little higher. For a rocks star external, you may get close to the max.

I been trying to advocate folks on this forum looking to buy to think about switching jobs and make more money for couple years now but typically just fall on deaf years. And I am not suggesting anything extreme, just going from core government to a crown corp, arms length or municipal, not do what Marko did.

Umm…..why is there a $15,000/yr spread on such a position? What difference in ability justifies +/- $15,000 annually. Wouldn’t imagine the job description being something you grow into? I’m a bit ignorant to this……please enlighten me. anyone, anyone? Anywhere in Canada, cost of living adjustments based on where employed, remote living allowances?

“Seems to me, most times one offer is all that it takes. Obviously the guy hasn’t been a realtor in tough times, when never mind not getting an offer is the problem, how about going for weeks without a showing or even a telephone call or text?”

All he said was that he thought this could be evidence that maybe the market for SFH had peaked as the other realtors he had spoken to had similar experiences. Not sure why everyone here is so negative about him detailing his recent experience and sharing his opinion.

Here you go HHV comments section prognosticators, put you and your forecasts to the test… CMHC wants you!

“In it he explains his listing last week only got one offer and he blames the market.”

Maybe his OPEN HOUSE signs blew down!!

Seems to me, most times one offer is all that it takes. Obviously the guy hasn’t been a realtor in tough times, when never mind not getting an offer is the problem, how about going for weeks without a showing or even a telephone call or text?

Traffic up about 20% from last year. You were right it does ebb and flow.

Bluesman, as Marko said no one can predict what will happen to the market in the future. One thing that doesn’t get enough mention here is how secure are people’s jobs in the aftermath of the pandemic? From the attitude on the forum here, most people seem to think their incomes streams are bullet proof, especially the ones working in IT and public sector.

Rush4life, that is almost a certainty. I think the subscribers to the Wallstreet bets subreddit increase 10x after game stop.

ks112 – I expect the market will be flat or perhaps just modestly lower after this run up cycle completes. I just don’t know what on earth or when it it could be that a catalyst will appear to take it higher for a next run up. Rates IMO can only go higher. Even at 3% the delta in payment versus now is significant on a conventional mortgage with respect to a benchmark SFD. Big question to me is wage inflation over the next 5 years. Notwithstanding that prices are detaching more from local incomes, wage inflation is still an important factor. If we’re going to rely on immigration and out of town buyers to support prices, I feel we have more to worry about.

Leo I’m seeing comments increasing pretty dramatically over the past few Months – are you seeing lots of new visitors here?

Bluesman, I think this all comes down to human psychology. Most buyers are usually too afraid to buy in a down/flat market thinking that prices will go down further and most sellers are reluctant to sell in a hot market thinking they can hold out for more $ by waiting. Then when the market shifts the other way most people are caught off guard thinking oh darn I should have done x,y,z and then proceed to try and right their wrongs. I posted on this forum in late 2018 or early 2019 that I was considering selling my GH house after the I figured the value had dropped by 100k from peak to trough and there didn’t seem to be any near term catalyst that would bring the price up. I wanted to trade up and the premise was that although my house had dropped, the houses I was interested in dropped even more. End of the day i wasn’t comfortable with the amount of additional debt i needed to take on and I didn’t do it.

This is why professional investors exist positions once their target price or exit multiple/IRR are hit.

I remember there used to be constant posts on here pointing out current money losing sales for houses that were originally purchased in 2016/2017/18. Those seem like a distant memory now even though it was just 2 years ago, i recall at that time a decent number of houses in broadmead/royal oak and cordova bay going for around $850/$900k and $1M would get you something pretty nice. Now people are forking over $1.2M for stuff in Oaklands. Where were these people 2 years ago? I doubt most people could not have saved that much more in the span of 2 years.

Marko: need to buy one of those crystal balls that double as a snow globe. To paraphrase Henry Kissinger:- 90% of real estate agents make the other 10% look bad.

Did the source have additional data such as the $ amount in the categories? For example, how big was the parents contribution as a percentage of the entire down payment?

We’re having a similar discussion in our household about buyer fatigue and the market direction right now. Having been in the market it “feels” like there is a bit less of a frenzy in the last couple weeks, but that’s likely because we are less frenzied ourselves. We have seen a few places recently and declined to place offers. The, after the offer day we find out there were not as many offers as we’d have expected. Akin to Marko’s comment, who can tell where the market is going. I’ll say that in reviewing sales prices and what appear to be comparables, its difficult to identify any type of parity some cases.

If you’re like me and are wondering about the statistical reliability of the first time buyer funding data in the table below, I asked the author about that and he shared a chart with the broken out yearly data. Though the n is low due to few of the survey participants buying in any particular year (avg 67), the years were grouped to bring the numbers up.

Will’s theory is the reduction in percentage accessing gifts from family may be because regulatory changes have made it harder to access home equity.

https://twitter.com/LooseCannonEcon/status/1376310900907474945?s=20

“CMHC can’t predict the market but someone guy in Vancouver with a 6 week course can. Makes sense ”

lol realtor is only a 6 week course? Let me guess, must be a shit ton of people wanting to be realtors in the past 2 months eh?

“It kinda just sounds like he mispriced his listing.”

maybe, but would be interesting to see if this is an outlier or a trend

CMHC can’t predict the market but someone guy in Vancouver with a 6 week course can. Makes sense 🙂

I hate it when clients ask me where I think the market is heading. If I knew I certainly wouldn’t be a regular HHV contributor.

Honestly, all I know about the guy is the first few minutes of that video.

In it he explains his listing last week only got one offer and he blames the market. He argues that everyone has changed their PCS to exclude SF and go exclusively condo?

It kinda just sounds like he mispriced his listing.

Did he say it was going to crash? He just said currently it seems like the crazy peak for SFH in Vancouver was last month for the time being.

What I gather from this is that it seems like people were all trying to get a jump on each other before the spring market (where people expect prices to go even higher) and all wanted to outbid each other now. Now it seems like buyer fatigue have set in and a lot of the ones that haven’t bought are parking it for the time being when it comes to SFH.

“Interesting development in Vancouver, if true then I expect Victoria to follow suit”

That guy seemed to be talking in circles to me.

That guy is talking about listing in metro Vancouver and getting no interest. Last week. And blaming ‘the competition?’

Did Vancouver’s real estate demand crash this week?

Interesting development in Vancouver, if true then I expect Victoria to follow suite in the coming weeks/month

https://youtu.be/1qWG-j4G2ys

You’d be surprised how many “kids” don’t tell their friends that their parents/grandparents helped them with their purchase of a house/car/debt repayments. Do you disclose all your finances to your friends and neighbours?

Sources of down payment by percentage of first time buyers accessing it from Will Dunning’s report to MPC. Don’t ask me why parents as source of down payment was much higher 2014-17. Makes no sense to me.

You can edit, press the little gear icon then edit. Used to be a 30 minute window for editing, I just bumped it to 3 hours.

Me: I don’t know many people being gifted hundreds of thousands by their parents.

Also me: all my friends doing the FTHB in the last few years are buying condos.

Has the number of hours decreased to build a new SFH home? I would think all the improvements in technology such as cranes, slingers, mini excavators, pre-fabed wall assemblies, etc., has been offset by more complicated homes with more features.

“Still need to deal with infrastructure, HVAC, electrical, plumbing, etc., etc. ”

As per the video these elements are being built into the cavity space in the wall.

Agreed, these can be dealt with more efficiently, and that will happen. I am amazed how quickly this “printing” technology has evolved and scaled up to building homes. In addition to the one in New York there was another prototype built recently in Seattle. What is really encouraging is that inspite of these both being prototypes they have already been built for less than the traditionally built competitor homes.

As an Architect I am seriously impressed with this new technology and this is what the construction industry has been dearly needing.

I’ve always been skeptical of the parental help theory. While obviously some people are being helped I don’t know that it is as common as many believe a or substantial enough to drive the market.

Of my social circles generally the millennials over 30 all own houses and the millennials under thirty don’t. Much of my social circle bought around when their household income went above 120k and they paid off their student loans. Those friends of mine who did that after 2017 all own condos.

Of those that own sfh two have received significant support from family. It allowed them to buy way younger. But I would consider both a bit anomalous as both of the gift givers(parents in one, grandparents in the other) have net worths measured in 8 figures.

I suspect family contributions also adds to and sustains the practice of unconditional offers. If family is willing to contribute $ they would also likely commit to co-signing etc so an offer made subject to financing need not be placed. Buyers without the good fortune of a backstop like that can’t compete.

I do not know; I see it a lot in my business. I would say parental help is not the norm in the general population, but it is often seen with my buyers buying SFHs. I believe part of the reason high-ratio mortgages are only approx. 1/5th of purchases in Victoria is a lot parents top up their kids to the 20% mark so they can obtain a conventional mortgage.

MJ- You’re an intelligent person, keep up the good work. I wasn’t being critical, just pointing out that parental help is not the norm, driving prices higher. I do believe that “flippers”, not investors, are driving up prices on the basis of the greater fool theory. I’ll pay 1.3 million, because someone will pay 1.5 million. Look at the example in Comox, someone doubling the price in 4 months. That doesn’t help anyone. Long term investors like myself, have little affect on the current market conditions, so long as the property is being utilized.

“You, and probably most of your friends, are highly educated and grew up on the right side of the tracks. Your circle probably represents the top 10% of the population.” Yes my friends and I come from middle class to upper middle class backgrounds. By no means was I suggesting that this is the norm for everyone. What I was suggesting is that the majority of millenials who are buying homes right now are being gifted funds from their parents. If anything, I view this negatively because it is only widening the wealth gap. I am a big advocate for increasing the housing supply and increasing density.

Leo – Are you starting to see spring inventory build as usual? Or is inventory still being absorbed by buyers? I’m curious if/when the usual push of spring inventory will begin to mitigate the demand and perhaps impact the supply/demand of the market.

” Are the gifted funds bringing the down payment to 20%?” I would say 25% of them get funds bringing their down payment to 20%, 25% of them have no savings at all and are gifted a 20% down payment, and 50% of them are gifted money and are still below 20% down payment.

“Are they in the market for SFDs, condos or towns?” All of them are purchasing SFD with suites. A couple of them have purchased homes and converted the basement to suites.

“Are your friends contributing or is it mostly family contributions?” Family contributions

MJ- Thanks for the insight. You, and probably most of your friends, are highly educated and grew up on the right side of the tracks. Your circle probably represents the top 10% of the population. My circle of friends are also highly educated but came from modest means. In the 1970’s I could pay for my entire year of university in less than 2 weeks of summer work, that is not possible now. Who paid for your education? I think your perspective comes from a privileged upbringing. Congratulations on your accomplishments, I don’t deny you did the work.

MJ – thanks for the insight. Interested in more color, if you know. Are the gifted funds bringing the down payment to 20%? Or more or less? Are they in the market for SFDs, condos or towns? Are your friends contributing or is it mostly family contributions?

Millennial here. This is very subjective, but everyone of my friends who has purchased a home has been gifted money from their parents and basically everyone of my friends has purchased a home or are in the market to purchase a home. I have managed to purchase two homes without help from my parents, but I was very lucky to have had a high paying job at a very young age and lived with my parents through university.

A lot of boomers are still waiting for their parents to pass away so they can inherit something. The boomers I know are not handing out huge sums of money so their kids can buy something beyond their reach. Most boomers anticipate living another 20+ years, and are concerned with having enough money for that length of time. Only the 1% boomers can afford to help their kids at these levels, and they are only 1% of the population.

I wonder how much of it is wealth and how much of it is debt taken out of their real estate. I tend to agree that much of the millenial generation may well be floated up by that though.

But high house prices are a drag on everything. We can overwhelm it temporarily by taking yesterday’s profits and piling them into tomorrow but that only gets you so far before the profits run out.

I would argue the forward looking prospects for real estate returns are also looking poor

Super low yield world in all areas

‘

‘

But think of all the inheritances Millennials will get from their boomer parents

“Where is the money is coming from to support this recent run up in prices? My best guess is boomer parents gifting or lending cash and/or using available HELOC to help their genx and millennial kids get into the market”

‘

‘

Good guess, I would say over 50% of clients I work with who have children plan to or are giving their kids money. I’ve had 3 clients in the past month either give their children one of their rentals, one was giving their children the proceeds of a 1MM vacation property in a few years and other just build in giving 100K to 300K to help with a house, when child hits 25 or 30. Lots of inheritances also where parents just give kids a large share of the money from their parents as its not needed so might as well help out the kids. There is soo much money out there right now looking for a place to go.

https://www.economist.com/graphic-detail/2021/03/15/young-people-stand-to-make-dismal-returns-on-their-investments

I would argue the forward looking prospects for real estate returns are also looking poor

Super low yield world in all areas

@Frank

They are moving into a house that they were planning on flipping

Still need to deal with infrastructure, HVAC, electrical, plumbing, etc., etc. I don’t think we are getting away from physical person power in housing anytime soon.

I used them in my personal home and we’ve used them in 15+ spec homes (we’ve tried three other companies within this span and circled back to Harbour) without substantial issues. As I noted, nothing special. I don’t believe in high quality kitchens mostly stemming from the fact that when I show the cheapest possible build 80s homes the original kitchens still function. Most people will want to renovate based on aesthetics way before the functional life is up. What I am trying to say is weather you spend 30k or 60k on a kitchen it will be dated in 20 years.

If you want something special with exceptional customer service there is South Shore Cabinetry, Jason Good Custom Cabinets, etc.

The reason I recommend Harbour and noted they are nothing special is the context of price which I assume is important to most people.

When I bought my Tesla 6 yrs ago everyone was freaking out about panel gaps, fit and finish, and all this other non-sense. If that’s going to keep you awake at night, for example, you buy from a German manufacturer that has been building cars for 100 years not a silicone valley startup. Context is super important imo.

Keep your eyes on the money.

It is coming from somewhere and getting into the system and I suspect it is being distributed through different means than before.

For example: Just because no one strolls through a casino with bags of money on their shoulders anymore….doesn’t mean that huge money laundering has been addressed.

The question is how are they doing it now?

Viclandlord- Where are your friends going?

Market is absolutely insane, friends house in Oakland’s just sold, 12 offers and on the market for 4 days.

Keep us posted.

QT: For countertop installations I have found flor-form to be exceptional. If you just want an estimate, try them. I don’t think you will be disappointed…..from the initial consult, to the measuring, to the installation. Let us know, I would be very interested as to how it turns out for you.

I would never recommend Harbour City Kitchens for anything. Their work for us was shoddy (adjacent cupboards that can’t be opened simultaneously because they’re spaced too tight on an angle, hinges that don’t keep door handles from banging into walls, some doors not hung straight, etc…). They pay zero attention to detail, and their after the sale support is truly horrible. Once they have your money they won’t return phone calls.

Speaking of tax avoidance, don’t miss out on some easy deductions:

https://financialpost.com/personal-finance/taxes/canadas-bounty-of-boutique-tax-credits-remind-me-of-a-popular-passover-song

Someone trying to flip for twice the price within 4 months in Comox. Doesn’t even look like any work was done.

1161 Moore Rd, Comox

Asking $1,790,000

Bought Dec 2, 2020 for $922,000

I can neither confirm nor deny.

Doesn’t make sense to me. Yes for sure low rates have caused prices to inflate. But in the end there’s very low inventory for sale and very low inventory for rent. No evidence that there are widespread empty homes as shown by Spec tax results.

So what’s left other than lack of supply? Household size may very well be dropping, we just don’t know it because we don’t get timely stats. One way for supply to suddenly materialize is if people combine households again due to an economic shock. That partially happened in the last year with rentals but not yet with owned accomodation.

3D Printing homes is here and is the way of the future, greatly speeding up construction times, way cheaper than conventional and environmentally friendly. Check it out !

https://youtu.be/EBaNBqI9dmE

No room for more SFH except out in the westshore, and even there not much longer. Bulk of new housing will need to be townhouses + condos.

Inspired by Jens’s chart. https://twitter.com/vb_jens/status/1372251931444350976?s=20

Globe and Mail:

The real estate game in big cities is broken. Young would-be buyers are better off not playing

https://docdro.id/ZAt9QL8

The approval of multi-unit dwellings in residential neighbourhoods could theoretically ease the pressure, and would make for healthier cities overall, but Toronto and Vancouver can’t triplex-their-way out of their unaffordable realities.

The real estate game in big cities is broken. Absent a truly radical policy initiative, there’s no going backward.

Of course we’re accommodating them. If we weren’t we would see average household size rising. But it’s not.

The increased price of housing is not caused by the amount of housing stock failing to keep up with population growth. In particular, the past year has seen large increases in prices in cities that are seeing little or no growth in population.

Thanks Marko, I’ll give Harbor city and Ikan a call.

That population growth should translate in Greater Victoria to about 5k people or 2k new households/year . Since 43% of homes are SFH, that should mean we need about 850 net new SFH each year to maintain that 43%. We are nowhere close to that in the core, which is where most people are looking to buy.

yea I just can’t see that happening even thought it is exactly what we need. There is such a strong emphasis on English proficiency and education. Without sounding like a total asshole poor english proficiency tradespeople would probably be ideal as it would be difficult for them to move into other careers, and there lives would be much better compared country of origin and Canadian would get lower housing prices. Instead we get highly educated people that are already living decent lives in their country of origin causing more demand on real estate.

I’ve now helped 7 young croatian families buy real estate in Victoria. All in Canada less than 5 years, out of 14 people not one works in construction. IT, government, IT 🙂

The ones that do work in construction (two that I know) haven’t been able to purchase in Victoria so it is kind of an ideal scenario for locals. You get much needed labor and they are putting demand on the housing system.

One that was a drywaller (super hard worker, would work 60-70 hr weeks) for Gordon n Gordon got sent back to Croatia cause he couldn’t deal with the paperwork. Need more of him, less of the government types.

Personally I would go harbor city and victoria granite. Harbor city is nothing special but very consistent.

You could also try Ikan.

Marko or anyone that have experienced with kitchen remodel please check in.

Who would you use for cabinet maker and counter installer?

Thanks

No need. You previously already identified the solution. Simply change the skilled immigration points system to prioritize trades we need. We could solve the trades shortage in 2 years if anyone cared to try.

Never heard any politician say a word about it though.

It’s pretty simple in my small brain. Housing gets built literally physically. There is no 3D printer for housing as far as I know. BC Housing, CMHC etc, just put out report after report.

Imo we need to provide more incentives to build housing including more trades persons versus bloating up the government with one useless department after another. If you retrained everyone in the spec tax department they could probably put out a small townhome development/year.

Which should be no problem at all to accommodate. The fact we can’t is a massive policy failure

BC Housing sent out an email news letter and one topic was on improving affordability in smaller markets in BC…..what a complete joke government is.

Over 30 emails re builder owner exam this week, vast majority from smaller places. From this morning

The poster was likely referring to natural increase which is births minus deaths.

Factoring that and emigrants in, the poster wasn’t far off, population increase expected to be about 440k per year in Canada (1.1% of population) (2021).

(Immigrants-emigrants ) + (births- deaths) = 400k-50k +375k-285k=440K= 1.1% of Canada population per year.

Sure it would be wise for the buyer, but not the developer. Among other things the pre-sales have to be unconditional for the developers to get financing.

The appropriate thing for the buyer to do is contract for under the current market price to mitigate the risk of prices going down. But people buy pre-sales because they expect prices to go up.

I am not familiar with pre-bulit/pre-sales, because I have never looked at purchasing anything like that. But wouldn’t the wise thing to have in one of these sales contract to have a condition to financing at time of completion? Or would developers never accept a contract like that? Or not be able to secure their own financing if all their sales contracts are conditional.

Just seems like a huge risk buyers are taking with these kind of purchases if they are unconditional.

375k babies born – 275k deaths = 100,000 organic population growth + immigration. As far as emigrants doubt that is a substantial number.

https://househuntvictoria.ca/2021/03/22/march-22-market-update/#comment-77945

Except owners get to extract equity appreciation funds via HELOC every once in a while…

Many in the GTA after the foreign buyer tax was introduced out of the blue on April 21, 2017.

Going back further in Vancouver there was lots of it in late 2008/early 2009. I remember there were even people picketing the Olympic Village with sandwich boards trying to get out of their condo presales – yes those are binding too.

But market shocks like that are a thing of the past, right? 🙂

You’re leaving out emigrants (yes they exist) and more obviously people who die.

Leo, I know someone that bought a house in 2019 and made it work by renting out the basement suite (parent co-signed for mortgage). When the pandamic hit that person lost their job and was forced to rent out the upstairs suite also and move in with family. Obviously now that person is in the clear and feeling very good but none the less this is also an extreme option for some.

The higher prices go, the less people seem to treat it as something ever to be paid off, it’s just a monthly payment that can be refinanced in perpetuity to keep payments manageable. Ironically the model is getting closer to paying rent rather than ever actually owning anything.

Likely meaning getting rid of capital gains tax and just having it fully taxable like income.

Basically the latter. They can sell eventually and move somewhere else, or extract equity. Just more options. I do agree with you in principle though. In the end a house is a house.

Bluesman, I think I read about this happening in Vancouver or Toronto on some pre builts where when it came time to close in 2018/19 the market turned and people couldn’t get the required financing with the updated appraisal. So they walked away and got sued by the developer.

They produced a long & good report on this in 2019 with a bunch of recommendations for munis but no teeth to actually force any of them to do anything. I bet 95% of municipal councilors have no idea this report even exists. https://www2.gov.bc.ca/assets/gov/british-columbians-our-governments/local-governments/planning-land-use/dapr_2019_report.pdf

Leo if someone is on the hook for a million dollar mortgage why does it matter if the home is worth the same or double? They are still on the hook for that million regardless. I suppose they will feel good if the value goes up but it doesn’t help day to day finances unless they do a HELOC and re-invest.

Has anyone seen an offer not complete in recent years? Did they lose their deposit as well as buck up for the difference, if any, between their offer price and the ultimate sale price? I’m still very uncomfortable bidding without conditions. Are successful offers out there still coming in unconditional in most cases?

Pretty sure the entire purpose of these HNRs are to serve as a step for the province to step in. Municipality not meeting their housing needs? Province steps in to override. Or at least I hope that’s the plan even if they can’t say it out loud yet for political reasons.

I think the writing has been on the wall for condo price increases for 4-5 months. Market tightened up around November, over asks ramping up, price/assessment ramping up. Prices going up, I don’t think it’s a shift in mix.

I still think this is a heck of a millstone to put around your neck. Say you got $500k together so that’s a $1M mortgage. Of course that’s nothing if house prices are $2M in 5 years and you can move away or whatever, but if we have a very long period of house price stagnation which I think is a real possibility then you gotta save $1M + interest. Little room for reducing those two solid dual incomes.

Everyone seems to ignore the obvious, or at least I think it is obvious.

400,000+ immigrants/year + natural birth rate 100,000 = 500,000 population increase per year.

Doesn’t matter whether people own, rent, low income housing, whatever, you need PHYSICAL space for 500,000 people and somehow supply and cutting red tape to increase supply seems to be the least common things talked about when it comes to housing.

Marko is absolutely right about failure to complete instead of failure to satisfy conditions. Once all the conditions are waived you really are on the hook. From a practical point of view one has to real take some somber thought about walking away from a deal . I suspect it is a rare occurrence. Marko is really giving sound advice here.

Yes, but we are talking about failure to complete not failure to satisfy conditions.

“Why should rents be tied to local wages”

Not sure if your being sarcastic but how else do you expect rent to be paid? I suppose some crazy bored rich person in Vancouver will pay you rent in Victoria just for the heck of it without any intention of using the place. A more realistic scenario would be parents helping out their kids on rent if they are above what local wages can support.

Marko, if an offer is accepted with inspection and financing as conditions can’t the buyer walk away by finding any little random reason?

The deposit comment is complete non-sense on many levels.

Barrister is correct in this instance, there is something called specific performance in law. If you offer 1000k with a 50k deposit and walk, but the home ends up selling for 900k you could be on the hook for another 50k, in addition to the deposit. This has been successfully tested in BC.

The average completion/possession in Victoria is only 7 to 8 weeks, real estate markets don’t swing that fast unless there is a massive sudden shock like an earthquake or similar.

Literally no one is going to take walking away from a 100k lightly, even if their bid was 200k over ask.

Indeed. Here’s an example from the GTA market slump of 2017.

https://financiallitigation.ca/2018/06/29/buyers-ordered-to-pay-470000-after-backing-out-of-real-estate-deal/

R Haysom: I am sorry to correct you (and you may not be old enough to have lived through a declining house market) but you are not just risking your 5 or 10% deposit if you dont close. You are actually on the hook for the whole difference between your offer and the actual sale price to someone else. Maybe a couple of the real estate guys can chime in on this. Also do real estate agents even bother to explain this to clients since so many clients seem to be under the impression that only the deposit is at risk?

Then again maybe BC is different than Ontario but love to hear from Marko or somebody. Come to think of it my agent never explained it either. Should real estate agents be liable if they fail to clear explain all the terms and conditions to a client and also ensured that the client had a clear understanding of a contract that was prepared by an agent. (lawyers are on the hook for explaining any contract that they prepare or advise on for a client).

A house can only sell for what someone is willing to pay for it. Building 1000 additional houses will actually bring prices down more than building 1000 additional apartment units, because the houses will have more people in them. The problem of course is where do you put them and how.

Because rents are a current expense paid by current income, not borrowing or capital inflows.

Hello? Investment properties have always been subject to capital gains taxation on the same basis as stocks or any other investment.

Ks112- House prices don’t seem to be tied to local wages, why should rents? Reducing rental inventory by eliminating capital gains on property to increase inventory of houses for sale, will put more people on the street looking for a place to live . There is such a thing as building apartment blocks but nobody wants them near their neighbourhood. That’s the solution to the shortage, not putting more houses on the market that most people cannot afford. Remember, 30-40% of people rent and do not own a home because they chose to or cannot afford a house.

Well if you think we have housing problems, check out this video of China’s problems, it’s a real eye opener !

https://youtu.be/jDIhTc6CJYY

Could it be with all these crazy bid offers, people are just saying to themselves, “well if the shit hits the fan, all I got to lose is my 5%, or 10% deposit?”

Keep it coming Totoro, your posts over the last years are one of the defining pleasures of my admittedly dull life.

The prolixity, the lack of any discernible emotion, the quote-back point.by.point.rebuttals.

It’s like a daily tennis match with a robot coached by Deep Blue.

It is a transporting delight.

Hear! hear!

But if you have enough money, it doesn’t matter anyway.

https://www.cbc.ca/news/business/cra-kmpg-settlement-taxes-1.5154610

I read that incorrectly and agree you can use tax avoidance without triggering GAAR and that would be legal. It is tax avoidance that triggers GAAR that is not legal, and that line gets decided on a case by case basis it seems. I’d restate that I don’t do anything that would trigger GAAR. I prefer peace of mind.

I see your point Totoro – you are defining tax avoidance at the extreme end of the scale. There are plenty of tax planning arrangements that avoid taxes and don’t fall under GAAR and the scrutiny you reference.

I understand your view, it is one that many people share, but CRA doesn’t. They can rely on the general anti-avoidance rule (GAAR) when tax planning becomes tax avoidance. I do agree there is a difference between applying GAAR and tax fraud/evasion but GAAR is there to stop abusive tax avoidance, even if technically correct.

https://www.canada.ca/en/revenue-agency/corporate/about-canada-revenue-agency-cra/tax-alert/tax-avoidance.html

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/ic88-2/general-anti-avoidance-rule-section-245-income-tax-act.html

Totoro – I disagree. Tax avoidance is a perfectly legal part of tax planning. Evasion is illegal and a criminal offence.

I’m always surprised when people judge without checking out things a bit more first. Twenty years ago if someone who had overcome financial barriers and was successful was willing to share that information I’d ask questions and assess credibility. If credible, I’d ask more questions so I could see if anything they did would work for me.

Tax planning is an honest and legal approach to paying taxes. Ex. when you contribute to an RSP this is what you are doing. Tax avoidance is unacceptable and abusive tax planning that goes against the spirit of the law. The general anti-avoidance provisions in the tax act make this illegal. I don’t engage in tax avoidance or evasion.

I’ve had friends with predictable lives get cancer, or hit by a car, or have a stroke and be trapped in their own body only able to move their eyes. They’re all younger than you. I’d say you’re not going to see your grandkids because your children won’t be able to afford to live here, but you have clearly told them in no uncertain terms that they’d be ruining this world by having children right?

Then why are you opposed Frank?

tax avoidance.

ftfy.

edit: apparently strikethrough markdown doesn’t work.

Frank, you and I can try to up the rent we charge out all we want but at the end of the day rents are tied directly to incomes in the city. So with wage stagnation combined with inflation there comes a point where rents are capped.

Well, don’t get your hopes up for any meaningful changes from federal politicians. This article pretty much sums up how inept all of the major parties are on the housing file:

https://www.vice.com/en/article/pkdj9g/canadas-housing-prices-are-ridiculous-can-anything-be-done

The thing I really don’t get is the NDP– they could substantially increase their share of voters under 40 by focusing on the generational wealth divide wrt housing. Yet as far as I can tell they haven’t engaged with the issue at all, and their suggestions in that article boil down to “30 year amortizations for FTHB” (will increase prices) and “foreign buyer’s tax” (negligible impact)

I would say the struggle was just to get to an accepted offer. We sold one place and looked for seven months making many offers before one was finally accepted. We also had to provide more information to get a mortgage as we ended buying at the top end and we keep our income relatively low as part of tax planning, so that doesn’t fit neatly into lending criteria. But this was a decision we made for our children, and we can afford it.

Twenty years we were below median income and house poor – the situation I described below – and as recently as ten years ago our finances were stable, but we were not particularly well off. The thing with saving and investing is that it compounds and starts to grow faster the longer you have if you reinvest continuously. That is why I am a fan of buying a home now rather than waiting if you can afford to do so. The near-term future is uncertain, but appreciation over the longer term seems a solid bet and your life is time limited.

Removing the capital gains tax exemption on investment properties would be a huge mistake and have the exact opposite effect. Some investors will feel compelled to get out and pay less tax, in the process putting tenants out on the street, and reducing vital rental inventory. Meanwhile, assholes like me decide to hold on and charge more and more for rent, eventually doubling monthly rent from $3000 to $6000. Best to leave things the way they are and not piss me off.

What I see left out of David Eby’s comments. and in my opinion the biggest issue facing the housing crisis at the moment, is how they are going to work with municipalities to eliminate some of the bureaucracy that has led to the low supply of housing.

Lisa echos Marco and Leo’s sentiment

Sorry for that wall! Also here is Lisa Helps response – much shorter:

Thanks for writing. Apologies for my delayed reply. I share your concern! And one of the things that I find frustrating sometimes as mayor is that when new housing proposals come forward for townhouses in single family neighbourhoods, or condos that people can afford, there is a push back from that older generation who own their homes and don’t want to see change. In the City of Victoria we’re working hard to address this through inclusive neighbourhood planning, our missing middle housing work and our housing strategy more generally.

I also think it would be great for you to check out Generation Squeeze if you haven’t heard of them already. There are a whole lot of people like you across the country to address exactly this issue and to make space in cities, economies and the future for your generation…

Thanks again for writing!

Lisa / Mayor Helps

Saw a guy on Reddit who sent 100 emails to politicians across Canada about the housing crisis. Only 5 really responded. It just so happens one was David Eby and another was Lisa Helps. Here is David’s response:

David Eby, BC NDP:

Thank you for your email of February 11, 2021, regarding your observation of numerous factors that comprise our housing crisis.

Factors such as wages that fail to keep pace with inflation, dramatic increases in housing prices and rents, and employment impacts of the COVID-19 pandemic can all contribute to an untenable situation for many, and these factors can have a greater impact on younger Canadians.

The British Columbia government understands that there is an urgent need to create more options for those who are struggling to find affordable housing. As part of the 10-year, $7 billion Homes for BC: 30-Point Plan for Housing Affordability (30-Point Plan), the Province implemented a number of measures to moderate housing prices, including tackling fraud and money laundering in the real estate market.

As part of the historic investment outlined in the 30-Point Plan, the British Columbia government is funding construction and/or renewal of 39,110 units of affordable housing, including over 14,000 rental units for low-to-middle income families and individuals; and 1,750 units of social housing for Indigenous people. Since implementing the plan in February 2018, we have more than 26,000 new units already open, under construction or in the approvals process in nearly 90 communities across the province.

The Province is also providing leadership to facilitate the development of additional market housing. New affordable housing units will be leveraged through BC Housing’s new “HousingHub”, a Crown corporation that is working with partners to build housing for moderate-income households, sometimes referred to as the ‘missing middle’. Through HousingHub, BC Housing delivers two major programs – the Provincial Rental Supply Program and the Affordable Home Ownership Program, which aim to increase the supply of affordable housing for middle-income households across British Columbia.

Getting the right housing built to meet a community’s needs is something my ministry recognizes is vitally important to addressing the housing crisis. This is why we introduced a legal requirement in April 2019 for local governments (municipalities and regional districts) to collect data, analyze trends and present reports that describe current and anticipated housing needs in British Columbia communities. Housing needs reports are a way for communities to better understand their current and future housing needs, which is critical to developing a housing strategy or action plan. Government is supporting local governments with over $6 million in funding to help complete these reports by April 2022.

In response to Maureen Maloney’s expert panel report, the Province implemented the Land Owner Transparency Act (the Act) for spring 2020. The Act created a publicly accessible registry of beneficial interests of land in the province. Government also recently launched the Condo and Strata Assignment Integrity Register to crack down on tax evasion and further improve fairness and transparency in the market. We have also required beneficial ownership of corporations in our province to be disclosed to government.

As part of the 30-Point Plan, the government also introduced and/or strengthened a number of “demand-side” measures such as the Speculation and Vacancy Tax and the Foreign Buyers Tax to help moderate prices. While there are other factors involved, benchmark prices in key markets such as the Lower Mainland began to decline prior to the COVID-19 pandemic. Foreign involvement in BC residential real estate transactions is declining, from about 4 per cent when the Speculation and Vacancy Tax was announced in February 2018, to 1.4 per cent in December 2020.

The COVID-19 pandemic has significantly disrupted people’s lives and threatened their security, especially for renter households. Government has implemented a freeze on rent increases to the end of 2021 and provided a rent repayment framework to help landlords and renters make agreements about rent arrears. We also provided funding for the BC Rent Bank to help community programs expand their programs for residents who have immediate needs.

Together, in partnership with all levels of government, Indigenous Peoples, non-profit housing providers and the private sector, we are striving to make housing more secure and affordable while weathering the storm of the pandemic.

The concerns you have raised are well taken and I appreciate your writing. I hope my comments will provide some assurance that our government is demonstrating leadership to address these issues

According to this chart, the average 5 year rate was over 5% as recently as 2009.

https://www.bankofcanada.ca/wp-content/uploads/2010/09/selected_historical_v122497.pdf

Totoro, I am curious, I imagine you are fairly wealthy just based on some of your comments about previous real estate investments, but It sounds like you bought again fairly recently and struggled? What’s the story behind this?

Leo, is that because of the higher end condos being sold or are all one of them going up?

Big jump in condo prices incoming for March stats

Did I brag? I am pretty sure i said something in response that in hindsight I should have stretched myself and bought the house I really wanted in 2013 when i was making 80k as my income has doubled in the 8 years since so it would have only been rough for the first couple years. This probably applies to most professional folks and their career trajectories as i would expect most to make at least 50% more in their mid-late 30’s compared to late 20’s.

The whole thing was in response to Cadbro’s dilemma where my advice was that if she had to buy in a hot market then it is better to max our her budget and buy something she likes because if a downturn happens then she at least has a house that is enjoyable.

It’s pulled mostly as dividends, so that is not possible. The rates are approx, I would need to clarify with my accountant, but it’s roughly correct.

Do questions ever come up about your personal income? Because for some reason you’ve felt the need to brag to everyone on an internet forum that you allegedly make around $200K.

Sideliner, I am not a small business accounting expert but if you are taking the funds out from your company and also take the 40% hit on your personal tax, can’t you just apply that to salary and wage expenses to your company and lower the corporate tax by 12% so your net tax rate is 28% on that $150k?

Only reason I discuss local jobs and income is because that question keeps coming up as how can home prices be sustained by local wages. Do questions ever come up about your supposed net worth or anyone else’s? The only other thing remotely close is Barrister asking how much people think his Rockland property is worth.

I am sure the bears will return at the first sign of market softness, don’t you worry.

Yeah I think this is the part that existing homeowners sometimes don’t comprehend. We put 20% down ($150k) last year which I pulled out of my company. That was taxed at 12% for the corporate tax , and approx 40% for personal taxes. So the 20% deposit on a basic SFH in Comox took almost $300k profit from my company. That was not particularly easy to earn. I could have spent that on hiring several more people, expanding productivity, making more products – basically expanding the economy through productive work.

The attached graph shows the increase in years it takes the average household to save for the average house in Vancouver. Moving to more and more remote cities as some suggest first time buyers should do, ignores the fact that employment opportunities are obviously much worse (on average) as you move away from large urban centers. A SFH in Sayward is >$400k now with almost zero jobs available.

Unlike the myopic view of Introvert and others, I don’t cheer on the increase the value of my house. I would actually prefer it to decrease for the sake of society. I wish Canadians would strive to increase their net worth through PRODUCTIVE WORK rather than viewing a non-productive asset as a path to wealth.

If this increase in wealth inequality continues, history tells us this will probably end in large scale social unrest. You can see the beginnings of it on this forum even, where the frustration and anger of the haves vs have nots is becoming apparent.

I don’t see this ending well for Canada at all.

I also drive an old car, don’t really eat out much, and don’t take a lot of vacations other than camping trips. For the most part, that’s because I don’t give a shit about those things. Diverting money away from depreciating assets, or European vacations doesn’t seem like a big sacrifice.

What I think sucks about homeownership is that you spend a lot of free time on maintenance/yard work.

Anyway, not trying to start an argument. Power to you if those are the things you want to spend your cash on.

“the bears that were here”

🙂

Right back atcha. Does it feel weird to be so obsessed with job hierarchies and salaries that you feel the need to constantly discuss them on an internet forum?

https://www.cgframing.com/

“I don’t know exactly where everyone is getting their money from but I am at showings every day and my observation is it is mostly young families trying to outbid other young families.’

I have a friend that recently bought a 1.8M house, couple with kids. bought a crappy sub $500k house in 2012 and unloaded recently for close to 1M. house hold income around $200k (fireman/cop and nurse/teacher couple). Not sure if there were additional family help involved.

“Ours is very predictable ‘ Are you sure your health is predictable too? I just had someone I know diagnosed with cancer at 34 years old. Its interesting you love to brag about your current net worth to the bears that were here and then at the same time boast your penny pinching ways. What an odd life you live.

I wouldn’t expect any serious action on cap gains for personal residence before the next election.

About 69% of households own a home https://tradingeconomics.com/canada/home-ownership-rate

Given that homes have risen 15% in the last year, most of these homeowners are sitting on sizable paper gains. The point being, it would be political suicide for a minority government like the Liberals to introduce a cap gains tax like this before an election.

The last minority government PM that proposed a broad new tax in a minority government was the Tories led by Joe Clark in 1979- proposing a 4 cent a liter gas tax. The government fell in non confidence, and this revived Pierre Trudeau’s career as PM. The Libs won a majority, and that was it for “Joe Who” as PM. This cautionary tale would be familiar to Justin.

That person had a ton of money in chequing 🙂

James Soper – Not everbody likes to take lengthy vacations. To each their own. Hey, some enjoy reading the transaction slips left at the ATMs to see how much money other people have in their accounts LOL.

It is possible if you started really young. For example, I had a young family with two kids buy a $1.5 million home a few days ago. They bought a townhome 10ish years ago before kids, made 300k +/- on it. Saved a bit of money in the meantime, solid dual income, and they upgrade to a $1.5 mill house.

I don’t know exactly where everyone is getting their money from but I am at showings every day and my observation is it is mostly young families trying to outbid other young families.

The listings I have go in multiple offers if we get 6 offers, for example, we get 6 letters from families. I have not had a number company or a business offer on any of my residential listings this year.

As I’ve said before once a month, at least, my buyers run into friends coming to or leaving a showing.

haven’t all those people lived in the Harris Green area for over a decade? Just on the streets instead of housed.

Ours is very predictable 🙂

You sound like a Hallmark card.

We do what works for us.

The mortgage isn’t the reason we don’t take big vacations; it’s that we don’t like big vacations.

This is true, but people live life according to values important to them. At the end of the day, what’s important is making decisions independently, and being content with those decisions. If someone was deliberate about their decisions and felt content with the implications, that person is likely happier than most. There’s nothing to feel sorry about.

My truth is different than your truth. It’s really that simple.

But think of how much joy she’s had badgering people on this forum, and reading graphs incorrectly.

People seem to have short memories….if you bought a condo in 2007 you were down 10% +/- in mid-2014. If you bought a Langford condo you were doing 15% +/-.

“We’re 12 years into homeownership and we’re still deferring non-critical improvements. Rather be mortgage-free by our early forties than have a super duper updated kitchen today. Coincidentally, we also drive one old car, don’t eat out, or go on vacations except road trips to Calgary and short camping trips.”

That is great in theory, but life is short an unpredictable. The only priceless things in life are the memories you make and you life can end abruptly. Penny pinching to the extreme when you don’t need to is not how I would live my life. If you do actually have a GH house for 12 years then you should have a substantial net worth, if you haven’t gone on a vacation outside of Calgary and camping in order to pay off your remaining mortgage with the current low rates we have experienced in the past 10 years then I truly feel sorry for you.

“All the people who were able to hang on for the first few years, were laughing after that.” unless you bought in 2007/8, it took 8 years for some to break even.

True. But it’s been ~20 years since we’ve seen formerly “normal” rates. Perhaps all this new COVID-caused government debt will increase inflation, necessitating big interest rate hikes, but many economists have their doubts.

Seems like globalism and countless macroeconomic factors have changed over the past couple decades, such that inflation has a hard time rising in general and no longer spikes during geopolitical crises.

So buyers just have to wait for a historical peak in interest rates. Gotcha. 🙂

Looking back at the last 40 years, one lesson is: buy a house even if you’ll be/feel somewhat house-poor in the beginning. All the people who were able to hang on for the first few years, were laughing after that.

Households are so indebted that we would be into deflation well before that point. Note that mortgage rates only broke 10% when inflation took hold in the 1970’s. Before that the norm was 5% or so.

That’s what people buying today have to worry about – not elevated interest rates, just normal rates. And in any RE bust it’s only a small fraction of owners who get into trouble.

We’re 12 years into homeownership and we’re still deferring non-critical improvements. Rather be mortgage-free by our early forties than have a super duper updated kitchen today.

Coincidentally, we also drive one old car, don’t eat out, or go on vacations except road trips to Calgary and short camping trips.

asking for a friend- anyone has a decent framer for recommendation? small addition in the back yard. TIA

True that asking prices are basically meaningless since underpricing is a thing that happens in hot markets. But the percentage of over asks is still a good measure of market hotness. Often that goes up before we see things like months of inventory and prices move.

IMO, over-ask is meaningless. I can price my house at $500k and I bet I can probably get 500k over ask also… should be a consistent benchmark like over assessed.

Really enjoyed reading that. Shifting perspective is a great way to get happier.

For the househunters who are understandably dismayed by our market conditions a glance at the could-be-worse file might be useful.

Garth has two examples today, one at $500,000 over ask and one at $575,000……

We’re constantly hiring, and end up having to hire people who are under-qualified for what we’re looking for, and then hope to keep them as their skills get better. We also would hire more people and less contractors if that was an option. So you’re wrong.

Well, just took a look a the new supportive housing map for Victoria. Great how there will be no consultation on it. It’s bad enough now, but I am really going to have to get my family out of the Harris Green area before those units are completed. At least I have a timeline to work to now…

If we ever got to 10% plus interest rates again, boy oh boy there would he a lot of hurt out there, not just in residential real estate. Not just hurt, full on fatalities.

No, but that is why we went five-year fixed when we bought. We knew we couldn’t handle a rise in those years without taking some more action, like getting a second job. It was worth the peace of mind, but we ended up paying way more than the variable rate would have been.

When we purchased this year we also went fixed. Rates are so low that the peace of mind was once again worth it even knowing variable has almost always been better.

And, as far as interest rates go, the 80s are now 30 years ago. It doesn’t mean we couldn’t get 10% plus interest rates again, but the mortgage qualification process today controls for reasonably foreseeable risk in the first five years imo.

We had to replace all the windows. They were aluminum frame and condensation was an issue even with wiping them every day in winter. Two of us have mold allergies and it just wasn’t something we could defer. We also had to repair a leaking shower, which we did ourselves. I think most of the big things can be mostly controlled for most of the time. Perimeter drains can be a big non-visible expense and water has to be dealt with so I’d be careful with those.

“When we bought our first house we couldn’t believe our good fortune and happily deferred non-critical improvements…”

Did you have to make critical improvements in the first five years though?

Considering home inspections are superficial and conducted by generalists that seem to hone in on things that don’t really matter (e.g., asbestos tape), the risk with going all-in – at least on an older home – would be that something critical was missed on inspection, and I’ve got no money to repair it. That would likely keep me up for a few nights.

Not really Leo. You don’t know what my lived reality is, the hardships I may have faced financially, and the choices I’ve made to achieve what I have. I have a lot of empathy for people who are in difficulty financially for any reason, it is not a great place to be, but buying a house doesn’t put you there imo – unless you experience divorce or illness and have to sell at a bad time. I also don’t appreciate the disclosure of personal information that I haven’t provided to you on a public forum – whether it is correct or not. Please remove it.

I think that during the entire period you’ve owned there has not been a significant rise in interest rates. That was the case for me, and I still had a few years of squeezing nickels at the beginning.

Not the case for the previous owners of one of my purchases, which had been foreclosed.

Where is the money is coming from to support this recent run up in prices? My best guess is boomer parents gifting or lending cash and/or using available HELOC to help their genx and millennial kids get into the market. I would guess a lot of parents are struggling with watching their kids being priced out of housing and want to help if they can. Lump sum from parents + dual income + max mortgage = being able to buy right now. Due to FOMO, we could be witnessing the rolling forward of a massive transfer of wealth. Anecdotal reports from RE agent friends suggest a lot of local buying is from 30/40 something couples, families etc. (are you seeing this Marco?). Wages would suggest this isn’t possible for most without large gifts or loans from family.

I won’t get into an argument on this totoro, but can you see how holding up the example of someone with I believe a law degree that retired in their 30s/40s as representative of the kind of stresses people might face is problematic?