Not (just) a Victoria problem and other tidbits

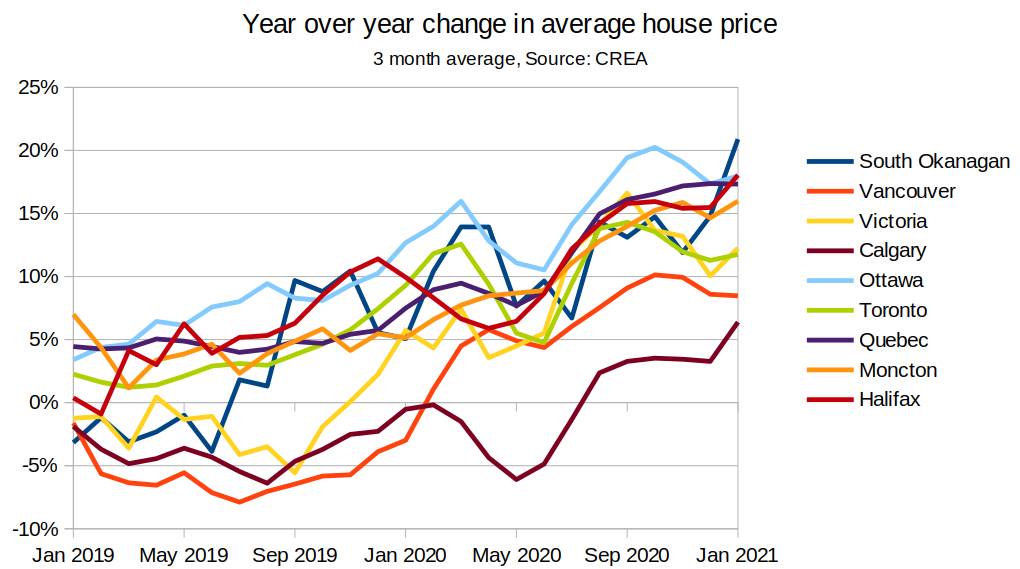

You’ll often hear that real estate is local, and especially in a country as large as Canada, the conditions in one market don’t necessarily reflect those in any other. That’s usually true, but the pandemic has been an exception, with unprecedented synchronization of price trends across the country (and in fact across the continent). The year over year price increase for the country hit 23% in January, which has only been exceeded a couple times in the last 4 decades (and at much lower baseline prices). Even markets that have been in the dumps for years like Calgary saw a spike in the average sale price after the pandemic hit.

Of course some of the jump can be explained by a shift in the sales mix away from condos and towards larger and more expensive detached or semi-detached properties. However this is looking in the rear view mirror. That shift is real, but just like the supposed flight to the suburbs it’s been overblown. Yes the detached market took off first, but we’ve been seeing for months now that condo markets are heating up and prices are starting to rise rapidly in that segment as well. That’s happening in our biggest cities as well, with downtown Toronto condos being extremely weak until last fall, but now are very active again. The flight from cities as well seems to have been temporary, with sales in Vancouver up 73% from last year.

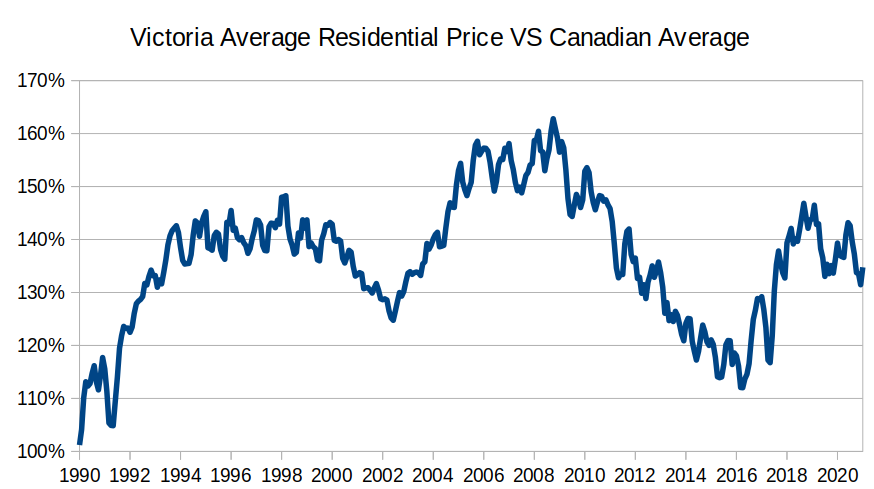

Another way to look at the data is to compare Victoria’s average price with the Canadian average. Victoria has been an above average market since 1990, and the current level at around 35% higher is in the middle of the historical range. In 2008 after a decade of price increases, we hit 60% higher than the Canadian average, briefly moving ahead of even Toronto. As spectacular as the price runup has been post-pandemic in Victoria, the rest of the country has been essentially keeping pace.

Risk of government intervention rises

If it was just Victoria prices going up no government would care. However because it’s a nationwide phenomenon it raises the risk of regulatory intervention to tamp down the frothy prices. So far the Bank of Canada has steadfastly refused to see the frenzy in the real estate market no matter that it’s been obvious for some time. Recently though it’s gotten so out of hand that they’ve been forced to acknowledge “early signs of excess exuberance” although they believed that conditions were still less active than 2016/17. That’s categorically false, as inventory is lower and the market is hotter nationwide now than it was four years ago, but perhaps that will be clear at the next meeting.

Talk of government intervention is increasing. In a recent note, ScotiaBank predicted that national measures to contain the housing market would be coming in the spring budget either March or April.

What could those measures be? No one knows at this point. The Bank of Canada is not raising rates and the stress test can hardly get stricter, which doesn’t leave much room for effective action. Unlike in 2008 we don’t have 40 year mortgages or the ability to put zero down on a house. Those were all permissive policies that were gradually unwound over the following decade, and now there’s little left to pull back on. Sure they could raise the minimum down payment requirements, but it would be spectacularly unpopular and I very much doubt that’s the direction they’re going. They could address the root of the problem by announcing a massive housing construction plan and wrest local planning control from obstructive municipal governments, but that’s no quick fix and also unlikely to happen.

If I had to guess, I’d put my money on a national vacancy tax as promised in their platform. The problem with that is that it will be entirely ineffective in BC, where we’ve already got one. Our speculation tax – while a good shot across the bow messaging that houses are for homes first – hasn’t been all that effective at curbing price appreciation. There was no discernible impact on the market when it was introduced, and results show that there simply aren’t many empty homes left in the region. Layering on another vacancy tax (comically the Vancouver region would then have 3) may convince the last few holdouts to sell, but it wouldn’t even be a drop in the bucket of the broader market.

However increasing regulatory risk joins the party with increasing rate risk. With bonds remaining stubbornly high after their recent spike, it seems the recent bank rate increases are here to stay, and surprises in the bond market are likely not over. For the housing market, all of the positive impacts of the pandemic have been frontloaded, but that doesn’t mean the negative ones don’t exist. The surprises in this market are far from over.

Stress test stops biting, but only for the wealthy

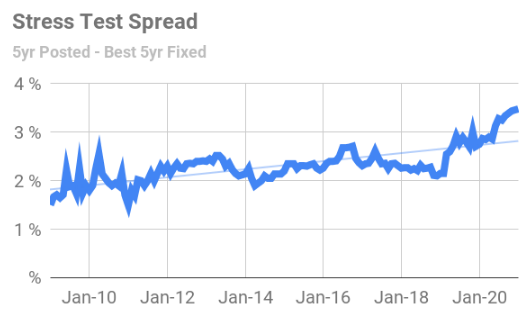

The introduction of the mortgage stress test back in 2018 was a huge hit to the Victoria market. Overnight it took out 20-25% of the buyers from both the single family and condo markets, shifting them from hot conditions with rising prices into ones where prices were flat for nearly 2 years. In fact it was such a major shift that it fooled me into thinking we had hit the top of the cycle early and were starting down again. That was obviously not the case, and around the end of 2019 the effect of the stress test started to wear off for buyers of detached homes. And now, even though the spread on the stress test is higher than ever it seems to have lost all of its impact for those higher priced properties.

The difference between the rate you can get on a mortgage (~1.5%) and the stress testing rate (4.79%) is at a record high. Source: RateSpy

Why exactly the stress test has stopped working is unclear. Some lenders have relaxed requirements, and allowed those with substantial wealth to avoid it entirely. Some buyers are accumulating higher down payments either through savings, borrowing, or gifts from parents. What seems to have happened is that the stress test continues to bite for those ordinary borrowers without a lot of wealth buying in the condo market, while it has less and less relevance for buyers of detached properties where affordability has become very strained even at today’s super low rates.

It’s another way that the pandemic has transferred wealth and gains to those with the most means going into it. Not only were the highest income earners least likely to lose their jobs and benefited from no strings attached government transfers, those who could afford to borrow were gifted with nearly free money while the barrier to entry remained high for those not yet in the market. We don’t have any solid data on this, but anecdotally it seems more existing owners are hanging on to properties as investments when they’re upgrading instead of selling those entry level homes for first time buyers to get into. Ultra low carrying costs make this possible.

Also the weekly numbers, courtesy of the VREB:

| Mar 2021 |

Mar

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 254 | 608 | |||

| New Listings | 323 | 1084 | |||

| Active Listings | 1338 | 2252 | |||

| Sales to New Listings | 79% | 56% | |||

| Sales YoY Change | +54% | ||||

| Months of Inventory | 3.7 | ||||

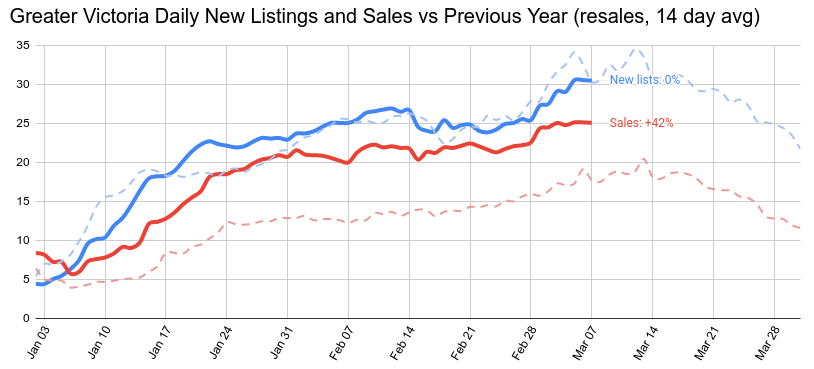

Sales took a step up last week to match the usual March increase in new listings and the market remains extremely supply constrained across the board, with 38% fewer properties available for sale than this time last year. The condo market continues to heat up, with a quarter of properties going over the asking price so far in March. 6 months ago it was only 8%. For detached properties sold in March, 62% went over the asking price.

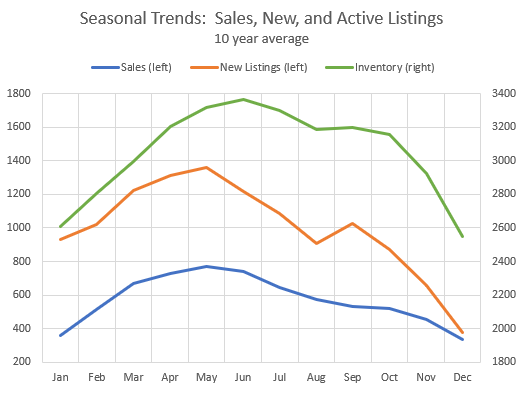

Remember that in a usual year, new listings peak in May so house hunters can still look forward to an increasing rate of new listings for some time, but of course that usually brings more buyers as well. Inventory normally would be climbing steeply at this time of year, but elevated sales has kept it almost flat so far. Average inventory for March is well over double what we currently have.

It continues to boggle the mind how little the rate of new listings is affected by market conditions. This year we have a pandemic and a huge price jump behind us but it hasn’t made any difference at all to listing behaviour. New listings have been tracking 2020 narrowly all year, but of course those year over year comparisons are about to become meaningless. We are about a week away from hitting the pandemic drop, so I will likely switch to a 2019 comparison soon to get a more normal baseline. Expect some wacky real estate headlines and infographics this spring (April sales up 348%!).

Interesting anecdote: Wife’s colleague listed her house in Maple Ridge and the agent hosted three open houses. Offers were due last week. In total she received one offer at approx $80K over asking….

Apparently there were a number of parties interested, but most did not want to get into a bidding war. The lucky buyer had a financing agreement that expired at the end of the month, so the buyer was keen to complete the purchase!

Take it for what it’s worth.

Has anyone else noticed that on the “Realtor.ca” website the search for House/detached is no longer working, it just comes up with nothing for sale? There is no way to filter out other properties in the Victoria/Saanich/Langford area but the filter is still available for other places. Could it be that there are so few SF homes for sale here realtors hope the folks looking in the Victoria area will be tempted to buy a condo if they don’t see anything else when the filter is applied?

New post: https://househuntvictoria.ca/2021/03/15/are-investors-driving-the-market/

I think it is obvious mortgage debt would be going up along with higher prices and younger people getting into the market. Also the deferrals would have added to the increase in mortgage debt.

I think the article was trying to explain why young couples/families were willing to buy at these high prices.

Increased mortgage debt is caused by the current market. Debt increase does not in and of itself drive up prices. Easy access to cheap credit is a driver and was discussed in the article.

Thanks for the standard deflections from the RE industry, but I find this simple explanation more compelling:

Canadian households added record mortgage debt in Q4: StatCan

I don’t know who to speak to Peter but there are definitely options for air to water heat pumps that can handle both your radiant heating and your hot water. Also big incentives right now for heat pumps and heat pump water heaters.

Makes no sense to bring fossil fuels into a house in 2021 in my opinion.

I once looked at appreciation rates by municipality. Would be interesting to see the difference in dollar terms for sure

https://househuntvictoria.ca/2019/12/19/which-municipalities-appreciate-the-most/

As always, your story doesn’t add up.

You were straight out of University when you moved here with no jobs or job prospects, and somehow had a 14% down payment on an house that was at least $450k. So you managed to save $63,000 while going through university? I’d say that’s atypical.

Doubt it if you’re dropping $600/month. I’d get an energy advisor out there before doing anything.

I think they’re fine for ‘standard’ stuff. Wouldn’t use them for bleeding edge.

Given a super high hydro bill my thought is there is a reasonable probability the home is older and Peter does not have PEX tubing.

For those who might be interested in where the money is coming from to buy houses, who is buying, and why is there such a crunch for available homes, this article is interesting. (This is an across the country view)

https://www.canadianrealestatemagazine.ca/news/is-talk-of-an-overheated-housing-market-full-of-hot-air-334541.aspx

Peter, we were in a similar situation as we were on a large acre lot with a 500 ft long driveway and wanted to replace our oil with natural gas. The quotes from Fortis to install the gas line were prohibitive, and after getting quotes from private contractors we found a solution. We had Fortis install the meter near the entrance to the driveway for no cost and had a private contractor dig the trench from the meter to the house. The plumbing company then laid the gas line and replace our old oil burner. Since the gas line was low pressure from the meter, the trench did not have to meet the exact standards of the one from the road to the meter. If you have a lot of rock this would be a problem, but we were able to find a path in that by-passed any rock. This was a huge saving and we are very happy we made the switch.

LOL, it is like asking a car mechanic to repair a printed circuit board on a computer monitor.

It is highly unlikely that the leaks are caused by faulty tubing, because the tubing have to be pressure test before the slab is pour, and hydroponic PEX (Oxygen barrier Pex, or Pex Al Pex) are rated at least as high as standard PEX tubing. Therefore, the fault is likely due to poor installer or was damage during slab pour (and installer didn’t check the pressure test after the pour).

The only time that hydroponic PEX tubing might fail have to be in combination of a long chain of events (practically impossible):

city water main pressure spike beyong 110 Psi,

house water main supply pressure regulator valve (PRV) failed,

boiler feed PRV failed,

pressure tank failed,

pressure relieve valve failed,

supply temperature sensor failed,

threeway mixing valve failed,

zone valve/s failed, slab temperature sensor and/or thermostat failed,

lead to runaway boiler.

thanks folks, appreciate the advice.

I’ll phone Hydro, but the reason I think bringing gas in will be prohibitive is their website says they charge you $125 per meter to bring it in after the first 25 meters or something like that. A rough guesstimate given the length of my drive made it prohibitive (property is an acre or so).

The house is well-insulated and I’ve already had an electrician check the system & he says that’s just the way it is. But yeah, before hooking up to radiant, it makes perfect sense to ask about the generation of the piping, thank you.

The house inspector recommended Island Energy; of course I don’t know if he has some relationship there. Has anyone used them?

Peter – also research the type of radiant plumbing you have. I’ve had two clients in my career that have ended up with leaks that required jackhammering the slab; therefore, if you have a generation of pipe that is leak prone another consideration to factor in.

If Fortis can’t bring the gas for free or reasonable cost I would personally go mini split + baseboards in bedrooms. I know everyone ****s on baseboards but maintenance free and essentially last forever.

Yea that is a tricky one. The few times we’ve done radiant heating the plumber has done the construction component but not sure who does this type of servicing/diagnostics but I imagine it is expensive. Which brings me back to baseboards, maintenance free and no need to search for elusive specialists 🙂

Peter – I agree with QT. I’d try and minimize your losses before replacing the system. There are a number of air-to-water heat pumps out there you can hook to hydronic heating, but I have no idea who to recommend.

Bought for $19,000, sold for more than $2 million, this Don Mills home is a reminder of when Canada helped Canadians house themselves

https://www.thestar.com/opinion/contributors/2021/03/13/bought-for-19000-sold-for-more-than-2-million-this-don-mills-home-is-a-reminder-of-when-canada-helped-canadians-house-themselves.html

Comparison is meaningless, since almost everywhere else in Canada cities have been amalgamated with suburbs. Ottawa has the lowest density of any major Canadian city but that’s meaningless too, which you will see by looking at a satellite view.

Just wait until the west shore runs out of greenfield land if you want to see a housing shortage

Peter,

Have an experienced tech check the heating system to make sure that it is running within spec. Make sure the boiler feed is working properly, as well as expansion tank, heat exchanger if applicable, threeway valve/s, circ. pump, zone valves, and the most important is remove absolutely all air from the system (eliminate air lock).

Make sure the house envelope and insulation is adequate. Seal air leak/s specially around doors and windows, and check the ventilation to make sure that it is not over worked. Upgrade single pane windows to double if applicable, and install double layers heavy curtains will greatly reduce heat lost.

In the heat pump category you have four options as follow, geothermal (expensive), air source to water (pool heat pump), air to air (require duct work in the attic, add inexpensive air conditioning option), mini ductless split (come with AC, but unattractive).

IMHO, the best option if you are looking for an upgrade of equipment is condensing gas boiler. And, give Fortis a call for a quote as most of the time there are no cost to the homeowner for running the piping or meter (standard $13/ mo rental fee) from the street to your house. The key to get Fortis to do the work is to tell them that you are looking to have many things service by gas (boiler, hot water heater, fireplace, stove, outdoor bbq, outdoor fireplace, etc…)

I’m hoping Ned Taylor will decide to run in Victoria instead of Saanich.

I greatly prefer gentle densification to increased homelessness and housing insecurity even if I am secure with my housing.

When you have a growing population I don’t think you can stop it by just saying, “no more development” in my backyard. In Canada we have freedom of movement and we rely on immigration for economic development.

The logical way to address this may be to take the debate from the neighborhood level and do what Oregon has done and pass a law that eliminates exclusive single-family zoning in much of the state. Local politicians face too much local push back to be effective until we are past crisis levels and this is really a provincial issue imo.

The people that currently own SFHs and don’t like this change and want less densification can move to more rural areas: they will have the means to do so later in life with the accumulated equity they have. The people who need the jobs Victoria offers, or want to stay in the City and are okay with greater density, can stay.

Along with this I would support the strongest legal measures possible to end homelessness.

Gentle density will happen whether I like it or not. A lot of what I’m arguing here can be summed up as “Old Man Yells at Cloud.”

I just hope it is gentle, and gradual.

Yeah, if I recall correctly, gift from the parents boosted us from 14% down payment to 18%.

I do forget that sometimes. Good point.

Wasn’t planning on upgrading anytime soon, so the increasing delta won’t keep me up at night.

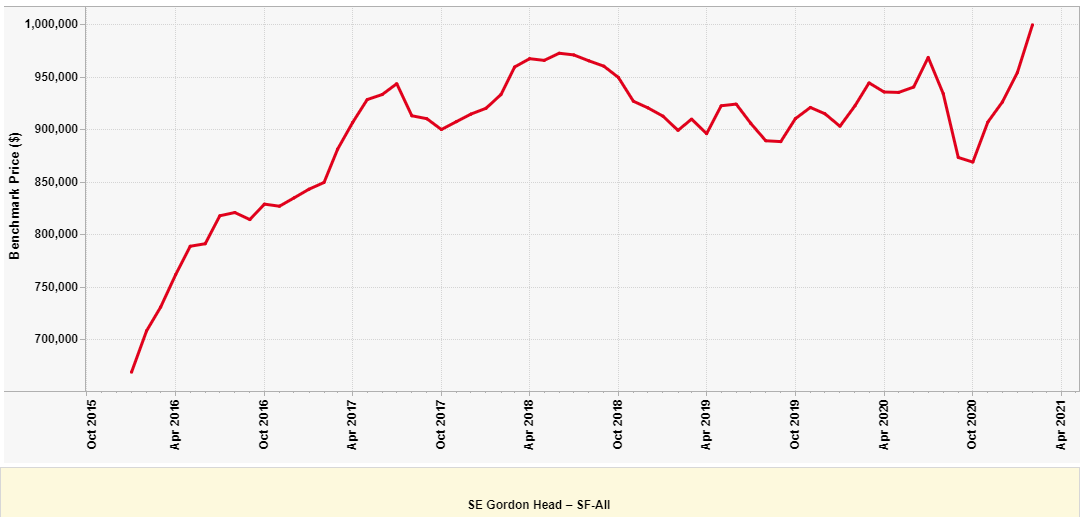

Would be interesting if Leo could put together some data on the changing deltas, over the years, among a few neighbourhoods like GH, Oak Bay, Fairfield, Oaklands, etc.

Here is someone who didn’t make a killing:

1331 Salsbury Drive, Vancouver BC. Listed 22 Feb 21 @ $1,699,000 & Sold 01 March 2021 for $1,910,000. They purchased it in September, 2016 (4 1/2 yrs ago), for $$1,811,000. I keep an eye on this area because my daughter’s house is just three blocks away. It is also an arts & craft built in 1912. Theirs is about 350 sq. ft. bigger than the Salsbury one and has an extra bath. Also dining room and living room are nicer with built in sideboards, bay window etc. I’m wishing they would sell and move to Victoria to be closer to me. Oh well.

Hey Barrister….don’t become a stranger here. As much as some things you opine on I don’t agree with, you are a gentleman with a great sense of humor and I enjoy your posts. Just to be clear about Leo, I don’t believe he sells real estate.

Peter, that hydro bill is incredible. Stroller gives some good advice. Also, especially if you have vaulted ceilings, it might help to install ceiling fans.

Same size house here, also on a slab. The solitary source of heat is a heat pump. The hydro bill for the two months ending on Feb 25 was $362, along with a note saying that this was 7% more than for the same period last year. Sounds about right – I think this winter had lower lows. There’s also a handy graph that shows my consumption relative to “similar homes near by”. Our consumption is about half of the others.

You should be aware that the effectiveness of the heating drops off once you are below four degrees or so. This is not really a big deal, it’s just if you are in the habit of turning the house temperature down at night as a savings measure it doesn’t really work – it takes the system to long to regain your daytime target temperature next morning.

Hi, heat pump question here as I saw in the past that there seem to be knowledgeable folks here on this topic. Sorry if this is derailing the other discussion, fascinating as it is!

We just recently bought a house that is something like 2300 sq. feet one level on slab. The current main source of heat is in-floor radiant heat with an electric boiler. Our first Hydro bill (for February) came in at over $600. This at a time when we were keeping the house very cold, as we haven’t really moved in yet. It was kind of shocking compared to what we were used to. Then talked to the prior owner, who keeps meticulous records. Last year same month, her heating bill was over $1,000 (for one month). So, pretty intolerable…

I am just starting to educate myself, but it seems a heat pump is a serious contender. We don’t mind spending on an up-front investment like that if it pays off, as we plan to live in this house indefinitely (big bad Vancouver retiree coming to the Island to drive up your house prices, sorry!).

The house does not have natural gas, and bringing gas to the house would be very expensive (hugely long driveway), plus not as efficient as heat pump anyways. I think roughly speaking we could get a heat pump, installed, for about the same price it would cost just to bring the gas line to the house, so I’m not seriously considering NG.

I’ve been reading about ducted vs. ductless heat pumps, but the option I’m most intrigued about is hooking the heat pump right to our radiant in-floor heating, as I really like the warm floors, plus would just as soon not have heat being blown down from my ceiling or be looking at the split units.

Has anyone done this? Was it a big job to do the conversion? Did you get significant electricity savings? Would you use an air-to-air heat pump? Any recommendations on type/make of heat pump in our climate (North Saanich)?

And most importantly maybe – who would you recommend if I want to have someone out to the house to assess the situation?

Much appreciated!

“Attractiveness was determined by the number of big cities in a 500-kilometre radius, accessibility by road, train and plane”

Ah yes much of my day to day satisfaction is based on whether I can take a train here, or how many big cities are within a 500km radius. These lists are all ridiculous. Rank the Canadian cities by price or rents. The most accurate measure of attractiveness.

https://www.vicnews.com/news/victoria-ranks-woefully-low-on-best-canadian-cities-to-study-in-list/

I don’t think you can stop growth. London is an example of where expansion is restricted and people end up renting out backyard sheds. I think planning for growth is the best way. People will find a way to live where they want or need, but there is no reason they should be forced to live in suboptimal conditions. A lot of people are now living in Greater Victoria in conditions that are a strain on their longterm wellbeing.

Providing more options for housing solutions is the right thing to do. Even if it means my house might drop in value or there might be more cars parked on my street.

Well introvert, my delta to upgrade to arbutus or oak Bay is now atleast 200k more than 2 years ago. I like to think I did ok in my investments etc. But I am definitely worse off if I am to upgrade right now. MY waterfront dreams are all but gone now given the current market.

I hope you realize that a 20% gain on 800k is less than a 20% gain on 1M, so unless u can make up for that delta elsewhere you will be further away.

“But we scratched and clawed our way in, and never advocated for more density and more development along the way. Why would we?”

Did you mention the help you got from mommy and daddy with the downpayment? Or does that not fit with the scratch and claw narrative?

God I hope you’re right :). But at the moment the market sure leaves the impression that it can just run away on us. Leo and Totoro have debated this ad nauseam but I’m of the view that rising prices like we’ve seen make it much harder to move up for existing homeowners. Just think what you could buy for a measly million $ if houses were still at 2009 prices.

My theory on why housing markets are so strong virtually everywhere right now: a combination of all time low interest rates and the COVID effect.

Covid has provided a lot of free time to people who used to be busy driving kids to minor hockey, commuting to work, hosting dinners, going to concerts etc. That has led people to accelerate plans to finally upgrade to the new house, move cities, etc. What better way to spend excess time and money? And, a higher than normal % of that group will hold on to their other property to rent out because of low interest rates.

I’m seeing several examples of this, including people returning to BC from colder parts of Canada after a long winter and no sunny/warm vacation. Covid is accelerating these kinds of moves.

Have to think demand will taper off for awhile post Covid.

Neighbourhoods can change without being effed up. Allowing gentle density like auto rezoning for duplexes for all munis in the core seems like a reasonable way forward. Would be gradual change, as not everyone would sell or develop all at once. I mean, even now we’re heavily constrained on construction resources. I’d support that zoning change for the Oaklands (my neighbourhood).

Big difference is that Beverly Hills has a wealthy tax base and massive urban sprawl surrounding it, so I think the need to grow population directly in the city is reduced.

I love the introverts of the past, but I would never talk to them 🙂

By way of response:

A) I’ve acknowledged that some growth is inevitable (because NIMBYs don’t bat a thousand), and as long as it’s a trickle, and not a torrent, I’m OK with it.

B) When we arrived, the signal was for us to scram, and we knew that. We went in eyes wide open. Vacancy was near zero. House prices were high (so high that, I shit you not, 90% of folks on this blog thought we were in a bubble that was about to pop — hah!). But we scratched and clawed our way in, and never advocated for more density and more development along the way. Why would we? We loved that Victoria wasn’t very dense, wasn’t bustling, that it still had suburban wastelands in walking distance of the ocean! For the people who want to move here today, I would say scratch and claw your way in like we did, without advocating for effing up existing neighbourhoods to make it happen; and if that’s too hard, or you simply can’t, then head up to Nanaimo or Port Alberni or the dozens of the other places where it’s easier to make a go of it. And if you do make it into Victoria the hard way (or the easy way because you’re rich AF), welcome!

Like someone on Reddit said, Beverly Hills doesn’t worry about accommodating newcomers. You can either buy a house in Beverly Hills, or you can’t. It’s that simple. Victoria should be like that.

My thinking is that as long as GH price gains are roughly proportional to the price gains of other neighbourhoods that I’m interested in, it shouldn’t become more difficult to move as time goes on. Yes, I still have to save up to cover the difference. But when our mortgage payments (and extra payments) are gone, our income will be freed up, turbocharging our savings (for decades, really, since we’re nowhere near retirement age).

Well, the plan is to stay put for the next 20-ish years. But plans can change.

Introvert, I assume you feel justified in your position. How do you feel about the Introverts of the past? If someone in 1990 had the same stance as you do now, would you agree with them? 1990 Victoria is perfect the way it is, no need to grow, should be a signal to people to live somewhere else.

Will be interesting to see what Saanich council looks like after the next municipal election. Current council is easily the most pro-density, pro-development council I’ve ever seen in my time in Victoria. Will the pendulum swing back a bit? I don’t see it happening, but you never know.

Introvert, the faster prices rise and the more desirable Victoria becomes the less chance you have in upgrading to a better house. I am experiencing this first hand so unless you are happy living where you are forever I don’t see how this benefits you. You could leverage your home equity into other investments but you said you are debt-averse so that is out of the question.

Yes. Wouldn’t be surprised if they’re some of the biggest ones in Victoria history but there may be some higher priced places at some point that were underpriced

Leo are those over asks all this calendar year?

I still don’t know where all these buyers were in 2018/19 when the market was soft. Pretty clear that most people buying right now are finding ways around the stress test because I dont think most people can save an extra 200k worth of down-payment in 2 years.

Biggest over asks in Victoria so far are

4349 Kingscote for $1.75M, $451k over ask

620 Normanton for 1.8M, $377k over

4906 Alamida for $1.8M, $329k over

2706 Forbes for $1.3M, $310k over

Using past development as the justification for any and all future development is bonkers.

The gift that keeps on giving.

Toronto house sold for $620,000 over asking — https://tinyurl.com/wdrumtfw

Victoria is full. And by people wanting to move here while there are insufficient housing options available, prices go up, which I like.

Yes, we do fundamentally disagree on this.

I think growing generally makes things worse, so it’s best to try to limit growth by pressuring councils to reject developments that are inconsistent with LAPs and OCPs. NIMBYs aren’t always successful, so some growth will happen no matter what. But I’m against opening the floodgates on development and population growth. A trickle is good. That’s what we have now.

One person’s suburban wasteland is another person’s peaceful and quiet oasis. Density will destroy that.

Fair point. But a bit of development here and there, I fear, is the camel’s nose under the tent. Advocates like you want more and more and more, and will never be satisfied. For you, there is no threshold beyond which a neighbourhood or community is too dense. That is crazy and worrisome to me.

“I never complain about people coming/wanting to live here.“

Dude, your entire shtick is that Victoria is full. Try a little harder now.

Everyone has the right to express their views to their elected representatives. I am not demanding anything, I am just using the advantages of my small platform and reasonable understanding of housing market dynamics to amplify my voice.

I’ve changed my views on supply over the years. I used to be a lot more skeptical of the supply narrative from the industry and I’m still under no illusion that most developers aren’t pushing it mostly out of self interest. However I’ve read more research on the impacts of construction both on the rental and resale markets, and now that the government has taken several steps to control toxic demand it’s the only sensible angle I can find to lean on that may have the chance to make a difference. Many of the other policies that have a big influence on real estate prices (rates, credit policy, consumer sentiment) are completely outside of our locus of control but supply response isn’t.

Swing and a miss. I never complain about people coming/wanting to live here. I complain about the notion that cities are obliged to try to house everybody who wants to come, as if there aren’t other places for people to live in Canada.

Population density of the city of Victoria( 4,400/sq.km) is already high, by Canadian standards. Victoria density is 7th highest in Canada. The highest in Canada is the city of Vancouver (5,500/sq.km), by a lot (20% higher than next city – Montreal)

https://www150.statcan.gc.ca/n1/daily-quotidien/170208/t001a-eng.htm

.

Of course other cities are 10-25X more dense, like Manila (100k/sq.km,), Paris (54k) https://en.wikipedia.org/wiki/List_of_world_cities_by_population_density

No they weren’t….back in the day homes were magically built without having to cut trees or inconvenience anyone.

I think people are simply too dumb to figure out in advance that they will enjoy the amenities. My reference to Boom + Batten is a great example. Insane opposition and after the fact it is so popular you can’t even grab lunch without a reservation.

As far as never noticing it again….what has been built since the View Towers 50+ years ago that someone drives by and says “damn I wish that wasn’t there?”

I just posted my suite for rent on Tuesday and got over 100 inquiries. That being said I generally rent my place for a bit under market value to give people a break. If you have had to rent out a suite it’s quite sad listening to people stories trying to find a place to rent. But hey, let’s not try to meet market demand and build more, It’s all good, let them eat cake.

“We didn’t write to municipal councils demanding that the city densify to accommodate our arrival.”

I bet you also didn’t write to complain about the densification that was happening when you arrived in the midst of a building boom, and the new housing units being added to help facilitate your arrival.

Back then, you were the problem that you complain about now. Pointing out the hypocrisy and myopia of your position hardly seems weak.

That’s our fundamental disagreement. I think growing makes things better, infill makes things better because it supports a wider variety of businesses, and walkable/cycleable neighbourhoods are better than suburban wastelands where you have to drive everywhere. Density gives us that.

As Marko pointed out people also overestimate how much any given development will affect them. Once it’s built they like the amenities it brings, or will never notice it again.

You’ve said the same thing. Existing townhouse developments don’t bother you at all and yet you believe somehow new ones will completely ruin the neighbourhood. Doesn’t make sense. I bet you wouldn’t even notice a difference if Gordon Head slowly put in more townhomes as properties came up for development.

It’s also about moral consistency for me. I care about sustainability and equity, and denser and more affordable forms of housing support both of those. Therefore I’m increasingly convinced that there’s an imperative to actively work towards enabling those opportunities. Maybe that will turn out to be a Sisyphean task. Certainly municipal councilors will have a hard time supporting change when most of their voting base are single family detached home owners but the political winds are changing in some cities.

And to pre-empt all the weak “You got yours so everyone else can suck it”/”You wanna pull up the ladder” criticisms that I invariably get, when we arrived in Victoria circa 2007 the vacancy rate was near zero and it took some time to secure a place to rent. But guess what? We didn’t write to municipal councils demanding that the city densify to accommodate our arrival.

I believe most bubbles also came with substantial overbuilding (US & Spain for example). As far as I know we have no evidence of overbuilding here and pretty good data now from the spec tax that there aren’t many empty homes.

There we have it. When you start with “we need investment into downtown” and work backwards from there, then all development proposals look great to you, which is basically your stance.

If there’s not enough housing in Victoria that’s a fantastic signal to prospective newcomers to maybe consider other places to live. Not sure why we should screw up Victoria for the folks who live here for no better reason other than “we need to grow.”

We’ll grow slowly no matter what, but we don’t need to actively encourage it and open the floodgates.

If that many people moved to Vancouver during those 5 days, then what’s the problem? They moved to the city and found a place to live. All is well.

AAA biking network is a key sustainable and healthy commuting option. Fewer cars on the road, and frees up parking spaces downtown for those unable/unwilling to bike. Better for the environment. Retains charm for Victoria (huge wide roads and ample parking are not charming). You know what’s charming/cute? Smaller versions of things. And separated bike lanes are just smaller cute roads. It’s a win all around, not virtue signalling.

And we do need to ramp up non-vehicular infrastructure. Roadways and parking take up a stupid amount of space.

Zoo time is she and you time

The mammals are your favourite type, and you want her tonight

Heartbeat, increasing heartbeat

You hear the thunder of stampeding rhinos, elephants and tacky tigers

This town ain’t big enough for the both of us

And it ain’t me who’s gonna leave

Anyone familiar with RE bubbles knows that rapidly rising prices are not a sign that not enough housing is being built. In fact in just about every market there is a strong correlation between the amount of housing being built and rising prices. Then when prices start falling, construction drops off. Rinse and repeat.

Marko: Leo is unbiased because you agree with him. I am sure you live happily in your condo and that is just great. I am sure my memory is failing but did you not have a wife and kids in that SFH when you owned it? If so, are they happy with you in your condo? I am about to again hear about how happy people are in your native Croatia to raise families in small condos.

Sorry but I have to take the opinion of real estate agents, especially ones that sell a lot of condos, with a grain of salt, But you have made an awful lot of money selling condos so where your stand on an issue has a lot to do with where you sit to eat.

I take it you mean this place. I know someone who lives nearby. As the article notes, this is pilot program. Six stories is way above the norm for that neighbourhood, but that’s the tradeoff for the rental guarantees. That’s the sort of thing the council is supposed to debate. A development that falls under the existing zoning wouldn’t have to go to council.

https://www.vancouverisawesome.com/vancouver-news/city-adds-35-rental-homes-to-vancouvers-west-side-some-at-below-market-prices-3519036

I tried to grab lunch a few days ago at Boom + Batten. We were told it was 1+ hour wait and left. On our way-out patio is packed and I noticed a couple eating lunch that live in my building. They were opposed and furious when the marina/restaurant was approved. There was insane opposition to it and now whenever I walk by there patio is filled with the elderly of the Songhees, the original opposition to the project. Now we move on to opposing the roundhouse 🙂

Barrister, have you ever thought that maybe it is just your problem and a few other 1%ers that Victoria is getting too big? Last time I checked thousands of people including myself live happily in tiny houses.

Leo has to be the most unbias person on HHV.

You know what my nightmare is…trying to sell a dated 6,000 sq/ft mansion in Rockland.

“Others may feel like the system is doing its job”

I suppose if you are the type of person that likes going to public hearings to shout down low-density development because some trees might be cut down, or some extra people might park on the street, then maybe the system is working. But in a growing region with a housing shortage, it seems problematic to me.

Leo: If you stop building tiny little housing people would stop moving here. While it is every real estate agents nightmare maybe there is a little to how large cities should get.

“I would be keen to come and see how virtue-signalling with bike lanes and turning a blind eye to the ulceration of public spaces can etiolate one of North America’s loveliest small cities in less than five years.”

Complaining about bike lanes and virtue signalling in a single sentence. What a lame old trope. Not sure what the embittered conservatives have against bike lanes. Can’t go ripping up Fort St at 60 km/h anymore?

Vancouver council just spent 5 days debating the approval of 35 units of rental housing. In that time 4 times that many people moved to the city. The system is broken.

Leo I love your posts but I have to agree that you support any and all developments. Really you should move to Vancouver or Toronto and then you can be surrounded by what you like instead of trying to turn Victoria into Vancouver.

Well it would be a crying shame to replace the quintessentially old Victorian charm of the existing rental car parking lot.

Lots of comments about sending the Telus building back for fine tuning but not specific comments about what needs to be fine tuned.

Disagree there. AAA bike lanes and mode shift are key to keeping Victoria lovely as it grows. We need to ramp up investment into pedestrian and cycling infrastructure in the whole region.

Moncton NB doing quite well:)

https://globalnews.ca/news/7680006/n-b-housing-boom-sees-house-prices-climb-30-in-2021/

It’s broken by definition. I don’t care much either way about Telus ocean other than we need investment into downtown. What I do care about is housing. And we’ve had dozens of rezoning applications for very moderate townhouse developments stuck in endless zoning fights. It doesn’t matter if 100% of them get approved, there are simply not enough hours in the day of staff and council to spend on approving a measly few units here or there. It’s like trying to walk up an escalator going the wrong way, you won’t keep up with growth. There is literally no way to create the housing we need if we stick with that process.

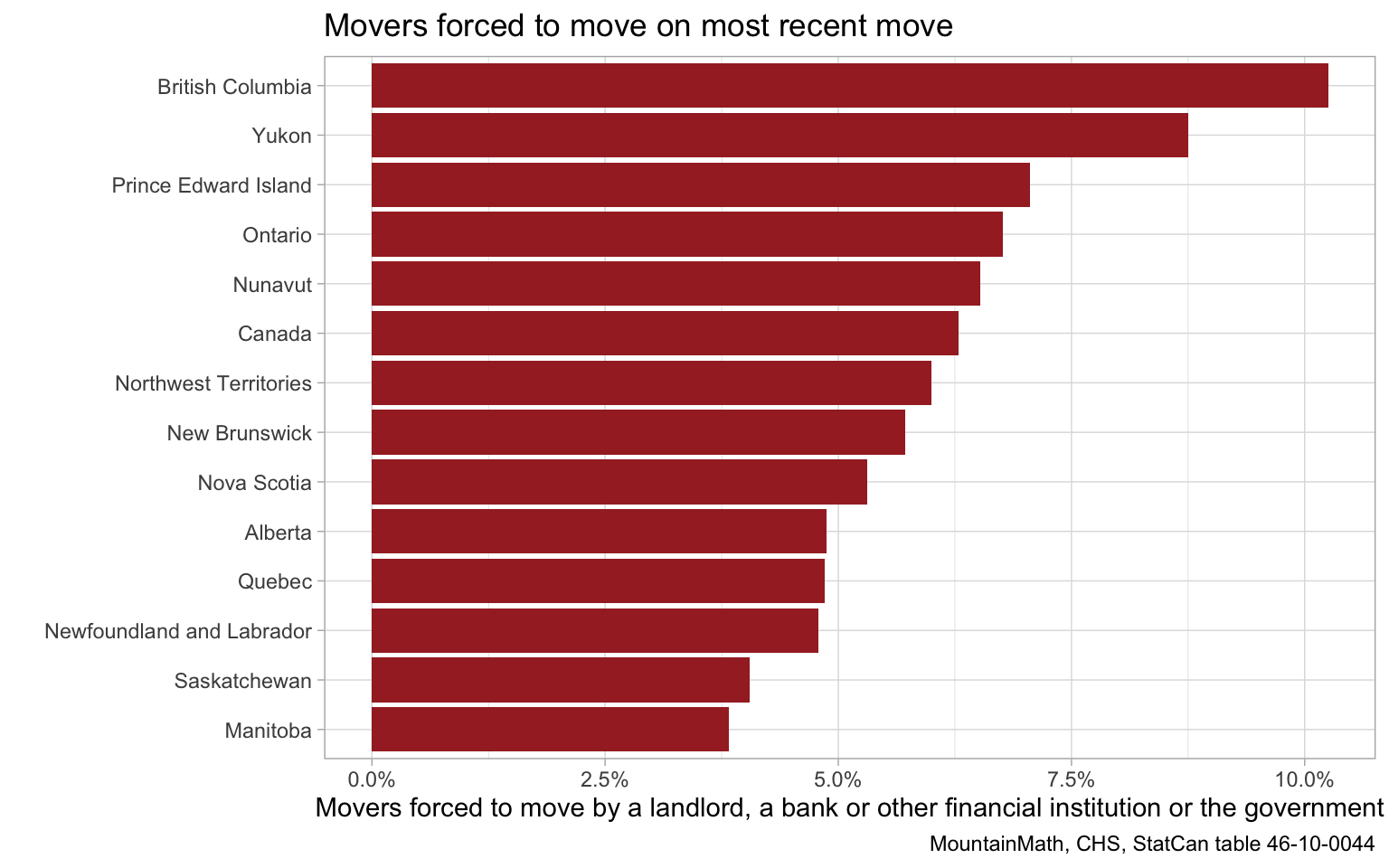

How do we know when we’ve built enough?

When we have a healthy vacancy rate of over 3-4%.

When resale prices for homes (not necessarily detached single family) stop spiraling upwards.

When people in BC aren’t being forced to move at the highest rate in the country.

Let’s get real, Leo. You’ve never met a development you didn’t think was good.

Second, development and change aren’t happening at the speed you would like, so you feel the system is broken.

Others may feel like the system is doing its job.

We already have that. We’ve made transparent rules and guidelines — they’re in the Local Area Plans and Official Community Plans.

The Telus building proposal, for example, is inconsistent with some the rules and guidelines laid out in said plans, which is partly why it’s receiving pushback.

The corollary to “Anything that meets those [rules] should just go ahead” is anything that doesn’t, should not.

But I don’t think you would like that. When it suits you, you’d really prefer that council ignore those silly rigid community and local area plans and approve projects that require variances.

And so we see that you’re essentially supportive of all development inside the Urban Containment Area. You have no standards.

If I was a city-council member from another location, I would be keen to come and see how virtue-signalling with bike lanes and turning a blind eye to the ulceration of public spaces can etiolate one of North America’s loveliest small cities in less than five years.

I thought they came for our feces, urine, needle free streets absent of being harassed on corners and at ATMs for cash.

The vast majority of tourists come to Victoria to see our condo towers. Nothing like them anywhere else in the world.

Not everything is good, but the system is broken. Let’s decide what we are shooting for as a region that is equitable and then have simple, transparent rules in place for new development. Anything that meets those should just go ahead.

Yes, such a shame that every development proposal that comes down the pike doesn’t get an immediate rubber stamp of approval because all building is good and it’s really that simple.

Well we wouldn’t want a towering checks notes 12 floor building in the middle of our downtown core would we?

Don’t worry though I’m sure the opposition at the public hearing will still kill it.

I too am not enamoured with the public sector, however, I chose a long time ago to pursue self- employment and invest my hard earned money in real estate. As I gracefully turned 65 (gasp!) and began receiving a modest $1160 a month pension, I am thankful that my investments worked out. If they hadn’t, I would be screwed. That’s the risk one takes in life. The end benefit of this decision is when I’m gone my “pension “ won’t disappear, but my investments will live on if handled properly.

Maybe they are distinct skill sets to a large degree. A concrete guy isn’t going to be good at fixing toilets. Construction down but renos up.

Ks112 i have a few colleagues at Brookfield who definitely sit in lots of meetings however they contribute and get compensated quite differently than the peeps in the public sector. The city of Victoria is in absolute disaster right now, running the city into the ground one day at a time. How did we have a 5-4 vote on the new Telus building? Someone needs to vote these tit lickers out.

The huge disconnect in construction job data and how unavailable every handyman is makes me think there’s some kind of mass covid money fraud happening.

MLS: 869421 $1.29 mil

I wonder if we are going to start to see few more of these in this market after the insane bidding wars driving nutty high offers without conditions.

Wonder what happened:

– Buyers get cold feet after winning?

– Appraisal not hit the mark for the offer?

– Financing collapse?

– Something wrong with it?

– None of the above or another reason?

Just curious to see if these start popping up more. I thought in this type of situation the seller would just call up the next highest offer? Unless the next highest was a couple hundred grand lower, you might decide just to relist….

GC, the head of realestate at Brookfield also gets paid to sit in meetings all day. That Pandora purchase probably came from above him for all we know. End of the day, government is meant to provide public service, their goal is not to get the best deal on every transaction. Looking at that guy’s LinkedIn timeline he probably replaced whoever was involved with the Johnson Street bridge.

Ks112 that guy gets paid to sit in meetings, typical government work. There is nothing strategic about the city of Victoria

You’d think that would give us a big vacancy rate, but doesn’t seem to have been that dramatic

I think you may have some misconceptions about what leads to life satisfaction. 🙂

Here is your guy Marko, looks like he started off as a corporate lawyer at a McMillan which is a decent corporate law firm.

https://www.linkedin.com/in/peter-rantucci-ll-b-75981b28

I have no issues with individuals working government jobs. If someone offered me 200k/year to work at BC Housing overseeing the owner-builder exam department I would definitively retire from my current gig right away. Who wouldn’t want a job managing something that is completely non-relevant that was made up out of thin air with no evidence? I would even strongly consider switching current career if the COV offered me the Head – Strategic Real Estate at 150k/year. Developers would certainly love with the COV paying $10 million for a property a developer bought 4 years earlier for $3 million and change.

I have a problem with the bloated inefficient system that often does not nothing but add bureaucracy.

One of my closets friends works for the government and all his does is make fun of all the ridiculous waste in his department. In one instance he was working on roof replacement projects on structures they slated for demolishment in two years.

This US article has some interesting ideas on another model to achieve home ownership. It gets to that idea about half way through the article…. so skip to there if you don’t have a lot of time.

https://www.theatlantic.com/ideas/archive/2021/03/why-its-better-to-rent-than-to-own/618254/

I shouldn’t generalize all union workers, just like everything else in the world it is a mixed bag.

I’ve worked in both union and excluded environments and cannot relate to this. The union staff I know can end up working OT off the books (no additional pay). There can be pockets of government with very different work cultures, regardless of union/non-union.

That is not how it reads James:

This policy applies to executives at public sector organizations with approved compensation plans for excluded management employees. This includes the public service, Crown agencies, research universities, post-secondary institutions, health and K12 education sectors. It also applies to employers’ associations.

The policy specifically applies to the CEOs, Vice Presidents, and equivalent senior executive roles within the organization with an annualized salary of $125K or greater.

In the BC Public Service, the policy will apply to all members of corporate executive. Additionally, the Deputy Ministers’ Council has voluntarily declined to receive compensation adjustments for the 2019/20 year. The policy does not apply to positions below the Deputy Minister, Assistant Deputy Minister, or Executive Lead Level. The policy applies to all forms of increases or adjustments, including salary, benefit improvements, pension adjustments and any other form of compensation.

No.

Those middle managers @ BC Hydro would be excluded management employees. This would absolutely apply to them.

This new executive salary freeze is confusing, it says all executives making 125k or over… so you can have an executive at a small branch making $125k and that person would get a freeze but middle management at BC hydro making $170k won’t be frozen.

Yah – the current management structure only dates from 2015. But for several years before that – and after that till 2018 – all management had a salary freeze. The only way to get a raise once you left the union was to find a new job and bargain for it.

I once worked in a branch where there was a team where the line staff(all accountants or lawyers) were paid about 83k, reported to a TL making 93k, who reported to a manager making 75k, reported to an ED making 100k.

Lol.

I work in Government. I work with Union employees every day.

I can’t relate. The people who have been in government the longest seem to care the most, and definitely don’t just leave it at the office.

Sorry.

People who get flex days still work the exact same amount of time (actually slightly more), they just do it in 9 days instead of 10. They work 70.38 hours in 9 days instead of 70 in 10.

Looks like this is related to COVID, they put a cap in place for crown CEO’s back in 2012 i think. This one looks like it is more wide spread.

Isn’t that exec freeze from 2012?

I just googled the salary freeze, looks like it has been in place for awhile now.

https://bcpsea.bc.ca/wp-content/uploads/2020/09/2020-04-Attachment-PSEC-FAQ-2020-Executive-Compensation-Freeze-Policy.pdf

James, I meant the ones are paid for 35 hours a week but actually “work” for 20 or less. You can try to argue this point but I am sure the other people on this forum who work in government can relate to this.

I can’t speak for the fed, but the BC province actually had fiscal restrictions put into place back when Carole James was finance – maybe last january?

IMO right now isn’t as massive a blitz as it looks for the province. With the new fiscal people are prepping to fill stuff that has gone unfilled this past year. As well, there are a select number of ministries and business areas(Advd ED for ex) that have a pipeline of money from the feds for federal liberal pet projects.

Other then that this is normal cyclical government hiring. Atleast in the jumbo ministries I have a network in(social sector, finance, and health). There is a general sense that this is the only hiring people will be allowed to do for the next year. But that was the same when Christy Clark was in charge. Basically there was a general bonanza for the first two years with Horgan, then belt tightening unless your programs were getting press coverage.

newhomeowner, not sure how many ADMs there are but freezes usually start at the top, so I guess depending on how the budgets look, the next step is to freeze other exempt employees also.

I think we just discovered where all the power that Site C promises to deliver will be directed: Bitcoin mining.

https://twitter.com/adam_tooze/status/1370384081771433989

ah – well, ADM and above makes up a fraction of a fraction of the public service. There are what? 100-150 of them? And ADMs start at around 170k as well.

The biggest protection that the public service has is that most of them are constituents of the BC NDP leadership. A BC Liberal win would definitely shake things up for the public service.

Dad, no I never had any direct work experience with union employees. I do have some friends working in union jobs at the government and that is what they all brag about. Oh ya, forgot about the flex days too.

The other end of the token is that the pay at the union is capped, but if someone is ok with topping out at 90k a year with job security an no stress then all the power to them. I don’t really have any problems with it either way, Marko is the one that constantly rags on the public sector workers so I am just speculating on his reasoning.

The thing with private sector and certain crown corp/government related entities is that your job security is much lower in exchange for higher pay, so there is that natural fear and people atleast try to make it look like they are adding value. Exempt positions in core government you also have job security, maybe not as much as in the union but I don’t think they regularly can people unless they do something really really bad.

It’s a bit of the job posting competition blitz on the Federal and Provincial side right now to get the screened in pools established right now so that employees can be deployed quickly once staffing a position is approved. The first wave of reductions in the public service won’t be coming as direct cuts, it will initially by not staffing vacant positions and gapping positions that people leave. It starts with the freeze on creating new positions followed by a hiring freeze and the spending cut comes from attrition without declaring a cut. So managers are sensing the fiscal restrictions coming down as things move into next year, so they want to get staff locked in before they can’t staff positions and suffer from being understaffed for several years during deficit reduction.

They’re lazy for working what they’re paid for?

Doesn’t apply to union, might be only executives for now (ADM and above). Can anyone on here can confirm?

Pay freeze for the BC government? Where’d you hear it?

That would be a surprise as BCGEU get a contractual 2% pay raise on April 12th. And by agreement all excluded staff and government contractors get a 2.25% raise next month as well.

The current contracts were signed to cover from 2019-2022. I think announcements for the next contract probably aren’t till October or so.

He said we’re at the tail end of rates dropping.

Pushing back against that would be saying that they’ll go negative, not that they might stay low.

5 year bond rates have tripled since January 1, so they better get cracking if they’re going to keep it low.

“The ones that like to work their 35 hours a week on the dot and never have to think about work once they leave, guaranteed collectively bargaining raises and very little risk of getting fired. I am sure the ones in senior management have stress just like any other private sector job.”

Could it be, ks112, that people who are able to complete their work within the allotted 35 hour work week are not lazy, just good at what they do? There is also a tendency to over hire in government, which has nothing to do with laziness.

I somehow doubt that the majority of people working traditional 9 to 5 type jobs in the private sector are working pure 8 hour days and fretting about work on the weekends. And if they are, is that supposed to be a good thing?

I guess you had a bad experience in the public sector with unionized employees.

Absolutely they could. In fact I expect it.

But here’s the change in the average mortgage rate:

1980 to 1990: -8% (rates spiked in 81/82 but were lower in 1980)

1990 to 2000: -38%

2000 to 2010: -42%

2010 to 2020: -35%

Going from a drop of a third every decade to 0% is a massive change in trajectory.

pay freeze now at BC government apparently, not sure if it applies to everyone though.

I mentioned that I know a number of people who lost their jobs…

For specificity I used to work for Flight Centre as a travel agent and store manager. February 2020: Flight Centre Ltd was raking in the cash handover fist and had 86 employees on the island. Today they have 2 employees on the island. 11 of their 12 stores are permanently abandoned.

I know a large number went into the health care field – old folks homes mostly – those places hire with no training, no experience, and at a livable wage. If you are willing to work it is extremely easy to get a job taking care of old people paid $30+\hr with no education or experience.

I know a large number went into government. Most of my most recent team did. These were all sales people with fairly long client lists. ‘My former client was on the panel’ is a common refrain.

Others just found work doing other sales type things. I have a half dozen friends that all work remotely for Shopify for example. Others in insurance. Stuff like that. These are hustlers who are used to working 50-60hrs per week. It is very easy for someone with a bit of hustle to get a job in Victoria right now. really easy.

Yes patriotz, thats what I meant BoC, I view them essentially the same as federal government despite them being an independent crown. Government sells debt with the left hand and BoC buys it up with the right hand along with other investors. There may come a point in time where no other investors wants to buy a 5 year CAD bond that yields 1%. In that hypothetical scenario either the BoC has to buy all of them or let the yield go up to whatever the market price is.

I think Marko’s comments about lazy government workers are pointed mostly at the unionized ones. The ones that like to work their 35 hours a week on the dot and never have to think about work once they leave, guaranteed collectively bargaining raises and very little risk of getting fired. I am sure the ones in senior management have stress just like any other private sector job.

They don’t. I think you mean the Bank of Canada. In any case Canada cannot diverge significantly from interest rate trends in the US, so what happens down there will dictate trends here also.

Canada 5 year bond yield is over 1% now. I be interested to see how much government can continue to buy their own bonds and push the yield down. In an extreme scenario they could be the only buying what they are selling if they are targeting a certain yield

The surprise from the BoC announcement this week wasn’t the rate, it was the continuation of the big bond buys. The BoC benchmark is only a small part of how lending rates to the public occur. Primarily, banks need to sell debt in a debt market in the form of a bond and someone has to be willing to buy those bonds so the banks can lend money. There isn’t much demand for those low rate bonds right now, so government is buying it up to subsidize borrowing. Once those big government bond buys disappear (eventually some sort spending discipline will come back) the bank rates will depart the BoC rate. There’s just so much debt out there to buy as an investment, they will eventually need to find a competitive way to get people to buy that debt and the way that is done when the government debt buys go away is through higher rates of return on the investment through increased interest rates. The last minority with Harper saw their way to a majority through spiking the housing market (people buying housing feel secure and wealthy) and it appears that the Trudeau minority government will likely do the same through the spring until after the federal election to assist in getting a majority win (keep the the taps wide open and hope voters are happy buying houses). We will probably see the big government bond buys disappear soon after the election and there will be a quick escalation in the rates offered by the banks no matter what the BoC rate is at.

I’m not arguing the merits of high or low interest rates; I’m simply pushing back against Leo’s tacit assumption that, because rates have fallen for 40 years, a) rates can’t stay very low for much longer and b) rates are about to enter a prolonged period in which they rise.

Look at what that has done to the Japanese market.

FIRE doesn’t mean fireman.

Finance, Insurance & Real Estate.

Did you find it easy to get your job as an RN? Because honestly seems fairly difficult to get a government job if you don’t already have one.

Wouldn’t that be a market failure? Are you wanting the government to step in here?

It’s the part of the market that the government is pumping. Makes sense that it would be where the jobs are.

How do you know we’re at the tail end of it? Rates could stay extremely low for another 10 years, or more.

Remember, the Bank of Canada couldn’t even lift rates above 1.75% during the entire 12-year period between the ’08 financial crisis and the pandemic.

It is the worst I’ve ever seen it….I got this email back three weeks after requesting surveying. We have plenty of people to complain about the cost of housing and write reports; however, don’t actually have the people to build housing which leads to more reports and complaining. How on earth cannot we train more surveyors? It isn’t a trench job. Ohhh wait, why survey when you can get a government job and have zero responsibility.

“Thank you for contacting JE Anderson & Associates.

We apologize for the delay in contacting you.

Unfortunately, due to an extreme workload, we have not been able to respond to all of the project requests arriving in our office and are unable to take on any further projects at this time.”

Yeah I don’t really trust these figures either. Big drop in construction goes against everything I hear from the industry every day. Hard as ever to find trades and labour, people booked way back. Sure there are some big projects that completed (wastewater and interchange) but not 5000 people worth.

Sure, fastest growing part of the economy, everyone jump in.

Great story ->

https://financialpost.com/real-estate/real-estate-could-be-a-viable-career-alternative-for-women-hit-by-pandemic-job-losses

As the job losess pile up we need more agents, make sense 🙂

how do you go from travel to healthcare and fire right away? Don’t you need education or training for that? I thought there was a long line of people wanting to be a fireman.

the jobless thing seems a little counterintuitive to me. I mean, culture\food\accom job losses makes perfect sense. But construction and health care? My only thoughts are that those job losses are at the margins. Low skill and\or parttime and were convinced to step out of the market because of the generous government supports.

I work in government and all of my new staff in the last 6 months have come from the accom\food\travel industry.

I also have tons of friends that lost their work(used to work in travel) and haven’t heard of any that didn’t land on their feet. They all went into either government, health care, or FIRE.

Note 3 month average

We’re down about 5000 jobs from this time last year

You’re absolutely right it’s a bit of both. In hot markets sellers switch strategy to an auction system and deliberately underprice to set up bidding wars. I don’t think there’s great evidence that that leads to higher selling prices overall, but it allows them to sell quickly, avoids negotiation because generally offers are unconditional, and gives them a chance to win the lottery by accepting an irrational above market bid.

So I completely agree with you about fair market value. A bidding war makes it impossible to tell whether the selling price is market value or not. I think it’s a big risk for buyers in this market is paying over market. If prices keep rising then it’s fine and you’ve just set a few tens of thousands on fire, but if they don’t you could be really stuck.

never mind you already answered!

Accepted offer, but it’s an estate sale so subject to probate.

Leo, any thoughts about demand being pulled forward?

I think if I lived downtown I would prefer to live in a condo. Downtown has always been like that. 20 years ago my sister lived on Pandora and anything that wasn’t nailed down was stolen, including their door mat. Certainly the escalating costs of housing has made the problem worse.

I actually love wollaston rd. The problem is the house and property which leave a lot to be desired. That said I think a 649k list will bag a 740k unconditional by next week.

It has huge hipster appeal. Great for two working adults with no kids.

Quite a bit. I think this is part of the reason real estate moves in cycles. On the way up FOMO strikes and causes people to accelerate their plans, then when people are priced out price increases stop there’s a hangover. Big recency bias and right now we have a double whammy of it. In this case people see prices boom over the past year so they jump in expecting to get a piece of the price appreciation. At the same time we are at the tail end of 40 years of dropping rates and people’s entire view of real estate is based on the outsized appreciation that has driven in properties. I think this is still wildly underappreciated in the market.

Increase in the home ownership rate – or multiple home ownership rate? Maybe a combination of people moving out of cities and buying for the first time, or cashing out of high value markets and buying more than one place.

Could be people buying second properties. Remember the homeownership rate is defined as the % of households which own their primary dwelling.

Conference Board only seems to be measuring gross economic performance. Do you think that PEI, for example, has a low quality of life? Didn’t see many homeless last time I was there. They had 6 opioid deaths in 2020. BC, which has about 30 times the population, had 1,716.

So with sales up massively in small towns and sales up in big cities as well, and with immigration remaining low, the only explanation is a massive increase in the homeownership rate in the last year right?

https://www.cbc.ca/news/canada/nova-scotia/nova-scotia-homes-buying-sight-unseen-housing-boom-1.5946827

re: 1038 Wollaston. People tend to overlook that this portion of Equimalt is one of the best neighbourhoods – strong sense of community, easy access to downtown and services. Wollaston is slightly less attractive than one street over, but Dunsmuir between Head and Lampson is very much sought after.

Cadboro, glad to hear you are coming to peace with this crazy market. While we’re talking alternatives to cookie cutter Langford houses, have you looked at townhouses along Shelbourne? I think the 90s era ones are in the 500-700 range. Not ideal but have 3 beds/2 bath, you’re in the Core close to daycares/work and not driving the Hat.

The “percentage of sales over ask chart” shows just how crazy things have got in SFHs. This is definitely a bubble, but who knows when it will burst. Renewed my mortgage yesterday, 1.89% on 3 years, was paying 3.07%. They told me that rates are going up today at RBC, and are going to continue to increase. That might cool things in the market.

Cadboro, we were where you are till 2019 when we couldn’t take it any more. Found new jobs and moved to Nanaimo. Daycare’s simple, we landed French Immersion with no fuss, houses are affordable, parks are everywhere, and I only notice the mill once in a while. C’mon up, the water’s fine.

Leo – from your perspective is the over ask ratio increase due more to the fact that list prices are purposely far below what sales prices are expected to be versus last year (orchestrated bidding wars). Or is it due to the fact that bidders are just throwing as much as they can at a property regardless? Probably very difficult to make that determination in this market. IMO there is no fair market value being assessed here when offers are being placed. Comparable sales references are infected with the insanity. Fair market value is what two parties can determine together with full information on both sides of the asset being sold, with no compulsion to act. Buyers are so incredibly frantic right now and the compulsion to act and sense of urgency is off the charts. My wife and I have taken a breather in viewing lately, trying to collect ourselves, but this is mainly due to really poor quality stuff we are seeing in our price range. But seriously I’ll take the rest any way it comes right now.

Re: 1038 Wollaston St. 2 bed 1 bath

Besides needing an extra bedroom and bathroom, I bet it will sell for 812k. Anyone else want to play the price is right and put their guess up?

Kenny you call that an outlier. If you travel around Victoria and you travel around Oak Bay its pretty clear where the presence of crime is likely centered. I’ve worked in both areas, and while I would never want to live in Oak Bay, it definitely has less ‘sketchy’ people walking around. It’s not hard to understand why people would feel safer their. I’m sure the crime stats would back that up despite the Oak Bay murders.

‘

‘

It not only sketchy people that commit violent crimes, there was another murder of someone in their late teens I think at an uplands house about 15 years ago. I think there is a common theme here that these murders all had in common some degree of marital and or financial stress so I wouldn’t call them outliers, as Barrister would say I’m not sure what to make of this

Rob Carrick (Globe and Mail):

Shut out: A well-qualified millennial home seeker throws up his hands after losing multiple bidding wars

https://docdro.id/7xrCE1c

Re Wollaston. Unfortunately that’s the going rate. The only 2 houses in my area for sale were 3 bed 1 bath and both asking 749,000. I’ve just looked and they’re both gone. I don’t even think that was 2 weeks on the market for both.

And those high tax low house cost provinces also have the worst quality of life. At least as measured by the conference board of Canada. They put BC highest of any province and also highest if were a country, tied with Ireland and ahead of Australia.

https://www.conferenceboard.ca/hcp/provincial/economy.aspx

“The Conference Board’s overarching goal is to measure quality of life for Canada, its provinces, and its peers. We ask two questions: Do Canadians have a high quality of life? Is it sustainable?”

“British Columbia puts in a remarkable performance, ranking first in the country and second overall, behind only Ireland. Ireland and B.C. are the only comparator jurisdictions with A grades overall on the latest economy report card. While Ireland’s swift economic growth puts it out of reach of any other peer jurisdiction on any measure based on GDP, B.C. outperformed it on inflation, unemployment, and employment growth for a well-earned position atop the rest of the peer countries. B.C. ranks well ahead of the third-placed jurisdiction, B-ranked Australia.”

Cadbro: Might consider a townhouse. I was speaking with my house painter the other day and we got to talking about house prices. He did point out that he makes $60 an hour and a good bit is cash while his girlfriend makes well over 80$ in her trade. Between them that is 200k plus.

1038 Wollaston: Ouch. 900 sq ft and 1 bathroom for 650k.

Lots of upside to it though. It’s just not very functional for a family with two small kids. Also, if he’s approved for 660k then it might take years to come up with the cash to finish the basement.

Still, to get in the market is worth it. The actual problem is that my guess is there’s just about 0% chance that it sells for under $660k though.

Does anyone know where are all the people are moving to, that are selling now??

Barrister, if Cadbro wants to live in Victoria then I think they should just do it when they can and not bother with Mill Bay. Take me for instance, when I bought the GH house in 2013, I could have shelled out another ~200k and be in Oak Bay/Arbutus part of GH. Now my delta is atleast $500K if i were to upgrade.

Obviously 2013-now is the all time bull market for house prices, if it was 2007-2014 then it would be a different story.

If I were a young couple/family I’d be taking a hard look at 1038 Wollaston. Close to town, shopping, schools. Cute, older house. Only 900 sq. Ft finished but another 800 unfinished. 649,000. No, I don’t know the owners.

Barrister funny you should mention that as we went to check out 2 places in Shawnigan recently. The 599k one on Fitzgerald that I think was discussed on this blog is at our max budget if you factor in the strata fee and $3700 annual property tax (why is this so high?) So the numbers didn’t make sense for 900 sq feet of living space and the commute. The other was too good to be true, 2 suites large house so could have been approved for more but it turned out to be a prev. grow op. (I have fallen for 4 of these, why isn’t it disclosed in the listing?).

We are looking further out but for our jobs and the need for daycare for the next 4 years it feels pretty desperate to go over the hat unless it’s worth it.

I feel that being priced out of the smallest Langford houses is a turning point in this market. What does that say about the city? And I’m talking about the city of LANGFORD, Victoria hasn’t been wishful thinking for us for years. The median family income in Langford is 80k and we pull well above that. And houses are almost 10x the median income there.

If it’s true that the provinces that have the highest taxes also have the least expensive house prices, I wonder if that is because there is better support for the people (Thus higher taxes needed)…… and as a result less crime and less wicked dog eat dog mentality that attracts brutal competition we see in our big cities.)

I know I am stretching things a lot here, but I feel that there are so many red flags that indicate that our society’s model is not at all healthy and we need a fundamental change on so many levels. (Look at the homeless and the drug use for example)

Cadboro: I have no doubt that you have thought about it but there are a couple of listings still in the six hundreds up in Mill Bay. A few challenges there but also a nice small community that is still in striking distance of Victoria. Just a thought since even Sidney seems to be hovering around 800K.

If you can squeeze some from family or your employer it is time to really think about it.

I’d probably agree with “Dad” to certain extent because I’m sure it is never one thing that creates a problem like we see in the housing market. However, it doesn’t take a lot of digging to find information on the massive scale of the money laundering that went on in Vancouver.

Here is one example: https://complyadvantage.com/knowledgebase/vancouver-money-laundering-model/

Also, where do you think the money from drugs ends up? There is a ton of money being laundered. Crime is one way to avoid taxation. It’s one of the reasons why our streets are flooded with drugs. (Among others.)

The government has been working hard to stop all this since around 2015, but when you squeeze the balloon, it just pops out somwhere else.

“I’m sure the crime stats would back that up despite the Oak Bay murders.”

Probably, but but being homeless or sketchy isn’t a crime, and I would bet the recent spike in the crime rate is mostly because of non-violent crime. Sucks to have your property stolen, and it makes you feel violated/less secure, but Victoria still seems pretty safe to me.

Leo, how much demand do you think have been pulled forward due to this covid panic buying? If it is mostly locals that are buying then I would assume this must be the case given the sales increase?

It bears repeating that the provinces with the highest taxes have the least expensive housing.

First time buyer update. Still glancing at PCS but we’re done going to viewings right now, this is beyond stupid. All 3 bed cookie cutter Langford specials on small lots. If realtors would stop writing “affordable entry level” in these listings that’d be great.

3296 Merlin, list 699k, sold for 695k

3392 Turnstone list 679k, sold for 705k

851 Arncote Pl. (I drove out to see this one, you cannot even park a normal size vehicle in the driveway or in front of this place due to stop sign, garage for bikes only? so small) listed 650k, sold for 736k!

I’m glad we’re over the sadness and anger part of grief and into the laughing. We’re priced out, and I’m banking $1300/m in savings so have no way of catching up now unless something changes. Bring on the government intervention or whatever it’s going to take, this is gross.

“When the government thinks it can squeeze people more, this has always happened. People find a way around the rules.”