Are investors driving the market?

Prices are ripping upwards, and it’s natural to wonder where all that demand suddenly came from. It’s true that the market reversed trend and started heating up in mid 2019, but low interest rates and other pandemic impacts drastically accelerated that trend.

One theory is that it’s investors and speculators buying up properties and driving up prices for everyone else. Of course investors are part of every market, but are they behind this recent mania?

First we can look at how many investors there actually are in Victoria. The Canada Housing Statistics Program has that data from 2018 as I’ve covered before. At that point 128,790 people owned one property in Victoria, 16,345 people owned two properties, 3,230 people owned three properties, and 1,455 people owned four or more properties. That means (assuming the investors lived in one of their properties), at least 27,170 properties in Victoria were owned by investors, out of 172,559 total properties in the region.

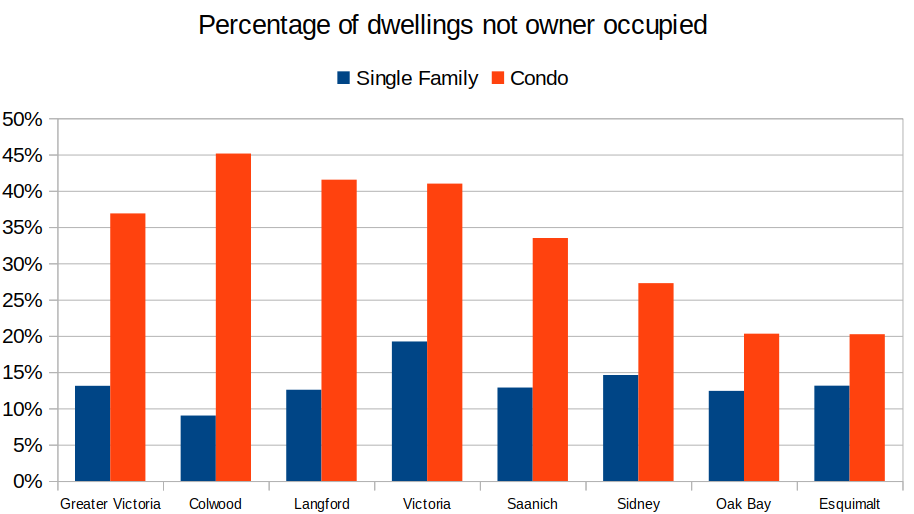

That matches up well to the data on non-owner occupied properties, where data shows that in Greater Victoria 13% of detached homes and 37% of condos are not owner occupied. Of course dwellings can be occupied by someone other than the owner for reasons other than investor ownership.

Source: Table 46-10-0029-01

Price gains drive investor interest

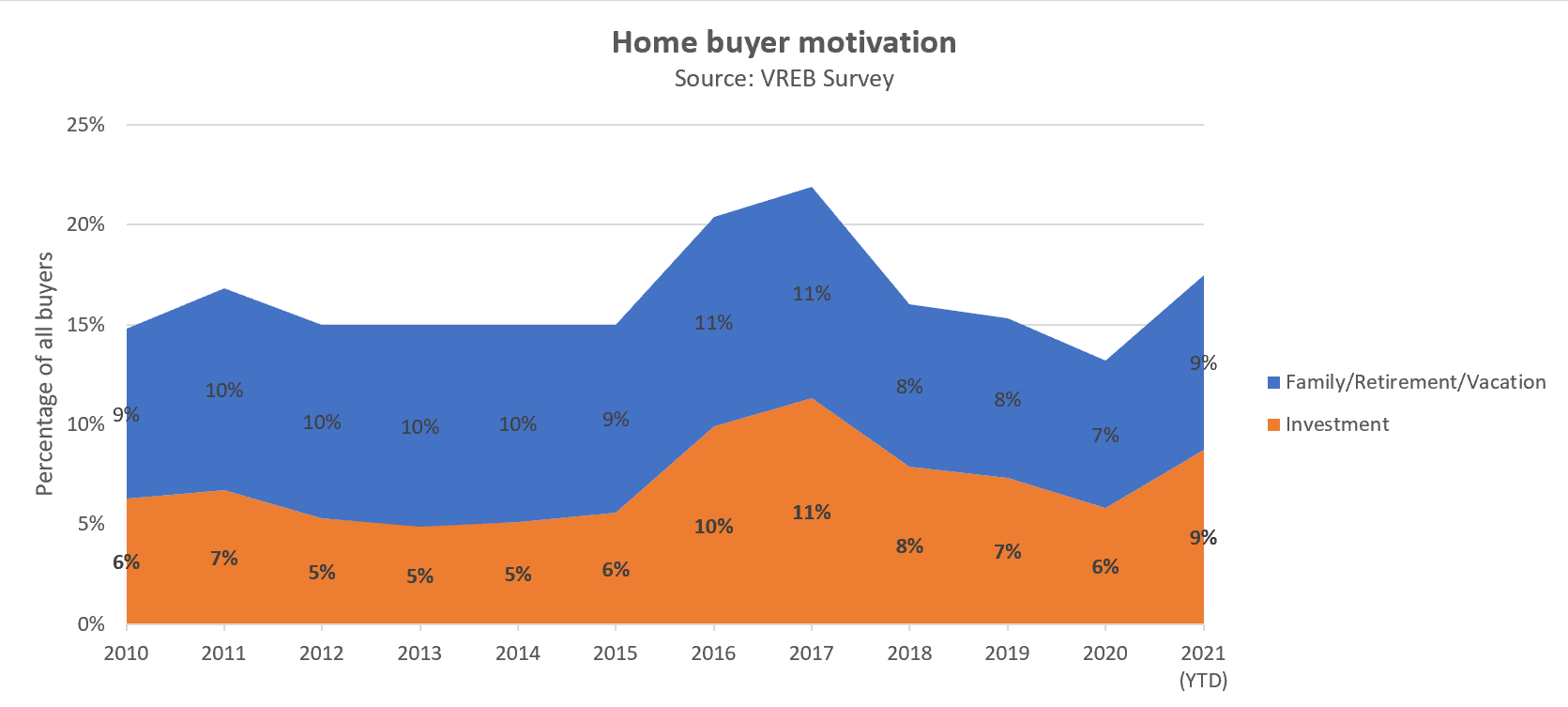

When prices start rising, investors tend to jump in and add fuel to the fire. That happened in 2016 when investor buying doubled after prices started jumping, and it’s starting to happen again today. In a market with high prices and a low cap rate, returns for condo investors have historically depended heavily on capital appreciation, so it’s no wonder that investors are ultra-focused on increasing prices.

To return to the question in the title, I’m doubtful that investors are driving the market per se. Sales are up way more than the small uptick in investor interest, but price gains make it profitable to flip homes, and investors jumping in certainly fuel part of the fire.

We don’t have all the answers

The figures on multiple home ownership are now two and a half years out of date. What has happened to multiple home ownership since 2018, and how are the 2018 figures in a historical context? We don’t know. The Canadian Housing Survey is collecting data right now so I expect we will have some updated data by end of the year.

In addition the buyer survey data in the chart above asks for buyer motivation, but it doesn’t capture people upgrading and simply keeping their existing home as a rental instead of listing it. There is reason to believe this happens more when credit is cheap, but I don’t think this is happening at a greatly increased rate than pre-pandemic, since new listings have come on at about the same rate as before. If low rates have motivated people to upgrade and keep their first house as a rental it’s not happening at a rate sufficient to show up in the data. Condo new listings were actually up substantially last year over previous years.

Are investors a problem?

There is no doubt that house prices would be lower if investors weren’t participating, at least in the detached market. Take away demand and prices drop. For the condo market it is harder to tell if investors push up prices or not, as investor demand can also spur construction of new supply. Investors and speculators can certainly add volatility to the market, as they tend to pile in when prices start rising, and sell in bear markets. That was a major factor in the US housing bubble, likely even more significant than the better known NINJA loans.

Many people characterize investor demand as inherently negative, but given we also have a very low rental vacancy rate, those investor-owned units are mostly homes for tenants that are also badly needed. Through decades of neglect of purpose built rental construction, we have created a rental market that became increasingly reliant on the secondary rental market, owned by private investors. In addition to apartments, those private investors often rent out detached homes which are more suitable to families and which the purpose built rental market has almost completely ignored.

I think there is a case to be made for limiting investor participation in markets where supply is limited. Although single family rentals seem to mostly be held by mom and pop investors here (the numbers probably don’t work for corporations), there are warning signs from the US that widespread centralized investor ownership may be something to curtail before it gets out of control. Through regulatory measures, investors could be discouraged from buying ground oriented housing and encouraged to instead invest in condos which we have an effectively limitless supply of. However if we as a society decide that we want to discourage investor ownership of ground oriented housing, then we’ll need to step up the construction of family suitable rentals in all areas to compensate.

There is talk of this kind of regulatory action to constrain speculation, and surprisingly even the mortgage industry lobby recently spoke in favour of it. Paul Taylor, chief executive of Mortgage Professionals Canada recently characterized “a 40 per cent equity downpayment for a rental purchase” as “smart for our domestic regulators to be considering.” When the mortgage lobby speaks for regulation that would constrain credit growth, it may be time to listen.

Also the weekly numbers, courtesy of the VREB:

| Mar 2021 |

Mar

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 254 | 508 | 608 | ||

| New Listings | 323 | 621 | 1084 | ||

| Active Listings | 1338 | 1329 | 2252 | ||

| Sales to New Listings | 79% | 82% | 56% | ||

| Sales YoY Change | +54% | 51% | |||

| Months of Inventory | 3.7 | ||||

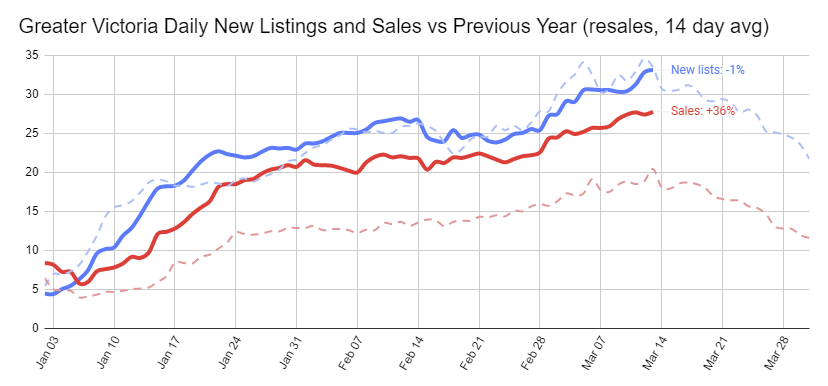

Buyers continue to snap up every single new property listed on the market. Instead of the increasing inventory that we expect to see this time of year, the 1329 active listings is the same as what we had in the first week of January. Flat inventory means that we are currently sitting on 40% less listings than this time last year. Note that the big drop in activity on the chart below for the year ago was the pandemic effect, we should continue to see new listings and sales increase into the spring.

In construction news, the number of under construction units continues to drift downwards as we see the number of completions ramp up. We’re still at a high rate of construction in a historical context, and I expect that this should stabilize soon given what I’m hearing. Although StatsCan insists we’re down thousands of construction jobs from this time last year, I still thing we’re running at roughly full capacity for construction in town.

New post: https://househuntvictoria.ca/2021/03/22/march-22-market-update/

Well sure, because so much had been destroyed and people had been displaced. On the other hand we have more housing per capita than we’ve ever had. The present crisis in Canada is caused by government policies that encourage misallocation of housing, and by growing economic inequality.

If you didn’t know about this I would guess of lot of people don’t. Probably should be signs up.

My biological grandfather was Harry Dare, (my mother divorced and remarried) He built traditional homes at great speed equaling time frames of modular homes and bettering them in attractiveness.

We should look back and learn from history. After WW2 Europe was in shambles, housing needs were desperate. Returning soldiers added to the demand for new homes. My grandfather was instrumental in building tens of thousands of homes at great speed in England right after the war. https://www.britishpathe.com/video/houses-at-speed

” 9/10 people use a finger to push the button to their floor.”

Always use your knuckle to push an elevator button, same for self checkouts and ATMs.

Typical having a friend over, you won’t be wearing masks, you’ll be eating/drinking, poor ventilation, long visit.

If you and your friend don’t have Covid, there is no issue and no risk. So the question to ask yourself is, if one of you did have Covid, would it be safe to meet in those circumstances.

“If you did an audit of all the pubs/restaurants at this moment I would make a 6 figure bet that less than 25% of patrons are from the same household.”

I think you’re probably right. The table of four soccer moms eating lunch together probably aren’t sister wives.

I get the sense that people aren’t following the restrictions too closely anymore, now that the end is in sight.

A capital gains tax on sale of personal residence would be a bad idea. Real estate is a huge part of the economy, and produces huge tax revenues for the government. They shouldn’t want to kill this cash cow with capital gains taxes.

It would be a disincentive for people to move-up, as the sale would trigger a capital gains tax. More people would stay-put and the government would lose taxes and economic activity generated by sale and subsequent purchase ( transfer taxes, agents, lawyers etc). End result would be less homes sold and less tax revenue for the government .

If the government wants to do it anyway, they could at least exempt the CG tax if another principle residence home was purchased within 6 months, as they do in the USA for some RE transactions. That would keep the sales going, but the government would only get capital gains tax on the final sale (death, moving out of country etc, a speculator selling).

If you did an audit of all the pubs/restaurants at this moment I would make a 6 figure bet that less than 25% of patrons are from the same household.

Way too much oxygen taken up by a capital gains tax on principle residences. It’s not going to happen even though I think there should be a lifetime cap. I think you could conceivably introduce a high enough cap (like everyone gets a million dollars tax free) and get it passed, but even then I doubt it.

There are tricky secondary economic effects here, so it would take careful design to avoid it becoming a disincentive to sell.

There is a public health order stating that you are not permitted to meet your friend at a pub – only with someone from your household.

The research currently shows that airborne is the predominate risk. Not to say that touch – fomite transmission – doesn’t play a role, it cannot be ruled out, but standing less than six feet from someone and inhaling aerosols way way higher risk than touching something. This also likely means that there was aerosol transmission route in Italy, something like walking in the same hallway, or perhaps fecal if drains are shared.

Also, cloth and homemade masks are not entirely effective at controlling this risk. You still need to stay six feet away. We switched to medical grade masks months ago when they became widely available. Cloth masks have been banned in many countries now on ex. public transport.

https://www.nature.com/articles/d41586-021-00251-4

https://www.nature.com/articles/d41586-021-00277-8

https://www.bmj.com/content/372/bmj.n432

You are not supposed to be meeting anyone outside your household in an indoor setting, including restaurants and pubs. This is the biggest and most frustrating hole in measures right now. It would be so simple to have restaurants check IDs for groups or just ask if everyone is from the same household.

A friend over at my house in more risky than meeting him or her at pub….I don’t know how that works, but sure.

Lots of evidence out of Italy and other countries that high-touch areas in buildings such as elevator buttons are directly correlated to transmission. You have buildings with no central ventilation where most occupants end up positive so unless they are all partying together has to be a reason.

Even thought the touch risk is a lot lower than airborne it is a lot easier just not to touch crap versus redesigning an entire HVAC system of a building, etc.

It’s a joke. Something that should take 6 business days takes 6 months with the COV.

My experience recently obtaining a permit from a small SFH in the Oakland’s area -> https://www.youtube.com/watch?v=MocTwO-Kk24&t=1s

I’ve heard a lot of this attitude in the comments here and from any contractor I’ve talked to. Is it a meme or is the city of Victoria really an “impossible” place to live? Someone I hired to assess trees before purchasing advised me, somewhat hilariously, to not live anywhere in Victoria because of the city’s bureaucracy. This was in the context of tree felling and trimming. This guy quoted $8k in tree services when it cost under $2k to actually get it done and it was really simple to get approval to remove a protected tree.

What’s the “impossible” part supposed to be? Writing an exam proving that you know how to properly construct something?

Alberta also has no restrictions on condo conversions, which resulted in a very large number of crappy purpose built rentals being converted to condos prior to the RE market going south a few years back. Note – in spite of no rent controls. The owners could simply make more money selling off the units than renting them.

Some of that is down to the increased specialization within our society. If you have the chops for it you will be much more financially successful with a singleminded focus on a career that society values rather than trying to be a jack of all trades.

I suppose he means property taxes by his “wealth tax”. It’s not a wealth tax, it’s an asset tax. Wealth = assets – liabilities.

And note that rental properties pay capital gains taxes as well as property taxes. I would think an economist would advocate a level playing field.

Soon I’ll be as stupid as I was in the 80’s again

Leo and others, what do you make of this economist’s argument outlined in this seven-Tweet thread:

https://twitter.com/michaelgsmart/status/1373982829936320518

“There are a lot of people who don’t even own simple tools to attempt simple repairs. Lots of useless people out there thanks to technology.”

Not sure that is a bad thing. I’ve seen enough shoddy DIY work by handymen who had no idea what they were doing, e.g., splicing wires with no junction box, making loose connections, using undersized wire, failing to ground electrical work, etc.

Residential wiring isn’t particularly complicated, and minor repairs/alterations are simple enough to complete, but

better to recognize you are useless and hire a competent person, than trying to be some hero 50s dad. Alternatively, if you are handy, the internet is a wonderful resource for figuring out how to do shit properly.

Yep. Small gatherings at home are the number one source of preventable transmission – not when you are out wearing a mask.

The jury is out on surface transmission, seems possible that you’ll get it from the elevator button – but more likely you’ll get it standing next to someone in the elevator through airborne transmission.

Bars and restaurants make less sense to me based on the science, but I guess keeping six feet apart and having staff masked helps – I personally don’t eat out and won’t until most people who want to be vaccinated have been.

Masked showing of houses in single groups would be considered lower risk.

No, it is a combination of science and public policy. Churches have been a significant source of transmission and source of superspreader events. Schools could be but they are trying to manage this with protocols and do so based on the benefit being deemed to outweigh the risk to children in terms of loss of education and social supports.

Introvert re: Alberta ownership rate. Their renter protections are also some of the worst in the country. Landlords can jack the rent to whatever they want once a year, in Calgary at least. I had 2 sets of friends who wouldn’t have considered buying if it wasn’t for a $400 monthly rent increase. Works the other way too, I’ve had friends negotiate their rent down in bust years. But when rents are higher than ownership it makes sense that so many own.

Yes, we put groceries, the economy and children’s education above church on the importance ladder in a pandemic. Thank god.

Felt compelled to reiterate what mince meat ties is saying about science denial in the media. I too have a hard science background. And I have observed that political agendas in both the mainstream media and on social media routinely cite having their agenda backed up by science without presenting any data. And anyone who disputes this “science” must be a science denier. It doesn’t work that way. But I see it ALL THE TIME.

If you live in society where you can go with the mob to Costco, go with the mob to school, and go with the mob to Spinnakers but cannot go to church it is neither science, nor public health policy. It’s simply jackbooted ideology..

There’s a minister in jail in Alberta who can draw you a diagram.

Dad- You left out drugs and rock and roll.

Patrick- It appears that studies exist that indicate IQ levels have been declining since 1975. Also, attention spans have also decreased, people simply are too addicted to their smart phones and cannot put them down long enough to focus on a given task. There are a lot of people who don’t even own simple tools to attempt simple repairs. Lots of useless people out there thanks to technology.

Pretty sure that old men have always blathered on about the succeeding generation being dumber, lazier, more criminal, less moral, and complained about influence of new technologies on the decline of civilization.

IQ tests seem pretty flawed. Scores can vary by up to 20 points in four years. They might be a better measure of how stable a society is on markers of well-being, including nutrition.

What “deterioration”? The story of IQ levels over time isn’t one of “decreases”, it is “increases.” There has been a massive increase in IQ scores, both globally and in Canada. For example, Canada/USA IQ levels have increased steadily, by a remarkable 30 points since 1900 (to 2013) and 2 points since 2000. (to 2013). Sporadic reports in a few European countries of falls of a couple of points have been seized upon by some as evidence of a fall, but the overall picture is clear of the huge IQ gains.

You can see by looking at this 2013 chart (most recent data I could find) of global IQ gains for various regions here. https://ourworldindata.org/intelligence

If anyone has recent evidence of falling Canadian/USA please post it. As of 2019, Canada is 8th highest IQ country in the world https://www.forbes.com/sites/duncanmadden/2019/01/11/ranked-the-25-smartest-countries-in-the-world/?sh=63d478ce163f

Or as BMO might put it, “we’re smarter than we think.”

Monday:

Sales: 769 (+64% from last year, getting into COVID decreases here as a baseline)

New listings: 939 (+17%)

Inventory: 1334 (-41%)

New post later today.

It is, but it isn’t itself science. And lots of other things come to bear like the economy, mental health, importance of schools to kids, and of course political pressures as well.

Since my building allowed two people in an elevator again I’ve been observing and 9/10 people use a finger to push the button to their floor. Things like this drive me nuts! I am not a scientist but guess what the person before you did? They probably touched their face. Guess what you are going to do before you wash your hands, probably touch your face.

The lack of common sense I see in my building and at showings is truly insane. We are lucky that we live in a sparsely populated part of the world and very few people take public transportation, etc.

The rules for Covid do seem odd sometimes but I would venture a guess that the bottom line is that the health authorities have to draw a line “Somewhere”.

They are under Huge pressures to keep business flowing and schools operating etc and all they can do is try and put in place measures that will keep our hospitals from being overwhelmed.

That might be the key thing to try and keep in mind I would think.

Where would any of us draw the line? Take a look at what is going on in Brazil.

Stay safe. Do our best. The fact we have a vaccine already is a complete miracle.

Shouldn’t public health policy be based on science?

That’s public health policy, not science. Masks work, that’s scientific fact, but what exact policy we should have in pandemics is certainly up for debate.

I can go to Costco, restaurants, send a kid to school with 500 other kids, do home showings all day long with a showing leaving as we arrive and a showing coming as we leave, but I can’t have a friend over 🙂 Not sure I understand, but whatever easy enough to follow.

I would put the blame for the deteriorating IQ levels on technology. Primarily the countless hours young people spend playing addictive video games. This is a waste of precious time that should be spent reading books, learning a musical instrument, exploring the outdoors, etc.. Lack of physical activity also encourages weight gain which usually is accompanied with high blood sugar levels that can affect mental acuity. It has been proven that brain development is inhibited due to the lack of hand eye coordination that is acquired practicing simple hand writing. Most young people have lost this skill as they peck at a computer screen to communicate. I feel the Chinese and Japanese are more advanced in this aspect given the complexity of their written language. Finally, our addiction to our devices has interfered with healthy sleep habits, critical to rejuvenating the brain’s ability to function properly. Unfortunately, I doubt anything will change to reverse this trend.

I’ve got no issues with science. In fact, my undergraduate training was in a hard science and I’m in healthcare.

I’ve got issues with people using science/scientific facts to push their own agenda. And it happens more often than you’d think.

There’s understanding science, and then there’s understanding when science and scientific outcomes have been hijacked so that someone gets recognized for their research/gets that drug approved/signs that deal, sometimes at the expense of the greater good of the public.

By the way, I’m not talking about masks. I agree, put on the damn masks!

Could be. On the other hand you have better diversification. One bad tenant doesn’t take out all of your cashflow.

The nice thing about science is you don’t have to believe in it, you simply have to understand it.

Don’t forget if you were sick at home away from grade school, Bob Barker was able to supervise for a couple of hours a day. That way we all still got to work on math skills to keep those IQ points up and that was just the morning. In the afternoon, we learned problem solving with tic, tac, toe thanks to Hollywood Squares and survival skills on how to avoid the dreaded whammy thanks to Press Your Luck. Then there was always the safety lessons from Astar the robot explaining that he can put his arm back on but you can’t……

When I was a kid there was a whole range of kids right on the same block and you knew everyone. Not so any more. Also there were a lot more stay at home moms.

That was funny introvert! Hey man, and to think when I took typing in the 9th grade, I was doing 74 wpm on a manual typewriter while the rest were struggling to get 35 wpm!! My error rate in old age is obviously going up.

Thanks Totoro. I too don’t believe kids are incapable of making their own friends, that’s why I think a lot of parents should butt out of forcing their children on play dates and such with others that they don’t particularly want to be with. Instead, try to understand what your child is feeling, and lovingly guide them towards making their own friendships. If they don’t learn this important social skill starting say around the age of 4, they will probably find difficulty in establishing successful relationships throughout their lives. Yep, statistics are out there for the picking alright. Select the ones that suits your preferences, stance, argument etc. (not you personally Totoro…in general I mean). You are brilliant….there is no doubt about it. (And every male on here knows it, lol) I’m not sure of the actual percentage but something like 85% of children that are abused are abused by those in their own family.

I’ve certainly noticed it in my 11 years of business. Sense of entitlement is also way up.

I just find it how incredibly dumb people are when it comes to COVID and following simple rules; whether you believe in the science or not. I would say before going into a showing if I say “you cannot touch anything, hands in pockets and ask me to open things for you,” 9/10 people will touch something. This includes medical doctors I have as clients. Then I have clients sitting down on the seller’s couch because they want to see what it feels like….**** like that happens at every other showing. I feel like every day I am working with children, it is really interesting, unfortunately I can’t be like “are you really that stupid?” 🙂

Same with masks, believe in the science or not, how difficult is it to put on a mask? Wtf.

🙂

I agree with your post in general, but I think the issue is not that kids are incapable of making their own friends or fun, but that parents have become aware of many of the dangers of unsupervised play so that it looks like negligence now to allow it. 62% of victims of sexual abuse are children. Lower levels of adult supervision are also associated with much higher odds of more severe injury in young children (5x the rate) and the risk increases in rural areas and on farms.

Leo- Point taken, however 3 properties have higher expenses and higher probability for headaches. I’m definitely not going to sell my house in Victoria to buy 3 in Moncton.

To borrow a quote… in the short term the real estate market is a voting machine, in the long term it’s a weighing machine.

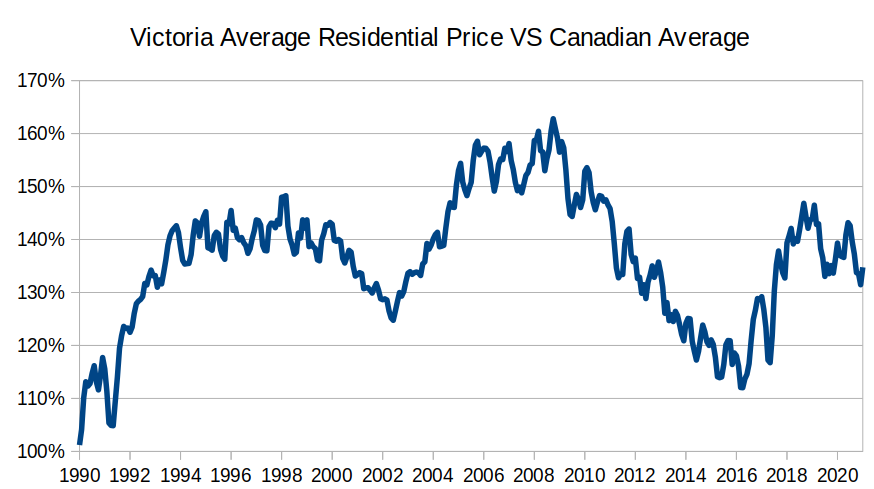

And in the long term it seems Victoria is about 40% more desirable than the Canadian average. Of course prices can go up and down in the whole country but it seems that’s about the premium.

Could be, but if you have the means to buy $1,000,000 in real estate you can buy 3 of the cheaper places or one of the expensive ones to even it out

Cheaper places might not have greater upside potential. For a $300,000 house to increase $100,000, it has to rise 33%, where a million dollar house only has to increase 10% to make $100,000. Higher probability of a 10% increase occurring. Plus more expensive places are more desirable while cheaper places might be more tied to local income, or reality. Just a thought.

Most of us, especially those who have owned a home in the Victoria area for a few years or more and have a decent pension or a stable well paying government job are indeed very fortunate.

But you know, this is Canada with a population of 40 odd million people and most of the populated areas in this country have cold winters and hot summers. I lived in Kamloops as a child and absolutely loved it. The winters can bring 40 below Zero and 105 degrees F. in the summer. We didn’t have TV (never mind cell phones and computers) until I was 9 years old. Children spent their entire free winter time sleighing and building snow forts. The summers were spent at Riverside park swimming. For the most part, my brother who is 3 years older than me, watched over me. Back then parents didn’t dote over their children’s every move, arranging “play dates” because they felt their kids were incapable of making their own friends. Kids made their own fun. They used their imagination. Those were among the years that peoples IQ’s were gradually increasing with every generation. Check it out……IQ’s are actually degreasing now. Being smart means putting what you learn & observe into practice successfully. All the academic education in the world doesn’t mean that one will ever grow in this way. Believe me when you get to my age, you will have met many well educated adults that really haven’t achieved much in their lifetime. A lot of whiners out there. There always have been “the poor me’s in this world. This syndrome is not new. (Anyway, a little off topic here) I also lived in Barrie & Ottawa, Ontario for a couple of years. Cold in the winter and so humid in the summer that one could only wear cotton. There, we went boating in the summer and snowmobiling and cross country in the winter.

What I am taking a long time getting at here is Victoria and Vancouver are not the only places that are livable in this country.

If one can find employment in Edmonton, you can buy a lovely home there for under $400K. Look at MLS E4233804, 5 beds, 3 baths, double garage for $374,900. Or E4233629, 3 beds, 3 baths , double garage, could suite the lower level, beautiful home for $399,900. Or maybe move to Saskatoon or Regina. Saskatoon is very pretty. Prices are also extremely reasonable. You can fly to Vancouver in 1-1/2 hours and it doesn’t take any more time to fly to Puerto Vallarta than it does from Vancouver. Just think, with all the money you would save by buying that home in Saskatoon you could spend much of your vacation & retirement years in the lovely condo that you were able to purchase.

Sure, you can converse with people who have moved here from colder (winter) climates, and they love it. But there are many who would rather live in Edmonton, Kamloops (very expensive as well), Regina, Saskatoon or Ottawa. They enjoy the recreational lifestyle each season brings.

Deryk, I enjoy all of your posts. I especially recall a number of them in 2019 on the Victoria market where you were pointing out some specific good value low priced houses that were being overlooked by some here. And you took some flack from some people telling you many reasons that they wouldn’t buy those houses. Some of them are still here and still looking.

Anyway, keep the posts coming!

Science is based on skepticism. You don’t believe a theory just because you want to, you believe it because the facts support it.

The problem with much of the public IMHO is that they are not interested in facts. That’s not skepticism, that’s delusion.

Yeah you can pretty much pick any spot in Canada and real estate is doing well.

That said I agree that the cheaper places have more upside potential than the expensive ones as a whole. Not sure what good that does anyone here though, anyone waffling between the east and west coasts for where to live?

In fairness, science, research and scientific literature has been spun and weaponized to fit personal, institutional and corporate agendas. The public, uneducated or educated, have every right to be skeptical.

Derek, I’m sure the good people of Moncton appreciate outsiders buying up their real estate and driving up the prices for people who actually want to live there

Ha ha…Thanks everyone for the support. I sense a genuine kindness in each response. That’s a positive thing and much appreciated.

Yes…. Moncton…and real estate in general…wow…how long “can” this ride go on? And what can the government do about it?

I still believe that a massive social housing plan across the entire country is the only answer for those being left behind. The federal government has to take over the reins or we are going to have civil unrest on a scale we have never seen before.

(PS: Great advice on pointing out the positive side of so much snow in NB…. snow mobiles, snow shovels and snow plows…all great opportunities:)

Deryk – Thanks for the response. Moncton is nice (have been there numerous times) but the winters can be a bit much for some. I would also offer that a move across the country for the “opportunity” to own a house is pretty difficult especially if one is established and has family and friends here.

As for Monton real estate doing well, I think every single city and town in Canada is doing well in terms of real estate price appreciation. Completely unsustainable imho and especially more true when and if rates (both central bank decided and bond market decided) rise.

But before that happens, and a little bit of a tangent here, people all over Canada are going to feel the effects (continue to feel the effects) of the massive inflation owing to these low rates. Net worth may be climbing for homeowners but at the same time monthly costs are rising as well for everything from food to reno materials. I doubt their available cash flow is rising as well. Next few years will be interesting.

Barrister – The question wasn’t an attack on his motives. It was a question about his motives. And now I know what his motives are.

Cheers

Deryk- I did some research on Moncton and it sounds like a great place for snowmobile dealerships. 330 cm of snow on average ( triple Winnipeg’s), no thanks. That much snow is great for heart attacks, keeps the personal care homes under utilized. What’s life expectancy- 52? Just being sarcastic, I’m sure the people are friendly and young.

Deryk: Welcome to our world these days. Even when you are trying to be helpful your motives will be attacked. This is especially true if you point out the positives that are out there. A lot of people seem to like the gloom and doom narrative.

Cynic: The reason I keep posting about Moncton is because I simply want to point out to people where some great opportunities are in Canada. I’m continually shocked at how cheap it is there. That’s all.

I try to see the glass as half full. Not half empty. Can you imagine….you can buy a full Duplex like this one for around $300,000.00. I think that is worth pointing out to people who feel left out of the housing market……that there are still many beautiful options and opportunities out there.

I see new people from time to time on House Hunt and I’m mostly talking to them.

I also had to listen to several people in the past who mocked Moncton and I now feel vindicated and ……..ha ha….. and …..I’m a bit guilty of gently trying to shake their world:)

Dude… I don’t get what your angle is and why you post so much about it? Is it to get more people to buy investment properties in Moncton or to pat yourself on the back for buying there a couple years ago?

I'm genuinely curious.

Moncton real estate doing quite well.

https://globalnews.ca/news/7680006/n-b-housing-boom-sees-house-prices-climb-30-in-2021/

It’s already eliminated for people with homes worth more than $1.739m.

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax/home-owner-grant#grant-threshold

“The grant is reduced by $5 for each $1,000 of assessed value over $1,625,000. This means properties assessed up to $1,739,000 can receive a partial regular grant.”

Further to Calgary’s controversial “Guidebook” proposal:

https://calgaryherald.com/news/local-news/a-guide-to-the-debate-around-calgarys-new-city-planning-guidebook

Today I learn:

The guidebook doesn’t introduce zoning changes that would automatically bring more density to a neighbourhood. It doesn’t change the city’s land-use bylaw, and people would still have to go through the existing process to redesignate a piece of land for a higher-density use.

The city’s “myths and facts” page about the guidebook says the document continues to support single-detached or other types of low-density housing in Calgary.

All this doesn’t sound too terrible from the NIMBY point of view, so I am a bit confused as to why NIMBYs are up in arms about it. Maybe they haven’t read the document (it’s 131 pages), or perhaps they’re worried about a slippery slope?

So given rush4life’s question, any other ideas?

What measures should the provincial government take on housing?

What measures should the federal government take?

What does this sentence mean? I’m sure you have a point to make but I can’t tell if it is a personal attack or a general judgment on a social class or ?

Where do you get that? I think most Canadians are not happy with the pandemic response until they compare it to the US

Agreed. We definitely need this.

Thanks everyone for the help with private sales, Marko, Leo, Frank, taking the time to reply to my messages is very appreciated. I will take this advice.

Cheers,

Jack.

A classical case of the pot call the kettle black.

I for once don’t try to solve climate change, world hunger, or housing/homelessness. Unlike some people constantly touted that they are over educated and should get special treatments even those they haven’t earn it and couldn’t solve their own problems at home, but somehow think that they know how to solve societal system.

There is nothing wrong with learning from others regardless of what countries they are from, and as we know even the ancient cultures still have much technologies that we haven’t fully understand and could learn from.

Canada is lucky to have a tiny population of a large city, that occupied the second largest landmass in the world, and it hold the largest fresh water and natural resources in the world. And, perhaps we can learn how to improve our inefficiency system from a poor country instead of beating our chest and boast of how great we are.

Will be interesting to see how the province handles the third wave. We just loosened restrictions, what can they tighten now? Or will they just hope for the best and bank on better weather and vaccines to stamp down the current increases? It’s a tightrope walk, with people yelling at them from both sides to both do more and do less.

BC’s handling of the pandemic has been decidedly mediocre against the best but we’re on the good side of mediocre so overall I think people are relatively satisfied how it was done. It does not seem like the majority are judging us against New Zealand or Taiwan, but rather against the rest of Canada or the US.

Self-perception needs to be tested for accuracy. I would say you come across as a black & white thinker and uninformed and very judgmental on many topics, and very well-informed on technical issues.

I admit, the contempt with which you view Canada is irritating to me. I’m not saying return to Vietnam, I’m saying maybe you have some rose-coloured glasses and maybe, just maybe, there is room for some more balance in your statements.

Vietnam has many positives, but I didn’t enjoy the overwhelming pollution, people throwing trash everywhere in the streets, lack of food hygiene, high crime rate and the constant feeling as a foreigner that you were going to be subjected to scams/fraud.

When you are looking at the covid response, I agree we could learn from Vietnam. However, health care here is much better overall imo – I suppose unless you are wealthy in Vietnam and can pay for private hospital care. As an aside, you have a 63% chance of surviving five years past a cancer diagnosis in Canada vs. 1.3% in Vietnam (all cancers combined).

Jack- This is how I purchased 2 properties privately: they gave me the price and I gave them $5000 more. Both were great deals. That home inspector they’ve recommended sounds awesome. I’ve never used one, I’m not an expert but I know a piece of garbage when I see it. Jump on it before he puts it on the market and gets more.

War was the reason, and I’m a Canadian citizen not a Vietnamese citizen. A side note for the uninformed, the Vietnam War wasn’t truely over till the US stoped the embargo vs VN in 1993.

I’m a straight shooter that will speakup for the unjust and I’m not afraid of regcornize talents, and enjoy working and learning from others regardless of creed, race, religion, national of original, and gender as many Canadians today seems to be afraid of. Presently it seems as if “equality” pandering is the mainstream way to get a head that is draging down our society, instead of hardword, leaning from others, and share ideas to better our society and quality of life.

P.S. I hope that you are not trying to tell me to go back to my country adage, because I would be a wealthy man by now if I get a penny for every single time that I heard it.

I second James Parr for a home inspection. Dude is super thorough and very nice. The report he gave us on the house we bought was very impressive. He walked us through the whole house pointing out anything and everything that was wrong or could be a potential future cost. He followed up with an emailed file full of pictures and written summary on eeeeeeverything.

Same here, one less thing to deal with each year on the form.

New rates effective 31 March 2021 for the BC Property Tax Deferral Program:

The Regular referral is now .45% per annum (simple interest) plus a $60 fee for the first year of application and $10 for re-applications . So if your taxes are $3,000 the interest would be $13.50. Only one of the owners must be 55 years of age and the other owner(s) may be any age.

Families with children or those claiming financial hardship pay 2.45% simple interest but there are no fees.

I can see letting a family undergoing financial hardship, with documented proof being able to defer their tax for up to say two years. But the rest of the program is ridiculous. If you can afford to live in a $900K home, you can afford the property tax.

No question Vietnam had a great response in many ways and the focus on science vs. conspiracy theories is something the West should take a look at. There is a problem when your society is so politicized and generally uneducated in science that they cannot trust their public health messages.

To be fair, Vietnam was able to act extremely quickly and keep the case count low because they are a collectivist society (in a crisis) and experienced a severe acute respiratory syndrome (SARS) epidemic in 2003 and human cases of avian influenza between 2004 and 2010. Vietnam had both the experience and infrastructure to take appropriate action.

As an aside, QT why are you living in Canada instead of Vietnam?

Yeah I’d support abolishing it for sure. The whole concept of governments paying each others’ taxes is ridiculous.

What do you make of the province taking over administration of the grant this year? Do you think that is meaningful at all?

Jack: You could try Highland Home Inspection. Helpful guy, no BS.

The home owner grant is such an epic waste of money.

Pissing away $1b/year to the wealthiest people in our province – homeowners.

I used to work on property taxation. Apparently every new government for at least the last 15 years has looked at eliminating it. They just can’t. It’s a $600 tax hike on most of the province. It never gets past the consultation phase.

Canada’s wild housing market is making a case for the country’s most unpopular tax

…

There’s plenty they can do. It’s just that truly effective measures would be politically unacceptable. And the provincial economy has become overly dependent on inflated RE prices. But if they really wanted to do something (in order of increasing magnitude of impact):

Ontario tried a speculation tax on property, and the market ‘collapsed overnight’

Exactly. And an appraisal is supposed to be independent of the accepted offer price, that’s the whole point.

I think one of the biggest risks after the pandemic is inflation. Huge money printing, and the government won’t have the resolve to raise interest rates to fight it. Economic theory says that’s a recipe for inflation.

We are doing great, thanks to the best minds/health professionals/politicians, to produce such brilliant results.

https://www.cbc.ca/news/canada/british-columbia/covid-19-update-april-19-1.5957145

In the meantime some back water country (95+ million population) with subpar medical system is about to produce and share their own Covid vaccines had less cases than Vancouver Island and a mere 35 death.

Nanogen Pharmaceutical Biotechnology, based in Vietnam’s Ho Chi Minh City, is willing to share know-how and technology for developing its COVID-19 vaccine candidate. — https://tinyurl.com/4349vyf5

Vietnam says homegrown COVID-19 vaccine to be available by fourth quarter — https://tinyurl.com/khzyd86h

https://www.worldometers.info/coronavirus/country/viet-nam/

For something off market definitively get two. Appraisals are often completely out to lunch when they can’t reference an accepted offer price.

If we’re talking about the price of single family homes there really isn’t much they can do. I think the remaining actions are on the federal side there like limiting investors purchasing them. However I haven’t heard a peep about the Cullen commission so far other than Sam Cooper’s tweets. They could do a better job communicating what has been found so far in that investigation. Maybe they can’t though.

For housing supply in general (duplexes and denser) I think they need to take some control away from the municipalities. They already have the mandated housing needs assessments that need to be completed by April 2022 (https://www2.gov.bc.ca/gov/content/housing-tenancy/local-governments-and-housing/policy-and-planning-tools-for-housing/housing-needs-reports). That gives them the perfect basis to mandate that municipalities create enough new housing before the 5 year deadline for the next Housing Needs Assessment to accommodate some level of growth. If municipalities don’t do that then the province steps in and does it for them. So the nature of growth remains in local control, but no is not an option.

Russ McCarthy from Barnes & Company and James Parr from Sound n Safe.

Good as I know they will appraise low or high? 🙂

Good news about the housing stock this week – we need it desperately. Leo if the Province were to look to stop prices going up this budget what would be the two best things they could do in your eyes?

Victoria might get more people visiting after the pandemic, but does that really translate to more housing being bought?

If anything it might be the opposite here, once people can go back to the states as a snowbird destination are they going to get rid of their places in Victoria?

There was definitely a lot more people camping and visiting within the province last year, Tofino was completely overran.

Any recommendations for good appraisers for Victoria?

Home inspectors?

Help appreciated 🙂

https://househuntvictoria.ca/2021/03/15/are-investors-driving-the-market/#comment-77482

Thank you @leo and @deryk.

Very helpful!

I think there is a certain amount of pent up demand for travel for sure but that money comes from somewhere. Seems like there is way too much magical thinking from some camps. Almost nothing but positive impacts during the pandemic and then more positive after the pandemic? Doesn’t make sense.

Finally seeing substantially more listings than sales for the week. For a long time they were basically equal or sales > new listings

https://www.vicnews.com/news/oak-bay-seeks-300000-from-homeowner-to-split-lot-into-two/

Well, if they will be listing the lot for a million, I don’t see why the municipality would subsidize any of the cost for hookups. However, 300k sounds suspiciously high to get get it done. I wonder if that is to assist in covering the cost of street upgrades that need to be done eventually by the municipality, then I can see the property owner having an issue. But if we are looking at adding housing supply across the region, a quick cost effective way to subdivide large SFD lots across the foolish number of municipalities we have needs to be found.

Covid outbreaks on local job sites, not good for construction

https://www.victoriabuzz.com/2021/03/possible-covid-19-cases-reported-at-victoria-construction-site/

What do you think an N95 mask is Frank?

It is astounding how destructive some people can be. $40,000/year is entirely credible.

Frank, I am woefully ignorant of many things but airplanes are not in that category.

It is very easy to find any number of sources that point to filter effectiveness of 99.993%. Have a read and travel relaxed…..

Ihttps://www.iata.org/contentassets/f1163430bba94512a583eb6d6b24aa56/cabin-air-quality.pdf

From: https://financialpost.com/real-estate/jury-still-out-on-canadas-housing-bubble-but-a-national-fix-would-do-more-harm-than-good

Seems like the thing to talk about nowadays. I guess the upcoming budget (if we can call it a budget anymore?) will be the signal to what regulations might be coming. However, I imagine that the budget will have a poison pill in it to trigger an election, so that will probably hold off any actual policy intervention in real estate until at least late summer or fall.

Stroller- I don’t think you understand how minuscule a virus is. They can only be seen with the aid of an electron microscope. I doubt there is a filter that lets air through that can stop a virus.

“Jamming 200 people in a metal tube for hours is not a good idea and paradise for a virus”

Incorrect. All modern aircraft have tremedously powerful hypoallergenic filters and the rate of air exchange within the cabin ensures that the air quality is better than a hospital operating room. Since the onset of the virus there have been less than dozen proven cases of transmission on board an airplane.

But you have to measure it somehow. If you just say inflation is when everything is getting more expensive then we’ve never had inflation.

Peter- 911 was 20 years ago and they still scrutinize every passenger as a potential terrorist. Travellers will be required to wear a mask for years and prove that they have received a vaccine. Not to mention the isolation protocols our government demands. Doesn’t make traveling very appealing. The gym I go to underwent a massive expansion, around 10,000 sq. ft. with 30 ft. ceilings and huge ventilation ducts. This is what is required to accommodate 200 people exercising to ensure proper ventilation. Jamming 200 people in a metal tube for hours is not a good idea and paradise for a virus. Air travel and cruise ships will be required to operate at unprofitable levels for a while. As for the vaccine, they will not provide the protection people are hoping for given the nature of corona viruses and its ability to mutate. From the looks of it a third wave is coming and further lockdowns can be expected. Canadians will be constrained in their ability to travel, which I believe is good for our economy, and opt to invest the money they are saving into upgrading their homes.

Well there’s inflation which is the devaluation of currency and then there’s various ways of measuring it including CPI. But if we’re actually seeing devaluation then everything should get more expensive whether it’s captured in the CPI basket or not.

real estate is tied to interest rates more so than inflation. Perfect storm would be massive CPI inflation with high interest rates as a result combined with wage stagnation.

No not everything. Inflation is defined in terms of an index which is based on some basket of prices. The best known index is of course the CPI. But consumer prices, commodity prices, asset prices (stocks, RE) and wages can all move independently of each other. Even just looking at consumer prices not everything moves in the same direction. During the RE bust of the early 1980’s CPI inflation was still strong.

I see a lot of people pointing at price spikes in certain commodities as evidence of inflation. Doesn’t really make sense though, if it’s inflation then everything gets more expensive, not just a few things. Maybe there is more inflation than accounted for in the CPI, but most of the price spikes are because of supply chain disruptions and unanticipated demand shocks. The pandemic caused a lot of industries to hunker down when they should have been ramping up to match the demand wave. That mismatch has caused all sorts of havoc with industries caught unprepared and shipping prices spiking as the pattern of demand shifts around. Most of that will normalize in the next year.

Good find, ummReally.

Remarkable survey results indicating that the public takes the housing bubble more seriously than the government. That usually doesn’t last long though, so we should soon expect to hear politicians saying the same things those survey respondents are now saying.

Namely…

“Housing is in a bubble” …“this isn’t good for the country”… “low rates are a problem”… “things are worse then previous generations”… “we shouldn’t just accept that houses are expensive”

Now that there are more millennials than boomers, we will start to see millennials’ problems getting special government attention because of their large numbers, like the boomers have received all these years. If that’s the case, we should expect much government talk and action coming on the housing front.

Jack…. Leo’s advice is fair enough. Do your own homework. Check the house out. Get a qualified electrician to look at the wiring. Many, if not most home “Inspectors” are not qualified to take off the electrical box cover.

If it’s an older house, it will have all the usual things like lead paint etc. It’s an old house….what would you expect?

Scan for a burried tank.

Keep in mind that you are paying for “location” not the house. (Victoria or Moncton….that’s why there are several hundred thousand dollars difference.)

People turn their noses up at paying several hundred thousand dollars for a house because it needs a new hot water tank or a new roof.

Of course it is a balance. People spend more for a house that has an “ok” kitchen instead of buying a house that has a kitchen that looks like total shit and end up tearing out the kitchen anyway.

Look for structure. Good bones.

Good luck!

Frank, on your comment about people not wanting to travel (sorry, don’t know how to quote), I can only speak for myself. I’m almost in your age group, have been going to the office every day during this pandemic (why not, hardly anybody there anyways, and way more convenient for me plus using the empty tenant gym), and the number one thing I want anywhere within striking range of the ‘end’ of this pandemic is to travel. Now that BC says we get our first shot by end of May, I think the cards are lining up sufficiently & plan to book trip to Hawaii this weekend. But admittedly, I may be nuts, as I also would have booked that trip in the middle of the pandemic if my wife had let me…

I do realize many will feel differently & that does affect behaviours. But I think on the whole, pent-up travel demand is one of the biggest “pent-ups” out there. We will see soon enough. We are actively considering buying an airbnb in Victoria.

Great opportunity in this market with near zero inventory if the price is right. Here’s a sneaky way and a fair way to approach it, given you say this is a friend let’s talk about the fair way. If you’re ok with the place given rough price from him I’d:

Of course specific situations may be more complex, and you may both also want to consult your accountants for potential tax implications.

Jack…I’ve bought and sold several houses without a realtor.

I have used a lawyer. (I’ve also used a simple Notary sometimes. )

I simply tell them what I want to happen.

Both of us used our own lawyer or notary and the lawyers prepare all the paper work for each party and we signed the documents.

It’s very straight forward.

I don’t like the way the whole process of buying and selling has evolved over the years. Far too many games going on with agents in my opinion.

Keep it simple.

Costs next to nothing compared to real estate agents fees.

I trust the advice of someone with a lawyer’s degree more than I trust someone with a real estate licence.

Frank…you make some good points. I should point out that I have been heavily involved with homelessness for over seven years now and I am well aware of what you point out.

The current system is fucked in the head.

I’m saying we need a total change. No drugs. Full support for those with addictions and mental illness. Currently there is nothing available. It’s a revolving door run by complete fools at the Archie Courtnall center, which releases people before a full assessment. Victoria police say this as well.

We need to force the laws. We also need to change the laws.

We need a total change of what we are currently doing.

I am a strong supporter of taking people into proper care if they insist on doing drugs and ruining property. I don’t mean arrested and given a criminal record. I mean taken into care …..like I hope they will do when I start to wander around the frozen streets in my slippers in a couple of years.

That’s not the case for most of GH.

The real question is, do you actually walk to them? Because I’ve walked to Save-On (was safeway at the time), and it’s really a pain in the ass. The tuscany thriftys is less so because of the layout. I’ve lived in Esquimalt, Oak Bay and right by Cedar Hill Golf Course, and those I could(and regularily did) all do walking grocery, GH isn’t really that possible. I’ve done it on bike though.

It really wouldn’t.

That’s over 3k a month per person.

Was wondering if anyone can help or can provide some more info. Hoping to move to Victoria in the near future.

A friend of mine who lives here is downsizing, and looking to sell his home. He is giving me first right of refusal to buy his home privately. I was wondering what the implications are, what the process is, if one needs a lawyer?

Does anyone have info on this, or any sites that discuss this?

Thanks

From: https://www.theglobeandmail.com/investing/personal-finance/article-almost-no-one-thinks-whats-happening-in-the-housing-market-is-good-for/

Derek- The point that was being made was when you house 2000 homeless people, another 2000 magically appear, then another 2000, and so on. Facilities already exist to house some of the homeless but they must abide by certain reasonable rules, which they admit they do not want to follow. You are also not taking into account the massive effort required to maintain these homes. Homeless people are extremely dysfunctional and would trash a new place in weeks. They would probably tear the copper out of each unit to sell for drug money. It would be loaded with trash in no time and soon become uninhabitable. The effort required to maintain these residences would far exceed $40,000 a year per unit. You have the misconception that homeless people are normal people who have fallen on hard times, this is true in some cases but the majority suffer from a combination of mental illness and substance abuse. They are incapable of taking care of themselves. I witnessed a homeless Indigenouis man fill up a water bottle at a hand sanitizer dispenser for consumption. It probably killed him. That is not normal behaviour and I seriously doubt that there is a solution to the circumstances that create the despair some humans experience.

….

HomeDepot.ca shows the same price for pick-up in Victoria.

Home Depot’s prices may be uniform across the country.

Frank….. do you enjoy paying the forty thousand dollars every year for every person you see on the street? Because that is what you are currently paying.

Cheaper to house them.

What would you do? Make them stay on the street and pay the forty thousand dollars a year it is costing?

I’m just curious.

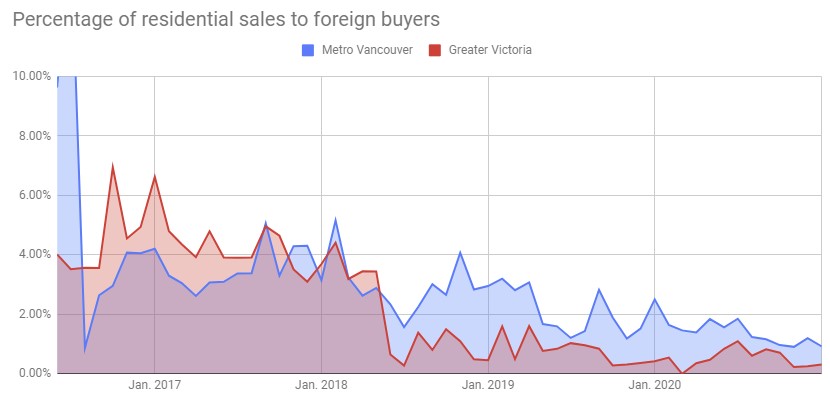

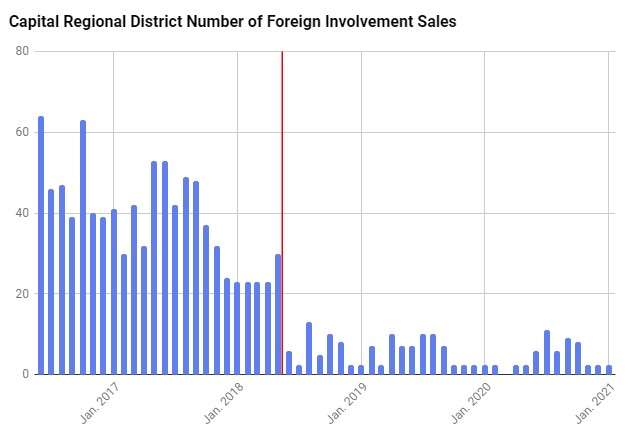

Pretty much. That said I think introduction was a good idea. Had a big impact in Vancouver and i didn’t see it directly in Victoria but theres a paper coming out later this spring where authors claiming it turned market downwards here as well. Looking forward to reading that.

#1 impact is removing it as a cause so we can concentrate on other things now.

Looks to be 1/250 home buyers are foreign in Victoria. That’s about 3 buyers per month in Victoria. Many with existing ties here or on their way to immigrating to Canada, so not so “foreign”. How low do the numbers need to go before people can realize that foreigners are just not a big factor and move on?

Biggest generation is millennials, more than boomers. They’ve delayed buying, but that’s changed and now they’re the biggest buying cohort. It’s going to be that way for decades.

===========

https://www.wsj.com/articles/millennials-are-buying-homes-in-big-numbers-11598543344

August 2020: “Millennials are powering the resurgence of the housing market this year. Americans in their mid-20s to late-30s were long viewed as reluctant or unable to buy a home. But millennials accounted for half of all new home loans last year, for the first time. They consistently held above that level in the initial months of this [2020] year, according to Realtor.com”

===-===-===-====

So hopefully we will see less focus on foreign bogeymen, and start to see more data documenting the millennial buyer boom powering the boiling Canadian housing market.

R Haysom – I don’t know what a 2×4 costs at home depot in victoria, but the lumber costs are up 140% to build a new condo from a year ago, and there is another 30% cash allowance being placed on top of that. Steel stud is up about 60% at the moment.

Who’s paying 2395/month, the tenants leaving are mid 30’s and both work from home, they just bought their own place in a strata house conversion over in vic west.

Previous tenant was a newish lawyer with her daughter she was there for about 3 years

It’s always young professionals that don’t want to live in a pile basement suite or A 50’s box.

The house was gutted down to the studs 6 years ago and we have had a 0 % vacancy rate on the 3 units since completion.

If inflation goes up and wages stay stagnate then there will come a breaking point on how much rent people can pay before falling behind. Not a good situation for landlords either as tenancy laws favor the renter.

Some of them in stable housing, a lot in unstable housing that is extremely difficult to replace or seasonal – like motels and then camping in the summer – combined with living in vehicles – or temporarily living with friends/family or a shelter which are often full. As prices rise those in private housing may find that their home is put up for sale. It is families, but also the elderly on fixed incomes. We need more purpose built rentals geared to the lowest 25% of income earners, not forgetting those that work but cannot afford to buy – ever.

http://www.burnsidegorge.ca/programs/homeless-family-outreach

Foreign buying update.

Ks1112 my thoughts exactly. There’s only so many people that can afford those rates, when looking for a 3 bedroom (most renting families are) it gets even worse. If you’re getting $2400 for 2 bedrooms, 3k for 3 bedrooms.. I hope you’ve verified the income your tenants make to see what % of it is going towards housing and it’s not ridiculous. I pay $2050 rent for a whole house, 2 bedroom, moved last yr.

Introvert- That is exactly correct, find housing for the homeless and in no time, a new group of homeless people appear and you’re back where you started. We might have to come to the realization that there is no solution. We also have to look at the source. I saw a young woman with 4 young children, one in a stroller, today. Those poor kids don’t have a chance, their mother simply cannot provide the environment for them to be successful and thrive. Society has to stop allowing people who are incapable of providing for themselves to have an unlimited number of children, as most of them end up having miserable lives. It hurts me deeply when I see these innocent children with little hope.

I think demand comes before building and also comes after, induced by that building. Similar to how, when BC Housing started buying motels to house the homeless, additional homeless people migrated to Victoria upon hearing the news. A number of people got housed, but nothing was “solved” in that the net homeless population is the same or even higher.

Where are they currently living?

If not having your house situated six feet from the neighbour’s house is wrong then I don’t want to be right.

There are a lot of services within walking distance from me.

$2395 for a 600 sqft 2br is high, but not out of the realm of ordinary.

The people paying these used to be the up n’ coming middle class. I work in government as well. I was chatting to a new staff member the other day. She and her partner(both government staff) were renting a 2br PBR at eagle creek for $2100\mo. I know how much she makes. $2100 is almost her entire take home pay(after tax\pension\deductions entry lvl staff take home about $1200\biweekly).

I was aghast. But she was unfazed. She was very clear that she and most of her friends pay around $2k\month in rent on 2brs.

Anything significantly cheaper then $2k\month is often very unstable housing.

Cadbro, my question is with wage stagnation who is paying that? And if someone is paying that then they might as well just buy an older 1000 sqft condo. Renting only makes sense in this market if someone has grandfathered cheap rent, not for new renters.

A steel stud is $6.42, hmmm…

“What are the prices in Victoria?”

About the same.

In Calgary a 2×4 8′ at Home Depot is $7.88

a 2×6 8′ is $11.33

What are the prices in Victoria?

I’d be more concerned about rates going up considering 3% interest on a million dollar mtg over 30 years is over 515K (big banks are already over 2%). Right now you can argue the rates support the prices – if we get a few bumps that will no longer be the case. Much harder to justify prices at higher rates. When rates are 3% they have to move to 6% to get the same impact – getting from 1.5% to 3% is not that crazy.

Charging $2395 plus util. for a 2 bed 1 bath unit in a house isn’t good on anybody, it’s gross

Peter- Travel restrictions are not the only thing keeping people at home. A lot of people in my age bracket (mid 60’s) are so freaked out that covid is going to kill them, they rarely leave their homes. I’m not sure the vaccines are going to do much to increase their confidence and I think that our behaviour will be altered for years. Especially travelling as extensively as people used to.

Because it is unnecessarily complicated and full of unexplained acronyms and doesn’t account for the fact that a house also has shelter value.

Show me your calculations. Back in the real world of leveraged primary residence purchases in Victoria I’d suggest this is absolutely not the case.

It is a gift. Ask someone who can’t get a mortgage and ends up renting all their life.

Makes me think the govt should offer stratas a service to invest their contingency funds for them. Let BC Pensions do it.

The dangers of a strata.

https://www.citynews1130.com/2021/03/17/regina-condo-corporation-invests-in-bitcoin-but-experts-warn-of-risks/

There are many arguments that home prices aren’t tied to incomes in Victoria but rent has to be. I am quite surprised to see what other landlords are able to charge for rent on this forum given that wages have been stagnate.

“800sq ft 2 Bed 1/bath, main floor character conversion with single car garage 2395 plus utilities”

That is more than what I charge for my upstairs GH suite which is ~1400 sqft with 3 bedrooms and 1.5 baths. Good on you if you are getting away with it.

The 120k worth of interest is at a low rate that will likely be refinanced at a higher one, and while appreciation rates in Victoria are high, the NFV of that stream of interest payments is still over 600k with a 9% real return in the stock market. When you factor in a 10% DP up front, the NFV is about 1.1MM. That 600k property NFV @ 4% per year real gets up to to about 1.5MM assuming that continues, so if you are comfortable carrying the debt, it might be a better investment than the stock market with a low DP but if you put 20% down, it is basically the same, ending @ 1.5MM. Both can be tax free if you use your TSFA as well. This is basically a long way of stating that the 120k in “interest” is not peanuts. Neither my math nor my comparison are perfect here but combined with the down payment, the “peanuts” can actually easily outperform the entire house over time (especially given that interest rate drop driven price increases can not continue given rates are so low). Generally most people have no idea how to digest what I just wrote and just buy whatever house the bank will let them buy because they are Canadian and as such, generally not properly equipped to negotiate todays financial environment anyway.

A large gap between interest rates and stock market returns is not sustainable in the long run.

The lower prices are the incentives. The reason more people don’t move (or stay) is lack of jobs, and I don’t think there’s a lot the government can do about that, beyond stuff like better internet. But just throwing money at job creation is not the answer. Or paying people to move.

r.haysom, way to man up on the cat thing! (I’m serious – love cats!). PS Frank, not sure about the rest of Canada, but there are no travel restrictions/isolation requirements for people coming your way from your main travel market, Vancouver. But I agree with you that covid is keeping a lid on travel one way or another & when that lid pops the pot will (over)boil

If you really want to get depressed, calculate how much absolute interest you will pay to the bank over the life of the mortgage even assuming a best-case scenario of 1.5% rate for the entire 25 years (which won’t happen, of course).

‘

‘

Now if YOU want to get really depressed imagine taking out a 500K mortgage and investing the proceeds at 7 or 8% over 25 years, I bet you’re ahead 1MM over paying off that mortgage. That is how the rich get richer.

Absolutely agree Totoro. And you will never see “affordable” rentals built by private developers. It’s just not going to happen.

No surprise that we are looking at inflation after years of creating money.

The problem is worst for those on low wages. Time for a revolution and strikes? I can’t imagine how young people survive today in our large cities.

I think it would be a good idea for the federal government to create major incentives for people to move to low priced cities. I don;t know what form that could take but something creative…outside the box thinking.

No hyperinflation as of yet, but gas is at $1.529, copper up 100% from last year to settle at $4, a stick of 2×4 is north of $15.

https://nationalpost.com/news/canada/inflation-is-coming-signs-that-everything-is-about-to-get-much-more-expensive

It is. Just not affordable low income rentals. Families in the lowest 25% who are not able to buy still need a place to live.

I’m not so sure one could say Langford is not providing rentals. I know a developer who has build several “huge” purpose rentals there.

Why there? He says dealing with Victoria is an “impossible” way to try and do business and he would never ever consider doing these projects in Victoria for that reason. Langford on the other hand moves very quickly.

Also: Many new homes we have looked at have legal suites in them. It’s a great idea. The ones we bought in Sooke all had suites. (In 2012 we bought new houses with suites for $375,000.00 approximately.) I mentioned to the builder that he should not sell them, but should rent them out instead. He made about $60,000.00 profit. If he had rented them out…. well….they would be worth about $700,000.00 + each.

He is still building houses for a living.

It does astonish me where all the people come from to fill all these houses and suites. I can’t imagine what Victoria would be like without Langford and surrounding areas filling the gap that Victoria seems incapable of meeting. Way too much beauracracy. Way too slow a process to get things done.

You’re comparing the City of San Francisco, which is only the inner core, with the whole of metro Victoria. City of Victoria is only a little more than 1/10 the size of City of San Francisco. Shows you how bad the numbers per capita already are in Victoria.

If you thought housing prices are crazy, look at lumber prices. If you invested in a lumber futures, you would have been pretty happy!

Housing Inputs: Lumber = largest by use material going into housing

BC Govt Report Comes out weekly

Synopsis = lumber has gone up 200% from 2019 prices and 100% from 2020 prices, way above historic values

https://www2.gov.bc.ca/assets/gov/farming-natural-resources-and-industry/forestry/forest-industry-economics/weekly-prices/forest_product_prices_-_2021-03-12.pdf

I think so. Langford is solving lots of people’s housing problems by providing them an affordable place to live in Greater Victoria. Not everyone’s housing problems, but many.

Peaking now according to some metrics. Vancouver SFH price benchmark currently at all time high (Feb. 2021 Teranet) https://housepriceindex.ca/2021/03/february2021/ )

It hasn’t been. Peak in Vancouver is still 2017 no?

So your view is that the demand is caused by the building and permitted densification? Doesn’t the demand come first? More housing might create some demand for services and therefor growth, but there is no building if there are not buyers or renters. And the research seems to point to restrictive zoning being correlated with lack of affordable housing.

I think it is also wrong to mix all types of housing together when you are looking at this. The housing market is not uniform, nor is the need. The most urgent need is for affordable rental housing – both subsidized and low income. Langford doesn’t provide this and there is a huge shortage in Victoria. Another need is affordable townhouses for first-time buyers. Langford sort of provides this, Victoria doesn’t really.

“By the way, how do you feel about the environmental cost of the sprawl happening in Langford?“

Asks the guy living in one of the worst examples of post war suburban sprawl in Victoria, with large inefficient houses on large lots, and few services within walking distance.

Compared to Langford where most of the development is small lot single family and medium density multi family built in accordance with a far more rigorous building code, less per capita than your hood would be my guess.

Last time I checked people/families are all living in these developments.

Yes, and is it “solving” anything?

Here we have a local municipality that is literally attempting to develop every square meter of land it has, as quickly as possible. Condos, rental apartments, SFHs — all relatively densely packed together. Has all that new housing in the region done anything substantial to improve Greater Victoria’s situation? Not really. Today, the problems are as bad as ever.

So that doesn’t give me hope that we can re-zone and densify our way out of our housing crisis. In fact, all the building that people are advocating for would probably just induce more demand, and then we’d be back to square one.

I still stand by what I said earlier. Peoples incomes have nothing to do with the price of homes in Victoria. If it did decide what the prices are then why would house prices be able to make such large leaps when incomes are clearly no going up that much? People somehow manage to scramble and pay $300,000.00 more than what they were willing to pay only four years ago. Where does that money come from? Their income didn’t jump. They get help from parents or grandparents who have passed away or are still alive and able to help out because they have money from a lifetime of work etc.

(Of course it’s also the low interest rates that help a lot but they were not that much higher four years ago.)

I’m not going to argue about it though. Just a difference of opinion and I respect those who don’t agree.

How often have you read that their homes made more money than they did last year? That has been going on in Vancouver for some years now.

The money is coming from somewhere else. Investments. Aging aunts uncles parents etc., not to even mention crime and money laundering.

We may never get to perfect affordability for everyone, but not sure why you would then just throw your hands in the air and give up.

We may also never get to perfect environmental protection, but that should not mean we don’t take steps to make things better.

I finally figured it out, why housing prices across Canada are skyrocketing- hockey. Canadians are saving millions of dollars on hockey tickets and bobble head dolls and investing it in real estate. Who woulda thunk.

Maybe. Maybe not. Some countries have success and the economic cost for taxpayers of homelessness is pretty high. And if things descend into madness over time we will choose to live elsewhere.

I don’t follow Langford’s planning processes so I’m not sure where they stand on urban sprawl and environmental issues. Weren’t they voted number one for livability recently? Not a fan of Langford for esthetics, but they are certainly building more housing more densely and many families are going there because there is nowhere affordable for them to go closer in.

I note that the ability to implement an urban containment policy and zone is predicated on an “increase in the proportion of apartments, row houses and other attached housing types within the Urban Containment Policy Area, especially within complete communities”… like Victoria.

You don’t want to, but you will. There are so many obstacles in the way of creating enough affordable housing to make a dent in the problem that we will never get there. Same for every other city.

It’s my understanding that much of the land between Langford and Sooke falls outside of the Urban Containment Zone and therefore will never be developed.

By the way, how do you feel about the environmental cost of the sprawl happening in Langford?

Over 25 years that is $400 a month. What can you rent for $400 a month?

I agree I am not worried about what I pay the bank over lifetime of a mortgage. It is peanuts compared to what lifetime renters pay their landlords.

Except that is not what will happen. You can’t just shut the door and say you are full.