Financialization of housing is a red herring

There’s a buzzword that I am seeing a lot in articles about the housing situation these days: the financialization of housing. That is, the supposed phenomenon of housing being turned into a profit maximizing undertaking controlled by large national or global firms and the negative consequences that come from that.

I’m going to pick on a recent and good piece in the Vancouver Sun entitled “Big money bets big on B.C. rental: ‘Good news’ for investors, ‘worst fears’ for residents“. It’s an excellent article and I recommend you read it, but it struck me as characterizing the problem of unaffordable housing as more of a problem of greed, rather than a failure of policy. The title sounds ominous, and the article hammers home the threat. Big faceless investors from “out east” are buying up existing rental housing, with the implicit threat that they will jack up rents to maximize their return. The response in the works from the province and non-profit housing groups seems to be to try to buy up as many of these rentals as possible to turn into non-profit housing first. That’s likely a good move and may stem the bleeding temporarily, but it’s going to be hard to compete with global capital, and it hardly gets at the root of the problem. Meanwhile I think the framing of spiralling rents as a product of corporate greed is missing the point and will lead to ineffective countermeasures.

Mom and pop investors aren’t necessarily a good thing

The Sun article presents the takeover of rentals by big pension and REIT money as a bad thing, displacing mom and pop investors that supposedly care more about the communities. And perhaps some do, but the reality is a small investor is just as focused on profit as a large one, with the added problem that they don’t have the same staying power. Due to our abject failure at building dedicated rentals, retail investors have had to take up nearly all of the slack to supply rentals, and it has increased housing insecurity.

One in ten moves in BC is forced, the highest proportion in the country. The mom and pop retail investors that are providing a growing proportion of rentals don’t generally hold them for decades. Usually they will be held for a few years before selling them during a price surge or if the investor needs the capital back. Housing that can disappear next month on the whims of the landlord is not the kind of stable housing that we need. We’ve been forced into it, but in my view our goal should be to meet rental needs almost entirely with purpose built, stable, and long term rentals. REITs and pension funds tend to be exactly that. Also who’s more likely to remove the windows out of their rental house, an amateur landlord or a professional management company?

Landlords increase rent because they can

The property management company Starlight is presented in poor light for cranking up rents in their buildings. In the article Professor Martine August was quoted saying “To squeeze people for their income and jack up rents for no reason other than to enrich investors, that’s considered legal, but I don’t think it’s morally right. And I think a lot of people would agree with me.” Perhaps true, but it’s a losing fight to have. In the end rents go up if there is little vacancy, and they do that whether the landlords are mom and pops or faceless corporations. The real problem then is not the landlords increasing rents, but the fact that vacancy rates are so low that they can. In a market with a healthy vacancy rate even the most evil of corporations can’t jack up rents because if they did everyone would simply move. That means 100% of our effort should go into solving the supply problem instead of worrying about trying to somehow abolish greed.

To add to our housing woes, a supply cliff looms

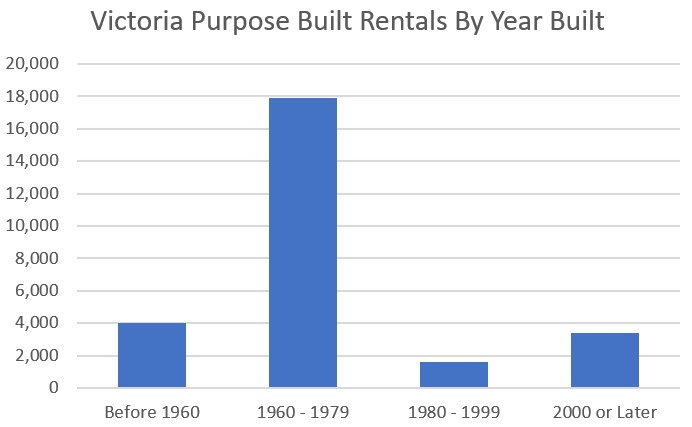

All those 60s apartments that are now seen as holy grails of affordable housing once started out as just regular new build apartments. They weren’t built to be specifically affordable, and afterwards they were run by for-profit companies. They were simply built in a low-frills way to house lots of people in Victoria and that’s what they did. Today we’d call them market-rate rentals (the horror). Now, 50-60 years later, the ones that haven’t been extensively renovated, with their the galley kitchens, laminate countertops, and scruffy carpeting have turned into relatively affordable housing.

The nice thing is, there are thousands of those 60s apartments in Victoria, so we’ve benefited from several decades of coasting on this affordable housing supply. What’s less nice is that those apartments are now approaching 60 years old, and although they theoretically could be maintained to last another 60, the reality is that even in the best case that will come with rising costs as every major system requires replacement over time. In reality, we are already approaching the time when these sorts of buildings are generally demolished.

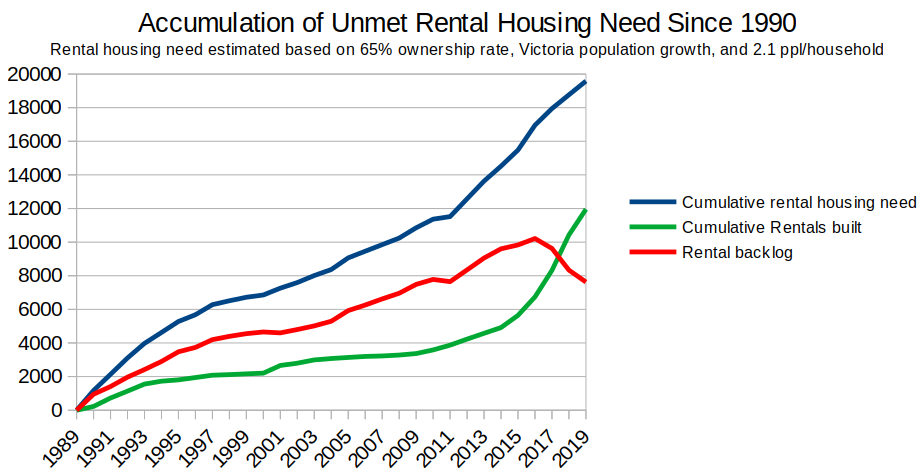

The issue is we don’t have a wave of 70s and 80s and 90s apartments to take their place when they do. In fact until recently we built nearly no purpose built rental in the region. Data is only easily available back to 1990, but for 25 years we built an average of less than 200 units per year. Set against the need for rental housing based on population growth, we built up a rental backlog of 10,000 units, which only started being reduced in 2017.

While the rental construction rate is impressive now, on this trend we need to continue this pace of construction until 2030 to dig us out of the hole we’re in. I’d say that’s a conservative estimate since it doesn’t account for the backlog before 1990, now does it allow for the demolition of existing rental stock, which will surely accelerate.

Tenant abuse is a separate matter

The Sun article sounds the alarm about a US-style takeover of rental properties by big corporations who exist solely to squeeze every last cent out of their tenants. For a good backgrounder on the abuses of disadvantaged tenants through poor management, a lack of maintenance, neverending special fees, and predatory legal contracts, I recommend watching the episode Slumdog Millionaire of Netflix’s Dirty Money docuseries, or reading this fantastic article in the New York Times. Large companies with outsized legal departments may well be more likely to develop these kind of one-sided arrangements that disempower tenants. However the solution to this is a strong regulatory framework that protects tenants from abuse, an area where we are already much further along in BC than the US. And again, more availability solves many of these problems. If the vacancy rate is 4 or 5% and market rents aren’t way above what you’re currently paying, you can simply leave if your landlord isn’t doing their job. It’s only in a tight and unaffordable rental market when people become trapped in their units and unable to stand up to abuse.

Profit in housing is not evil, or if it is it’s a necessary evil

Because we’ve ignored the problem for decades we’re now in a situation where rents are spiralling (temporary pandemic excepted) and there is a desperate lack of affordable housing in the region. That has lead to increased calls for new builds to be affordable right from the start rather than waiting for the buildings to age. That’s an admirable goal, but the reality is that dedicated rental buildings are already barely viable and require a lot of very cheap government money to get built at all. Adding the requirement that they are affordable instead of market-rent units increases the demands on subsidies drastically and will simply make many projects non-viable. While I think direct subsidies are a good use of money to get some units built fast, the money for this isn’t limitless. With a $300B hole in the budget from COVID, we need a sustainable solution that will keep construction rates high for decades, not just this year or next when the political winds are favourable. That means affordable units when possible, but also lots and lots of market units. We should never vote against supply just because it’s merely good, not ideal.

Right now we are in a perverse situation where NIMBY’s oppose new housing to maintain the status quo, and some progressive housing advocates also oppose any new housing that isn’t affordable from the get go. Strange bedfellows indeed, but with our current discussion heavy approach to development, that means a lot of projects are shot down before they can be realized. But if we are to have a chance to solve this problem, we will need to find a way to work together and allow the housing for new Victorians to be built, just like housing for us was built by those before.

Also weekly numbers courtesy of the VREB

| August 2020 |

Aug

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 207 | 449 | 661 | ||

| New Listings | 339 | 655 | 1006 | ||

| Active Listings | 2713 | 2695 | 2838 | ||

| Sales to New Listings | 61% | 69% | 66% | ||

| Sales YoY Change | +41% | +44% | |||

| Months of Inventory | 4.3 | ||||

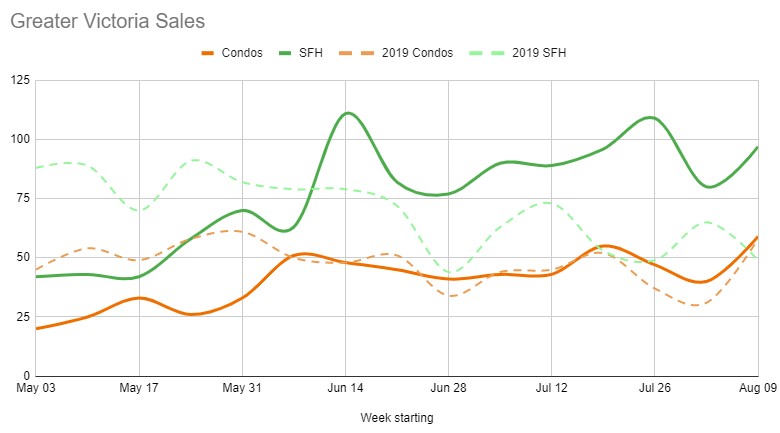

Market activity continued more or less steadily last week. Overall the market is in remarkably similar balance to this time last year, but of course we know that there continues to be a strong bias towards single family homes.

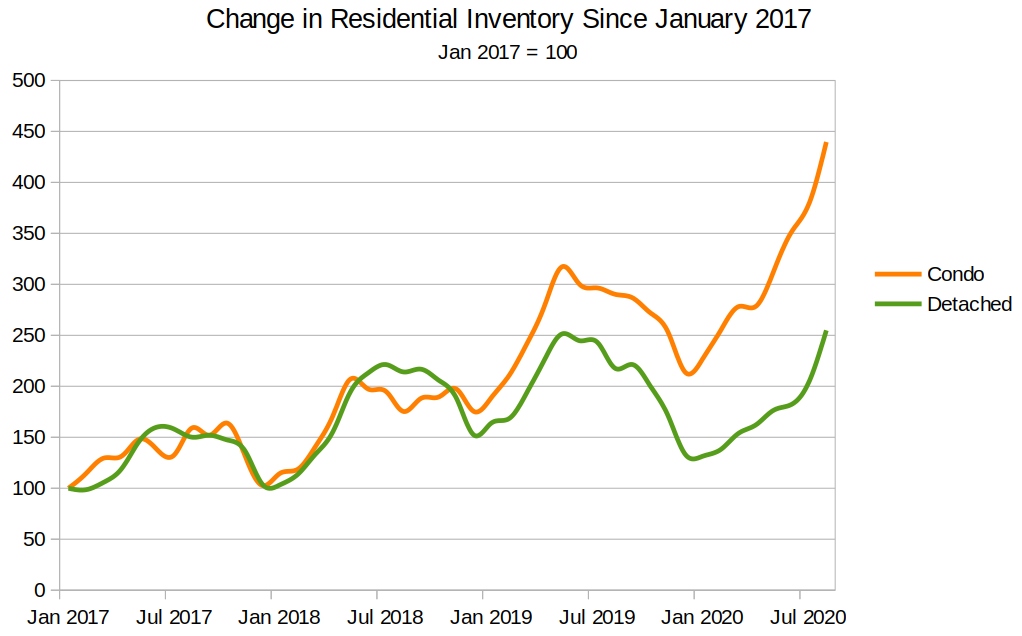

The lack of strength in the condo market isn’t getting discussed much, but I think it’s going to be more and more apparent as we move into the fall. Right now all seems well with sales at last year’s levels, but that is with the tailwind of pent up demand. The detached market is so strong it can absorb that drop in demand when it is exhausted, but I think we’ll see a very soft period in the condo market coming soon. Looking at the change in residential inventory since 2017, we can see how active listings for condos have left detached in the dust.

The irony is of course that the condo market is weak because fewer people want one right now so if there are price drops it won’t help the majority of house hunters that are looking for detached under a million. But it’s a segment to watch.

Can anyone recommend a reasonable price real estate lawyer? I use Perry Fainstein in the past but I heard he retired.

China has a $50,000 limit on person capital outflows.

How did all this money “legally” get out of China?

BTW, I’m in full agreement on the abject failure of all levels of our complicit & compromised government to protect Canadians from satellite families & global fraudsters, and wealth parasites. I blame them more than I blame the grifters.

I suspect pee tapes & juicy offshore bank accounts.

I don’t think that there is any debate that the foreign buyer’s tax has had an impact on the high end in Vancouver and lowered the already low numbers of foreign buyer numbers in Victoria? We have data on this. It is up to government to set these rules and, to date, it remains legal for foreigners to purchase real estate in Canada, they just have to pay more for it and worry about the vacancy tax now in BC so it is less popular.

What we do know is that many high net worth Chinese investors entered Canada legally through the foreign investment program until it was ended in 2014. Of 121,650 investor immigrants admitted since 1986 and still declaring residency in Canada, 52% are now located in British Columbia. Recent investor immigrants own single detached houses with average values of $3.11 million.

That is a lot of capital coming in housing which is legally invested yet has likely had an impact on affordability and our laws encouraged this. The lack of a language requirement for this program meant that the primary breadwinner in many of these families was unable to function in Canada and continued to earn income outside of Canada which they did not always declare. This gave rise to the astronaut or satellite family where the wife and children maintained permanent residency and owned high end houses here while claiming low income benefits. I’d suggest these individuals are more detrimental to our economy than foreign buyers are.

http://www.vancouversun.com/news/Ottawa+scraps+investor+immigrant+program/9496380/story.html

I’m presuming that you are referring predominately, to VanRE.

The sales volumes in the target market segments were already turning well before the FBT was even considered. The FBT was little more than a market shock which, once it wore off, it bounced back and soon resumed its deteriorating trend. It was the same trend that you could see in other “glamour markets” across the globe, Vancouver wasn’t different in that respect. I remember us talking about this very point on HHV a few years ago.

Personally, I’ve come to think the FBT had little to do with it. Those buying with offshore cash today are almost certainly failing to trigger the FBT, as I described below.

Not sure what effect capital controls were having at that same time, but as they clamped down further in 2017 and 2018, I think it’s reasonable to presume there was an effect.

Actually, I tried looking for data, but couldn’t find what I felt was reliable, so I asked you, since you seem to know everything.

If I had a fentanyl covered ș20 bill for every time a gaslighting race baiter cried xenophobia in effort to deflect from the reality of foreign buyers/capital infiltrating the Vancouver housing market, I’d have enough hockey bags full of money to buy several multimillion dollar teardowns.

The fact that the high end luxury market began stagnating around the same time as the implementation of the FBT, and Chinese capital controls on real estate isn’t indicative enough for some. Quite convenient that govt doesn’t keep good data, eh?

Outbreak in South Korea shows that what we are experiencing in BC is the norm. There’s no such thing as permanently flattening the curve. It will be a constant dance of outbreaks that surge up, get swatted down, then surge back up again. As long as we don’t have too many hospitalizations that should be fine.

Because of course you would.

Beneficial registries are not the issue in this context.

Because, while I think it’s good to close that off or at least provide some scrutiny to who is opening a company, the majority of the time that’s not what was happening. There was extensive research into this in 2014-2017 through west Van sales and all the different condos being deliberately marketed to Asian buyers. Personally and anecdotally, when I was pouring over sales and ownership data a few years ago in West Van, I saw for myself the vast majority of them had a person’s name on title (for some reason I noticed that when it was a numbered company, it seemed to often be 4 or 5 homes in a row right next to each other). But I think what was scaring people more than anything was the lack of standards in BC on what was required to begin a proprietorship and the potential that opens up for snow-washing.

You get much warmer in your next paragraph though. It’s not only families that are carrying the title on behalf of the breadwinner, there are actually networks in Vancouver whose function is to do exactly that for people who don’t have those family contacts – even when the two parties don’t even know each other. There were whole sites dedicated to doing this, some have actually been around for a few years. They are inherently risky of course for a variety of reasons, and it was one of the investigative avenues that the CCP used to jailed some people apparently for life. But if you’re over here and have a reputation for doing your craft well…incentive enough. Where there’s a will there’s a way, and in China, laws aren’t something to be obeyed as much as they are to be gamed and skirted by those with the means to do so.

I don’t really think any of this is news. It’s been talked about extensively over the last few years. Funny money buying homes is unfortunately by nature not amenable to becoming reliable data to make definitive conclusions, but the market behavior of the last decade is highly suggestive of a very substantial problem.

Requiring 5 years worth of T4’s prior to closing on a RE deal with connectivity with the CRA and FINTRAC would be a good start, IMO. Oh, you’re a homemaker and buying a 10M home? Let’s have a little chat…

To take a break from Covid I ran into this amazing video on You tube. Do you remember what you were doing when you were nine years old? https://youtu.be/qDqTBlKU4CE

I’d disagree. I think it is significantly more difficult to use a corporate workaround and you risk being found liable later with penalties as this is illegal, and the number of corporate-owned residential properties in remains low whether foreign or local.

What remains easier and should not be permitted, in my opinion, is satellite families who have spouses/children with permanent residency funded by a breadwinner located in ex. China who is not declaring their worldwide income in Canada or paying taxes on it here. The spouse/children can access low income social services while living in million plus dollar homes and selling without any capital gains taxes. There should be more enforcement on this as it is unfair to Canadians overall and contributes to demand/rising prices.

https://www.vancouverisawesome.com/real-estate/widespread-tax-evasion-real-estate-audits-bc-1942522

It only seeks citizenship of non-residents. If they are non-resident than it is most likely the funds are coming from a foreign country.

However, I do agree that the citizenship doesn’t necessarily mean the money is coming from the country of their citizenship.

Our reporting structure seeks to identify the citizenship of the person taking the title to the property, which may or may not be the actual source of the funds used to purchase. The Province can seek all the “declarations” it wants, the reality is tracing the routing and influx of money generated in another economy is by design almost impossible to do. This activity is what has the market effect; citizenship is nothing more than a label.

If you’re a foreign buyer today looking to purchase in Vancouver, I don’t think it’s very much harder than it was previously, and how to do it is plastered all over Chinese and even English-based websites.

Ants, ants, everywhere. Or smurfs, if you prefer. There’s a very large, mature infrastructure in China dedicated to this…

I guess this depends on your definition of modest. I am quoting from this research study out of the Sauder School of Business at UBC: https://news.ubc.ca/2017/10/23/foreign-buyers-effect-on-vancouvers-housing-prices-is-modest/

That is not to say that a modest effect does not impact demand and have an impact on price increases that taxpayers are opposed to – here the overall estimate was in the 5-10% range in Vancouver. What was more interesting is that the study behind the article found that locals were disproportionately dis/advantaged by foreign buyers with lower income Canadians negatively impacted and higher income homeowners positively impacted.

As for the legal case, judges get to decide the law. They do so on the basis of the evidence provided to them. They are not experts themselves on matters outside of the law, nor do they do independent research outside of what is presented to them by experts unless it is a legal point. A finding of fact based on the evidence presented of significant effect by the experts accepted by the judge may also be classified as a modest effect by other experts. The real question in this case was whether the foreign buyers tax was discriminatory, which it was found not to be.

In any event, whether you class the prior effect as modest or significant, it is clear that a 15% tax has dramatically reduced the number of foreign buyers in BC, and yet prices continue to increase so something else must be at play.

Why not? It’s reporting on the citizenship of the purchaser(s).

PTT data is unlikely to be a reliable measurement.

And in that article I said the much bigger effect was Vancouver buyers coming over, possibly (but not necessarily) because of foreign money driving prices up in Vancouver and giving a unique opportunity to cash out.

Buyers coming from Vancouver have declined drastically in the past few years, but they may very well return. The big difference in house prices remains when historically it was much smaller. If the market in Vancouver stays heated like it has been, it could very well encourage people to come over again.

Too funny, hadn’t read that before.

That “estimate” from National Bank refuses to go away. Here is how they actually arrived at it:

http://www.vancouversun.com/business/chinese+buyers+responsible+third+value+vancouver+home+sales+national+bank/11804486/story.html

“I do think that foreign buyers in Vancouver had some impact on house prices there, although studies show the effect on prices is modest and there is now a tax for this.”

The only people I’ve heard from who said foreign buyers only had a modest impact on Vancouver home prices are those in the real estate industry. This is what the The BC Supreme Court had to say about this topic in a recent ruling on the foreign buyers tax

“The view that foreign nationals significantly contributed to the escalation of prices of housing in the GVRD is neither a stereotype nor a continuation of racist policies from the past. The experts have agreed that the inflow of foreign capital has significantly contributed to price increases in the GVRD.”

https://www.bccourts.ca/jdb-txt/sc/19/18/2019BCSC1819.htm#_Toc22721539

From Steve Saretsky- In 2015 it was estimated by the National Bank of Canada that 12.7 billion dollars of Chinese money flowed into Vancouver real estate. That is 33 percent of the total dollar volume of sales that year.

It’s no coincidence that home prices in Vancouver shot up over 30 percent that year.

https://www.youtube.com/watch?v=cmPII6KrInA

Could it possible be that xenophobia was popular at the time, and good journalism research weren’t properly explored?

Foreign buyers scarce in latest provincial property transfer data — https://biv.com/article/2018/08/foreign-buyers-scarce-latest-provincial-property-transfer-data

And, please educate us how “Detached on a tear” when only 1% of the transaction involved foreign nationals in Lower Mainland, beside the ultra cheap mortgage rate and free bail out monies?

Detached on a tear while condos disappoint — https://househuntvictoria.ca/2020/08/04/detached-on-a-tear-while-condos-disappoint/

Google broken for you?

I do think that foreign buyers in Vancouver had some impact on house prices there, although studies show the effect on prices is modest and there is now a tax for this. My concern with foreign buyers has more to do with satellite families who are granted permanent residency and may access primary residence capital gains tax exemption and get full government services without ever giving back to the economy or paying income taxes in Canada as the primary breadwinner remains working abroad.

There is a link between prices in Vancouver and local demand as Vancouverites make up more than 40% of our out of town buyers. The statement I was responding to; however, was “How many homes are owned by numbered companies, with Chinese owners?”. I provided the data to show not much of this is going on in Victoria.

I think the question you are asking about why prices have gone up faster than incomes doesn’t have a scapegoat-style answer like “dirty money” and “the Chinese”. Prices have been growing faster than incomes for decades and there is an inflationary snowball effect like compound interest. It is a combination of low interest rates, desirability, restrictive land development rules, lack of any taxation on the proceeds of this type of investment, and, perhaps most importantly, a growing population which creates more demand. The biggest factor at the high end is likely home equity itself. A Vancouver buyer can afford an uplands home after selling their modest home in the city. A local buyer who has held for fifteen years may have a million to put down on the next home.

Can anyone recommend a good contractor in Victoria? I am looking at doing a bathroom renovation and possibly some other minor renovations

Here is our very own admin, Leo, making the case that foreign money (how much of it dirty?) essentially jacked Victoria housing – far better than I ever could.

Thanks, Leo.

https://www.capnews.ca/news/foreign-capital-money-laundering-victoria-real-estate

Genuine question: could you please post a link how much foreign capital has been used to buy BC real estate, as compared to domestic capital, every year, say in the last 15 years or so?

You don’t think that foreign buyers jacking Vancouver real estate had the ripple effect of lower mainlanders cashing out and jacking Victoria real estate? Why did housing prices suddenly become disconnected from income?

So, going into the 3rd quarterly reporting periods, we should get a better idea of the active deferrals. Apparently, they are still reporting 760,000 deferrals as of June 30.

https://cba.ca/canadian-banks-are-standing-by-canadians

Reducing credit card interest rates, deferring payments and instituting low minimum payments on credit cards and lines of credit. As of June 30, more than 445,000 credit card deferral requests are in process or have been completed by eight banks.

Canada’s banks are offering mortgage payment relief to customers by way of deferred mortgage payments. As of June 30, 13 CBA member banks have provided help through mortgage deferrals or skip a payment to more than 760,000 Canadians, which represents about 16% of the number of mortgages in bank portfolios.

LeoS: “Those were lender statements I really doubt they would risk making material false statements.”

Sometimes, Leo, it comes down to the interpretation of the lender’s statements. You can either say 6% of their total portfolio or 20% of their total portfolio but it is somewhat meaningless without perspective. It is sometimes easier to just read their statements whereas they state that total active deferrals were down to 30% of the peak.

So, 30% of the people who had requested deferrals are still actively deferring their mortgages. In any event, they were able to bring their deferrals down significantly. Perhaps those people that actually needed the deferral are the remaining 30%.

I imagine if only 30% of deferrals at every bank and alternative lender went into default …. oops.

https://financialpost.com/real-estate/mortgages/equitable-bank-says-mortgage-deferrals-have-plummeted-from-their-peak

Toronto-based Equitable reported Tuesday evening that loan balances on COVID-19-related payment-deferral plans peaked near the end of May at 20 per cent of its total portfolio, or approximately $5.6 billion.

As of July 17, however, Equitable said loan balances still on deferral plans were down to six per cent of its portfolio, or approximately $1.66 billion.

http://eqbank.investorroom.com/quarterly-results?item=37#assets_158_37-9

The duration and depth of the economic contraction, as well as the impact of government support initiatives, will be the key determinants of the

defaults and loan losses that are ultimately realized. A positive signal for defaults is that total active mortgage payment deferrals as at July 17, 2020 were down to 30% of peak levels.

The quote mentioned “… defer or skip…”

That’s not a deferral and would not have been counted as such.

Pent up supply and demand being rapidly depleted now, about 40% of each left. However this may be the lower bound of pent up demand because market was outpacing last year pre-pandemic.

If they are also including people that skipped a payment, then this stat is useless. My mortgage offers me the ability to skip one payment a year no questions asked.

I decided to skip a payment early during the shutdown due to the uncertainty even though technically I didn’t need it. Our trip to Europe got cancelled and airline and resort did not give a refund, but $6,000 in vouchers instead. We decided to rent a trailer instead for 3 weeks during the summer, and I didn’t want to deplete my backup savings too much.

Only the price has been keeping up. A house also provides yield, i.e. rental value. So do stocks. i.e. dividends.

Keeping up with Victoria detached house prices for the last 30 years is something

True, but there’s a reason people aren’t rushing into the job. All great to be in the trades at 20. Not as great when you’re 45, injure yourself and then lose income for 6 months. Needs to be addressed to increase uptake i think

Those were lender statements I really doubt they would risk making material false statements.

Right but cumulative deferrals isn’t meaningful at this point. To know the size of the deferral cliff we need to know current active deferrals.

Pretty sure he was misinterpreting that. I read it as, among those who have more than one deferral of payments, a quarter have two mortgages deferred. Tells us nothing

Between 1/3 of people working for the government, 1/3 pushing paper, and 1/3 on benefits who will actually work? 🙂

If I was finishing high school I would seriously go into trades right now. Trades like plumbing could be serious $ going forward.

Leo S: “Evan Siddall says they believe 14% of mortgages are currently in deferral.

And yet average of First National, Equitable, and Home Trust is 5.9% in deferral.

Does not compute.”

Leo,

Only one of those companies is associated with the Canadian Bankers Association. Perhaps “rates.ca” and “lowestrates.ca” have an interest in downplaying the statistics. Worried homeowners to be don’t take out mortgages.

…. and perhaps the problem is even worse than we originally thought?

Ben Rabidoux:

https://twitter.com/BenRabidoux/status/1296862972548087811/photo/1

And the new benefit will be even less of a disincentive to work

https://twitter.com/creeksidealison/status/1297119850905481217?s=21

He bought shares in Barrick Gold Corp. That’s not the same as buying gold itself, which as Buffett has pointed out does nothing.

Didn’t Warren Buffet recently endorse gold? Kind of surprising…sign of the times I guess.

With the amount of money being spent, one would seem to want some inflation hedge in the portfolio. Real estate, gold, whatever, but I’d be nervous being fully liquid with this amount of money being printed. CPI may stay low but that doesn’t mean we won’t see price inflation.

Cook from Earls with a positive Covid test….

Yep this week was the first week condo sales have substantially outsold the same week a year ago

On Wednesday I went to book 10 run of the mill condo showings in Langford and 8 had an accepted offer….I expect to see a big uptick in condo sales to end the month.

This is both incorrect and misleading. This figure includes land owned by government, corporations, partnerships and sole proprietorships and is across BC, not Victoria. Victoria’s number is 5.2% non-individual owned and the majority of residential land in BC not owned by individuals is vacant and undeveloped. Government owns 3.8% of these lands. Construction companies own 2.1% Unclear how the rest is split between corp/partner/sole prop and the majority of corporate ownership, imo, will be by Canadians.

You may prefer to believe this but it appears to me that Canadian buyers are causing prices to escalate in Victoria because it is perceived as desirable, they have the move up equity, access to cheap mortgages, and a longstanding belief that this is a good place to invest – which it has been in the past because of cheap mortgages and no capital gains taxes. Very easy to blame others.

By your own numbers, foreign & corporate buyers own (at least) 9% of homes. Of course that impacts prices.

And what percent of homes have been bought with foreign and/or dirty money?

I think you missed my earlier comment: “Locals haven’t driven up prices. Dirty foreign money, and Airbnb did that. With the full blessing of our corrupt politicians and bureaucrats.”

Seems like scapegoating.

The number of corporate owned residential properties in Victoria is 5.2% – most of this being vacant land. And this includes not only corporations but properties owned governments, sole proprietorships and partnerships. Of those owned by corporations, a very small proportion in Victoria may be owned by foreign buyers. More common is that retained earnings in small business corporations are used to purchase a residential property – yep, blame the Canadian lawyers, accountants, doctors and other small business owners. Except of course that these people have no public pensions and properties owned by their corporations are not eligible for HOG and pay capital gains taxes – unlike those owned by employees with full full pensions as a primary residence which contribute almost nothing to the economy other than what is spent in home improvement dollars unless they rent out a suite.

If you need a blame target I’d focus on government for low interest rates and lack of any sort of taxation on the sale of primary residences.

https://www.vancourier.com/real-estate/non-individuals-own-10-of-b-c-residential-property-cmhc-1.23631286

You’re not accounting for the years of Chinese buyers prior to the implementation of the FBT, or the propensity of those buyers to scam.

Remarkable how similar the market balance has been the last month to last year.

I wonder if the big demand for detached housing is not new demand, but rather redirected from the condo market. Same number of buyers but all piling in there, via lower rates or stretching affordability.

I was hoping for lower Covid numbers today. Not horrible at the moment but not heading in the right direction.

Sales

Evan Siddall says they believe 14% of mortgages are currently in deferral.

And yet average of First National, Equitable, and Home Trust is 5.9% in deferral.

Does not compute.

What about household debt to GDP? It was approaching saturation even before covid and since we’re a consumption based economy now, that is a major problem. If additional debt is not used to produce new income streams, then all it is doing is moving demand from the future to the present and reducing future growth. ‘Japan is not that bad’ is probably not a great target for us to use. You’ll no doubt know that Japan has tried everything under the sun to stimulate growth through fiscal and monetary stimulus for well over a decade (“The lost decade”). Why mainstream economists still follow this policy and think it works, who knows.

Stagnating growth despite the massive injection of ‘stimulus’ in a period of rising prices is what we can look forward to. This will lead to a much larger homeless population (more deaths and suffering), lower standard of living for most families, reduced social services due to diminishing tax base, and larger wealth inequality. ‘Just fine’ is very subjective.

Pandemics are a bitch.

I think the concern is more related to the sudden and violent rate of the deterioration, not the deterioration itself.

Such a company is legally a foreign buyer and is included as such in the statistics. Of course there may be some cheating going on, but that’s tax fraud. Pretty big risk to take to save on the FBT.

agree, the Chinese are here and looking to buy if they have not brought before. Looking at those new developments in Langford, a few Chinese players already there a few years ago and they are here to stay…..

You may be unaware of Chinese buyers in Victoria because there is still no beneficial ownership registry. How many homes are owned by numbered companies, with Chinese owners? Hopefully we find out in October.

Chinese (dirty) money hugely impacted Vancouver – Vancouverites cashed out and some moved to this island, driving up prices. Chinese money absolutely impacted Victoria real estate prices, both directly & indirectly.

Real estate “investment” is largely dead money to government. There’s less velocity relative to the amount of money tied up, and property taxes are pathetically low, relative to other cities. Little is created (unlike investment in a legitimate business with employees).

Stabilizing the market? These are homes, not widgets. Investors drive-up the cost of our homes. That is not beneficial for society as we have daily proof in tent cities all over the country.

Locals haven’t driven up prices. Dirty foreign money, and Airbnb did that. With the full blessing of our corrupt politicians and bureaucrats.

Couple interesting things on the retail sales picture.

As I understand it, despite a $343 billion deficit (thus far) Canada’s debt-to-GDP ratio is not even approaching worrisome territory yet.

And the good citizens of Japan — the country with the world’s worst ratio — aren’t all eating dog food under a bridge.

So, big picture, I think things are gonna be just fine.

Most investors usually buy assets when prices drop or are low, so they actually help stabilize the market. There are some speculators that try to cash in on rising prices. However, it is predominantly “locals” that have driven the prices up to where they are now.

Only a few countries have wealth taxes and a lot have abandoned the idea or plan to get rid of it. In the Netherlands the Wealth Tax is there instead of Capital Gains. So if you make a giant profit, you don’t pay capital gains over it. However, if you lose money you still pay the wealth tax. More stable revenue for the government, but not sure if it increases their overall tax take.

A wealth tax involves a lot of overhead in tracking and reporting on value of assets at all times and encourages hiding (value of) assets.

Calculating capital gains is relatively easy, because there is a transaction that shows the value at time of deposition. Having to evaluate the value of assets on a yearly basis can be complex especially if there is lack of market pricing on the asset and is ripe with manipulation.

Helicopter money is going to have to happen in order to force inflation (at least by the BOC’s questionable metrics) and monetize all of it.

I will not be surprised if it means home prices go up from their already sickening levels, as people relive the stagflation of the 70’s and rush in to hedge.

Except in the 70’s, the overall levels of debt were virtually microscopic compared to now…

I dont want to imagine the amount of debt that is being taken on at this point by the Feds.

Sigh.

If I knew what company supplied all the printer ink to the US and Canada for all this money printing, I’d be buying their stock.

Forget Tim Cook. Bezos is a bozo. The magic money tree will make me a octonondecillionfiffillionaire…

Consumer spending hit will be brutal once deferrals and CERB/CEWS/CRB expires, assuming they ever do.

So CERB extended by 4 weeks until end of September.

But not to sweat, because the new Canada Recovery Benefit (CERB-by-any-other-name) is there to replace it, so really there is no end date to CERB, it just drops to $400/week and with a sliding scale for income earned rather than a hard cutoff. https://ca.finance.yahoo.com/news/ottawa-extends-cerb-and-announces-three-new-covid-19-benefits-190619588.html

That is how I understand it.

Really good question. If it’s the latter, the effect would have been a massive temporary liquidity injection into the economy at the cost of increased household debt load.

Is that supposed to mean that over 2/3 of borrowers who were behind in May got their payments up to date by July? Or just that the deferred payments were capitalized and they starting making payments again in July? I find the latter more believable than the former. The source article is not very clear.

https://rates.ca/resources/mortgage-deferrals-end-it-worry-time?utm_campaign=deferralend

Back in 2017 I offered the property in Ladysmith to my long term tenants for $325,000, they turned it down probably because they couldn’t qualify for financing. They are still there and it’s now worth $500,000. Some people simply are unable to afford to buy a house possibly because they are not disciplined and waste their money on bad habits. They are paying less than $1500 a month for a 3-4 bedroom home with an amazing ocean view. I doubt they could do any better. I’ll soon have to invest $10,000 in a new roof, there goes any profit. Buying investment properties is not easy, you never know what the future holds. I also own it as a potential retirement home some day.

I wasn’t talking about primary residences. Read the post. I was talking about all assets subject to capital gains tax. There is a deemed disposition upon death. There are some limited exceptions, such as being able to transfer assets to a spouse with capital gains tax levied only upon future disposition by the spouse.

Looks like a flood of 2bdrm 2bthrm condos came on the market in the last couple days. Don’t see any discounts on prices yet, but it should be interesting to see how long they hang out as listings.

Update on mortgage deferrals from rates.ca

Equitable Bank

May 2020: 20% of portfolio deferred.

July 17, 2020: 6%

Home Trust

April 30: 23%

July 31: 7.5%

First National

May: 13.9%

mid-July: 4.2%

You’ve linked an article from 2018 about Chinese investors. We have implemented a foreign buyer’s and vacant home tax in BC since that article was published and I am unaware of any issue regarding Chinese buyers in Victoria? I think our foreign ownership rate is less than 4% and the majority of these are Americans.

I don’t have a problem with a Canadian person buying a rental home here in Victoria, there is low vacancy and this is a needed service and the cost of such housing doesn’t make it super profitable unless you are able to hold longer term which is a risk. The issue with affordability in Victoria likely has a greater link to low interest rates, general desirability, lack of land base in the core, and Vancouverites in a higher priced market selling out and moving here – not locals owning rentals which doesn’t even make sense for most to do in any event.

Your stock market investment is not providing accommodation. And if your investments are in TFSA your gains are not providing the government with tax revenues like rental income and capital gains do. I’m not saying that prices are affordable in Victoria but your premise was that people should stick to stock investing and avoid any other investments as if this was the only moral choice – I’d strongly disagree.

“Untested”? Wealth taxes, heavy taxation on all but primary residences, increased property taxes, and banning foreign ownership is done in countries around the world.

Investors drive up prices & compete with locals who simply want a home to live in. How is driving up prices to the stratosphere “socially better”?

https://www.businessinsider.com/china-investors-inflating-housing-markets-in-us-canada-australia-2018-6

This is incorrect. When you die your primary residence is exempt of capital gains tax until the date of death. It is only taxable on the gain between death and sale and not even that if the heir is eligible for the exemption because they do not have principal residence.

I didn’t know that patriotz. I have been the executrix of a couple of smaller estates….but over $200K. This was for some relatively distant relatives having their kids as heirs. Just a home and basically some cash, bonds & autos involved. Quite a few years ago though. I am going to look into it just over general interest, so thanks for the heads up.

These are already subject to capital gains tax upon change of ownership, including being part of an estate.

Deemed capital gains upon the death of the owner is the main reason why Canada doesn’t have an inheritance tax.

They’re taxed all right. How much of revenue actually goes to winners? Much better marketing wise than hitting the winners with a visible income tax.

I’m not a fan of governments using lotteries to raise money in any case.

whoops……….whether not weather….yikes.

I don’t agree with having a capital gains tax on ones private residence. Nor do I agree with paying inheritance tax. These are the only things left that we aren’t taxed on. Even if they had a capital gains tax on homes worth over say $1.5M…..eventually everyone would be paying. Maybe some kind of inheritance tax in future sales by the heir(s). Such as valuable arts, coin collections etc. So if they want to keep these items to treasure and enjoy in the family fine, but if they sell them they pay a tax on it.

Don’t agree with a wealth tax either. What do people do? Report to the government every time they buy a new Tesla or a 4K diamond? Talk about Big Brother watching.

Absolutely free of tax on Lotto winnings certainly doesn’t make sense. I mean no tax being paid on a windfall of $8M dollars? Silly. Perhaps a base amount of 25% of the actual winning over say two million dollars.

I am in total agreement in having a Universal Basic Income. But forget about separate personal deductions or credits for your non working spouse and children. Same goes for extra funds/credits for seniors. Have this all built in and included in the basic income calculations.

I am also for free medical & dental for children under the age of say 25 years weather they are dependent on their parents, students living on their own or working. There should be exceptions for parents or family caregivers of people with severe disabilities. These caregivers deserve more. Then after that medical & dental should be universally covered with payments pro rated according to family income. So families and individual on the lower income scale would pay very little and the high income earners would pay a substantially more.

A full 70% of working private sector Canadians are employed by small businesses that are not listed on the stock market. Not everyone can be paid by government or publicly funded institutions – although these jobs are really important too. Someone has to take the risk and invest in small private sector businesses and then put the time and energy in to run and manage them so that 8.3 million people have a taxable job. An economic system that doesn’t support this type of labour and investment is not going to have the tax base to pay publicly funded employees or more than basic social services.

If you want to invest I would suggest that the stock market is a fine place, but don’t think you are doing something socially better with your money by investing in this rather than a small business or rental property.

The easiest way to get funding to create more affordable housing is likely to tax primary residences through capital gains. Pretty unpopular but easy to implement.

Government’s job is to make clear, fair, rules and processes to ensure that our society is able to function economically while providing a social safety net. That costs money, more money in times like these. Personally, I’ve got no problem paying taxes and never have – I’d prefer to pay more taxes and not have to avoid Beacon Hill Park or to know that I can go to the hospital without worrying about cost. I also have no problem with tax planning, only tax avoidance.

I’m not aware of Freeland advocating any of these, although she has in the past advocated higher income tax rates at the top end, which the feds have already brought in during their first term.

The federal NDP does openly advocate a wealth tax.

https://www.ndp.ca/news/singh-challenges-trudeau-super-wealth-tax

“We need a complete reset of society – wealth taxes, heavy taxation on all but primary residences, increased property taxes, and banning foreign ownership would help. Use the funds for quality subsidized public housing. A Universal Basic Income is a necessity.”

It is unbearably arrogant to say things like this. It’s fine to criticism our current system, but to assert that a new (untested) system, especially one so specific, would do fare any better is foolish and dangerous. Although it sounds like our new finance minister is in complete agreement, so I guess we’ll find out soon.

That would make housing even less affordable, because people would put even more of their wealth (they already put far too much) into their primary residences to avoid taxation. The current tax breaks for primary residences are already a major contributor to housing unaffordability.

I’m generally OK with the other items, although a wealth tax poses a lot a practical difficulties. I’m more inclined toward taxes on luxury consumption.

Poor Frank. He could sell instead of hoarding our homes.

Ahms for the poors is so Dickensian. Waiting for Scrooge to donate to the prisons & workhouses is the new black. Sorry for the snark Leo – I appreciate the hard work you put into this blog, but selective philanthropy to NGO’s (especially where advantageous tax receipts are issued) has done little to alleviate the very real problems faced by the young and the poor. In fact, it’s getting much worse.

The market “is what it is” because we’ve allowed Canada to be hijacked by global and local wealth parasites who think little of the issues facing the 99%.

We need a complete reset of society – wealth taxes, heavy taxation on all but primary residences, increased property taxes, and banning foreign ownership would help. Use the funds for quality subsidized public housing. A Universal Basic Income is a necessity.

Want to invest? Play the stock market.

Once you have the asset, who will be willing to charge less than market rent or sell their house for less than market price to avoid screwing the next occupier? The market is what it is, and in the end you’d be a chump to intentionally underprice. More bang for your buck to give the windfall profits to organizations that help the homeless / working poor if you want to help.

Market rate is what it is – why is that unethical? Frank said he is breaking even after repairs – maybe. If small-time landlords can’t cover their costs, fewer will enter the market. Affordable housing is just not going to be addressed in the private market overall unless the housing is significantly substandard – the provision of which I would argue is unethical and often illegal. We need more publicly funded rent-geared-to-income units to address this shortage.

Interesting. I think there is a lot I don’t know and, even more, a lot that can’t be known at this point.

We need to keep in mind the difference between premise and proof. Covid is new/novel. We are eight months in. Data is being collected still. We don’t have many proven premises and the data can be interpreted in different ways. Thinking you are right doesn’t make you right and the precautionary principle applies in these circumstances. You don’t get to gamble with other people’s lives.

In specific response to the paper on T-cell immunity – would be good news and there are a number of studies that support some degree of immunity – no-one is sure how long it lasts yet because – yep – so new. To say it is “long-lasting” falls in unproven premise which appears to be speculation. Only time will tell. And, of course, the biggest issue is that to have T-cell immunity you need to have contracted covid in the first place with all the risks that brings to you, or to those you come in contact with who are high risk.

As far as being less deadly, I’m not sure what you are getting at with this? The risk of hospitalization is measurable from data – 20% of those with symptoms end up in hospital – most of them with age/health risk factors, but not all. More than 30% of adults under 65 have health risk factors with covid that could put them in hospital and/or cause death. And we know the risk of death rises as hospitals become more crowded.

Sweden shuts down in July for holidays, only people still working are generally under 25. There are other reasons for the drop in death rate as well as identified in the article linked. Let’s wait and see what the fall brings shall we before jumping to conclusions based on a drop over summer. https://www.businessinsider.com/sweden-coronavirus-cases-deaths-fall-not-mean-lockdown-plan-worked-2020-7

The state of the information about covid we have now does not provide a solid base for lifting restrictions or other measures imo. At least masks are now being brought in for school children under some circumstances. The data supporting their use (which was widely available at the start of the pandemic) plus the precautionary principle would mean this is a prudent step.

Cry me a river.

Bragging about screwing Victoria renters. Good grief.

And older generations have the nerve to chastise millennials for spreading the virus to generations who don’t give a damn about them. Enjoy hiding from the virus in one of your many speculative hoards.

BTW, I’m part of the older generation.

Anyone got a job that pays in gold?

As much as I like arguing with Totoro, I keep coming back because I think I’m right. To further push my agenda of getting the world back to normal, here’s some more really good stuff, from Sweden this time:

https://sebastianrushworth.com/2020/08/08/what-is-the-best-way-to-measure-rates-of-covid-immunity/

“The body’s main defence against viruses is T-cells, not antibodies, and that the only reason we test for antibodies instead in clinicial practice is because it is easier and cheaper”

“the fact that significantly more participants had T-cells than had antibodies, suggests that if we want to know the true rate of immunity in a given population, then we should be looking at the proportion who have covid specific T-cells, not the proportion who have antibodies.”

“SARS-CoV-2 elicits robust, broad and highly functional memory T cell responses, suggesting that natural exposure or infection may prevent recurrent episodes of severe COVID-19”

The implications here are huge – if in fact there are many more people out there that have developed T-Cell immunity (which no one is testing) and T-Cell immunity is Robust,

That’s it for today!

I own 2 rental properties on the Island, one in Victoria the other in Ladysmith. I’ve been an investor since 1989. I have never depended on the rent for income. It seems there is never anything left after repairs, taxes and insurance, as they increase every year. I rarely ask my tenants to leave, unless extensive repairs are needed. The tenants in Victoria left on their own and I was able to increase the rent $600. The previous tenants were there for several years and were getting a good deal. The Ladysmith tenants have been there for around 10 years. I hold the properties strictly for future appreciation and do not expect any income although I probably realize a bit of profit. Bottom line, I can’t make money fast enough to replace the appreciation of the property. Sometimes it hurts to shell out for repairs but you just grin and bear it.

Really interesting interview on money printing and inflation here: https://youtu.be/kJEvuaHyPlQ?t=1378

Inflation will kick in when the central banks start having to pay for government expenditures by directly printing money, which will be required if markets don’t purchase all of the issued bonds. Already happening ‘temporarily’ in the UK. There is a law to prevent this funding method in the US, but there will be pressure to change the law if needed. An alternative solution would be to drastically cut government spending, so I wonder which option they’ll take. Cough.

That graph was before Covid and only up to 2018, but the billions of $ ,,, sorry trillions that has been added since… makes that chart look ridiculous.

We cannot hide from this.

Hmmm @ Fool “That implies limitless confidence in a product that, in this case, has no inherent store of value. If crashes could be prevented by activating the printing presses, then they’d never happen.”

They just started printing $ in USA/Canada in 2009-2010 , Bernanke’s idea . they called it QA or Quantitative easing.. I know you know this.

How many crashes have happened since it started in 2010? Leo , please show them the graph of M2 money supply.

Anecdotal: I was in Parksville/Qualicum Beach last week and the tourist industry there seems to be fine. RV Parks and Mini-golf as busy as ever. Places like Victoria and others that cater to international tourism are crippled. But others that cater to local tourism will probably be fine this summer.

The one thing that might ease the rental situation in our major cities across Canada is the fact that people will likely be working more and more from their homes. It’s already been mentioned by some major businesses that they are quickly recognizing the cost savings that reduced office space offers. They also see the incentive for attracting much sought after employees. I believe that people will start to recognize for themselves the massive cost savings of working from home and will decide to leave the cities to places where houses are much cheaper and taxes much lower…. especially if they do not need to go into to the office.

This new investors driven purchases of apartment buildings could prove to be a short sided bad investment. I wouldn’t do it. Their hope of buying these rental buildings and driving up the rents will only make it easier for people to decide to move out of the cities because now they have a “choice”…. where as before….. they were stuck, because so many people do not want the long commute. Working from home solves a lot of problems. And yes… of course this Covid virus will pass. But anyone running an office or business will need to compete with everyone else and those that embrace having their workers work from home will have a huge advantage. Keeping or expanding the work from home model will also place those businesses in a great position to handle the next virus that will come…. sure as hell.

The calm of diversified investments (Vanguard VTI)

Source: http://stock-chart-art.herokuapp.com/

More on 1560 Brodick Cres (bought to be a student rental in 2017?)

Leo: That is rare these days. I wonder about the wisdom of this sort of offer. It makes the seller sound desperate and my first thought is what is wrong with the house that we dont know about. leo,what do you think?

1560 Brodick Cres

“New price and seller may consider Vendor take-back mortgage.” (on previous listing)

Now that’s rare.

When governments print money something has to balance that money on the other side of a balance sheet. Unfortunately the other side is residential housing, almost the only asset banks will take as collateral. Properties are not going up in value, money is going down in value, therefore it takes more money to buy the same property.

The Covid numbers over the weekend are worrisome. My guess is that even if we start looking like Texas we will not go back into lockdown. Worst case they will require some level of mask wearing to be imposed. They will also have to end restrictions on restaurants as the weather turns worse and patios stop being an option. But that still would leave us a long way from full recouvery since the tourist industry is crippled and likely to remain that way for a long time.

My guess is that the next month will give us a hint whether the dragon is loose.

Morneau is out. Wonder if he’s the fall guy for WE or if there’s something more at work here

Rental supplement will expire Aug 31, so how many Victoria renters could be in trouble?

Back of the napkin math:

I don’t know where the government source is, but there were a few recent stories saying that 86,000 households had received the rental supplement. https://www.burnabynow.com/news/new-rental-framework-attempts-to-block-burnaby-evictions-1.24186523

In BC in 2016 we had 599,360 renter households. So that would mean about 14% of renter households received the rental supplement.

In Victoria we had 60,745 renter households, so extrapolating the BC percentage that would mean 8,700 households in Victoria accessing the rental supplement, maybe it’s ~9500 now with population growth.

Then the question is how many of those households are now back on their feet and will be OK when the rental supplement expires?

Well we’ve regained about 75% of the jobs we lost in Victoria by my estimate, so let’s say 25% of those 9500 cannot pay their rent when the rent supplement expires and CERB expires around the same time. That’s about 2400 people.

+1

Unfortunately the supply and demand model that Tim mentioned is broken by the free money that the government is throwing around. We have tax break programs, incentives, wage subsidies, CERB, CEWS, welfare, low income, etc… that prop up the housing and rental market, therefore the demand is artificially higher than what it would be. And, landlords are in the business of making money, hence they also want to get their hands on some of that free money by increase rent which ever way they can.

“I’m not sure if this is currently happening anywhere, but it makes sense to look into abuses stemming from a large market share.”

This happened in James Bay.

“I would like to see evidence of this.”

No evidence unfortunately. Just personal observation.

“Excellent article. Thank-you for bringing a bigger picture into the debate.”

Agreed! Excellent article. I also appreciate the big picture look at things. The linked VS article was great too.

Excellent article. Thank-you for bringing a bigger picture into the debate.

I’m not sure if this is currently happening anywhere, but it makes sense to look into abuses stemming from a large market share.

I would like to see evidence of this. I don’t think it makes business sense to keep units empty on purpose to try to artificially raise rents. Unless you had cornered the majority of the market this would backfire.

No doubt cracking down on this kind of bullying is a good idea.

I agree that supply is a major problem but so are the actions of companies like Starlight. Starlight creates a monopoly in an area by buying up as many buildings as possible then jacking up the prices for all their buildings and setting a price precedent that other buildings will then copy. If people can’t afford the prices they leave the units empty, creating more of a shortage of supply. If Starlight bought the odd building it wouldn’t have such an effect, but the fact they buy multiple buildings in the same area makes their effect on rental market prices much more harmful.

The real problem in Venezuela was and is dysfunctional governance. The money printing and inflation is just a symptom, as it was in Zimbabwe, former Soviet bloc, Zaire, etc. They weren’t responding to downturns in otherwise functional economies.

The great increase in money supply in developed economies post-2008 didn’t result in consumer price inflation (as many had predicted) because productive capacity was functioning.

I thought the problem with Venezuela was that the Americans will do anything to interfere in governments when they want to steal a country’s resources.

People hate simple answers. Supply and demand period.

With Venezuela, wasn’t part of the problem that they QE’d vastly out of scope with the global average? If every country across the globe increased their monetary supply by 10% over 2020, wouldn’t everything just kind of balance out? Genuinely curious as I’m no economist.

That implies limitless confidence in a product that, in this case, has no inherent store of value. If crashes could be prevented by activating the printing presses, then they’d never happen.

Like I’ve pointed on this site numerous times, they’ve tried that for eons whether it be through pure fiat, or by reducing the weight of precious metals in coins and replacing it with something cheaper. Same difference in the end, and if that can bring down the mighty Roman empire…ya I don’t think there’s a lot of argument supporting a “print to prosperity” mantra.

The one thing that the US does have going for it is it’s status as a reserve currency. But history shows that doesn’t tend to last more than a century or two, and besides, Canada does not enjoy that status.

I think that’s generally correct, but when owners are amateur investors, it’s more likely that they’re disconnected from stats like vacancy rate and are focused on keeping consistent tenants more than jacking rent up as high as possible.

My experience with Starlight was pretty shit. They know the laws obviously as they’ve been around for decades but they do their best to ignore them and make pseudo legal threats by email for no reason. We even had a property manager steal tenant items. Eff starlight.