Supply is not the problem? A rebuttal

This weekend I read an article by Dr. Joshua Gordon in the Globe and Mail arguing that the focus on housing supply is a red herring, and demand stoked by foreign buyers, cheap credit, and speculation is the real problem behind our unaffordable prices. I was going to write an irritated tweet in response, but the article is such an egregious example of misdirection, half-truths, and poor logic that I felt the need to reply at greater length.

In this article, the author would like us to subscribe to a peculiar type of magical thinking: that housing is the only good in the world where supply and demand do not apply equally. If you stood up in an economics class and argued that the price of oil was set more demand than supply you would be laughed out of the room. Having the debate about whether one is more the problem than the other is absurd, it is always about the balance between them. Any problem on one side can be restated as the inverse on the other. For example, in the early days of the pandemic the demand for oil collapsed, but you could equally say there was an oversupply problem that caused prices to crater. So the whole discussion about which is more important is going down the wrong path, but let’s put that aside and look at each of Dr. Gordon’s arguments in turn:

First, there have been no major changes to the regulatory framework around supply in either city since the early 2010s. Yet benchmark house prices in both cities have risen between 75 per cent (Vancouver) and 115 per cent (Toronto) since 2010.

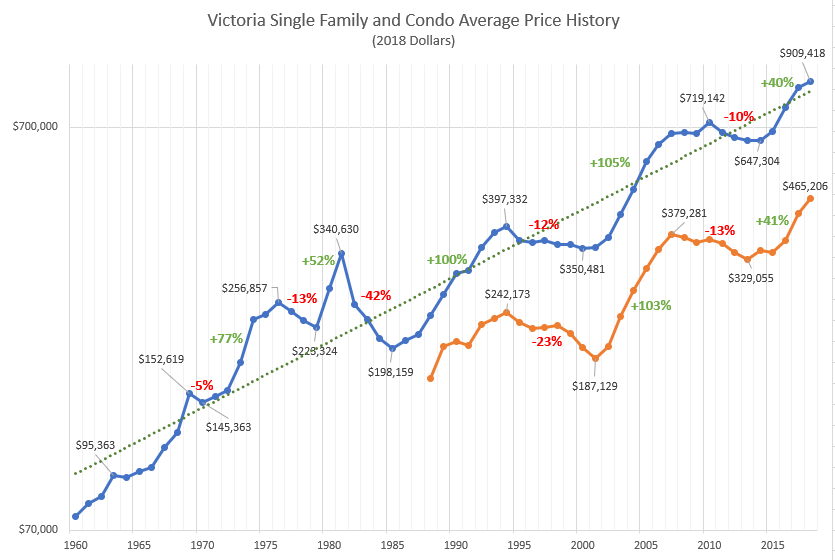

The idea that affordability challenges in Vancouver and Toronto are new after 2010 belies an ignorance of history that I am surprised to hear from someone who is focused on housing policy. The reality is that house prices, especially detached, have been rising at a rapid rate in those cities for many decades. Note I will use Victoria data in my arguments because I have it readily available, but the same factors apply in Vancouver. Were people not concerned about affordability when prices doubled from 2000 to 2010? Was affordability not an issue when they doubled from 1985 to 1994? In fact if you look at the average in Victoria, detached prices have been doubling every 10 years or so for 60 years. I think the rate of appreciation will slow down substantially in the future for various reasons I’ve discussed before, but it’s clear that prices have been outpacing income gains for a very long time.

Back to Vancouver where Dr. Gordon is from. If you have any doubt that people have been concerned about housing affordability in our big cities forever, just watch this play from 1981 in Vancouver where Boomers humourously take on the outrageous house prices and rents in the city. It’s clear that this problem has been building for many decades.

Second, rates of housing construction have remained very strong for several years. In fact, in Vancouver there were more housing completions from 2015 to 2020, in the midst of the housing crisis, than there were in any five-year period before that.

This is a statement that should be true in every single city that has a growing population. If a city is growing at a constant 1% or 2% a year, then every year should have more construction than the last to house the growing absolute number of newcomers. Of course market cycles mean construction goes up and down, but over time it should always go up. Without an analysis of housing need, this statement is meaningless. The rapidly increasing prices during that time provide a strong signal that the level of construction was in fact not enough to meet demand.

This broad pattern applies to rental construction too. For example, Vancouver saw more rental completions in the five years from 2015 to 2020 than in the previous 15 years before that combined

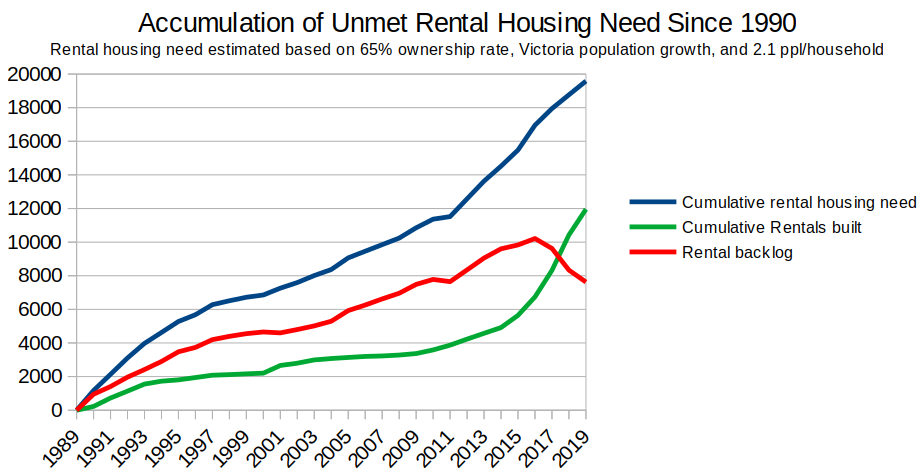

I’m having a hard time imagining how someone could look at our record on rental construction and see it as some kind of success. Yes there was a surge in rental construction in the last few years and we’ve kept a pretty good rate going since then. However that came after literally decades of neglect where almost no purpose built rental was constructed at all. In Victoria, we will have to keep building at this level for another 10 years to just dig ourselves out of the hole we made since 1990, let alone before that. The situation in Vancouver is much the same.

Sure, we may have a temporary spike in rental vacancies right now due to the pandemic, but before that we had a 1% vacancy rate, and a rapid escalation in rents. BC has the highest rate of forced moves in the country and many are suffering due to insecure or unaffordable housing. Although the pandemic may be all-consuming right now, it will pass and the demand for rentals will return. The solution will require years of a high level of rental construction followed by a steady medium level in perpetuity to ensure we don’t make the same mistake again by neglecting the problem until it turns critical.

Third, sharp increases in housing prices have happened in many cities surrounding Toronto and Vancouver, even though there are far fewer regulatory and geographic supply constraints in those areas.

While I appreciate him linking to my article in the Capital, I’m truly baffled at his assertion that Victoria has fewer geographic or regulatory constraints than Vancouver or Toronto. I assure you the blue on the map around Victoria is not buildable land. With 9 municipalities each with different regulations some of which are decidely anti-growth, a sharply constrained urban containment policy (which I support), and a population that thinks going to the supreme court is a reasonable response to some townhouses, it’s quite an amusing thought that Victoria is an easy place to build.

However, there is no clear relationship between the prevalence of single-detached zoning in Canada and the level of affordability in a city. If anything, Canadian cities with the highest share of single-detached houses have the least intense affordability challenges

No wonder that there’s a crisis in social science if this is what passes for an argument. Yes, small cities generally have nearly 100% single family zoning and also tend to be relatively affordable. And shark attacks peak when ice cream sales are highest. To be fair Dr. Gordon quickly backs away from this line of argument, but why even float the association between prices and zoning amongst non-comparable cities if you aren’t meaning to imply a causal link?

Of course, that pattern exists not because single-detached zoning causes improved affordability. Rather, it’s because strong demand pressures tend to cause both denser housing patterns and higher prices.

In this section in an attempt to disprove the YIMBY argument, the author proves it himself in the next sentence. Yes, demand pressures force up prices because more people want to live in a city. If we build more housing for those people, it helps alleviate those affordability pressures. If we don’t build more housing, affordability gets even worse and many of those people don’t get to come at all. There is nothing simpler.

That’s why Hong Kong and Manhattan are highly unaffordable, even with no single detached houses in sight. Similarly, paragons of “missing middle” housing, such as London and Stockholm, are also highly unaffordable.

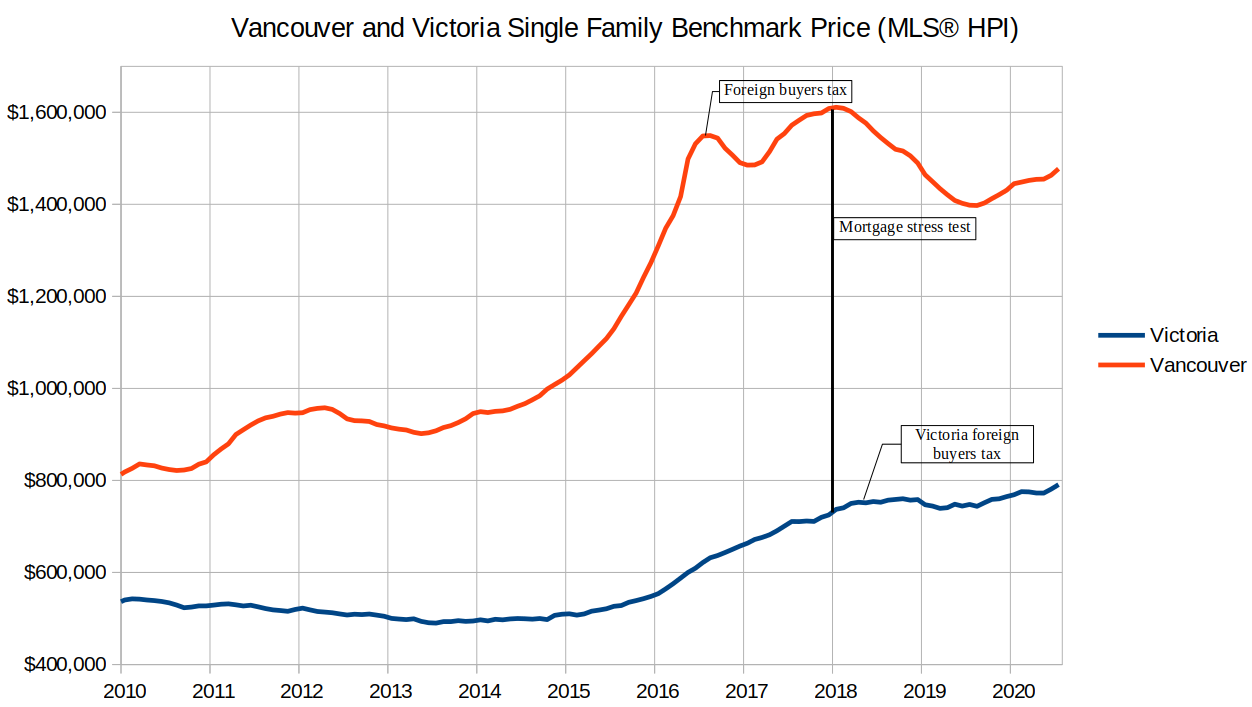

By analogy we might say “It’s still hard to find N95 masks despite a huge increase in worldwide production. Therefore production makes no difference to availability”. Closer to Dr. Gordon’s heart we might say that restricting access to mortgage credit or limiting foreign buyers did not make Vancouver housing cheap, so demand measures are useless. Obviously this is not the case. The mortgage stress test and the foreign buyers tax both had a measurable impact on the market, causing it to flatline for some time when it otherwise would have continued to increase. However there is no such thing as a silver bullet in housing that will make properties affordable overnight.

Coming back to the example of expensive cities; first of all Manhattan is only Manhattan because it has the density of high rise towers. If Manhattan was zoned as single family it would be a backwoods commuter community that no one had ever heard of. As for any other dense but expensive city, it simply shows that despite increased supply, demand is still high enough to push up prices. But if there was no missing middle housing in London many people who want to live there simply couldn’t and the city would be much less economically successful (and prices would be just as high or higher).

Demand measures are important, but we have already done a lot

There are several peer-reviewed articles that document the connection between demand-side factors and housing prices in Toronto and Vancouver, particularly the role of foreign ownership and speculation. Yet that peer-reviewed research is dismissed or ignored by advocates of the supply narrative.

I agree it’s important to look at demand, and ensure it actually represents people living in homes rather than speculative purchases that won’t be well utilized. But to argue demand measures have been ignored flies in the face of the facts. In the last dozen years, governments have:

- Reduced mortgages from 40 year zero down to 25 years 5+% down and tightened mortgage credit dozens of times.

- Introduced the mortgage stress test which took some 20% of the most highly leveraged buyers out of the market

- Introduced the foreign buyers tax which dropped foreign buyer activity by some 80% in Victoria and 70% in Vancouver

- Introduced the Speculation and Vacancy Tax provincially while Vancouver introduced their own vacancy tax

- Taken steps to limit AirBnB in Victoria and Vancouver

- Started investigating money laundering with a new public inquiry

- Planned to roll out a new beneficial ownership registry for housing.

And what happened to prices? It helped some for sure. Especially the stress test had a big impact and the foreign buyers tax also seems to have helped in the hotspots like Vancouver. Prices dipped a bit after its introduction, while the stress test caused a good price decline in Vancouver and held our prices steady. Vancouver detached prices are roughly unchanged from 4 years ago. The jury is out on the spec tax, and we’ll see what comes out of the money laundering investigations.

I support all these demand measures with only some reservations. While they each have their downsides, I believe the net effect is positive in controlling toxic demand and preventing consumers from over-leveraging. But these measures can only do so much.

What does it mean to control demand anyway?

We can all agree that sensible demand measures are a good thing. We don’t want people borrowing too much and creating an economic collapse like we saw in the US. However you feel about foreign buyers, we can likely all agree that homes are meant to be lived in, and we don’t want our cities to be filled with vacant homes while locals struggle with affordability or are forced onto the street. Similarly we don’t want our residential areas turned into AirBnB hotels or homes to be used as a way to launder money. That is toxic demand, and BC has taken several steps to control it in recent years and are implementing several more.

However, after all the measures listed above were implemented, toxic demand is not a large part of the market anymore. Double vacancy taxes in Vancouver mean that people aren’t leaving a substantial number of properties vacant and data from these taxes backs this up (other good data on vacancy here). Direct foreign buyers were reduced drastically already, and the noose is tightening on other loopholes allowing money to be hidden in real estate. We might argue about investors scooping up condos, but if they’re not leaving them empty, I don’t see the problem. Investor interest in housing increased because of the gap in the market left by our failure to build purpose built rentals. They are a symptom of the problem, not the cause.

With toxic demand tamped down, what kind of demand is left? Regular people wanting a place to live.

Thus, when people say we must further control demand they are effectively saying we must prevent people from having a home. If people were only fighting resale supply they could conceivably hide behind a misguided concern that all the demand is toxic, but here we hear a similar push back against new rental supply which isn’t subject to any of those problems. And who lives in newly built resale housing? Data shows it’s normal families, mostly locals. Yes new housing is more expensive and won’t be affordable to everyone from the start, but as long as someone is living there, it prevents housing from becoming even less affordable and prevents the displacement of lower income folks by higher income people competing for fewer properties. That is true for rentals and the resale market.

Dr. Gordon concludes his argument by innocently wondering why people may not agree with him. “The narrative is useful to powerful people” he surmises in an attempt to appeal to our desire for conspiracy thinking. I’m all in favour of being aware of motivations and being wary of real estate industry talking points. I’ve often pushed against them on this blog. But the importance of supply to the supply and demand equation is not a talking point, it’s economic reality.

If the big expensive cities were losing people then affordability wouldn’t be a problem and we could forget about new supply. But we aren’t losing people. We’re gaining them, and in Victoria we’re gaining people at a faster rate than in the past. So given demand is high, we need to focus on creating the supply to allow those newcomers and existing residents to continue to afford a place to live here. Let’s not bury our heads in the sand and think this can be solved by doing nothing.

But at least you got the last word in 🙂

A house which you need to live in is very different than a share in a garbage company that makes no money. The analogous house would be one made of cardboard, in which case I agree that more supply of cardboard houses does indeed not help. Or alternatively, supply of high quality public companies actually would help a stock bubble as it would disperse investors into more stocks and reduce overvaluation of the market

Also the demand for housing is quite inelastic, while the demand for trendy stocks is highly volatile and can collapse to near zero when sentiment changes.

No didn’t mean that. Probably past the point of being worthwhile discussing as I’ve already posted what I meant in detail below.

No – not sure how you got that from what I wrote. I don’t even know what the first part even means. As for the second, I don’t know. We already have more citizens/residents moving to Victoria than leaving. Housing is more complex than one factor which is why it is not easy to talk about it without accounting for all the factors and whatever mysterious compound they end up making that keeps prices rising.

I also agree the tech bubble in 2000 analogy does not really make a lot of sense. A better comparison would be to Apple stock which had been going up for years. Apple just made their stock way cheaper by splitting it in 4 and multiplying their supply by 4.

So increasing supply made their stock more affordable. Another way of increasing supply of stock when the price is high is for the company to issue more shares which usually has a downward pressure on prices. This is a logical thing for companies to do when their shares are overvalued.

My analogy is probably as useless as the original one…

Are you saying that if the market were allowed to set rates and/or the government were to deem residential housing a strictly a necessity of the citizens/residents living here that we would not see bubble like declines in the price of RE?

The fact that there is a pre-existing upwards trend in housing prices neither proves nor disproves the existence of a bubble at any point in time. Stock prices have a 200+ trend in the upward direction. That in no way stops the market from occasionally rising to bubble levels.

If I take your statement literally you seem to be saying that because housing prices generally go up they can’t rise to bubble levels ever. I doubt that is what you meant…?

You asked why the analogy didn’t work. This is not a cliche for affordability or justification for housing prices, but a response to your question as to why stocks prices and housing prices are not comparable investments. The demand for stocks is not propelled by the basic need for a necessity of life. When used as a pure investment vehicle they are also not the same because you can finance a house with cheap credit and the majority of buyers do and you can deduct the interest against the rental income which a stock does not provide. The analogy just doesn’t work to prove that supply does not affect the pressure on demand for housing within the affordability bands. And it is a waste of time to debate the analogy imo when the real question is what does create affordable housing options and potentially dampen appreciation.

When housing becomes unaffordable, building more unaffordable housing does not solve the issue. What is needed is more affordable supply which is, again, why large cities with an exodus of younger folks are looking to increase density on existing SFH lots by allowing both subdivision of existing stock and legalizing rental suites and carriage homes. Capping prices on redeveloped units on SFHs forever at a level affordable to those with a current income of 80k will definitely create more affordable housing if there is any uptake by owners. I’d suggest that capping the capital gains tax exemption for a primary residence and using the tax windfall to invest in affordable and subsidized housing may be helpful as well.

https://www.policyalternatives.ca/sites/default/files/uploads/publications/BC%20Office/2016/05/CCPA-BC-Affordable-Housing.pdf

This cliche must be the weakest ever justification for housing prices. You could literally use it to justify any level of housing prices.

Housing affordability has worsened despite significant new additions to supply.

Because people need to live somewhere, they don’t need to buy stocks and the price of entry for a home is precluding ownership or rental for many. Almost anyone can buy a stock and it is not a necessity.

Owned houses are shelter and investment. Rented homes are not assets for those who rent, but pure shelter. When people cannot find an affordable place to live it is not just about supply, but one aspect is creating more affordable supply when we need workers at various income levels to run a city and when we also have a crises in homelessness that is growing (also many factors). This is why Portland, Vancouver and Seattle are all considering how to increase density in core areas on SFH lots to create more affordable places for rental and ownership and, at the same time, Vancouver is taxing empty homes and there is now a foreign buyer tax.

How can there be a bubble in real estate if there has been a 60-year trend in this direction? A one-year rise in the stock market based is really not comparable.

OK. Let me put it another way for you. Real Estate and stocks are both assets. Both asset classes are prone to bubbles at times. Why would increasing supply be a useful and necessary response to a real estate bubble but not to a stock price bubble?

I believe what Caveat is saying is that both stocks and residential RE have comically mutated into investment instruments as opposed to their intended purpose – one to provide shelter and the other to provide capital for expansion and production. While a house still provides shelter it is also looked at a primary investment, at least for the middle class. Both have become dead weight in terms of productive allocation of capital – housing due to the skyrocketing prices. This unhealthy economic system being the creation of the dual forces of globalization and monetary policy. Increasing supply will do almost nothing in this monetary environment short of paving the entire island into one gigantic hood. I doubt even that would stop it. Just a guess. The cost of money is almost nil and with the free market system essentially declared dead what makes anyone think that money would stop flowing into housing or the government would not backstop it all until hell freezes over. If you build it the money will come. I see no end to this other than allowing the market to set rates and implode, removing the financial incentives to park money in residential housing, and choking off globalization. None seem likely, but the latter should be done solely for the sake of the planet. Nobody seems to be talking about how consumerism i.e., cheap goods are one of the worst contributors to climate change.

I’m confused by the stock analogy. Are you comparing a 60-year trend in RE with the 2000 tech bubble? You can’t live in a stock. Affordability is a fundamental issue with shelter and shelter is a basic need. We objectively have a shortage of affordable housing – whether to own or to rent.

There has been a lack of government investment in affordable (non-market) housing. It has been needed for decades and this need has not been met by basement suites and condos. New purpose-built private market rentals won’t be affordable for most. They can’t be. The land would need to be free for a developer to be able to provide this type of housing.

If we are talking about affordable SFHs in the core, that boat has passed.

I think saying that more housing supply is not needed is obviously incorrect, but it is not just any supply and there need to be other changes if the goal is to create more options for families who are median income or lower to own or rent in Victoria other than a small apartment.

Sooke is a beautiful area and has potential to grow a lot (not sure how much land they have to expand into?). What would concern me is the sketchy road access. Used to have a colleague that lived out there and commuted to Victoria, and she was often either delayed for hours due to an accident or the road would close entirely after a storm. But if you don’t have to commute every day…

This analogy makes no sense whatsoever

Monday numbers: https://househuntvictoria.ca/2020/09/14/new-condo-listings-up-50-but-detached-inventory-remains-tight/

Leo re supply and demand:

It isn’t absurd to look at changes in supply and changes in demand separately in trying to look at the causes of price movements.

Let’s apply Dr Gordon’s and Leo’s (paraphrased) arguments to the tech bubble of 1999-2000.

Dr Gordon: We don’t need more IPOs (supply) of sh**ty internet companies. Rather the rise in stock prices is driven by artificially stoked demand.

Leo: We need to look at the supply side. Prices are rising which means demand is exceeding supply at the current price. We can alleviate this by having more IPOs (supply) of sh**ty internet companies.

With 20 years of hindsight does anyone really think it is useful to explain the 2000 tech bubble in terms of an inadequate supply of equities to invest in? Would more IPOs and secondary offerings of stock (increased supply) have been a good response to the bubble?

QE has been increased…. so is the inflation. The land price level only got one direction to go. Unless the building cost and labor cost can be controlled, it is unlikely to get the housing price down.

I feel even Sooke is booming ( sorry I live in Victoria and seldom go out to Sooke or Langford.) My friend just sold his older box in Gordon Head and move over to Sooke as they believe to invest something relatively cheap and hoping to hold for the next 20 years before he retires. We will see what happens.( I personally do not think GH/Victoria would have that much room to go up any more whereas Sooke has lots to room to growth in terms of appreciation)- thoughts?

I don’t think there is data on demolitions although I have seen some people estimate it roughly, via a formula I can’t recall. I have posted building vs population growth charts before, if I could only find them….. There is this article: https://househuntvictoria.ca/2019/05/08/construction-per-capita/

But it’s not exactly what I was thinking of.

But this is really the wrong way to think about supply. Population growth is a dependent variable on housing construction. If you don’t build the housing people can’t come (unless household size increases). And the increasing prices seem to indicate more people are wanting to come than are being accommodated. Could be useful to track overbuilding, but likely that would be evident more in high inventory and high vacancy rates.

For the past 2 or 3 decades there was no need to add many purpose built rental buildings because during those same decades the number of basement suites grew exponentially, albeit mostly ‘illegal’ suites until relatively recently. In addition, many condo buildings were actually de facto rental buildings because individual investors bought the new condos and immediately made the condos rental units, Marko and many others did this. Only when the growth rate of basement suites and condo-rentals started to decline a few years ago did it become economically feasible to start building purpose built rental buildings.

I don’t see any ‘neglect’ when purpose built rental building were not being built, it simply wasn’t economical or profitable because an adequate supply of new rental units were added each year with basement suites and condos, until a few years ago.

So has the rate of building (minus demolitions) exceeded, equaled, or fallen short of the population increase? That would be one way to say if there is a supply problem. The only building statistics you show are for purpose built rentals which are a small part of total housing stock.

No wonder there’s a crisis in social science indeed. That linked article is a total blockbuster. “Actually diving in to the sea of trash that is social science”. Yikes. Glad I’m not a psychology researcher.

Gordon Head/Mount Doug house prices: In and around the beginning of 1971 a 3bedroom, 1-1/2 bath, 1200 sq.ft bi-level home with unfinished above the ground “basement” went for about $28K. Now in almost 2021, the same house with the same unfinished lower level would go for $750-$800K. In the beginning of 1973 that same house would have sold for about $32K, a few months later for $36K then by the end of the year $46K. In the beginning of 1981 it would have sold for between $125K – $130K. Then when the crash came, that same house fell in price very rapidly down to about $95-$100K. The prices really soared in 1980…..so the losers were really the ones that bought in about that 12 month period. Many had to walk away as they lost everything including all credit. So the that house bought in the beginning of 1971 til lets just guess the beginning of 2021 (50 years), would have almost increased in value by 100% every 10 years. And really, all you would have had to change in that home would have been the flooring/carpeting to hardwood in the main areas once and the roof if you were lucky once . Most people did put in new 1/2-3/4″ thermal windows. I remember the one I bought in 1973 ish had 1/4 inch thermal windows.

That chart shows inflation adjusted house prices. Average real increase yearly is about 3.75% after inflation, but that is about 7% nominal (inflation used to be higher).

https://househuntvictoria.ca/2016/03/17/a-brief-history-of-prices/

interesting article, but it seems premised on the idea that housing prices have doubled every 10 years over the last 60 years. No fair measuring from a price trough to a subsequent price peak as you did for a couple of representative time periods. That would mean an appreciation of about 7.2% per year, or a current mean house price of about $4M. Instead, taken over the 58 years shown, the average yearly price increase is 4.6%, or doubling every 15 or 16 years. That’s still well above inflation, but not as scary especially given current interest rates. I think the affordability graphs you’ve shown in the past are more relevant.

With what California, Oregon, and Washington are going through, we can only hope…

https://www.bloomberg.com/news/articles/2020-09-13/bp-says-the-era-of-oil-demand-growth-is-over

No doubt. But any measure to reduce investors would have to be matched with an equal increase in purpose built rental construction.

In 30 years, Vancouver is predicted to have the climate of current-day San Diego. Victoria will be similar, I assume.

So in 30 years, maybe Prince Rupert will have the climate of current-day Victoria.

https://vancouversun.com/news/local-news/climate-change-predicted-to-transform-vancouver-into-san-diego-but-at-a-heavy-cost

Immigration numbers are only part of the story. It is the type of immigrants we are letting into the country that creates a housing problem.

Croatia is a small country of 4 million. Victoria is a smaller city in Canada and I know 10 Croatian recent immigrant families that have purchased real estate in Victoria in the last three years. So 10 couples x 2 = 20 people. One electrician and one guy works installing garage doors. Remaining are government (at least 6 or 7), IT industry, finance, etc.

I had a drywaller friend from Croatia that was renting a crap place on the Gorge working 50-60 hrs a week and after two years he couldn’t get PR (application wasn’t perfect) and he had to leave so he is now drywalling in Munich, Germany.

My on the ground assessment is it is so ridicolously difficult to get into the country (you basically need to be <35 yrs old, great english, university degree, etc.) that the immigrants we attract create demand within a few years of landing but we aren't attracting immigrants that can help with the supply problem (insanely expensive constructions costs partly due to labour shortage in that industry).

Having smart immigrants might help overall but certainly doesn’t help housing affordability imo. If I know 10 couples from a super small country that have purchased in Victoria than on a national scale it must be just nuts.

I still think a primary residence or gtfo policy makes sense.

I agree, but I think this symptom is more like an infection that just a symptom. It worsens affordability if left unchecked.

Sorry what?

Here is what I have written about immigration in just the last year:

Immigration and Home Ownership: https://househuntvictoria.ca/2019/04/16/immigration-and-home-ownership/

Let’s talk immigration and housing: https://househuntvictoria.ca/2019/10/17/lets-talk-immigration-and-housing/

Do non-permanent residents add to housing demand? https://househuntvictoria.ca/2019/12/27/do-non-permanent-residents-add-to-housing-demand/

As for cutting immigration to reduce demand, I don’t know enough about the policy to have many thoughts about it, but great, let’s have that conversation nationally. However for city policies where most supply decisions are made, there is no control over national immigration policy, so you gotta deal with reality on reality’s terms. For a city to say “well we’re ignoring housing problems because we feel they should be solved at the federal level” is a huge cop-out.

Good response Leo. Someone needs to get a a rebuttal out there that people can understand as Dr. Gordon is now being used as an authority to support the NIMBY argument. That would be fine if his assertions made sense, but they don’t. They confuse the facts in a manner that the average person can’t easily respond to. You might be interested in this take on the data used in the working paper: https://doodles.mountainmath.ca/blog/2019/06/25/how-not-to-analyze-the-roots-of-the-affordability-crisis/

James: I understand your PC comment but this whole concept that someone decides the parameters of rational thought based on their ideology seems totally perverse. The most political incorrect thing I can think of these days is this insane concept of political correctness that has been foisted on us.

You start getting into un-“PC” territory pretty quickly with that. I do like your often stated solution gleaned from Switzerland though.

LeoS: Now that is a response that I would expect. I made no reference to Dr, Gordon but rather to your discussion of the demand side of real estate. But you are right neither you nor Dr. Gordon mention the single biggest driver of demand which is population increase which in turn is primarily driven by immigration.

You will note that I did say that you did a good analysis of Dr. Gordon’s position. My point is that I have noticed that in repeated discussions of supply and demand in the real estate sector on the single biggest factors, population increase, is usually totally ignored or overlooked. I find that incredibly strange.

Sure, and if that’s Dr. Gordon’s desire then out with it. Immigration wasn’t brought up once as a source of demand that he would like to reduce

LeoS: Good analysis but I noticed that you have left out the elephant in the room when it comes to demand.

Increased demand is principally a product of increased population. Yes, there are other factors like shifts of population from one region to another or rural to urban. But the single biggest demand driver these days is population growth.

In Canada the vast majority of population growth is exclusively due to immigration. We are currently running at about a net immigration of about 300K a year. That translates into about 100,000 housing units that need to be built per year. More people equals more crowded cities which equals increased prices.

The reality is that controlling demand relative to supply is easy. Massively cut back on immigration for a few years and let the supply side catch up. Even suggesting this leads to major fits of apoplexy in everyone in the real estate industry. The mere suggestion of freezing immigration for a few years gets the usual charges of racism being trotted out followed by the assertion that we need increased numbers to produce more prosperity. The problem with the latter assertion is that there is scant evidence that immigration over the past decade has increased the prosperity of the nation as a whole.

Back to my point which is that in my experience virtually everyone in the real estate industry seems to totally ignore the single biggest driver of demand which is population growth. At the very least one would think that housing crisis in most of our major cities would spark a serious review of immigration policy. But can any sane person suggest that if our population stopped increasing that the demand side for housing would be greatly reduced.

I think it’s simple, if mortgage rates were 7-8%, house prices would be 1/2 or less. Unfortunately, uncontrolled money printing creates a glut of money supply, therefore, interest rates are extremely low, and house prices are extremely high. The result of high interest rates would be money hoarding which would create a stagnant economy. Maybe it’s not that simple.

Thank-you for being a voice of reason and sanity in the world of Canadian property journalism. Leo, someone should really give you a grant to do more of what you are doing.