Construction per capita

Thanks to reader James Soper for the idea for this post. Given the preponderance of cranes downtown and the construction industry screaming for trades, it is sensible to look into whether the amount of building going on is actually overbuilding. I have previously looked at a rough version of construction rates vs dwelling needs from construction and population growth data but it makes sense to also compare the construction rates to other cities in Canada to determine what is normal.

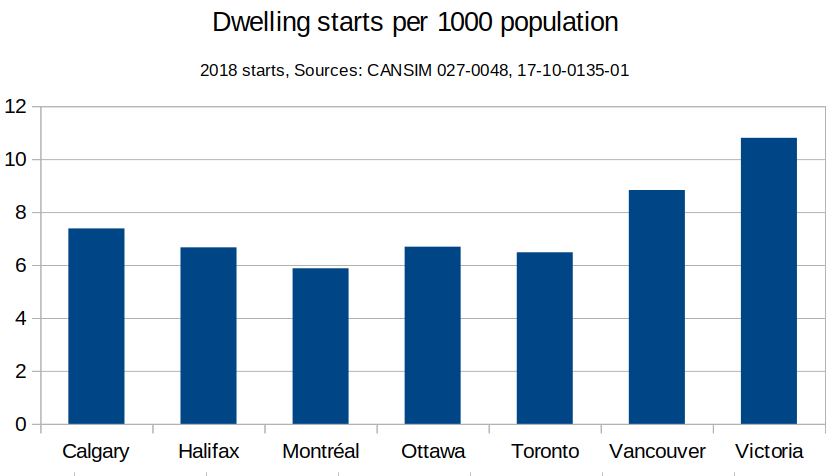

One way to do this is to look at construction per capita, where we see that we are currently starting substantially more units per capita than other major Canadian cities.

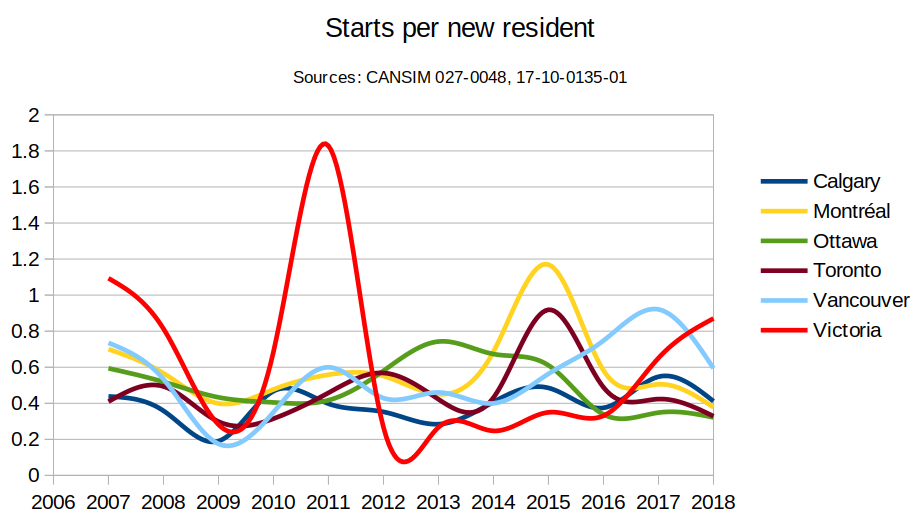

But of course what matters is less the size of the city and more the rate of growth. Fort St. John is small but growing quickly, while Chicago is big but likely not requiring too many new houses. So instead of per capita we can look at construction starts relative to the growth in population (new residents).

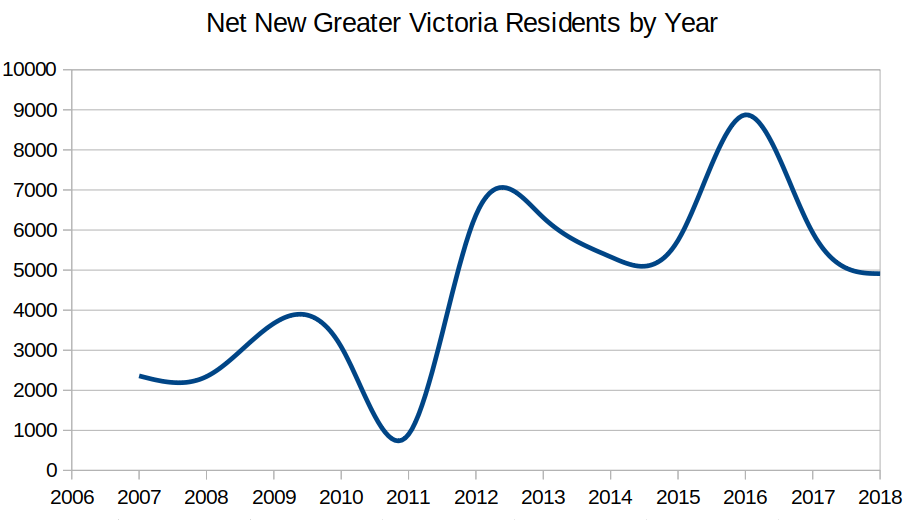

This chart might be surprising to you. How is it that we are building an all time record number of units but the units/new resident is much lower than in 2011? The answer is of course in the rate of population growth which was almost zero in 2011 (at least according to statscan data) and has recently been elevated.

So our high construction rate is certainly outpacing the requirements from current population growth (an average of 0.5 dwellings per new resident would be sufficient to house incoming residents) but it doesn’t appear that the construction rate constitutes overbuilding given we are building from a position of low resale inventory and low rental vacancy rate. Construction starts also seem to be turning down so I suspect 2018 will be peak construction.

Also note the spike in population growth in 2016. This coincided with the surge of Vancouver buyers and associated jump in market activity. It will be interesting if the elevated growth rates in the last 5 years are the new normal for Victoria or if this will settle down again towards our longer run average of ~1% annual growth.

@guest_59533

My husband is a BC master electrician, he would be happy to talk to you about EV charging.

New post summarizing my thought and the issue of the magnitude.

https://househuntvictoria.ca/2019/05/10/5-bajillion-dollars

Question for EV drivers:

I’m running wires for my EV charging points and wondering if anyone would recommend going above 60A. I believe 60A is currently the max for the Tesla model 3 and I believe the leaf uses less.

I would assume typical usage is charge it overnight, so having big juice isn’t a big deal?

I’m also installing a Nema 14-50 (mainly for my welder) which can be used for car charging.

I saw those exceptional job numbers this morning. Damn economy adding jobs! Maybe the latest Trump/China thing will cause some trouble. That would be nice.

caveat emptor “You may not like what they have done but they have done quite a bit on housing and money laundering in 2 years. Really more than the previous government in 16.”

I think the previous government did a lot with regards to housing and money laundering in the last 16 years.

I don’t really care who started it I just want someone to end it.

Money laundering is a Canada-wide problem (as already know from previous studies) and is a federal job to fix so I don’t see any reason to politicize it, and endlessly blame the B.C. Libs for it or heap praise on the BC NDP for having already done “quite a bit” to fix it. Do you consider the small changes done with casinos and nominee RE reporting to be doing “quite a bit” to combat $6bn/year money laundering? I’d call those minor tweaks, not major changes.

Here’s Eby summarizing (April 24, 2019) what has been done in 2 years, and of course punting over to the feds for the “major changes”.

https://vancouversun.com/news/local-news/ag-says-government-still-weighing-public-inquiry-on-money-laundering

“Already the B.C. government has taken steps to close loopholes that allowed money laundering to flourish through B.C. casinos and has also introduced new legislation designed to expose nominee owners of real estate, Eby said. But, he said, most of the major changes needed to combat money laundering have to be made by the federal government. “The big challenge provincially is that so much of this jurisdiction is federal,” he said.

Might want to lock-in those low rates now on a mortgage renewal….

“National Post May 10, 2019:

Canada’s job numbers make history with biggest gain on record

The country’s jobless rate is hovering near four-decade lows”

https://business.financialpost.com/news/economy/newsalert-economy-adds-a-record-106500-jobs-in-april-unemployment-rate-dips

““Employment rose by 106,500 in April, Statistics Canada said Friday in Ottawa, the biggest one-month increase in data going back to 1976. As much as I try to poke holes in these numbers, I can’t,” Derek Holt, an economist at Scotiabank, said by phone from Toronto. “You’ve got sector breadth, you’ve got regional breadth, the four biggest provinces are up.

The Canadian dollar jumped 0.7 per cent to 74.70 US cents at 9:54 a.m. in Toronto. Two-year Canadian government bond yields climbed 4 basis points to 1.62 per cent, as investors pared bets the Bank of Canada would need to cut rates to fuel the expansion.”

We are arguing semantics here but I prefer the latter two definitions as they are more or less standard economic definitions.

You may not like what they have done but they have done quite a bit on housing and money laundering in 2 years. Really more than the previous government in 16.

As for the studies they have commissioned: Sure they have weaknesses, but they are a lot better than proceeding based on anecdotes and hunches. Also there is a LOT more to the reports than just estimating and blaming. The core of the expert panel report is a set of recommendations to help address (we’ll never eliminate it) the problem.

Personally I absolutely support the government commissioning reports and getting advice from non partisan groups of experts.

“Methinks our blog bearonomics guru needs to go back to the Econ 101 textbook”

“While many downplay this factor (‘it’s only X% of the buyers!’), Economics 101 will tell you that the marginal buyer sets the price,” Porter and his colleague BMO Senior Economist Robert Kavcic wrote in a June 2016 report.

“If you introduce a wave of new buyers on an already tight market, prices will soon reach for the sky as the demand curve shifts even slightly to the right,” the BMO economists added.

https://www.livabl.com/2017/01/chart-shows-foreign-buyers-driving-toronto-victoria-home-prices.html

I don’t think that’s the point.

We cannot eliminate crime, so should we abolish the Criminal Code and adopt anarchism? We cannot eliminate poverty, so should we cancel all social spending and charity? We cannot eliminate the foolishness of human beings, so should we all step into disintegration stations?

I don’t think it’s a good thing to adopt a fatalistic approach to the problem and say, “We can’t stop it, so why try”. Sometimes it’s the approach and effort we take to life that matters. All we can do is the best we can do, and learn from our experiences.

Re Money Laundering

Was driving through a super wealthy area with my dad, utterly confused at how there are so many multi million dollar homes. They can’t all be doctors since we have almost none of those, so who are they? Apparently many are criminals! Just another reason to be suspicious of the super wealthy (haha).

« Last year Global News obtained a study of more than 1,200 luxury real estate purchases in B.C.’s Lower Mainland in 2016 found that more than 10 per cent were tied to buyers with criminal records »

To me thé reports suggest (a) most of it was in Vancouver – not a big impact here (b) most of it was in the luxury segment, which is not an area thé average person buys in.

So we are ok, shop on.

800 billion to 2 trillion or 2 to 5% of World GDP.

https://www.unodc.org/unodc/en/money-laundering/globalization.html

@ Leo

Having been exposed to the international banking/commerce systems in all continents over a 35+ year period, and seeing the table of how to launder money in the BC Report, there is much easier methods to cleanse your funds if you are a criminal. This is like a 9/10 or 10/10 in terms of complexity or difficulty. For example, show up in almost any country outside of the G7 countries, you can buy everything with cash!

This report pertains to illicit cash generated from illegal activities in BC or close to BC. Some enterprising business people (higher level criminals) found a way of a making a double ended % commission by matching people who wanted CDN Dollars (e.g. Chinese immigrants) with the supply of cash generated from illegal activities.

Trying to stop money laundering is complex and requires extensive resources…often yielding very little results.

The only out of the box solution that might curtail this IMHO is:

1/ legalization of all drugs

2/ flat 15% income tax for the population with writeoffs

3/ implement a 20-25% consumption/VAT tax on everything including RE

You’ll never stop it, but can only curtail its sources.

The scary part is that criminals are using cryptocurrencies to launder now; the odds of any transparency involving these transactions….are well zero.

I believe there is extensive money laundering throughout Canada, including B.C., and this has been the case for at least 50 years. I don’t believe any of the reports, including the latest one showing more ML in Manitoba/Sask than B.C.

What I object to is the current govt trying to blame it on the BC Libs, and repeatedly spending our tax dollars hiring consultants to make reports with “estimates”. The govt has been in power long enough to stop “estimating” and “blaming the Libs” and start taking action.

Claim hasn’t changed one bit, and it isn’t going to. I stand by it completely. No further response on this.

LF you have retreated to a defensible economic claim, actually an economic truism really.

Price gains are driven by the most eager buyers. (and of course restrained by the most eager sellers)

Use your common sense and the context I was clearly laying out. It was a simplified example to illustrate a point. One sale in a entire metro market does next to nothing, rather obviously. Actually I’m pretty sure I pointed that out when I subsequently replied to you earlier.

So do you believe there is extensive money laundering or not? Just a second ago you held the graph up as gospel and said it proves the Liberals are owed an apology.

Simplified example. Point is the description of the marginal buyer is correct according to how actual economists use it in real estate

I consider every so called “fact” about BC money laundering coming out of the govt and their hired consultants to be subject to “a list of provisos a mile long”. Meaning I don’t consider any of them to be accurate. Including this latest one, from govt hired consultants, showing lower money laundering in BC than Manitoba/Saskatchewan, shows me what an absurd exercise this is, and they should just stop wasting tax dollars hiring consultants to estimate money laundering (with a list of provisos a mile long), and start enacting specific measures to stop BC money laundering

https://m.imgur.com/iF4nzh8

I remain confident that I could find a seller willing to sell me a barrel of crude for $250.

Well then we both seem to agree that LF’s example of one sale for way above market value dragging the whole market up is bunk.

Well no, the panel made the chart, not the government.

And they explain the model and estimates quite well in the report, providing a lot of caveats and cautions about the accuracy.

The govt made the chart, not me. Would you have disputed it if it showed B.C. being high in money laundering?

If they are buying from each other potentially the more they can overpay the better but that isn’t always the case. Spending 4 million of dirty money to buy 2 million worth of “clean” RE would mean the laundromat cost you 50% of your initial sum which the criminals wouldn’t like any more than you would.

I recommend you read the report and how that chart was generated. There is a list of provisos a mile long. I wouldn’t put any stock in that chart.

Now that the govt report has concluded that B.C. had the lowest rate of money laundering in any region west of Quebec from 2011-15. (With Libs in power), the question becomes, when do the Libs get an apology from the NDP for accusing them of governing BC with disproportionally high rates of money laundering in Canada ?

https://m.imgur.com/iF4nzh8

Mathew: Thank you for the article I found it very interesting

Sorry, I’m still in 2018.

For 2017.

Again, if it’s not too much trouble.

Exactly. If you read about their Gravity model for estimating laundered money flows between jurisdictions, one factor influencing the flow is the “attractiveness” of a region for money laundering.

The goal of the recommendations is not to stamp out money laundering in Canada, they are not so naive to think that that can be done. The goal is to decrease the attractiveness of BC such that more of the laundered money relocates to other jurisdictions in Canada. The equivalent of the old urban legends that certain cities were buying homeless people a one-way greyhound ticket out of town.

And you know what? That’s perfectly fine with me. Let the money launderers move to Alberta, I’m sure Kenney will welcome them.

OK. I tried to give you fellows a basic explanation for how money is laundered thru real estate. Instead of getting “nice job, Matthew, thanks” I got a bunch of silly, rhetorical questions like “why would they do that”? Now you can read the full article for yourself. Enjoy …..

How is money laundered through real estate?

Nyman Gibson Miralis

Nyman Gibson Miralis logo

Dennis Miralis

Australia May 14 2018

The laundering of illicit funds through real estate is an established money laundering method in Australia. Criminals may be drawn to money laundering through real estate due to the fact that it is relatively uncomplicated and requires little expertise. Furthermore real estate can be bought using cash, true ownership can be disguised, and property is a secure investment with good potential to increase in value.

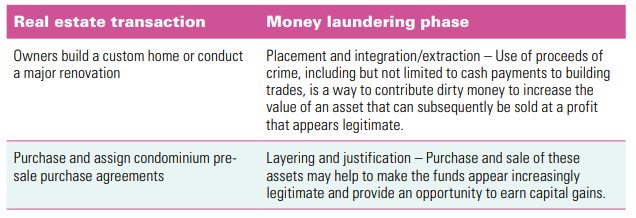

In the report ‘Money laundering through real estate’, AUSTRAC identifies some common methods in which criminals launder illicit funds through real estate.

Method 1 – use of third parties

Criminals may buy real estate using a third party or family member (often someone with no criminal record) as the legal owner. Property is either purchased on their behalf, or proceeds of crime are deposited into their bank account to make the purchase. This method allows criminals to avoid direct involvement in the money laundering process.

Method 2 – Use of loans and mortgages

Loans and mortgages can be used as a cover for laundering proceeds of crime, and their repayment can be used to mix illicit with legitimate funds.

Method 3 – Manipulation of property values

Criminals can collude with third parties such as real estate agents to under or overestimate the value of a property.

Under-valuation

Under-valuation involves recording the property value on a contract of sale which is less than the actual purchase price. The difference between the contract price of the property and its true worth is paid secretly by the purchaser to the vendor using illicit funds. The criminal (purchaser) is able to claim that the amount disclosed in the contract as having been paid is within their legitimate financial means. If the property were sold at the market or higher value, the apparent profits would serve to legitimise the illicit funds. This method is also used to pay less stamp duty.

Over-valuation

Criminals may overvalue real estate with the aim of obtaining the largest possible loan from a lender. The larger the loan, the greater the amount of illicit funds that can be laundered to service the debt.

Successive sales at higher values

Criminals may further confuse the audit trail by reselling property in quick succession. The property is sold at a higher value, either to related or acquainted third parties, or to companies or trusts controlled by the criminal. This gives an appearance of seemingly legitimate profits while the criminal maintains ultimate control over the property.

Method 4 – Structuring of cash deposits to buy real estate

Criminals deposit cash below the $10,000 reporting threshold across different banks/branches to avoid triggering threshold transaction reports to AUSTRAC. The funds are then used to obtain bank cheques to buy real estate.

Method 5 – Rental income to legitimise illicit funds

Criminals lease out their properties, providing tenants with illicit funds to cover the rental payments, in order to legitimise the illicit funds.

Criminals may also buy property in a third party’s name and pay that third party rent using illicit funds. By ‘renting’ their own property via a third party, criminals can disguise illicit funds and ownership.

Method 6 – Purchase of real estate to facilitate other criminal activity

Criminals may buy property using illicit funds to conduct criminal activity at the property, such as the production of drugs. The revenue generated may then be used to buy additional properties in an effort to disguise the original source of the funds.

Method 7 – Renovations and improvements to property

Criminals use illicit funds to pay for renovations, thereby increasing the value of property. The property is then sold at a higher price.

Method 8 – Use of front companies, shell companies, trust and company structures

Front companies, shell companies, trusts and company structures established in Australia or overseas can be used to launder money through real estate. Property held in the name of one of these companies allows criminal to distance themselves from ownership.

Method 9 – Use of professional facilitators

Professionals such as lawyers, accountants, real estate agents, financial advisers and trust and company service providers may assist criminals to launder money through real estate by:

establishing and maintaining domestic or offshore legal entity structures – for example, trusts or companies

facilitating or conducting transactions on behalf of the criminal

receiving and transferring large amounts of cash

establishing complex loans and other credit arrangements

introducing criminals to financial institutions

facilitating the transfer of ownership of property to third parties.

Criminals may use multiple professionals to further complicate the money laundering process in an effort to avoid detection. The use of a professional also provides a veneer of legitimacy to criminal activity and a buffer between criminals and their financial activities and assets.

Method 10 – Overseas-based criminals investing in Australian real estate

Overseas-based crime groups and individuals may buy real estate in Australia using illicit funds to conceal assets from authorities in their home jurisdiction. Criminals may seek to integrate their funds into Australian assets in an attempt to avoid confiscation in their home jurisdiction. Purchases may be funded through overseas-based personal, company or trust accounts. Criminals may also use third parties to buy and sell property to further conceal ownership.

Conclusion

As an established money laundering method, criminals are likely to continue to use real estate to launder illicit funds. Money laundering through real estate may be identified where transactions intersect with the regulated AML/CTF sector. This provides AUSTRAC with a degree of visibility over possible money laundering through real estate.

Nyman Gibson Miralis – Dennis Miralis

I would actually think due to the nature of the activity, an estimate could easily be biased to the downside. Who knows.

You know what though? I don’t even care what the number is. In some ways it’s not even relevant. What’s relevant is a governance system that actually pays attention to this sort of thing and takes all reasonable measures and transparencies to help keep it at a minimum. Houses, cars, ice cream cones….just go take your dirty money elsewhere.

I wouldn’t put too much stock in the $5B number. As the report says: “The task of estimating money laundering globally or within a specific country remains very challenging. Analysis has been done on this issue for approximately 20 years; however there appears to be no consensus about which methodology, if any, can be relied on for this purpose.”

Extremely unlikely that the three authors cracked the problem in a few months when no one else in the world has. Maybe it’s more, maybe it’s less, but suffice it to say there’s a reason that Vancouver had completely detached from fundamentals, and this is extremely likely to be a big part of that.

See page 45 onward in the report. The model is extremely shaky and amounts to an educated dart thrown at the wall.

Thanks for highlighting an example, but I continue to disagree with you. In an actual RE market setting, you’d have multiple sales going on each of them having a marginal buyer, ie the buyer willing to pay more than anyone else. One isn’t going to do it, but the plurality of that activity will have the net effect of enhancing the upward trajectory of the price metrics. The people that aren’t willing to pay that much are not going to have that effect – they are not the marginal buyer. That’s exactly what happened in VanRE, and more or less what happens in any up-cycle.

Anyways, we can agree to disagree on what the term means.

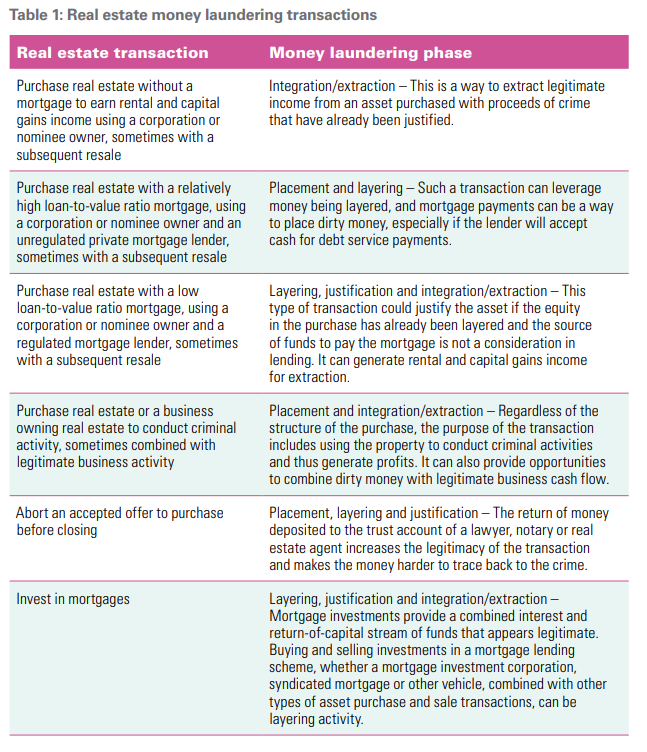

@Barrister See page 17 in the report and subsequent examples

I believe that was the yin to Hawk’s yang. They couldn’t exist without each other.

Barrels of oil are not sold like houses. The market is transparent and you can buy at the asking price. There is also a global market with near perfect information which keeps the market efficient.

Real estate has a lot of information asymmetry between buyers and sellers and is quite inefficient. When markets get hot the winning bid may well be several hundred thousand above the next highest bid without anyone except the seller ever knowing. When that happens once it can be discarded as an outlier, when it happens many times it starts to push the market up with each new sale setting the next benchmark.

Local Fool is right about the common use of marginal buyer in real estate. In this article, BMO Chief Economist, Douglas Porter, and Senior Economist, Robert Kavcic say “While many downplay this factor [foreign buyers] (“it’s only X% of the buyers!”), Economics 101 will tell you that the marginal buyer sets the price; and, if you introduce a wave of new buyers on an already tight market, prices will soon reach for the sky as the demand curve shifts even slightly to the right.” https://www.moneysense.ca/spend/real-estate/buying/whos-to-blame-for-high-home-prices-demographics-for-one/

I’m going to say those two probably know a thing or two about economics.

now now .. play nice .. people dont want to be proven wrong

Uh… sorry. Hate to bring it up again but didnt someone on here state that the $100 million in laundered money was no big deal and would be forgotten soon enough? Had no impact ect.

Smart cookie that one was. Just can’t remember who it was.

Of course campaign finance reform was hugely important. So what do you suppose the BC Liberals will do when they next form government? They will water that shit down under whatever guise(s) necessary in order to regain some semblance of the big-money corporate donations they had/have come to depend on.

The ownership registry might go as well. “An overstep on the part of the former government,” I can hear them spinning it. “An invasion of privacy that will also hinder investment in this province.”

Hmm, I wonder what the province will do with the ill-gotten gains from the property transfer tax…

I am not overly concerned about who is in power. Campaign finance reform was hugely important and beneficial ownership registry too will have very long term positive effects on this province beyond the term of the current government.

Not so sure of that. The radical transparency from the registry might scare quite some people into selling.

And yet, the opposite is happening. Record rental construction.

That’s the first chart (2018). Otherwise not sure what you mean.

I guess it’d work the same with any of the properties that were torn down and rebuilt.

Suppose I buy a barrel of crude for $250. All the other oil companies will obviously want the same for their barrels of crude. Ergo I just quadrupled the price of oil and snapped Alberta out of recession.

In the real world it doesn’t quite work like your example. An instantaneous quadrupling of prices would cause a supply response that would move prices back towards where they started. Also real markets don’t usually consist of just one reluctant seller. In reality there are a range of buyers and would be buyers ( demand curve) and a range of sellers and would be sellers (supply curve).

Correct!

Matthew,

In your example, the “clean nephew” flips the house for a $100k profit. Now that’s a good business. Why wouldn’t he just do that legally without committing crimes on behalf of his uncle? What clean person would do this for their drug dealing uncle?

And at the end of the day, the criminals have unexplained money that their “nephew gave to them”. When one of them gets busted, or audited the whole thing falls apart, and the nephew “comes clean”.

As I understand it, laundered money quickly leaves the country, zipping it’s way around multiple jurisdictions offshore so there’s no trail to follow. It doesn’t stay in town for years during renos and house buy/sell cycles awaiting local authorities to catch up to it.

Methinks our blog bearonomics guru needs to go back to the Econ 101 textbook

Mathew: That sort of works except that the bank would red flag any account that got multiple cash deposits of ten thousand over a year. But it is a possible route to launder.

You would have to be looking at a lot of transactions to launder even a 100 million but the smartest suggestion so far.

Yes, I know that. The corollary to that is the marginal seller. The former would leave the market if the prices were any higher, the latter would sell if it were any lower.

The marginal buyer always pays the top price in the market, by your own provided definition.

Let’s say there’s 10 people, all competing for the same house. Nine of them can afford a maximum of 500k. One of them, the tenth person, can afford a maximum of 2M. The seller is pricing aspirationally, and wants no less than 2M .

Nine of them put in a 500k offer, but the one with the 2M puts that up for offer. What you’re saying is those with the 500k are the marginal buyers, because those offers were “marginal” i.e., they sucked. But that’s not what this example means in economic parlance.

It means that the highest price payable in this hypothetical market was 2M, which is at the very edge (or margin) of the seller’s willingness to pay. If the seller wanted no less than 2.1M, that marginal buyer would bail and there’d be no sale.

Now, because that buyer bought that house for 2M, comparable houses around them will want the same. Ergo, the marginal buyer sets the price.

Patrick: I bought a house without a mortgage so are they counting my purchase. For that matter there is a whole bunch of boomers who downsized and bought without a mortgage. Most of the Vancouver refugees bought here without a mortgage as well.

Hopefully they are not including Chinese money that was bought to Canada in the “laundered: category. The Chinese may have violated their currency control regulations in taking money out of China but that is not a crime in Canada, Unless there is proof that the money was obtained by crime in China this does not fall into the category of laundered money for the purposed of Canadian law.

But let me read the report.

@Barrister: How criminals use real estate to launder money

Example: Criminals sell coke and get big cash. They convince their clean nephew (or someone else) to buy a house. Each criminal drops $10K in cash into the nephews bank account until he has $100K for a deposit for a house purchase. Nephew gets a legitimate mortgage from a bank for $700K and buys house for $800K. After nephew buys the house, the criminals spend 300K renovating the house. They pay all the workers in cash. Then, they sell the house for $1.2 Mil getting a clean, laundered cheque from a law office.

This is just one example.

Look at slide 9. Actually they’re all worth looking at.

https://www.slideshare.net/AjayVaishnav6/n-gregory-mankiw-principles-of-economics-princ-ch07presentation

Please let us know the results. I scanned the articles and just saw them list red flags like buying a house without a mortgage, or quickly paying off a mortgage. And let’s hope that wasn’t sufficient “evidence” to add to the money laundered totals. Their $47 billion total represents (for example) 47,000 transactions of $1m and you have to wonder how long they spent on each one, since they’d need to look at way more than that to eliminate the legit ones.

Also let us know if you discover the justification for their finding (see beancounters graph below) of more money laundering in Manitoba/Saskatchewan than BC.

They have 5.3 billion just through housing last year in this province. Somehow I don’t think it’s nearly all going through housing, or that it’s grown significantly since 2015. I’d also be shocked if Quebec was actually lower than BC.

Well I completely mis-remembered that one. Either way us mining coal is as bad as Quebec with the asbestos mines that were still operating until 2012.

Well I am going to now have to read the actual reports. Maybe there is an actual example of how real estate is used to launder cash. I am also intrigued on how they came up with this “estimate”. But let me read the reports before I become too cynical.

No it isn’t.

The marginal buyer is the first one who cannot afford to buy if prices go up, i.e. who can just afford the current market price. I wish people would quit using it to mean the opposite.

Just as a marginal student is one who just passes, a marginal swimmer is someone who can barely swim, etc.

If this number is even close to accurate, that represents a very significant force in the market. BC’s RE market is about 50-55 billion dollars per year, so that’s coming up to almost 10% of the market.

That may not seem like much, but you need to understand both the impact of the marginal buyer, as well as how a RE sale based on laundering differs from a legitimate one.

The marginal buyer concept is simple – it is the buyer who pays a price that is outside of the prevailing market trend, which then sets the new standard from all the other homes around them. So on the way up, a marginal buyer paying 1 million over the asking price lifts up everything else around it. In a downturn, the reverse is true when a seller accepts a lowball offer.

But the money laundering effect takes the marginal buyer concept and magnifies it. Normally, a buyer and seller have opposing interests. The buyer wants to pay the least possible, the seller wants to get the most possible. That friction forms the basis of the market and provides a primary pricing stability function.

In a laundering scenario, the interests of the buyer and seller may actually come into alignment. The seller wants the same thing they always do, but the launderer wants to clean as much as possible in one transaction. So, they pay almost any amount and in fact, the more they can overpay, the better. The higher RE climbs, the more effective it is at washing bulk amounts of cash. Sellers are overjoyed, local buyers go frantic, and it removes that earlier stability function. In turn, the market goes haywire and into bizarro-land. Sound familiar?

If nearly 10% of sales fell into that category, that’s a huge portion of the market’s functioning, IMO, and the effects of its reduction or withdrawal could be dramatic.

Thanks for the coal correction. The tailings contained toxins and were released into the environment.

Mining companies, including Imperial Metals, were also big donors to the BC Liberal Party during all the years they were in power.

I noticed that too. Interesting!

If the chart posted by beancounter a few posts ago from the task force released today is to be believed, we see that BC has the lowest money laundering ($6.3bn) of any region west of Quebec. Lower than Alberta (10.2bn), Man/Sask 6.5bn, Ontario 8.2bn.

https://m.imgur.com/iF4nzh8

Mount Polley is a copper/gold mine. The mined rock is mostly material other than the metals, thus the tailings.

I hate it when we agree, but you’re absolutely right.

I’m sure some did. But what are we going to do about it? And what’s going to be done about all that laundered Vancouver RE money?

As far as I can tell, government can only release reports and take steps to ensure it doesn’t happen again. But, for the most part, what’s done is done and there will be very few individuals held to account, if any. And all that shady money that was invested in RE will stay there until it leaves (or doesn’t) by market forces.

Yeah, that’s a good point.

Gone are the days of only hundreds of millions being laundered. “Desirability” has taken on a new meaning with regard to BC real estate.

My goodness – 40+ billion a year being funnelled into the country….If my napkin math is right that’s about 2.5% of GDP!

James Soper ” You’d have to think that some of that had to make its way to Victoria.”

I’ve often thought that if someone sold their house in Vancouver and moved to Victoria especially in the last 5-6 years that laundered money had to have a hand in it somehow.

They didn’t even vote Clark out. It’s a coalition government that has the majority by 1 seat! BC politics is as corrupt as the day is long, and as far as I can tell, it’s always been that way.

Neither is the way they do coal (Mount Polley).

So 9% of the entire BC real estate market is laundered money. You’d have to think that some of that had to make its way to Victoria.

To ask an obvious question, perhaps to someone familiar with this sort of thing…

How do you verify that the claimed beneficial owner, is the beneficial owner?

From the executive summary of the panel report:

Disclosure of beneficial ownership is the single most important measure that can be taken to combat money laundering but is regrettably under-used both internationally and in Canada. The BC Land Ownership Transparency Act will be the first such registry to be fully compliant with best practices

Not an activist, and not really even terribly political. I think what I outlined just elucidates more common sense than rampant house flipping. I don’t know if it’s shared by the majority or not, but the last election result did seem to demonstrate the public was fed up with something. With what, I don’t know, I didn’t read the hot button issues chart. Have a few guesses, though.

This government news release has links at the bottom to the actual reports released today (German report and panel report).

https://news.gov.bc.ca/releases/2019FIN0051-000914

“All residents deserve to have a sustainable economy based on what BC does well – our natural resources, tourism of its splendour, and all kinds of future orientated innovation. Not sticking ourselves in ruinous levels of debt flipping unproductive assets back and forth to each other, as our vulnerable citizens die in the street from fentanyl overdoses…”

Holy crap LF, had no idea you were such an activist. Unfortunately while I agree with the sentiment I am less optimistic that it is one shared by a majority of our population. I can’t see the current government staying in power after this term, and can only imagine the media messaging that will come out saying that government intervention destroyed the housing market and the lives of those invested in it. Perhaps I am being too cynical….

The way B.C. does logging doesn’t look sustainable to me. Government is still allowing old-growth clear-cuts like it’s 1905.

That’s redundant. And you mean “oriented.”

Not everyone has ruinous levels of debt. Some do, but that has always been the case.

And what productive assets do you suggest we should be flipping back and forth?

While I don’t disagree, the fact that the FIN Minister needs to say this is a pretty sad testament to the state of affairs out there.

However, it is also a powerful indicator of the winds of change and the underlying political sentiment/anger held by at least a sizable portion of the population. Thank god.

This information and the inevitable policy changes around transparency are not something that an incoming political party is going to be able to backtrack on for at least a generation, for instance, choosing to allow beneficial ownership to become opaque once again. True to human nature though, we chose to do nothing until it virtually ruined an entire metro housing market. Healing will be tough, but in the end, worth it.

All residents deserve to have a sustainable economy based on what BC does well – our natural resources, tourism of its splendour, and all kinds of future orientated innovation. Not sticking ourselves in ruinous levels of debt flipping unproductive assets back and forth to each other, as our vulnerable citizens die in the street from fentanyl overdoses…

Laundered money funded $5.3B in B.C. real estate purchases in 2018, report reveals

https://www.cbc.ca/news/canada/british-columbia/bc-money-laundering-real-estate-reports-released-may-2019-1.5128769

Wasn’t it just 1-2 Billion and now the numbers are over 5+Billion for 2018 alone in laundered money that purchased real estate in BC? That they know of so far, and likely even more…

Now they need to start actually doing something about it – reports are one thing, prosecutions and seizing ‘dirty’ assets need to start happening on a large scale, this is getting ridiculous. And they need to fix our broken system that’s letting this happen in the first place!

“BREAKING NEWS: An estimated $5.3 billion worth of real estate transactions in B.C. last year were the result of money laundering, helping fuel the meteoric rise of housing prices in the province, according to a new report.

Our economy should work for regular people, not criminals,” said Finance Minister Carole James. “Housing should provide shelter, not a vehicle for proceeds of crime.

The report was one of two released Thursday that examine the influence of money laundering in B.C.’s real estate market. Both paint an alarming picture of how criminals are using homes to clean their cash.”

https://www.cbc.ca/news/canada/british-columbia/province-releasing-2-reports-today-into-money-laundering-in-real-estate-1.5128769?fbclid=IwAR2qTmES6cFmLh_qtPszHrhuIrBq1_rNUQW0usMCuVOOILZbB2iC9UnBoxI

I’m referring to 4300 starts per year (2018) which is what is shown on LeoS graph and can be compared to population increase per year.

That’s precisely the message I want to send. Invest your money in productive assets.

How did I know you were going to chime in on that…LOL

Hey Leo, can you do the dwelling starts per 1000 for last year(or a couple of years) as well(if it’s not too much work)?

It would give a good indication on how long this has been going on for. It’s one thing to have 1 year of overbuilding, but it seems like we’ve got multiple years of this incoming.

Could also be Hawk’s head exploding as another month passes by without the forecast price crash?

We’re currently building 6035 homes though, not 4300.

The escalation in prices has certainly kept some people away. Anecdotal evidence, but we had people from out of province accept jobs here (in 2016 especially) who then tried to arrange housing, and ended up telling us they weren’t accepting the job any more because of housing.

From the article LeoM posted:

As I see more houses being put up for sale where it’s clear there is a renter in the basement, I often wonder what I would do if given the choice. A purpose built rental apartment offers more long-term security than living in someone’s basement and being at the whim of a sale or forced move due to “relative moving in”. Will be interesting to watch as more buildings come online and compete for renters.

@LeoM Very interesting point. So you’re theorizing that during construction booms much of the increase in residents actually comes from the construction workers themselves?

Should be easy to test by looking at population data further back during the 2000s construction boom, but this particular series only goes to 2006. Will have to look for another one.

LeoS, good article on construction per capita , however I think you’ve missed the most important point in this analysis. These construction stats are like a circular reference, a self perpetuating cause and effect. There’s probably a statistical or economics textbook word to describe this effect.

The effect I’m talking about is this; a high percentage of the new residents are in fact the construction workers who are building these new “dwelling starts”.

For the past few months I’ve made a point of chatting with construction workers whenever possible and the repeating theme is they are from out of town, want to buy in Victoria, but realistically know they will be leaving Victoria when the building boom is over next year.

@guest_59444

Great picture. From that distance it looks like a small volcano, or perhaps that is just speculation money going up in smoke.

I heard on the news last night the fire repression system had been turned off just one week ago. I expect the investigation into the cause of the fire will be ongoing for quite a while.

I think partially yes. A functioning rental market with more normal vacancy rates (3-5%) and less price appreciation due to more inventory will definitely make Victoria more attractive for newcomers. Not sure if it’s a big factor though. Likely others dominate in people deciding where they want to live.

Very interesting article about the ghost cities. Kind of like real life sim city

Money laundering report in real estate to be released at noon.

Continuing from an earlier thread can anyone explain why 1857 Bowker Place is worth 2,575 million. While a block from the beach it is not actually waterfront. It is about a 3000 square foot house with a second floor that is a dormered attic on a 10,000 sq ft lot.. It is a nicely renovated house but it is still originally a 1939 built house.

Obviously someone thought the house was worth almost 2.6 million, when you add in Land Transfer and closing costs, but honestly I am having trouble understanding how house prices have reached this type of insane valuations in Victoria. No wonder the millennials are upset when a pleasant middle class house is going for more than 2.5 million.

Sorry to rant first thing in the morning but this seems rather insane to me. Where is all this money coming from in the first place?

But it is a beautiful day out and I am about to do some trimming in the yard and then have a lovely walk with my wife.

Downtown Victoria fire, as viewed from Port Angeles, WA

You’re right and it’s already happening in Vancouver according to the CBC article linked below. Victoria will be next.

This is part of the normal cycle that precedes real estate stagnation and eventual price declines.

I’m still sticking to my 24+ month prediction from a few months ago; this spring is the beginning of wide spread small price declines, with next spring showing widespread larger declines in Greater Victoria followed by a dismal winter, then sharper declines for the following year as we go into a recession when all the construction workers, both direct and indirect, get laid-off.

https://www.cbc.ca/news/canada/british-columbia/first-month-free-landlords-offering-pretty-perks-to-attract-renters-1.5128773

@Numbers hack, what you predict may have been true in a balanced regulated market, but our government has tripled down on their message to the world not to invest in residential real estate in BC. They continue to charge GST on self supply of rental buildings, reduced allowable rent increases 50%, increased property transfer tax, added a 0.4% “school tax”, added a speculation tax, and these inevitably tell all investors in residential RE – “you’re not welcome in BC”.

As we all know capital will flow to the best investments, so I have to disagree with your post that purpose built rental in BC will become a first choice for global investors. It will actually do the opposite and dwindle even further.

Leo, EXCELLENT post.

1/ build cycles from your graphs indicate short 5 year cycles

2/ before supply was behind the curve, now it is ahead of the curve

3/ so the next 5 year cycle will Victoria be behind the curve again? Who knows

The only difference from my vantage point is that:

a/ the world is still awashed with money and no where to put it (think Berkshire’s last AGM).

b/ you will have a bunch of suits half way around the world or country looking at financial metrics and then making a bet on housing (especially purpose rentals).

c/ Victoria has not had purpose rentals built for nearly 30-40 years with only ramped up activity in the last 5.

d/ Money is dirt cheap right now vs any historic standards.

Prediction is rentals will be increasing in a very large scale. New Condos for sale will ease along the patterns as indicated in your graphs.

FYI: Rentals will only ease once the vacancy rate approaches 5%…which is really far off!

Great stats as always.

Leo,

Great post! You work fast… James just suggested that a few hours ago….

Since we are clearly building more homes (4,300) than expected need (2,500 dwellings for 5,000 people), it brings up the question.

If you build it…. will they come?

Will excess construction create vacant homes that cause people to move to Victoria to live in them? Especially since with unemployment at 2.8% there are jobs waiting.

We all heard of the “ghost cities” built in China, where there was no need as people weren’t moving there. It turns out that many of those cities are full now, as described in this article. Also described are other new cities in Asia created like that.

https://www.forbes.com/sites/wadeshepard/2018/03/19/ghost-towns-or-boomtowns-what-new-cities-really-become/#7c7404c45e3f

“Today, China’s so-called ghost cities that were so prevalently showcased in 2013 and 2014 are no longer global intrigues. They have filled up to the point of being functioning, normal cities — ex-ghost cities are rarely news.”