5 bajillion dollars

If you read the news you will have seen headlines like this yesterday: $5 billion laundered through B.C. real estate, Money Laundering Provided 1 In 20 Dollars For BC Real Estate, and Dirty money driving up B.C. home prices as more than $40-billion laundered across Canada in 2018.

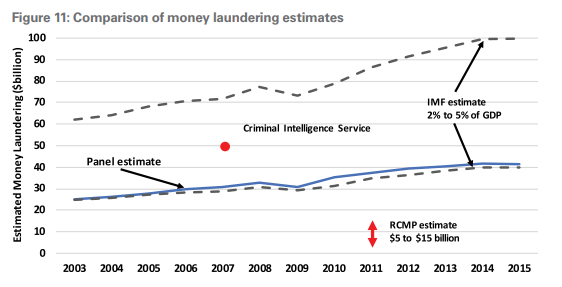

The stories are about a government commissioned report that was released yesterday written by an expert panel on money laundering. But if you read the section on their estimates of the magnitude of money laundering in the actual report (pp 44-52) you will find things like “there appears to be no consensus about which methodology [to estimate money laundering], if any, can be relied on” , “wet finger estimate” , “accurate measurement extremely difficult”, “factors could contribute to a divergence”, “Canada … was unable to provide a ranking of the money laundering threat posed by other countries”, “portion of monies available for laundering that is invested is unlikely to be lower than … 28 percent …. the upper bound is 100 percent”, “depending on a set of assumptions about flow types and criminal savings and investment behaviour leads to a very wide range of results”.

Spot the difference?

But the news business lives by clicks and the figure of $5 billion is just too juicy to leave out of a headline. I mean, just look at how many zeros it has: $5,000,000,000. Impressive.

The reality is – while I admire and am interested in the effort to apply academic rigor to the process of estimating something we have essentially no data for – the $5B figure is essentially meaningless. It is an educated but poorly informed dart thrown at the wall and the real figure could be lower or higher as shown by the range of estimates from different sources below. The report discusses a number of factors that could lead to the headline figure being an underestimate of the magnitude but no one knows for sure.

However it doesn’t really matter. So what if the figure is actually $2B or $10B? Does that change what we should do about it? The fact that Vancouver real estate has detached from all local fundamentals is irrefutable, and we know there is an issue with money laundering in casinos, luxury cars, and real estate from individual cases.

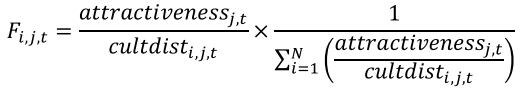

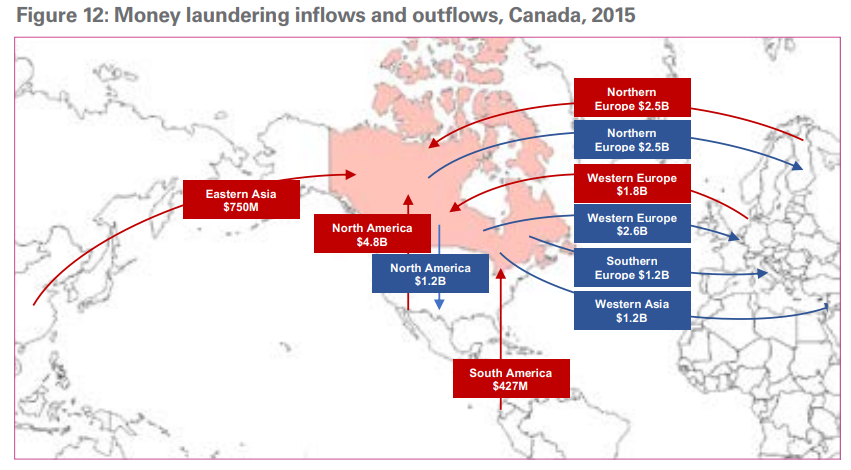

The report uses a Gravity Model to estimate flows of laundered money between regions and countries, with the magnitude of the flow determined by the attractiveness and cultural distance between the two regions.

Despite the fact that the Gravity Model is built on a foundation of quicksand (i.e. garbage in garbage out), the underlying construction of it seems logical. Unlike money laundering in Canada as a whole which our provincial government has near-zero power to do anything about, they can very well reduce the relative attractiveness of money laundering in BC. There are no quick or easy fixes here, but the province is starting by shining a bright light on who owns real estate in BC via the Beneficial Ownership Registry which the report calls “the single most important measure that can be taken to combat money laundering”.

This won’t stamp out money laundering in Canada or make real estate cheap and the report authors are not nearly so naive to believe it will. However it will introduce significant additional hassle to hiding the proceeds of crime (or really any shady money) in BC real estate. Those money launderers will likely just move their operations to other jurisdictions, and it may be an un-Canadian sentiment, but that is fine with me. I’ve said it before but a sense of fairness is important in real estate as the idea that some people are getting away with crimes and tax loopholes while the rest follow the rules like shlubs breeds resentment and discontent as well as other negative social and economic effects also discussed in the report (pp. 12-16). Action on the recommendations in this report is another step to restoring that sense of fairness in the market and for that reason I welcome it.

Re Patrick’s generalization – “If you don’t believe me, try this. When you see a post, try adding the phrase to the end of the post …”All of this so I can get a lower price point to buy my home.” If that works, chances are you’ve spotted another bear, looking for something to lower house prices for him via a self-serving post, rather than a genuine concern for the original issue.”

A generalization can be made about most of your posts Patrick – When you see a post, try adding the phrase to the end of the post …”All of this so the price of my house will never go down.”…………” If that works, chances are you’re reading a post from Patrick, who is always looking to defend high house prices via a self-serving commentary, rather than a genuine concern for any issue that might effect the market in a negative way.

Monday numbers: https://househuntvictoria.ca/2019/05/13/may-13-market-update/

Based from my experience of living in VN in the past and recent visits, the average Vietnamese would welcome the wealthy foreign neighbor with open arms because are more opotunities for business.

Great post!

The Vietnamese factory worker should not be considered in the “fairness” scenario presented, because they have nothing to do with it.

All good, sorry, no comment, still works I hope!

James Soper: When you were pointing out that my previous statement about Milan Lucic scoring 2 goals last season was inaccurate, why did you not report the actual goals he got? I just looked it up and learned that he got an amazing 6 goals last year (not 2), so I stand corrected on this point. That equates to $1 Mil per goal which might be an NHL record for failing to fulfill one’s duty. James, did you omit the 6 goal statistic because revealing this fact would not have helped your argument in any way?

Also, please note that for every court case there’s two lawyers. One is wrong and loses. So I would not be so quick to “take free advice” about the current real estate market in Victoria from someone on this site just because he is a lawyer. And whether Barrister is a lawyer or not, though likable he definitely is, he may have had absolutely no training in real estate law or economics.

It is like when you are training a dog……leave it!……leave it!…..that is what the HHV comment section is like sometimes! smiles and peace to All!

“Obviously, the Gov’t knows that any legislation they pass on this subject matter will be immediately and fully Charter-tested. So whatever they do, it’s going to have to be reasonable.”

How would the government know that the matter would be “immediately and fully Charter-tested” if they didn’t think that there was a potential charter violation? Personally I don’t think the government should pass laws that it knows run the risk of violating fundamental guarantees. If it does this willingly, then even more reason to think that such a government shouldn’t have expanded powers, right?

I am not a wealthy person. I am an average middle class person with an average middle class life, which i love. I also love being Canadian and living in Canada, especially because of all the freedoms I have here. I’ve been to other countries with far less freedoms, and there’s nowhere I’d rather be than in Canada. A simple awareness of historical events and atrocities committed by states in the present should be sufficient to remind anyone of the importance of placing robust limits on state power. We are so free only because we limit the state, to a great extent, in what it can do (and how it does it) when exercising power.

That’s my 2c.

Per capita income in Vietnam is about 6,000 USD. What do you think your average Vietnamese factory worker thinks of “fairness” when a Canadian moves in to the neighbourhood with $3 million dollars that was not taxed by the country in which he is presumably enjoying? Or should that factory worker not be considered in this “fairness” scenario?

Barrister: “But I cannot support unfettered powers to a bureaucracy that can institute proceedings on a whim”.

Is is disingenuous to suggest that the BC Gov’t is going to pass a law into effect that gives them unfettered power to institute legal proceedings on a whim. If this is the kind of advice you give out for $1,180 an hour, I feel sorry for your clients. Obviously, the Gov’t knows that any legislation they pass on this subject matter will be immediately and fully Charter-tested. So whatever they do, it’s going to have to be reasonable. It will be up to them to figure out an acceptable formula for who gets accused and who does not, and why, and what form of proof a person will have to submit to exonerate himself. But I would start with guys like Johnny from my previous post because his situation (as I said previously) speaks for itself.

By the way, “res ispa loquitur” (the thing speaks for itself) has been applied in many different ways in court proceedings, not just tort law (perhaps this is your misgiving?), and also in literature. In fact, it was first first stated by Cicero in 25 BC while he was defending Milo in a murder trial. He was suggesting that certain facts (while circumstantial) pointed to another person as the killer. So I don’t know why you are suggesting that I misconstrued the saying. In any event, what I am saying is that Johnny owns millions of dollars worth of assets, but he has has no job, and he’s just 18 years old. In my opinion, this situation speaks for itself. It should be investigated for potential criminal activity.

The other point I was making (that started all this off) which you have a still not addressed, is the fact that a “reverse onus test” (placing an onus on a person to rebut a presumption in law) in some situations is a good way to deal with a problem. And it has been accepted as good law in this country for years. For example, in impaired driving law, a police officer is entitled to arrest you, take you to a police station, and demand that you blow into a breathalizer machine to demonstrate your blood alcohol level is below the legal limit, based solely on his opinion that you are impaired or over 80. And it’s entirely legal. Essentially, you have the “reverse onus” of proving that you are not over 80 by giving a breath sample, once a police offer believes you are impaired. If you don’t blow, you get charged with the criminal offence of refusing to blow. While it is true that every person standing in a court room charged with an impaired driving offence is presumed innocent until proven guilty, in actuality, that person is called the “accused” and was previously subjected to a “reverse onus test” where he or she was required by law to demonstrate he was not over 80 by providing evidence as to innocence. Also, any person charged with refusal to blow is duty bound in the court room to provide an acceptable explanation about why they did not or could not blow. You cannot exercise your right to silence in this situation. You must give evidence or be convicted. If that is not a “reverse onus test”, I do not know what is. But the question to ask is: is it reasonable to have such a law? Many people would say “yes”. And the Supreme Court of Canada agrees, though they still must always examine each specific set of facts in every criminal case.

Also, in estate law, as I previously mentioned, owning a joint bank account with your deceased mother gives rise to “reverse onus test” where you have to show that mom’s intention was to give all the funds to you. If you don’t demonstrate this, the law of survivorship fails, and the money goes to the estate to be shared by the siblings.

I, for one (and this is just my opinion) agree with a “reverse onus test” against an accused person who purportedly owns millions of dollars of real estate, cars and other assets, but is just 18 years old, has no job, and on the face of it does not appear to have acquired the goods through legitimate means. I don’t see anything wrong at all with asking that person to justify his wealth (and giving him a full opportunity to do so) or lose it.

As a Canadian, how “fair” do you think it would be if:

– you moved to, say Vietnam, and brought $3m with you that you earned and inherited legally in Canada.

– After living awhile in Vietnam, you get a letter in Vietnamese from the govt announcing an “unexplained wealth order”, which will confiscate all of your $3m life savings without a trial unless you can satisfy a Vietnamese official through documentation that you acquired the money legally and through “legitimate sources of income” in Canada. Your assets are frozen until the issue is resolved.

– Would your thoughts be… “well, this sounds fair!”

– This is what BC is proposing to do to some rich immigrants to Canada. We can do better than this, starting with adhering to the rule of law and the Charter of Rights and Freedoms.

So when you are counting Chinese tourists, how do you distinguish between (Chinese) Canadian tourists from Vancouver, Richmond, Nanaimo or Toronto, vs Chinese tourists?

“But I cannot support unfettered powers to a bureaucracy that can institute proceedings on a whim.”

+100

I find it scary how many people are willing to give away their rights so easily – particularly privacy, which is vitally important to a healthy/functioning democracy. It shouldn’t be reduced to anything less.

There needs to be some reason, more than just a hunch, to pursue these matters.

Not so Patrick, at the times of my observations, my bear suit was at the dry cleaners, and I decided to go Racoon that week. It is a way better look for surveying the local populace.

What drop are you referring to, that needs to “pick up”? Meng was arrested in December 2018 – are you anticipating a big fall in Tourism from China in March? That’s possible, but so far, Chinese tourism to Canada is at record high for 2019 YTD, up 1.2% from last year, which was a previous record. And that’s after Meng’s arrest. This is official Canada stats from counting Chinese tourists, not some RE bear walking around Victoria counting visible minorities ( the vast majority of which are not “tourists”, and are as Canadian as anyone here).

https://www.destinationcanada.com/sites/default/files/archive/863-Tourism%20Snapshot%20-%20February%202019/TourismSnapshot-Feb2019_EN.pdf

“Following record gains in January 2019 (+31.6%) and an exceptional performance last year in February 2018 (+79.2%), overnight arrivals from China in February 2019 contracted year-over-year (-21.3%), as was expected with an earlier start to the Chinese New Year travel period this year. For this reason, a better indication of performance is based on the total for the first two months of the year. Year-to-date February 2019, overnight arrivals from China (+1.2%) edged up to a new high point, bettering the previous 2018 record.”

Mathew: You brought up hourly rates not me and I never claimed that I had a special predictive power when it came to real estate. May I remind you that it was you that was claiming that a legal principle was applicable in your argument and I am pointing out that in my opinion you have totally misconstrued it. I dont agree with your argument but we can debate that on a equal footing.

Viola makes an excellent point when she says that no one should ever take any legal advise from anyone online and I would strongly caution the same. Incidentally, I would point out that only a fraction of any lawyers billing rate ends up in their pocket at the end of the day. Strangely both my secretaries and my law clerk expected to be paid each month along with the rest of the staff. I am pretty confident that a number of real estate agents in BC earned more than I did in my best year.

But make your argument and lets deal with that on the merits. Out of curiosity, exactly what criteria would the bureaucrats use to decide who should be picked to bring to court in the first place,Is it anybody with a luxury house? Is it anybody that owns more than one house. Is it simply on their whim or their need to be busy to justify their jobs? If it is young person that got a big family loan then are they also required to have their parents prove how they acquired the money? In essence you are accusing a person of being a criminal so how do safeguard innocent persons reputations.

The problem is that all the government has to show is that the accused owns assets and under that criteria more than half the population is caught in that net. I think your goal is meritorious and I have no problem in confiscating every piece of property that any drug dealer who is convicted owns whether it was purchased with drug money or not. But I cannot support unfettered powers to a bureaucracy that can institute proceedings on a whim.

That was then, and this is now. The tourist number may pick up again after the Meng/HuaWei affair settles later (what a naive thing we did, with Trump in power) …

LF, I live downtown and was making the very same observation just the other day. With cruise ship season started there appears to my eyes and ears to be a marked decline.

@ Barrister

I think prices going down are going to be a little like watching paint dry – it’s starting but nothing’s happening fast… yet. But I think if we start seeing Van pick up speed, then Vic will follow at a faster rate. If we see a major crash in Van, then I don’t see Vic being able to hold up prices – Vic’s not going to outprice Van at the end of the day.

Chinese tourism to Canada seems to be at all-time high.

https://www.destinationcanada.com/en/markets/china

“In advance of Chinese New Year celebrations starting on February 5, 2019 (11 days earlier than in 2018), January arrivals from China [to Canada] jumped to a record high of 54K visitors in January 2019, up 32% year-over-year.”

Seems like a similar story with Japanese tourism to Canada

https://www.destinationcanada.com/en/markets/japan

“About 51% of Japanese trips to Canada are for pleasure and recreation. Japanese tourists most often visit British Columbia and Ontario, with Vancouver and Niagara Falls being the most visited destinations.L

I wanted to ask the board about an observation I’ve been having to see if anyone has seen this too.

I have been to the Butchart Gardens twice recently, and am downtown with some regularity including areas popular with tourists.

I am noticing what seems to be a marked reduction in the number of Chinese (or perhaps more fair to say, Asian) tourists. I’m not saying they’re suddenly hard to find, but in the last few years it’s been just wall to wall with them and now it just looks much more sporadic by comparison.

You can even hear it – touring the Butchart Gardens for instance, previously, the sound of Chinese would dominate. Not now. Now it’s mainly English, followed by Farsi, Portuguese and something that sounds like Hindi. But mainly the first two.

Hardly scientific, and perhaps it was just the times I’ve observed. But I have indeed observed, quite a number of times. Does anyone else notice this?

It’s not a good idea to take legal advice from anonymous people purporting to be lawyers in the comment section of a blog.

Barrister didn’t say he had any clients, he just said he charged $1180 per hour.

If I was taking free advice w/r to law matters, i’d definitely take it from an lawyer, ex or otherwise.

No such thing really, if you were over-charging you’d quickly run out of clients.

Not true on either account.

Exactly – there is no high number of Vancouver sellers to be explained. Nor would one expect that yet.

What they have is a serious dearth of buyers at current prices. FOMO is well dead for now.

Barrister: you fail to understand me. Of course I am assuming that Johnny is a crook. That’s my whole point. That’s why I said “the thing or situation speaks for itself”. Just like Wilt Chamberlain’s member. The thing speaks for itself. But that’s a different kind of legal maximum. But I digress …

Normally, I like your comments on this site, but I have to respectfully ask you: why would you feel the need to inform total strangers on a real estate chat site that you are an ex-member of the legal profession? Why would you brag about making $1,180 an hour? Do you think that your opinion is more important or valuable than others because you are or once were a lawyer? As far as I am concerned, over-charging lawyers give the profession a bad name. Why don’t you just call yourself “Filbert” and provide your opinions anonymously like the rest of us, without trying to sway readers’ opinions based on past titles or wages?

Finally, Milan Lucic is a washed up professional hockey player with the Edmonton Oilers. He got a grand total of 2 goals in 82 games last season. Do you want to know how much he made last year? $6 Mil. Do you want to know how much he will make next year (after his year-long demonstration of hockey prowess)? $6 Mil.

It looks like peak inventory in 2018 was 2628 mid July

There is compared to last year. Even more so the year before.

As barrister says, there are a number of complicated but completely legal reasons a home would be held by a corporation. From a tax perspective it is almost always better to hold it personally, but there are many exceptions, such as the funds to buy it are from corporate retained earnings and the corporation pays for it and holds it because it would be tax prohibitive to take a dividend in the amount needed for the purchase. Lots of other reasons and money laundering would not be high on my list. Money laundering probably occurs in some private mortgages.

I don’t think there is any issue with a beneficial registry except the pain to transition to it and cost to administer.

It’s the opposite. Sellers are recoiling big time over there. Problem is, buyers are recoiling even more so inventory is growing anyways.

Renter: listened to the video and I understand why comments are disabled on it.

There are always people who need to sell. Death, divorce, job loss, forced move, etc… I am not sure what really needs to be explained? There aren’t even an unusually high number of sellers in Vancouver.

Unless something changes in the latter half we will almost certainly have a sales increases this May compared to last. Last may was unusually weak.

Yes inventory usually peaks in June/July

Thanks! Looks like May 22 could be a good day to pass 3000.

On a different note, I just watched ViREB April update. Talk about beating a dead horse – the stress test was mentioned numerous times as the reason for all ills in the current housing market. That and buyers expectations for lower prices on “market value properties”. I could have sworn that market value is defined as what someone is willing to pay and not what the ViREB deems a true value.

https://www.youtube.com/watch?v=qP_yXmB5RLc

Is it usual for inventory to be increasing at this time of year?

Didn’t miss it. Will be posting tonight just at a conference.

306 sales

671 new listings

2881 inventory

Just wondering about Monday numbers – did I miss a post on that?

James: The most common reasons for forced sale are death and divorce. The former is often less painful than the latter. Disability is up there as well when older people enter a nursing home or job transfer. I am not sure how one would go about getting stats on that. I know that when I was house hunting I would check out the closets to see if one side was empty.

Why do you think a bunch of people in Vancouver suddenly need to sell? Like this guy:

Mathew: I will be happy to spend an hour explaining it to you and my billing rate when I retired was 1180 an hour but I will give you a discount since I dont have office overhead.

Notice in your comments that you start with the assumption that little Johnny is actually cheating the government. I dont have a problem with you making your argument just do it without dressing it up, or trying to buttress it, with a legal maxim does not apply.

Barrister: “Please read the case law on res ipsa loquitur since you clearly have no idea what you are talking about”.

Wow. A sweeping generalization with out a single point to back up your argument.

The only reason why I referred to that latin phrase is to point out one simple thing: Johnny’s situation speaks for itself. Instead of offering gratuitous insults, why don’t you provide a logical argument for why you think that the Gov’t shouldn’t go after people like Johnny who are cheating the system? By the way, I charge $400 a hour to read case law, so please send me a cheque for the first hour, and I’ll get on it.

The legalization of marijuana was a got first step in reducing the amount of illegal cash for the criminal community. As much as I dislike drugs I really believe that it is time to follow Portugal’s lead and provide drug addicts with a maintenance dose program of heroin. If you really want to reduce drug use one first has to remove the profit motive for criminals.

Spoke with a local lawyer today who stated that the use of corporations for holding real estate in his experience has little to do with drug lords and is mostly used for tax and estate purposes. His point seemed to be that the tax rate for corporate dividends is less that if rental income is treated as straight income. There was a complicated explanation as to how with the proper share structure the property is effectively transferred to the children without triggering a deemed disposition. Not my area of legal expertise. Also if the shares are sold there is no land transfer tax. He stated that none of his clients have any problem with the notion of a beneficial ownership registry other then they are going to have to pay his bill for the additional filing. The CRA already knows that they own the company since they are declaring the dividends.I support the registry since transparency is a good thing but but we might discover that it is less of a black box than some people think. But it does mean one more permanent bureaucracy to administer it.

I think some sellers “hopes and dreams” pricing is in full crash mode while actual market prices have only inched down a few percentage points.

Despite being down overall only a few percentage points we should see some larger percentage declines from some folks that got carried away in 2016/2017 if they suddenly need to sell.

Really good discussion on this thread. The problem was identified years ago and these reports simply confirm Sam Cooper’s investigations. You will note that every layer of investigation pegs the dollar value and impact on society higher and higher. A local generation will not be able to afford a home in Canada.

Rush4Life: I agree that there is some softening but I am not seeing major price drops, or at least not yet, as some people were predicting.

So far it is not resembling the crash that was experienced in California although Vancouver is shaping up that way. Although during the crash in LA I noticed that some areas like Malibu and Beverly hills only inched down a little. Wonder if that might be a bit true in Victoria.

To be clear I am not making predictions one way or the other. Mostly I am still surprised that anyone would pay almost two million for that house.

The report on money laundering can’t provide an accurate estimate of anything because there is no reliable data on proceeds of crime – which will hopefully be addressed as a result of the report. The information on the use of casinos to launder money is much more tangible. Proceeds of crime have been a part of the economy since long before the latest real estate run up in bc, and are part of the economy in other provinces where real estate did not experience what Vancouver has. There may have been a contribution to demand that grew as prices rose, but many interconnected factors are at play. I’d guess the capital gains tax exemption and foreign investor programs had a much larger effect.

Danger inherent in bidding wars. Market certainly still up in that period.

I am starting to think that prices really are not going down yet.

Certainly not going up either. Home in Cedar Hill sold a few days ago for $1,165,000 and January 2017 purchase price was $1,200,000 (250k over ask at the time).

Barrister your thoughts are incorrect on this. Terranet index which actually is derived off of previous and current sales is trending down (and should be at least seasonally trending up right now which it’s not). So your one anecdote (or many) is unfortunately not reflective of the actual environment.

901 Hampshire road in Oak By just sold for 1,868 and was bought in August 2016 for 1.6 million. Even after expenses someone made a fast 200k. It was built in 2016 so not a matter of a reno. Somebody paid almost two million for a 2100 sq, foot on a small 5000 sq ft lot.

I am starting to think that prices really are not going down yet.

Numbers hack, I agree with many of your points, but I don’t think you’ve represented my actual beliefs correctly.

No, I am not stupid enough to believe that money laundering is the sole cause of the Vancouver bubble. I’m not smart enough to accurately quantify the various reasons for the bubble, but here’s my rough attempt:

-50% of the price gains due to real economic prosperity/beneficial immigration/population growth;

-30% of the price gains due to the effect of persistent low interest rates/local speculators;

-20% of the price gains due to criminal money.

This is likely wrong. We will never know. If money laundering was 1% or 0% of the reason for the bubble, I am still strongly anti-money laundering. I would think that everyone commenting on this blog would be. If reducing financial crime makes no difference to house prices, I would still love to see less financial crime. More is at stake than simply housing here.

I did not use the phrase “dirty foreigners” and yet you put it in quotes. Why? I am pro-legal immigration and I believe it is generally positive for Canada. That said, it’s pretty clear at this stage that there is a lot of international money laundering going on in Vancouver. We can say that without the implication that many non-Canadians are criminals, can’t we?

The reality is that it’s tough to communicate any complex points through comments on a blog.

“Even animals are smart enough to migrate to better pasture where they can find food and shelter. ”

Two thumbs up!! This was so common with previous generations, but the new generation seems unaware of this simple fact of life.

“This won’t stamp out money laundering in Canada or make real estate cheap and the report authors are not nearly so naive to believe it will.”

As the author of the 15% foreign buyers tax let me be naive if I want to and say that the Chinese are now considered by most Governments around the world as the REAL enemy, not Russia. I sincerely believe that the head of the money laundering snake is being cut off as we are seeing. There are NO BIDS on larger homes at the moment. Being an expert on trends and charts I’ll defer to Marc Cohodes who says this pain will last a generation at worst and at best home prices will sink to 2014 levels. So who wrote this anonymous byline? Fake News AGAIN

@broccoli sprouts

though your anger is transparent and palpable; your suggestion that RE’s meteoric rise in value is because solely of “dirty money” and “dirty foreigners” is disingenuous.

So everyone who lives in an expensive house in Vancouver is crooked? Give your head a shake. This is a world wide issue where a bunch of governments printed a boat load of money and it found its way into the hands of the privileged. Factually:

1/ most drug dealers and/or people involved in illicit activities are locals

2/ chemical precursor are sourced globally to make harmful drugs who have fallen through our social safety net.

3/ YES, foreigners have accumulated tons of wealth over the last 2 decades; but the majority of them didn’t steal it, they earned it.

4/ Programs were set place to invite wealthy foreigners into our country

5/ The Gini co-efficient (wealth disparity) is only increasing

https://www.conferenceboard.ca/hcp/Details/society/income-inequality.aspx?AspxAutoDetectCookieSupport=1

It is not that people don’t agree with arguments for the erosion of civil liberties for better transparency, but painting an entire swath of the population is crooked does little to solve real problems.

The world is always evolving, but the pace of evolution is much faster now than 25 years ago. Unfortunately, if you don’t have a skill set that the global system assigns a high economic value; than you are scr*wed. But for those who want full equality in concept, there is always socialism (now that is topic after a few drinks!)

Yes, I completely agree, and am happy and expect to pay higher taxes for health care, education and all the standard social program each year. It’s just the provincial govt social engineering regarding RE, foreigners, spec/vacant homes and stripping privacy /legal rights that I object to,

Mathew: Please read the case law on res ipsa loquitur since you clearly have no idea what you are talking about.

>”Oh, I get it, let’s forget about the drug addicts problems (solved by treatment, clinics etc) and talk about confiscating RE so inventory rises and prices will fall so the poster can get a lower price point when buying”

Patrick, assuming your first statement indicates that you are generally against government raising taxes, how does that compute with your next statement? Solving drug addict problems via clinics and treatments cost money. And I can assure you it cost a great deal more than the province can currently allocates to these challenges. By that I mean crazy long waiting lists for inpatient treatment for instance. And let us not forget those struggling with mental health issues as well.

If you really believe (as I generally do) that enhanced treatment options for addictions and mental health is the way forward, then those of us who are comfortably well off should welcome the opportunity to help and embrace higher taxes.

Of course if my first assumption (that you think taxes should not be higher) is wrong then you and I are somewhat on the same page. In which case, apologies…

Anyone wondering why the money laundering chart

https://m.imgur.com/iF4nzh8 presented by the govt report (showing B.C. with lowest ML region west of Quebec and lower then Manitoba/Sask) only covered the years 2011-2015 should check out this article.

May 10, 2019 https://vancouversun.com/business/real-estate/panel-found-some-money-laundering-estimates-unreliable

“Panel found some B.C. money laundering estimates ‘unreliable’

The panel that produced the German report said it didn’t include dollar estimates for money laundering in B.C. for the years 2016 and 2017 because it wasn’t confident in the data available for those years, which happen to be when the Vancouver real estate market was at its hottest and money flowing out of China was at its highest.

Thursday’s report said getting a handle on the extent of the province’s money laundering problem is like “estimating the immeasurable.” But it did eventually settle on a way and, in a chart, produced dollar estimates on money laundering in B.C. for every year from 2003 to 2015, and then for 2018.”

If someone tells you they are “estimating the immeasurable”, at what point do you use common sense, and ignore their results completely? At a minimum, there’s no point in quoting specific numbers as gospel. We all know ML is a long standing problem across Canada, we don’t gain anything from hiring govt consultants to “estimating the immeasurable”. And no, I don’t believe that ML is higher in Man/Sask than BC, I’m just mentioning that to point out the nuttiness in the report.

I happen to think this “estimating the immeasurable” applies to all the govt estimates of ML that have appeared over the last few years. How big a problem is ML?- who knows?

Couldn’t be any more overprivileged. I’m sure that there are billions of people who happened to be born outside of Canada are happy to trade place with the “underprivileged” Canadian millennials.

The solution is to wait.

ya what a drama queen .. should of been born a century ago when lands are free .. be smarter next time .. time your birth !…

Many people are myopic and are too busy at focusing on the problem instead of searching for the solution. Even animals are smart enough to migrate to better pasture where they can find food and shelter. Instead of crying how hard that they are done by or looking for handouts or scapegoats to lynch on.

I’m sorry but my family and I, along with many immigrants that risks our lives to seek freedom in Canada apposed the will to give up our privacy for a contrived security.

IMHO, there are ways to fight crimes with out impede on citizens rights and privacy.

It seems that many posts here talking about serious issues like drug overdoses end up switching to the topic more important to the poster – namely the govt doing something that will lower the entry price point for the poster on the house they want to buy.

Look at the above – we go from drug overdoses to drug dealers – and oh the horror… the drug dealers live in luxury homes. Oh, I get it, let’s forget about the drug addicts problems (solved by treatment, clinics etc) and talk about confiscating RE so inventory rises and prices will fall so the poster can get a lower price point when buying.

Many posts here are like that, whether the issue is foreign buyers, immigrants, vacation homes, Airbnb, interest rates, money laundering, drug addicts, drug dealers, higher property taxes…. the post inevitably turns into action needed that will lower RE prices for the poster’s benefit.

If you don’t believe me, try this. When you see a post, try adding the phrase to the end of the post …”All of this so I can get a lower price point to buy my home.” If that works, chances are you’ve spotted another bear, looking for something to lower house prices for him via a self-serving post, rather than a genuine concern for the original issue.

Here comes intro…. the real estate investment guru. Soon enough she will regale us with her net worth.

Stupid peasants and your inability to buy in 2009. Everyone should have been like intro…. whether you had the means to or not.

Sorry, pal, but very few people thought the “getting was good” when I bought. Quite the contrary.

Just like in 10 years, people will probably see, in retrospect, that the getting was good today. But bears can’t seem to see that far down the road.

I totally agree. These are different issues though (drug addicts, drug dealers, money laundering, unaffordable homes). Sure there can be links, but the govt proposed crackdown on ML doesn’t even propose any criminal investigations, so how is that going to help. How about some old fashioned police work and arrests by the RCMP? And where is the outrage to our NDP and fed govt that there have been so few ML charged with crimes?

Introvert, just because you got yours while the getting was (in retrospect) good, doesn’t mean you have to be a jerk.

What a drama queen! Had you bought five years ago instead of complaining and waiting for the crash that never came, your mortgage could be a quarter paid off and you’d have even more equity from the recent run-up.

Having lived in Vancouver since 2000 and having watched the disgusting real-time progression of a city selling its soul for dirty cash, I am in favour of harsh measures and large government expenditures to fight money laundering.

People on this thread are saying… what about privacy, etc. Listen, at this stage, I will gladly trade one problem for another. I question whether all of you have really processed how bad this money laundering problem has become. (But I can understand that, because you’ve been in Victoria, where it is less obvious.)

Personally, I would love to see some signs that our enforcement of existing laws against money laundering is not a total joke. I would love to see some signs that tax-paying residents of B.C. are valued over foreign criminals. I would love to see some signs that dirty money doesn’t buy a place at the top of our social hierarchy. I would love to see some signs that the erosion of the rule of law here in B.C. has stopped. I would love to see some criminals go to jail. I would love to see some names named when it comes to policy makers who looked the other way while all this was happening.

The real estate unaffordability is only one negative consequence. Thousands of people in this province have died of drug overdoses in recent years. Should their drug dealers live in luxury homes while taxpaying families flee the region? That’s what’s happening in Vancouver, plain and simple.

Have we completely lost our core values in this Province? Where is this headed if we don’t act decisively?

If Johnny illegally stole the $2.5m from his elderly mother in Alberta, and B.C. seizes the money (ie the $2.5m Vancouver house) as “likely unlawful”, when his mother finds out about it, how does she get her money back from the BC govt? Will the BC govt be “cool” and not require any kind of due process to prove that her son stole the money from her, or will BC require all the due process and legal proof that they didn’t afford to Johnny before they return the money to his mother?

Same idea, if the money was stolen in India by (alleged) corruption in India…. Will B.C. give any money seized back to the Indian govt (without requiring due process proof of the corruption) or does BC somehow think they have a right to that money stolen in India if they seize it from a BC homeowner?

Hard for govt to get re-elected doing that though. Since BC portion of total personal income taxes is only 1/3, and property taxes in BC are only half of BC income tax, then raising property tax by N% will lower personal tax bill (PROV+fed) by N/6% (1/6th of the rise in property tax)

Property taxes in BC raise ($5b for municipalities, $7b total) about half of personal income taxes ($11b) in BC. So what’s the idea, raise property taxes 10% and lower BC personal income taxes by 5% (which would translate to lowering fed+PROV taxes by 1.7%.

Would you like to try to get re-elected lowering personal taxes by 1.7% and increasing property taxes by 10%? Lowering 1.7% changes a 50% marginal rate to 49%. I think Joe Homeowner would say my “income tax bill fell by 1.7%, and my property taxes went up 10%…wtf???”

Aside from the fact that govt almost never sticks to promises to lower taxes when they raise other taxes. Like the BC carbon tax, that was introduced as tax neutral, until they quietly scrapped that idea of lowering other taxes.

Pretty hard to evade for sure. Also tough to move your 1/4 acre to another jurisdiction.

Beats unchanged property taxes and even higher income taxes.

Property taxation is the best form of taxation, and some of the best minds in economics, going back to Adam Smith, have recognized this.

Barrister: “I am distressed at how many people think that guilty until proven innocent is a good idea”.

That’s one way to phrase the issue, but it could be also stated as a simple “reverse onus test”. Let me explain my thoughts. There is an old legal maxim called “Res Ipsa Loquitur” (the thing speaks for itself).

Meet Johnny. He’s a flashy 18 year old guy with no job and is driving around in a $300K Maserati and owns a $2.5 Mil house on the west side of Vancouver. He poked your daughter last night when you were away working overtime so you could pay your mortgage next month. Some might conclude that Johnny acquired those goods by unlawful means. In other words, the thing (or the situation) speaks for itself.

What Carole James did is she noticed Johnny driving around in his F-rich Maserati (with the help of an outraged public) and is now asking for a law that puts a “reverse onus test” on Johnny to demonstrate that he acquired those goods in a lawful manner. This should be simple task for Johnny, if he got the goods legally. He could show that he graduated from Harvard Medical School at the age of 13 and has been working full-time at the hospital for 5 years and saved up a bunch of money. Case closed. But if he cannot show that he has a job, and is contributing to society, and acquired the goods legally, then he fails the “reverse onus test” and forfeits the goods.

Another example of a “reverse onus test” is this: Bill’s mom dies and leaves a Will giving Bill and his brother Jeff a 50-50 share in the estate worth $1 Mil. Just when Bill is at the bank making plans to conservatively invest his $500K inheritance, he learns that (one year earlier) brother Jeff talked their mom into getting a joint bank account, so that Jeff and Mom both owned the $1 Mil together. And, the minute she died, the entire $1 Mil went directly to Jeff through the law of survivorship. Bill might be extremely upset about this situation, until his smart lawyer informs him that there is a “reverse onus test” that applies in this situation. A joint bank account owned by one son (and his mother) is deemed to be held in trust for the benefit of all the beneficiaries of her Will, unless the one son can demonstrate a different intention. So you see, in some situations, it may be a good idea to have a “reverse onus test”.

I think the majority of BC citizens who acquired their wealth through lawful means might very well support a “reverse onus test” for Johnny and his ilk, especially when RE prices have risen dramatically throughout the west coast because of their criminal activity.

I was bored this morning so I thought i would take a look at how the rental market is doing in Victoria. Downtown seems to be all over the place, clearly there are people who bought condos attempting to get cash flow neutral by renting the units out. check out some of these prices:

https://victoria.craigslist.org/apa/d/victoria-brand-new-condo-in-downtown/6864115183.html

https://victoria.craigslist.org/apa/d/victoria-brand-new-one-bedroom-condo/6874696788.html

https://victoria.craigslist.org/apa/d/victoria-brand-new-condo-in-downtown/6864117260.html

https://victoria.craigslist.org/apa/d/victoria-1-bedroom-condo-central/6872408429.html

lol those are essentially coal harbour, yaletown prices!

Curious to see if they will have any luck renting them out while there are much more reasonable alternatives such as below:

https://victoria.craigslist.org/apa/d/victoria-1-bedroom-apartment-in/6881001809.html

https://victoria.craigslist.org/apa/d/victoria-one-bedroom-availability-at/6885341820.html

https://victoria.craigslist.org/apa/d/victoria-downtown-hudson-bldg-2br-2ba/6879953316.html

https://victoria.craigslist.org/apa/d/victoria-one-bedroom-at-hudson-mews/6869333495.html

Lots of homes selling in Gordon Head under assessed.

Example: 1798 Brymea Lane Assessed $1,087,000 sold for $976,000

That’d be OK. But what’s coming is higher property taxes and higher income taxes.

What’s workable and desirable, in many respects, is higher property taxes and lower income taxes.

Great line!

Would you report your neighbour to the appropriate authorities if you knew they were laundering money through real estate?

I’ve had multiple neighbours in the past five years who rented self-contained basement suites with private entrances, but never declared the income. Surprisingly they were foolish enough to mention that they don’t think they are required to report the income, in one case because the “renovation for the suite cost more than the rental income they would receive…”

This is money laundering too; it’s criminal, it’s rarely reported, but it should be.

One neighbour has sold their place after the house doubled in value but they will never pay tax on their rental revenue and they will not pay capital gains on the increased value of the rental suite which was about 45% of the total floor area.

Cashless societies are on the horizon with several governments exploring the concept, so if you cheat on your taxes or if you don’t report your neighbours who blatantly evade taxes, then don’t be a hypocrite and complain when the cashless concept is brought to Canada.

Re: UWO: Just what we need another giant bureaucracy. But if we do implement this then the act should mandate that anyone falsely accused gets all their legal costs paid for by the government and an additional $100,000 penalty for their aggravation to be paid by the government. There has to be some form of check upon the bureaucrats before they are allowed to just drag people into court.

At the very least there should be a two step system where the government first has to show some reasonable and probable grounds for starting the proceedings to a judge such as a conviction for drug trafficking or major assets with only minor income reported.

Over the years I have learned to fear bureaucracies far more because of their stupidly than their ill intent.

Perhaps in a moment of optimism I am hoping that Carole James is floating the idea of UWO in order to panic the criminals into selling their BC real estate and moving elsewhere. I am okay if she tables a bill but after a lot of consultation and a big media campaign lets it die on the order paper.

I am distressed at how many people think that guilty until proven innocent is a good idea.

Money laundering is a world wise issue, see “Super rich buying up Italy’s mansions under new tax regime”:

https://www.theguardian.com/business/2019/may/11/super-rich-buying-up-italy-mansions-under-new-tax-regime?CMP=Share_iOSApp_Other

About the title search, anyone can walk into BC assessment office on 3350 Douglas St and search owner info of any property on BCA title database (which is not on internet) free of charge. The proposed new measurement is to expose person(s) hidden behind those “Ltd/LLC/…” titles.

First time buyer. I’ve got a 500k downpayment saved but the house rental market is appealing. Quite a few brand new houses in OB or GH that rent for 3500-5000 a month which represent cap rates of ~2%? Saw a post a while back which said when the housing bubble popped in the US that prices only decreased 1% per month. In the case of these houses that would be a 10-20k depreciation per month making the rental equation easily in my favour.

@Numbers hack

I don’t think they were doing it legally so the 200% wouldn’t apply I would imagine. From what I read, they would push the car off the barge into the water if they were about to be caught by the authorities. I’ll see if I can dig up that article…

@rush4life

I think that’s fair. If you bought it cleanly, or it was inherited, there’s going to be an easy paper trail to follow. If not, so sad, too bad. I have no patience for dirty money that misplaces a local population.

Great post Victoria Born.

Actually only competing again the 5-10 people who are even in the market to buy in Gordon Head at the moment, since there really aren’t that many people who can afford a basic house in Gordon head any more suddenly. Even though the economy is booming (https://www.timescolonist.com/business/victoria-has-canada-s-lowest-unemployment-rate-1.23819723) – lowest unemployment but somehow we’ve lost 5800 jobs in town over the last year (only 3% of the jobs in town) but our unemployment rate has dropped from 4.2% to 3%. But you know, the number of good paying jobs decreased while the number of shit paying jobs increased

So, all bodes well for a increase in real estate spending right?

Yawn! Why not 1982? Doesn’t the market have some sort of obligation to prove Hawk correct?

762 Victoria in Oak Bay back on the market – 2.595M. That one sold for top dollar a few years ago and I remember folks on here discussing what a crazy price it was. It will be interesting to see what that sells for.

Also can anyone tell me what 59 Moss sold for (finally). That one is going to have some misleading DOM as it was listed for ages last fall and then again this spring.

VicBorn,

When you are buying your house in Gordon Head (for example), you won’t be competing against money launderers. You’ll be competing against people just like you. Sorry, but that the way it is. Lots of people want core Victoria homes.

Any RE market subject to excessive raw demand that aligns with the interests of sellers is going to be affected directly or indirectly. I would argue it’s affected numerous other regions in the province. We’re all connected in some way.

In a housing bubble, you will by definition have some form of fraud, misfeasance and irregular financial practices. Perhaps one of those, perhaps all. I’ve mentioned this in the past when referring to a point in which the market turns and people actually start looking at the books.

We’re almost there now.

There has been a lot of conjecture on this issue. Many here opposed the thought of money laundering having any impact on RE prices in this very special City known as Victoria – perish the thought: Victoria is just so special and in high demand because of the climate, the horse-drawn carriages, the Oak Bay Tea Party, the Wax Museum, the Empress Hotel – it is such a special place that the average home should cost 15 to 20 times (or more) household incomes such that you should have to work to your last breath to live here, never be mortgage-free and, even if it means driving a 1984 Hyundai Pony, never leave this hidden treasure.

What a load of crap. This scourge of laundering dirty money it seems is not restricted to BC [and, yes, it is happening right here in sleepy old Victoria] – it is a nation-wide phenomenon and apparently a greater issue in Alberta, Ontario, Manitoba and Sask. Now, there is a shocker. But I digress.

Bottom Line: local incomes do NOT, even in your wildest dreams, support the house prices in Victoria. If you bought here from 2013 to now, you are in trouble. Plain and simple. The home ownership registry is but the first step. The homes held for the purpose of money laundering or “suspicious” ownership will eventually be identified. My hope is that civil forfeiture will result, with the onus being on the owner to prove where the funds came from the purchase it, to prove the funds were legitimate, and prove that the purpose was for a place to live or a legitimate investment [and that all taxes were paid]. Failing that, the BC government takes ownership and sells the property – pocketing the money in to general coffers and pays down the BC debt or reinvests in to affordable housing or infrastructure. The time has come to put local people who paid taxes, built the roads, schools, hospitals, and pay taxes: front and center. Whether you are a Mexican gang cartel, Chinese drug importer/manufacturer, or local Hell’s Angel, if you are laundering the proceeds of crime, let’s follow the money and take our Province back. We want immigrants who want to work and contribute, we want new ideas, we want legitimate investment – we do NOT want dirty money distorting our economy and lives.

The reports [German and Maloney] speak only of 2018. Just imagine how profound and large it must have been in 2015, 2016 and 2017 [the peak years of rising prices]. Maureen Maloney was a UVic law prof teaching tax law and business associations. She was then the deputy minister of finance under the NDP. She has strong socialist values. Not my cup of tea, either as my professor or a researcher, but here she has it right. But, I think their estimates are conservative.

Let’s see if Eby has the jam to follow through – I suspect he does not. Like Trudeau, they are both toothless. Reverse onus is a Charter violation; but so is what he is doing to ICBC and the Rules of Court.

The Registry has to be public – transparency demands it. the second reason is that the public has to work with the Brown Shirts by ratting out the cancer. This is what James and Eby are hoping for. Rat out your neighbor. Sick.

You don’t think it is happening here? Look at the rise in listings in Uplands – come on, wake up. One house was sold in the Fall of 2018, and now listed for $800K more with no alterations.

A reverse onus directive (ie prove you’re innocent rather than the state prove you guilty) is never going to have the sanction of Criminal Law in Canada, but civil penalties are another matter.

This type of law is not without precedent either – they probably tore a page straight from Britain’s recently enacted Criminal Finances Act.

Instead of the “Unexplained Wealth Order” I support confiscation of assets under the “LMEWINTWMTY” Order*

*Let Me Explain Why I Need That Wealth More Than You

A bridge too far is what I think.

We don’t need to shred our rights to fight money laundering.

Just saw this CBC article about how to fight money laundering – specifically Unexplained Wealth Orders (basically taking someones home if they can’t prove they got it legitimately – no presumption of innocence.) Carol James is considering. here are some highlights:

“B.C. has a $7.4-billion problem — that’s the bottom line of two bombshell reports on money laundering released this week.

The big question now is how the province plans to fight it.

Together, the reports make dozens of suggestions for tackling the issue, but civil liberties advocates were alarmed to see something called unexplained wealth orders (UWOs) among the recommendations.

These orders go a step beyond civil forfeiture and “allow confiscation without finding the crime,” an expert panel led by criminal law expert Maureen Maloney wrote in its report, released Thursday.

“I think it’s an incredibly troubling notion,” said Micheal Vonn, policy director of the B.C. Civil Liberties Association.

With UWOs, anyone targeted by the government would be required to prove they bought their property using legitimate sources of income. The province wouldn’t need to show any link to criminal activity.

……..

B.C. Finance Minister Carole James told CBC News in an email that the government will consider adding UWOs to the list.”

https://www.cbc.ca/news/canada/british-columbia/bc-money-laundering-unexplained-wealth-order-1.5132202

What do you all think?

Hmmm, thanks Bigland, that was a small punch in the gut to this permanent resident from the U.S who still works as a contractor for a U.S. company. Quite the pseudo-nationalistic slippery slope, a suggestion casting a pretty wide net leaving me feeling like bycatch.

Or perhaps it’s because I just paid the invoice to my accountant for preparing the two 175+ pages of tax returns and disclosures to both taxing jurisdictions who now, by default, give me the proverbial stink eye.

I don’t know Grant, I think I can provide you and the rest of Canada a pretty decent personal guarantee that what I do with the rest that is left over after taxes is definitely not running up the cost of real estate in Victoria.

Can someone please explain to me how this argument, which I heard this morning, works? “We need to build far more rental units so I am all for densification and development of any old homes because I am priced out of the market.”

Cannot agree with that video. His idea that to claim the PR exemption the money has to be earned and taxed in Canada is completely unworkable. So a Canadian that works in the US for a few decades and comes back to buy a house can’t claim PR? Nonsense.

Completely disingenuous how he calls the new taxes “envy” taxes but when it comes to Canadians (that would be what foreigners with citizenship are called) buying houses he’s for taxing them massively

Owen Bigland has a new video out where he discusses how we’re not truly addressing the big money problem. This video doesn’t include discussion on money laundering but rather how the governments have chosen an approach which is only going after the low hanging fruit and is ultimately only producing nickles and dimes of tax revenue. He said the much bigger problem of allowing foreigners (who have subsequently obtained their citizenship or PR status) to claim the principal residence tax exemption is a much bigger factor in the run up of prices. He argues that not only are the governments missing out on the big money but with the taxes they have introduced they are also penalizing those who have been doing things the right way – e.g. a Canadian resident who has paid taxes on their earnings and purchased a second house. It’s a worthwhile watch.

https://youtu.be/x_GVrFqknL4

@Barrister

Now now…..some of us ex-bankers are nice people. We could discuss it over a few pints at the next HHV get together. However, if you are still not convinced, I could tell you some lawyer jokes 😉

Proceeds of crime have been part of the Canadian economy far longer than the current run up in the re market. It is good that Canada is taking action to manage this issue, but I find it silly that they’ve given a dollar estimate that is now being bandied about when there is little to no reliable data to work with.

Why would someone legitimately want to buy a luxury car in BC to ship it overseas? Does Canada have the best price on Maseratis? Last I checked there are no luxury cars made in Canada. Why not go to the source?

I had a friend that made a killing shipping cars out of Cnd and US back to Croatia for a couple of years when the currency was favorable. One of his best margins was the BMW M3. He was buying it new in the US for 58k and he would sell it for about 85k US in Croatia (MSRP at time was over 100k US in Croatia). There was about 10k worth of costs involved as you have to ship the car and make modifications (turn signles in Europe have to be yellow, etc.)

I know people that ended up being banned from buying cars at Porsche dealerships in Vancouver. You buy a Cayenne in Van and ship it to China for re-sale. Not in Porsche’s interest as it impacts their dealerships in China and they already have over 100 dealerships there.

For whatever reason a BMW in produced in Munich is going to way way cheaper in the US than in Munich.

The report makes it sound like everybody who lives in the Uplands is either a banker or a drug dealer and who the hell wants to live next door to a banker.

Luxury car exporting is alive and well in Alberta, and any B.C. business in it will move to Alberta and face no 20% luxury PST on exports.

The “straw man” in the deal isn’t something illegal, it’s because manufacturer agreements between the car makers and the dealers prohibit sales to exporters , hence a straw “middle” man is used.

You can read how it’s done (legally) in Alberta here…. https://www.ctvnews.ca/business/luxury-car-dealerships-are-targets-of-growing-multi-million-dollar-export-businesses-1.3368819

I doubt the govt will follow through on this threat to refuse PST rebates on these legitimate transactions. If you resell a car in a week you get a PST refund, and if you export a car you don’t pay PST. And I expect permission from the feds would be required to slap PST on car exports. The govt should attack money launderers directly, not attack legitimate businesses.

“Maybe there are people that don’t want this disclosed to the public for safety reasons (celebrities, women afraid of a stalker etc.).”

Doesn’t take a genius to figure out that there are serious/legitimate reasons why some people wouldn’t want their information published. Imagine a judge who sits in criminal court having their home address published for all to see. If this happens, I will personally be disgusted.

Full disclosure: have not read the act, not sure of the details.

For people who know or have worked with Ms. Carol James

“I don’t think it’s isolated,” James said. “Look at the escalating prices. Look at the Greater Victoria area. The Metro Vancouver area. Look at Kelowna. The speculative real estate market rose by huge numbers.”

One might trust her “financial analysis” as much as receiving “legal advice” from Michael Cohen

@Leo: Thoughtful analysis on this post. As per previous thread, targeting the source of illegal cash could be more effective.

@Andy. False. Anyone wanting to import a car into Asia and China are faced with up to 200% tariffs on autos. Luxury cars are likely going to SE Asia or Africa. There is no arbitrage opportunities once tariffs are factored in.

https://www.justlanded.com/english/China/China-Guide/Travel-Leisure/Import-a-car-to-China

@ Underachiever

Good question, I don’t know, but I just read about this dynamic the other day – apparently you can buy a high end car in Canada, ship it to China and sell it for double the price. And I think you get a 20% sales tax refund on it if exported from BC as well. And it’s a pretty easy shipping route.

It’s also another way to launder money, and considering BC has very lax laws on this issue and is known worldwide as a laundromat, that’s probably why at the end of the day.

“She also had a message for people who think the dirty-money frenzy is confined to high-end mansions in Vancouver.

“I don’t think it’s isolated,” James said. “Look at the escalating prices. Look at the Greater Victoria area. The Metro Vancouver area. Look at Kelowna. The speculative real estate market rose by huge numbers.”

https://theprovince.com/news/bc-politics/mike-smyth-more-money-laundering-bombshells?fbclid=IwAR20-4ZYem8AQKZI9hzA3oiYex-lz3sGEI5LkHIcKoWvRCW_KvqzD9OQM38

Why would someone legitimately want to buy a luxury car in BC to ship it overseas? Does Canada have the best price on Maseratis? Last I checked there are no luxury cars made in Canada. Why not go to the source?

@ Patrick

I’m more worried about Google and Facebook.

15 price drops in Victoria today. If you go to this website and click the top left icon, it will list the price drops according to the city you want to look at:

https://www.yvrpulse.com/d/price_drop_1_days_ho?fbclid=IwAR3EtW1hJ8-Wh4pOjApRRuqxIDlavqmn-dEnBRNweS1B0kdMaT6GmdGFTcg

Caveat,

Awesome, that exemption for health or safety is there, and looks straightforward. Thanks for spotting it, and that was my main concern. Hopefully that exemption gets well publicized, and I’ll paste the text of it here….

https://www.leg.bc.ca/parliamentary-business/legislation-debates-proceedings/41st-parliament/4th-session/bills/first-reading/gov23-1

Application to omit information if health or safety at risk

40 (1) An individual may, by application to the administrator, request that some or all of the individual’s primary identification information be omitted from or obscured in publicly accessible information if the individual believes that making that information publicly accessible could reasonably be expected to threaten the safety or mental or physical health of

(a) the individual, or

(b) a member of the individual’s household.

(2) An applicant under this section must do the following:

(a) specify in the application

(i) the grounds on which the application is based,

(ii) the particular information the individual seeks to have omitted or obscured, and

(iii) the address at which the individual is to be notified of the administrator’s decision under section 41 (2);

(b) give the application to the administrator, together with the applicable fee;

(c) provide to the administrator any other records, information and verifications the administrator may require.

(3) Promptly after receiving an application under this section, the administrator must omit from or obscure in publicly accessible information the information specified by the applicant under subsection (2) (a) (ii).

(4) Despite subsection (3), the administrator must cease omitting from or obscuring in publicly accessible information the information specified by an applicant under subsection (2) (a) (ii) if the applicant fails to provide, within the time specified by the administrator, any records, information or verifications required under subsection (2) (c).

Patrick – click on the link I provided below to the legislation before Parliament. Then look for Section 40 entitled:

“Application to omit information if health or safety at risk”

I think that section will allow people at risk to have their public information obscured. It looks good to me.

Relevant also to the privacy concerns check out section 35 and 37.

Section 35 sets the default that the PUBLIC will be able to search by Parcel ID and by name. The latter is somewhat surprising to me (and likely to Leo given his earlier comment). However Section 37 authorizes the governments to restrict searches from the “default” specified in Section 35.

An extreme blunder by the Supreme Court in 2015 needs to be at the top of the list of reforms if the government is serious about combatting this issue:

https://business.financialpost.com/legal-post/lawyers-secure-exemption-constitutional-exemption-from-fintrac-reporting-rules

If someone who wants to continue to hide their ownership for safety reasons is able to do so using some type of exemption, then that would be great.

I’m not sure if that exists in the legislation or not. If you find an exemption like that, please let me know as that’s my main objection.

For sure, they are building privacy based exemptions into the Act, and giving themselves the power to make regulations that create even more exemptions.

Privacy was raised as a big issue in the consultations on this, the statements of the government on this have said privacy concerns are important. The draft legislation shows that privacy concerns are being taken seriously. With all of that in the background I am going to assume that the government, and more importantly the civil servants actually writing the legislation are competent enough to avoid creating gross violations of privacy.

Of course, the hidden agenda revealed. Creating a surveillance state where citizens can spy on each other and publicize and turn the info over to government. In this case you call it “non-governmental investigation”. Lots of that going on in North Korea. Disappointing to see it welcomed in BC.

I am not sure this is a case of hardship. Assuming this actually happens as you describe homeowners would be better aware of the true value of their property (i.e. someone acquiring land around them). This lets them capture more of the value.

That is a bad thing???

You’re saying women escaping abusive partners currently set up companies and trusts to hide their ownership of property? Sorry, I am not downplaying the seriousness of abuse or stalking but this is not a real world issue.

As for celebrities, I am not overly concerned about that as their homes are currently already an open secret in most cases and they are well positioned to handle stalkers. It’s not like a registry will turn ordinary people into stalkers.

Except you don’t know that. The current land title system is public. You can go online and search a title right now. What you can’t do is find people by name. Who knows what search capabilities will be available in the new system, but they will clearly have privacy as one of their design criteria.

As for why not just limit it to law enforcement, we have just seen how effective journalists or researchers can be at forcing the hand of the government. There is huge value in having an avenue for that kind of non-governmental investigation.

I’m referring to someone who currently has their name hidden ( by using a company, trust etc). Like a celebrity. Their ID is currently kept super secret. And yes it will now be public, meaning you can walk in and search a title. I’m asking what the benefit of making it public is, instead of just viewable by govt officials. If there is a loss of privacy, as citizens we should at least question what the benefit is to public disclosure.

Land titles already provide this info for individuals. Pay the fee and you can pull any land title which lists names, occupation, mortgages, etc. If they make it much more easily searchable that could increase the accessibility of this info, but it’s not like this is currently super secret info.

I don’t think they have defined what “public” means in the context of the new registry. They have already said it would be a user-pay system similar to the land title system which already will discourage the vast majority of idle searches. I’m sure they’re not going to open up advanced searching like “find out where Jane Doe lives” to the public

I get the idea that the beneficial land ownership registry is intended “to crack down on tax evasion and money laundering in the real estate sector.” https://www.theglobeandmail.com/canada/article-bc-unveils-canadas-first-beneficial-ownership-registry/

So far so good.

But why is the registry also being made public, instead of just being restricted to view by authorized govt officials that are involved in investigating tax evasion, money laundering, real estate transactions etc.

Maybe there are people that don’t want this disclosed to the public for safety reasons (celebrities, women afraid of a stalker etc.). Why isn’t disclosing it to govt officials enough for this registry, why must it also be made public (retroactively, for everyone https://www.ubcm.ca/EN/meta/news/news-archive/2019-archive/land-owner-transparency-act-introduced.html?

Dad,

Yes, I said the govt should do something about it, as long as they are targeted measures that hurt ML, not measures that mainly hurt legitimate activities. Do you disagree with that?

“So the govt shouldn’t be in a hurry to enact every suggestion on the ML list, unless they are sure that it is well targeted, and a measure that doesn’t hurt legitimate activities.”

Didn’t you just say that it was time for government to stop wasting money on reports and information gathering, and do something about it?

I get that you don’t like the NDP, but c’mon…

Leo,

Great post,

I agree with that, and expect that everyone here would as well. But I would qualify that statement by adding a phrase…. “reduce the relative attractiveness of money laundering in BC., while not reducing the relative attractiveness of legitimate activities in BC”

This is because well-meaning govt measures to target money launderers can have collateral damage that hurt legitimate legal businesses and investors. For example, some businesses acquire land in “stealth mode” because surrounding land values would skyrocket if people knew about it, so why should they disclose. Same story with some personal RE, maybe a woman doesn’t want a stalker knowing where she lives. There are lots of legit reasons people don’t want to publicize who owns property.

Even worse, we hear that to target luxury cars being shipped out-of-country (possibly by ML), the govt plans to slap provincial sales tax on these exports. There’s no way PST should apply to that, yet some legit person doing it will now get hit, not just money launderers doing it. The money launderer just switches to a different method, but the legit exporter may be out of business.

We saw the same scattered approach with the spec tax, which ended up not targeting speculators at all- just more govt collateral damage.

So the govt shouldn’t be in a hurry to enact every suggestion on the ML list, unless they are sure that it is well targeted, and a measure that doesn’t hurt legitimate activities.

Right now you can get a free charger from ZapBC by the way (on the condition that you link your charger to their account so they can take credit for the carbon emissions saved) and with a 14-50 there wouldn’t be any install costs so you would only pay the tax. https://zapbc.ca/doityourself/

Thanks! Will do.

Great post Leo, as usual.

If anyone is interested here is the Land Owner Transparency Act that is before Parliament:

https://www.leg.bc.ca/parliamentary-business/legislation-debates-proceedings/41st-parliament/4th-session/bills/first-reading/gov23-1

From previous article:

No point going above 60A. Actually even 50A is fine. Model S/X can charge faster (48A) but most Model 3s max out at 32A just like Leaf/Bolt/Kona/eGolf.

Actually 14-50s are the best option for max flexibility. Just put in a couple of those and then anyone can just plug in their own charger without the expense of rewiring.