December 20 Market Update

As 2021 draws to a close, we can reflect on an extraordinary year in the Victoria market through some random statistics of note. It was a year of market frenzy that we haven’t seen since the early 90s. Back then we only have partial data available which shows us we had a similarly high level of sales, though we don’t know if inventory got quite as low as we’re seeing now.

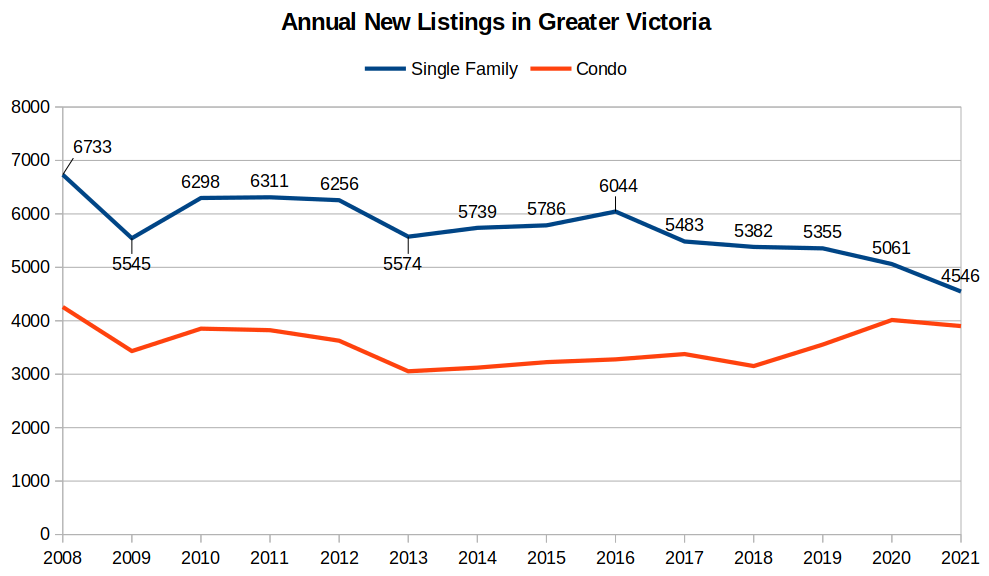

Obviously the major part of the reason behind the low inventory is simply our supercharged rate of sales which depleted our already meager levels of inventory to enter the year. However the lack of new listings have also been a part of the problem. Since July I’ve pointed out how new listings suddenly started lagging, but it’s a bigger story than that. While the rate of new listings for condos remained roughly normal in 2021, new listings for single family homes took a substantial dive, continuing a slow trend of deteriorating new listings that has been going on for a decade.

There were 4628 new house listings so far this year, with about another 20 to come. That’s down some 28% from the levels we saw at the start of the decade. If there’s one thing we could use right now, it’s another 1400 or so listings that were missing in action this year. With some luck those sellers were just scared off by the ulta-competitive market and will come out of the woodwork again when the market cools off. However many of those that put the pause of moving this year were likely just move-up buyers in the market anyway, with little net impact whether they sell (and rebuy) or not.

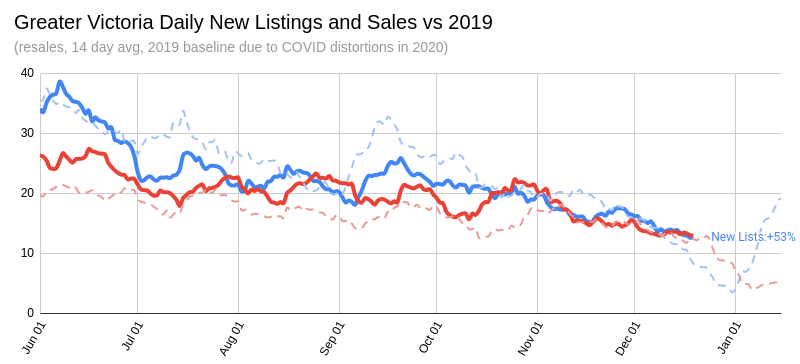

In the past few days we’ve seen new listings not drop off as much as they normally would this time of year. Of course the +53% figure is exaggerated because of the low base, but any increase is better than nothing.

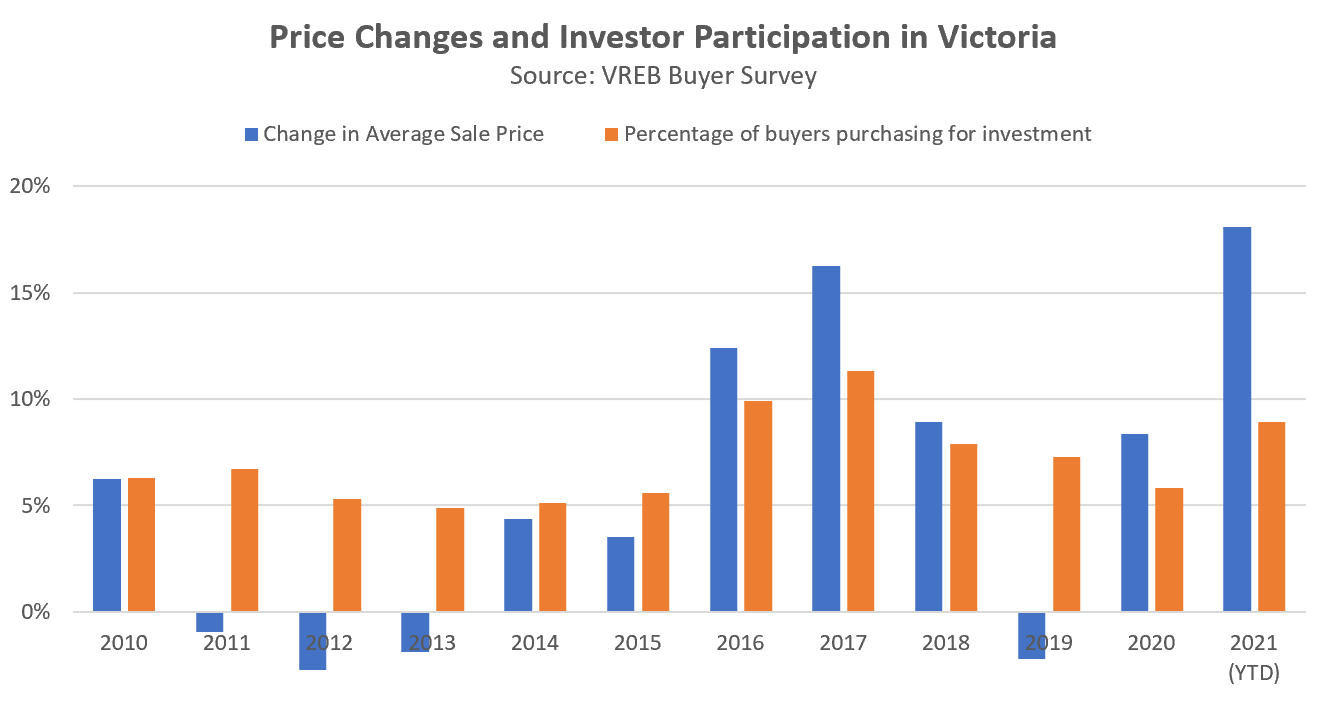

Investors keep responding to higher prices

With a few more months of buyer’s agent survey data from the board, we can see a continued increase in the rate of investors in the market, and the correlation to price movements. It seems that at least according to these data, the base rate of investor participation is about 5% of buyers in slow years, with another ~5% that start buying when prices are rising. Of course it would have been better for investors to buy during the flat years rather than after prices had risen (and expected return dropped), but it’s hard to argue that any of the entry points have been wrong so far.

How to reconcile this rate of 5-10% investor participation with the report of 25% of purchases being by investors in Ontario? That’s a question of definitions. The rates charted above are for buyers specifically buying for investors, while Teranet defined investors as anyone that already owns a property. That includes buyers of vacation homes, retirement homes (while they haven’t sold their previous), or homes for family where they’re also on title. Add up all of those categories and the rate for Victoria was 18% in 2021.

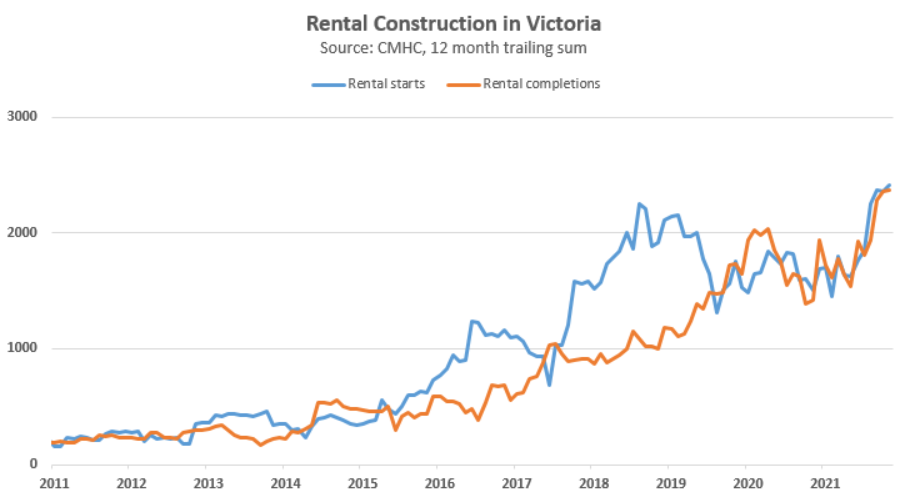

Rental construction stays high and will change the rental landscape

However I think the power balance may be slowly shifting away from individual rental investors and towards tenants. For years if you wanted to rent a modern apartment, your only choice was to rent it from a private investor. Some small investors are excellent landlords and hold their units for the long term, but on average they tend to turn over units more frequently, and they hold the ultimate eviction trump card: the owner or their family moving in. That’s part of the reason why 15% of renter moves in BC are forced, the highest rate in the country.

That has changed in the last 5 years, with rental construction exploding in Victoria, increasing tenfold from 200 to over 2000 units built per year. That means that tenants now have a choice in the modern rental space, and purpose built rentals provide a lot more security in tenure. After decades of neglect of rental construction, it will take years to make up the deficit, but it’s a promising sign.

Rental starts fell somewhat in 2019, but have rebounded recently, with thousands more units in development. That means completions should remain very strong in the coming years.

Meanwhile for private investors, a surge in condo prices and the lowered cap on rent increases have combined to drive down capitalization rates on investment condos. While current tight market conditions will likely lead to some more short term price gains, condos are starting to bump into affordability constraints that should start cooling down the market in 2022. it probably won’t happen next year, but I wouldn’t be surprised if we saw some investor outflow from the market in 2023 and beyond as they face increasingly stiff competition from the professional operators leveraging economies of scale, cheap financing, and government supports at all levels.

Either way, we can hope that 2021 marked the toughest time for tenants, and things are looking up in the future.

Next week we’ll go through the predictions for the year we made 12 months ago and see close or far from reality they all came. Happy holidays!

I lived in Atherton / Menlo Park California in the 60s to 1980.

In 1960, my parent bought a 1450sq ft rancher on 2 acres for $24,000.

That was a lot of money.

They bailed in early 80 selling for 385k.

In the next decade the house sold for 1.2m and 1.7m.

The 1.7 m buyer demolished the house and built a mansion which sold in 02′ for 12 million.

My point is simple, the population since 1960 grew from 3 billion WW to 7.8 billion today. Twice ++ the wealth

and much never changed hands.

Predictions post: https://househuntvictoria.ca/2022/01/03/2022-market-predictions/

User experience is better with crypto? In what possible way? It’s more expensive to transact, less secure, no recourse if you lose your passwords or are defrauded, the currencies are super volatile so you can’t use it reliably day to day, it’s incredibly inefficient contributing substantially to climate change (bitcoin and other proof of work currencies at least) and it’s accepted nearly nowhere.

The tech is useful (though overhyped), but literally the only value of something like bitcoin is that it goes up in value. If it didn’t, no one would care.

Lots of crypto bashing on here! I have about 0.5% in crypto. Lots of arguments out there not to buy it but one that doesn’t hold water is that it isn’t backed by anything. It is: a user experience that is generally better than fiat. No forex, no inflation, etc. There are over 6,000 coins now though so it is tough to suss out the best ones but if you could get paid in a stable currency immune to inflation that you could spend anywhere in the world would you?

For those that don’t understand the concept of the value of something being backed by a user experience, look at blockbuster versus netflix. Same content. Different…user experience which one do you use?

I suspect that many if not most first time buyers in Victoria are actually out of town buyers. Often this might be their retirement home but first time buying in the city especially in the SFD market. A lot of the market here is not driven by local incomes.

Oh great. That means the people on HH here that are waiting for rates to go up before buying. will pay higher mortgage interest, but still pay the same or higher prices for the house.

Unless they are prepared to also wait out this “time lag” you’ve discovered. How many years is it?

Some interesting historical data on real wages for workers under 40, who make up almost all first time buyers and thus support prices in general. Full report below.

https://www150.statcan.gc.ca/n1/pub/11f0019m/11f0019m2018405-eng.htm

There is a time lag between mortgage rate increases and price declines. Likewise there is a time lag between falling rates and a market bottom, because the falling prices scare people from buying. As well, falling prices often accompany recessions and high unemployment. Like in Ontario circa 1991.

Specially during the current situation thanks to the extra money that the government created that is chasing an all time low amount of supply. Therefore I believe price will continue to grow even if rates increase, because the supply side is not being address. Unless, we face an extremely high level of jobs loss.

… yes despite posted mortgage rates rising from 10 to 15% during that period. https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

Yes, despite posted mortgage rates falling from 14 to 8% during that period.

So we cannot assume that rising mortgage interest rates will lead to lower house prices. As always, supply and demand are the biggest factors.

Not how I see it….

To buy vs rent a $126k Victoria SFH in 1981…

1. BUY….- If you put down $26k, and took out a mortgage of $100,000, you would have averaged mortgage payments of $700 per month over the first 25 years and then $0 for the last 6 years. +property taxes+maintenance. And you’d have an asset with $1.1m, tax free when sold.

I see the first option as more “tempting”

So… if you set aside $126k for 31 years, let a further 7000 after-tax dollars evaporate for every one of those 31 years for property tax, insurance, and maintenance the gamble MIGHT pay out a 2% return before inflation.

Tempting, tempting.

Here is a nominal price graph. https://www.vreb.org/media/attachments/view/doc/2_2020_historic_average_selling_price_graphs/pdf/2_2020_historic_average_selling_price_graphs.pdf

And nominal price data https://www.vreb.org/media/attachments/view/doc/3_2020_historic_summary_of_single_family_detached_sales_by_year_2/pdf/3_2020_historic_summary_of_single_family_detached_sales_by_year_2.pdf

Return in the 1980s (from 1980 to 1989) was +63%. If you bought at peak in 1981 and sold at trough in 1985 you would be down 24%. Of course if you bought at the worst time (1981) for $126k and held on until today, your house is worth $1m+.

Right. And during that time when Toronto prices were falling (1990-94), Victoria prices rose 43% from $179k to $256k. And interest rates were the same in both places.

Toronto prices doubled from 1985-1989, then lost half their value over the next 5 years or so. It took 13 years to recover the lost ground.

Are you kidding? Massive RE bust in BC and Alberta, in the early 1980’s. Vancouver benchmark down about 35% nominal, 50% real. I think the 42% real price drop for Victoria graphed below would be 25% nominal or so.

https://househuntvictoria.ca/2016/03/17/a-brief-history-of-prices/

You have the Bank of Canada and the Fed both saying they’re going to raise rates 3 times next year specifically for inflation reasons and that inflation can not be seen as transitory any longer. That’s the reason I believe that interest rates will rise.

Call me crazy, but I think there’s a huge difference between leaving rates at 4% (during ww2), and leaving them at 0.5%.

WOW!!! $1,425,000 for a lot on Ash Road. That’s like non view South Oak Bay/Rockland prices for a building lot.

I can’t find any data that indicates wage outpaced inflation throughout the 70s. In fact the opposite occurred.

Canadian family average income in 1971 = $43,437, and 1980 = $55,061. Total growth of $11,624 or 26.76% in 9 years.

Canada average inflation from 1971 to 1980 is 116.98% in 9 years.

Canadian Council on Social Development Fact Sheets — http://www.ccsd.ca/factsheets/fs_avgin.html

BoC Inflation Calculator — https://www.bankofcanada.ca/rates/related/inflation-calculator/

Not sure what “house of cards” you’re referring to, but there wasn’t any collapse in nominal house prices in 80-81 or the 1980s. US house prices rose 16% from 1979-82 and doubled during the 1980s. Is that the “collapse” you’re referring to?

https://fred.stlouisfed.org/series/ASPUS

Monetary expansion was similar in size during ww2 to the 20-21 pandemic.

Money is created by all banks (ie commercial banks like JPMorgan) , not just the fed. The central bank buying securities is one way of creating money, but that’s only part of it. The commercial banks create most of it, and the fed attempts to control this by lowering rates, direct lending to the banks, changing reserve requirements and repurchasing securities from them.

The important point is is to look at the money supply, (m0,M1,m2) as that tells you the sum total of how how much money actually got created. The M2 money supply expansion seen in WW2 was the same as what we’ve seen with the Covid pandemic.

M2 in USA increased 52% in the 5 years of the war 1941-45

The last 5 years of our economy (2017-2021) have seen M2 increase 51%

https://www.longtermtrends.net/m2-money-supply-vs-inflation/

The point here is that in ww2, a similar expansion of money supply did result in inflation from 1946-50, total 32%. But then it was back to normal (prices stayed high, but inflation fell to 2-3% so was transitory). But interest rates didn’t rise, because the fed wanted to keep them low. And they stayed low until the 1960s https://advisor.visualcapitalist.com/us-interest-rates/

The relevance of all this to Victoria house prices, is that some people here are expecting interest to rise in response to this inflation that we are seeing, in the hope that this will lower house prices. Of course they may be right, but I don’t think so. I think governments and central banks will look back at these postwar periods (ww1, ww2) as a template of how to recover from the huge new debts, by inflating and expanding the economy. Instead of introducing austerity and higher rates. That’s why I expect years ahead of inflation, low rates and higher Victoria house prices.

Wages outpacing inflation and shift from one to two income households. Are we going to see that going forward?

Also mortgage rates actually didn’t go up all that much 1960-1979. From 7% to 11%. Then a couple of years of high rates brought down the house of cards.

https://www.bankofcanada.ca/wp-content/uploads/2010/09/selected_historical_v122497.pdf

How much is some though?

Many of the war time bonds were marketed directly to your average person.

Looks like they issued about $2.9 trillion in bonds in today’s dollars.

The Fed has bought over double that in the last 2 years no?

The actually tapered the growth in the money supply though.

Thanks I hope I was bullish. Lol

Yes, tons of predictions. New post coming

Runaway housing price (inflation) started in the middle of the 1960s till 1981 despite interest rates increased.

So it is likely that we will see price increase/inflation for long time before a crash.

14 charts that show what inflation and monetary policy will look like in the next year

But keep in mind, predictions are hard – especially about the future.

Wet is the best time to find the leak in your attic, and the leak/s likely to be around valleys and vent penetrations.

What can go wrong?

Low interest rates, high resale price, and now assessment up several folds over an average family yearly income.

I can see that young inexperienced buyers are going to trip over themselves to buy as much house/s they can afford in the coming months. And, renters will continue to blame boomers and foreign buyers, while call for more taxes as the only cure for the cancer that the governments created.

Tread carefully. One year my basement showed up on the assessment as finished. It is not (other than one small corner) I phoned and they were happy to correct it but the following year my finished corner showed up as a new bedroom. Not sure what they thought was in the finished basement as it did not change the number of bathrooms, bedrooms etc. when it went from unfinished to finished. When I was talking to them they said so many people have quietly finished their basements they just assume finished unless told otherwise.

When I have disagreed with my assessment I have phoned and asked to speak to the analyst for my area. I very politely explain that I do not want to dispute the assessment if their assumptions about the property are correct but that I would like to make sure they had an accurate picture. They seem to appreciate that approach and it has worked in my favor with the exception of the above case. (which didn’t actually change the assessment)

I would agree with the others who have suggested letting sleeping dogs lie if the changes are not in your favor.

Leo was there a contest this year? 2021

Don’t give bc assessment any info that is positive

Depends. Do they think you have a bigger house than you do? Then correct it, which will bring down the assessed value and your property taxes.

If it’s the opposite then I’d leave it, no reason to sign up for a higher tax bill.

We did this a couple years back. Just emailed them with the correction (I sent floor plans from the listing when we bought the place) and they corrected it with no issue.

If your assessment is incorrect on # of bathrooms, bedrooms, sq ft etc… Do you correct it with BC Assessment? Does it matter?

Happy new year! Really got to know the new house over the last couple months especially the attic. Leaks are just a part of my life now until it’s dry enough for someone to get up there and do a better assessment of the flashing around anything sticking out of the roof which seems to be the problem. I move an industrial fan around to dry up the leaks. One roofer sounds promising but won’t get up on the slippery metal shingles until it’s drier or they come back with ropes and harness so hopefully once the weather turns. In the meantime we’ve been having a blast in the snow.

Metal roofs… Kind of cool, if installed correctly, which ours apparently wasn’t. Still hoping for a moderate fix, doesn’t appear we need to re-do the whole roof.

Sannich 15%. House beside me sold for 700k more than my new assessment.

Lake property up 70% Still below sales.

Lake front up 100% in 2 years.

Fun times

I see my daughter’s home in Vancouver (in the city), “only” went up 20%

Yes.

Okay. I think I understand. So, is that an example of the “mill rate” in action then, or is that something else?

That 3.494% is the rate for last year’s taxes. The rate you pay for this year will get set by May 15th. They will reduce the tax rate by the same amount that assessments have risen, so that the total taxes stay the same. And then raise it a little to generate the increased taxes required (maybe 3-4% raise).

So if assessments rose overall by 30%, they will lower that 3.494% rate to 3.494/(1+.3)= 2.69% to generate the same tax revenue.

Patriotz,

Can you elaborate on that a bit more? So for instance, the municipal deduction could theoretically drop percentage wise given the larger total revenue?

Like I said I must be missing something because the resulting tax increase that this entails would seem pretty disproportionate to any increases of their actual operational costs.

What you appear to be missing is that it’s municipal spending and assessment that are set independently, and the property tax rate is a function of those two.

You know, I do wonder about this. Different people say different things – ie as valuation goes up, property taxes go up. Others say your property taxes only change if the value of your home changes differently relative to the others around it (ignoring tax rate changes from the municipality).

I’m in North Saanich. When I look at their website, they identify the total tax rate for 2021 as being 3.494% of every $1000 of taxable valuation.

So to me, that seems more like taxation changes YOY is directly tied to valuation, not changes in value compared to nearby homes.

So in this case, say last year’s assessed value was $900k . That would mean an annual PT bill derived from 900,000/1000*3.494= $3144.60 per year.

But if next year (assuming tax rate is unchanged) the valuation is, for example, $1,305,000, that means 1,305,000/1000*3.494= $4559.67

Or am I missing something? In the end we’ll just have to find out, but either way it’s safe to say my house made more than I did last year….

Good timing on that buy in a time when it wasn’t clear that it was a buying opportunity.

Agree it’s bad for the country as a whole.

The hunt for cheap. Pretty crazy some of the gains in the cheaper markets.

Sales coming off their record peaks due to low inventory.

Our up island place went up 48%. Here in town it was 27%.

+44.5% here

‘

‘

To be fair if your assessment went up 40 -50% you’re property was undervalued in the past, it appears that all it takes is a few neighbors to sell their homes at FMV to bring assessments back in line, but seeing your taxes go up $500 to $1,000/year, permanently, plus annual increases isn’t fun.

Right. But when you switch to a new house as you did last year, you first payoff all previous deferments in full. So you’re starting deferments again.

‘

‘

yes, that’s the way it works.

The only thing missing from that crazy-uncle-at-the-Thanksgiving-table rant was the recommendation for all of us to buy gold.

+44.5% here. Same throughout the neighborhood. Just astounding, and I don’t mean that in a good way. This doesn’t take into account any price inflation since July.

Print, print, print, you zealous central banks. They aren’t even trying to hide it anymore. Despite what they say about tapering QE, they won’t (and now can’t) do anything of the sort. They may get a hike or two in there, but sovereign, corporate, and consumer debt is far too high to let them get anywhere meaningful. I will not be surprised if this price escalation continues, because a market flooding with misallocated and non-stop printed money is not about fundamentals and genuine price discovery. I do not believe it’s a coincidence that prices exploded as Covid hit and the printing presses turned on in earnest.

The Canadian Central Bank is now apparently involved in fiscal policy, as they have started to directly fund our government’s operations. Then we see inflation destabilizing, inequality continuing to rise, and our currency (and our debts held in that currency, by implication) becoming absolutely worthless – all the while we get told it’s all good for us. Flooding society with liquidity as a last ditch attempt to smooth over a debt soaked, broken financial system is not a new concept, and it generally ends up the same way. Until that day…

Happy New Year everyone…your hard-earned cash is going to be trash. 🙂

Right. But when you switch to a new house as you did last year, you first payoff all previous deferments in full. So you’re starting deferments again.

22% here on the Marigold/Strawberry Vale Border. Looks like less than most other posters but I seem to recall this area being on the high side the previous year.

Happy New Year.

.

I’m guessing my old neighbor won’t be happy when he sees that his assessment went up 42% this year most likely due to us selling our home last year.

I’m happy to see my assessment up only 18.5%, we may actually see a drop in our tax bill, although we actually defer our taxes.

No. The fed doesn’t issue bonds. The government does. And in WWII, the fed was doing the same thing that they (and the Bank of Canada) are doing now. Namely “open market purchases” which is buying bonds (with created money).

Here are the relevant quotes from the link I posted confirming that…

‘ Federal Open Market Committee announced that it would maintain the annual rate on Treasury bills at three-eighths of 1 percent by buying or selling any amount of Treasury bills offered”

“ the System made some open-market purchases to influence the yields on short-term government bond”

That is frequently true. M2 grows about 5-10% per year, and so the last 14 years will show that. For example, in 2020 M2 grew 20%, which is big. But it’s like 1942 when it grew 18%. And there was inflation for a few years. But they didn’t raise rates much and it went away after a few years.

Here’s a long term graph of inflation and M2 money supply where you can see these similar temporary inflation peaks after the end of the wars – us civil war (1860’s), wwi and wwii ended, due to the large increases in M2 during the wars.

Here you can see m2 growing including huge peaks during the wars, causing inflation peaks for a few years…. https://www.longtermtrends.net/m2-money-supply-vs-inflation/

The relevant point is, despite all this inflation after ww1 (1920, 21% inflation) and ww2 (1947, 19% inflation) , interest rates stayed low throughout (<4%) and didn’t move higher than 4% until the 1960s

Look at this chart and you’ll see these post war periods where interest rates are staying low, despite inflation up to 20% in a year. https://advisor.visualcapitalist.com/us-interest-rates/

The point being, after periods of huge government new debts and money expansion, the government keeps rates low, and lets the inflation happen to inflate their debts away, which I expect they will do this time too.

Expect further big price rises in everything including houses for a few years. But rates will stay relatively low

Condo owners should get a small property tax reprieve this year as single family takes over more of the tax burden.

Before thousands of pixels give their lives in frenzied posts about upcoming jumps in property tax, perhaps someone could revive a post from last year explaining that your house assessment increase, judged in isolation, has NOTHING to do with changes to your next tax bill.

27% here, just outside the barbed-wire of the Victoria pale in Saanich.

Up 3.5%…..guess my tax bill be dropping!

They were issuing bonds, not buying bonds. Which would be deflationary instead of inflationary since they were actually reducing the money supply by trillions(in today’s dollars) instead of injecting trillions.

During the entire history of the United States 75% of its money supply was added in just the past 14 years.

+32% property taxes are not looking good in comparative

+26% in Saanich East.

+19% for me and my neighbours in the COV

I have a suspicion it won’t be June before MLS listings reflect updated assessments this year…

+26%

+30%

Absolutely. Of course it was done during WWII, which is when the bonds were issued and the highest deficits occurred.

https://www.federalreservehistory.org/essays/wwii-and-its-aftermath

“ Perhaps the most important actions performed by the System during the war were to control government bond prices to promote stable financial markets and (even more critical) to help reduce the interest rates on financing the extraordinarily large fiscal deficits associated with active participation in the war. In 1939, shortly before the beginning of the conflict in Europe, the System made some open-market purchases to influence the yields on short-term government bonds. The goal was to promote stability in short-term funding markets and prevent market disorder in the face of uncertainty at the outset of the war. Once the United States formally entered the conflict, the system made a firm commitment to support government bond prices. In April 1942, the Federal Open Market Committee announced that it would maintain the annual rate on Treasury bills at three-eighths of 1 percent by buying or selling any amount of Treasury bills offered or demanded at that rate. For longer-maturity government securities, the System also established a maximum yield (or a minimum price) by standing ready to buy whatever amount of these securities was necessary to prevent their yields from rising above the maximum yield. Such a commitment to maintain low yields (high prices) of government bills and bonds necessarily resulted in the purchase of a significant volume of government securities, producing a substantial expansion of the System’s balance sheet and, in particular, of the monetary base. Indeed, the monetary base increased by 149 percent from August 1939 to August 1948.”

No, that’s not how it works. If there’s inflation one year I+10%) and the next year it’s 0%, then inflation is gone. The higher prices stay. But the term inflation is gone.

+35%

2021 Assessments are out: https://www.bcassessment.ca/

Up 27% here

It’s never temporary, the price inflation always stays. There’s been little to no deflation in the past 100 years.

The fed printed billions of dollars daily after ww2?

Even Powell is saying that it isn’t transitory any more.

I think inflation is here, but temporary (<3 years) and they will keep rates low, and house prices will rise throughout.

You’re assuming that inflation isn’t temporary. There have been 6 periods of inflation since wwii and some have been temporary. The current situation is most similar to the inflation after wwii (supply chain disruptions, pentup demand). And interest rates stayed low during that (2% https://advisor.visualcapitalist.com/us-interest-rates/ ) . And inflation was temporary. (5-15% for 4 years, then back to normal 2% http://www.aboutinflation.com/inflation-rate-historical/us-inflation-rate-historical-chart

And US housing prices rose throughout, and rose uninterrupted for the next 60 years . https://observationsandnotes.blogspot.com/2011/06/us-housing-prices-since-1900.html

Here is the official take of the WhiteHouse economists, who believe inflation will be temporary, like it was after wwii.

https://www.whitehouse.gov/cea/written-materials/2021/07/06/historical-parallels-to-todays-inflationary-episode/

“ No single historical episode is a perfect template for current events. But when looking for historical parallels, it is useful to concentrate on inflationary episodes that contained supply chain disruptions and a spike in consumer demand after a period of temporary suppression. The inflationary period after World War II is likely a better comparison for the current economic situation than the 1970s and suggests that inflation could quickly decline once supply chains are fully online and pent-up demand levels off”

Well, either way, it’s a nice pickle. No one will buy bonds to back debt at such a a low return on risk (so the need to bump interest rates). The use of Central Banks to buy bonds through massive paper issuance to back debt leads to currency devaluation and pumps up inflation. As well, the latter erodes confidence in the financial system and the solvency of those conducting the policy. I’m sure in the 80s and the early 90s the government would have loved just to of said “hey, let’s take our debt servicing payment down from 40 billion to 20 billion by cutting these high interest rates”. Still comes down to debt being a market and someone needs to want to buy yours and the only way to make that happen is to pay a return. If Central Banks keep purchasing debt through new paper, people will be even more shocked by inflation or by the interest rates that will be needed to start getting it under control or to have markets wanting to buy sovereign debt. That also goes for the renewals on all those mortgages from the last year. Thwt mortgage debt is supported by bond buying through BoC and CMHC to get those low rates. On renewal, lenders are going to need to sell those mortgage bonds on a market that might not like the heavy indebted risks of the people holding those loans. The only mechanism the market has to alleviate that risk to get someone to buy those bonds, is to increase the return and require a much higher interest rate to be paid. This will be at a point where the central bank and government won’t have the ability to intervene because they have used the fiscal capacity up and any further central bank style bond buying programs to support private lending to artificially keep rates low will be detrimental to the system.

The huge government debt is a reason that they won’t want to raise rates as fast as they should. If we are looking for things to end the housing mania, I think a recession might do it.

Let’s not put too much pressure on 2022; we saw what happened when we had big hopes for 2021.

Happy New Year to one and all. Hopefully a better year ahead for all of us.

2789 Arbutus Rd. looks like a steal in comparison to 1559 Ash. The lot is almost three time the size in a much fancier hood on a much more quiet street (section).

https://www.realtor.ca/real-estate/23807973/2789-arbutus-rd-saanich-arbutus

Wow. That’s bananas.

Vacant building lot at 1559 Ash Road in Gordon Head, 8,676 sq/ft for $1,425,000.

If you are going to buy crypto 1-2% of your portfolio, or an amount that you would be willing to gamble in Vegas.

Cryptomanie is a modern version of tulip mania, hence have 0 cryptocurrency in my portfolios.

Position in ethr.to and hut.to here. Had one in coinbase but sold out of it recently.

@Umm…really

I don’t disagree but the problem is governments can remain irrational longer than you can stay solvent…

Umm……I am with you there, I echo your post loudly. Matter of fact “I can’t wait for it” might be my new handle on this blog.

From: https://financialpost.com/executive/posthaste-majority-of-canadians-fear-a-negative-impact-on-their-finances-if-mortgage-rates-rise-poll

Come on mortgage rate escalation! Let’s get this done. Mostly to quell the fantasy of vast salary escalation people are expecting. It’s even more of a fantasy for government workers that don’t realize when their employer has just went on a borrowing binge, that hiring and wage freezes are just around the corner for anyone tied to the public sector. You know, like many of the people in Victoria that just took on massive mortgages with duel family incomes both from the government. Yes, the private sector is agile enough to quickly adjust to compete for talent (the immediate need to hire someone to get a job done and bill more to cover the the cost escalation), however, this does eventually balance out. For governments, there is no longer room to borrow, and people that are being pinched by inflation with costs escalating through everything that they do; these people are not going to be overly receptive to anyone proposing increased taxes. Thus begins open season on government wages. It always starts with the consultants and contractors and followed by denying backfills for folks on extended leave… Then the attrition battle (do we really need to fill this position now that it’s vacant?). Then the morale goes (well, I know that’s a great opportunity, but since I can’t backfill your position, I will not approve your secondment or temp assignment, even though it’s valuable experience for you or comes with a pay raise). Then a zero % mandate in all contract renewals and the elimination of those one time program funds that just kept reoccurring, suddenly disappear. This all should be a fun watch!

I think there’s a decent chance that crypto/ decentralized finance will lead to big changes, some predictable and some not. But how to profit from this uncertain future is a totally different question. Buying crypto IMO is still a crapshoot (I have <1% in BTCC-B.TO).

Instead of bit coins…..One might want to look at investing in lithium. (The USA only produces 2% of it’s own lithium I believe.)

The “Thacker Pass” Lithium project in Nevada looks exciting. (Currently 41 cents a share). It’s set to be the biggest lithium project in the US. and a judge recently made a ruling in the companies favor)

Production starts this spring.

(In my opinion, one might want to consider Investing in the mining company as well as the parent company.)

Right, same here. I think that ultimately cryptos will be worthless, but owning a tiny amount as play money is fun.

If you’re comparing the 1970s with today, you need to adjust for inflation or better still to GDP. (Nominal GDP is up 10X since the 1970s.). If you do that, you’ll see that economic losses from weather disasters are also down.

The huge drop (down 66%) in loss of life from weather disasters is 2X more impressive when we realize that population has doubled during this time. Because that means we now only see 1/6 of the loss of human life (per capita) from weather disasters compared to the last 50 years, which is remarkable, and unexpected.

Please note that I am not suggesting that weather disasters are reducing over time. But they don’t appear to be worsening. And at least it’s good news to hear that, despite 50 years of population growth and climate change, that the impact of weather problems (impact measured by human lives lost) has actually fallen to 1/3 of previous levels. Remember, we are told by many that climate change is leading to weather disasters that could ultimately lead to human extinction. So far, that doesn’t appear to be happening. Some good news data points like that might cheer some people up.

Thanks Barrister. Happy New Year to you as well. (And of course….Happy New Year to all of you)

I still follow House Hunt Victoria and enjoy the general overview it gives about where things are, where they were, and where things might go.

I’m still a big believer in looking at the big picture when I want to understand where Victoria is likely to go. (For example: I look to Vancouver.)

As crazy as it might sound…..I still think Victoria is cheap and there is still lot’s of room for prices to go up.

(I think I waivered once on that idea, but overall, I have been fairly consistent that prices are going to go up further.)

Same with Moncton NB ( prices there went up 30% + overall in the past year. ) I still like Moncton because it requires so little to get into. You can still get a full duplex there for $275,000.00 and the rents have increased substantially there in the past year. (If one can afford it, then I’d still say that Victoria is a great long term investment.)

Immigration and few homes being built are some of the reasons for what has happened….as many of you have already commented here in House Hunt Victoria.

My grandson has been keeping us busy:)

All the best.

Why bitcoin is worse than a Madoff-style Ponzi scheme

https://www.ft.com/content/83a14261-598d-4601-87fc-5dde528b33d0

https://docdro.id/aMCLDdu

If you think fiat currencies are going down the toilet there’s a proven defense – buy gold. I don’t own any (I do own gold producers via ETF), but if I felt we were headed for Weimar Republic that’s what I’d do. It’s always going to be worth something.

Crypto is supported by nothing but attitude. Ownership of a number isn’t inherently worth anything.

No, and I haven’t seen anyone make a rational case why there is value in doing so other than Soros’s quote of “When I see a bubble, I rush in to buy it.”

However I do have a bet that the proof of work coins will do badly against the proof of stake coins as people wake up to the complete insanity of the proof of work system. Think of it as ESG pressures for the crypto space. Many people are enthusiastic about crypto but not comfortable with the attrocious environmental impact of coins like Bitcoin. They will shift to Ether once they switch to proof of stake (or other coins using similarly less energy intensive validation techniques)

I have a minor position in an Ether ETF that I will just leave be indefinitely, but it’s basically play money. 99% of our investment assets are in diversified assets, with some dividend bias. If that poll you cited is correct, it reflects a pretty crazy situation in my view. I mean, over 50% of assets in crypto? that’s insane…

Who on this blog has money invested in bitcoin or other cryptocurrencies?

I don’t yet.

https://financialpost.com/fp-finance/cryptocurrency/burning-questions-could-this-be-the-year-crypto-finally-goes-mainstream

Yes it’s good news, but looking at the details those large death tolls in the 1970s and 1980s can be attributed to conflict and misrule in 3rd world countries. For example, #1 death toll in Ethiopia in 1983 was largely the result of the wrongheaded agricultural policies of the Communist government of the day – blamed by them on drought. #2 death toll in Bangladesh in 1970 was when it was still East Pakistan and was misruled by the government in former West Pakistan, leading to civil war a year later. And so on.

Improved administration and food aid have reduced those 3rd world death tolls in recent decades. But take a look at the trend in economic losses (Table 1).

It is an indication that the thermocouple isn’t generated enough power to keep the gas valve solenoid open.

Clean the thermocouple with fine no soap steel wool or sand cloth.

Check and tighten the thermocouple to solenoid connection.

Make sure the pilot flame fully cover the thermocouple (Clean or replace the pilot gas tube if the flame doesn’t cover the thermocouple after you turn the adjustment screw because of clogged or kinked pilot gas tube).

Replace the thermocouple if the above didn’t work.

Is it natural gas or propane?

QT: The fireplace actually lights and goes up to a full flame for about thirty seconds and then sputters out. I googled the problem and there seems no quick fix.

It is possible that the exterior wall temperature drop down below freezing if the interior side is not heated, however the slab in the house shouldn’t be anywhere near freezing temperature as our ground temperature is a steady +3.5 to +10 C or more at around 3.3′ deep pending soil type/conditions/season (average around +7 C), hence the incoming water shouldn’t be anywhere near freezing. The only thing that I can think of is that the waterline is not covered by insulation in your wall and perhaps the pipping is on the exterior side of the insulation, or there is a pocket of no insulation in that portion of the wall.

I haven’t heard of that claim. Copper is a better conductor than pex so it will freeze before pex, and given enough time stagnant water inside pex pipe will freeze at 0 C air temperature.

NRC Canada Ground Temperatures – https://tinyurl.com/2p9d5knd

Dropping down to the year’s low.

Yes, “weird” is a good term to describe the recent climate change and weather extremes. Because in terms of causing disasters with loss of human life , it isn’t worse, more extreme or more catastrophic than in the past.

The good news…There are far fewer deaths from extreme weather events than there used to be. We are only seeing 1/3 of the deaths that we used to see in the 1970s or 1980s. This is from global drought, heat, storm, landslide, flood and wildfires. For example, 168K deaths in the 2010-2019 decade, and 667K deaths in the 1980s.

This Data is from the World Meteorological Organization “WMO ATLAS OF MORTALITY LOSSES FROM WEATHER, CLIMATE AND WATER EXTREMES (1970–2019)”

https://unfccc.int/sites/default/files/resource/2021.09.20%20-%20WMO%20Atlas%201970-2019.pdf

Note the source here is the official UN weather organization “ WMO is the specialised agency of the United Nations for meteorology (weather and climate)”

I don’t think you could make that claim without knowing the exact situation. How much insulation outboard of the pex, interior temp, etc.

@QT

I have photos of everything and the main is under the ground and enters an insulated wall. It does enter up an exterior wall into the suite as based on the layout there is no other way. I guess we could have furred the wall out.

Though if even with code insulation and no heat to the interior its just a matter of time before the resistance of the insulation allows the interior temps to drop low enough when the exterior temps are -10c. I did read that a pex line in an exterior wall takes to -6.6c to freeze. Or am I wrong on this?

Running taps should keep anything from freezing.

Thanks Mt. Tolmie. I will look into that for sure. I remember my parents wrapped insulated oven mitts around the outside taps. Don’t know if it helped but I can’t remember any problems with burst pipes during winter.

The foam covers work well to protect taps.

https://www.canadiantire.ca/en/pdp/frost-king-hard-plastic-cover-for-standard-sized-outdoor-faucets-0640942p.html?rrec=true#spc

I find this quite odd, unless the main water service that enter the house is not bury underground or lack of insulation where it penetrate the house. Ground temperature should keep the waterline warm enough through our short and mild cold weather.

Good idea, and cover the meter with sawdust as well.

Might want to check the float switch to make sure that it is not sticking or waterlogged float.

Yes many older homes were built with no internal shutoff for hose bibb. You can retrofit all sillcock connections with ball valves inside the house, or install frost free ones. However, I finds that by disconnect all hoses from the hose bibbs will prevent freezing/cold from travelling into the house piping in our environment (my parents old home pipping didn’t freeze back in the 80s cold spell when we experienced -14 C and -30 C with wind chill for 2 weeks).

I mean the current house was built in the 90’s, the old one in the 60’s.

Our house doesn’t seem to have individual shut off valves for outdoor taps. Just have the main water shut off. No crawl space as well. Are there many houses built this way? My last home had shut off valves for every outside tap. They were all located in the basement or crawl space areas. House was built in late 90’s.

“Many people here in the forum with any frozen water lines? ”

yep. the condensate (1/2″od tubing) line that runs from the gas furnace water pump to outside froze. pump spinning its wheels and overflowed onto the basement floor. all fixed.

pump is required as our old house does not have a floor drain

Re frozen water pipes.

Our house was built in 1905 so probably before indoor plumbing. It has been modified extensively over the years by several owners (by extensive I mean gutted to the outside walls, shimmed to 2X6 construction, insulated, re plumbed, re-wired etc.). We have been here 40 years. When we moved in it froze most winters but over time, we added insulation, moved pipes etc. and have not had any issues for the last 20 years or so. Somewhere in the 90’s it froze under the sidewalk and required a visit from the COV (they warmed the sidewalk with a tiger torch until if unfroze) Given that it froze in an area outside my control, I am still concerned when it drops to -10 for a week or so but that doesn’t seem to be happening as often anymore. Speaking of such, I should probably be renewing the sawdust in the water meter manhole. Thanks for the reminder.

So far, so good. Before the cold snap, I shut off the outside water taps.

Plumbers have been busy — article from today’s paper:

https://www.timescolonist.com/local-news/cold-snap-keeps-plumbers-busy-with-frozen-pipe-calls-4905583

All good here. Disconnected the hoses, no issues. No fancy frost protection spillcocks either.

Many people here in the forum with any frozen water lines? Just curious how the older homes are handling these temps? One of my customers was without water to there suite when the tenant left for a few days and turned off the thermostat.

I don’t have the foggiest idea what will happen. The fires post was just an observation based on growing up in the interior and seeing how different it had become. Probably a safe bet that no area of Canada will be unaffected. I like climate scientist Katharine Hayhoe’s characterization of global warming as global weirding. Weather will get increasingly weird and less predictable as the climate changes.

Canadians are bolting into real estate jobs, but are there enough sales for everyone?

Regulator/control valve rarely fail. Most of the time pilot light doesnt stay lit or have a hard time starting up because of dirty/failed thermocouple or dirty burner port. And, try youtube to replace the $20 thermocouple if you don’t have a multimeter to test the voltage.

Handyman skill level 1/5 required to replace thermocouple.

Hi! I’d love to hear your thoughts on the increasing volatility in weather. I’m scared that we’ll see more wild swings in the future like we did this year. On another note, I’m also doing research on what the changing weather would mean for Eastern Canada.

I found your last post on this topic (focusing on wildfires) to be extremely informative and it influenced my decision not to stay in mainland B.C.

Happy New Year Deryk: Hope all is well with you since it has been a while since you have been online here. Difficult time these days with Covid haunting all of us.

Checked all the obvious on the gas fireplace and I am guessing that the regulator may be flawed. But I rather have a pro look at it and fix it. Not needed to heat the house. But I appreciate the advice.

On a separate note, I just looked out the window and it is absolutely beautiful outside.

Part of Frank’s response was offensive too. Gonna suggest emotional, which I believe was newishomeowners original dis too. DCs have a purpose sure. So do MDs. So do DMDs, psychiatrists, naturopaths, physiotherapists, RMTs, psychologists and so forth. That said the DCs I know in my cohort of friends from my school days didn’t qualify for canadian med schools, dental schools or schools of naturopathic medicine and went stateside for a relatively easier academic qualifying path. Some have also failed miserably in a market saturated with competition and only work as chiropractors part time.

Sorry to bring this up, but I can’t let Frank’s comment stand that the medical profession’s ” answer for everything is take a pill “. Having spent over four decades dedicated to the profession I am deeply offended.

Get up into the attic to find the source of the leak, and use roof repair wet/dry patch such as Black Knight, etc…

Most leaks are around vent penetrations that need a coat of wet/dry patch or replace with a new roof vent with over size flange.

What wrong with your gas insert?

Make sure the gas valves are on.

Try cleaning the dust out off the insert, brush off the burners, and clean or replace the thermocouple.

Good luck

I don’t know of any company of the top of my head, but gas insert is very simple. Follow the steps above to see if it work before calling someone or replace the igniter/control valve/thermostat/insert.

Can anyone recommend a good company to assess a gas fireplace?

I have a cousin who met a young man in Scotland and they had a baby together. He is a bricklayer. The Canadian government refused to allow him to work in BC even though his Canadian wife had the new baby and was not able to work. At the same time…. the government was actively searching in Europe for bricklayers.

One hand of government not knowing what the other hand was doing.

Happy new year to everyone by the way!

While not important or urgent for me I did call my heating guy for an appointment to look at my gas fireplace. Really surprised that the company is closed for the week. I would not have thought that the dead of winter was the best time for a holiday? That seems to be so typical Victoria.

That’s so unfortunate. The system definitely isn’t working and needs to be overhauled.

I agree 100%.

Physiotherapists are the best doctors in the world. They were the only ones who ever fixed me up. PTs always helped no matter the injury. Generally understated and overdelivering. All hail the God-King Physio-Nitus.

On another tropic: Cadboroceros mentioned on her/his last post (I think), that their roof was leaking on the home which they had just purchased and was asking about roofers. Caddy, if you are there; did you get the roof repaired or did you need to get a new one installed? Were you satisfied with the result? Been concerned. Let us know.

.

Thank you for that, Introvert. I didnt feel like being these people’s google assisstant. You are one of the few good ones on here. Lol This community isnt as informed or as rational as I had hoped.

The great debate. I think people have been snowed in on holidays too long. Lol…

According to a 15-year-old Gallup poll, the chiropractic profession rated last (36%) among health-care professions in terms of perception of honesty and ethics. Nurses were tops at 84%.

https://dynamicchiropractic.com/mpacms/dc/article.php?id=52038

And in California, from 1997-2000, chiropractors had a fraud incidence rate 9 times that of medical doctors.

https://en.wikipedia.org/wiki/Chiropractic_controversy_and_criticism

Based on my own personal experience, I don’t have a high opinion of the profession. However, I know people who feel very differently.

These fake doctors cause alot of harm to people. Say whatever you want, cyberbullying or whatever B.S. I will not stay silent on this issue.

@mus im uninformed because you hqve respect for a scam? Lmao go read any study on the dangers of these scam artists. At least I know from the comments who the ignorant are.

re: Newishhomeowner comment

wow. that was the most idiotic, uninformed post that i have read in a while.

having a bad day, and need to take your frustration out on someone?

from personal experience, i have utmost respect for the Chiropractic profession.

pray tell us know what you do for a living, and how it benefits society

Cyberullying is alive and well on some blogs. There is one for young lawyers that comes to mind that is very extreme.

Chirpractors are as much “doctors” as any other doctor clearly. Respect for all healthcare professionals. Having said that, why do we have the construct of “doctors” at all?” I guess to make sure people follow recommendations for their health rather than going all over hell’s half acre. Sometimes it gets taken too far. Someone should write an essay on the history of doctorhood and what it is for.

People have forgotten that cyber bullying is a criminal offence.

Not sure what the purpose is in posting false, offensive and derogatory comments, but it adds nothing to the conversation. Sorry this happened to you Frank, and perhaps Leo can exercise some moderator magic on the comment and the poster can refrain from this conduct.

That comment is extremely offensive. You have no idea what problems I helped people with that the medical profession was uninterested in pursuing. Their answer for everything was take a pill, they rarely got to the cause of the problem. Your comment was completely uneducated. You should be banned for being so insulting.

Number one employer in Victoria is the government or one of their subsidiaries.

Frank maybe get off that high horse for a moment. You were a fake doctor, nothing more than a con artist. You people put Dr. In front of your name after a weekend of schooling. Shame on you and your “profession”. You did not work hard – you are nothing more than a human MLM.

Marko- I totally agree, I was a Chiropractor for 16 years and opted to go a similar route. I haven’t done the math but I estimate at least 75% of my net worth today is the result of asset appreciation. I did however, had to work hard to acquire these assets. Nothing was handed to me.

I believe the federal government is the largest employer at 500,000.

When you combine municipal, provincial, government, military, etc., it is a solid number.

I have tangible frontline health care skills (respiratory therapist) and I also have master in health care admin from UBC, but why would I work in health care when thnx to our brilliant government my networth increased more than 7 figures in the last 18 months just based on my real estate asset and stock market appreciation.

I am going to go work nightshifts in a stressful hospital environment for 100k pretax when I can do **** all just by simply positioning myself (taking on cheap debt) for the government printing money and make many multiples of 100k not including my business income.

As I’ve said before ICU nursing/etc needs to be 150k+ without overtime, but as a society we don’t put value on that. We value an ICU nurse the same as a COV tree preservation officer.

Bank of Canada’s inflation narrative is less certain as it no longer refers to high price growth as ‘transitory’

After 40 years, maybe the shoe is going to be on the other foot.

Come on off it. There just aren’t that many government jobs in Canada, and many are biased toward locals (e.g. bilingualism requirements). Victoria is highly unrepresentative in public sector employment (high) and immigration (low).

I live in Ottawa and I can tell you that the lion’s share of immigrants either wind up in taxis, restaurants, Walmart, etc. for the lower skilled ones or in high tech for the higher skilled ones. Many high tech firms were founded by immigrants, most recently Shopify. That was also my observation from my years in Vancouver.

What I find fascinating is the fact that our government has the resources to process 400,000 immigrants efficiently each year but cannot provide adequate health care (long wait times), senior care homes, etc… I’m glad they have their priorities straight.

Problem with construction is on average you can’t get enough points and meet other criteria. For example, a lot of construction workers abroad would not have proof of funds -> https://www.canada.ca/en/immigration-refugees-citizenship/services/immigrate-canada/express-entry/documents/proof-funds.html

and QT is right about healthcare. When I worked at the hospital other than some niches (i.e. South African doctors) there weren’t a lot of foreign trained employees. There were immigrants, but more like came to Canada, went to BCIT for training, and then obtained a job.

When my parents came to Canada in the 1990s my father worked in construction as a stone mason and my mother at the Vic General as a housekeeper and most of her colleagues were hard working eastern europeans (until housing keeping was privatized) . Unless coming in as a refugee or something, that wouldn’t fly anymore.

My overall impression of current immigration, unless going to Moose Jaw on a Saskatchewan immigrant nominee program, is you have to speak solid english, be savvy enough to make it through the bureaucracy/paperwork, and have some financial backing (proof of funds). When you poses these qualities you are also savvy enough to land in Canada and be like….hmmm, why the **** would I clean or do manual labor when I can play the system (i.e., interview well, etc.) land a government job and go from there.

I’ve helped multiple landed immigrants buy property in greater Victoria on 2x BC provincial jobs in the last few years. I am happy for these fellow Croats in them securing great stable lives, but big picture they contribute nothing and increase demand on housing.

Of course, my friend who is a drywaller and worked 60 hrs a week gets shipped back as he can’t make it through the paperwork/points/etc. while every other construction project in Victoria is delayed a year or two due to labor shortages. Makes sense.

People conveniently forget that a 2022 Civic is a much better car than a 100k msrp 1992 Mercedes S Class which is like 1/10 the cost, inflation adjusted.

People also forgot that a 60s bungalow had one light per room, one bathroom, etc. and then they compared that with a 4 bed/3bath two car garage 2,000 sq/ft home with 50 pot lights when arguing erosion of affordability. Obviously, SFHs are far less affordable now but the SFH has evolved into something that takes much more resources both in terms of soft and hard costs. Pretty sure it didn’t take 6 months and multiple consultants to get a building permit in the 1960s….oddly enough the homes are still standing.

I don’t think there’s any case to be made that the Canadian middle class have done poorly, and even less that their poor results would rise to the level of a “societal issue”.

Why? The Canadian middle class is the wealthiest of any country in the world, according to California based investopedia based on median income and wealth. Remember, the Canadian middle class owns homes, which are a bigger asset than they had in previous generations, and more middle class own homes than previous generations. Lots of middle class “average Joe’s” in many places in Canada are millionaires due to their home asset.

https://www.investopedia.com/ask/answers/040615/what-country-has-richest-middle-class.asp )

Which Country Has the Richest Middle Class?

“For decades, the United States boasted the honor of having the richest middle-class. However, since 2019 Canada has the wealthiest middle class of any country in the world ”

It’s a matter of opinion, but I wouldn’t call these “huge”. Yes people spend more time in school today but as I’ve said before I don’t think it results in an economic benefit. The child mortality and life expectancy are just chipping away at the margins. By comparison in 1920 child mortality in Canada was 24%.

On the economic front I was thinking less about poverty however defined (which varies a lot ) and more about how the majority (i.e. what is called working or middle class) is doing. And I don’t think they’re doing better.

No.

There have also been huge improvements in the time frame (1990s to present) and countries you’ve mentioned (Canada USA and Europe) on major social issues: (all of this accomplished just in the last 30 years in North America and Western Europe)

As you can see on this single chart

The purpose of the taxes would be to generate revenue for the government to help pay for the increasing cost of healthcare etc. If there was a reduction in home prices that would be an added bonus though.

” There have been dramatic, sustained global improvements in the important social metrics, over the last 200 years and since the 90s. ”

Funny, I ‘m sure I’ve heard about slavery, child labour, smallpox and other mass killers, maternal/infant mortality, warfare, famine and stuff like that in the 19th and early 20th centuries in the mainstream media. Why I’ve even seen movies about those things.

As for the post-1990 decades, almost all the the improvement in living conditions has taken place in East Asia and India, with a smidgen in Eastern Europe. That’s a lot of people and it pulls up the global average. But unfortunately the social metrics have gone pretty much nowhere in Western Europe and North America, and have gone down for many people in the US in particular.

Good luck with that because provincial and local groups have interests in keeping the foreigners out citing language barrier and superiority of local educational system.

Please elaborate how a product costs would drop if you increase the price through taxations?

Wouldn’t the price increase even more throught taxations, because the costs will be passed on to the consumers?

And, wouldn’t it create another road block to availability of SFH supply (who in their right mind would downsize to a condo if they have to pay more taxes)?

The immigration discussion doesn’t need to be either/or. The question isn’t is immigration good or bad but what level is best. The level of immigration could be reduced to .7% rather than current levels to allow for housing and services to catch up. We could still prioritize bringing in people with the skills we need (healthcare and construction etc.) and could make up for any lost tax revenue by increasing taxes on real estate profits as well as possibly increasing the GST by 1%.

From: https://www.ctvnews.ca/canada/why-canada-gets-less-for-more-when-it-comes-to-building-transit-1.5719903

Well, our government, politics and regulation just doesn’t impact our housing inventory. If you truly want to save the environment by getting more people out of vehicles and on transit (even your electric vehicle is worse for the environment than transit) we need to fix the corruption of incompetence that plagues all levels of government and pandering to the loud voices that leads to endless consultations and meaningless symbolism that increases the cost of everything we try to build. Some local examples would be the sewage plant, Johnson street bridge and lack of an alternative route over the Malahat.

Merry Christmas and the joy of the day to everyone. It is even a white Christmas with a bit more to come.

You would never know that from the mainstream media.

They are mulling at making 70 as permanent retirement age from 65 after asking employers to employ people over the age of 70 a few years ago, and currently their academics are suggesting that retirement age at 75 is more appropriate for their populous.

Thanks for all the great work Leo! Merry xmas

Merry Christmas to everyone

There have been dramatic, sustained global improvements in the important social metrics, over the last 200 years and since the 90s. These have occurred during huge global population growth

Such as:

– Much better educated

– More political freedom and human rights (democracy in more countries)

– Improved health and life expectancy (e.g. 100X improvement in child mortality)

– Improved literacy

– Less poverty

You can see all this in one chart.

Marko, I don’t have a conclusion to laneway houses as I have not tested the market with sales as few properties with laneway homes have sold.

Tentatively my assumption is that the contributory value of the laneway home is much the same as a basement suite. It’s a mortgage helper.

The trade off is between the additional income generated and the loss of privacy/ enjoyment for a home owner in occupation of the property. As per the article, high income neighborhoods are less likely to have any additional value added to their property for a laneway home as privacy/enjoyment is a priority over that of the additional income it generates. While other neighborhoods where it is difficult to qualify on income can get a boost to the property’s value.

Gordon Head for example has lots of homes with basement suites. If you own a rancher / one storey in that neighborhood putting in a laneway would make sense. My guess is that any boost in value would be similar to comparing the difference in the sale prices of a one story home to a home with a basement suite with similar main floor areas. That would capture the loss in privacy/enjoyment (ie Bundle if Rights of Real Estate). Then you could relate that boost in property value to the income it generates. And I’m GUESSING that boost would be somewhere between 36 to 48 times the monthly gross income of the laneway house. Not much of a boost in value relative to the cost to construct at say $250,000. In accounting terminology this factor is called the pay back period.

A neighborhood where the home owners are concerned with privacy may have a lower factor or non at all. So each neighborhood will have a different factor which has to be derived from the marketplace.

This still has to be tested. But for example in Oaklands if you are thinking about putting in a laneway house that would rent for $2,000 per month the guestimate factor of say 48 would be a contributory value to the property of nearly $100,000. But it will likely cost $250,000 to build or more.

What I am NOT,NOT,NOT saying is that you shouldn’t build a laneway house. Every person is different and every circumstance is different. In fact I will repeat that ” What I am NOT,NOT,NOT saying is that you shouldn’t build a laneway house.” What I’m saying is if you intend to sell the property immediately afterward it isn’t going to be the smartest thing to do as you will likely net less on the sale than if you had not built the laneway house. If you are intending to hold the property for the long term, like a decade and more, it might be worthwhile.

If you own a property and have lots of equity and intend to keep the property for the long term, building a laneway may be an option. It’s good for the kids when they get older or for the grandparents or for when you may want to down size and rent out the main house or just for the cash flow. Everyone is different and every circumstance is different.

All of the above is guess work at this time. It has to be proven through sales in the neighborhoods. There just isn’t enough data, at this time, to make a conclusion. I wonder how much these Sauder School studies cost to produce? Likely tens of thousands of dollars. You got mine for free, and that’s exactly what it’s worth.

OTOH, Canada has grown (in population and economically) and that, also, has correlated to many social issues.

Nope, we can always cut services and expectations of the population. As well, with a Ponzi you shuffle the same assets around to look like some is there when it isn’t (so no actual growth). Where with immigration and GDP growth we simply make a bigger pie for everyone. You know, from that productivity thing…

That has led to stagnant growth since the 1990s and if you do follow Japan, that has correlated to many societal issues they are dealing with today (now they are looking to change their immigration policy to add more population).

Japan seems to manage ok without population growth.

@umm..really

So its like a Ponzi scheme. That will blow up if we don’t keep feeding new tax dollars through growth in GDP. Demand for products that are taxed and income tax can only grow if immigration grows.

Then you have a municipality like Sooke that is looking at limiting further development and growth to meet climate objectives. Yet the majority of the population moved out there for an opportunity to afford a home.

@ Patrick

Agreed we are all immigrants on this land. Pay it forward.

Canada is a country of immigrants, built by immigrants and their families. May it continue!

Things are never built before they are needed, almost all policy is reactionary because government and politicians live in an election cycle of the moment. Your hospitals, schools and housing are not being built without immigration and the economic growth that comes from it. Not to mention the money to fill the tax coffers, pension plans and all those cheques that people now believe be the government must send to them. If you want to limit immigration you will need to start with a massive roll back government services that you consider are essential from piles of public servants to medical provisions and programs. Not to mention tax hikes and the need to push pension eligibility back by years. The GDP growth needs to come from somewhere to maintain services, Canadians are great at borrowing and spending money, but not great at creating it (we have a super low productivity rate). There is the fantasy of taking from the rich, but it can only be taken once and then it doesn’t come back and the majority of the wealth is actually held in the middle by scale of population. So, taking from the rich, very quickly becomes the taking from the you and me. I guess there’s the MMT folks figure you can just print money and give it out that’s not tied to any productivity, that hasn’t had any consequences?…lol.. Neither does borrowing it I guess…lol. So, to reconcile debt and money supply to our GDP, GDP needs to grow and since Canadians really don’t do that, it is necessary to pump immigration as much as we can.

Re. immigration and immigrants. I do know some of them came with bags of valuables including money, experiences of management and entrepreneurship and their families members( including kids and grantparents). They have been contributing back to society by paying above average tax amounts, creating jobs and help building out quite a considerable supplies of housing in Vancouver and Edmonton.

Canada is quite generous compare with any other place I know of and I love being treated the best here . Also plan to build out a rental condo project in greater Victoria area in a year or two.

I’m holding the door for you Frank.

“That’s 150 years of nation building, now people come to Club Canada and enjoy all the benefits and infrastructure that took 150 years to build. There should be a steep membership fee. If their abilities are so valuable, why are they allowed to leave their countries? Instead, they are holding the door open for them to leave. Not every individual is an asset, many are a liability, and Canada has plenty of liabilities.”

This is the worst take that I’ve seen in a long time.

Yes immigration and population “have been” below previous levels, but now they are “above” previous levels. It’s just from processing slowing down and now catching up. It is expected that clearing this huge 1.8 million backlog of immigrants is going to add lots of PR/citizens to “pour fuel on the red-hot housing market”

The fall in population numbers was just processing delays and closed borders. Things are getting back to normal, and we are now (using statscan real-time population clock) at the highest population growth levels (1.2%) seen since 2009 (1.23%). For example, this is above 2019 pop. growth of 0.9%. https://www.macrotrends.net/countries/CAN/canada/population-growth-rate

Using the real time model from statscan. https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2018005-eng.htm …Canada’s current population growth rate is 455,000 people per year. Which is a growth rate of 1.2% per year.

None of the immigration numbers are falling. There are a record 1.8 million existing immigration applicants waiting to be processed. These are all types, non-residents and temp/permanent. About half of them are already here. Victoria’s share of that backlog number would be 18,000 people.

Any apparent drops are just because they stopped processing applications and closed offices in 2020. In 2021, they are still slowly processing this huge backlog.

BC share of the 1.8 million immigration backlog is 240,000 people. A significant point for Victoria and BC real estate is that only citizens and PR are able to buy RE without paying foreign buyer tax. It’s not just the foreign buyer tax, as typical mortgages are only available to PR/citizens. That means that some of the backlog represents a backlog of people waiting to buy homes and get mortgages when they become PR. About 10% of immigrants buy homes right away, and that is discussed in this np article “new migrants could pour gasoline on the red-hot housing market” https://financialpost.com/real-estate/canada-opens-door-to-immigrants-adding-fuel-to-hot-housing-market and immigrants are predicted to buy about 6,800 homes in Victoria over the next five years https://www.livabl.com/2019/10/new-immigrants-canada-buy-homes.html

Patrick from what I’ve heard the reason they are loosing office staff is a combination of lack of compensation, women not being treated fairly in the construction industry, lack of mentorship from senior staff, disorganization from ownership. Just check out some of the reviews on indeed. Quite shocking.

https://ca.indeed.com/cmp/Campbell-Construction-Ltd./reviews

“ if their abilities are so valuable, why are they allowed to leave their countries? ”

why 8 out 15 total Canadian Nobel Prize winners were allowed to leave Canada?

There are also 2.8 millions Canadian living aboard. Are their abilities not valuable so they are allowed to leave Canada?

Sources: https://www.science.ca/scientists/nobellaureates.php

https://policyoptions.irpp.org/magazines/may-2021/canadians-living-abroad-should-be-embraced-as-hidden-assets/

Our current shortage of workers is the direct result of baby boomers who have opted to retire instead of putting up with pandemic restrictions at work. Ask any employer, they are extremely difficult to replace. Most are fully capable of supporting themselves, but cannot afford to take care of the rest of the world. I’m not opposed to immigration, some of the nicest people I know are from around the world and I make a point of interacting with them. The current levels our government insists on maintaining is not sustainable. Not enough schools, hospitals, housing, etc.. to meet our current needs. I doubt this will change. Expect everything to get more expensive, life is a competition for resources.

And growing because the baby boomers are retired/retiring, thus come the working age immigrants asset to support the ageing liabilities.

Demographic dividend — https://en.wikipedia.org/wiki/Demographic_dividend

Trading Economics: Canada – Age Dependency Ratio (% Of Working-age Population) — https://tinyurl.com/2n2d38sj

patriotz- 6 of one, half dozen of another. It’s still 401,000 more people accessing our stressed health care system and social welfare benefits. Canada is going bankrupt fast. Wake up Trudeau.

My grandparents were immigrants over 100 years ago. My grandfather worked for 50 years, my mother worked for 50 years and I’ve worked 50 years. That’s 150 years of nation building, now people come to Club Canada and enjoy all the benefits and infrastructure that took 150 years to build. There should be a steep membership fee. If their abilities are so valuable, why are they allowed to leave their countries? Instead, they are holding the door open for them to leave. Not every individual is an asset, many are a liability, and Canada has plenty of liabilities.

Most of these people were already living in Canada. Actual net international migration and total population growth have been below pre-pandemic norms, as previously discussed.

https://www.cicnews.com/2021/12/canada-breaks-all-time-immigration-record-by-landing-401000-immigrants-in-2021-1220461.html#gs.k9qen0

I bought a pre-sale condo (nothing crazy, middle of the road) in Croatia last year and here are some of the specs. Keep in mind this is a three story condo building and this has nothing to do with building code but rather just expected norms (i.e., no one would buy a stick frame home in Croatia).

So in a way poorer country new construction methods are better, but it has been like that for decades so everyone is familiar with it. Trying doing concrete partions here instead of steel stud, it would be a shit show with all the contractors/inspectors/engineers, etc. as it isn’t common practice.

I did this video last year in Sooke on duplex project using ICF partion wall -> https://www.youtube.com/watch?v=HjYIbX_oE-M

Haven’t seen it since…why? Too much cost/hassle and end user could care less.