2022 Market Predictions

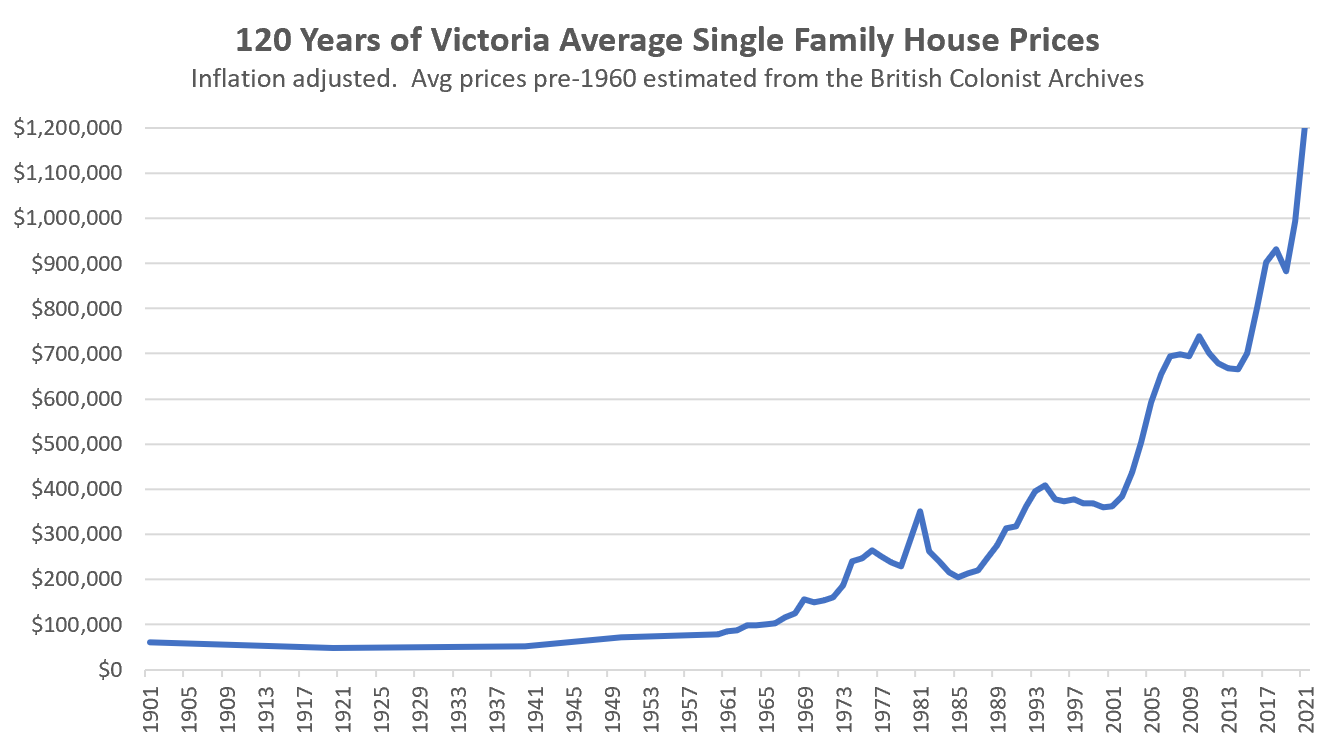

The market has been on fire for nearly 18 months now and there has been plenty of coverage of price gains in that time. However the recent release of 2021 assessment data has seemingly reinforced the reality of the sheer magnitude of the increases in people’s minds. For those left out of the gains, frustration and disapointment at the situation and the failure of our governments to address this crisis in any meaningful way is boiling over. This is not just a Victoria problem or even a BC problem, it’s a nearly nationwide jump in prices with the prairie provinces still being a notable exception.

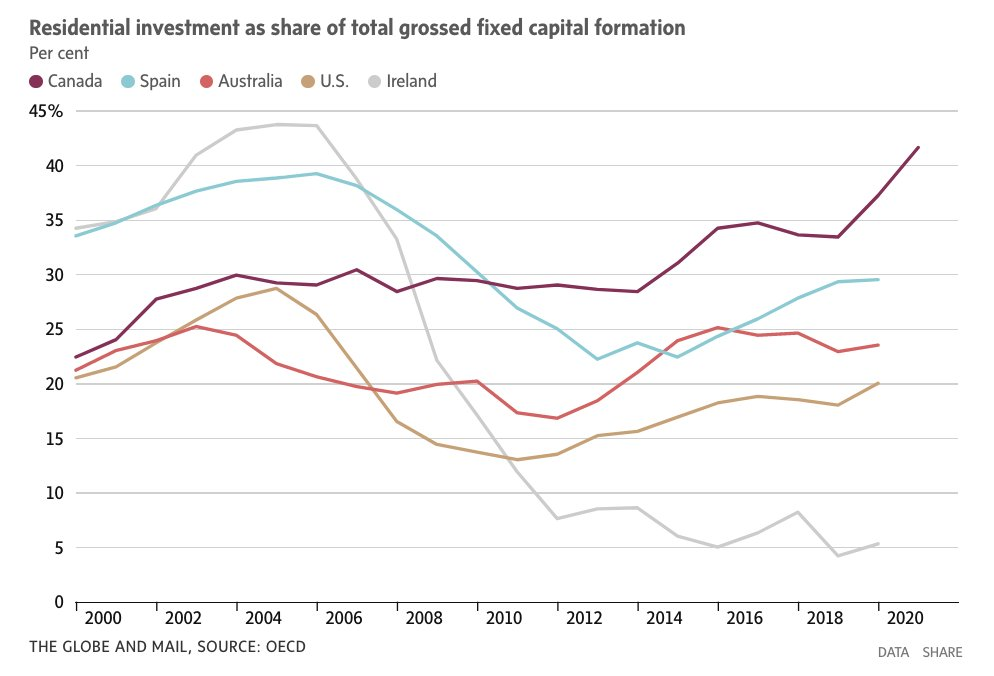

Make no mistake, though many will benefit from the gained wealth in the short term this is bad for the country as a whole. Real estate is eating the economy, buoyed by ever increasing debt, both public and private. I expect there will be a reckoning for these excesses, but no one knows how much more time this run has in it.

On to our predictions. As you may know, every year we make predictions on this blog about the real estate market and every year we take a look at how we did with our prognostications. Usually we get a wide range of guesses, some accurate, some out in left field, but before 2020 the average guess tended to be not too far off reality. However that was before the strange and wild pandemic economy broke all the models and intuition that people may have based their forecasts on.

Suffice it to say that in 2021, the market strength blew all predictions out of the water. 12 months ago I expected prices to rise pretty strongly during the year, with condo prices leading the charge. Well I got the direction right, but substantially underestimated the magnitude. I expected the market to peak in the spring and then gradually slow down throughout the rest of the year. For a few months that actually did seem to happen, with market activity easing up after a March peak. However in August that brief cooling trend turned around and we saw another massive resurgence, with prices taking another jump upwards while inventory dropped to never before seen lows.

Before we get to making new predictions, here are the predictions we made for 2021.

| Name | Annual Sales | Single Family Median (Q4) | Condo Median (Q4) | Inventory (Dec) | BoC Rate |

|---|---|---|---|---|---|

| Leo | 8600 | $980,000 | $475,000 | 1800 | 0.25% |

| Megan | 7300 | $850,000 | $375,000 | 1500 | 0.50% |

| Jay Herrick | 8700 | $940,000 | $420,000 | 2000 | 0.25% |

| Alias | 10,000 | $925,000 | $425,000 | 1300 | 0.25% |

| Chris L. | 7300 | $910,000 | $432,000 | 1650 | 0.25% |

| S | 8000 | $1,000,000 | $500,000 | 2000 | 0.25% |

| Melissa | 9000 | $950,000 | $440,000 | 1400 | 0.25% |

| imnotarobot | 8300 | $990,000 | $460,000 | 1390 | 0.25% |

| Megan Evans | 8944 | $932,000 | $430,000 | 1950 | 0.25% |

| deryk houston | 7250 | $1,010,000 | $463,000 | 1600 | 0.50% |

| Cadborosaurus | 11000 | $750,000 | $375,000 | 3200 | 0.50% |

| Marko Juras | 8100 | $950,000 | $430,000 | 2000 | 0.25% |

| DYJ | 6336 | $799,999 | $475,000 | 2100 | 0.75% |

| Rush4life | 6932 | $825,000 | $396,000 | 2323 | 0% |

| Frank.the.tank | 9000 | $1,200,000 | $500,000 | 2000 | 0.25% |

| QT | 9000 | $997,000 | $472,000 | 1400 | 0.25% |

| Faron | 7500 | $880,000 | $425,000 | 2100 | 0.25% |

| Deb 7220 | $815,000 | 0.50% | |||

| NE14T | 9122 | $965,000 | $445,000 | 1612 | 0.50% |

| caveat emptor | 8402 | $940,000 | $449,000 | 1900 | 0.50% |

| zzejnula | 7200 | $900,000 | $430,000 | 1000 | 0.50% |

| LevelMaterial | 7500 | $925,000 | $9,000 | 1900 | 0.25% |

| Teresa Howe | 8,200 | $900,000 | $425,000 | 1600 | 0.25% |

| AM | 8900 | $975,000 | $455,000 | 1500 | 0.25% |

| Jk | 9000 | $875,000 | $420,000 | 1500 | 0.25% |

| Mt. Tolmie Foothills | 8100 | $850,000 | $450,000 | 2000 | 0.50% |

| DuranDuran | 7550 | $907,000 | $449,000 | 2112 | 0.50% |

| brent | 8500 | $930,000 | $430,000 | 1500 | 0.50% |

| Samantha | 9500 | $950,000 | $400,000 | 2000 | 1% |

| The Underwriter | 9001 | $1,010,000 | $430,000 | 1500 | 0.25% |

| Dave | 9100 | $967,800 | $467,200 | 1792 | 0.25% |

| Annie | 9000 | $1,025,000 | $460,000 | 1990 | 0.25% |

| Thurston | 7800 | $1,000,000 | $435,000 | 1800 | 0% |

| Mrs LeoS | 8150 | $925,000 | $437,000 | 1750 | 0.25% |

| Zhi | 8100 | $950,000 | $450,000 | 1600 | 0.25% |

| Kiki M | 7111 | $950,000 | $399,000 | 1750 | 1% |

| Silky | 7000 | $950,000 | $440,000 | 1500 | 0.25% |

| Anon1 | $950,000 | $400,000 | 1500 | 0.50% | |

| Richard Haysom | 8162 | $1,038,000 | $482,500 | 1668 | 0.25% |

| Yoji | 7250 | $925,000 | $435,000 | 1525 | 0.25% |

| Dane | 9200 | $1,001,000 | $441,000 | 1748 | Negative |

| Anon2 | 9910 | $932,000 | $460,100 | 1420 | 0.25% |

| alexandracdn | 7750 | $910,000 | $435,000 | 1800 | 0.25% |

| bitcointo100k | 8664 | $1,000,010 | $477,777 | 1567 | 0.25% |

| 80for20 | 7501 | $975,000 | $434,000 | 1412 | 0.25% |

| Anon4 | 9561 | $925,000 | $436,000 | 2000 | 0.75% |

| Anon5 | 9001 | $1,000,000 | $420,000 | 1400 | 0.25% |

| Dtjmcd | 8900 | $980,000 | $433,000 | 1550 | 0.25% |

| LL | 8900 | $970,000 | $440,000 | 1600 | 0.25% |

| Sallie Cabrera | 9500 | $950,000 | $440,000 | 1500 | 0.25% |

| Trutts | 7200 | $945,000 | $450,000 | 1250 | 0.25% |

| Jodi M | 8599 | $950,000 | $431,000 | 1650 | 0.50% |

| Kitty | 10000 | $1,100,000 | $475,000 | 3200 | 0.75% |

| Tomie Thomas | 10,050 | $945,000 | $436,000 | 1420 | 0.25% |

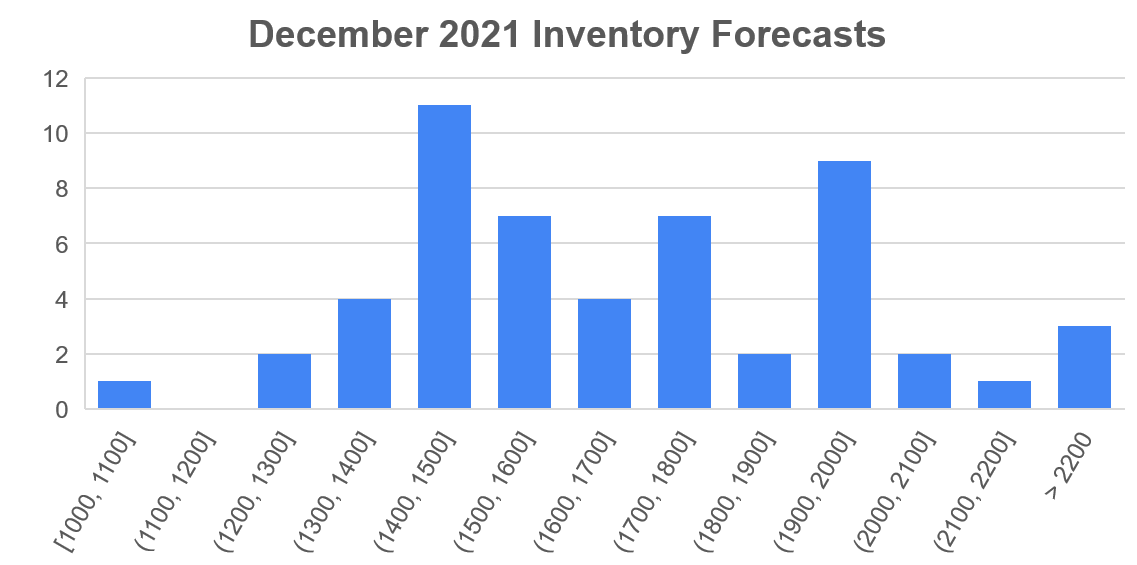

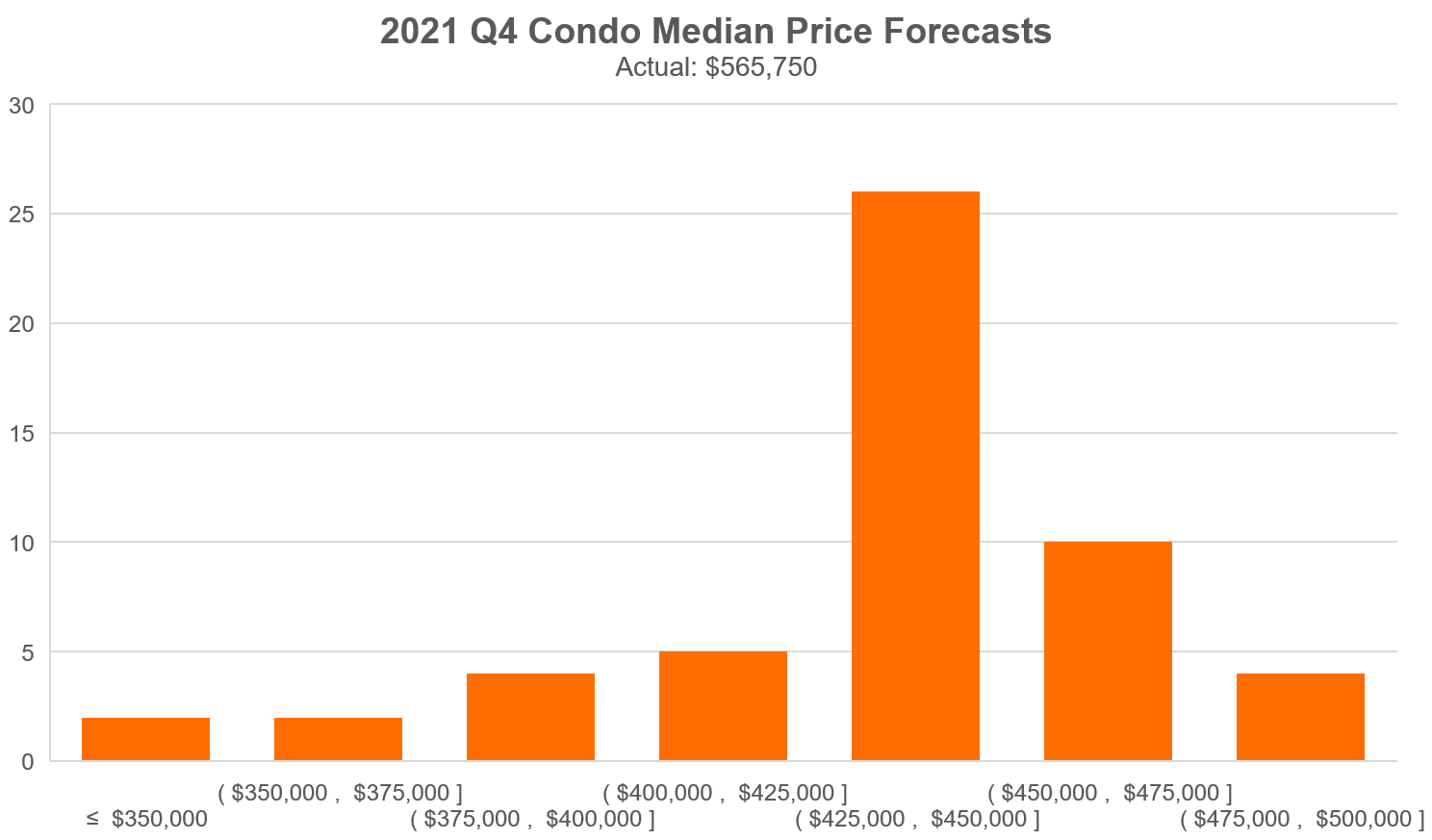

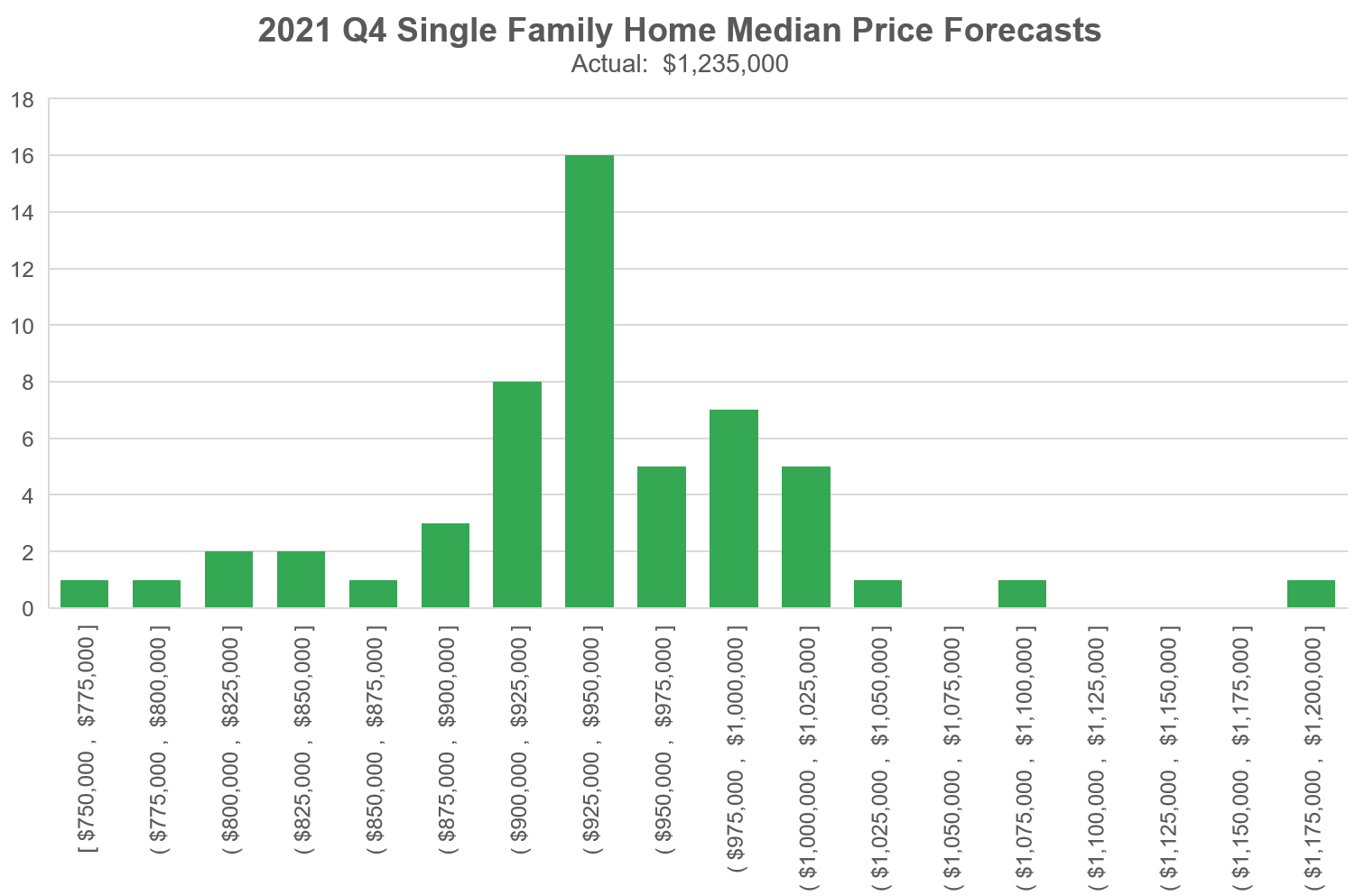

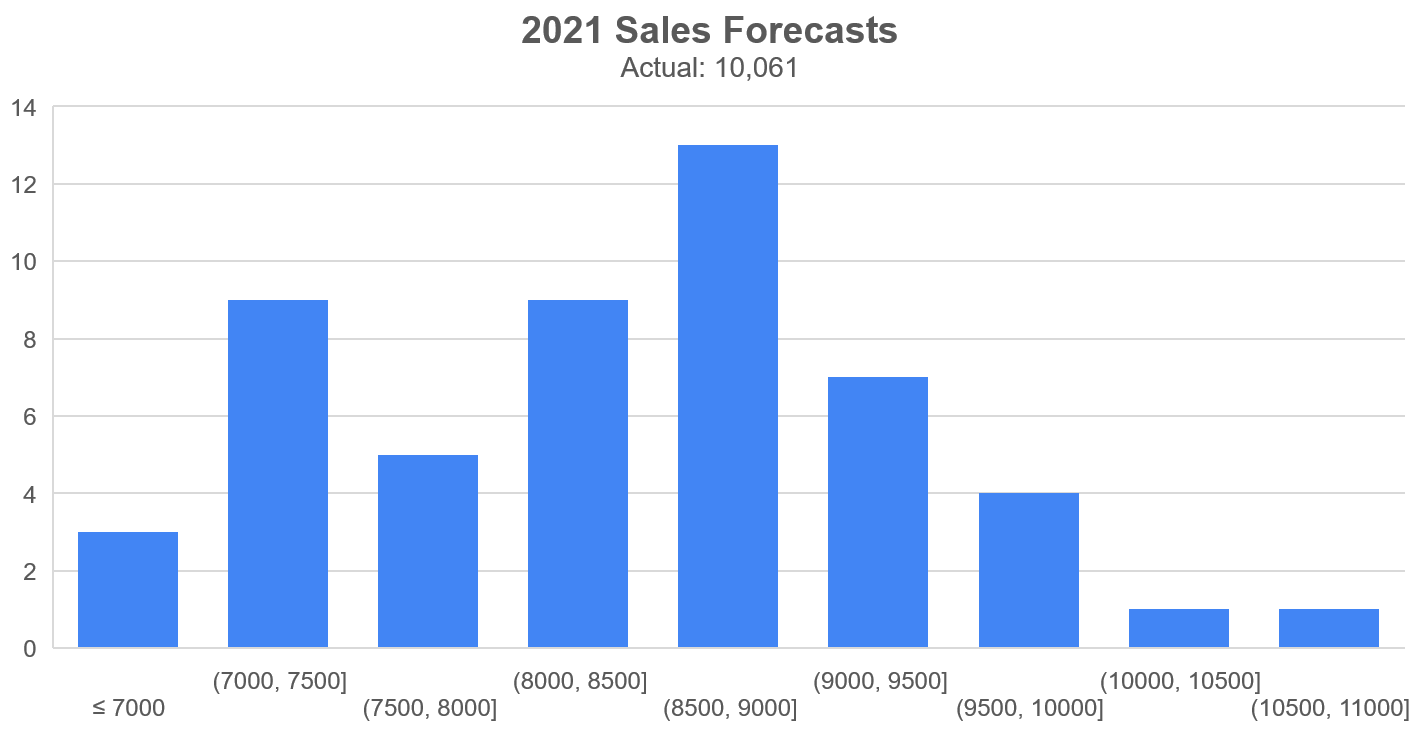

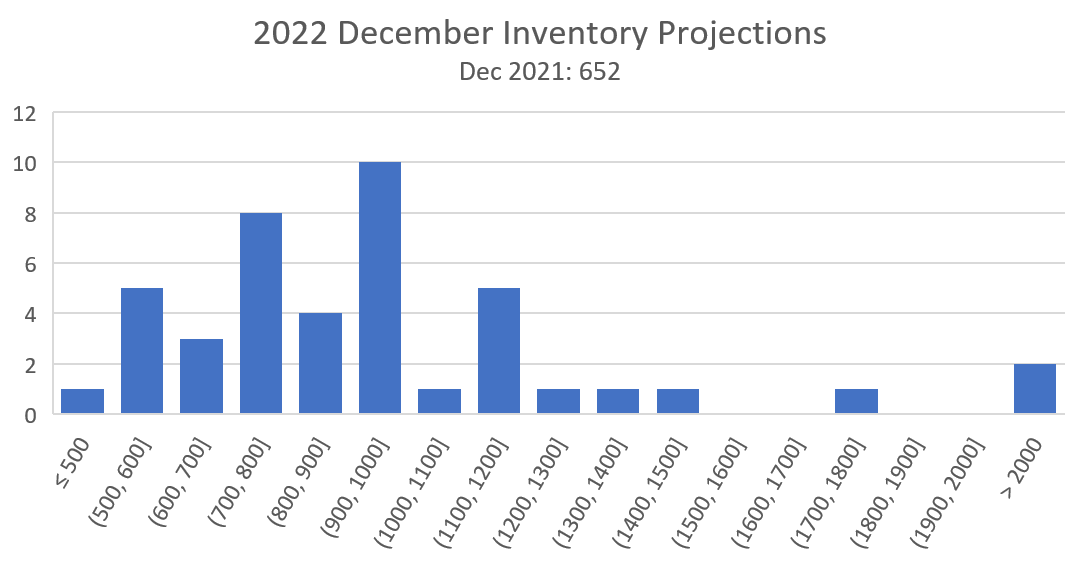

And visually.

The real figures are:

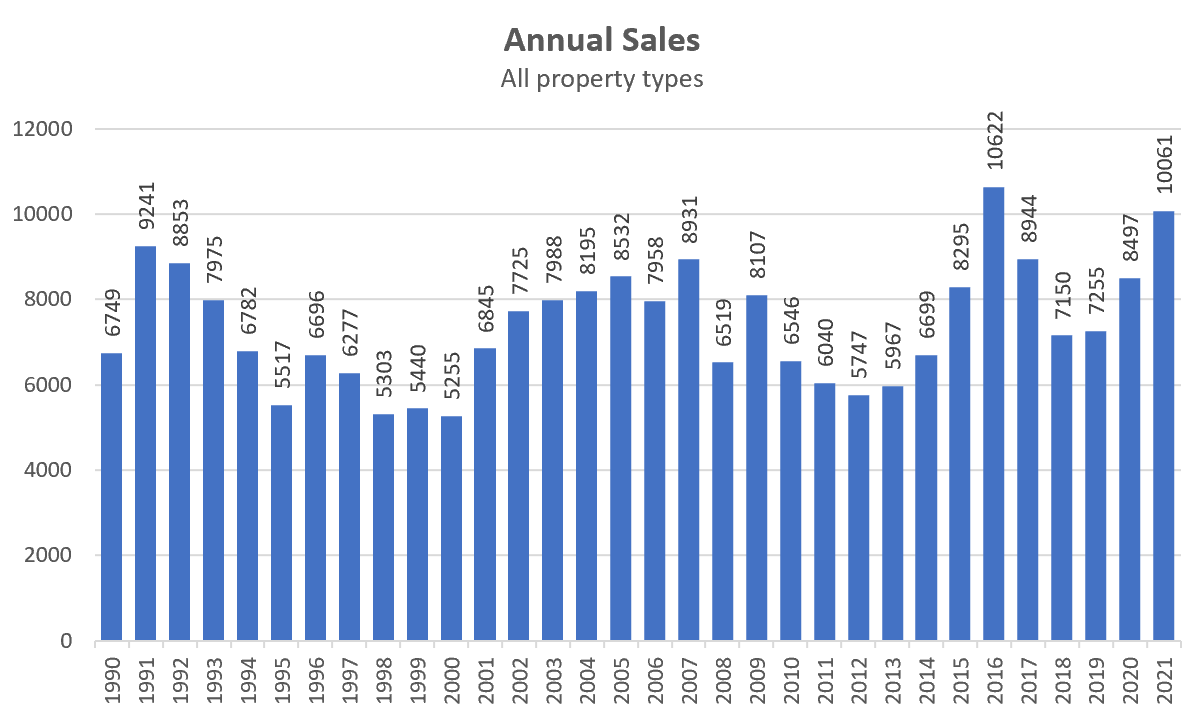

- Sales: 10052

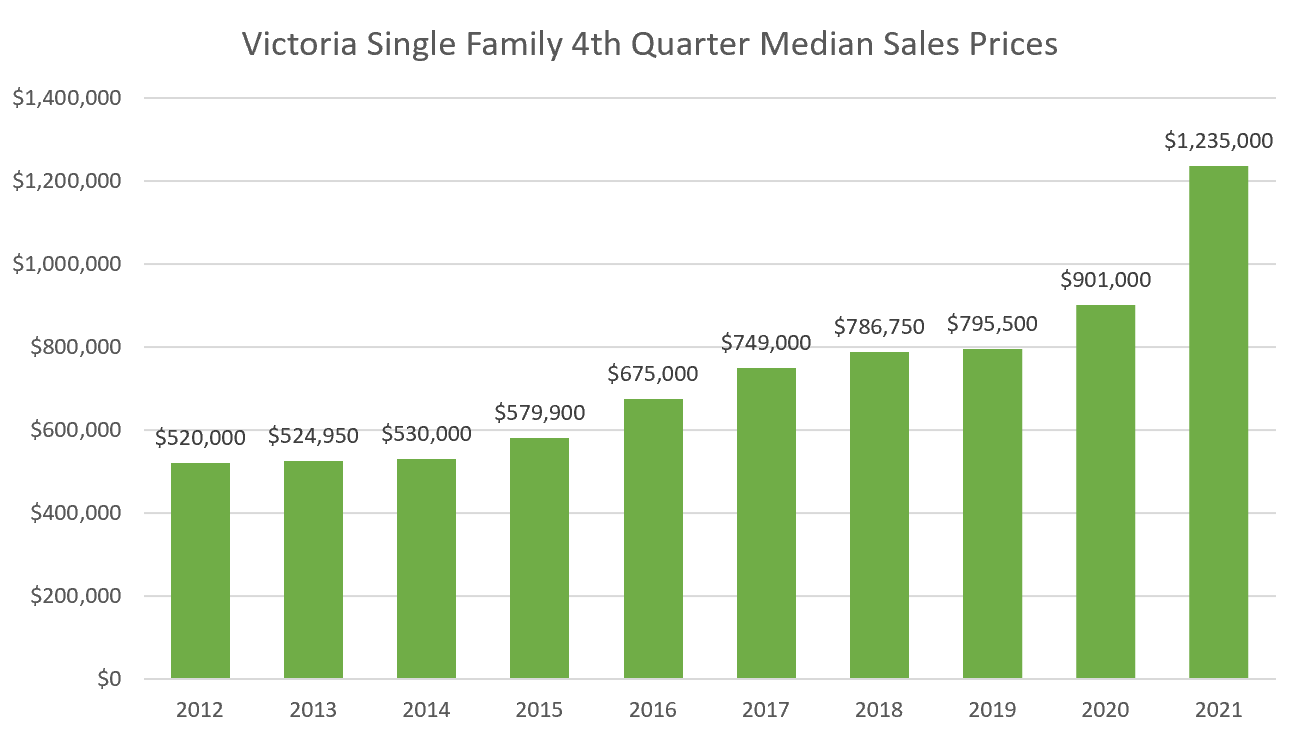

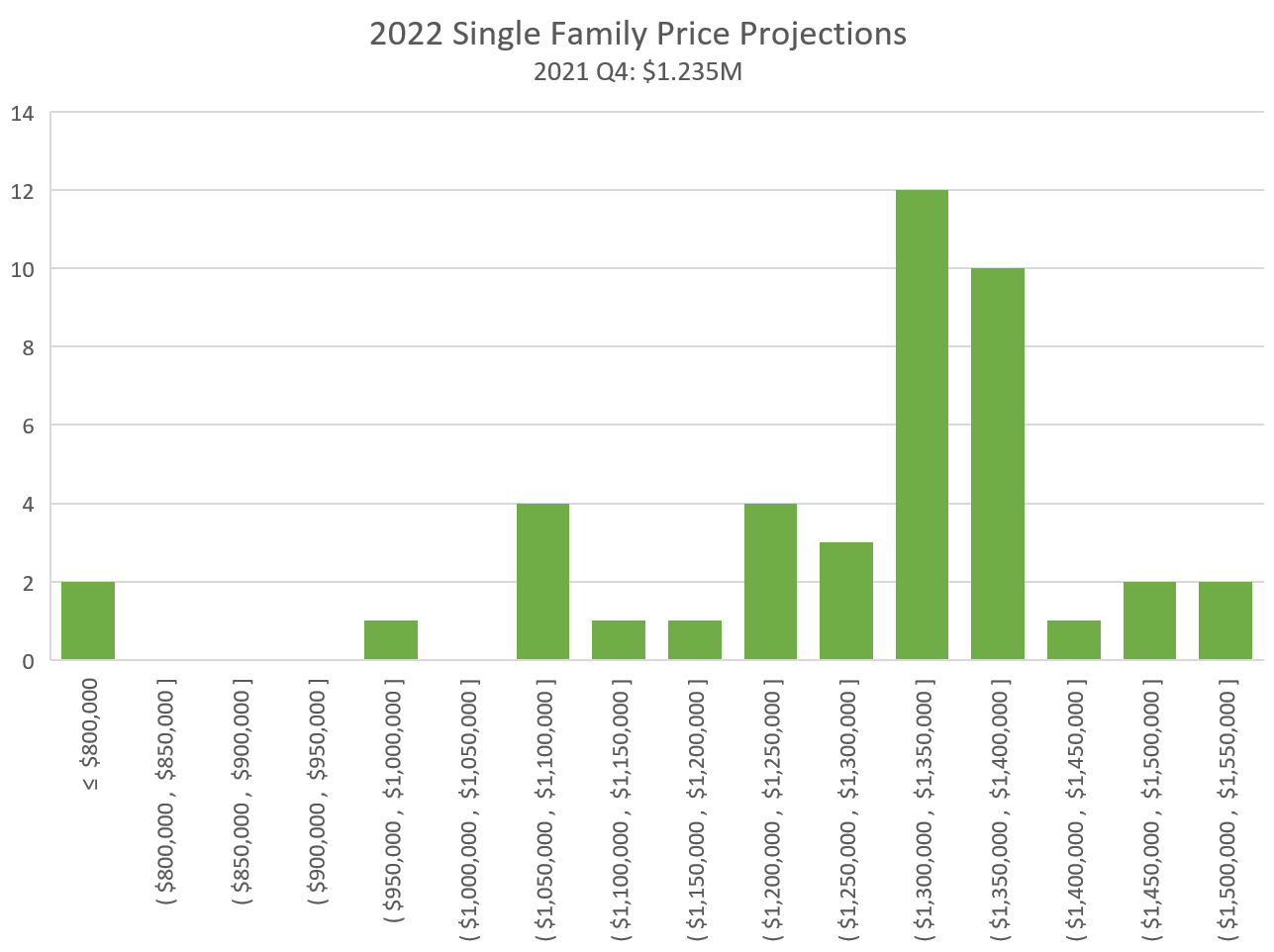

- Single Family Median (4th quarter): $1,235,000

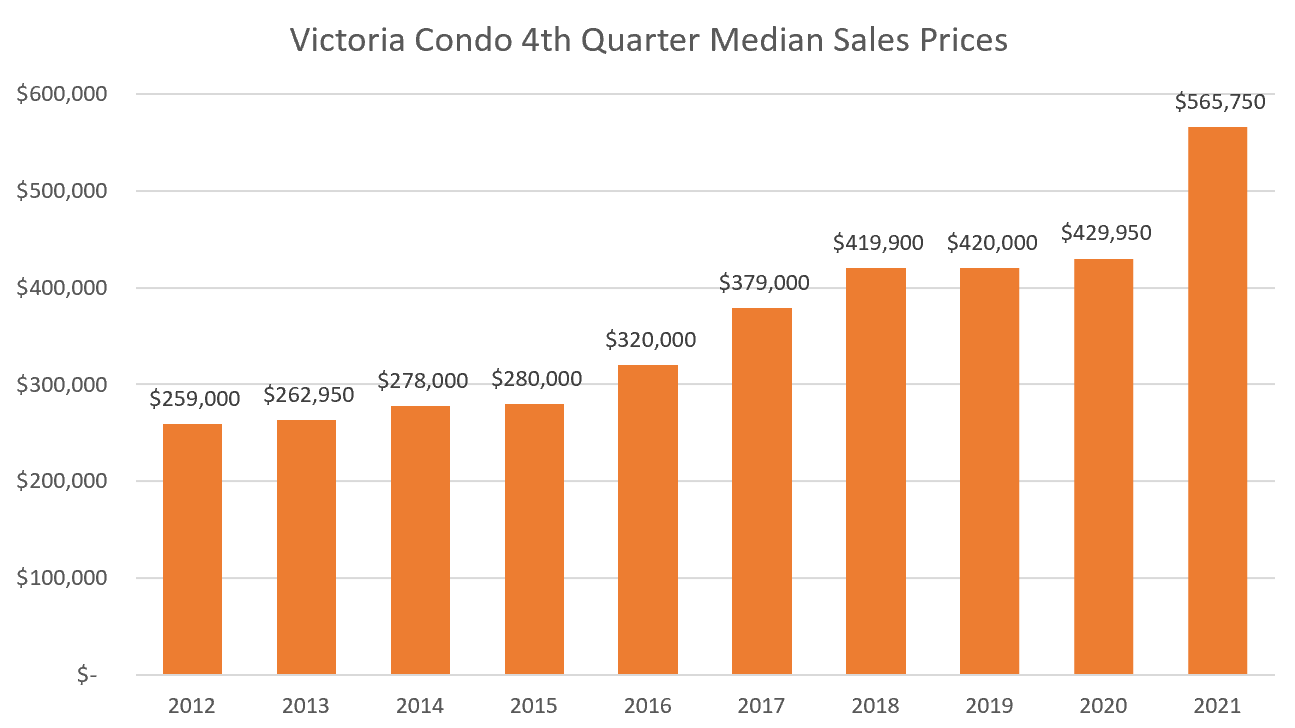

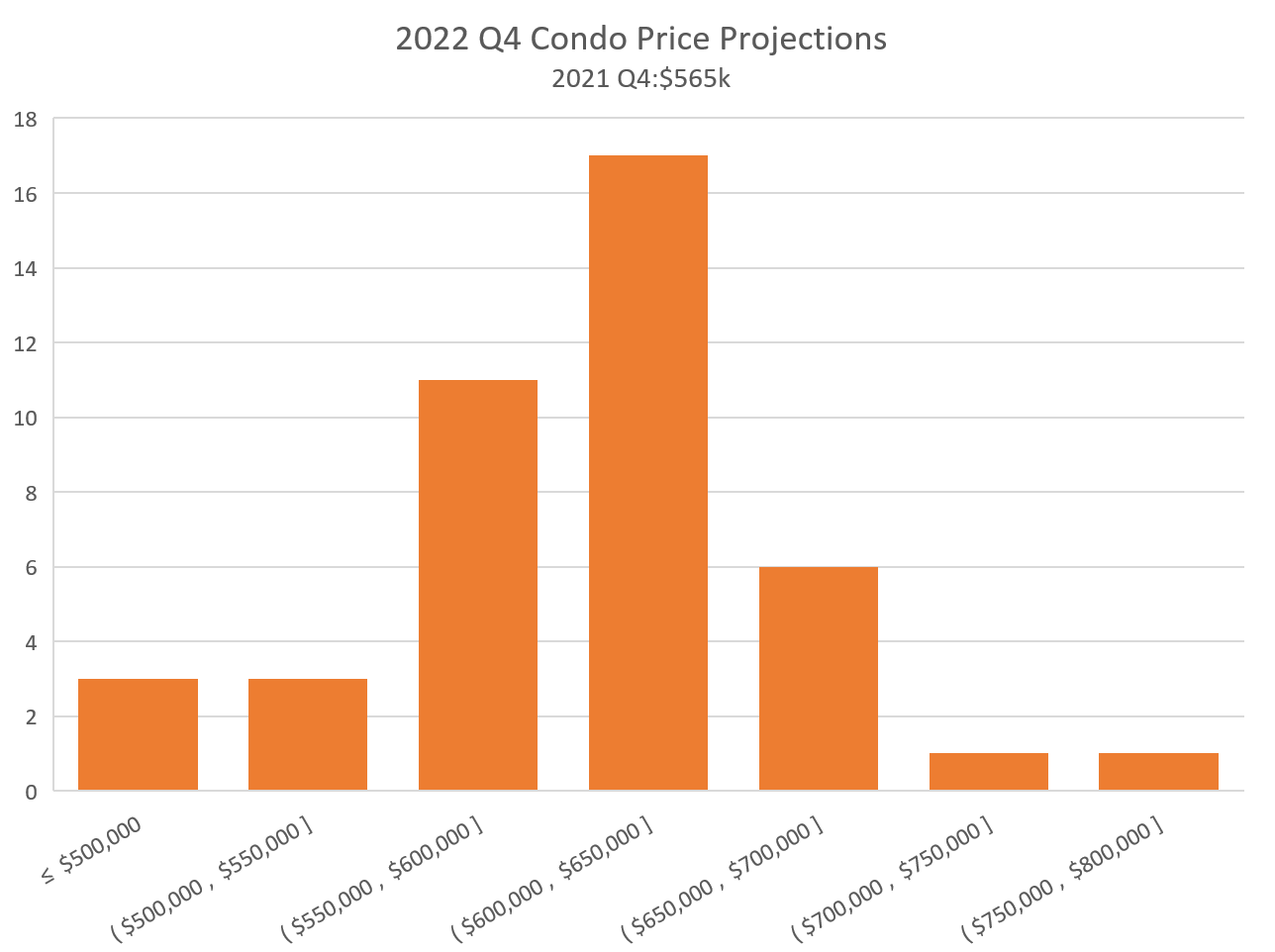

- Condo Median (4th quarter): $565,750

- Bank of Canada Rate: 0.25%

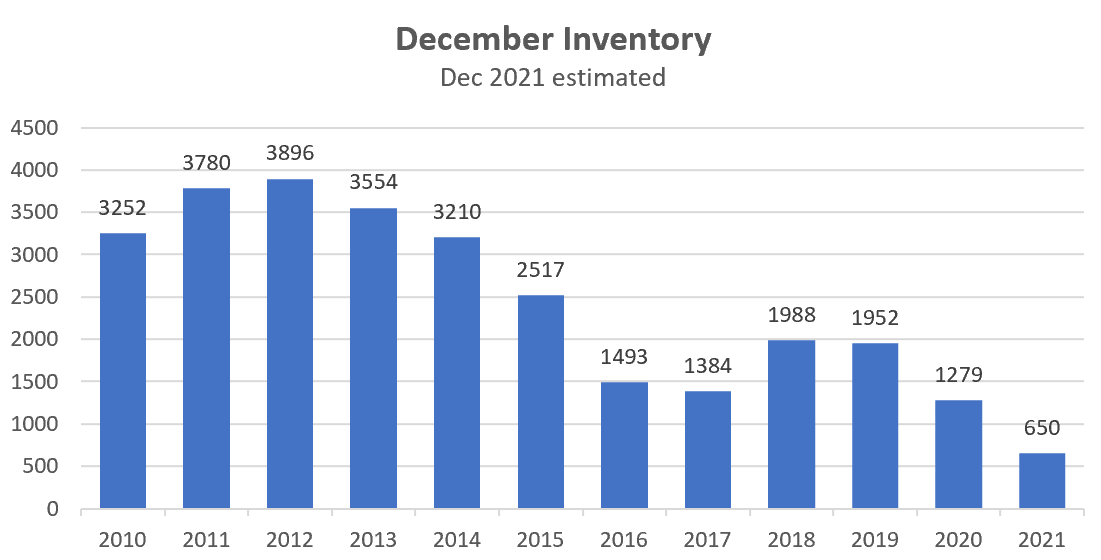

- Inventory: 652

All the forecasts were so far off that there is hardly any point in awarding winners this year. No one thought inventory would fall this low, very few guessed sales would be this high, and the actual prices were above every single guess made. That’s never happened before. Frank the Tank was closest on prices with a guess of $1.2 million for detached and $500,000 for condos. The only thing there was broad agreement on was that interest rates wouldn’t budge, which they didn’t.

2022 Predictions

Again the predictions are very difficult this year. Last year I thought COVID would be over in 2021, but here we are starting the year with the highest case counts ever and renewed lockdowns in many regions. At the same time it seems both the public and governments are about tired of the situation and are responding in only halfhearted ways. Is this the last hurrah with the milder Omicron, or is the next and deadlier variant just around the corner?

On the bullish side for the market:

- Interest rates remain at record lows. The noise about increasing rates has picked up, but as of now the overnight rate remains at the effective lower bound. Meanwhile the 5 year bond briefly regained pre-pandemic levels, but has recently fallen back again by about 0.25%.

- There’s no clear end to government stimulus. The big spending programs and quantitative easing are winding down but they are far from over. Renewed lockdowns means more relief spending and it doesn’t seem like Omicron will be the last variant we will face.

- Tourism is back and the labour market is strong. Local tourism has been active for quite a while, and with 350 cruise ships set to dock this year, even those trinket shops should do ok this summer. Meanwhile it seems like every industry is short of workers, and that is putting upward pressure on prices. That’s one way affordability could improve without dropping prices.

- Rental demand is higher than ever. Students are back, and despite a big increase in purpose built rental completions, the rental market is tighter than ever. Expect a substantial drop in the vacancy rate when the CMHC stats are released later this month. This also supports investor buyers.

- The Vancouver market is hot. Even though the price gap between the smaller markets and the largest ones narrowed somewhat during the pandemic, a hot Vancouver market allows more people to cash out and move here.

- Market conditions are incredibly tight. This is likely the most significant reason in the short term, because it is actually measurable and correlates well with prices. There has been no relief in market conditions and we remain at levels where we have historically seen 10-20% annual price appreciation. If price gains are to stop in 2022, the first thing that will need to happen is a substantial slackening of demand and an increase in the months of inventory.

On the bearish side:

- Extreme spending can’t last forever. We’re still apparently living in the pandemic fantasyland where deficits don’t matter and every hardship can be solved by spending more. Will 2022 break the spell? Who knows, but eventually it will be broken and we will need to mop up the mess.

- We can’t pull forward demand forever. Early retirees from Vancouver, low rates, FOMO buyers, and new investors. There’s no shortage of demand that came out of the woodwork during the pandemic and its lasted longer than anyone expected. However I still don’t believe it’s a sudden new normal of elevated demand. Those who accelerated their buying plans for whatever reason won’t be around to buy later, and at some point we’ll see the numbers of buyers fall back into a lull as we’ve seen before.

- Affordability is very strained. I don’t think prices are necessarily in bubble territory, but there’s no denying that affordability has deteriorated extremely rapidly in the last year, and we are near or even beyond levels where prices have flattened out or turned down in the past. That doesn’t mean prices can’t keep going up (in the 80s affordability got way worse before a crash) but it is a substantial headwind to the market. Many people still forget that the majority of the market is not crypto millionaires or people cashing out of Vancouver, but rather ordinary people buying with income from their jobs. They may have a significant family boost, but even that is not endless. Fundamentals matter in the long term.

- The government is paying attention. This may be the biggest risk to the market in 2022. Governments at all levels, but most importantly at the provincial and federal level have finally realized they can no longer afford to turn a blind eye to runaway housing prices. Whether it’s ending blind bidding, instituting mandatory cooling off periods, boosting the stress test, raising down payment limits on investors, or reforming zoning, I expect some pretty substantial moves from senior government this year. And even though many of the individual measures are not getting at the root of the problem, a set of actions together could knock the confidence out of the market and cause a rapid cooling as buyers wait to see what happens.

With that said, here are my predictions:

- Sales: 7400. I expect a pretty significant drop in sales in 2022 for two reasons: there simply isn’t much to buy, and sometime this year I believe the market will slow down due to either government action or buyers simply being priced out.

- Single family Q4 2022 median: $1,300,000. In the first quarter to half of the year it will be almost impossible to avoid more price gains. Months of inventory is at extremely low levels and there’s just no arguing with those market conditions. I think the market will lose steam this year and price gains will end, but I honestly can’t tell if that’s just me optimistically hoping or a rational forecast given the continued record tight market. Perhaps further price gains will be an overshoot and declines will follow, but the market condition indicators are a lot more reliable in the short term than affordability which acts at longer time scales.

- Condo Q4 median: $605,000. The huge jump in prices in the last 6 months have absorbed most of the affordability headroom on the condo side, but I still think they will slightly outperform detached in 2022. The stress test seems to have lost all power, and the huge jump in assessments will allow more parents to dip into their home equity to get their kiddos into that condo before everyone is priced out forever (blast from the past). The one thing that could torpedo the condo market in 2022 is government increasing the required down payment for investors from 20% to 40% like they did in New Zealand. With high investor participation, the condo market is more vulnerable both to interest rate increases pricing out first time buyers and government action against investors.

- Inventory: 1400. Inventory will be critically low for some time. I think we will see a build in the latter half of the year, but I’m not overly hopeful.

- Bank of Canada overnight rate: 0.75%. Despite a pretty strong economy in the first half of the year I expect we’ll only get two minor rate bumps in 2022, at which point the Bank of Canada will take a breather to assess the impact.

Again we’re doing the same predictions in the Vancouver Island Housing Market Facebook group, so to facilitate collecting responses, I’ve set up a survey.

Click here to submit your prediction for 2022

What do you think will happen in our housing market this year? Leave your prediction for sales, single family price, condo price, inventory, and interest rates using the form above, then drop them in the comments below to discuss. What else do you expect to happen in 2022?

New post: https://househuntvictoria.ca/2022/01/10/where-buyers-came-from-in-2021/

Sure you can sell your property to a holding company. More PPT for the government and you’ll trigger capital gains. The government wins again.

Savvy investors don’t do things on rumors. They wait until they see the trends emerge. Or at least see what the politicians, with inside information, are doing before it becomes public.

And I don’t think that it’s a small amount of investors that would be effected by an increase in the CG tax. They would re-evaluate their holdings to determine if the loss is equivalent to any potential future gains. They could sell now or hold their properties and sell later and pay even more in CG taxes if the properties continue to rise. The government wins again.

This is all pure speculation. But I think the government has to do something and investors are the low hanging fruit.

How about increasing tax brackets limits with inflation. Cost of living has gone up, lets increase the bracket limits with inflation. A small increase in Capital gains won’t reduce investor interest. People need somewhere safe to park there money and can’t sit on cash. It may push people to sell like some of the older multifamily building owners. Recently there have been owners looking for a quick close on there apartment buildings to beat the year end because of this rumor.

That was a white paper of proposals, open for discussions and submissions many of which were modified or not implemented. https://digitalcommons.osgoode.yorku.ca/cgi/viewcontent.cgi?article=1161&context=jlsp

There’s a big difference between proposals for discussion and tax law.

Just like Justin Trudeau promising a 1% foreigner homeowner tax in his April 2021 budget, “scheduled to come into effect Jan 1, 2022 in Canada” . Except it didn’t.

https://www.canada.ca/en/department-finance/programs/consultations/2021/tax-unproductive-use-housing-non-resident-non-canadian-owners.html

Maybe because we tugged on Superman’s cape, and the US threatened to tax Canadian sunbirds with US property…

https://www.politico.com/news/2021/06/23/brian-higgins-trudeau-canada-tax-495739

If fear of a future cap gains increase was going to make people sell investment real estate, they would have done it already (or at least crystallized the gain). Because if you’ve been following this topic, you’d be expecting cap gains increases coming. Because federal Liberals (and the NDP) have been musing about increasing the rate of cap gains to 75% from 50% for at least two years. And 2022 may be it. Many savvy investors have crystallized gains in preparation for this, and anyone sitting on stock or property gains should consider it, as once they announce it as official, it’s too late. btw) People sell RE properties to their holding companies to trigger (crystallize) gains so it doesn’t mean that the properties go on the market.

https://nationalpost.com/opinion/tasha-kheiriddin-get-ready-for-tax-hikes-to-pay-for-liberal-spending

Patrick, that’s the root of the idea.

The properties being bought today, as rentals, are not being bought for their cash flow but for appreciation.

That’s a lot different than years ago, when someone buying a rental property wanted a ten percent return on their investment. Today’s investor is not buying on cash flow but mostly for appreciation. With the allowable right offs, these properties may reduce personal taxes.

This raises a question of fairness in the tax laws. If these properties have a negative cash flow for years why shouldn’t the gains then be fully taxed?

Which is more fair. Increasing personal taxes or taxing capital gains at a higher rate? After all, the appreciation that we have seen in Canada is all gravy. No one had to work overtime to reap these prices. They just had to buy and hold. It’s all passive income.

Besides Canada probably needs the money to offset the recovery benefits paid out.

In 1987 the Toronto RE market, the country’s largest, was near the top of a bull market which was followed by Canada’s biggest RE bust.

Ahem.

The government would never be foolish enough to pre-announce a capital gains increase. The tax department is in the business of fairly setting and collecting taxes, not lowering house prices as part of a goofy scheme to get rid of rental properties (by evicting their tenants) in favour of home occupier owners like “whoeverIWant”.

The “a Victoria townhouse isn’t good enough” crowd here needs to forget about the idea that government (or anyone) has any interest in helping them with their “problem.”

Patriotz, you’ve the better memory. Do you recall what happened to stocks when the government changed the rules on how the gains would be taxed? I think the term was crystalizing????

He said announcing an upcoming change, thus encouraging investors to sell at the lower tax rates.

Frank, it really depends on how much money you would be losing by holding and how those thinking of buying short term for quick appreciation would react.

This wouldn’t effect your home just your rentals. If you notice a spike in listings you could always sell now and buy back when prices are lower.

Okay, enough about giving investors a heart attack.

Most of us have heard about the mobile home park in View Royal with the notice given to the mobile home owners that they are to be evicted to make way for a new development.

What I don’t understand, is why people are still buying them?

Does anyone have any thoughts on this?

Increasing capital gains taxes would not produce an influx of properties being listed, investors would only hold onto them longer, decreasing supply. Rents would go up, along with prices. Investors aren’t desperate, they can hold on for a long time, I have, and plan on holding even longer.

That’s it? I thought the barbs would be sharper. Patrick didn’t disappoint me. I knew I could count on him. I’m just surprised he didn’t call me a “lefty”?

Getting rid of the capital gains exemption would likely mean the end of the current government. The other parties would be quick to say. “Vote for us and we will bring it back”.

But like the GST, they wouldn’t. That’s a lot of money flowing into the coffers.

What it would do is reduce the amount of people buying multiple properties when all or most of the gains become taxable. Holding residential rental properties would not be as attractive of an investment anymore. And home occupation buyers would not have to compete with deep pocket investors.

No doubt the politicians making such a determination would sell off their residential investments before such a tax could be introduced. So if the news starts to report that they’re dumping their residential real estate investments- that’s your warning.

My opinion is that residential real estate shouldn’t be an investment. If you want an investment then buy a purpose built apartment building not houses and condos. But don’t get your shorts in a knot, the government doesn’t listen to me. Although I don’t doubt they have thought about it.

Beware the ides of March (budget speech) are upon us.

Who’s next? Eh Tu, Totoro?

Oh you can eventually. The problem is dealing with the consequences when the outsized RE sector inevitably collapses, as shown by the first graph on this page.

But you’re right that a more sophisticated approach is dealing with misallocation of existing and new RE investment. When we have a housing crisis at the same time that RE investment consumes a record high % of capital formation, that should be apparent.

Getting rid of both the HOG and property tax deferral should be no-brainers. They may have effect only at the margins, but that’s what moves prices. Likewise interest expenses should not be allowed to create an operating loss for RE, as is already the case for CCA.

There are people in all these homes. Either renters or owners. Your idea is that we “smoke ‘em out” with higher taxes. Presumably so you can move in? Or is there something deeper to your idea than that?

I’ve never seen the point of the home owners’ grant. I doubt that removing this subsidy will make any difference to the real estate market.

But it could be a signal of trends to come as real estate becomes an increasing cash cow for the government to milk. With the great wealth of Canadians from real estate, I can envision that we could be heading to an inheritance tax as well as a change in the Capital Gains Tax.

Real Estate is one of the last areas that the government can milk to bring in tons of revenue.

My opinion, and believe me no one agrees with me on this one. Is that you can’t build your way to lower home prices with new construction. Construction stimulates the economy and drives prices higher. But if you stimulate the pre-owned/used housing market to put their homes up for sale then it is possible to increase inventory and bring down house prices without stimulating the economy.

The real estate market comprises only 2 or 3 percent of the total housing in Greater Victoria. There is a massive amount of existing homes that could be brought onto the market. If the government announced an upcoming change to the Capital Gains tax, then some investors might to chose to sell now rather than later when the new CG rates come into place.

Aren’t you glad I don’t work for the government. Awaiting your daggers to come my way.

Ending the homeowner grant wouldn’t lower rents or house prices. It would just insure that the provincial government loses the next election.

Governments should add “rental payments” income tax credits for low income renters.

Sales: 68

New lists: 128

Inventory: 686

New post tonight.

Why are B.C. renters subsidizing B.C. homeowners? Answer: Politics

We are thinking about buying something on a larger lot at some point 5-10 years from now and putting a garden suite on it for kids to stay in while they attend university. Of course many unknowns there still

Wow, that’s a lot of text that no one is going to read. Was there a point to that?

We have four so was not affordable for us to do this. Did what we could at the time and it has worked well so far. I think most homeowners can’t afford to buy a home for a child at today’s prices so suite or multifamily (which are admittedly rare) might be possible.

totoro,

I remembered that you promoted multi-generation living before, sounds like you went ahead and bought a big house for it. Good for you.

For those who want to live close-by but not together with adult children or don’t like the complication of co-ownership, we went the other way – bought separate property for our child.

The most common scenario going forward for people wanting a place for their kids may be coownership. If you have a largish SFH that has or can be suited you can sell part of the home to the child, register a private mortgage, and transfer the interest without PTT or capital gains implications.

So for those able and willing parents, you could buy a property and let your young adult child live there. When the time (the child and you are ready) comes, transfer it to the child but register a private 90+% mortage on it. If the child has been living on the property before and after the transfer, there will be no PTT, but the parents would need to pay tax on CG if there is any as the transfer need to be market value based. Sounds simple?

You can easily register a private mortgage on a property. Same forms as used by banks.

I heard that some people resigter high percentage (90+%?) value of the house/condo/.. they paid for their children to live as a private interest-free loan/mortage from the parents, the loan will be forgiven when the parents are gone.

Sounds like a protected early inheritance, a simple way to help children enjoy benefit of home ownership earlier and also to protect the property from divorce and bankrupt, …

somehow I am not able to paste the link fromCRA. here is the full contents on Section 85.

~~

Transfer of Property to a Corporation Under Section 85

From: Canada Revenue Agency

NO.: IC 76-19R3

DATE : June 17, 1996

SUBJECT: Transfer of Property to a Corporation Under Section 85

This Circular cancels and replaces Information Circular 76-19R2 dated June 15, 1990. It provides information and guidance to help you make elections under subsections 85(1) and (2) of the Income Tax Act for certain types of property transferred to a corporation. You should read this circular in conjunction with Forms T2057 and T2058, and Interpretation Bulletins IT-169 and IT-291. Any reference to an Interpretation Bulletin or Information Circular in this circular refers to the current version of that bulletin or circular.

This Information Circular incorporates the 1991 to 1994 amendments to the Income Tax Act and clarifies the departmental policies. It does not include any comment on 1995 draft legislation.

Where applicable, Revenue Canada has extended its position on section 85 elections to elections under subsection 93(1), Election re disposition of share in foreign affiliate, subsection 97(2), Rules where election by partners, and subsection 98(3), Rules applicable where partnership ceases to exist. You should use Form T2107, Election in Respect of a Disposition of Shares in a Foreign Affiliate, Form T2059, Election on Disposition of Property by a Taxpayer to a Canadian Partnership, and Form T2060, Disposition of Property Upon Cessation of Partnership respectively to make these elections. The Department’s views on the merger or amalgamation of Canadian partnerships are set out in IT-471, Merger of Partnerships

PROPERTY TRANSFERRED

The rules in section 85 apply to each property transferred. Accordingly, if the parties intended but failed to include a particular property transferred when filing an original election form, we will consider that the transferor disposed of the omitted property for proceeds equal to the fair market value. However, according to subsection 85(7) or 85(7.1), the parties may file an additional election for that property after the date the election was otherwise due (see paragraph 15).

Although Form T2057, Election on Disposition of Property by a Taxpayer to a Taxable Canadian Corporation, and Form T2058, Election on Disposition of Property by a Partnership to a Taxable Canadian Corporation, require a specific and adequate description of each property transferred, the parties to the election can exercise some discretion when transferring many properties. For example, if you are transferring all the depreciable properties of a prescribed class, it is not necessary to list each property, or show the consideration for each on the election form. Instead, you have to indicate on the form only the total fair market value of the properties, the lesser of the undepreciated capital cost and the cost of the properties, the fair market value of the consideration received, and the agreed amount for the whole class. However, you must retain supporting schedules. They are particularly important to determine the designated order of disposition of each depreciable property, as described in IT-291, Transfer of Property to a Corporation under Subsection 85(1).

The Department will accept elections reporting a nominal amount as the agreed amount for the transfer of property, provided that the amount is within the limitations imposed in the relevant paragraphs e.g., 85(1)(c), (c.1), (c.2), (d), and (e).

Paragraph 85(1)(d) ensures that the agreed amount for eligible capital property for a business cannot be less than the least of 4/3 of the cumulative eligible capital of that business, the cost, and the fair market value. When the lowest of these amounts is zero (e.g., earned goodwill for which there is no cost) and the parties intended to transfer the property on a tax-deferred basis, the parties still have to list the property on Form T2057 and state a nominal amount. If the parties transfer goodwill and do not include it on the prescribed form, we will consider it to be disposed of at its fair market value. It may be possible to avoid this tax consequence by filing a late election (see paragraphs 2 and 15 to 18). For more information, refer to IT-143, Meaning of Eligible Capital Expenditure, and IT-123, Transactions Involving Eligible Capital Property.

Forms T2057 and T2058 require you to disclose the fair market value of both the property disposed of and of the non-share consideration received. You should keep the working papers used to arrive at these values.

Even though you may list several properties on a single election form, section 85 requires a separate agreed amount for each property transferred. The Department will adjust an election form to disregard all references to a transfer of an ineligible property, without affecting the validity of the other transfers. There may be tax consequences in transferring ineligible properties. Therefore, it is important to ensure that you include only eligible properties in any election filed under section 85.

CONSIDERATION RECEIVED

FILING REQUIREMENTS

Two or more transferors may elect to transfer the same property, or a number of partners may transfer their partnership interests. In these situations, one designated person should file all the completed T2057 forms and a list of all the electing transferors simultaneously at the tax centre serving the transferee corporation. We will accept the signature of the person that the transferors authorized to act on their behalf if that person has provided proof of authority. The designated person has to provide the address and social insurance number, or the corporation account or business number for each transferor resident in Canada.

For a transferor that is a partnership, one partner designated by the partnership should file Form T2058. All partners, or a person authorized in writing by the partners to sign for them, has to sign the election form, along with an authorized officer of the transferee. We will accept the signature of the designated partner only if the partnership provides proof of authority. The partnership has to file the election form separately from any income tax return, at the tax centre where the transferee usually files its income tax return. (See comments on the transfer of property to a corporation by a partnership under subsection 85(2) in IT-378, Winding-up of a Partnership.)

The deadline to file forms T2057 and T2058 is the earliest date on which any of the parties to the election has to file an income tax return for the taxation year in which the transfer occurred. Under subsection 150(1), an individual has to file an income tax return for the calendar year in which the individual disposed of a capital property, or has a taxable capital gain. For property other than capital property, we have to consider any election under subsection 25(1) or 99(2) that extends the fiscal period of either an individual proprietor who disposed of a business, or an individual member of a terminated partnership.

The parties to an election have to provide all the information required by the forms, obtain the appropriate signatures, and pay any late-filing penalties when filing the forms. All parties should ensure that they file their election on the most recent version of the prescribed form (available from their tax services office).

The relevant forms provide more details on filing requirements.

LATE AND AMENDED ELECTIONS

We will generally accept an amended election under subsection 85(7.1) if its purpose is to revise an agreed amount, and without this revision, there would be unintended tax consequences for the taxpayers involved. We will permit revisions to correct an error, omission, or oversight made at the time of the original election. However, we will not permit revisions when, in the Department’s view, the main purpose of the amended election is:

retroactive tax planning, such as taking advantage of losses or tax credits not considered when the election was originally filed. In situations where the changes are partly retroactive tax planning and partly to correct errors, we will advise you that we will only accept an amended election for the latter;

to take advantage of amendments in the law enacted after the original election was filed, e.g., an increase in the agreed amount of an election made in April 1985 to create a capital gain that may be offset by a capital gains deduction under section 110.6;

to improperly avoid or evade tax; or

to change the agreed amount in a statute-barred year.

17. The Department will accept an amended election only if you or your representative originally filed a valid election under subsection 85(1) or (2). For example, if, in the original election, consideration received by the transferor does not include at least one (or a fraction of one) share, it will not be a valid election.

it corrects an inaccurate property valuation that gave rise to unintended tax consequences;

it reduces the agreed amount of transferred shares to the correct cost amount when a transfer at cost was the intention, e.g., subsection 83(1) dividends were omitted when calculating their adjusted cost base;

it corrects situations where it is clear that an amount was inserted in error, such as the transfer of depreciable property at its net book value instead of its undepreciated capital cost; and

it corrects other situations which resulted in unintended tax consequences, e.g., the application of section 84.1, subsections 15(1), 84(1), and 85(2.1), or paragraph 85(1)(e.2), when it is clear the parties wanted the rollover without any immediate tax consequences.

AMENDED ELECTION NOT REQUIRED

Paragraphs 85(1)(b), (c), (c.1), (c.2), (d), (e), (e.2), (e.3), and (e.4) automatically adjust the agreed amount of the transferred property. In such cases, you do not have to file an amended election. However, we will need an amended election if you want to avoid the tax consequences resulting from the automatic adjustment to the agreed amount, subject to the comments in paragraphs 15 to 18 above.

PENALTY FOR LATE AND AMENDED ELECTIONS

(a) one-quarter of 1% of the excess of the property’s fair market value at the time of the disposition over the agreed amount for each month or part of a month after the election’s original due date and before the filing of the late or amended election; and

(b) $100 for each month or part of a month referred to above, to a maximum of $8,000.

22. The penalty described in paragraph 21 is subject to the provisions of subsection 220(3.1). For details on the cancellation or waiver of any penalty, see Information Circular 92-2, Guidelines for the Cancellation And Waiver Of Interest And Penalties.

BENEFIT CONFERRED ON A RELATED PERSON

The potential deferred tax liability in the hands of the transferee does not reduce the fair market value of the transferred property. You should consider this when you determine the amount of consideration that has to be taken back to ensure that paragraph 85(1)(e.2) does not apply. Generally, we will not apply paragraph 85(1)(e.2) when you satisfy all the following conditions:

the transferor takes back retractable preference shares having a retraction amount equal to the fair market value of the transferred property less any other consideration taken back;

the net fair market value of the transferee corporation is not less than the retraction amount of the retractable shares immediately after the transfer; and

the rights, conditions, and characteristics of the shares are such that they maintain their value until they are redeemed.

For clarification purposes, “retractable shares” are shares that are redeemable at the option of the holder.

DEEMED DIVIDENDS AND APPROPRIATIONS

PRICE ADJUSTMENT CLAUSES

LOSSES FROM DISPOSITION OF PROPERTY TO A CONTROLLED CORPORATION

PRE-1972 APPRECIATION

FACSIMILE ELECTION FORMS

Director

Publishing Directorate

Revenue Canada

17th floor

Albion Tower

25 Nicholas Street

Ottawa ON K1A 0L5

You should send a copy of the proposed facsimile form with your submission to the Department at least 60 days before the electors have to sign the forms. For more comments on facsimile forms, see Information Circular 92-5, T1, T2 and T3 Customs Returns.

more info section 85.

IwAR2yqVBfTeVdxvwNnCB2xsgqx0W2oD73ZmDLGl8X1a1KQndG5OuQHqS__eY

Saanich by-law enforcement is complaint based. So unless the tenants make trouble (e.g noise, garbage, etc.) to cause two or more neighours to complain, there wouldn’t be enforcement. Otherwise there can be.

apparently, there are some deep knowledgable accountants and lawyers here. I bet someone used a bare trust to structure the the beneficial owners( in this case, it can be either a person, multiple partners or a corp or a family trust, or a blend of all if needed to be when a new partner to get on to the deal) someone is specialized in estate planning an tax advisory can set it up what is known as a bare trust :.

it will help with mitigate the capital gain. ( note, those kind of accountant wont be your typical $150/hr guy)

On the legal side of things:

the lawyer needs to done up a bare trust agreement.

completely legal and seen it from time to time for those ultra rich.

Does anyone know if Saanich is enforcing the rule that homeowners must live in houses with a rental suite rented out? Given the housing shortage especially…

They wouldn’t pay any PTT under this route and this would be their first home so seems fair they would pay on the next one which will in all likelihood be over 500k anyway which is the limit for the PTT exemption.

The other consideration is that they could not withdraw RRSPs for the homebuyers program or be eligible for 5% down for a subsequent home. I did the math and it is better for them financially to get in earlier than withdraw from RRSPs later and to pay 20% down on the next place if they can and not pay CMHC insurance fees. There are some ways around this if you have a partner later who has never owned a home.

Totoro, would the kids lose there first time home exemption then?

Not really. It is entirely possible to remotely manage a rental these days, particularly when you have family on site. Only thing keeping the kids in town right now is covid. Later in life the biggest factors will likely be who they have as a partner and what type of career. We don’t need them to stay here, just need to to be possible if they want to.

It does allow children to be added if it is your primary residence without PTT.

That is more complicated and I would say talk to a knowledgeable accountant about how to structure your agreement for tax purposes, there are many ways to go, but remember that the sale of part of a primary residence that is used as a primary residence, which this is, is tax exempt. This is a legal non-strata multi-family so there is only one title.

Be careful that as parents you don’t meddle too much with your kids futures. Mom and dad pushing for and funding the Victoria property will tie them down to a life in Victoria.

And cutting off potential life and career options. Maybe they have a desire to sell real estate in Croatia that you don’t know about

Then Totoro, are you putting them on Title as Joint Tenants or Tenants in Common?

How are you going to handle capital gains when you sell to them and they sell back to you?

What you’re suggesting is a new idea to me, but a deemed partial sale of your multi-family building should have tax implications. You might not set a value to the “shares” but the government will.

I think there may be a clause in the land registry that will allow you to transfer ownership without having to pay property purchase tax if the transfer is between legal partners (married/common law) but I don’t know if that extends to children.

Anyway it’s an interesting idea.

I’ve found the same as you Marko.

If you want a foreclosure, then it would be an idea to sit in on several proceedings and educate yourself.

When there are more than one bidder, the judge may call a recess for new bids to be submitted. I’ve been there when there have been 30 bidders packed outside the court room. And I’ve been there when there has only been one offer.

But I can almost guarantee you, that if there is nothing odd about the property there will be multiple bids. Maybe if you’re bidding on a property on Galiano Island you might be the only bidder but most things within the Victoria CMA will have multiple bids.

But strange things do happen.

Our places are already townhouse equivalents – no need to sell to move to this. If they want to sell we will buy back if they want to buy a different home in Victoria, but we’ve recommended they convert to a rental at that point and we will lend the equity and they can pay back from rental income. And it is not shares, it is a form of co-ownership with a co-ownership agreement so the equity will be tax exempt if it is their primary residence.

Sorry Totoro, but I’m not understanding how shares in your multi-family building will get them a town house in five years? Are you making them partners in your business? Can they sell their shares to someone else when it comes time to buy the townhouse? What about income taxes on the sale of the shares? Will creditors have a claim against their shares?

How are you going to handle those things?

Median family income in Victoria is about 90k. If your kids are median then the maximum mortgage they are going to qualify for is about $400,000. With your 20% they’ll be able to get something for 480-500k if you note it as a gift rather than a loan. That will get you a two bedroom apartment here if you are under 50 and most singles won’t have 90k income alone at the start of their careers so your child may need a partner to qualify which may or may not happen.

I prefer our route as we bought much earlier at a lower price with our credit and each child will be able to buy a townhouse equivalent (ranging from 2-4 beds) in town if they wish suitable for a family without restrictions vs. pets and kids. And the eldest is still probably five years away from this stage. I can imagine that affordability will decline further over this time period to the point that your 20% down payment loan may not get your child an apartment here by the time they are in a position to purchase as it has in Vancouver already.

Nobody wonders why.

Yes they they still have to qualify for a first mortgage. Don’t your kids have jobs?

That doesn’t overcome the barrier of qualifying for a mortgage here for the 80% remaining. And a loan for a down payment affects the overall debt ratio negatively. It is a help for sure but will leave many young adults without the means to qualify. My guess is that more parents will end up cosigning. You can manage the risk to a great degree with a written agreement in a market where appreciation has a good long term track record – meaning negative equity is less of a risk.

In my 11+ years seems like every single time I’ve been to court the place has sold above market value. My thoughts here -> https://www.youtube.com/watch?v=Drk2xOJE3PE

We had the transaction on Pandora where the City of Victoria paid the developer $10 million for a property the developer had purchased and made zero improvements to a few years earlier for $3 million and change and now this

https://www.timescolonist.com/local-news/big-project-pitched-for-whitespot-site-on-douglas-lower-cost-housing-in-towers-offices-grocery-restaurant-shops-large-public-plaza-4935251

Government paid $26 million for 43,566 sq/ft.

Chard Development paid $7.55 million (at a much later date in a rising market) for 28,800 sq/ft.

Even if we factor in the utility of the hotel for 3-4years at let’s say $5 million the government overpaid. Worse part is you have a bunch of government employees making well into the 6 figures coming up with these brilliant transactions.

Everything I’ve seen from COV/BC Housing has been like winning the lottery for the seller. Don’t understand why the government(s) just doesn’t buy the finished product.

Now watch the COV takes years to approve rezoning with bureaucracy/politics so more municipal government works can collect their 6 figure salaries as well.

And then we wonder why we have a housing crisis.

Whoeveriwanttocallmyself: I don’t know what most parents/grandparents do in order to provide funds to assist their adult kids iwith their various wants and needs. Myself I paid for my daughter and granddaughter’s education in full out of my savings. With my grandddaughter, I purchased RESP’s each year. My daughter’s education funds came from savings from when I was working. I helped considerably with the down payment on her first and 2nd homes both located in Vancouver. These funds also were from savings. However, if I didn’t have those savings, I would not of helped by putting myself in any kind of debt.

I like what Totoro has done.

I believe quite a few seniors/pensioners have helped their kids by taking out a reverse mortgage. To each his own I guess.

The downside of lending the money for the down payment as a second mortgage is that it will probably impact the total amount of mortgage they are qualified for. Typically the bank asks for a letter indicating the source of the down payment and that there is no claim against it. I believe that banks will also often tie up a lot of the equity beyond the mortgage amount to stop them from adding a second mortgage. I am not sure exactly how that works or the circumstances it is done under but I believe it can complicate schemes like using a second mortgage for a down payment.

Everytime someone comments on what is affordable and what is not, they should include the group trying to buy and the market segment they are trying to purchase. I know the dictionary meaning refers to average, but in my mind median would be a more relevant.

It seems like Patrick’s definition of affordability is based on the top quintile of earners/wealth is currently purchasing the houses currently for sale, so housing is affordable.

It seems like most first time want to be buyers commenting are using the following segments: median of all want to be first time buyers (so not just the actual first time buyers) cannot afford the median of properties currently for sale (so not a median or average of all properties, because there is no way for them to buy a house not for sale).

That’s an interesting way of doing things, Totoro.

I would just do it simpler. I would lend them a second mortgage of up to 20% of the purchase price.

Thanks Alexandracdn, the follow up question I would ask is from what source are the parents/grandparents getting the money to gift. Is it from their savings or from the equity in their homes? And what is meant by “gift”. Are the parents giving the money with no strings attached? Going on Title as joint tenants? Co-signing the loan? Or a verbal or written agreement that the money is to be paid back to the parents or form part of the kids’ future inheritance?

The risk is if the gift is from the parent’s equity. if any of them default on their mortgage ie loss of employment, health, etc. that could cause a cascading effect of defaults for some of the others. A case of all of one’s eggs in one basket again.

Along the lines of holding a second mortgage. If you are behind the lender on title and the property goes into default then as the parent you should be prepared to buy out the first mortgage or take over some or all of the payments.

Well done!

The report was very interesting and reflects our plans with the exception that we do not help our children purchase vehicles.

We have taken things a step further and have already purchased multiple family housing for our children and they will be able to buy an affordable share from us allowing occupation of a unit when they are ready if they want. Not fancy, but in Victoria and they can choose to rent it out or live in it and they will be added to title.

The housing market is not affordable to first-time buyers in Victoria. If you are a homeowner want your children to be able to stay here then I think you have to face the fact that you have benefited from the appreciation to their detriment and consider assisting them. The takeaway from the report reflects a shift that occurred for me when I was a young adult looking at how different cultures treat family economics, and it it this:

And my job is great. Challenging and meaningful and still leaving a lot of free time. Thanks for asking.

Hi Totoro and others who may be interested on transfers of inter-generational wealth. Google a 2021 article “Family Matters. A report on Affluent Canadians and the transfer of Wealth.” Breakdowns for Education, First Home, Car, Living Expenses, New Businesses, Second home, Vacation Property.

Also from CIBC: Vancouver parents (and to a lesser degree grandparents I’m sure), on an average gave their kids in 2021 an average of $180K to help with the purchase of their first home.

How are you enjoying that post retirement new job Totoro?

True. But this future “mobile home” will be modular, solar powered, self-driving, and equipped with meta verse Step 85 integration, so you’re convinced that you’re living in a waterfront Uplands mansion.

Sure, the standard is changing and dropping. Never mind of a townhome or condo, maybe someday Patrick will call a mobile home as the average home in Victoria for the average household 😉

Yes, you just have to look at the numbers to see how an average household income buys an average home. (

A poster here (Whoeveriwanttocallmyself ) told us:

I agree freedom, It’s like the cost of living index. Steak gets too expensive so the government substitutes hamburger for steak in their calculations. Voila – no inflation.

My opinion is that there is a disconnect from what historically has been called middle income housing and middle income earners. Now condos are middle income and what was middle income homes are now upper income. I have no “F”ing idea what water front homes would be then. Bezos homes??

Really? Do you know the difference between the rate of average household income increase vs the rate of average home price increase in past 5 years?

As the mortage rate hasn’t changed too much, if the income increase rate is the same as house price increase, then the affordablity would be the same. If the average home price has increased much faster, then housing is becoming more expensive and less affordable.

Yes, we should be all grateful having a roof over our heads, be it a SFH, a condo, or a mobile home. But if the average household who could afford a SFH 5 years ago can only afford a townhome/condo today, it can only mean one thing – the average home is harder to reach for the average household, period.

I bought a Court sale previously in Alberta. It was listed on the MLS and I used a Realtor to write the offer, and we needed to revise 3 times as the banks lawyer kept waiting for more offers and higher prices. It ended up with 5 offers and it took about 6 months to get to Court.

It's also my understanding all Court sales are listed on the MLS, and you also need to buy the house "as-is, where is" and have no conditions on your offer, the Court even sets your possession date. Maybe different in BC, but that was my experience in Alberta. Definitely not easy like you see on American TV.

In Victoria to buy a first SFH you need above median income or help via a cosigner and/or down payment gift. A median income family could still buy a condo. In any event, waiting until you have diversified assets into other investments is pie in the sky for the vast majority of first time purchasers – in fact they will need to withdraw their TFSA and RRSP most likely to come up with the down payment. Once you have equity things are easier.

The average household in Victoria can afford an average home, which by your definition makes Victoria homes affordable.

All this “Un affordability” talk on HH is referring to above average price homes (SFH). When was the last time you heard anyone here say condos are unaffordable ???

People with average incomes are not prepared to settle for average price homes (condos, townhouses). Not because they can’t afford them, they just don’t like them, and feel they deserve better.

Agreed.

‘whoeveriwantocallmyself

Thanks for your information.

I called the court house, they advised me it would fall under : Supreme Chamber List

I asked further if you can release what time on Jan 25 they are scheduled? The court agent told me they need a name for the parties involved. Address can not be used in their system.

It’s super annoying when the public get some information without paying anyone or feel guilty using Marko’s time.

options are:

1) wait for the 25th and pull the records from the daily court list on that day to get the time

2) to pull the title on file https://ltsa.ca/ with a small fee and it’s on demand without calling up Marko or anyone else.

3) find someone who has access either to the title office or MLS.

it is super inefficient world we live in…

From dictonary:

“un·af·ford·a·ble – too expensive to be afforded by the average person.”

Unaffordable and Unsellable are two totally different things. House market is hot and sell-able houses do sell fast. But the fact is (for us and lots other home owners) – if we didn’t have a house and need to buy today, we wouldn’t be able to afford to buy the house we live today. It is not just expensive, but too expensive.

LeoS Jan 4,2022: “I don’t think prices are necessarily in bubble territory”

Patrick, you are over estimating the size of the real estate market.

There are over a hundred thousand homes in greater Victoria but only a small fraction of those are for sale at any time and those make up the size of the real estate market. And only a small portion of that fraction are starter homes. It doesn’t take many above average income earners with above average down payments to raise prices. So 40% of households is way too high. It’s more likely well under 5% of total households that are driving our prices.

That puts the house in jeopardy if the kid runs into trouble with creditors, gets sued, gets divorced, etc. Once someone gets added as a joint tenant you can’t take them off or sell the property without their consent. Also possible capital gains issues.

Leave the house to the kid in your will. The cost of probate is cheap insurance against the above.

So Totoro we are back to the word “average” again.

Is the average person buying starter homes in Victoria?

We know that the average household income is around $85,000 and that the average one-bedroom condominium in the core sells for around $425,000 and the average two-bedroom sells at around $560,000. So, are the people buying their first home today average or above average?

A question best answered by a broker or real estate agent.

Patrick in 1636:

“It sounds like many people here will only accept the idea that tulips are unaffordable. It doesn’t matter that some single tulip bulbs sold for more than 10 times the annual income of a skilled artisan, because clearly who ever is buying them can afford them because they are buying them.”

It sounds like many people here will only accept the idea that homes are unaffordable.

And that they are so unaffordable that Leo expects them to rise in price by 5% this year.

Yet all of these unaffordable homes will be purchased and afforded by thousands of fellow Victorians, many with multiple offers.

If this logic makes sense to you, then continue to refer to the homes as unaffordable.

For me, I think they are in fact affordable to large numbers (70% ) of Victoria households. This would consist of 40% of households that can buy above avaerge homes (SFH). And another 30% that can buy the below average price homes (condos). So homes are in fact affordable to about 70% of Victoria households IMO. And this group will continue to purchase them, year after year.

Why does this matter? Well, some of the “homes are unaffordable” believers here expect that these unaffordable homes won’t sell (because they’re unaffordable). And so my point is, yes they will sell, because lots of people can in fact afford them.

A better word to describe Victoria home prices would be “expensive.”

if we increased the amortization up to 40 years or 50 years for a mortgage. Would prices just go up as there would be a frenzy of buyers now able to afford more? Or would we reduce monthly mortgage costs?

We have statistical analysis that demonstrates that first time buyers share many characteristics on average. Half are under 35, 3/4 are families, and 30% had family help with the down payment (average amount of 82,000). Also, 9/10 homeowners 25-44 have a mortgage. We also know that the family home is the single biggest asset for Canadians and that current prices in Victoria for a SFH are not affordable without family help for the majority of first time buyers based on median incomes.

https://www150.statcan.gc.ca/n1/pub/11-627-m/11-627-m2019091-eng.htm

https://torontosun.com/business/money-news/one-third-of-first-time-canadian-home-buyers-get-parental-help-cibc

https://www.canada.ca/en/financial-consumer-agency/programs/research/canadian-financial-capability-survey-2019.html

Totoro, every person is different and every situation is different. Real Estate has made a lot of people paper millionaires. Resulting in intergenerational wealth being passed within families when they kick the bucket. Instant millionaires.

For court ordered sales you can search the Victoria Court House web site. Myself I would contact Marko and ask if he would search the MLS system. I think it is well worth what he would charge, as buying property under duress can be tricky. It isn’t the same as buying a home when there is a willing seller involved. The process is well regulated by the courts and the odds are not that good that you will get a discount from market value for the risk involved when buying this type of property.

A better way is to look at Estate Sales where the executors are not from the city or the estate is being handled by a law firm. The vendors seem to be more motivated when it comes to disposing of this type of property. Again you’re going to need someone, like Marko, to assist you. The emotional factor with these properties comes from sibling rivalry. Especially when properties are selling quickly, as one of the family members might argue that the executor under sold the property as it sold in under two weeks. I think anyone who has ever been an executor of an estate will explain to you how all of the skeletons in the closet between siblings come out at that time.

Do your relatives a favor, sell all of your stuff before you die. Or if you have a kid that you want to have your property, put them on title as joint tenants. Then the Right of Survivorship will apply regardless of what your will states or doesn’t state.

Unrealistic. To buy today for the first time you will likely need to put everything in and, more to the point, it is not a bad idea based on historical performance and the fact that shelter is a basic need. You can’t live in a stock. Not to say you don’t need an emergency fund, but I’d be comfortable going all in on my first home and for most there is no other option.

If this was used as the definition of affordability then homes are ALWAYS affordable. At any point in time every home that sells is sold to people who through a combination of saving and borrowing can meet the purchase price.

This is something that only becomes apparent after the fact, so is not a useful definition of unaffordability. And as patriotz said here is always a proportion of people who buy something and then can’t pay for it.

interested in the court order sales . Is there a link to check the court schedule and the property address without accessing MLS or using a realtor? TIA

Somebody is always buying something they can’t pay for. That why credit cards get declined or cars get repossessed or people go bankrupt. Granted that in the US circa 2005 more people were buying houses they couldn’t pay for than usual, but the fact remains that most buyers could pay.

Not a useful definition at all.

That will eventually collapse, as no industry can be supported simply by demand coming from the employees of the industry itself. That’s one of the messages behind the first graph that Leo posted.

Patrick that’s the point. What do you mean by “people” because real estate is always being bought therefore it is always affordable. Never have “people” stopped buying real estate.

I would say you should buy real estate when you can afford it and the housing meets your basic needs and you’re not risking all of your fortune in one asset class. You should have a back up plan in case the market goes upside down on you. Make sure you have investments in something the creditors can’t take if things go sideways on you. As the other commenter said. Don’t put all your eggs in one basket.

So draw from your HELOC and invest in the alternative asset classes you refer to. Then your liability is matched by your alternative asset. And you own a house for your family.

There’s one very good part to renting even if it’s a high price. It’s that I am not committing a quarter of a million in capital into an asset that I also have to spend $3000 to $4000 a month to service debt on. Unfortunately, people just tend to look at their monthly in and out costs instead of possible opportunity costs by the large commitment to a single illiquid asset class (and no, drawing from your HELOC is not releasing trapped equity or spending your gains, it’s adding to your liabilities and your costs). The problem is the religion of property ownership that has convinced people to sacrifice everything else and destroy financial capacity, wiggle room, alternative means of gains and has drawn in multiple generations of some families to be singularly committed to the success of one vehicle to ensure financial stability and success in life. It’s a terrible amount of eggs to put in one basket.

A. When the people that buy it can’t pay for it.

Now a question for you…

Q. What’s the problem with buying a home that you can afford?

Fatigued buyer that actually seems like an interesting definition of affordable housing. If we took that to the extreme then houses in Victoria could be ten million dollars and considered affordable as long as the inventory stayed low and a few people could buy them. Supply meets demand and therefore real estate must be affordable. It seems like a logical fallacy of circular reasoning to me. Because under that premise, when is real estate not affordable?

Shawn, I’m thinking along the same lines as you commented. The term “affordable housing” is a moving goal post. We assume that higher prices are directly related to low supply. But what if it is more complicated than that.

The solution has always been to build more and more and eventually prices will come down. What if supply and demand are not independent of each other. Then the more you build, the more people are needed and wages in this sector keep increasing and that increases demand. Maybe we have it somewhat backwards. Maybe we can’t build ourselves out of high prices as the very act of building stimulates demand among high wage earners and is the cause of high prices.

I doubt we will get the answers to these questions until we experience a recession and the construction industry starts to lay off workers. The term “bubble” gets bandied about but you can not tell if you are in a bubble when you’re in one. Only in hindsight can you say it was a bubble.

Since these days I’m fascinated with the James Webb satellite and astronomy it now seems that the picture of our spiral Milky Way galaxy may be wrong. As the spiral shape is is how we assumed it would look like but could not be sure as we are inside it looking out. Just like a real estate bubble when you are in one . We could be wrong about the shape of our galaxy. We would then have to tear out all of those pictures in our science books.

Things that make you go Hmmmmm.

Very true Patriot. The price to rent ratio is astronomical. If we make the assumption that renters make less than home owners as they tend to be younger and are at the beginning of their careers. Then renters are likely paying a very high portion of their income towards rent. As well as paying for other items such as city water, garbage, insurance, heat, electricity, phone, etcetera. Items that are also increasing along with rents. My guess is that renters are paying over the ratio for their accommodation than what banks use to qualify a buyer for a mortgage. That could make it very difficult to save up the cash for a down payment of say 5 or 10 percent or at least extend the years it would take to save for a down payment.

I would think that isn’t good for the local economy as renters would have less disposable income for things like restaurants, cars, vacations, etc. Service industry jobs employ a lot of people but this generation couldn’t take this type of job because the jobs don’t pay enough to allow them to live near the city. This generation of renters might also delay having children or limit how many children they have and that would have an effect on housing twenty years from now.

There are very few options left for this generation as the best paying jobs are in construction within the Victoria CMA. It’s not like they can go work in the oil fields and make a ton of cash anymore. Those jobs haven’t returned.

I’ve always envisioned real estate as pyramid shaped with lots of renters at the bottom level moving up the pyramid from condo to starter house to middle income housing. But if you knock out that bottom layer – what happens to the pyramid then?

I don’t know the answer to these questions, but it sure is a strange time we live in. When renting may take a higher portion of a household’s disposable income than buying.

Hi Patrick,

Fair enough. Whether it’s a social problem/issue/crisis or not is beyond what I was considering.

The point remains that relative to other years in the history of the CRD real estate market we are at peak unaffordability…it is what it is I guess.

I feel due to lack of land of being on an Island, green attitude, red tape, and anti development sentiment that there will be a lot less new homes being built. There will be more townhouse and condo options. Though I can see the attitude of middle class being disgruntled that they will only be able to afford these options. If there were more new homes being built then the older homes would be more plentiful and the more affordable option. Nothing wrong with a townhome I just don’t want to raise my two kids in one.

Using your definition, there are plenty of homes that are available/affordable to the average disposable income first time buyer. They are townhouses. Talk to some forum members here, who bought one recently. These are the average homes, between condos and SFH. What isn’t available to the average disposable income income is SFH (detached homes). Those aren’t average price homes, they are above average price homes. And they are affordable/available to above average disposable incomes. As expected.

If you look at the people buying the detached homes in Victoria, you’ll see that they aren’t average disposable income people. They are above average incomes, and second home buyers. And there are plenty of them to buy these homes, hence the bidding wars.

Average incomes can afford average Victoria homes. What’s wrong with that?

Hi Patrick,

In the context of Leo’s discussions, “affordability” is a term of art that relates the price of homes that sell to median income… (EDIT: wrote disposable income for some reason)

Also, how does the fact that homes sell reflect anything about affordability of real estate in Victoria…even in its colloquial definition?

Hermes makes $50,000 purses and they sell out. Demand meets supply. Does that make a Birkin bag affordable?

How liquid does a market need to be under your conception of affordable? Demand meets supply at these prices in this low inventory environment…but what if supply and/or demand is affected by a black swan event. Does your conception of the term change?

This is why we have terms of art with rigorous definitions…it gets too confusing and impossible to pin down in discourse otherwise.

I think you’re conflating “affordability” and “salability”…but what do I know

Have a great night everyone! Stay safe if you have to venture out in the snow.

“Why would you use the assessed value? And not what you think your home is worth?

The latest assessments, in most cases, are still below market value. Using the assessment is going to give you a lower estimate of the rent. If you use the assessed value then you will have to use a lower factor than 280. And if BC assessment has not caught any improvements you might have made then the factor can be way off.

That’s why I said to use the value you think the house is worth and not the assessment.”

Well, just so happens I get right about what the assessed value is in rent. At least the assessed value is something to reference when working with tenants and not just your attitude of “oh well this is what I think my home is worth, so this is what I expect you to pay”. Who would want to deal with a landlord like that?

Sure it’s six months old and I know it’s worth more now (I appreciated your free TED talk on that), but I really don’t know what someone is willing to pay for it and neither does anyone on this forum. If you don’t believe that just look at the sales over the past six months. Do I add $50k or $250k?

Also it’s completely flawed to say that “rent is unaffordable” based on what someone/anyone (including the delusional) thinks their home is worth.

Finally, even at my make-believe market value it’s still reasonable, so I don’t think your little 280 equation stands up.

Why would you use the assessed value? And not what you think your home is worth?

The latest assessments, in most cases, are still below market value. Using the assessment is going to give you a lower estimate of the rent. If you use the assessed value then you will have to use a lower factor than 280. And if BC assessment has not caught any improvements you might have made then the factor can be way off.

That’s why I said to use the value you think the house is worth and not the assessment.

Quite possibly. But bear in mind that the approval data would have been submitted to the FDA well before HC (as is almost always the case).

I agree.

Having our own review process that inevitably starts later than the US process adds a bit of friction for getting new drugs to market in Canada. One study suggested that median time from filing to approval was about 10 months in the US and about 12 months in Canada and Europe

“Renting is very expensive these days. To give you an idea of how expensive, here is a little guide to determine what your home might receive as rent.

Take the price of what you think your home is worth and divide that price by 280.

Could you afford to rent your home?”

Yes, quite comfortably (I used assessed value), although I do agree renting is expensive. But that’s probably because it would seem many landlords are renting their SFHs or condos out at a rate much higher than your equation

No, I said we wouldn’t receive “substantial quantities”, not that we wouldn’t receive any. Perhaps there’s a compassionate grounds delivery that we’d get, or a source from another country (e.g. Bangladesh is making a generic version, approved by Pfizer). None of that can happen until it’s approved. So approval isn’t a moot point.

Moreover, it isn’t Health Canada’s role to delay approvals based on estimated procurement of a drug. They are supposed to base it on science.

The elephant in the room for Health Canada approvals that might be guiding them is Canada’s thalidomide disaster in the 1950s. This is the morning sickness drug that Canada approved in the 1950s, and kept it in the market despite other countries pulling it. Of course it caused severe congenital abnormalities in thousands of Canadian babies. And the USA never approved it, thanks (ironically) to a Canadian Dr. Kelsey who was working for the US FDA alerting them to problems. For which she got an award by JFK. https://thalidomide.ca/en/the-canadian-tragedy/

So perhaps Health Canada has compensated by being “extra cautious”. However, in this case, the risk/reward favours approval. There are big rewards for the Paxlovid COVID drug (life saving), whereas for thalidomide it was an unnecessary nausea drug for morning sickness. I predict that Health Canada will approve it within a couple of weeks, and have nothing negative to say about it. I just think they are too slow in these circumstances.

FWIW, here’s a young Canadian blogger who makes many of the same points that I’ve been making about Paxlovid. https://www.nenroll-nenroll.com/we-need-to-talk-about-paxlovid-press/1519352022/

That’s about twice the historical price/rent ratio you know. I can personally remember when it was about 100 in Vancouver.

If true this seems to undercut your original complaint about HC’s slow approval of the drug. The approval status is moot for now if there is none of the drug available.

James,

Sure. There have been situations where lots of homes were sold to people who couldn’t afford them. The most famous example is the US housing collapse in 2007. Homes were sold to people who couldn’t afford them, based on NINJA or liar loans. After buying, they couldn’t pay the mortgage, resulting in millions of foreclosures. So this is the case you asked for, where there weren’t enough buyers to afford the homes, but they bought them anyway. And this led to a price collapse.

This isn’t the case in Victoria, where mortgages are stress tested, and almost no one is unable to pay the mortgage after buying. As seen by almost zero foreclosures. That means, unlike the US in 2007, Victoria homes that we are told here are “unaffordable” are in fact affordable to the Victorians that buy them.

Renting is very expensive these days. To give you an idea of how expensive, here is a little guide to determine what your home might receive as rent.

Take the price of what you think your home is worth and divide that price by 280.

Could you afford to rent your home?

Caveat, I agree in that I’m not expecting kindness from Pfizer. The kindness I’m referring to is from the US government, which needs to approve exports of COVID drugs made in USA by Pfizer to Canada. The US government is guided by their national interest, not Pfizer’s profits, and certainly not by Canada’s interests. They didn’t allow Pfizer/Moderna to send us US made COVID vaccines until they were overflowing with them in the USA. They will do the same with Paxlovid. Trouble is that only 80 million Paxlovid are expected to be made in 2022, which is 1/25 of the 2 billion vaccines that they made.

The point being, I don’t think Canada will see ANY substantial quantities of US made Paxlovid for several months or longer. Why should they send Paxlovid to Canada, when it’s made in the USA, if it’s needed to treat Americans?

The US government has already told Americans that Pfizer Paxlovid production goes straight to the US government “ “We’re getting them as soon as they come off the line,” the US government official said. https://www.reuters.com/business/healthcare-pharmaceuticals/pfizer-supply-10-mln-additional-courses-covid-19-pill-us-govt-2022-01-04/

And the US government has made it clear that they will “activate the Defense Production Act or use other extraordinary powers to speed deliveries if Pfizer encounters any production difficulties.”

Translation… the USA is going to get all the Paxlovid until they have enough for all Americans that need it. Canada, as usual, will get the leftovers, but not until the summer or later IMO. It’s a difficult drug to manufacture, with some sulfur-based components in short supply for example. And each regimen is ten big pills, much more drug to make per patient than the tiny vaccine dose. Oh well, time to again to cue the Canadian “procurement minister”, to search the world to scramble and hope to find some.