Where buyers came from in 2021

The full year buyer origin data is out, so let’s take a look at what changed and what didn’t about where Victoria buyers moved from in 2021. Remember, this is filled out by agents and is in response to the question “Where is the buyer currently residing?“. That means it’s not a measure of buyer citizenship, and of course it’s always debatable whether someone who moved here to rent for 6 months before purchasing should be considered a local or out of town buyer (in these data they would very likely be considered local). Nevertheless it’s an interesting dataset given it’s been running for 18 years and it seems to match pretty well with both other data sources on migration from StatsCan (figure below) and changes in market activity.

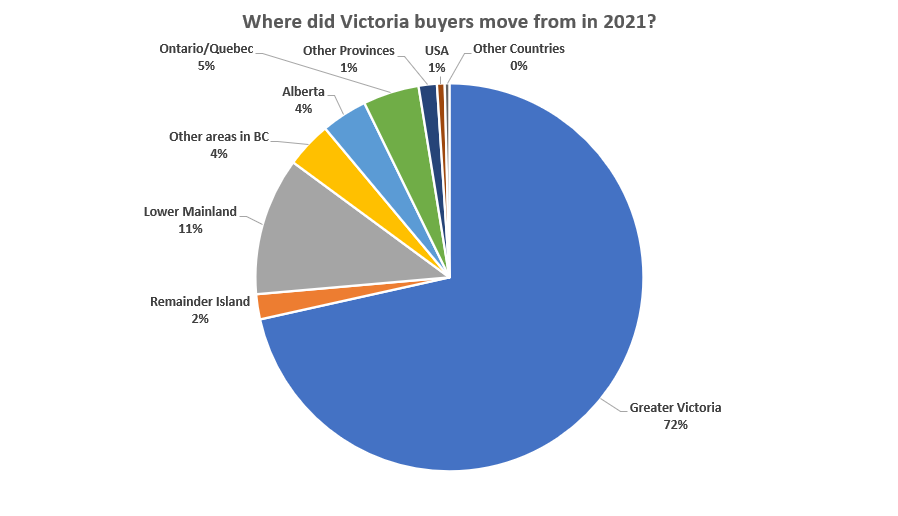

In 2021, we saw 72% of buyers already living in Greater Victoria, while 28% were from out of town. As a reminder for why the split is important, out of town buyers have a much greater impact on the market than in-town buyers. They buy properties without listing one for sale (similar to first time buyers and investors) while in-town buyers generally sell one property and buy another. The biggest source of out of town buyers by far is the lower mainland at 11% of buyers, with the runner up being buyers from Ontario/Quebec, Alberta, and the rest of BC being roughly equal in second place.

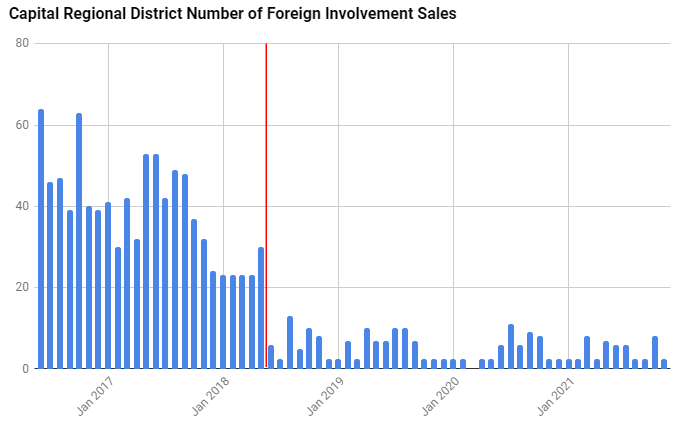

Buyers moving from out of the country were an insignificant part of the transaction volume. The US was the largest source of that small group, which has been the case every year of the last 18. This can be backed up by provincial foreign buyers data, which has remained at an average of only 5 sales a month since the introduction of the foreign buyers tax in 2018.

Percentage of foreign buyer transactions dropped from an average of 4.24% before the foreign buyers tax, to 0.64% after

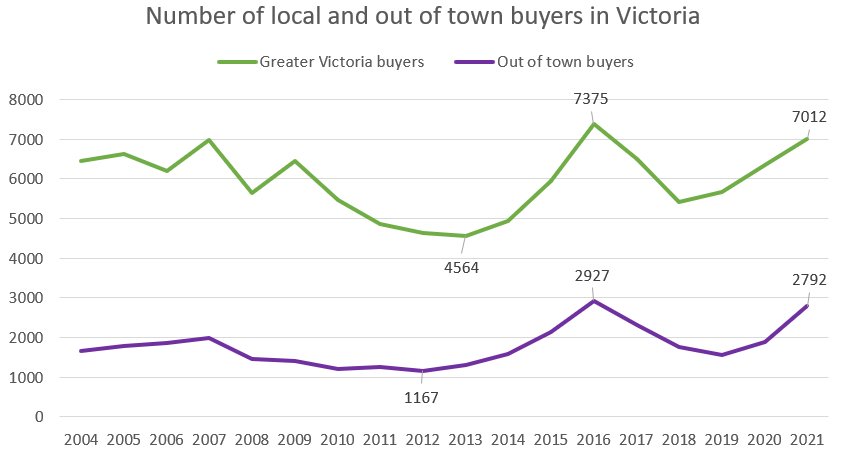

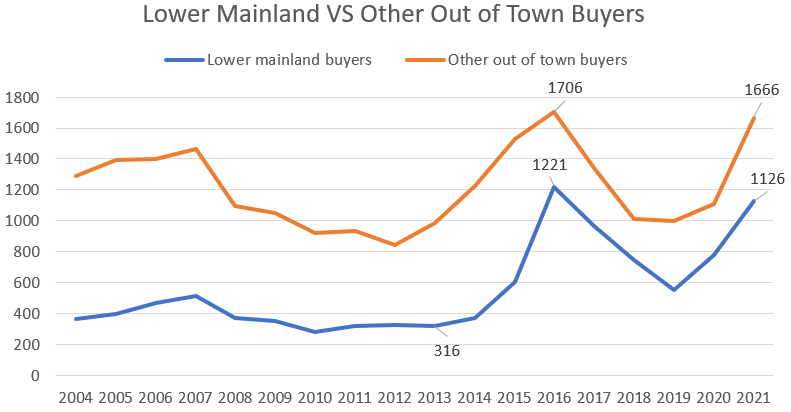

The big story in the last few years has been the variability in out of town buyers, specifically from the lower mainland. The number of out of town buyers varies a lot more year to year than local buyers. In 2016, local buyers increased 62% compared to the slowest year, but out of town buyers increased 250%. After the mortage stress test kneecapped the market in 2018, out of town buyers dropped nearly all the way back, but that changed when the pandemic hit and out of town buyers jumped back up to near peak levels.

Of the out of towners, lower mainland buyers are both by far the biggest single group and the most volatile, increasing 386% between 2013 and 2016. The increase in Vancouver buyers is perhaps largely explained by the price gap between Vancouver and Victoria but there’s clearly more to it, since other out of town buyers also jumped in 2016 and 2021. It’s not entirely clear why, since Victoria prices certainly haven’t lagged behind the rest of the country post-pandemic. Worth keeping in mind is that when the market pulls back in the rest of the country they are a class of buyers that could drop back again as quickly as they came. For now, we continue to fly high.

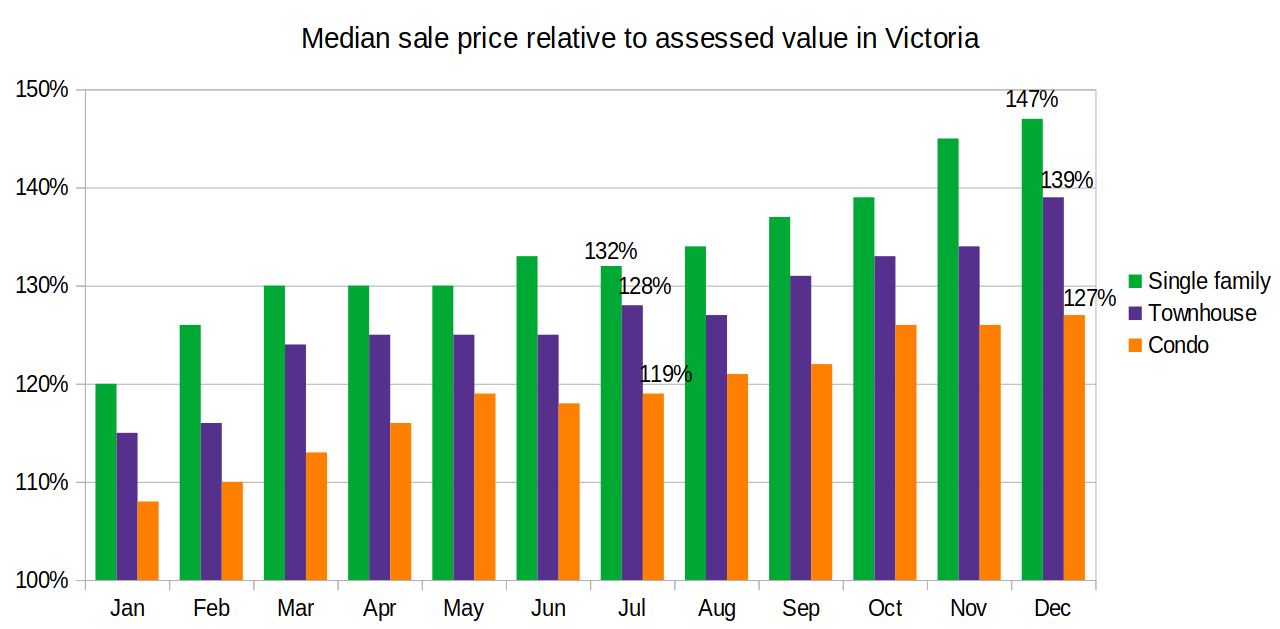

In other news, there’s been a lot of focus on the jump in assessed values this year. No great surprise, given that only a small percentage of people are buying or selling every year, the reality of the increases don’t sink in for most until they get that slip of paper in the mail. In a time when inflation is being driven by excess demand in the face of supply chain disruptions, the resulting wealth effect is not going to help this year.

Of course the assessments are valuations as of July 1, 2021. Given the strong price gains since then, they are already quite badly out of date and lagging market value. Once we start charting sales relative to the new assessments this year we will likely be starting around +10%.

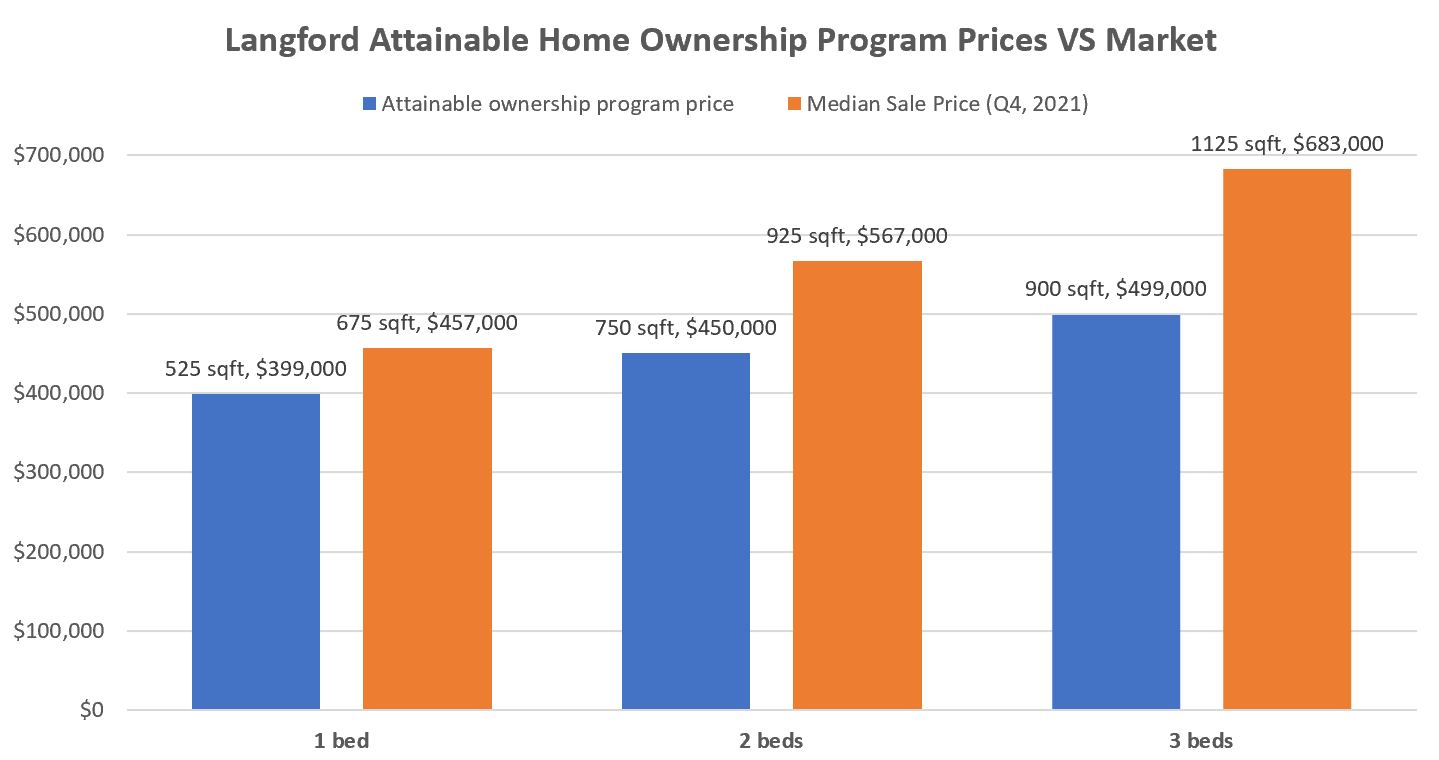

Meanwhile, Langford staff have released an update on the Attainable Home Ownership Program which I commented on when the first iteration came out. At the time I concluded that while it’s hard to criticize the city for trying to make housing more affordable, it’s also a tough case to make that couples making $100k are those most in need of public subsidy in this market. Regardless, staff are proposing to expand the program from the original 2 bedroom condos to 1 and 3 bed options as outlined below.

When this program first came out, I said that the $450k price point was substantially under market for 2 bedroom condos, and that discount was likely to be worth more than the actual cash downpayment assistance that Langford was proposing. This has now been raised by staff as well, who write that “it is very likely that either the “carrot”

or the “stick” will be necessary moving forward to gain developer participation” and that the “development community indicates that additional incentives will likely be necessary to gain voluntary partners for additional buildings” which could come in the form of development cost charge refunds. In other words, Langford is going to have to pay a lot more money than the actual downpayment assistance to get this program off the ground. Either that or Stew is going to have to twist a lot of arms.

Of course these units will be purpose built for the program, and as you can see in the chart above, they will be smaller than what is on the market right now and likely finishings and location will be a cut below to close the gap. However that’s a substantial gap, and with red hot market conditions continuing even in the condo market, it’ s a gap that is likely to widen more by the time these units are actually identified. Regardless of how they pull it off though, if you’re considering a condo in Langford, you’ll want to be on that list of applicants. It could be quite a good deal, especially if prices rise further.

New post: https://househuntvictoria.ca/2022/01/17/more-on-victoria-comings-and-goings/

Are the assessment usually that far off?

Some can be. But the way you should be looking at the sales to assessment ratio is how they are distributed in each class of real estate and exclude the outliers. Not on a one by one basis.

When you look at a group of single family homes within a geographical area over the last six months then you’ll discover that the majority of the sales to assessment ratios (SAR) lay within a narrow band centered around the median.

The sales below the median usually signal that the house is in need of repairs and updating. The ones at the higher end of the range usually have undergone recent substantial remodelling. The assessor has not caught these changes as the property may not have been visited by them in over 20 years.

All bets are off when it comes to views, acreage or water front. Then they can be wildly off in either direction. Because these are tough properties for the assessor to value as the sales data is very limited and can be very subjective. ie which type of water front is worth more? One that faces east or one that faces west? Do you prefer morning sunrises or evening sunsets?

If your property is very similar to most of the homes in your neighborhood then the new BC assessment will be close to what the property could fetch in the marketplace. Then you can determine the median SAR and apply that factor to your assessments.

If properties in your neighborhood are selling at say a SAR of 1.1 times their assessed value, then if you have a typical home for the neighborhood you can multiply your assessment by 1.1 and get a fair and equitable indication of your property’s worth. That’s how Zillow works or should work. But Zillow is a 100 percent computer generated application without human judgement input.

1236 Oscar St sold for 475K over asking (2.175M)

That’s good to know! I think with the low ball they under estimate because no one actually entered the dwelling to see its assets. The highball suggests they never checked the yards which are rocky. If you do assessments by paper or photos you can get it wrong. But still, $100,000+ off seems excessive. If you go by photos, history, and area stats without actually seeing a property you have to miss something if the historical sales don’t show a clear trend. Maybe.

Re: downtown condos without parking. There are tons of Modo cars downtown- for $4/hr + kms (in 15 minute increments) you can save a ton on owning a vehicle if you don’t need it for a daily commute. I’d skip the parking space.

We’d be car free entirely if it wasn’t for one child’s sport commitments (which are still scheduled under the assumption that every family has a minivan and a non-working parent.)

Not usually, but it can happen if there are improvements or defects not accounted for in the assessment.

Sometimes the assessment is way off for no reason.

I just got home assessments for two different properties based on July 2021. One seems well over $100,000 too high and the other well over $100,000 too low. Are home assessments usually that far off? Or do I need to rethink my own assessments?

“ RV buyers” are empty nesters, enjoying life. The guys I feel sorry for are the ones that don’t manage to do that, and just end up with a bunch of dividend paying growth stocks when they die.

If we lived downtown without kids we wouldn’t own a car period. With kids, we might still have a car, which means it would be a tough choice whether the lack of a parking space was worth the savings.

I’m looking at downtown condominiums that don’t come with dedicated parking. It seems that you can save yourself $50,000 to $75,000 buying one of these. Anyone have any thoughts on if they would buy a condo without parking?

Nither buyer wanted to pay for heatpump in the end and I knew houses would sell no problem with just the NG furnance, given the market, so that is why we did just the rough-ins. Makes it easy down the road, just pour the concrete pad and order a heatpump without having to drill through the envelope, trying to get power there, etc.

In a crap market you leave the heatpump off and then throw it in during negotiations with the buyers.

I have a feeling that “regular Joe” is more likely to tap into equity to buy a RV than to load up on solid dividend paying growth stocks.

You don’t have to always run a big mortgage….if you just make regular payments half the payment is principal at these rates.

I view this similarly to variable vs fixed. Sure, once in a blue moon you’ll get burned with a fixed mortgage but over a lifestyle if you go variable each time statistically speaking guaranteed you’ll do better.

It looks like fill was brought in and the houses are sufficiently elevated to not be flooded.

The yard is well irrigated, though.

Re: warmer or colder. It often depends on the season and location for sure.

In winter, it’s actually warmer around the waterfront around Cadboro Bay/Ten Mile Point/Uplands than up the hill at the University, for example. It’s definitely cooler in the summer by the waterfront there than up the hill at UVic and beyond.

South Oak Bay/Fairfield/Dallas Rd. waterfront is much colder and windier than everywhere else all thoughout the year. Not sure why that waterfront is so hyped up when it so cold and windy all through the year. The wind chill factor there definitely makes it feel colder than the actual temperature.

Lived in most of those areas and can attest to that.

Just saw this on reddit and wondering why the builder puts $1.4M houses in Millstream creek flood plain?

https://www.reddit.com/r/VictoriaBC/comments/s6ah12/brand_new_waterfront_property/

This is great Covid news, Pfizer’s wonder-drug Paxlovid COVID-19 antiviral pill has been approved for use in Canada. And a big thank you to the USA for allowing some to be exported to Canada when paxlovid is also needed desperately in the USA

=========

https://globalnews.ca/news/8516373/pfizers-paxlovid-covid-antiviral-pill-approved-canada/

“ Health Canada announced Monday it has approved Pfizer’s Paxlovid pill for use in the fight against COVID-19. The regulator posted on its website that the drug has received authorization.”

“ A Pfizer spokesperson told Global News the company is ready to start delivery in Canada immediately. Some [paxlovid] supply is already in the country and will be distributed this week.”

========= – =====

Paxlovid is developed and manufactured in the USA. They have very small supplies of it in the USA. If they are allowing Paxlovid to be sent to Canada while it is needed in the USA.. wow! A big thank you to the USA!

Remember that BC wouldn’t help Alberta with ICU beds, because BC might need them. Aren’t we fortunate that the USA is friendlier to its neighbors than BC is. And most people here agreed with that “BC first” policy.

Yet USA will send us Paxlovid pills to be sent to us when they need them and we need them. We will recall how many countries including USA, UK and EU didn’t export vaccines until they had enough of them.

Of course now we need to see how much Canada has received. I expect it will be a small amount, because the USA also has a small amount, about 1/10 of the demand in the USA. Since we need to depend on the “kindness of strangers” to develop and send us Covid drugs, we should be grateful for any amount. So we will need to be patient and wait for supply to meet demand.

This point will be controversial…. with it in short supply, it will be given to people at greatest risk, and that means un-vaccinated have priority (assuming other risk factors are equal)

Monday numbers. CORRECTION, my script which compares to previous year was broken, previous percentages comparing to last year was wrong, looking into it). New post tonight.

Sales: 150

New list: 273

Inventory: 710

@Fatiguedbuyer

Something else to keep in mind is that the cost to go from oil to heat pump will be impacted by municipal rebate top-ups. Or at least it did a couple years ago when we switched from oil to HP – Victoria residents were getting better rebates than say Saanich or Esquimalt. A quick look suggests that’s still the case

https://betterhomesbc.ca/municipal-offers/

Whether well-insulated or poorly-insulated, a heat pump is more efficient than gas.

Agree. Best bang-for-the-buck is to update the thermal envelope first. Consider signing up for the ‘Canada Greener Homes’ program and have an audit done.

I’m not disputing this one…

It could be that the house settled or shifted that caused a break/collapsed portion of perimeter drain, but more than likely the trees roots are the cause. A power drain snake can cut trough the blockage but the blockage will reoccurred if trees roots make it into your pipe.

Get a quote after the drain cleaning guys clear the blockage tell you where the blockage is and perhaps some pictures with it. And, comeback to let us know because I can walk you though the repair process if you are interested, however it will be dirty back breaking work.

Excelent work Marko.

If I was a buyer of one of your houses, I would request to have both NG furnace and heat pump installed. One can check the gas price vs electric to set the cross over threshold, as well as switch to gas to avoid expensive step code 2 electric bills when needed, and save the wear and tear on the heat pump.

It seems that the only “hot air” in Victoria is coming from the people claiming it’s warmer where they live

‘

‘

So your telling me on a typical summer day it will be the same temperature in Fairfield or South Oak Bay compared to North Oak Bay or Gordon Head. Obviously you’ve never gone for a bike ride along Dallas Road to Beach Drive then up to the University, I can tell you it’s easily 3 to 4 degrees warmer during the day at the University. Same thing goes for Victoria Golf Club vs Uplands Golf Club.

You bought a custom built newer home in the Uplands for $2 million?

‘

‘

We were talking about which golf course I moved near.

Thanks to those who responded regarding heat pump vs NG.

I suspect our landlord will be after the most cost effective solution for short term. Sounds like NG is probably that, and will be a fairly significant upgrade for us as tenants. I’ll pass this along.

Thank you so much all of you for your suggestions for perimeter companies. I really appreciate it! QT: my house was build in 1997. I don’t think it’s on a rock bed and don’t think it has a sump pump. It does however have a few trees close to the outer walls…

Now I’m not saying this is certain to happen again, but I’m not saying it can’t happen again either.

Seconded. This is who we use.

The Spring market doesn’t happen until the Tulips start to flower. We are still in the dark days of Winter.

Sure, but the item under discussion wasn’t liquidating a tax sheltered account (rsp, TFSA) to pay off a mortgage. It was paying off a mortgage with non tax sheltered savings.

It was also a discussion for a ”regular Joe” that might lose a job through sickness or layoff, with a family to feed. Seems to me they shouldn’t want to run a big mortgage forever, always counting on the stock market.

Plus if you are collecting dividends what are the odds your book dividend is cut down to the mortgage interest rate.

If I liquidated my TSFA and RRSPs, after tax, I could pay off my principal residence mortgage. Even thought it would feel good it would be the dumb thing to do. Just let inflation erode the mortgage away while the portfolio appreciates/pays out dividends.

I like Rod from Rival Rooter (not to be confused with Roto Rooter).

Only thing I will add is sometimes in older oil heated homes there can be benefit in getting rid of the ducts/furnace/etc., to improve utility/headroom in the basement. Then go ductless + baseboards in the bedrooms, maybe a gas fireplace in addition.

We went back to forced air heatpumps in our new builds but we did a couple of houses 2019/2020 with NG furnaces with rough-ins installed for adding a heatpump and that worked well. Neither buyer opted to add a heatpump, but if someone wanted to everything is roughed-in.

I am helping a friend look and I was sort of expecting new inventory to already starting coming on market. Is it still too early for the start of the spring inventory?

You bought a custom built newer home in the Uplands for $2 million?

This website also has thermometer readings across the region and I’ve noticed there are sometimes wild differences, especially on hot summer days, when, for example, James Bay will be 5-10° C cooler than Gordon Head.

https://www.victoriaweather.ca/

I’m not sure that is correct Patrick and I don’t think the temps take into account direct waterfront exposure and the microclimate it creates – or the effect of sea winds on comfort – wind chill is real. I’ve lived on the ocean here and it was definitely colder, especially in summer. Land heats up way faster than the ocean so inland will be more comfortable most of the year – or less if we have a heat dome. It seems like only in really cold weather would the sea have a moderating effect on oceanfront homes and that would likely be nullified by wind effects.

I was waiting for your post! You are clearly the expert of the board on this and I am considering a heat pump so this was helpful.

Depends on what you want to do, and how much you want to spends.

Existing home with oil furnace already have ducting in place that can be convert over or add a heat pump to the system that also provide central AC, but it is likely that you will need to up size the return air opening and duct trunking to get the most out of efficiency. And, perhaps have to upgrade the electrical service from 100 Amp to 200 Amp if it is not already.

If you don’t need to have AC then I would put serious look at NG furnace as it is a cheaper solution for now till they increase the carbon tax to the point that it match the cost of electricity. Return air doesn’t need to be upgrade on NG furnace or electrical upgrade so you will save money on this. And, another point is, if you have a NG fireplace it will run as normal during a power outage.

Gas HW is the way to go as they lasts longer than electric or hybrid tank if you flush the tank regularly (once or twice a year), and the heat recovery rate is at least 3 folds greater than electric or hybrid (like any heat pump hybrid often kick in electric backup during recovery mode, so efficiency is out the window).

The saving will be felt if you upgrade to heat pump or NG furnace, but IMO is money better spent if you put it toward insulation (refill the attic, upgrade windows, caulk all gaps and cracks, and replace the seals).

And. I’m waiting for people who have no field experience in HVAC to come in and dispute this.

I’ve heard various people saying certain areas of Victoria are warmer than the oceanfront. Then along came Wunderground.com with 50 live thermometer readings sprinkled throughout Victoria. You can also look at historical averages by the week/month for each weather station.

And surprise!…the data shows that the temperature is the same all over Victoria, in any month.

It seems that the only “hot air” in Victoria is coming from the people claiming it’s warmer where they live 🙂

https://www.wunderground.com/weather/ca/victoria

Here’s a screenshot from 11:30am Sunday (today).

Not really. This is something that may suit some renters but I’m more interested in practical steps to ownership and coownership seems like one. In terms of low income housing, this provides an alternative to renting a room I guess, but I doubt it will be any more affordable than the 800-1000 month or more folks are paying for a room, and which is unaffordable on IA or disability.

For me the most concerning aspect of the article were the quotes from the head of Together Against Poverty stating that their clients (under the poverty line):

This is, in my opinion, uninformed and impractical. We already have rent control and the only way to more vacancy is to increase availability. We need more rent geared to income and subsidized units – there is such a long waiting list for this type of housing. Co-housing units would be a good option for single individuals living under the poverty line and any reasonable housing options should be supported and encouraged imo. No one is entitled to their own suite, however everyone should have access to secure shelter.

It is possible to turn the heat down at night and up before you get up in the morning, and while you are at work and before you get home with programmable thermostats. And, then there are wifi enable programmable thermostats that give you even more control with your phone.

Another difficulty with comparing natural gas vs. heat pump is that with a heat pump you can’t turn the temperature down at night or when you are out. They don’t have the capacity to raise the temperature quickly like a gas furnace.

So you don’t save as much as you might expect, but your house will be comfortable all the time and that has value.

This is not a simple question with one easy answer. You should have a heat loss calculation done to determine proper heat pump sizing which is the difference between huge win and mediocre success for a heat pump. An open plan house is much more suited to a mini split than an older house with lots of small rooms and no circulation. Existing electrical service is going to make a big difference. Your views on climate change and the morality of moving to another fossil fuel source and the associated risk of future restrictions would also be a factor. Typically a new NG furnace is going to be less than a whole house heat pump solution. If you have to upgrade the service and are leaning towards a new technology high end whole house forced air heat pump that doesn’t need any backup you are looking at a LOT more money than upgrading to a NG furnace. Adding a conventional heat pump to your existing oil furnace can often be done with existing electrical service and will save you a lot of operating cost but is a bit of a compromise. Assuming you are getting the work done, a few estimates from reputable companies would be a good place to start.

You specifically moved away from beaches and the ocean to live on Bear Mountain? Maybe all those golf balls into the water hazards have you thinking differently cause who wouldn’t want waterfront? I get that low-bank oceanfront is risky, but it’s not like we’re in the Maldives or Miami

‘

‘

no not Bear Mountain, Uplands. Waterfront is just too cold unless your talking about the Saanich inlet which has wonderfully warm waters in the summer.

If you lived in a poorly insulated, older home with oil heat and hot water (newer water tank and oil tank but aging furnace), would you look at replacing with gas (if it was already on the street) or a forced air heat pump? Which would be more economical from an install and operating cost point? Im guessing a ducted heat pump in a poorly insulated home wouldn’t actually be that efficient and gas might be the way to go but curious if anyone has insight to share.

That is nuts.

In a related note, my tenant will never leave my suite voluntarily.

Sounds like Totoro’s dream rental unit.

On top of supply chain issues and labour shortages, who can shoulder the land cost for a proper conservatory? My days of sowing wild oats are over, but I’ll stick with gardens thank you very much.

“Sorry, that’s not me, the last place I would want to be is on the water, in fact we moved to be further away from the ocean and our new house is about 3 degrees warmer then our old one in the summer and closer to the golf course.”

You specifically moved away from beaches and the ocean to live on Bear Mountain? Maybe all those golf balls into the water hazards have you thinking differently cause who wouldn’t want waterfront? I get that low-bank oceanfront is risky, but it’s not like we’re in the Maldives or Miami

Weren’t you telling us here that your housing goal was to get a place on the water?

‘

‘

Sorry, that’s not me, the last place I would want to be is on the water, in fact we moved to be further away from the ocean and our new house is about 3 degrees warmer then our old one in the summer and closer to the golf course.

Am I alone in beginning to feel sorry for Garden Suitor? All that ardent attention to the Garden over all these years and yet, and yet, there has been no progress to Garden Spouse.

Perhaps you should widen your view and become Conservatory Suitor? At least there would be some chance of response whilst we are in these dank, dark days. At this time of year an ordinary outdoor Garden is very, very unlikely to respond to your attentions.

What year was the house build?

Is the house on rock bed?

Does it have an existing sump and sump pump?

Are there any trees or bushes near the house?

When most people say something is over/under-priced they’re speaking to a belief in future potential that isn’t commonly shared (otherwise it would be priced in). In 2013 some people likely thought Amazon had a better future than the market did, and thus would say $AMZN was underpriced at $300. It’s just kept going up and up so I think those people were right that it was underpriced.

My daughter used a fellow out of the phone book to clear her drain and get an estimate for a permanent fix. It blocked again a few days later so she tried Rotor Router. Excellent service, cleared the drain, guaranteed the work for 6 months and gave a cheaper estimate for a permanent fix. I would certainly use them again if required.

Try Royal Router 250-480-4806, I found them really good.

Hello All!

Had a problem with flooding in November and am looking for a perimeter drain company as the one I’ve been trying to contact is not returning my phone calls. Any suggestions/recommendations? Thank you so much in advance!

Weren’t you telling us here that your housing goal was to get a place on the water? Couldn’t you have managed that if you went “all in” with investments on a house, and made a killing on appreciation too? Or don’t you care about waterfront anymore?

So before you pay down your mortgage, you’ll be part of a wave of stock and bond market selling. Reducing your returns and creating taxes payable. And then you’ll be paying back your mortgage at higher rates.

‘

‘

Sounds someone missed out an incredible stock market run. I could have paid off our new house at the end of 2020 but i happily took out a large 5 year mortgage at under 1.50% with a dividend yield that’s more then my mortgage payments. I get that it feels good to payoff a mortgage but like I said before I couldn’t sleep at night not taking advantage of these low rates to borrow to invest and if the stock market falls 20% or 30% like it did in 2020 the only thing I will do is stop looking at my account until it recovers.

🙂

The fallacy in this argument is displayed in this excerpt above . When “things change” lots of people will be doing the same thing as you, likely ahead of you. “Sell stocks. Sell bonds. Payoff mortgage”

So before you pay down your mortgage, you’ll be part of a wave of stock and bond market selling. Reducing your returns and creating taxes payable. And then you’ll be paying back your mortgage at higher rates.

Lots of people have major sources of income in their profession or private business. They are experts in that area, and should focus their time on increasing returns there. Instead of playing amateur leveraged-up stock sleuths, who usually get killed in market downturns. You can’t go wrong paying off a mortgage, there’s lots of ways to go wrong leveraged into the stock market.

Perhaps people are trying to promote the area.

I think Royal Bay will be similar to Gordon Head in the next decade or two when the trees and bushes are filled in, because at the moment it is very windy and hot in the summer. And, it is looking to be a charming step up enclave SFH/Townhouses from the densely packed Westhills. However, only time will tell how it will fare, because the projected road map indicated one of the phase is going to have densely packed condos. And that is a big downer that everyone have to take the congested Sooke Road into Victoria or cut across Colwood and Langford to get to the Trans Canada Hwy.

Add: Google maps indicated that it take 31 minutes of driving to get to downtown Victoria from Royal Bay, 42 minutes from Sooke, and 23 minutes from Westhills (1:00 PM, Saturday 15th).

Interesting article with Scotiabank estimating the size of the structural housing deficit in Canada vs other countries, and among the provinces. For example, France has 25% more homes per capita than BC. (fwiw, Average age in France is 42.3 and is exactly the same in BC 42.3) . To get to France numbers, that would mean an additional 40,000 homes in Greater Victoria for example. To get to G7 countries average would be about 20,000 homes in Greater Victoria.

https://www.scotiabank.com/ca/en/about/economics/economics-publications/post.other-publications.housing.housing-note.housing-note–january-12-2022-.html

I don’t understand the meaning of “under priced”. If the property is under listed, then the marketplace would have buyers swarming over the properties bidding up prices to market value.

Would that be Interstate -5, going down the Pacific Coast? More seriously, “almost permanent” is not a basis for financial planning.

@ Patrick” I still want to pay down my mortgage fairly quickly and would rather not have another mortgage for the rest of my days.

Well done. Good plan.”

WRONG WRONG – we are in an almost permanent negative interstate rate ( inflation minus interest rate ) so do not pay down your mortgage until things change. Borrow at 3% interest in a mortgage is your best move if inflation is at 3.5%

I consider these comparisons essentially meaningless except for countries that have similar incomes, housing stock and property tenure to Canada, which leaves Australia, NZ and the US. So this shows us that housing in Canada is marginally cheaper than across the Pacific, and almost twice as expensive relative to incomes as the other side of the 49th, or the strait as the case may be. But we already knew that.

New Zealand 7.78

Australia 7.27

Canada 7.24

United States 4.04

We stopped and looked at Royal Bay a while ago since I like to see what is going on. They had free burgers is what I remember. Seriously I thought for a young family this was a pretty good deal compared with the price of condos.

“Royal Bay was underpriced for 3-4 years, I never understood it. Nicely planned (for what it is), next to ocean, a lot of amenities being built in next 5-10 years.”

Yeah, that was my impression too. I looked into it around late 2019 and the entry-level SFD with an unfinished basement and detached garage was priced in the $600s. That seemed like a pretty good deal.

I know some people get upset when I use the term “affordable”to describe our home prices, as it appears that it is only acceptable to say that homes are unaffordable.

But hopefully it’s still OK to compare Canada home prices relative affordability to other countries…

If we do… It’s nice to see Canada still one of the most affordable countries in the world to buy a home. Canada is (as of mid 2021) the 3rd most affordable of the 20 G20 countries (after South Africa and USA). And we are #14 of the 102 countries. https://www.numbeo.com/property-investment/rankings_by_country.jsp?title=2021-mid&displayColumn=0 (this is measured by price to income, and also other metrics for the “affordability” index, methodology is here https://www.numbeo.com/property-investment/indicators_explained.jsp ).

You can see that affordability is much worse than Canada in the countries that are big sources of immigration to Canada. (Philippines 4X higher prices than Canada, Hong Kong 7X, China 4X). This is one of the reasons that people immigrate here and buy homes ASAP.

This is a chart from a different site, but it is likely using similar data https://www.worldpropertyjournal.com/real-estate-news/saudi-arabia/riyadh-real-estate-news/saudi-arabia-real-estate-news-roofing-megastore-most-affordable-place-to-home-a-home-in-the-world-in-2021-most-expensive-place-in-the-world-to-buy-a-h-12813.php

https://www.worldpropertyjournal.com/assets_c/2021/11/The-World%27s-Top-50-Most-Affordable-Places-To-Buy-A-Home-31989.php

I talked a lot of my clients into Royal Bay vs Westhills, but this was before the run-up when Royal Bay was cheaper. This is a 5 year old video I made in Royal Bay -> https://www.youtube.com/watch?v=66bbwfW6Td0 the pre-sale home on the 8,500 sq/ft home I am referring to my clients bought for $529,900. Would sell north of $1.2 now.

Royal Bay was underpriced for 3-4 years, I never understood it. Nicely planned (for what it is), next to ocean, a lot of amenities being built in next 5-10 years.

I guess it is kind of like condo pre-sales, majority of people just can’t picture the finished product in their head.

“I would pay 550k for a lot in Royal Bay. Not many other better options.”

I think Royal Bay is a good development, and the houses I’ve seen seemed pretty well built and nicely laid out. I’d take it over West Hills any day.

No easier way to get ahead in life than avoiding MERs and real estate fees but for whatever reason the consumer still pays for both. If you can save 15k on real estate fees (mere posting or similar) and than invest those funds at 5%, with MERS, you’ll have 100k extra to retire with.

Assessments are still all over place from property to property. My best guess on Sparrowhawk is it sells for $1,150,000 irrelevant of assessment.

I would pay 550k for a lot in Royal Bay. Not many other better options.

“The lot is worth half a million.”

Half a million for a 5100 sq/ft no privacy lot and the other 635k is for the 1900 sq/ft cookie cutter house. Insane…

Sparrowhawk should sell for around $1,135,000. The lot is worth half a million.

“Taxi drivers = essential service, Real estate agents = something that could be largely dispensed with.”

I mean sure it’s an essential service when Uber has been stiff-armed out of your city. Allow Uber, Lyft and other ride-share options here in Greater Victoria and why would anyone call a cab?

Following that logic, imagine what an “Uber of real estate” could offer people looking for something other than posting their home on Used Victoria or Craigslist only to be bombarded by realtors replying to your ad asking if you’re currently represented or informing you that you don’t know what you’re doing.

I originally asked what people were noticing about new listing prices relative to assessed value this year but edited my comment. 3482 Sparrowhawk Ave in Royal Bay was just listed for essentially the assessed value, which seems really low for the current market. But I did my own check on realtor and it looks like anywhere from $10k over assessed to $750k over (lots in the $200k plus with a couple of notable $500k plus). Now I’m curious about people’s take on that.

As you know, all kinds of stats during the pandemic went wild. Sales collapsed in 2020, then roared back in 2021, and have settled down again. In that context, it’s not surprising that the % of investment sales varied from 18 to 21%. For example, maybe the sales collapse was mainly non-investment, which would raise the % of investors. We would need to wait a few years to see if it’s really a trend.

From: https://vancouverisland.ctvnews.ca/multiple-privacy-breaches-linked-to-victoria-councillor-s-email-city-confirms-1.5739319

A question for Barrister or other lawyers in the room:

Does this kind of conduct cost someone their entry into law school?

The big deal is the trend since the pandemic started in 2020. When we saw an unprecedented Canada-wide price increase at a time of slowing population growth.

Taxi drivers = essential service, Real estate agents = something that could be largely dispensed with.

Anywhere in society where there are large flows of money, there arise “professions” dedicated both to facilitating that flow and at the same time diverting a bit of that flow into their pockets. Think mutual fund salespeople (and big chunks of the financial industry in general) and real estate agents.

Not to say that some people don’t benefit from these services.

“It depends on one’s definition of “professional,” but in my book taking a 30-hour online course doesn’t qualify someone as a professional.”

“In any case I don’t think it means a lot in itself, for example taxi drivers require a criminal check.”

Yeah, let’s try not to lump in RE agents and taxi drivers with doctors and engineers. A RE agent is a professional as much as a taxi driver is a professional driver. Oddly, both industries are also very cartel-like.

On BNN: Investors make up 19% of home purchases since 2014- Bank of Canada.

Investors were 18% of buyers (2015) and now they’re 21% (2021).. and this is a big deal?

Right. They may be unaware of it. Just like Victorians and rainfall.

Many Victorians still don’t realize that, because of the Olympic Rain Shadow ( http://www.olympicrainshadow.com/olympicrainshadowmap.html )

— it rains less in Victoria city (23 in, 583mm https://www.eldoradoweather.com/canada/climate2/Victoria%20Gonzales%20Hts.html)

— than Central Saanich (32in, 822mm https://www.eldoradoweather.com/canada/climate2/Central%20Saanich%20ISL%20View.html)

—- or the YYJ airport (33in., 841mm https://www.eldoradoweather.com/canada/climate2/Victoria%20International%20Airport.html )

— Not to mention Sooke ( should be called “Soak” 🙂 ) (49in., 1242 mm https://www.weatherbase.com/weather/weather-summary.php3?s=717991&cityname=Sooke,+British+Columbia,+Canada)

Only if you’re not good at reading graphs. What really matters is that the scales of the Y axes are the same. This illustrates how the gain in investor purchases is coming at the expense of FTB purchases.

Personally, I’m not as concerned about migration between cities as I am about the level of investors snapping up real estate in Victoria. These units can come flooding back onto the marketplace and disrupt the local economy. I think the term for this is “shadow inventory”.

The US and Canadian west coast have had considerable speculation in real estate as the rising prices have drawn more people into buying properties as a get rich quick scheme/investment.

It could be as high as one in every four properties purchased in the Victoria CMA are for investment and not home occupation. In my opinion, properties purchased solely for appreciation and not positive cash flow are risky and are more likely to come back onto the market if price appreciation does not occur.

Your twitter buddy could be reporting these Vancouver “supposedly vacant” homes using VanConnect or to spec tax hotline and they’ll look into it;

Except, when they do, every year so far, the numbers of deemed vacant homes FALLS after the revisions. More false positives than false negatives, and net refund of taxes sent out.

“Chart 4”is quite something. Uses two separate Y axis. Makes it seem like there are the same number of FTB as investors. Until you realize that even though they are measures of the same thing, they are using a separate Y axis. In any event, seeing investors rise from 20% (2018) to 20.5% (2021) seems insignificant. And as usual, they only measure investors buying, and there could be equal or more selling than buying.

Interesting charts from this thread: https://twitter.com/DavidMacCdn/status/1481661784868241410

I think your theory still holds but the timeframe is way off.

No doubt some people are moving away due to prolonged summer smoke/wildfire danger; however, there is as yet no shortage of people eager to take their place. In other words, we won’t see a net population decrease in the Interior anytime soon.

Why? Beats me. Maybe people think the extreme heat, wildfires, and persistent smoke will somehow just get better as time goes on.

Good luck with that.

So much for my theory that people would move away from the interior due to fires. Kelowna was the fastest growing CMA in the country. Victoria up there as well though.

Great charts. Thanks.

Better dwelling posted statcan population numbers from Q42021. Big trend of “move to BC” and “move to Canada” going on. Some of these big Canada population numbers are processing the huge Immigration backlog (1.8m), which means we will continue to see big numbers like that for awhile.

https://betterdwelling.com/canada-just-saw-the-second-largest-quarter-for-population-growth-ever/

“Canada Just Saw The Second Largest Quarter For Population Growth Ever

Most Of The Population Growth Happened In 2 Provinces

Two provinces managed to represent the majority of population growth, BC and Ontario. BC saw its population increase by 0.7% (34,830 people) in Q4, growing 1.9% (93,048) from last year. It was the second most people any province added“

========

If Victoria got its share of the 1.9% population growth, that’s about 7,000 people added to Victoria in one year.

https://dailyhive.com/vancouver/canada-interprovincial-migration-statistics-october-2021

“More people moved to BC than anywhere else in Canada over the past year.

Newly released estimates from Statistics Canada show British Columbia saw the country’s largest net gain in interprovincial migration over the period, with the province gaining 34,277 people from seeing more people moving in than moving out

This also amounts to the largest net gain in interprovincial migration into BC in 28 years, since 1993/1994, when the province saw a jump of nearly 38,000 people.“

Not sure who you mean by “we”, but it’s been a well publicized issue in Vancouver for decades.

I was not seriously advocating for a tax on non citizens but rather was trying to point out that we fail to account for the impact of immigrants with large capital resources on the housing market. I agree that it might be challenging to develop metrics for analyzing the impact on housing but ignoring the impact removes a major driver behind escalating prices.

I absolutely agree that one buyer like my wife will not move the market in BC. But will a hundred buyers with deep pockets move the market, what about a thousand a year? What do I mean by deep pockets? Lets simply say that they can outbid virtually most of the local buyers. Certainly they can outbid most people on local salaries including all the lawyers and doctors and IT professionals.

This is the point where in the conversation that some Real Estate professional wisely points out that most of the buyers in Victoria are people moving from Vancouver and not new arrivals. Exactly who does he think bought that house in Vancouver for five million so that the person could retire in Victoria. Sure there are some people in Vancouver that have made sizable fortunes but not nearly enough to account for the price of houses.

One should bear in mind that house prices are set by auction and if you have a thousand new people in BC each year with deep pockets they end up bidding up prices against each other as opposed to locals.

Before someone points out the obvious, this is not the only factor but it might well be a major factor.

Once people come to Victoria they’re (on net) not likely to leave. We lost more than 10 people to only 5 different places in 2020, with the biggest moving from Victoria to Duncan.

Area outside census metropolitan areas and census agglomerations, Nova Scotia Net negative 10 people

Area outside census metropolitan areas and census agglomerations, Prince Edward Island

North Bay (CA), Ontario

Port Alberni (CA), British Columbia

Duncan (CA), British Columbia Net negative 55 people

“Anyway, next time someone mentions vacant homes, think “Victoria” and “BC owners”, not “Vancouver” and “foreigners”

‘

‘

You might want to check out this twitter account, almost everyday he shows a home in Vancouver that says owner occupied that has no furniture, its obvious that a lot of homeowners in Vancouver just ignore the vacancy tax.

https://twitter.com/mortimer_1/status/1481126762813616130

Updated chart with data that just came out today

Well that explains the strength in Vancouver then.

Real estate licenses are issued by BCFSA, which does require a criminal check. However:

In any case I don’t think it means a lot in itself, for example taxi drivers require a criminal check.

https://www.bcfsa.ca/industry-resources/real-estate-professional-resources/education-and-licensing/becoming-licensed/criminal-record-check

https://researchco.ca/2022/01/11/housing-trust-bc/

Totoro, it depends on where Zillow is getting its information. Half prices are associated with legal separations and deaths on the Certificate of Title recorded in the land registry and are treated as non-arms length transactions by BC Assessment. So I suspect that is where Zillow is buying its information. Zillow shouldn’t use that data as it can skew results.

I’m not sure of the dividing line when it comes to “professional” Is it self-regulation? Education? Insurance? Continuing education? Professional Ethics and standards?

It’s kinda like the words “investment” and “investor” People seem to have different interpretations.

Engineers and medical doctors are self regulated and their professional body ensures that the public’s interests are supreme over its members. They will suspend, censure and expel their members if the member puts their private interests over that of the public.

For an example. Do real estate agents, and brokers have to pass a criminal check to be in good standing as a member of their professional body?

I don’t know.

It depends on one’s definition of “professional,” but in my book taking a 30-hour online course doesn’t qualify someone as a professional.

Interesting. I noticed a low sale price coinciding with a divorce (where one party bought out the other).

The answer as to BC’s “spec tax-iest” city is surprising, because it’s the city of Victoria The typical narrative for the the prototypical “vacant homeowner” to be caught by the BC spec tax is the rich foreigner with a vacant big house in Vancouver (e.g. Shaughnessy) or Richmond. The BC government was so convinced of this they even created a special category – “satellite family” – to capture homes that we were being lived in full time by BC residents, but are owned by foreigners.

Vancouver media in 2019 ran with ridiculous stories that 800 mansions in Vancouver were being suddenly rented out ultra cheap. https://bc.ctvnews.ca/is-this-real-hundreds-of-vancouver-mansions-for-rent-for-cheap-1.4329826 Sadly some HHV members here bought into that goofy narrative. https://househuntvictoria.ca/2019/03/05/appealing-your-assessment-a-book-review/#comment-57417 Meanwhile, spec tax data shows City of Victoria always had more vacant homes than Vancouver during 2018-20 measurements. And no one can find the 800 Van mansions that are supposedly rented out cheap to uni students – rendering this an “urban myth”. Instead, as discussed in the UBC article below, instead of 800 mansions rented out what happened was “UBC: Between 2018 and 2020, they [foreign owned] seem to have been largely replaced by Other properties, mostly owned by residents of BC and other parts of Canada. For the most recent year (2020) , a cynical read might suggest that the SVT simply replaced higher-taxed Foreign owners of empty homes with lower-taxed Canadian owners of empty homes.”

So a funny thing happens when they actually tabulate the spec tax and measure where the spec tax homes are actually found. This tabulation and spec tax analysis was done recently (nov 2021) by UBC sociology Prof. Nathanael Lauster.

The city in BC with the most vacant homes per capita is. …… not Vancouver…. Not Richmond …. But is.. drum roll…city of Victoria BC! And it is not because of foreigners, satellite families or ROC… it is BCers owning second homes in Victoria BC

Well that doesn’t fit the narrative! So why do BCers own second homes in city of Victoria BC? I don’t know…. but maybe a big part is the politicians (MLAs) and government employees/contractors that are moving about the province and feel they “need” homes in two places? If so, this would be quite the irony… the politicians designing a spec tax to capture people needlessly speculating and owning two properties… and they end up targeting and revealing themselves as the biggest abusers!

As you can see on the chart below, city of Victoria has the highest rate of any BC city – 1.6% vacant and paying spec tax. Next is West Kelowna 1.2% and then the foreigner rich cities like Richmond is well back at 1.1%. North and West Van (0.8%) are about half the rate of a Victoria. And the green bars of the chart show that most of the spec tax homes in Victoria are BCer owned.

Anyway, next time someone mentions vacant homes, think “Victoria” and “BC owners”, not “Vancouver” and “foreigners”. And you have spec tax data analyzed by UBC to back that up! https://homefreesociology.com/2021/11/22/three-years-of-speculation-and-vacancy-tax-data/

“Notably, Victoria and some nearby communities have a larger share of tax-paying properties than Metro Vancouver municipalities that often take the spotlight in discussions around the tax.”

Hmm, this is interesting: are realtors really just chiropractors in disguise? Both have tried to sell me Amway in addition to there other services…..lol…

At this point it may be helpful to be precise with terminology. Realtor is a trademark, like Mr. Rooter, and is licensed to members of the local real estate boards. The boards do have some authority to discipline their members but it’s similar to that exercised by other franchisors.

On the other hand real estate agents are licensed and regulated by the BC Financial Services Authority. Its directors are appointed by the BC Government. So real estate agents don’t comprise a profession in the legal sense, in contrast to doctors and engineers who are governed by their own professional societies.

From: https://vancouverisland.ctvnews.ca/victoria-councillor-wants-landlords-to-be-able-to-raise-rents-to-match-rising-property-taxes-1.5738072

Well, since owners in Vic are just as much responsible as tenants for electing the councils they have for the last 15 years here, just go ahead and enjoy your increased taxes. Victoria has had a windfall of ever increasing revenue, but the municipal government has grown by even more and is always seeking to increase taxes to cover it’s expansion into areas municipal governments were never meant to tread.

“ Couldn’t this simply be blamed on the explosion of former hospitality industry individuals that are now new and inexperienced RE agents? Or an agent blaming his sellers? ”

realtors be considered as “professionals” , not the department cashiers. Can you imagine if other professionals such as doctors or engineers use inexperienced or blaming their client/boss for their misconducts?

Unclear what you mean here. I’m just presenting the two data sets, one is just a survey asking where people “moved” from, and the other is citizenship of buyers at time of title transfer. Both show a very small percentage of what you might call “foreign” buyers.

I have no doubt this happens to a certain extent. Many ways to get “foreign capital” that does not involve a non-citizen buying. That’s everything from money laundering to people working in the US tech industry and collecting a large USD salary while living here. Not at all clear cut where one should draw the line as to what foreign capital is OK and what isn’t.

However I would say that the luxury property market in Vancouver still hasn’t recovered to 2016/17 peak, so the foreign buyers tax was very effective on its own.

Worth remembering is that most of the prominent news stories in the last year have been reporting data from before measures like the foreign buyers tax and spec tax came into effect and thus don’t necessarily reflect current conditions.

Looks like some of the oddball low prices are from a new spouse buying added to the property. I see a neighbor’s house that he bought a couple years before getting married “magically” sold for half price right around the time he got married.

” I think if a home sells for 20% over ask it should trigger an audit/investigation into how the price was set (i.e. listing agent has to provide comparables for a panel to review, etc.). If determined the there was no attempt to price property at market value discipline the agent.”

Couldn’t this simply be blamed on the explosion of former hospitality industry individuals that are now new and inexperienced RE agents? Or an agent blaming his sellers? Besides, wouldn’t their audit be conducted by a panel of their peers (nice kangaroo court!) or do you propose hiring a panel of the 100k bureaucrats you openly bash on HHV to review the audit? Seems like a lot of red tape…

No government would enact this IMHO, but if attempted it would most likely be unconstitutional, since economic rights are granted equally to citizens and permanent residents.

Marko is absolutely right that people like my wife , who is an American citizen, are not counted as foreigners if they have landed papers. Marko makes an excellent point. So maybe instead of a foreign buyers tax what we actually need is a non citizen tax.

I’ll go along with that Marko

Personally, I think it is completely ridiculous but the one problem I’ve run into trying to price at market value right now is barely anyone shows up to view the home as buyers viewing the listing are automatically assuming it will go 10-15% above ask, so they don’t bother to look. I.e. you price a $1.2 million property at 999k, you get a bunch of showings/offers and it sells for $1.2 million. You price a $1.2 million property at $1.2 million and buyers are assuming it is going for $1.3, for example, so not even bothering to look as they think it is outside their range, or they don’t see the value at the number they THINK it will actually sell.

I think if a home sells for 20% over ask it should trigger an audit/investigation into how the price was set (i.e. listing agent has to provide comparables for a panel to review, etc.). If determined the there was no attempt to price property at market value discipline the agent. I think that would clean up a lot of price baiting quickly.

RE sales are inherently auctions, since you have a single property which more than one party is willing to buy at some price.

I do agree that the process needs to be improved though.

I have always had an issue with agents under listing properties in order to intentionally create an auction environment. The function of an agent is to facilitate a trade between buyer and seller of real property. They are not licensed auctioneers. Blind auctions are even more questionable in my opinion. In my opinion, If they conduct a blind auction then the auction should be scrutinized by a licensed auctioneer or a lawyer that will validate that the bidding conformed with acceptable practises.

It’s a practice that, in my opinion, is not in the interest of the buying public as a blind auction lacks transparency in the bidding process and diminishes the perception of the public in their profession.

Send your comments to the BC Financial Services Authority (BCFSA) they are the regulators for real estate in BC not the local real estate board.

Notice all the “in my opinion” I peppered through out the above.

I would guess West Kelowna, since it’s essentially a resort community with a small population. My guess is that the largest number of owners is from Alberta, but it might be BC. Why? Because short-term rentals are defined as “vacant” under the spec tax regulations.

Blind bidding wars will likely be history this year. Both the province and the feds have promised to kill them.

Agreed on VREB, quite silly they are still fighting this fight when the TREB court loss showed years ago this is a losing battle.

I find it’s interring that people on here and FB blaming more on foreigners, immigrants and out of town buyers but nearly no discussion on VREB hiding public data and allowing realtors set biding war for houses sold 30%+ over the asking.

https://househuntvictoria.ca/2022/01/10/where-buyers-came-from-in-2021/#comment-84401

Ridiculous that VREB can do that. Isn’t this 2022?

Thanks for all you do Leo. I also enjoyed listening to you on capital daily on Monday.

HHV Quiz:

Q. Which city in BC has the highest % of Vacant homes, subject to the Spec Tax

A. Richmond

B. Vancouver (city)

C. Victoria (city)

D. West Vancouver

E. West Kelowna

?

Bonus Question:

Q. For this “winning” city with most vacant homes, what are the main source of owners?

A. Foreign owned

B. Satellite families

C. BC residents

D. Other Canadians (ROC)

?

Kelowna, which has similar demographics to Victoria, gets more per capita. Not coincidentally, Victoria and Kelowna are also outliers among urban areas in having more deaths than births. 🙂

It’s my understanding that most of these situations are “astronaut” families where the house is in the name of family members who have immigrated but Dad stays abroad. Which are subject to the spec tax by the way.

80% of the people coming to Victoria are existing Canadians moving from the rest of Canada.

20% are immigrants

Those numbers are relevant, as many cities have much higher immigration than Victoria does (e.g. Most people moving to Vancouver are immigrants)

It’s about 1,000 immigrants per year coming to Victoria. That represents about 400 dwellings. Most rent. All those 400 homes (rented or purchased) are off market to househunters.

The unusual stat for Victoria is the net number of Canadians that move here from the ROC – 5,000 per year. Vancouver and Toronto actually lose existing Canadians as more move away than come. Only Ottawa has metrics like Victoria of big numbers of fellow Canadians moving to Ottawa.

You don’t need stats to tell you this. Walk around Victoria – you won’t say “wow, a lot of immigrants here”. Then, do the same thing in Vancouver or Toronto – different result!

Many BC MLAs own second homes here in Victoria to be close to the legislature. These would be considered “vacant” under the rules designed and voted for by the MLAs. They have told us how unnecessary it is for BCers to own a second home here. Except for them of course.

But they have also passed rules so that MLSa are reimbursed for expenses and property taxes on their second homes that they own here. https://members.leg.bc.ca/home/remuneration-benefits/salaries-and-allowances/

I assume this means that taxpayers are paying their spec tax for them, as a type of property tax.

If so, that’s another example of “do as I say, not as a I do” from politicians. God forbid that politicians would be subject to the same taxes that they enact for the rest of us.

“Buyers moving from out of the country were an insignificant part of the transaction volume.”

So you’re saying they might have been significant, but that doesn’t matter? The title of the article is “Where are new Victorians coming from” It seems true buyer origin might be relavent.

Yes, that happens. But many of these ”foreigners” are in the process of emigrating to Canada anyway. So the term “foreigner/temporary worked” vs “permanent resident/citizen” is a temporary distinction, as they’ll all be Canadians within a few years.

We know that foreign buyers aren’t a significant source of empty homes, as the spec tax tells us that there are less than 1,000 empty homes in Victoria total, and most of them are owned by BCers.

Leo, do you suppose there’s any chance that some foreign buyers might be using friends/relatives/associates as coinduits to try to avoid paying the Foreign Buyers Tax?

Suppose someone had their eye on a $5,000,000 West Vancouver house… Do you think any of them might see the risk/reward of that strategy to save $1,000,000?

Might this account for some of the news stories that listed students and housewives owning Shaughnessey properties?

Because they are not in any of the stats/data/number of foreign buyers. Instead, you should ask/check for immigrant buyer number/stats. Note immigrants (those with PR but not citizenship yet) are about 28.3% of the province’s total population, and 21.5% of the total Canadian population.

Here is one: https://www.mpamag.com/ca/specialty/specialized-lending/where-do-immigrants-buy-homes-in-canada/310809.

That seems like a you problem.

Dad- So it’s a matter of semantics. Immigrants come from foreign countries, bring money from foreign banks, buy property without another property to sell, yet are not impacting the real estate market. I understand the definition of foreign buyer, but fail to see how a recent immigrant is not technically a foreigner.

“410,000 recent immigrants are living”

Immigrants aren’t foreign buyers.

patriotz- Then please explain where 410,000 recent immigrants are living. And where are the next 410,000 immigrants are going to live, igloos?

https://www.westerninvestor.com/british-columbia/foreign-home-buyers-have-nearly-vanished-from-metro-market-3832839

https://www.cbc.ca/news/canada/toronto/ontario-foreign-buyers-tax-real-estate-1.5135338

Shawn,

Agreed.

And no doubt that leverage paid off in the past, and it may well continue like that. I guess I have a low risk appetite. Thanks for the discussion, and best of luck with your investments.

The pie chart shows very little foreign buyers in Victoria, but who do you think are buying the properties on the lower mainland and Ontario? Maybe foreigners? Indirectly, foreigners are having are large influence on Victoria real estate.

Marko can only see construction keep on going up as we add more and more regulations remember we use to quote 35 a square in the 80s a lot has changed

Nice. BChome.ai briefly had the sale data, until the VREB pressured them to remove it.

It’s starting to happen. As mentioned Edmonton and Toronto eliminated parking requirements. But I do agree that stepping back and giving up control is by far going to be the biggest challenge in solving the problem. I see it in housing advocates too, who are for more housing, but then still get excited about new requirements that would be good to impose. Difficult to understand the scale of the problem, most people are focused on individual solutions (like garden suites, or more co-ops) when in fact we need an all out approach, similar to climate change.

Patrick,

Yes, I would agree. It comes down to risk appetite.

Past performance is the best predictor of future results (analysis must be nuanced obviously)…What would you use instead?

The point remains that those that were risk averse didn’t do as well financially…not even close. They should have done better because central banks have been irresponsible with monetary policy and they shouldn’t have but that’s a completely different discussion.

The vast majority of our mortgages are non-recourse commercial long term fixed and in America though so…I probably have a slightly different perspective.

We do keep low LTV mortgages here in Canada.

The weather is gross out there…hope everyone stays during commutes!

That part is logical. Pandemic + remote work leads to explosion in smaller markets.

What is still somewhat mysterious is why the big markets are also on fire. They didn’t go quite as nuts as smaller markets, but it’s not like they weakened as people left the big cities. Vancouver and Toronto both seeing steep price increases.

Adequate student accomodation on campus. Like room for 50%+ of students, not 10% like we have now.

Parking minimums need to go entirely. Edmonton did it, Toronto did it. Long overdue here as well.

You should remember….

“Past Performance Is Not Indicative Of Future Results”

You must know about the times leverage would been a bad financial decision, which is why you qualified your statement to “almost any market”, “English speaking world” and “last 8 decades.”.

Moreover, life doesn’t always go “simply by the numbers” as you put it. You may lose a job due to economic or health reasons, and so you can’t afford big short term losses. And you sure don’t want to be max-leveraged with loan obligations when that happens.

Good for you Josh, but I think totoro may mean mortgage for rental properties, not for Principal Residence.

Paying down a mortgage comes down to risk tolerance. If you’re risk averse and your mental health will suffer pondering worst case scenarios, by all means factor in that intangible cost…

But if you’re going simply by numbers and use almost any property market in the English speaking world in the last 8 decades as an example, failing to maintain leverage is a terrible financial decision.

To each their own.

Hope everyone is maintaining good health during this Omicron spike. Best of luck to all.

Or, if you had taken 80% out of the property in 2007 and simply bought the market you’d have a couple million dollars, created several hundred thousand in equity, and still own the property.

Isn’t it true for leveraged investerments that the payment for the principal (of a loan/mortgage) is not an expense nor a loss (and that is exactly the reason of why one can’t deduct principal payment from rental income)? So it might not be a super good investerment, but the owner hasn’t really lose any by paying back the principal from elsewhere (unless the owner sells the propeprty at loss, but that would be a gapital loss).

Well done. Good plan.

I feel like that’s the prevailing attitude these days and it’s backed up by stats on ever growing consumer debt. I still want to pay down my mortgage fairly quickly and would rather not have another mortgage for the rest of my days. Pretty sure that’s considered insane.

I’ve never claimed CCA because of this. Unless you have an extremely high income, the kind of income where you should incorporate if you can, the math does not work in your favour to pay recapture later.

In 2007 I was offered $500,000 for my Langford property and thought about investing in the Royal Bank of Scotland.

‘

‘

Frank, If you’re investing style is to take stock tips from a random tv personality and stick everything in 1 stock your better off sticking to real estate.

If you bought 500k worth of Apple in 2007 you would have over $33 million now. It goes both ways.

I bought my first 500 shares of BMO in 2009 for $32 (that wasn’t even the bottom, dropped even further to 24) and now BMO is at $144 + 13 years of dividends + adding to the position over the years. Unfortunately still dwarfs gains in real estate, thanks to leverage.

In 2007 I was offered $500,000 for my Langford property and thought about investing in the Royal Bank of Scotland (a 300+ year old company paying a 6% dividend, a recommendation on BNN). The financial meltdown resulted in the stock dropping 95% and the dividend eliminated. I don’t think it has recovered much. Thankful I stuck to real estate, I would have been devastated.

The capital cost allowance (CCA) helps somewhat with the situation where you are showing a paper profit from rent but your mortgage principal payments results in negative cash flow. Of course, when you sell you would have to pay tax on the CCA recapture.

You could also put down a large downpayment to get your Victoria rental property to be at least cash flow neutral.

Over time, the principal repayment from rent plus capital appreciation with leverage should work well. I wish had done more of that in the past. We’ve had some good results with out of province properties that cash flow and pay down principal although the capital appreciation is much more muted. Still, with leverage it’s better to have slow, steady growth in your capital than spikes either way.

Stocks are much less time consuming than rental properties but you get big moves often which can easily shake you out of a position. That’s why I would never use leverage with stocks. With RE it’s much harder to get shaken out of a position as you just can’t click on your iphone and pay a tiny $10 commission to sell a large position. The thought of listing the property on the market and paying tens of thousands of dollars to my friendly realtor (no offence to the wonderful realtors here) keeps me hanging on to that asset.

You are 100% correct, but realistically if I drop a million in the stock market I am not going to leverage another million at 3-4% as my personal strategy is dividend growth stocks.

I don’t mind leveraging real estate as the interest rate is much more favorable and downside volatility in Victoria is pretty low.

5 biggest drops in the last 34 years in Victoria

1995 – 5.47%

2019 – 3.34%

2011 – 2.25%

2012 – 1.72%

1998 – 1.17%

That I can stomach leveraged. Stock market dropping 10% in a month + leveraged, not my cup of tea. That being said after investing in registered accounts since 2008 and getting my dividend income into the 4 figures each month it is kind of cool because you literally do nothing. With rentals you still have to do a bit of work and worry about tenant flooding the unit or some nonsense; whereas, I don’t loose sleep worrying that BMO, Fortis, or Telus will go under any time soon.

@ Marco “if I move the money from real estate to anywhere I have to get a substantially higher rate of return, without leverage.”

Marco, where are you getting this misinformation?

The only pace you get no leverage is in registered accounts, even with them, options offer far more leverage than any real-estate investment. Non registered accounts offer 70% leverage on equities above $5 for any accredited investor. One of us is missing something here.(likely me)

Our darling Leo recently on the Capital Daily podcast:

https://www.capitaldaily.ca/podcast/property-assessments-push-victoria-homes-24-over-last-year

Langford seems to be only municipality with some common sense….

Coun. tried to bring in redtape regarding trees….Coun. Lillian Szpak brought a motion to start research on a tree protection bylaw, which she suggested would be a progressive addition to the Development Permit process that Langford has used to manage trees on developing land since 1997.

It was shot down…

Stew Young….”If you truly want to save the trees on your land, come forward to the city and put a covenant on it, and we will do that for you,” he said, ending the meeting.

Unless of course you are a long term investor who is more comfortable with a tangible investment they control than a stock, wants to provide shelter in the future for their children, and has spent the time to understand all aspects of RE. In this case it may well be the best investment you can make despite long-term negative cash flow.

I’ve been posting here for a decade now, saying the same things. I was extremely grateful to pay out of pocket and carry losses in 2012 for what is providing security for my children today and into the future. Where other people view mortgages as a burden, I’ve always seen them as a great blessing.

Stroller’s perspective is not unusual among Canadians. I would say it is; however, not backed up by our long-term market performance for those suited to manage a rental and willing to hold long-term – which admittedly is not everyone by a wide margin.

According to Zillow, two of the rental houses near me were last purchased in the ’90s for $210K and $235K.

Could very well be that they were owner-occupied for a number of years and eventually the owners bought elsewhere but kept these to rent out.

“Rental property in Victoria has normally been a long hold type of situation at a yearly loss as rents do not meet expenses by a wide margin” ….

If it is “normal” to go for years with expenses exceeding income by a “wide margin” you do not have an investment, you have a grotesquely leveraged speculation play.

That’s why many people don’t like mom n pop landlords buying up houses. Lots of tenants get evicted merely because the owner is “fed up with being a landlord.” Which puts them out to find a new home.

A better situation in the USA is a rise of B2R (Build To Rent SFH). These are purpose built communities of SFH houses. Then sold to REITS that rent them long term.

Some of these are not just rentals. Some come with maintenance, lawn service, shared pools etc.

Everything else is turning into a service these days, why not your home too?

https://www.realestateconsulting.com/single-family-rental-industry-act-2/

“Full-service B2R model:. Services include property management, 24-hour maintenance, lawn service, and trash valet. Amenities can include gated entrances, private streets, pools, and parks.

Minimal B2R model: Akin to traditional single-family detached neighborhood with virtually no amenities or on-site services.”

The New Face Of Rental Housing: Single-Family Built-For-Rent

https://www.forbes.com/sites/bradhunter/2020/01/16/the-new-face-of-rental-housing–single-family-built-for-rent/?sh=6a8f9bdd3a10

“ The average rent in their units, throughout the southeastern U.S., ranges from $1,800 to $2,500 per month.”

Zillow.com now shows sale price history for all Victoria properties. Have fun seeing what your neighbours, friends, and enemies paid for their house!

Seems accurate for most properties, but I have encountered the occasional missing or oddball sale price, so beware.

Since January 1st I’ve sent the owner builder exam to over 50 people….100% useless exam, we are in a housing crisis and government has done shit all about cancelling the exam. Emails from just morning……some of the scenarios this 100% useless exam puts people into are just sad. This is just a small reflection of all the non-sense going on pertaining to housing when it comes to talk (making housing more affordable) versus reality.

“came across a YouTube video tonight where you offered a pdf study guide for the home owner builder test. Would you please share that with us? We are living in a trailer trying to get permits for a house on Galiano. Any help is greatly appreciated. ”

“Am so in agreement with what you said in the video! All politicians talk about doing more for making housing more affordable and then add to cost and time by mandating an exam.

If you are still sending out your study guide, please forward a copy to:”

“I watched your video regarding owner builder exams here in BC. Is it still possible to get a pdf study guide? I bought land in the kootenays and would like to build a small house…we’ve been living in a fifth wheel for the last 2 years, and can’t afford to hire a licenced builder.”

“I wanted to try the exam before I own the property so when I sell my house and move over to where I want to build I could have started to build right away if I had the Owner Builder already in place but they need an address before they can even look at the application so I need to sell this home and then move onto the property in a trailer , then take the course and then after I hopefully pass finally get started. I wish they would make it so you could take the course and supply the address for approval at a later date, Sucks. Thanks in advance, ”

“Sorry to bother you Marko but like many others I am overstressed about having to take this exam to build a small home (under 1000 sq ft) using licensed trade people. I have come across your videos and wish to thank you for your hard work.

Have you considered running for mla here in BC? This is an issue that in a time of housing shortages we need to see government cut through the bureaucratic red tape intended to prevent people from building their own home. Finding a licensed contractor who is willing to provide a 10 new home warranty here in the kootenays is cost prohibitive.

If I could get a copy of your study guide/exam questions, I would appreciate it and support you if you ran for mla.

Thanks again”

I feel your pain…..I’ve cut some large cheques to Bunt & Associates for a traffic/parking study 🙂