January: To the moon

If there was hope of the new year bringing some relief to the market, that has been dashed with sales results in January. No relief to the inventory shortage – which remained at record lows for the time of year – constrained sales to 474, down 27% from last January.

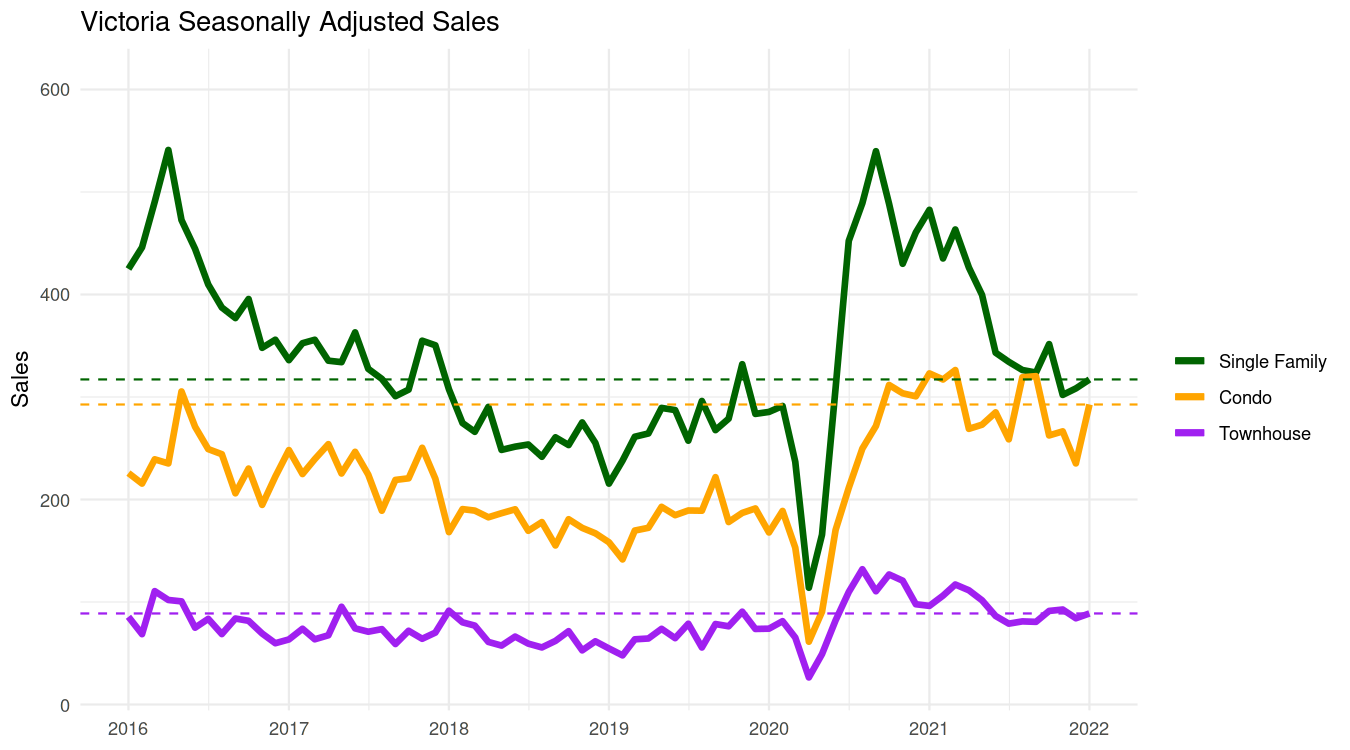

If we were to naively look at sales on a seasonally adjusted basis, we might think this market is nothing unusual. Single family and townhouse sales are only somewhat above pre-pandemic levels, with only condo sales remaining extremely high.

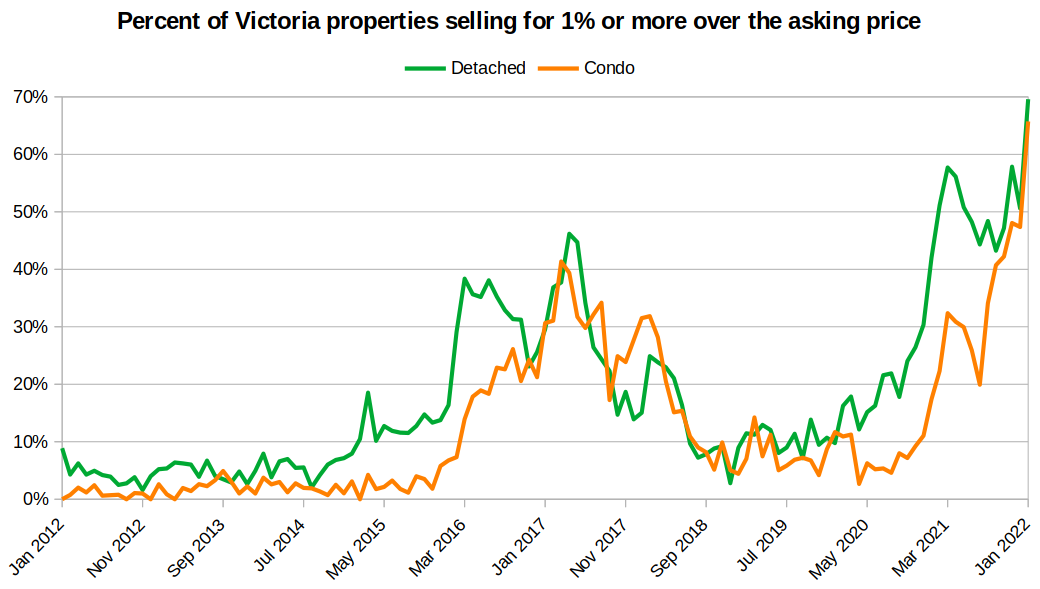

Of course – and at the risk of repeating myself – at these inventory levels we need to look at something other than sales numbers to get a sense of how hot the market is. More importantly, we want to know whether anything is changing in the market or if there is any slackening of demand. If there is, we will see it first in the rate of bidding wars. And things did change in January, but not for the better. A staggering 70% of detached sales went over ask, while 66% of condo sales went the same way, blowing away the high water mark for both. Engineering bidding wars is a logical strategy for sellers given the evidence that it may work to secure higher prices in hot markets, but it leads to a continuation of the miserable situation for buyers. It’s going to be very interesting how the coming cooling off period will hit a market where the majority of properties are going over ask, most with no conditions.

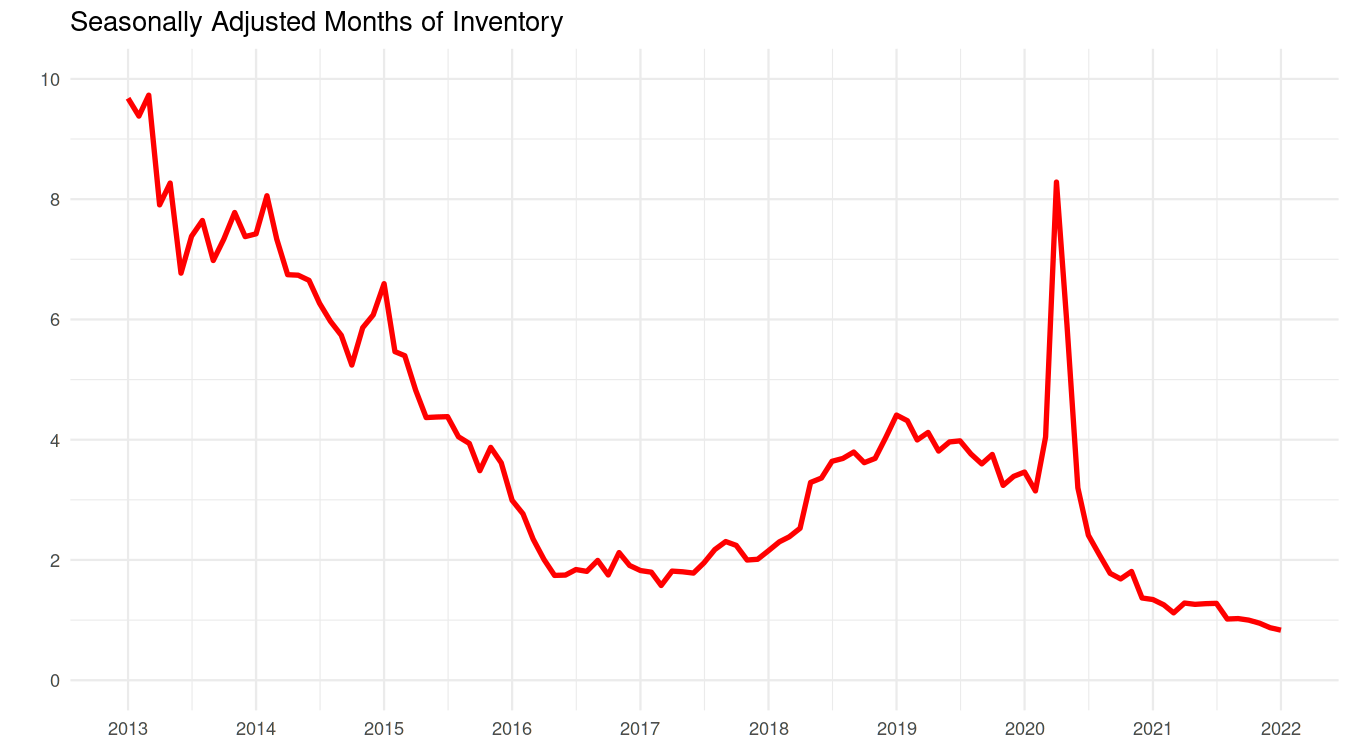

House hunters have been suffering from this kind of market for so long that it’s easy to forget what a normal market looks like. Once months of inventory rises above about 2, the rate of bidding wars falls down to a much more manageable 5 to 10% of sales. However, we haven’t seen that kind of market balance since mid 2020. January brought no relief, in fact on a seasonally adjusted basis it’s worse than ever.

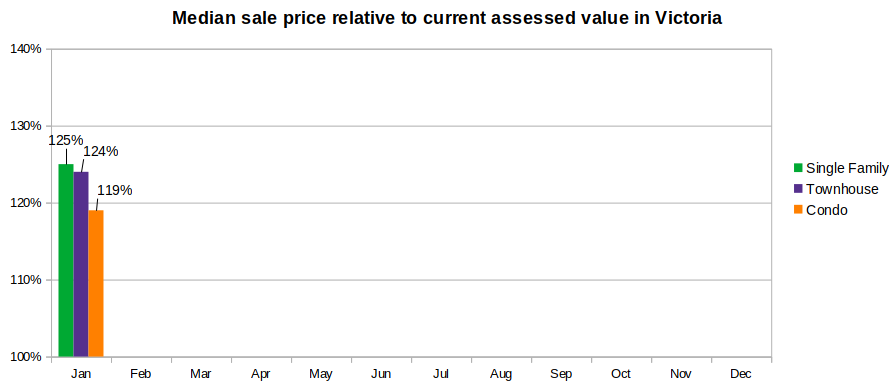

A few weeks ago I pointed out that the end of year prices had already moved well in advance of the assessed values (which try to gauge market value as of July 1st). Comparing December sales to those from July, the median detached home had already risen 15% over the assessed value, while townhouses were up 11%, and condos 8%. But that was December and prices have just kept rising. We are now comparing to 2022 assessments, and the median increase over those assessments was 19% for condos and 25% for detached properties. The only caution I would add to this chart is that the sales price over assessment between the different years aren’t necessarily comparable (assessments changed by different amounts depending on area and product type), and January has fewer sales which will increase noise. That’s both because January is a low sales month and because I only looked at solds that had been listed with their 2022 assessments (about 80 sales each for condo and detached).

The increases are of course also reflected in actual prices, which have continued their path upwards accross all product types. The 12 month rolling average of median prices is now increasing at a rate of $15,000/month for detached properties, and $8500/month for condos.

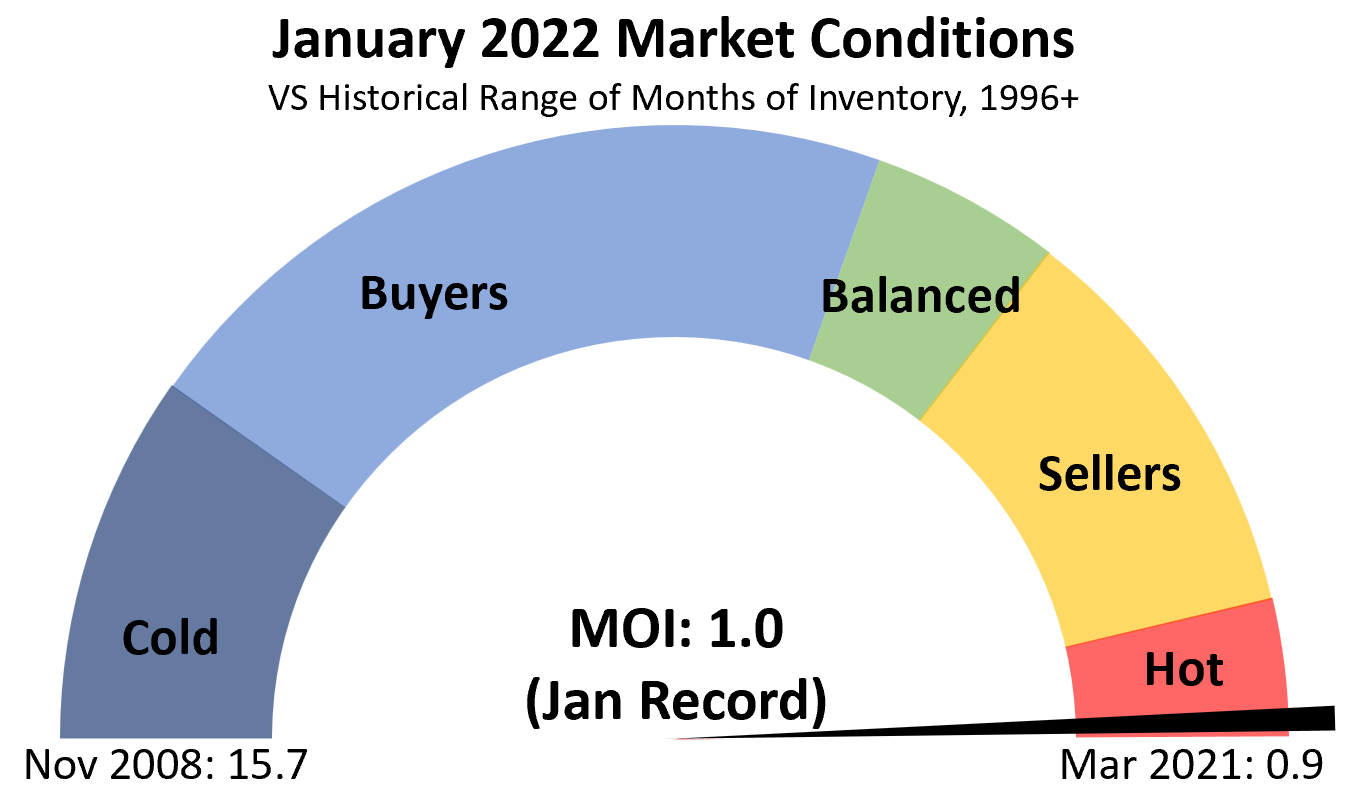

The market temperature guage has barely moved in months, stuck pegged to the limit.

As I mentioned last week, there are many reasons to be cautious about buying at these prices with conditions more heavily tilted against the buyer than we’ve ever seen. Prices, especially for detached properties are into uncharted territory on the affordability side, and that’s before the rising rates that the Bank of Canada has effectively guaranteed are coming. While there was a lot of focus on the lack of an interest rate increase in January, they took great pains to make it clear that the era of emergency rates is over.

“What I would stress is that we announced a significant shift in monetary policy. We’ve signaled clearly to Canadians that they should expect a rising path for interest rates. The time for emergency policy settings is over” – Tiff Macklem

At the same time the fact that the market has showed absolutely no sign of cooling on its own gives both the provincial and federal governments license to act. The blind bidding ban and cooling off period are almost certainly coming sometime this spring, and I also expect the OSFI to introduce something to cool down investor buying. Though not the causes of our runup, it’s a one two punch that could significantly sour consumer sentiment.

“This year people can expect some significant moves on housing. Major reforms with legislation around municipal approvals processes to make sure there’s housing supply available, around reducing froth and speculation in the market, and short term rentals” – Minister David Eby

I’m still divided on whether we should expect a pullback in prices from these levels. On the one hand some of the sales prices are just staggering and seem to have detached themselves entirely from any fundementals, on the other hand we’re still stuck with those ultrahot market conditions that point nowhere but up at least for the next 6 weeks. However even a minor pullback and long stagnation in prices is an underappreciated risk to both our market and the broader Canadian one. When everyone expects prices to go to the moon, simply not rising is a disaster for those that are highly leveraged.

Didn’t quite get to this, though most variables are actually like that (fixed payments). Will dig into some mortgage docs and see what the thresholds are.

Oh boy, Marko. Let’s agree to disagree on this topic.

No, but appropos this topic I’ve written a new post: https://househuntvictoria.ca/2022/02/08/fixed-or-variable-a-risk-analysis/

Theory aside, do you personally believe rates will increase that quickly to that extent?

What they’re saying is that to average a 1.5% increase over the term with a gradually rising rate you’d have to rise to +3% at the end. Problem is rates could also rise quickly then stay there, which would get to the same average rate over the term without needing to go +3%. Also the actual average gap is 0.64% as of November data, not 1.5%

No one is asking you to give up your dog. When I sold my house I didn’t want to give up my EV and that meant 99% of condos/appartments didn’t work (I’ll await the bashing of how can I compare a family member to an EV). I searched through the 1% of options so I could have a level 2 charger and this meant not securing the ideal building/layout/etc. It is a tradeoff as a result of my decision/actions. No one forced me to buy an EV back in 2015.

I am not demonizing the act of owning a pet just like I am not demonizing someone for owning a boat at Oak Bay Marina. What I don’t like is the emotional appeal pet owners use whether it be housing problems or other. I’ve never ordered a boat but my impression is you call a dealer of the brand you would like. You place a deposit. You wait for the boat to be built and then you wait for it to be delivered. Some people buy used boats but used boats wouldn’t exist if people didn’t order new ones.

I’ve also never ordered a pet but I am guessing you select a breed you like. You call a breeder of that breed and give him or her a deposit. The pet is born on x day and then you wait a couple of months to pick it up. Some people adopt but I am guessing if there were no breeders in the first place there would be very few pets to adopt.

If you need a fix on either it would appear that marine mechanics and vets are of equal cost.

If pets were aquired from an overcrowded mythical forest where they are all going hungry sure I’ll go for the emotion, but such does not appear to be the case.

I know there is the argument of “the cat is part of our family” but I view children differently because one day your 3 year old is going to be operating on my knee so having stable housing for purposes of kids, I am on board with that. Your cat isn’t going to do anything for me and nither will all the boats at Oak Bay Marina.

Easy is not the same as smart. Signed, Paul Volcker

Lots of people have aging pets that have become part of the family, which they acquired when they had (what they considered) stable housing. Also, while it has always been more difficult finding rentals with a pet, it was usually still possible with some other sacrifices.

Going down the path of blaming renters for their peril because they chose to get a dog (or they didn’t buy when they had a chance, etc) doesn’t move us any closer to a solution and just further fuels the divide between the haves and have-nots.

Case and point: we acquired our dog when we owned our place. We had a child, that place was no longer suitable for us, we moved into a rental. No chance in hell I’m giving up our family dog. You try telling your 3 year old why their dog can no longer live with them.

I know you’re fighting the good fight for supply Marko but please don’t demonize pet owners.

Right now it would make sense. Everything you are listing would add up to less than 100k and the return of the extra square footage/suite would exceed that. That being said, I hate pumps especially storm. Sewer not a big deal, just don’t shower/use excessive water until issue resolved but if your storm pumps fail and you have a finished basement that sucks.

The least reasonable “deals” gone as of Friday…Tresha increased their studio prices by 45k. Now everything is insane with the exception of Haven. At Haven you can literally buy a studio right now for 40k-50k below current market. The catch is an investor can’t buy it, but great opportunity for a first time buyer that can plan 2-3 years in advance.

I know this isn’t a popular opinion, but no one forces you to purchase a pet. I feel like it is common knowledge that finding a rental with a pet is much more difficult. I also feel like it is common knowledge that pets are expensive, just look at the last few days of reddit threads

https://www.reddit.com/r/VictoriaBC/comments/sh9y0k/vet_tooth_extraction_is_this_a_normal_estimate/

We breed the animals and then you take the puppy/kitten away from its mother for your personal enjoyment. You buy the pet stuff/food that has to be shipped (not good for the environment) and vet clinics/staff are society resources not used for housing, human health care, etc. My point being you aren’t doing the animal or society a favor owning a pet.

Spent a lot of time on my grandfather’s farm as a child/teenager milking cows, herding sheep, and hiking with my grandfathers’ dog, love animals, but don’t love the complaining from pet owners when it comes to lack of adequate rentals. Maybe secure home ownership first and then buy the dog/cat/lama whatever floats your boat. Please check local zoning if buying a lama.

Finally, solution to the problem? Building more housing rental stock. Last year I didn’t have time to fix up one of my condos once a tenant left after 10 years and there was quite a bit of new rental inventory coming on at the time so I simply allowed large dogs and rented it out right away to a nice tenant with a large dog. Normally, I never allow pets but the market guided me into my decision (I didn’t want to fix up my unit and I had competition from a few new rental projects). If vacancy was 5% there would be no issues securing pet friendly accommodation.

*comments exclude assistance dogs, etc.

Patrick- Prices are going crazy in Winnipeg due to the influx of new immigrants.

[xenophobic musings about different ethnic groups removed. Consider yourself warned – admin]

Billions of people want to move to Canada, primarily for our opportunities and social services. They don’t realize how stressed out our system is at only 38 million citizens. Until the government puts the brakes on this mass migration, don’t expect anything to go down in price. New immigrants may not be moving to Victoria, but the older boomers are cashing out across the country and looking to the Island to retire.

When you have inflation running at 5% in Canada, 7.5% in the USA and mortages can be had for 3% or less, it’s an easy decision to buy more leveraged real estate. What are the alternatives? Stocks have been choppy, cash loses value by the month, gold is going nowhere and bitcoin crashed. I know a couple of people who have “thrown in the towel” on the stock market after the recent high volatility and are using that investment money to buy RE in Victoria (mainly investment condos and pre-sales). By the way, the pre-sale condo market in Victoria is going nuts with prices being raised every two weeks at some projects.

I will say that if you wish to buy RE in a more orderly RE market, the City of Vancouver (proper) RE market is much less insane than Victoria (for now). There is a much smaller risk that you will overpay than in Victoria at this particular juncture.

$1.315M

What did 2265 Marlene Drive sell for?

2261 Marlene Dr listed at 899k and sold for 1.15M

Their neighbour then listed 2265 Marlene Dr for 1.25 M.

I wonder which was the better listing strategy?

Both seem compatible properties. 2265 has a garage (vs a carport) so I assume has been upgraded more since when both were built in 1968. 2261 assessed value 885k vs 2265 assessed value at $946k.

Central banks all over the world.

Come on people, this is no the time for fear, weakness or cowardice. Get in the market! Already in the market, buy another property! Let’s pump this thing as high as we can. Take that new assessment to the bank and extend that HELOC by as much as you can. Your parents can’t pull anymore equity from their house? Well, get your in-laws to pull out all they can too! (Just explain to them it’s child abuse for their grandkids to be in a rental) Then just offer all you can on anything you can. Don’t worry about your payment, those kids working at Starbucks can pay $4000 a month in rent to you if you suite that basement. This is awesome, the more people in the same boat just ensures that nothing is allowed to go wrong.

Yes you are 😉 Considering the selling + buying cost, you might have camped in a van for nothing, and lucky to buy your old house back when the year ends …

Am I crazy to think I should sell me house, live in a van for a year, then buy in 10 Mile Point after the market collapses? It’s bound to happen.

RTB rules tend to favour tenants, which is a good thing in many ways. The problem comes when you have a tenant who is not playing by the rules and using the system to stay in place, often without paying rent. In that case, the adjudication process delays are unfair to landlords in my opinion and this is not excused by having a hard time finding another place to live.

I have sympathy for this family in not finding a place, it is very hard out there, but they had four months’ notice, agreed to move out, and then did not. In their shoes I would having been reaching out to family and friends to take the rabbits and cat if need be and expanding the search to places that don’t accept pets.

I would also be looking at ways to increase income and, once housed keep looking for pet friendly accommodations, particularly coops. I’d also consider renting a bigger house with another family. The truth is that if you are in the market for 2-bedroom pet friendly child friendly accommodation for 2300 utilities in you are probably not going to find anything without a big media campaign…

Regarding the family of 4 who cannot find a place to rent, I cannot help but think they were caught in a “waiting for prices to come down “ mindset that deterred them from getting into the market when prices were reasonable. Maybe they didn’t have enough for a down payment, maybe they weren’t focused enough on sacrificing and saving their money. They seemed to have enough money to raise two children, unfortunately they should have secured their own property first. They would be in great financial shape today and have accumulated a ton of equity, instead of paying rent. I feel for them, unfortunately they are screwed now. Buying your own home should be everyone’s first priority once they are earning a living.

They aren’t coming from Winnipeg, since Winnipeg RE is also going nuts.

The explosion in January 2022 house prices and bidding wars isn’t limited to Victoria. It’s all over North America. For example, in Winnipeg prices rose 5% in one month for detached houses in Jan 2022 compared to Dec 2021 https://www.youtube.com/watch?v=gx3aIkKKqjI

If you listen to this January report for Winnipeg, you will all the same issues as we are talking about here; , no inventory. Bidding wars, sales way over ask.

This Winnipeg house frenzy is going on in the midst of bitterly cold weather and blizzards …

https://www.cbc.ca/news/canada/manitoba/manitoba-blizzard-winter-weather-warnings-1.6334746

“It’s like driving or walking in a snow globe,” Dave Phillips, senior climatologist with Environment and Climate Change Canada, told Information Radio host Marcy Markusa. “Snow is blowing at you from every direction.”

ok but if you read the backstory, Viclandlord was just trying to move into his/her own house and had gone ahead to rent out their current place on the basis of these tenants confirming to him/her that they were indeed leaving, then they pulled the rug out. Inexcusable in my view. Yes life is hard, so why make it harder for other people? Sound more like these folks just didn’t focus on things to begin with and then pulled a fast one to game the system.

It’s very hard to really figure out how the tenants are going to be (or the landlord, I would think) from the brief meetings one has before making a rental decision. The one safeguard there used to be was when you could make it a one-year fixed term lease providing that the tenant would have to move at the end of that year (and then offer them a renewal if the relationship was working). Of course that’s gone now. Now you’re just captive to howsoever it turns out, plus the gov’t has shown that in a real crisis like Covid, they think it’s fine for the tenant to have a rent moratorium and that all those costs should be the landlord’s (I’m ok with a moratorium in a time of true crisis, as I think as a society we need to pull together, but in that case it should be society as a whole paying for it via taxes, not all off-loaded on the mom & pop landlord – ridiculous situation).

So not for me, not ever again.

I’m sure nobody out there will bemoan me being out of the landlord business, but that said, my wife and I did provide long-term peaceful, well-maintained tenancies through thick & thin for almost two decades, and we’d never dream of doing it again.

A business without competition or Google reviews, backstopped by the government, where your product is an essential need.

I get there are some crappy tenants out there but at least the RTB and associated delays give families a fighting chance to sort out the mess that is this housing landscape. Four months may seem like a long time to figure things out but if you have a budget, pets, and some self respect, it can take a hell of a lot longer than that to find a place right now. I know because I’ve been looking. Comments like this show me that people are still unaware of exactly how bad it is out there.

Mount Washington real estate anecdote:

Extended family plus our family have co-owned there since 1990’s. I check MLS and actual sales semi-regularly. Around 2011-2012 units comparable to ours were selling for about 200K – roughly 25% more than 1990 prices. At that point in time I remember an MLS view of the community there would show you 40-50 chalets, condos and bare properties for sale.

Prices dipped even further after 2013 (two crappy ski seasons in a row) probably down to comparables for $180 in 2014. MLS listings in the 70-90 range

Fast forward to today:

4 MLS listings in the entire area, two for bare land, one for 1/4 interest in a condo, one for a condo for over $1M. Comparable units now north of 450K.

This blows me away for a mid-tier ski hill whose days are probably numbered thanks to low elevation and climate change.

I read his post, was wondering where these new “money is no object “ buyers are from. Just curious if Marko or Leo have heard anything from other realtors.

Frank, Leo posted recently a chart showing where people are coming from – mainly Victorians and Lower Mainlanders. Also note this is not exclusively a Victoria issue – its an Ontario, BC, East Coast issue (and currently increasing in AB). Seems like more then just the nice weather of Victoria. Look at the bottom of the chart: https://housepriceindex.ca/2022/01/december2021/ – 3/4 of these places have gained more than Victoria (percentage) – mainly in Ontario and the East Coast.

No doubt the increased gain in population and low interest rates aren’t helping though.

Any idea where all this crazy money is coming from? Mainland B.C., central Canada and the prairies? One of the worst winters on the prairies may be motivating retirees to relocate. The pandemic has definitely influenced people to retire instead of putting up with the “new reality” at most workplaces.

Sales coming in today are eye popping. Condo on Shelbourne, wood-framed building for $1,130,000. 2015 purchase price 455k.

Starting to blow by of doubling since 2015 in more and more market segments.

Has to be the worst market I’ve personally seen. Had to cancel two pre-inspections last week for my buyers as sellers took bully offers, one 470k above ask. I think when the dust settles and the market flattens or corrects at some point there will be a decent amount of outliers where buyers way overpaid even in the context of the market at the time.

driveway for duplexs:

“But that (a 4-car-width driveway) wouldn’t look good, unless you can do two separate double-car-width driveways (that is okay for a wide frontage lot or a corner lot)”

if the developers could make some extra profits, they will try their best efforts to do so. To build lower unit for suite in a duplex does not make much financial sense in my opinion.( as I have not seen may been built since 2019)

for example, dealing basement toilets, showers and kitchen sinks/fixtures that drain below the main sewer line- depends on the acceptable elevation for city’s connection, it often requires sump pumps, a backup pumps, a small battery backup if it fails… it also adds up to the maintenance fee/cost..

However, in other cities like calgary , they actually allows 6 plex in 50 wide ft lot.( 3 townhome setup but each townhome has a suite in it. ). I guess if the developer could scale up, they will.. unfortunately, even city of Langford does not like the idea about building 3 townhomes on 50 ft wide lot.

btw, calgary now is filled with tons of BC investors picking up building lots( about 600k for those 6 plex set up).

Still outselling Jan 2020 despite the inventory collapse.

Sales: 130 (down 21% from last year)

New lists: 220 (down 6%)

Inventory: 794 (down 42%)

New post tonight.

🙂 is that what the cartel commissions is called these days

I said “If it was so lucrative the private sector would be willing to get involved without government backing”. Genworth (which is now called Sagen) is backstopped by the federal government..

And I also said as a caveat there are purely private sector mortgage lenders which make high ratio mortgages. Check out their interest rates – that’s the free market speaking.

Makes sense. Thanks.

Yes they also have one cat plus two bunnies. She said “5 years ago, my family had a whole 3 bedroom.house for $1300 plus utilities. Its insane how high rents have gone” on her FB page. Depending where it was, but $1300 for a whole house sounded a special good deal, even for 10 years ago. Hopefully them will have good luck this time, too.

Commission should never be tied to what you are advising your clients; therefore, nothing to disclose.

This is a really indepth topic too much to cover on here. In my 12 yrs of experimenting with coops its a bit of a game. If you offer $1 every offer will come in with an attached fee agreement (for the commonly seen rate); however, if you offer 15k and a commonly seen coop is 20k not that many agents will go back to their buyer and ask him or her to sign off on asking for an additional 5k as it makes the agent look greedy.

I’ve listed everything from $1 to 2.5% coop (above commonly seen) and my conclusion is best net outcome is go in at commonly seen or slightly below but not substantially below. Going above doesn’t help.

Wouldn’t the agent be obligated to disclose to the buyer the reason they aren’t advising a high bid is that they don’t want their client to get the winning bid, because of their low commission? To a layman, that would seem like the agent would be clearly acting against the interest of their client. (I’m not naively suggesting that it doesn’t happen, I’m just asking if the buyers agent would be violating the RE rules, and risking sanctions if they did that without telling their client).

Anyway, I really appreciate the detailed replies, and I will pass that on the my friend in whiterock. I expect he will go for that hybrid option you described. Thanks!

Your tenants were clearly unscrupulous. Maddening that they made a false claim like that. We’ve had mostly good experiences, and a couple not so good ones. The bad ones do indeed teach you to be businesslike.

I have read through this particular tenant’s situation though. It is not the landlords’ problem – but things have changed. There are too many tenants for the places available and prices have gone up a lot. Last summer we had a record number of applications for a suite we had for rent and I took down the ad after one day. If you have kids (like they do) and/or pets you are not necessarily a top pick and landlords can pick and choose right now.

Maybe there is more to the story, but it is possible it really is that difficult right now in that price range.

As I mentioned, compare apples to apples. 1% would most likely be a 0.5% coop or 8k so we have 8k+8k or 10k+23k. The difference on the listing end is 2k. Agents will show the listing for sure at 8k coop because in this day and age the showings are driven by their buyers and there is no inventory. If you are going to get 30 showings over the course of the weekend with 23k coop you’ll get 30 showings over the course of the weekend with 23k. Then comes to part about advising the buyer on how much to bid over asking price. If the coop, for example, was $1 is the agent going to be motivated to get his or her client 300k above ask?

“we do more than they do?” what does that even mean. I am sure there are 1% full service agents out there that do a way better job than 4% agents.

At the end of the day I am believe in what I call the hybrid model, keep the coop reasonable (99% of buyers are working with an agent) and get the best possible value on the listing end of things.

I am not a huge fan of advertising a very low commission via substantially cutting the coop, especially with an offer delay strategy. If you are going to cut the coop I would start high on the price and combined with low inventory wait for the right buyer, it might work as well. Problem is, right now the best net outcome, for the seller, unfortunately seems to be underlisting.

I have zero sympathy for the couple in the article, they had four months! the system is broken and the RTB needs a complete overhaul, the claim they filed is baseless.

As a landlord my wife and I were in this situation last year trying to move into property we bought, I think we spent about close to 20k in legal fees.

Current Tenant was paying 2800/month so not a case of someone paying 600

Removed conditions and gave 4/months notice for landlord use, told them that if they needed more time to let us know and we can work something out, because we haven’t listed our current place for rent yet, the tenants responded and said all was good and they would find a place.

We went ahead and rented our current place and had the lease signed for 15/days after we were supposed to move into the place we bought……almost a month passes and we are served papers from a lawyer saying they are disputing the notice on the fact that they have a fixed term tenancy for 2 years (the lease aggrement we have from them is month to month)

We call their lawyer to see this missing lease agreement, well not a surprise he does not have it and the tenant can’t find it but says its in existence, we’ve dealt with the RTB enough to know that this is going to drag out for months with their wait times, so we offer the tenants lawyer 10k if they drop the case and move out after the 4 months, lawyer tells us they are not settling and want their day in arbitration.

so from the time we gave notice to the time of the hearing it was just over 5 months and then it took the RTB another 30 days to make a decesion and they decided in our favour as they could not produce a lease agrement in the end.

They decided to move out 5 days after they lost the hearing, if they didn’t we would have had to filed for a writ of possession and hired a bailiff and moving company to drag them out.

The RTB needs some sort of pre screening, their claim can be absolutely baseless and yet as landlord you need to wait months to get a hearing.

after being a landlord for years and losing tens of thousands in damage and unpaid rent, I will not entertain anyones sob story, you have to take all the emotion out of it and run it like a business or you will fail and fast.

Thanks for that detailed reply. I understand that the $33K you’re outlining should end up with the same exposure as a full commission. Which has a great saving from $46K and should get a great full service selling agent and a happy well paid buyers agent.

For completeness, let’s talk a little about the 1% flat fee guys. If I’ve understood the 1% flat fee guys, they would do it for $16K total, instead of the $33K you’re mentioning. Would some buyers agent refuse to show the property to their client? How would that be split up with the selling and buying agent? That $16K they charge is 33-16=$17K difference, so I’m wondering what services would be lost in going with the 1% flat fee guys. My friend has already mentioned the 1% guys to a full service agent, and of course their reply was “we do more than they do”. Is he correct on that point?

some one should do a home prices vs physician availability .. yay

Patriots, the private sector is involved with high ratio financing. ie Genworth

100%

More broadly, billionaires shouldn’t exist until we sort some stuff out as a society.

Fair enough, but if we have enough $ as a society whether it be government or private to be rescuing cats from Kabul this family should not be worried about having a roof over their head.

Appears not to be government funded, and in any case the cost likely is less than what BC pet owners spend in a week.

Agree that the problem with addressing housing is lack of will. And I have given my opinion of why.

If you want full exposure and zero lingering thoughts in the back of your head offer the commonly seen coop. So 23k +/-.

This leaves $23k +/- on the listing end of things. The incremental costs to the agent would be $300 to $700 for floorplan/photos/video or virtual tour/mls fees plus $250-$350 to their brokerage (deal fee, only paid if successful sale). So let’s round that to $1,000 for expenses. The agent’s fixed expenses you should completely ignore. If they are paying their brokerage $1,000/month for a “desk fee,” driving a fancy car, spending a ton on having their advertising on the back of a bus….that is their problem, not yours.

Most houses are being listed Thursday, selling Monday or Tuesday evening so the time commitment isn’t huge. Like realistically you should be able to find a solid experienced agent willing to do it for $10k (list end) + 23k coop = 33k so that is a 13-14k savings not impacting anything, just spending a few hours sending out emails and interviewing agents.

Also, I wouldn’t hesitate to email back agents and be like “we liked your listing presentation, but we are not interested in 1% listing end, if you can do $10,000 we will go with you otherwise we are going with someone else. Please let us know in next 24 hours.”

And always compare apples to apples (i.e., compare commissions based on an equivalent cooperating commission). Obviously someones gross commission is going to be way less if they are offering a 5k cooperating instead of 23k cooperating. Basically, fix the cooperating to a X % or absolute number, and work on negotiating the listing portion.

Beyond the above the next cost saving measure is mere posting + commonly seen coop and beyond that is mere posting + cut the coop substantially (not sure I am a huge fan of that in terms of best net outcome).

If it was so lucrative the private sector would be willing to get involved without government backing. It isn’t. Well let me correct that – it is, but at very high rates.

Sure it looks good when prices are going up. The test is when they’re going down.

Best way to regulate is to build a ton of rental housing so the average Joe landlord with a mouldy basement suite isn’t in the driver’s seat when it comes to renting it.

Article notes they received notice in September so how much extra time do they need? (making an assumption landlord is operating in good faith). It also notes that their budget is around $2,300 which is enough for a two-bedroom apartment and bunk the kids for a bit until you figure things out.

Yes, I feel for the family, but we are flying in hundreds of abandon Afghan pets to BC. We have the resources to figure out housing, just not the appetite.

All true Patriotz, but that doesn’t mean Canadians are not being milked for the cost of insurance added to their mortgage. Insurance that they no longer are using but will be paying for over the course of the full amortization period.

High ratio insurance is a cash cow for the government.

Right. This is a sad story. Hopefully the hearing buys them extra time, and the publicity may lead to a rental.

Maybe the city councilors will see that article, and think of that family next time they are considering delaying vs approving applications to build rental housing.

Not if the landlord is acting in good faith. This is, however, a move that means they get to stay in the home a bit longer. Hopefully they find something.

“That’s not going to be persuasive to the adjudicator, is it?”

It’s not a relevant consideration. The test is whether the landlord intends in good faith to occupy the rental unit.

With Bill-7 has been effective since July 21, 2021, renovictions in BC have been tightly controlled and must be applied through and be approved by RTB:

https://www.vancouvertenantsunion.ca/renovictions2021

I think another factor that makes life hell for tenants is renovictions. I have seen several instances of children of friends buying a house with an existing tenant, evicting the tenant while they do varying degrees of renovation (or living there themselves) and then turn around and re rent at a much higher rent. While I am sure some of them feel a bit guilty they are all able to justify it because their mortgage is so high they have to do it to survive. (well, it is either them or us). I have no idea how you could or should effectively regulate against that sort of practice but it is certainly not helping the rental landscape.

This family is disputing their eviction, citing an inability to find a new place to live. That’s not going to be persuasive to the adjudicator, is it?

It better not be. Although I do feel for this family…

Saanich family soon to be homeless due to rental competition, unaffordability

https://www.cbc.ca/news/canada/british-columbia/saanich-family-soon-to-be-homeless-due-to-rental-competition-unaffordability-1.6341248

Let’s not forget there are some shite landlords out there. We were tenants to one. They had no idea or played dumb to having to give the required notice of the prescribed rent increase (expected it the next month after the demand) then when the covid freeze was implemented they went ahead and demanded an increase anyway. Our investments were doing just fine lol and my wife became employed so the pandemic was certainly no burden to our income. We gave the increase anyway regardless of the moratorium because we knew when we moved out they would claim all sorts of crap against us which was nonsense and we wanted a card to play which we did and got the increase back. Unbelievable what some landlords will try to do.

I actually pretty much believe in karma.

No, she didn’t refuse to pay. She ultimately broke the lease, but at that point we were happy enough that it was over. Over the course of all the years we had tenants, she certainly wasn’t the worst, so we were ok with it. Just that one comment really irritated me.

I sleep well at night.

“Our last tenant, after holding the rent moratorium thing over our heads, when finally leaving actually said to me “you never asked me how my investments were doing during this pandemic”

Someone with this mindset is going to have a hard time getting ahead in life. Karma is often just a bad attitude come back to roost”

I would love to believe this, or in some type of cosmic justice but in reality you are DEAD WRONG.

You think a billionaire out there gives a shit about karma or rules or laws? LOLOL they have no problem getting ahead in life and yet karma is THEIR bitch. The panama papers is a perfect representation of this.

The sad truth folks is that those who are willing to do things the rest of us wouldnt is the reason we are peasants compared to the bezos’ of the worlds. While you are following the rules, tororo, bezos was having a dutch historical bridge dismantled to get his super yacht out of holland. LOL

One thing is that both agents split the commission that comes from the seller, so buyers’ agents are disincentivized to show 1% or FSBO listings. I recall discussions here and on Reddit where buyer’s agents wouldn’t let clients know about or show those houses. Seems like a big downside, though not as bad in a hot market maybe.

Everything aside from that seems doable yourself (staging, photos, MLS listing, hire lawyer, etc). But Marko would obviously know more.

There are private insurers, and their terms aren’t much different. Plus they are backstopped by the taxpayer.

Fact is these terms are necessary to protect their solvency in a downturn. The last truly private mortgage insurer, MICC, went bankrupt in the early 90’s after the Toronto bust.

And any mortgage lender can come after you for the deficit if the property doesn’t sell for the amount of the mortgage.

Marko, the standard commission on a 1.6m house in whiterock appears to be $46,700. That’s the standard commission as seen in a calculator here . https://wowa.ca/calculators/commission-calculator-bc\

He plans to contact 50 agents as you suggested. What would be the lowest commission someone could realistically negotiate, and still get a sale that would reflect full exposure to the market?

For example. I’ve noticed there are 1% flat rate commission agents in Vancouver. That would mean paying $17,000 instead of $46,700 (a $30,700 difference). What would the full service guy do that the 1% RE agent wouldn’t do?

Rush4life, you should check your mortgage document. Not all mortgages are portable.

Like everything in life, it’s the fine print that is important. You might grind the bank down to get a low interest rate but the penalties for selling before your term is up can be substantial.

Cadborosuras, if you were an American buying a home in the states using high ratio financing, then the unused portion of the premium added to your mortgage would be pro-rated and returned to you if you refinanced to a conventional mortgage.

However in Canada it isn’t.

CMHC is the Devil you dance with in Canada. CMHC calls the tune and tells you when you can stop dancing. If you fall on hard times and owe more than your house is worth and sell at a loss, then CMHC can garnish your wages through the CRA. CMHC is evil.

Great! Thanks for the reply Marko.

Someone with this mindset is going to have a hard time getting ahead in life. Karma is often just a bad attitude come back to roost.

I can see housing market impact on shortage of local doctors and good professors, but failed to see that on local/national gas prices? But if the “canada-goose (=honk and shit) protest” can be reduced/stopped by the gas price increase, so be it.

Gas prices hit all time highs nationally – https://www.google.ca/amp/s/globalnews.ca/news/8594963/canadian-gas-prices-crude-oil-february-2022/amp/

According to gas buddy which may not be perfect but either way gotta be close to all time highs.

“The national average retail fuel price sat at 151.6 cents per litre as of 1.p.m. ET Friday, according to fuel price tracking website GasBuddy.com.

That’s the highest average price on record, according to the website, which has data as far back as 2008.

It’s also 38 cents higher than the average price at the pumps last year, 11 cents higher than the average last month and almost four cents higher than the price of gas just last week.”

Did she leave with unpaid rent? Sue her.

Well, I’ll be happy if these vacancy proposals don’t come to pass, but what bothers me is just the gall of it, and the notion of the proponents that private property is completely meaningless. We had rental units on and off for two decades, some great tenants, some bad, just normal human beings, but as the RE markets have become more out of reach, the whole tenor of things has changed. Our last tenant, after holding the rent moratorium thing over our heads, when finally leaving actually said to me “you never asked me how my investments were doing during this pandemic” – OK, lady, let’s leave it there & all the best. With any luck, that was the last tenancy I will ever have to deal with.

I do agree with Patrick where he says the Horgan NDP is doing a decent job. I’ve been quietly surprised by them throughout their tenure. Certainly a far cry from the Glen Clark ideologues.

i/ Ask friends/colleagues/acquaintances.

ii/ Reddit search “White Rock Realtor” and same for Surrey and Langley. Reddit is wastly better than google reviews for agents imo. Problem with google is as an agent you aren’t going to ask a dissatisfied client to write a review and a dissatisfied client won’t write a google review (too personal unlike a restaurant, for example) so all agents pretty much have 5.0 ratings.

Reddit should give you about 50 agents. Put a template email together “I am looking at selling my propery at xxxxxx. I am aware the market is exceptionally strong and the primary decision point will be a lowered fee structure. Let me know if you would like to interview?” Copy and paste 50x and interview the ones that seem open to the idea.

I would strongly advise against just Facebook/Craigslist/etc. If you want to go full out private be smart enough to at least spend a small amount of money on a mere posting to get it up on MLS. With places sometimes going 100k to 500k over asking you really need max exposure and reality is pretty much everyone is searching on MLS. Someone looking on facebook is also looking on MLS, but someone looking on MLS is not necessarily checking Facebook and, as the seller, you really don’t want to miss the buyer willing to pay 500k over ask as the next buyer in line might only be 300k over.

City council came up with the idea. It’s so dumb that obviously it has zero chance at the provincial level. The concern is why is the council wasting time on this when they should stay in their own lane. Last time I checked BC Tenancy Act is not in their jurisdiction. The idea also shows they literally have zero grasp of basic economics. The fact is they are a reflection of the people that elect them; therefore, I have zero confidence the housing crisis will be solved which has made me bullish on real estate long term (we could very well see a correction in the short term as things are out of control in terms of appreciation, but long term we are kind of screwed imo).

Patrick- Why don’t you suggest your friend post his property on line himself. Set the price he wants, take 10 pictures, write up a description and put it on Facebook or any other online marketplace that has a category for houses. It takes 30 minutes if you’re slow on a computer. I believe it will cost him next to nothing and if it doesn’t work out in a few days, simply delete the ad. He can still get multiple offers and is not under any obligation to sell the property. I’m sure you can help him with this.

Could anyone tell me what 116 Simcoe went for? Please and thank you.

Yes. Overall I’ve been impressed with the Horgan NDP. Either they’ve moved to the center or I’ve moved left.

A question for those in the know here…

I have a friend in Vancouver (white rock) who will soon be listing a SFH for sale. Likely $1.6m range. He doesn’t have an agent yet, so is just going by flyers that he gets from local RE agents, and will interview a few.

My questions for those in the know here are:

– since sales are so quick, there’s presumably less for an agent to do. Will agents accept a lower commission than usual in this hot market, and how much less?

– He doesn’t know any agents. Is there a better way of finding an agent than looking at flyers and for-sale signs in his neighborhood?.

There seem to be a few more listings showing up in the last few days.

I think they will have to follow the Fed. The CAD has been dropping recently despite rising oil prices, and further declines will bring on even more inflation.

It will be interesting in March to see if the BoC going to raise rates when the “Canadian economy lost 200,000 jobs in January… marked the largest drop since January 2021, when the economy shed 207,800 jobs, Statistics Canada said Friday.”

About 200,000 jobs lost in January, but the big hit looks temporary, economists say — https://tinyurl.com/4cvcn86w

Who is “they” supposed to be?

“Obviously, it is the ideas they are coming up with that are frightening. It’s a reflection of how out of touch they are with reality in terms of addressing problems.”

Out of touch? But the housing minister is from checks notes Vancouver-Point Grey, soooo…

Obviously, it is the ideas they are coming up with that are frightening. It’s a reflection of how out of touch they are with reality in terms of addressing problems.

“Instead we get idiotic ideas like this rental non-sense.”

Calm down man. The province isn’t interested in implementing vacancy control.

https://www.theglobeandmail.com/real-estate/vancouver/article-bc-housing-minister-eager-to-spur-supply/

Too many barriers, but instead of looking at addressing those barriers to build garden suites what makes the most sense is to punish those that jump all the hoops and barriers to build the garden suites, or discourage those that haven’t started even more. Genius.

As I said a few months ago, there are a lot of super simple things that can be done. For example, all townhome development proposal in the COV that meet the “missing middle” guidelines guarantee rezoning/building permit in <6 months and waive DCCs in exchange for developer registering a 20-year rental covenant on the property. Your increase the tax base, your create jobs, your providing purpose-built rental solutions financed by the private sector.

The politicians don’t have the balls but why not waive public hearings on rental proposal that meet all the requirements within the OCP? Listening to NIYMBS for three hours at each public hearing isn’t constructive.

Instead we get idiotic ideas like this rental non-sense.

Already have a spec tax department. We have a BC Housing department administering a completely useless exam. Why not another agency?

As it is, there are only, like, ten garden suites built annually in the core.

Who in their right mind would spend several hundred grand to build a garden suite knowing that they’d only legally be able to increase their initial rent by 2% a year in perpetuity?

Many of you might not know that BC did have rent control between tenancies from the mid 1970’s to 1983 think. Landlords actually ran ads in the classified section (remember that?) saying “NO VACANCY”. Looking for a rental was a nightmare, places disappeared as soon as advertised, also there were cases of landlords demanding illegal payments or other favours.

There was a monthly rental above which controls were lifted, so most units had gradually passed this ceiling before the controls were abolished in 1983. Also the rental market was very soft at that time due to the recession, so the impact of the removal was not large.

That type of rent control is problematic. Doesn’t give flexibility for expense increases and penalizes some landlords who never raise rents during a tenancy. We don’t. We only raise rents when a long-term tenant leaves and we assess market conditions. Landlords would have to raise rents every year for all tenants – or risk never being able to catch up. Wish there was more focus on affordable purpose-built rental solutions.

We ended up lowering our rent by $200 per month for a single mom with 2 kids that came to us after her initial 6 month term was up and said she would have to move out because she couldn’t afford it. We lowered the rate with her understanding that we might not get to maintenance right away though. She was the most grateful and great tenant to have after that. She even paid for an oven repair out of her own pocket. She was a tenant with us for 8 years and we raised the rent back up once by $50.

Great opportunity for inefficient bureaucracy here! All landlords would have to register their current rental rate per unit with some government agency to police this…

Looks like Eby isn’t going to bring the forced-upzoning hammer down on municipalities until the fall sitting of the legislature:

https://subscriptions.cbc.ca/newsletter_static/messages/metromatters/2022-02-04/

You betcha. I gave my tenant a decent deal on rent back in 2012. That tenant is still with us and I’ve never raised the rent, so you can imagine what kind of discount it is today.

Councillor Geoff Young nails it:

Rent control between tenancies: How ridiculous. Big corporations renting out apartments for the most part charge what the market will bear. It is the private rentals that tend to give people a break. There are loads of SFH with suites or individually owned condo’s that are being rented out at MUCH lower than market price. Many rent to seniors on lower incomes. Maybe they mow your lawn for you or walk your dog twice a day, take care of your home while you are on vacation etc. Sometimes they just get a break because they are older and quieter. Other individual landlords rent to their kids, their parents, other relatives or friends.

Re: rent control between tenancies

Have the place vacant (say a month or two) between tenancies, problem solved. In current time, have time in between is actully good for the new tenant health wise, also give landlord more time to clean/repair it properly without stress.

So, they want to restrict existing supply and not encourage rental construction? If someone has been renting under market for 15 yrs and their tenant moves they should be punished as a result? Worst idea ever.

Not going to happen. Eby himself has said he is opposed.

I see an article today that the effort to implement rent control between tenancies is gaining some steam

https://www.saanichnews.com/news/victoria-wants-b-c-to-regulate-rent-increases-between-tenancies/

(sorry, not sure if I’m posting properly…)

anyways – if they do this, just another confirmation how tough it is to be a mom & pop landlord. Glad I no longer need to be in this business.

Fixed payment mortgage with variable rates means you pay a higher fixed amount than if you were to have a variable payment.

For example they will often base the payment off of having a fixed 3% rate even though current variable rate would be 1.5%.

This means you end paying more towards principal and would reduce your amortization period.

A trigger event could be that the fixed payment no longer is enough to stay under the original amortization based on the current interest rate.

RBC The fever breaks: Canada’s housing market will cool but stay strong in 2022 — https://tinyurl.com/mtwtwbm6

There are many factors that drives housing demand according to RBB, but the main driver seems to be coming from memillennials at the present and perhaps for the next decade or more.

Stockhome syndrome

Right. They would be insolvent if they had to pay back insurance premiums to anyone with enough equity. fwiw, they modelled they wouldn’t be “solvent and well capitalized” anyway if the covid pandemic effect was “very severe” https://www.cmhc-schl.gc.ca/en/media-newsroom/news-releases/2021/coordinated-government-action-key-withstanding-pandemic-scenarios

“ CMHC would remain solvent and well capitalized in all scenarios with the exception of the Very Severe one.”

“Houses that are above a certain price point may drop faster and be harder to sell aka Uplands in down times.”

That is true in up markets to like this one. I note on the BC Assessment map, Uplands had some of the slowest growth in the CRD – 14.5% vs 20% in most of the rest of the core. I think that’s true today too as there seem to be definitely more listings in Uplands than in other areas of the core for SFH. And many are sitting for months. The price points are just not doable for most buyers hence the lower demand.

And the Westshore areas like Langford you can see 30% increases. The more “affordable” SFH are rising at the fastest rate in this rising market. Again, same issue.

However, in a down market, I would wager the Uplands home will hold value better than the average core house which in turn will hold value better than the Westshore which will also hold value better than say Port Alberni (which is up 50% or so). And so it goes.

Re: Broadmead. I was not a huge fan of Broadmead when it was fresh and new (yes, my age is showing) – just a bit too “nouveau” and far from the water for my taste. However, it has aged gracefully with really nice mature landscaping and homes that fit in with their surroundings. Somewhat remote earlier but now it’s reasonably central to easy traffic patterns in and out of the city. Much more convenient and visually pleasing than Bear Mountain.

For a time, Broadmead was the most easily obtainable upscale area for the middle/upper middle class buyer and excellent value. In the last few years, price growth has made it much more difficult to buy into (like almost every area of the core and peninsula) so it is definitely not affordable. And it’s the hardest area by far to have a mortgage helper suite in your home.

Madness. Benchmark house in Parksville-Qualicum is 953k.

https://www.pqbnews.com/business/benchmark-price-of-single-family-home-in-parksville-qualicum-beach-hits-953k/

You only pay it when you buy the property. It’s a lump sum, however I guess you can say you’re paying forever since it gets added to your mortgage balance.

You also have to pay it again if you extend your original amortization, and you don’t get anything back from the first time.

For the core or any fast growing cities, I would argue the graphic is a wrong policy direction. These missing middles should be built on the left side of SFHs or mixed in the SFH zoning slightly away from downtown. The middle space should be reserved for Mid-rise or even high-rise zoning, otherwise, we will be running into housing shortage again once this middle space be filled.

They are assuming rates rise steady over the 5 years. So if you rates go up steady you will be lower for the first half and higher for the 2nd half roughly equaling out the same as a fixed. If rates go up 12 times in the first half of the term (2.5 years) and stay flat for the 2nd half then you are worse off if they go up 12 times in the latter half then you are better off.

I’m not a fan of Broadmead. When I try to figure out why it is a bit of not wanting to live out that way and a lot of just a general vibe of a lifestyle I’m not into. Objectively it is a nice place to live, and and a good value investment. I suspect my prejudice would fade quickly if I lived there.

People have this adaptive tendency to value where they live more highly as they get attached to it and have a sense of belonging. This is a good thing if you can’t afford the neighbourhood you want – you’ll probably be as happy in a different one unless there are irritating factors affecting attachment.

Cool graphic. Those few SFH at the left would likely cost a fortune. And they’d probably be reserved for government officials.

Yeah, SFH will just keep going up as our population does. I don’t see any way around that either.

Missing middle would likely be quite attractive to a huge chunk of people though, especially the duplex side by side. Moreso if they were the 1900sqft units that Marko proposed (1500 sqft 3br main with 400 sqft suite).

Price is the best measure both looking backwards and forward into the near future. An Oak Bay bungalow is going to be a few hundred thousand pricier than the Oaklands equivalent, so I’d conclude that Oak Bay has been more attractive. In the next 12 months I’m confident that it will remain more expensive than the Oaklands, thus more attractive.

Good working definition. It is very subjective, as some people would still prioritize Fairfield for proximity to town/park/ocean even with increased crime. I don’t like Oak Bay and would value a comparable house lower than ours in the Oaklands (too far from town and up island/peninsula, traffic is agonizingly slow). But that’s just me.

Never heard of a rebate. FWIW you may have received a lower interest rate because you were CMHC insured and you may make up the difference this way in any event – check with your lender.

Do I pay CMHC forever or is it only in place while I’m high-ratio?

We put the min. Down when we bought, aprx. 7%, and paid around 30k CMHC as a result, and it’s included in our mortgage.

A couple comparable properties to ours, same size / layout / area, but needing more work, have sold for over 1mil this week. If we had an appraisal done we’d probably come in higher which is insane but would put us at 20% equity.

Does this have any effect whatsoever on our CMHC? Or are we just paying it for life because we had less than 20% down when we bought?

Thanks

I agree. Yet the narrative presented here is that increasing density will lead to more affordable housing. I don’t see how that can be true for SFH. It may be true for condos, but almost no one here on HHV is looking for a condo. Because we aren’t adding SFH when we add density – SFH numbers are falling per capita, while condos are rising.

btw) my oak bay example was just an example of a city. The point is the same for Greater Victoria. namely… double the density (and population), but because of fewer SFH per capita, SFH affordability will worsen.

Fairfield used to be my top choice for where to live, especially closer to cook street. Now it isn’t just because of its proximity to downtown and the increase in crime in the area.

More desirable for me means “if I could afford it, where would I choose”. Most people can’t afford the house they want in the neighbourhood they want when they start out. Each person has subjective criteria for this, but it gets expressed in how fast prices increase and how well they hold their value. In other words: demand.

Historically Oak Bay has appreciated at a higher rate than other areas of Victoria and has had high demand. Not sure how that will play out going forward given how unaffordable it has become. Houses that are above a certain price point may drop faster and be harder to sell aka Uplands in down times.

“So that only half as many Oak Bay residents could afford a SFH there, which is worse SFH affordability.”

Depends on the sales price of these potential new condo towers and locations in Oak Bay. If they just random add some condo towers, say in South Oak Bay or Estevan close to Uplands, in short-term, I’d say it will make Oak bay no different than their border neighborhoods, may be less desirable than East Fairfield due to the longer commute to downtown. In long-term, SFHs affordability will be worse everywhere in the core unless population decrease.

@leo, regarding fixed/variable, I received the following email from Spin Mortgage:

“Should You Go With a Fixed Rate?

Short answer: No, don’t rush into a fixed rate or lock in your existing mortgage.

Long(er) answer: Variable rates would have to rise significantly to justify choosing fixed over variable. On average, there’s a 1.5% spread between current fixed and variable rates, which suggests that the overnight rate would have to go up by 3% (or 12 X 0.25% increases) during your 5-year-term before you would finally break even. The current economy still largely favours variable rates.”

Could you help me/us understand why 12 x .25% increases would be needed before breaking even on fixed? I’m in the first year of a five year variable and I’m very interested in understanding the break-even point between the mortgage options currently available.

Thanks!

Increasing density would allow more people to live within boundaries of a city. But is there any evidence that improves SFH affordability? I think it will worsen SFH affordability. Many areas within big cities have much higher density than Victoria, but their prices are as high or higher than here. Maybe increasing a city’s population through increased density will increase SFH house prices.

For example, if Oak Bay’s population doubles by adding a bunch of condo towers, but no more SFH, maybe that makes SFH there much more expensive, since there are half as many SFH per capita. So that only half as many Oak Bay residents could afford a SFH there, which is worse SFH affordability. Is there evidence one way or another?

From: https://financialpost.com/news/economy/banking-watchdog-warns-housing-prices-could-plunge-20-when-speculative-fever-breaks

I have more time for things coming from OFSI than CMHC on the prognostication side of things.

I would like these details as well. The ‘trigger rate’ is largely believed to be when interest exceeds the payment then the payment will go up. However I have seen other people talking about when it exceeds the most recently agreed upon amortization. According to here – https://www.canada.ca/en/financial-consumer-agency/services/mortgages/interest-on-mortgages.html – “If the market interest rates increase to a certain percentage or trigger point, your lender may increase your payments. This payment increase will make sure that you pay off your mortgage by the end of the amortization period.” Not sure what the ‘amortization period’ is – the original AM or the AM at the most recent renewal etc. Not sure if any of the banks even use this or not. I had a friend working at one of the big 5 during the pandemic and they were re-amortizing payments out to the original 30 year or more in some instances to make sure people could make their mortgage payments (only for people who needed it) so I can’t see them being bound to it anyway. That being said rates were down quite a bit and house prices were up during the pandemic so maybe the banks were a little bit more flexible then they will be it rates go up and prices come down.

Is there a graph correlating increasing immigration levels with house prices since 2000?

Well first we have to establish what is meant by “attractive”. If you mean resistant to price drops, that’s just a tautology.

If you mean the most expensive, historically that has not been guaranteed.

If you mean anything else, it’s simply subjective.

The increased money supply was actually a response to falling demand, including housing demand.

Qt- Excellent graph correlating house prices to money supply. Now what came first, the chicken or the egg? Did increased money supply cause housing prices to increase, or did increased housing demand cause the money supply to increase?

Why Toronto house prices keep going up — https://tinyurl.com/2625dfvy

delt *

Maybe you could describe how the variable works that has the same payments, regardless of rates. That must lengthen amortization if rates go up, and how would that work if rates go way up. The question would be is that a better choice than a variable where the payments change when rates change.

That’s an article I would love to see. A historical comparison of the growth in money supply to the change in value of housing, plotted the same way as Leo’s very useful MOI vs. annual returns chart. That, and a return of the weekly numbers 😉

Re: next week’s topic, it would be great to have some kind of discussion of past market shocks that are comparable to the COVID pandemic, and whether it would have been advantageous to choose fixed vs variable in the ensuing years

Great post, Leo. Thx

Based on history what are the statistical odds that going 5x 5 year variable mortgages in a row underperforms going 5x 5 year fixed mortgage in a row?

It’s nice to see someone in Ottawa stating what many here are also saying. Which is that the boom in house prices was due at least in part to money printing and huge spending – $400 billion deficit. Having a $400 billion deficit and printing that much money was bound to screw something up. It seems that runaway house prices are one unwanted result, and there may be many more in the years ahead if we don’t get government finances back on track.

https://ca.news.yahoo.com/inflation-isnt-main-factor-driving-090000303.html

“Conservatives, meanwhile, point out that housing prices in Canada surged by 33 per cent from March 2020 to November 2021 — something the party blames on what it calls the federal government’s reckless spending during the pandemic.

The price of the average Canadian home hit $713,500 in December 2021, according to the Canadian Real Estate Association (CREA).”

“The inflation in house prices followed the government printing about $400 billion of new cash, dumping it into the financial system, much of which was lent out in mortgages,” Conservative finance critic Pierre Poilievre told CBC News.

“More dollars chasing fewer goods means inflation, and in this case, housing inflation.”

Next week’s topic: Choosing between a variable vs fixed rate given the ultra large rate gap and risk analysis of future rate changes.

Any questions you have about variable vs fixed, drop them here.

That would be my suspicion as well.

It’s a double edged sword, as I expect house prices to drop a bit as interest rates rise. Buying more house now doesn’t make financial sense. But in a downward market I expect our house to lose value against any likely upgrade. Ah well

That it was! I have no crystal ball and couldn’t guess at the magnitude of any drop (though I would be surprised if nominal housing prices didn’t drop going forward).

I’m sure it was purely an arbitrary number to use as an example, but, if prices did come down 20%, whoa, that would be something to see. Certainly would wipe the smugness off the faces of a great many folks.

I think Oaklands and Mt. Tolmie will have a higher appreciation rate this year than Estevan as Estevan homes are now above two million and it seems like this cuts out a whole swath of buyers leaving a storm of competition for those houses in sought after but less expensive areas – like Cedar Hill, Oaklands and Mt. Tolmie. If there is a drop I would say the more attractive the area is perceived the more it holds value and SFHs hold value better than condos typically.

“SFH rungs going to be if prices correct some?”

I did exactly same comparisons by using BC Assessment Value for few houses in Estevan and Mt Tolmie. For all the bad years, Mt Tolmie always had higher price drop than these Estevan. In 2002, all these houses in Estevan were in the $200k-$290k range and these houses in Mt Tolmie were in the $150k-$220k range. In 2018, these houses in Estevan were in the $1M-$1.2M range and Mt Tolmie were in the $650-800K range.

I know the limitation of BC Assessment Value and may be just coincidence, but these few collected samples was part of the reasons to support my decision.

Excellent question Garden Suitor: Love to hear some analysis on this.

Back on topic, what is the difference between SFH rungs going to be if prices correct some?

We’ve got an Oaklands bungalow, bought for the median SFH price in mid 2016. We’re considering a move up in the next 5 years depending on life and market conditions.

If prices drop say 20%, would that be reflected proportionally both on our current house and say a Fairfield SFH? Does the nominal gap between the two stay the same?

I don’t know Leo, I think Patrick saying “let them eat cake” a few more times might crack the medical system problem.

“ 2) Brokerage data call

BCFSA has approached all brokerages in BC to request that they share data around sales transactions for the last week in February 2021 and February 2022. BCFSA is hoping to use this data to inform what consumer protection measures they will recommend to government. BCFSA intends to leverage insights from data for rationale for regulation change. BCFSA requires this data by March 11 because they are delivering their recommendations to the government this spring and want to have the weight of any data to assist decision makers.”

Maybe connected to the cooling off period but maybe something else as well. They’re gonna get a ton of unconditional offer transactions there!

Money laundering audits dropped precipitously during the pandemic.

https://globalnews.ca/news/8585741/canada-home-prices-skyrocket-covid-19-real-estate-money-laundering-audits/

We need way more transparency on the federal level. Similar to the immigration backlogs it feels like the feds had a huge productivity problem when people were working remotely. Someone needs to look into it.

I don’t think you’re going to solve the medical system here folks. Can we get back to topic?

Nothing to wonder about Barrister, you’re paying for it out of your own pocket.

One has to wonder about a situation where one can get a CT scan for my dog almost the same day but where there is a six month wait for people. Personally I like dogs better than people but nevertheless this seems a bit strange.

In terms of private scans and treatment Seattle is still an option for many people.

Using American facilities does reduce the line for Canadians. I had excellent treatment in Rochester when I lived in Toronto.

What’s your solution?

Absolutely have a problem with that.

It should be needs based. The lines should be shorter all around.

You’re the one on this forum telling us that the system here in Victoria for finding a family doctor or wait times is not “acceptable care.” So why would we stick with a “unacceptable” medical system like that without at least trying adding some optional private care. Private medical care solves that “unacceptable care” problem immediately for those who can afford it. For the ones who can’t afford it, there are the longer term solutions (hiring nurse practitioners) being implemented by Adrian Dix that he hopes will fix things. If you have any better ideas for a quicker fix, make sure to share them with Minister Dix.

here is your quote about that…

“There is most definitely a shortage of family physicians attached to patients in Victoria. I did not comment on this shortage as a GP shortage and my main issue with your comments was stating that the current state of affairs was acceptable care.””

The cooling off period seems like a terrible idea, for obvious reasons. I really hope they don’t do that. Transparent bidding would be more effective, and fairer for everyone concerned. Neither would be as effective as steamrolling over the NIMBYs and municipal bureaucrats and building more supply, but unfortunately there’d be a time lag before any effect would be seen.

No one is telling you or anyone to go to Vancouver for an MRI. It is your choice… Stay home, wait 6 months – great! But what a great thing that there is an option for people that are able to pay, and want to get the test sooner. I’m assuming you don’t have a problem with that, do you?

Under the Canada Health Act the province must provide all residents reasonable access to medically necessary services and access must be based on medical need and not the ability to pay.

Funny that we have devolved into a conversation about denying yourself health care because you won’t pay for it.

Fact is, many can’t pay and legally they don’t have to and we see the disastrous results of a for pay system just south of the border.

Funny that people easily spend thousands of dollars on their pet, yet deny themselves the opportunity to get help for their own health issues.

Never said that. Weird lie.

Never said that. Again, weird lie.

What I was answering was your question, “why wouldn’t you use that clinic instead of waiting months for the government line to get to you?’’

And my point is that the majority of Canadians are not in a financial position to prioritize a $1600 MRI for their back vs. waiting for a covered one. I’ve been there myself. Back pain is generally not life or death. Even in the current system if you have a recognized potential life or death issue you’ll get seen quickly because of triage. It is the preventative, non-urgent and attached care that is lacking. Most people will wait for covered non-urgent care.

Maybe my MRI test is negative, changing my prognosis and therapy, allowing me to return to my construction job sooner. My wages generate taxes which help pay for your free MRI test and additional health care staff allowing you to get surgery sooner.

Good grief. I’m not talking about a real case or a real person. We are talking about if people’s access to private medical care should be limited, because rich and poor don’t get the same access. Should I be able to stop someone else getting private health care?

Then why are you posting it on a public forum?

If someone spends $1,500 on a weekend of booze and partying in Vancouver, you have no problem with it, but you have an issue if they want to spend their money on their own health to get a private MRI? Excuse me, but this should be none of your business.

The MRI done 6 months earlier does allow in a way to jump the line. It allows for an earlier surgical referral if something is needed to be done (a diagnostic is a diagnostic). So, you can get a 6 month head start on the next wait list of 2 years for the surgery. Or if you just want to pay for the surgery, you can decide between the pain management, loss productivity, quality of life or waiting the 2 years for a free one.

If Patrick and I both need an MRI for the same knee injuries, but he pays $1300 for his today and I wait 6m for my free one, who gets surgery faster in the public system? What do you do with results from a private MRI? Does he go on to further jump the line for free surgery because he has his MRI sooner?

It will be interesting to see what happens. Strata title was enacted in 1969, so we’re just coming up on buildings reaching their 50 year design life.

So your question is, if you have a sore back why would you not pay $1600 (gas/ferry/fee) to go to Vancouver to have a private pay MRI the next day rather than wait months for a no cost MRI? So many people are in the category where this would be a low priority or unaffordable expense.

Units under construction ticking up again after a couple years slow decline from peak

To be clear, my comments about 11 days wait for a tele-medicine being acceptable were referring to “now, during peak cases of a 100 year pandemic”. It’s clear that the health system is under heavy stress now and we should expect longer wait times.

As an aside, I think we’ve all noticed that the waiting times for everything have gone up, not just to see a doctor. I don’t know about you, but the way I see it, many of us are sitting at home 24/7, doing more and more clicking on screens requesting “needed” products and services . And so we aren’t in any position to complain about it. Just be patient and grateful, while ‘skip-the-dishes’ brings your dinner, doctors appear on your iPad for free, and the postman delivers your house assessment with news that you gained $200k tax-free on your house by doing nothing.

“Means nothing, how much above current market value?”

Well it would probably be ~20-30% over what we paid last year. It’s a early 90’s built complex, but in great shape generally. I figure if we sold it in 5-10 years, it’d be worth more than that, without having to wind up the strata.

You’re someone on this site that’s been complaining about unacceptable waits for primary care that you’re receiving under the government system. Most private care I’ve seen has excellent care, and ultra-short to no waiting times.

For example, this private MRI clinic in Richmond gets you a MRI next day for $1,300 CAD. https://prioritymri.ca/ If you take that, instead of using the government system, it means shorter waiting times for the public system too. Now if you needed an MRI for a sore back (with a referral from a doctor), why wouldn’t you use that clinic instead of waiting months for the government line to get to you?’’

Really difficult to pull off, you need 80% of registered owners in favour…. It is not a quorum vote like you would have at an AGM.

Means nothing, how much above current market value? You would be a fool not to sell at 50% above market value imo. Most likely developer would allow a rentback so you would have a ton of time to shop for something else.

Cadborosaurus,

I agree that 1200 sqft is doable for a family (we used to have a 980 sqft 3bed/1bath old bungalow).