No gain in affordability, but conditions have improved

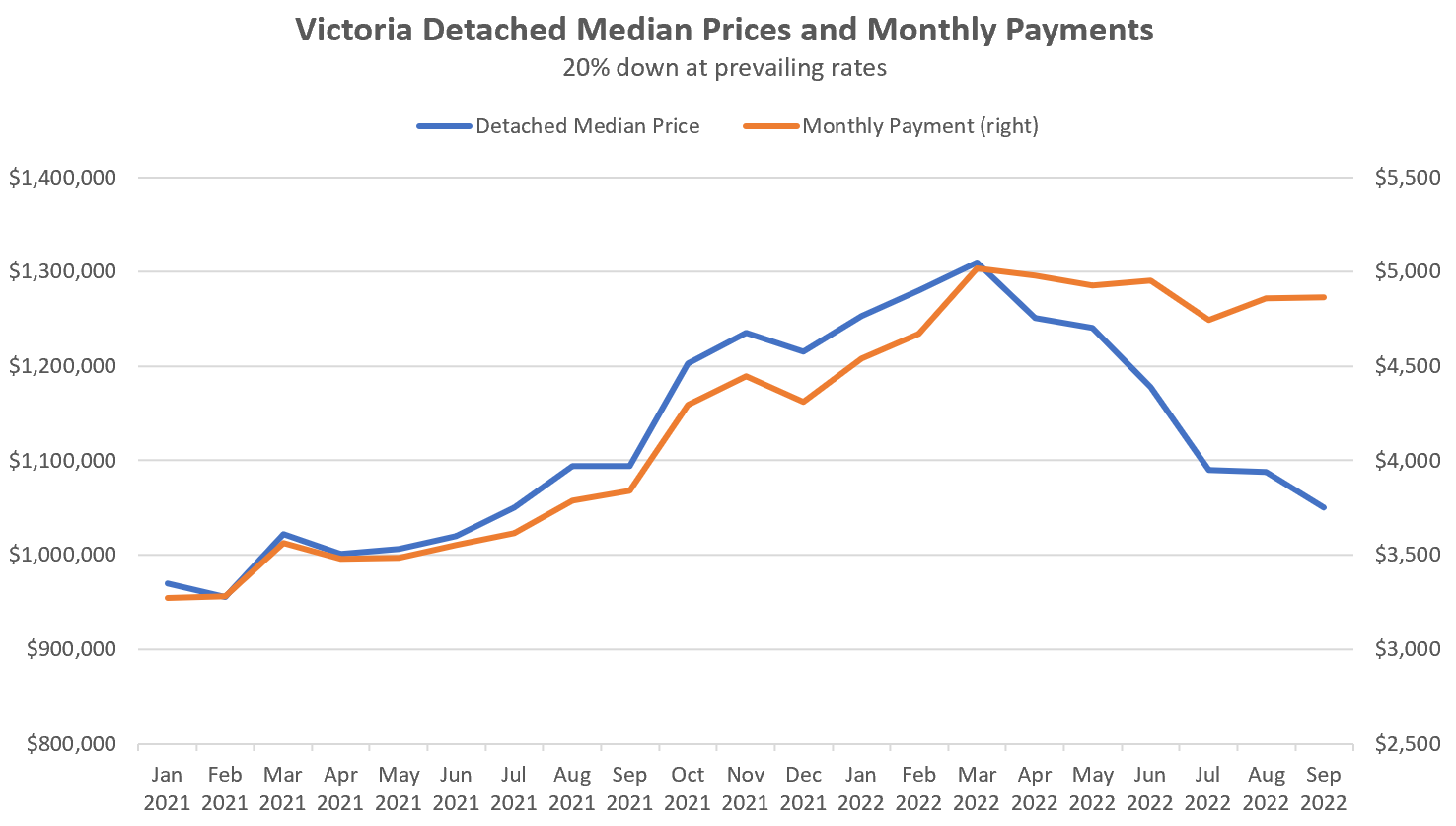

Last September the median detached house sold for $1,093,750, which at an average 2.3% mortgage rate and 20% down cost $3840 per month. 6 months later in March the median price had jumped to $1,310,000, which at a typical rate of 3.1% worked out to $5016 per month.

That was clearly the affordability limit for many buyers and as rates spiraled upwards, prices began to fall.

5 months later, the median detached price had given up all the gains to land at $1,087,500 in August. However due to an average mortgage rate of 4.5%, mortgage payments on that house had barely budged at $4859 per month. With September’s rate hike it seems that month to date medians are down again to compensate.

Setting aside income gains, it seems as if the situation has not improved for buyers with the median house still costing about as much to own on a monthly basis as it did in February. But that’s not the case. If payments are equal, it’s always better to buy a home at a higher interest rate and lower price than the same home at a lower rate but higher price. Firstly the down payment and transfer taxes are less at the lower price, but any given prepayment also has a greater impact on the smaller mortgage (example here). In addition, buying at the higher rate reduces rate risk.

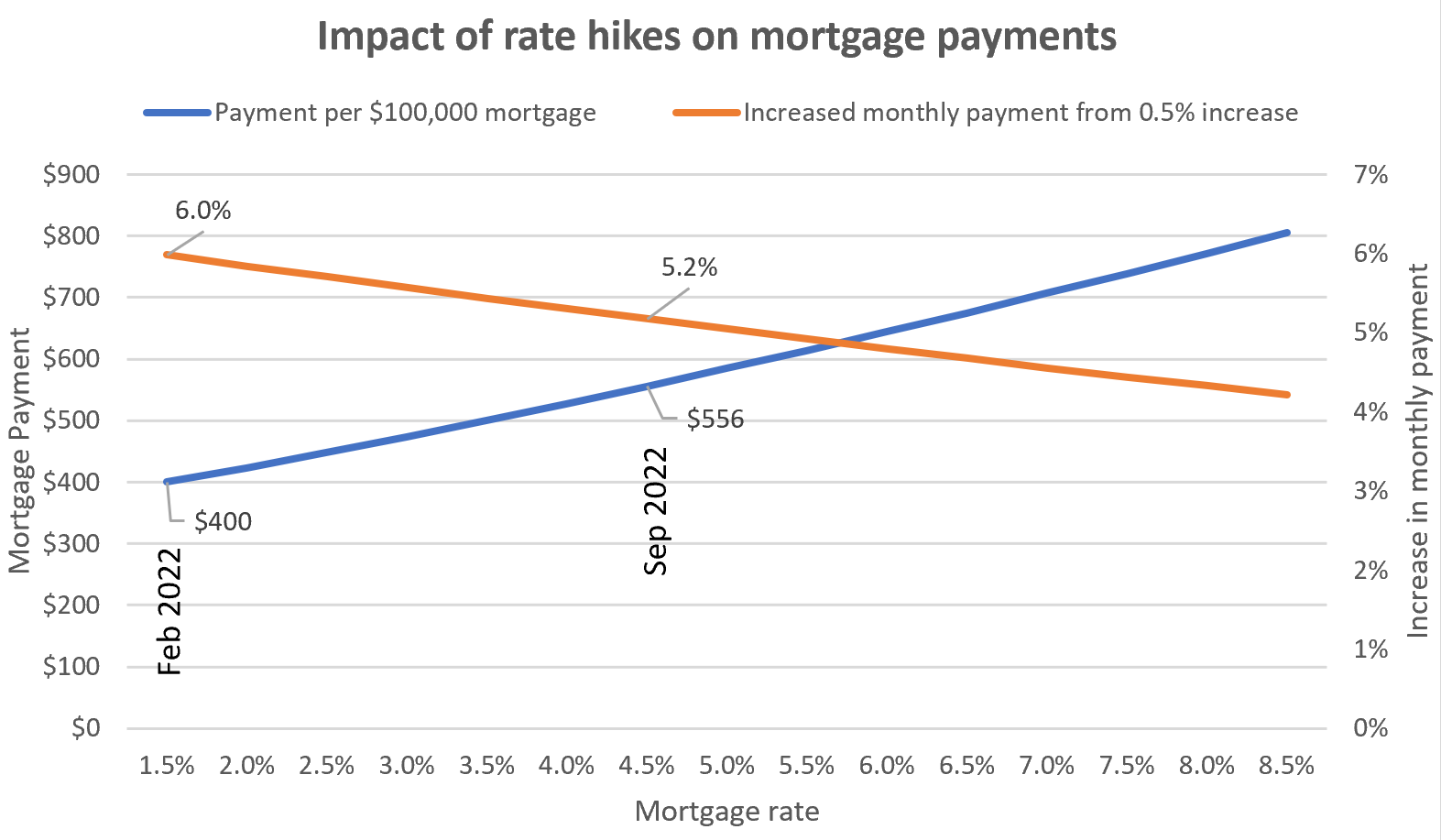

About a year ago rate risk was extremely high. Bond yields were keeping fixed rates at incredibly low levels, while the overnight rate and associated variable rates remained at the effective lower bound. In February I analyzed the risk of going variable and though I didn’t expect the huge rate hikes that were coming, it was clear there was a serious risk of variable mortgage payments rising substantially and putting budgets at risk. Since then the Bank of Canada raised faster and further than anyone expected and that situation in fact materialized. For anyone with a floating variable rate, their monthly payments are up some 38% since then.

Today that rate risk is lower for two reasons. First, rates no longer have nowhere to go but up. While rates can (and almost certainly will according to the Bank of Canada) continue to increase, by definition we are closer to the peak for this cycle’s rates than we were 6 months ago. Secondly the impact of rate hikes decreases somewhat when we start from a higher base. The last 3% resulted in about 38% increase in mortgage payments, but if we jumped another 3% from here, payments for a current buyer would rise “only” 33%.

Back in the 80s speculation seemed to have more legs, and prices kept rising while interest rates jumped, bringing (un)affordability to unheard of levels and leading to a price crash. Though affordability remains very poor, it seems like we’ve avoided that situation this time around and dropping prices have drained some risk out of the market for the time being.

Also the weekly numbers courtesy of the VREB.

| September 2022 |

Sep

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 51 | 131 | 239 | 761 | |

| New Listings | 101 | 384 | 701 | 978 | |

| Active Listings | 2072 | 2152 | 2229 | 1124 | |

| Sales to New Listings | 50% | 34% | 34% | 78% | |

| Sales YoY Change | -41% | -47% | -47% | ||

| Months of Inventory | 1.5 | ||||

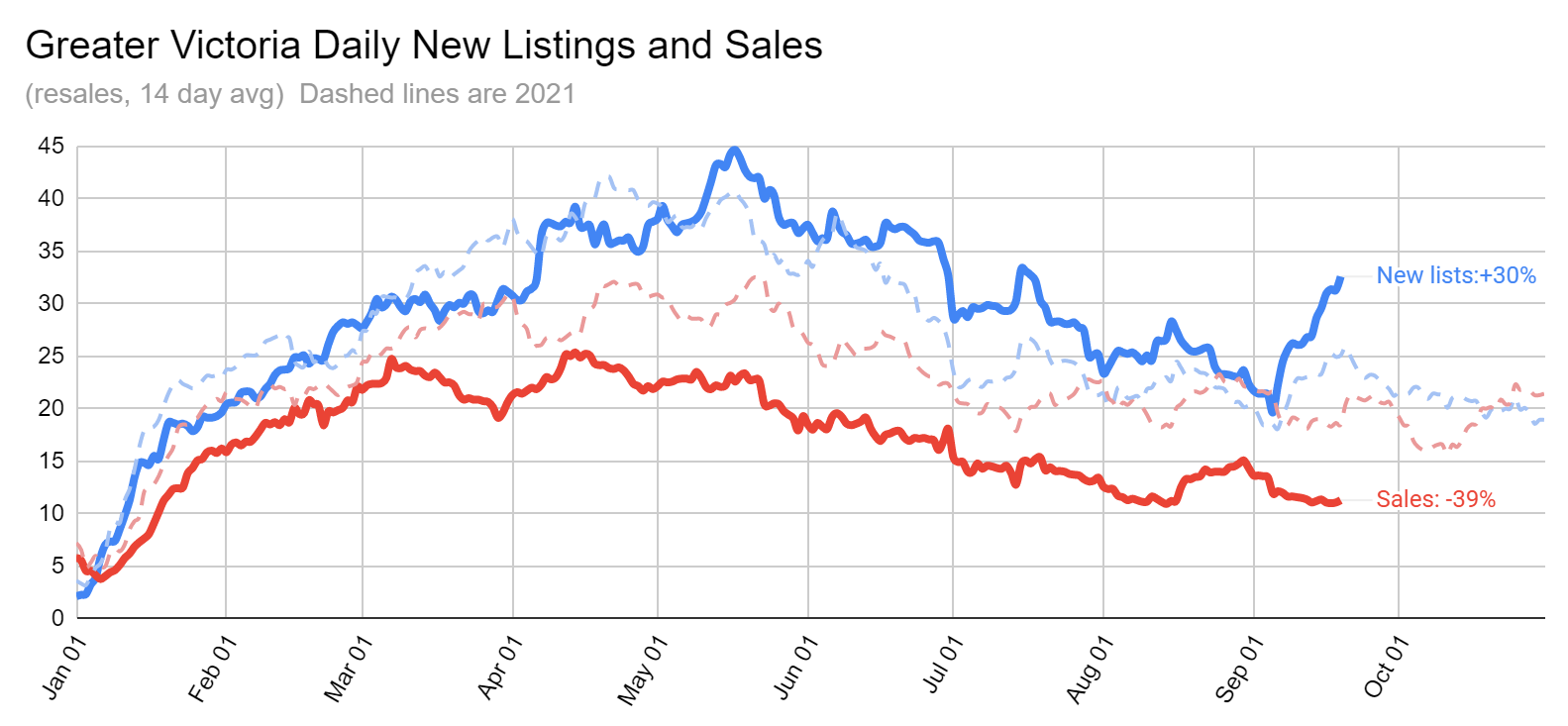

New listings remain strong so far this month compared to last year. While for all properties (including commercial), listings are up only 14%, in the last two weeks residential resale listings are up 30% from the same period last September. Still too early to tell if there are distressed sellers among the group, but the next two weeks should clear that up. We would normally expect the fall listings rush to peter out around this point.

That’s continued to drive inventory up which is expected for this time of year as fall listings come onboard. Expect some increased sales and listing cancellations to work against that trend towards the end of the month. Normally September ends with about the same level of inventory as August, and then the steep slide into the winter begins. We are up substantially over this time last year, but still have not built up enough to recover the level from two years ago.

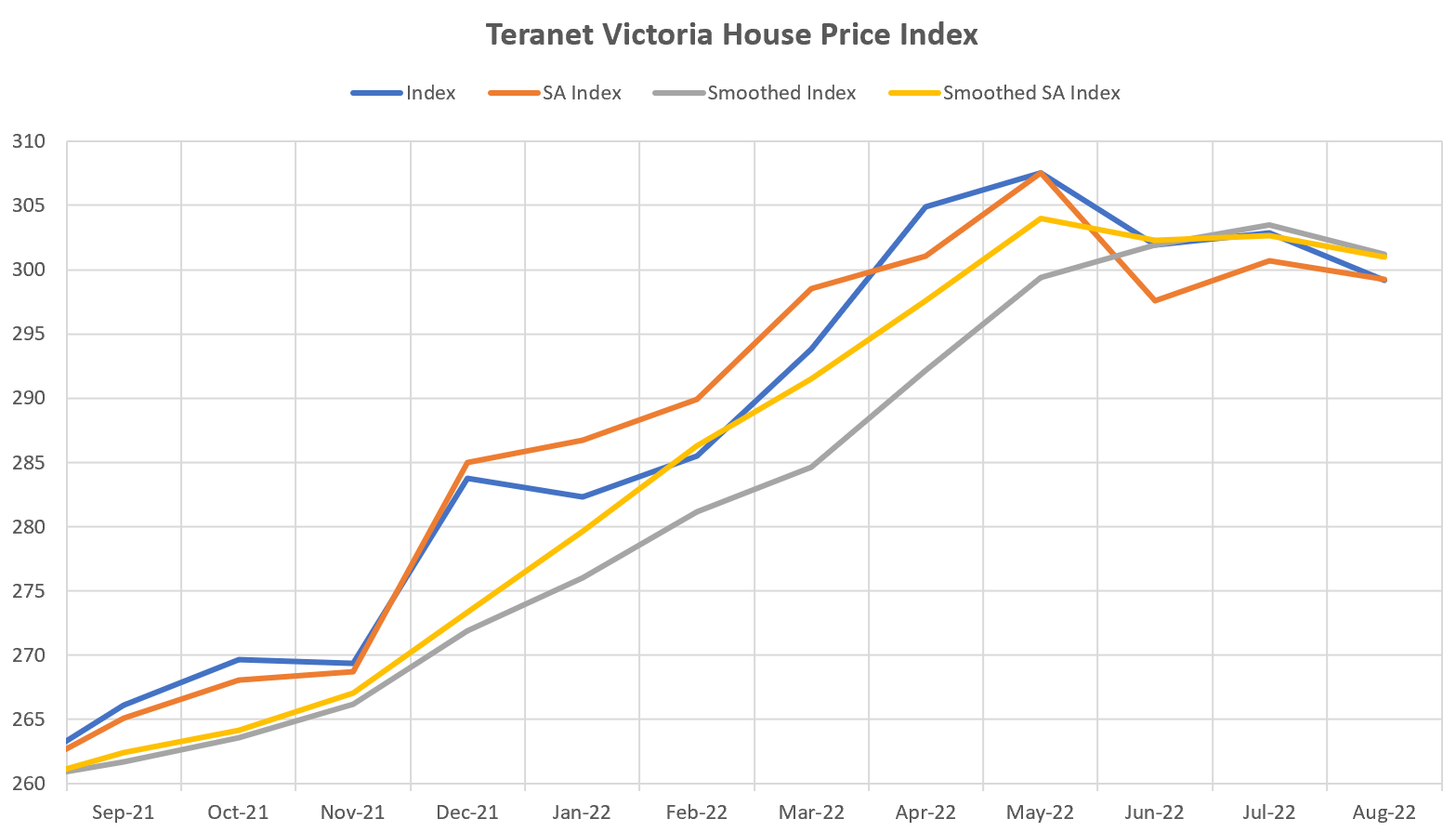

House price indices have had a rough time dealing with rapid shifts in the market, and the MLS HPI seems to have been hit worst of all. Even today it says that detached prices are still up 5.8% from February, which of course is total nonsense. CREA hasn’t said a word about their broken tool, but the folks at Teranet have recently recognized that their repeat sales index was slow to react and have now released an unsmoothed version that should reflect current conditions more accurately. Note that the Teranet house price index is based on the date of completion when title transfers, which is generally a couple months after the contract is signed. That means Teranet data for August represents deals made around June and explains why Teranet shows a price peak in May instead of Feb/March like we see in median and sales/assessment data.

It’s clear that the raw index is more responsive than the smoothed index. However it still seems to significantly understate the decline, putting the market at 3% down from peak instead of the approximately 10% indicated by both the median price and sales/assessment ratios (to June to match the Teranet lag). However over longer periods there is broad agreement. Median detached prices are up 45% since the start of 2020 while the Teranet index is up 43%. The MLS HPI continues to insist prices are up 57% in the same period. Assuming the HPI eventually comes back to earth, it’ll be interesting to see if CREA will feel the need to explain when their index continues to show big price declines even after the market stabilizes. 🍿

Do you get what the people want? Or what the developers find the most profitable to build.

The missing middle has eliminated the option for many of staying within the same neighborhoods. Once someone’s household size grows they have limited options to stay in the city. They have to move from a small condominium to either an expensive house in the city or move to a less expensive house in the suburbs. We have to close the gap between a condominium and a single family residence.

That current situation could be a problem in the future for Victoria City as unemployment rises in the 20’s and 30’s age group in most recessions. Those small condominiums go vacant and take a longer time to sell or to rent. And if we enter a prolonged recession then these units could default with unpaid property taxes and strata fees and remain empty.

Victoria City has put a lot of its eggs in one basket.

I would have personally liked to have seen a more equitable mix of town house and condos being built in the city. But I don’t think we could do that now. We could re-zone those neighborhoods with big lots for town houses but I doubt that will go over well with those that live in Rockland. Now there are neighborhoods of older housing in Mayfair , Gorge, Vic West, and Hillside on smaller lots but the cost to assemble these smaller lots into strata titled town house developments would likely not be economically viable.

If we want to solve the housing problem then we have to stop doing what we have done in the past because it doesn’t work. We need to think outside of the box and yet still make these developments profitable for private enterprise to encourage development. Re-zoning alone will not solve the problem.

You get what people want, detached houses.

Totally agree. There’s definitely a long list of things that should be reformed, and in some ways it’s easier to change and in many ways its much harder because it’s more of a staff culture thing than a bylaw problem. For example way too much staff time gets wasted on aesthetics and bikeshedding. Limiting planning staff and design review panel feedback to a very strict set of areas like accessibility, safety, and functionality would be great but unclear how to approach it. We’re speaking with some retired city planners right now on how to best approach the smaller tweaks to try to come up with a strategy for this post-election.

Yeah that’s what I heard later as well. Quite possible that next year will be a banner year when those deferrals show up. It’s convenient to squeeze the unions during collective bargaining time.

The only thing worse than being blind is having sight but no vision.

Helen Keller

VicREanalyst The old pictures for Anna Clare are online, on the HatterKing website.

Doubt very much whether if it would make a difference as to whether to put in a suite – and I’m pretty sure suites are going in almost everywhere they’re allowed these days anyway. It would just be a gift to the builder.

If you want more density, just zone for it as an outright use and let the market do the rest.

Those houses in topaz heights have 7’ basements, and many have unauthorized suites already.

The flat roofed houses on alder back right on to blanshard. Can’t see someone tearing it down to build a new SFD. And fwiw, they are solid little houses that are fairly easy to update.

Now if the City were to refund all of its charges if I built a house on the Alder site that had a basement suite that would be a way of providing more housing. How many of you think that has ever crossed their minds?

Nice sale of a 5,600 square feet lot with a small tear down house on Alder that sold for $655,000. Probably about 40 to 50 to demolish and dumping fees makes the lot worth about $700,000. Had to pay between $750,000 to $800,000 for a city lot six months ago.

Almost worth looking at buying land in the City again. – Almost

We’ve been increasing density by building more 1 & 2 bedroom condos yes, but the majority of the land is still taken up completely by single family housing. So opening up new areas of development hasn’t made the problem much better. You get bigger cities with the majority of it taken up by roads, and yards, everything is spread out which means you need more commercial services to service those new areas.

So we have a general consensus on how to solve the housing market -build more. And how is that really different from what we have been doing for two decades by increasing density and opening up new areas for development? Has that made housing affordable?

I would rather have sustainable long term growth at a lower rate than have boom-bust cycles. It’s too late now. The horse has left the barn. We chose years ago, to become another Vancouver. And I don’t think that’s a good thing.

Hey Leo, thanks!

If I’m reading that list right, looks like the last point on the HfL platform is the one that has to do with red tape. I’m curious if you have a much more detailed version of it in mind. For example, if the extremely enthusiastic woman down our street ends up getting a seat on the Central Saanich council, could she be presented a list of suggestions for where to begin? (Seems like a war on two fronts has to be fought: zoning, and obstruction.)

By the way, a couple weeks ago you mentioned that UVic is facing a shortfall on account of drops in student enrollment. They have yet to confirm it in official University-wide communication, but informally it’s been passed down to the various Faculties so that Departments can begin planning accordingly. Apparently the drops in international students are supposed to have a lot to do with IRCC being slow to grant study permits, an issue seen at other universities throughout Canada, although when it comes to the shortfall the claim is that it has more to do with COVID-related fallout than enrollment. (Although since there hasn’t been much transparency on the subject it isn’t really clear one way or the other.)

Here was our top 7 and part of how we evaluated candidates. Certainly not exhaustive. Basically legalize more housing forms by right, then shift staff resources from mostly slowing down market housing (which takes up most of their time now) to speeding up non-market housing (which requires a lot more effort and subsidy to get built).

Anna had a substantial upgrade that effectively updated the home from a mid 1990’s boring standard quality house to one that is now effectively a semi custom home of only five or ten years old. But it isn’t just the house. The land the house rests on went up in value by $250,000 too. If the house and yards had not been updated it would only be worth around $1,350,000 today.

And depending on if the renovations have been completed in the last six months, staging of the interior, or if it is a real estate agent’s own house it will get a premium price in the marketplace of an additional 2 to 5 percent. It’s a “turn-key” property and that is worth paying a little bit more for some buyers. It only takes two prospective buyers to compete against each other to drive up the price.

Does anyone know what 1417 Anna Clare looked like when it was sold in Dec 2020?

A bounce is expected as those that were fence sitting took the plunge as they had a rate guarantee and the prices dipped. It’s a “W” shaped correction.

Lol, still bitter about being labeled slow?

My problem with the “hot dog party” discussion is that your local bank mortgage person likely has zero idea about the macro picture and most likely never seen a full housing/interest rate cycle through. I would not pay any attention to their forecasts and only put weight on the current stats they have access to.

And there are still people who doesn’t believe interest rate drives the housing market……

b-side issues:

Unlike regular bank mortgages, B-side are generally 1 or 2 year terms (some do 3 year but they aren’t common according to my friend who works on the b-side) so we should see the impacts of this sooner rather than later.

Closing in on 3.5% 5 year bond yields again here in Canada. US bond yields have gone bananas, 2 year @ 4.3% today. CAD dropping hard. Funnily the least volatile thing in the market right now seems to be Bitcoin.

So here’s a question to Leo, Marko, and anyone else that feels like they’d like to chime in.

When it comes to removing red tape, obstruction, unnecessary delays, etc, what is your wish list for “what is to be done”? Specifically, what are the easiest local changes that could be made in such a way as to get the biggest benefits for future development and sanity more generally? That could potentially be implemented by sane additions to CoV/Saanich/Peninsula councils in the years to come?

That’s a believable story to me as I track pending sales. They are way down. At this moment there are only 153 pending house sales in the core. That’s slim pickings for mortgage brokers to make an income these days.

Only two things are infinite – the universe, and quotations dubiously attributed to Einstein.

Whoops we have 750000 more people so it doesn’t look so bad lol

Guess that August bounce was just confined to August after all. Same thing happening in Vancouver, the signs of life in August died again

Wow and we have added 2 million people since then crickey

Wonder if we will clear the all time (since 1990) record low of 395 sales seen in 2010. All time record high is 2020 with 989 sales.

Month to date numbers:

Sales: 317 (down 49% from same time last year)

New lists: 943 (up 16%)

Inventory: 2284 (up 96%)

New post tonight.

I’m sure Albert Einstein knew the difference between about and “bout” Haha!

Albert Einstein said: “Only two things are infinite, the universe and human stupidity: and I’m not too sure bout the universe.”

House sales are obviously down in a major way so it is not exactly a secret that mortgage originations would also be down. To me that is stating the obvious.

That a lot of first time buyers with triggered mortgages have trouble with coming up with an extra six or seven hundred a month strikes me as being almost self evident when one also considers that inflation is also ravaging the pay cheque on every front.

Maybe someone here can get an approximate number for how many mortgages have triggered in either the province or the country. I would be rather surprised if the banks were at all prepared for these numbers over a few short months and that the mortgage departments feel swamped and that there is a scramble to figure out how to ensure that defaults are few and far between.

Bank managers are far more indiscreet than one might think. It is not like any of the above would be really be considered as confidential.

There is a real likelihood that interest rates will continue upwards and possibly more than some people think. There is also a real possibility, although only a possibility, that the housing market will suffer a major setback and one that might last a decade or more.

I am sure that a number of people would prefer that any mention of a possible housing decline be dismissed but lets not bully people on this blog.

I would strongly hope that a manager level employee at a big bank would have more professional discretion when out amongst mere acquaintances than to have a ‘rant’ like this.

He lost me when he referred to it as a “social.”

Oh very upscale and classy, a Scotch tasting you say? I actually read in another comment section on the internet that renters attending free and unsolicited mortgage broker TED talks like this are the leading cause of diminishing down payments for FTHBs

I’m curious why so many are doubting Umms story? What about it specifically doesn’t sound realistic?

Umms discussion was actually with DebtMonster.

Folks, take it any way you want, the person is barely an acquaintance and they were holding their rant in front of 6 or 7 others. I guess we’ll just see what happens with the actual numbers to find out if it has any substance to it or not. However, hotdogs might have been a good addition to the scotch tasting, I will pass on your pairing suggestion.

Yes it does rather sound like a ribeye dinner tale. However in this case it all sounds very believable to me. I bet it’s either the truth or close to it.

We’ll soon see. Lack of applications for mortgages would be reflected in lack of sales. Owner distress should be reflected in increased new listings

Lol

Time to bust out the HHV polygraph.

Sounds about as believable as barrister’s ribeye dinner. Was VicREanalyst also at the hot dog party?

Sounds like quite the TED Talk, can’t believe it wasn’t at a backyard BBQ where others get their info. How long ago did this drunken dispenser of free advice complete their few week long course to become a mortgage lender?

Had an interesting chat with a mortgage manager from a big 5 bank who had few too many drinks at a social the other evening. They started offering some current mortgage market insights without any prompting or discussion on interest rates and real estate. Apparently, mortgage originations have just cratered with few new purchases on the horizon (even with seasonal variations factored in); also, they said increase in rates (with the trigger variables) has caused more havoc then anything they forecasted and they are slammed with with trying to refinance folks right now. They stated they are being overwhelmed with distraught people that don’t know how they can manage a refinance (the surprise to me is that they reference amounts between $500 to $800 month in mortgage change was breaking some folks, to me that seemed very low sum of money to do that). As well, they mentioned they haven’t seen things this bleak before and the downturn has blown past all their estimates. They ended the chat with saying they tossed their forecast because they had no idea where things are going and they are working day to day without an idea what the bottom will be in prices or a possible end date to the downturn before a recovery.

Here an example. Christine Lintott is an architect.

Solve one problem then move on to the next.

I think people also underestimate how much time of extremely smart people is wasted on things that never happen. Architects, engineers, planners, consultants, all spending hundreds of hours each year on projects and proposals that will be abandoned or revised another 13 times. What if we didn’t waste their time, perhaps they could put some of that time into improving construction productivity.

“Importing more workers to build more housing cannot support prices beyond the short run, for the simple reason that they soon build more units than they require to live in.”

That’s exactly what we need: for the supply to outrun the demand for a few years until we get to the point where affordability returns to reasonable levels. What I find absolutely tragic is that so many people got so brainwashed that they now accept the status quo as unavoidable even positive and will argue that having affordable housing is somehow impossible in Canada due to some insane reasons like not enough buildable land etc. If Canada doesn’t have enough land then where do people in Japan, China or Europe live??? I’ll give you a hint – definitely not in tent cities like lots of people in Canada.

Importing more workers to build more housing cannot support prices beyond the short run, for the simple reason that they soon build more units than they require to live in.

Anyone who thinks otherwise should take a look at what happened in Ireland circa 2008.

A lot of redtape actually increases labor and material demands. For example, hand de-construction. For example, COV requiring full sidewalk replacements of perfectly functioning existing sidewalks when you rebuild, etc. We just spent somewhere around 70-80k on what I call the “sidewalk to no where” in the Oaklands area on a small home. I made a video about it last year https://www.youtube.com/watch?v=s6aSPG47AQo&t

Secondly, if a builder or developer doesn’t have to wait years for permits and rezoning that means they have smaller carrying costs and they can make the same profit by spending more on construction (labor and materials). If you increase what you are offering to pay for labor you have more people that opt into that career route. A lot of materials are also a global market so whatever we do in Canada has no impact on something like the price of steel, for example. Labor you can also further solve by improving immigration policy and bringing in labor versus high-educated immigrants.

We need to tackle a bunch of problems and it makes senses to start somewhere.

It sounds like the general consensus on this blog is that we can solve the housing issue by speeding up the application process.

Now how is that going to solve the supply chain problem of workers and materials by increasing demand for more materials and labor. How exactly is this going to solve the problem of importing more workers to build more housing that increases demand and home prices?

The funny thing about constructin a house is that the sub trades build the house not the builder His role is to have game face ( a short fussed dick ) and write checks on Friday Not sure what the test accomplishes

It isn’t a conspiracy. It is simply human nature. Why wouldn’t you want to protect your own position and create job security by introducing redtape? Understaffed doesn’t mean anyone is working after 4pm or weekends it just means they take 2 months to get back to anyone.

I’ve received thousands of emails in the last six years for the owner builder study guide and probably the number one comment is “we don’t have any licenced builders in our area.”

There may have been a bit of lobbying from builders but the vast majority of builders could care less if the occasional owner builder is doing a build. I certainly don’t know any builders who care.

When it came out it was touted as the first of its kind in Canada and how smart BC Housing staff was for introducing it and protecting the public from the evil owner builder.

I honestly think it had more with one particular executive flexing a stupid idea vs lobbying.

Yes, exactly this.

No idea about city hall. Maybe the permit office is full of tyrants trying to ruin your day, but I somehow doubt they operate with that much autonomy. But I really don’t know, so maybe you’re right.

As for the owner builder exam, what percentage of homes were owner builds prior to then exam? I seem to recall it was substantial, like 15 per cent or something. If true, that would be a pretty big chunk of the pie. Why wouldn’t builders also want that chunk?

By the way, I’m not arguing that we’re not over regulated. We are, but I doubt it’s because of some deep state conspiracy in the permit department.

Days of the small time builder are numbered. The government (BC Housing, munciaplities) have set things up so only huge builders can make it.

This is a small example, but it gives you the big picture. A small builder has to take a week of courses every year to maintain licencsing with BC Housing which takes him or her off the construction site for that week.

A large builder can send a “nominee” aka literally anyone from the company to do the courses.

Wonder what that chart looks like for high ratio mortgage balances, i.e. recent buyers. That’s where it really matters IMHO.

Marko I’m in the same camp I don’t know how small time builders can do it building today it will shorten your life span I c no change coming just more of the same You cannot build affordable housing today but you can build more expensive housing

Not sure I understand. The folks without secure housing aren’t going to be mollified with ineffective small changes. They will remain mad until their housing situation improves.

+1, when the City of Victoria removed the rezoning requirement for garden suites, almost immediately the owner-builder exam was applied to garden suites.

Obviously the removal of rezoning was in the news, the added barriers were not.

Current mortgage book in Canada.

So Lisa Helps goes down to the the building permit department and gives staff instructions to increase building permit wait times and asks them to add a bunch of non-sense to the permit checklists making the process of building more and more complicated every year? I often get emails from COV apologizing for not reply in two months because they are short staffed, but the problem is what I need from them (inspection of boulevard grass) or some nonsense is complete nonsense they brought in. They bring in red tape and then they don’t have the resources the to handle their own red tape.

Too many exaples. On a recent project they made me hire lawyer to draft some stupid bond agreement for a sidewalk then that person left the COV and others don’t know anything about the agreement and I am having to explain what is going on. Complete joke.

What executive is going to go into BC Housing and cancel the owner-builder program? It would mean firing an entire department. I am sure they would be super popular.

As I’ve mentioned on HHV last six months even if we get past the politics (i.e. something like missing middle is voted through) we are still screwed on the beaucratic front and this is why unlike Leo I am not optimistic on housing long term. The beauracy is suffocating and historically speaking there just aren’t good examples of beauracy decreasing.

There will be an opportunity to buy in the next 6 to 36 months and then we are back to the same old non-sense of no inventory.

I’m a one issue voter this election, housing or gtfo. Leo I really appreciate the work you are doing with Homes for living, it saves a lot of time trying to sort the information.

I’m finding in conversations with people that it doesn’t take many steps to relate many problems to lack of housing. Homelessness, cost of living, staff shortages, infrastructure, lack of services, traffic? To borrow from James Carville, it’s housing, stupid.

Well I suspect that the outlying suburban areas will be impacted due to a higher level of job losses and underemployment. My assumption being that a greater portion of the population in these areas are dependent on construction related jobs than those in the inner core.

One way to falsify this assumption would be to watch the number the number of homes that are being offered for sale vacant. As I suspect this will increase as those in construction pack up their bags and leave the island returning to where they migrated from such as rural BC and Alberta.

.

@Leo i agree that there’s a tipping point and too many unhappy people will lead to change. But that suggests that we can keep just under that tipping point unhappy indefinitely and won’t have to change. So a few minor changes can cause the scales to tip back – rather than significant social change. What is needed to foster ongoing significant social change must also therefore include a change in values.

Love the grid, Leo.

If you look at the relative placement of indigenous and climate issues for those in their 20s and those in their 70s you get a nice illustration of the difference between those who are wise and those who collect their opinions ready-made from the Twitterverse.

The strategic plan objectives include:

What is meant by “a Welcoming City”?

What we do know already is that north of Malahat has taken a much bigger hit than CRD. In the Lower Mainland the Fraser Valley has taken a bigger hit than closer in. In the GTA, the 905 has taken a bigger hit than the City of Toronto.

But who knows how it will eventually play out.

I suspect prospective purchasers are shifting their buying decisions due to the higher interest rate. Instead of buying in the more expensive neighborhoods they are purchasing in the adjoining areas that have lower prices. Something that is call the ‘substitution effect” in real estate.

ie) Instead of Oak Bay they are looking at Saanich.

My opinion is that it is going to become challenging selling a property in Oak Bay over the next few month. As it is now, there is a lot of inventory to sell and it takes longer to find a buyer. My guess is Oak Bay will be one of the first neighborhoods to transition into a buyer’s market.

And this might cause a domino effect as Oak Bay prices get reduced to make a sale. Then the home sellers in the adjoining neighborhoods will have to lower their expectations to compete against lower Oak Bay prices.

Could we be looking at a top down market correction?

That is why I am more hopeful on housing than you are. All it will take is the folks that are not comfortably housed who are pissed about housing to outnumber those who are comfortably housed and don’t care. Table below is from the Victoria budget survey. Starting to happen now. Then it’s just a question of getting them to vote in effective policy rather than kneejerk nonsense. Also starting to happen in a lot of regions.

“As I’ve mention a greater Victoria owner contacted me about the owner-builder exam and his municipality is requiring a tsunami risk study on an established non-waterfront street because some paper pusher wanted to add an extra item to the garden suite checklist.”

Absolutely insane! How about the government commission a single tsunami study on the whole greater Vic area and then simply base their building permit decisions on that one study instead of every single home owner who wants to put up a garden suit having to pay for their own studies… What a wasted time, effort and money – repeatedly! In order to tackle the housing affordability crises we need the building and zoning process to be completely overhauled (simplified and streamlined), as many obstacles as possible removed, new land opened up for development instead of these useless do-nothing one-step-forward-two-steps-back government changes which are being celebrated as some kind of progress…

Is there a reason you believe this, or does it just fit with your narrative of bureaucrats running around creating solutions in search of a problem to satisfy their lust for more departments?

In my experience, bad public policy usually results from a political decision or in response to lobbying, not because of staff running amok.

Maybe in the spring we will break the 3000 ceiling on listings with sales cratering

There might be a small lobbying component of the builders/developers, primarily builders.

The bigger component, in my opinion, is it was spear headed by an executive at BC Housing to boost her role. Why not create another department? Now she oversees more departments. More managers are hired. More staff are hired. They completely ignored a lot of my FOI requests when I started questioning the exam. They have a monopoly so you can’t get around them, etc.

It isn’t just the NDP, it is all levels of government. Trying to go through the process of getting a building permit for a garden suite in Victoria or Saanich and then report back to HHV. There is a big disconnect between what politicians talk about, “affordable housing,” and reality.

As I’ve mention a greater Victoria owner contacted me about the owner-builder exam and his municipality is requiring a tsunami risk study on an established non-waterfront street because some paper pusher wanted to add an extra item to the garden suite checklist.

The we part is really important. The politicians are a reflection of the people.

Who are the best paying private sector companies on the island?

Say top ten and what % of the island population do they employ?

Anyone?

Do they have pension plans that world equal or beat the government or municipal pension plans?

The mates I have in gov save little to nothing apart from their pension contributions.

Also, seeing quite of few relists coming back now after cancels from the last month or two. Wondering if they are going to be on for the long haul now or they were just hoping to catch that September bump and will cancel again wait for the new year.

Simply not true. There is tons of land with perfectly good climate in Canada. We simply decide not to let people build enough homes on that land.

Where’s the sales at?

You think everyone working in private is hard working and rich? I’ve worked in both and plenty of lazy people in the private sector too. Not everyone can make 100k+ a year that is just facts.

Don’t forget that the vast majority of our land area is virtually unusable. The high cost of real estate is directly related to DESIRABILITY. If you want affordabilty I’m sure it’s better in Prince George. You could move there if you like… Didn’t think so. The USA is almost the same land area as Canada but almost all of it is usable. No surprise housing is way cheaper there, especially relative to incomes.

Time to go get a better job if they’re not happy, but many of them know they couldn’t make it in the private sector.

Canada having almost the most expensive real estate in the world when compared to incomes is equivalent to a person dying of thirst while swimming in a river. We have almost unlimited land and resources and yet somehow we end up the worst off in the world. It’s a totally absurd situation. The red tape is of course one of the main reasons. The totally useless owner-builder exam was created with only one purpose – to force as many BCers as possible to pay the developers. It needs to be scrapped ASAP and it’s shocking that NDP which claims to be pro-affordable housing didn’t do it even while the housing affordability crises has hit the worst levels in decades. It’s pretty clear that the developers have our politicians in their pockets irrespective of the party. SAD!

Could have trained them as IT workers. Because we all know how much we need yet another IT worker!

Or just think how many hours of resources have been spent as a society on fighting to save two trees at 902 Foul Bay….could have probably trained 5 doctors with that many society hours, but as a society that is what we have chosen.

Personally, I am 100% pro BCGEU getting a huge payday for these exact selfish reasons….it will drive up rents (I own rental properties) and it will prop the real estate market over time.

However, big picture. For example, you’ve seen me bitch about the owner-builder exam for years. We as a society have a department administering COMPLETELY USELESS “redtape.” The exam and this department was created out of THIN AIR in 2016. Who knows how many completely useless positions there are throughout municipalities, BC and the country.

Should we have people in completely useless manufactured redtape positions or would you rather have those same people trained as nurses, doctors, etc.

https://www.reddit.com/r/VictoriaBC/comments/xmyi3c/has_anyone_else_experienced_extreme_medical/

I’ll take some medical professionals please and take the risk the my neighbour builds a garden suite without the owner builder exam. There is only the designer, structural engineer, city inspector, and framer left to oversee that a basic 2”x6” structure doesn’t fall over.

Those “redtape writers” are also home buyers and renters. You might think they are getting in the way of you making a living but they are also the ones buying homes from you. Every time they buy a cup of coffee or a car or a home, etc. they are supporting small businesses and the local economy.

Real Estate is the cash cow of an economy and all levels of government take a piece of this big pie. That’s one reason why most if not all government affordability projects are orientated to promoting new construction and not re-sales. They get a bigger slice of the new construction pie rather than a smaller piece for existing homes. And the size of that pie is mostly created by the banking industry as the banks increase the money supply by generating new mortgages.

My impression as well. Suffocating ourselves with red tape. For every person swinging a hammer you have three writing policy on how to swing the hammer.

@deryk i also think we’re in for a hell of a ride in the next couple years bc of fiscal policy. And we are also just now starting to See actual impacts of climate change. I have no idea how that will impact housing markets in the medium/long term but it’s a pretty big wild card. I wonder how insurance policies will change for example.

We absolutely need high levels of immigration to support our social infrastructure and aging population. I agree however with those saying we need to prioritize brining in people who can build housing and healthcare professionals.

The issues and problems in our society are like the spokes on a bicycle wheel.

When one spoke goes, often not much attention is given to the idea that we should have tightened it or replaced it..

Then a couple more spokes go and we sense a tiny wobble but it doesn’t get much more than a raised eyebrow because we are focused on getting to our destination before it rains.

Eventually, that critical last spoke, the one that made the difference between “still functioning” to “catastrophic failure”, pops, and the whole wheel becomes a mangled mess.

Our fate was established in the first spoke that broke.

I think we are all in for a hell of a ride.

Maybe. But I don’t agree that it’s entitled for people, many who are just scraping by, to want to keep up to cost increases. Especially when the BCGEU already gave it to a group of government workers who all make over 100k a year. I can see where they are coming from.

Sure it would, but based on past performance and current political landscape I would dare say anything that get done around here would move at glacial pace. So at the end of the day either we get able bodies to come to Canada to carry the weight of an aging population, or we kill off ourselves with redtapes and over burden working citizens with taxes.

The vast majority of workers out there, union or non, will be getting “effective pay decreases” because raises simply won’t keep up with inflation. That’s why high inflation hurts. So IMO it is a little entitled to demand wages keeping up with inflation. It’s just not realistic now. Members will feel the pain just like almost everyone else too.

Huh? Wanting to not have an effective pay decrease is entitled? I don’t think they are being unreasonable. Also keep in mind average union wage is probabaly like 55-60k. Many make less than that.

They would be fools to vote against the current offer thinking they’re going to get a better deal. The level of entitlement among my cohort of millennials is embarrassing.

I don’t think the people suggesting current immigration levels are too high are suggesting there should be zero immigration, just less. It seems reasonable to think that a more gradual increase in population would give us time to build the extra housing and healthcare capacity needed for more people.

If that was the case they would have accepted the first offer and not voted to strike. I’ve talked to several members who are voting against it and none this far who will vote for it. Also, obviously totally skewed to younger people, but the BC public servant subreddit is basically 100% against it. It’s a large pool but obviously not representative of the BCGEU. I think it will be a close vote – I doubt it’s a blow out on the acceptance side.

Nothing official but ya, word on the grapevine is the vote will be early October. Union negotiators are encouraging a yes on the tentative agreement. It’s not a good deal (IMO) but it will come down to whether the union thinks it’s better than the alternative. My read on a limited number of union members is that they don’t really understand what a good or a bad deal looks like, they just don’t want the work disruption and will vote yes on anything that mentions a raise.

Lol didn’t Steve Saretsky tell people in March that there is no way BoC can increase rates past 2% so keep taking on debt because real interest rates are negative. Then he himself bought property in Calgary in March and now here we are in September with BoC rate @3.25% and oil below $80……

I think OP is conflating Egypt’s new capital with Saudi Arabia’s new high tech city.

I sometimes see mortgage originations reported quarterly by lenders, it is used in their profit forecasts for public corporate reporting to support share prices.

Isn’t Cairo in Egypt?

It’s nice that Saudi Arabia is doing something to help out an Egyptian city.

With declining prices and increasing rates it makes much more sense from a regulator perspective to maintain the stress test. It’s even more important now to mitigate the over borrowing risk and to protect the consumer and system. Still not sure the logic to the argument to get rid of the stress test other than make sure these people can borrow all they can without any extra capacity to get that money into the market before it really comes undone. Anyways, people can dodge the stress test with the non-OFSI regulated lenders. Banks are only stress testing at 7% now…….

Great posts recently, thanks to everyone for sharing their insights.

Does anyone know if real estate purchases are tracked my mortgage origination? For example, are there stats that breakdown when a buyers’ mortgage originated?

Don’t want to see the government fingers in the real estate pie Prefer a good old fashion recession

Who knows if it will come to fruition but i’ve seen a few people talking about this:

Obviously the banks won’t mind earning a lot more interest at peak rates – what was the point of the stress test if they are going to circumvent rate increase impacts anyway? As for OSFI – if they truly are discussing this its pretty sad considering we aren’t even back a year in prices. especially since it likely helped a lot of people by mandating the stress test – what if rates go up another 2% and there is no stress test? bring back 40 year AMs to ensure the precious housing market doesn’t drop in price? Anyway the last OSFI rumor didn’t come to fruition – maybe this one won’t either.

What we tend to do is concentrate growth in just a few cities in Canada which stimulates their local economies and causes more and more people to move to these same cities for jobs. This causes the demand for housing and home prices to increase. Keep building and prices will keep rising.

Just for argument sake, what if we moved the naval base in Esquimalt to Prince Rupert. And expanded Prince Rupert’s seaport for container shipping. That would shift immigrants moving to Victoria and Vancouver to Prince Rupert for well paying jobs.

Saudi Arabia is doing just this kind of thing as it is building a new high tech city to ease the urbanization pressure off Cairo.

https://www.oakbay.ca/municipal-services/building-inspection/secondary-suites

We need immigrants, period. Canada is an empty country with declining aging population where the government provides zero support for local families ($1.5k monthly per kid in daycare – give me a break!). Also there are massive geopolitical risks if we stay with the status quo (US is getting more and more polarized and could slide into dictatorship and China would just love to control Canada with its massive territory and miniscule population). The north is opening up due to global warming and Canada’s territorial claims will get challenged there. The politicians know this and they will keep ramping up immigration as fast as possible. Expect 1 mil immigrants annually in the next 5-10 years (as long as people are still willing to come). The problem is that just like the politicians are unwilling to spend on health care and families they are absolutely ignorant to the effects of this massive influx of people on the housing costs and services – i.e. Trudeau’s laughable and totally impotent plan of building 17k houses in the next X years to combat rising housing costs… This needs to be ridiculed in the media and yet people actually talk about it seriously as if it’s some sort of a break through! Unless we have a plan to build 10 million homes in the next 10 years – nothing will change. To do that we actually need to structure our immigration to bring in trades and skillsets which can help us accomplish this. We need a fast track to get the trades certified when they reach Canada or even before arrive. We need to train more medical professionals and bring more of them as immigrants.

Someone mentioned that we don’t have enough young people. Yes, we don’t and it will get worse because young people would have to be stupid to stay here instead of taking a job south of the border where they will make more money and spend way less on housing. The way things are heading currently – the quality of life in Canada will keep declining unless we radically change direction. If we want to have an ambitious plan to bring in millions of immigrants that’s fine but we also need a matching just as ambitious plan to strategically grow the housing, infrastructure and services to maintain and improve the quality of life (provincial and municipal governments have to be onboard with the huge changes that such a plan requires and this is not currently the case at all).

The USA’s anti-immigrant stance will have an impact as America like Canada needs immigration. America is in a worse situation than Canada when it comes to workers versus non-workers in the years ahead.

Canada is just experiencing temporary growing pains.

Excellent life expectation, but what kind of quality of life can we expect when the bulk of the population required extensive medial care and pensions that retires at 65 and live well pass 80 years?

The fact remain that soon we will have greater ratio of unproductive population than productive population that need expensive care/services for 40 years or more (18 years from child birth to adult, and 20 years at end of life).

And, without immigration of young productive bodies Canada would follow Korea path to poverty in the near future.

Del tree

If we want to maintain a high standard of living we need immigration. I do think we could be smarter about immigration demographics thought. My first hand experience here in Victoria with young Croatian immigrants is IT sector no problem, paperwork quickly sorted out. Spouse lands a BC government job and they are buying real estate (putting pressure on housing, not adding supply through their skillset)

Construction worker working 50-60 hours a week good luck with the paperwork. You simply don’t have enough “points.”

This raises a very good question about “standard of living.” Alternative to mass immigration followed by other countries aside, even if you look at growth in general you have doubt standard of living ought to be essential for happy and healthy families. We don’t need electronics, expensive food, SUVs, and big houses to be happy. What we need is excellent quality of life. And excellent quality of life is about community, hobbies, meaningful work, wanting what you have, health, and yes financial security which is primarily threatened by sky high real estate prices and million dollar mortgages. Not “standard of living”.

There is a reason behind that. Which groups of people are the most against immigrants?

Good points. Government should make an easy path for transition from visa to immigration for skilled trades people like that, who have demonstrated working successfully in Canada on a visa.

We are just at the start of the problem of worker shortage, especially for young workers. It will get much worse

The young workers these days are Gen Z (age 25 or under), not millennials. The distinction is important, because there is a big drop off in numbers between millennial age and Gen Z. Foreign workers/Immigration is the only way to replace these young workers. This problem will get worse as there is no population boost following them.

You can see the drop off in this chart. For example, there are 750,000 (2% of population) less age 15-19 compared to age 25-29. That’s 25% less in that lower age group. So 3 workers instead of 4. And 400,000 less age 20-24 compared to 25-29. So we’d need to bring in that many in this age group to prevent a falloff in population as this group ages.

This isn’t just a “future” problem. We already see it – “sorry, closed today due to staff shortage”.

Next msg

I am okay with less immigration if everyone is okay with a lower standard of living such as my cousin and her family of four in a 532 sq.ft. condo.

If we want to maintain a high standard of living we need immigration. I do think we could be smarter about immigration demographics thought. My first hand experience here in Victoria with young Croatian immigrants is IT sector no problem, paperwork quickly sorted out. Spouse lands a BC government job and they are buying real estate (putting pressure on housing, not adding supply through their skillset)

Construction worker working 50-60 hours a week good luck with the paperwork. You simply don’t have enough “points.”

As I pointed out below, immigration targets DO include anyone who ends up remaining.

800’s was the bottom end for Ardmore around 2018. House must have been needing help then and would have had upgrades since.

Crystal Ball

Even with renovations isn’t that price really low for 2018 ? I don’t remember acreages being that cheap back then

Completely false. Canada let in 90,000 people a year under Pierre Trudeau. Now we are letting in 1,000,000 new citizens over three years not including foreign students, temporary foreign workers, and others who end up remaining. We have higher immigrations rates by far than any other country on the plant. We should bring our intake in line with other western countries such as the US, UK, and Germany.

Anyone who lives in areas of highest immigration are well aware that immigrant families include people who themselves need healthcare and medical doctors. Obviously there have to be limits. There have to be boundaries. We should seek to match source country immigration levels. Wouldn’t that be fair!

The median price for a single family home in the Victoria Core districts increased from $1,052,000 based on 1,043 sales for the six month period bracketing date Dec 15, 2020 to the current 90 day median (292 sales) of $1,190,000 which is 13% increase.”

Thank you WhateverIwantTocallmyself!!!

I was trying to sort it out this morning and the way Teranet stated the number seems to have changed – it was 230 something in Nov 2020 then 260 something in Nov 2021 and for August, it’s not displayed that way.

It seemed to me that it was more than 13% that I was coming up with, from Nov 20 to Nov 21 to Aug 22, but I’m probably wrong. I’m specifically interested in Saanich East actually, not the whole large Core. But Teranet doesn’t break Victoria down.

But thanks again 🙂

Canada NEEDS immigration. These are the working Canadians that are going to support the social programs when we retire. Canada is a huge country with a small population. What we have to do is stop concentrating the population in a dozen or so cities along the border. We need to build new cities and better transportation routes between them.

I’ve said this before. Either the students go home, or they stay and get counted as immigrants. Adding them to the immigrant count is counting them twice.

https://househuntvictoria.ca/2022/09/20/no-gain-in-affordability-but-conditions-have-improved/#comment-93798

@ Patriotz: Add in 600,000 (up 500% since 2002) students who can buy what ever they want and you’re well over the 500k. Sure there is up to quadruple counting in of these numbers but even assuming they all stay for 4 years, this is still over 150k new people in Canada each year that can buy.

https://www.statista.com/statistics/555117/number-of-international-students-at-years-end-canada-2000-2014/

https://www.studyinternational.com/news/canadian-study-permit-house/

Demand is simply too high for it to be addressed by Canada’s relatively meagre construction capacity (about 250,000 houses/ year). Unless those immigrants and students are going to build their own houses, the ONLY way to make housing cheaper is to reduce the number of people who can buy them.

A friend of mine who will remain anonymous recounted a conversation with his friend, a prof @ UVIC who noted that a number of his students hadn’t done any work one semester. When questioned, the students made it clear that not only were they not going to do the work, but they were only in Canada to buy real estate with their study permits.

Immigration isn’t bad but too much immigration is. Just like Water, Sun, Electricity, Fire etc. a controllable amount is good but if you have too much and lose control, it will kill you.

Worth noting that Brownoff and Chambers are the worst Saanich incumbents from the affordable housing perspective. Maybe the “best” from the NIMBY perspective though.

It’s important to call out incumbents on their record as the unfortunate tendency is for incumbents to coast to re-election.

We can’t “stop letting in 500,000 people a year” because we’ve never let in that many in the first place.Note how immigration levels have trended around 1% of population per annum since the 1950’s. And natural increase used to be a lot higher.

https://www.cicnews.com/2021/02/canada-welcomed-184000-new-immigrants-in-2020-0217133.html#gs.d83y85

The solution to the housing crisis is to stop letting in 500,000 people a year, an immigration level that is several more times that of the United States per capita and higher the past 30 years than at any time in Canadian history by far. We are in extreme times, we ought to look to more rational ways to develop the society. The doctor shortage is also a product of massive population growth. Until we stop shooting ourselves in the feet, we will continue to have more traffic, more environmental damage, worse healthcare, and lower quality of life all round.

Looking forward to seeing that

Our rankings for top candidates to take action on housing for Saanich:

Details here:https://www.homesforliving.ca/elections/saanich

Victoria coming next week, Oak Bay and Esquimalt shortly after.

Thanks for the heads up. I used up 15 minutes of my lunch break to write a concise letter in support. I have no direct stake one way or another, but I feel like building a nice set of smaller but still family friendly units should be the default on the rare occasions a vacant lot comes up in established neighbourhoods.

No one likes cutting down beautiful old oaks, but surely we can support cutting a handful of trees here and there for sensible urban developments.

Yes – I remember the museum at the top of the ridge being pretty visceral. Also, many interesting airbnb’s in Dubrovnik, maybe in consequence of the war, the outside walls are preserved and the insides are often redone & can be quite modern.

It’s all just another reminder why Victoria is a great place to live. Happy to live here, and just visit elsewhere…

Delete.

Do either of the parents work from a home office?

Here’s an interesting one: 908 Falkirk Ave, North Saanich, listed for $1,785,000.

Price History

Date Status Price

Sep 30, 2021 Sold $1,575,000

Nov 12, 2019 Sold $1,385,000

Mar 1, 2018 Sold $860,000

I agree, you have to build to the market.

DECK MATE, I don’t have the numbers for Teranet but I do from the real estate board. The Victoria Core is a HUGE geographical area and comprises a large variation in house and lot sizes and depending on the change in the mix of housing in the two samples these numbers will have variation. In otherwords, you cast a wide net (pun intended)

The median price for a single family home in the Victoria Core districts increased from $1,052,000 based on 1,043 sales for the six month period bracketing date Dec 15, 2020 to the current 90 day median (292 sales) of $1,190,000 which is 13% increase.

902 foul bay is going to council tonight. If you want to have your say (one way or the other), you can email Mayor and Council (mayorandcouncil@victoria.ca)

That’s because they need to do education sessions to explain to the membership why they should vote for this deal.

That’s a pretty rosy view w/r to Central Banks in my opinion. Don’t know why you’d bank on them to actually fix a problem they created.

In 2016 I sold a ‘small’ house. Houses were selling like hot-cakes at that time but it took a relatively long time to sell due to the small size (2 bed, 2.5 bath). This experience led me to build an excessively large house (in my view) the next time around. Even though there are many advantages to smaller buildings, I wanted something that appealed to a broader market.

I have a condo on the coast as well and my parents have a house too.

Despite the small square footage of my cousin’s condo both she and her husband speak English and German. Kids already know English. Older one is now learning Italian.

Musically talented, sports talented, etc.

I just don’t see the argument for large SFHs as a need but purely as a want.

Families with children typically have a higher homeownership rate. Likely because of the need for a stable place to raise the kids. The boomers had more kids than millennials do (they gave birth to the huge number of millennials!) and that is one reason boomers had a high homeownership rate. Millennials do everything later in life (the term “emerging adults” was coined for them). They’ll get around to owning a home a little later in life, and have lots to choose from, since there are much less Gen Z that could outbid them.

Btw, age 30-34 homeownership rate in 2021 census is 52%. That doesn’t seem so bad.

There were real bombs falling on Dubrovnik about 30 years ago, you can look down from the heights and see which houses needed to have their roofs replaced – the new tiles are a slightly different colour.

Croatia is a member of Nato now and I don’t see it as more or less risky than nearby Italy or Greece.

Hopefully on a beach in Hawaii, sipping a pina colada.

That’s an interesting illustration of how locals see their market vs. how an outsider might see it. One could argue that Victoria has also had such a dichotomy though it played out differently, where for the last 10 years or so the locals saw the Victoria market as increasingly crazy & disconnected from reality, whereas the outsiders who were increasingly driving the market at the margins just saw it as relatively cheap.

If I were you, I’d probably take advantage of this dichotomy by selling that Zagreb condo. If you’re determined to maintain a foothold in Croatia (couldn’t blame you), it would be interesting if you could achieve better ROI metrics buying a condo say in Dubrovnik and airbnb it to tourists. Maybe wait until Putin is done & no bombs going off, but that’s another story…

So great. Always so impressed with Europeans’ language skills.

Yeah it’s a little odd given the negative reaction. Are negotiations still going on or is this final until the vote?

Where is frank????

Hard to predict. We’ll see what happens.

I hadn’t heard that. But I’m only able to go by what’s in the media.

There were even bigger numbers of boomers back in the day, and they were a lot more successful in their home buying. So it isn’t just about large numbers in the first time buyer cohort.

Isn’t it set for October?

Probably going to end up being a pretty good deal with the coming recession and falling inflation.

Maybe, but I think inflation will return to target faster than expected (barring another price shock) once the base effect kicks in. That should happen early in the new year.

It’s been 14 days since the BCGEU reached a tentative deal with the government. Still haven’t heard a peep about a ratification vote. Haven’t heard a peep about anything.

Super weird.

I think, once we’re in recession, if inflation is still well above 3%, the BoC won’t drop rates as it typically would. I think the plan really is to slay inflation at any economic cost.

Free, there’s a download link on their webpage

Leo on the provincial airwaves!

Scroll to about the 30:20 mark:

https://www.cbc.ca/listen/live-radio/1-4-bc-today/clip/15937973-vladimir-putin-mobilizes-troops-war-home-ownership-canada

Hi Leo, can anyone look at Teranet data or do you need to pay for that? I’m wondering how much the percentage increase of SFD in the core has increased since Dec 2020, couldn’t seem to get in to Teranet.

With a modest mortgage, and zero consumer debt, I’m not too worried either way.

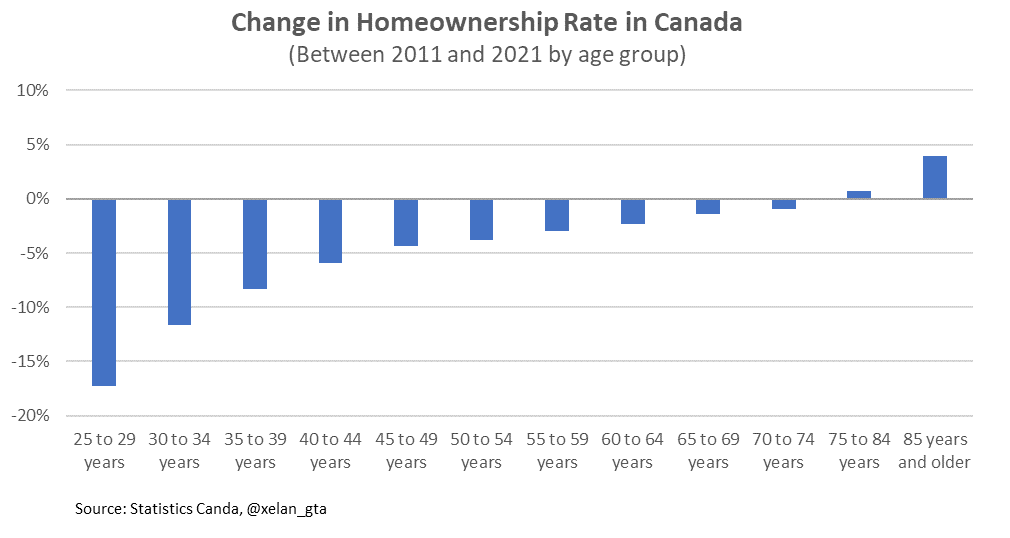

I don’t see a “generational conflict”. Just a huge number of millennials increasing the 25-39 age group of buyers by 17% (2021 compared to 2011). Bidding against each other as FTB for the same starter homes. With Canada’s overall population rising only 11%, it’s not surprising that age group 25-39 were less successful in becoming homeowners. The millennials will be fine, as the cohort behind them (gen z) are 16% fewer in number, so millennials that missed out can catch up as homebuyers in the next ten years

statCan population numbers help explain the larger drops in younger age groups. The peak homebuying ages are 25-49. Canadas population rose by 11% from 2011 to 2021. But the age 25-40 age group rose by more than that, by 16% (from 6 million to 7 Million). Those are now the millennials.

If there is to be generational conflict, it is the same “intra-generational” one we already see, namely millennials bidding against each other to buy the same types of homes they like (FTB, starter homes). The bidding wars in the spring for starter homes (FTB) were millennials against each other, not boomer vs boomer. There are huge numbers of millennials, so it’s not surprising that a lower percentage of them were successful in their home buying. The statCan chart you posted shows this.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710000501&pickMembers%5B0%5D=1.1&pickMembers%5B1%5D=2.1&cubeTimeFrame.startYear=2011&cubeTimeFrame.endYear=2016&referencePeriods=20110101%2C20210101

Finally, now this is on brand 😉

It’s hardwired into our brains to think that what is now or what was in the recent past will continue in the future – i.e. 20% RE price growth per year or what not. In the overleveraged Canadian economy with consumers saddled with record debts, it will get worse than the price decline we saw so far. The RE prices are defined by the leading edge of buyers and sellers (those who can buy vs those who must sell at the moment). When the economy deleverages and goes into recession early next year, job losses will mount and the picture will change dramatically. Canada is already projected to be the worst performing advanced economy in the next decade. Having one of the most unaffordable housing in the world and extremely indebted population is one of the main causes and is the result of incompetent policies of our government and people driven by greed supporting these incompetent policies. I.e. Trudeau’s laughable affordable housing initiatives => building 17,000 affordable houses will do absolutely nothing for our housing situation if we are bringing 500k immigrants annually to this country. And we are not even talking about building infrastructure (roads, schools, hospitals etc.). How about instead of bringing only high tech workers and rich criminals we also bring proportional number of electricians, plumbers and construction workers who will build housing and infrastructure instead of only counting how much more taxes we’ll bring in and how our national per capita debt will nicely decline with the increasing head count?

Canada is the land of abundance and nothing justifies that young Canadians are being turned into slaves of banks. Overleveraging and greed lead to volatility – things will get worse before they get better.

Whatever you need to tell yourself; however, declining rates will be unlikely for some time, the bond market which backs lending will be pricing risk in a recession period (thus higher mortgage rates). The reserve banks can’t force rates lower without new rounds of quantative easing (which is highly unlikely in the near term) and that is the only real mechanism they have to artificially suppress rates. Since governments have really over borrowed in the last few years, they won’t be in much of a position to stimulate by other means either. What does bode well now is that the risk of a housing recovery in the spring market is becoming less and less likely now. So, we might get to see a normalization of housing inventory again. Just imagine, a spring market with housing inventory growing to 3000, 4000 or even 5000 in Victoria.

One of the causes of low vacancy rates has been an influx of construction related workers. People from rural BC and Alberta have been moving here for work. The policy of higher rates to reduce inflation will crush the construction industry throwing these people under the bus. Victoria is a very expensive city to live in without a job.

The effect on the unemployment rate has yet to manifest itself until those projects under construction end. Then we will see vacancy rates rise along with an increase in active listings.

A recession does bode well for declining rates. In every dark cloud, etc.

From: https://financialpost.com/news/economy/99-9-odds-fed-induced-north-america-recession-bmo

From: https://financialpost.com/news/economy/cooling-very-quickly-more-economists-join-chorus-predicting-a-canadian-recession

Nice to folks catching up to what’s been going on.

I read another opinion calling for vacancy control. I don’t understand the logic. Isn’t the problem that there aren’t enough rentals? Wasn’t this caused by successive governments failing to invest in purpose built rentals, combined with pig-headed NIMBYISM (that is also horrible for the environment btw)? In Victoria in particular in seems that there is a great reliance on mom-and-pop landlords (i.e. secondary suites) – this being the result of the failure to build purpose built rentals. If this is the case, isn’t it utterly ill-advised to disincentivize these mom-and-pops from renting out their units? Mom and pop landlords have a choice – they often don’t need to rent out their secondary suites. How many of these smaller landlords have already taken their units off the market or put them on Airbnb – often after reading (or experiencing first hand) stories of rentals gone wrong. I don’t get it. I am honestly confused. There is one solution to the housing crisis – ONE – and it is: build more housing!!!!!

Generational conflict on housing heating up.

One of the drawbacks with affordability measures like the one above, at least for near-term use, is that a common assumption is a 20% down payment. This makes sense to qualify for an uninsured mortgage, but I’m not sure it makes sense in the context of a first time home buyer in Victoria.

Say someone has $200,000 for use as a down payment and homes are priced at $1,000,000. They have 20%, and would have a mortgage of $800,000. If there market were to correct downwards, say, 20% in the span of six months, homes would be $800,000 but, critically, they would still have $200,000, or 25% down.

So in the post-correction case, the chart would assume a mortgage of $640,000, when our hypothetical FTHBs would only have a mortgage of $600,000. Their payments would, of course, be lower on the lower mortgage principal.

I do appreciate that there is a time cost to money, and putting down a larger down payment than is required means forgoing returns on the $40,000.

I’m not sure, however, that FTHBs would take that $40,000 and throw it in RRSPs or a renovation – and if they did it’s because they could afford to because of the easing of affordability.

I don’t have any elegant ideas on how to account for that in affordability graph, but thought it was worth mentioning.

Tell that to anyone over the past two years that saw huge gains in both land and building value, BC Assessment assigns value to both. Personally, from the 2021 assessment over 1/3 was on the value of the buildings and ~2/3 was land. Whether that’s a pandemic blip or not, Covid changed the way people value the building/space they live in here in Victoria/Canada.

That’s crap, they said it was inflationary this time last year, and here we are at double what it was last year this time, not zero.

They took a lot of flak because it was bullshit.

Not sure what you mean but freehold/fee simple is land and all immovable structures as one legal entity. If land is removed or added or structures removed or added the content of the freehold changes, but not the nature.

https://en.wikipedia.org/wiki/Freehold_%28law%29

That wouldn’t be indivisible then. Sorry if I’m hyper-focusing on words today. Tired.

I was specifically talking houses being a depreciating asset, not land. I think we might be on the same page.

Why not? Once you build a home it is affixed to the land and because part of the same freehold/fee simple interest.

Someone selling that 20 year old house in Japan is usually selling the house and land and over time in most markets they have appreciated. Some structures do depreciate faster in Japan due to building techniques, cultural values and earthquake risk.

I have been clear I am referring to freehold properties in Victoria in my posts. If you would like to discuss Japan or leaseholds this is different.

Interesting short thread on inflation from an econ professor:

https://twitter.com/stephenfgordon/status/1572348385289736192

US Fed projecting another 125 basis points before the end of the year.

Canadian dollar has already dropped almost 3 cents against the USD in the last month.

That can’t be true, otherwise no one could build a new house?

Regardless, it’s the land that’s appreciating in price (even though that’s not actually happening right now), and the house is not. It requires a lot of upkeep just to maintain a depreciating price.

Try to tell that to someone selling a 20 year old house in Japan. They are effectively worthless. A 10 year old house would be 1/2 as much as a new one. The land is a different story.

If anyone is interest I’ll be releasing some interviews I did with family members in Europe and their living arrangements -> https://www.youtube.com/watch?v=bndG02UvDLg&t=5s

Family of four in 532 sq/ft.

Recently I’ve been trying to study the real estate market in Zagreb (capital of Croatia) as the prices are insane with a larger run-up than Victoria and much worse unaffordability metrics. My condo has gone from 168,000 Euro (2016) to 400,000 Euro (current). Zagreb is not constricted by geography for development (flat in three directions), the country is losing population. In 2016 it was approximately 4.2 million, now we are at approximately 3.9 million. Average gross salary in Zagreb is 1,600 euros per month or 19,200 euros per year. This would put the net salary at well under 15k Euros. Interest rates higher than Canada.

So far my investigations have yielded some interesting factors that are not prevalent in Canada and some that are.

–

In Canada, the ownership of land is held in fee simple, which means you own the land and the buildings attached to it. For assessment purposes the structure depreciates and the land appreciates but in reality you own the part and parcel together and indivisibly. A more accurate term would be freehold or fee simple ownership of real estate, which, as I stated is an appreciating asset in Victoria long term – and not a depreciating asset.

demand has exceeded supply and fee simple ownership has been subject to appreciation in excess of inflation for more than my lifetime here in Victoria

First, this is a local to Victoria board. Second, this is not even true for “Japan” and people would tell you houses in many areas have appreciated. Prices overall have increased 77.5% in Japan in the last ten years. In rural country areas suffering significant population declines, the prices are lower for some older homes, particularly when adjusting for inflation.

https://www.globalpropertyguide.com/Asia/Japan/Home-Price-Trends

https://www.globalpropertyguide.com/Asia/Japan/price-change-10-years

How so? Rates are higher now than Jan 2020. Yet current prices are up 43%. I think there are bigger long term factors that determine prices than rates.

Not at the moment I think. Shows the dependency of asset appreciation on interest rates.

Actually you’re both right in a sense, since the house itself depreciates while it’s the land that appreciates (except when it doesn’t).

You conveniently ignored the part where totoro said this: A house is also an asset, and in our market an appreciating one.

Houses are depreciating assets just like cars. When demand for them exceeds supply even used cars sell for more than what they were bought for as we’ve just witnessed. No one in Japan would tell you a house appreciates in value.

75 bps increase in the US. No surprise though the stock market currently isn’t happy with it. WE will see how the speech goes at 11:30.

If these HHVers recently went from renting to owning but chose a variable mortgage and are now paying mostly interest and very little towards principal they are essentially still renting from their new landlord, the bank, and there is no 2% annual cap on rent increases.

Of course it is money well spent. It is being spent on shelter. Next to air, water, food; the most fundamental of all human needs.

Houses are not like most other goods and services are they though? Consumables and depreciating assets are in an entirely different category, as are some services. Other services like good legal or tax or medical advice might well have a high ROI and not paying the money will cost you more.

A house is also an asset, and in our market an appreciating one. Plus you have to live somewhere so there will most likely be an unavoidable shelter cost.

If you compare renting to owning you are getting shelter value from renting, but if you could spend money on an appreciating asset and gain shelter value then it is clearly the winner from an economic point of view so the argument that renting is, in comparison, like throwing your limited cash away when compared with owning is sometimes accurate.

Of course only if you can afford to buy in the first place and hold on through a downturn.

Money spent on food just ends up down the drain. This is factual not a glib RE phrase.

But if you buy a farm you can produce your own food, and farmland is an investment that has appreciated in price over time.

That makes it “official” then.

Feel free to consider rent to be money well spent. At a certain point, you might change your mind. Thanks for the discussion.

A specious argument at best. Are all payments for goods and services, therefore, monies “down the drain”?

As a homeowner, you have an investment. The expectation is that the value of the home rises more than interest and property taxes paid. So those expenses aren’t money down the drain, in terms of the house as an investment.

With a rental, there is no investment. The “down the drain” refers to that.

I’ve seen rent being referred to as “down the drain” by HHVers here . Typically it is from a renter or ex-renter commenting that they are/were tired of pouring rent money “down the drain”.

Leo – “but the folks are Teranet have” is probably supposed to be “but the folks at Teranet have”?

Great article – seems to (re) confirm that monthly affordability is the true driver of prices. Question is which factors will be involved in a return to more affordable times? Price depression, wage inflation, rates dropping back down… Time to break out the crystal ball Barrister.

The “rent down the drain” argument ignores the opportunity cost of owner’s equity. An owner is paying rent of this nature. And rent isn’t down the drain in the first place – you’re getting something for it.

How does “down the drain” apply to rent and not to interest paid, nor to property taxes? It seems that such glib phrases abound in the Real Estate sales world.

Yes. All the new rentals aren’t PBR. But a lot are . Victoria had a record breaking year for PBR in 2021, with 3,500 more under construction. Compare the 3,500 PBR units to be added to the tiny 95 SFH (net) added to the Victoria core per year, and we get a glimpse of where people will be living,