Despite rising rates, Canadians still loving variable

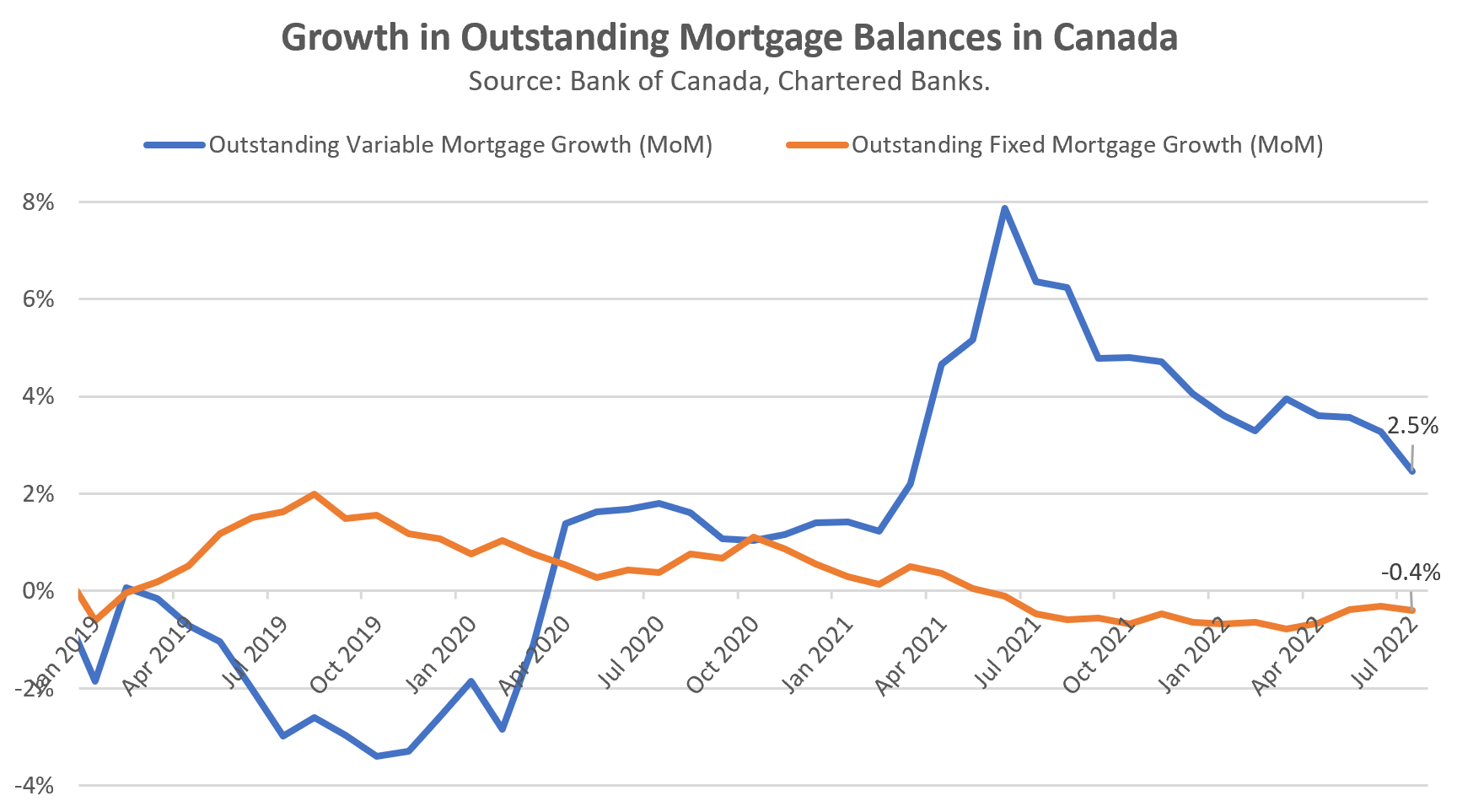

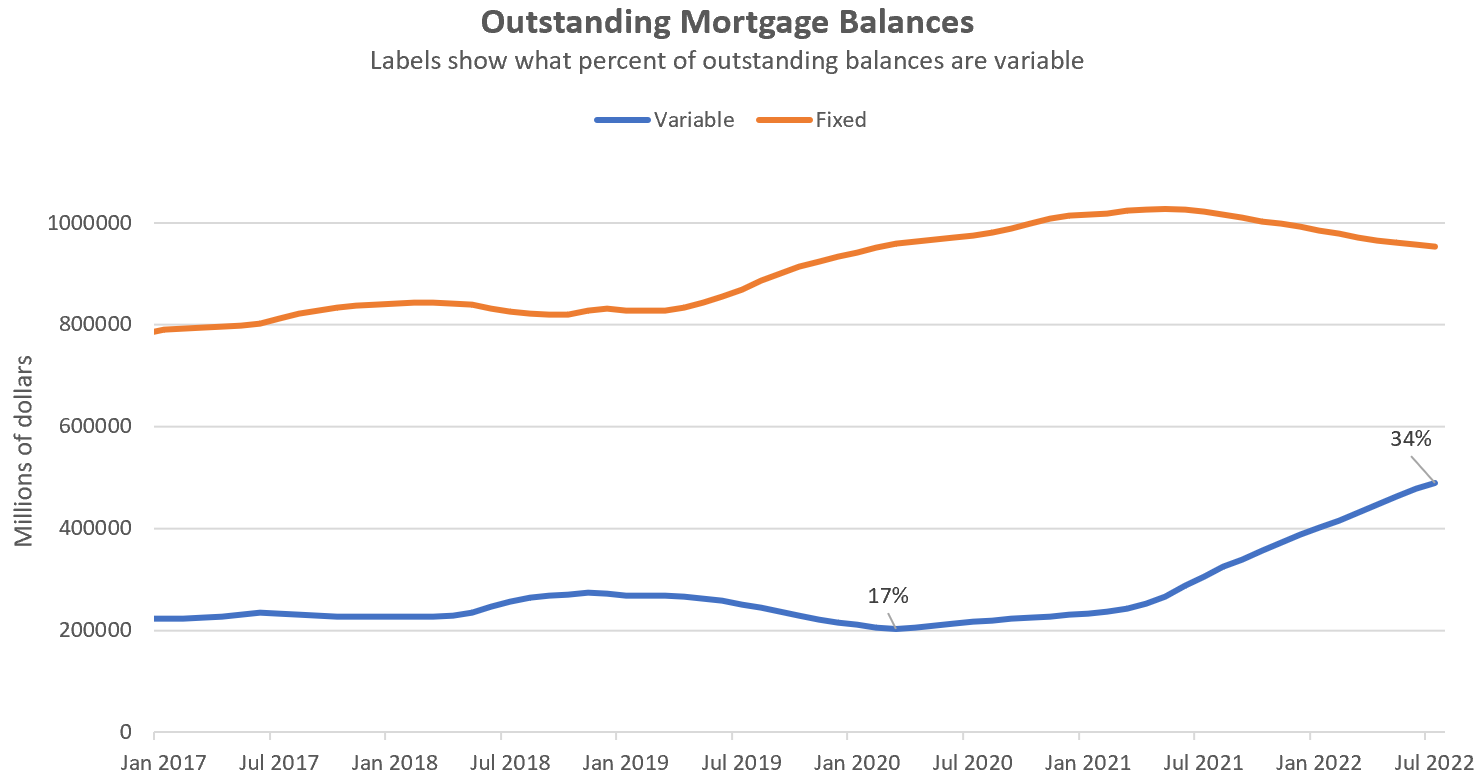

It seems that despite overnight rates rising at a rapid pace, Canadians have not fallen out of love with variable rates. At least that’s the case as of the latest data point from July, which doesn’t encompass the latest rate hike. One might think that borrowers have been rushing into fixed rates since the central bank started tightening, but so far that is not the case. Bank of Canada data on outstanding balances for mortgages held by chartered banks shows that variable rates were still growing month to month at a pretty good clip while the amount of debt in fixed rates has been dropping for over a year.

That has driven the amount of outstanding variable mortgages to a record high, with balances doubling in just the last 16 months, and going from 17% of the mortgage book pre-pandemic to 34% now.

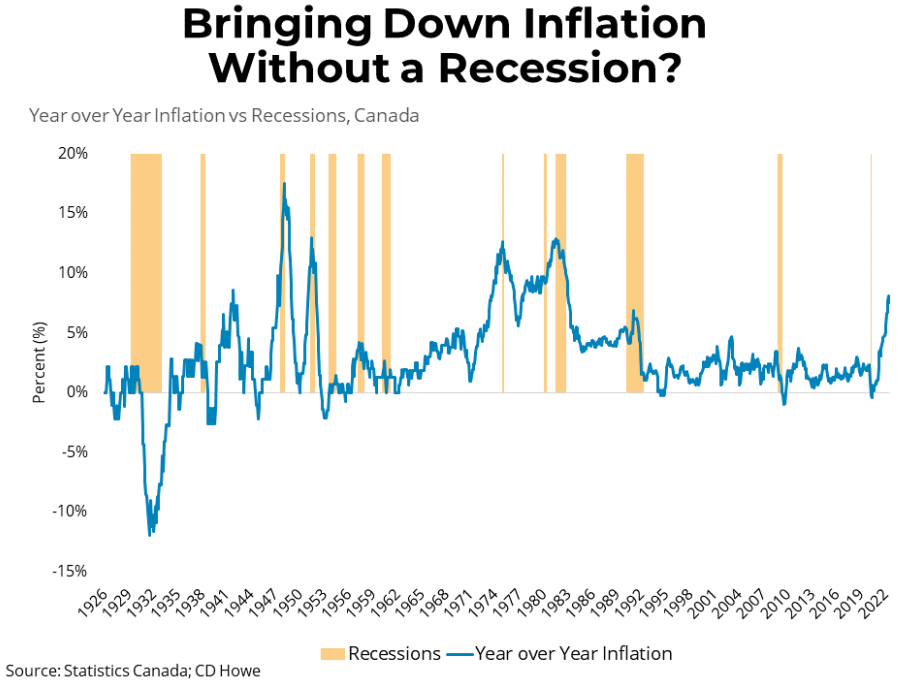

It will be interesting to see if that changes with the latest rate hike. It seems that borrowers have been hyper-focused on the cheapest rate and not at all concerned about rate risk. Alternately borrowers are thinking on a macro level and betting that the coming recession will bring rates down again sooner rather than later. While the latter is doubtful, it seems clear from increasingly hawkish messaging that neither the Canadian nor the American central banks are likely to blink on their rate path before we get a serious economic pullback.

As of September, variable rates and fixed rates are essentially identical and the variable rate discount has evaporated. That’s potentially why sales have been so sluggish as variables are no longer a way to qualify at a lower rate. However this may also be a temporary situation, as US yields have broken out to the upside after some time of relative stability. It may be a good time to consider that fixed rate in case we follow suit.

Speaking of sluggish sales, here are the final weekly numbers courtesy of the VREB.

| September 2022 |

Sep

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 51 | 131 | 239 | 317 | 761 |

| New Listings | 101 | 384 | 701 | 943 | 978 |

| Active Listings | 2072 | 2152 | 2229 | 2284 | 1124 |

| Sales to New Listings | 50% | 34% | 34% | 34% | 78% |

| Sales YoY Change | -41% | -47% | -47% | -49% | |

| Months of Inventory | 1.5 | ||||

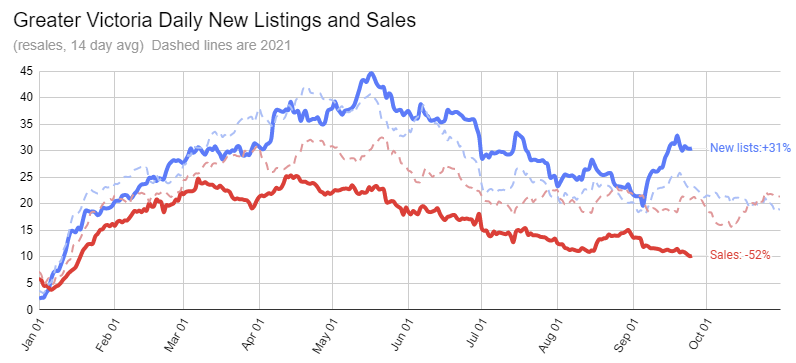

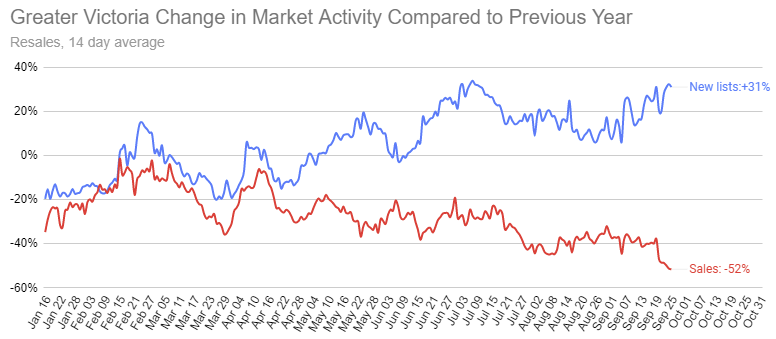

Despite healthy new listings numbers, the bump in sales I’ve been expecting has not materialized. The discussions of an uptick of activity we heard from other markets in August have also subsided so it appears that the most recent rate hike has done its work. Even though we are still well below the 10 year averages for inventory, it seems that inventory is no longer a significant constraint on sales. In spite of more selection we are simply lacking the willing (or able) buyers to absorb them at current prices. Sellers are still holding on for yesterdays prices, while buyers are waiting on the sidelines.

We are currently at the biggest year over year decline in sales we’ve seen since the pullback started.

Even though carrying costs haven’t budged much, prices for detached properties are down some 15% from peak in the spring. There’s two ways to think about that:

- Prices are dropping, don’t catch a falling knife, OR

- The last time anyone got 15% off a Victoria house was 1981.

So far it seems more buyers are betting it’s the former and expecting tomorrow’s deal to be better than the one today. I suspect for the time being they are correct, with prices likely to continue weakening into the fall as rates rise further. However I also think it’s worth paying very close attention as a buyer to what comes on the market now and in the next few months. I expect a long and relatively flat period in prices once the market stabilizes, but the severity of the pullback so far combined with motivated sellers may allow you to buy ahead of the market this fall.

New post: https://househuntvictoria.ca/2022/10/03/sluggish-september/

Ya, especially in the 3 bdrm plus and SFD rental segments. Seeing few price drops as well.

Seems to be a lot of rentals coming on if you look at usedVic or Craigslist. More than I’ve seen in a long while. Is everyone moving away? Seeing the number I wouldn’t be surprised if the rents start to drop as they compete for renters.

The free market will solve the problem. When the economy goes bust, property values tumble and the starter homes are now once more affordable. The free market is boom/bust cycles.

We haven’t had one for quite a long time as the various levels of government have tinkered with the market in order to sustain growth and employment.

That was basically my point. But we wouldn’t be looking at 3rd world situations of people living in the open. Even people on minimum wage here could pay for some level of housing. Just not much.

We don’t want to see people living in trailers in people’s front yards or in tenements, so we have zoning to a higher standard. And that’s OK with me, but it comes with a social responsibility to see everyone housed to community standards.

Do note that for me a truly free market would also mean getting rid of government subsidies and tax policies that inflate the price of housing.

@patriotz re: “If we really had a free market it would, but people might not like the results.”

How would the free market take care of it? Aren’t there ample examples of zero government interference leading to hoardes of people living in shanty towns (globally)? I personally don’t see how the free market would ever provide any kind of livable low income housing. More likely people would just be living outside, like in other places in the world where entire families live on sidewalks – sometimes right outside the gates of those with mansions. To me we should all do everything we can to ensure that never happens here – we all share a common interest in ensuring adequate housing for all.

Michelle for mayor!

i very much enjoyed reading her entry

from City of Victoria Candidates Profile Guide 2022

All candidates for Mayor and Councillor positions were given the opportunity to submit a brief candidate profile and photograph to let voters know about themselves and their platforms

https://www.victoria.ca/assets/Departments/Legislative~Services/Documents/Candidate%20Profiles%202022__6DIGITAL.pdf

Michelle Wiboltt

fREEDOM of/from religion Bill 21, finally.

Evolves democracy: Our plans: Going forward …

1. Democrasize city hall’s = Mayor and Councillors have local constituencies, revolving, attend and be accountable for going’s ongoing inclusively 5 years old and better, with.

2. Revenue generation for universal wage’s = privatize Victoria’s 70+ religious + divisive institutions.

3. Expectations that requests for improvement be submitted to City’s administration building simply, comprehensively. (S.W.A.T analysis, grade 2 level. Simplest. Passes)

4. Build “pod” villages, diverse, in, initially, downtown, evolves. Democracy pleases, local’s, housing’s firstly then, understanding depths and breathers.

5. Build social site (i trilingual) truest representatively eh, reconciliation, democratic style with/of/for participation in of the creation of a MAPPING/game for us and our values visiting public And, assessing if potential new businesses added cause more “out of business”, non.

6. Free from/of conflicts’ language.

I think you can only do two modules a week or something like that and there are 20 modules plus then scheduling a date/time for the exam ends up being around 6 months. However, someone that has attended college or university and is familiar with multiple choice style exams could do the 20 modules and pass the exam in 2-3 weeks if it wasn’t restricted to how many modules you could do in a time period. I had harder individual courses in my master of health admin program at UBC and I found the masters program to be a complete joke.

However, keep in mind this month we had 410 sales and there are 1600 realtors.

That being said working at VIHA for four years I realized there were plenty of bad doctors out there and working in real estate you certainty run into bad lawyers that I wouldn’t pay $50k let alone the $120k average. I don’t make any assumptions based on level of education. I’ve met plenty of people with only a highschool education that are smart and have more common sense than doctors, lawyers, and pHDs I’ve met.

I haven’t seen these “investor groups” in Victoria. There are investors for sure but usually an individual buying one or two units in a complex. A lot of investors myself included manage their own rental condos.

Even if the investor gives his or her condo to a property manager the condo will rent at market value, just like large apartment buildings rent their units at market value. The rental rates are dictated by supply and demand not some conspiracy of a few property managers controlling everything.

Not the worst idea except I don’t think $500 million goes that far. With the amount they will be overpaying they won’t be able to buy that much.

For example, the new development where Chard and BC Housing are partnering at corner of Douglas and Caledonia BC Housing paid $26 million for the crap old hotel, a year later Chard bought the Whitespot for $7.5 million. Imagine owning a run down crap hotel in a crap location and getting $26 million for it. If Chard paid $7.5 million for the Whitespot I can’t see how the hotel was worth more than $12-13 million. Obviously they bought a teardown since they are now tearing it down.

City of Victoria paid over $10 million for the property on Pandora the developer picked up for $3.5 million.

Re: law school/lawyer income. It’s clear looking at the stats that Alberta and Ontario lawyers make considerably more than lawyers in British Columbia. I think that’s true for MDs and a host of other professionals such as Engineers and CPAs. The average seems to be around $120,000 which is a good income but consider the time needed to be in school (seven years plus articles/bar admissions course). No offence to the excellent realtors on this site but I think it’s six months to get your realtor’s license.

Regarding the proposed government $500 million to fund non-profits buying rental apartments.

if I was a RE speculator, I’d be buying up multi-unit rental properties that would be suitable for these non-profits to buy. With $500 million of government money about to rain down through these non-profits purchasing, there’s going to be a lot of overpaying going on. So I’d re-sell them to the non-profits at higher prices. If I was a scammer, I’d also make sure my listed properties got above market bogus offers from a “friendly” buyer, so the non-profits would just be matching that offer, thereby greasing the wheels for the government to approve funding.

I hope I’m wrong, but I’m cynical enough to believe that the government would be more concerned with getting rid of the $500 million fund, and won’t mind overpaying so they can say that a non-profit now owns the building. And who cares if they paid $11 million for a $10 million building.

If we really had a free market it would, but people might not like the results.

Interesting times. Population growth in the last quarter was 285,000 and in the past year almost 700,000 according to Steve Sarasky. Exactly how many housing units have we added in the last year? Since the vast majority of this number is due to immigration I am wondering where Ottawa thinks these people are going to live and has anyone done an analysis of the impact on the housing supply for young Canadians?

Exactly.

I don’t find the concept of ROFR issue that concerning. A society would have to match the top offer so the owner should not be impacted, and it will only apply to low rise housing complexes. I do think there are a lot of details that would need to be worked out on this though ie. how will the societies know the offer amounts and how will existing tenants be grandfathered in when the society may have different occupancy parameters? I’m not worried about REITs. They’ll find other opportunities.

September numbers:

Sales: 410 (down 46%)

New lists: 1155 (up 18%)

Inventory: 2300 (up 105%)

New post tonight

Yes, please add the remove script to all of your PC’s.

Free market will never take care of the bottom housing market because the costs to build low income housing outweigh any profit potential. Government needs to be in charge of making sure low income housing is built. I’m hopeful about some of Eby’s ideas to solve the crisis but the right of first refusal makes me a bit uneasy. I guess I worry that this much power might lead to more government corruption. I hope there are lots of checks and balances. I also worry that the ROFR would have other unintended consequences with perhaps ripple effects. Just seems risky and not not sure I like that one thing.

Works fine, I just happen to have multiple computers, so I get to ignore you multiple times. Just one more thing you’re completely ignorant about.

Interesting article on one of our primary exports here in BC. What a waste.

Love how it’s gotta be a foreign media company that figures this out.

Your “ignore Patrick” script that you boasted about isn’t working. https://househuntvictoria.ca/2022/09/26/despite-rising-rates-canadians-still-loving-variable/#comment-94125

If it was, you wouldn’t have seen that message. Or you just couldn’t take it anymore, and removed it, so you could continue to see my messages. After just one day. I’m flattered.

I wrote OSFI about this a few months back and they don’t seem to care about the market. They are there to protect the lenders. Here was the first paragraph of their response:

“OSFI’s influence in the housing market may have left some observers with the impression that OSFI is Canada’s housing market regulator. We are not. […] Our main responsibility within the Canadian housing system is to ensure federally regulated Canadian lenders manage their risk in a manner that encourages sound credit quality within real estate secured lending (RESL).”

The email basically said as long as the lenders aren’t being risky they don’t have a dog in the fight.

It’s anything but a free market. A lot of the problems can be traced back to ham-fisted government intervention.

New Zealand did this. 40% down for investors. OSFI would have to do this.

Have heard of this happening. Not sure if the banks are in the habit of checking, but careful this could be considered fraud if you are borrowing money and saying it’s for a primary residence when that’s just a ruse to circumvent lending rules. Consult a lawyer. Grey area of course it does happen that people plan to buy a principal residence and life changes.

Please explain how more properties for sale pushes down rents.

Yup. There is some research into the impact of home ownership on economic mobility but results are mixed. https://www.researchgate.net/publication/313107515_Homeownership_Mobility_and_Unemployment_Evidence_from_Housing_Privatization

Anecdotally, an acquaintance bought a condo during university and regretted it. He said it limited his employment opportunities because he couldn’t leave to pursue jobs in other cities (condo had dropped in price and was hard to sell and he couldn’t rent it out). Mostly case specific bad planning/timing though.

They’re not wrong. Don’t take it as an insult, take it as a chance to become more informed.

It’s probably counter-instinctive for most, but I wonder with the talk of it being to worst September for sales in 30 years, will prompt more listings to come on market from now through winter while inventory is still historically low. The limited selection for preferred properties might be one of the last advantages that some sellers still maintain in the market. Delaying a listing might the current instinct and might be considered the common or best practice to see if there’s an improvement in the market into the spring. However, if the worst September in 30 years becomes the worst February, March, April and May in 30 years, is there any advantage left in selling into a panic? Especially if listings start adding up by the thousands, presenting a better selection and greater competition to sell across all segments. Those in a must sell position in the next year or two might want to consider selling before the new year with the still historically low inventory.

Its definitely not working, hence the housing crisis we are experiencing under the current system.

Thank you! Well said!

New post tomorrow.

You can look at it that way, but the development would most likely be built anyway if there were no investor participation. A better case could be made that investors are needed for many condo developments to proceed.

No, I mean average income for all lawyers. Very few lawyers make hundreds of thousands a year even in Vancouver.

If you want to look at the top earners only, there are social workers who make $200,000/a too. I thought it was the averages you were concerned with.

Hi Leo, curious about sales in Sept and median price relative to current assessment? Thanks

Realist, doesn’t have to be a guy. Anyone hooking up with someone that is $200,000 in student debt and not being able to make monthly expenses makes that person a EUD. Economically Un Desirable.

She’s gotta put her heels on and get out there and find someone. Or if it was a guy I would say his best running shoes. Which is what is happening today. People are doubling up to pay bills. They might hate each other but they can’t afford to separate.

Sorry Patrick. I probably could have been a little less harsh on that. My tolerance for these types of opinions is lower than it ought to be. Edited.

The only information I have about pre-construction condos and town homes is anecdotal. Some of the units don’t get listed as investor groups will buy a dozen or so of them before they are finished. Locals don’t even get a chance to bid on them. I don’t know how that is helping people that want a place to live in. When they are completed then they rent them at high rental rates through a property manager. That isn’t a free market when most of the rental units are controlled by a few property managers.

I expect that to change as I suspect these investor groups are exiting the market. Then these units will come back on the market. And that leads me to the opinion that we are going to have a significant increase in strata units in the next few months. Some sales activity is highly suspicious when dozens of units sell on the same day at full price with zero days on market. Take a look at condos in Florence Lake. They were sold out in zero days and never came on to the market for locals to bid on. Hundreds of them.

But may be it’s just a co-incidence.

Oh, so you inform me that you’re an expert and I’m profoundly ignorant. Thanks for the discussion.

Could you point me to the original source statement from Eby on this? CTV news is not an original source. I provided you the link to the actual platform backgrounder released by Eby where this is stated nowhere. In fact this particular fund, as opposed to the indigenous housing fund, is targeted at non-profits and not FNs.

It appears, based on the source document, that the intent is to fast-track new social housing units in complexes run by FN non-profit societies through the Indigenous housing fund – as occurs currently.

Many FN people, who are disproportionately homeless (35% of Victoria’s homeless are indigenous although indigenous people are 5% of the population of Canada) have specific cultural and support needs that are never going to be met in a general mixed social housing which is not run by those who are indigenous.

Have you ever read RCAP? If not, I highly recommend you do. https://www.bac-lac.gc.ca/eng/discover/aboriginal-heritage/royal-commission-aboriginal-peoples/Pages/final-report.aspx

If they are buying a new-construction presale, then yes, they are increasing the housing stock.

We are talking about Eby’s idea for a $500m Rental Housing Acquisition Fund. It’s plainly stated that FN (or non-profits) would be purchasing existing, for sale rental properties. Obviously those will have existing tenants, including non-FN tenants.

I have no problem with the government funding $500m to non-profits and FN to buy housing. I am only opposed to the bizarre-sounding scheme where they would get first right of refusal, ahead of other buyers.They can just buy properties like everyone else. With all this free-flowing $500m of government money, they will have no problem overpaying for them, as they have done for decades.

How would someone feel if they owned a few townhouses, and were selling them as a group to a company owned by their kids (or friends), and FN stepped in and “scooped them up” as they would be entitled to first right of refusal under Eby’s plan? Does that seem fair? While that seems an extreme example, there are lots of friendly sales from company A to company B, that aren’t related, but share common interests. So it would be very disruptive for them to not be able to sell a property from A to B, when that means it could get “scooped up” by some non-profit or FN, contrary to their wishes

https://bc.ctvnews.ca/david-eby-proposes-rapid-construction-of-affordable-homes-new-flipping-tax-1.6088485

“ The plan also includes a $500 million Rental Housing Acquisition Fund, which would see the province provide grants to First Nations, non-profits and co-ops to help them purchase affordable rental properties that are listed for sale before they can be scooped up by investors.

Off-reserve, FN should live in the same housing as the rest of us. The FN societies can subsidize their rent, but there’s no need for “FN only” housing. That would be as dumb as “whites only”. So your claim that they will “ house off-reserve FN people” is wrong. Social government funded housing (off-reserve) is available to all BCers FN or not, based on needs. We should keep it like that

From: https://financialpost.com/real-estate/mortgages/september-home-sales-likely-lowest-in-30-years

My view is that this is intended to provide options for FN societies to house off-reserve FN people. There is no other interest that FNs in Canada have in off-reserve low income housing and your view that they are now going to engage in for profit housing backed by the NDP government is ludicrous given the financial position and specified roles of FN housing societies and the plan itself.

And to understand what Eby intends accurately it is best to read his plan, which states, in relation to FNs:

BC Builds:

• Work with First Nation and city governments, and private and non-profit partners, in both urban and rural areas to offer rapid approvals, increased density, land, and construction financing to deliver multi-family housing developments that can offer attainable middleclass housing for a range of incomes, both rental and purchase.

Action for those without homes

The most acute symptom of the housing affordability crisis is that despite B.C.’s prosperity too many are unhoused without adequate shelter and support.

• Increase the Indigenous Housing Fund and engage further First Nations and Indigenous led housing groups to fund, build, and/or support housing for Indigenous people both in and away from traditional communities

The Indigenous Housing Fund is SOLELY for non-profit social housing: https://www.bchousing.org/projects-partners/Building-BC/IHF

https://assets.nationbuilder.com/davideby/pages/169/attachments/original/1664383997/A_good_home_for_everyone_-_Backgrounder.pdf

Huh? These are existing rentals, full of non-First nations tenants. How could First Nations buy them for FN people? They’d need to evict the tenants. And then rent only to First Nations. Does that sound sensible to you, instead of building them new housing?

“ “A rental-housing acquisition fund that allocates $500 million for one-time capital funding in partnership with First Nations, non-profits, and co-ops to buy at-risk affordable rental housing and “discourage speculation by investors.

No. This is incorrect. The intent is to provide off-reserve housing for First Nations people is my understanding. These endeavors are generally run by FN societies otherwise they are ineligible for funding – both provincial and federal. No off-Reserve investments in low income housing are going to be supported by the very few communities in BC who would be able to access own source revenues to do this. There would be a great outcry from on-Reserve unhoused residents.

Banking on making it into the top 10% of earners in law is poor planning. If this individual was in this category it is quite likely she would be on scholarship already. To become a lawyer you first have to article. This is a generally low paid one year position after law school with lots of competition. Only those at the top of the law school get picked for positions with higher-paid big firms with significant upward earnings potential. And then you have to be able to handle the excessive and stressful workload for years and decide how you will balance this with ex. having children. There are other ways to go to make more money, but that generally involves entrepreneurship and specific expertise and relatively few lawyers choose this path.

It might be worth it to incur some significant debt to become a medical specialist or engineer, but a criminal defence lawyer is not in this category imo.

https://careerinlaw.net/ca/lawyer-salary-canada-2022-detailed-review/

I can’t judge the efficacy of First Nations as landlords one way or the other. But given the genocidal cruelty they’ve endured, I’m okay with them being included here. Ideally there would be more granularity, ie. $450MM for non profits and $50MM for First Nations, etc.

You must mean starting wage right? But with experience the sky is the limit and that’s what really matters.

The government isn’t restricting this $500m funding/partnership to non-profits. They are including First Nations as well. First Nations are for-profit. Since your post was describing the evils of for-profits vs the benefits of non-profits, and free markets “wreak cruelty on people ”, are you OK with governments using some of the $500m to partner with First Nations? Do you believe that First Nations would be better landlords than REITs?

The only good parts of Eby’s promises is that they are just that – political promises. They likely won’t happen

Just like their previous promises e.g. 2017 promise to spend billions to build 114,000 affordable homes. That would be about 11,400 built in Victoria. We are 5 years into that 10 year promise…”to make life more affordable” , and affordability has worsened. And no mention of those 114,000 homes in Eby’s new promises. Note that the NDP 2017 promise was to BUILD 114,000 new affordable homes, not their useless new idea to fund buying of EXISTING rentals (which doesn’t create more housing – just promises different landlords)

https://www.policynote.ca/housing-promises/

“During the 2017 election campaign as part of its plan to make life more affordable, the BC NDP promised if elected to “build 114,000 affordable rental, non-profit, co-op and owner-purchase housing units through partnerships over ten years. These homes will be a mix of housing for students, singles, seniors and families and will range from supported social housing to quality, market rental housing.” “

I have my doubts that free markets will best provide stable housing, especially for the bottom quartile(s?).

REITs exist to generate value for shareholders, regardless of the hardship imposed on tenants. Their primary and only aim is to return value, everything else is in service of that.

Non-profits will almost certainly have tenants’ best interests in mind more than REITs. But they won’t generate wealth for capitalists.

Wouldn’t shareholders have a legal case if a REIT turned down profits from say an eviction+reno+rent increase for the reason that it would unduly disrupt people?

Regulations exist to temper the cruelty that free markets can wreak on people.

You only get a capital gains tax exemption for your primary residence. You are suggesting that owners of a second or third property pay more tax than capital gains and tax on rental income? I’m not sure what fair purpose this would serve exactly?

Disclosure I own some REIT’s, my understanding is that REIT’s don’t receive different tax treatment than individual non-resident owners, the ownership is simply sliced up.

They do, for example the following. Also some commercial property REIT’s are developing part of their properties (i.e. parking lots) as residential.

https://www.newswire.ca/news-releases/minto-apartment-reit-to-provide-financing-for-a-new-229-suite-multi-residential-development-in-ottawa-858032572.html

I’m not aware of REIT’s participating in buying SFH in Canada, that’s not their business model. What I an concerned about is the various partnershjps or similar vehicles that have sprung up in the last few years to buy individually titled properties. These lack transparency and regulation and both drive up prices and confer substantial risk to investors. If the rise in interest rates and fall in prices doesn’t weed them out I think the tax system needs to discourage them.

Average lawyer makes about $80,000a in Victoria. Also most graduates can’t jobs in the field.

I have no problem with all housing being taxed or capital gains exemption on primary residence being abolished or limited. I am also okay with starting at third property like green party Ontario suggested.

Eby wants to avoid large real estate investors (REITs or other large corporate investors) from buying up affordable rentals in BC. Seems reasonable to me. Perhaps REITs and others can start building new housing instead.

“A rental-housing acquisition fund that allocates $500 million for one-time capital funding in partnership with First Nations, non-profits, and co-ops to buy at-risk affordable rental housing and “discourage speculation by investors.” Eby said rental housing in B.C. and across Canada is increasingly being bought up by huge international corporations, driving up rents for British Columbians.”

https://www.timescolonist.com/local-news/eby-housing-plan-calls-for-flipping-tax-fund-for-non-profits-to-buy-rentals-5885341

“He promised to earmark $500 million to provide grants to non-profits so they can purchase rental buildings slated for redevelopment and protect renters living in the older building from displacement. He’d like to see a law ensuring right of first refusal giving non-profit housing societies first crack at buying low-rise buildings up for sale.”

https://vancouversun.com/news/local-news/b-c-ndp-leadership-race-ebys-housing-policy-includes-flipping-tax-legalized-secondary-suites-and-increased-density

As mentioned the current leader of Canada is strongly influenced by a lobby group working on behalf of the large real estate corporations that Eby is trying to fight against.

https://en.wikipedia.org/wiki/Century_Initiative

I’m not an expert, just see the increasing wealth inequality in society and think we need to find a better balance.

Many entrepreneurs who have made money have also purchased a rental property because they have no pension. If you are concerned about housing wealth being disproportionate then all housing should be taxed. Why should a person who owns a house and gets a pension and has no need to create a stream of revenue in retirement get to keep 100% of the disproportionate gain on their primary residence then?

I was thinking of housing wealth primarily.

Thanks, that clarifies it.. The issue that Eby is proposing ( * ) affects REITS, not homeowners. And like you I’m unaware of any specific policies from government to help REITS per se.

( * ) right of first refusal for non-profits to buy rental complexes before REITs have access”.

Lol boasted. Sure thing boss. Good riddance.

It’s literally a line for anyone else not wanting to waste their time.

jQuery(“.comment:contains(Patrick)”).remove()

She’s planning on being a criminal defense lawyer. The national average salary for a Criminal Defense Attorney is $84,224 in Canada (net 60k in ontario – or 5k per month). She’s not going to be fine taking that route and she should know better.

200k in debt? She is choosing at least part of it by paying 1600/month for housing in TO where you can rent a room for under 1000 near Osgoode.

If she has no financial help and financial need she’ll get up to 25k in student loans a year – 6k of which will be in a non-repayable grant. Even if she got the max student loan for 7 years her debt should only be 133k at the end, without any scholarship or bursary help. She is already using a line of credit with immediate interest costs, in addition to student loans which do not have interest until post graduation.

The cost of tuition has gone up, but there is no way a student in Canada who can demonstrate financial need and is working summers needs to be 200k in debt for their education. Very few careers will have an acceptable ROI payback period on that. Not to mention the fed loan rate for variable is 5.25 and 7.45 for fixed. To put this in perspective, to pay off a 200k debt at 5.25 over ten years means paying 2,251 every month with a total interest payment of about 60k. If you need to reduce the monthly payment you could pay $1704 a month over the max permitted – 174 months – 20 years and $86,342 of interest.

So people who have saved and invested and started companies and are now finally at a point in their life that they have some level of financial security should be taxed on this as well as the income they made along the way?

Every tax policy change comes with consequences and one of them, if we are simply looking at net assets, is going to be to disincentivize entrepreneurship.

Your question did not correspond to my original comment which referred to both home owners and REITs “The government constantly interferes with the “free market” to benefit home owners and REITs so very happy to see any policies that will benefit renters”. So I responded with information on both.

The question was “ What’s your best example of this “constant” interference in the free market that the government is doing to benefit REITs?”

Most of your list doesn’t apply at all to reits. If you understand that, perhaps you could answer that question and post the single best example of something the government is doing to benefit REITS.

The following is a list of policies that benefit owners/investors and/or REITs: QE, ultra-low interest rates, CMHC backed mortgages, low property taxes and capital gains exemption on sale of primary residence, property tax deferral, home owner grant, renovation tax credits, preferential tax treatment for REITs, Fed government being strongly influenced by century initiative (blackrock) to massively increase immigration to increase housing demand (and profits for owners/investors), blind eye to money laundering, etc. Taxing income not wealth!!!

Love Eby's policies to address a few of these inequities and level the playing field a bit for renters and others.

Do you guys think rental prices may come down for apartments in Vancouver ? Much crazier than the Victoria market .

I agree. I perceive it as a gaudy rendition of a middle-eastern inspired decor, especially in the front foyer. And those downtown-design street lights running all the way up the pointlessly endless driveway irk me somehow. Plenty of far more beautiful, classy homes and for less money.

That place just looks cheesy.

Well Telus is providing telephone service. And so in your landlord example, who is providing the rental product/service if not the landlord owner?

Investors don’t only buy homes, they sell homes too. If your concern is about housing stock, you need to consider the homes that they are selling. If you don’t know the net buying of investors, your concern about investors lowering housing stock isn’t supported by data.

New builds are heavily skewed towards condos. And towards rentals. That likely accounts for the fall in homeownership. We would need to see data on homeownership for SFH to know if investors are playing a bigger or smaller role in this category. For example, there are thousands of purpose built rental apartments built and being built in Victoria, and not a single SFH purpose built (according to Marko). The investors in those thousands of apartment units are helping the chances of homeowners finding a SFH to buy.

I own stock in Telus among others but I don’t say I’m “providing” telephone service. It’s an investment in a profit making business. Likewise landlords.

The issue with investors owning houses is that they are outbidding potential owner-occupiers and thus reducing the available securely tenured housing stock. As is discussed endlessly here, the stock of houses is limited and investors who buy them are not increasing the housing stock.

On another topic, I only own one property which I reside in as my primary residence. I have a friend with a second property that’s a large house which she rents out to a family with 3 generations living there. It’s really hard for larger families like that to find a rental with the space they need and they are quite happy in her place. So I don’t understand why some people think she’s doing something wrong. She’s providing long term rental housing to people that are very happy to have it. She makes money off of it but I don’t think she’d be willing to be the landlord if she wasn’t making money ( like a volunteer landlord??) I find it confusing that people complain about lack of housing and in the same breath advocate against people that are providing housing.

Ok, i see so you meant a guy would be stupid to begin a relationship with her? Still amounts to the same thing.

Funny to see “envy” of the rich (“multiple homeowner”) by the middle class (“single homeowner”) being described as “exploitation”.

Anyone want to pick this place up yet?

advertised price from $9M to $5.9M in 18 months.

https://www.realtor.ca/real-estate/24920315/1700-mt-newton-cross-rd-central-saanich-saanichton

Farm status so we all get to subsidize their property taxes.

What’s your best example of this “constant” interference in the free market that the government is doing to benefit REITs?

The government constantly interferes with the "free market" to benefit home owners and REITs so very happy to see any policies that will benefit renters.

And love the idea of taxing people with multiple homes or over a certain value (as well as a cap on capital gains exemption). The exploitation has gotten out of hand and am happy to see any evening of the playing field.

You’re just making stuff up. How about you add me to your “ignore” script that you boasted about . https://househuntvictoria.ca/2022/09/12/is-victorias-market-more-stable-than-other-cities/#comment-93563

Realest, I’m not calling her stupid. Go back and re-read the post.

Hmm, a surprising amount of new lists popped on today, especially considering it’s an end month long weekend.

She’s going to be a lawyer. She’ll be fine. It’s not like she’s taking on 200k debt for an art degree. I don’t think it’s fair to call that stupid. Tough road but will likely payoff bigtime longrun.

Wow, the article says she is $200,000 in debt!

It doesn’t matter if you’re a woman or a man, that is a non starter for someone else to start a relationship with.

Generally, guys at that same age are pretty stupid, but that’s a lot of stupid.

Realist just think of it as “gentrification”

If you remove the age restrictions then that is an economic bonanza for the current owners. But I don’t see how that improves affordability in the city.

If you force these older condominium complexes to allow investors to buy up the units then you are opening up an opportunity for investors and REITs to gain control over the Strata Councils.

Just a few weeks ago, I spoke about leasehold condominiums and one of the comments was that in one complex the occupants had to pay a special assessment that they had little to no control over. This is the same thing that would happen if REITs gained control of the Strata Councils. This is a Pandora’s box that should be kept closed.

There are some older four-storey condominium complexes in prime locations that have surface parking which makes them have huge lots. These would be choice properties for REITs to obtain control over the Strata Councils. Crank up the strata fees and buy options to purchase on the remaining units.

One way or another these older pre 1980 2×4 wood frame complexes on big lots are going to be torn down. The land is too valuable not to re-zone to a higher use. That makes them ripe fruit for REITs.

“Luxury” at one of the scuzziest intersections in Victoria

What I don’t agree with mostly in many strata’s are age restrictions on purchases. I can see the one exception and that would be for seniors only buildings having a minimum age of say 60 or 65 years. These units would be turning over on a regular basis as seniors sell there SFDs and move into a “retirement community” for their final years.

The current age restrictions are all over the map. Some at age 60, and others at 55,50,40,30,19, 18 and once I even saw 16.

There are some wonderful older condo’s, in convenient areas having between 950-1400 square feet. If those age restrictions were removed, it would really open up affordable home ownership for singles, single parents and couples with one or two kids. There are even two and three bedroom townhomes with two or more baths and double garages that have these age restrictions.

This proposal by Eby is outrageous…

If party A owns a rental complex, and wants to sell it to party B for N$, they should be allowed to, without

any non-profit being allowed to step in to buy it at that agreed price. This is interference in the free market, against the wishes of party A.

Leave the free market alone. Let the non-profits buy through the market like everyone else

Starting out as a young adult is incredibly expensive in 2022. We crunched the numbers

https://docdro.id/2JJ7xYq

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-cost-of-living-young-adults/

I see a listing this morning for 3174 Harriet, near the corner of Burnside and Harriet. The developer is putting in a 4 bed, 5 bath luxury home with almost 3,000 square feet, which is listing for 1.7 million. This is a spot where a row of townhouses would make more sense, but I’m wondering if Saanich’s zoning laws are forcing the developer into building a luxury single family unit at a busy intersection which can’t really be classified as a desirable location. Who would buy that?

David Eby’s plan to remove rental restrictions in stratas gets mixed reaction

https://www.timescolonist.com/local-news/david-ebys-plan-to-remove-rental-restrictions-in-stratas-gets-mixed-reaction-5895572

Not a strategy I recommend to my clients, but each to his own.

However, I do not understand why the buyer would take conditions off any sooner? As the seller you can’t bump a buyer during the conditional offer phase unless you have a seller subject which is incredibly rare and no buyer would accept in this market.

The majority of listing agents place a note in the database noting “Accepted offer with conditions until October 7th,” for example.

In my personal opinion this is poor practice. As the listing agent the seller is paying me a ton of money to sell their home and if I add such a note to the database for other agents to see I am not representing the best interests of my seller, who is paying me a ton of money.

If a buyer’s agent sees “Accepted offer with conditions until October 7th,” they will let their buyer client know and not reach out to me. If the deal collapses they are not triggered that it collapsed.

If an agent does not see “Accepted offer” they will contact me to book a showing at which point I will tell them there is an accepted offer in place and I will ask them if they still want to arrange a showing. Most will say no to a showing.

So what is the big deal? The key with my method is I have a list of all potential interest I can reach out to should the accepted offer collapse.

No problem, sure, but you also have no problem saying that it’s dumb.

I have had some really interesting and long conversations recently with my friends on Bay Street. I found them concerning.

Let me ask people here, what sectors in our economy actually generate wealth for the country and the people in it. Does the creation of housing generate wealth or is it mostly just a consumable?

Yep, and that makes the 100 points to be added to the BoC rate by Christmas likely the low estimate now.

“Some questions for Marko or Leo. What do most agents do when a conditional offer is in place that may have a 2 week period before conditions expire or are signed off.? If a house has an accepted offer with conditions like finance or house inspection does the selling agent place a note of the listing in the VREB or VIREB database so the other agents know there is an accepted offer in place? If so do they indicate the conditions? If the answer is no then agents would be showing clients a place that they cannot buy (in most cases) and it is a waste of the buying agent and buyers time.

Not an answer as I am not Marko or Leo, but in a couple of sales I made I immediately dropped the list price to the accepted conditional price to put pressure on the people who held the conditions. Did not take long for them to take conditions off as I was still showing the houses.

Some questions for Marko or Leo. What do most agents do when a conditional offer is in place that may have a 2 week period before conditions expire or are signed off.? If a house has an accepted offer with conditions like finance or house inspection does the selling agent place a note of the listing in the VREB or VIREB database so the other agents know there is an accepted offer in place? If so do they indicate the conditions? If the answer is no then agents would be showing clients a place that they cannot buy (in most cases) and it is a waste of the buying agent and buyers time.

That’s hard or impossible to predict. We are just a few months into this downturn. There are some trades that are going to feel the pinch sooner than others. And it seems to follow along the line of where they are in the building process. The closer you are to the beginning, such as excavation, get paid on time while those at the end such as landscapers never get paid. If you’re a sub-contractor??? The exception is real estate agents – they always get paid first on a sale.

Once you lay-off workers, it’s difficult to get them back. They have moved on to different locations or different vocations. Depending on the severity of the decline, it will take longer to start up and train new people again. And then there is the problem with money. Declining home prices reduces peoples net worth and their ability to access funds, so they are not going to be well positioned to buy even when a good deal comes up.

I hear a lot of people on this forum state that if houses drop by “X” amount they are going to buy them up. Well where are they going to get the money? Their home lines of credit?

From the developers and past investors? They are going to be busy licking their wounds from their losses and are not going to be excited about real estate.

Then there is the possibility of the vacancy rate going up to 2 or 3 or 4 percent as the transient workers leave town for better jobs. That scares me. Too many people are dependent on that basement suite income to make their mortgage payments. If their suite is vacant for a couple of months they are not making the mortgage payment and the lender is calling.

I do expect that there will be a rebound. There is still lots of money out there and lines of credit. But it will likely be short lived. Then the market could go into a steep and prolonged decline. Hopefully the world economy will have recovered before that happens and inflation is back in line with BoC expectations.

If house prices fell by 20%, I don’t think that would be bad at all. That would be a soft market correction, most of us will be alright and not even feel it. Lenders would still be secure and not need to call in short term loans or reduce lines of credit for most of us. And it is all about the Banks. The Banks have to be protected at any and all costs. Without the banks, there is no Canada.

More that 20%. I don’t know, that could really hurt. And I don’t know if would be better to have a fast drop or a slow decline. Is it better to tear the bandage off or slowly peel it off?

We are far from all this doom and gloom. A lot of other things have to happen in the real estate market. Like the number of listings. There has to be a HUGE increase in the months of inventory over a three month span. At this point this seems to be contained to the high end of the housing market such as new homes and Oak Bay. If you are moving here, with lots of wealth locked up in your home, you have to sell your home first or take on a massive mortgage at an expensive rate.

Canadian $ = 0.723 https://ca.finance.yahoo.com/quote/CADUSD=X/

Uggh…

Whatever I do agree and would add let’s make this a quick downward crash and a faster bounce back rather than a slow painful death like the 90s what a waste of time

Right. According to a teranet (aug 2022). Branford had risen a huge 77% during Covid, and has fallen 13% from the peak. And fell 9% MOM. Probably has a lot farther to fall https://housepriceindex.ca/wp-content/uploads/2022/09/Teranet_E_220920.pdf

Unfortunate, that it took so long to get the approval for the Foul Bay road project. With the change in the market it has become a bigger gamble for the developers to proceed with construction past the foundation stage.

I suspect that we will hear of more planned multi-family projects being put on hold in the next couple of months. That may not be the case with Foul Bay as the developer was lucky to find a large site that was vacant because it wouldn’t be possible to assemble a half dozen improved sites, demolish the homes and then build to make a profit in that neighborhood.

Anyway, this project would not have improved affordability in the city or provided low income rentals. The finished home prices would just be too expensive to solve the missing middle, affordability or rental problem. At 18 town homes on a half acre, the units would be too small and too expensive. We would just be doing the same thing as we have done for the last two decades and hoping for a different outcome.

What we have been doing is trickle-down economics. Increase the supply and prices are suppose to come down. That works well if your manufacturing cans of soup but not for real estate. Now if you build an astronomical amount of homes, which most people seem to suggest, that will eventually trickle down to the lower to middle income households. Only because you created a glut of housing and collapsed the real estate market. That’s your Boom-Bust cycle.

Personally, I don’t think this will ever change. It is so imbedded in our Western Culture that the only way to make homes affordable is to build more, and more, and more. It doesn’t matter what you build – just build more!

And that’s why I think recessions are good for the housing industry. It’s a way to reach out and hit the “re-set” button and purge the market of its excesses and mistakes.

https://www.brantfordexpositor.ca/news/local-news/house-sales-prices-decline-in-june

I’d hardly say that house prices in Halifax NS are “Cratering”.

It’s funny how reporters angling to give legs to a non story will pick the average price and also refer to the biggest number that one house sold for and then report how much real estate has dropped! Great story but not very meaningful.

Let’s face it….. I bet most people can’t tell what the value of their house is worth within 7% anyway.

I do believe however that prices will drop to some extent all across Canada though and everyone should be cautious.

Bigger problems are on the horizon…..such as whether “Tactical” nuclear weapons will be used shortly for example.

Glad to know all those plastic “save the trees” signs that littered the neighborhood went to good use.

Finally. No coincidence that this occurred after Eby’s announcement?

https://www.timescolonist.com/local-news/foul-bay-road-townhouses-get-green-light-was-site-of-1911-house-that-burned-down-5891330

I think he has it backwards. The “outside the GTA” markets are cratering. And anyone who thinks markets like Edmonton are going to approach the GTA any time soon (or not soon) is dreaming. For example:

https://huddle.today/2022/09/08/halifax-home-prices-still-falling/

I thought maybe the twitter post was from a year ago, but no it’s current.

We haven’t, nor have the 4 or so other households we know with high ratio mortgages.

For some time now, I have had the same “Notion” as Introvert in regards to people shifting to outlying areas as it dawns on them that they do not need to be a slave to commuting to work every day. ( Tons of articles about people refusing to go back full time even when they offer “Nail Buffing” , ” free Breakfast” etc.)

It has to change everything.

https://twitter.com/MikePMoffatt/status/1575831215357104130

Foul Bay Road townhouses get green light

https://www.timescolonist.com/local-news/foul-bay-road-townhouses-get-green-light-was-site-of-1911-house-that-burned-down-5891330

The one benefit to this being a mid cycle election is Eby will have two years before the next Provincial election to make good on his all these promises. If they get executed poorly or not at all then it will hurt his chances of reelection. Safe to say he knows that and will try to ensure this gets implemented as intended. They Province has some sway over the munis in which to accomplish this. I’m hopeful.

The owned “hot dogs” have secure tenure.

Transferring ownership from individual to a corporation realizes a capital gain to the individual. Might be of use to those purchasing multiple properties going forward though.

I’ve said before if you want to discourage speculative ownership, don’t allow an operating loss on a rental property to be deducted against personal income. NZ is eliminating deductibility of mortgage interest altogether, with some exceptions.

https://www.ird.govt.nz/property/renting-out-residential-property/residential-rental-income-and-paying-tax-on-it/property-interest-rules/how-interest-deductions-are-affected

I like your hot dog example the best for explaining the housing problem.

“Yesterday I made 6 hot dogs for 6 people.

Today I made 8 hot dogs for 10 people.

I made more food so I don’t understand why people went hungry.”

Doesn’t matter if the hot dogs are owned or rented.

100% agreed on this as well. Leo is a little too optimistic. It will be 10+ years before the first person has keys to a housing unit that was built under some sort of provincial override re zoning.

The only thing this announcement might do is it MIGHT sway some councilors to vote for approvals, versus against. Nothing else will change, will still take 3 to 5 years to re-zone something. Projects will be delayed years because of one tree, etc.

Not sure why people think this announcement is a game changer, just seems like a lot of political posturing.

100% agree, so simple yet so difficult for people to grasp. You could tackle this in so many simple ways. For example, approve missing middle and if the owner is willing to sign a 20 year rental only covenant on their 6-plex build all building permit fees waived (city would get huge uplift from yearly tax anyway).

Or give rentals a bonus unit. For example, missing middle 5 units max stratified, 6 units long term rental building.

I don’t think this would make a huge change in my opinion. As I’ve said before when I am showing SFHs it is not unusual for my clients to run into their friends or acquaintances viewing the same house just before, or just after us, but of course the foreign investor is driving up prices and leaving houses empty.

Secondly, we are literally building ZERO SFH purpose built rentals. If you take out the individual investor there is literally nothing to rent (SFH).

Has anyone that has purchased with <20% ever had CMHC or a lender follow up to make sure they are living in the home?

Interesting point. I’ve met two people in the last little while that are doing this. One person cannot afford to get into the market in Victoria so she bought a rental condo in Edmonton earlier this year to “get into the market” even thought her plan is to stay in Victoria. I haven’t given it much thought as to weather it makes sense or not.

Whatevericallmyself, nothing you have said in this entire thread makes any sense at all.

Need more houses or less people. EOM.

I think taxing investors for owning more than X properties is a terrible idea, but it would never work anyway. It would be avoided by using incorporations and/or shell corps to each only own X-1 properties.

From: https://financialpost.com/real-estate/mortgages/cmhc-to-forecast-steeper-housing-price-decline-of-10-15

Oh well, there’s the dagger in the heart of the housing decline. I guess things will steady or increase now that CMHC is weighing in with their forecast housing price drops….

Huh?

I have had some very nice kind landlords in my life. However their decision to rent to me was not “kindness”. It was based on an assessment that I would pay the rent and not trash the place

Nice one Patrick. Way to insult every renter.

I have no problem with people moving wherever they want, for whatever reason. And I’ve never said differently.

To beat a dead horse, my wish is that the government would not focus on investment properties as commonly defined, but entire property holdings, both in value and numbers; people smarter than I could work out some sort of formula that is more equitable for today’s real estate environment. We’ve got a widening gap between the rich and poor, which continues to widen as people get shut out of housing. Things I have read recently talk about how this consequential shrinking of the middle class contributes to the erosion of democracy and increased extremism. It seems a bit of an out dated approach to apply a tax to investment property ownership or its capital gains, full stop, without considering the number or value of the total property ownership including principal residences. Sometimes people own investment properties because it is the only thing they can afford, in communities far cheaper than that in which they live. It’s a way to get in. Tax someone’s second property, tax at a certain value threshold, tax beyond a certain gain, but don’t make it harder for people to work towards better housing security, towards entering or staying in the middle class, while at the same time letting people who live in their principal residence see unprecedented wealth increases with no taxation at all. I get that an increase in housing numbers is the end goal, but we risk undermining this goal if we don’t consider the impact on a working person trying to enter the housing game without the privilege of parental help or inheritance. I think some sort of balanced consideration could still work to increase housing stock/decrease investor numbers but not penalize people with minimal wealth.

Give me that royal bay!!!!!

With over 2000 listings of good used houses on the market nobody seems to want where is the supply problem

Rodger, I question if penalizing investors with an increase in capital gains tax would be effective. My feeling is that most would just give the finger to the government and not put their secondary properties up for sale. Continue to collect the rents and let their estate deal with the sale.

Personally, I prefer the carrot over the stick approach to increase the inventory in the pre-owned starter to middle income markets. It wouldn’t have to be the total elimination of the tax just enough for those that hold a large portfolio to consider the windfall of divesting. Perhaps the investor groups REITs that have bought up chunks of the housing in some of the development projects and thereby have control of a large block of rentals might divest.

You’re expecting to move across the world, and yet you can’t fathom people moving across the country?

Another potential way to reduce property prices is to change capital gains tax to cover 100% of the profit from properties. Giving a one-year grace period will bring a lot of properties immediately to the market. What’s the federal government doing to solve this problem?

Yes.

Correct me if I’m wrong but you’re also expecting immigration to solve our demographics issue?

Not saying that the number of units freed up is not primary to solving the problem, just that supply and demand is affected by a number of things, including tax burden. Just putting it out there that perhaps taxes should consider shifting from principle ownership advantages to single property ownership advantages. This may increase chances/options for people to enter the market somewhere and get the advantage of increase equity/appreciation. Then, if we want to tax multiple property owners to increase the number of secure units available for renters, all owned properties could be considered, past a certain value or number threshold. It just brings in a level of fairness. Otherwise, those who live in an owned/principal residence will enjoy yet another incredible tax advantage over those who do not.

And, btw, it’s not my situation – just something I’ve thought about for a while – the hidden advantages owning/living in SFH, especially one in an urban centre that has appreciated greatly, and assumed wealth of someone who is trying to build some equity with one rental property away from where they live. Time to perhaps rethink how we tax, that’s all.

Finding a nice rental is hard, and relies on the “kindness of strangers” – namely the landlord approving/choosing you as a tenant. With no local references or rental history, that might be harder.

If you’ve got equity from selling a house, you can likely buy in the new location, or at worst afford a better rental.

But sure, if you’re at a point your life where you consider having “no roots” in a city to be an advantage – go for it!

Hope you can resolve this!

For those who recently called renting “money down the drain” , here we have an illustration of one of the key benefits of renting. Makes it easier to move to take on higher paying or better suited employment elsewhere. Potentially improving your finances more than by purchasing a house.

Why?

I don’t think they care about your wealth. They want to insure that people have a place to live (Maslow’s hierarchy of needs). Number is what matters.

I agree, generally, with the efforts to increase density and make housing more affordable. I think it is of benefit to no one if we ignore the health of our communities – we all win when society is healthier and housed.

But, I just want to say be careful in your assumptions. Sometimes those with “investment properties” are not people with multiple homes, and/or are not part of the wealthier sect. Sometimes they are people who rent in higher priced cities and buy in other places to get a foot in the real estate market; sometimes they are great landlords who do not try to get the maximum rent out of their tenants because they have been and continue to be in the same boat; sometimes they are people who are using creative means to get ahead and find security (not wealth) in retirement because they have no family wealth or inheritance and/or no pension; sometimes they are excluded from home-owner advantages because they own a rented dwelling and continue to rent elsewhere. The capital gains tax, for example, will be applied even though wealthier people who could afford to buy where they live and have much greater property wealth are exempt.

If the rationale in taxing people with multiple properties is to ensure adequate/secure housing, better to incentivize keeping the property rented than scaring away investors and making it even harder for those without traditional means to get ahead.

However, if we want to move to taxing multiple properties I would say it’s time to consider applying it not to the number of properties, but rather the aggregate value of those properties. And, while we’re at it, perhaps also consider the inclusion of a principal residence in this equation, e.g. those with multiple properties must pay a tax based on the total value of all properties above the median value of a principal residence in the area.

Bottom line, I don’t know what the best formula would be but I think consideration of number of properties without consideration of value/wealth of those properties (including principal residence) fails to see the forest for the trees.

News from south of the border…

From: https://time.com/6217372/us-housing-prices-fall/

Patrick, what I would like to see is that the gap between condominium ownership and purchasing a single family home to narrow. The so called missing middle. There are lots of starter homes in Victoria – there just isn’t enough of them for sale.

An increase in housing inventory effects both the rental market and the for sale market. More inventory leads to both lower home prices and lower rental rates. Both the rental and the for sale market are part of the housing market.

At this time we don’t have enough inventory in the housing market to significantly increase vacancy rates but we have only been in this higher interest rate environment for a few months. We have experienced a drop in the number of sales. The next stage is an increase in the number of homes for sale along with an increase in the days-on-market to the point that it pushes the market into one that favors buyers and renters.

How that increase manifests itself is going to be important. Is the increase going to be spread out among all income groups or more concentrated in the high end or low end markets. If it is in the low end, that may be an indication that Victoria had a significant amount of investors that were relying predominantly on appreciation and without that appreciation they are exiting the market.

Plenty of homes are affordable already. They’re called condos. It sounds like you want the government to make SFH less expensive. And so you’re hoping that landlords sell SFH, and so the buyer can buy one and evict the existing tenants. I don’t think the government should play a role in helping buyers to make that happen.

What are the ramifications for immediately renting out a home purchased as a primary residence? 5% downpayment, high-ratio insured, keys in hand but not moved in yet. Very good job offer in another city. Would you need to come up with another 15% downpayment, do lenders allow these situations?

If the goal is to make houses affordable, the current prices must go down by a lot. This can be done by forced-selling by the investors or preventing them from buying more. How about 30% down payment for second property, 40% for third property, etc.? This will probably require a federal government rule change, but can the province do something on this?

Gentrification will change everything I see around my Victoria home?

Put me down for the pro-gentrification faction.

What changes in Victoria is a process called “gentrification”, with low income people being forced to move away or become homeless. Low income people can only afford rentals. Converting rentals to homeowner occupied reduces the rental stock. Victoria isn’t a closed system where the evicted renters would just buy up a home. Instead someone wealthy from ROC (e.g. Alberta) would move in and buy it. This leads to low income people moving away or becoming homeless.

This is easy to grasp if you think about when you rented in your life. I bet the answer is “when I was young, with a low income”. Why would we want to reduce the amount of rentals available to those people?

The total number of dwellings is unchanged right? What does change?

A simple step to help immediately would be to increase the notice period for eviction-for-landlord-use from two months to 12 months. This would give the tenant plenty of notice to find a new place. This doesn’t create more houses, but the extra time would help a lot.

Wow, you’ve got “no problem” with this wacky tax idea of taxing (N-1)% on Nth property owned?. I call it “wacky” because a tenant in a home with a landlord that owns 20 homes is is much less likely to be evicted for landlord-use than a tenant with a landlord owning one 1 rental property. Yet this idea taxes the professional “many properties”landlord more than the amateur “mom-n-pop” landlord.

“BC has the highest rate of forced moves for renter households in the country. 15% of most recent moves by renters were forced.”

I am not surprised at all. The problem here is that some people who are trying to address our local housing crisis often forget the unique aspects of our current rental stock and instead make unhelpful comparisons to places like Winnipeg in arguing for things like vacancy control. In Victoria we rely (way too much imo) on secondary suites and these are a significant share of the rental stock. It’s not like that in other places like Winnipeg where having a secondary suite is very rare and most renters live in PBR. We have to be careful to increase stock of PBR urgently while avoiding new rules that disincentivize renting secondary suites. Secondary suites are an inherently less secure form of rental and I can’t see the law changing to disallow an owner from reclaiming possession of a secondary unit. So again, significantly increasing supply of PBR is the only real solution. Once we have more of that supply we can look at more regulations for secondary suites.

I honestly don’t understand the argument about house hoarding. Does it matter how many houses someone has if they’re all rented out? If all those second, third houses were taken off the market tomorrow where would all the renters living in them go? Again it would probably be wiser to look at disincentivizing this kind of rental once we have more PBR. Or am i missing something?

Maggie The end buyer pays for all that so doesn’t much matter If your building a spec house it’s cost plus that’s it done

Yes, it’s a good sign, but what’s to keep a municipality from setting up new barriers that aren’t addressed by the provincial legislation? For example, Victoria’s “Demolition Waste and Deconstruction Bylaw”? If that’s still in effect, it’s a large disincentive for a developer to tear down an existing SFH and build a new triplex. More generally, won’t any devoted council of NIMBY panderers start dreaming up new hurdles for developers to jump over?

I’ve got no problem with this either. If we are ready to build abundant purpose built rentals in every neighbourhood then it makes a lot of sense to discourage investor ownership. BC has the highest rate of forced moves for renter households in the country. 15% of most recent moves by renters were forced. And if we look at why they were forced, the overwhelming majority are because their homes were owned by investors and those investors decided to sell or take over the home for their own use.

Everyone should have secure tenure whether they rent or own.

If that works out I’ll be very happy. Thanks for the discussion. Cheers.

Almost all of the increase in home prices over the last few years has been in the land. That made it possible for builders to make a good profit over the construction period. Well they are not getting that land bump anymore. There profit margins have shrunk. And over the last few months, buyers are not as abundant. Only 6 new house sales in the last 30 days. Three in Langford/Colwood, one in Cenral Saanich, one in Sidney and one in Sooke. Builders are now caught between a rock and a hard place and I understand why they are not out buying land to start new projects. There has only been one land sale on the real estate board’s data system in the last 60 days. And that was a steal. A level half acre water view lot along Lochside for $800,000 with no GST payable. That’s what a lot in that neighborhood was selling for back in mid 2017.

Lay-offs are coming in the construction industry. And unemployment insurance doesn’t pay the bills for long. So it isn’t that much of stretch to think that in a year from now, Victoria will start losing population as these transient workers move to find work in other places. And that will have an effect on barber shops to coffee shops as the GDP of the city declines.

I don’t think we have to worry too much about affordable housing. We just have to wait. It’s coming.

This is such a temporary solution. You free up some homes, renters buy and you are back to square one. People are still moving here – at an increasing rate. and now the homes we freed up are gone and guess what. We need more homes. And if we change zoning so that companies that normally stick to SFH builds don’t have to navigate the system of rezoning you add more builders to the pool and more competition.

i’m not – one scenario has more homes for more people. the other scenario has the same amount of homes for the increasing population. you need to consider the growing population when deciding whether we need more homes or if we need to ‘rebalance’ the ownership of homes.

https://www.theglobeandmail.com/investing/investment-ideas/article-canadas-housing-market-is-in-a-much-more-perilous-state-than-americas/

People from out of town would be buying places in either scenario (i.e. status quo or 10K investors selling). You can’t just pull it out of the air to make one scenario look worse.

So where are you going to get all these workers to build all these new projects? These workers are coming from out of town and need housing. The very act of building increases demand for housing.

Instead shift the focus to existing homes. You don’t have to bring in new workers. You’re increasing supply but not increasing demand.

Yes but the way you suggest doesn’t change vacancy rates or inventory long term which keeps prices high. Assume there are 20,000 rentals and for ease 20,000 renters (families or individuals) in Victoria and suddenly 10,000 owners are incentivized to sell their home. Great, 10,000 of the renters become owners and this causes prices to drop. Well now we are back to square one. We now have 10,000 renters yes, but now only 10,000 rental units available. Vacancy rate is still zero and rent prices are still going to go up because of that. This doesn’t include that people from out of town would buy places so it would leave us worse off. Also after the sales we still have the same amount of low inventory on the market and prices go back up. Thats why we need additional supply as well. You’re argument would make more sense if we had a higher vacancy rate – like 5%. Not at less than 1%.

We need more units. A mix of units is better but when you build higher end homes some of the buyers will be people moving ‘up’ and it will free up older units as well. But agreed – more lower end units is great. Thats why I’m for both demand and supply side measures.

Whatever, the only GST payable on a resale home is the GST on the realtor commissions.

In life everything “depends”

Yes it does make sense. What we have been doing is increasing the supply of new housing and that has not brought home prices down. New houses are expensive and do nothing for people wanting to buy their first starter home. It’s insanity to think that doing the same thing once again is going to have a different outcome. The economics to build affordable housing isn’t there. In fact the concept of building “affordable” housing in the way we have been going about it, is a farce.

The BoC interest rate policy is going to increase unemployment and that will increase the vacancy rate. And that means those starting out in life will have the hardest burden to carry. If life is a pyramid then that is the bottom rung of the housing market. That’s why the policy is going to work. Fewer jobs, less migration, higher vacancy rates. Because in a declining market it is the land that drops the most and starter homes are mostly land value.

Depends on the buyer.

This makes no sense. You aren’t converting vacant units to occupied units, you are converting occupied rental housing to homeownership with the risk of risk converting some of those occupied units to vacant units.

That’s a red herring argument. The population is going to grow either way. If there are more properties for sale then there is more available for a growing population. Keeping inventory low only causes rents and home prices to increase.

And I don’t think that basement suite is going to stay vacant. It’s financially tight for most buyers for the first five years, After a decade or so then they may chose to not rent out the suite because they want their privacy. In that way the vacancy rate is more likely to increase than decrease as it is more of a necessity to rent out the basement when the home is purchased and less necessary as the mortgage is paid down.

It’s actually musical chairs with a growing number of participants because of population growth, with the possibility of some participants occupying more than one chair. For example, an investor owned house might have an upper and lower unit that are both rented, whereas an owner-occupier might decide to occupy both units.

Hands up, homeowners that have a vacant basement suite in their house…