Is Victoria’s market more stable than other cities?

Many people believe that Victoria real estate only goes up. Given that our last two “corrections” in the 2010s and 90s were more like temporary price plateaus with very minor price declines, it’s also an understandable impression to have. While readers of this site will know that we had a bona-fide price crash in the early 80s, that was over 40 years ago and when you look at a chart of nominal prices today it hardly registers anymore.

Of course given we’ve seen substantial declines since February due to rising rates, it’s clear that prices can fall in modern times as well. But is there some truth to the idea that Victoria is more stable than most markets in Canada? Though every market is equally subject to changes in credit cost and availability, given we have a larger percentage of retirees and public sector workers it’s logical that our market may be less influenced by economic fluctuations than other cities.

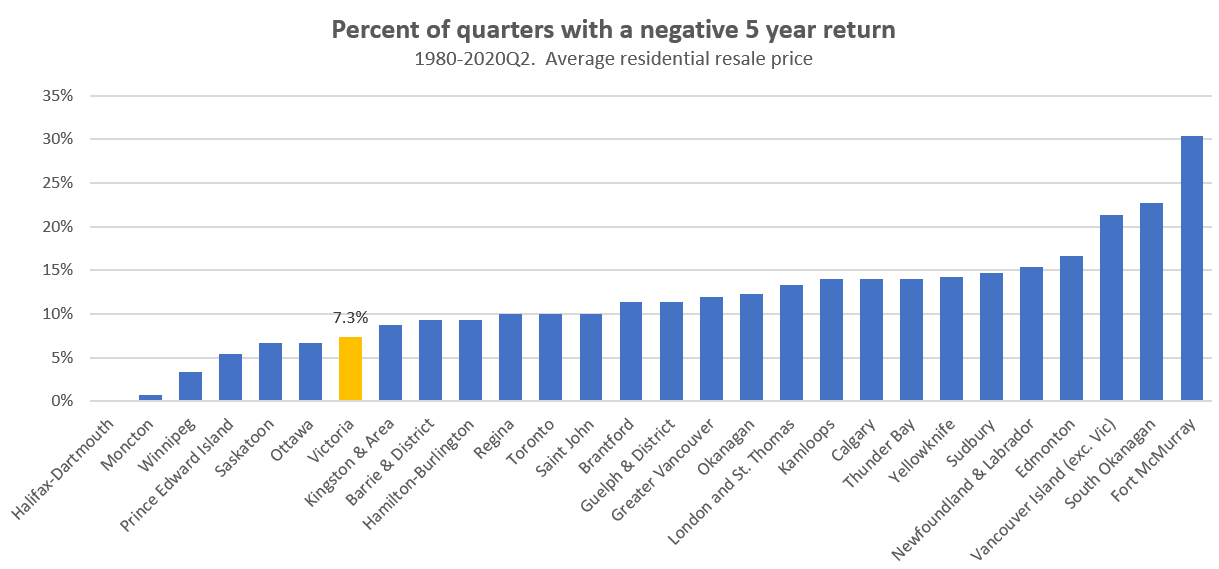

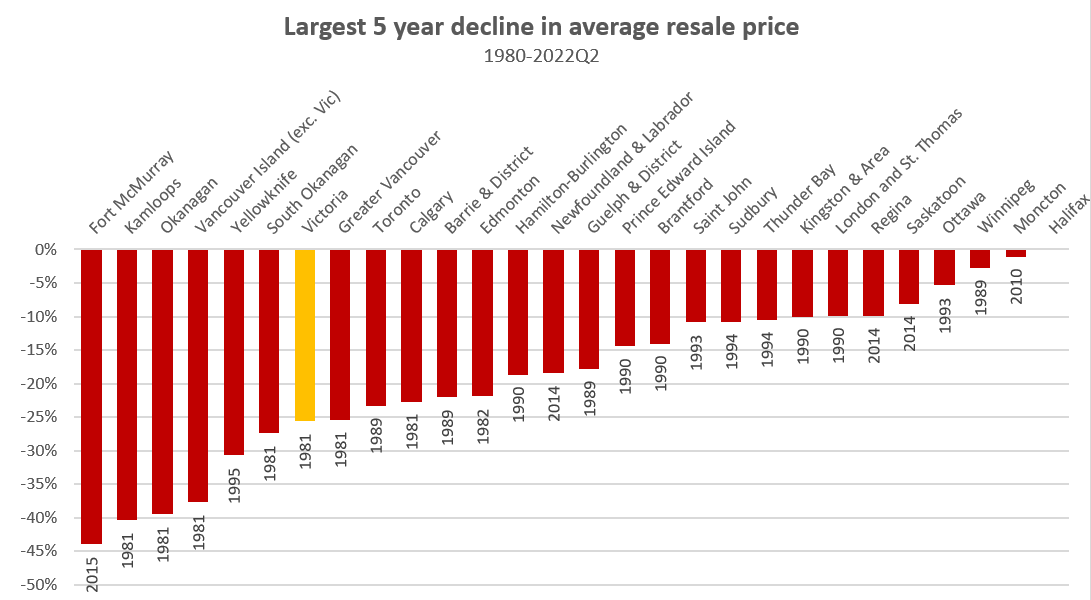

To check into this, I pulled quarterly average resale price data for cities and regions across Canada and compared both the frequency and the magnitude of real estate downturns over 5 year periods. Why 5 years? Due to high transaction costs and variability in market conditions, I believe 5 years should be the minimum planned holding time for real estate, and longer is better.

For the frequency of downturns I looked into how often the average resale price was down 5 years from any given quarter as a percentage of all quarters since 1980. By that measure, Victoria is indeed more stable than most other markets in Canada with only 7% of 5 year periods ending with prices dropping. Ottawa was similarly stable, but the most stable was Halifax which had never seen a 5 year period with decreasing prices. Interestingly enough outside of Fort Mac, the rest of the island and the South Okanagan is also quite prone to periods of decreasing prices.

When we look at the largest downturns on record, the picture is somewhat different, with Victoria in the top third for 5 year downturns in real estate. All of BC crashed in the early 80s, while most of Ontario did 10 years later. A few markets suffered from the oil crash (Fort Mac being the worst) while the cheaper markets have not seen any large declines in the past four decades.

Though 40 years is not a lot when it comes to real estate cycles, it does seem that Victoria is somewhat more stable than other markets in BC, with a more moderate worst-case downturn and less frequent periods of down markets. At the same time it’s clear that higher rates of price appreciation also raise the risk of larger downturns. While I don’t expect an 80s style downturn in Victoria this time around, I wouldn’t be at all surprised if we haven’t recovered peak pricing 5 years from now.

Also the weekly numbers courtesy of the VREB.

| September 2022 |

Sep

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 51 | 131 | 761 | ||

| New Listings | 101 | 384 | 978 | ||

| Active Listings | 2072 | 2152 | 1124 | ||

| Sales to New Listings | 50% | 34% | 78% | ||

| Sales YoY Change | -41% | -47% | |||

| Months of Inventory | 1.5 | ||||

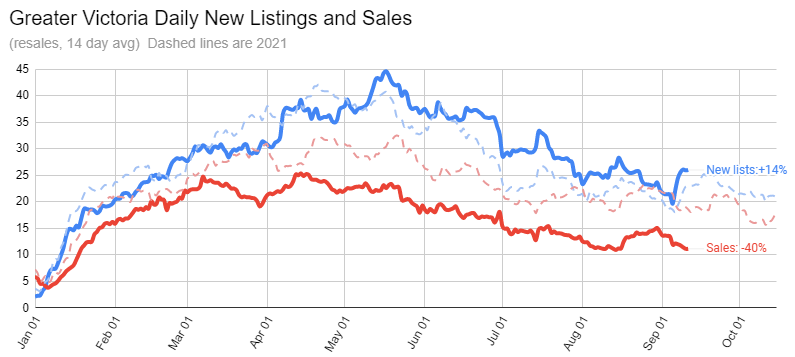

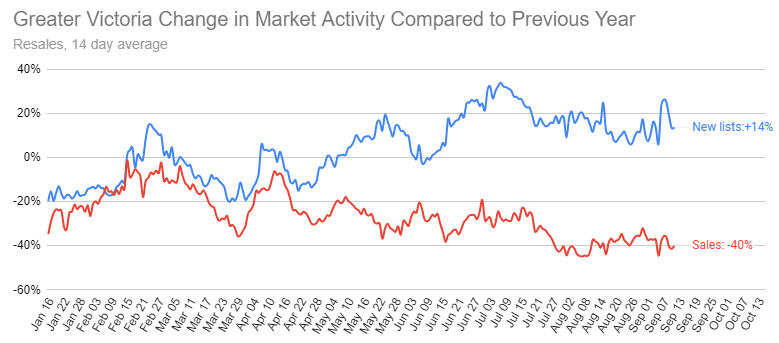

Meanwhile September is off to a good start in new listings which are coming on at a more or less normal pace, while sales started off slowly.

New lists have been pretty consistent at 10-15% above the year ago levels (which were historically low) while sales have been down about 40% the last 6 weeks. No sign of any significant number of distressed listings which I believe remains the biggest risk to the stability of the market. Continued lacklustre sales will drag the market down slowly but a surge in listings (again like we had in the 80s) could really accelerate the drop.

It’s a little too early to tell how much demand we’ll see in September, as buyers usually wait for the fall listings to come onboard before sales rise as well. I would expect an increase in sales in the latter half of the month as selection improves.

Meanwhile there are early signs that rising rates are dragging on the economy more broadly than just housing. We are seemingly cresting the top of employment and may be heading down again though it’s a bit early to call it a trend. Many indicators of the supply logjam are easing, indicating that demand for consumer goods is pulling back. It will be interesting to see how the Bank of Canada interprets those signals, though I doubt they will be strong enough by October to prevent another increase in rates.

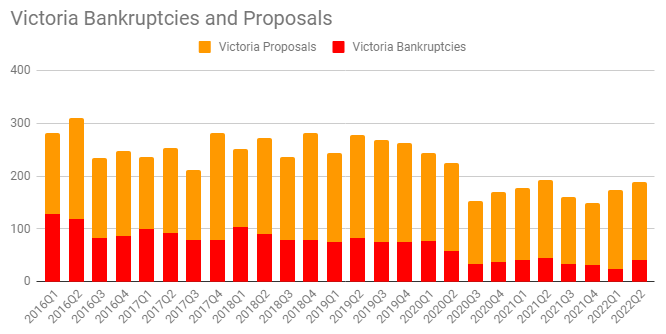

Though clearly a lagging indicator, bankruptcies in Victoria remain well below pre-pandemic levels.

Yes they are taxed on their freehold value. But you missed the BIG POINT. “The aggregate for all of the units” The city collects less taxes.

New post: https://househuntvictoria.ca/2022/09/20/no-gain-in-affordability-but-conditions-have-improved/

I believe leasehold properties are assessed and taxed based on their freehold value.

But would a four-plex solve the missing middle? Or just add more small one or two bedroom units.

Thanks Leo. That makes sense. I really like the four-plex idea too, especially that half the units would be accessible.

As for financing of a co-operative, what has happened in the past is that the shares are deposited and held by the bank. Co-ops are more expensive than leaseholds to purchase as the owner has a reversionary value in the land upon destruction.

I’m using the examples of leasehold condominium versus a strata condominium to illustrate that the cost to purchase is lower. That’s the point of the thread. If the city wants is to encourage development of “affordable” housing then this is one way to accomplish it.

We may be talking about different types of co-ops. Buying shares in a co-operative was a way of owning an apartment before strata titling. My basic understanding is that a corporation would buy up an apartment block. Shares in the corporation would then be sold, entitling the shareholder to occupy or “own” a specific unit. While apartment corporations still exist and you can still buy into them, it has been superseded by strata titling. And for good reason. The main one being, the buyer can get a mortgage with 5% down. Buying shares in a co-operative requires a much higher downpayment.

Dad, that’s not true. People still buy shares in co-op housing in BC today.

Yes, and the nice thing about a strata titled condo is there is a statutory scheme in place whereas leaseholds do not have one. Just contract law and common law. Good luck navigating that as a layperson.

Seems we are both wrong. Strata Titles Act, and it came into force in 1966. Condominium Act came into force in 1979.

Buildings age and items like windows, roofs, and elevators have to be replaced. Doesn’t matter if it is a strata or a leasehold if you own a condo long enough you will have to pay a special assessment for repairs.

If the land owner did nothing then they could also be sued just as someone in a strata can sue their strata council if the building is not maintained.

The Strata Condominium Act came in 1972 and has been revised several times since. Nothing is carved in stone.

Yes. Much cheaper ($2m vs $4m). But man, paying $2m + mortgage interest + repairs for a house that you won’t own at the end of the 25 year mortgage just doesn’t seem worth it.

647 Michigan:

https://www.timescolonist.com/local-news/legal-imbroglio-over-windows-doors-divides-james-bay-leaseholders-they-face-1m-in-fees-4681886

I also seem to recall financing leasehold properties can be challenging, i.e., there are a limited number of lenders.

Shares in a co-operative, aka apartment corporations were rendered obsolete when the Condominium Act came into force back in the 60s.

Don’t have to go to Vancouver for an example

647 Michigan is a leasehold condominium with the last one-bedroom suite on the tenth floor selling at $265,000

Monthly assessment at $529.

620 Toronto is a freehold condominium with the last one-bedroom suite selling on the 15th floor at $540,000

Monthly assessment at $422.

All buildings come to the end of their physical life and have to be demolished. Leasehold is cheaper because at the end of the buildings life span there is no reversionary value to the owner of the land for a leasehold. While a strata owner will receive a value of the land apportioned by it’s unit upon destruction schedule along with the rest of the suites. After demolition costs that’s not going to be very much.

It’s not a good deal for the City because the property taxes on leasehold land is far less than the aggregate for all the strata units.

Another solution to high prices are Co-operatives where the owner owns shares in the entire complex and not the individual units. These are difficult to finance as the lender’s security is not the real estate but the shares. Hard to foreclose on shares. It’s not impossible but most lenders would grapple with this concept as they do with homes in manufactured home parks. It would have to be a chattel mortgage and not a regular mortgage. For example, New York City has a a lot of Co-Operative condominiums. Oak Bay has a few along Beach Drive such as the Rudyard Kipling complex.

There are options but if I were the city, I would ask the real estate department at UBC for advice. Those at the Sauder School of Business (UBC) study real estate. They have PHD’s in Real Estate and Appraisal. Let’s see what the egg heads in the ivory towers say.

Yeah, looks like at least 1/4% there even when interest rates were falling. Seems remarkably stable for a very long period there.

It does make properties cheaper. Compare:

https://www.realtor.ca/real-estate/24729219/6042-crown-street-vancouver

https://www.realtor.ca/real-estate/24841286/4177-staulo-crescent-vancouver

I like the idea of ground rental rates as a way to lower the cost of housing under a public/private partnership. The government/ non profit society/ pension fund/First Nations provides the land and charges a lease rate for the land while the developer constructs the improvements and sells the improvements without the land. Purchasers are buying a leasehold interest that can be bought and sold at a lower cost rather than a Fee Simple interest, and the owner of the land is receiving a secured and marketable cash flow.

It’s worked for Grosvenor International for centuries.

Just eyeballing the owned accomodation on this chart. Not all of that is interest rates of course.

Month to date numbers:

Sales: 239 (down 47% from same week last year)

New listings: 701 (up 14%)

Inventory: 2229 (up 87%)

New post tonight

Although the declines are lagged the peaks should not be – pretty incredible how much its moved in the two years of the pandemic:

https://housepriceindex.ca/wp-content/uploads/2022/09/Teranet_E_220920.pdf

heard it from a neighbour over ribeye steak?

That is a lot higher than I thought it would be in March. How’d you calculate that?

And something like 1.5 percentage points of year over year change is due to rise in homeowner costs, which is basically cost of higher rates. Three quarters of the BoC target is from their own mechanism to bring it down

Teranet for August

Victoria -1.22% MOM, +14.83 YOY, -2.72% from the peak in May 2022

This is the new-and-improved “month over month” Teranet reporting that goes with the latest month (august) only. Previously did a 3 month average.

Based on closing date, not sale date – so still lags about 2 months. So they may be measuring June sales, with the market sales prices peaking in March.

Overall: This new teranet data looks more reasonable, if you apply a two month delay to account for completion date vs sale date

https://housepriceindex.ca/2022/09/august2022/

Its interesting, CPI is down, so Canadian bond yields are lagging compared to the US, and as a result, CAD is dropping against the USD, which should lead to a higher CPI…

Components of inflation change month to month

With some of the streets here, removing front yards would almost make more sense. Put a new one lane street through the front yards on both sides, and get rid of street parking. Then put a whole new set of houses where the street used to be.

Yes I know. You will note that I didn’t say where he was from.

A tax on land rent received is a tax on “income”

Property tax is a tax on “property” (regardless of income generated from the property)

To me, those are quite different types of taxes.

At least we agree he was talking about taxing rental income received by landowners from land rents. And he wasn’t talking about the real estate “property taxes” we have today, based on value of house+land, irrespective of rental income.

He was from Scotland actually, but that’s not the point. I would call a tax on land rents as described by Smith a property tax within the context of the land tenure of his day, you can call it something else if you like. But land rents were something quite different than rental income from dwellings – a topic that Smith also discussed below, and is worth reading. So I don’t consider taxation on the land rents of his day to be analogous to our present income tax on rentals.

No.

The only property related tax that Adam Smith favoured was a tax on the portion of rental income that was paid for “ground rent”. Ownership of the ground (land) in England was often separate from house ownership. Adam-Smith felt the landowner should be taxed on income from his land (ground rent). And of course we do tax rental income, as “income tax” for the owner. That’s nothing like our “property tax” that is levied in the value of house+land, regardless of income generated from it.

If you disagree, kindly provide a quote from Adam-smith saying something different. But here are two of his quotes advocating only a tax on rental income from land (not the house rent, not a property tax on value).

Adam Smith (wealth of nations):” Ground-rents and the ordinary rent of land are, therefore, perhaps, the species of revenue which can best bear to have a peculiar tax imposed upon them”

Adam Smith (wealth of nations):” Ground-rents are a still more proper subject of taxation than the rent of houses. A tax upon ground-rents would not raise the rents of houses. It would fall altogether upon the owner of the ground-rent, who acts always as a monopolist, and exacts the greatest rent which can be got for the use of his ground. .”

Does MMHI allow for a second house to be built in the backyard, making it a duplex, thereby avoiding the need to tear down existing livable house while adding another house to the property?

Well they could but generally don’t due to cost. If there’s going to be something like a 4-plex then it would be 2 accessible units on the ground floor and 2 not accessible above

Thank you. The only problem I see with this is that three level apartments don’t have elevators.

If only Smith knew of the carbon tax and GST.

It was offered as a ‘where would it end?’ response to Barrister’s comment about realtor’s potentially having to disclose possible future zoning changes.

But I should have quoted rather than what I assume was making it seem like a new question ;-).

Adam Smith felt that property taxes were the best form of taxation you know.

The City could rezone large parts of the city for town house development but I doubt that developers would be interested as the cost to assemble properties that are already improved with single family homes, that then have to be demolished, is too expensive to make a profit.

Having the land zoned for low rise development doesn’t mean that it will be built. There has to be a profit to be made. Otherwise nothing is going to happen. That’s why you see most of these developments occurring along busy streets dotted with older and smaller houses where the costs are lower to assemble. Parts of Bay street are proposed to be multi-family but the underlying land is an old lake bed where the cost to construct a foundation to hold the weight of the building would be ridiculous. That dooms most projects.

Zoning by itself isn’t going to be the magic solution. One has to consider soil conditions, if the site is physically large enough and most importantly if it is economically feasible. If any of these factors are not favorable, then it is not going to get built. If the city intends to pour money into these projects without looking at feasibility then that would be a waste of tax payers money.

My personal opinion is that the city shouldn’t tinker with the market. Leave the market alone and it will take care of itself.

“Laissez-faire”

-Adam Smith “The Wealth of Nations” 1776

If we are speaking about Garden Suites as upzoning then the answer to the question does this increase the land value is no.

It is economically unfeasible to construct a Garden Suite as the cost of construction is greater than the suite’s contributory value to the property as a whole.

To put it another way. If you are building a new home with a Garden Suite on vacant land for the purpose to sell then you will net less than if you were building a home without a Garden Suite. So you are NOT going to pay more for the land.

And that’s the reason why we don’t see more Garden Suites being built.

For Garden suites to be economically viable then the cost to construct has to drop substantially or the achievable rents have to rise substantially or a combination of the two.

That could change if the City allowed the principle dwelling to have a suite which would make the property a tri-plex. But otherwise the alternative of building a primary dwelling with a basement suite (duplex) is more profitable than building a house with a detached Garden Suite.

That doesn’t preclude those that want a Garden Suite for other reasons such as family. In that case fill your boots.

The specific Victoria missing middle housing initiative is only up to 3 floors. So I would call that low rises only. It doesn’t address or allow building mid or high rises. Missing middle in general is often defined as including larger buildings, such as 4 floor courtyards, but it’s not part of this proposal.

Thanks Leo, could you please explain to me if the proposed missing middle policy differentiates between low, mid and high rises?

Missing middle vs status quo. It’s simply legalizing what is already called for in Victoria’s official community plan.

The 3 floors from 2.5 was done to improve accessibility (ground level entry) and I believe the 1.1 FSR is only available with affordable housing contribution.

Wut?

It seems to me a big part of the “missing middle” is building low rises and mid rises rather than high rises. I’d love to see a percentage of low rises and mid rises included in neighbourhood plans but am fine with a ban on high rises. Mentioning this because most the discussion re “missing middle” is focused on building higher density than only SFH on big lots. What is missing is the other half – missing middle means between the extremes of both large SFH lots and high rises.

So when SFHs in the COV were upzoned for garden suites it increased land assemblies as a result? I don’t follow?

And not sure what you mean by potentially. What exactly would you build on a land assembly under the missing middle upzoing?

“Wouldn’t that require a rezoning? Question was missing midding upzoning not land assembly rezoning.”

Potentially but that’s what typically has happened in the lower mainland when property gets up zoned. Very few people doing laneway Houses or duplexes

Wouldn’t that require a rezoning? Question was missing midding upzoning not land assembly rezoning.

So the agent should also explain every single rezoning possibility on adjacent properties/neighborhood?

Should the agent also explain that the province might step in?

Should the agent also explain should the owner next door decide to teardown their property the exact bylaws to which they can rebuild?

It is a city, it evolves. If you want peace and quiet go buy 100 acres of ALR and plant the house in the middle of it.

“My best guess would be uplift on teardowns 50 to 100k. Livable house no change, the numbers don’t work.”

I disagree , with land assemblies you could get much more know tons of people in north van and Coquitlam who’ve done it . Could be as much as 20 percent of project cost. Each townhouse should sell for around 900-1.5.

My best guess would be uplift on teardowns 50 to 100k. Livable house no change, the numbers don’t work.

Is there any consensus as to what (if any) effect that upzoning might have on the value of a typical SFH property?

This would be interesting for the entire CRD. Although in NIMBY paradises like North Saanich, I’d be surprised if any of the candidates were in favour of missing middle development.

Barrister – no need to take my ‘conclusions’ for anything more than a quick read through the proposed bylaws: https://pub-victoria.escribemeetings.com/filestream.ashx?DocumentId=82348

Scroll down to section 3.0 to see the restrictions for a ‘houseplex’, which I think would be the most common implementation. You can compare that to the existing R1-B/G/X zonings. This section stipulates a 40% site coverage, 0.5 FAR, etc. These are pretty close to existing SFH regulations, with the biggie (that I see) being the height bumped by an extra floor (and basements are not allowed).

Reading through the design guideline document (https://pub-victoria.escribemeetings.com/filestream.ashx?DocumentId=82353), I see that most of the example photos they’ve provided would not apply/comply with their houseplex bylaw.

Can you point me to the documentation that stipulates 94% site coverage? Is that for a houseplex or some other special designation?

Office closed today.

Patriotz, you are quoting what a seller has to disclose which is completely different than what your own agent should have to inform you of or advise you regarding a property. . As I am sure you are aware the seller has no fiduciary duty to you while you real estate agent does.

Sidekick, since you are a big pro Missing Middle advocate I have to take your conclusions as to impact with a rather large grain of salt. I find it hard to believe that most intelligent and forthright people would even suggest that this is a minor change. Whether or not it is a good change is open to argument but nevertheless it is a major zoning change being proposed.

The issue is whether your own agent has a duty to explain the MMH which will be before the new council.

Seems to me that a potential zoning change in the future is just as removed from the physical condition of the property.

Leo – any update on your missing-middle friendly CoV candidates list?

Barrister – where do you see 94% lot coverage? I just read through the proposed bylaw changes and they seem surprisingly restrictive (to me). Except for corner lots, you’re basically looking at an extra story of height versus the normal SFH zoning. You can ‘pay up’ for over 0.5:1 floor-area-ratio, but they’re pretty steep prices.

I am aware of someone who built a house under the circuit at the airport in November and was shocked when they returned in July and there were airplanes flying overhead all day. Should a realtor be required to disclose that the airport is busier in the summer?

I wonder if the fact the missing middle is still an outstanding issue in the CofV whether this is having any effect on the sale of SFH. The potential to end up with a four story building next door with 94% lot coverage might certainly be a major factor to consider for some homebuyers.

Do real estate agents who represent a buyer have either a fiduciary duty or a ethical duty to explain to potential clients that a major zoning change has been deferred to the next council?

Do you think that your professional real estate agent has a duty, particularly to out of town buyers to advise them of this major zoning motion still before council? I suspect that any lawyer who failed to advise a client of a major potential issue would likely be held grossly negligent. Since real estate agents, in many of their ads, keep focusing on the representation that they are professionals should they be held to the same standards?

Seems like no update from the board on weekly numbers this morning, but I’ll likely still post an update tonight.

It seems like this is starting to normalize now. Used vehicles in general anyway.

Yes. Some types of buy downs are available at all times to any home buyer, to get you a lower mortgage interest rate (lower mortgage payment) for the first few years. There’s a way to get a buy down (lower) rate at any time if you’re dealing with a mortgage specialist at some banks (like RBC), or any mortgage broker. Ask them if they’re getting a commission (they are at RBC). If the bank offers 4.5% which the specialist tells you is the lowest rate, the rate can actually be lower with “management approval” if the specialist agrees with RBC management to receive a lower commission. This is a buy down which costs you nothing. You get it by shopping around and letting them know that you’re aware of a lower rate through a buy down. You save for the first few years (typically a 5 year term). You can try the same trick at renewal though you may have to switch banks because they don’t give commissions to renew their own mortgage.

This is further explained here…

https://www.findmeamortgage.ca/index.php/blog/post/207/pros-and-cons-of-getting-an-rbc-mortgage

“The bank sells RBC-branded mortgages solely through its employees, (mortgage specialists and are not provincially licenesed hold title under the bank), branches and call centre. It does not directly participate in the mortgage broker channel, but its subsidiary, RBC Dominion Securities, funds several mortgage broker lenders. Mortgage specialists are the primary sales channel at the bank. Essentially, they are commissioned representatives. Their direct pay and/or bonus may be based on factors like the amount of your mortgage, the mortgage type and the rate they sell you. There’s one very important thing to remember about mortgage specialists. They have the ability to ‘buy down’ your interest rate. They do that by trading some of their commission for a lower rate. Use this knowledge to your advantage. A few other notes: Mortgage specialists don’t generally service existing RBC customers who are up for renewal. If that is you, you’ll want to call the above number instead. If you need a mortgage specialist referral at RBC on Vancouver Island feel free to email me directly”

We know that COVID and supply chain issues messed with how vehicles normally depreciate — used EVs even appreciated!

Yeah, many folks are out to lunch on the asking price for their used car.

This is called an interest rate buydown. The dealer or carmaker turns around and sells the loan at market interest rate and a lower price, which is the effective sale price. You pay PST and GST on the higher price. If they won’t sell to you for cash at the effective sale price, it’s not too bad a deal though.

This same tactic surfaces during RE market slowdowns, so keep an eye out.

Was this during Covid?

Recently bought a new vehicle and got a 1.99% rate for 6 years. Decided to put the money we had saved for it on our mortgage instead since we are paying higher interest on that.

This is a bit of a superficial view but the last couple of cars we bought (1993 and 2009) I didn’t see the dramatic drop in price when you drive it off the lot. We looked at a lot of 2 and 3 year old vehicles and they seemed to want new price minus a few thousand dollars. It got worse as they got older. A car with 150,000 km was asking about half the new price. My view at the time was that it was half worn out so if I was buying half a life car I would rather have the first half than the second. As it turns out, we keep vehicles a long time and I ended up with both halves. I still prefer the first half. Because we drive so little (< 10 K km per year) and buy cars so infrequently I am not suggesting the above impression is even accurate but it seemed that way at the time.

If I’m doing the math correctly here (not a given)…

You buy a $45,000 car with 10% down. Loan is 72 months at 5%.

Total loan interest = $6,461

So you end up paying $51,461 for a car that is worth (briefly, before you drive it home) $45,000 and is worth ~$26,000 after 3 years.

It arguably doesn’t even make good financial sense to buy a new vehicle with cash, let alone on credit, due to the steep depreciation early.

I myself don’t like borrowing money (and therefore paying interest) on depreciating assets. Just doesn’t seem wise to me.

Makes sense, I suppose. As long as the reno actually produces higher rent and the rent differential pays for the cost of the reno + loan interest over a reasonable period of time.

Sounds good.

Why not start saving now and buy it outright?

@introvert I see cars is on the list. We’re going to have our first car payment when we retire this one in a couple years. It’ll be fine bc we can afford it. I’m also surprised renovations is on there. We borrowed to renovate and in so doing increased our rental income in a short amount of time (tenants left on their own). We are paying off the debt quickly and then we’ll just have that increased rent. I mean maybe you make an exception if it’s revenue generating? I don’t think we would get the rent we are now without the Reno’s (certainly not the kind of tenants we look for). We also got a 0% interest loan for a highly efficient heat pump that save us way more than the loans carrying cost of $80 a month. I don’t think that’s bad debt either.

Debt is bad when people have to rely on it for day to day living or if it causes stress or financial strain. And then it’s not bad like a moral failing but just sad because so many people will be in that position with inflation.

My personal philosophy has been to rely on debt to buy a house, but not rely on it for anything else (including vehicles, furniture, vacations, renovations, or even emergency funds).

Yes some credit unions are federally regulated and must apply the B20 stress test. In BC Coast Capital Savings Federal Credit Union I believe is the only one. As you pointed out in your clarification post VanCity Credit Union is provincially regulated and does not require a mandatory stress test (although it may be used as an evaluation tool). Here is a list of provincially regulated ones in BC.

https://www.bcfsa.ca/public-resources/credit-unions/bc-authorized-credit-unions/find-credit-union-search-results?type=credit_union

Here I go again. I apologize. It is Vancity Investment bank that is Fed. regulated. Also Coast Capital Credit Union.

So VanCity Credit union is not.

Sorry, I meant Federally regulated credit unions

Roger: VanCity and Coast Capital credit unions are both federally regulated Schedule 1 banks. Deposits up to $100K are insured under CDIC.

Getting a low rate with a bank -approval letter from a few months ago is one source of mortgage funds. The other is credit unions.

Credit unions offer mortgages at rates lower than banks. There are several reasons for this but I suspect it is because they pay less interest on the funds they are using and have lower operating costs. For example on a 5 year GIC RBC is paying 4.6% while Van City is paying 4.3%. 5 year mortgage rates are 5.24% and 4.74% respectively.

Credit unions are not federally regulated so they are not subject to the federal B20 stress test rules. This means buyers can qualify for a larger mortgage at a credit union than they can get a bank as long as they put more than 20% down. (With less than 20% down they need CMHC insurance so the stress test still applies)

I had a suspicion that mortgage pre-approvals might be giving this RE market some legs as buyers scrambled to find a deal before their time ran out. This article sheds some light on the topic.

https://betterdwelling.com/canadian-real-estate-fueled-by-pre-approvals-enormous-shock-coming-bmo/

Those interested in co-ownership may want to connect with this group: https://www.cohobc.com/

Major banks like RBC will pay 2.9% on GIC for 180 days. You can get Bankers Acceptance notes for 3.25 % for 180 days. So on 300K the interest would be from $4350 to $4875 respectively.

I’m curious. Could Dee give a very rough estimate of what $300k would give you back in six months with a GIC. (Total)

Thanks.

@james put the 300k into a 6 month GIC then re evaluate in spring once we know more. Long term if you have any interest retiring up island why not try to buy your future retirement home now (or in a few months). But only if you can rent it out. If you hate the idea of managing a rental hire someone.

Vacant land takes the biggest % hit in any RE downturn. Price of SFH is mostly land value. Expenses to pay but no revenue. Plus it’s my understanding that BC’s spec tax applies to vacant lots.

Wile E. Coyote time it appears. Wait until you see the puff of dust.

If I just happened to have a bunch of cash right now I would park it in something short term and wait for better opportunities. The risk is that you miss a good time to invest. But seems like right now multiple red lights are flashing lower asset prices ahead in the short term.

Where to put $300,000? Most people on this blog seem to think that this is just a temporary setback. If you feel the same way then buying vacant land would be something to think about.

There are 24 lots for sale in Victoria’s core but only one lot has sold in the last 60 days on the real estate board. Builders are going to need lots when the market returns, so lots will be the first to go up in price.

James:

You did ask….where can I park $300,000.00?

It’s a fair question because what does one do with cash sitting around.

I suggest a well maintained duplex in Moncton.

$2,750.00 “total” income per month from both suites.

With some of the best opportunities and cheapest housing in Canada, it’s not likely that Moncton will drop in price.

Think about it. Where is someone who is forced to sell in Toronto or that surrounding region going to move to? Rents are not likely to come down so a former home owner is not going to go back to renting. They will look to new horizons and be forced to accept living somewhere else. A place that is still substantially cheaper.

Moncton is quickly growing into a hub as new businesses are relocating there.

A Property management company could easily look after the place for you. You sit back and the money is sent to your bank account.

We do not plan on selling any of our properties because we would be left with the same problem….where would we park the money. (With the understanding that nothing is totally risk free.)

Good luck to you.

? I don’t know if you are talking to me. Just google what is in the quotation marks below for the info.

Are they on the Victoria Real Estate Board’s site?

Stats for Esquimalt and Oak Bay: “Esquimalt Household Income, Population and Demographics. ” Ditto for O.B.

Lots of neat stuff there.

I don’t have data on how many homes are owner occupied in either Esquimalt or Oak Bay. Where did you get this information?

Whateveriwanttocallmyself: That is interesting re: volume of homes for sale in Oak Bay. I just looked at another comparison. Oak Bay and Esquimalt have almost the same population. Right now Esquimalt has 18 SFD for sale and 25 Condo’s. Oak Bay has 63 SFD and 20 condos for sale. Owner occupied homes in Oak Bay has a much greater percentage than Esquimalt however. Anyway, thanks for the post.

Heyhey, there’s Freedom45! What, no post about a looming housing crash? That’s off-brand 😉

I have 300k in cash aside from my emergency funds. Where should I park my money ? Gordon head detached house or North van town house ? Or just stock market ?

Our RBC HELOC can kind of do that. At any point, we can break off a portion and convert it into a mortgage at the then prevailing rate. We managed to lock our first draw in at 2.5%. Of course it would be somewhat higher now. The only downside is that you are then stuck with whatever prepayment penalties that might apply.

Well, there’s always that slick troll that will be a troll’n with her different way of knowing.

There are about 24 time zones in the world not including day light savings. So a broken clock is right more than 48 times a day. However a working clock, not set to the right minute, is never correct.

Sage advice. A broken clock is right twice a day, as the old saying goes.

As for interest rates, maybe the past decade was an anomaly, but I won’t be surprised if they fall back to rock bottom after the coming recession, which seems inevitable.

The policy rate is set to create inflation during hard times and to stop it during good times. Rates will go where they go, and Oswald acted alone.

If Greater Victoria is going to see a significant downturn in prices then it will begin in those neighborhoods where home owners spend more of their disposable income on housing than other neighborhoods. Typically that is in the suburbs of Greater Victoria such as Sooke.

The Sooke market is ahead of the urban core and has transitioned into a balanced market with 4.6 months of inventory, a sales to new listings ratio of 0.56 and an average days-on-market of 41. And that has softened prices as most sellers have to make concessions in terms, conditions, and price to make a sale.

My suspicion is that Sooke will be the first neighborhood to cross over from a balanced market to one that favors buyers

On the other hand, Oak Bay seems to be showing similar ratios. I have to re-think Oak Bay as I may have had a bias believing that everyone buying in Oak Bay were incredibly rich having sold their homes in Vancouver and are therefore not as affected by higher interest rates as less affluent neighborhoods. There are a lot of houses and condos for sale in Oak Bay relative to the stock of housing. About 1 percent of the entire stock of housing is currently up for sale. Victoria and Saanich have only 0.5 percent of the entire stock listed while Sooke has between 1.5 to 2.0 percent of the entire stock of housing for sale.

People in Oak Bay, might be human after all and subject to the same financial problems as most of the rest of us.

R – try not to take the comments here too seriously. Over the past couple years it’s become evident that those with the most to gain from a housing crash love to share the doom and gloom stories. Also many who post their hot takes about interest rate hikes, the CAD, inflation, the stock market etc. are also the ones that despite all their so called financial knowledge somehow haven’t secured a property. There was a post a while back from someone still looking for their first property that claimed they’re also on track for the freedom 45 club, which could be attainable I guess if they’re 19 years old. The one thing the comments section here proves is that climate change is real because it seems a few people’s brains have evaporated 😉

haha, you were a good 2 steps ahead of us. Our lightbulb didn’t go off until Trump gave his first TV address on covid where he said it was just a handful of people and would be gone next week. At that exact moment wife & I looked at each other & said we need to get groceries right now. That was about 7 p.m. and we drove directly to the grocery store, which at that point was packed full of Asian folks (this is not meant as a racist comment, just the facts) cleaning out the shelves.

we’re all pretty lucky & have come a long way since then, especially when you think of all the people who didn’t come through it

I’m not an expert but at what point do you stop treating historical rates as the benchmark for the possible future? I’d never look back to the 1920s and say “because the average rate in 1925 was X, that is the benchmark we must prepare for in the future”. 1982 was 40 years ago.

I think rates will inch higher for awhile but it will be non linear and people will have time to catch up and adjust, other than a small handful of people who overextended, but that won’t be a catastrophe number of people.

Of course I still imagine/prepare for a full on 1930s style depression because that is my personality type and what I secretly expect haha. In which case all bets are off and everyone is doomed 🙂 But you’re talking to someone who bought a chest freezer in January 2020 when rumours were just getting started in Wuhan in order to prepare for a deadly pandemic. I’m a low key prepper and I’m ok with that, even though logically I know it’s a bit silly.

Nobody’s saying they will.

That’s the point. And do note that we had been seeing all time lows since late 2008, and relative lows since 1982.

@patriotz growing up we didn’t have a lot of money and parents were very debt averse. It wasn’t until I had a good friend who grew up with more money that I started to understand the importance of debt. She told me without debt there’d be no middle class. I think she’s right. Usually people rely on debt to maintain a middle class lifestyle. Even now there are smart things one can do with their debt. For example, I just locked in my line of credit at 5.2% for one year. That’s saving me about 3% interest. It’ll be paid off before the year is up but I wanted to lock it in now since rates will almost certainly increase further. Can interest rates on HELOCs be locked in? If not maybe switch to a line of credit with a fixed rate. I think the effects of the tightening have barely started and it’s going to be a rough couple years. But, I could be wrong!

Thanks! Compared to my stress comments a month or two ago on this blog I do feel pretty good. Some worries but it’s manageable. I took some time to reorganize our finances and feel more in control. Certainly an epic catastrophe could sink us but that’s true for anyone. We at least have enough savings etc that we can withstand a reasonable amount of financial pressure.

I mean to be fair, does anyone actually think rates will just rise in perpetuity now? I doubt it… maybe they won’t drop to the same all time lows, but I don’t think it will be a never ending ascent for the next 10-20 years….and wages go up and principals get paid down…

You’ve always seen a secular decline in interest rates. What worked for you (and me) is not necessarily going to work going forward.

We’re already seeing what’s happening to those who over-leveraged a year or so ago.

I find it crazy how resilient the market has been to the interest rate hikes. Sales haven’t cratered, completely, and neither have prices when you look at the big picture. Sure they’ve come off insane short lived peaks in Feb/March but looking at condos, for example.

2021 August condo median @ 482k @ interest rates 1.5%-2.5%

2022 August condo median @ 550k @ interest rates 4.5%-5.5%

Massive jump in interest rates and we aren’t even close to 2021 prices at much much lower interest rates.

You have to take calculated risks and debt to get ahead. It was all the over-leveraging from my mid 20s to early 30s that put in a position to have enough cash to pay off my variable debts now and then I’ll load up on debt again when things are more favorable.

I’ve always been of the opinion over-leverage when you are young and then scale it back. If you go bankrupt before 40 yrs old you still have 25 years to recover. My parents came to Canada in their late 30s with literally nothing and started with low paying jobs and they are extremely comfortable heading into retirement. Over-leveraging 50 onwards you taking quite the risk imo.

Point taken. However, sensible use of credit, so as to live with repayable debt, seems to be quite rare in present times. Perhaps we shall all see a return to carefully measured borrowing in the future(?).

Signpost, your rhetoric about not taking on debt makes no sense on this forum. Wrong audience.

Nobody ever got ahead in real estate or business investing without taking on debt first to do so. Although it’s true that over-leveraging is bad, your posts about living debt free are nonsense unless you’d rather enjoy having no debt from a mobile home.

Too true! It is a very troubling time for those who were persuaded to borrow above their pay-grade. By ignoring the tried and true formulae which have guided Canadians in past times, such heavy borrowers have painted themselves into a corner. Those who have little or no debt will (sadly) also feel some of the adverse effects on our general economy. There will be tears…

It’s the outgoing tenant’s job to clean, not the landlord’s. Takes a bit of finesse to actually get them to do it well though.

Just clipped and scanned this article from the newspaper. Seems that one of the banks used by many first time homebuyers is closing down.

Layla- I predict that we are going back to 2017 prices. As a high income single property person I’m elated because there’s no one I dislike more than realtors and arrogant tradesmen.

R- you’ll be fine !

https://househuntvictoria.ca/2022/09/12/is-victorias-market-more-stable-than-other-cities/#comment-93597

The entire point of the stress test is to eliminate demand when people can’t afford what they can technically “do”. The reductions in commissionable volume is the point and the realtors bitching about it means it’s working.

How many people have massive mortgages? On personal finance Canada (Reddit, very unscientific) it seems like most mortgages are under 300k, so I imagine a lot of Canadians don’t owe TOO much and can extend amortization and be ok? Probably just us expensive city suckers who bought in the last few years who are in a “really big loan” situation. As a percent of total population… maybe not too many people?

I have done much soul searching on this topic in the past because we have a massive mortgage and the mere idea of high rates at renewal was stressing me out. Now I realize it’s not the rates that scare me the most, it’s a recession as a result of those rates and losing my job in a layoff.

Rising rates come and go and anyone with a bit of savings/who aren’t totally maxed out already can probably struggle through a few years of pain and they’ll eventually drop again to some degree… But if you lose your job and can’t find another, that would be tough. And with a lot of people starting to talk about an impending recession in the news, maybe that will happen to some.

Realtors have been pushing for the OSFI to get rid of the stress test. That 2% on top of the bank mortgage rate pushes the qualifying rate used by federally regulated banks (not credit unions) to a little over 7 % for fixed and variable rate loans. But it ain’t happening…

The OSFI boss Peter Routledge in a speech he has just made this commitment:

Interesting – I’m starting to notice more homes that sold under a year ago popping back up for sale at prices around or below what they last recently sold for – like this one: https://www.realtor.ca/real-estate/24881753/4460-majestic-dr-saanich-gordon-head

Wonder what happened there? Bought for $1.42 in January, now listed at $1.275.

It does seem like new construction in Royal Bay is getting beat up a bit as house builders want to get rid of their stock. Generally, builders have a profit of around 25% on a new build, but they have to pay sales commission out of that. So they have wiggle room to drop their price and clear their inventory. So you might get a better deal on a new house than one that is two or three years old.

I can envision buying opportunities for those that want to move up the property ladder.

I suspect high priced homes are not selling well, but if you have a middle income home the demand is still good.

The next few months might present an opportunity for some people to move up into a better home or neighborhood.

https://www.realtor.ca/real-estate/24391237/3335-curlew-st-colwood-royal-bay

lol 127 days on the market!!

And then there is this: https://www.realtor.ca/real-estate/24529994/360-tideline-lane-colwood-royal-bay

I’ll let the others take over from here now LMAO

https://househuntvictoria.ca/2022/09/12/is-victorias-market-more-stable-than-other-cities/#comment-93568

Those stats make absolutely no sense. Perhaps the fact that Canadians were buying housing at these prices and commensurate interest rate risk at all is all you need to know about their financial literacy or lack thereof.

Perhaps folks have a ton of dough stashed in their TFSA’s but taking money out of there is pretty dumb. I would wager that most of those down payments that come from anything other than an RRSP or equity which are documented are lies about gifts from parents. Unregistered savings? Yeah right. What even is “Other”? Canada’s word for “Laundered”?

My parents loaned me 100k (that I have paid them back since) to help me avoid the CMHC. That was of course reported as “unregistered savings” when we bought.

In addition to that, I have had 2 separate conversations this week that covered 4 houses in total that the owners fear they would have to sell. All owner occupied, the main cause? a number of things but generally the main catalyst was interest rates.

So whatever the bullshit biased data says, I think like Ron Butler has pointed out pretty much every day for the last 6 months, Canadians with VRM’s are fucked and if rates stay up, so is everyone else.

Long gone, they’re only $1.5m now, but the lot is under 4k sq/ft

https://www.realtor.ca/real-estate/24391237/3335-curlew-st-colwood-royal-bay

Not monitoring every minute, but my work is at home so I do see most of the neighbourhood happenings. It must also be said that I tend toward the nosy, busybody end of the spectrum, so I probably pay closer attention than most 🙂

I’ve met the landlord and we’ve spoken a couple of times over the years. Very nice person. Maybe next time I’ll ask her how she handles tenant turnover. Would be interesting to know.

I noticed that the latest tenants to move into the lower level did a lot cleaning in the first few days of occupancy. I remember thinking to myself, That’s brilliant! Get the tenants to do your job!

Victoria’s severe housing crisis has to be an explanation for some of this…

Usually same two days. Most, but not all, repairs/ repainting can be accomplished in 24 hours.

Those that do, do it to their detriment, since they can’t claim anything on the way out.

Highly doubt appearance is reality. Are you monitoring every minute of the day? Condition inspections are legally required and landlords don’t skip inspections that I’ve seen.

There’s a house that’s rented to UVic students close to me, and the landlord seems to have zero downtime between tenants and isn’t present at changeover. Move-in and move-out inspections don’t take place, either, it seems (maybe they’re done over Zoom, but I kinda doubt it).

If appearance is reality, this rental is a super duper low-work, low-stress cash-generating machine!

Nice to hear from you again, Cadborosaurus.

We’ve always left our suite unrented for a month or two in between tenants. We always felt like we needed to take a breath, clean the place a bit, and not rush the tenant-selection process (which, I don’t need to tell you, is especially important when the tenant is living inside your house).

Mind you, we’ve only had three tenants total since we bought 13 years ago, which isn’t a lot of turnover.

Haven’t been here in a bit, the back to school busy is no joke. Wanted to provide an update to what renting our suite was like this time around. After getting 1m notice from the last tenant this summer we had 1m to have it rented and this was stressful and didn’t feel like enough time. Their situation meant they couldn’t do earlier notice but it did mean a time crunch for us and we had camping plans etc. For those with rentals do you leave a gap in-between tenants or have one move out and the next move in within the same 2 days? I think I want to ask the current tenants for more notice next time and provide incentive for doing so. There was lots of quantity of summer applicants (60+) but not quality. We decided to extend the time by a month for breathing room, had family visit and use the space, and painted. Lost a month of rent but this was the right decision.

We were prepared to sign 3 different sets of tenants and had even completed screening on them before they bounced for who knows what. (A roommate set broke up and the one left behind couldn’t find another roommate, one couple decided last minute they wanted a dog which we said no to, 2 students just ghosted us after a really good reference check). Learned some lessons on wasted time. But after changing it to a potential Sept 1 move in we did get a lot more quality applicants and picked some great ones.

We did a lot of virtual showings this time around as a lot of applicants were moving here from elsewhere, more than half. And made a video of the place that we could send easily then did zoom meetings with prospective tenants. Our spidy-senses are getting better and we didn’t offer to meet anyone that had a bad vibe or questionable social media, and those we did meet in person or virtual all seemed great.

Wish me luck on round 2, so far so good.

Agreed.

It’s interesting that RBC is using the benchmark prices. I assume they mean the mls hpi benchmark.

They changed the methodology in that benchmark calculation in June 2022 https://www.creacafe.ca/mls-home-price-index-methodology-changes-heres-what-you-need-to-know/

And the benchmarks have shown less price declines than other measures (average, median)

IMO, The sale price to assessment that Leo does is a much better measure than benchmark

Where royal bay prices at now? I am guessing 1.6M for a house on a 4k lot is long gone.

RBC market update

https://thoughtleadership.rbc.com/canadian-home-buyers-feeling-the-heat-of-higher-interest-rates/

Thanks.

I’d have to look for them again but the mixer mortgage through VanCity is for co-owners: https://www.vancity.com/Mortgages/TypesOfMortgages/MixerMortgage/

Co-ownership agreement templates are available pretty widely now and not that expensive to have done by a lawyer.

Umm..really,

Perhaps tax increased, but I fear both Canada and the US governments will just kick the can down the road.

May well be correct, but it’s Toronto in any case. A bit closer:

https://dailyhive.com/vancouver/vancouver-homebuyer-down-payments-parents-gifting

As it happens I rode the CTrain (NE line) just a couple of weeks ago on a Saturday afternoon and ridership looked pretty good. Not a scientific sample of course.

As it is entirely at grade, it has much lower construction costs than a system such as Skytrain so the numbers work with a lower ridership.

Right. Lose your job, and you may well move out of your rental – to work in a different city/province, or move in with family etc.

Ha, of course I forgot about that one! Rents are also related to this as well.

The “full employment” bogeyman is still around. If homeowners become unemployed (in a recession), they will sell homes. That may create more homes for sale than the rate rises will. In BC during the early 80s, unemployment rose from 8 to 15%, one big reason that the bust was much bigger in BC than ROC. BC lost people too, to the ROC.

So which bogeyman is left other than the interest rate bogeyman?

12% from family/friends is a small amount (17% for FTB) . I think many here think it to be more than that.

If the average Canadian house down payment is $150k, that would mean the average from family/friends is 12% of that, $18k. ($26k for FTB) . Doesn’t sound like much.

Assuming this data is correct, it seems like another house price bogeyman (“down payment gifts from parents”) has been slain.

It’s been eight days since the BCGEU reached a tentative agreement with the B.C. government. Haven’t heard anything about when members will vote to ratify. Usually, a ratification vote happens expeditiously if union leadership thinks it will pass. This suggests that what I gathered from reading social media — that members aren’t thrilled with 11-13% over 3 years — is accurate.

Where does the down payment come from? Interesting article with stats…

https://storeys.com/bank-of-mom-and-dad-fund-fewer-home-down-payments-than-think/

I think most “loans” to the kids were never going to be repaid. I am sure many of them considered it to be getting their inheritance early. And with 40% of marriages ending in divorce the property is sold off and without a documented loan agreement at least half the money (if any is left after this meltdown) goes with the in-law spouse. I believe most banks require that any down payment money coming from parents be declared as a gift (if they are aware of the source).

https://www.ratehub.ca/blog/bank-of-mom-and-dad-down-payment/

Ouch! Stocks to get clobbered again tomorrow…

FedEx CEO says he expects the economy to enter a ‘worldwide recession’

https://www.cnbc.com/2022/09/15/fedex-ceo-says-he-expects-the-economy-to-enter-a-worldwide-recession.html

FedEx CEO Raj Subramaniam told CNBC’s Jim Cramer on Thursday that he believes a recession is impending for the global economy.

The CEO’s pessimism came after FedEx missed estimates on revenue and earnings in its first quarter. The company also withdrew its full year guidance.

Shares of FedEx fell 15% in extended trading on Thursday.

“I’m very disappointed in the results that we just announced here, and you know, the headline really is the macro situation that we’re facing,” Subramaniam said in an interview on “Mad Money.”

Careful, then they won’t be able to get a rental (and risk being called idiots for having a dog in the HHV comments section!)

You have to be greedy when others are fearful, if possible people should be accessing their HELOC after the next BOC rate increase and start acquiring more rentals! Don’t worry about cashflow or cap rates as RE always increases in the long run.

This comment has encouraged me to write a one line script that gets rid of comments from specific posters.

Adios gnomos!

Yep, nothing like having multiple generations being single asset committed and both now highly indebted. Unfortunately, there’s going to be quite a few of the gifters having to put off retirement because they thought their kids would just return the money when the equity on the new property allowed them get a HELOC and return the payment. Hmm, I do recall someone mentioning this a few times over the last several years here.

Here’s a question, before I send to our bank…

Can you port a fixed rate mortgage from a rental property to a newly purchased house (would be principal residence). Obv better to have higher rate on rental property.

The rental property would not be sold, but there would be the new purchase. I am thinking this might be a one off question for the bank as our mortgage broker told us no. I assume if we gave the bank our business in the form of another mortgage they would be happy and maybe work something out for us?

Building out is the Calgary way.

But sentiment is changing somewhat, as evidenced by council’s decision not being unanimous.

The CTrain in Calgary is excellent, but its ridership has never been what it should be. Then COVID hit and ridership just plunged; and it hasn’t recovered.

@Introvert from a climate perspective we should be building up – not out. I hope Calgary gets some energy efficient light rail out there and makes all public transportation free so as to encourage those living far from work to use public transit.

Meanwhile in Calgary…

Council approves five new communities as critics raise climate concerns

https://calgaryherald.com/news/local-news/council-approves-five-new-communities-as-critics-raise-climate-concerns

Call me old-fashioned, but if I don’t have money to give to my kids, I won’t give them money.

I don’t think anyone bases their opinion of me based on how I treat trolls in the comment section.

We all would like to give our kids a head start in life. But there is no guarantee that they will do any better or worse in life than the next person. Live long enough and eventually crap happens.

-buy them a dog.

No idea if that story is true or not and cannot verify, but I am certain there are some real life situations where the parents used a HELOC for a child’s down payment and now they are both feeling the pinch. When you have assets but lack cashflow, rising debt service costs can become burdensome.

Paper gains disappearing tends to make some people stressed out especially those who don’t have any other investment experience outside of buying houses during the boom years.

Some good news..

https://ca.finance.yahoo.com/news/lululemon-founder-chip-wilson-gifts-194033455.html

Whatever: The other scenario for parents is that there was an understanding that the child would actually carry the costs of the Heloc and eventually repay it. No idea how common this may or may not be. Caught between inflation and spiraling interest rates both parents and children may be up the creek.

By the way, my comment on them cancelling vacations was less than clear. If it was just a matter of some young people having to cancel their vacations we would not really be facing any problem. I am not sure that a lot of people really understand how bad this could get. Again I dont have a crystal ball but I suspect that the situation might become extremely dire for a lot of younger buyers. I think it might be prudent to start considering whether some form of bailout is appropriate and, if so, what its shape and contour should be.

But rather then just dealing with crisis management some serious consideration needs to be given to replicating the US 30 year term ( along with making the mortgage transferable) which would also free us of the stress test rules.

I did not say that we need to start bailing people out yet but rather we need to give it some serious thought. Allowing thousands and perhaps tens of thousands of young people to be up the financial creek is not a good thing.

Why has the comment section become so cringeworthy and mean. Sad. Why is everyone so aggressive. Be nicer

Totoro,

You had a helpful post awhile back about the benefits of co-ownership of a property, vs other things like promissory note etc.

You mentioned some resources discussing this. If you had any links that would be appreciated.

With so many homes being funded by parents, and complicated situations with marriages, I could see the benefits of co-ownership to protect everyone’s interests. Of course there can be downsides too.

Perhaps ”co-owernship” could also be a future HHV article.

https://www.mortgagecwf.com/knowledge/bankruptcy-stop-foreclosure.html#:~:text=Filing%20for%20bankruptcy%20looks%20much%20better%20on%20your,second%20mortgage%20or%20try%20to%20refinance%20your%20loan.

https://bankruptcycanada.com/foreclosure-vs-mortgage-bankruptcy-in-canada/

I have a working assumption about whether your neighbour friends feel that reciprocated sense of friendship if you carry yourself in the same way you do here in the comment section 😉

If parents have given a gift to their children to buy a home, then the parents have no say in how the money can be spent or lost.

It’s unfortunate if the parents used their HELOC and now their children need more money to meet their obligations. The dilemma for the parents is whether to increase their HELOC to protect their initial investment in their children and thereby putting their own interests at stake or let their children risk losing their home and lose all or most of the gift. AKA throwing good money at bad money in the hope the problem will go away.

This has the potential of causing a domino effect if the children had re-financed the home to supplement their income in the hopes that things would get better and lost all or a good portion of the equity. Now the parents gifting them more money may cause the parents to be over extended and facing a reduction in their life styles or possibly defaulting on their home.

It’s hard to say no to your children when they are crying at the kitchen table.

Some parents might have also co-signed the loan or gone on title but I think the results would be the same.

My working assumption is that you just spouted some bullshit.

Patrick, you seem to love finding fault. I changed just enough of the inconsequential details to make sure that that the people are not identifiable.

The point is that there seems to be a fair bit of pain already particularly with younger first time buyers. I am still at a loss why we have not followed the American precedent of thirty year term mortgages as being both available and being the norm. I also question the role of the banks in selling an obviously high risk product like a variable mortgage to first time buyers with interest rates at historical lows. The rates were so incredibly low that there was, in my mind, a clear and present danger in this product to borrowers with limited depth of resources. Finally, I suspect our educational instructions have seriously failed to provide our young people with any real financial literacy. Should add that I dont recall real estate agents warning their clients about the dangers of a variable rate mortgage in the face of impossibly low interest rates.

No common, this is just as believable as the move to Switzerland.

Allow me to restate my question.

Is it better to declare a bankruptcy if you owe more than your house is worth (no equity – no CMHC) before being foreclosed on?

Otherwise if you are foreclosed on first then the court has a judgement against you. Would that make the court judgement a priority over the creditors that still have to negotiate a payment?

If this is the case, then it makes a huge difference in the order that you proceed if you are facing bankruptcy. If the lender has to negotiate with other creditors then the lender may only receive a fraction of their loss and that debt would be written off after a few years.

If your sad Rockland dinner housing tale is true…

How do your good Rockland neighbours feel about you spilling all of their gossip onto a public website? If I’d just had a retired matrimonial lawyer from Rockland over for ribeye dinner, and then read about my family discussions over the dinner table here on HHV, I might recognize who you were talking about! Especially when you tell us all that you felt sorry for them, as you enjoyed the perfect ribeye.

The older generation that I know would exercise more discretion than that

However. To be honest, my working assumption is that you just made this whole story up to stir discussion.

And I’m happy to leave it there.

The “chat about weather” was a simplification. I do get together with neighbors, and we talk about a lot of things. But I’ve never delved deep into whether they’ve tapped out their HELOC or will be giving more to their son , who feels trapped, and observed his wife giving dirty looks during all of this chat.

Totoro has done a great summary but the devil can be in the details.

Patrick, I have been here for a lot of years and a number of my neighbours are like familly. Actually it was six people because grandma was there as well. This was not planned since we were having a great dinner together when the kids dropped by and let lose. Maybe I should have left but I was in the middle of a perfect ribeye so even Putin could not have got me away from the plate.

I suspect I am part of a older generation where getting to really know your neighbours and in turn being a good neighbour was really important. The world has changed in so many ways.

I did answer your question. If the home is sold for less than the mortgage then the bank has a claim to the entire equity as they are a secured creditor. For the part that is unsecured, they become another unsecured creditor. This is a question of priorities. A court judgment doesn’t give priority to one unsecured creditor over another, the trustee in bankruptcy deals with this according to the Bankruptcy and Insolvency Act which, after secured creditors are paid from the proceeds of the security, then pays any extra to preferred creditors (ex. municipal taxes), and then unsecured creditors.

All of this information is available online.

Patrick, Victorians love to talk about their real estate. You can’t escape it. It’s a topic in every coffee shop.

Now that the bloom has come off the Rose for real estate, I am hearing more horror stories about real estate. And as we get further into the market downturn I expect the conversations in the coffee shops to turn more negative. That changes peoples’ perspective and confidence in the marketplace.

That’s really sad. I’m friends with a large group of my neighbours, and I’m merely a lowly renter. You’d think you’d take the time, especially when you know you’ll be living in the neighbourhood for a while.

Was this a real conversation? You and the neighbour’ s family (4 people). All spilling their guts about finances, inter-family gifts, feeling “trapped” etc.?

That seems like something from a Dr. Phil show, rather than a chat across the fence.

I never get past talking about the weather with my neighbors.

Totoro: The kids equity in his house was actually was mostly the parents equity lent to the kid. I am not clear but I have the strong suspicion that some of the kids equity, actually most of it, came by way of the parents Heloc.

I am also getting the strong impression that the kids wife is reconsidering her options.

Totoro, that doesn’t really answer my question.

While in bankruptcy and the mortgage later goes into default and the home eventually is sold for less than the amount of the mortgage does the lender have a claim for the entire amount or would they have to negotiate along with other creditors.

In contrast if the home is foreclosed on before the person is in bankruptcy then there is a judgement for the loss and that judgement would supersede the actions by creditors after a bankruptcy is declared.

I think that a drop of 22 percent in just a few months seems staggering. But I’m wondering if this is an apples to apples comparison. One would have to dig deeper into that percentage as more of the top end homes may not be selling due to the higher interest rates and that would skew the results. An analogy being that steak has become so expensive that more people are now buying hamburger.

I see this when comparing areas of high end homes in Oak Bay to middle income areas such as Saanich East. Oak Bay had 6.4 months of inventory in July and then screamed up to 12 months of inventory in August. In contrast Saanich East remained unchanged having 3.9 months of inventory in both July and August.

Oh the horror.

Because of their HELOC?

If you are in a position where you need to declare bankruptcy it doesn’t give you any special protection from foreclosure. The bank is a secured creditor with first priority on the equity in your home. Bankruptcy deals with unsecured debt.

If you owe more than the mortgage and it is insured then the bank will put in a claim with CMHC and CMHC may pursue collection against you. If it is an uninsured mortgage and you owe more than the mortgage then the bank becomes another creditor for the unsecured debt.

I think affordability versus buying where there is value are fundamentally different when it comes to RE.

Talking with one of the neighbours sons who bought less than a year ago and he is really upset. Financially , he feels totally screwed at this point. He has a variable mortgage but not fixed payments and the increase is completely squeezing him along with the inflation costs of everything else. He thinks he is going to have cancel both of his vacations this coming yearbut he also feels trapped since he suspects the the prices may have dropped enough that he has virtually no equity in house anymore.

What I found rather sad in all this was during the rather lengthy conversation where his parents were trying to gently tell him that they were tapped out and that their heloc was killing their plans, that his wife was just giving him that “look”.

I am not sure what to think of this but mostly I feel sorry for my neighbours his parents.

Barrister may correct me if I’m wrong. But if you declare bankruptcy BEFORE going into foreclosure then you would be protected in some degree from the bank going after all of the loss in the outstanding mortgage.

Real estate slowdown continues, with average price down 22% since February

https://www.cbc.ca/news/business/crea-august-housing-1.6583733

Only a small amount of the debt is short term. A short sharp increase in rates to beat inflation has less impact than letting the problem go on for years and resulting in more and more debt being reissued at higher rates.

Back in the 80s and 90s having a place on saltspring was like a chalet up in Whistler expensive compared to Van kind of a big deal Just from memory Another 3 in the morning post lol

Or we are going into a period of reduced government spending and increased taxation. Leaving inflation to “run amok” is just too corrosive for overall economic and fiscal stability. It will be an interesting tug-of-war if politicians try stimulate and reserve banks mitigate it with an interest rate hammer.

Thats what I like about Leo, when he does not know he says he does not know.

Hard to say. Can’t look back far enough and few sales so very volatile. Tried to take a look at sales to assessed values this year, maybe has pulled back less than Victoria so far? Tough to say because more variability in properties too.

In no way am I predicting it but 5 yr rates of 9% a year from now would not shock me. Nor would really substabcial price drops. But I definitely do not have a crystal ball.

But I was wondering if first time buyers who bought in the last two years are feeling a sense of panic? Still if house prices drop 30% then it would make things more affordable for some.

Was going through an old book of Christmas parties and came across the annual interest rate prediction. Here is the page for ’94.

Patriotz, correct me if I am wrong, but while it is a minority of states those states also represent a large portion of the population. But yes the devil is in the details but over the years I have run into far too many people that thought they could walk away from a house with no other consequence. But lets move on unless one wants to score points on something.

Leo, Curious to know if you think the southern Gulf Islands hangs with Victoria in terms of retaining value or if it is in line with the rest of Vancouver Island, excluding Victoria?

Caveat are you speaking only in terms of a mortgage default? Because speaking from the experience of having had a spouse go through bankruptcy and be discharged, RRSPs are most certainly not safe from creditors unless this changed since about 1997/98. They took all that was there in my ex’s RRSP at the outset of the bankruptcy and then when we reached the discharge point 9 or 10 months later they went back and scooped up what had accumulated during the time of the process because my ex didn’t listen to me and change his RRSP at work to contributing to a spousal RRSP which he could have 100% done, and it wouldn’t have been touched because it would have been in my name. I would be interested to know if this indeed did change. Always seemed quite low to be going after people’s retirement income.

I don’t think the Fed or the BOC can afford to raise rates much more, because national debt need to be service. And, so far both governments haven’t cut spending to reel in debt. Perhaps we are going to see inflation run amok for sometime.

As Marko noted the spreads (discounts) were better last year. Prime minus 1% was common. Now it may be prime minus 0.3% on variables.

It will vary but many lenders it’s 0.10% more for a rental. And also 0.10% more for 30yr amortization vs 25yr.

I could be missing something here, but it’s easy to calc your monthly interest. Say your bance is 156k then at 4.36% montly interest component is about $567. You’d be making interest only payments of $738 if the rate got to 5.67%

Only a minority of states, and many have restrictions. In California for example only the original purchase financing is non-recourse. Any refinance, HELOC, 2nd mortgage or the like is recourse.

Interestingly there was little correlation between recourse status in a given state and the degree of price declines in the great bust of a decade and a half ago.

So far, the only misinformation I’ve read today was your post claiming “barrister: Mailing in your keys was exclusively an American phenomena” and “In Canada everything you own is fair game although most banks will not try to sell your children or your body parts.”

Fortunately that was spotted, and the exceptions of Alberta and Saskatchewan pointed out to you.

And it’s good to see you now incorporating that into your latest info-post “ barrister: My point with perhaps some exceptions like Alberta is that one needs to be aware that walking away from a house is not that easy”

So yes, don’t take advice from a blog, but there can be baseline information learned from posts with supporting links to good sites.

Caveat is correct about the list of assets but that list in many cases is rather limited. My point with perhaps some exceptions like Alberta is that one needs to be aware that walking away from a house is not that easy. Always check with a lawyer as to what the implications are including damage to your credit score.

Most of all dont take advise from an online blog.

In reality each province has a list of assets that can’t be claimed. And your RRSP is safe from creditors Canada wide