August: Dropping prices attract some buyers back

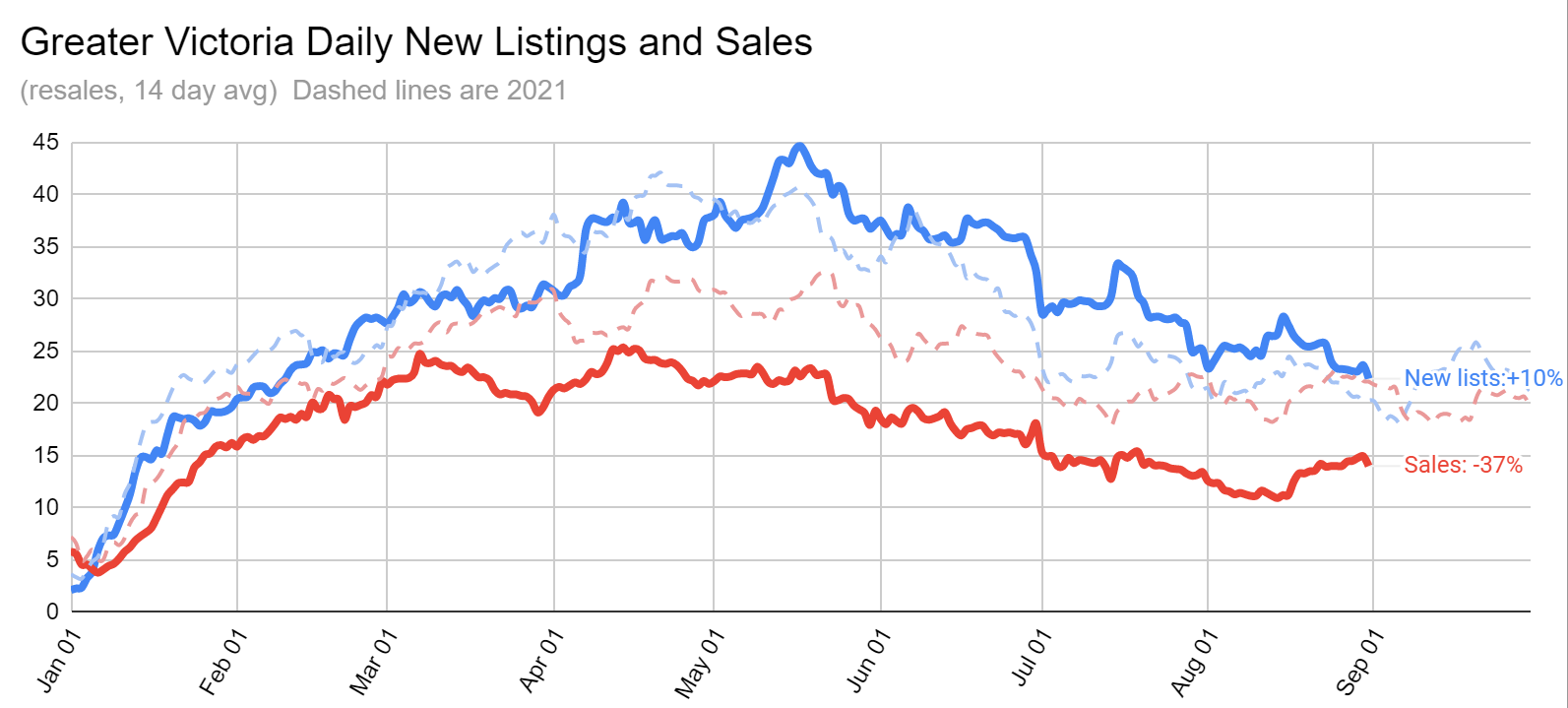

The year over year market activity figures were very poor in August. Detached and townhouse sales were down 30% and 29% respectively from last August, while condo sales dropped a whopping 57% from last year. But the last couple weeks we’ve seen a slight increase in sales that has firmed the market up a bit from the trajectory it was on previously. As discussed last week, it’s a sales bump that isn’t typical for end of August, and along with similar reports of increased activity in other Canadian cities is worth watching closely to see if it continues into the fall market. However the uptick in sales to end the month was not enough to stop the deterioration in market conditions on most metrics.

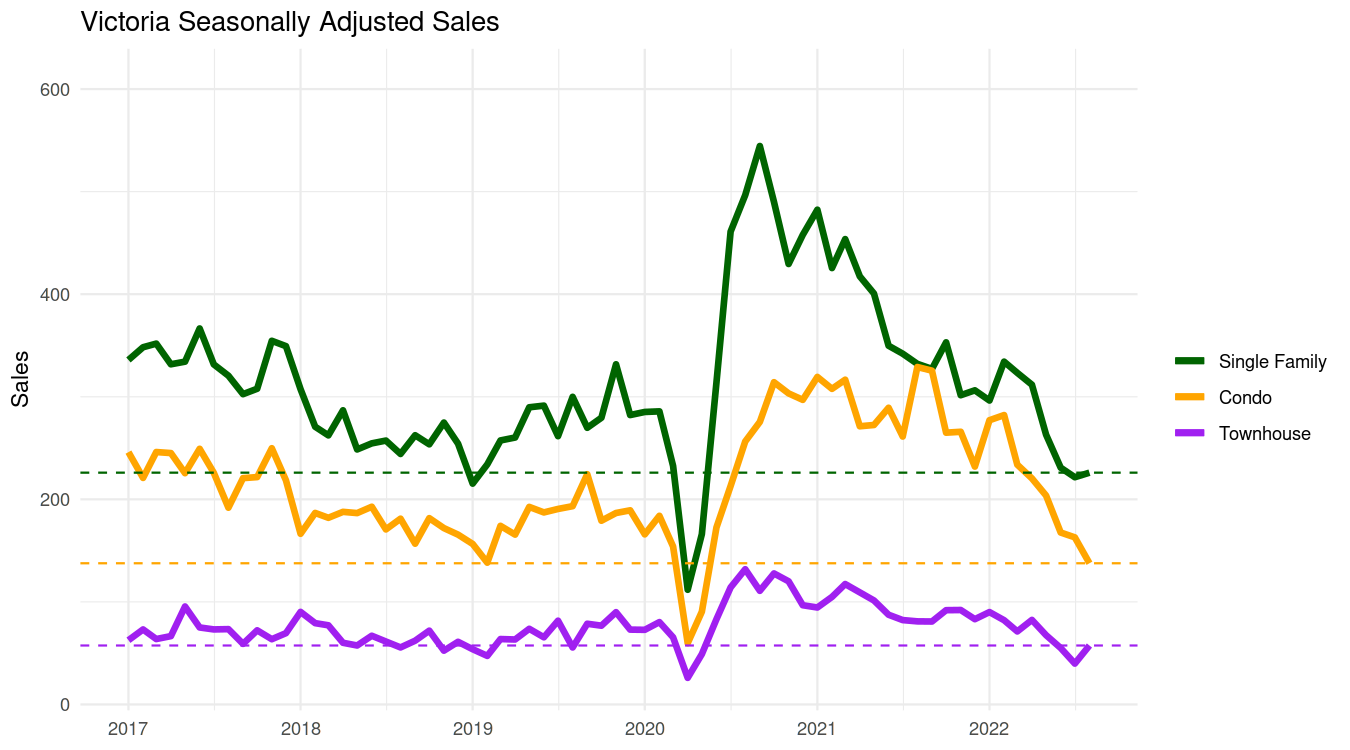

Overall for the month, sales for detached and townhouses ticked upwards slightly on a seasonally adjusted basis, while condos dropped. Overall sales are down around the levels of the buyers market of 2010-2014, but with substantially less inventory.

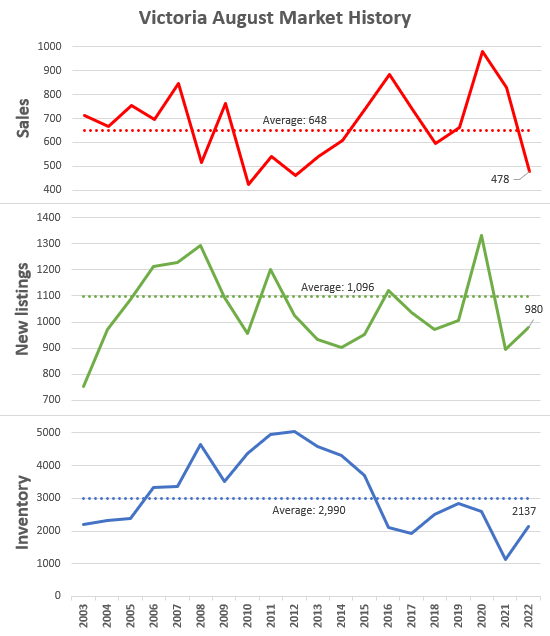

For those who prefer the unadjusted figures, here is what it looks like for the last 20 Augusts. August 2022 came in third slowest, after August 2010 (425 sales), and 2012 (462 sales). New listings are up from last year but remain below the long run average, and inventory has spiked but again well below the long run average.

Inventory declined by 25 listings from July, but during the average August we lose 86 listings, so on a seasonally adjusted basis it is still creeping up. Expect the small surge of fall listings to come on after labour day.

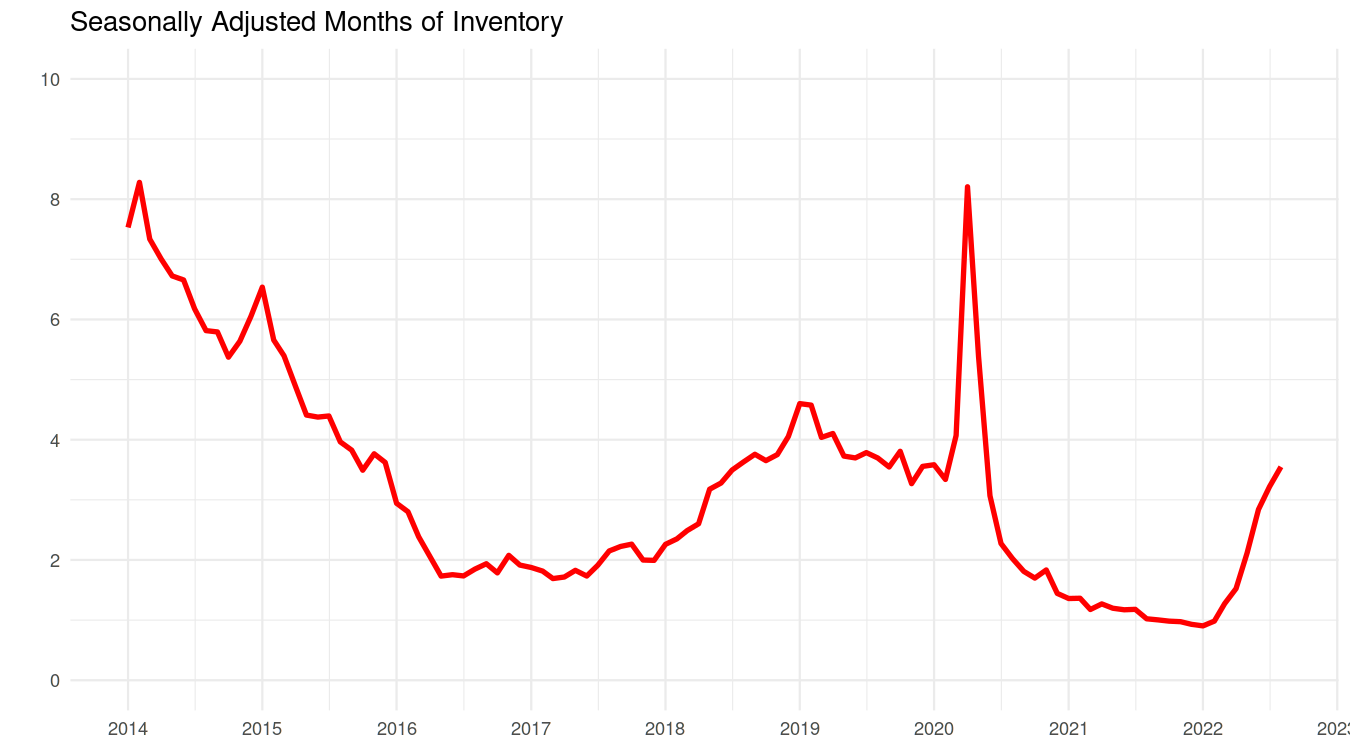

Months of inventory also kept rising, though it’s worth pointing out here that we are still not at levels that would be traditionally seen as a buyers market. The only reason prices have been dropping is because market conditions have been worsening so quickly.

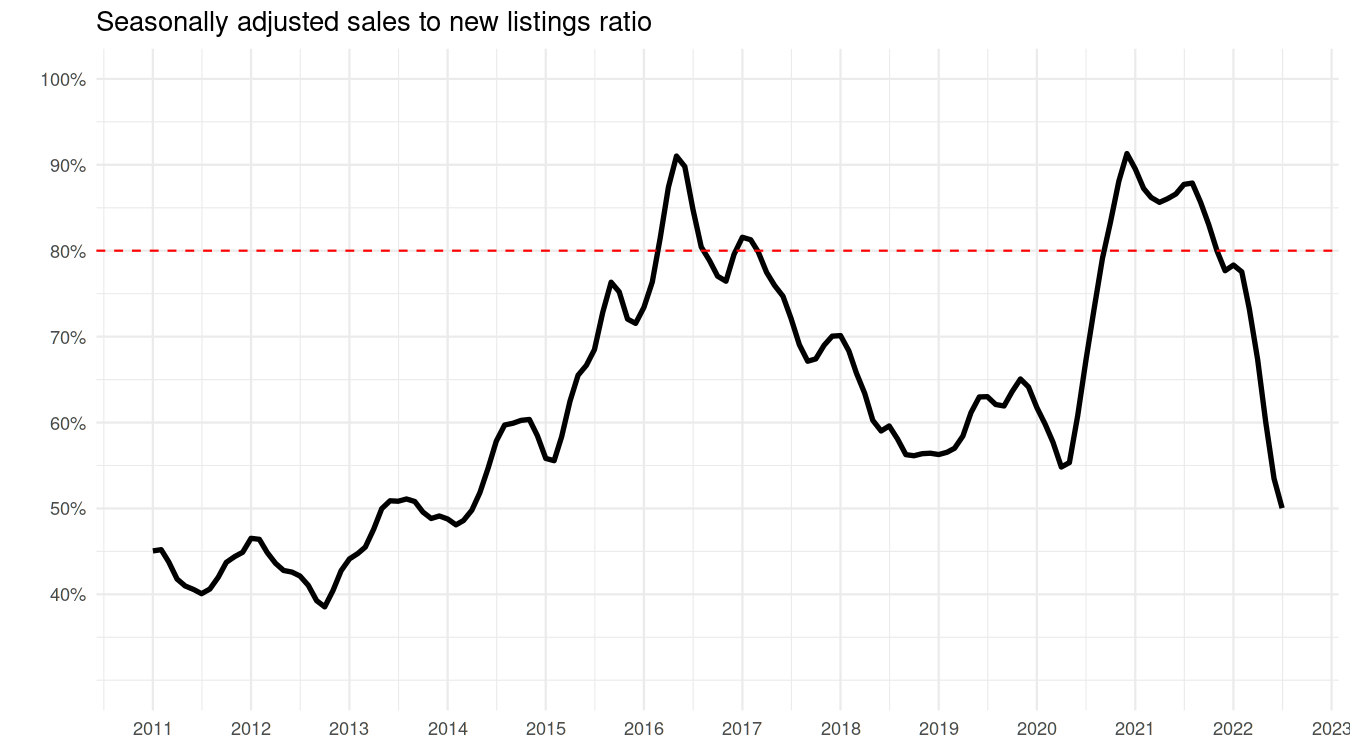

Sales to new list ratio also printed a weaker value in August. There was a slight pick up in the sales to list ratio at the end of August in the daily data, but this measure is highly seasonal so needs to be adjusted to interpret it.

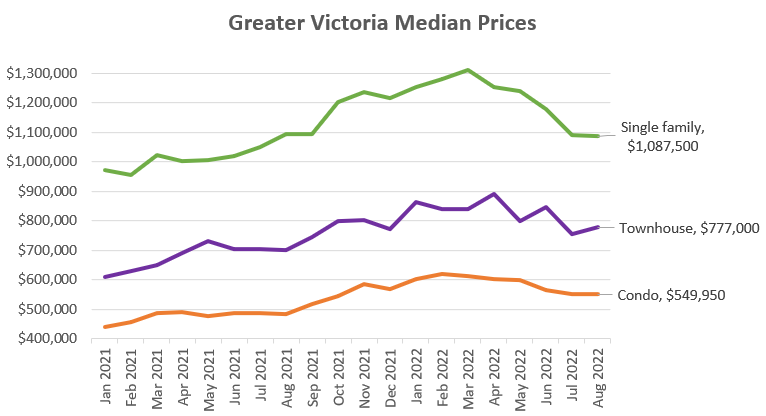

Median prices were flat in August, with no movement beyond the normal noise.

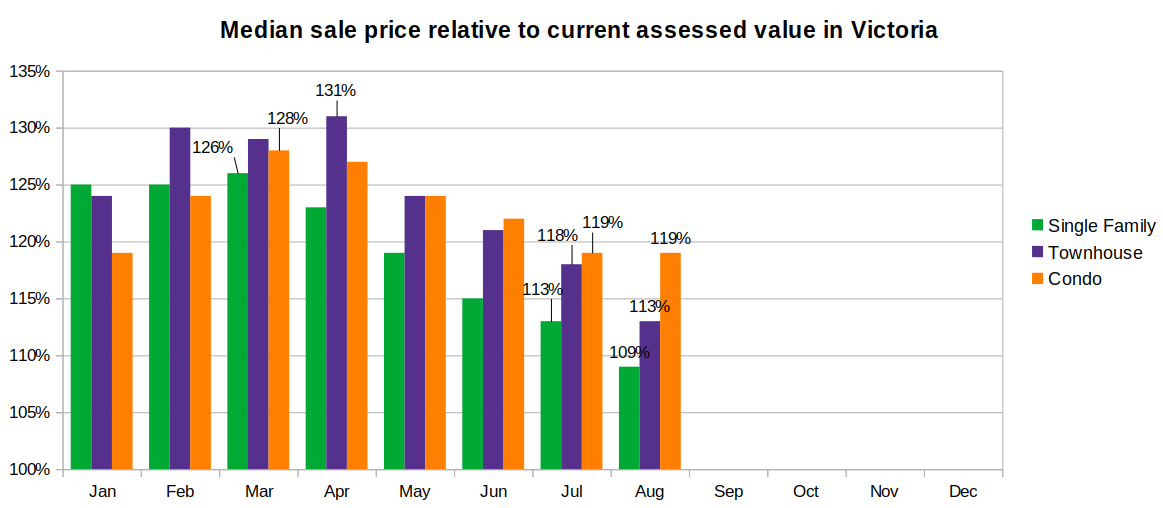

Interestingly enough, there was no change in the median sale to assessed value for condos in August, despite that home type seeing the biggest drop in sales. Meanwhile townhouse and detached house prices continued to drop relative to their assessed value. That may have attracted a few of the buyers back in, as those more expensive properties are now down some 15% from the peak.

I mentioned a while back that you shouldn’t be surprised if the rapid price declines we’ve seen since spring don’t continue going forward. Drops of a couple percent a month are very quick and unusual for the real estate market compared to past downturns when we lost only a few percent a year. And unlike the 80s we haven’t seen an explosion in new listings, inventory, and months of inventory to get to buyers market levels. That makes our current market weakness extremely sensitive to buyers continuing to stay on the sidelines. Because of low inventory, even a small uptick in buyers would be enough to stabilize prices.

In the detached and townhouse markets I think we are close to that point and I don’t expect a lot more price changes there in September and October. Unless rates go much higher or existing owners are destabilized by upcoming trigger rates, I think we’ve probably shed enough risk in the detached and townhouses markets that they can achieve a relatively soft landing from here on out (that enough weasel words for ya?). Condos are more uncertain as a strong rental market could provide price support in the future, but they are also less supply constrained than ground oriented housing. In past downturns we’ve seen condos correct more than detached homes.

New post: https://househuntvictoria.ca/2022/09/12/is-victorias-market-more-stable-than-other-cities/

Does anyone, sorry to get back to housing, have any more detail how banks are dealing with triggered mortgages? I am guessing that there must have been thousands of mortgages triggered by the most recent hike and there should be some specifics on how the different banks are handling it.

Dude, the list price and sales history is on the Realtor.ca….. anyways you better go do the dishes now before your wife takes away your TV time.

I think avoiding posting individual addresses is a good call. These things seem harmless, but you know, when you actually put ‘123 Anytown Lane’ in a comment like that, search engines pick it up. Forever. So now that bit of idle banter is forever associated with someone’s home. Just like you wouldn’t want your kids’ names spelled out online (especially if it’s a rare name), you probably don’t want your address associated with some bs either.

Clearly the healthy part is not unanimous.

If this were true, there would have been no objection. But it wasn’t as you say an “unknown someone”. Their address was posted, which clearly identifies who it was. If you don’t believe me, how about you posting your home address and see if you’re still anonymous here.

Leo completely fixed it by removing the address. And so now you bears are free to continue to speculate on the possible ways this – now anonymous – person’s “life may have been ruined” or not.

I believe it was a third party shaming with a person being offended on the possible or theoretical scenario whereby an unknown someone else that might have lost some money, possibly might be having problems or none of the above, and that person might eventually possibly read a thread where the declining asking price is mentioned or having it maybe reported to them by someone else….lol… I do admit, that some threads here are just too damn hilarious.

Someone blindly speculating on how someone else might feel given an unlikely scenario is far too reactionary and controlling the conversation topics based on one persons outsized reaction to discourse that has gone on for years is outlandish to me .

At this rate why discuss any specific properties at all? Might hurt someone’s feelings if we critique things about any particular house, it’s price or how much it was purchased for since a readers friend may report back to them. I think censorship would take away a lot from the blog.

Several months ago me and some regulars were discussing prices in the sauna and someone asked us not to discuss housing since they were stressed at being priced out. Nothing here is anything a basic realtor feed wont tell you. It’s ok to discuss things. Just don’t dance.

Someone tries to set healthy boundaries. Someone else gives advice on how to be more appropriate. Internet says I don’t like that, people who ask others to respect boundaries are too soft.

Realtors actually put use these as advertisements.

I think we all agree these are creepy and cruel.

Shame on these p̶o̶s̶t̶e̶r̶s̶ realtors!

“meh, I think its fair game. This is no different than people posting how much a property was bought and then sold for and how much potential profit was made other than it is the inverse.”

People are too soft these days lol

meh, I think its fair game. This is no different than people posting how much a property was bought and then sold for and how much potential profit was made other than it is the inverse.

Wow, a bit of a listings surge today. Usually don’t see this many SFD show up on a Monday on the portal. Typically, see the listings come in like this on a Wednesday or Thursday. Well, see what the rest of the week brings, curious to see if that September bump happens or not. I was chatting with a few realtors and they mentioned that activity was up, but they wouldn’t really comment on if that has carried through to sales.

BC gov released their quarter 1 adjustment today. Original budget plan was a 5.4 billion dollar deficit. As of today’s adjust we have a 700 million surplus. Not going to help negotiations of they go back to the table with BCGEU –

https://www2.gov.bc.ca/assets/gov/british-columbians-our-governments/government-finances/quarterly-reports/2022-23-q1-report.pdf

Regarding this specific property, one way of rephrasing Patrick’s comment is to point out that a lot (though not all) of the discussion about it has been petty gossip. Presenting an instructive example of recent trends can be worthwhile; this.. has been something else. There’s no cost to being constructive.

LMAO didn’t you say that whoever bought at the peak would care less about where the market is currently and will be enjoying life? I can find the exact post if you want since you can’t edit them anymore.

And what misfortune? House prices rise in the long run so why don’t you drop a little note in their mailbox and let them know that if you feel that bad about it?

Just the property actually. I thought the purpose of MLS was precisely that – to identify the property for sale to the entire world – to get the homeowner the highest possible price.

You want to publicize a sale, people are going to form opinions. Not that the seller cares about what you or I think anyway. Just what they can sell for.

“The impact of higher interest rates will be felt in other ways too. Canadian households have accumulated a lot of debt over the past decade. And they’ll soon face significantly higher debt service payments. This is a bigger issue in British Columbia, Ontario and Alberta where household debt is highest relative to disposable income. This shift comes at a time when soaring inflation is already squeezing many households’ budgets and the drop in residential property values is shrinking their net wealth. We expect the one-two-three punch of rising rates, high inflation and eroding wealth to take a serious toll on supercharged consumer spending…”

Source RBC Provincial Outlook

You could have made that bold and title capped. Shame.

“British Columbia: Tourism rebounded this year and capital investment remains brisk. Still, we expect annual growth to slow to 3.0% in 2022 from 5.9% in 2021, as the post-pandemic spending boom plateaus and the housing market correction weighs on activity. B.C. is likely to be hit harder by the housing market correction than most other provinces as residential investment represents a larger share of its economy. The negative wealth effect from falling property values will further amplify the weakness by slowing consumption.”

Source: RBC Provincial Outlook – September 2022

Thanks Leo!

The point was not to speculate, the point was to note the risk of bidding wars and short holding periods. Spring 2022 was a super high risk period to buy even without the interest rate spike as was discussed here many times. Many will be in trouble and though everyone should be doing due diligence, the industry also didn’t do enough to warn people of that risk. Fair point though, the address isn’t required to make that point and I’ve removed it.

Regarding whether greater Victoria is “special” relative to the rest of Canada: I was wondering how inventory and new lists compare here relative to the major markets that have seen declines (e.g. Vancouver and GTA). In our parts (up the Peninsula but not Sidney), it seems like (1) there aren’t that many properties available in the 1-1.5m range (which would I think be of less interest to wealthy retirees and such), and (2) sellers have been, shall we say, optimistic as to what they can get. So I see a number of lists at well above assessed value just sitting there. Trying to figure it out. Simple guess is weak supply..

Also, took the oldest boy out on the Juan de Fuca trail to backpack for the weekend. My God, how beautiful.

————

These posts are creepy and cruel

You’ve identified a specific homeowner (by posting their address) for the purposes of speculating on how much they would have lost, and what horrible reason may have occurred for them to sell. Odds are high that a friend or neighbour of this homeowner will alert them to this thread, so they’ll become aware of these HHVers trying to gain pleasure from speculating on their possible misfortune.

Shame on these posters!

Month to date:

Sales: 131 (down 47%)

New lists: 384 (up 9%)

Inventory: 2152 (up 82%)

New post tonight.

Easy come, easy go:

https://www.theglobeandmail.com/business/article-statscan-canadians-household-net-worth/

Note that the BoC index is heavily weighted toward the GTA, which was at the top of a major bubble in 1990. Wonder what a BC or Victoria index would look like – ideally carried back to 1981.

I can see that for an investor but it’s very unusual for an owner-occupier, who as many of us have said is most likely to try to ride it out.

Longtime lurker…first time poster. My HSBC variable triggered with this past hike, I had been in talks to increase my payments 20% voluntarily, but that was not going to be enough to keep my timeline in check. So my payments are going up a whopping 46.5% – bit of a shock to say the least.

“why is the owner bailing after such a short time?”

Could be for a variety of reasons but I can see panic selling being one of them

Where do you think the money is coming from for them to buy those million+ houses?

Listing says the suite is tenanted but will be vacant soon. Main appears to be lived in but maybe just staging. But if main was tenanted listing would have said so.

In any case the question remains – why is the owner bailing after such a short time?

I believe TD is one of the only ones that will allow negative amortizations until you reach 80% LTV

I think this has come up before, but do we know what the average down payment % is on houses selling for over a million? Is it the bare minimum of 20% or are most people doing a far higher percent cash down payment?

Rising rates won’t affect people who bought expensive houses as much if most people are only financing a smaller portion of the house?

One of my TD variable mortgages is showing a 53 year amort online. Originally 30 years. Looks like it will let them do 15% a lump sump payment no penalty so I’ll probably do that and then I am guessing no trigger.

You are assuming they didn’t rent it out.

I haven’t heard anything yet. It’s odd as there are a bunch of blank fields when I look at my TD mtg online. I had a quick look at my other variable mtg (where payments change with prime):

Jan 2022, 1.55%, 2:1 payment to interest ratio

Sept 2022, 4.55%, 1:3 payment to interest ratio

What a difference 8 months makes…

They’ve likely paid about 30k in interest to the bank in that period as well.

Any word on how banks are handling triggered mortgages?

Just had some work done 2 quotes for 3000 and 1200 Took the cheaper one very happy to leave 1800 bucks in my pocket

ouch…. but according to some people the owner is likely too busy enjoying life to care about the $2M purchase price.

I’m wondering what’s going on in some peoples heads… 1335 flint avenue sold for 2 million dollars during the peak. A regular house in Langford …I think we are going to see a lot of lives ruined during this downturn

Vic- more like a 200k bath after realtors fees and transfer taxes since it won’t sell at list.

I bought during the peak as well but my payments after suite income are around 1200 which isn’t too bad I suppose . Can’t win them all .

interesting, so they are willing to take a $100k+ bath to get out now…..

No it completed. Interestingly enough BC assessment now shows the “sold” date as the date it went pending, not when the title transferred. I thought it used to be the latter.

Did the Dec 2021 sale fall through?

Yeah, I don’t tend to factor in opportunity cost on stuff because many of the alternatives aren’t ones I’m comfortable choosing (e.g. investing in the stock market).

By no means is my analysis on this comprehensive 🙂

We bought when we were able and ready, and we’re counting ourselves lucky that, possibly, we will have enjoyed historically low interest rates for the entirety of our mortgage.

You’re not likely to see houses sit vacant even if you get a population decline, since there are always renters at some price. Not to mention there are always buyers at some price. The demand for shelter is elastic, that is if rental prices fall, people renting rooms or living with parents will move into their own places and that percolates through the market.

If I can add something from personal experience I bought a foreclosed house once and the electricity was on.

It takes a real exodus like Kitimat saw a couple of decades ago to get empty houses. No empty houses now though.

Perhaps Victorian hasn’t got the economic memo, because I was at rib fest yesterday and it was packed with queues of people ( more than 2X at any other rib fest in the past) waiting half an hour or more to pay $30-55 for ribs.

Why connections and disconnections? Because the stats people rely on data that is dated. At one time I would just ask the owner of the U-haul company one simple question.

Are you moving more people out or more people in?

Patrotz, who is going to pay the electricity on a vacant house then? The banks don’t. They hire a company that turns off the water, electricity and secures the house. The home owner that left might keep the electricity on waiting for it to sell, so maybe the water connections and disconnections might be a better source. Best to turn off the water in case a pipe breaks or the hot water tanks blows if the house is going to be left empty. Few if any are going to keep paying the utility charges for water and recycling on an empty house.

Have you already forgotten about the boarded up houses in the Alberta subdivisions in the 1980’s recession? Or the excavated pits in downtown Vancouver that were left fenced for years as the new condo market collapsed.

Greater Victoria is around the 15th largest metropolitan (CMA) area in Canada.

Colwood and Langford has about 66,000 and I suspect a high portion of that population is employed in some industry related or indirectly related to construction? The months of inventory hit 4.5 in August. Way up from 1.3 in February. The average days-on-market went from 14 to 30 for the same periods. New home sales in Langford and Colwood went from 44 units in August 2021 to 8 last month.

And September is going to be worse because vacant land sales are way down while active listings have doubled since February. There was a 3 to 4 year supply of building lots available in July. Since there was zero sales in August, the MOI is meaningless.

Yes, things could turn around but higher interest rates definitely are effecting new home sales. And that will effect the employment rate. I suspect we will see a “W” style correction in the next few months as prices decline and draw in some of the fence sitters and prices bump up temporarily.

@Introvert

“Also, when you eventually reach the point of having a paid-off house, your housing costs drop substantially. The total of property tax + insurance + utilities + maintenance is lot less than what it costs to rent an equivalent place.”

You’ve dropped opportunity cost out of the equation. For even the most average Victoria home that would easily be $50,000 annually.

That would indicate dwellings are being abandoned in effect, since you need to keep the electricity on for the furnace among other things. Not going to happen.

The stats people do have indicators on population inflow and outflow based in MSP, driver’s licenses, school enrollment and the like.

Home prices don’t magically increase by themselves. There are always precipitating factors such as an increase in economic activity, increasing employment and declining vacancy rates. In my opinion, the massive public work projects such as extending the sewer lines and upgrading the highways were primary causes of home prices to increase. These projects brought a lot of workers to Victoria from the rural areas of BC and Alberta and opened up large tracts of land for development. These workers needed houses to buy and to rent and caused a modern day “Gold Rush”.

And like Gold rushes when the Gold peters out, the workers and speculators will leave, and the economy will decline. I suspect that when our unemployment and vacancy rates increase we and most of the urban areas of Canada will see the beginnings of a glut in housing. I can’t tell you when that will happen as the economics are still good in BC, although in August, BC had the biggest decline in employment and a good chunk of that was in construction. I just have to watch the drop in vacant building lot sales as builders hold off on starting new projects and have to lay off more workers.

Victoria is a very expensive city to live and unemployment cheques are not going to be able to pay the bills for most of these workers. Anecdotally, I have friends that have had no problems finding a contractor to do home repairs just with one phone call and the workers where there in a couple of days notice. That wasn’t happening six months ago.

I would really like to get information on connection and disconnections for electricity as that would be a good indicator of what is happening now and into the future. When disconnections out number connections that would indicate more people are leaving Greater Victoria than moving here.

Story of a listing.

Saanich house

Sold 2017 for $730k

Major renovations

2018: $1.1M listing, no sale. $1M listing, no sale

Dec 2021: $1,1M listing, $1.42M sale

July 2022: $1.38M listing. Now dropped to $1.3M. 51 DOM

Depends on what your rent was and whether you could save more by renting or owning during that time period. Apples to apples (if you were renting an equivalent house during 2009-2014) you’re probably right.

Also depends on if you bought and sold. I think especially in a flat period is not a good time to do the condo -> house move. Just renting is often better than buying a condo and trying to upgrade in 5 years. Without increasing prices you end up paying more to own in many situations.

Yes, it’s hard to assign a monetary value to housing security, but it’s certainly worth a lot.

Also, when you eventually reach the point of having a paid-off house, your housing costs drop substantially. The total of property tax + insurance + utilities + maintenance is lot less than what it costs to rent an equivalent place.

If I was a cash buyer I’d personally wait until next spring and buy then since I suspect prices will adjust further over the next 6 or so months. The pandemic rates were historically low and I would be surprised if rates ever go that low again in my lifetime (especially if BOCs plan backfires and we head into a nasty recession). If I was relying on financing I don’t know what I’d do.

Ive read arguments on this blog about whether it’s a good financial investment to buy housing but these overlook a perhaps even bigger benefit of owning – housing security. When you own you don’t have to worry about being kicked out because the landlord is moving back in or wants to renovate. To me that’s the biggest benefit of owning over renting. Housing security.

I have always been a lot better at predicting the past.

Someone who bought in the early 80’s got both. Think about it.

Yes looking backward it’s easy to pick an optimal time to buy, but you don’t know when the market is going to take an upturn and by how much. You just have to look at the numbers at any given time. Goes for any investment.

Predicting the future is difficult.

It would have been better for me to buy in 2014 rather than in 2009, as prices were pretty flat during that interval.

On the other hand, had I bought in 2014, my mortgage principal would be a lot higher right now and subject to these big interest rate hikes.

Buying when the market is fearful does make sense. During the leaky condominium crisis it would have been a good investment to buy condominiums that few people were willing to purchase. Condos dropped substantially in price but you could still rent them and get a positive cash flow and afford to wait for prices to rebound. The problem was getting a mortgage but if you had cash it wasn’t a problem. Cash was king.

And I suspect that would happen again if home prices dropped substantially as banks would be hesitant about those that wanted to use their lines of credit to buy houses. The banks would consider someone holding too much real estate as too risky as the marketplace would be in decline and experiencing higher loan defaults.

If we did slip into a prolonged recession I would expect the banks to claw back lines of credit and to start calling in short term loans in order to improve their stock prices. If the bank’s stakeholders lose confidence in the bank that can cause a run on the bank. The banks would have to hold a larger amount of liquid assets to prevent a run and that causes the money supply to shrink. Similar to the 2008 credit crunch that affected most of the world. But in Canada the solution was for the government to stuff money into the vaults of banks and expand the insurance of loans through the crown corporation of CMHC.

This is when it paid off to have a social democratic country that bank rolls home insurance as compared to America as their home insurance were privately owned companies that collapsed.

What would have made buying real estate a better investment in the early 1980’s would have been to hold off on buying until after 1986. Then you would not have held real estate during its flat market and would have rode the wave at the beginning of the up cycle. It’s better to have a 5% increase over one year than a 5% increase over 5 years.

There are no bad debt on investments unless you are over leverage, and buys on impulse instead of based purchase price on fundamentals.

Extra cash on hand or rental income can be use to buy stocks. As long as cash flow cover the interests or neglectable negative carrying cost then it make perfect sense to invest on undervalue stocks that have good fundamentals, because the upside is likely to be way ahead of bank interests.

Hmm, I think you missed my original comment “or hang on to cash until the stocks fundamentals meet your criteria.”

It’s really the fundamentals of the asset you’re buying that are good or bad, not the debt you’ve taken on to buy it. For example, borrowing to buy in Vancouver in the early 80’s paid off very well.

Good debt can turn into bad debt if we slip into a recession. If the bank’s stock prices drop then they will increase deposits on hand by reducing lending on long term debt, increase cash on hand, and call in short term loans such as unsecured lines of credit thereby reducing the chances of a run on the bank. This reduces the money supply.

During recessions or worse a depression cash becomes king and all debt is bad debt.

I’d watch the stock price of HSBC as my opinion is that HSBC is the weakest of the big banks and likely the first to get into trouble. Smaller Trust and Credit unions are going to have trouble too if they can not lend out enough money at a higher interest rate than they pay on deposits.

Clarence: “No, we don’t use money in Heaven.”

George Bailey: “Oh yeah, that’s right. I keep forgetting. Comes in pretty handy down here, bub!”

Paying off debt is good, but there are such things as good debt and bad debt. If you have low risk tolerance then pay off your debt, but IMHO it make much more sense to buy when the market is fear full, or hang on to cash until the stocks fundamentals meet your criteria.

Warren Buffett: How To Overcome Fear When Everyone Else Is Scared — https://acquirersmultiple.com/2022/09/warren-buffett-how-to-overcome-fear-when-everyone-else-is-scared/

Legitimate concern re. cash/credit if you are still in the accumulation phase.

We are meeting with our accountant soon to adjust our plans based on the rate increases. The math has changed and all of a sudden it makes sense to invest spare cash in short-term instruments and pay off the mortgage if variable or upon renewal of a fixed term (looking forward) instead of holding cash for renovations/purchases. We are in a similar situation to you most likely with retained earnings held in cash being devalued, while rental income is reduced by increased interest costs.

I expect a lot of people are considering paying down mortgages and moving from investing in the market to fixed term interest-bearing deposits.

Kisber sold… full list plus 1000. Kinda surprising, but not unwelcome.

That’s my understanding. Current interest rate and current balance, 3 months worth.

Marko, remember Hitchhiker’s Guide?

6 emails yesterday to send owner builder study guides to people across BC. Removing the exam would help so many people out and the exam achieves absolutely nothing. However, it employees a completely useless department at BC Housing and that must be worth it. Broken record here but government will do **** all to solve housing problems. Bureaucracy never reverses as is evident but this useless exam. Brought in without any evidence, zero analysis of its effectiveness in the last 6 years.

This seems really attractive assuming no penalty if pulling out at any time after 90 days. Unless you are making offers right now as we speak pretty safe the 90 days works no problem as most completion-possession periods are between 30 and 60 days so even if you make an offer 30 days into this cashable GIC offer you just set the completion-possession 61 days out and collect on the interest.

I am going to go this route for the time being just to hang on to cash; however, if another 0.5% increase I think I’ll max lump sum one of my variable mortgages which is currently 4.31% after the recent 0.75% increase. My worry about paying off debt which I have the means to do so is not being able to get it back again when an opportunity comes up.

Anyone know on a variable mortgage the three month interest payable if you pay it off, that would be on the current interest rate I assume?

No you get the interest as long as you cash it AFTER 90 days:

“Your Redeemable GIC can be redeemed on or after 90 days with no interest penalty”

Re:4% cashable GIC

Read the fine print as you can likely cash it but may get $0 of interest if you do

Congrats! Go do some good!

That’s a really nice place. Your dad must have done really well on the builders exam.

Sweet house! Best of luck to your folks on the sale.

No, that’s not how it works.

“The money” the bank advances for a mortgage didn’t exist before the mortgage started. It was created by the bank from a data entry when the mortgage was created. When the loan is paid off and returned to the bank, the money ceases to exist and the things return to where they were prior to the mortgage.

This is easier to explain with a line of credit. If you borrow $100k from it, the $100k is created money, and the account shows you owing the bank $100k. If you pay it back, the bank just changes the $100k owing to $0 and the money disappears. That $100k doesn’t still exist somewhere after you paid it back. It disappears from the bank’s books.

Of course the bank is constantly creating/destroying money for its customers. Right now there is an overall net large creation of money, because more is being created than destroyed. That could easily change if deleveraging continues. But when you pay them back money, they aren’t lending it out to someone else. Because it never existed prior to the mortgage in the first place.

Who wants to buy my childhood home? Built from scratch by my dad. https://www.realtor.ca/real-estate/24856287/100-lidstone-road-salmon-arm-enderby-grindrod

Does anyone know if lenders that have traditionally said they don’t require requalification for mortgage renewals have started requiring them?

Thanks for the good news. I have cash in that and had been suffering through sub 1% rates, nice to know that’s in the past.

Hubert FInancial is one of a number of Manitoba credit unions offering high deposit rates. The Manitoba government does not legally guarantee their deposits. The risk of not getting your money back is pretty small, but I would keep it in mind.

Nice try Kenny. Two months before your sale, you boasted about how you WOULDN’T sell…

You specifically said (Jan 15, 2022) “Kenny G: …if the stock market falls 20% or 30% like it did in 2020 the only thing I will do is stop looking at my account until it recovers”. https://househuntvictoria.ca/2022/01/10/where-buyers-came-from-in-2021/#comment-84490

Anyway, I never believed you in the first place about you buying and holding stocks through downturns . And so your recent revelation just confirmed that.

Thanks for the discussion.

We pulled all of our investments out of HSBC a couple of years ago. One of the few things that we could do to say that we did not agree with China’s actions re: HK

“It is with delight that I see you that you didn’t “walk the walk”, and have sold your stocks after all.”

‘

‘

I never said you buy and hold forever, I was sitting on some very large gains and took advantage of a rebound in the market to sell in mostly tax sheltered accounts. I rarely try and time the market and still hold my positions in taxable accounts but I got lucky this time to my delight 🙂 as the market and the positions I held tanked after a rebound in March.

Interesting development In Ucluelet. Only four people ran for council for the four spots available. I am from now on Councillor Ukeedude.

Marko – HSBC has a 4% cashable GIC offer right now – cashable after 90 days – https://www.hsbc.ca/investments/gic/products/redeemable/

I’m not that guy, but I don’t think there is any thing wrong with borrowing against your house to invest in the stock market?

Similarly many people leverage their property by borrowing against it to purchase more properties, or people who chose to invest in the market or real estate instead of paying more toward their mortgage when they can.

It is all about risk tolerance and familiarity. Like others that have high risk tolerance, I use my HELOC to invest in the stock market, and will be looking at increasing my position in non registered account after the US midterm election.

Here is a tip, Enbridge (ENB) is currently paying 6.39% dividend.

Set up account with TD Direct and buy their ISA fund. Currently pays 2.85% with no withdrawal penalty. Works just like a savings account that you can add or withdraw cash. Rate increases whenever BofC raises bank rate.

https://www.td.com/ca/en/asset-management/additional-solutions/

Are the rates comparable or is it more?

Still got a little ways to go before it hits that August high.

Haven’t considered Hubert, that looks to be a better product overall but very high probability I will need to funds between 3 and 6 months so losing the interest for the quarter makes it pretty much a wash against 3% and not losing interest (after 90 days). Also, I have accounts set up with the credit unit so a bit less work.

Marko Juras – Have you considered Hubert financial 1 year term deposits? 4.25% and you can withdraw but if in between quarters you lose your interest for that quarter, which is the only downside I can see.

Marko, which credit union?

Also, I’ve been looking into products to earn interest on cash while keeping liquid if an opportunity arises. Best I can find so far through a credit union is 3% you can withdraw at any time but needs to be in the account for 90 days to earn the 3% (on those 90 days) and then going forward after the 90 days you are earning 3% and can withdraw at anytime or can keep it in the account for up to 1 year.

Thanks — that was my guess, but wasn’t completely certain.

Hoping to be able to pay out the mortgage at renewal in two years or, worst case, do a one-year to finish it off.

So far so good on the start to fall season listings.

Whateveriwanttocallmyself – You hit the nail on the head with your post. Some people are in for a shock a year down the road…

They just lend the money out to someone else.

After tax to boot.

I would have to pay capital gains, real estate fees, etc. Rents are high and I am bullish on real estate in Victoria once we weather this patch over the next couple of years.

With the flavour of municipal politics the odds of a condo being vacant are close to zero.

Another alternative would be get variable, sell condo and put the proceeds in a GIC. Will depend on cap rates for the condo and the potential for a special assessment.

Right. It’s interesting, with any pay down of a bank loan, that money is “destroyed”, as a reverse of the process where it was created by the bank when they lent it to you. That’s de-leveraging that makes money more scarce and tends to raise rates further.

Mortgage under my holding company (which owns the condo) versus my personal name, but yea still had to qualify with basically everything including personal income.

Yes, hard to argue for a better no risk return elsewhere.

What’s the difference in a commercial vs residential mortgage? For example, do you still have to qualify based on your personal income, pass stress test etc.?

Yes because the loan expires at end of term and technically the whole balance becomes payable.

Yes. No letting involved. The full balance is due unless you renew. Paying out the mortgage is the default option

Is that how it works — at renewal, you can opt to pay off the principal entirely?

Pretty close. 17M deficit

One of my commercial mortgages came up for a rental condo. Currently at 2.7% with TD.

For the Oct 1st renewal they offered me

1-year fixed at 6.76%

5-year fixed at 6.40%

Variable at prime (5.45%) + 1% = 6.45%

Opted to pay it out.

Until our rankings come out, here’s a list of who’s in favour of missing middle in Victoria: https://twitter.com/bromptonymous/status/1568009270213644289?s=20&t=meHKiUs38mgaSG7uaaRY2A

Potts is not running again.

Isitt has the worst housing record on council. Not just market housing either, he voted against tons of rentals and below market affordable housing. 100% left NIMBY

Fantastic! Looking forward to that list.

The only chance is electing a pro-housing council that will immediately pass MM when it comes back to council at the end of the year (along with enacting a ton of other zoning reforms). We’re ranking the councilors on housing and raising money to spend on advertising (both paper and onine) to distribute the results as widely as possible for the core munis. If anyone is interested in donating, you can do so here: https://ko-fi.com/homesforliving Please read the donation rules first.

Adjusting one’s spending habits isn’t as easy as throwing a light switch. People will continue to spend at their previous levels into the immediate future as they hope that the current conditions are temporary. Not until they see the red ink will they begin the process. As It takes some time before one faces the reality of the new paradigm and change spending habits.

My opinion is that people use credit to augment their life styles. They don’t safe up to purchase goods and services but use their credit cards and lines of credit to receive immediate satisfaction. Changing the mindset to postponing immediate satisfaction and to become a saver isn’t easy. Add to that that it seems every time you cut one expenditure, prices for the other necessary goods, like food, increase and it is easy to get frustrated as one’s costs are not declining and instead more financed debt is carried forward.

So my opinion is that instead of paying those debts off at the end of the month more people will carry some of their debt over into the next month (s) and eventually might only be able to cover the minimum credit payment each month. Any good hypothesis / opinion should have a way to falsify the claim and that may be illustrated in an increase in the bankruptcy rates over the next year.

Precisely, that is for my amusement.

What works for me is just to follow a preset financial plan on investing. The one I use for stocks is based on the Canadian Couch Potato model. I don’t sell in downturns, I continue to buy what I can afford reasonably and ignore what the market does. It really depends on how long you have until you start to withdraw though. We have more than 15 years so are less sensitive to the downturns.

I really recommend a written financial plan that spans current to end of life. We did ours ourselves based on a template, and then went over it with our accountant to minimize tax and inheritance issues. Lots of info available online.

Says the person that went out of their way to dox people on here, sorry, who has too much time on their hands and needs to get a life?

Modern times

Exactly, people that take the back and forth on this forum seriously or gets offended needs to get a life.

So many experts live on the internet and you can turn them off by the flick of a switch.

Ha!

It is with delight that I see you that you didn’t “walk the walk”, and have sold your stocks after all.

You used to lecture us on investing, by telling us about the worst kind of investors – “amateurs” like doctors, lawyers that managed their own money. The problem being they got nervous in downturns, and sold. And then they didn’t know when to get back in because you can’t time the market. And the best kind of investors were people like you – long term buy and hold . With “strong hands” that never sold in downturns – you boasted how you didn’t even know how much the market was down in downturns because you wouldn’t even bother to look at it. And now we hear that you “exited most all of my non taxable portfolio back in March”…

Maybe you should take the same advice you gave us, which was to find a professional to manage your money. That will be someone for you to phone when you get nervous and want to sell. The 1% per year you pay him will be worth it for that alone – you told us all that too.

Next Victoria council to decide fate of ‘missing middle’ housing initiative

https://www.timescolonist.com/local-news/next-victoria-council-to-decide-fate-of-missing-middle-initiative-5798023

Who will try to refer it to the next council.

Make that 4.2% with the strong open this morning.

Long haul game just like buying a rental property. My TSFA is down 5.3% from all-time peak. The dividends have helped to mitigate the downturn. However, even with the 5.3% down from all-time peak up well over 100% from max contribution room. I am not going to do it, but I wanted to I could sell 200k right now and pay down my mortgage.

Would I be borrowing at 5% against my house right now at this exact moment to enter the stock market. No, however if you did it the last 12 years you did really well and you have an opportunity to exit right now at a relatively small pullback and pay down debt.

Kenny g Yes leveraging has worked well in the past and I will be back at it in a year or 2 looking for value

I agree that Alto is the better choice on housing. For councilors I’d appreciate hearing other’s views. We are losing most of the incumbents. Including ones that were relatively solid on approving housing (Loveday) and confirmed NIMBYs (Young)

What I think so far:

Of the incumbents running again:

1) Issitt is a grandstander and I will not vote for him. Even if you support his politics/ideology there will be more effective candidates that will actually make a decision rather than prescribing more consultation as the solution to everything.

2)Potts is part of the Together Victoria group that voted against a lot of housing. Don’t know much about her but inclined to NOT vote for her

Of other candidates

1) Marg Gardiner’s claim to fame is as queen of NIMBY with the JBNA – definite no

2) Dave Thompson comes recommended by several friends and his platform looks reasonably positive

Anyone have views on some of the other councillor candidates?

“Curiously, we’re not hearing much from the guy who advises folks to borrow against their house to invest in the stock market.”

‘

‘

Sorry to disappoint you by not posting lately, I lurk from time to time. If you review my previous comments which some people seem to have time on their hands to do you will see that I exited most all of my non taxable portfolio back in March as well a leveraged portion, I also called a housing top at that point. Yes the markets haven’t been great this year with the TSX down about 8% ytd before dividends. Nasdaq down substantially more. As I mentioned earlier borrowing to invest isn’t for everyone, but in moderation is still a sound strategy.

I think these people are BANANAs (Build Absolutely Nothing Anywhere Near Anyone), they don’t seem to care strictly about their backyard.

Yes. And I think a lot of homeowners are doing this now.

Yes, even if you can afford to pay it it is still a loss to your savings and the plans you might have had for the funds.

Doesn’t work that way. Universities receive provincial per student grants for domestic students, and the maximum number of domestic spaces is determined by provincial funding. Universities don’t get provincial funding for foreign students, so they can admit as many as they want. Eliminating foreign students would not create more domestic spaces.

Missing middle vote is postponed until after the mid- October election. Such a strange process thus far.

No rental Totoro. Although I’ve been trying to buy a house with a suite to rent for about three years, LOL. The first purchase was with my ex, then sold 15 months later to buy my current home when we moved apart. House price/payment affordability is always relative. Yes, I bought a home a shade under $500,000 with 20% down (unheard of today, I know), which was my cap at the time in 2016, but as the single-wage earner covering the mortgage, even having had some increase in salary in the almost 7 years since I bought, it’s a bit of a stretch to cover the now $400 and soon to be almost $500 a month increase to my mortgage and it’s sad it is all going to interest. I’m sure I’m not alone in feeling the pinch!

The people who lump Lisa Helps in with the rest of Together Victoria really haven’t been paying attention. Stephen Andrew has voted more like Issit and Dubow on housing. I regret voting for him once, but it definitely won’t happen again.

There are 133 building sites listed for sale in the Core, Westshore and Peninsula but there have only been three sold in the last 60 days. Seems like the contractors are just working to finish up their jobs and then take a wait and see attitude to what is happening in the market. Lay offs will be coming soon.

The only serious candidates so far are Marianne Alto and Stephen Andrew. Marianne has a better record on housing. Stephen will take whatever position he thinks will get him the win, and in this case he thinks the NIMBY vote is more powerful than the youth vote.

Who’s the Mayoral choices? I honestly don’t believe Steven Andrew will serve the younger generations well. He will talk the talk but backs Nimbys. Also Isitt for being so against any market housing, sure is doing a great job of making it worse for the student crowd.

Fixed this for you ^^^ because grammar and being accurate can both be tricky

I look forward to my DoorDash driver dropping a RE biz card in with my delivery

On the plus side of mmhi being deferred maybe this will invigorate and mobilize more prohousing people to come and vote especially being so close to election. If this motivates a few more people and those few more people are the difference between 5 prohousing seats over 4 then this will actually have worked out.

If the government’s policy is to increase interest rates to the point that national home prices reduce by 20 to 25 percent that would go a long way to improving “affordability”. Whatever that means?

Home owners would still continue to make monthly mortgage payments given that most of the increase in prices has been over the last 24 months. So you won’t see home owners walking away from their homes in significant numbers.

But it will be tough on jobs in the finance, insurance and industries associated with real estate as unemployment will be higher in these sectors as new construction is put on hold.

Just a few who wants to borrow against their house to invest in more houses.

Curiously, we’re not hearing much from the guy who advises folks to borrow against their house to invest in the stock market.

Yea, it’s a bit simplistic. I think others understand that normally, the link between changes to economic activity and the overnight rate are indirect but nevertheless there.

As you say, if RE tanks, that doesn’t cause the rates to fall. It’s the knock on effects on the economy (ie the multiplicity effect in reverse) that theoretically weigh down growth, thus inflation, thus rate hikes.

So I think you can make the argument, loosely, that a falling or collapsing RE market will ultimately be compatible with rates that hold or even fall. That connection is liable to be especially strong if the GDP is over-reliant on the RE sector, which Canada currently is.

Personally, I think they should hold and assess the effects of the hiking they’ve done to date. I don’t agree with the analysis that states, “the overnight rate needs to exceed the inflation rate to solve the inflation issue”, because that ignores the effect and degree of debt obligations currently sitting in the financial system. The economy has demonstrated several times in the last number of years its elevated sensitivity to rate increases.

The real, more unspoken risk is stagflation, especially if inflation remains where it is. I’m not sure whether they will be able to get to 2%. On the other hand, one perhaps isolated benefit would be in having it run hot (3-4%) over the next few years…as it would provide a degree of debt relief in real terms.

Referred to the next council. Ben Isitt and Stephen Andrew were against MM, the others don’t matter because they aren’t running again.

There seems to be a lot of wishful thinking by Canadians who have only known low interest rates. The hope is that as the real estate market tanks the BOC will stop raising the overnight rate. Or if the economy dips they will call a halt. The BOC prime mandate is to keep inflation under control and other factors like the economy, real estate and personal finance situation of Canadians are secondary. Below is a graph of inflation in Canada since 1966. The second graph is the BOC overnight rate (which is currently at 3.25%) over this same period. We have a serious inflation problem and it will be stubborn due to global factors. Anyone who has seen this movie before knows what is going to happen. The days of low interest rates are over. People need to adjust their spending habits and start saving again.

This current council is so ego-diseased they can’t see how damaged their reputation and how generally embarrassing they’ve become in the public’s opinion and there’s even a report they’re actively postponing coming to council that backs all of this up. They should really just bow out and let a new council readdress this one. As much as the region needs it, the buffoonery of this group will overshadow any possible good it could result in.

I am saddened that with the passing of her Majesty we have come to the end of the second Elizabethan era.

Yeah, there have been problems mostly for Universities in the States that have come with too much foreign student enrollment. The problems I’m aware of did not involve crowding out domestic students per se (although perhaps that was a secondary issue) but were rather financial. Because international student tuition is so much more expensive than domestic (28k vs. 6k at UVic, worse in the States), small fluctuations in international enrollment lead to large fluctuations in University income. Risky business.

Doesn’t look good for missing middle. Council currently deliberating

Looks like they’ve added about 4000 spots in the last decade, so I don’t think they’re crowding anyone out.

That’s about an extra 5% deficit. (Comes out to ~ 20-25m out of an operating budget of ~ 450m)

Problem is, that implies a deficit for each of the next three years too, since the “missing” students would have been here in 23/24, 24/25, and 25/26.

I’m still curious whether UBC/SFU have similar declines this year. (For example if the decline is largely due to Chinese COVID response it should lead to similar impacts for all three..)

I’m honestly surprised the drop is that small, especially with Chinese domestic Covid policy being what it is. Be curious to know what the country breakdown of that data is, although that may not be released publicly.

I don’t necessarily think that a drop in foreign enrollment is always a bad thing. I don’t know what the “ideal” ratio of foreign/domestic students is, but a university that becomes addicted to foreign cash resulting in crowding out domestic applicants, at least to me, is never a good thing.

Interesting – UVIC has 22K students (according to here https://www.uvic.ca/about-uvic/about-the-university/index.php) and 4000 of those are International (https://www.uvic.ca/about-uvic/about-the-university/international-perspectives). So 17% of that is 680 International and that means 18000 domestic at 3% is 540 students. So 1220 students total. And like you said thats big money for the University. I wonder what percent of those aren’t coming due to living costs.

Thanks Leo!

Like Jack Nicholson’s Col. Jessop in “A few Good Men”.. we need you on the wall! https://youtu.be/9FnO3igOkOk

The money I got from renting our basement suite was seriously the easiest money I ever made (not counting property price appreciation). Granted a few stressful moments along the way.

Apparently -17% international students ($$), -3% domestic.

I’ve deleted a number of comments. Please be nice, or I may need to put people on the review list which means all your comments go through moderation first

Found it. First part is here:

https://higheredstrategy.com/laurentian-blues-1/

with many more parts there after. (Just follow the “Laurentian University” tag at the bottom of the post if you wanted to keep going.)

Yes, although the main differences aren’t the ones you say but rather have to do with fiscal practices, accountability, and transparency. (A hostile governing party dropped the axe, yes, but, metaphorically speaking, Laurentian had found a chopping block, laid down on it, and called the axeman for a visit.)

There was an excellent several-part summary of what went wrong and what it all meant that got distributed in our Department last year when all of this down.. I’m trying to dig it up and if I find it I’ll post it.

Any idea how much? Could help to ease rent prices increases.

Very dissimilar in a number of respects, not the least of which is that Sudbury isn’t Victoria and the area doesn’t vote for Ontario’s current governing party.

They probably want to extra cautious after what happened to Laurentian University. However, it does help explain all those SFD rentals in Gordon Head dropping their prices now.

Intelligence is normally distributed, but I would say that tenant quality isn’t. 🙂

Hi Leo,

Do you mind dropping the link for that? Those are the kinds of things that don’t get discussed in university-wide emails. 🙂 I’d also be curious how UVic is doing this Fall relative to UBC/SFU..

I think you’re right about that. I guess landlords who didn’t have a mortgage might still have been relying on the rental receipts to live on, though I realize that’s a first-world problem (but then most of this is)

Peter’s run down is pretty accurate. And it is work to save up to buy a home as any homeowner who has done this knows. It is also risky to be a landlord and it is often cash flow negative in Victoria, sometimes even accounting for principal pay down which you pay tax on at your highest marginal tax rate.

How well you do and how much work it is largely depends on your skill in risk management and how well maintained your properties are and remain. It is a fair bit of work when tenants change.

It is more akin to self-employment than it is to a salaried job but it really is an investment strategy rather than employment.

Big enrollment drop at UVic. Hiring freeze + large deficit this year they need to make up.

Just like how studies indicate that a majority of people think they’re smarter than average 🙂

It seems like you consider yourself a clairvoyant.

Maybe I’ve been a tenant elsewhere before? Look into your crystal ball and let me know.

Even when presented with everything Peter described you still come up with the lame response that “becoming a landlord is hard, but being one isn’t”. I’ve had the same 20/60/20 mix Peter described. I’m still in touch and even friends with some of the great 20%, give references for the 60% and am still paying off damages from the awful 20%. It’s not so simple James and maybe one day you’ll spend less time complaining on a real estate blog comment section about what you deem as a fair raise in your BCGEU job and go do something about your situation if you’re clearly so unhappy. In the meantime your angry, juvenile, unhinged comments just further confirm that you have no idea what it’s like in the real world of property ownership.

It seems like you consider yourself a model tenant and you may well be one. But most tenants consider themselves to be good tenants.

Perhaps Peter‘s tenant with the messy dog also considered himself to be a good tenant. In terms of being judged a good tenant … “it’s not over ‘til it’s over”. Many of the tenant problems are undisclosed and discovered as “surprises” after the tenant leaves.

Shipping costs may have declined, but business still have to clear the old inventory that was purchased at a higher price. Most businesses will not react until the competition starts to lower prices.

@Peter, a lot of that seems like “becoming a landlord” rather than being a landlord. I honestly understand that there can be shitty tenants and they’re the hassle, but my landlord has barely come by the house I live in, certainly less than once a year, and their investment is cleaner than the day I arrived. Anyway, Up and coming assures us that they never rent to shitty tenants, so clearly has no hassles, and can spend all of their time not contributing anything of value to this message board, as well as some other facebook groups apparently.

Also correct me if I’m wrong, but weren’t you allowed defer your mortgage?

Excellent post but there are more tenants than landlords so the politicians will dump on you.

Great post Peter! That says it all. My hat’s off to the landlords out there that have to deal with all this.

James, for God’s sakes.

I can only tell you some of my own experiences as a landlord. None of this is all that bad, I get that everything is relative while people are desparate to get a roof over their heads, but now that I don’t have to, I’d never, ever do it again. This is sort of an amalgam of rental experiences:

Spend a few years saving up minimum downpayment. No holidays, drive 10 year-old car, maintain it yourself, save, save, save.

Buy older place you could then finally ‘afford’ to reach to buy. Taking into account mortgage and all other costs, meaning you will be falling short on cash-flow (or call it what it amounts to, subsidizing the tenants) to the tune of $X thousand for #Y years.

Put in sweat equity to repaint and do fix-ups sufficient to get the house in better rentable shape. No income at all during this period of course.

Big day arrives and meet with prospective tenants. Weed through all the undisclosed landmines – one was a hoarder, one had been in a cult, one had an undeclared bankruptcy (I’m not making this up, and I’m also not judging them, but this part of the process is about risk mitigation, not social justice).

Property is rented – yes!

Then you get to your day-to-day stuff, which is as you intimate, not that bad, but only IF the tenant is a decent, reasonable individual. Nobody minds dealing with normal-course repairs and maintenance with reasonable people on the other side. However, some things you do mind:

I really could go on and on. Over 15 years or so of doing this, to be honest we had probably 60% of renters being ok, 20% great to deal with, 20% terrible. Trust me, dealing with all of this is a real job, and it takes its toll. If you’re not treating it as a part-time job, you’re not doing it right, and your property will suffer, quickly, as a result.

So then ok, you finally get cash-flow-positive – yes!! And then you get:

rental restrictions that are capped the first time inflation seriously shows up

lots of musings about closing the “loophole” of going to market rent between tenants

laws changed to make it very difficult to deal with or god-forbid, evict, a problem tenant

So finally you sell – yes!!! Pay your taxes, that’s fine. Ignore all the sh#theads who just want your money because you’ve made a “windfall profit”. Sigh and invest elsewhere, move on and simplify your life and never have to deal with tenants again.

Heaven

From the Feds to the provincial government handing out inflation affordability handouts fighting every move of the BOC. Trudeau has to go back to living like a teacher rather than a billionaire with unlimited coffers. Stephen Harper days just keep on looking better and better.

And so it begins. I was wondering which central bank would blink first. Looks like it might be Australia … is BOC next?

Australia central bank (reserve bank) delighted their stock and bond market, by hinting at a pause. Their rate is at a timid 2.35% in the face of 6% inflation.

Result is AUS stocks/bonds up, and AUD down. AUD/USD is low at $.67 usd

Here’s what they said. As usual, you need to read between the lines, in this case the bolded parts pointed to a pause for the markets. For example “there are lags” is code for “we are slowing down to wait and see”.

“In a speech on the policy outlook, Reserve Bank of Australia Governor Philip Lowe said further rate increases would be needed to contain inflation but the RBA Board was not on a pre-set path and was aware rates had already risen sharply. This was followed up by a speech referring to a “flexible policy” looking at both economy and inflation as a guide to rate hikes. https://www.rba.gov.au/speeches/2022/sp-gov-2022-09-08.html?&utm_source=twitter&utm_medium=social&utm_campaign=speech-gov-2022&utm_content=anika-foundation

“We are conscious that there are lags in the operation of monetary policy and that interest rates have increased very quickly,” said Lowe adding that he recognizes that “all else equal, the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises.”

It doesn’t work. My neighbours invited some people over for a barbecue. The subject of interest rates came up, and four people were sent to Royal Jubilee with severe spatula lacerations.

+1. Might be time to step away from the keyboard and, as able, enjoy yet another beautiful day..

Still nothing hey? Can’t read or respond. Pretty useless.

Consumption has fallen off in part due to the higher costs leading to the lower cargo volumes and the drop in rates. Typically these movements in shipping are the leadmark to a recession. Just more of the follow on inflation fun. There will be a number of businesses stuck with over priced inventory that they can’t move and there will be opportunities to get nice discounts as they are forced to make write downs.

I agree it has been going on for a while. James has been trolling people for years here. He has been kicked off every other forum imaginable. HHV is all he has left. It’s either that or it’s Leo/Juras/Barrister/Introvert’s alter ego that they are trolling with to get more interaction from visitors here haha. I often wonder if this whole forum is just a scheme by one person wearing many hats. Ponder that!

But I bet businesses will take full advantage of the perception that shipping costs are still astronomical in order to maximize profit margins for as long as possible!

I’m not very active here and I’m not in the real estate biz. I’ve lurked for a while and posted occasionally. I’ve noticed an ongoing feud between a few regular posters and it seems to be devolving to the point of name calling and using curse words. Go ahead and hate each other but please keep the comments civil so everyone can enjoy this space. Ty

This reads like a Vancouver Island Housing Market Facebook post, such a typical ignorant renter mindset

I actually am not. Up and coming & Realist clearly are though.

They’ve also been saying for a decade that rates were going to go up.

This is hilarious. Obviously a case of “those who can, do; those who can’t, teach” as the amount free economic and housing advice coming from someone that has zero grasp on what it would involve to be a landlord let alone just a property owner all lines up. I look forward to your next post about interest rates, the CAD, inflation in the 80s, CPI, etc.

No shit – I’ve said that all along. But when a (formerly) trusted institution says to expect rates to stay low for a long time, consumers might listen. Just sayin.

Right! Time to disengage from these pointless repetitive discussions.

The embittered millennials and hard knock boomers can duke it out with the last of the permabulls.

I think you are confusing a job with an investment. Use of capital is not the same as working for a wage. You might as well say that someone who has stock market investments can’t comment on your salary because they don’t work for the gains. I thought you had investments as well?

In order to have any meaningful information you’d have to add the labour to to amass the capital to invest, subtract lost opportunity costs, and then consider the time required to operate a rental property – which is different depending on the size and condition of the property.

Go on then. List some things. What do you do on a daily basis?

As I’ve expressed before, I have zero confidence in the government to do crap all when it comes to housing. Why are rents so high and going up? Super simple econ 101, supply and demand (more people want to live here than we have housing for). The government is simply ignoring the supply portion. All the 2% does is play musical chairs and doesn’t solve any fundamental problems. You can blame investors and everyone else but reality is there are no places in mass sitting vacant. Whether it is owner occupied or rents for the most part housing is occupied in Victoria.

Let’s help the poor deserving tenant and punish the greedy landlord but in reality will end up with less rental supply and those tenants that don’t end up in long term rentals capped at low rate increases will end up having to outbid eachother at ridiculous prices on the limited rental inventory available at market.

What confidence does it give to an developer/investor to spend 2-3-5 years fighting NIMYS/local municipality such as Victoria or Saanich, plus two year build out, to have the rents capped way below inflation. Might as well just sit on the cash and not go through the stress and agony.

The 2% is just an absolutely terrible policy and this is coming from someone who has never given an existing tenant a rent increase.

Also, where is the motivation to maintain a property whatsoever. At 2% as a landlord wouldn’t you want to do as little as possible in the hopes that tenant leaves?

I think a better approach would be don’t cap rents, let the market do its thing, allow for more quicker construction, and help the tenants that cannot afford market with subsidys for rent or have the government build truly affordable rentals.

Shipping costs have absolutely plummeted

No, sounds like a you problem.

Historically, no. But house prices are just a smidge higher now…

Just look at Leo’s affordability graph to see we’re not far off the all-time worst affordability of the 80s (maybe we’re equal with the latest bump).

Pretty sure my TD variable has ‘triggered’. What started as a 25 year amortization had grown to 60 and now it just shows blank for the amortization field. Mortgage value is under half the current property value, so no where close to the 80% LTV limit. So far no changes to payment. I’m guessing my mortgage balance will be getting higher from this point on (although I do plan on increasing payment).

I remember people here giving you shit when you suggested something like 5% mortgages….

Just for the record, a five year fixed for 6% is not a high rate mortgage. If anything it is about low average historically. Considering what inflation is running at why would I lend you money at six percent?

Also anyone interested in what exactly Volcker did in the 80s i found this article on it – https://www.vox.com/future-perfect/2022/7/13/23188455/inflation-paul-volcker-shock-recession-1970s

As you may have heard in Powells last speech the US tried unsuccessfully to reduce inflation for many years prior to the spike in rates. President Carter promised to find someone to fix inflation and appointed Volcker in August of 1979:

“After a couple of modest increases in the first month of his (Volcker) tenure, he called a surprise meeting on October 6, 1979, and set the Fed on a new, dramatically tighter course of monetary policy. The Fed would allow a much wider band on interest rates, effectively allowing them to go higher than before, and announced it would recalibrate policy regularly in response to changes in the money supply. If the money supply was growing too quickly, the Fed would crack down harder.

That month, the Fed’s interest rate was set at 13.7 percent; by April, it had spiked a full 4 points to 17.6 percent. It would near 20 percent at times in 1981. Higher interest rates generally reduce inflation by reducing spending, which in turn slows the economy and can lead to mass unemployment…

The approach took two tries to get its intended effect. Volcker’s tightening slowed economic activity enough that by January 1980, the US was in recession. But Fed interest rates actually began falling sharply after April, which limited the effectiveness of the Fed’s anti-inflation efforts. The Fed tightened again after that and sparked another recession in July 1981. This one was far worse than the first; while unemployment peaked at 7.8 percent during the 1980 recession, it would peak at 10.8 percent in December 1982 in the middle of the 16-month second Volcker recession. That’s a higher level than at the peak of the Great Recession in 2009. Over the course of the 1980s, this policy regime would become known as the “Volcker shock.””

So I would guess even if inflation starts to come down, if they are taking history into account, they will keep rates high until they are sure we are in a good spot.

I would be curious to see how many mtgs during the pandemic circumvented the stress test. I’ve stated before that my Big 5 broker told me if I had 20% down that would qualify for more mtg. I asked what the difference was and he noted that for insured (less than 20%) down that CMHC (or one of the other insurers) had to approve the mtg and they followed the rules as designed. If there was 20% down and no need for oversight then the banks were commonly increasing your debt servicing ratios to lessen the impact of the stress test AKA helping you qualify for more mortgage. He said he figured nearly 50% of the uninsured mtgs he did during the pandemic had these requests attached to them. Not sure if his book is reflective of that bank in general or the larger mortgage world but I suppose we will see a fallout if that was a bigger part of the books then the banks would like to admit. Also presumably those requests would have been mostly for fixed mortgages where the impact would be more noticeable – which means we would need high rates for a few more years to come to see those impacts.

The worst for me is that I cannot take an extended vacation without having to get someone to look after the house in case something goes wrong. Dealing with issues while I am in town while annoying is tolerable. I suppose I can just get a property manager but that would eat into the cashflow.

If you bought 7 and 8 years ago then your buffer is far lower house prices, any increase in income, and if you are renting out, much higher rents.

It is impossible for anyone to predict the future and that goes for central bankers as much as anyone else. If you want a guaranteed interest rate, take out a long term mortgage. I’m pretty sure that a year or two ago you could have taken out a 10 year term at rates well below those for a historical 5 year term.

People borrowing short term are taking on the risk of rate increases and if it doesn’t work out for them I don’t want my tax dollars bailing them out, thank you. I’ve already helped them out by getting below inflation returns on my savings. That said I’m not opposed to the kind of deferral we saw in 2020.

Sure thing. I don’t anticipate it getting to that point either.

Prices have dropped to keep affordability roughly constant since April. The +75bps doesn’t move it much in September if prices stay the same. Of course this is with some assumptions on incomes

I doubt if anybody is going to get bailed out nor do I think that a lot of people will need to sell. I absolutely have no prediction of future rate hikes but another hike of .75 before the end of the year would not shock me at all.

Lets watch to see what the US Fed does. ( I am sure that the US Fed is extremely concerned about interest rate hike effects on the Canadian Housing Market.)

Nice!

I picked up nomination forms to run for council in Ucluelet. It is meagre compensation but it will be my side gig to lessen the impact of these rates and also give me an opportunity to advocate for affordable and missing middle housing here. Other than that I gave up my vehicle wrangled a couple more house design projects and sold all my music gear. Dusting off the pandemic food stuffs is next and a burning barrel and some home made fingerless gloves. Im not sure any of this was necessary but better safe than sorry.

It’s not that hard. You just have to use words like if, should, could and may. For example: “if the Bank of Canada increases the overnight rate to 6%, then most people should be ok.”

Hope this helps.

I sure hope that’s someone’s idea of a joke! I can see maybe one more increase (hopefully the smallest of possible increases) in October because it will be too soon to really judge any effects from most of the increases, particularly this last one. But I sure hope we don’t see any in December. If there are still increases in the spring, or rather the new year into spring, I might also have to put someone in my spare bedroom, ie a homestay student (have done so in the past short-term) as millenialhomeownerX2 mentioned. I already have a second part-time job on top of my full-time one, so not much room for a side hustle to keep up with my adjusting variable rate mortgage.

As for the stress test which is supposed to “protect people” from overextending themselves and the dangers of rising interest rates, I think a lot of people forget it hasn’t always been there. Our memories are so short. I bought in 2015 and again in 2016 only 15 months later. No stress test in sight as it didn’t come into effect yet for the first purchase and it was an uninsured mortgage for the second, when it was in effect but only for insured mortgages. And the idea was that the rate was higher than rates would reasonably be expected to go. I’m at 4.35% now up from 1.35% (renewal almost a year ago). Just about the bottom in terms of rates when I refinanced, although I’ve heard of some lower, but I imagine there are people already at 5.25% from increased variable rates and then some.

Also, not everyone picked a variable for the rate/payment, some people who have been trying to buy a new home and knew they would break a fixed chose it for the decreased penalty, as did I.

When you’re trying to read in the things you want to see, there’s no amount of clarity I can add to fix that.

Foreclosure is the last possible negative outcome, and there are many things that can and should occur way before that (refinancing with adding an extra 5 or 10 years to the amortization, making an additional lump sum payment increasing the monthly payment, or just selling). Remember some lending is only pegged to the BoC rate (mostly just a signal or a reference) and it’s the bond market determines what the loans will be set at and if the BoC keeps their rate artificially low, they have to undertake QE to provide the liquidity for the low lending rates because the bond market isn’t doing it, so to hold that 2023 thought on low rates would take a massive rate suppression effort that would end in just adding to the current problems. As well, offering bailouts too early just ends up in it being abused or turned into a subsidy.

February CPI would be available mid March. March CPI would be available after April 1, when the wage increase takes effect.

LoL. James you have no idea. If it’s so effortless why don’t you outbid VicRE on his Maplewood property, kick up your feet, and watch the easy money flow in.

Oh I see. Well consider taking the time to edit your comments for clarity before you post them.

If it gets bad enough, I would support some sort of bail out for first time buyers at risk of foreclosure. The Bank of Canada pretty much guaranteed low rates until 2023 and it seems unfair to hold working people accountable for the mistakes of central bankers.

What’s the extra work? You have to occasionally call a plumber? or is it difficult stuffing your money under your mattress? I sure hope it doesn’t involve actually reading, because it’s clear you can’t understand that it’s not an 11-13% YEARLY increase.

My apologies, I was looking at Canada CPI, not BC specific, which as you say is 3.7. I still have no idea why you’d use February.