Fixed or variable? A risk analysis

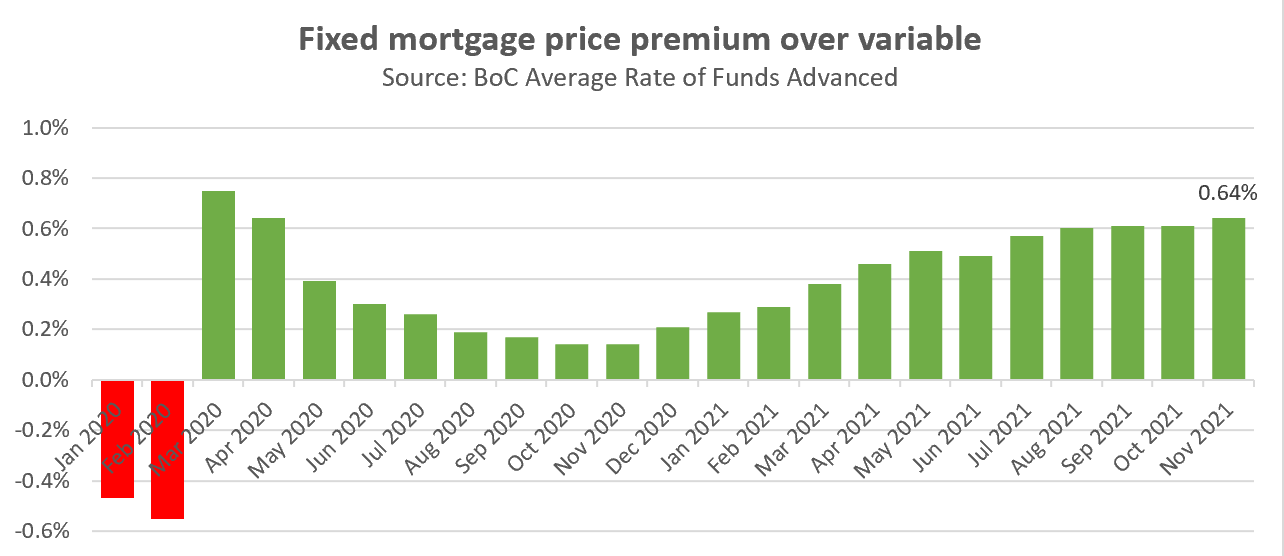

We’re at a somewhat unique moment in time for mortgage rates. One the one hand the gap between variable and fixed rates is huge and has made variable rates more tempting than ever for Canadians. On the other hand our central bank has essentially guaranteed that rates will be going up this year, which means that gap is set to shrink.

Note: Ratehub quotes the current gap between variable and fixed rates at 1.1% but Bank of Canada data represents what people are actually getting.

For anyone braving the chaotic markets right now, it raises the question of what kind of mortgage to choose. Setting aside other mortgage considerations for the moment, what are the chances that a variable will remain cheaper than a fixed rate for the duration of the term?

A study commonly cited in the mortgage industry showed that based on an analysis of the period 1950 to 2000, chosing a variable rate was the superior option 89% of the time. That finding is not surprising from a theoretical standpoint. With a variable rate mortgage you are taking on additional rate risk which should come with a risk premium. Or stated the other way, you should expect to pay the banks a fee for providing you with the fixed rate certainty.

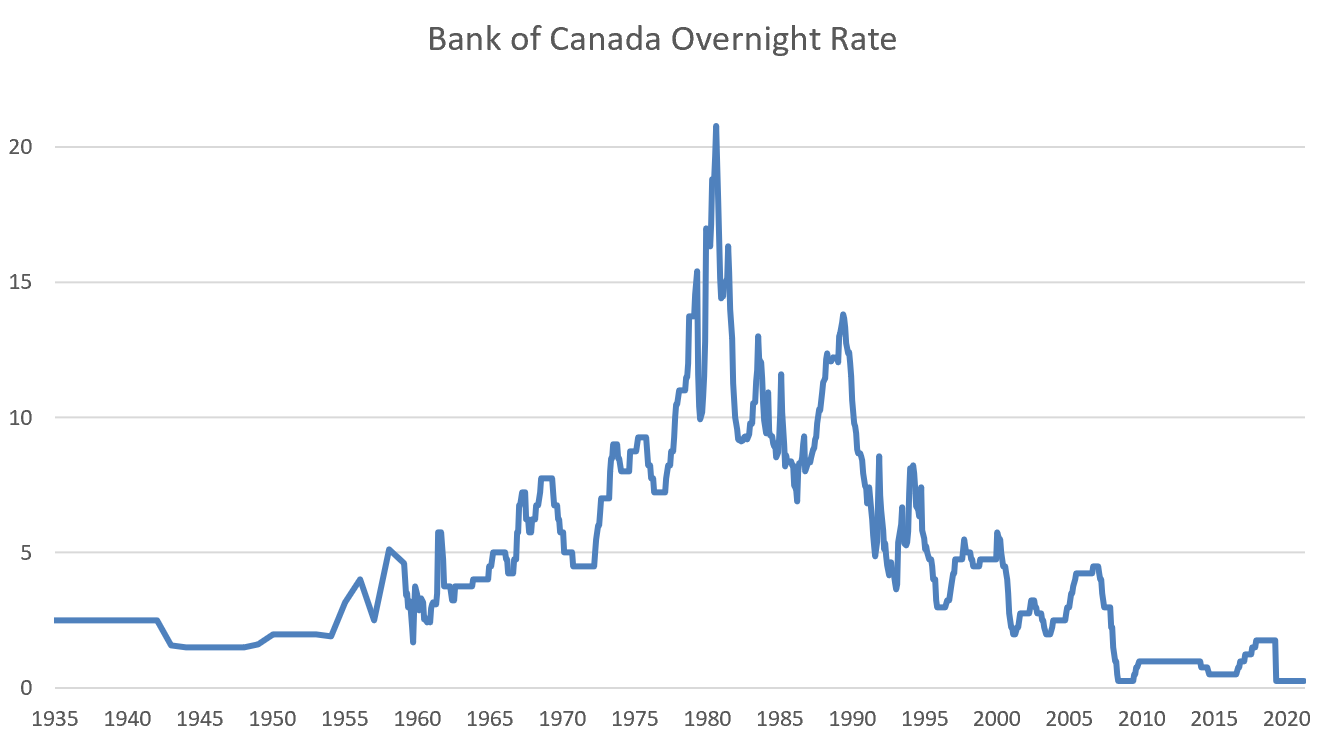

However that study also offers the following caution which perhaps should give us some pause about choosing a variable rate at this point in time: “The cyclical nature of economic cycles and interest rates dictate that when rates are high compared to historical averages, they tend to move back down. Likewise, when rates are low, they tend to move back up.” Rates are clearly very low, but it’s hard to say what the historical average might be when we have only one relatively flat period from 1935 to 1955, then 25 years of rising rates followed by 30 year of falling rates and a relatively flat last 10.

Ever since rates were dropped in the 2008 financial crisis, a common sentiment has been that rates can’t possibly go any lower and the next move will surely be higher. In fact expert predictions for rates have had a consistent upward bias for decades. Variable rates did rise a bit coming out of the financial crisis, but overall mortgage rates kept drifting downwards and have dropped lower than most expected they could. One might think that because the Bank of Canada calls their 0.25% the “effective lower bound” for interest rates and has strongly signaled a coming increase that there is zero possibility of rates going down further.

However I think it would be hubris to suggest that the scenario is impossible when we know other countries have lower and even negative overnight rates (Switzerland recently maintained their -0.75% policy rate). The Swiss have a bit of a special case with their currency being a safe haven, but is there really any reason we couldn’t go to -0.5% like the European Central Bank? I don’t think so, and when we hit the next recession our record debt levels may be just the excuse that the Bank of Canada needs to find a new lower bound for rates. However it’s impossible to assign a probability to a scenario that hasn’t happened before and they’ve assured us won’t happen, so for now we’ll take Tiff at his word and assume that 0.25% really is the bottom.

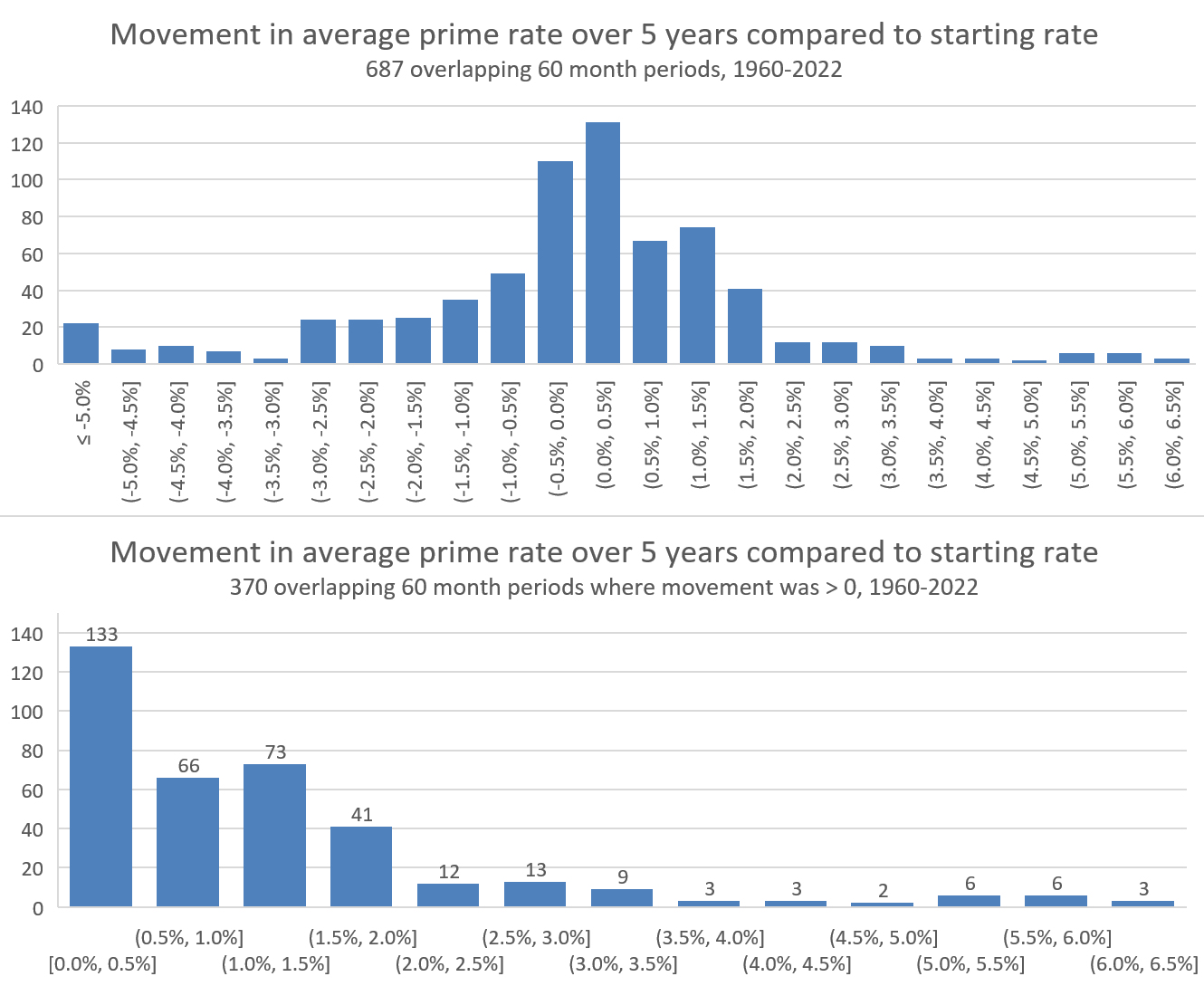

Of course theoretically the interest rate risk on the upside is unlimited. The Bank of Canada could increase rates to 100% tomorrow and everyone would be bankrupt. However for a more realistic range of potential outcomes, we need to bound the potential rate outcomes to something. Let’s start by using the last 80 years of rate history and see how the average overnight rate during a 5 year period compares to the starting point. In other words, how much did the average rate typically move during a 5 year period? That chart is below both for all historical movements, and only those in the upward direction that we’re interested in.

Most movements have been small, with the average overnight rate for the period staying within 0.5% of the starting rate in 36% of the cases, and within 1% in 54% of the cases. Possibly worth noting is that the last time we were at at the 0.25% floor on the cusp of rising rates, the average overnight rate over the following 5 years increased by 0.7%. If that happened again it would erase the variable rate advantage but it certainly wouldn’t be a disaster for variable mortgage holders.

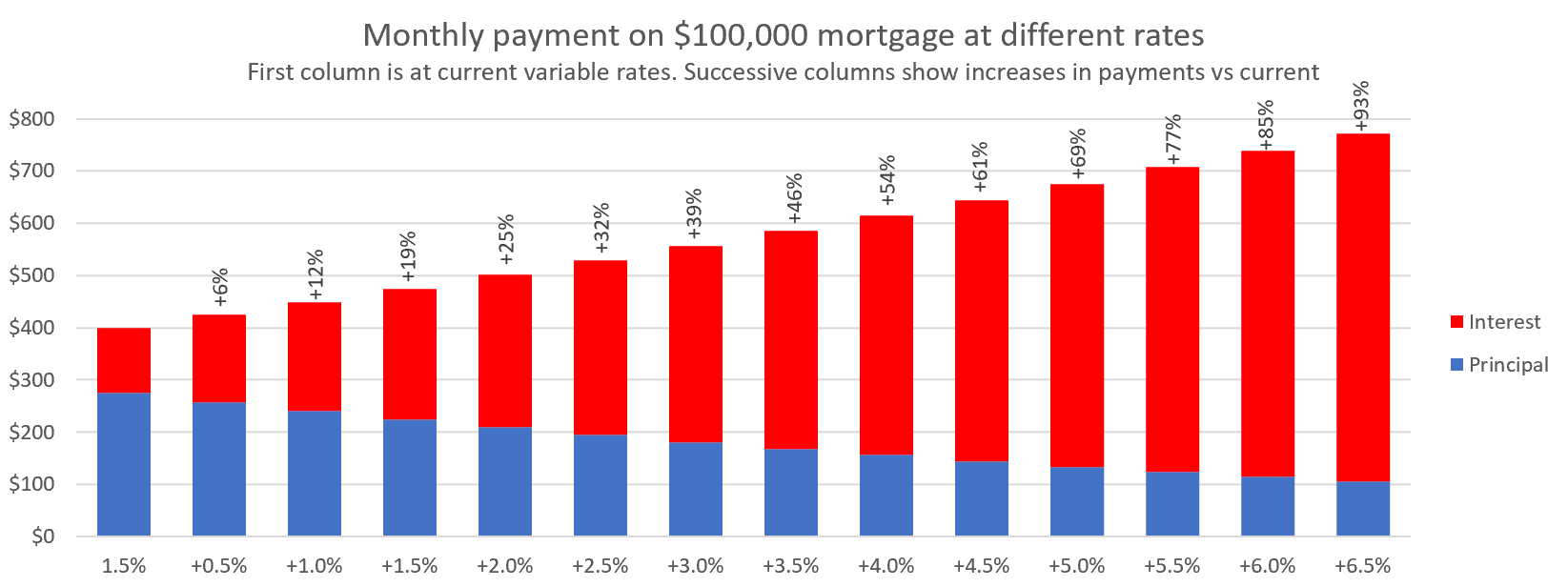

What about increases beyond 1%? Well in another 31% of cases, variable rates increased from 1 to 2% over the initial rate. After that the probabilities drop substantially, with 10% of cases rising between 2 and 4%, and only 8% going up more than that. However this is all pretty abstract. What does it mean for your mortgage payment? Below is the chart of how payments would change at the increases in rates we’ve seen in the historical record. Note that most variable rates are not true adjustable rates, and thus payments wouldn’t actually increase with increasing rates until they passed a threshold, but either way you’d be paying the increased interest costs. Talk to your mortgage broker for details.

The increase in payments ranges from a very mild bump in payments to a near doubling on the extreme end of possibilities.

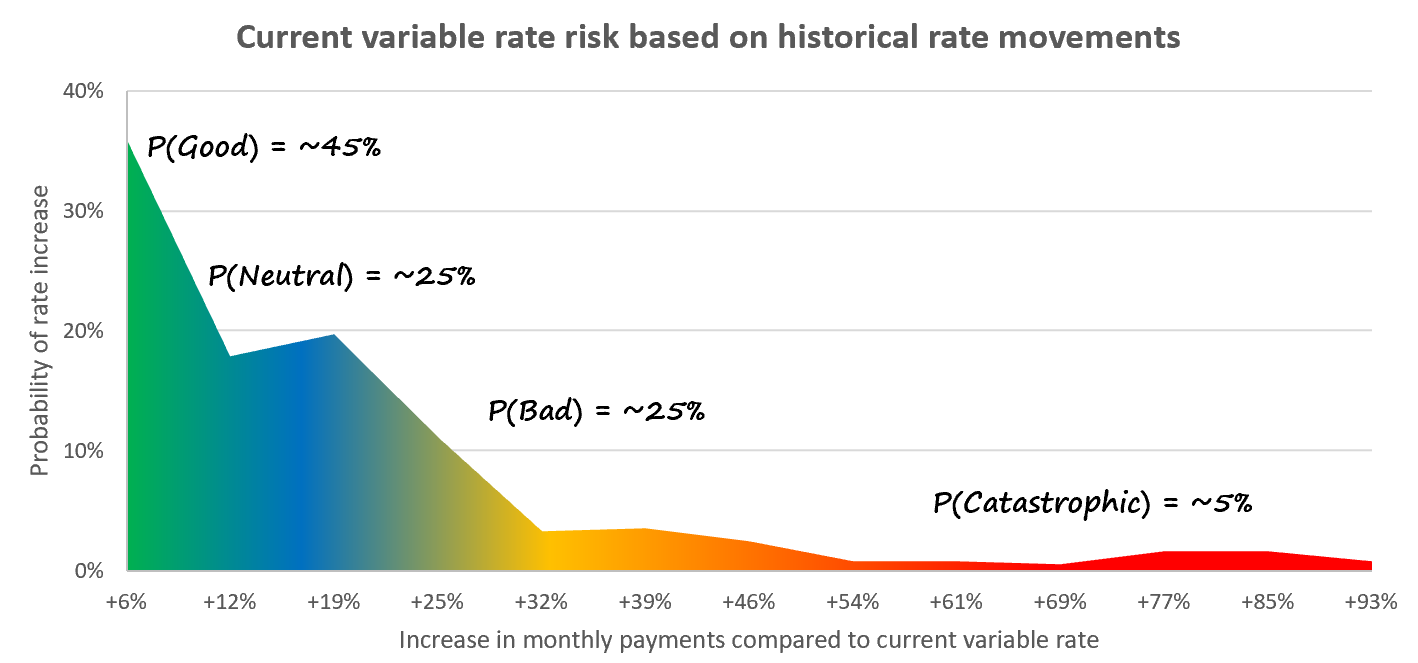

However to turn this into something useful, we need to take a step back and think about the potential groups of outcomes. Fundamentally if you choose a variable rate today, your outcome could be good, neutral, bad, or catastrophic compared to choosing a fixed rate.

Good outcome: The average variable rate stays below the current fixed rates and you save some money.

Neutral outcome: Payments on the variable rate rise up to about 10% above the fixed rate but you retain the flexibility of the variable rate.

Bad outcome: Payments on the variable rate between 10 to 40% over the current fixed payments.

Catastrophic outcome: Payments on the variable rate rise 50% or more over the current fixed rate.

Using the historical data, the combined situation looks as follows.

The chance of a good or neutral outcome is clearly in the majority, but in the good case you’re only saving a few percent on the payments relative to fixed. Meanwhile a 25% probability of a bad outcome with a substantial increase in payments or even a 5% probability of a catastrophic outcome is nothing to sneeze at.

To be clear, I don’t personally expect rates to rise to the levels where we get into the bad or catastrophic outcomes. I think debt is so high that after a few rate hikes the Bank of Canada will be forced to pull the brakes again. Also one could argue that if rates did rise very quickly, choosing a fixed rate would only delay the catastrophe rather than avoid it. Clearly the majority of Canadians are banking on rates being lower for longer rather than seeing the risk in taking on record high mortgages at record low rates.

In the end, it’s worth remembering that the Bank of Canada can and will move rates, and occasionially in the past they’ve moved rates a lot. Very unlikely they would move enough to get into the bad or catastrophic scenarios, but the economic case for choosing variable does seem relatively weak at the moment unless you bag a larger than average discount from fixed rates. One analysis showed that Canada had the largest rate hikes priced in, with markets calling for a 1.57% bump in central bank rates this year.

As usual, the only person that can put that theoretical risk into personal perspective is you. Would you go variable or fixed if you bought today?

Test post

Any good resources for how to fine tune for tax optimization?

New post: https://househuntvictoria.ca/2022/02/14/the-dispersion-of-risk/

I’ll keep that in mind the next time I buy a 5x bagger 🙂 Reminds me of this classic advice from Will Rogers:

The emails today re owner builder exam just insane….love how the government is trying to make housing “affordable.”

“I successfully obtained an Owner builder permit on a vacant property we purchased but we have change our plans and will not be building at that location any time soon.

Instead we are endeavouring to build a one bedroom suite on top of our existing two car garage. I wrote to BC Housing appealing to them to allow me to leave the one permit dormant while applying for an additional Owner Builder permit for the suite above garage project.

Denied with zero consideration to common sense.

I will be required to cancel the one permit, with a rebate minus $50 bucks for administration. Then I will apply for a second permit and write the test for a second time, the test I recently passed.

Then if we want to build on our vacant land in the future – I would need to re-apply and write the test for a third time after an 18 month period.

Nuts.”

Another real life problem I’ve seen with downsizing is “space.” I remember last year, or the year before, I forget, I showed a single woman in her 70s a two bed + den 1,220 sq/ft condo and she was “in shock” how small it was. Walked out of showing after 2 minutes….spare room too small for “TV Room,” also needed a bigger “guest bedroom.” Living room “claustrophobic,” it was kind of funny as I live in 1,000 sq/ft and I consider it be large/luxury.

Ha ha…I live in the “empty condos” as do two of my tenants 🙂 I am bias but I think Vic West will be top notch in 10 years once Dockside is finished, Roundhouse gets going etc. Right now the city has 4 excavators running every day until the summer improving Songhees Park. Even as someone who walks through it every day a complete 110% non-sense waste of resources, but it would look nicer when done.

+1, I agree but I wanted to present how effective the simplest option is. I.e., buy companies that have paid out dividends plus had dividend growth for decades. Obviously if you are going for a 5x bagger it is best it is inside the TSFA.

Looks like I’m somewhere in between University kids and the old, sick and dying. Good for the university, a reliable source of cadavers.

That depends on your demographic.

You’re better off going for total return instead of dividends in a sheltered account for long term investing.

CCP has a good 6 part series with more info:

https://canadiancouchpotato.com/2011/01/18/debunking-dividend-myths-part-1/

IMO the real no-brainer for tax sheltered retirement investing are the all-in-one globally diversified equity + CAD bond funds like VGRO (or VEQT if you just want global equities and have another fixed income/bond strategy). Once you max out the shelters, then you can fine tune for tax optimization.

Leo, That’s a great article on variable rates. Thanks.

From the analysis, it would seem that variable is the way to go. For a theoretical decision, it would depend on the consequences of a big rate rise. If a 50% rise in mortgage payments is going to risk you losing the house or worse, then a fixed would be the better choice. But if you’d still be OK with a big rise like that in mortgage payment, it looks like variable is the way to go.

For sure. In fact only about half of those eligible (i.e. 18+) have a TFSA at all. I am among the small minority who have maxed both. No excuse for a mortgage free homeowner not to.

When my parents decided to down size, they first rented a condominium to see if they liked living in a strata community. They rented for a year and then bought a condominium. They couldn’t see the purpose anymore of having a family home once all the kids had careers and family across Canada. The kids just didn’t come home for holidays anymore as everyone had families. The logic of maintaining a big house stopped making sense to them at that point.

Like so many people thinking of down sizing they are not sure if they will like a condominium/town home and are reluctant to leave the family home.

Frankly, it isn’t the marketplace but it’s the life style change that is holding retirees back.

There are awesome locations within each of the 13 GV municipalities. Totally depends what you are looking for. Urban, rural, waterfront, hilltop views?

My parents and in laws are in a similar situation. The market is just in a total gridlock with people fearful to sell. Will be interesting to see what happens when things finally get moving again.

Exactly. For another “real world example” – last week I posted on HHV about my retired friend who was planning on selling a SFH in WhiteRock, and you (Marko) gave me some good tips on hiring a RE agent. Anyway, the WhiteRock guy has decided not to sell the house after all. Because he first searched for a suitable replacement townhouse to rent and couldn’t find anything – so he’s decided to stay put. That’s exactly the scenario that Marko has described here previously.

How do you quantify desirability?

In our western culture we tend to use money as the common denominator, but that isn’t the same as other cultures.

That would make the more expensive neighborhoods the most desirable then in our western way of thinking. But that does not include “happiness”. You can have the most expensive home in the capital area but that does mean you are more happy than someone living in the least expensive area.

For the people saddled with dual U.S. citizenship, TFSAs are problematic, because they can trigger a lot of problems with the IRS, depending on which tax accountant you want to believe.

Real life problem I see with downsizing over and over again is a lot of people want to downsize from a house they haven’t updated in 40 years to a brand new oceanview condo and they want to pocket some cash. Doesn’t quite work like that, usually what they want to downsize to is a straight trade dollar wise.

No one wants to downsize from an 1970/80s dated house to a 1970/80s dated condo.

‘

‘

I agree for the average person owning a Gordon Head box, the only real way to downsize and come out with a decent surplus is to go into a condo which doesn’t appeal to that many people. The people that I see on the other hand have very large homes maybe worth 2 – 4MM + and its easier for them to downsize into a newer unit and pocket 500K to 1MM. In fact I have 2 clients like that right now, one says we will stay in our home until money gets tight in mid 70’s then look at selling home and move to something half the price, they currently live in 5 acres. The other has 5,000 sq/ft home in West Van and they want to downsize to a new development so go from 4MM to 3MM.

Real life problem I see with downsizing over and over again is a lot of people want to downsize from a house they haven’t updated in 40 years to a brand new oceanview condo and they want to pocket some cash. Doesn’t quite work like that, usually what they want to downsize to is a straight trade dollar wise.

No one wants to downsize from an 1970/80s dated house to a 1970/80s dated condo.

Slim pickings for sure.. My parents are looking to downsize from 160 acres to a house or townhouse here, but we’re gonna hold off a bit until the market gets less manic.

If you contribute the max TSFA amount, adjusted for 2% inflation (the max contribution goes up with it), 6% rate of return, over 40 years you end up with $1.31M nominal. That sounds good but in 2022 dollars that’s just $592K.

The max RRSP contribution is 18% of earned income for a reason. That’s how much you have to save for a comfortable retirement income.

https://www.fidelity.ca/fidca/en/growthcalculator

Downsize into what? There’s nothing to buy. I know several baby boomers like myself who consider downsizing but don’t want to live in the available alternatives. If seniors only apartment complexes were built with rent controls, small pet friendly, and possibly a cleaning service, more seniors would opt to sell their homes. I doubt that will ever happen.

Isn’t carrying mortgage into retirement a type of borrwing? You would be in a weak position at mortgage renew time comparing to when you are working. Set a HLOC just before retirement and use it whenever and however you like/need would be better than carrying a mortgage into retirement, if one can do it.

Clearly Colwood & Langford along with Cadillac road since those are the places that have seen the most appreciation right?

No. Net worth matters. Period.

Just because it might take two months in a buyer’s market to sell your home doesn’t mean you don’t have the ability to convert it to cash if you have to.

Yes. But we are talking about retirement. Why are you borrowing?

Just out of curiosity, what are the 5 or ten most desirable areas of Victoria to live?

Oddly enough i’ve never seen any good stats on what % of people downsize in or before retirement. Mostly it’s just a bunch of surveys of whether people intend to downsize, and the large majority of people don’t. But of course many more are forced to in various ways.

A minor point: it’s TFSA

Yes, they wont re-examine an existing HELOC even if house prices crash, or your income falls to zero. So it is similar to cash that you can depend upon pulling out. As long as you make payments you would be good. I think the critical part would be to get it setup before retirement though. Because when you are setting up a HELOC, they would require that you qualify for the maximum available under the HELOC based on income (and assets other than the house). And when you set it up, you’d need to payoff any existing property tax deferrals and any mortgages on the house, so that the HELOC is first in line.

If someone retired with low income decided to setup a heloc, they might have trouble getting a typical one , (because of low income) although maybe there are other options available to them.

Perhaps for some. My mom stayed in the family home till she was 86, and only sold the house after she had a stroke.

+1, I remortgage once to buy two pre-sale condos and max out TSFA/RRSPs. Just the uplift on the condos and the investments could pay off the mortgage. You have to take some calculated risks in life to get ahead. For 13 years I’ve been buy CND banks, for example, that have usually paid a dividend that is 2% +/- higher than my mortgage interest rates. Sure, Royal Bank could not pay its dividend after paying it 150 years in a row but I’ll roll the dice on such a risk.

As far as I know they don’t re-examine your HLOC once processed it, so this is a solid option.

Totoro – net worth matters less the more illiquid the net worth is. A strong balance sheet is fine but without incoming cash flow you are not in a strong position from a credit standpoint. Im not getting your message what u r trying to say.

You just need a pinch of common sense and 2 hours of google research to retire on stable ground. The government slaughters you on taxes but they give you two freebees in life you should really take advantage of.

If you put away $6k per year into your TSFA and just buy some no brainer stocks like CND banks (Royal Bank has paid its dividend 150 years in a row), telecoms, utilities, railroad, etc. over 30-40 years of dividends + compounding + stock price appreciation you’ll be well into the 7 figures by the time you retire, just in the TSFA. It is so simple, you don’t even need to do any accounting year end in the TSFA. Unless you have some insane pension, RRSPs is another solid tool.

If you can’t put away 6k into your TSFA every year you better be driving a used Corolla but based on all the Model 3s and other luxury cars I am seeing on the roads of YYJ lately I am assuming everyone is maxing out their TSFA at the very least.

If this was a surprise maybe this is the education piece. Once you understand the variables you can plan for it.

The point is that retirees with mortgage would have less options than working people with mortgage.

Like the couple in the article below, they downsized and wanted to port existing $250K mortgage to their new smaller ($435K) townhome but were turned down by their bank as their income was lower after retirement. They ended with a 4.69% two-year mortgage from another lender while the market mainstream rate was between 1.99 to 2.89%, “They also had to pay upfront fees of approximately $5,000 and pay off their car lease in full even though it wasn’t due for another year” to get this high rate mortgage.

Mortgages are normally good debt. But the cost of carrying it could be (much) higher when you are retired.

We have had two sets of friends who have downsized into condos just in the last few months. it was not a matter of finances as much as having a house is simply too much as you get into your seventies. A couple of others moved into their six by three basement condos. it may be slow but the baby boomers are increasingly moving out of their houses.

“Rarely do retirees sell the family home“

‘

‘

Actually, it’s quite common for empty nesters to downsize in their 70’s, why have a 3 or 4000 sq foot home and all the yard work that comes with it, I would say at least 25 percent of clients I see have that plan, downsize and pull out 500k or 1MM if your in Vancouver

Once you have an asset, it is about planning.

If you don’t have enough to acquire an asset in the first place, or you have depreciating asset, then there can be financial hardship as you age.

I personally am not feeling the pain for people who retire and want to stay in their home but don’t plan well around this. They have many options including:

reverse mortgage

sell and downsize

rent out rooms

defer property taxes

sell part of the home to an adult child

suite before retirement and rent out in retirement

rent the house out and rent an apartment with the rent money

Its not like we can’t estimate annual operating costs and we don’t know that aging results in lower ability to do some repairs. Good grief.

And I’m really tired of the argument that house equity magically doesn’t count if you don’t use it. Asset valuation is a thing and your net worth matters, I argue more than income even if it is in your primary residence. The higher the net worth the more options you have typically in retirement.

Here’s a better scenario: retiree stays in steadily appreciating home, cashes in RRSPs to pay remortgage(tax free income) and writes off interest against RRSP withdrawals. Win, win, win. Correction- they can’t write off interest, my bad. Win, win only.

See “Retired? No mortgage for you” in link below. Note it even suggested in the article: “perhaps they (the retired people) could ask their adult kids to co-sign a loan for them”. It would likely be similar for renewing mortgage after retirement as well. So retired people with mortgage might be forced to go to lenders with high rate on renewing, or forced to sell.

https://www.thestar.com/business/personal_finance/2019/11/04/this-couple-planned-to-downsize-for-retirement-but-the-mortgage-stress-test-wouldnt-let-them.html

Indeed not. But it’s not a certain situation either. And betting on it in the absence of other retirement funding could turn out to be tragic.

Does it matter how much your property appreciates after you retire if you never plan to sell? What matters is that you have enough income to pay for repairs, taxes, insurance, maintenance, etc. Having a mortgage when you retire is like paying rent to the bank then. As you will never reap the benefit of appreciation.

What should be your golden years, now that you are on a reduced income, could be spent travelling and spoiling the grand kids is now going to payments to the bank. But that is what more retirees are facing.

Rarely do retirees sell the family home. The only exceptions are when the property taxes become too much of a burden on them or their health makes taking care of the property too much effort for them. Sure they can differ their property taxes but again it is not something that many retirees do.

For most retirees they will stay in their homes until they are moved to a hospital bed and then into a retirement home.

Houses aren’t cars. Low rate debt tied to an appreciating asset in retirement is not a tragic situation. You have options a retired renter will never have.

Carrying a mortgage into retirement is becoming common today. Unlike previous generations that had a paid off mortgage before retirement. This is definitely risky in the event of a death of a spouse (decline in pension income), higher interest rates and mortgage payments on a fixed income, increasing vacancy rates as construction slows down in the years to come as Victoria becomes built out, and health concerns.

But you simply don’t have a choice -if you want to keep the home.

With less disposable income than the previous generations, the golden years will become more like tarnished brass for some people.

It is not about age, but about whether or not carring a big mortage into retirement.

The article didn’t mention that people who are retired with no or small pension would likely have issue or much harder time to renew/refinance mortage, or to get a HLOC with a paid off house, as most lenders want to see stable salay/pension income and trust less on wealth. A good idea is to pay off the mortage and get a HLOC Before retirement, if you can.

I am going to still have a mortgage into by 60’s but I am ok with it as my income will well out pace my mortgage payments. If I didn’t remortgage several times throughout my younger years I would have not grown my networth to where it is. My thought like Marko’s as well, as long as you can get a much better return then your debt costs it does not make sense to pay off your mortgage. And just like the government inflating currency to lessen the total debt value, the same goes for your mortgage. Though I am risk taker and its not for everybody.

Meanwhile I’m striving to be mortgage-free by 41 🙂

Mortgaged until I die? For many, that’s okay

https://www.theglobeandmail.com/real-estate/vancouver/article-mortgaged-until-i-die-for-many-thats-okay/

https://docdro.id/aK6bJDR

I ended up at Florence lake one summer day driving around Langford with my kid looking for a lake to go swimming. A really pleasant little area and just a couple other kids swimming. Hard to believe Costco was just over the hill

I just Google from my friend place on San Miguel Gordon Head to Belleville and Douglast is 20 minutes by car, and from my place Florence Lake Langford to Belleville and Douglast is 21 minutes so 1 minute more of driving isn’t going to kill me for several hundred thousands in saving (and a heck of a lot nicer house, nicer neighbourhood/view, on almost 1/2 acre lot, and 10 minutes walking to the stores/coffee shops/groceries).

Actually we did compare Toronto/Vancouver to Victoria before making the decision to move back (after away for 20 years). We had enough of “international” cities and seen enough of “best schools/clubs” and are glad to be back for what are lacking in those big cities. Just had a couple hours of walking along the sunny beach and feel so blessed.

Always impossible to compare areas such as Langford or sooke or any part of Victoria to a counterpart in the Vancouver area…but I do have to say something when I hear someone say ” Langford is like Langley, Sooke is like Chilliwack”.

This ignores the fact that people often spend more time waiting to get across the oak street bridge in Vancouver than it takes people to drive out to Sooke. I’m serious. After you get across to the oak street bridge….. there is also the tunnel to get through heading out of Vancouver.

Victoria is spoiled.

I will concur that the Sooke road is a problem but they are working on that. But even then, it’s not much of a burden to nip into Victoria for something. It’s absolutely nothing like driving from Vancouver to Chilliwak which I’ve also done many times in my life.

I’ve often spent an hour just trying to get from English Bay to the Stanley Park intersection at rush hour.

Sooke or Langford are a breeze. (45 to 50 minutes to Sooke depending on whether it is rush hour or not.

Haha…so called rush hour.

Nothing wrong, sold subject to probate (awaiting that before price can be reported).

Noticed Asquith, as well. It looks like it may have sold earlier or was taken down from the market then relisted. Not sure what the problem is as it’s in a core, convenient location.

Anyone know what’s wrong with 2536 Asquith Street. Listed for $799,000 and it has been on the market for 173 days

From the Capital Daily Article.

Morgan is also currently appealing to local municipalities to pursue options to make housing more accessible for new doctors looking to move to the peninsula. Ideally, she would love to see some secondary suites that the community could offer to incoming doctors for a certain period of time to help hasten their transition into communities like Sidney, which have notoriously low vacancy rates.

That is a great idea. For the overhoused or with too much money, that would be a great contribution IMO. Our family would consider doing this. Wonder if other baby boomers have the same thinking?

How Saanich Peninsula’s Shoreline Medical Society has been fighting the doctor shortage

https://www.capitaldaily.ca/news/shoreline-saanich-doctor-shortage

Except Patriot, the population of Vancouver City proper is 662,000 and the Greater Vancouver area is 2,463,000 while Victoria proper is 92,000 and all of Greater Victoria is 397,000.

The City of White Rock has a population of 21,500 and Oak Bay has 18,500

Apples to apples.

“Uplands has been slowly picked up by the chinese–same goes to the nice lots on Parker Ave or West Point Gray in YVR : all of those owners are more likely to be of those ultra rich, business owners or children of political families from china.”

Not sure what’s the sources come from, may be I’ve not lived in OB for that long. Can’t speak to Vancouver West, but I don’t think Oak Bay at least North Oak Bay or Estevan attracts new Asian immigrants. I only saw two Asian families live in Uplands-status unknown. Only know five Asian families in the entire Estevan area – 3 families with more than 2 generations in BC, 1 family is double doctors, 1 family is double professionals. Before I moved to Estevan, I lived in North Oak Bay for over two years, only met two Asian families, one already moved to oversea in 2020.

If there’s any counterpart to City of Vic in metro Vancouver, I would say New Westminster. Literally a former capital of BC.

South Surrey and Crescent beach are outer suburbs, maybe akin to the Saanich Peninsula.

And the counterpart of Oak Bay, which is a pre-WWII suburb, would be the municipality of Point Grey, now known as the west side of Vancouver.

“Uplands has been slowly picked up by the chinese–same goes to the nice lots on Parker Ave or West Point Gray in YVR : all of those owners are more likely to be of those ultra rich, business owners or children of political families from china.”

It’s perhaps a bit hyperbolic to put lots on Parker Ave. or even Uplands into the same category as West Point Grey in terms of the population of wealthy Asians. West Point Grey and other Vancouver Westside areas are full of wealthy Asian families, some recent immigrants, some well established families with many generations in Canada. Perhaps 70% of the homes on some streets are Mandarin or Cantonese speaking households. Many made their money in business or real estate here or abroad. Some are successful local professionals (MDs etc.) of the second generation. I can’t say how many are political families from China. I know they do like W. Point Grey and other Van Westside areas for the elite private schools located in that part of Vancouver.

Based on what my friend on that street tells me and my observations going there, I would say Parker Ave. is overwhelmingly grey haired, non-Asian baby boomers. Maybe someone who lives on that street can correct me and provide more accurate info? I know some very wealthy Asian families in Victoria. A few live in newer, large, exquisitely designed homes in Queenswood and the Uplands. A few in 10 Mile Point near the water. Kids go to SMUS and GNS. Not huge numbers % or absolute at all though in even those areas compared to Vancouver.

Lil, I wouldn’t compare Victoria or the CRD to Vancouver.

The CRD is more similar to the Fraser Valley in population and climate.

South Surrey, White Rock and Crescent Beach are like Victoria and Oak Bay. Langford is like Langley, Sooke is like Chilliwack, and our airport is more like the one in Ladner.

Victoria doesn’t have anything comparable to an international city like Vancouver.

What is your source for this?

It’s rare for a median to be “skewed” for a data set like incomes, as the median is the middle element. The average (mean) can be greatly affected by outliers though and is susceptible to “skew”.

You can make the case that net worth is separate than income, and we should be considering both. But that doesn’t affect the stats around income.

Oddly, we noticed that most of the lots in south oak bay were quite small at well under 6K

Like the vibe of Fairfield and cook st found the houses too small 2 bedroom 1 bath nice thing about south oak bay is the larger homes north oak bay around willows reminds me alot of Fairfield once again houses too small

Uplands has been slowly picked up by the chinese–same goes to the nice lots on Parker Ave or West Point Gray in YVR :

all of those owners are more likely to be of those ultra rich, business owners or children of political families from china.

Re: Toronto – Lawrence Park and Sunnyside I think have the highest incomes in Canada. Forest Hill is up there, with Rosedale and the Bridle Path too. Sections of Oakville also would be there.

There is one small segment of Uplands (strangely enough it is a part farthest from the ocean and not nearly the most expensive part) that has high incomes that might start approaching the minimum for a high end Toronto area. Otherwise, nowhere else in Victoria or Oak Bay do incomes compare to those high end Toronto places.

When we were looking to move 1.5 years ago the one place we said we weren’t interested in was south oak bay, the biggest drawback was the hassle to get in and out of there, it’s also colder and you are paying a premium. We ended up settling in North Oak Bay.

Median household income can be skewed by a high number of retirees living in an affluent area. Their incomes from pensions and investments would appear on the low side while they own their 2 million dollar home and have millions in RRSPs and other investments. Net worth would be a better indicator.

Who’s “you”?

That appears questionable on its face as very very few individuals have that kind of income, and those who do tend to live in the Bridle Path or Rosedale. So I checked it out. Note household income, not individual income:

Index York Mills Toronto Ontario

Median household income $131,819

https://www.areavibes.com/toronto-on/york+mills/employment/

Meh. Fairfield homes are about the same price.

And if you own a home in Oak Bay and drive an older Mazda 3, but mostly just tootle around on foot looking a bit grubby from gardening? Asking for a friend.

Meh. Sounds like a lot of work.

I am a bit surprised that the city is not charging for on street parking, At a hundred a month it would produce serious revenue.

Thanks for your input Marko, do you expect some of these sales will be outlier rather than moving the market?

Whoeveriwanttocallmyself:

I am not comparing Toronto to Victoria. Having lived there I am aware there are many snobs. I was making a comparison between Victoria and outlying areas of the GTA, or areas even outside the GTA, like Hamilton, which still make Victoria look ‘cheap’ (especially when you factor in amenities/location). Places with very little ‘prestige,’ few private clubs, and full of what you might call “riff raff”. I doubt any status-conscious buyers made one of the many offers on that bungalow beside the train tracks in Mississauga.

“ You can’t compare Toronto to Victoria. It’s like comparing Victoria to Moosejaw. ”

People here would be shocked that the premium locations in Moosejaw is less than $50k to other areas, even Regina’s “Uplands” Wascana Views/The Creeks is less than $100K to other middle class areas, but for their locals that’s huge different.

My personal thoughts on other areas vs Oak Bay right now is it is a function of an irrational market rather than anything to do with basement suites (or lack of), out of town buyers who don’t care about area, etc. Two recent sales in Oak Bay I thought would sell for equivalent amount and one went for 200k over ask and one went for 470k over ask creating a large discrepancy in sale prices.

I think when the dust settles Oak Bay will command a solid premium over the likes of Tillicum yet again.

Personally, I don’t like the feel of a Broadmead or Dean Park drive-in/drive-out of your garage type subdivision. Much prefer something like Fairfield/Fernwood/Oaklands where you have a mix of owners/tenants/old/young and people walking around you can bump into and chat with. I don’t mind the cars either, reminds me of Europe which I love. Even the streets here with “parking problems” are kind of a joke of a problem compared to Europe where you are parking your Smart car perpendicular to the curb to make it work.

In general people have not idea what actual parking problems here are. This is me in a video in front of my parents house in Croatia talking about a legit parking issue (neighbors parking on your driveway) -> https://youtu.be/_R7UylUVPNo?t=29

Lil, the difference between Victoria and Toronto is social status. Your kids go the best schools, you belong to the best clubs, and you vacation in Florida and Europe. You can’t compare Toronto to Victoria. It’s like comparing Victoria to Moosejaw. There is a reason why Toronto is the financial hub of Canada.

The average annual income in York Mills, Toronto is 1.2 million.

Good discussion tonight on Twitter spaces about supply vs demand measures. I chime in about 1.5 hours in lol

https://twitter.com/daniel_foch/status/1489745020395606020?s=20&t=5XuQkYCxznlyDlN5Tn1vhQ

$2,005,000

Lil, that’s true. But if you want cleaner air, less traffic, nicer beaches then move to Parksville or Tofino.

Totoro, if it weren’t for pretentiousness then people would not pay premium prices to live in Oak Bay or drive high end cars. You can not rationalise paying another quarter of a million dollars for a home that is a block away from another but in Victoria. It’s not the physical attributes that people are paying for, it’s the pretentiousness of saying you live in Oak Bay or drive a high end car.

Yes it’s a stinky attitude, But I’m honest about it. If I’m paying 4 million for a home. I don’t want to see a homeless person or someone rooting through my garbage for bottles on my street. That’s for people in Victoria to deal with who elected Mayor Lisa.

Embrace the dark side, Totoro – it pays better.

Can anyone tell me what 335 Moss sold for?

I think OB/Victoria is still cheap when you can sell your small/old bungalow in the GTA and exchange it for a small/old bungalow within walking distance to the ocean, a town centre, clean air, and are not caged in by 400 series highways/sprawl:

https://www.theglobeandmail.com/real-estate/toronto/article-six-bids-for-bungalow-near-mississauga-go-train-tracks/

I suspect this kind of trade-in will become more attractive with remote work.

Marko mentioned a few surprising sales in OB recently. I wonder where those buyers came from?

If affordability is your criteria. A huge market segment but someone coming from TO with a big budget may be very attuned to this.

Award for pretentiousness. Do you even live in Oak bay?

Interesting, consensus seems to be OB premium isn’t so much reflected in price, as lack-of suite-at-that-price. This would suggest OB homes with suites might not fetch much a premium for the suite, and/or that houses without suites outside OB would be significantly cheaper. I have not been following the market closely enough to say if this is the case.

I guess I echo what Maggie says down below: in this crazy market neighbourhood seems to be an almost non-factor. And conversely, I disagree with Dr. Suess! I think out of towners and more recent immigrants are especially attuned to neighbourhood: they came here to be by the ocean/parks lifestyle. I think they might put more of a premium on proximity to these than locals. (Speaking for myself)

It makes sense. A nice bigger house with a suite in Gordon Head was selling for 900k+.

Oak Bay looks not as expensive as some areas because it’s strictly based on income or cash, but a large portion of new buyers need rental income to qualify for mortgage or rely on rentals to offset monthly payment. Victoria is small, we don’t have that many $300K+ income or wealthy people compared to Toronto. If Oak Bay remove the rental restrictions, I bet the price will go crazy especially in Willows catchment.

I can tell you its faster go get to downtown vancouver on the helijet than from mississagua to toronto in a car.

When I was looking for a house back in 2019. There was an old house on a 6000-7000ft lot in Oak Bay for sale, asking for about $870k. No one bited. When it was dropped to around $840k, sold right away. (Well sadly I was late.) It was not a modern new house, but nice inside. It might need some updates to the kitchen or washroom.

Maybe “Buy High Sell Low” is a norm.

Lil, it’s probably because of the commuting time from Victoria to downtown Toronto.

I use to like Oak Bay. But it has changed. What I don’t like is the parking problems along some/most streets. It looks so trashy with all the cars and trucks along the street now.

In Broadmead, they have restrictive covenants that won’t allow you to park on the street or to have a suite. That keeps the neighborhood attractive.

There are still some streets in Oak Bay that I like, but they are narrow and winding which means you can’t park on them. Like around Gonzales Hill. That helps to keep the riff raff out of a neighborhood that you are paying top dollar for in Greater Victoria.

The same reason that if I won the lottery, I’d move to the acreage parcels in Southlands in Vancouver. The community won’t allow the city to upgrade their streets because they don’t want the traffic problems in their neighborhood. It keeps the riff raff out.

I accept many houses in OB are small/old/potentially hazardous, but it seems true in many neighbourhoods in Victoria (and Mississauga too). Having only lived here 5/6 years I have never figured out why there isn’t more of a premium for land/location of living in OB. If you are going to buy a house that needs work, wouldn’t you want to do it in OB with better upside?

This should slow down the trend of mainlanders cashing out and moving to the island…

https://theprovince.com/travel/local-travel/move-to-langford-bc-visitors-guide

Todays Canadian 5 year bond is 1.82%. This is 0.2% higher than it was in Jan 2020 before the pandemic began. https://www.marketwatch.com/investing/bond/tmbmkca-05y?countrycode=bx

That means mortgage discount rates (currently 1.99%) should be 0.2% higher than they were pre pandemic (2.49%), so mortgage discount 5 year rate should be 2.69%

That means, for new mortgages, we should expect mortgage 5 year monthly payments to rise 8% from where they are now. That might cool down this market.

I think we have seen an increase in demand. I think the biggest factor is pulling in future demand. With covid, some people that were planning to buy within a few years have decided to buy now. They want to secure home office space as well as a stable place to live. This would be analogous to the nesting instinct seen in pregnancy. https://en.m.wikipedia.org/wiki/Nesting_instinct

Greater Victoria is not equal to Greater Toronto?

Oak Bay looks not as expensive as some areas because a lot of the homes are old and small despite the reputation of the area being upscale. Some are rather mouldy and full of asbestos. When you actually do the dollar for dollar comparison you will find that other upscale areas like Broadmead are actually better value (until recently at least).

Lil, Oak Bay is cheap by Totonto standards but then Oak Bay has a lot of old housing. As these older homes are now being replaced with modern upscale housing, Oak Bay will become comparable in price to Toronto. You can buy an old house for 1.5 million in Oak Bay, but a modern home will be 3 million plus.

I’m still not used to seeing an “M” instead of a “K” on every sale price on here.

I would say it is neutral (market wise), as long as the house is occupied.

It is one less rental but also one less renter or in one previous case (that new owner has another house), one rental repalced by another one.

CAD 5 year bond yields touching 1.8 today.

As someone not from Victoria, I have always thought that Oak Bay is “cheap” and have never understood why there is not more of a premium for this area. Although perhaps this is changing with recent sales… any long-time residents have thoughts?

Coming from ontario, I have been surprised that houses in OB are still cheaper than similar sized houses in outer region of GTA/Mississauga.

Yes, sometimes.

But this is what we have in the market and no better solution in place.

I agree with working for a better solution, but removing any rental stock from the market creates more competition for the remaining stock and increases the sense of instability and motivation to buy. I don’t believe we can say that it is better to push those renting out a house to sell to a home buyer who will occupy the unit.

59% of City of Victoria residents rent. Most because they are not in a position to buy due to age, stage or income level. Many will remain lifelong renters. Current vacancy rates are 2% and rental prices are rising.

$1.33M

You were talking about SFH renters lost to owner buyers, right?

I have heard purpose-built rental/coops apartments and townhomes, but never heard purpose-built rental SFHs. Most of SFH rentals are “short-term” (i.e. a year to few years while the owners are away or in the process or expectation of moving or sell), they shouldn’t be treated as part of the regular rental base, but a small private and dynamic block that constantly changes. Most SFH renters are aware of the instability, too.

I support growing affordable/stable rental housing stock, but SFHs and their owners are not part of it, as SFHs are just not afforable to be built and kept as rentals, especially in recent times.

Is it possible for someone to share what 4079 copperridge lane went for?

It is an issue because there are different groups affected differently. Those who can buy are lower risk from housing insecurity than those who cannot buy. I am referring to the impact of lower rental stock on “those who will never be able to buy”. This is a growing group of people in Victoria and we are not growing our affordable rental housing stock. We hear a lot about how first time buyers are impacted, and they are, but the pressure on rental housing prices from further reduced rental stock is affecting those who can least afford to bear the cost. If, instead, we as a society put more money into affordable coops/rent geared to income this should reduce upward pressure on prices.

It’s one less renter out there though. It materially changes nothing except that the person now has more secure housing.

Insanity. Prices of new and used cars are rising due to chip shortages. And now the truck convoy has closed the USA/Canada border (ambassador bridge Windsor<detroit). As you can see the convoy and no traffic moving on this live web cam https://www.ambassadorbridge.com/into-the-united-states/

And so now parts of North American auto production have been shut down. https://www.yahoo.com/now/auto-industry-cuts-production-as-ambassador-bridge-protest-continues-172820672.html

“ The Ambassador Bridge is the busiest border crossing between Canada and the U.S., with an average of 40,000 commuters, tourists and truck drivers crossing the border carrying more than $300 million worth of goods each day.

The border crossing is an especially critical link for the North American automotive industry. Flavio Volpe, the president of the Automotive Parts Manufacturers’ Association (APMA), says about $100 million in automotive parts cross the Ambassador Bridge on a daily basis. Given most automotive manufacturers operate under a just-in-time production model, Volpe says there are only enough parts “for a day or two” before production will be affected.”

It is also one more place not available for rent in a situation in which we have a dire shortage of family friendly rentals. In a situation in which there is a shortage of housing to both buy and rent it is those who will never be able to buy who will most affected by increases in rent. I don’t see that focussing on the buying end as a positive without balancing affordable rental housing stock is sustainable or in the best interests of society as a whole.

These are 2 different types of “demand”, individual vs market. I think Patrick is referring to Individual Demand while Leo is discussing Market Demand.

So both are right.

Right, and the cure for that inflation was rising rates to 10-20%. To illustrate that, if someone bought that $1.4m Cadillac SFH with a $1m variable rate mortgage, if rates rose to 20% they would need to be paying $240,000 mortgage per year ($200,000 interest per year as well as about $40,000 principal payment)

lol.

Tiff – WE didn’t cause this, flooding the market with money isn’t the issue… supply! supply is the issue!

…. the supply of money?

Tiff – No comment.

There are also hourly wage and salary increases. According to statCan, BC hourly Wages are up 10% in 2 years in BC. Average went up 10% from $27.63/hour to $30.54 (Median wage increased 8% from $25 to $26.92)

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410006401&pickMembers%5B0%5D=1.11&pickMembers%5B1%5D=2.2&pickMembers%5B2%5D=3.1&pickMembers%5B3%5D=5.1&pickMembers%5B4%5D=6.1&cubeTimeFrame.startYear=2017&cubeTimeFrame.endYear=2021&referencePeriods=20170101%2C20210101

On the US inflation – Rate futures showed a nearly 50% chance that the Fed will raise interest rates by 50 basis points in March, from a 30% chance before the CPI data. For the year, futures have priced about six hikes of 25 basis-point increments, or 150.9 basis points of policy tightening. – https://www.reuters.com/article/ousivMolt/idUSKBN2KF1VX

U.S. inflation rate soars to another 40-year high of 7.5% – https://www.cbc.ca/news/business/us-inflation-january-1.6346282

7.5% lead by food, electricity, and shelter. Pretty crazy.

“I know a family that is abroad right now for two years and decided to leave their SFH vacant for various reasons including the flavour of the RTA. Not even paying spec tax as the garden suite on the property is rented. Perhaps if the RTA wasn’t leaning towards tenants they may have rented it.”

I don’t blame them at all. If our rentals were not cash-positive and appreciating YOY there’s no way we’d still be landlords. The level of entitlement over the past dozen years has increased at an alarming rate and couple that with the RTB pendulum swinging so far towards tenants and it’s no wonder people leave homes vacant for two years.

Tiff Macklem says inflation mostly about supply, suggesting more gentle path for rising rates

https://financialpost.com/news/economy/tiff-macklem-says-inflation-mostly-about-supply-suggesting-more-gentle-path-for-rising-rates

That doesn’t happen in housing without a shortage. All the increase in credit availability in the world will not push prices up if there are enough homes to buy. We see this in markets that haven’t moved much despite existing under the same credit conditions.

That would shift the ownership rate down, we’ll have to wait to see if that happened in Toronto.

Demand, by definition, is the quantity the public is willing to buy at a given price. It’s not the number of people or the number of households.

If the same number of entities are able and willing to pay a higher price for the same number of properties, that’s an increase in demand. A number of factors can be behind that – like low interest rates, expectations of inflation, or increased buying by investors. Are we seeing any of that?

If a landlord sells a property to an owner-occupier that’s one more family who CAN buy. Why is this so hard to figure out?

+1 for sure, I’ve had sellers consider giving tenants bad faith 2 months’ notice under “owner to occupy” to clear them out before the property goes on market. Thought there being if you get busted you just pay 12 months’ rent, but offset by getting an insane sale price and it is much easier to sell vacant versus tenanted. I’ve talked everyone out of it so far with “well it is 12 months’ penalty but you’ll also end up on social media/newspaper, etc.”

None of that makes a lick of sense.

Population increased by 274,185 people and they added 159,060 new dwellings.

That’s 1.72 people per dwelling which is roughly correct given that the vast majority of new dwellings are condos which have a smaller average household size, and these are new condos which are smaller than older ones.

Now we know how much supply was added, and we know how much price went up. That tells us demand was higher than the 274k people that moved in.

That said, Toronto should add a vacancy tax like we have to ensure places aren’t literally kept empty.

Good. We went blinds shopping a few years back. Totally nutty experience from the last century. Instead went online, put a custom set together and had them delivered cut to order good quality for a fraction of the price

Rate of dwellings not occupied by “usual residents” continued to decline in the region as a whole and most municipalities.

Many of these are only temporarily vacant or occupied by students.

I have a friend that moved here from out of province and bought a home with huge windows, but no blinds. Quote from a local company was over $50k. Sure, they are custom blinds, but it also seems like many are just tacking on an extra 20-30% on estimates.

‘

‘

Our nearly new home thankfully came with Hunter Douglas blinds on all 3 levels, they are great except for the fact that the blinds are light colour which is great except for in the bedroom where they aren’t blackout. We got a quote for curtains in 3 of the bedrooms, master has wall of windows and 2 other side widows, quote was over 10K and I was told that was the sale price. ended up doing it ourselves for under 2K.

They aren’t building the homes that people are wanting to buy. 1 BRD Condos in Langford don’t make up for wanted core Victoria SFH. We are just filling up those condos with people who still want SFH.

The new RTB rules for renovating your property are horrible. Before if you needed to do a major upgrade you could give your tenants a 4 months notice and then if they thought it was bogus they could appeal. Now you have to apply to the RTB and they will take a couple of weeks to get back to you. When they get back to you, they let you know your arbitrator date is 2 months in the future. A 4 month notice to end tenancy turns into a 7 or 8 month process(9 or 10 if you count getting permits).

Also the fines they have for bad faith evictions are way to low. 12 months rent if you don’t do a major Reno is way too low with the difference in what long time tenants are paying and current market rents. Flipping over a unit from a long time renter to a new renter could likely increase the value of the rental by $300k to $400k(based on a 4% cap rate)….. vs paying a $15k fine.

It’s a complete waste imo. BC Assessments has 100x the resources you have and much better software and they are still all over the place property to property.

Also, every buyer that has come up with something like this that I’ve worked with has bought the crappiest property. People get too obsessed with assessment vs list and other non-sense that they miss the obvious like is it a solid house, quiet street, etc. I’ve looked at 50 houses with buyers where they’ve overanalayzed everything to death and then they settle on a house on a super busy street and I am left scratching my head.

You also have inefficiency thought. I know a family that is abroad right now for two years and decided to leave their SFH vacant for various reasons including the flavour of the RTA. Not even paying spec tax as the garden suite on the property is rented. Perhaps if the RTA wasn’t leaning towards tenants they may have rented it.

And, conversely, one less home for a family who cannot buy, which is about 40% of the population, to rent. I’d suggest that it is actually better for society as a whole and the RE market dynamics to increase secure rental subsidized housing by a lot. Adding market rentals helps a bit, but not for the majority who just need a good place to live at an affordable price.

Gosig Muis, the purpose of the software is to assist real estate agents and their clients. But as Marko pointed out the prediction was grossly out from what the Oak Bay property sold at. But I did make a mistake inputting the wrong dates.

https://www.theglobeandmail.com/business/article-census-data-shows-torontos-housing-units-growing-faster-than/

If a house isn’t rented out it’s going to have a new owner-occupier. That’s one less family who has to rent.

“You seem confused, this all began with your “unsolicited and misinformed analysis” of a post I made. But hey, go with whatever simplicity that allows you to make sense of your world.”

I commented that the 100,000 new homes promise was made four years ago in our own province and how miserably it’s failed, but somehow you felt attacked and lashed out. Also, thanks for the several lessons via multiple posts about how to mansplain on the internet!

“138 Cadillac. Disgusting price. Ugly house, ugly street. Sold 1.425 in 4 days. Listed at 1.18. Assessed 851K”

It’s nothing compared to 1043 Victoria Ave, Sold $920K in Jun 2020, assessed at $1,25M, just sold again last week for $1.67M with no improvements.

Re: “ Maybe it will work better on condos”

I’m not sure how your rational prediction program could possibly determine what an irrational buyer will pay. But good luck

You seem confused, this all began with your “unsolicited and misinformed analysis” of a post I made. But hey, go with whatever simplicity that allows you to make sense of your world.

Maybe it will work better on condos.

I’ll try it on a downtown condo listed at $736,000. The auction ends on the 15th.

S604 737 Humboldt projected at $840,000. Which seems high to me as it sold for a lot less a year ago.

“Again, seem to be reading in things that are not really there, but nice twist attempt of playing a victim and attacking at the same time. It seems you’re mostly reflecting your own issues and combining them with your not so subtle trolls. However, at least it has been amusing.”

No twist, I simply said you should save your name calling for Facebook, as that’s where people tend to go to call others “slick” when they’re frustrated and to provide their unsolicited and misinformed analysis of other people’s posts. If you can’t agree with that, you sound like someone that should probably get over themselves.

Re building a fence:

Agreed that building it yourself is the way to go and it’s not as daunting as it may seem. It seems as though anything property related is keeping up with the ever-climbing price of local RE right now, so having someone else build it will be costly. I have a friend that moved here from out of province and bought a home with huge windows, but no blinds. Quote from a local company was over $50k. Sure, they are custom blinds, but it also seems like many are just tacking on an extra 20-30% on estimates. I guess they see home buyers out there doing it and are just following along.

Marko, that’s quite far off. Doesn’t seem that the software is that reliable. But maybe I inputted the information incorrectly. It does say that the listing has to be active with the projected sale date not more than a week into the future. Still playing with it.

I was responding to Marko – seems reasonable at 1.6 compared to some of the other sales!

Tototo, I’m not saying anything. Just testing the software to see if it is accurate. I don’t know how it works.

Although I could have inputted something wrong as I’m still playing with it.

@totoro – It sold for 1.6 but last sale was 16 months ago, not 4. Had me worried for a moment.

2167 central sold (oops) 16 months ago for $1,289,500 – are you saying it just sold for 1.9 or 1.6?

You would think that with so few listings and a near zero vacancy rate that should have an effect on people moving to Victoria. Unless you want to live out of a truck.

You are only $152,500 off.

“Has anyone here built a fence lately? What’d it cost? Any cool alternatives to wood as I assume it’s still a fortune?”

Yes. All wood, did it myself and can’t remember the final cost, maybe $12-1500? Planning another small section in the spring and I will be incorporating galvanized roof panels in the design to cut down on lumber costs.

How long do you want it to last? What is it’s purpose (kids, pets, privacy, all of the above) Any big restrictions or covenants on materials in your community?

That said, they doing some pretty amazing concrete fence products right now that can match almost any esthetic.

Fencing via contractor is way overpriced, it is something we always do ourselves on our new builds. Up there with margins on drain tile work, mattresses and real estate fees.

Dig posthole, set fencepost/concrete, install panels. It isn’t rocketscience, plenty of youtube videos.

Helpful if you can find your surveying pins.

Again, seem to be reading in things that are not really there, but nice twist attempt of playing a victim and attacking at the same time. It seems you’re mostly reflecting your own issues and combining them with your not so subtle trolls. However, at least it has been amusing.

Marko, I’ll try the program on an Oak Bay Auction

2167 Central Avenue listed at $1,490,000. Projected sale price in seven days is $1,752,500

We will see how it works?

Problem with loopholes is they create inefficiency within the system and for the most part those inefficiencies will be felt by tenants. Owners of SFHs will be less likely to rent them out due to risk (stories like this) and result will be lower rental inventory of SFHs and higher rents as we are building zero purpose-built single-family home rentals. Tenants lose, only slight benefit might be for buyers as more SFHs potentially hit the market.

My parents have been renting their suite for 25 years in a row with the only two months of vacant to renovate it. They paid off their house 15 years ago and they don’t need the money, but they don’t need the space either, so they continue rent it. One bad tenant experience, which they haven’t had yet, and they are done. Suite would be off the market and sitting vacant and an inefficient use of resources.

Having the RTA in favour of tenants is not necessarily a net benefit for tenants. That all being said I am big into following laws and legislation. The stories on reddit this year of landlords trying to increase rent illegally because “taxes went up” are insane. If I was the tenant I would be livid. If you are going to become a landlord spend 30 minutes educating yourself as to how the RTA works then determine whether your want to operate within that environment, or not.

Has anyone here built a fence lately? What’d it cost? Any cool alternatives to wood as I assume it’s still a fortune?

Function of price baiting listing strategies, tough to say where the final number will land. Sometimes you have 5 offers within 100k of each other and the 6th person is 300k over, or you have someone going in with an insane bully offer or you have sellers accepting a bully offer when they would have done better waiting for the offer deadline.

There were two recent sales in Oak Bay where I guessed both homes would sell for the same amount, but one sold for 200k more than the other.

Principal residence or investment?

Cadillac Ave. used to be one of the cheapest addresses in town for SFH. Not exactly the Cadillac of neighbourhoods. My how times have changed!

Re: should you purchase a condo now. We had relatives buying a pre-sale condo and the price kept rising up and up while they waffled and finally pulled the trigger.

Beta testing some new predictive software to see how well it works on blind auctions that have the property selling in a week.

4249 Quadra listed $949,000 in a blind auction. The program predicts a value of $1,018,000 at the time of sale.

734 Rogers listed at $1,295,000. Predicted sale price is less than asking at $1,283,500. Should be interesting to watch.

155 Lurline listed at $998,000. Predicted at$1,087,000

I’m interest to see how accurate this really is?

Comparing 2707 Forbes at $1.35M to 138 Cadillac at $1.435M…..this market is unpredictable and has totally lost its mind. Or rather the buyers in it have. There seems to no sense of parity out there. What to make of it, gobsmacked.

Buying one place and moving the kids in together seems to be a popular strategy to get them on the ladder and keep a stable roof over their heads.

Just curious. What’s happened to prices for commercial properties in Victoria (I’m referring to small size commercial properties like offices that would be under 10,000 sq ft). Are they participating in this run up?

With Saanich’s plan to add towers around uptown by up zoning it all, the property owners around there have hit the jackpot. 1.425M for Cadillac is a good deal if you can tear it down and build a 25 story tower.

Are there limitations on the bank of mom and dad? … Last year the average gift in BC was $340k.

Goes to show what adding three unpermitted suites to your home can do in a market like this.

Is 138 Cadillac Ave now the winner for worst house for the highest price? Nice return for the previous owner(not so much the one before that).

$526,500 – 04/30/15

$515,000 – 11/15/10

It’s hard to believe the market can keep going like this but who knows I’m sure many have been surprised over the last several years.

138 Cadillac. Disgusting price. Ugly house, ugly street.

Sold 1.425 in 4 days. Listed at 1.18. Assessed 851K

Oak Bay has 104 fewer residents today than it had in 2016.

Of note, Esquimalt also saw a slight decrease.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=9810000202&pickMembers%5B0%5D=1.4568

I think there are limitations on the bank of mom and dad. If mom and dad are re-financing their home to “gift” their children with a down payment then mom and dad’s mortgage increases.

So how much are you willing to “gift” your children for a down payment when they will need $100,000 to $200,000 each for a 20% down payment on a condo? That “gift” will increase your mortgage payment significantly today.

Then there is the matter of whether the parents would qualify with their income for a larger mortgage. And that’s just one child. What if you have two or more kids that want a down payment? Are you going to play favorites?

With so few listings available, there does seem to be price compression as the traditional differences in market value between the neighborhoods is narrowed. It isn’t so much of what the property’s location is worth but what one can pay.

If you want to buy a house today, then you have to accept the location that is available. I don’t expect that to continue as more listings historically come onto the market in the Spring.

“It’s almost like neighbourhood doesn’t matter anymore, so long as a house isn’t on a busy street. I would guess the differential between neighbourhoods will return if and when the market cools off.”

Only long term Victorians seem to care about the petty differences between neighbourhoods. If you’re moving from out of town, they all look the same and are all so close to downtown, even the Westshore that many seem to think it the equivalent of outer space.

I need help from the real estate educated which I am not. would you buy a condo in Victoria right now or wait?

Re: Gorge and TIllicum. I actually think that area has finally been recognized as pretty darn good. My girlfriend and I lived in the area between TIllicum and Admirals for 8 years and loved it. We would walk our canoe down regularly plus the walk withall of the landscaping the city does is one of our faves and is severely underrated. I’ll take it over the cluster that is the dallas/cook walk. If we had found a house we liked when we were shopping we absolutely woud have bought there. Close to town, Tillicum mall, theatres, short jump to get on the highway out of town…. Not surprised its taken off in the least.

RE: the stories about RTB abuse.

I do sympathize for landlords who have crappy tenants who game the system. But I can’t help think that this is symptomatic of the larger issue of the financialization of housing. When such gross sums of money are at stake, emotions run high and the human aspect is lost. Tenants despise their landlords, landlords despise their tenants and you end up with some nasty situations on both sides of the equation. I hope that one day we can all treat each other like human beings again.

Of course these ugly loopholes in the RTB should be closed, but likewise we need to find solutions to make renting more stable. With 20-30% YOY gains we’re going to see a lot of tenancies cut short and a growing conflict between renter/landlord (IMO).

A few years ago, it seemed like there was a discount associated with buying in the Tillicum/Gorge area. That seems to be evaporating now. For example, 3080 Albina, which just sold for 1.25 million. It’s almost like neighbourhood doesn’t matter anymore, so long as a house isn’t on a busy street. I would guess the differential between neighbourhoods will return if and when the market cools off.

There’s a long-established pattern of higher growth in BC occurring in tandem with lower growth in Alberta and vice versa. The last 5 years have seen a weak economy in Alberta together with a stronger economy in BC. Bar charts in article below are illustrative. Take note that the overall growth rate in Canada 2016-2021 differs little from 2011-2016.

https://www.theglobeandmail.com/canada/article-2021-census-canada-population-highlights/

You met with Eby?

BC 5 year growth rates:

2011: 7.0%

2016: 5.6%

2021 7.6%

I would be interested to see the overall interest paid over the 5 year term, rather than just comparing ending mortgage payments. In a rising variable rate situation, you’d need to account for the money saved at the beginning of the term and compare that to the extra paid at the end of the term to get an idea of how much you pay overall to compare variable vs fixed.

I think this would be more relevant as many have said, once the term is up you still need to face the new interest rate regardless of which term you went with; the best you can get is how much money you save over the term period.

So many masochists!

“There seems to be no consequence for bringing any dispute to the branch, even when they are frivolous and unfounded like this one,” said McGowan. “All he had to do is suggest that there’s new evidence and everything stops again. And there’s no consequence for that.”

There are 100’s more stories like this, no wonder why there is a 3 to 4 month wait, you can dispute absolutely anything with zero consequences, oh and after you lose, just file an appeal

I actually just got a call last night with someone going through the same thing.

This also goes for someone that stops paying rent. we’ve had people not want to do our application because it’s too invasive, well this is why and that’s the first red flag.

It should be a month turn around at the most and you should Actually have to produce evidence when you make the claim, landlord or tenant.

They RTB system is a joke.

Victoria 5 year growth rates:

2011: 4.4%

2016: 6.7%

2021: 8.0%

Landlord says dispute system needs changes after tenant holds up house sale

https://www.timescolonist.com/local-news/landlord-says-dispute-system-needs-changes-after-tenant-holds-up-house-sale-5043200

I mean, what could go wrong?

https://www.theglobeandmail.com/real-estate/toronto/article-housing-market-supercharged-by-the-bank-of-mom-and-dad/

They are not the people who elected him. The riding is about half renters, and most voters are in Kitsilano and UBC. Common misconception for those not familiar with the area that the Point Grey riding is coterminous with the West Point Grey neighbourhood.

Oil bust. Canadian rates had to be higher to support the CAD and keep inflation down.

Excellent article that provides useful information

Remains to be seen. We’ve met with him and he gets it and is fired up about it, but he’s already said province wide upzoning isn’t on the table and wants to work with munis instead. The guy is MLA for Vancouver-Point Grey, so I doubt the Point Grey owners are going to have any interest in his housing reforms.

Thanks totoro, appreciate it.

See chart below. They usually move together but can also stay several percent apart for many years at a time, notably late 80s/early 90s where we were 2-4% above them for 10 years. .

Also pretty sure the expectation is that the fed will hike several times this year as well.

It’s getting scary reading these posts, even for people that aren’t looking for houses. Hopefully the insanity will pass in the spring with more listings.

Wow, really? The increases have been so dramatic it’s hard to gauge what makes sense anymore

Cancelled listing.

In this market it hardly seems to matter. House on Adanac just sold for $1.27M with multiple disclosed floods. Bonus: The medivac helicopter hovers 15m above your roof three nights a week.

If 2707 Forbes had recent flood damage, was that disclosed? Would that have affected the sale price? Would have thought it would have received a higher price by perhaps $50K-$100k.

We looked at that house. Recent flood damage in the basement as well.

Sales history for 2707 Forbes provides a picture of recent price spike. Some updates to the interior since but nothing major.

Sold 2016: $575,000

Sold 2018: $791,000

Sold today: $1,350,000

Can someone please look up what 1016 Adeline sold for?

Thanks!!

Mostly correct. However as cited by Exxon and Repsol, the reasons for leaving are moving goalposts regulations and delays.

I think employment rate will affect the BoC decisions. And, it seems as if the BoC doesn’t have much of a wiggle room at the moment, because employment still is lower than the mid 2000s.

Canada Employment Rate — https://tinyurl.com/yc3pyspc

Maybe because they can get their investment back quicker with shale oil, which has lower up front investment and a shorter well lifetime. They know oil’s days are numbered.

The chickens are coming home to roost.

The trendy demand to go green starting to affect our economy, because investors are dumping Canadian oil sand projects to invest in the American shale and else where. Thus, oil price is up and the CAD is languishing.

Doubt it, for the simple reason that they cost more. Only a small fraction of buyers today are able and willing to pay for 10 year term. You do know they are available today?

Nice article. However, I feel that one thing that’s missing is the link between the BoC rate and the US Federal Reserve rate. An analysis of how often movements in the BoC rate mirror movements in the Fed would be useful; the next question would be how often the Fed has moved and by how much. Maybe I’m asking too much.

Extended amortizations and longer fixed term mortgages will become the norm within 24 months. I guarantee it. This change will be before the overnight rate hits 1.5%.

This prediction is based on nothing but a gut feeling.

Yeah, that’s trash.

If what we’re getting is anything even close to that, I’ll be leaving my job. Already there are senior development roles that are available that pay double what BC Government is paying in Victoria. Pensions and Benefits aren’t worth 100k.

“The article and recommendations are from Ontario not BC. From a de-regulation and efficiency stance not a government led build program. From a tory and not a dipper government.”

“I didn’t assert that at all.”

I read this as you asserting it could work. Apologies if I assumed too much, but “slick”? Maybe keep your name calling for your property search Facebook groups, as I’m not here for you to take your housing situation frustrations out on.

True, but 1.31% annualized is a really weak deal for the nurses given what they’ve endured during the pandemic, given current inflation numbers, given the AB government is lately flush with cash from skyrocketing oil prices, and given there is zero certainty the AB NDP will retake power after the next election.

I didn’t assert that at all. I posted a news story with the highlights of what another province received back from it’s working group as something topical on housing with neither an endorsement of disapproval, just a comment on how it might be received. It seems you like to read more into than what is written. So, enjoy your happy being wrong there, slick.

“I am confused or am I missing something?”

Both it would seem if you think that all it takes to get from 5300 new homes to 100,000 is a different province, some policy and a more conservative government. And I only mentioned Eby as some seem to think he’s going to be some sort savior in the housing crisis, which I disagree with, but would also be happy to be wrong about.

It’s really a 2 year deal going forward, as it’s retroactive to 2020. Alberta is having an election next year and I’d guess they’re betting on the NDP getting back in.