The dispersion of risk

We all know that current prices are extremely high, but it’s anyone’s guess whether they are sustainable. On the one hand, average prices this year are pushing into uncharted territory on the affordability side even ahead of coming rate hikes, while on the other hand those averages are not based on a lot of sales and Victoria real estate has a record of surprising to the upside. However that discussion rests on prices as a whole, while individual transactions can vary substantially around those averages. Remember that just because a property sold at a certain price doesn’t mean that the price also represents its market value. Market value has a lengthy definition, but a key part of it is that buyers must be “well informed” (hard to do with blind bidding and unconditional offers), and “typically motivated” (no extreme FOMO) with a “reasonable time allowed for exposure in the open market“.

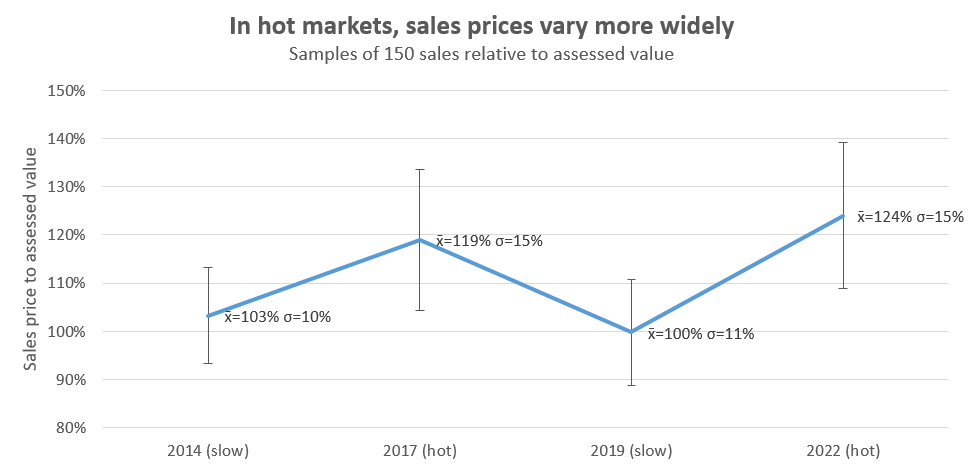

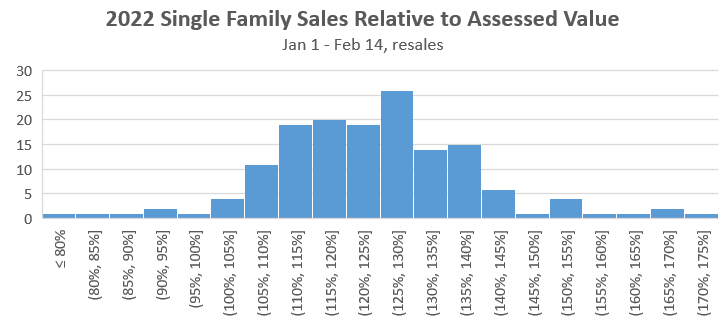

Given the majority of properties are going for over the asking price, conditions are ripe for properties selling over market value. It’s difficult to define what constitutes an obscenely high sales price, but most will know it when they see it. Outside of noticing individual examples though, we can also see this increase in sales variability in the data. To take a look I used samples of 150 single family home sales from 2 hot markets (2022 and 2017), and two slower markets (2019 and 2014). The sales prices relative to assessed value had consistently higher standard deviations in hot markets than in the slow markets, as well as more outliers on the high end.

Now a standard deviation of 15% vs 10% may not seem like a big difference, but at current prices an extra 5% turns into an additional $50,000. And while the average sales price is 24% above the assessed value, with an increased variability there are also plenty of sales going for 30%, 40%, and even some 50% higher than assessed.

Some of these sales are perfectly OK and the assessment is simply too low, but that’s a factor in both slow and hot markets. Others are simply over market value, and it’s not certain that rising prices will pave over that pricing error. Right now affordability is very poor, and in the past poor affordability has been followed by flat or negative prices in the medium term. If you’re overpaying, even a flat market will look like a decline. The province’s upcoming cooling off period will give buyers a second change to reconsider an above-market bid made in desperation, which might protect some buyers from themselves. However to really fix the problem we need to cool the market to at least 2 months of inventory, which will reduce the frenzy and associated risk more naturally.

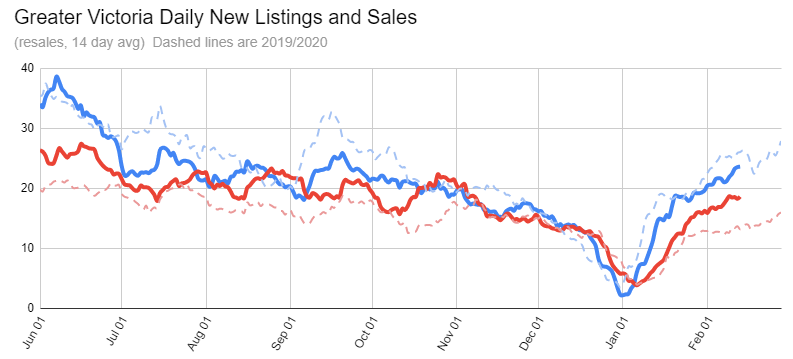

In the short term though, the market is showing no sign of letting up. New lists are roughly normal, but sales are some 40% above the pre-pandemic levels, despite rock bottom inventory levels.

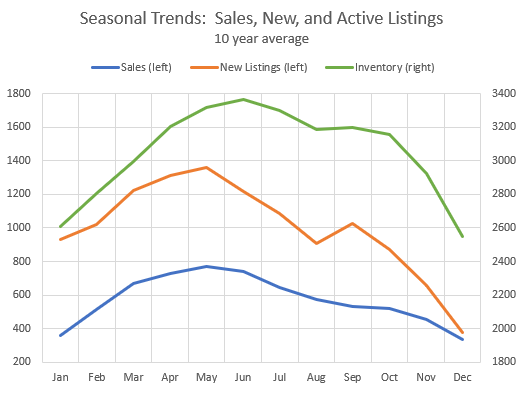

It’s worth remembering that new listings will continue to increase from now until May. That will at least increase the selection available for buyers even if those new listings end up being sold off quickly as sales increase in tandem.

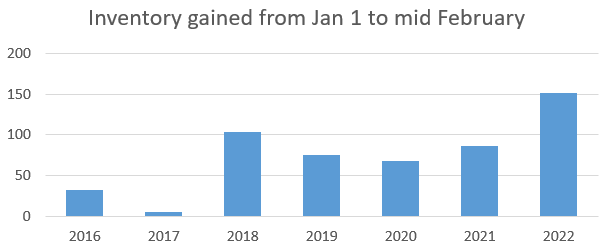

Inventory should build until about June, and despite the continued hot market we’re off to an OK start, having gained more new listings in the first 6 weeks of 2022 than we’ve seen for previous years.

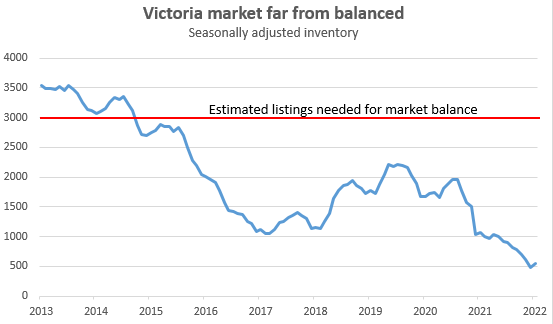

However we’ve got a long way to go. At average sales levels we would need about 3000 listings on the market to stop price growth, meaning we’re nearly 2500 short. That won’t happen anytime soon, although a rapid pullback in demand can also stop prices appreciating while inventory builds more slowly. In the long term it’s a supply problem, but in the short term we need to knock buyer sentiment down several notches to get some breathing room. Hopefully that will happen this spring.

Not sure if Leo took down my post about the full duplex for sale in Moncton showing what you can get there for $495,000.00.

I believe that some people might be interested and it might be helpful for people who feel that they might have to look at other options. That’s why I post it.

House prices in Moncton jumped 30% in 2021 and are expected to rise again substantially again this year.

This duplex is higher priced than most duplexes in Moncton. You can still get a very modest full duplex for less than $200,000 in Moncton.

FinancialFreedom- Take out the open mortgage. I would never expect anything to go flawlessly, especially at the level of finances your talking about. The extra expenses are worth the peace of mind. Too many variables you have no control over, play it safe.

I would be way more worried about the developer not being able to deliver occupancy on the agreed upon completion/possession date and you not having a place to live. It’s been a few years since I’ve had anything pre-sale complete as scheduled. I had clients move into a Gablecraft home last Wednesday and the original contract we started with was August 2021 completion. We even went beyond the contractual “outside date” which would worry me with a smaller developer as the price of the home appreciated over 300k during construction.

2x completions on the same day is not ideal (especially on a Friday), but common practice so don’t lose sleep over it.

This is how I personally try to set it up with my clients. Completion on purchase on a Thursday, for example. Possession same day at 5 pm on the Thursday.

Then on the sale completion Wednesday (day before) and ask for possession at noon on Friday. This wouldn’t fly in a slow market but right now buyers will do anything to secure a house.

Thursday you start loading up the truck. Start unloading at 5 pm and then you have the evening of the Thursday and morning of the Friday to have your place cleaned.

I will never understand how someone can, one minute, admit they know nothing, then the next minute, very confidently give their opinion on the topic.

But they will tell you that your dog food is ruining the environment 🙂

Long time observer here – figured this group may be the right crowd to ask a couple questions that have been keeping me up at night.

We bought a new build house last summer with expected completion date this spring (it’s on schedule ). We thought about keeping our existing house we bought a few years ago as a rental property but took a conservative approach and decided to sell it last month with exact same closing date as our upcoming house. Given the upswing in housing prices since we bought last summer, we want this new build purchase to have NO hiccups in our ability to close it. We’re fortunate enough to have ~25% of the new house cost available to use thru ‘cash’, and the remaining amount is planned to be covered from the existing house’s sale (i.e.,plan is to fully pay for the new house without a mortgage).

….What keeps me awake at night is the uncertainty on whether we’ll get our existing house proceeds on closing date to use towards the new house (what if there is some delay for some reason, out of control, even one or two days). The real estate agents assure same-day closings are very common and a few weeks before close all the docs will be prioritized to ensure no hiccups etc. Am I over thinking this, I’ve contemplated getting an ‘open mortgage’ for the new house to eliminate any risk of not closing on time (to avoid relying on our existing house sale proceeds, and just fully pay it off as early as the following day from the use of the proceeds).

The mortgage route I’m told should be unnecessary and likely costs 1500-2000 bucks in fees that is a waste of money/time. Should we just trust that the same-day closing will go smoothly, and even if it doesn’t that the builder/developer wouldn’t damage their reputation from not giving us the extra day to close? We’ll also have paid nearly 50k in upgrades that are due before completion if we pay via cheque.

I’m told worst case we could tie up the title in a lawsuit where the court process could drag on for ages (and expensive) so nobody would want that leading to another reason I’m over thinking this in this scenario.

Anyone have a strong point of view here? Any tips or thoughts are greatly appreciated.

-Cheers

It is an interesting concept that may pan out, but IMHO another layer of government meddling would likely increase costs instead of solving the backlog. Example, the foreign, empty home, and speculation tax micro management didn’t quell the cost of housing.

B.C. prepares to remove some housing approval powers from local governments: minister — https://tinyurl.com/2p8mavs3

CPI increased 6.21% from Jan 2020 to Jan 2022. That’s 3.06% annually. That tells me that monetary policy was too easy. Also negative real rates at the consumer level tell me it was and is too easy.

Easy to say in retrospect of course, but the sooner the general nuttiness – which now extends to paying big sums of money for things that don’t even exist – comes to an end the lesser the impact of it ending. “When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.”

Calling monetary policy “poor” because it results in high RE appreciation implies that there is a “better” monetary policy that could have been chosen.

Was there a “better” monetary policy for RE that could have been pursued? Sure.

Was there a “better” monetary policy for the overall health of the economy during the first 1.5 years of the pandemic? I highly doubt it.

I am not well versed in such things but as I understand the process, the OCP is updated every 5 years and forms the basis for future zoning. While I am never going to like a high rise built next door to me I would at least have 5 years to get used to the idea that it could happen and move if necessary. I never understood the purpose of the OCP if you can amend it and do the first reading of rezoning it in one meeting and several weeks later do second and third reading in subsequent meeting. In my perfect world, there would be public hearings for the OCP and subsequent rezoning 5years later and no public hearing required for a permit that conformed to the zoning. Personally, I would make it harder to change the OCP outside of the schedule or what is the point of having it?

Lots of other reasons I suspect agents avoid it. Imagine you are blogging on HHV or Reddit providing content and a disgruntled client comes on to voice his or her concerns about you. Not a good situation. This is why you never see developers commenting on their own projects on VibrantVictoria even thought they follow the threads.

Others I’ve talked to can’t handle the criticism or they take it personally.

IG seems to be the preferred online marketing tool for agents right now. Selling the lifesytle of walking your dog along Dallas Rd seems to be the most effective method of putting yourself out there. No one is going to be mean and tell you that your dog is ugly 🙂

Just out of curiosity, if the projects DOES meet the OCP would you be comfortable it passing without any public hearings?

This is politics (important), but we are forgetting about bureaucracy (equally as important) at the municipal level which is nothing short of outrageous. I am sure our two HHV builders/developers (small time developer and Viclandlord) can chime in on their experiences of getting applications ready for rezoning, permits, etc.

Right now every day I walk by 4 excavators and constructions crews working on Songhees Park. As a Vic West resident there was nothing wrong with Songhees Park in my opinion. Then you go on reddit and people are getting 100 applications for their rental suite.

While the time to turn around a permit just keeps increasing, take a look at the new bulletin on the COV website -> https://www.victoria.ca/EN/main/residents/planning-development/permits-inspections.html

“We are currently experiencing delays in processing times, resulting in review timelines ranging from 20 – 40 business days in some cases. We apologize for the delay and appreciate your patience.”

Before it use to say 20 business days (aka 6 months). Now it is 20 to 40 business day (aka 9 months).

So enough resources to upgrade an already existing park, but can’t turn around a permit for someone looking to add housing while we are in a housing shortage. Makes sense right.

Exactly. Why? Maybe we have to pay for their advice? Maybe putting themselves out here is not beneficial to their business? Or maybe they just don’t care?

Of course Marko is not an expert on everything, but he is very knowledgeable, honest and frank as a realtor, and cares enough to give good advice here. I appreciate the agent discount, but appreciate even more when he says “this place doesn’t fit what you want” as a buyer agent.

This is a copy and paste of what I said in December that you took issue with…. “Not to mention appreciation, as a result of poor monetary policy, is through the roof.” I followed that up with why I think such. I don’t believe BoC can operate in a vacuum.

Another example, if next week the government comes out and says they are increasing federal mortgage insurance through CMHC to $1.25 million and average mortgages amount goes up across the country further increasing interest rate sensitivity I don’t think the BoC can completely ignore variables like that, let alone public debt and many other fiscal policy decisions.

I think we can assume there will be no swing ridings or core MLA seats included….lol.. On a more serious note, I think just hard and fast timelines for approval or not, and limiting the extent and cost of approval process is what the target should be. A quick no, is almost as good as yes, so the capital investment can leave the community instead of it getting bled out over years. Then municipal politicians can longer pretend they are trying to solve housing problems, but obstructing them at the same time.

As a good NIMBY I have sat though a few public hearings. In my limited experience, the discussion around height and density is almost always because the applicant wants considerably more than the OCP allows. If the provincial government keeps its regulation to within the OCP I don’t expect a lot of change. If they decide to arbitrarily override the OCP and zoning density I would expect a lot of flak.

I wish them well. But this might backfire, adding another level of government bureaucracy, with overlapping jurisdiction, slowing things down further.

Maybe they just want to set overall targets for them, and if they don’t make the targets they get a financial penalty (“NIMBY tax”). Wealthy cities like Oak Bay would likely pay the penalty to stick with the decisions that they’ve made. NIMBY cities would just end up happily paying for the increased density to happen somewhere else (“thanks Langford!”).

From: https://www.timescolonist.com/bc-news/bc-prepares-to-remove-some-housing-approval-powers-from-local-governments-minister-5085726

It will be interesting to see how far they go with this one and if they make universal or target certain municipalities.

I’d say there is generally a direct correlation between the expertise offered by a lawyer, architect or engineer, for example, and the rate they charge. Not the same with realtors. A realtor with one year of experience vs. 20 years charges the same for a reason. No reason for someone with special expertise and skills that makes a significant difference in outcome for you to reduce their rate.

Being a realtor is based on following an easily mastered set of steps and having access to realtor.ca with oversight by the brokerage firm and the regulating body. You are very unlikely to get a better outcome re. sale price by using one realtor vs the other because the biggest thing is getting on realtor.ca and then having someone who organizes viewings – which involves giving lockbox access to the buyer’s realtor for the most part.

This means you probably should consider price when choosing a listing realtor. Unsure why people don’t.

If lawyers charged a fix rate of $300 per hour set by the law society, there’d still be plenty of lawyers advertising lower rates. Many RE agents have no listings, and are making nothing, so should be happy to get lower rates. For example, if they charge 30% lower than full-fee rates, they are getting more than the full fee that they would have got two years ago (because prices have risen more than 30% since then).

Not only do we not see many RE agents promoting lower fees. More amazing is that we see very few sellers even seeking lower fees from the agent. These timid sellers seem convinced that unless they pay full 2.5% fees, their agent won’t sprinkle magic fairy dust on their listing, and it won’t sell.

As Marko said, it is a head scratcher.

Marko provides tons of great advice, on a range of things. I’ve taken lots of notes over the years, reading this blog and watching his YouTube videos.

However, when Marko implies that he could better set interest rates than a group of trained, experienced experts I sometimes can’t leave that alone. If know-nothings like Marko or me were in charge of monetary policy, we’d wreck the economy in no time flat.

Deleted

I cant imagine why other agents are not advocating for getting paid less.

It would appear I am a polarizing figure on HHV 🙂

I also wonder why other agents aren’t participating and offering advice on how consumers can negotiate their fees down. It is a head scratcher.

There are three listing on Ten Mile Point if you dont mind living a bit further out.

According to BNN, 28,000 people left Hong Kong last week. No doubt a percentage of them will come to Canada. Even more pressure on real estate across the country. As travel restrictions are lifted, expect more buyers coming to our country, resulting in even higher prices. The turmoil in the Ukraine, population 50 million, will also create more refugees that Canada will feel obligated to accommodate. I have a good idea which way prices are going. I don’t know where average Canadians are going to live. Don’t expect our government to have any solutions.

Well is is my opinion on the market. I have no idea of where it is going or what anything is worth any more.

“For people who regularly follow this blog, the amount of advice provided by a certain realtor who even offers discounted rates is my opinion head and shoulders above other based on his efforts alone. I am surprised younger realtors don’t try to emulate him. Just my 2 cents.”

You call it advice, most would call it ego as Introvert pointed out, he seems to be the local expert on everything. Why not give a recently retired bouncer/server/used car sales person a shot their first listing in this market? It’s not like they need to do much more than have access to the lockbox in this market. Your hero even admitted he’s lazy, so who would want to emulate that?

Also side note, there are clearly many realtors that follow this blog too, so why aren’t they putting themselves out there and providing advice? It would be nice to hear opinions that may differ from “a certain realtor”. The people that regularly follow this blog could use some new and differing opinions from others that may be willing to provide their thoughts and hopefully discounted rates

The good news is that there are now four houses for sale in Rockland.

More data indicating that the insanity seen in Victoria regarding rising rents and house prices is being seen across North America.

https://www.thestar.com/life/2022/02/20/rents-reach-insane-levels-across-us-with-no-end-in-sight.html

Rents reach ‘insane’ levels across US with no end in sight. Rents have exploded across the USA

In the 50 largest U.S. metro areas, median rent rose an astounding 19.3% from December 2020 to December 2021, according to a Realtor.com analysis of properties with two or fewer bedrooms. And nowhere was the jump bigger than in the Miami metro area, where the median rent exploded to $2,850, 49.8% higher than the previous year.

For people who regularly follow this blog, the amount of advice provided by a certain realtor who even offers discounted rates is my opinion head and shoulders above other based on his efforts alone. I am surprised younger realtors don’t try to emulate him. Just my 2 cents.

Why would anyone care about their dog or kids?

+1, when I have a listing and we get 10 offers usually there are 8 attached letters of younger couples featuring a picture with their dog or kids.

Recent reddit thread -> https://www.reddit.com/r/VictoriaBC/comments/sohzpg/those_of_you_who_make_100kyr_here_what_do_you_do/

We have everything from nurses to government management to trades such as floor installers, etc.

If you have a couple at 100k each. That is 200k. If they bought some crappy condo a few years ago they have 200k of equity in it due to the recent spike in condos.

200k equity, ask parents for 100k = 300k and 200k/year with no debt qualifies you for 1.2ish mortgage which means you can buy something up to $1.5 million. Not sure I would feel comfortable taking on 1.2 mill in debt but people do it every day.

I’ve personally helped a number of young couples into 7 figures homes and I don’t think they’ve actually saved 50k in their entire life. Buy first property with 5% down, acquire 100s of thousand of equity via market appreciation, sell and upgrade. Appreciation covers the 20% requirement above a million and income (often increases for younger people) allows for the debt.

Sorry to pick on you but this is why commissions are insane. 99% of sellers ask the wrong question, but then they complain about the cost. Really, the question should be can anyone recommend a realtor who they’ve had a good experience with AND offered a lower commission structure.

Specializing in a certain area (other than rural/small communities/islands, etc.) is not an advantage, imo, the way the system is structured. For example, when I pull up the last 50 sales in Gordon Head there is one unrepresented buyer sale and 49 buyers used a buyer’s agent; therefore, that buyer’s agent is advising his or her buyer. The listing agent never talks to the buyer, in fact the listing agent majority of the time doesn’t even talk to the buyer’s agent. What is the listing agent going to do? Try to explain to the buyer’s agent how great of an area Gordon Head is?

If you have a Nordhavn yacth you want to sell it makes sense to hire a broker that specalizes in Norhavns or trawlers as the buyer is interacting with him or her; however, that is not how real estate works.

As far as a determination of market value it would be wise to obtain three different opinions and draw your own conclusions based on the comparables you are provided with by the three different parties. At this point there is a lot of educating guessing going on.

You could get 5 offers between $1,250,000 and $1,350,000, for example, or you could receive 6 offers with 5 being between $1,250,000 and $1,350,000 and the 6th being $1,425,000. That is 75k difference dependant on one buyer stepping up to the plate, or not. As you can see it makes it difficult to come up with an accurate market value. No one can predict if you are getting that 6th offer.

I guess that’s why we have such an abunance of rental housing. All those investors…

This housing frenzy isn’t a story with impoverished millennials watching on the sidelines. They earn more than their parents or grandparent did at the same age. Many millennials have high incomes and are the ones bidding up the house prices.

‘

‘

Many millennials are choosing not to have children or having them later and it doesn’t hurt when their parents give them a few hundred thousand to help with home purchase some thing that was much rarer in previous generations.

As for Gordon Head, the current Sales to Assessment ratio ranges from a low of 1.3 to a high of 1.7 with the majority of properties selling around the median of 1.4 times their previous years assessment. The real estate board has yet to update to this years assessment that’s why you need to use last years.

So look at your previous year assessment and multiply it by 1.4. If you’ve significantly updated the home in the last year or two then it would lay between 1.4 to 1.7

I think any real estate agent can provide you with an estimate. They are using the same data and best of all their estimates are FREE! That’s cheaper than an appraisal which costs between $300 to $500.

Hi Deryk, thanks so much!

In answer to “Rightsaysfred”…I highly recommend Rick Hoogendoorn and his wife Chery Crause with Royal LePage

( 250.592.4422)

Hope this does not violate rules on House Hunt but the question was asked.

If you want honesty and good advice, these people are the best.

Nope. There was no bear market for house prices in Toronto in 1984. Prices had doubled in the previous 8 years and were at all-time-highs. https://trreb.ca/files/market-stats/market-watch/historic.pdf

You’ll also note the statscan data points to millennial Inflation-adjusted incomes (2016, $44K) being higher than boomers (1984, $33K) , and GenX (1999, $33K) and those aren’t affected by house prices.

The point being… This housing frenzy isn’t a story with impoverished millennials watching on the sidelines. They earn more than their parents or grandparent did at the same age. Many millennials have high incomes and are the ones bidding up the house prices.

Note the sample points. In 2016 RE prices had been rising strongly for years. By contrast 1984 was the bottom of a major bust in BC and Alberta, and a less pronounced bear market in Ontario. Not surprising that the millennials who owned in 2016 would have a higher real net worth than boomers who owned in 1984, many of whom would have bought at higher prices.

Note that in real terms the millennials have more debt. That makes them vulnerable to rising interest rates. In contrast, the boomers who owned in 1984 saw decades of falling rates. So they were much better off than it would appear just from looking at real net worth in 1984.

Millennials in Canada are on track to be richer than their boomer parents/grandparents. StatsCan Data shows that millennials in Canada are richer and earn more (inflation adjusted) than their boomer parents at the same age

Statcan did a study finding that millennials make more money (inflation adjusted) than previous generations at the same age, and have more net wealth. They owe more, but that’s mostly RE debt, which is backed by the house asset – the point being their net wealth (assets-debts) is higher than previous generations at the same age, according to statcan.

https://www.cbc.ca/news/business/millennials-income-statistics-canada-1.5106460

“Among the main takeaways are young people are wealthier than previous generations were at the same point in their lives.”

“For the purposes of this study, Statistics Canada considered millennials to be between 25 and 34 years old in 2016. The agency then compared them with the same age group in 1999 (generation X) and young people in 1984 who are today’s baby boomers.

The millennial cohort had a median after-tax household income of $44,093 in 2016, by Statistics Canada’s calculations. That compares with $33,276 for gen-Xers and $33,350 for boomers at the same age. Those figures are inflation adjusted, meaning an apples-to-apples comparison”

I am considering selling. Can anyone recommend a realtor who does really good home appraisals and specializes in Gordon Head?

Real estate investing frenzy rips through Canadian housing market

https://docdro.id/lLWO4Yg

https://www.theglobeandmail.com/business/article-real-estate-investing-is-off-the-charts-ramping-up-demand/

A million dollars is still a lot of money to almost everybody but the cost of building a house has gone through the roof. In a lot of areas the cost of building has actually gone up faster than the cost of land.

I am wondering if our grandkids are going to be poorer then we were and if so why?

It is interesting that a million dollars is the unit of measure for house prices.

I remember when a million dollars was a lot of money.

$1.2352M

Hi could a pro please tell what 4240 Cedar Hill road went for

Cheers and thanks

They have in the past, when their mandate, as it is today, was to control inflation. The Chretien government was forced to cut spending to address the debt servicing problem.

$1.25

I am noting the opposite (they have to factor it in, i.e. they cannot ignore it aka they haven’t overlooked it).

I’ll be sure to pass this along to the decision-makers at the Bank of Canada. I can’t believe they overlooked this key insight!

Anyone know what 415 Henry St sold for?

You can be a smart as you want at the monetary policy level, but you aren’t operating in a vacuum. Fiscal policy and public debt matter for monetary policy, in my opinion. Can the BoC completely ignore things like public debt charges? Which is a function of our budget, which balances itself apparently.

An issue with BOC and many economists is that they are slow to adjust policy when things change. When it became apparent by the fall that inflation might become entrenched they didn’t want to admit they had been wrong. The risk of escalating wages in 2022-2023 implies drastic interest rate increases (1 to 1.5%) over the next few months are appropriate. I tend to follow the people like Bullard from the Federal Reserve who were early in seeing the problem.

We get it. You would be able to set Canada’s monetary policy more judiciously than a group of trained, experienced experts. And your blanket criticism of government means you’re really smart.

I’m willing to trust that the Fed and BOC generally know what they’re doing. The supply of money isn’t an issue on it’s own, it’s how that money flows within our economy. If we had government policy that kept it from pooling in the hands of the wealthiest, that would help a great deal. This is why the central banks are constantly explaining that they are limited in what they can do, and that it’s really up to fiscal policy to address problems like houses costing too much or whatever else.

And you are telling me that the BoC operates in a vacuum of what the elected government does pertaining to spending/deficits?

You do know that setting monetary policy entails more than looking at:

Unlike you, I don’t pretend to be able to set a G7 nation’s monetary policy more judiciously than a group of trained, experienced experts (the Governing Council of the BoC).

I guess, compared to a Canadian child. But on a global scale my life was and has been very very easy. If my parents had the means for a 2,000 sq/ft of living space, a dog, and hockey, and me not working I would probably wouldn’t have done well. Not having a lot of money and being lazy (no way on earth was I going to ever work as hard as my parents) forced me to start looking a very young age of how to make money on paper aka playing the game. Biggest hint for me as a teenager was doing masonry work on houses in the Uplands. Other than doctors/lawyers it was a lot of vague crap like I “sell insurance.” So you flip paper while I am slaving away here carrying rocks for your ego extension rock pillars, makes sense.

My parents are super hard working and don’t spend money but they could have been rich if they had some financial saavy. Their financial saavy was blowing $30k on Nortel and then never touching the markets again 🙂 Last couple of years I’ve set them up on TSFAs, etcs., so their cash isn’t deflating.

For the record, I like that people complain on here. Complaints make for great reading and often lead to entertaining discussion.

In the context of illustrating monetary policy being idiotic, but according to you it is just fine. Government knows best.

Look at how much you learned Marko from your parent’s business and at such a young age. You worked hard obviously when you were young, much more than many in your age group. But a good part of your success now is a result of their knowledge, expertise and work ethic. You were fortunate to have such good parents.

Oh you don’t need to comment on that. Comments like this work just the same:

As opposed to bombed people wandering the streets today, I guess. I thought the city was just fine in the 90’s. It’s also a bit telling that it’s not brought up that the city was far more affordable.

Hockey and dogs are luxury financial decisions imo. When I was a kid I don’t remember being asked about my opinion, wants or feelings. I remember being told to deliver fliers for the first few years we were in Canada and then working construction with my dad. I am inherently lazy so I was very happy when I got my N as that meant I would spend less time mixing mortar and more time driving my dad’s truck picking up sand/cement/stone. Btw, I am selling the truck if anyone is looking for a F450 dump 🙂 -> https://www.usedvictoria.com/all/39368151

For the most part, I complain about how stupid the system is for the purposes of discussion, not about my own personal situation as everything I complain about benefits me immensely on an individual level. Do I think monetary policy is dumb and I complain? Yea, but at the same time in the last 18 months as a result my net worth has increased more that most people will save in a lifetime, by virtue of doing nothing.

But maybe you are right, less complaining and more commenting on how many properties I plan to pay off by age 41.

When a person is single they have nobody to answer to but themselves. You can usually afford to take risks. ( I know, I did it many times except I did have one child to consider). You can live fairly comfortably if need be in a 300 sq ft accommodation. You can maybe movie home and pay your mom and dad for that bedroom you once used if things go down the drain for awhile. When you are married with kids and maybe a dog as well, then you have responsibilities. Huge responsibilities. You must take their opinions, their needs, their wants and their feelings into consideration for just about every move you make…..especially financial ones. Thus, it is much more difficult for them to “play the game”. They are too busy taking their kids to hockey ……so they can play their game.

Victoria already had the nation’s third-highest prices before that massive percentage gain was tacked on, making the absolute gains here….nuts.

“It was?”

Hmmm. I think it was crappier than it is now. Higher unemployment, higher crime rate. Downtown was kind of bombed out. Esquimalt, Vic West and Fernwood were the wrong side of the tracks. Langford was a mud patch.

But I guess it’s mostly about how you experience a place, and I was a young buck in the 90s. My recollection is that employment opportunities were limited, and there just wasn’t much going on for a young person. The place was just kind of….blah. Boring and bland.

Teranet January 2022, Victoria prices +1.5% MOM, +20.8% YOY.

Victoria price gain of 20.8% YOY during 2021 was 3rd highest of any of the 11 CMAS they track (after Hamilton (31%) and Halifax (25%)

Windsor wins largest YOY increase for any city +33%.

https://housepriceindex.ca/2022/02/january2022/

“It seems like whenever I turn on the local news whenever there is a violent crime it seems like its usually in and around Nanaimo”

Said the old white person from Oak Bay that remembers Langford in the 80s and 90s. Sure it used to be rough, but ride your penny-farthing out there on a weekend and you might see things differently. Or, just look at the crime numbers QT posted. Unless you listen to Together Victoria propaganda, Langford is much safer than Victoria and the days of turning up your nose at a community that’s now very family oriented should be over.

Rental vacancy rate down to 1% again.

It was?

https://twitter.com/j_mcelroy/status/1494698622314635268

But there is a point in complaining about all the other stuff you complain about?

+1, exactly. No point in complaining. If society rewarded savers I would save, but such is not the case so you play the game.

Seven murders in seven weeks in Winnipeg, and this is the slow season. Bordering on civil unrest. Businesses constantly robbed without fear. Police chasing their tails, arrested criminals immediately released to continue their crime spree. With no solution in sight, many Manitobans looking to relocate. I’m one of them.

Comparisons between municipalities such as Victoria versus Nanaimo are not meaningful as one is an inner city and the other is a metro. Really only CMA versus CMA is meaningful.

https://www150.statcan.gc.ca/n1/pub/85-002-x/2021001/article/00013-eng.htm

Based from Statistic Canada violent crime per 100,000 people for 2020:

Canada — 1042

BC — 1120

Victoria — 1810

Nanaimo — 1548

Langford — 768

Nanaimo — https://www.areavibes.com/nanaimo-bc/crime/

Langford — https://www.areavibes.com/langford-bc/crime/

Victoria — https://www.areavibes.com/victoria-bc/crime/

Marko, completely agreed on both points. Everyone who is already ridiculously rich or powerful has an inherent motivation to keep things functioning as they are. If I’m not going to be able to change things for the better I may as well try to make bank along the way…that’s why I play the game.

System isn’t designed to fail, every possible option will be thrown at it to prevent it from failing. If it gets to the point where I am financially destroyed then I have other things to worry about like securing food, crime and gangs taking my food. Realistically, the average rich person being financially destroyed and a blue collar worker that has been saving his or her pennies, not leveraging, coming in to buy assets from them cents on the dollar isn’t going to happen. The government isn’t going to let it happen. I guess my point is there isn’t that much risk in playing the game.

Problem is there is one of you and millions of dumb people that vote in politicians that actually put them further behind (even thought the politicians promise to fight for them).

“I thought it would be a lot worse than it is from how people in Victoria describe it”

Old school attitudes from old school Victorians. Victoria was pretty crappy back in the 90s fwiw.

Last Saturday, a random murder happened in a coffee shop.

https://www.cbc.ca/news/canada/british-columbia/nanaimo-homicide-victim-identified-1.6353998

I like North Nanaimo, too. Lots of properties with fantastic ocean and mountain views.

“It was cheap back then which meant you got what you paid for.”

I mean you access all the same recreational activities you can in Victoria, and Victoria doesn’t have much for big city amenities in the first place. As long as you don’t live in the sketchy areas the facilities like the aquatic centre are very nice, and there are many newer houses to choose from. With gentrification and mainland money pouring in I think Nanaimo gets a much worse rap than it deserves. I thought it would be a lot worse than it is from how people in Victoria describe it

Yeah everyone heads over to West Van for tea. Had family there for quite a while, they lived N. of Departure Bay which is quite nice, rest of city is pretty crappy. It was cheap back then which meant you got what you paid for.

What do you guys think of Nanaimo ?

‘

‘

It seems like whenever I turn on the local news whenever there is a violent crime it seems like its usually in and around Nanaimo, followed by Langford.

“What do you guys think of Nanaimo ?”

Lots to like about Nanaimo in my opinion once you get off the strip. It’s kinda like a bigger Duncan in that regard.

Nice parks and waterfront, cool little downtown, all the usual amenities. I like it. I thought about moving there a few years ago, but I don’t think the lady would have approved.

Or 1854 Emery Pl @$959k next to Uvic, with some work.

What do you guys think of Nanaimo ? Some nice ocean view houses in Nanaimo considerably cheaper than living in Langford . Very nice access to best parts of Vancouver, central to the island .

Leo, that CPI trend graph is one major reason I’m betting (literally) that interest rates won’t be increasing as much as everyone seems to expect. Blaming YOY inflation for all of our woes is a convenient, simple, and politically-motivated scapegoat, but really up until a few months ago the real concern was deflation.

The heart of the problem is not short-term inflation, it’s that real wage growth has been essentially non-existent for decades now. That’s not due to printing money for CERB or whatever else…that’s capitalism in the long-term, baby. There are two clear options to “win” in this environment:

1) Understand the system you’re working within and play the game. Do as the wealthy do. Lever up, buy and hold assets. Don’t worry about short-term fluctuations and the panic of the day, just hold on. Yeah there’s a risk getting financially destroyed, but again, that’s capitalism. You might also win big. It’s all easier said than done, but it’s a marathon not a sprint.

2) Even harder than Option 1, try to change the system at a structural level. Attempt to politically shift Canada towards becoming a social democracy (or something more extreme I guess).

Those sitting around complaing that “Trudeau giving money” to struggling people/businesses is the reason that they can’t buy a house have been duped by classic technique of pitting the lower classes against one another.

How’s the local ski hill in Saanich?

duplicate

rush4life – comox is a tiny town in the middle of nowhere. It should be cheap with more land! Better to live in Saanich if you have to move far away…

1274 Garkil Rd @ $929,000 and 3850 Saul St @ $950,000

Not really – that’s considerably cheaper than the average CRD SFH and that is in comox (which is the nicer part of the Valley) and its 12K sq ft. lot – thats a 2 million dollar home here, if not more.

Up island is starting to make Victoria look reasonable to cheap!

https://www.realtor.ca/real-estate/24047514/351-mcleod-st-comox-comox-town-of

Yes.

This is pretty interesting

Alberta’s RE trend is always correlated to WCS trend. Just personal opinion – I’d say Alberta is the worst place in Canada for RE investment from a long-term perspective, unless world oil demand continue go up or they stop put all eggs in a single basket. The higher the oil price, the more money Albertans made, which means a portion of that money will flow into BC RE market.

I’ve never owned Calgary RE; I was 24 and renting when I moved to the Coast.

It’s good to see Calgary’s market picking up a bit, but I’m not super bullish on the future.

Looks like Calgary is suddenly getting better weather than BC again. Look out people.

That makes sense, thanks.

That doesn’t matter to what I’m actually trying to ask, since it’s calculated the same every month. As interest rates go up, this piece will increase, correct?

Still got any Calgary RE Introvert?

I believe inflation is calculated comparing today’s prices to prices 12 months ago. Last year the country was in lockdown and prices were down, with some exceptions. No denying prices are higher now , but the high inflation number may be due to lower prices a year ago and supply shortages caused by the pandemic. This time next year inflation may be a lot lower when compared to this year. Overall prices have increased, especially housing, and there is obvious inflation, but the inflation number might be inflated. For that reason I don’t think interest rates will increase more than 1-2%. What needs improvement is the supply chain, from production to distribution.

DR is still saying most of the inflation is due to the supply problems and his opinion is that there won’t be a need to jack rates as much as the street thinks to bring inflation down in the second half of the year. We’ve heard this already I know. Who knows, guess we’ll see.

The CPI is a tool used to suppress inflation through underreporting to manage the “Inflationary expectations” component of real inflation. If the CPI is being reported at 5.1% you should really be making financial decisions using a higher rate 50-100% depending on how risk adverse you are. For me personally with CPI being reported at 5.1% I would expect a minimum RoR of 10% for any investments. Interesting times

Last time inflation was this high mortgage rates were about 9%

And today we have David Rosenberg predicting that 2 or 3 BoC rate hikes will be it…and as well it for the hiking cycle. Yield curve which is historically successful as a predictive tool is indicating no need for the aggressive cycle the central banks are making a case for.

Mortgage interest is 3.5% of CPI. But that’s the mortgage interest that everyone is actually paying, not just what people would pay when buying or at end of term. So the short term impact on CPI even from a doubling of rates would be small.

https://www150.statcan.gc.ca/n1/pub/62f0014m/62f0014m2017001-eng.htm

Canada CPI doesn’t have an imputed rent calculation per se for homeowners in the Canadian CPI. The US has an imputed rent in US CPI as “Owner Equivalent Rent” https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.pdf

But the Canadian CPI includes something similar – homeowner expenses (mortgage interest+ property taxes + maintenance + other charges) https://www150.statcan.gc.ca/n1/pub/62f0014m/62f0014m2017001-eng.htm

For the average Canadian homeowner that homeowner expenses amount is going to be much less than imputed rent.

$1,370,000. Purchase in 2018 for $829k including GST.

This is specifically related to CPI. Housing is a piece of it, but they don’t do it on cost of housing, they do some weird conversion where they try to figure out what it would cost the home owner to rent to themselves, based on what they pay for their mortgage (my understanding). So wouldn’t that part of CPI go up as mortgage rates increase? – maybe resulting in a short term increase in CPI as the rates increase, but before the demand decreases.

Would someone be able to share the sale price for 3487 Sparrowhawk Ave? Thanks so much!

Housing as in units or prices? The thought on the latter is prices in a vacuum will drop as rates rise as you can afford/ and qualify for less. There are many variables of course – are wages rising with inflation, do they move the qualifying rate as interest rates rise etc. But the number i have seen floating around, parroted on many sites is a 1% increase in rates drops house prices by 10%. Now given we are in a frenzy maybe it cools the market more, maybe not. a 1% rise in a low rate environment with crazy high house prices likely means more than when rates were 5% as well (1% increase can literally double the interest in a variable rate mortgage right now). Lower prices doesn’t equate to affordability when rates increase mind you.

One of us commutes to UVic 1-1.5hr round trip, the other is fed government and working from home, hopefully for a long time.

Correct me if I’m wrong, but as interest rates rise, certain pieces like housing should actually increase as mortgage rates go up, no?

What’s your, and/or your wife’s, daily commute like, if any?

We looked at several houses in Langford and Colwood last summer on septic and our realtor did some good digging with each to see where the sewer lines were and when the houses needed to hook up. It was going to be 20-25k to do so, and yes there was financing available but we were already at our max budget so with 2k/m daycare there was no way we’d be able to afford extra things like sewer financing until both kids hit kindergarten. We passed on a decent house on Acacia because sewer was coming in asap and we couldn’t afford it. The house we bought is on septic in an area Colwood has “no immediate plans” to convert to sewer so we bought some time.

CPI numbers out – 5.1% – https://www.marketwatch.com/story/canada-cpi-accelerates-to-5-1-in-january-update-271645020998

Canada’s consumer-price index increased 5.1% on a year-over-year basis in January, Statistics Canada said Wednesday, versus a 4.8% rise in November. Inflation in January surpassed market expectations of 4.8%, according to TD Securities. The last time Canadian inflation was this elevated was in September of 1991, when annual prices advanced 5.5%.

Rockland only has two houses as well, at 2.2 and 2.3 million.

There’s currently a total of 2 houses for sale in the entire Fernwood/Oaklands neighbourhoods. One on Gladstone for $2M (converted into a fourplex) and another on Stanley for 1.65M. Absolutely brutal right now for buyers in this segment.

re: 1833 Beach

I walked by while a home inspector was touring the property with a couple last week. They seemed pretty excited to be moving in….

re: 1833 Beach

My guess: developers tries to subdivide 4 ways, then placates the neighbours by settling for 3.

And why the speculation that 1833 Beach is going to be rezoned and carved up? SP you are in the know are you? Curious to how these threads get started. Or people like to assume a lot.

Check out 417 Walker in Ladysmith. Assessed value $707,000, asking $1,385,000! Very modest house built in 1957, nicely renovated on .57 acre lot with ocean view. No bidding war there.

pro immigration to keep the population going to pay for our social programs and job vacancies. Just getting that out there.

1.3m is the target over the next 3 years. Governments is feeding a housing crisis without a plan to house everyone. I do not have an answer but i can tell you things are not going to get easier in finding a place to buy or rent in the next few year. More taxes is not the answer. Need to build and build quicker and higher and closer together.

All levels of government don’t seem to have a clue at what to do. Very scary.

Buying pre sewer line may be a good way to get in the market. Seems like it should be under 20k and Langford offers options for payment.

One option is to finance through an environmental company and another is to finance through TD Canada Trust in which is prearranged by Langford. Households with an income between $38,921 and $67,842 and who have received a rejection letter from TD Canada Trust can apply directly to the City for financial assistance. Over a 10 year period, the City will then collect the fees from the property owner plus interest at a prime plus two per cent rate.

Those with a household income of less than $38,921 are eligible to apply for a five-year exemption of payment of all connection fees and physical connection to the sewer system. If, after the five years, the household income is still below the low-income threshold, the property owner will have to apply for financing.

Re-1833 Beach rezoning.

The easiest way will make the outside lot’s driveway facing to Beach drive, inside lot’s driveway facing to Greatford Pl, similar layout to 2793 Sommass dr. Another option could make both driveways to Beach dr, similar concept to 1580 York Pl. The potential 3 lots would be similar to these three houses on Hampshire Terr that front onto lanes, will be very tough but if it get’s approved, the new owner will just hit the jackpot. There will no shortage buyers on any kind of properties at this location. The biggest challenge may be remove these Oak trees in front yard, may be ended like the Foul Bay condo development situation.

Thanks up and coming. They are pretty strapped so they are going to have to figure it all out between the two of them. They only have the one child now but would like to have another soon or the kids will be too far apart in age.

Apparently, at least 95% of homeowner’s in Langford where it is mandatory for them to hook-up have complied.

An interesting article: January, 2020: ” Langford STRATA owners worried sewage bills will swamp homeowners. It will come at a price tag of $25K just for the main sewer installation for his household. ”

Each homeowner also is required to have their individual septic tanks pumped out and disengaged somehow. I guess the costs are dependent on how far the sewer line will have to run to the main, whether or not a survey is required, if a new easement with the other strata owner will be required, how much rock is involved, if grinder pumps are needed etc. etc. Also, that article was two years ago, and costs for everything labour and supplies have skyrocketed. Once the sewer is hooked up, Corix has an annual charge based on water usage. Some strata duplexes share their water bill, others are separate.

“The couple would be extended enough re their finances and the conversion costs from septic tank/fields to the sewer would be too much of an extra burden for them. I really feel for them.”

With the sewer line not being in front of the property yet (as long as the current septic is working properly) wouldn’t that give the couple time to save for the sewer hookup? Also, with it being a duplex wouldn’t any cost of a shared line off the property be split with the other owner? Finally, I believe it is a Langford bylaw to hook up to sewer by 2020 and their approach, like most bylaw departments, is compliance over enforcement. I think your young couple could consider those factors.

Well, I got my question about Jenkins. Called the Corix people. So there isn’t the main sewer line at the 1000 hundred block, just up to the 900 block. I was thinking of helping out a young couple and they were thinking of looking at this. Anyway, probably within the next few years

the sewer line will be installed. The couple would be extended enough re their finances and the conversion costs from septic tank/fields to the sewer would be too much of an extra burden for them. I really feel for them.

It would be interesting hearing on here from couples like them and the experiences they are going through right now. Most of the commentators here already own and certainly are not “house hunting”.

How is the number of new listings below the dashed line from January 1 onward, but we still have gained the most new listings in first 6 weeks in years?

1833 is a good sized lot, but I doubt that it can be spot re-zoned as re-zoning just this one site would have a negative impact on the adjoining properties to develop their properties in the future.

The road to the north is only a half road, and I would expect the city would want that road expanded to a full width road which reduces the depth of any house built fronting onto that lane once the road is expanded to a full width. There may be houses in Oak Bay that front onto lanes, but I can’t think of any.

I could envision punching a cul-de-sac road down the southern property line but that would mean easements over the back of the properties fronting along Somass and that will be another 1.5 million for easements plus the cost of the road.

One can never say never. It could happen but it’s going to be a tough one to subdivide.

Just wondering if any realtors on here or anyone in the know could tell me about 1027 Jenkins, just listed at $549.999. It is a small 2 bedroom strata duplex. Being as it is on Jenkins Rd., would that property need to hook up to the sewer? Basically if the property is on an accessible sewer line, then it is mandatory for the owners to hook up to the line at their costs. The deadline was a couple of years ago. Thanks.

It’s highly likely 1833 Beach dr will be divided by two 80×120 lots or 80×100 outside and 80x 140 inside, outside lot will be worth somewhere between 1.5m-2m, inside lot 1.9-2.2m or more, after paper works, it looks like a good deal for builders or investors. There is also a potential for 3 lots.

Actually my friends in Toronto are now looking for a winter place instead of Victoria. Lets face it the winters here only look good in comparison to other parts of Canada. Not great in comparison to being down south or other parts of the world. That downtown is beginning to look like Portland does not help. Their last trip to Victoria seems to have turned them off to the city.

Judging what people are paying for houses not everyone sees it that way.

1833 Beach- A $2 million house (replacement cost) on a $2 million piece of land for $3 million, what a bargain. It didn’t go for $620,000 over ask (which was the assessed value) it was under priced $600.000. They probably could have got more if it was priced properly. Barrister, where were your rich friends? They sure missed out on this one.

1833 Beach Drive just sold for 620k over asking. Gulp