Rental reprieve over: vacancy rate returns to 1%

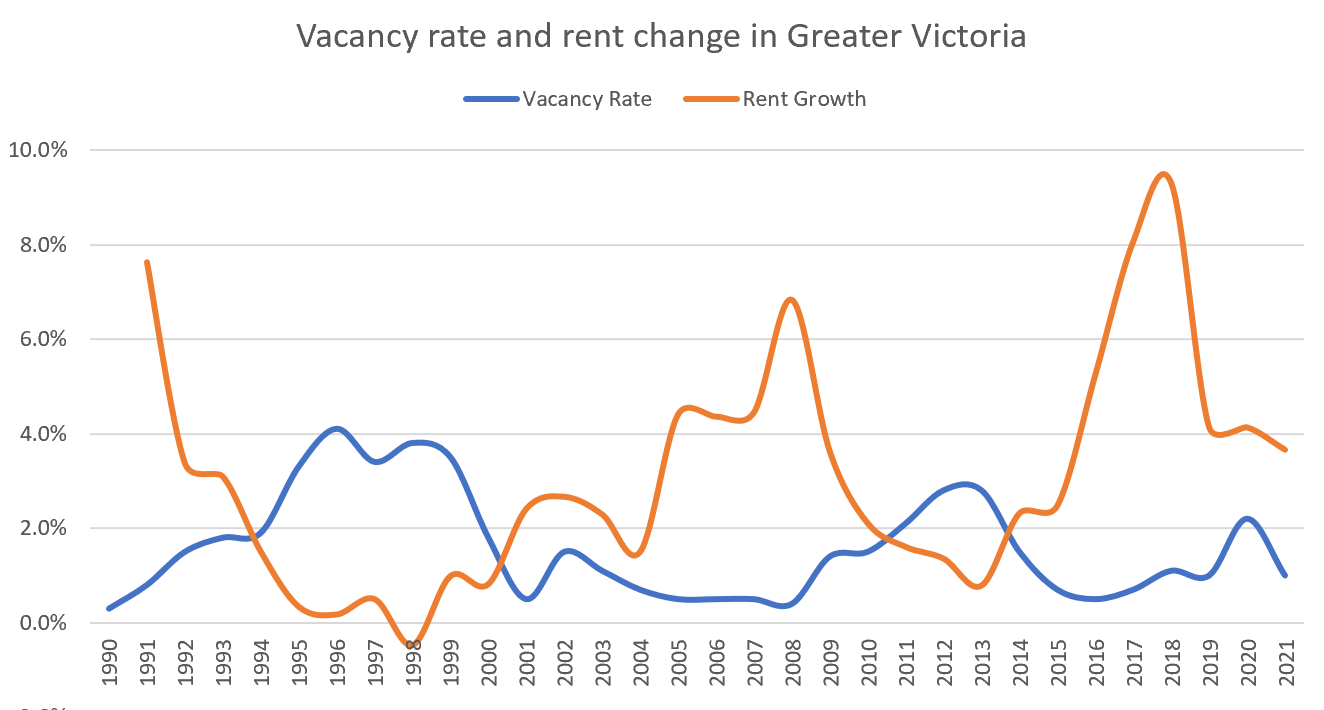

Back when the pandemic first hit I wrote an article saying the rental market – which at the time had a 1% vacancy rates and rapidly increasing rents – should be getting a lot better due to the outflow of students and reduction in AirBnBs. That was evident in the 2020 rental data, which showed that vacancy rates doubled and rent growth slowed.

Unfortunately, we’ve known for months that the brief reprieve for tenants was already over, with reports of ultra low vacancy rates in purpose built rentals, a rental crisis for returning students, and swarms of applicants for private suites. The recent CMHC rental report confirmed the return of the dire situation, with Greater Victoria vacancy dropping back to the pre-pandemic rate of 1%.

That has put enormous pressure on rents in Victoria, with third party measures of the rents of vacant units showing double digit increases. The CMHC headline rent figure is the average of occupied units which is substantially lower than market rents due to rent control. The average rent paid by existing tenants is buffered somewhat from large increases in market rents, but nevertheless the relationship between low vacancy rates and increasing rents is clear. With a 1% vacancy rate, expect rents to keep increasing this year.

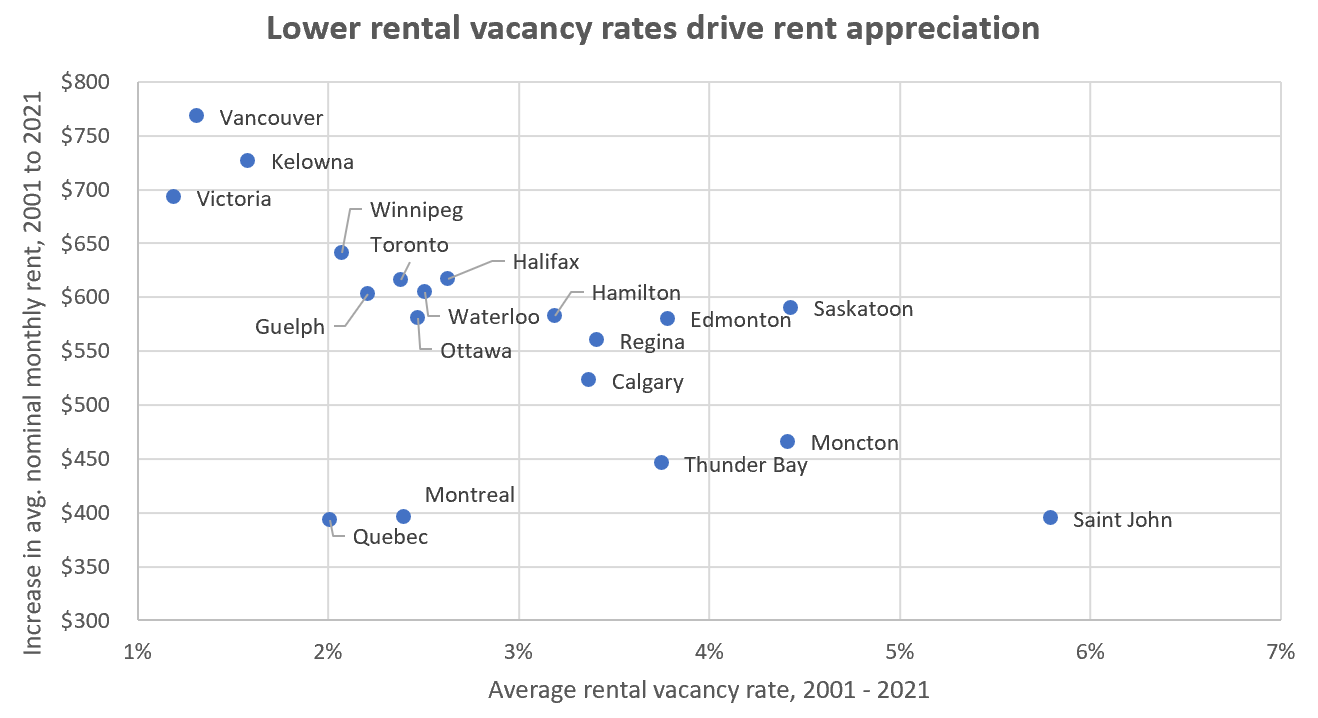

To remove some of the effects of timing and buffering, we can also look at the relationship between vacancy rates and rents across cities and over longer timeframes. Charting the increase in rents in most of the major CMAs in Canada, the inverse relationship between vacancy rates and rent growth is clear. The cities that failed to build enough rentals to meet demand had the largest increases in rents. Chief in that category are Vancouver, Victoria, and Kelowna, which have the dubious honour of maintaining vacancy rates at critically low levels for the last 20 years, downloading the associated rent increases onto tenants.

Quebec City and Montreal stand out as outliers, having kept rent growth very low despite also relatively low vacancy rates. I don’t know enough about the rental market in Quebec though to theorize why that might be.

Where did all the rentals go?

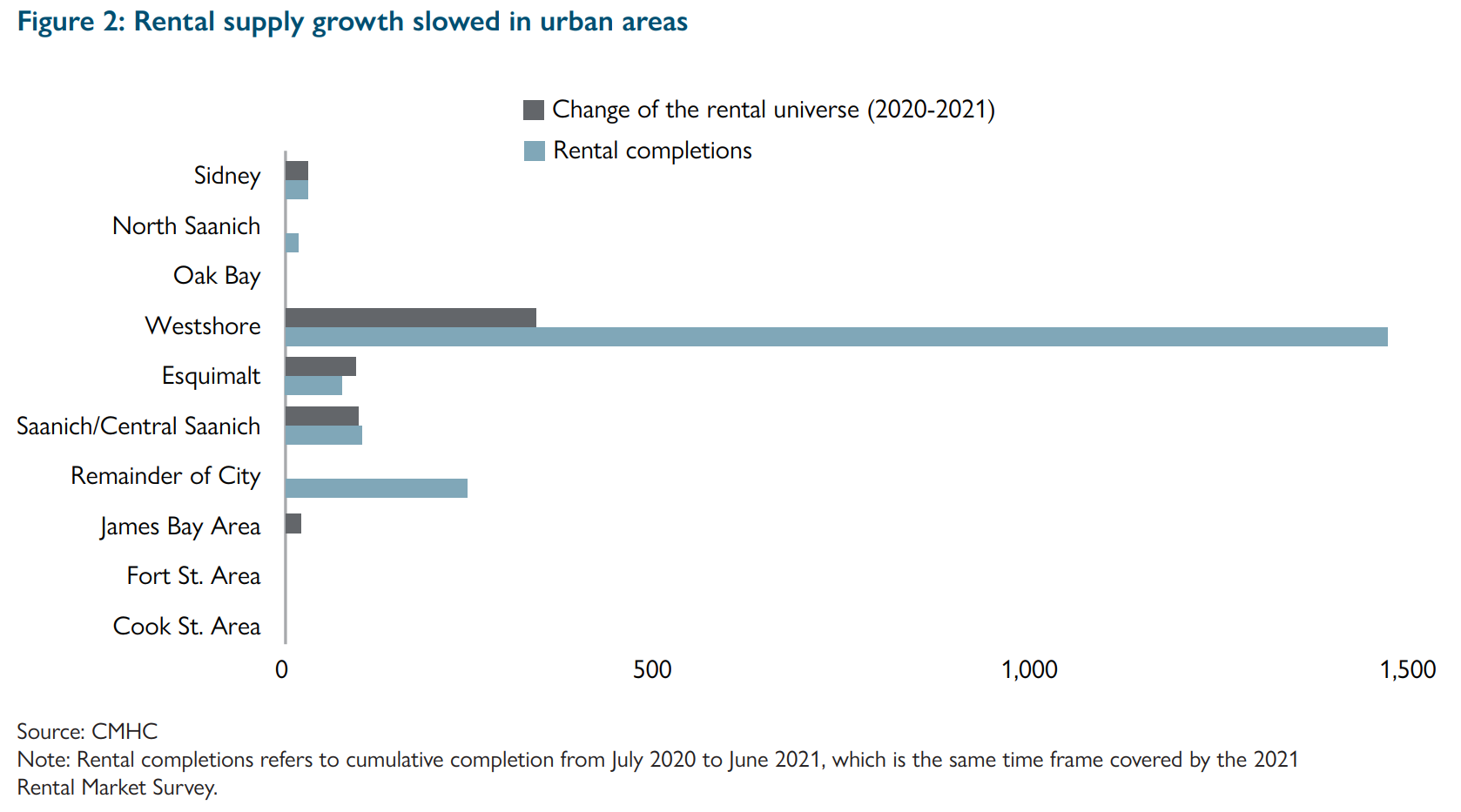

We know that rental construction has been surging in the region for a few years now, but it’s unclear exactly why that construction hasn’t made its way to the CMHC statistics. CMHC tracks the size of the purpose built “rental universe” in the region, which is all of the purpose built rental units that exist. In recent years as completions ramped up, I’ve been wondering why the rental universe wasn’t growing by similar amounts. In this year’s rental report CMHC also pointed out the discrepancy, but offered no explanation for it. Their data show that there were nearly 1500 rental completions in the westshore, but the rental universe grew by only 421 units.

Where are the missing 1000 units of rental in the westshore? Some of the difference can be accounted for by differing definition of rental. The rental universe figures only include purpose built market rentals, while construction statistics include rental suites in new homes and non-market housing. Some rentals could also be lost to demolition or renovation, but it seems unlikely that we lost hundreds of existing rentals in the westshore without anyone noticiing. I’ve reached out to the CMHC for details but so far haven’t received a conclusive answer.

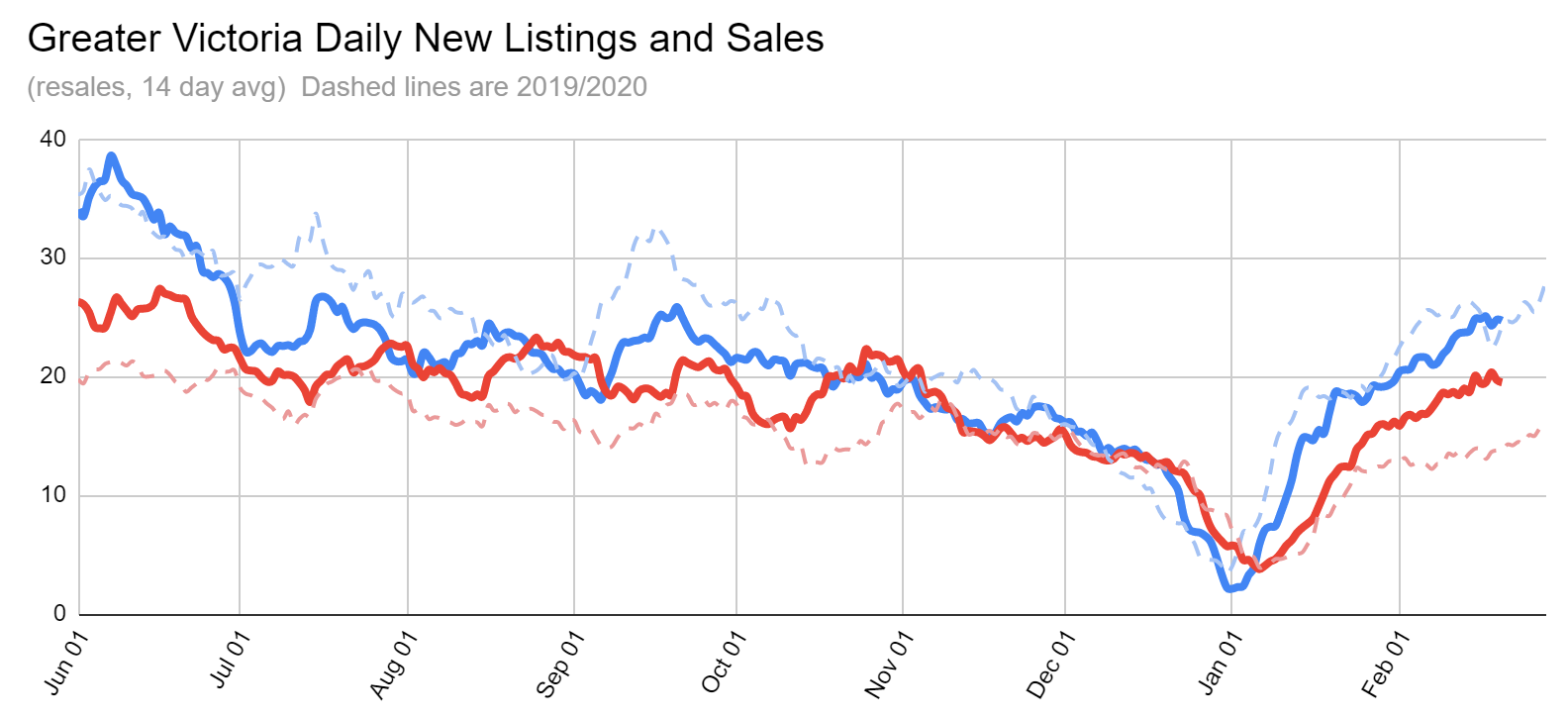

Meanwhile the resale market continues to be extremely active. Despite murmurs of a slowdown in Toronto, that doesn’t seem to be the case here. Month to date, we’ve seen 66% of all properties go for over the asking price. If there’s any pullback in demand or reduction in the numbers of offers on properties, it’s not yet shown itself in those early indicators.

As you can see, sales have stayed very close to the rate of new listings, indicating that any new properties priced even remotely close to market value are immediately absorbed. With the Bank of Canada heavily hinting at imminent rate increases (the next meeting is March 2nd), while inflation isn’t letting up, and provinces race to relax restrictions, it’s looking more and more certain that at least that stimulus will be pulled back. We’ll have to wait a bit longer though to see if rates will throw some cold water at the market. Either way, the impact of rising variable rates should be felt sooner than fixed rates where buyers benefit from rate holds. Stay tuned.

Well sure. I agree with that. That’s not the same thing as saying it has happened to 18,000 homes.

You attempted to measure how much of this has actually occured because of the spec tax. The data you quoted from the CMHC is owned existing dwellings that have become rented dwellings. There are lots of reasons for that, and one is simply the condo being purchased by a landlord investor who rents it out.

You can’t just assume that all that occured because of the spec tax.

New post: https://househuntvictoria.ca/2022/02/27/the-discrimination-discount/

$1.289M

It’s disgusting to see a megalomaniac dictator arresting protesters and putting them in prison. Let alone what’s going on in Russia.

Anyone know what 908 Bucktail Rd in Mill Bay sold for?

“ I’m well aware of the diversity of doctors in Canada but did you check their credentials? ”

Sources directly from Canadian Medical Association website.

“ There is a higher concentration of foreign medical graduates in Saskatchewan (52% of all physicians) and Newfoundland (37%) than in provinces such as Quebec where only 10% graduated outside Canada5.”

“ 75% graduated from a Canadian medical school, 22% graduated from a foreign medical school, 3% not stated.”

https://www.cma.ca/quick-facts-canadas-physicians

SP- I’m well aware of the diversity of doctors in Canada but did you check their credentials? How many received their degrees in India versus how many were trained in Canada. Maybe their affluent parents sent them to Canada for their education. I know that doctors trained in South Africa are able to fast track into our system. Probably other European trained doctors from certain countries are readily accepted. Too many shaky degrees from unaccredited universities out there. Also, we’ve found some “doctors “ with forged documents. I’m not up on the subject as I should be, but then I rarely go to doctors. The ones I have seen were Canadian trained. Having long time friends who are medical doctors doesn’t hurt either.

Going to join the rally now: https://www.cheknews.ca/solidarity-rally-for-ukraine-set-for-sunday-at-bc-legislature-958937/

Least we can do. What is going on in the Ukraine makes it hard for me to focus on Canadian housing issues at the moment. That we have peace and security in our country is something I’ve been taking for granted. https://www.bbc.co.uk/news/extra/dqwtziap8e/ukrainians-under-fire?fbclid=IwAR103PxSklxuJLa4UlpnDwj8cjUV_u9VZjCBTCiO6B0cnZEImyE1WqLxsJM

“ Unfortunately, as stated months ago, doctors from most countries do not meet our educational standards and require years of additional training”

According to the the link below, it looks like about 50 Indian doctors along at where you live Frank. Based on my long time live experiences in the Prairies, a large portion of doctors came from India and east Europe, especially in small communities, a large portion of nurses from south east Asia and pretty much every single Tim Hortons cross the entire Prairies has multiple Asian workers.

https://indianbusinesscanada.com/category/indian-doctors/40/winnipeg/68/manitoba/13/

1953 is not 2022. World population has tripled. Current population is generally older in developed nations. Most women are in the workforce and delaying having children or not having any. I don’t see many similarities, we live in a much different world. More people are single, divorce rates are higher, and life expectancy longer.

This article from 1953 is fascinating. So many things are similar today. Difference is Canada was growing at about 3 times the rate back then as it is today, so some struggle with accomodating that growth is understandable.

https://archive.macleans.ca/article/1953/1/15/our-sorry-record-on-housing

That would be super dumb. We had one done a few months ago to access the Greener Homes grant. 100% useless information, just a make work excercise.

The problem with a 2 year accreditation is most immigrants don’t have the luxury of not working for that length of time. This also applies to engineers, and other professionals, necessitating their taking average employment, such as furniture sales for the Brick (I know an educated immigrant who settled for that). Definitely not the skill level we need. I don’t deny our need for new skilled professionals but what do the countries they are leaving do? Without?

Yes, number of households grew 13% higher than population growth from 2011 to 2016 census. (5.00% pop growth, 5.64% households growth).

Much of this can be expected from aging in the population, as older people have fewer numbers of people per household. This trend will continue. As we can see, median age in Canada has increased from age 28 (1977) to age 41 (2016)

This means there is demand for more housing each year even if the population were to stay the same

Frank – That’s a problem with our accreditation process, not with immigrants. There’s no reason an experienced, university educated doctor should have to do a two year residency. Why do that, when they can go to the U.S. instead and make more money? Fewer government hurdles and higher pay will solve the problem faster than reducing immigration. I’m not saying a homeopath from Brazil should be brought in to perform lung transplants. I’m saying a trained endocrinologist or family doctor from Brazil is capable of going to work in Canada.

https://newcanadianmedia.ca/research-shows-canada-has-overlooked-immigrant-doctors/

The problem isn’t really population growth per se, but growth in households. The high growth rate in the 1950’s was mainly adding kids to existing households. Bunk beds, anyone?

Further to that, many if not most households have far more living space per capita then in the past. That is, for those who can afford it, which increasingly means people who got into the market decades ago. Thus more SFH in Victoria CMA than households with 3+ members, for example. At the same time families cannot find secure housing.

That’s another way to talk about the missing middle I guess.

Maggie- Unfortunately, as stated months ago, doctors from most countries do not meet our educational standards and require years of additional training. I believe nurses are being fast tracked due to our severe shortage. Highly educated professionals do not grow on trees and the supply simply cannot keep up with the demand. This is especially true given the overall poor physical condition of North Americans.

Italy lost 2.0% population (worst of G20 countries) over the same period 2016-2021 that Canada gained 5%

Here’s what happened to Italy house prices…. https://www.globalpropertyguide.com/Europe/Italy/Price-History

To be clear… I’m 100% for higher immigration and higher population growth. The point here is that we need to increase housing construction, and if we do build more houses than our population growth, we may see falling house prices like in Italy. Which would be the best of both worlds – high population/economic growth and lower house prices.

Because immigrants are never doctors or nurses?

BOC will increase 25 whatever the US does in my view

My grandparents immigrated from Poland over 100 years ago, probably to escape tyranny. Canada was built by immigrants. Our best and brightest minds are immigrants. I’m not against immigration, just don’t complain about housing shortages and astronomical prices, lack of rental inventory and escalating rents, Doctor shortages and long wait times for treatment. Instead of growth we cannot accommodate we should be looking to maintain a homeostasis that we can all enjoy. Overpopulation is at a threshold, resources are being stretched thin, this isn’t going to end well.

https://docdro.id/QgXFSJR

https://www.theglobeandmail.com/opinion/article-the-next-age-of-uncertainty-is-here-what-does-that-mean-for-canadas/

I agree. Canada needs to do more, and quickly. For example, I agree with NDP leader Jagmeet Singh’s call to eliminate visa requirements for Ukrainians coming to Canada. Ireland has done this already. This may be a massive migration crisis, and Canada should be a leader in accepting them, without red tape and delays. Parts of Europe have “migrant fatigue” and may not be as accepting. Canada needs to step up, and I expect it will.

https://www.cbc.ca/news/politics/ukraine-asylum-seekers-canada-1.6364714

“[Jagmeet Singh] suggested the government allow Ukrainians to come without a visa, to make the process as easy as possible for people to find safety in Canada.”

Ottawa’s next push on ‘green homes’ is to require an energy audit before you can sell

https://docdro.id/wdsFUzX

https://www.theglobeandmail.com/business/article-ottawas-next-push-on-green-homes-is-to-require-an-energy-audit-before/

I mean just look at our population growth rate. How could we possibly keep up with a radical and unprecedented * checks notes * 1.03% growth rate?

Here’s where they’re coming from. This is what density looks like. I don’t think this would fly here. Looks more like Legoland

Good. We need immigrants. We have an aging population and a labour shortage. If that means denser housing in my neighbourhood, I’m fine with that. Maybe someone will open a coffee shop I can walk to.

Let them in in.

Our failure to build housing has lead people to believe that immigrants are the problem. But reality of population growth paints a very different picture.

Average annual Canadian population growth rates:

2006-2011: 1.15%

2011-2016: 0.98%

2016-2021: 1.03%

The fact we can’t seem to build homes for a 1.03% growth rate should be a national embarrassment.

More immigrants coming to Canada from Eastern Europe. I wonder if the government will raise their 400,000+ level to accommodate the influx. Not good for our housing shortage.

Some missed irony here. But a good example of how hard it is to find a billion dollars of spending cuts that wouldn’t affect services.

It’s literally spending and it’s shown on the budget as such. The money is coming out of the provincial treasury.

The government could save $1.6 million by not postal mailing spec tax notices to 1.6 million people each year. https://www2.gov.bc.ca/gov/content/taxes/speculation-vacancy-tax/how-to-declare

Since the form is filled out online, it is absurd to keep postal mailing it to people who have filled it out online in the previous year, since they have your email address on file. If they don’t fill it out by march 31, then postal mail a reminder.

While they’re at it, they could start out the “declaration” (for people with simple declaration from previous year )to ask if anything has changed from last year, and if you said NO, you’re done. That would likely mean that 1.5 million people just need 1-click to finish it, saving about 300,000 unproductive hours of peoples time.

The HOG is not spending. It’s a round-about way to tax non-primary residences at a higher rate.

(from the FP article)

…is that we [delayed the] second Great Depression…

FTFY. Do policy makers really think that debt is no longer cyclical?

lol @ Stephen Poloz still thinking inflation is transitory. They haven’t stopped goosing the market with billions daily yet.

That’s largely due to past moves of the CAD against the USD driven by oil prices. Higher oil prices resulting in higher CAD which cools inflation. Similarly with lower oil prices.

But the CAD has not risen with higher oil prices lately.

https://financialpost.com/news/economy/stephen-poloz-predicts-inflation-will-slow-quickly-over-the-next-12-months

If memory serves, someone on the blog recently pointed out that the BoC has, historically, not always followed the Fed on interest rates — with the delta between the two rates sometimes being quite significant and long-lasting.

Just putting that out there.

Picturing QT singing this at karaoke night…

It is spending. And it doesn’t provide any services. Those are exactly my points. Plus it is regressive and costs money to administer.

However if the government cancels a program that exists solely to send tax dollars back to taxpayers then that is effectively a tax increase. I don’t particularly support a tax increase at this point in time, especially not just to “pay down the debt” which as I stated is not a terribly high priority for BC.

Cutting $800 million would be hard. Certainly there is no single program that I would support cutting that would generate that level of savings. Contrary to some people’s opinions most government programs exist for a valid reason. Fortunately as I stated earlier debt reduction is not a high priority for BC. Looking through the recent budget I do feel there are a number of things that could be cut generating 100-200M in savings but beyond that I would need much more knowledge of spending levels in different program areas.

There are some relatively useless government programs that I would happily cut, but most of them are quite small such as Marko’s bugbear the owner builder exam. One would need to come up with scores of those to really save much money ( though if the program is counterproductive getting rid of it is important even if the savings are trivial).

They won’t move without the Americans. So if they think that for any reason that the US won’t increase their rate in March, they won’t either.

I think this time BoC will increase the rate. They said they would at the last one and omicron can’t be used as an excuse anymore. They can point to war risks but as QT mentioned that could just as easily cause inflation. My bet is 25 bps up. NZ just increased theirs again – they are up to 1.0% now and 50 bps over the last 3 months.

I’m a big proponent of keeping money out of government pockets and keeping it in people’s pockets where it can circulate in the real economy and help everyone. Governments are such prolific money wasters, I cringe every time they commission a study that costs millions and accomplishes nothing.

The HOG is spending. And it doesn’t provide any actual services.

What BC spending item would you cut that is of the order of the HOG?

You are correct that it’s likely that BoC going to follow the US and stay. However, the development in Eastern EU is a reprieve of what is coming to the rest of the Western world, due to myopict governant and energy insecurity.

Let the inflation roller coaster roll

Let them knock you around

Let the good times roll

Let them make you a clown…

The other obvious way to balance the budget would be to reduce government spending. I’m all for government spending when it is needed, but we are hardly at the point in the economic cycle where we need to be stimulating the economy with large government spending.

Paying down B.C’s debt is hardly a big priority anyhow. Our provincial public debt is totally manageable. I do think we should be cautious about adding more to the debt when the economy is booming. Save the deficit spending for when we really need it.

My point is if they think the conflict will prevent the Fed from going on their next meeting my bet is BOC stays put on Wednesday.

True. If a single person makes more than $150k interest (salary/pension/..) income, BC tax is higher than AB. But if the income is split 3 ways (CG, dividend, and interest), BC tax is higher only for $260k+. (Those high earners are of very small percentage).

It’s all talk until proven otherwise.

For 100K, and the reason is that BC has low rates for the 0-43,070 and 43,070-86,141 brackets. BC’s brackets are much more progressive than Alberta’s, and more progressive than Ontario’s. So go farther up into 6 digits and you will pay the least in Alberta.

Good idea, also could be used for more afforable housing.

As for provincial income tax, I happened to help someone checking income tax (using TaxTips calculator) yesterday, and a bit surprised that BC seems to have the lowest income tax among provinces.

e.g. For a single with $100k interest income, while fedreal tax is the same, BC income tax is about $6.5k, AB is $8k, NS is the highest with $13k+. If this $100k income is split with 1/3 capital gain (actual) , 1/3 dividend (actual) and 1/3 interest, BC tax is just a bit over $500 while AB is close to $4k and NS is over $8k.

How about just reduction in taxpayer debt? This year they are forecasting 500M deficit – without the HOG it would be a 300 million surplus and could be applied to reduce the Province’s overall debt position (assuming all things being equal of course).

The HOG is pretty ridiculous. Take money from the population as a whole (general government revenue) and give it back to a broad chunk of the population who average wealthier than normal. And incur the cost of quite a few government employees to administer the shell game.

A side effect of the HOG is that it probably encourages municipal over-taxation because most of us are partially sheltered from the full impact.

Of course just getting rid of the HOG would be a tax increase. I’d only support abolishing the HOG if it was offset elsewhere, ideally with a reduction in provincial income tax.

…so who believes our BOC will hike next week?

I think you’ll find that those who are annoyed by the property tax deferral are also plenty annoyed by the HOG and other homeowner subsidies. The former is being discussed on this thread simply because someone brought it up in the form of a colourful graphic.

I agree with Patrick – a few million is a drop in the bucket for what the Province is subsidizing for homeowners. If you wanted to be annoyed, then how about directing it at the homeowner grant – last year we subsidized homeowners (who are largely much better off than non homeowners) to the tune of 870 million dollars. And if that doesn’t bother you how about the fact they indexed it this year so now those poor people who own 1.9XX million dollar homes are still included with the grant. If you take no issues with that how about the fact they haven’t indexed the first time homeowner property transfer tax exemption in years and only qualify for the full amount if your purchase is 500k or less (i think its up to 525K for partial exemption). Meanwhile the median CONDO price in Victoria last month was over 600K. I realize condemning the HOG while complaining about the first time homeowner exemption being too low may seem in contention with itself but i would assume people buying there first home are generally less well off and established homeowners are better off. Though I’d be up for canceling them all or having the HOG go for the first few years of homeownership and then be done.

Of course getting rid of the HOG would probably be career suicide so they won’t touch it but i’m certain they could have gotten away without indexing it this year with little repercussion yet they chose to.

You’ll likely get your “let’s tax everything” wish.

Tax deferral is floating rate debt. BC government pays less than bank prime for that – more like 1.6%. Making the spread 1.6-0.45 = 1.15% like I said.

Fair enough. I’ll sign out on this topic. Thanks for the discussion!

Selling something for a historically high price at a huge gain is hardly losing it. It’s better known as profit taking. It’s a perfectly normal lifestyle transition for someone to sell a house when the upkeep – which includes property taxes – doesn’t suit them.

That’s what people do in other provinces. which have nothing close to BC’s deferral, even with a means test. Or they take out a reverse mortgage – the free market in action.

Patrick,

I have nothing against my neighbour or any other seniors, I just support what I believe, i.e. If a person doesn’t need the low interest loan, it is good to lend it to someone in need, seniors or not.

Sure, good idea, go for the works.

Added: the senior program rate is (bank prime minus 2%) at 0.45% currently, so the cost is at least 2%, not 1% as you claimed.

FYI: Your “vivid” imagination of someone you don’t know is quite “funny”.

Well that’s my point. Because you expect your senior neighbor to fail the means test and not get tax deferral if they add it. With all her pensions and trips abroad, how could she be eligible?

What I don’t understand is why you are bugged about a program that costs so little to the government ($3.5 million per year as I detailed in previous post). All that is being “given” to the people is a 1% break in the interest rate on their loan. My goodness, is that too much to give to a senior?

Once we have a circular firing squad in place, why stop at killing the tax deferrals only? If you want to means test things that cost almost nothing, you should be means testing everything, not just things that would affect your neighbor, but things that would affect you. Like the personal residence exemption, homeowner grant, gift taxes, annual wealth tax on your net worth … the works! Then, when you meet your neighbor, and ask how she is financially, she’ll say “I’m broke”… and you’ll happily say “yep, me too”.

You shouldn’t feel guilty about taking it, without a stress test. If you defer $7,000 taxes, the government is lending you money at 0.45% instead of 2% like they are paying. So that’s about $100/year in interest they’re giving you. Think of it as “frequent flyer miles”. You’ve paid taxes and played the game according to the government rules for the last 40+ years, and are now retired. And they’ve promised you this, so take it!

btw, there would be a tax deferral means test that I would be in agreement with. If you earn too much, and fail the test, you are still eligible, but you need to pay prime rate interest (currently 2.45%). That way, your “rich” neighbor could still get it, but it would cost the government close-to nothing in the long run (since they borrow below prime)

Patrick,

I think I know my neighbour well enough after 15 years, and Yes my post was to support means testing for tax deferral program for all seniors.

BTW, we are qualified for the program ourselves but haven’t taken up on it (yet) and my neighbour was promoting it to me then (thus the talk). But we would support means testings regardless if it would impact us or my neighbour.

Well you don’t know the personal financial details of your neighbor either, and you’ve told us you’re not a financial expert anyway. Yet you’re telling us about your single senior neighbor lady getting the tax deferral, with the obvious implication that you think she shouldn’t be getting it. And you throw in that she “goes on trips abroad” each year, as if that should convince us to fail her on means tests and deny her these government benefits.

But please tell me if I’m wrong,… was the purpose of your post to say that property tax deferrals shouldn’t be available to people like your neighbour, or not?

No need to get personal Patrick, as you don’t know me nor my neighbour.

I smiled as my neighbour is a smart lady with double pensions + CPP/OAS and goes to trips abroad every year (other than the past two) and she doesn’t need my advice on how to use the loan. We never borrowed a loan for investment purpose ourselves, so I knew that I am not qualified to give advice on it.

BTW, we are qualified for the “senior” deferral but haven’t taken up on it (yet) and my neighbour was promoting it to me then.

They should really means test that tax deferral program. I would go out on a limb and say that the vast majority have absolutely no need for it.

‘

‘

This topic comes up fairly regularly in my work and i would agree that almost everyone I work with who take advantage of it doesn’t need to but why not, if your taxes are 5 – 10K/year why not defer and give yourself and extra $400 – $800 after tax money per month, if your house is paid for the amount after 20 years is still peanuts in the bigger picture and its an easy way to extract capital out of your home at the current 0.45% simple interest.

There is still a segment of the population that doesn’t like the idea of owing money on their home even if it makes financial sense.

With the principal residence exemption and property tax deferral, at subsidized rates, home owners really have an advantage over renters.

So we have a single aged senior, who has a little nest egg. And he/she has actually been helped a little by the government (“god, forbid!”). And so hearing of this event this becomes a target for you, with you responding only with a fake smile So apparently we must eliminate this outrage, that this senior has been able to borrow a little money against equity in her home at 1% interest.

So assume that we cutoff this senior from the tax deferral cash flow. And then your neighbor comes to you in a few years and says “I’m broke, and cannot pay my bills. What do I do?”. Instead of the fake smile you gave when you heard she was doing well, will you now smile for real, because you’re genuinely happy she’s broke? Will this bring you closer to your vision of utopia? Will this smile turn to a “happy dance” if you see a moving van outside her house, with the senior leaving and a thirty something moving in?

Oh, and a bonus… “shame on you” for not giving that single senior a little financial advice when they asked you.

I ‘d say the frontage length is more important than the total size. I’d pick a 6k sq. ft lot with 60′ frontage every time than a 8-10k sq. ft lot with less than 40’ frontage unless a rezoning opportunity.

One of my single senior neighbours mentioned to me recently that she started the tax deferral four years ago, but said “what do I do with the money?”

I could have said to buy Oaken 4 years GIC (3% interest rate) or to buy VBAL (or even XAW), but I knew better and offered nothing, other than a smile 😉

Adding means testing would avoid the harship for those low-income seniors, and also save unnecessary handouts regardless the amount.

And then there’s farmers and ranchers with hundreds, even thousands of acres.

Personally I’m on a 9000 sq.ft lot, and can’t imagine how you live on that postage stamp without the extra 3000 sq. feet.

So you’re hoping that by eliminating it, seniors will lose their tax deferral, and this pushes some of them over the financial edge to losing their homes? This would be against the goals of the government, namely promoting “aging in place” – where seniors stay in their homes. The government spends lots of money in programs and services to promote this, and this includes the tax deferral program.

The BC government defines “healthy aging” to include when a senior can “age in place and enjoy your later life in your own home on your own terms” https://www2.gov.bc.ca/gov/content/family-social-supports/seniors/healthy-aging

“Senior” being over 55, only one owner required in joint tenancy. That’s peak earning years for a lot of people.

Maybe they don’t run the ads much in BC, but retired people do have access to reverse mortgages.

What the property tax deferral does, in addition to buying votes, is reduce the number of properties that would otherwise be sold and thus reduce supply.

Retired people don’t have the same access to new HELOC loans, since those are based on current income. The deferrals are low interest loans (not gifts) from the government, to seniors and families with young children. The cost is just the difference in interest in what the government pays (~2%) and they charge (~1%). This is a tiny amount, and an accounting entry.

Moreover, killing the program wouldn’t save the government much money. With $325 million total outstanding loans, they probably lose a net of 1% in interest, or $3.25m per year. Most people don’t realize how cheap it is for them to have this program. Why do it, to save $3m per year? Of course “killing the program” wouldn’t affect the existing $325m loans, so they wouldn’t even save that much.

Issues, shmissues. There are always buyers. Those units in Sydney look like rowhouses with every 2nd unit bombed.

One legitimate issue is that townhouses in BC always seem to be strata for some reason, which may turn off buyers. Not so in other provinces.

They should really means test that tax deferral program. I would go out on a limb and say that the vast majority have absolutely no need for it.

That’s the kind of lot I’m on too, and it’s a great size. But I also wouldn’t say no to a 10,000 square-foot lot — more space for trees, gardening, and kids to run around. (I’m weird and actually enjoy mowing the lawn.) And even though I wouldn’t build a garden suite, having a large lot ideally suited for one doesn’t hurt resale value one bit.

I think as subdividing, duplex- and garden suite-building increases in the core in the future, and as all the new communities in the West Shore are building smaller lots than those found in the core, a segment of buyers will pay an ever-growing premium for medium-to-large lots with one SFH on them — a.k.a. what everyone had in the good old days, but what everyone can’t have today.

TIL you can’t move your mortgage from one lender to another if you’ve deferred your property taxes.

As expenses rise, more homeowners embrace program that defers payment of property taxes

https://www.timescolonist.com/local-news/as-expenses-rise-more-homeowners-embrace-property-tax-deferral-plan-5092181

One thing that I dicouvered while renting a condo in the Songhees is that a lot of old people dont sleep a lot and also that they are either a lot or somewhat deaf. The TVs would blare into three oclock in the morning.

Why? Service cavities make plumbing and wiring much faster than stick frame.

Well there are mass timber structures being built locally, so someone is figuring it out. I don’t really get it because they come from the factory (in BC no less) CNC machined and ready to go. Hard to get any easier than that.

Lol Marko. You’re on the right side of density/location and the wrong side of embodied and operational impact. Lots of studies showing how much room for improvement there is from an operational and embodied footprint. Also, is there gas in your building? No idea how common it is, but when I was in your neck of the woods, gas was rolled into the strata fees. I also got to spend some quality time in Vancouver over the summer (in a glass tower) getting absolutely baked out of the unit every afternoon as the sun swung around.

Could be. StructureLam seems to be doing a booming business so they’re going somewhere.

If you’d like to know what 2800 to 4000 square foot lots in an old residential neighborhood can look like with sidewalks, boulevards with trees google 1900 block Napier in Vancouver. Not much different looking (probably better) than much of James Bay area.

Townhouses make more economic sense for everyone. The developer gets slightly more density while providing a more affordable housing option. I am curious to see how many townhomes will have suites moving forward. There is a 9 unit townhome project going up on Nelson street in Esquimalt that is all ICF construction. A concrete party wall between all the units. I am sure an extra cost and time delay to the developer. Be interesting to see if the units command a higher price with the superior sound and fire protection. Or will the customers just a look at the quartz countertops and not worry past finishes.

One thing about townhouses here, shared walls/noise aside, is the strata fees. Why almost all of them here are strata? Why can’t we have more “freehold” townhouses like in Ont and other provinces?

I think that issue will dissipate. Townhouses will probably take over from detached as the main housing for families.

From a societal perspective, sure, but people take issue with shared walls.

Surprised there’s nothing in the budget. NDP being quite fiscally conservative

Like these units in Sidney would be better off as townhouses.

I think lack of expertise is a major barrier, that is why the Tresah developer ended up being switched from CLT to concrete.

Maybe investing in trades scholarships/bursaries/etc., would be a better way to go.

I’m rubbing my crystal ball, and predicting bc gov subsidies for CLT construction. As others have said builders need an incentive to use it.

That is interesting because my neighbors are losing sleep over the future density 🙂

Other than work I walk everywhere I want to go. Obviously not close to a mall but other than an attached grocery store I visit a mall once every two years. The cool thing is you can walk right along the water in three directions (Esquimalt, Downtown, Mayfair). Tennis is my fav sport to play and I walk along the water to tennis courts that are pretty much on the water (Barnard Park). I think the biggest plus for me is you are close to downtown, but it is quiet at night. As for coffee you have Boom & Batten (not just a restaurant), Starbucks, Caffe Fantastico, etc. Will get better in next 10 yrs.

I know this sounds crazy but I think Vic West still has upside and people don’t really see it. The Dockside masterplan is very nice and they are already well along on the first three towers. The next set of towers will incorporate some nice public spaces. Roundhouse in the next 5 to 10 years hopefully starts rolling and that will bring in more commercial. The City of Victoria is throwing useless money at the area like the new Songhees Park. While a complete waste of money, will be very nice.

Just got my BC Hydro Bill…I live in a one of those horribly inefficient bad for the environment glass towers 🙂

“Your bill for …………, VICTORIA BC V9A 0H1 is ready.

Your bill amount of $41.31 is due by Mar 14, 2022.”

The GCs in town have no clue how to build with CLT and the concrete core causes issues with scheduling that they have never had to deal with. Overall, there is no experience and a big financial risk.

Builders are in the business of making money, thus height and they will use which ever materials that generate the greatest return of investment.

As for Cross Laminate Timber, cost of plumbing and electrial wirrings/receptacles finishing would kill a builder profit.

No technical reason you can’t substitute concrete with CLT and use a decent envelope. It’s possible to cut way down on both the embodied and operational loads with today’s technology. The developers may groan and complain but these are buildings that are going to be with us for 100+ years with no good future retrofit option. I’m all for density and towers, but it would be even better if they took the initiative to tick all the boxes. Nice to see a few of them popping up in Victoria/Vancouver.

I remember when we first were looking for a house to buy I was really fixated on a large lot. I was looking for those places with 10,000sqft+ But there wasn’t really any rationale behind it. Now we’re on 6000sqft and if it was 10k it would have zero or negative value for me unless it came with some kind of development potential. Just more maintenance.

Small lots don’t bother me. Probably better to turn those into townhouses though. Silly to cram houses on small lots together when the space between them is an entirely useless dark valley. Might as well use that space for more living area

No city lot is an acreage. If you want one of those move out of the city.

The trees can go on the street side to make the neighborhood look nice.

Yeah I think once the towers get too large you start to get into problems with a lot of embodied energy and emissions from the steel and concrete. About 6 floors is ideal from a density and minimum embodied carbon perspective. But I don’t know if that factors in the counterfactual of 6 floors plus another 6 floors of people needing to live somewhere else

$1.275 million. Purchased 14 months ago for $730k+GST.

Could someone share what 232 Caspian Dr just sold or? Thanks!

Marko- curious what’s it like living in the Roudhouse District- I know it’s not far to walk downtown or over to the Save-On-Foods, but the area feels really lacking in services (coffee shops) and just general vibrancy for such a high number of units nearby. Always feels dead when I go through the area on foot or by bike. Busiest place by far in the neighbourhood is the skateboard park.

What’s it like living there? Do you actually end up walking places, or do you end up driving everywhere?

Towers ever better 🙂 Dockside + Roundhouse can accomodate 20 towers x 150 units each = 3000 units with no new roads to build, no trees to cut, groceries and everything else is walkable, etc.

In the core of a 2.4 million population metro.

Meet the new Vancouver, same as the old Vancouver. Just a lot smaller.

“True, but let’s talk about space. The lots of today, like in Royal Bay, for example, are 3500 square feet — half the size of lots in established neighbourhoods.”

That’s just the compact lots on Caspian St. They’re essentially detached townhouses that appeal to some people. Most Royal Bay lots are at least 4,500ft2 with plenty bigger than that.

From an environmental perspective this is exactly what you want.

13500 sqft lots (north oak bay) certainly allow more trees, but they also make for unwalkable neighbourhoods, as well as a lots of fertilizer, pesticide and ride on mowers. Honestly sounds like you still want to live in Calgary.

I had to sell a few homes on Bear Mountain recently and some of the streets that are 10-12 years old really starting to look appealing as the boulevard trees grow and mature. For example, I remember Players Drive in 2010 looked like crap but now with the trees somewhat grown it looks quite nice.

Here is google streetview from a few years ago -> https://goo.gl/maps/nfy1CWaSnqSWpDvb7

Looks even better now.

“True, but let’s talk about space. The lots of today, like in Royal Bay, for example, are 3500 square feet — half the size of lots in established neighbourhoods.”

3500 doesn’t seem too bad. A typical lot in the City of Vancouver is only 4,000 square feet.

There was a lot of shade with Danbrook One from poaching materials from RJC to poor engineering and overall design. EGBC should really drop the hammer down on this one as it is not good for the profession overall. The City of Langford should not be responsible for this mess.

True, but let’s talk about space. The lots of today, like in Royal Bay, for example, are 3500 square feet — half the size of lots in established neighbourhoods. No number of future mature trees is going to enlarge your postage-stamp-size lot.

IMO the axes are labelled reasonably well enough and extra labelling would be more visual noise and space than it’s worth.

Looking at the 2 charts that Leo produced:

The first one is titled “Vacancy rate and rent change in Greater Victoria”. The y-axis has numbers with a % after them, so it would be the percentage change for both of the data. The x-axis has a bunch of numbers in a row, starting with 1990 and ending with 2021. I imagine that the vast majority of people would properly interpret those as years, especially since “change” based charts often operate over a period of time along an x-axis. Granted, a “years” label wouldn’t be too obtrusive here, since we scroll websites vertically.

The second one has a title of “Greater Victoria Daily New Listings and Sales”. The y-axis has no units, but the title of the chart speaks to discrete items (listings and sales). The x-axis again is a time based measure with months denoted. The only change I could see being worth the extra space is specifying that the x-axis denotes the start of each month, so a reader doesn’t take “Jun 01” to mean “June 2001”. But the context of the surrounding paragraph speaks to the present, which helps to alleviate that ambiguity.

However, the second chart does need a legend for the data (which color is new listings and which sales). But that’s a legend, not an axis label.

Nor should they. Not their job to verify engineering work. Danbrook One was an engineering failure, that’s pretty much the end of the story.

I know everyone loves to hate on Langford, but honestly driving around there are some pretty nice missing middle type developments with stacked townhouses and neighbourhoods that did a good job of preserving some of the natural environment too. Yeah I think they should focus less on car centric design and put more effort into pedestrian/active transport infrastructure, but they are doing a lot of things right. I think people forget that the established neighbourhoods in Victoria didn’t look nice when they were put in. The mature trees are there now, but at the beginning it was mostly just flattened lots too.

Seems to be only about 230 SFH in greater Victoria (and yes I include Sidney, About 18 f them under 2 mil.

Not sure how much this had to do with Langford. It doesn’t matter which municipality I’ve worked in when you bring in materials stamped by an engineer the city staff just immediately accept it. From my experience they aren’t questioning engineering work/calculations.

I also don’t believe staff in any municipality are running background checks on the engineers to make sure they have experience in whatever they’ve designed. Investigation on the Danbrook discovered the engineer previously designed 5 story wood-framed buildings and 2 story concrete buildings so he was in fact a structural engineer (not a fake or electrical engineer, for example), but just with limited experience on high-rise concrete.

Could it be the impact of the unsafe high rise building in Langford so they now take extra time to inspect before issuing move-in permit?

We need more housing, but Langford building permission style of everything goes and go fast may be a bit on the dangerous side, especially on high rises. Danger on lives aside, it would be much cheaper to spend time to properly inspect the plan before giving building permit than moving people out and repair it afterwards.

Full Duplex in Moncton for $495,000.00.

This is one of the more expensive ones for sale. (You can still get a full duplex for under $200,000.00 in Moncton)

Downtown Moncton, Resurgo Place (Museum), Universite de Moncton, COSTCO, 2 Hospitals, Super Store, Champlain Mall & Highways.

Prices in Moncton exploded 30% last year. Rents have jumped as well.

People are flooding into Moncton from Toronto and Montreal.

Still incredibly cheap by BC standards. (Still incredibly cold by BC standards:)

Not my choice of places to live but millions of people still make eastern Canada their home.

If this won’t convince him, nothing will.

Leo, your charts are always great but you need to label your axes. Unless someone has followed your blog for years, there is no way to know what the red and blue lines relate to.

1290 Camrose… ouch. Nicely updated but 1.51M? 2022 assessed at 923k. Absolute insanity.