Sluggish September

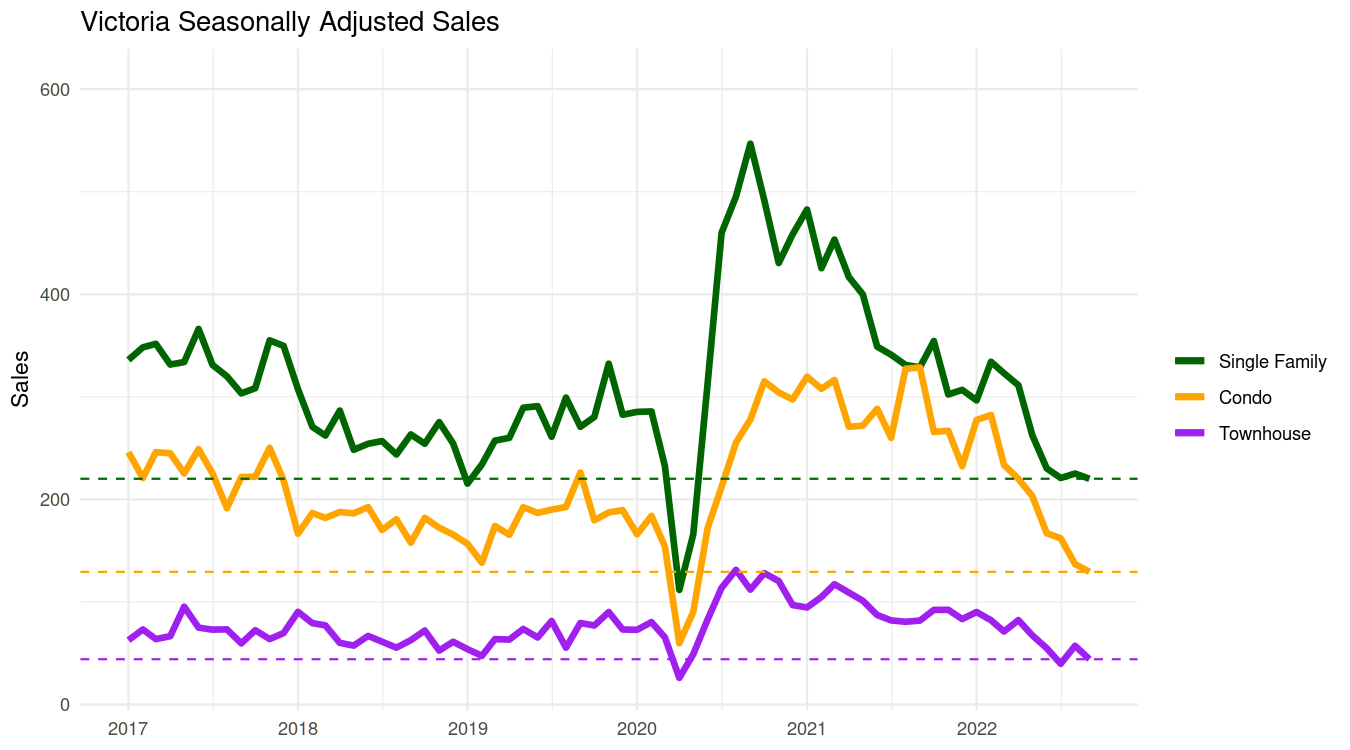

After fleeting signs of life in August, sales in September drifted downwards again across all property types. The month ended with detached sales down 32%, townhouses down 49%, and condos down 62% from a year ago.

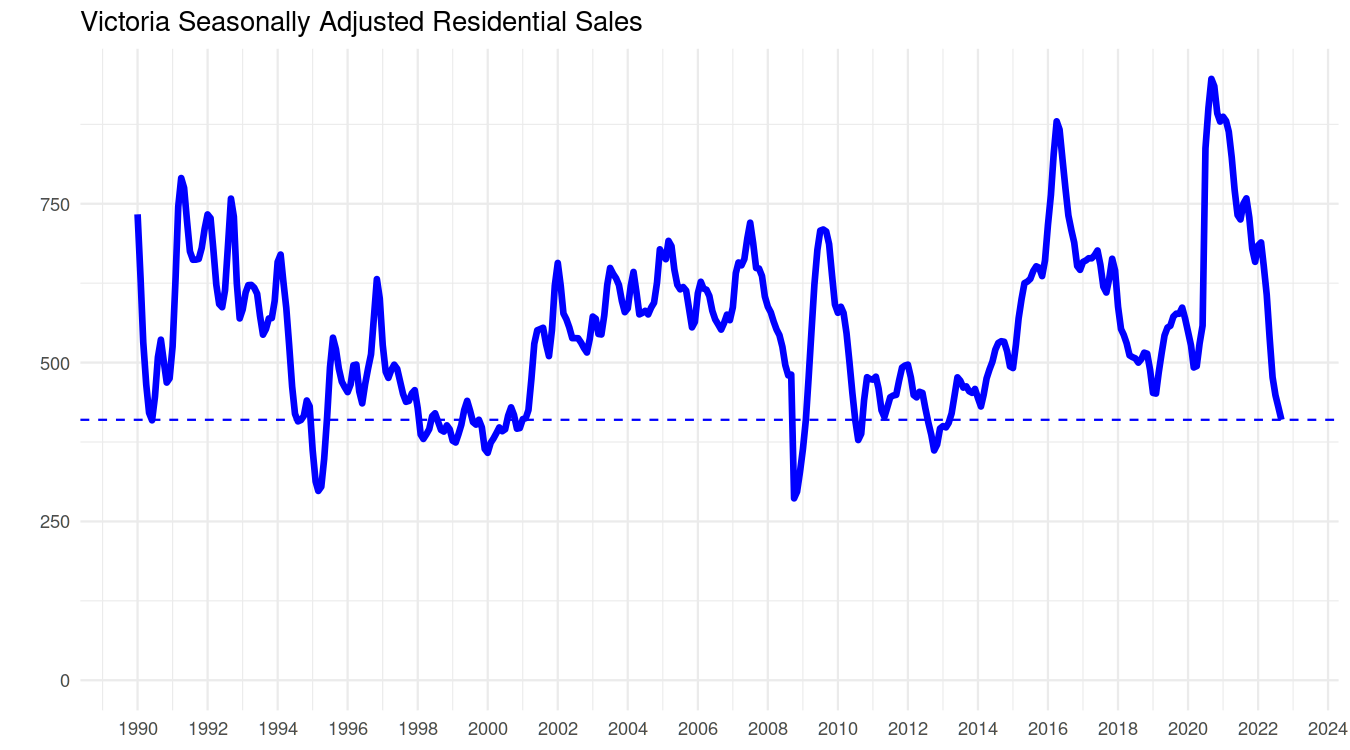

While we’ve had the occasional short periods since 1990 where the market was even slower, those periods are few and far between.

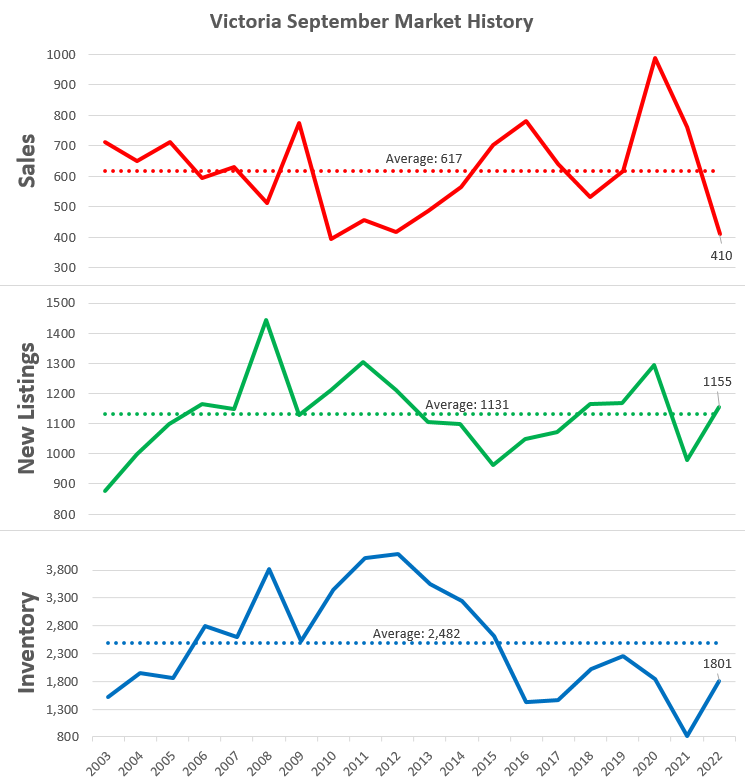

As a whole, the September sales of 410 are the second lowest in the last 20 years, beaten only by 2010’s reading of 395 sales. New listings are average, and while they have rebounded from last year, there is no indication that there are substantial numbers of distressed sellers putting their properties on the market. Inventory too has more than doubled from last year but remains 27% below the long run average.

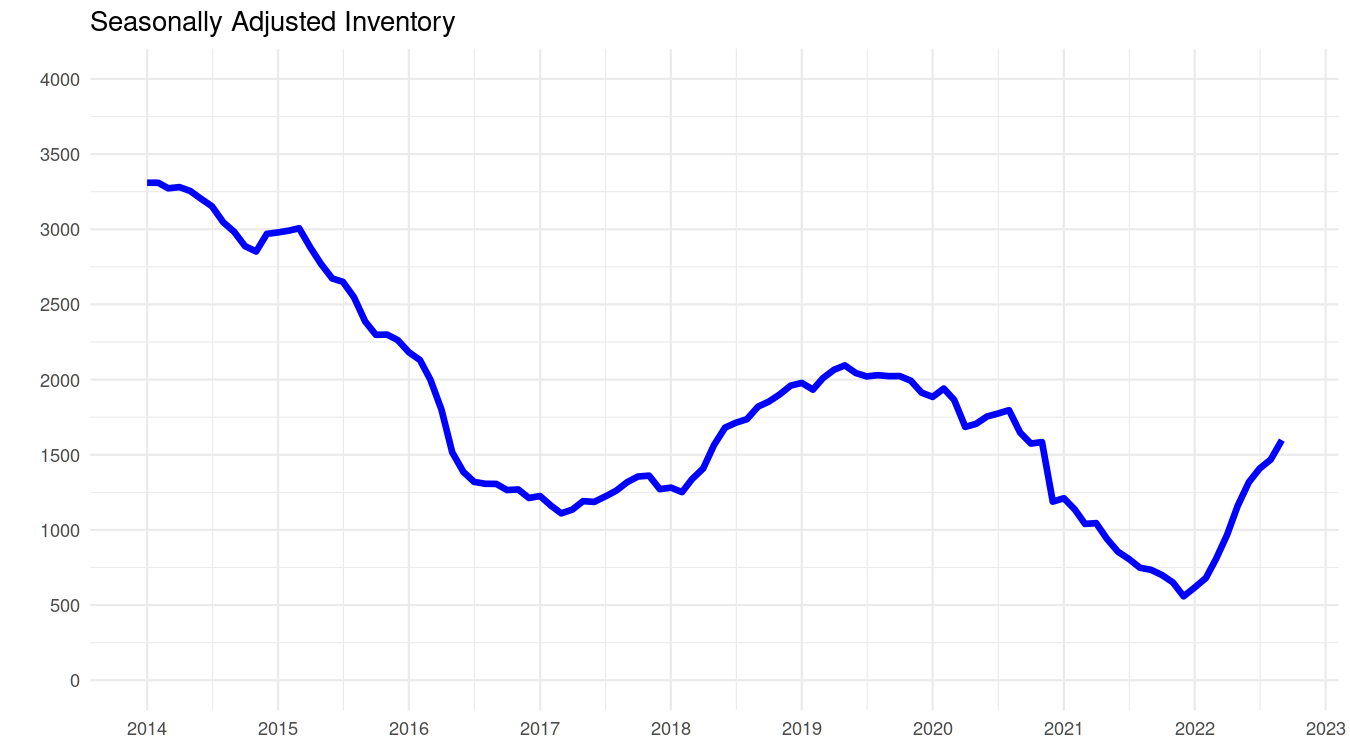

Inventory moved up solidly in September. Generally after October is the time of year when absolute inventory levels start dropping, but the seasonally adjusted numbers will tell us if the trend remains towards cooling or not.

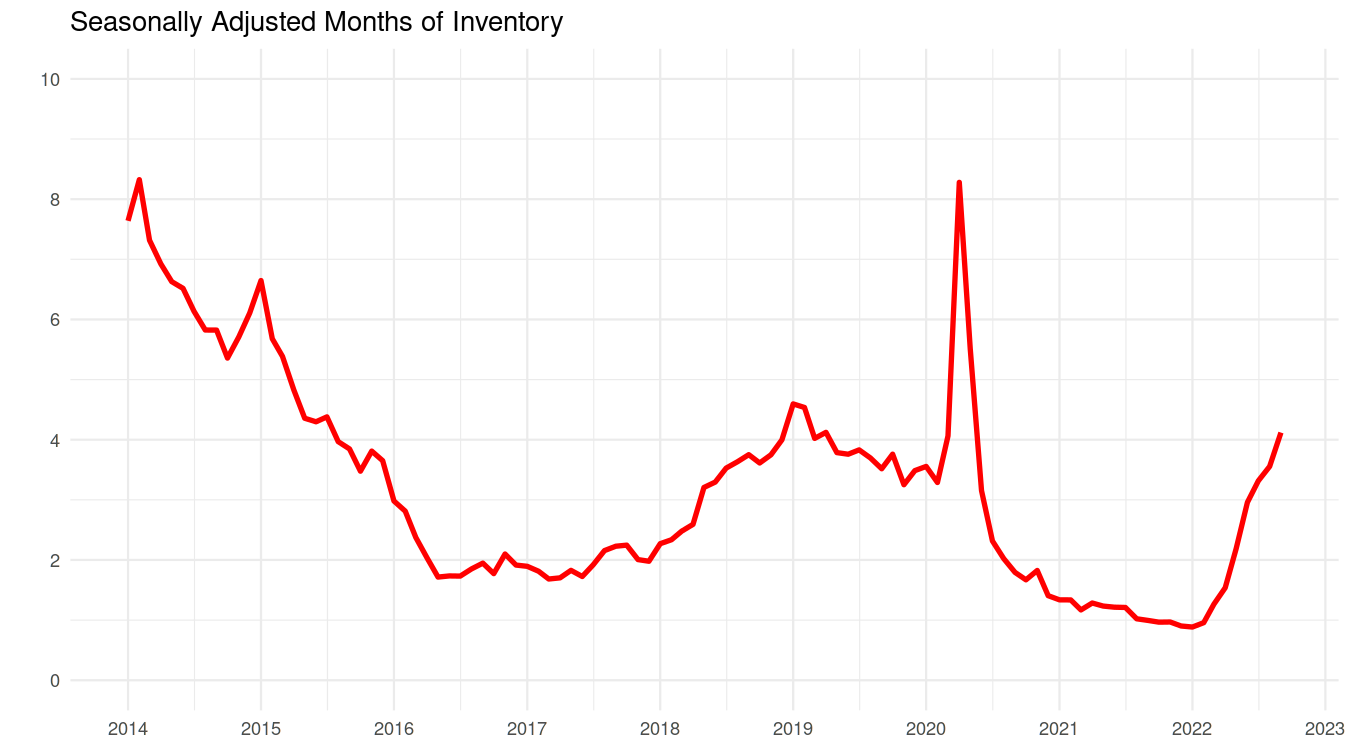

Months of inventory also resumed a more rapid rise after some slowing in August. However 10 years ago we were at double these levels despite our rapid cooldown in the year to date. As mentioned previously, until we get to levels that traditionally indicate a buyers market (over 6), we need continued relatively rapid increases in this measure to keep prices trending downward.

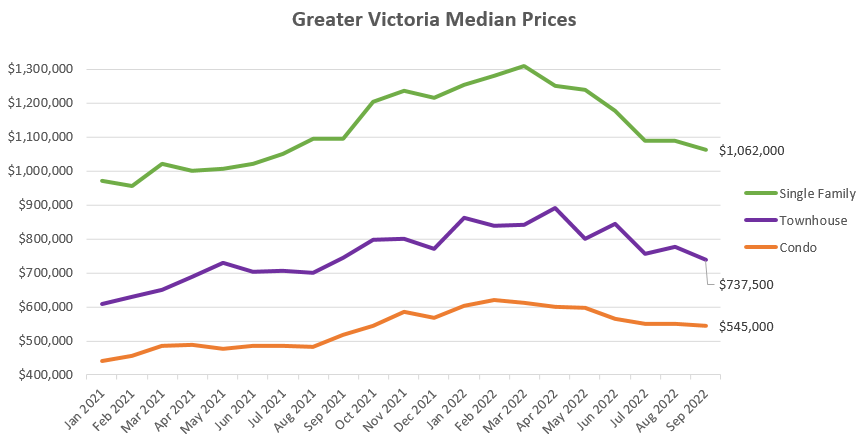

Speaking of prices, they were relatively stable in September, drifting slightly downwards in every property type.

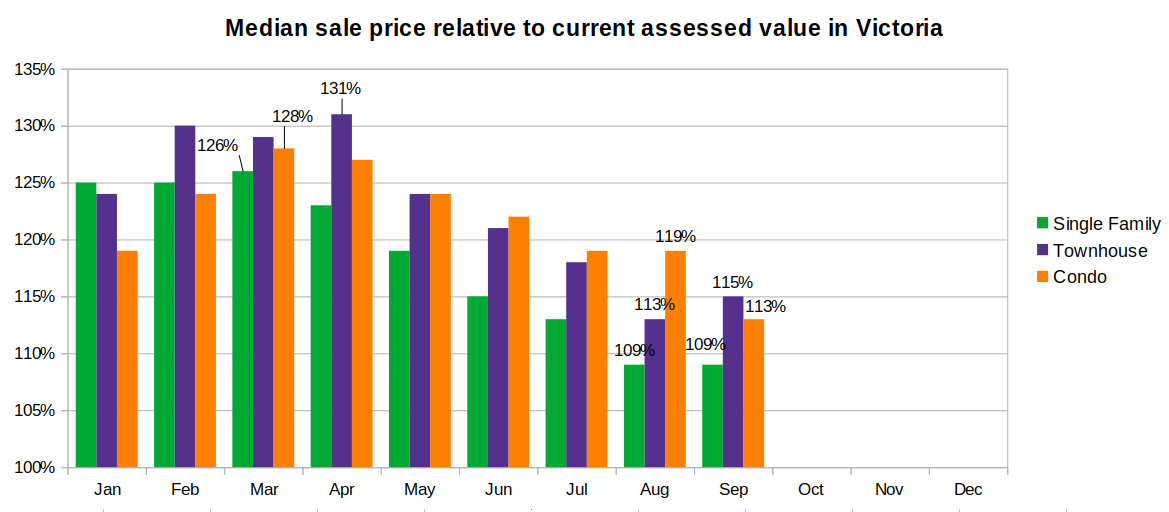

On a sales to assessment basis, condo prices made up for August’s relative stability by posting a large drop, ending the month with the median sale at 13% above its assessed value and catching up with the ground oriented housing types. Meanwhile detached and townhomes were stable with townhouses even posting a small increase. Note however that there were very few townhouse sales which makes this reading noisier than the other two.

Last month I thought that we may be getting close to a level of support for houses and townhouses, and though we may see more price weakness as variable rates continue to rise, I didn’t expect that we would match the pace of decline that we’ve seen so far. So far that is the case in September, with both sales and prices relatively stable in those two market segments while condos continued to weaken.

It’s a little unclear what the impact of future variable rate hikes will be if fixed rates don’t rise in concert, as borrowers could return to their preferred fixed terms without a rate penalty. Concern over the rate trajectory keeps increasing, with the latest objector being the UN calling for a pause to rate increases to avoid a deep global recession. The problem is that we have no evidence that central banks can tame inflation without a recession, so this is a warning unlikely to be heeded. The waters are uncharted but we are full steam ahead anyway.

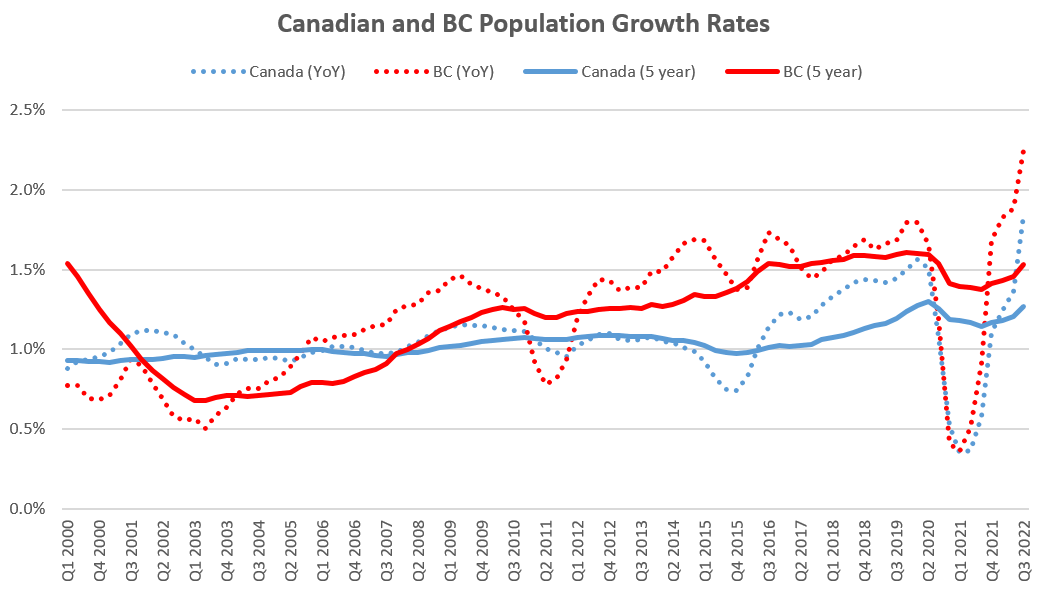

Meanwhile strong population growth has been in the news lately, but it’s worth remembering that this is just catching up from slow growth during the pandemic. Granted pre-pandemic growth levels were 20 year highs so this is a strong showing. It will be interesting to see if long run growth stays elevated or if economic slowdown and strained affordability will push more people into lower priced provinces going forward.

Don’t have a particular price point but rather looking at cashflow profiles. Up and down suited on 6000sqft plus lot is what I am targeting.

Absolutely. Why would anyone list a property that has a sub-2% mortgage rate, is currently being rented and covering all costs plus and subsidizing other rentals and/or a primary and will knock thousands more off the principle before a renewal is necessary years from now?

Sending thoughts and prayers fellas 😉

What’s the price point you’re looking for? For example, if prices drop 15% from here by Feb 2023, are you buying?

Seeing every other house on the block for sale will motivate sellers to drop their prices. Right now most sellers are still in the mindset that the correction will be mild and prices will rise in the long term (which I agree) so that’s why I think there aren’t many motivated sellers dramatically slashing prices. This the reason why I feel Feb 2023 to possibly be a time where there are decent deals to be had as far as investments go.

Learn something new every day, thanks Marko.

You should go buy as much RE as you can as soon as you can!

If a family’s mortgage comes due at a higher rate, what alternative do they have other than absorb the higher payments? Putting their house up for sale creates another problem, where are they going to live? Unless they move to a different, more affordable part of the country, they’re stuck trying to find a place to rent that simply doesn’t exist. Only an exodus from B.C. will improve the current housing shortage. I don’t foresee that happening any time soon.

I feel like the real question is whether that inventory even matters. There’s this saying that crops up from time to time here that the prices are set on the margins. I don’t know that the inventory of people trading houses really matters all that much. We’re already seeing price drops at low inventory levels (normally a sellers market), I think it would be much greater if it gets back to normal levels.

I wonder if very low 5 year fixed rates that a decent portion of owners have are holding back some inventory? If you have 2,3, or 4 years left on a 5 year fixed at 2% for example, psychologically, you will have a tough time letting it go to replace it with a 5%er.

Except the factor isn’t x3 but x4. We’ve had one business week with three to follow plus the 31st is a Monday which is also good for 20-25 sales.

Still yet to see anything that makes investment sense yet, there is a suited house in gordon head listed under $1M although it is beat up. https://www.realtor.ca/real-estate/24922353/1641-alderwood-st-saanich-lambrick-park

Per Leo’s comment above, October sales so far x3 is within spitting distance of October 2008..

From: https://financialpost.com/executive/executive-summary/posthaste-even-bigger-home-price-drops-seen-looming-as-interest-rate-forecasts-rise

So continuing with a sluggish October Definitely seeing the same houses hanging around I would imagine that we will see the big uptick in inventory in the spring market wouldn’t be surprised if it starts in January

Quite a resourceful couple. Building a boat from plastic bottles and recycle bins and it’s seaworthy enough to get them to Campbell river.

The disgusting part of the story were the “ intoxicated teens inciting violence against the homeless population.” How about the police arrest these teens, and they get sentenced to do some community service?

Way to trivialize.

We all owe our existence to the desire of our ancestors to procreate even in circumstances less than ideal.

Most people incorporate because they’re starting a business, planning to employ people. Society benefits from this, and encourages it. Regarding your idea to incorporate just so you can get personal use out of company assets; forget about it, the tax rules discourage that in many ways, and you’d end up spending more in accounting and paperwork than you get out.

You want me to acknowledge the privilege that some people get of “one hour of free parking at the airport”? Is this a joke?

The article doesn’t mention either issue, though it is always possible those are present in the background. Which could explain why these seemingly pretty resourceful folks can’t get ahead and are stuck in a situation far less than ideal.

And they’re having a baby!

I think they should also get a dog.

Yes. These individuals have many complex issues. I would suggest it is less about housing and more about how we support those with mental illnesses and addictions.

I feel very ambivalent about this:

Unable to find housing, couple takes to the ocean

https://www.timescolonist.com/local-news/unable-to-find-housing-couple-takes-to-the-ocean-5936222

In order not to pay any income taxes your income less deductions must be under about 13k per year for each spouse. Also, we don’t have a tax code in Canada. The US has this. We have the Income Tax Act.

Investment and dividend income in Canada are both taxed unless the investment is in a TFSA.

You are in an unusual category in that you appear to have a small mortgage, rental income, and a large TFSA while still having young children and therefore likely receive the max child tax benefit, earned income benefit and GST benefit.

Your question as to fairness is interesting.

In order to reach this category you have, most likely, paid taxes on the revenue used to invest in the house and TFSA (unless you inherited the funds) and you also live very modestly – with any monthly shortfalls likely being met through the child tax credit and TFSA withdrawals. You may also have a suite in your home which you may claim deductions from rental income for.

I’m not sure if this is unfair. I suspect you are good at planning and living modestly and an outlier in general as most people do not reach this stage while benefiting from child tax and dependent credits. You may have also immigrated to Canada with funds in hand.

Are you incorporated? If so, your corporation will be paying income tax and you will be paying taxes on any funds you withdraw from the corporation. If you have no corporation your earned income is extremely low. By not contributing to CPP you are not going to receive much in retirement from CPP. You will need to plan for this.

No one can predict macro economics. The only way you can protect yourself from an investment point of view is to buy assets that provides value and some buffer. In RE that comes down to cashflow and cap rates and whether those provide enough of a buffer against either downside volatility in rent and upside volatility in cost of capital.

Monday numbers:

Sales: 115 (down 43%)

New lists: 318 (up 21%)

Inventory: 2270 (up 101%)

new post tonight

I was thinking about what happens if boc raises but bonds don’t, but I think it’s not really possible. Supply and demand pressures won’t let the overnight rate get too far away

5 year CAD bond yield touched a 52 week high this morning. No one knows where the market is going, yet many are saying rates have already peaked this cycle

But Patrick isn’t the tax you described RBC’s obligation? I think graber was talking about their own tax obligation?

I think it’s disingenuous to suggest that the system doesn’t favour those who already have wealth in a number of ways including by reducing their tax obligations via – for example incorporation. Can’t I incorporate and have my corporation own a bunch of stuff that I use that if it were taken out via labour and taxed would net me less? Doesn’t take a rocket scientist to see how this benefits those with more money to begin with.

My dad who is very working class and wore a uniform to work every day was shocked to find out the executive class parking at the airport was free for the first hour (pretty expensive elsewhere). I think there are small benefits like this everywhere and denying them is…not cool.

I had no source deducted income. Am a private contractor.

No need to malign sex workers. Almost everyone sells their time and body.

“The previous year, I paid $200

Did you get a refund of all your source deducted taxes too?

my labour based income is indeed very low. What can I say, not sure how my financial managers pull it off but this year I paid 0 taxes though I declared everything including rental income of course. I suppose some may say I live off little but what I see is that I’m living a fair bit better than many if not most people I see around me. I certainly live considerably better than where I relied on labour-based revenue. I own my home with a small mortgage and benefit from writing off a number of expenses of course. The previous year, I paid $200 and I expect I may owe a touch more this coming tax year. I assure you I have no interest in ’embellishing’ my situation. TBH, I feel a little embarrassed to be so clearly benefitting from what I see as a fundamentally flawed system, as exemplified by my own personal situation. I think Patrick’s post is probably more to the point but this avoidance of ‘double taxation’ leads to a situation like mine that, to my estimation, is not in the broader community’s benefit.

The tax code is not structured this way. Passive income is taxed as regular income (up to 53% in BC, depending on total income).

Eligible Dividend income has already had corporate tax paid on it, so the tax credits you for the tax the company already paid, and charges you the difference. Many people with incorporated businesses are well aware of this. And the system is designed to prevent double taxation of Canadian corporate income (via dividends), while insuring that the government ends up getting about the same total taxes as if an individual had earned that dividend as income.

The dividend system actually works quite well. In the case of you receiving $73k dividend income from RBC shares, rests assured that this represents $100k of income that RBC made. And they have already paid $27k tax on it. So if that $73k is your only income, you won’t likely have to pay any tax on it. Since RBC has already paid $27k tax on it. But if you do have lots of other income. you’ll end up paying about $26k tax on it, which brings the total the government receives to wok+26k=$53k which is the marginal tax rate in BC.

The principal at work here is avoiding “double taxation” not your stated principle of “reducing your tax liability to zero”.

There seem to be some contradictions in what you’re saying. I’m aware that you can receive dividend income and not pay net taxes but the dividends you receive are actually grossed up and added to your other income to get taxable income and then a tax credit it applied. So I don’t see how you could be officially regarded as below poverty level, unless the taxable income is actually that low, which is not much to live on.

Happy Thanksgiving everyone.

I think one of the main issues is the preferential treatment of wealth generated income vs. labour generated income. In my case, my income is officially extremely low (poverty category) even though I live a nice life, go out frequently and own a nice home. Nothing too lavish but certainly better than most. I pay no taxes federal or provincial taxes. We all know that many dividends and capital gains are preferentially taxed. In my case, that means I’m elegible for almost the top rate in child benefit for instance. When the Fraser Institute released its findings re. taxes, I wonder if they used Rev Can sources for income. If they did, I would be slotted as someone with an extremely low salary who therefore pays no taxes. Not one of the upper quintiles, that’s for sure. Truth is that I am fortunate to be in the top 10%. The problems is often not income inequality but wealth inequality. To be clear, I make a point of declaring all sources of income. On this blog, we tend to conflate passive income with rental derived income. For me, as I suspect for many, my principal source of passive income is investments and the tax code is structured so as to reduce to nothing my tax liability. It makes no sense that I pay nothing while someone on minimum wage pays something. So if we are engaging in a discussion about fairness in taxes, I would ask: does it seem fair that I not only pay not income tax but receive maximum benefits as an official poverty line individual even though I never worry about food, money for my kid’s education, energy costs, housing costs and can even save up for an occasional trip abroad?

‘Most’ people are coin operated, even so called professionals. Human nature. Pretty simple concept.

On that note, happy thanksgiving

For some people it’s all about the money. They are called prostitutes.

So, If you’re going to treat me like a whore then you’re going to pay me like one too.

It’s always about money, even though people like to pretend it’s not.

So why is the bcgeu so pissed off about 11-12% over three years? Shouldn’t they be satisfied with helping the people of BC and reasonable working conditions?

Marko, paying a person more doesn’t mean that their job has gotten better. The same nobs to deal with on a daily basis and possibility of getting hurt are exactly the same.

Both governments and corporations have to work within a budget. If these bodies pay people more then these employees have to cut expenses. And the first place they cut is the number of employees. So you have actually made the work environment worse as less employed means those that are left have to work more hours. Then you will see the number of sick days increase and a higher turn over of employees as they leave for less paying jobs that are less stressful.

If one is not suitable for these vocations, the money isn’t going to keep them. They will be moving on within the first few years. If you don’t like what you are doing – then quit and find something else because you are never going to be happy.

Marko brings up a interesting question about homes that are tear downs. As most people purchasing a lot to build on in the core will have an older home of nominal value on the site. Those improvements intuitively still have a value associated to them. It boils down to what is or what is not a tear down. If the home is habitable and can be re-conditioned at a reasonable cost to provide a rental income then it is not necessarily a tear down as it adds value to the property. The home still has economic value.

However if it can not be re-conditioned , at a reasonable cost, then these improvements are suppressing the underlying land value. When that happens you will pay less for a site improved with a home than if the site were vacant and ready to build on.

This is a problem in Oak Bay and Victoria where there are so many old and small homes on expensive lots where the improvements only add nominal value to the property as a whole, yet some people chose to re-condition the existing improvements while others see them as tear downs. To a person wanting to re-condition the home the improvements still have value of say 30 percent of their replacement costs while the other sees the improvements at only 5 or ten percent of the replacement value.

How I look at which is what is by asking yourself will a lender grant a 30 year mortgage on the property as it is now. Or is the condition of the improvement so bad that a lender will pass on financing the property as the improvements do not meet their minimum lending guidelines. The same improvement could then suffer either 70 percent depreciation or 90 percent and more and thereby suppressing the land value as it is not a viable candidate for reconditioning. In the latter case you would have to buy the property at its vacant land price less the cost to demolish. One still might purchase the property but then have to hold the property until market conditions are more favorable and it becomes economically feasible to redevelop the site and make a profit.

Someone buying the property for their own use and wanting to build would not be constrained by a profit motive.

When it comes to what is or is not a tear down sometimes comes down to a flip of a coin.

I’ve been driving an EV for 7 years and never plan to buy a gas car again and live in a place heated by an electric heatpump but 100% agreed. Just look at Germany’s brilliant energy strategy. Now an off the rails dictator threatening nuclear weapons has them by the balls.

Pump natural gas and oil, sell it for a profit, and buy everyone EVs and develop other clean energy with the profits.

lol, right. I worked in ICU at Jubilee and General for four years and money was definitively a huge factor for the majority of people. People don’t work 12 hr Saturday nightshifts having to roll overweight patients throwing their back out because they love helping people so much. Personally, I 100% left my healthcare job because of financial compensation, not going to lie.

I am sure police officers absolutely love getting recorded by noobs every 2 minutes and getting shot at. People go into policing because after 4 years they are close to 100k with benefits for their family, vacation, sick pay, and pension.

In my opinion, part of the problem is we as a society have decided we need more real estate agents and policy analysts than nurses and here we are. Emergency rooms can’t stay open.

Given a huge percentage of HHV readership have flex days I’ll refrain from commenting 🙂

That being said, in the last 24 months I’ve changed my opinion 180 degrees on government employee compensation. Whether government employees are productive, or not, I am pro better compensation. The more the better. It supports rental prices and real estate prices. Anti-development city with a huge population of government and union employees with wage increases coming can only send rents in one direction long term.

Barrister, for a two storey home (bedrooms on the top floor) including allowances for site improvements such as decks, garage, landscaping the cost is about $300 a square foot. Developers profit which includes real estate fees is about 25%.

There is going to be variation if you alter the plans say by upgrading to a double garage, or quality of finishing. It will also vary by the contractor’s reputation and availability. But given the limitations of your question this should suffice.

2,000 sq. ft. @ $300 per sq. ft. = $600,000

less developers profit ($150,000)

Hard costs are about $450,000

This will vary depending on the municipality as the development cost charges paid to the cities are different. But for illustration purposes this would be the approximate costs.

Some of those reading this might disagree as they have had estimates to build a 600 square foot granny suite for around the same price. But that granny suite still has the most expensive items such as kitchen and bathrooms included as well as development cost charges. Once you have met those initial costs then you are just adding open space such as a bigger living room or a family room. Those rooms cost far less to build than kitchens and bathrooms.

There is an economy of scale when building. Assuming all other things being equal, the bigger the home the lower the price per square foot. A 2,000 square foot home may cost $600,000 to build but a 4,000 square foot home might be $1,000,000. Doubling the size of the home does not double the costs.

Maybe in Langford. If starting with a teardown going to be a lot higher than $300 per sq.ft in COV and Saanich.

The problem I see going forward is interest rates for construction are variable and very expensive now. 7-8% for builders and developers is a lot of money to pay to wait months on end for permits which will compound the huge drop in housing starts, in my opinion. Once the rates and market stabilize everyone will scratch their heads as to why inventory is so low. The COV and Saanich should do what Langford did during the 2009 crash -> https://canada.constructconnect.com/dcn/news/government/2009/02/langford-reduces-taxes-and-waives-permit-fees-to-attract-developers-dcn032740w

and pump out permits in less than 30 days, but obviously that is a pipedream as that would require some common sense.

Just think about it if you are a small builder with $400k cash and you buy a $800k teardown. If you are waiting 9 months for a permit (when it should take 1 month or less) you are paying 8 months at 8% at 400k for bureaucracy.

I’ll say it for the 100th time. We might solve the politics on housing, but we will never solve the bureaucracy.

I’m out of the loop, but I suspect the floor has got to be at or near $300/sq.ft.

Excluding land what does it cost to build a modest two thousand square foot house in Victoria (GVA)? Cost minus profit to the developer.

Read better. Flex days aren’t extra days off. 35 per week is still a 35 hour week regardless. You can’t work 35 hours in 2.5 days, which is clearly stated in the “contract” you “read”. You’d also see that people start with 15 days leave, but go off.

Paying nurses, police, firefighters or a social workers more, doesn’t solve the problem. Most of them did not go into those professions for the money. What they want is a more balanced life style. Money is not the best way to motivate people. At a certain point of meeting financial obligations and saving needs, making more money doesn’t make you happier or better at your job. Actually I would say that money is a piss poor motivator for most people and can be the cause of unhappiness for some as they spend more to self medicate themselves. There is a reason why some of the highest paid people are addicted to drugs.

If their pay was half but there was twice as many doing these jobs then they would have a less stressful working life.

Many BCers use fossil fuels to heat their homes and power their cars. But they draw the line at allowing other people to do so.

Hahaha, well of course that was never going to be a popular view!

I think you lost a lot of people with that.

Hey what a great idea. We could call it Coastal Gaslink or something like that. Did you have too much to drink at the Danielle Smith victory party or something?

So maybe it was just the last time he got a raise? Well that broadens the field a bit, after all we know that most unfilled positions are in the sub $20/hr range. But I wouldn’t want to live on 3 1/2 days a week pay at that wage.

Patriotz : He said the last time HIS taxes went up, NOt the last time taxes rates were adjusted.

Public Servant: It isn’t what “I believe”. It’s in the union contracts for all to read. Count the days.

And I am not saying many don’t do a good job. I agree though, I most certainly wouldn’t want to be a nurse, police, firefighter or a social worker working on the streets with the drugs, alcoholism, homelessness and the mentally ill.

I do think most of those areas where we’re having problems do require significant new expenditures, particularly housing and health care. And so I agree you’re quite right to ask where the money is going to come from if not more taxes on an already heavily-taxed population.

On the housing front, for example, I suspect that way more social housing of one kind or another ie. subsidized, has to be part of the direction, and that all costs money of course. Let’s first find out what works in other countries & see if it makes sense here or why our patchwork has failed. There must be lots of resources to draw on for a plan, here’s what a 2 minute internet search showed: assets.ctfassets.net /learning from international examples of affordable housing – sorry, I don’t know how to post a live link on this site that works, my bad…

Here’s a radical idea of how to get a bunch of new resources for a new housing policy: instead of our current war on energy, let’s recognize that natural gas is a logical, reasonably clean(er) transition fuel that will be in high demand for probably decades, and let’s build some energy corridor in the north that allows our country to produce & ship the cleanest most ethically-produced fuels in probably the whole world. Instead of having countries import more energy from the likes of Saudi Arabia or Russia & instead of the embarrassing spectacle of Trudeau telling the German president who comes here hat in hand to avoid his subjects freezing in the winter, no, there’s no business case for this. Let’s develop this industry and allow it to flourish responsibly and dedicate a big slug of the new taxes this would create to housing and healthcare, and the rest to developing alternative energy. Win win.

Healthcare, well let’s maybe recognize that the slavish insistence on absolute universality isn’t helping. Maybe having some elements of healthcare means-tested for $ contributions by patients wouldn’t be the end of the world – can you imagine how many useless clinic visits would be avoided if everyone making over a certain $ threshhold had to pay some amount, even just a token $20, every time they take their kid with the sniffles to the doctor? I mean, look at the new dental plan being rolled out, it’s not universal either. Or, here’s another radical idea, why do we leave accreditation in the hands of these self-serving professional organizations instead of mandating that all foreign-trained doctors & nurses who meet an XYZ standard can compete openly for residencies and the like?

OK, so now I’ve got taxation, housing, healthcare, and resource development, I guess this means you have my basic platform if I’m elected for my one day as PM. Forgot indigenous issues, but that takes another paragraph.

Sorry for ranting

The last time income taxes went up that was only for those earning $220K+. People making less got a tax cut not long before that.

No takers for $220K+ jobs? What industry is short of such rare talent as you at that price?

It depends on what sectors of the public service. Bureaucratic paper pushers, I agree. Police, fire paramedics, doctors and nurses, forget it . You couldn’t pay me enough. The stress of their work leads to a shorter life expectancy.

@peter – there is a difference between substantive and formal fairness. As the saying goes – “from each according to ability, to each according to need”. So yeah, the fact that the top 20% pay 2/3 isn’t unfair – not to me at least.

Most of the Boomers I know think this way about the public service and also can’t believe that a person could possibly be productive while working from home.

Can’t really blame them. They were basically trained from day one to participate in an industrial workforce.

“work an average of 2.5 days per week”

Do you really believe this or is this hyperbole?

Marko, probably public servants (provincial 35hr work week), work an average of 2.5 days per week considering, flex days 52, 13 stats,104 weekends, sick leave, annual leave 20-35? days, family related (or what ever they call it), special leave, Dr. appointments, and most likely more. Not to mention “working from home so…..blogging leave?

Alright thanks for engaging with me everyone. All very good points made. Going to bow out now because I tend to get a bit compulsive with responding and it takes up a lot of mental energy for me… and not in a way that I enjoy. I need to remember that lesson for next time!

People don’t get this. Those making over 250k on average are not working 36 hr work weeks with flex Fridays.

If I was paid 200k to be a respiratory therpaist in ICU I would have never left, but I wasn’t so I left and it doesn’t surprise me health care is in crisis. If we paid GPs 3x the msp fees or 500k/year salary magically everyone would have a doctor. Money talks. Human nature.

Not that I have an important role in society anymore but yea I took a number of actions as well. I stopped offering mere postings due to taxes which makes the marketplace less competitive and I started taking more time off (which actually improved my life….should have done it sooner too).

What worries me is the specialist I might need to see one day while I am in pain taking time off because of tax reasons.

The last time my taxes went up I started taking more time off. Good deal for me I should have done it sooner.

Unfortunately it contributes to the critical short staffing in my industry.

I guess I would say: Why is it fair that the top 20% pay just as much as the top 1%? Is that fair to the top 20%?

But I see your point of view as well Peter and I don’t even entirely disagree with it. It’s a very complicated issue. Is there another way outside of more taxes to improve the areas where we are currently having problems?

Yeah they probably can, but is it fair? For 35 years of tax raises I’ve been told “it’s time to pay your fair share”, well wasn’t it “fair” quite some time ago already….when does calling it “fair” stop and just become a rationalization for “I just want what you have”.

I think in any discussion about tax fairness, you should look at society’s needs as a whole and then how the load to pay those taxes is spread out among contributors. Someone below has already explained three times that the top 20% of earners already pay 2/3 of all income tax, but that point isn’t one you seem to have taken into account much or really responded to, you just want those people to pay even more.

How do you really respond to the statement that was made about the top 20% already paying 2/3 of all income tax? Why isn’t that “fair” enough? You could just say thank you.

Well, personally, I think it’s already unfair & skewed. You sure don’t want me Prime Minister for a day – I’d go to a flat tax, we all pay exactly the same percentage of income over a basic living wage, and wipe out all tax breaks.

I used to work in a financial-related industry, and I can tell you from 35 years’ experience that the 50% or so tax threshhold is a funny thing. Above it, a lot of people who were perfectly law-abiding start giving the gov’t the finger – now, maybe you say well that’s cheating then and we should just go after them more. OK do it, but studies have shown it doesn’t much work. At about 50% people just tend to say enough is enough. I can tell you what happened to my mindset once I started getting taxed over 50%, I just stopped working so hard. I’m not somebody’s slave, and I’m not going to get up in the morning and drag myself to work earlier than anybody & stay later than anybody, sacrificing who knows what in terms of health, family etc. if my bloated, wasteful government is going to take more than half of my income, no way. No. And if folks like you insist on finding a way to take more than half of what I’ve got, trust me, I’ll find a creative and legitimate (yes, you can be creative and legitimate) way to counter it, or I’ll just gather up my marbles and leave.

Now maybe I’m just a cantankerous f#@k, but just based on what I’ve seen, an awful lot of productive people feel the same way. Enough that it starts to move the needle on what governments can actually accomplish with punitive taxes, by which I mean much over 50%, or meaningful wealth taxes.

And then these simplistic comments like if you earn passive income you must be rich enough to pay even more taxes. Sigh. From your posts, it really seems like the only people who are being appropriately taxed are the working middle class, or really basically, everyone who’s like you shouldn’t be taxed more, but everyone who has more should be taxed even more even though they already pay TWO-THIRDS of income taxes subsidizing you and everyone else. Yeah, I get it, it’s easy to see anyone better off as someone who can just pay more.

Well – I don’t think that’s fair beyond the point we’re at already. But as I live in a society where far-left leaning thinking has to be taken seriously, and where now the Liberals are as ardently socialist as the NDP ever were, well, I’ve a long time ago recognized it & learned to deal with it as what it is, and that is simply being a situation where people just want what you have and would like to just take it from you, rationalizing it any which way they choose. I’ve learned how to protect our hard-earned left-overs in this environment as best I can, and I’ve also made my own decisions as to what sort of extra tax/wealth tax ‘tipping point’ has to come before I just leave. Because that’s the other thing you’re missing here, wealth is pretty movable.

oh yeah 100% that’s what I mean by “I am not a saint” there is a lot more I could be doing if I were! And I’m also not an activist. I have these points of view but I’m not one to go out and fight for change. So really I am the worst. It’s actually embarrassing, I probably shouldn’t have even started this conversation! ha.

Also I am slightly flattered that you made note of previous comments to figure out where I live! I am a victoria native but yes we bought a house in broadmead in 2021. And mostly we just have debt and no equity, but that will hopefully change over time. And yes I benefitted from selling a starter home in cedar hill area that increased in value from 2016-2021. So yes. Luck and privilege here.

On a world scale you are a solid 1%er; however, are you going to sell your mansion (that is what a Broadmead home is on a world scale) to address inequality. Probably not.

Not sure if you saw a YouTube video I made recently. Highly educated family of four living in 500 sqft – https://m.youtube.com/watch?v=bndG02UvDLg

That is life around the globe for the majority.

Yeah that’s a good and interesting point. Maybe having a better system for people avoiding taxes today would be a better starting point than adding more.

Anyway I am not a saint, I also have a “f you I got mine” attitude inside my heart and would have some internal conflict when voting for stuff like this… but when I think about the world as a whole I feel like it’s better to improve our community than to have severe inequality.

Perhaps we need to increase corporate tax rates, which would mean that some who make their money off real estate would have to share more.

Yes I would 100% be ok with that if it helped people who are struggling to get housing. It would not be fun of course and in private I’m sure I’d grumble about it to friends and family, but in the same way I am “ok” with paying income taxes because I know it goes towards services that everyone needs and uses, I’m “ok” with property taxes being higher for single family homes vs condos. I don’t want to live in a city where only the rich can thrive and everyone else leaves.

In reality people making over 250k set up corproations, holding companies, etc.

I am just giving you hypotheticals. Raising taxes has unintended consequences.

Based on your previous comments sounds like you live in Broadmead. Houses in Broadmead, on average, are very large.

I take it you wouldn’t mind if your property tax mill rate was doubled and we reduced the mill rate for everyone living in a condo in Saanich. Surely people living in such larger houses can afford a higher mill rate since they gain a lot more wealth tax free (in absolute terms) through appreciation?

Are you trying to bait me with extremes? 😛 99% does sound a bit ridiculous to me too but maybe? I was thinking something like 350k + = 56%, 500k+ = 59%, 650k+ = 63% etc. And at some point there is a cap but 53% seems weirdly low and 227k seems like an odd stopping point when a ton of people make WAY more than 250k.

So we should have a sliding scale to 99%?

Where does the money come to build that housing? Isn’t it tax dollars?

That’s a fair point. My points aren’t really real estate specific (oops!) but more general. I don’t like that the CEO of a mega corp making 1m+ annually is taxed relatively low compared to their income/how everyone else is taxed.

But I agree that when adding taxes we have to be careful not to accidentally disincentive things that have a positive impact on things like housing.

And finally, I also do not begrudge or care about the financial success of others. I am happy for them! Really! I do think we should all pull our fair weight, but I don’t blame people with money for any of that, it’s just circumstances of life and not their fault.

I have a friend who is from a wealthy family. She lives only off money from managing property and doesn’t work otherwise. We mostly get along very well even though ive had to work very hard for my money including my home that generates passive income. (There’s the occasional misfire when she says things like “i don’t understand why you don’t eat at this restaurant every day!” and I say “you don’t?”) I guess I am aware that it is unfair in some sense that she has a life that she didn’t earn whereas I had to work hard for less. But then I think about it and I also didn’t earn being born in one of the richest countries in the world – I just got lucky. I also didn’t earn my healthy body or my intelligence or so many other things. I think people massively underestimate the role of luck / randomness. Really most things are luck and random chance. I don’t get angry or resentful at people with more financial luck than me – what a waste of time and it doesn’t solve anything. Instead I hold the government responsible for failing to do what it should have done all along which is build housing that fits the needs of the population. It’s the governments fault and massive tax hikes for those with passive rental income will not add to the rental supply (wouldn’t it decrease incentives to rent? What’s the objective – more housing or not?)

So you’re saying that by adding money to the problem we’d make the problem worse?

This is partly why I added the caveat “as long as it’s done correctly. I don’t want to pretend I know how to solve these problems in the right way, so someone who is good with setting up proper programs would have to find the best use for that money”

Anyway this doesn’t really seem true. You COULD be right for my random example, but it’s pretty speculative, and if that’s a risk then I’d assume when setting up programs they would identify it as a risk and find work arounds, like perhaps instead of an increased salary they offer better student loan forgiveness in certain fields of work, or some kind of “return of service” contract. I don’t know! It’s not my expertise! But I think there is a solution that more funding could help with.

This is a tricky one to respond to because you make it personal about yourself, which tends to cause more of a argumentative stance and it’s hard to debate without hitting someone’s nerve when it’s personal. But I will try, please forgive me if I accidentally say something rude

You are assuming that I am coming after you with my discussion and you don’t like it, and then you cite how hard you worked and how careful you were with your money to get where you are today. Which is totally fair!

But a few things:

My actual example for why I first started thinking about taxation on higher income brackets is this:

For income tax, the highest possible marginal tax rate in BC is 53%, which you trigger when you surpass an income of 227,000 (or thereabouts, I didn’t look it up) So everyone making under and up to this amount pays various slowly rising tax amounts on chunks of income. Ok that makes sense. If you make peanuts, you’re taxed peanuts. If you make 250k (not peanuts), you’re taxed a little more than 50%.

but someone making 800k is being taxed at 53% for all of the 227,000 – 800k. Someone making 300k is also being taxes that 53% for that 227,000-300k. So once you hi that final trigger point, ALL income is never taxed any higher. This doesn’t really make sense to me. Why would everyone be on this sliding scale and then suddenly after you hit the mid 200ks you never have to pay any higher tax rate? Those people making 800k are mega rich if they have been making that salary for a few years. Can’t they afford a bit of a higher bracket?

I don’t “like” being taxed either. I definitely make use of my RRSP to get some of that tax back. And I’d be ok to increase our tax sheltered savings limits to help cushion the blow of adding more tax brackets. (assuming someone does the math and makes sure by doing so it doesn’t actually make gov finances even worse)

My overall opinion though is this

– Everyone thrives when the community thrives, and it’s up to everyone to help with that. Some people don’t make much and therefore can’t help. Everyone else should contribute based on their income. Improving our social programs help both the poor and the rich. Sure a rich person can fly to the states for healthcare, but it would be much more convenient if they could do it at home, for free.

– People often think that when taxes are discussed it will somehow impact them. What I’m suggesting means that unless you are making > 350k annually… it might not. And even then the individual impact would be pretty low, if we added incremental brackets of 2-3% higher each.

– The government is probably wasting a lot of tax dollars right now. Just a guess, based on the stories I hear from government employees. If we were to do this I’d definitely FIRST want the government to take a serious look at how they spend money and share with the public how they plan on cutting inefficiencies and improve their use of existing tax dollars.

From: https://financialpost.com/personal-finance/family-finance/housing-downturn-cash-crunch

No one made them do it…

On the other hand, if you start with rich parents and a large inheritance, passive income does fall out of the sky.

If your children required the assessment of an exceptional pediatric specialist but he or she opted to work only 3 days a work as a result of incremental tax load; therefore, increasing the waitlist from 6 to 12 months would you find that beneficial?

If I wanted to I could call it a day and live off passive income. I bought my first 500 BMO shares at $33 in 2009. The money to buy those shares didn’t fall out of a tree. I worked 6 straight 12 hr nightshifts across christmas/boxing day 2008 in the ICU @ Jubilee. I remember we had a patient on ECMO (rare at that time at the Jubilee) it was super busy a couple of shifts there was no break. Then on new years eve I picked up that shift too. I am not going to lie, the motivator to work that much across the holidays was 100% stat pay plus overtime. I lived with my parents in 802 sq/ft one bath and I walked to the Jubilee so I wouldn’t have to pay for parking.

A lot of my colleagues I graduated with bought new cars, dogs, and rented nice places. Instead of vet bills I picked up every stat and overtime shift I could and threw my money into dividend paying stocks, a masters degree (bust) and a real estate licence (success). Then I made it a financial priority above everything else to max out my TSFA and RRSPs every year since then even if it meant living at home until I could afford to max those out + get my own place.

If you start with nothing passive income doesn’t fall out of the sky, it takes decades of discipline and hard work. Not sure if taxing aggressively discipline and hard work is the best way to go on the whole in my opinion.

That 20% isn’t the same people every year though. Today’s doctor was yesterday’s medical student, and today’s stay at home mom may have been yesterday’s professional.

Not to mention retirees.

Seems like we have a lot of ailments that could be solved by throwing money at it, as long as it’s done correctly. I don’t want to pretend I know how to solve these problems in the right way, so someone who is good with setting up proper programs would have to find the best use for that money, but stuff like: if we made BC more attractive for medical care professionals by improving the compensation, that could be a nice use of taxes. Healthcare in Canada seems to be struggling big time. How can we make it better, and how can we use money to do so? Also – More social housing, better care options for people with substance issues and mental health issues. Better care for the elderly who don’t have good retirement savings and struggle with the cost of living. I’m really glad they are improving childcare costs for young families, so more of that as well. Better public transit… I’m sure there’s plenty more. Basically making it so that the have-nots in the world still have a decent quality of life relative to the rich folks.

What IS the the middle class? Seems like a very grey term. But I think any income being made should be taxed on some kind of scale, similar to how income tax works today. I just think the scale stopping at 53% seems like too low of a stopping point.

And it would be great if people who are so rich they don’t have to work have some way of paying their fair share too but this is a bit beyond my understanding of how taxes work today for this group of people and how they could be improved

When you introduced this by “we can do more”, I expected you to give an example where you would need to pay more taxes. For the “betterment of society” as you put it. But all your ideas were for other people to do more (pay more tax). Do you think the middle class should pay more tax, or should they be left alone?

Well, if we are getting into wealth taxes, let’s not forget to tax the value of those defined benefit pensions annually as well. Lots of wealth and money sheltered in there from high income earners. If the defined benefit folks are chasing other people money that’s being put away for retirement, don’t forget to include their invested wealth too.

I think we can do more here…. I don’t know a ton on this topic but there must be ways we can better tax wealth. If you are so wealthy that you have passive income, I think it’s reasonable to tax that pretty aggressively.

Also the highest marginal tax rate on income is 53% so once you break that barrier all extra income isn’t taxed any higher. I think we should introduce another bracket or two above the 53%

But I’d also like to see those taxes get used appropriately for the betterment of society… as in, the government should do a serious audit of inefficiencies on their end as well.

1738 Ross St Victoria BC

Been seeing a few more like these popping up. Splash and dash flip jobs that have been dropping their prices. I believe this one sold back in February for $1.1 mil.

The top 20% of income earners already pay 2/3 (67%) of all income tax, and 50% of all taxes. Leaving the other 80% to pay 1/3 of the income taxes.it looks like we already “tax the rich”.

But the other 80% (“not rich”) wants more “tax the rich”. Is that an example of the“bias in place” you’re referring to?

https://torontosun.com/opinion/columnists/goldstein-make-the-rich-pay-new-reports-show-in-canada-we-already-do

“ The report, “Measuring Progressivity in Canada’s Tax System,” says while the top 20% of income-earning families in Canada making more than $206,267 annually pay almost two-thirds of federal and provincial income taxes (63.2%), and more than half of all taxes (54.7%), their share of total income is only 44.1%.”

Everyone wants the tax system to get them what they want. It’s just a little less obvious when the bias is already in place.

This might temp me to sell my rental condo, but never my rental SFH. As mentioned previously, they are a premium as far as a rental is concerned and always will be as I don’t see anyone (including Mr. Eby) stepping in to build purpose built SFH rentals.

It’s always interesting to see how eager some people are to tax others assuming it will get them what they want

Does anyone know what 941 Fullerton avenue went for?

Or increase them substantially with one year of notice.

” If you want to incentivize sales, decrease or eliminate capital gains taxes for a few years.”

Interesting point but of course it could hurt those who are renting because there would be a good chance that the new owners would want to live in the property.

I still prefer solutions that would encourage and increase supply of housing. For example: Perhaps a complete rebate on all taxes on materials for new buildings….. for a period of time.

I get tired of this mathematical illiteracy. Correctly put, wages rose 5.2% in the year ending September. Or, wages were up 5.2% year over year as of September.

lol, lots of internet white knights here…. Where were ya’ll when “insider/bay street tips” was getting all the flak? LMAO

I don’ t think we’re out of the inflation woods yet.

can you really not just let it go?

Still busy with those bully bids?

Murray Gell-Mann Amnesia effect.

It’s time we levelled with young people: Housing affordability as we knew it is gone forever

https://www.theglobeandmail.com/investing/personal-finance/article-housing-affordability-young-people/

https://docdro.id/6HdFfbF

To me, the story here isn’t the PM incompetence. Sure, it was stupid/incompetent to propose to lower rates and increase the deficit. And so bond yields for the UK20-year rose from 3.5% to 5.0%. And this rise nearly collapsed $1 trillion in pension funds.

But for me, the takeaway is that pension funds (and banks in general) are absurdly OVER-LEVERAGED, where a predictable event like this can almost wipe them out.

Because, for example, as you can see the bond yields are rising up again, to 4.5% and close to the 5% level that caused the panic.

A more thorough peak back in time would reveal a capital gains exemption in the late 80’s, early 90’s. Introduced in 1985 at $500,000 it was decreased to 100,000 in 1988. This provided the incentive for investors to liquidate their property. Additionally, interest rates were much higher and they could take their tax free gains and invest them risk free in term deposits. Increasing capital gains taxes would only decrease investors willingness to sell their property. If you want to incentivize sales, decrease or eliminate capital gains taxes for a few years.

Yes, I’m still alive.

A peak back in time on the effects of government intervention in the market regarding a change in Capital Gains tax.

Here’s where government intervention comes in. Federally, the capital gains tax was increased from 50% inclusion to 66.67% in 1988, then to 75% in 1990. This catalyzed a huge sell-off as owners looked to get out. In 1991, a provincial NDP government came to power, promising to increase tenant rights and impose rent control. Actual rent control legislation wasn’t adopted until 1995, but by then the investment community had been long expecting it.

Do I think the government would do this again? Only as a last resort if they fail to get the inflation rate down to the target rate in a reasonable time period. It is a pretty heavy way to bludgeon the market-place. But it works.

Now, some of the wealthier MPs that hold a lot of real estate will know if it is about to happen before any of us. So I would watch what these MPs are doing. If they are selling off real estate, as Jean Cretian was doing at that time, then I would get worried.

Now everyone is an economist…. save yourselves the guesswork and just go read what BOC released today and also look at what the 5 year yield is at

https://www.bankofcanada.ca/2022/10/restoring-price-stability-for-all-canadians/

https://www.marketwatch.com/investing/bond/tmbmkca-05y?countrycode=bx

I don’t think we will see any relief in the interest rates until rents come down substantially. If rents fell from peak rates by 25% that would solve a good portion of the homeless and affordability problems in Victoria.

This happened because yields shot up after the so called mini budget was announced. In other words, it was more about the incompetence of the prime minister, than it was about inflation.

I’m sure the UK would have been totally fine last without the minor injection of $65B.

Bank of England official says $1 trillion in pension fund investments could’ve been wiped out without intervention

https://www.marketwatch.com/story/bank-of-england-official-says-1-trillion-in-pension-fund-investments-couldve-been-wiped-out-without-intervention-11665050865?mod=home-page

Also nothing unconscionable about the BoC doing what it takes to create inflation.

The official story is/was that QE is initiated when central bank policy rates hit their effective lower bound but more stimulus is required. Since the terminal rate is higher this time ’round, all things being equal, there should be more room to go before hitting the effective lower bound and less need to rely on QE. That was really my only point.

But yes, as the Bank of England’s recent use of QE shows, it may be used in…unique circumstances.

Which just means we haven’t even hit the halfway mark.

Classic GPT-3 post right here, you can smell the envy of incoming GPT-4. *

*this post was written by GPT-3

As for when QE (print money, buy bonds) will return, it could be any time….

We don’t need low interest rates for QE to return, and we can’t predict when QE will happen.

Of course QE is inflationary, but that doesn’t mean it won’t be used during times of inflation

Because QE isn’t just a tool like interest rates to stimulate the economy.

It is also used in crisis situations to prevent IMMEDIATE DISASTERS in the economy. Some recent examples:

(The pension collapse was because their bonds fell in value due to high rates)

So the next Canadian disaster will see immediate QE from the BOC, regardless of interest rates. Who knows when it will be. Perhaps in a few weeks if Credit Suisse collapses. Or maybe nothing for years. But rapidly rising inflation and rates makes it MORE likely we need QE, because bonds fall in value, destabilizing the banks and pensions that own $trillions of them, leading them to sell them, with no buyers except the BOC via QE (as just happened in UK)

Barrister I agree I am not seeing a whole lotta pain out there or a stressed out house market I do think job loses are coming but off a bottom We are most likely in for a long flat boring market for a good long stretch

I feel like there is an old adage somewhere: “the future is unpredictable, so be prepared for anything”.

Canada sort of spun that adage on its head. While life was good we all got leveraged up to our eyeballs, meanwhile the feds and BOC egged us on.

As a strategy that more like climbing onto a roller coaster, forgetting to lock yourself in and then crossing your fingers that you can hold on tight enough as the ride starts…

Well so we’re in a bad position for the current moment. I guess we can all hope that our stable government, plentiful land and natural resources and generally resourceful populace will help us to deal with the coming recession.

Here’s to hoping for a soft landing after we fall off of the roller coaster…

I just dont see anything that remotely even looks like a collapse. Will house prices adjust, without a doubt. Will some people, including investors, take a hit hit– naturally. But overall higher interest rates will create a more stable economy a couple of years down the road.

Perhaps this is the new normal:

Thanks Marko, I appreciate your candour. .

The job – the only job – of the BoC is to meet a consumer price inflation target of 2%. Nothing unconscionable for the BoC to do what it takes to fight inflation. What’s unconscionable is not doing that job.

This is an opinion I hear from people a lot, that the system would collapse with normalized rates… If that is truly a risk, what does the new normal system look like? Low rates, a new, higher target inflation rate and 5-7% COLA increases each year? Serious question: What’s the end game?

Don’t be such a pessimist. There’s good things too. 🙂

We apparently won’t need QE much going forward,

An image of King Charles will soon grace our legal tender, worthless as that tender may be,

Housing here is still cheap compared to Hong Kong,

If we get tired of inflating houses, we can do as the USA did and just move to inflating tuition costs. Kids get educated, we get rich. Win win.

Wait, what kids? Hmm. Might not matter given the fatal demographic trends befalling almost all advanced and even some developing economies. Eh, it’s good for the environment.

Bonus for the environment: Our lifetime carbon footprint might shrink since our life expectancy now appears to be doing the same,

Per the above two points, we won’t have to worry about a lack of people, as all your human contact needs will be met with robots using the GPT4 artificial intelligence paradigm (it promises to be very impressive),

When our social institutions and safety nets wither due to lack of a tax base, we can just demand new, never-before-tried social systems of the more “collectivist” variety with a large, tax paying robot citizenry to support it, and,

For those of us left, cynicism, misanthropy and fears of the end of the world couldn’t possibly go out of style.

The world is on the brink of WW3, we are experiencing the highest inflation in the last 30-40 years, food crises in the third world imminent, massive energy crises in Europe, China on the verge of economic collapse due to Ponzi-like real estate – meanwhile Canadians holding the most debt in the developed world. What could possibly go wrong?

The consensus view seems to be that the short burst of QE was in response to the turmoil caused by attempting to introduce Thatcher/Reagan failed tax policies (stupid at the best of times) in an era of high inflation (mindbogglingly stupid). Not sure why people would take that to mean QE is back.

As for QE making a return, the terminal rate before the last recession was 1.75%. We’re already at 3.25% with probably a bit more room to go. So, all things being equal, it seems that conventional monetary policy would have more mileage this time around, and less need for QE.

lol look at the sterling.

Usually that’s in September and would be done by now. You’re right about wholesale though.

I suspect QE will be back sooner than some think. I get that it seems unconscionable right now. But then again, so did the aggressive rate hikes the BOC put in almost immediately after nearly begging people to go borrow large sums of money.

Some people in England are already convinced QE is back, and they may have a point too. The system cannot handle normalized rates – heck even the first hike hasn’t worked its way through the system and look what’s happening already.

I assume you mean intervening with QE.

How on earth are they supposed to create inflation in the long term then? It’s just a series of short terms.

We’re probably talking about different timeframes. I agree rising interest rates can create disinflation or deflation in the short term.

Central banks had previously utilized QE without the adverse effects of inflation so they put the pedal to the metal during March 2020. Given whats happened since and the criticism they got, one would rationally assume they will be more cautious going forward using QE and perhaps they will let a recession occur without any intervention.

That is completely backwards. Much higher interest rates lead to disinflation. Proven in practice.

That would be extremely unusual and has not happened in the past when prices had run up. At best I think we’re in for a long flat period

Isn’t this because of the usual annual refinery shutdown in Washington State? The wholesale price of gasoline is still way, way off its June peak.

I think it’s more about the effect of pent up demand, post-pandemic savings rates, a labour shortage, supply chain bottlenecks, the whims of a murderous Russian dictator, etc., etc., than kicking the debt can down the road.

Still more expensive than it was a month ago. BC Average is nearly up to it’s all time high that it hit in June.

It’s one thing to have an unprecedented monetary policy response in March 2020, and another to continue it all the way until 2022 when inflation had already reached over 8%.

I don’t see it as conspiratorial, just irresponsible. We’re experiencing the effect of kicking the debt can down the road for 20 years, and a 30+ year steady reduction in interest rates. Papering over fiscal issues has been the standard for quite some time. The pandemic fiscal and monetary response is just another manifestation of that. What we’re seeing now is what happens when we don’t have the luxury of stealing productivity from the future and bringing it to the present by dropping interest rates. I hope the folks who think this will be a mild or short recession are right, but I don’t see it.

I disagree with this. The fiscal policy response in 2020 was unique to the pandemic – overnight, unemployment rose to double digits, which required deploying rapid fiscal support to affected individuals without the usual delays and application process. No way that the federal government steps in with that level of fiscal support in the next recession. That’s what EI is for.

As for the monetary policy response, I’m not sure what the alternative would be. Let the economy burn to the ground in the face of a 100 year pandemic? I think people have lost sight of just how dire the situation looked in March 2020, and I see nothing conspiratorial or irresponsible about the way governments or central banks responded, except that they kept the stimulus turned on too long.

The price of gas is a lot cheaper across the country. Even Kelowna is substantially cheaper.

2008 VS 2022.

In 2008 things really ground to a halt as of October. Also we had double the inventory on the market.

Price of gas affects good prices because trucking isn’t electric yet.

Yeah, back in February I calculated we would need about 6.5-7.5% mortgage rates to match the 1981 level of unaffordability that caused a 35% crash in prices. Now that prices have dropped we’d have to go even higher to get to a similar level, perhaps around 8-10% (need to check).

That said affordability is not the only factor. Of course required down payments are much higher now and could play a role.

We’re so used to the gov/central banks stepping in to save the day that we think nothing bad could possibly happen. The BOE’s $65B pledge last week was the difference between the UK pension sector collapsing vs not collapsing. That’s 65 thousand million dollars. Also UK gov debt yields were increasing rapidly (creditors demanding much higher interest leads to hyperinflation). Our own gov isn’t really a bastion of fiscal prudence either. I think we added 1/3 to our total money supply in the pandemic or something like that? I think the risk with deflation or even disinflation is that it will expose the very high leverage of individuals and entities.

At the risk of inviting a lot of ad hominem arguments, I find the perspectives of Lacy Hunt and Dalio to be pretty compelling in terms of where we are in the debt cycle and what happens next.

Back on the topic of housing, this listing looks unfortunate up in the Comox valley.

https://www.realtor.ca/real-estate/24920615/4374-forbidden-plateau-rd-courtenay-courtenay-north

May 24, 2022 Sold $810,000

Sep 29, 2022 Listed $749,900

The latest VIREB stats show a 4% drop in benchmark price in September, but I’m pretty surprised at the number of sold signs I’m seeing around town.

Yes I’ve brought this concept up many times, but I was simply replying to a post which did not reference population adjusted records.

Only in Victoria/Lower mainland and we have the highest % of EVs in BC so the net impact is subdued a bit.

Gas is $2.29 a liter, almost back to what it maxed out at in June. I don’t think we’re out of the woods yet.

Inflation looks to have peaked and we are likely at the end of the jumbo rate hikes. Still have too many people with trigger rates and renewing mortgages at a higher rate but if we can maintain at ~4.75% for a 5 year mortgage I think the market can handle that.

https://www.cnbc.com/video/2022/10/03/eric-johnstons-about-face-on-the-markets.html

It looks like Whistler wont be exempt from the foreign buyer ban.

Because it has a CA (core) population of over 10,000 so doesn’t qualify for the recreational property exemption. That’s according to this article https://www.mpamag.com/ca/mortgage-industry/industry-trends/foreign-buyers-ban-proposals-private-lending-association-reacts/422235

I’m cynical enough to expect that rules will be changed so that the rich and famous foreigners will still be able to buy at Whistler, just like they don’t have to pay BC spec tax while they leave their properties vacant.

I wouldn’t be surprised if the coming recession is deep but brief. I expect house prices to come roaring back sooner than some might expect. We need time for the new interest rates to be absorbed and some adjustments, then a heated market will return. The feds won’t go too much higher from here – then an adjustment term, then back to fundamentals of limited supply with large demand (particularly here in Victoria).

My take is that the tackling of inflation so far has been going pretty good Hopefully no black swan and 2023 will be the worst of it maybe see some stability

https://bcgov03.maps.arcgis.com/apps/webappviewer/index.html?id=01154009281e464f84e187d6624a3507

…because of a dumb prime minister’s uncosted plan to implement a completely discredited fiscal and tax policy. Oops.

The logical end point of a tightening cycle (unless something insane happens which is possible in our current stupid/authoritarian era) would be a recession and disinflation. CPI seems to have peaked, and you would expect the downward trend to accelerate as the effects of the big rate hikes start to show up…not sure how we are getting to hyperinflation.

Well, the chance of a catastrophic tsunami is relatively small even if the result would be bad. People want to live the most joyful lives they can, I guess. The more realistic tsunami is that we’re all gonna die, so live it up while you can!

9997 Third Street Sidney – yeah, not my cup of tea either…

Agreed.

A crazy shock isn’t that far fetched. The UK’s pension system almost collapsed last week before the BOE was forced to step in and offered to buy $65B of gilts. The cracks are beginning to show as QT progresses and if or when the pivot happens, the logical endpoint is hyperinflation.

Mark, when looking at lowest sales on record one has to really tak into account how many more units there are in Greater Victoria today as opposed to ten years ago, So using sales records from ten or twenty years ago might be a little misleading.

…or in an earthquake zone, or on a flood plain, or in a combustible forest(???). We are strange creatures, but we all do our best with what we have and where we are.

Back to housing, sorry for the credit card post. My issue with waterfront is not the Tsunami danger and i dont believe Sidney is in a Tsunami zone, but rather it is really cold being right on the water in most places. Lots of things like your car are also prone to rusting. Moreover, people seem to overlook how noisy a Marina can be especially in the summer. It is like when people buy on a golf coarse and are then surprised when the heavy lawn machinery drives by at six every morning making about as much noise as a Russian tank column retreating in the Ukraine.

Nothing to do with housing but a heads up for all the fine folk here. I dont have all the details but the court has ruled that merchants can pass on their credit card costs to consumers. Telus has advised that it will charge an extra 1.5% if paying by credit card but not if paying by debit card. Each business will be having its own policy.

I am guessing that most merchants will not pass on the debt costs since handling cash is expensive. It will be interesting to see what places like Cosco decide to do since their rewards program is tied to Mastercard.

But the lack of uniformity is going to be a pain. I expect some places like restaurants are going to maybe try to pass on the debit costs as well.

Same with South Oak Bay

I don’t think a recession on the order of the great recession is crazy at this point. I wouldn’t be surprised if it was worse.

I’ll never understand why people will pay that kind of premium to live in a tsunami zone.

To describe the federal government response to Canadian housing as embarrassing is, course, and understatement. The feds are doing nearly everything they can to keep housing prices as high as possible, while pretending that they care about “affordability”.

However, I disagree that a foreign buyer ban will do nothing. For one, it will present another barrier to purchasing for foreign investors, that will take time for them to skirt around through shell companies, local buyers and other means. I doubt very much that the feds will enforce this adequately, but every barrier counts if you’re trying to move money.

Second, it will signal to both foreign and domestic investors that the headwinds might potentially be shifting to the downside for several more years. I really think this will play out most in the pre-sale and luxury markets of which the former is already starting to decline.

As a potential near time buyer, I can tell you that I am watching the effects of these policies on sentiment closely. Of course,

Interest rates are still by far the most important factor to attend to over the next few years.

No, we will still clear all time lows even with a 1% in October. Of course, Putin could launch a nuclear attack on Seattle, we could get a massive earthquake, another deadlier variant of Covid could appear, or some other crazy scenario but aside from huge shocks I don’t think we are setting all time record lows for the next 5 months. I don’t think the economy is going to spiral out of control that quickly either.

October – 316

November – 268

December – 239

January – 277

Feb – 311

If any month comes in below those all time record lows feel free to call me out.

There are enough people out there with cash and not willing to wait forever to time the market to keep us above record lows. The $3.6 million sale in Sidney a perfect example.

9997 Third St, Sidney BC. Easy to search for given the town and square footage.

Interesting point. Does your opinion change if BoC raises rates another 0.75 to 1% in Oct?

Which house is that, Barrister (sorry, I don’t have access to sold info)?

I see a few waterfront listings around there that are quite a bit bigger and on bigger parcels, for similar price range. Some of those don’t seem like a ‘bad deal’ (depending on specifics of course) for a certain subset of buyers given similar houses in Oak Bay or even up towards Gordon Head probably go for closer to 5 million. I realize Sidney is no Oak Bay, but it’s a very pleasant little town centre with a good sense of community (and yes, it’s subjective & yes, I’m biased, as we live not that far away).

Doesn’t answer the question where the money is coming from, but just using our own situation as an example, we did the proverbial swap of a little post-war rancher in Vancouver for something incomparably nicer out this way. It was a no-brainer no matter how ‘elevated’ the Victoria prices were considered to be at the time, and the pandemic has only heightened peoples’ desire to grab their little piece of paradise.

An article in the NY Times talks about “Deflation”.

Not the only one I’ve noticed.

My opinion is that foreign buying is an economic plus for Canada too. It’s one thing to tax foreign buying in cities with small vacancy rates, but there’s no reason to ban it in rural areas with high vacancy rates.

America doesn’t liked to be pushed around, and especially doesn’t like to see their citizens get second class treatment. So I hope they do retaliate. Most Americans would support a ban, once they heard the simple logic “Canadians banned Americans buying in Canada, so we’re going to do that too”

The wild card is the “idiot” factor where Trudeau made this a two year only ban, and then back to normal. I’m not sure how the Americans deal with something stupid like that.

Shall we attempt to explain the ban to them by saying something silly like …”Canada house sales are at near record lows, so we decided to ban foreigners buying them so there will be even fewer house sales”

Well you’re entitled to your opinion, but in the parts of the US where Canadian ownership is significant, e.g. Florida or Arizona, it’s viewed as an economic plus.

People who are good at predictions wouldn’t waste their time commenting on HHV.

Yes, the 2-year Canada-wide foreign ban on home buying goes into effect January 1, 2023. An embarrassment to Canada, which will accomplish nothing. Recreational properties outside cities are exempt. Foreign workers and students are exempt. As is typical, they haven’t even sorted out the rules yet. https://www.cmhc-schl.gc.ca/en/media-newsroom/notices/2022/thoughts-ban-non-canadians-buying-real-estate

The ban seems perfectly timed to come into effect when the housing downturn is already in full swing. Terrace BC has vacancy rate of 11%, but will be subject to the ban. Same for Prince Rupert (6%). The federal government is hopeless.

The USA should respond by banning Canadians from buying US homes

“Zero chance of low sales records being broken for next 5 months as the all time low for the next 5 months will be the 2008/2009 crash.”

People who are “good” at predictions never use 0% or 100%. They always “one hand” and “other hand”.

Thanks, Leo, as always.

Oh, it went through! I remember the original announcement as being more aspirational. “We are announcing the intention to pursue..”

Two other pieces of news:

– UVic is surveying its employees wrt housing, and one of the things they gauge is interest in University housing for employees, perhaps with the possibility of ownership. (I guess the model would be something like affordable housing, where you can own but gains are restricted.) I am not very hopeful that something will happen there, but they should absolutely pursue that idea in addition to expanding student housing.

– On a personal note, looks like our PR is finally going through any day now. Took two years and an enormous amount of hassle, but c’est la vie.

A few foreign buyers seemingly front-running the impending federal ban. We’ve had more sales recently than before (though still quite low)

Given our declines have come out of the start of the year jump, we may end up with the second largest correction in Victoria entirely hidden by the yearly data which is still up from 2021.

No offense taken. In addition to dim wits I also have a thick skin.

Here is a slate of Victoria candidates https://www.bettervictoria.ca/ourselection.

I believe that all have opposed the missing middle in its current form. They all rank pretty low on the housing ranking that Leo posted.

I feel like the top candidates from Leo’s list are mostly solid candidates who would represent an improvement on the current council (a few real duds) and would increase action on housing