Busted Benchmark

If you ask the Canadian Real Estate Association, average and median prices are trash. They “can change a lot from one month to the next and paint an inaccurate or even unhelpful picture of price values and trends.” In place of those simple but volatile measures of prices, they have the MLS Home Price Index, which is basically a fancy repeat sales index (edit: a mathematician told me its actually a hedonic model) based around a typical or “benchmark” home. They define a typical home based on what is common in the area, then use the sales of other homes (adjusted for their various qualities) to update the value of this benchmark.

For example, the benchmark single family home in the region right now is a 3 bed 2.5 bath 1600 sqft house on an 8000sqft lot with a garage, a basement, and baseboard heating, built in 1982. In Esquimalt that house is a bit smaller and older and sits on a smaller lot. In Gonzales it’s a 2300 sqft house on the waterfront. They’ve got 365 pages detailing the typical home of every type in every neighbourhood. It’s all very interesting, and complicated enough to effectively be a black box for any outsider. A black box that CREA claims is “the most advanced and accurate tool to gauge a neighbourhood’s home price levels and trends”.

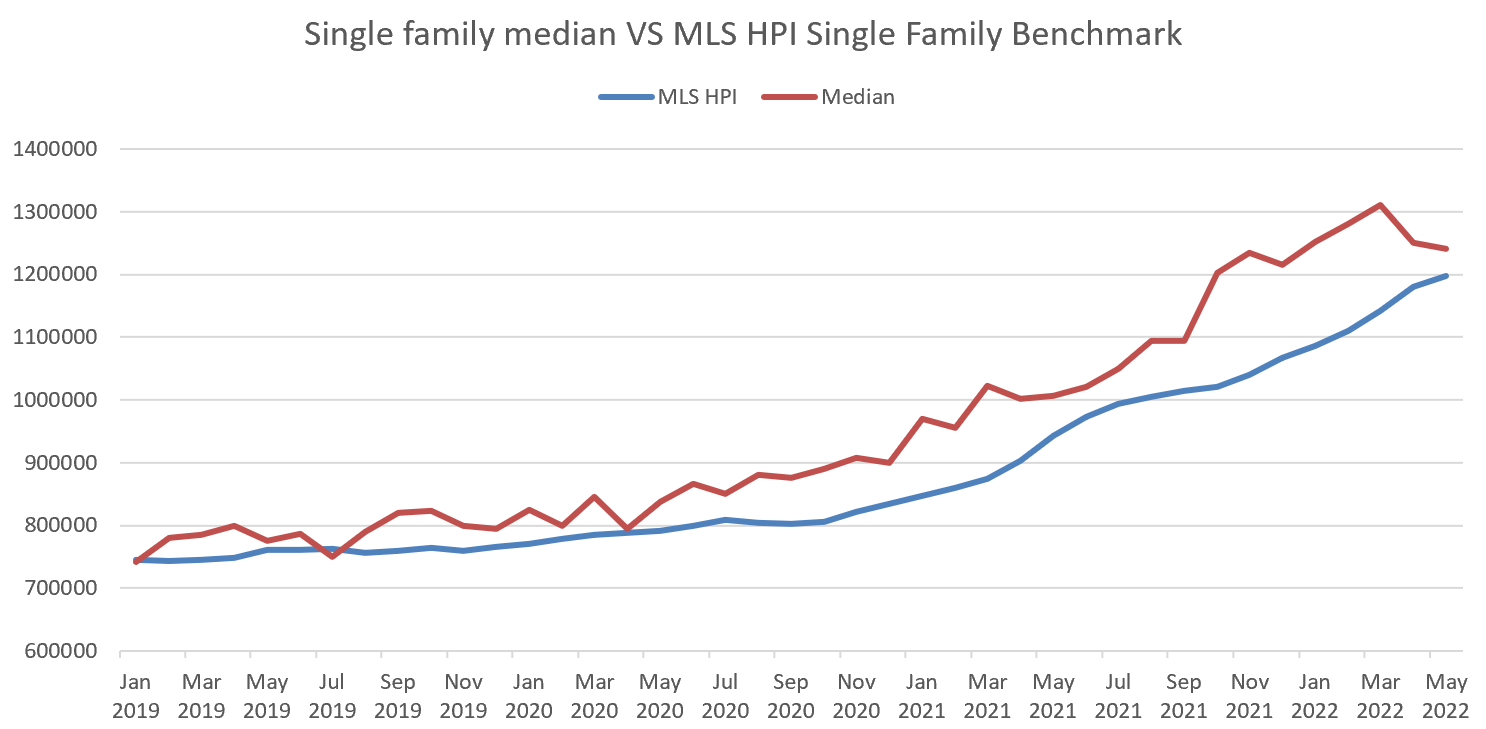

Is that true? Well in general the idea is good. It’s true that medians and averages are very volatile and affected by sales mix. It’s also true that a repeat sales index is a tried and true approach, with the long running Case Shiller index being the gold standard for US real estate, and the well established Teranet Index in Canada. Teranet only tracks single family prices and is based on land title transfers which always lag the market by a couple months: both deficits that the MLS HPI promises to address. In a relatively well-behaved market it also seems to succeed, having minimal lag, and offering a lot more specific home types and areas (even if it sometimes gets so specific that it is estimating value based on literally zero sales).

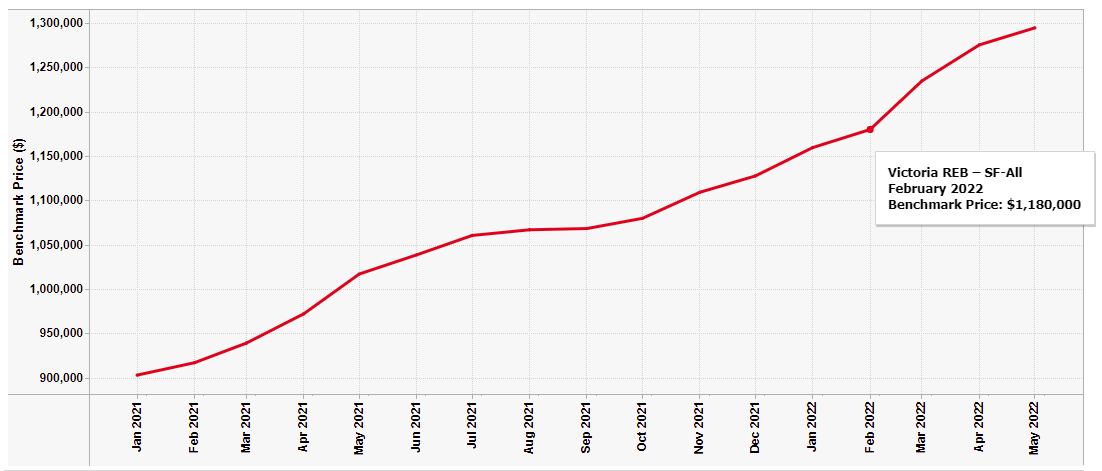

But since the pandemic the benchmark has gone a little haywire. A year ago the HPI benchmark prices were lagging badly, saying that prices had risen only 10% when they were up at least twice as much. Now we have the opposite problem. According to the benchmark, prices are still on a rocketship to the moon. Look at the chart of the single family benchmark price and it’s up a stunning 9.7% just in the last 3 months.

Clearly that’s not the case. Medians and averages are flat to slightly down since February, and the median detached house is selling for a couple percent less relative to its assessed value. Most agents or market watchers will agree that the market is roughly flat since February, and certainly not up 10%.

If you zoom out it’s clear that the MLS HPI is just catching up after lagging, and recent benchmarks are likely more accurate than the ones from earlier in the year.

But the selling point of the benchmark is that we are trading all this complexity for a more accurate measure of prices. If we aren’t getting accurate prices in the short term (which is where medians and averages are weak), what is it good for?

Also the weekly numbers courtesy of the VREB.

| June 2022 |

June

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 111 | 942 | |||

| New Listings | 224 | 1208 | |||

| Active Listings | 1789 | 1375 | |||

| Sales to New Listings | 50% | 78% | |||

| Sales YoY Change | -20% | ||||

| Months of Inventory | 1.5 | ||||

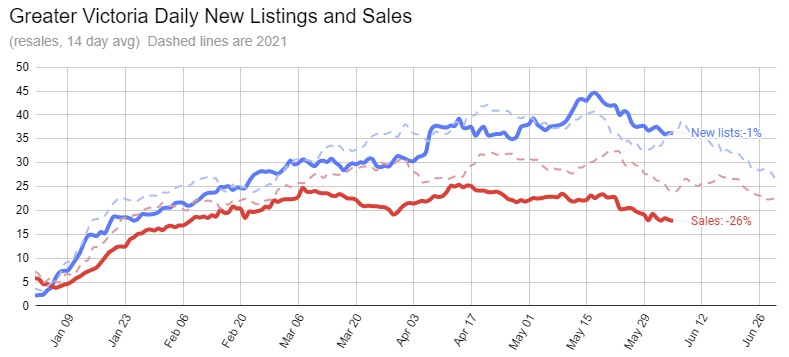

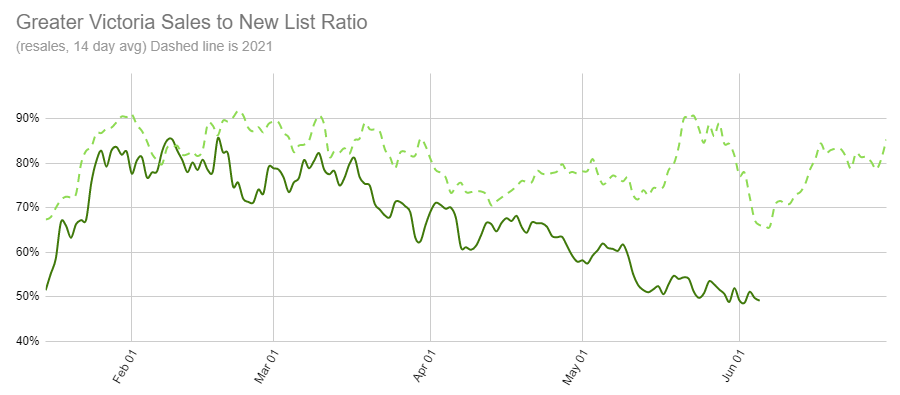

Little change in the first week of the month, with sales down 20% and inventory up 20% bringing the sales to list ratio to a balanced 50% where it was for most of May. May generally marks peak sales for the year, so we should see a continued drop in the sales rate this month and for the rest of the year, while inventory generally peaks in June. It would take a relatively strong slowdown in the market to keep inventory from decreasing through the summer and into the fall.

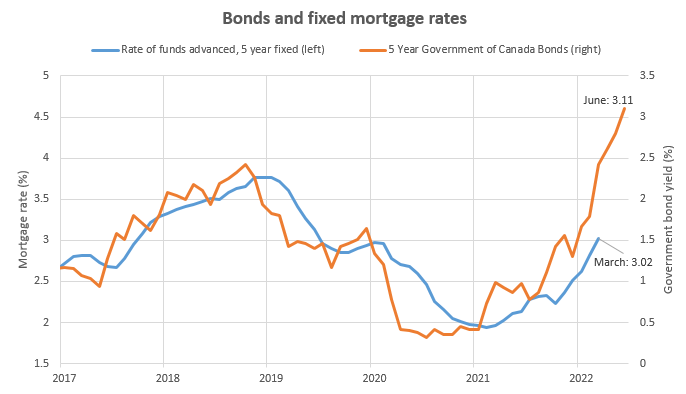

With variable rates rising last week and 5 year bonds cracking 3.1% which will likely lead to another round of fixed rate hikes, I would expect the demand pullback to continue for the next few months at least.

New post:https://househuntvictoria.ca/2022/06/13/poor-affordability-continues-to-drag-on-the-market/

They manage a $419 billion fund, so 150 million is literally a rounding error (0.0357995%). The Quebec Pension plan does some really wacky things in my opinion, and it shows when you compare their rate of return vs. BCI’s rate of return. I imagine it’ll be much harder in the upcoming years.

I’m sure it was a small play, but a public pension fund investing any amount in a crypto bank should be cause for the termination of whoever thought it was a good idea.

Celsius Crypto Banking network froze all assets, meaning you can’t access your cryptocurrency investment. Quebec invested 150 mil. into the “bank”. Other platforms have had to temporarily halt trading. Haven’t heard of real estate transactions ever being halted. Equities, crypto , all tanking. Real estate, still an asset in demand. That’s not changing anytime soon. Smart investors know what to hold and dump what has little tangible value. Higher interest rates are going to create a lot of poorer people.

+1, instead we are helping the Russians indirectly. Global prices up 60% so even if Russians have to sell at a discount of 30% they are still laughing and have enough to fund their war crimes.

Whether we produce or not reality is we will hit peak all time global oil demand for the next 10 yrs so why not produce, cash in with revenues, and then spend it how you like. For example, with the windfall of revenues offer huge incentives on EVs or similar if the environment is the concern.

Have to love people complaining about gas prices while airports are jam packed, cruisers back in full swing, average person buys a 300 hp SUV, people want bigger houses, not smaller. It is all kind of hilarious. If the average person drove a 999 cc Toyota Yaris I would understand.

Then you have all these complete losers like Dicrapio and Harry and Megan talking about the environment while Dicrapio is on a 300 foot yacth and Harry/Megan flying a private jet to England and back.

Canada total refining capacity is 1,979,000 bpd; 23% convention heavy crude, 30% synthetic, 47% light sweet, and consumption is above 2.5 million bpd.

Canada total daily imported crude and refined oil products is roughly 1.3 million bpd, or 52% of our consumption.

Thus, we are far from energy independent.

CANADIAN REFINERIES — https://www.oilsandsmagazine.com/projects/canadian-refineries

https://www.theglobeandmail.com/business/article-private-mortgage-lender-magenta-suspends-new-loan-applications-until/

Well I don’t know exactly what you mean by “large”, but refineries in both Ontario and Quebec do process heavy and synthetic oil.

https://www.cer-rec.gc.ca/en/data-analysis/energy-commodities/crude-oil-petroleum-products/report/2018-refinery-report/canadian-refinery-overview-2018-energy-market-assessment-western-canada.html

Kenny,

What happened to the “old Kenny”, who told us last year you couldn’t sleep at night if you weren’t borrowing money to put in the stock market? Now we hear you’ve “greatly reduced my stock market exposure”

For example, remember this comment you made? When you told us last fall how the “rich get richer” by borrowing against their house and investing in stocks. And you couldn’t sleep at night if you weren’t doing that.

Kenny G: Aug 30/2021: https://househuntvictoria.ca/2021/08/26/election-housing-policy-the-bad-the-ineffective-and-the-missing/#comment-81890

“Kenny G: It’s very simple to borrow on a secure line of credit to buy stocks and the interest is tax deductible, there is nothing unusual or difficult about it. As long as your buying high quality stocks, have stable employment and a long time horizon you’d be crazy not to at current interest rates.

The other option is to take a mortgage against a fully paid for house to invest, this is how the rich get richer. Some people say they can’t sleep at night borrowing to invest, i couldn’t sleep at night not taking advantage of these low rates to borrow. Our savings are being devalued due to inflation, this is a way to help keep up.”

These things have already happened.

Those 3 refineries process upgraded bitumen.

The Sarnia one for instance happened in 2007 – https://www.suncor.com/en-ca/what-we-do/refining/sarnia-refinery

Whenever I hear someone cashed out of the market or got in because they were so smart…… https://www.aish.com/j/jt/Saturday-Night-Live-Financial-Advice-Seminar.html

“Most people in Victoria are pretty clueless”

Most people are pretty clueless.

Screen shots or it didn’t happen!

Where’s our financial planner (HHV member) when we need him most?

In good times, he’s posting here all the time, boasting about the benefits of borrowing against your home and investing in stocks.

He seems to have fallen silent. So what are those investors supposed to do now?

‘

‘

‘

Patrick, if you look back at my earlier comments in late winter I told you I had already greatly reduced my stock market exposure and I also said house prices had peaked, looks like I nailed both, perhaps you weren’t paying attention?

Most people in Victoria are pretty clueless, I am sure quite a few will still jump on the variable not evening knowing the difference between Royal Bank and the Bank of Canada.

“There’s the Montreal refinery owned by Suncor (137 000 bpd) and the two Sarnia refineries owned by Imperial and Suncor(121,000 bpd and 85,000 bpd). Those seem pretty significant to me.”

If all these three refineries shift from processing large portion of light crude to heavy crude, that means lower value outputs, significant construction expense on additional equipment, more operation expense because these refineries were not designed for refining heavy crude at beginning (aka we screwed ourselves).

Demand was lower then (“two years ago” was Covid outbreak). Now demand is up and exceeds supply. If Canada had more O&G production/distribution, it would have been great for Canada’s economy, and helped lower O&G prices in general too.

There’s the Montreal refinery owned by Suncor (137 000 bpd) and the two Sarnia refineries owned by Imperial and Suncor(121,000 bpd and 85,000 bpd). Those seem pretty significant to me.

“we bring in oil tankers from the nice people in Saudi Venezuela Nigeria etc.”

That’s because our nice people screwed ourselves before Canadian refineries been built. There is not a single eastern refinery can process large volumes of Alberta’s heavy oil. The size of western heavy oil refineries are too tiny, so we have no other choice than sale the heavy crude to US refineries at a smoking cheap discount.

The current gas prices have nothing to do with obstacles to O&G production in Canada. Those were around 2 years ago when gas was under $1/litre.

From: https://www.reuters.com/business/nasdaq-futures-tumble-3-aggressive-rate-hike-bets-2022-06-13/

An official bear market for stocks now…

Same as housing. Putting in a million obstacles to build housing and then complain about housing prices.

Agree. That works as long as variable doesn’t catch up.

5 year bond yield north of 3.5% now. Crazy when Leo wrote this post a week ago we were at 3.1%.

Maybe you need glasses, because BC is the leading province for that phenomenon already.

Investors are demanding return of capital via dividends and buy backs instead of production expansion, lenders are very cautious as well. Lots of CDN oil companies will go debt free later this year/mid next year given current strip pricing. So even at $80 WTI there should be meaningful returns and should see north of 5% dividend yields for a lot of them given their current stock price.

That will just drive more people to variable, 10x income house prices are not designed for +5% interest rates.

They could always advise them that people have to live somewhere, so it should work out. Maybe it would be more affordable or they could find the money if the rented to themselves and then paid the mortgage. Oh, wait a minute.

Economics is a funny thing, it’s less likely that money will come out of the woodwork and probably more likely that you’ll see vacancy rates rise, the cost of renting decrease and owners of properties that need an increase to cover their costs having to keep the prices low or even cut them ending in a subsidy to keep the renter. In the end it’s better for some money to come in rather no money when costs escalate past revenue and what the market will bear. Or if the bleed of cash is too much and it just needs to be sold.

I can tell you from 25 years in the business (gas) that investors are forever scarred by the recent hostility in the market. So many projects that we have bid on have been shuttered. Shareholders are still there but are looking for cash generating projects. Smaller scale. Less capital. Anything outside of conventional drilling and Oilsands will be a hard sell. Too many obstacles. Federal / provincial politics. Taxation. Regulation. Environmental. First Nations (elected vs hereditary), Leonardo DiCaprio etc.

Will nice to generate some major revenue and tax dollars with LNG. Most end users and EPCs though are sitting until the infrastructure is more complete before Exploration, drilling and Compression to fill it.

The fact that we are transporting oil by rail car and can’t get a pipeline east of Ontario is proof positive of how screwed up we have become.

Invest in Canada at your peril.

Whether or not you approve of fossil fuel development I agree with Marko that this is not about to end for a while. We can feel smug about crippling AB (and NE BC) but don’t complain about lack for energy security, high gasoline and gas prices or choose to look the other way when we bring in oil tankers from the nice people in Saudi Venezuela Nigeria etc.

TD 4 year fixed 5.29%

TD 5 year fixed 5.64% special rate of 4.84%

Pretty sure you’ll see a 6% fixed by the end of June, so with the stress test at 8% it looks like a big decline in the markets.

There will be the possibility of a .75% rate hike in July. 7 -8% mortgage rates by the end of August.

My guess is the Central banks want/need a recession to slow labour demand and will increase interest rates till they get one. A recession will include weaker housing in both the USA and Canada. Neither inflation or interest rates will return to 2020/21 levels but inflation will be under 5%.

I thought that residential construction, except perhaps for some high rises, was non-union.

Ask the Japanese how fast stock markets rebound. They’re still waiting to recover from the 1987 crash.

Project cancellations due to higher borrowing costs should address this issue.

We basically have 100% occupancy in the current inventory of properties. And there is a demand for more. Hard to see people giving away their primary residences, or investors tossing desperate renters on the street. It’s amazing how money can come out of the woodwork when your back is up against a wall. The few foreclosures will easily be bought up buy someone else. If anyone didn’t take out a fixed rate mortgage over the last couple years, they were crazy and deserve to take their lumps.

Nope, if you can buy and sell realestate in 5 seconds from your phone while your on the toilet you would see much more volatility and also much faster price discovery. Lots of people would have panic sold when BoC first raised rates, smart ones would have sold when inflation started getting hot consistently late last year.

Construction costs are at all time highs, and the biggest year over year increases in the past three years have been with labour. The union carpenter wages are being pushed far above the union agreement and will see another significant bump by the fall. Too much work and not enough workers coming down the pipeline, especially on large scale residential projects.

So what does better or even first out of a recession stocks or real estate

Disagree. Stock market investors are far more realistic. Helps that the stock market moves faster and is much more transparent. Nobody has any illusions about what a stock is currently selling for.

Leo, itt would interesting to see you do a post showing the fluctuation in building cost in Victoria YOY.

Same psychology as all other investments. Only difference is realeastate is costly and onerous to liquidate which makes people hold longer which actually helps to weather temporary downturns.

I am personally looking at buying long duration bond etfs, which is pretty hated right now. The central banks are looking to crush the long end of the yield curve, which I think they will get sooner then people think.

Isn’t this the classic chasing the market down? Lol, told you Victoria people are slow and couple months behind Toronto and Vancouver.

Ha ha. Yes, where is our good pal, Kenny G?

The psychology of RE is wild.

There never is really. However I’ve been putting some cash in the taxable account into rate reset preferred shares. Also have cash in RRSP waiting for the stock and bond markets to go lower. Yes I know you can’t time the markets but I think a couple more rate hikes are a pretty sure thing.

Right now you can lock in a 1 yr GIC @4.01% through GIC direct (on Cook St) or another GIC alternative would be at Hubert Financial where you can purchase a 1yr GIC @3.25% but your can cash in quarterly with no penalty. After three months, if you cash in you would receive 3.1%.

I have a couple of reno’s that I want to have done but I think will wait for another year. (Maybe lumber at Home Depot will be cheaper then).

Heard about LNG Canada? One of the biggest energy investments in Canadian history. Many other LNG proposals as well.

The capital is there all right. There’s even capital for new oilsands development, although deployment is subject to capacity issues.

https://www.ctvnews.ca/business/dozens-of-new-oilsands-projects-have-been-approved-but-don-t-expect-them-to-be-built-anytime-soon-1.4833848?cache=sbklajmajdo

At the same time, when people are insisting on pricing it incorrectly, won’t those listings sit for a long time?

Leo I myself am waiting on some Reno’s no rush just really expensive for materials and labour I myself am pretty sure subtrade prices will come down having been one fighting for work in the past lol

I’ll continue to harp on this! Not enough new listings coming to market will make the inventory climb very drawn out. According to my calculations still a reasonable probability we ended up with the lowest new listings (<12,000) for the year since 2005.

High fliers like Amazon is already below the pre-pandemic levels of Feb 2020. Facebook is well below. Google is still up, and Bitcoin is still over double. So still obviously some unwind to happen there.

Where’s our financial planner (HHV member) when we need him most?

In good times, he’s posting here all the time, boasting about the benefits of borrowing against your home and investing in stocks.

He seems to have fallen silent. So what are those investors supposed to do now?

Nice to see it back on the upward trend from last week’s stall.

Short term I agree, but long term I am super bullish on energy as I have zero faith in humanity. All I have to do is step onto my balcony and see 3 massive cruisers in James Bay every few days. Airports in chaos. I personally think we are still another 10 to 15 years away from hitting peak daily oil consumption even with the switch to EVs.

This was about 2 weeks ago, but that was his persective at the time. They were so crazy booked that a few cancelled projects likely wouldn’t even register. I do agree that higher rates is going to jeopardize a lot of projects, especially rentals and affordable housing.

Right. But it’s inversely co-related with the other investments you mentioned. Hedging helps.

That’s a tough one too. In talking to SFH builders recently all the contractor quotes are coming in at all time record highs. When the builder approaches the contractor about the quote being too high they get a reply of “sorry, all my employees asking for wage increases which I have to give otherwise they go to a commercial construction site, can’t go lower on the qoute.”

I’ve always had the philiopshy of just keep building and things will fall into place, but not sure if I would want to start a spec project right now. Seems a tad risky.

Do it when you have the time, energy, money and manpower lined up. I’ve never found it useful to wait for anything else. You get the extra value in comfort/quality right away. This applies to homes you don’t have to sell, and most particularly to your primary residence.

Real estate too early to start lowballing sellers, maybe fall/winter. Even a 15% drop wouldn’t get us where we were 12 months ago

Stock market seems a little sketch to add positions especially outside of registered accounts

Pay down very cheap debt? (my mortgages are 2.55-2.65% so low 3s after next rate hike)

Locking up money in GICs at below rate of inflation doesn’t seem exciting

Doesn’t seem like there is a super smart play.

I think that’s correct, we’re just in one of those phases where nothing much works. Even energy in my view has become too much of a consensus play & is subject to some downdraft for slowing economy risk. I think at these times, one should focus more on capital preservation than anything else, even if it does mean using a 1.8% HISA or a cashable GIC or something like that and eating the inflation. I think there could be a lot of value to staying flexible and having cash to deploy, just not right now. If you do get one of these opportunities to pick up say S&P at a real discount (ie. an overshoot situation, not just the unwind of the last year or so of excess), or dividend stocks/ETFs at outsized yields, I think that ends up being a good way to build long-terms wealth and security, and will outweigh the current loss to inflation.

I don’t think we get a real estate crash, but too many headwinds to buy in this environment, I really think better opportunities are coming up.

It’s hard to be patient, harder still in the age of the internet.

Also for big renos, do you do it now to get ahead of inflation, or do it when the recession hits and people are more interested in the work?

If you are sure you won’t need it for a year or more and you don’t want to buy stocks/housing and don’t have a business that requires capital then you are probably looking at a GIC. Other places to put cash are improvements to existing properties that will improve value if you plan to hold long term.

Not super convinced they go crazy high, wouldn’t bet on it.

Monday:

Sales: 234 (down 36% same week last year)

New lists: 547 (up1%)

Inventory: 1878 (up 25%)

New post tonight.

If you expect yields to go higher than current (for UST 20 year bonds), there’s TBF. https://finance.yahoo.com/quote/TBF?p=TBF&.tsrc=fin-srch

Or if you’re sure of it… TBT (2X inverse) or TTT (3X inverse)

20 year bond is 3.45% now https://ycharts.com/indicators/20_year_treasury_rate

Have quite a few listings coming up and sellers are having a tough time accepting even 5% pullback on certain product. If you tell the seller your property was worth $700k 12 months ago, it peaked at $1000k and based on comparables it is now $950k reply you get most often is “wow, shocking drop,” completely ignoring they are still up 250k in 12 months.

Huge during the 20% rate period in the 80s. VREB said one of the main things that were still selling were places with “low” assumable mortgages in the 12-15% range. I do wonder if we’ll see a bit of a comeback.

I’ve been researching this a bit as I have to complete on a pre-sale condo in Croatia in September and I’ve been disappointed that the CND isn’t stronger (even thought it is approaching a 10-year high) compared to Euro at current oil prices. Consensus seems like you note lack of new investment for fossil fuel (less damn for CND dollar; therefore, doesn’t go as high with higher oil prices).

Anyone have any experience with assumable mortgages? I haven’t been involved in one in my career but you would think a seller with a 1.5% 5 year fixed from last year selling that it would be a pretty big incentive for a buyer if it can be assumed.

Interest times. What do you do if you have cash sitting around with inflation burning away at it?

Doesn’t seem like there is a super smart play.

Rates are going up faster than I expected.

4.59%

With the 5 year bond at 3.4, the rates should rise to close to 5%.

That was around the stress tested level. Beyond that, there’s no safety net.

https://www.ratehub.ca/best-mortgage-rates/5-year/fixed

I work in the building industry and this does not jive with what we are hearing from other builders. Builders are struggling heavily with inflation and with the rise in interest rates. The mortgage broker we work with has been saying there have been a significant increase in cancelled projects, but the majority of the projects he works with are in Vancouver. It makes sense with the increase in equity you need now. Per Steve Saretsky

If the surveyor conducting the survey hears someone answer yes to all these:

– I don’t know how inflation or rates work

– I can’t afford my home

– It’s impacting my mental health

I wonder if the surveyor is ever tempted to end with a little unsolicited advice like saying “Thanks for taking the survey. And some advice… perhaps you should learn how inflation and rates work.”

What are five year fixed mortgages going for right now?

How many people did they survey? Four? What nonsense.

Canadian 5 year yields hitting 3.4% this morning, that’s what 50 points since the beginning of the month?

And just to be clear, that is 40,000 listings in Greater Victoria alone right 🙂

Yeah those surveys are 100% useless.

Given interest rates are guaranteed to rise further, I’ll be looking forward to 40,000 listings in 2 months though

Surveys are sometimes such bs. It cannot possibly be true that 25% of homeowners will have to sell if interest rates go up any more at all. I mean half of Canadians have no mortgage at all so this would mean that 50% of the remainder are selling if interest rates rise another percent?

Some other “fun-facts” from the ManuLife survey.

“—-The survey revealed nearly one third of Canadians admit they don’t understand how inflation or interest rates work

—- The survey, conducted between April 14 and April 20, also found that 18 per cent of homeowners polled are already at a stage where they can’t afford their homes.

—- Additionally, close to half of indebted Canadians say debt is impacting their mental health”

https://torontosun.com/business/money-news/nearly-1-in-4-homeowners-would-have-to-sell-if-interest-rates-rise-more-survey

Basically if you reduce the amount of CAD out there one CAD will buy more. Suppose the US is running 7% inflation. If we increase interest rates enough to pull the CAD up against the USD 7% in a year, presto no inflation. This is actually the reason why inflation in Switzerland is so low, although they got the currency rise against the Euro without raising rates, as the country is seen as a safe haven.

But boosting the currency has downsides. Thus we are likely to just follow the US rather than lead it.

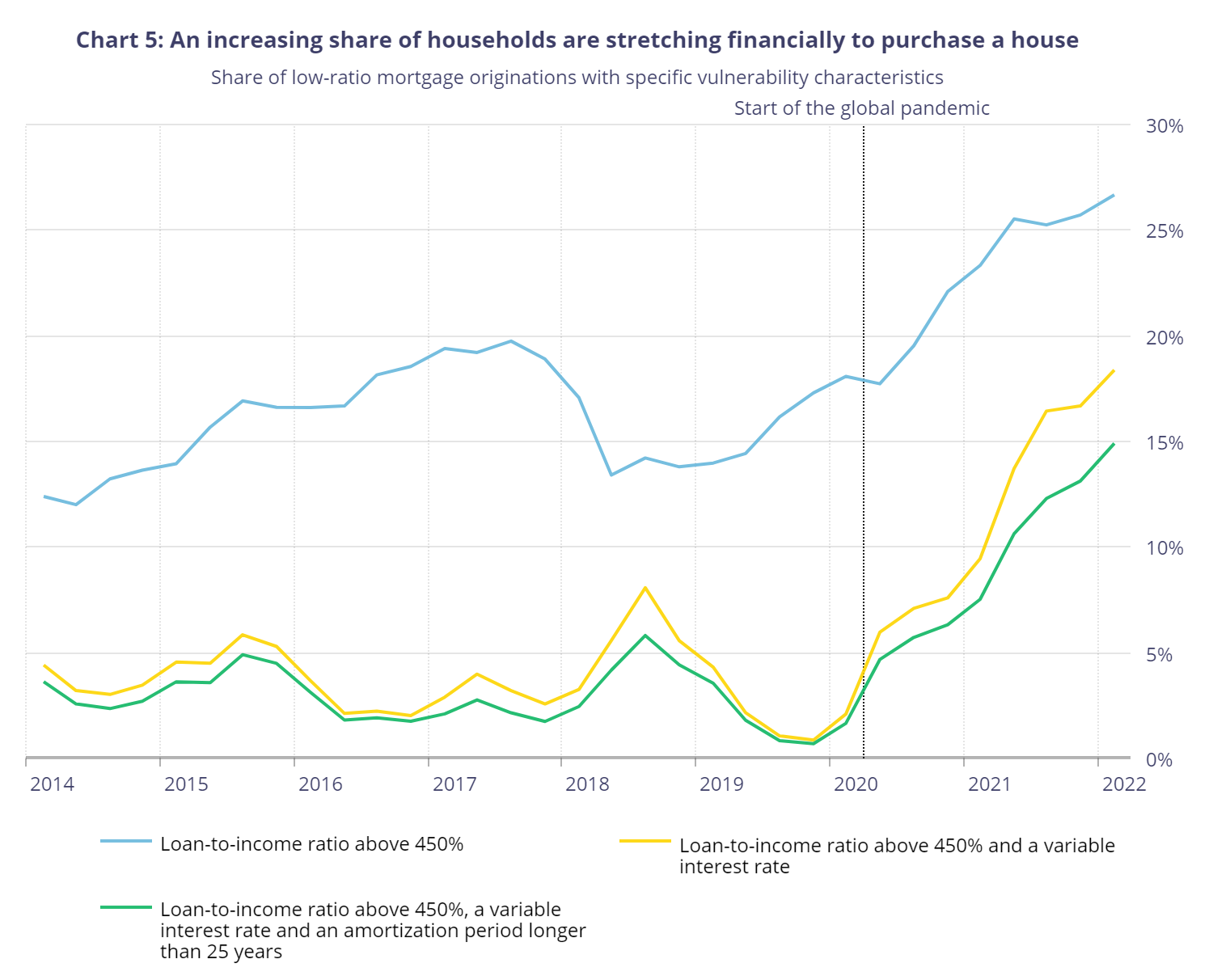

Now I’m skeptical of surveys and I don’t expect that many to be forced to sell in the end. However it does illustrate how stretched many homeowners are. I expect the biggest impact on the RE market to come from homeowners unable to move up or to help children to buy, and from investors selling.

https://www.theglobeandmail.com/business/article-nearly-1-in-4-homeowners-would-have-to-sell-their-home-if-interest/

Patriotz with globalization we have a very different economy in comparison to 82 how raising interest rates will effect inflation in 2022 I’m not so sure we shall see though

An interesting piece about crime and the response in a city.

https://www.bbc.co.uk/news/world-us-canada-61763912

Victoria is a small town compared to San Francisco, but somehow we have adopted big city problems. But is amusing to see how our politicians have followed it’s lead over the last several years leading to the same outcomes.

I’m glad that you point it out that the CAD is low when oil is up, and oil & gas price will continue to stay up for the foreseeable future. My guess is that Canada would be a failed state if we don’t have oil & gas to bail us out at the moment.

The reason for the low CAD is due to the current western political fossil fuel rejection, thus there are no new capitals for fossil fuel development in Canada. And betting that dictatorship China will recuse the global energy demand by giving them 80% of renewable materials and manufacturing control.

I do not know where you get your fact from, but oil price peak in 1980 and inflation was absolutely out of control in the same year that didn’t see the start of a down turn till the latter half of 1981.

Add: Another reason for the CAD is not following current oil price is that Canada Western Select oil is heavy oil and the US is releasing heavy crude from their reserve. Thus CWS is not in demand and currently price $20 or more lower than West Texas Intermediate instead of the normal a couple of dollars spread.

In 1974 the CAD was worth USD$1.05 mainly as a result of record high oil prices. Today it’s USD$0.78 with record high oil prices. In fact oil was more effective at countering inflation then than now.

The different between now and the 70-80s is that we are not relying on dead industry of forestry and fishing. This time we have oil gas that the world need and it is not going away at anytime soon till nuclear power come back into play. Therefore inflation is transitionary and will not be around for long.

Re: Nanaimo

The main drag is ugly, but so are Blanshard and Douglas.

Otherwise, Nanaimo isn’t too bad a town. Quaint downtown, nice waterfront and parks, close proximity to nature, Mt Washington is a day trip, etc.

Ladysmith prices went crazy on my block this year. Two properties came up for sale at double assessed value. One sold in a week for over ask, the other still hasn’t sold. They were around 1.2-1.3 million, a price that was unheard of. The houses were both 1950’s era, nicely updated with great views. At one time there were only a handful of houses for sale. Read somewhere that Ladysmith was the fast growing community of over 10,000 people the year before with a 4% increase. There is a lot of construction and empty lots available, but new builds are going to cost plenty.

You think inflation wasn’t imported in the 70’s – early 80’s? War and oil embargo – gee sounds familiar. 🙂

I’m of the thinking that this time around inflation will be more difficult than 82 It would seem like it’s being imported so the idea of raising rates to break inflation is yesterday’s solution cant believe we are going there again in 2022

Yes the north side is nice I used to have family in the Departure Bay area. But that’s the expensive part of town. The city as a whole doesn’t have a lot going for it and in my experience even those who lived there – and elsewhere on the Island – didn’t think otherwise.

The city appears to be more expensive than Ottawa where I now live, which makes no sense to me.

Absolutely.

This, from someone who lives in Ottawa?

patriotz- Nanaimo just like any city has good and bad areas. During our search I spent a lot of time in North Nanaimo and it’s gorgeous

We purchased in the Ladysmith area. There are definitely still high prices in Nanaimo depending on the area but there are deals to be had if you’re watching closely. I’ve seen some single family homes go for 600-650k which is the price of a condo in Victoria. They were homes needing some work but by no means tear downs. Just dated homes often estate sales and they came with huge lots. I was on the email portal for the area and the prices up there are dropping significantly. There is hope for people wanting to stay on the island but priced out of Victoria. Renting is another story. Just like Victoria the rents mid island are very high.

Congrats Karise! Great decision and enjoy the house!

https://www.nanaimore.com/blog/real-estate-prices-in-nanaimo-dropping-may-2022-market-report/

Median price down 20% but still incredibly expensive for a city that has lots of room to grow and is not particularly attractive IMHO.

Karise – Just curious which community you purchased in? I noticed Nanaimo prices averaging around $900,000, that’s a lot less expensive than Victoria but still high for that area.

Oh it can be contained. The better question is will it be contained. Reduce the money supply and things will get cheaper. But there are downsides. We saw that in 1982. On the other hand we were dealing with over a decade of sustained inflation back then. We just don’t know how things will go this time.

Congratulations Karise!

The cure for high prices is high prices. I’m definitely bullish on population growth on the island in the next 10 years. Lots of lovely towns on the island with lots of room to grow.

I just wanted to throw out to anyone looking and able to relocate that the mid island prices have come down significantly. We just bought and were able to negotiate lower than list price with full conditions. We also still had a low rate hold. We purchased a family home with a suite and a huge lot in a wonderful neighbourhood that we could never dream of affording in Victoria. In mentioning my move to people I’ve already come across 7 other people moving that way this summer. I’d be curious to know any stats on the growth of the Nanaimo/ladysmith/Duncan area. There’s an enormous amount of building going on up there.

It will be great if inflation can be contained. We’re not in a good starting place for that to happen though. Record low unemployment point to strong income gains ahead, and then the inflation is coming from local factors. Something has to “break” (as you put it) for this to end. And I consider it the BOC’s role to be the ”bad cop” to break it. I see a hard landing.

What if inflation is caused by factors that just don’t respond well to interest rate hikes this time? War, severe weather, production and supply chain disruptions. Rate hikes should constrain demand, but some things like food and gas are relatively inelastic.

I do agree with you there. You don’t get big RE pullbacks without a crappy economy. But with inflation + interest rates + RE declines that could happen.

Talking to the owner of a major geotech firm in town, they generally get the first hints of a slowdown since they’re doing the site investigations, and he said no sign of it yet. Fully booked as far as they can see, strong inquiries, he thought the construction industry should be solid at least 2 years out.

I think it is fine to have something in NB if you want. $200k to $350 is a good rate of appreciation for sure. Lower values mean more management for less return though, although at least you can get in. I wouldn’t buy there though because of the high property taxes and the fact that I have no desire to visit. I like RE partly because I can improve it, so I prefer to more hands-on. It would be a good place for a remote worker just starting out to buy a duplex and live in half. With the world opening up they could also sublet and spend their winters in a warmer climate.

We are hanging in for the long term with our NB investments. I’ve been reading sour predictions for three or four years now about how prices there will drop and that logic and prediction has proved to be silly. (There were predictions from banks just a few short years ago that $200,000.00 for a beautiful, old world Duplex….was “insane” and definitely would face a price correction. )

Those duplexes are now worth $350,000.00 and more….but still an astonishingly low price for a full duplex in great shape and within easy biking range to downtown.

And the rents have also gone up by 50%.

I find it interesting to hear people who can’t see the obvious.

I could be proved wrong of course. But everything is a gamble and I simply see NB as one of the safest gambles I’ve witnessed in my entire life.

If there are any young families in BC looking for a chance to own a home and not be overwhelmed by big mortgage payments, then they might want to consider a new life and move east.

I am not talking about Toronto which I feel is over priced. (People are selling in Toronto and moving to places like Moncton etc.)

I find it interesting that no one wants to believe that the printing presses in Ottawa just ate your lunch. And why has the weather been so crummy? Off topic but this June has been a real loss for nice days.

What broken, investors sentiment or credit?

Dry up credits will take some of the retail players out of the equation, but most institutional players are well prepared with over flowing war chests to buy the dip. It is posible the party is over for the minnows and just starting for the whales.

I agree, with current conditions a 10% pullback seems logical. Unless rate hit at least 6.5% as stated, we would be looking at 15% to 20% pullback. Greater than 25% pullback would require extremely high unemployment combine with population lost.

I don’t think we will see a devaluation beyond 20% even with rate at 7-8%, because our population in Victoria is increasing, plus the additional Ukrainian refugees ontop of regular growth. If anything, high population growth, global manufacturing and shipping retun to normal in the near term will make the pullback a short live. And, the bears will once again cries for rain because RE price will resume the forward march due to high demand with inadequate supply.

That would be an ideal soft landing. We raise rates, and inflation and house prices cool down so we stop raising rates. Easy.

But what if the economy is the “something that breaks”, but inflation is still high? That’s what happened in the late 1970-early 1980s, and we called it stagflation (unemployment, inflation, falling real GDP).

The cure for that wasn’t stable interest rates, it was much higher rates. A lousy economy and house price bust won’t stop inflation. It will just lower the CAD and worsen inflation. Ask yourself…..Would you keep your investments in CAD if the BOC was keeping rates low to support housing and ignoring inflation and a falling CAD?

The BOC will ignore anything that “breaks” until inflation is under control.

Home prices drop up to 31 per cent in some west Toronto neighbourhoods

These are prime centrally located areas. Is it different here? We’ll see.

LeoS. You might be right but 6.5% fixed five year in my view is more than just possible. With all respect, I think that you may be missing the point that something has already broken and the choices to deal with it are extremely limited. It has been a wonderful party but it looks like the musicians are packing up.

By my calculations at about 6.5% fixed rates we would be in a similar position in terms of how far away affordability is away from the mean. In that case I wouldn’t rule out a 30% price decline similar to the 80s. But… I don’t think we’ll get to 6.5% rates before something breaks. Without a rise to 6.5% I think we’ll probably end up with a 10% pullback or so but it all hinges on the trajectory of rates.

Not sure I understand this. Banks don’t get compensated for their loss of profit in the event of default. Only for the difference between sale price and mortgage debt. And any shortfall then becomes a debt owed by the mortgagor to CMHC.

In 2 years from 79 to 81 SFH price jumped 100%, and interest reached 22%.

In 2 years from 2019 to 2022 price jumped 46%, and currently 5 years fixed is below 5%.

IMHO, even if rates go up an additional 2-3% I couldn’t see price drop 45% as it did in the 80s. However, based on past events and current conditions perhaps a devaluation of 15-20% from February peak is possible.

Thanks for clarifying this for me. I have stayed away from REITs so am pretty ignorant of them. I should have kept that point out of my argument.

There was a buyers incentive in the 80s, but the widely awaited mortgage bailouts or rate caps in the fall of 1981 did not arrive.

I don’t buy this logic. Just because they went up the most doesn’t mean they will drop the most. They’re still relatively very cheap. As long as remote workers don’t rush back to the big city offices they might very well hold up.

Roughly similar impact on houses and condos in the 80s

From: https://www.ctvnews.ca/business/housing-prices-in-canada-could-fall-15-per-cent-by-dec-2023-after-bank-of-canada-rate-hikes-report-1.5943236

Maybe wait on that Moncton purchase for a bit… But if you do buy there, the locals are probably looking to blame out of towner’s for their increase living costs. It’s not unheard of their for vehicles to get torched for having out of province plates, but if you have local plates, best not to have them on a Tesla, Audi or BMW either.

If the default is going to be on an insured mortgage, best for the bank to just push the default through, sell the property, let the insurer pick up the difference and make their profit that would have been over the mortgage term right away (best business case for those). Maybe some negotiation leway on uninsured, however, typically the traditional bailout route is bankruptcy for the defaulter. Sell off the assets that have any value and a 2 year period of paying creditors half their earnings and then they are free to start buying back their credit.

I would hope there would be no bail out of folks that have bought and might be under water for a few years Hasn’t happened in the past so no need for it But if banks want to be forgiving case to case it’s their business Let’s just have a good ol fashion recession

Far, far less. Even in the worst year of the US bust, 2010, the rate only got up to 2.23%. And note – 2010 was the price bottom in most markets. As prices increased, the rate decreased in turn.

https://www.statista.com/statistics/798766/foreclosure-rate-usa/

https://atlantic.ctvnews.ca/moncton-named-the-top-place-in-canada-to-buy-real-estate-1.5935273

If the inflation rate was 10% and there were no rent controls, would I raised the rent 10%? No, I wouldn’t, why? I would probably lose my tenants, and have nothing. I’d like to think the lenders would apply the same rationale to outstanding mortgages. Do they want a lot of foreclosures? I doubt it. I’m not sure what the current foreclosure rate is, I think it’s something like 2% or less. In a serious downturn, it might increase by double, not exactly the end of the world. Nobody wants prices to collapse due to high interest rates, for that reason it probably won’t happen.

Good point. People get hung up on resales that have been fully renovated saying that part of the increase from value is from the renos, which is true. But if you want to take that into account you would also have to take into account that the homes that didn’t get renovated appreciated less than the market due to their condition deteriorating.

For medians you can safely ignore this, for repeat sale indexes you have to be a bit more careful with outliers.

I understand this, but I’m making the assumption they won’t stick with their new formula next year, even though they should.

As for renovations, I would say don’t get hung up on how much the vendor has spent updating the home. People spend money in some of the craziest things that don’t add value. Instead when you look at the home decide if the home is like a new home, a ten year old home, or a twenty year old home depending on when and how the updating was performed.

That’s what you would then be comparing it too. What you shouldn’t do is compare it to homes that have not been updated and then tacking on another $300,000 to form your offer to purchase.

I like using medians and find them accurate. However it is how you derive the median that is important. A good way is to bracket the property you are looking to purchase by its square footage and lot size within a set geographical area.

If you are looking at buying a 2,500 square foot home on a 7,000 square foot lot then you would bracket 2,000 to 3,000 square feet homes on 5,000 to 9,000 square feet lots within a two-kilometer radius over the last 90 days. If this captures more than 30 sales then you will get a good indication of the property’s worth. The only thing that will make a difference is if the home is in better or worse condition to that of the typical home for the neighborhood or has an amenity such as a water view or fronts along a heavily travelled street. Then the price will either fall between the median to high end of the range or the median to the low end of the range.

The median is also a good way to determine how prices have changed. If you look at the last sale of similar property that sold along the same street that sold two years ago, then you can look at the median at the time the property sold and the current median. That will show you how much prices have changed between the two periods. Apply that factor to the older sale and it will result in a present value for a home similar to what you are looking to purchase. You can do the same analysis using the past sales history of the property you are looking to purchase.

Then you can cross check all of the above by using a sales to assessment ratio for properties that have sold in the last 90 days within the same area. Take that ratio and apply it to the property’s assessments that you are wanting to purchase.

A median analysis does work – you just have to know how to apply it.

patrioz, thanks for the video. If everyone read that free book and took the lesson to heart, just imagine the effect on home prices….

https://www.youtube.com/watch?v=R3ZJKN_5M44

Who compelled anyone to buy that which they cannot afford?

“Desire is the source of suffering” (paraphrased Buddhist philosophy)

An investor cannot pull their money out of a REIT. They can only sell their holding to someone else on the stock market.

Once upon a time there were RE mutual funds where in fact someone could pull their money out, like any mutual fund. They are now gone and replaced by REIT’s because of the scenario you described.

“They tied max allowable to inflation which they called 1.5% for last year and therefore the 2022 increase limit.”

It’s a 12 month rolling average which is why it was 1.5% in 2022. They changed the rent control formula from inflation + 2 per cent to inflation only. The definition of inflation has not changed.

I’ve been thinking about this as well. I highly doubt they will allow the full CPI increase even though they should just stick to their policy

I am glad you clarified what your definition of an investor is. Because it is much broader than most people would view the term investor.

On the other hand both your theory that investors are net buyers in a downturn and that they contribute to more volatile prices can both hold true. This is because there are different types of investors. You have highly leveraged investors that try to use as much leverage as possible to make outsized profits. These would most likely be forced to sell at least part of their portfolio for whatever they can get in a rising rate environment putting downward pressure on prices, even if the person or company buying the property is also an investor. This buying investor might be a more well capitalized investor and want a bargain based on rising interest rates. This leveraged investor could be a mom and pop investor trying to get ahead quick or an institutional investor owning a 200 rental unit building selling to another institutional investor.

Also REITs may be forced to sell in a downturn if their investors try to pull their money out in a decreasing price environment to realize their gains. A lot of these properties would probably be picked up for a bargain by other investors.

This overal downward pressure would also impact the price owner occupiers could sell their property for, even if they are selling to a (bargain hunter) investor.

The BoC rate is really only a signal and a benchmark for private lending, it does not control it. For consumer debt and mortgages, it has to be sold in the bond market: meaning someone has to want to buy the debt as an investment. The high debt load of many presents a risk, so therefore, to sell that debt it needs to get marketed at a higher rate to find a buyer (the low rates would not have occured the last two two years without the BoC and CMHC bond buying program that kept low rates legitimate). So, to maintain legitimacy and to fight inflation the BoC rate must increase right now because the debt market is departing the BoC rates and it needs to keep up. If the BoC rates do not keep up, lenders will just change how they peg their prime rates to BoC rate to make up the difference from the market rate. Not to mention, the rate must go up to find a buyers for Cdn government debt now as well (which there is now double what is was 3 years ago). So, if the BoC doesn’t raise rates, confidence in government debt sinks because is doesn’t pay a marketable rate of return and runs the risk of a currency devaluation which in turn spikes inflation.

“And so if inflation of 6%+ sticks around, yes I’m expecting policy rates of 6%+. And so should you.”

I have a hard time believing the bank will be able to hike much above 3% before they break something important, so no I don’t expect rates to get anywhere near 6%. That would be shit house is in flames, time to move into a van down by the river territory.

Ya 6 or 7 percent rates really not that far off the norm I think folks are underestimating how high or long inflation can go on for

Does anyone else wonder what the NPD will do with allowable rent increases for next year? They tied max allowable to inflation which they called 1.5% for last year and therefore the 2022 increase limit. Think they will stick to their own policy and allow something like an 8% increase for 2023?!? I wish they would, but there is no way I can imagine they will follow their own policy. Instead they will somehow limit it by fakely calling inflation way less than reality or cap it at something laughable. Any bets – 3%?

BOC rate will not need to get anywhere close to 6% before rising rates have the banks desired effect on tamping down inflation. The amount of consumer debt out there has never been higher and therefore rates don’t need to get to that point.

https://youtu.be/_R4kLQ-WPKQ

A BofC rate of 6%+ only seems weird to you because you’re too young to know better. Have a look at historical rates, and you’ll see that the BOC rate was 6% or higher for 20 years, from 1972 to 1992. And so if inflation of 6%+ sticks around, yes I’m expecting policy rates of 6%+. And so should you.

Are you expecting variable to rise to 8%?

That would absolutely kill the RE market and economy, because 5 and 10 year fixed would be 10% or higher.

“Any homeowner with a variable rate that would be unable to pay mortgage (ie lose their home) if rates rise to 8% should switch to a 5 or 10 year rate now”

This seems like weird and bad/terrible advice. Are you expecting the BoC to hike its policy rate to 6 to 6.5%?

I think you’d be much better off not panicking and locking in a rate that is the worst in recent memory, for the next 5 or 10 years.

This isn’t news, has been like this for months now, lumber came off the highs in march. Also, these are traded futures just like oil so “Canadian lumber” is also priced off of that, takes time to filter through to your local home depot though.

Apparently lumber prices in the U.S. are in steep decline. Prices are down about 50% ytd. Trading below $600 per thousand board feet when 12 months ago the price hit a record high @$1733.

Just spoke to a broker friend who works at one of the big 5 and they were recently told to call all their clients who had rate holds and tell them the new bank policy is 15 day rate holds (instead of the 120 they had) due to fluctuating rates. She’s totally embarrassed to call all her clients to tell the rate she ‘guaranteed’ them isn’t actually guaranteed now unless they have a firm offer in place. But if you are just shopping – too bad so sad – give you today’s rate for 15 days and then we have to do another hold at those rates in 15 days. Called another friend who works at a different FI after, and they are still standing behind their rate commitments. For now anyway.

VE Analyst – we pay our employees well above minimum wage and give them paid sick and vacation leave far beyond the BC minimums. So no, that is not why we are contracting our BC operations. Let’s just say the NDP is out of touch and messing up.

Patriotz I had a good chuckle over that title sort makes raising interest rates is just all about the real estate market too funny

At start of 2022 Affordability was near record levels (ie worst affordability) and I assume it has worsened farther with the price rises and mortgage rate rises exceeding wage gains. We likely need to see house prices fall 10% to just improve affordability to where it was six months ago – which was very bad affordability.

The Boc shouldn’t pay attention to house prices. The BoC mandate is to fight inflation and it should keep going with the rate rises.

Any homeowner with a variable rate that would be unable to pay mortgage (ie lose their home) if rates rise to 8% should switch to a 5 or 10 year rate now

Note how the conversation has moved from “will prices fall” to “how much will they fall”.

How far do housing prices need to fall before the Bank of Canada stops raising interest rates?

If their goal was to own and live in their home, they haven’t wasted anything if they keep the home. Their savings were lost the day they bought the home and traded it for a house and mortgage. If they lose the house, then yes it was a waste.

They’ve wasted their life savings anyway, along with what the Bank of Mom and Dad put in, if prices fall. But holding onto the property makes it easier to ignore that.

Forced selling where the homeowner is unable to pay because of rising rates would be the worst possible outcome. The government/banks will try various mortgage deferrals to help.

Deferrals aren’t “bailouts”, because the homeowner still has to pay the full amount owing + interest, they just do it over a longer period. There’s nothing wrong with that.

What policies? Min. wage and 5 paid sick days?

I think it is reasonable to work something out for first time home buyers should rates go above what they were stress tested at. Maybe keep the payments at the stress test rate then extend amortization on the remainder. Hate to see a hard working young family spending their life savings on a home only to loose it.

A recession is certainly coming because the source of inflation won’t be easily fixed by modest rate raising. For example, energy prices are high for supply/factors that are won’t be fixed in the next few years without an end to sanctions on Russia or a serious recession which kills demand.

BC is particularly vulnerable because, frankly, the business climate is poor. We run a business that spans a few provinces and, unfortunately, thanks to provincial government policies we have stopped hiring in BC this year and anticipate BC staff reductions and shifting positions out of here.

I really cannot see a government bailout for real estate. The closet program might be some additional construction projects to try to provide extra jobs. I worry that the job situation in BC could take a rather bad turn by the end of the year. So much of the local economy has been dependent on real estate and logging.

I do not know of the truth of it but a couple of my friends in Toronto are saying that major condo projects that were in the pipeline are being put on hold. Heard the same about Vancouver. I dont have a crystal ball so I am not about to do any projections . On the other hand, it is not a total surprise. You cant run the printing presses like Ottawa did without having to eventually pay a price.

I’ve seen people making big deals out of mortgage income fraud recently – i’m not sure how rampant it actually is – presumably pretty small. I never saw anything like it when i worked at the bank but it would have been really easy to do. Before i left in 2016 i remember hearing that eventually our systems would link up to the CRA for income verification so we knew the information was correct. That still hasn’t happened yet. not sure why. Anyway another story from Ben R’s twitter:

[img [/img]

[/img]

again some crazy updates to expectations for our friends out east:

[img [/img]

[/img]

This one would show for sold over ask despite dropping 350k from original ask

The fact the places like Keswick ran up close to Victoria is mind boggling. Even with the 30% drop still same price as Duncan but worse than Duncan, crap winters and a solid 1 hr + commute to downtown TO and at some points you are in like 6 lanes of traffic. No thanks.<

I don't think I've ever heard "Victoria" and "Keswick" mentioned in the same sentence before. Like Pluto and Lake Taho. Nothing in common. When I first went to Keswick and York Region I thought I was on another planet. Yeah the best of the GTA measure below Vancouver Island on natural scenery 8 days a week. Poor Ontario.

There has never been a government bailout for a RE crash in Canada, be it the 1980’s crash in BC/Alberta or the 1990’s crash in Toronto.

Given the fiscal challenges governments will be facing going forward, I’m not sure there will be much appetite for direct handouts to a few fools at the expense of services like health care. And even in a major crash it’s only a few who actually get into trouble.

Kicking the can down the road in the form of tax deferral or stretching amortizations, which we saw during the pandemic, is more likely.

What was actually said:

Surrey is still policed by the RCMP, as are most BC municipalities. Beyond that you have the core city versus metro city issue when comparing statistics. Not denying you have a problem, but so does Kelowna and other cities.

Not likely, have to follow. See how weak the Canadian dollar is with 120 oil. If boc don’t follow or one up then Inflation just gets worse.

I think bailing out first time home buyers is fair.

It’s amazing how fast the discussion changes. Hopefully we are way too early to talk about bail outs. A part of letting real estate slip with the increasing rates is that employment is ample and the economy can handle it even if the real estate market comes back down to earth. Would it be so dire if the market gives back 2 years of gains that came out of the COVID anomoly? As COVID was an unpredictable event on the way in and throughout, the way out it will likely have the same unpredictability. The question also is: how capable is the government/taxpayer to support a possible bailout? Federal debt servicing is going to be jumping from the $21 billion now to about $50 billion by the next federal election. On the provincial level, BC has sustained some land transfer tax windfalls that may be disappearing along with having to service it own debts in an increasing rate environment. So, there might not be the capability to support a massive bailout, unless there is a lot of people out there that think they could really use massive tax increase. Or we just might have to start digging things out ground and getting them sold again (this is tough because we are experts at stopping everything now).

Lol ok

I hope we don’t get a crazy real estate crash.

If we do the government (aka taxpayers) will bail out homeowners. Better just to get a medium decline and then long stagnation.

The somewhat strange thing about inflation is that for owned households, interest expense is a big part of it. So as the Bank of Canada raises rates to fight inflation, the primary lever will also go directly into increasing the CPI at the same time.

And because of our unique mortgage market where Canadians are exposed to rising rates much faster than americans, rising rates drive up our CPI inflation more than down south.

US inflation numbers are really not good. The US Fed likely to ratchet up the interest rates and we are likely to follow.

Gas wars, that’s hilarious. When was the last time the Victoria gas collusion had one of those? Also, wow that’s the first time I’ve seen that place not look like an absolute dump.

https://www.facebook.com/photo/?fbid=3707882542581414&set=gm.2218223234977492

Probably because they’re in the vicinity of a police officer, who wouldn’t feel unsafe in that situation?

As time goes on, the gap between condos and detached houses will become larger and larger. That’s why missing middle is so important. Family-suitable housing that can remain attainable if we allowed more of it.

From : https://globalnews.ca/news/8912629/victoria-residents-dont-feel-safe-downtown-night/

Wait, how can people feel unsafe? doesn’t everyone understand that these are just vulnerable people that are being stigmatized. It’s your own fault that you being accosted because you are the real threat and you are responsible for the circumstances that these people find themselves in. Feeling unsafe downtown after being harassed, mugged or randomly assualted just contributes to the problem by amplifying the stigmatization and your responsibility for this happening. Just go downtown, ask for forgiveness, take your punches, give up your wallet, go home and don’t complain.

However, some congratulations are in order. We are number 1, we beat out Surrey and are tops for crime in the province. Gotta take the trophies you can get.

Hmm, no. Maybe yours is. Our portfolio is still up (mildly) YTD.

I am thinking around $1.5M to $1.6M currently would be ok. Given current rates and rent you may break even on mortgage only at around $1.1M to 1.2M as a rental assuming 20% down then eat the negative carry on the other costs, add in some premium for the neighborhood and the jumbo lot size so I think $1.5M $1.6M would be reasonable. The other house that got sold on the same street was $1.1M for a shittier house on a much smaller lot but with another min 50bps hike in July and the rise in fixed rates next week coming I don’t think that is a good baseline anymore. Things are changing pretty quickly so pretty hard to price right now.

2007- That was a scam whereby unqualified lenders were given mortgages with low initial payments that soared after a few months. They were doomed to fail but the bankers that bundled the junk loans and passed them on as viable investments made billions of dollars. That resulted in thousands of foreclosures across the US. I don’t think that is happening today. Let me reiterate, today’s high prices (inflation) are the direct result of supply shortages, nothing else.

OK. How about 2007?

This is where it may be worth separating the differences that matter from the ones that don’t.

I wish people would stop comparing today to 1980. It’s not even close. Saw on BNN yesterday that the world’s net worth was 530 trillion dollars. I won’t get into the obvious lack of fair distribution but you might as well compare that crash with the Dutch tulip market crash of 1637. A lot has changed, the internet alone has created trillions in net worth. Anyone with a computer can start their own business with little investment and millions have . You couldn’t sell your torn pair of jeans to someone in Asia for $100 in 1980. Why do you think there’s a labor shortage, you can create stupid YouTube videos and earn a good living if you get enough followers. The top YouTube earner makes $45 million a year. We have 40 years of wealth accumulation around the world, and yes, billions of people have been left out, that didn’t exist back then and opportunities that we could not even dream of in 1980.

2.5 mil, all day long. Happy?

As a self proclaimed Victoria RE analyst I’m more interested in what you think and why

Fair enough. Like they say “A recession is when your neighbor loses his job. A depression is when you lose your job!”

Patriotz yep know it well Fresh out of school swinging a hammer it came to a end abruptly Headed to kits beach to lay in the sun others left for Toronto for work

To illustrate how bad the June 81 – Nov 82 recession was in BC, here are BC unemployment stats from StatCan from that period.

One in 12 BC workers (8.2%) lost their jobs during this 16 month period!

And mortgage rates hit 21% in August 1981 https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

https://bcbc.com/dist/assets/publications/the-2020-shutdown-how-deep-is-the-economic-hole/BCERO_2020_02.pdf

uhh, James. Your quote refers to the most recent recession to the 2009 article, when BC “ was last plunged into a recession” and there was” consecutive annual declines in employment” . The most recent recession to the 2009 article where this happened would be the 82-83. However there was a bunch of recessions, including the biggest one in BC from June 81- Nov 82.

If you’re interested in the 1981 BC recession (and I’m sure you are), here’s some info from a U Vic professor https://www.rrh.org.au/journal/article/1265 as you can see in the chart,

The 81-82 BC recession was brutal, -6.4% GDP which was worse than the -4.5% drop in Canada overall Many articles refer to the BC recessions as 81-86 https://ojs.library.ubc.ca/index.php/bcstudies/article/download/1457/1501/6011

“ However, in 1981 a major recession caused widespread unemployment leading to major restructuring in forestry, mining, and the energy sector. Thousands of jobs were lost in the forestry sector. This began a wave of depopulation in rural BC, which accelerated during the recession of the early 1990s and has, in the current recession, accelerated even more. The loss of income as mills and mines have closed has led to declines in local tax revenues and the ability to fund local infrastructure and, in many cases, the heart of rural communities has been cut out. As well, as the jobs in these towns disappear dynamic and well educated families tend to leave, further eroding the social capital in these communities and increasing their economic and social vulnerability3-6.”

uhh, Patrick, from the same article (https://www.cbc.ca/amp/1.819377):

“The report also says the province will see the first consecutive annual declines in employment since British Columbia was last plunged into a recession, in 1982-83.”

Point taken. I didn’t lose my job until 1982 though. 🙂 Nor did most others who lost their jobs.

Hey Frank, what do you think this house on Ascot is worth? https://www.realtor.ca/real-estate/24522246/3845-ascot-dr-saanich-maplewood

Wrong.

The recession began in 1981. In BC and Canada

https://www.cbc.ca/amp/1.819377

“British Columbia has had four recessions since 1961, with the longest downturn starting in 1981”

https://en.m.wikipedia.org/wiki/Early_1980s_recession

“Canada had two separate economic contractions in the early 1980s.[4] These were a shallow drop in GDP and a slowing in employment growth for five months between February and June 1980, and a deeper 17-month contraction in both GDP and employment between July 1981 and October 1982,[6] although both contractions were driven by the same desire of governments to reduce inflation by increasing interest rates.[7] Real Canadian GDP declined by 5% during the 17-month 1981-82 recession with the unemployment rate peaking at 12%[“

Takes about a 33% drop to erase the 50% gain, so far so good.

lmao you only getting the 12% yield if you bought at the low, if you bought before the drop your yield doesn’t magically turn into 12%. The actual cash dividend will be stable at best when the stock gets hammered. So you will still get your 3 bucks a share or whatever the dividend is but your portfolio is down like +50%.

Not surprisingly, blowing off a little froth from the 50% they gained in the previous two years. That doesn’t mean much to me.

Exactly. I’m retired with no pension. Having a (reasonably diversified) dividend flow plus fixed income component lets me sleep at night without worrying about having to sell pieces of our investment portfolio at inopportune times, like the one we’re in now.

The inflation rate in 1981 was 12.47%. The same year Vancouver and Victoria house prices (nominal) declined by over 10%.

The recession didn’t happen until 1982.

Yes, it’s sure looking like that. We may see stagflation (inflation, fall of Real GDP, unemployment). Keep in mind this may mean inflation of 8% and nominal GDP growing 7%. That’s -1% real GDP making it a recession. So prices and wages keep rising, it’s just that people and businesses and the economy is falling behind. Nominal house prices can still rise during that, because they’d need to rise 8% to match inflation. Of course a recession with unemployment would hurt the house prices as a separate issue.

It’s actually the other way around, if a company cuts dividends the price of the stock usually goes down as it becomes less attractive to investors. Companies don’t cut dividends just because the stock price went down, indeed it’s just what they don’t want to do as it would depress the stock price further.

Canadian banks kept their dividends going through the 2008 financial crisis – some were paying 12% at one point.

No one has suggested using home ownership rate as a proxy for investor purchasing. Charts like the one you posted of investors buying with a mortgage aren’t really a proxy for anything useful, since they just might be measuring investors increasing use of mortgages during Covid (ultra low rates + higher home prices= I want a mortgage). You seem to care about an unclear subset of investors that are buying homes using mortgages, but I don’t see how that data point could be used as a proxy anything else useful outside of that.

The Homeownership rate however, is an excellent measure of investor ownership, because homeownership% + investor ownership% = 100%.(assuming a broad definition of investor including any type of landlord charging rent, and spec home -second home – investors)

And statCan census measures things properly, which includes added suites in homes as rented dwellings, which they are. Of course your “investors using mortgages to buy” chart would ignore all that, as it alsoignores most other investor activity ( buying multi-units, adding suites in properties, buying without mortgages, selling of any kind).

Anyway, an increasing use of mortgage helper suites increases the housing supply. So it should be captured under the heading of “investor activity”, since homeowners become landlords subject to income taxes and rent regulations like other landlords.and it is captured in the census homeownership number.

So simply looking at the homeownership number provides the investor owner number, and for me provides an excellent proxy for the total, net investor participation in the market. You seem to want to only consider a subset of investors (perhaps mum n pop investors?).

It would clarify things if you simply told us what you are referring to when you say “investors” – for example do you include more than mum n pop investors (like apartment owners, REITS, non-profit NGO, spec taxable property homeowners, mortgage helper suites etc.).

Higher interest rates are sure hammering the stock markets. That hurts a lot more people than those with highly leveraged mortgages. RRSP’s are going down along with pension plans, people relying on dividends from all those high flying stocks are going to have to learn to live more modestly. Once a stock drops 30% their dividend usually gets cut and everyone bails, it gets ugly. Maybe some will have to sell their homes to survive, that might increase inventory. I’m sure we’re headed for a recession, lots of businesses are hurting due to the high costs of goods and wages. Some will inevitably close, at a certain point it just doesn’t make sense to stay in business.

There’s the upside surprise.

Canadian 5 year yields up to 3.32% this morning. Woof.

Interesting, missed that. 2018, so they only owned it for 6 years.

BCI sold it to Gablecraft. They had to diversify out of some Canadian realestate because they were too concentrated.

Is it Gablecraft that owns it or BCI?

Ouch! Good luck to whoever building (not gablecraft as they got the land for cheap years ago) and buying those.

It’s almost as if ownership rate is not a good proxy for investor purchasing because it mixes in a lot of other factors.

Yes. That makes Canada’s high homeownership (68.55%) even more impressive. Because they count a house with a suite as 1 owner and 1 renter, so that would mean 50% home ownership for that house. If 5% of dwellings are suites in owner’s houses, and they didn’t count the suites, homeownership would be 68.55/95 = 72%.

Canadian homeowners are increasingly renting in-house suites as mortgage helpers.

That will also lower the homeownership rate as reported by statCan from the census.

For example, if the homeownership rate is 68%, and no one buys or sells anything. But 2% of the homeowners add a suite to their home, then the homeownership rate in the census will fall to to 68/(100+2×0.68)= 67.3% .

So if we see a slightly falling homeownership rate on the census , maybe it’s just attributable to more mortgage helper suites in homes, rather than any change in investor/homeowner buy/sell activity

Nah, they’re going for $1.8m now

https://www.realtor.ca/real-estate/24494620/3423-trumpeter-st-colwood-royal-bay

Are houses in royal bay still going for 1.5?

I still think that there is a chance that the BofC rate is at three points or above by the beginning of next year. But will that really do much more than flatten the real estate market. One of my friends seems to think that we will not see significant impact until rates for the five year are closer to eight.

US CPI estimates were 8.3%. actuals for May 2022: 8.6%. Canada CPI out next week as is the US Fed interest rate decision. All will be telling for our rate hike decision in July.

That is what Statscan would say too. Their homeownership rate is based on dwellings, not properties.

What I think they should do is not tinker with interest rates in the first place. Set a strict range: bank rate at 3-5%, pay depositors 2-3%, This would provide stability which is what people and markets like and might also be good for the value of our dollar. This problem was created by historically low rates in the first place. Was that really necessary, no, those rates only applied to certain products and certain customers. Low rates probably didn’t help anyone who actually needed a break on interest rates.

If such a policy was in place, housing prices probably would not have gone crazy. I also believe only a select few have access to these rates to play Monopoly in a market of $1 mil-2 mil properties. When properties were $200,000-300,000, a little fish like me could qualify for investment loans. The banks have been tightening their criteria for investment mortgages for years. Once you owned a certain number of properties, you were basically cut off. Some banks had a limit of 5 properties, at one time CIBC’s limit was 10 (my friend was a broker for CIBC). The individual investors playing in the million dollar plus market are extremely well off, they’re just amusing themselves by playing Monopoly. Like I said, I’ve been shut out of buying additional properties for years. There is no way 95% of the population can qualify for investment mortgages at these stratospheric levels, its only a select few that can go to the bank for million+ dollar investment properties. Anyone else has to go to the secondary lenders and pay much higher rates.

Agreed, but…what do you want him to do with inflation raging? They can’t wait for it to get entrenched in wage demands (probably already happening). Oversimplifying, I think they’ve pretty much decided housing and energy are two key factors driving real inflation, and at this point they’re ok with a recession to tamp down on both. I think best one can do is sort of get out of the way to the extent one can (ie. I would not be buying a house right now) and wait a while for this to unfold, personally.

https://www.bnnbloomberg.ca/cibc-to-raise-minimum-wage-to-20-boost-frontline-worker-pay-1.1776763

Starting to look like that inflation is priced in.

Your move central banks.

Leo, would it be possible to update your mortgage risk graphs? https://househuntvictoria.ca/2022/02/08/fixed-or-variable-a-risk-analysis/

I agree. So I’ve changed my post from “subject to rent controls” to “considered a tenant under the law”. I don’t think room rentals are considered tenants, but yes, I would consider room rentals as part of the property that is “investor owned”

The reason the idea of “what is an investor?” came up for me in todays HHV discussion is the idea suggested by our bank of Canada of investor owners being “fickle” and likely to sell quickly in a downturn. Because , I don’t see that happening , especially when we consider the broadest group of investors. For example, someone owning a 200 unit apartment block isn’t going to sell it in a panic as condos to homeowners – evicting 200 tenants in the process. The reverse happened in Seattle in the 2008 downturn – many new big multi-unit builds planned as condos couldn’t be sold and ended up as long term full time rentals with a single owner.