High frequency (un)affordability

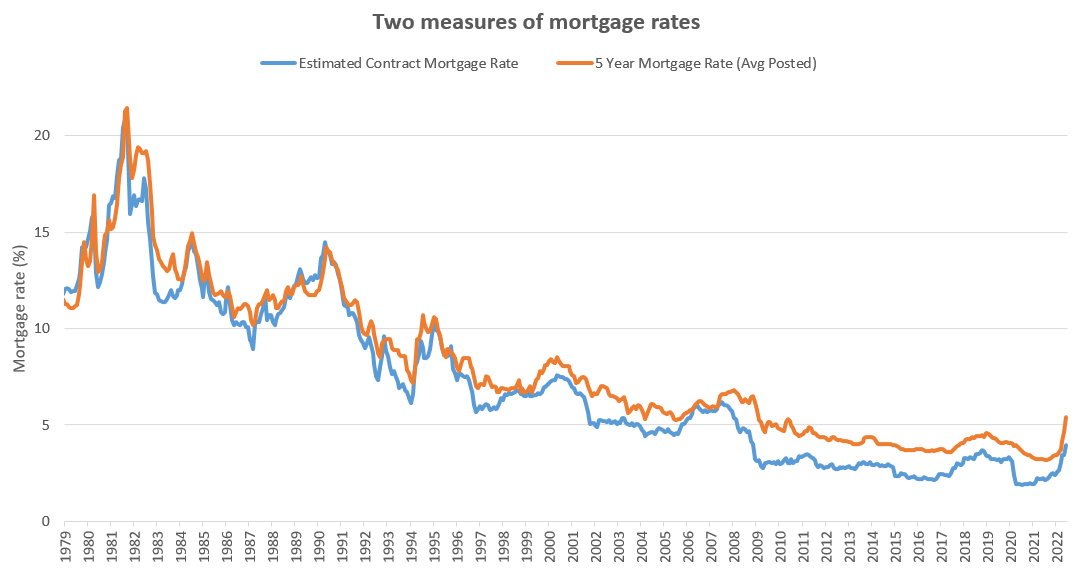

I’ve talked about affordability a lot on this blog, most recently a few weeks ago when I looked at the relationship between unaffordability and price changes in Victoria. The measure I used is useful because it shows cycles in affordability going back about 45 years, however it also has some issues. The primary problem is that the measure was based on annual data, which means that it was pretty slow to react when prices or rates are changing quickly (like now). For example the most recent data point for the average posted 5 year rate is 4.93%, but for the 2022 data point I would use the year to date average, which is 3.92%.

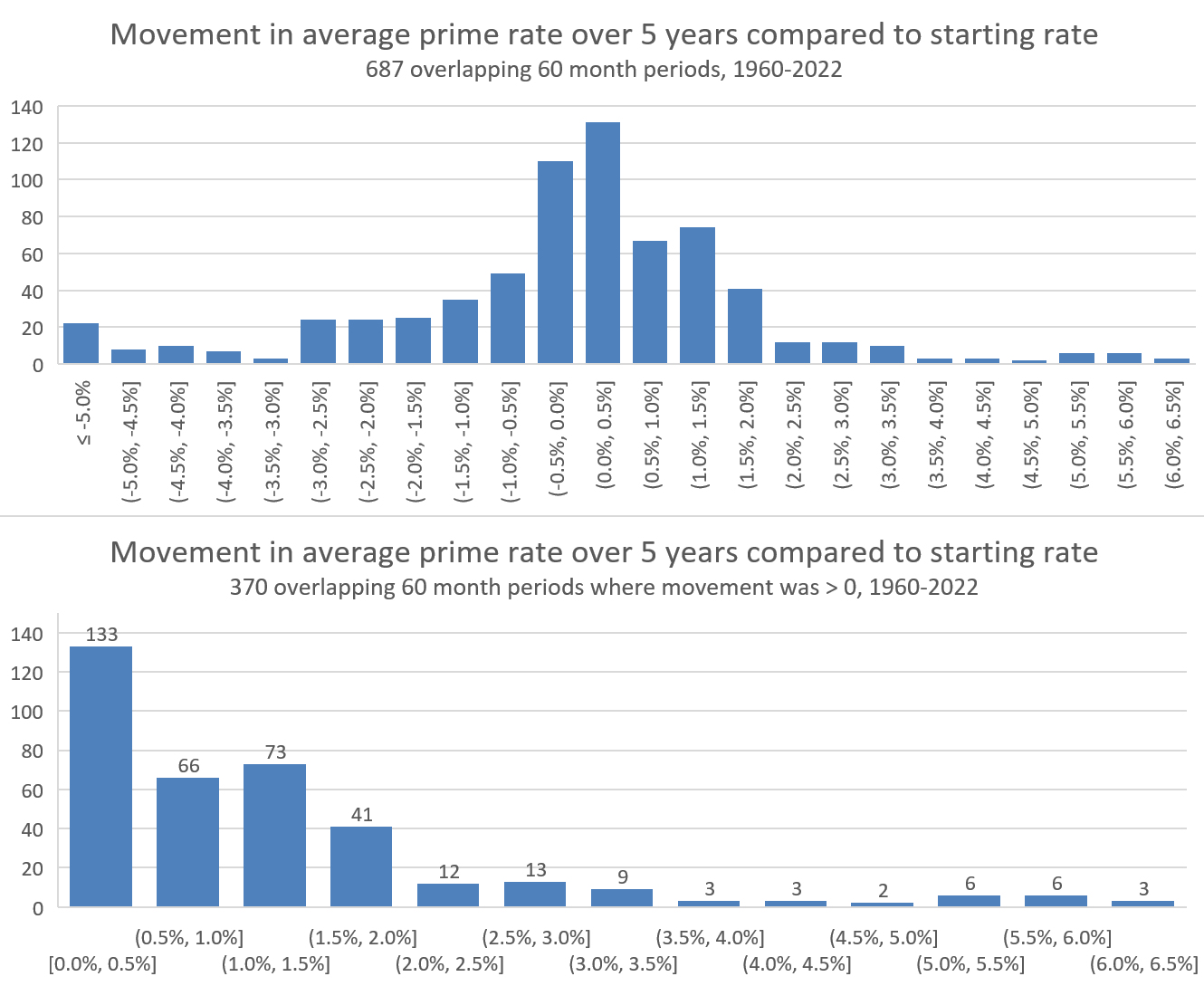

The second issue is the rate I use in the affordability calculation itself. I’ve been using the StatsCan series 027-0015, which is the “conventional mortgage lending rate, 5 year term” from the CMHC. The advantage is that the data goes back to 1953, but because it’s an average of the posted rates of about 3 dozen lenders, it doesn’t reflect market share or practices around discounting. That keeps it about 1% above the actual contract rates that people are getting. A constant offset would not be a problem (we are interested in changes in this measure, not the absolute value), but the big banks’ habit of keeping their posted rates artificially high since 2008 has widened the gap between average posted rates and contract rates. Equally important is the recent trend of over half of consumers opting for variable rates which should be accounted for. To correct this I constructed a new rate series which is the average of the overnight rate + spread and the 5 year bond yields + spread. Spread was calibrated against actual contract rates and set at 1.5%. In general the old and new rate series are close, but the new method is lower in more recent periods.

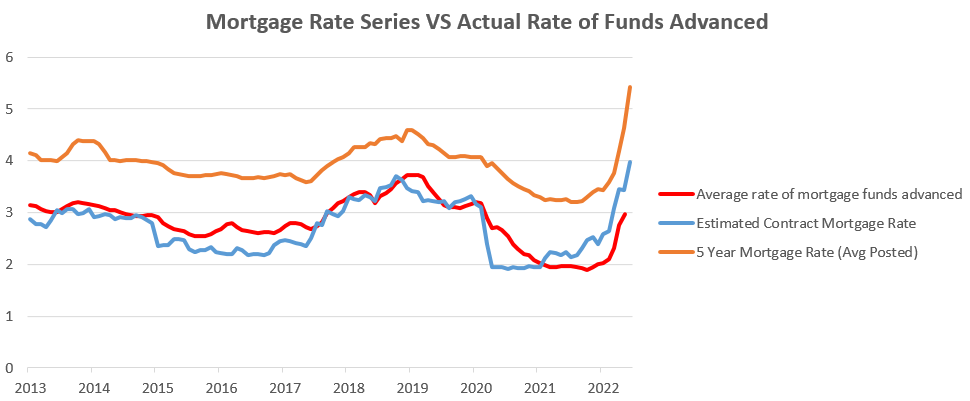

More important than their relative standing is the relation to the rates that people are actually getting. Of course if we had that data we could use it directly, but it only goes back to 2013. Actual mortgage rates are influenced by changes in spreads over time and rate holds on the fixed side, but overall we can see that our new estimate is pretty close to the actuals. I’ll use this series going forward.

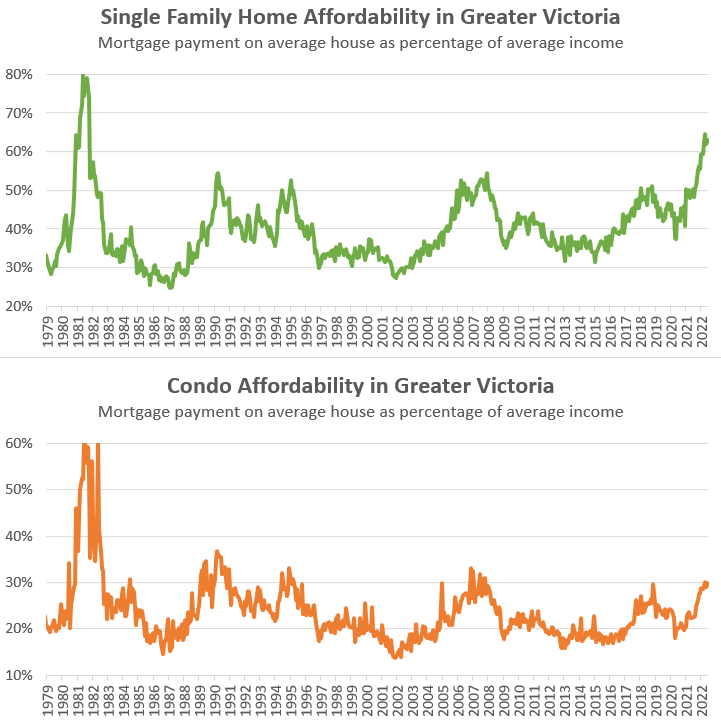

Does it make a difference to our assessment of affordability levels? In general it will slightly improve affordability levels in more recent periods without changing the bigger picture much. I’ll take a closer look at that in the future, but more importantly we can now monitor affordability on a monthly basis. That is shown below for single family and condos.

It’s fundamentally similar to the yearly charts using the previous method, with condo affordability being at a point where prices have flatlined and drifted downward in the past, and single family affordability being somewhat higher than where we’ve seen soft landings in the past depending on your assumptions of how quickly single family affordability is expected to deteriorate. Again it shows how incredibly insane the 80s bubble really was and why prices declined quite dramatically back then.

What’s the point of the new method when it yields essentially the same picture as the old one but in a messier chart? Well we’ve just had a 1.00% rate hike which will immediately worsen affordability. At the same point we have dropping prices and rising incomes which are improving affordability. The question for many buyers will be when enough risk has drained out of the market in order to feel comfortable jumping in. The monthly series will be much more responsive and useful to make that kind of call.

Incidentially on the income side, that’s a point still to be improved. Currently the last reading is from 2020 with increases after that extrapolated from the previous trend and inflation. I’ll see if I can improve on that method using other measures of wage growth to get closer to current income levels. At that point I’ll publish the live chart and data somewhere so we can keep an eye on it at as it changes.

Also the weekly numbers courtesy of the VREB.

| July2022 |

July

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 147 | 835 | |||

| New Listings | 346 | 971 | |||

| Active Listings | 2090 | 1270 | |||

| Sales to New Listings | 42% | 86% | |||

| Sales YoY Change | -36% | ||||

| Months of Inventory | 1.5 | ||||

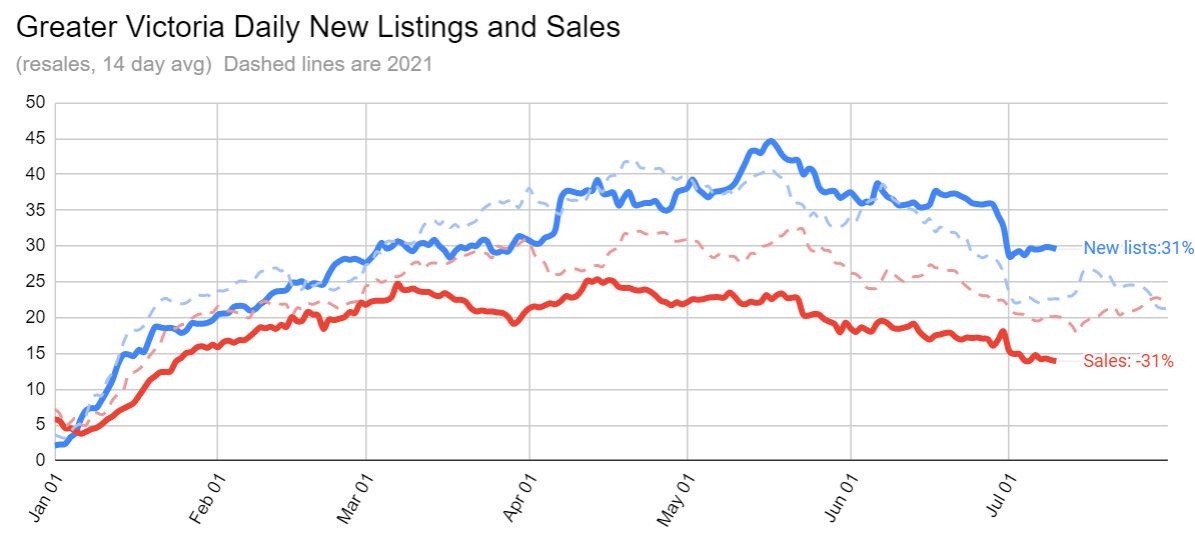

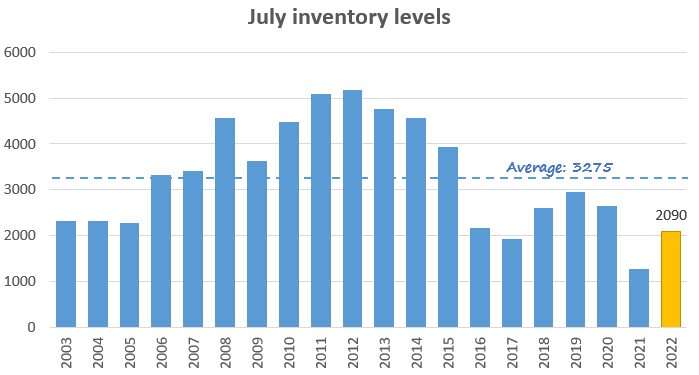

My big question going into July was what would happen to new listings. This time last year they dropped precipitously as people chose to go on vacation instead of sell. Luckily the same hasn’t happened so far this year, and we seem to be on track for a more normal pace of new properties hitting the market. Sales continue to drift downwards and we should expect July sales to come in at the very low end of the historical range if not the bottom.

Bidding wars continue to decrease. This should stabilize soon at less than 10% at which point we can stop tracking it.

Inventory continues to increase in a time it usually starts to stabilize before dropping in the late fall. That’s a good sign, but we’ve got some way to go to hit normal levels for July. Hopefully selection for buyers will continue to increase during the summer. Very low sales levels are putting pressure on prices right now, but low inventory makes that balance precarious as it hinges on sales remaining depressed. For a sustained buyers market we will still need to see substantially higher inventory levels persisting.

Ironically Turner was right at the time, April 2008 was a market top in Vancouver and Toronto and prices began to fall rapidly in the following months. What he didn’t see coming was the response to the GFC in the fall, namely the slashing of interest rates by the BoC and the efforts by the Harper government to stop the price decline and use RE to juice the economy.

And it worked until – you know when.

New post: https://househuntvictoria.ca/2022/07/18/triggered/

That’s just cruel

He’s like that on the blog too. No respectful back and forth possible unless you drink the Koolaid first

If Leo were Bonnie Henry then Garth would be the foaming at the mouth anti-vaxxer marching back and forth in front of the Legislature.

Regarding the possibility of migration from the States, here’s an amusing (well, to this expat) comic on the matter:

I think Garths analysis focuses so heavily on fundamentals and completely ignores the unpredictable psychology and emotion that has equal influence on the real estate market. He always seems surprised by peoples actions. After 14 years you would think he would at least try to factor that in rather than simply shame people into buying his books and investing with him (Turner Investments) rather than housing. There are stories out there of people regretting following his advice.

Garth Turner is terrible in terms of analysis. I am not sure that he understands the subtle interplay of economic forces.

I recommend starting from the beginning: https://www.greaterfool.ca/2008/04/28/the-canadian-subprimes/

That Greater Fool blog is terrible. Garth Turner sells books and has been flogging the crash since before I started following his posts in 2009.Even went to see him speak in Calgary and while he is pretty entertaining he is a bit of a dick to people that even ask a question that challenges his views. But he has garnered a large cult like following amongst the bear crowd and he has ramped it up to the point of being the Alex Jones of Real estate. Search his post history and see he has been wrong for over 95% of time. Listening to him which I almost did in 2010 would have cost me well over a million in equity and I would be still renting. Even a broken clock is right twice a day.

I’m sure you are learning lots.

I have recently begun visiting another blog which seems vastly larger than HHV given the number of posts per day and this is a daily blog. It’s called greaterfool. Victoria seems to be getting a few honorable mentions. Today the author referred to Victoria as the nation’s most “stuck-up” market. Interesting description of us.

@Frank of course you’re right that eventually the market will roar back. But in order for the concentration of wealth to move ever upwards (which it must in a capitalist system) the tide must go out so that some people lose everything and the cash buyer can come in and seize the opportunity. Also, if money is too easy to come by people stop working, and of course cheap labour is also required in a capitalist system. So the writing is on the wall, this down cycle will go further down before it goes up. My guess is the going up won’t happen for 4-6 years. The next couple years will be rough. But we are lucky here in Victoria – I suspect our housing market won’t plummet like it will elsewhere (even though it will correct).

I watch several news channels and gather information from each. 16 mass shootings in the U.S. this weekend alone. Several reports on news channels, radio, newspapers, that more Americans fear for their children’s safety and are considering moving to Canada. Who knows? Maybe some doctors and nurses will move back and take a 75% pay cut. I doubt that. Most will be educated and highly skilled, just what Canada lacks. Not to mention the extreme climate, fires and water shortages making regions uninhabitable . Their dollar also gives them an advantage. The micro-analysis everyone is focused on misses the bigger picture, massive immigration and severe shortage of housing. This temporary slowdown will turn around just as fast as it slowed, just not sure when.

I am just returning the favour 😉

Given the timing delay of the stats, I am thinking now that August will be the month where the full rate hike impact will show up in the data instead of the second half of July. Curious to see where sales versus assessed end up.

Once again, thanks for making me your priority today.

It wouldn’t surprise me. The levels of sophistication line up.

Re July numbers

We are at 285 currently. Quick eyeball test tells me we gained 138 since last week.

Let’s say this week we do 130 and the following week 115 that is still 530 (285+130+115).

Based on the number of accepted offers out there I don’t believe 130 + 115 is a stretch by any means.

I would really be surprised if we hit a 22 year low, I think we will hit a 10 year low instead.

Here are a couple from you from May and June Up and Coming,

https://househuntvictoria.ca/2022/05/16/new-and-active-listings-what-happened-during-the-crash-of-81/#comment-88758

https://househuntvictoria.ca/2022/06/13/poor-affordability-continues-to-drag-on-the-market/#comment-89818

Another beauty of this anonymous forum is the linking of prior posts made 🙂 Speaking of prior posts, where is that debt monster poster? lol he should be the one calling you out, not me! Or maybe I am him 😉

That’s the beauty of an anonymous internet forum.

No one does, but he can’t let reality get in the way of his narrative.

I don’t remember seeing that. I think most folks probably recognized that once the Bank started its tightening cycle, the writing was on the wall. The only thing I’m surprised by is how quickly rates have risen, and by how much. But Tiff Macklem is also very surprised by it, so I don’t feel that bad.

Frank from Winnipeg seems to be the only permabull on here.

Not many people have the foresight to go all variable until all time low rates and then flip to think that they would rise sharply and lock in as a result. So congrats to you if you actually pulled it off.

As for people in Vic being typically slow to changes in the RE markets comments, I absolutely stick by that one. Look at how many people thought we were immune on this forum when Toronto and Vancouver first slowed down. Some even thought that suburbs in the Westshore were more desirable compared to Oak Bay, how’s that for a laugh.

Hey, if being skeptical helps you feel better you go right ahead, but just because you missed out doesn’t mean that everyone did. Someone keeps posting on here that people in Victoria are slower than people from Vancouver and Toronto when it comes to RE, so maybe that’s the case here?

Also

https://www.crd.bc.ca/about/news/article/2022/03/09/crd-regional-parks-strategic-plan-online-engagement

https://www.victoria.ca/EN/main/residents/parks/parksandopenspacesmasterplan.html

I am disappointed that in all the talks about development very little is said about developments that have greenspaces on/around them. I would like to see a committee come up with a green master plan – like what they have in Singapore. I don’t care if buildings are 4, 6 or 8 stories high. Is there a green master plan for Victoria/surrounding areas? Perhaps I’m wrong about this.

Wow such impeccable timing that you managed to get a minimum of 3 properties locked in to all time low rates. I am a little skeptical of that claim but unfortunately have no way of verifying. Let me guess, you had variable rates on all of those prior to locking in right?

My comment was about past Julys. Leo already answered my question. Thanks Leo!

Such a weak attempt at trolling, but no I locked in my primary and all rentals at rates under 2%. Imagine that, someone figuring it out before you arrived here and started dispensing your free advice.

Right, so every July there’s a 1% rate hike following two straight 50bp hikes?

Believe it or not, this isn’t the first July we’ve ever had.

Sales are pretty flat usually in July and August.

Only thing that will make housing more “affordable” in the short term is the process of deleveraging. Keep in mind that wealth is not created, it is merely transferred (whether its from one group to another or from a bunch of groups to one group) and the process of deleveraging transfers wealth from those with home equity to those with cash. The process of deleveraging will not make homes affordable for those without cash.

How would you know that if today is July 18th? I anticipate this to be the case but the data is not available yet.

Actually, it is not a matter of just building James Bay but the plans for the railroad lands should also be moved forward. People keep arguing that we have a housing crisis and that we need to rapidly increase the housing supply to make it more affordable. If that is the goal then major high density needs to be built in large parts of Victoria (in addition to missing middle). My understanding from the city planners is that the missing middle will not make housing any more affordable nor will it make any significant increase in units any time soon.

It is fine by me since a developers has made me a generous offer for my property subject to the missing middle being passed.

On the good news front permission has been granted for my renovations to at least partially restart. But we are still having problems sourcing roofing slate.

Neither, but there’s no reason it all has to end up in James Bay.

If you don’t have to go through 2 years of garbage to build a 3 story walk up in Oaklands that would be better, since you could build what you need in James Bay and Oaklands.

I thought that the back half of July slowed considerably for sales?

Logical fallacy – Appeal to extremes:

I don’t like density. Therefore I will argue against a mild form of density that many support by proposing a ridiculous form of density that few support. Let’s expropriate James Bay and build a Burj Khalifa of low income housing instead.

James: I never said that at all. I actually said that we need both if we are to meet the CHMC figures within any reasonable timeline. I never suggested that it was a choice between one and the other. Nothing particularly sacrosanct about James Bay in my book.

The real advantage to the highrises, in addition to building more of the missing middle, is that a lot of housing can be achieved in a comparatively fast time line. Incidentially, I dont have a personal dog in this fight. It simply does not affect me. I am not arguing against the missing middle here and I dont think it is a totally bad proposal except that it is not well tailored in my opinion by doing a blanket rezoning. My point is that if you are looking to have any meaningful density increase over a reasonable timeline then you need to go high density. I am not going to be around to see any of it in any event.

Thanks for that. Looks like BC and Ontario leads the way with the google search, If you drill down by city, Abbotsford is #1 and Victoria is #9. Up and Coming and Frank, are you two contributing to this? 😉

https://bmoficc.bluematrix.com/sellside/EmailDocViewer?encrypt=38f234ab-42df-43c8-b6ef-cea7bc455bce&mime=pdf&co=bmoficc&id=ROB_Research@globeandmail.com&source=mail

No one is asking for Hong Kong or NY though. Only you are arguing for it because you don’t want it.

People are asking for the missing middle, and you’re saying Kowloon Walled City is the ideal for the masses while everyone else can live in Single family housing.

Don’t need to ‘feel’ it, when we can check Google Trends:

[img [/img]

[/img]

The most recent peak is dotted as they are waiting for more data to come in but it will likely solidify next week. We are at peak interest for people searching “Bank of Canada Rate Hike” on Google Trends. Not a surprise i guess.

Let’s see if my call on market lock up post July hike and rate holds expiring stands. I have a feeling that everyone interested in RE is finally frantically googling “Bank of Canada rate hike” now. That probably led them to a bunch of Steve Saretsky videos, lol the same guy that called for a debt jubilee and BoC can’t raise much past 1.75%.

For those who have a vested interest, please watch and read the actual BoC meeting press releases and interviews (there is a reason these releases move capital markets). They clearly said that they will sacrifice the equity of those who bought recently to bring down inflation and a slow housing market is a mechanism for that, also their concerns about the weakness in the CAD given the current high oil prices.

The whole country is available. A population growth of 1% or a bit more annually is no big deal, we’ve had more than that in the past. 3% in the early 1950’s for example. The real issue in recent times hasn’t been population growth per se but falling household size and resulting increase in households. But that trend is just about spent.

https://www.macrotrends.net/countries/CAN/canada/population-growth-rate

In Europe you have masssive chains like LIDL that have Costco sized stores but they also have excellent grocery stores the size of a Red Barn with great prices. Here for some reason we don’t have smaller Safe On Foods/Thrifys/etc. Every that is small is not exactly value driven.

+1 love this too.

When I lived there, regular grocery was pretty impossible to do walking. Looks like things have changed a little bit if you’re in the right area.

When you legalize suites then the owners do pay additional fees. In terms of extra parking, you have no right to road parking as a homeowner. You are supposed to be parking on your property and the road is then additional parking for the general public unless redistricted to residential only. There are already a whole load of suites in all areas, including Oak Bay.

There is a move by Oak Bay Council right now to amend the work from home rules to allow much more of this activity. Still would be residential zoning but would increase the ability of individuals to earn a living in the neighbourhood and provide local services like massage, lessons, and professional services.

I personally love small commercial with one or two floors of residential above and bought deliberately based on access to this walkable amenity. I’d be in favour of allowing this in more areas through gradual changes to expand existing areas that are already zoned this way.

There would be a lot of uptake imo. Just not for businesses that compete with Costco. You’ll see niche grocery stores like Red Barn, Peppers or Old Farm Market along with bakeries, coffee shops, and restaurants. Estevan Village, Cadboro Bay at Estevan, Cadboro Bay Village, Cook Street, Oak Bay Village, Oak Bay Avenue, Quadra Village… people love them.

Will end the month between 525 and 550 which isn’t that bad on 2200-2400 inventory. Market hasn’t locked up as hard as I thought it would over the summer.

Monday month to date numbers

Sales: 285 (down 31% from same week last year)

New lists: 631 (up 13%)

Inventory: 2141 (up 51%)

New post tonight

No for sure, I could live in Yorkville, TO if I didn’t have to commute anywhere in TO but I’ll still take puttering along the water in Vic West over Yorkville. Way better weather here, condo is like 1/2 the price in Vic West, strata fees 30% less, taxes less. Vic West will be perfect by the time they add 15-20 towers/commercial @ Roundhouse but I’ll be 80 yrs old by then (realistically).

Was really disappointed in Montreal waterfront too, great they copied London and got a ferris wheel but yea no where as nice as I thought it would be. I guess I am holding up everything to Europe standards.

As I said I really enjoyed Ottawa but I was there last summer. Winters are just brutal.

To be clear I am not advocating this as a good plan but I am suggesting that this is a likely coarse that may need to be taken or may be chosen within the political parameters of today. It is a straight numbers game.

1) You dont want Urban sprawl

2) There is no interest in creating multiply new cities and infrastructure

3) People want to have net immigration of and population increase of 400k to 600k a year.

4) It comes down to where do you house about a half million each year in the few cities available.

5) I am sure that I will get the usual word salad of a response from people but let me reply that ultimately it is time for some real thoughts on this problem.

From the CHMC numbers I am guessing that just upzoning density, by way of the missing middle, is not going to even scratch the surface of meeting the CRD numbers over the next few years. In addition to any low rise buildings a lot of high rising buildings are going to be required especially in the downtown core. Some might argue that to meet CHMC projections we should plan on a good part of the City of Victoria being turned into highrises.

Caeveat: A number of cities have gone the expropriation route. You piss off a handful of homeowners but you can afford to be very generous with the compensation since you are massively up zoning the property. Done properly there is serious financial and political support not only from the developers but also all the union workers and contractors. Throw in BC Housing and supportive housing facilities into the mix along with bicycle projects and the Woke will pile on. If we enter into a recession, as appears possible, this sort of social megaproject can be a real political winner for the right party.

If there is a recession, private construction might come to a screeching halt. I know that projects in both Vancouver and Toronto are being put on hold in major numbers. Not sure about Victoria so if anyone actually knows for a actual fact speak up. But jobs for the boys is usually a big political winner.

By the time you get to California you are likely to be one of those people who are too old to be vibrant.

“GTA on the whole super disappointing after having travelled to 30+ countries“

I feel like if you live and work in one of the hip areas of Toronto or any other major city and can bypass commuting it could work. You’re often on the move for business or travel so you never quite get to relax and you’re forced to experience the downsides someone doesn’t necessarily need to see. Even Calgary has cozy walkable neighborhoods like inglewood that have everything someone needs.

The downside of Victoria is none of the areas are really that vibrant and the median age needs to go down 15 years to fix that.

Northern California can’t be beat for a working person imo. That’s my long term goal.

Low income households also spend a lot of their income on cigarettes, alcohol, junk food, etc…,

items that are heavily taxed.

They don’t, because lower income households spend a disproportionate % of their incomes on shelter, food, and second hand goods which are not subject to these taxes. On top of that, they get GST and carbon tax rebates funded by taxes which higher income groups have paid. And, they are less likely to own a car or live in an independently heated unit in the first place.

The % of income paid for these taxes actually rises going up from low to middle income, and then starts to fall going to higher income.

I’ve been to Toronto 6 times in the last 8 months and it sucks. Give me Amsterdam/Vienna density not Toronto and 10 lanes of traffic to drive to some crap suburb.

GTA on the whole super disappointing after having travelled to 30+ countries. They even managed to screw up Niagra Falls. I never realized when you looked away from the falls you would be looking at what looks like Vegas or Reno from the 1970s. Seeing different parts of Canada in the last year has made me really appreciate BC, but density would not change what makes BC desriable imo.

As for Vancouver if I was in a different profession I would consider it but 98% of my profession is my name and 2% tangible skills so not the easiest to move.

I think it is an attitude thing. For 20% of the population “parking problem” = someone parking in front of their house.

Example. I live a few blocks off Dallas Road. 6 or 10 times a year some big fun event happens along the waterfront and all the street parking disappears for a few hours or half a day. For me this is a tiny inconvenience that is a consequence of living in a nice place. For some in the neighbourhood this is a “problem” that needs to get fixed by “resident-only” parking zones. Sigh!

I’m still curious about this part of your solution Barrister. You were a lawyer and presumably understand something about expropriation. Do you truly think this would be an efficient way to add density vs market processes? Do you think this exercise of government authority would have popular support? Do you think any government would actually do it?

You’re describing the grand bargain. Go big density in the downtown then preserve the single family sprawl outside of that. Vancouver and Toronto are good examples of this type of thinking. I would argue a much better approach mostly taken in Europe is mid and low rise more broadly. So then you don’t need the 40 story tower, but you have 3-6 stories allowed everywhere. The city stays human scale and green, the height supports mixed use, and it’s basically optimal from a climate standpoint.

City of Victoria estimates an immediate deficit of 4500-6300 homes in this report: https://www.victoria.ca/assets/Departments/Planning~Development/Community~Planning/Housing~Strategy/Victoria%27s%20Housing%20Future.pdf

CMHC came to a similar conclusion but at a province and country level.

Marko, I truly appreciate that density and street life is extremely important to you. I am surprised that you have not moved to Vancouver or Toronto where you could have this immediately instead of waiting for decades to see if develops in Victoria.

Downtown Amsterdam is still not high density compared to Hong Kong or NY. I believe the argument is that to make things more affordable then we need to seriously increase density. High rises in James Bay would go a long way towards the goal of more housing units. Not saying other measures are not needed.

Actually, I have never been able to have a city planner tell me how many units we need to have built to make things affordable. Does anybody here actually have a number range of how many more units need to be built both in C of V and/or the CRD for it to become affordable?

I’ve been to the Netherlands 3x, love it.

Outside of poorly planned new subdivisions on the Westshore where exactly are these parking problems in Victoria? I would like to drive by to assess.

Personally, I would find more secondary suites, duplexes, townhomes, and six plexes way way more desirable. I really like density and activity on the street and in the neighbourhood in general. Can’t stand the car centric community planning/neighbourhoods, like Gordon Head is just complete trash planning imo. In Croatia I even like the soviet style condo blocks as they have nice parks everyone goes out in the evening with their kids, and it just feels really vibrant. My cousin lives in this lower end soviet style neighbourhood and there are always people outside socializing from kids to 80-year-olds as you can tell by this google street view -> https://goo.gl/maps/WU7J3Snai6EhTLn4A I don’t think density is all bad as long as we aren’t removing parks, tennis courts, basketball courts, etc.

My parents have been renting their secondary suite for over 25 years in the Oaklands area. Vast majority of tenants have been UVIC students. For example, they had two Phd students from Tanzania for two years. My mom would invite the students for dinner with us upstairs a couple of times a month and we became friends. Next thing you know I am in Tanzania on Mount Kilimanjaro visiting them. Each to his own, but this is desirable to me not living in Happy Valley cheering for the Oilers in my media room driving a Dodge Ram 🙂

Also, if anyone actually gives a rats ass about the environment we need density and a lot more of it; however, the cold hard truth is no one gives a **** re environment so I ‘ve accepted with are completed screwed on that front.

When something isn’t convenient for people like a few extra cars on their block everything else from housing affordability to environment is tossed out the window.

It’s not the goal, unless you’re talking about the actual cIty of Victoria instead the city of Langford.

Missing middle is actual high density. The downtown doesn’t have to look like NYC to have high density. Look at downtown Amsterdam.

Yes, lower incomes being dependant their vehicles is an easily verifiable fact and additional costs have a disportionate economic impact on them. It may not be to others that don’t view that cost as significant or recognize that impact on others may find themselves in an elite category.

I did not advocate against more rental housing or freeing up space for density. Simply, folks already facing the hardship of high costs brought about by the lack of affordable housing options can be impacted by the further application of additional costs. Sometimes a focus too much on the macro blinds the micro.

What does that have to do with street parking in Oak Bay for suites?

By the way it is not rhetorical because no one has actually provided me with an intelligent answer. The standard answer was that we have to preserve the character of the neighborhood. The missing middle initiative pretty well gives the green light to removing most of the SFH along with most of the character.

If you want to increase the density of the city and afford walkability to the downtown than James Bay strikes me as the logical choice.

A easily verifiable fact = elitism. OK buddy.

City of Victoria did a study on various apartment buildings and parking usage. Average was 0.6 cars per unit. When we lived in a rental apartment we paid extra for a parking spot, and why not? It’s an extra service we wanted, and the people without a car should not be subsidizing my car. Building a parking spot in an underground parkade costs many tens of thousands of dollars.

We have the lowest rental vacancy rate of any major centre in Canada. That drives up rents very quickly and costs people 50x more than a parking permit. Space is limited. You can use it to house people or house cars. Pretty simple.

Caveat: I sincerely dont understand why if the goal is to increase the population of Victoria why James Bay should not have the same density as the Songhees at the very least. It is the most easily walkable area to the downtown core. So instead of replacing the SFH with the missing middle it strikes me as a better alternative to have actual high density that is easily walkable.

Marg Gardiner – superhero NIMBY powers

Do you sincerely not understand or is this question (which you have posed numerous times before) purely rhetorical?

I worked on Queen Street, building after building after building that were max 3 stories high, right in the core of the city. Kensington Market, right there in the core of the city as well, either 1 or 2 story stores or single family and duplex. Easily could have been 3 or 4 story, residential overtop of commercial in the whole city block.

That’s the blind spot of elitism in this case though, assuming because someone is low income and needing to rent a basement suite will not own a car or require as a necessity based on a belief that lower incomes on percentage down own vehicles. It’s almost exclusionary in a sense that adding the cost will make vehicle ownership prohibitive. Conversely, that vehicle may be critical to the sustainment of that person’s income if they work multiple jobs, split shift, or nights where other mobility options are not practical. Placing such barriers, impacts the ability of that person to earn an income and sustain a lifestyle (a home) not to mention telling them by their economic station in life, society is going to act against them and limit their freedom of mobility and their possible future upward economic/social mobility. This is how consumption taxes, value added taxes and carbon taxes (because they need to drive older vehicles or rent a place without a heat pump) disproportionately impact lower incomes, because those in that bracket typically are more dependant on those types of goods (as well as not affording a home with their own driveways).

It’s mostly the inhibitive nature of the thought process and the outlook to possibly obstruct a potentially beneficial outcome by placing barriers before it happens. It seems to parallel a lot of the thinking that comes from those looking obstruct densification.

You’d start with gas cars. Gas tax doesn’t even begin to cover road maintenance let alone the actual construction. We paid more for one overpass (Mackenzie), than has ever been spent on bike lanes in the history of the city. Pedestrians everywhere subsidize car drivers, and that’s not even taking into account pollution (from tailpipe to actual production).

Re Parking in Europe

I have seen the parking situation in Europe. I am having a little trouble understanding why you want to bring that level of conflict to Victoria. If the choice of how to make Victoria un-affordable to lower income people is high housing costs or a myriad of incidental charges I would prefer that those who are profiting from the increased density (ie suite owners) should pay the costs of extra parking, garbage collection etc.

If the solution is pay parking, why don’t we bring it in first before we have a problem. If it seems to be working, we can raise the density at that point. Even better, why don’t we have zones of the city where we try that approach and see where people would rather live.

So far I have seen a lot of arguments for increased density. I am not hearing any body arguing for increased commercial zoning in residential neighborhoods which is what it would take to achieve the walkable neighborhood you envision. That seems well down the list for our enlightened municipal councilors. FWIW, our society has clearly demonstrated a desire to shop at Costco, Home Depot, Walmart, McDonalds etc. to the point where the corner store / family restaurant from 40 or 50 years ago is pretty much extinct. My guess is that even if you do manage to get commercial zoning in residential areas there won’t be very much uptake.

While I appreciate different people have different visions of what is desirable, it certainly feels like the hidden goal is to gradually reduce everything people see as desirable here until until nobody wants to live here and thus solving the problem.

For the doctors simply pay them more and then the housing will not be unaffordable.

James Bay is actually easily walkable to the core and I dont see why Vic West gets towers and James Bay does not. The missing middle proposes most SFH would be rezoned anyway so if we are making zoning changes anyway lets be logical and put highrises in the most walkable area to downtown.

What’s driving them out is the cost of housing due to the housing shortage. Preventing the freeloading problem of street parking is a non-factor, especially since lower income folks are less likely to own a car than higher income (doubly so if we allow them to live close to where they work).

Pricing negative externalities is good actually. Most of what you mention does not have a negative externality so the analogies are invalid (except for charging road tax for EVs which would be fine).

Should all be 6 stories minimum that close to the biggest city in Canada. Have you been in Vancouver’s west end? That height is perfect. Streets are leafy, not that busy, tons of services to walk to.

James bay already has a pretty cool mix of buildings, let’s start with the lower density hoods first.

Don’t threaten me with a good time.

Alternatively just ban all overnight parking between 2 and 6. it will encourage more people to get a bicycle.

Leo: I know that part of Toronto in the photo and virtually none of it is single family homes. The density is a lot higher than the missing middle. I guess they could have done more forty story towers.

Actually, I dont understand why if the goal is more density we dont zone all of James Bay for forty to fifty floor towers. Expropriate the land and we can make that whole area walkable to downtown. Get BC Housing involved to make sure all the building have both subsidized and shelter housing. The condos should have a good mix of three and even four bedroom apartments for families. Done properly we should be able to increase Vic’s population by about 15 to 20%

A nice house – 3 beds upstairs, 1 bed suite downstairs, a good neighborhood, a maintained garden, deck, heat pump, below $1M……..Things are definitely improving! It will be interesting to see what it goes for.

https://www.rew.ca/properties/4252762/3246-doncaster-drive-saanich-bc?search_params%5Bonly_open_house%5D=true&search_params%5Bquery%5D=Saanich%2C+BC&searchable_id=1016&searchable_type=Geography

Lol @ overvalued. lesson #1 in RE – land value is much more important than house value.

Don’t homes with legal suites pay more in property tax because of their higher value? Also, aren’t people complaining about a lack workers? Nothing like driving up the living cost on that person working at your grocery store, restaurant, construction site, and (might as well include doctors now as a low income service sector since they are bailing on this city) with hitting them with an additional parking fee. However, if we are getting into anything that has been publicly installed and maintained at sometime as a public subsidy: let’s make sure those bikes on roads and bike lanes have their paid permits, electric vehicles metered to road use since they don’t pay gas tax, walking on the sidewalk pay permit, a Beacon Hill park entry fee and etc… Where would people like that logic loop to end? At items they personally believe should not have a fee? It’s kind of like people’s view on most tax policy; I’m special, I should not have to pay, but make sure to charge that other person.

The whole street parking is actually public parking thing is lost on so many people all throughout Greater Victoria. They think they own the street in front of their home so they park there while their driveway is empty. No one should have sympathy for any Oak Bay anti development/density whiners that call bylaw when someone parks in front of their 1950s, not updated, over valued house.

Really looking forward to getting a good laugh from the letters to the editor section of the Times Colonist that declare the world is ending because of secondary suites that are signed by Walter and Mable in Oak Bay.

Exactly. You should need to pay for a permit to park on the road and they should be limited in number.

One thing I find odd between here and my places in Croatia is in Croatia if you live in town pretty much any location is within 5 minutes walk of a quality supermarket along with a bunch of other amenities. Here even in town areas like Gordon Head you can’t walk to shit so tenants often need a car. If we had more density there would be more commercial and less need for cars imo.

Also if you haven’t spent time abroad you have no idea what parking problems look like. Until someone starts parking on your property like my parent’s neighbor you have nothing to complain about 🙂 Here is a video I made about the situation -> https://m.youtube.com/watch?v=_R7UylUVPNo&t

End free (aka taxpayer subsidized) street parking.

Yes. Ridiculous planning failures in Toronto that’s for sure

Maybe the only way that Victoria/Vancouver becomes affordable is if they take back all of their land?

Toronto is a massive sea of suburbs. Would have ended better if they had just allowed actual infill.

I am not sure why the majority here appear to dismiss parking as an issue with suites. While I can see it being an obstacle to those wanting to develop a suite, allowing them to push the problem out on the broader public is not a very good answer. Around here there are several side streets that are chock a block full and pitting neighbor against neighbor making a pleasant area much less pleasant. A couple of times fire trucks have been unable to navigate corners due to parked cars. In the cases I am aware of it was a practice evening and not an emergency but it easily could have been. Shortly afterwards, cars were ticketed and things improved for a couple of months but it did not last. The only way I can see accepting bicycle parking as a replacement is if part of the lease specifies the tenant is not allowed to own a car. I am not sure but I suspect this would not be legal or enforceable so I am back to holding out for adequate off street parking for every suite.

Still not posted… Probably in the next few business days.

Does anyone know what the recent sale on St Charles went for?

Note the distinction between on-reserve development (e.g. the Burrard Bridge property) and off-reserve development in which the bands have an interest (e.g. the Jericho Lands). The latter are subject the the normal municipal approval process, the former are not.

Although it doesn’t seem to be making a difference time wise.

That would make more sense. Weird way to list though with both properties at $5M instead of 2x$2.5M

I think that that was 2.5 million x2 = $5 million? No

Saanich

I’m so pleased with the OB response to community concerns about how difficult they were making secondary suites in the draft policy. I spent quite a bit of time on this and I’m sure others did too. Thankfully they have loosened up on the parking requirements, recognizing that secure bike parking is an option, and I feel hopeful people will be able to legalize existing and new units without a whole bunch of illogical and expensive or impossible regulatory requirements.

Not everyone slammed you. A few thought it was a reasonable forecast. At least for be those that have the understanding that the more debt that is issued and out there, the more interest rates need to rise to make it marketable and sellable. For some reason folks make a false assumption that because people have a lot of debt, that rates need to stay low because of it and don’t realize that high debt can sometimes create the need for high interest.

Saw the same pattern in Toronto. Did not end well.

They are also working on an infill strategy which we’ve met with them a couple times on. Nowhere is safe!

Most victoria folks are slow to what is happening and believe the past will be an excellent predictor of the future without understanding of the current shift in the broader macro paradigm. No real capital markets or large corporate presence here outside of bci so people aren’t really in tune with what is happening in the broader economy. Lol need a real corporate lawyer, you will need to get one from Vancouver.

Oak Bay set to legalize secondary suites

https://www.timescolonist.com/local-news/oak-bay-set-to-legalize-secondary-suites-5591294

Dev property:

3861A Cadboro Bay

List Price: $4,999,000

Assessed: $1,631,000

Sold: $2,500,000 after 55 days

Pretty cool what First Nations in the lower mainland are doing on housing https://vancouversun.com/business/real-estate/indigenous-developers-to-create-25000-new-homes-in-metro-vancouver

I just had a delightful Sunday phone call with a couple of Bay Street lawyers this morning. Nice to catch up with who is on their fourth wife, what the kids are doing

and their opinions on the economy and the housing market. Last time I passed on their opinion that five year mortgages will hit five or six by the new year I got absolutely slammed for spreading nonsense. I have learned my lesson but I am happy to share how one should manage with a fourth wife.

I have to agree that Parksville is more of a retirement community than an actual working town. Sidney is definitely more of a town but is turning into a suburb of Victoria. Not sure about Lady Smith. These days it does not seem to matter where you go there is a real Doctor issue on the island and medical care.

I would be more inclined to call Parksville a retirement community than a small town.

Thanks for your efforts on this Leo, the GV region obviously needs more housing and while I tend to side with Marko that the hope for increased inventory remains low, it will be great to see where candidates stand on the issue. Hope you get some quotes or promises to accompany the rankings because as the COV clearly demonstrates, a person or group like Ben Isitt or Together Victoria can promise all the housing in the world and then vote against all the housing they don’t agree with

Stay tuned, Homes for Living is ranking all the candidates in Victoria, Saanich, Esquimalt, and Oak Bay on housing policy and we’ll be publicizing those

Just keep in mind they’re both going to tell you what you want to hear, but I’m interested in what they shared with you. I imagine they’re very similar in their approach to housing having seen Murdock as a councilor a term or two ago and Haynes for the past four years.

Most importantly, always remember the mayor can steer the conversation or the agenda, but they’re still just one vote.

Yeah, I doubt there will be a ton of daylight between the mayoral candidates when it comes to density.

Vacationing with some of our Alberta family at a beachfront property in Parksville this week. Saw a few houses for sale in the area. One is $1M. The other $1.2M.

Pretty crazy that going from my old GH box to something like this would be basically a lateral move.

On the other hand, there are no nearby schools, and I’m not sure small-town living is what I want at the moment.

I have had a number of conversations with Dean but meeting with Haynes coming up I will let you know. I’d say both realize Saanich has to build a lot more housing. For example Haynes voted in favour of bringing the elk lake drive project to public hearing despite staff recommending against, citing the housing crisis

Beauty candidate right there.

Now tell me, who is less pro-density, Haynes or Murdock?

Weird I knew this guy’s family when I was a kid. Always odd to encounter the adult version of someone you knew as a kid, especially when they are…. A bit different in opinions/values than you might have expected.

Sasha seen sitting in his backyard which he will not allow anything near.

Leo, what would you put the odds at of the Missing Middle passing?

Introvert I found your guy for this fall

If you have been a good customer and are making regular payments most often the bank does not want to know if the house value has dropped too much. They are likely to be happy if you increase payments to couver the trigger rate breach.

Yes, what is unclear is whether the lender will do another assessment on LTV. Because all else the same you could be at say 75% LTV based on the assesement at time of lending but if the lender determines the value of the house has dropped by 20% then you are instantly in breach and have to come up with cash to cover.

Okay, I have read up on it. I understand the loan to value (LTV) limit now.

Thanks for the lesson!

Yes, okay. So, the trigger rate is when you have reached the point that your set payment is no longer paying any principal but does cover all the interest and the Trigger Point is when your payments no longer are enough to cover the interest? Is that right?

No Alex, just because your payments no longer pays doen principal or cover the interest portion (trigger rate) doesn’t mean you automatically breached the LTV limit of the loan (trigger point). Trigger point is where you have to pay up immediately.

Maybe we are saying the same thing. On a variable rate mortgage, I think of the Trigger point as when your set payments of P&I no longer cover the interest portion of the loan. So then you have some options ( I think) such as making a lump sum payment so your are no longer in that predicament i.e. your normal payment is covering at least the interest payable, or maybe the bank will let you lock into a longer amortization period providing you would qualify. Otherwise the mortgage is called.

I never have had a variable rate mortgage. When my daughter bought her home in Vancouver, I encouraged her to get an “open” mortgage vs a closed. The interest was a tad higher but she was able to pay down the principal anytime she wanted to. Which they did on a regular basis. Sometimes though you can attain a closed mortgage with the option without penalty to pay down the principal every six months or annually on the anniversary date.

Seems too aggressive.

That’s probably the trigger point where the bank knocks on your door and ask you to pay up. The trigger rate is lower (I think around 2% higher), the trigger rate is the point where you stop paying down any principal. Trigger point is when you breach the LTV on the loan (80% for uninsured and more for insured) and have to pay up or else the banks forces a sale.

Right now I think most trigger rates have been breached for buyers from the last 2 years before the hikes so they are essentially paying off zero principal going forward. What’s unclear to me is whether the lender will do a new assessment to determine the LTV because they could have ramifications in a declining market and the rate hike may not need to hit 3.5% for the trigger point to happen.

But yes curious to see Leo’s article to officially summarize.

Unconfirmed but I have read in two seperate articles that the Bof C rate would have to increase 350 basis points before most variable mortgages would trigger. I am looking forward to Leo;s articles which will give us actual facts to look at rather than some of the speculation.

Note that it’s the markets which have gone up the most in % terms – the fringe and rural areas – which have shown the largest % declines to date.

https://www.theglobeandmail.com/business/article-canadian-home-prices-spiral-down-in-june/

You don’t have to wonder, Leo has posted newspaper clippings of the usual suspects saying just that, sounding much like the usual suspects today. I remember them myself, and I personally did not expect prices to go down.

You said deficit before which is not the same thing. But it was pretty clear you meant debt though.

There’s a nuanced difference between pre-qualified and pre-approved. Typically, variables are pre-qualified and fixed mortgages are pre-approved. A buyer using a variable will still need to be approved once their offer is accepted where the fixed pre-approved buyer doesn’t require anything other than an appraisal to support the loan value.

From: https://www.investopedia.com/articles/basics/07/prequalified-approved.asp#:~:text=A%20pre%2Dqualification%20means%20that,the%20money%20for%20a%20mortgage.

If the buyer has a finance condition in place, they will fine of the their financing doesn’t come through. However, if they don’t have a condition, they would be in repudiation of the deal and they would likely need to face the seller’s litigators.

I wasn’t in the market for a house in 1981 so I honestly can’t remember property dropping 40%. I do remember hearing stories of Vancouver houses dropping considerably. I don’t think that applied across the country. I remember my cousin buying a house in the 70’s for $30,000 and selling it a couple years later for $67,000. He then purchased a place for $90,000, raised a family in it and sold it decades later for $144,000. At 75, they now live in a fairly new house worth around $700,000, in Winnipeg. Both his children, now in their 40’s don’t own anything. My cousin also owns a cottage worth around $300,000. He would have no problem selling either one of them today.

Our debt is over one trillion dollars, see below.

It sounds like there may be a possibility of a preapproved variable triggering before closing. Is that correct? What happens then? What if a buyer cannot qualify for enough mortgage to close. Waiting for the article on preapprovals but this might get a bit troubling.

Seems like you’re just making stuff up here frank.

Na, just a rollback of those artificial pandemic gains, that’s only 37% in Victoria.

I wasn’t. I was just wondering if people also found it inconceivable that house prices could fall by 40% from peak. I assume many probably did.

In 1981 I had a net worth of maybe $10,000, and finishing the last year of my education. It’s slightly higher now. The amount of wealth that has been created in the last 40 years was inconceivable back then. The internet has created trillions of dollars of wealth. Yes it isn’t evenly distributed but that holds true through the history of humanity. Please stop comparing the dark ages with today.

10% interest rates for 10 years will bankrupt our country. We have a trillion dollar deficit and an ill conceived government agreement that wants to hand out money like candy to stay in power. I’m losing faith in the viability of our country in the hands of incompetent idealists. The government wants the public to curb spending, why don’t they set a good example.

I wonder if people said the same thing in 1981.

Hard working, saving families have been able to buy a house all along, just not in one of the hottest markets in a country millions of people want to move to. High interest rates haven’t slowed immigration or made houses less expensive to build. Anyone waiting for prices to drop 40% is dreaming.

Ya let’s see what 10%+ mortgage rates for a decade will do to home prices with the exact same municipal policies….

People talk about “fundamentals”, such as income and mortgage rates, but in the long term those are swamped by municipal policy.

That is, the market can be unhinged for the long term.

~ First lesson from statistics: don’t draw any conclusions from small samples.

Ya fair enough, I guess for a small sample size it’s better to goto a neighborhood full of new houses like royal bay to get a more accurate picture as it reduces the chance of inaccuricies due to renos, etc.

He said the July hike will be the wake up call for the average folks here? I’ll stick by end of summer will be when the data clearly points to a correction which no one can argue against.

Still couple folks on here a little slow to what is happening and think immigrants, foreign buyers and vancouver/toronto transplants will bail the market out.

Of the listings that changed their asking price, what was the average change?

Technically yes, but practically no.

Any given sales/assessment on one property is basically useless. Assessments on individual properties can be badly wrong. But when you get enough sales the median sales to assessed value ratio is quite good and I’ve found matches the actual movement of prices quite well. But we need enough sales to make the median reliable. How many? I haven’t thought about it, but for the monthly figures we have like 100-300 sales which seems sufficient. The month to date figures I posted below are about 60-120 sales which is probably OK but I would get nervous if it was less than that.

Meanwhile Oak Bay single detached, 3 sales this month. Sales to assessed value ratios: 0.99, 1.02, 1.29. No information there.

Total nonsense. Also we have don’t cold winters here.

VicREanalyst, I think it was the Debt Monster that said that first and you told him to come back at the end of summer. Local Fool, DM said that you knew what was happening. Do you agree with him that prices are going to drop a lot more than 30% in Victoria?

I’ve been following the CREA stats and prices have been dropping nationally every month.

Personally, I think home prices here need to drop 40 to 50%. Even then, they’d still be expensive. People are so used to the numbers of today that they’ve lost all sense of how truly unhinged this all is.

Hopefully hard working, saving families can get homes once again soon.

Alex, you sure that wasn’t me saying that awhile back ;), told you all that the July hike was going to be the wake up call for the average person.

https://househuntvictoria.ca/2022/05/30/cooling-off-period-whats-the-impact/#comment-89105

“Late-1980s market”means the peak before the Toronto bust of the following years.

https://twitter.com/SBarlow_ROB/status/1547908882034372610?s=20&t=PNxIgPXpKugEWxN-7RTXvQ

I think this kind of panic is what Totoro was saying awhile back. Its the psychology. People actually have to hear the bells or the sirens, they have to see the accident before they can believe an event can actually happen. Now they see the people running and they follow. There is no thought before or after, only desperate action.

Seems odd, everyone was already pricing in 0.75% so I can’t imagine an extra 0.25% would cause this type of last minute panic. Its not so much pre approvals that’s the issue, its more potentially pulling financing at the last minute on deals I believe.

Yes, but I’m still not convinced a stitch in time will save nine. Maybe seven, or eight on a good day.

“Had a heat pump took it out and put in natural gas very pleased a different kind of warm I wasn’t getting with a heat pump“

I don’t doubt some people have very positive experiences but I think there’s a lot of drawbacks as well. If you have very high ceilings or many smaller rooms or hallways mini splits just don’t distribute heat efficiently and the payback period probably isn’t worth it . I’m betting the larger the building the less efficient with bc hydros stepped billing costs.

If we have a long cold winter on the opposite end of a heat wave than the suffering from that cancels any cost savings for me. If I were to build a house again I’d do heated floors with heat pump.

I know what you mean Maggie. Many credit unions have been amalgamating recently. For instance Hubert is going with Access Credit Union (on-line Accelerate Financial).

I have been a client with several of them in the past. Never had a problem. Wouldn’t go with Outlook though

just because of their client services reps.

People swear by them though. Lots of prairie residents only deal with Credit Unions. They feel more comfortable with them.

But with every acquisition there comes either responsibility or risk, sometimes both. All one can do is do their homework and then make an intelligent & informed decision and go with it……and always have a plan B. So many tend to overanalyze absolutely everything and then they don’t do anything because they freeze up.

“Over analysis causes paralysis ” “You can’t see the forest for the trees” , “Don’t put your eggs all in one basket” “A bird in the hand is worth two in the bush” All these old sayings are so true.

There’s no rate hold on a variable like with a fixed pre-approval. So, it’s better to re-qualify those variable folks before they make an offer and find out they actually don’t have the financing they believed they had. The variable is qualified by the amount of the payment, it’s almost like they hit the trigger value before they even bought because the interest payment just ate up their payment or exceeded it.

I guess they are expecting more rate hikes as well…

Interesting – could be prudent but sucks for people with preapprovals if true:

[img [/img]

[/img]

I’ve always wondered how secure the Deposit Guarantee Corporation of Manitoba is, and whether the Manitoba government would back them up if something went wrong. Hopefully I’ll never find out, because I have a couple of GICs with MaxaFinancial.

Given the current yield on GIC’s and the uncertainties in the equity and RE markets, it is a pretty attractive place to park some $ and wait to see how things shake out. I am still of the opinion that early next year there will be some deals to be had in the RE market here where you can get cap rates of potentially 6%.

Actually now that 3 mo is @ 3.95%. It is with Hubert Financial. You purchase a one year GIC with them first.

After 3 months you can cash in and get 3.95%, the 2nd three month period you get 4.05%, the third 3 month period you receive 4.15% & fourth 3 month period 4.25%. If you keep the GIC for the full year you would get 4.1%;

i.e. the average of each increment.

Also, some banks do promo rates for target customers on HISA. I’m getting 2.8% til the end of Aug and some others are getting 3% and so on. This particular one is from Tangerine Bank.

Because of my age, I now always opt for interest paid annually GIC’s. Some older people purchase GIC’s with interest paid monthly. This is an alternative to say purchasing an immediate annuity. If you have no government pension, you need to play it safe, and you want monthly income you could go to CWB downtown and purchase 3 $100K (CDIC insured) GIC’s ,one with CWB, one with CWT and one with Valliant. So say next week the 5 yr is at 5.2%. That would bring in $15,600 annually. Or you can opt for monthly, every six months or monthly payment. You can have them put the funds directly into your main/on-line bank such as CIBC. Of course there are other ways like purchasing 6 $50K ones or 12 $25K.

This is just me talking. I have never been employed in the financial services sector. I think I am done with real estate investing now but then again, because of the game, I just may buy another investment condo. Who knows.

I’d be interested in that too. According to ratehub, the best right now is 2.00% from Oaken.

Right. A typical condo near sea level in sunnier areas of Maui has no heater – just an AC.

You didn’t see the part about Tiff agreeing that the CAD weakness with high oil prices is a concern?

missed that line, Who is giving 3.65% for 3 months?

Why wouldn’t you just go with the 3 month @3.65%.

I still wonder if they hike again in September. Everything points to them trying to front load the rate hikes for a pause in Sept, but maybe the data is bad enough that they have to keep going.

I’m not a fan of burning wood either, out at my cottage the air is incredibly fresh, you literally can smell the difference from city air. When anyone nearby starts burning in the summer I get irritated. I’m just interested for emergency backup if the power goes out at -30c. I’m sure wood and pellet stoves are sold out in Germany now, they might run out of nat gas this winter, something they never expected. Climate change isn’t as important when your survival is in jeopardy.

Code typically calls for a make-up duct interlocked with the exhaust fan. But cracking a window also works…

Alex, given the probable upcoming rate hikes one could be better off with a cashable until after the Sep hike and then locking in. 2.6% for an HISA is pretty good given the current environment.

Where are the bears with that investor psychology graph on asset prices? If there was ever a time to post that graph it is now!

VicRE:

I never bother with the cashables. However, some banks, C.U.s offer pretty good HISAs.

For instance Hubert Financial HISA is at 2.6%, Achieva Financial @2.4%, Motive (CWB) @ 2.2% & Peoples Trust/Peoples Bank & Wealth One all at 1.8%.

Not sure if sarcastic, but unless you have a source for free/cheap firewood, this would be a truly bad idea.

Frank – to heat our 3 level 2700 square foot home it will cost us 15K minus rebates of 7k. That is for a top of the line Daikun one. Our hydro bill is $400/month (equal payments) and we expect that to go down by half. Even better is that we will have AC in summer – which I’m certain will become a necessity as the climate changes and heat domes become a more regular occurrence. We did the energy audit and a ductless heatpump was recommended to us. We have an old wood burning fireplace that used to be for heating the house but I’m not comfortable with wood burning. My friend who relies on wood burning living on a small island said it’s a lot of work and also that some people apparently don’t burn wood correctly and it creates air pollution. I don’t know how that works so best to stay away – in my case anyway.

Entirely depends on where you are in Hawaii. Even on the same island, Kihei vs. Hana for instance, are massively different.

got any on cashable ones?

Had a heat pump took it out and put in natural gas very pleased a different kind of warm I wasn’t getting with a heat pump

Best GIC rates:

3 Month@3.65%

15Month@4.4%

19Month@4.5%

1yr@4.32%

2yr@4.72%

3yr@4.9%

4yr@5.0%

5yr@5.1%

Regarding wood burning stoves: The ashes make great fertilizer for your garden. Pellet stoves are also interesting that I may look into one day. I wonder what the houses in Hawaii have, I personally wouldn’t need any heating/ac system. A couple small electric furnaces and portable room ac unit would probably be sufficient.

More so, the article mentions that a year of gains on the national average have already been given back.

Does this imply that just maybe the Victoria locals are indeed behind the curve or aka “Slow” to market shifts??

From: https://www.cbc.ca/news/business/real-estate-numbers-june-crea-1.6521568

The Ontario unravelling driving that average price down with BC in hot pursuit.

You can always go for something local and sustainable, they have done great things with wood burning furnaces in the last few years. There’s ample fuel available locally, it will work during an emergency or disaster and you get to improve your personal fitness through the exercise of splitting and stacking firewood (take strain of the healthcare system by being shape). On top of the fuel source being organic, it saves you from needing to spend on new insulation and windows.

Friendly reminder that it’s usually more cost-effective to improve air-tightness and levels of insulation before a new heating/cooling plant. I would recommend signing up for the Canada Greener Homes grant/loan, getting an energy audit done, and then following the recommendations given. I believe the government is covering the cost of the audit (assuming you follow through with one upgrade) and you’ll get info tailored to your specific situation.

This is also why the oft-derided step code is important. Once a structure is built, it’s challenging/expensive to retrofit. The only “good” time to do these updates is when it’s being built.

We looked at that product, actually. For a few reasons we decided not to do it.

One of those reasons was, while it seems like a great idea in theory, if it breaks it kills your heat and hot water. The limited market penetration these things have could mean much more expensive and time consuming repairs. They are also helpless in a power outage, although that matters only to the degree of your grid’s reliability. Ours is not very reliable.

We also considered a Navien NPE240A (ie forget the home heating part), but we rejected that for other reasons. The utility cost savings to go to tankless water heating is negligible unless you have 5 people each wanting marathon showers every day. The ROI for our energy usage was over 17 years for the tankless. Plus, despite the marketing material, those units still give cold water sandwiches.

We went with a 50G direct-vent non-condensing gas, and it’s awesome. Heats fast, inexpensive to operate, completely silent and requires no electricity to run. Last winter we had a 12 hour power outage when a line went down, and we had full heat and hot water the entire time.

Here is the price of 3 different systems I have recently installed.

1) House with suite. 2 heads in the main house. One in the master and one on the main floor. Another head in the suite with its own outdoor unit. So 2 outdoor units in total. Approx 20k. However I recently bought a 18000 btu one head zone Mr.Cool for a suite on Amazon for $2400. Roughed it in myself and then got a refrig tech to do the final hook up for $600. Huge savings.

2) 4400 hundred square foot house. Fully ducted with heat pump and natural gas furnace as back up. Furnace kicks in at any temp below 5c. 27k. A year ago this would have been 18 to 20k. Huge increase in equipment prices

3) A combi NTI/Navien Hydrondic boiler. Older home already had duct work. Added a hydronic boiler. Essentially it creates hot water for home and has hot water coils that connect to the ductwork to heat the home. $4500. 1k for sheetmetal crew to make small changes to the ductwork. $5500 total minus a 3k grant from Fortis. There are a few brands producing these. Space saver as you dont need a hot water tank or on demand heater. It is all in one. Which also means maintenance just on one unit to.

On really cold days I use an extremely effective Scottish technology to minimize the cost of heating. Try a wool sweater.

Could someone provide the cost of some of these heat pump systems? Thanks. Like a lot of the new technology out there, like solar power and high efficiency systems, a lot depends on getting the right system to match the efficiency of the house. I don’t know how many times I’ve heard of a company installing the incorrect size of furnace. In my 6500 sq. ft. commercial building (2 storey) I have 2 mid-efficiency furnaces and it keeps the 1960’s brick building toasty in -30c Winnipeg winters for under $2000 a year. It does face south and on sunny winter days, it does not kick in even with people walking in and out all day long.

Re Heat pumps

I suspect the reason we are getting conflicting reports is that there are several generations of heat pumps. I am sure the HVAC people here can give more details but the gist of it is early heat pumps which would be most of the ones from 15 plus years ago that were added to an existing furnace rapidly lose efficiency when it is cold outside so call for the furnace to kick in which runs up the bills. Mini split and new whole house heat pumps from companies like Fujitsu and Mitsubishi use a technique called vapor injection to dramatically improve cold air performance. They will often work down to -15F with no backup heat. They also cost more. My bigger concern about heat pumps is that the refrigerant they use is a serious green house gas that is about 2000 times worse than CO2. I am sure they are careful but there will still be lots of losses over time. Something else to keep in mind is that the output air temperature is a bit lower than gas or oil so you need larger ducts or put up with higher velocity air which can be noisy. Some people don’t mind and others do.

“Useless in cold weather which barely ever happens here”

There’s been several years where it’s dipped below -5 for several days in the winter and my electricity bill was atrociously high with much worse performance than a natural gas furnace. I’ve had both- heat pumps from central to mini split and I have experienced several times where the heat pump didn’t cut it. I’m guessing you have a small house with lower ceilings. My neighbours and I were spending 500-1000 bucks a month in the winters from 2017-2019 on electricity- they even installed a brand new heat pump and had a <15 year old house. Finally swapped to natural gas . Mini splits seem to have better performance but the issue is getting the heat to all the smaller rooms.

No, insider contacts obviously! Come on girl you should know that by now

Tiff macklem exclusive on financial post. Lol looks like he’s been reading my past posts on here about the issue of weak CAD/USD with high oil prices, inflation and the need to hike rates.

https://financialpost.com/news/economy/exclusive-tiff-macklem-bank-of-canada-rate-hike-inflation-forecast-miss

Useless in cold weather which barely ever happens here. The money saved over the other 362 days of the year more than covers the 3 days a year the backup furnace kicked in on my unit last year. I have not found it to be useless or expensive in fact it is the opposite. Maybe my unit is better than average but it has saved me thousands over the last two years and never once felt a chill. A house is a system though so mileage will vary depending on the level of insulation and performance of windows.

“don’t understand why people would want a fossil fuel heating system that doesn’t even provide AC when you can get a heat pump (ducted or not).”

Heat pumps are useless/ expensive during cold winters. Heat pump /gas combo is best imo

Is it your Ouija board or your magic 8-ball?

I don’t understand why people would want a fossil fuel heating system that doesn’t even provide AC when you can get a heat pump (ducted or not). I had a heat pump in our second last home (built in 70s) and it was amazing – hydro bills went way down and we had AC in summer. Our current house is over a hundred years old and we are waiting for a ductless mini split heat pump to be installed. Two of our neighbours that have homes the same age have ductless heat pumps and they both love them. Can’t wait to get ours!

The rental project on Richardson is dead. After 2.5 years of work the city managed to kill it. Congratulations all around https://twitter.com/archimommac/status/1547762287385014274?s=21&t=QU9ID0-QEBc66dpXT7S2cQ

A heat pump would probably be the best option on a new build. How they work in a 60 year old house with inefficient windows, etc… I have no idea. Either way, the ducts are going to cost.

Excellent income growth in Victoria

Having lived in houses with every kind of heat from oil to natural gas, wood stove/baseboard, boiler/radiator and now finally heat pump I wouldnt ever consider anything else currently available. I had my house built in 2020 with a heat pump installed by Temprite out of Nanaimo. Ducting and Daikin Fit unit all in at 13k. Its a small home just over 1300 sq.ft. but I keep the thermostat at 23C in winter and have the AC set to 18 in the summer. Before we had a hot tub installed the power bill was on average $60/month. We do have propane for the kitchen stove and hot water on demand which runs us less than $600/year. Compared to our last home which was freezing cold all the time and hydro bill was $600/month in the winter. Heat pumps keep the temperature locked in so it never fluctuates hot/cold like baseboard or furnace heat does.

I know absolutely nothing about heat pumps, I think my place in Henderson came with an oil furnace and some sort of heat pump/exchanger. I think it was used for providing air conditioning. When it died I didn’t bother replacing it . When my insurance company wanted me to get rid of the oil tank in my garage, I contacted Fortis and had a gas line installed, the cost: $25. Then had a high efficiency furnace installed. For the temperate climate of Victoria, it’s all you need. I recommend a Trane, very reliable, easy to repair. If I hadn’t put in a restrictive filter, which caused the igniter to burn out 3 times, I would have had zero problems with it . Changing to the cheapest filter you can buy finally solved the problem. I would invest money in a back up generator, if the power goes out, your furnace will still work.

Heat..

Wait for it….

Pump!

Karise- A natural gas high efficiency furnace should be around $5000, you might also need to change the hot water tank. I converted from oil to nat.. gas several years ago, it was $4000. Again, if it is a single storey house and basement, you might get it all done for $15,000. The materials alone are expensive. At least you have a starting point. If you can get it done for around $10,000, grab it.

Floating rate preferreds:

https://www.theglobeandmail.com/investing/markets/stocks/BBD-PR-B-T/

I think summer 2020 buyers are still pretty safe, I don’t expect prices do go lower than that. Maybe temporarily, but not sustained given current interest rate expectations and market rents.

Interesting to see if construction actually does slow as some predict.

Patriotz I guess everything is a loser right now with inflation If u bought a rental property in the last 2 years I guess u will get handed your head

Nahh, I like testing out various scenarios.

Seems to me you should focus on saving up a down payment for one house, find an agent and bid on it like everyone else. And don’t spend any more HHV time talking about your “multiple simultaneous unconditional offers” idea.

Theoretically that could work, I don’t think my success would be very high right now and would still want an inspection before hand so I will be out of pocket on the unsuccessful ones or potentially all of them.

Maybe it was a poor example, but my point is that there are potential deals to be found in any market.

Why would you make the unconditional offers at the same time? That seems ridiculous if you aren’t able to close on all of them.

Just make one per day, open for 24 hours.

Because I don’t want more than one to be accepted.

What’s stopping you from doing that now?