June: The froth is gone

The final board figures aren’t quite out yet but we know enough to see how the market went in June. It’s pretty clear that after several months of cooling the remainder of the froth has been flushed out of the market.

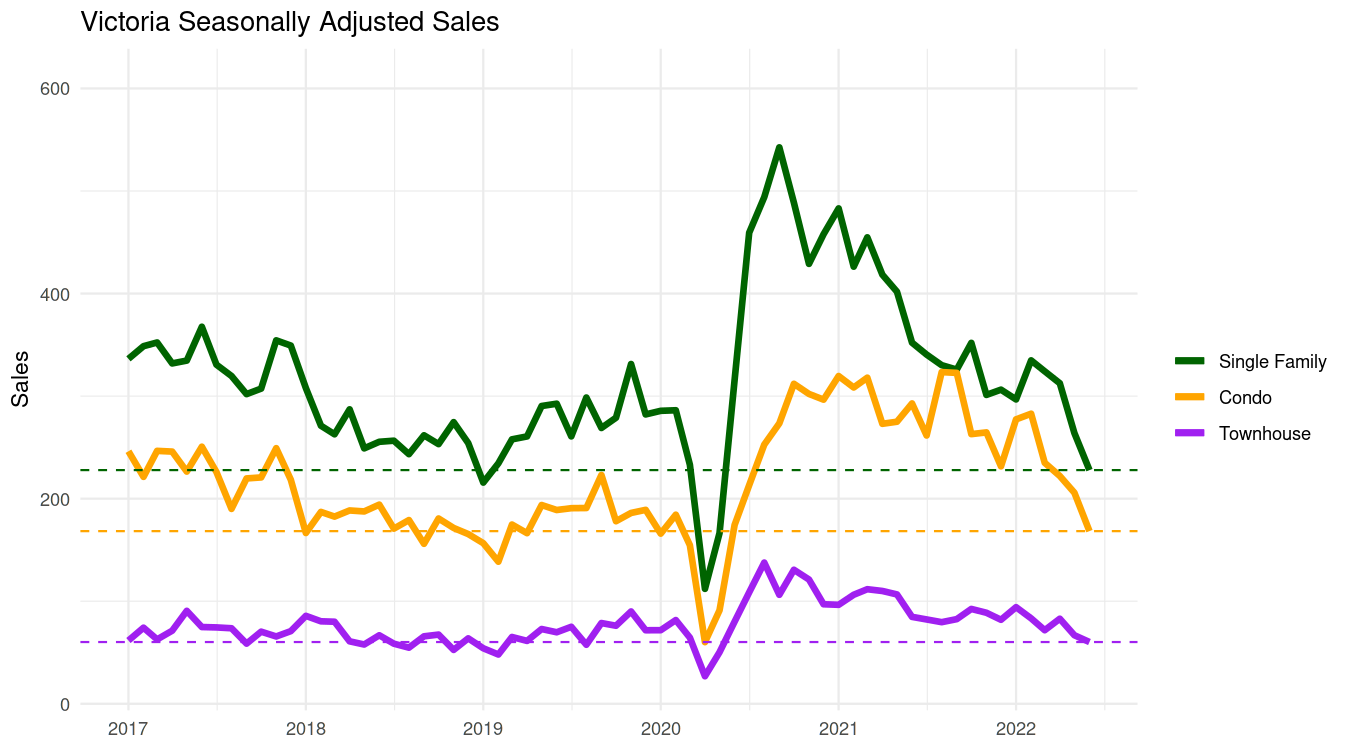

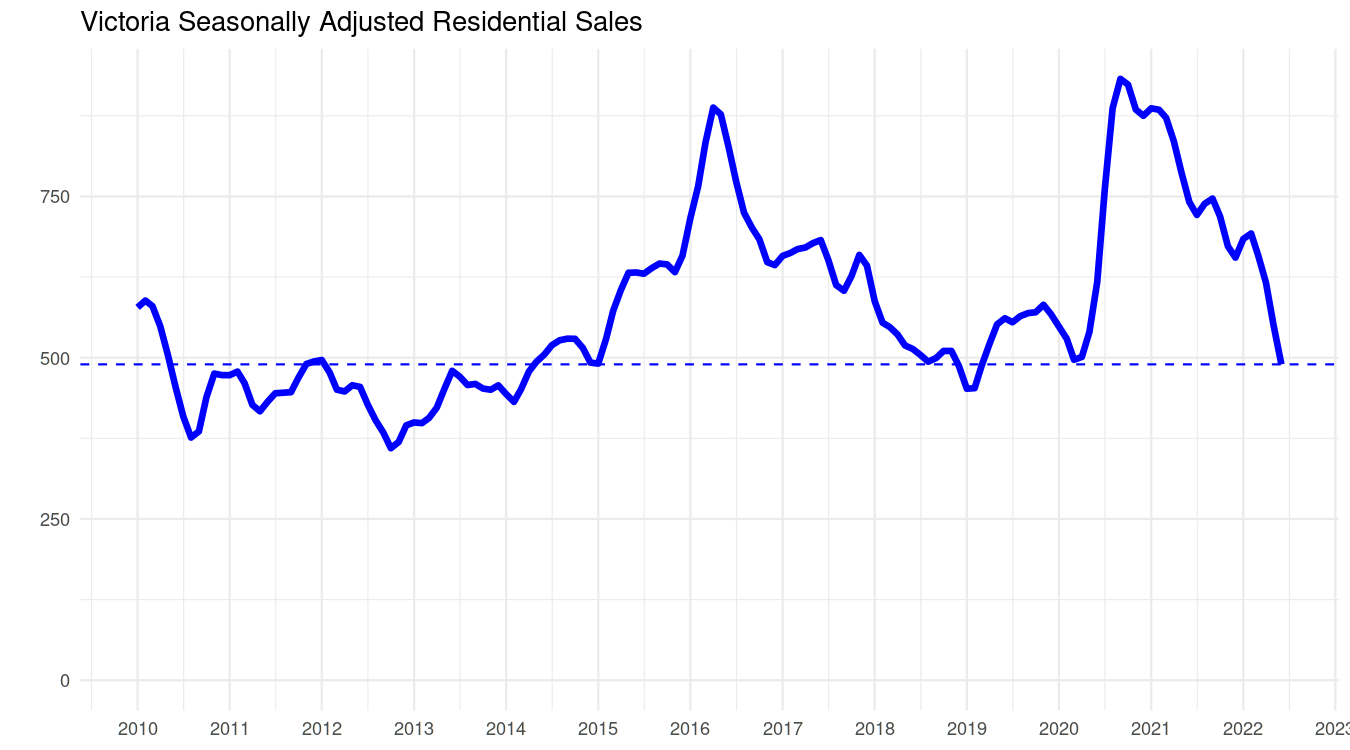

We ended with 612 sales, which is the lowest sales total for June that we’ve had since 2000 when there were 511. That’s 22% below the 10 year average for the time of year. The dip from previous months is very clear on the seasonally adjusted chart, where we see that sales are now well below pre-pandemic levels for all home types.

In some ways this picture is clearer when we combine all the sales together. The pandemic sales bump is over and we are back to sales levels we saw in 2018/19. That’s still somewhat ahead of the slowest months between 2011 and 2014.

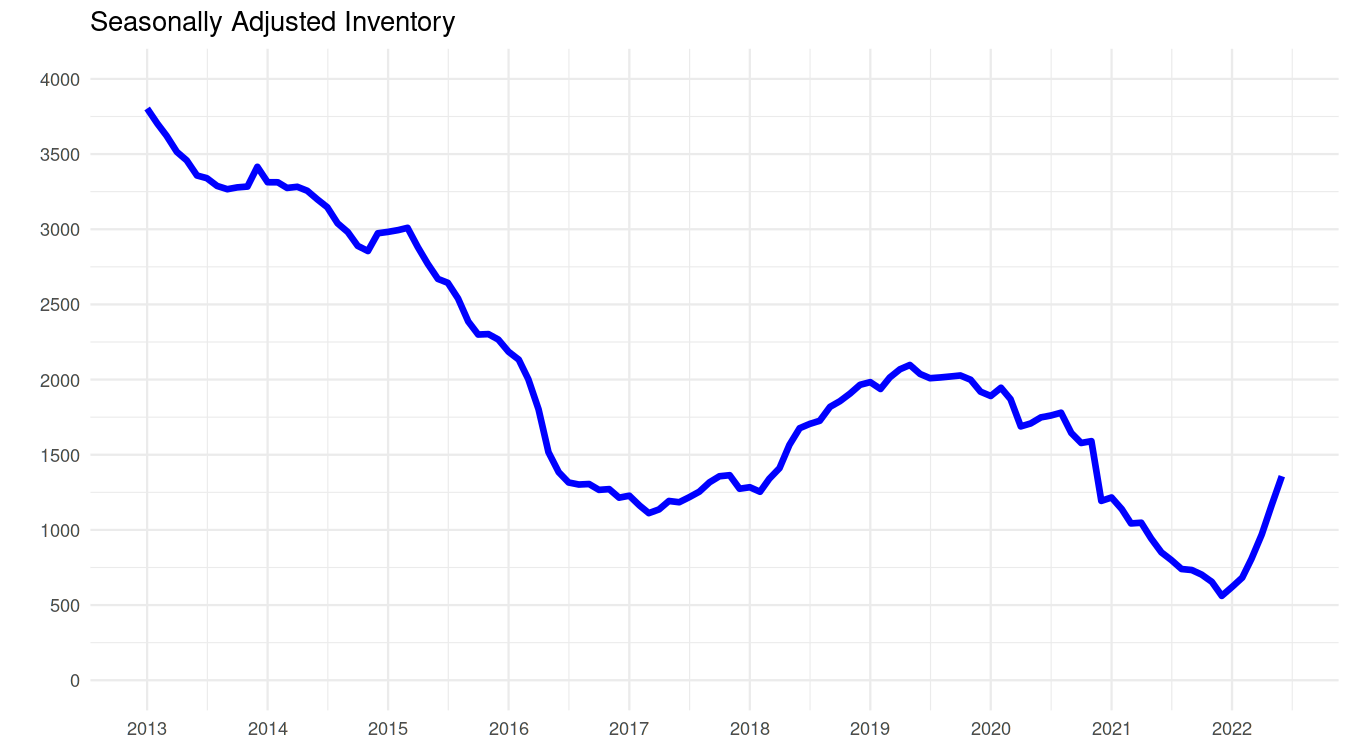

Inventory is heading up at a pretty good pace but we are still a long way from where we were in the last truly slow market. In June of 2011 when we had a nearly identical number of sales there were 4108 residential listings on the market, some 2.5 times more than now.

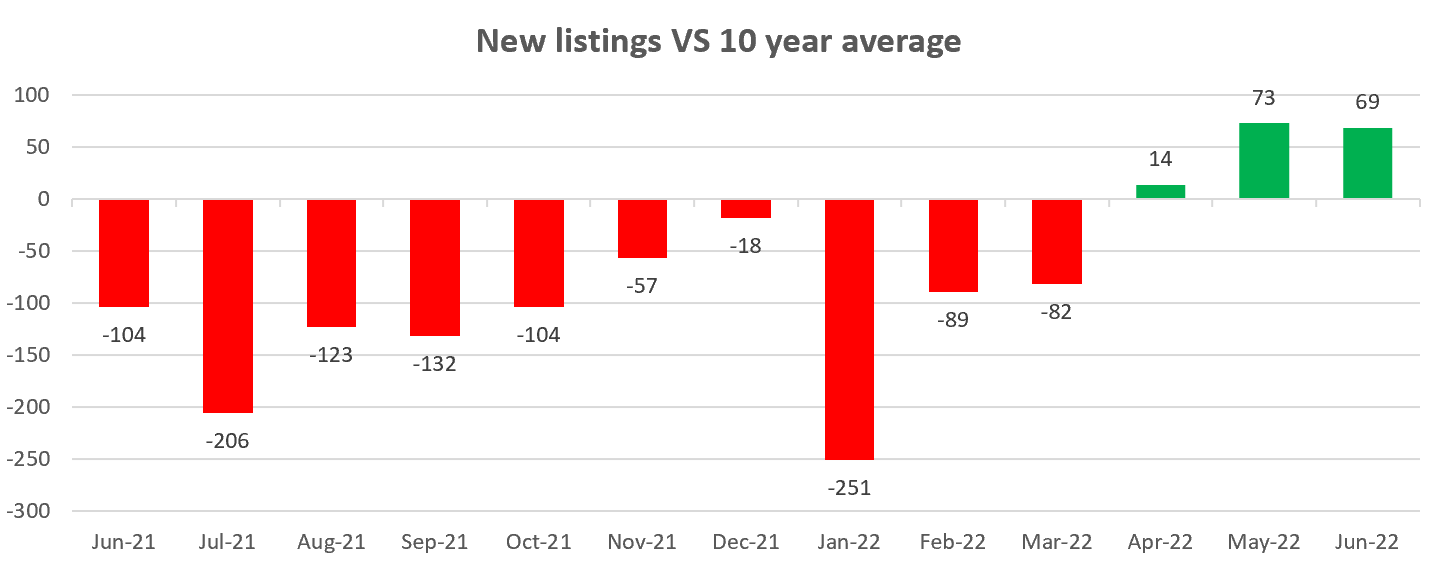

Last July was the start of a quiet period for new listings as sellers took advantage of the restriction-free summer to travel instead of listing their homes. There’s been a shift there, with new lists modestly exceeding the 10 year averages in the last 3 months. It’s not a huge increase and certainly no sign of panicked sellers, but it’ll be worth watching to see if this summer is a repeat of last or if we maintain a reasonable pace of new inventory coming to market.

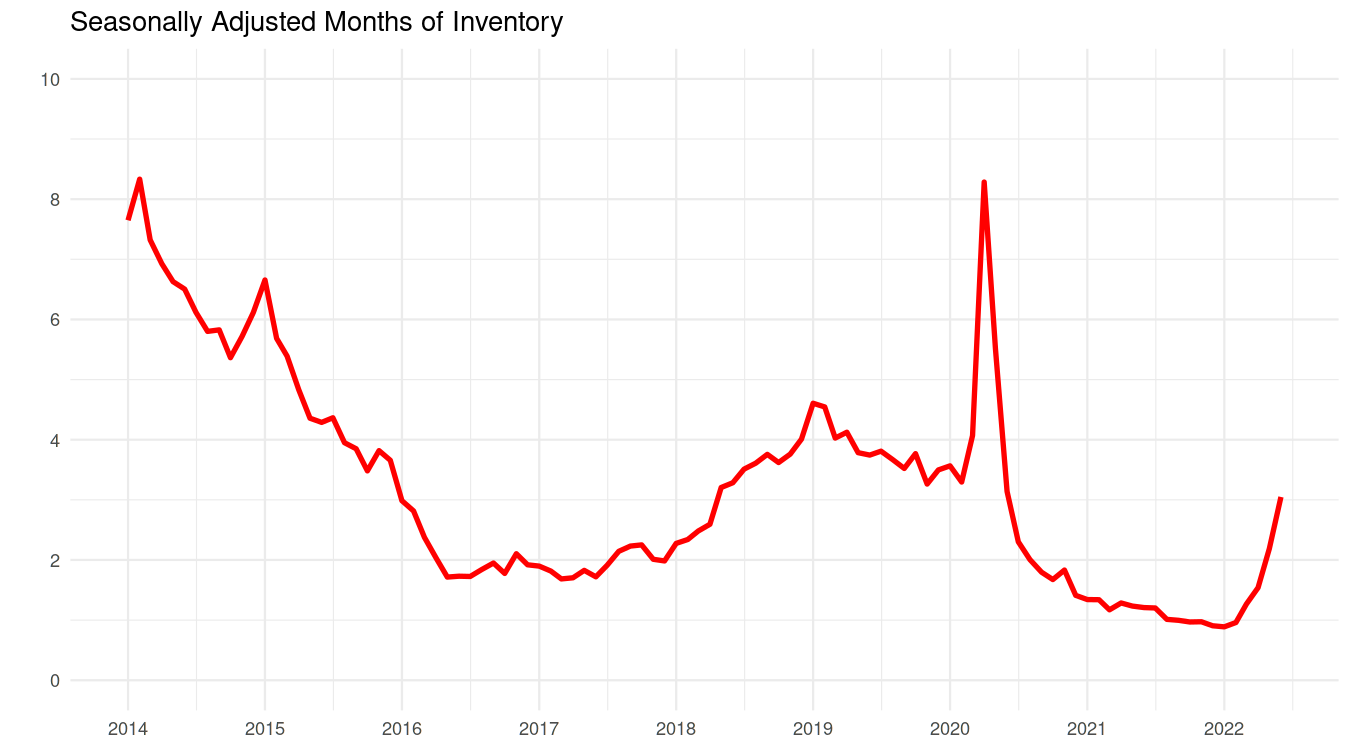

Similarly, months of inventory increased in June to about 3 on a seasonally adjusted basis. That’s still low, but enough to take out the widespread bidding wars. Only 22% of detached homes and 17% of condos sold over ask in June, and the rate at the end of the month was substantially lower than that.

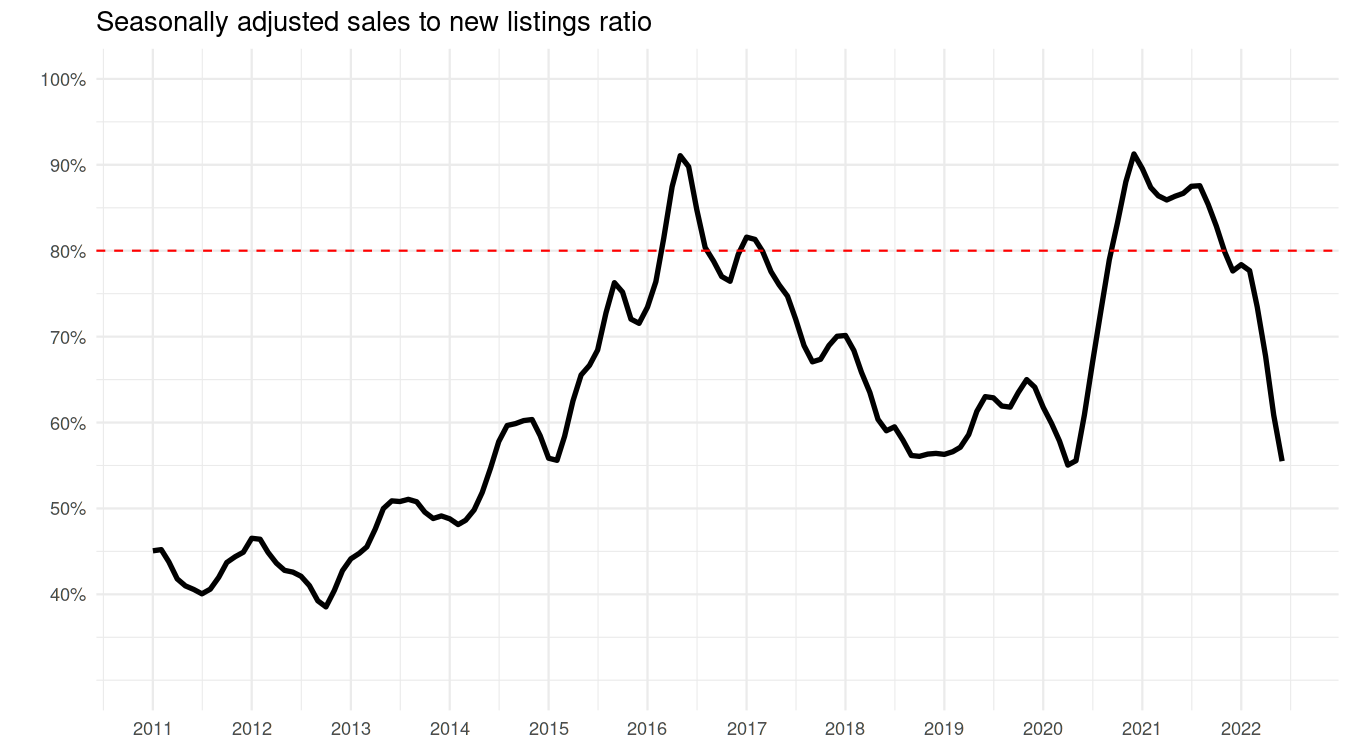

I’ll leave out the market guage this month just because the rapid change in sentiment has made it currently somewhat misleading. I’ll bring it back in future months when the market stabilizes a bit and it’s more reflective of current conditions. Better right now is the sales to new list ratio, which shows approximately a balanced market but rapidly falling. We’re now around the levels of 2018/19 when prices were flat, while remaining substantially higher than a true buyers market like 2011-2013.

Prices have kept drifting downwards as the market moves through balanced territory and towards a buyers market. A huge amount of froth has left the market since February, but of course a $1.2M detached median only brings us back to the valuations of last fall.

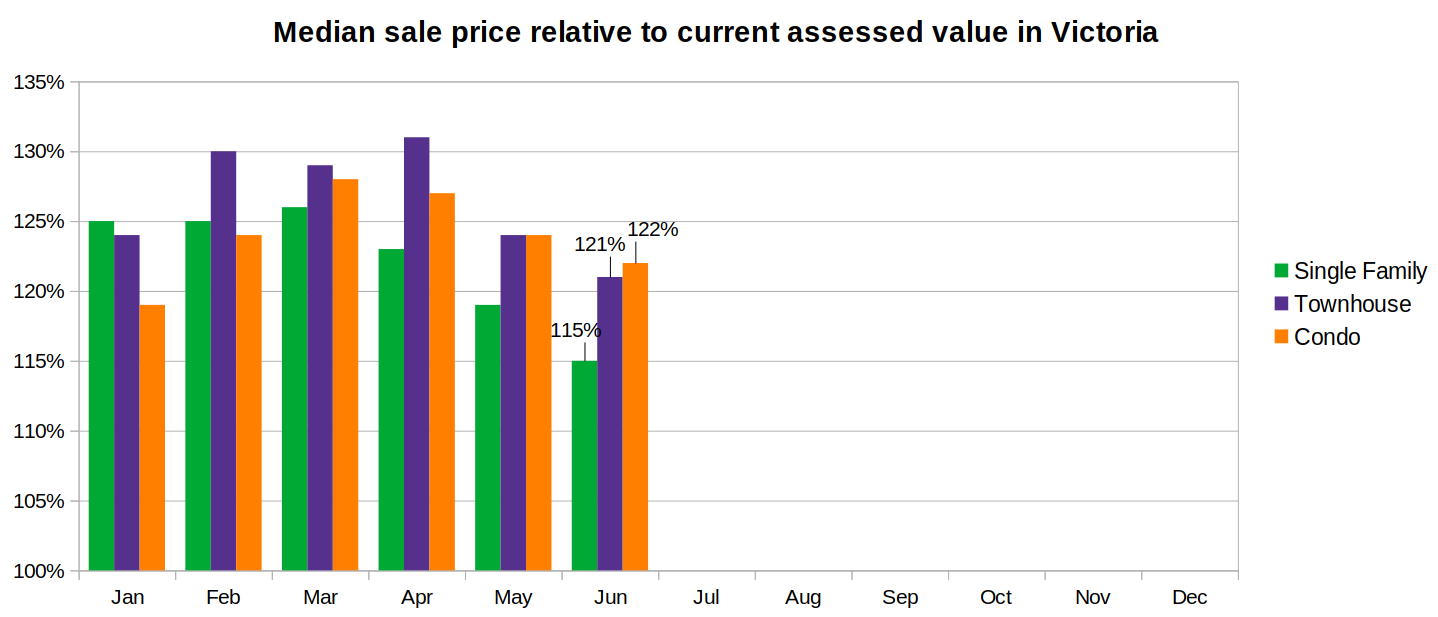

The same picture is evident in the median sales to assessed value ratios. We’ve had substantial declines in this measure since the peak across all property types. Single family seems the weakest at the moment which is also reflected in sales to list ratios. The condo market has lagged the detached market during the entire pandemic, and it seems to still be the case now with prices not receeding as far from peak. Worth noting that despite the decline the median property is still going for 15 to 20% above the assessed value from a year ago.

The same picture is evident in the median sales to assessed value ratios. We’ve had substantial declines in this measure since the peak across all property types. Single family seems the weakest at the moment which is also reflected in sales to list ratios. The condo market has lagged the detached market during the entire pandemic, and it seems to still be the case now with prices not receeding as far from peak. Worth noting that despite the decline the median property is still going for 15 to 20% above the assessed value from a year ago.

Fixed rates meanwhile have paused their hikes and we’ve even seen some rate cuts recently as 5 year bonds gave up some gains. Variable rates remain certain to go up, quite possibly by 0.75% in July as the central bank plays catchup with both inflation and fixed rates.

On inflation, some early indicators (chip supply, commodities prices, and shipping delays for example) are starting to point towards upcoming inflation relief on the supply side, and it remains to be seen how entrenched the inflation will become in wages if the goods side eases. Certainly the province seems to be fighting hard not to lock in wage inflation with their own employees. Overall it might mean that much of the rate hiking job will be done after this year, with markets even expecting rate cuts next year. I wouldn’t put too much stock in those bets since many things can happen in 6 months, but I maintain the prediction that fixed rates likely won’t get to levels that would really trigger catastrophic price declines (6-7% in my estimation). What we don’t know yet is whether or how affordability will return in Victoria. Will it be mostly through price drops? Will we get another cycle of rate drops to stabilize the market and bring back affordability, or are we doomed to stay unaffordable forever?

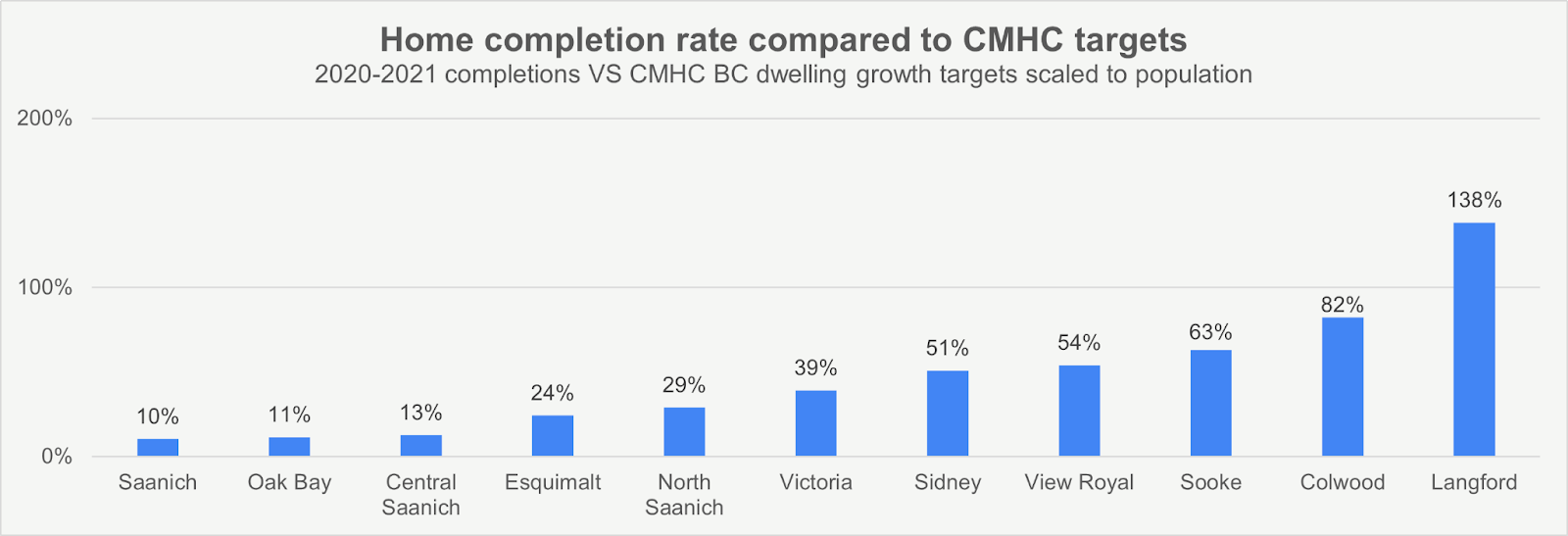

CMHC came out with a report last week about the nation’s housing shortage where they predicted that Canada needs 5.8 million homes by 2030 to restore affordability. I wrote an article for the Capital Daily putting those targets into context with local housing needs targets produced by municipalities (hint: they’re very conservative) and local construction rates. Perhaps to no ones surprise most municipalities are falling well short of CMHC’s aggressive targets. Though there’s a lot of room for improvement via zoning reform, it’s also extremely unlikely that we can hit those targets and I certainly don’t think we’ll solve our affordability challenges by 2030.

However while home prices are all about supply in the long run, in the short run they’re all about demand. The pandemic has certainly showed how demand can ramp up and shift rapidly, while the last few months showed it can subside just as quickly. Canadians have developed relentlessly positive sentiment about housing in the past two decades, and it’s going to be interesting whether the current pullback is enough to really beat that sentiment down, or if it’ll just turn out to be a short correction again.

Sure is Dad. Don’t be sour just yet up and coming, the Westshore pain has not really arrived yet.

New post: https://househuntvictoria.ca/2022/07/11/high-frequency-unaffordability/

Personally I limit my predictions to past events. Reasonably good success rate with that.

Could also be a used car salesperson as VicREanalyst has insiders everywhere it seems. That and he goes to BBQs and bases his analysis on the topics of conversation after everyone is filled up with hamburgers and beer. He could CMHC a run for their money

“Another example of slow/unsophisticated Victoria people”

Is this information from an elite industry insider?

If it comes out of the model it must be true

A lot of economics is just wild guesswork.

Another example of slow/unsophisticated Victoria people – Rushing to lock in rate commitments before the rate hike announcement on Wednesday……

From: https://infotel.ca/newsitem/survey-says-inflation-rising-interest-rates-have-bc-residents-cutting-back-on-essentials/it92775

That’s probably the biggest reason why the historically low rates post-2008 didn’t result in high consumer price inflation. What’s happening now of course is that China is no longer able to meet the increase in demand. It’s zero Covid now but in the long run I think demographics will also factor into it.

That’s why the BoC isn’t afraid to raise rates.

No pressure son, but if your lemonade stand doesn’t have a record summer, then we are out on the street.

Bad parenting

That is true, however mean reversion over an extended period of time is very much real.

The worlds smartest economists have different opinions on where the market(s) will go. If a goal in life happens to be financially successful step one is to have enough common sense to realize no one can predict the markets with any sort of accuracy. This alone can make you millions over the course of a lifetime…for example, you aren’t paying 2% MER for someone to “manage” your portfolio every year.

What I want to do know is how much money is spent on CMHC coming up with these useless reports.

Super duper accurate. Any claim to the contrary is misinformation and disinformation.

I am watching two homes in the Uplands closely…..may be an opportunity come Nov-Feb.

Well, Boomers have entered that age group where it’s a 50/50 coin flip on if they wake up the next morning. I guess a part of the other 50 are heading to long term care or moving in with kids. As for the non-boomer cohort, there’s a reason why rental demand is high. When it comes down to affordability and a person can’t maintain the asset at it’s cost, they just have to sell. Also, there is probably a number of folks that this is the final months of an opportunity to sell close to peak and they don’t want to or can’t wait 5-10 years for it to get back to this point. (Note on cost, saw a father tell his 3 year old in the store the other day that if he buys him “that toy” they will lose their house). He was probably just being overly dramatic, but it seems a lot of folks are feeling the strain.

Hey Leo how accurate is CHMC in historical forecasting?

Having seen the data in several companies and spoken to other owners the workers and subtrades are not even close to being as productive anymore . Changes in construction compliance, building codes, waste disposal, safety standards, wcb, and lack of on site innovation has hampered productivity. Even the way concrete formwork is removed these days takes significantly longer.

The construction sector is the least innovative industry and most reluctant to change. This is a pervasive issued among all the big GCs and subcontractors in town. Lack of labour, reluctance to use new technology and innovate combined with low productivity is such a big issue that it has become a strategic issue with all the RCAs (regional construction associations)

You beat me to slagging CMHC’s predictive powers 🙂

The only thing a CMHC prediction gives me confidence in is that reality will look nothing like the prediction.

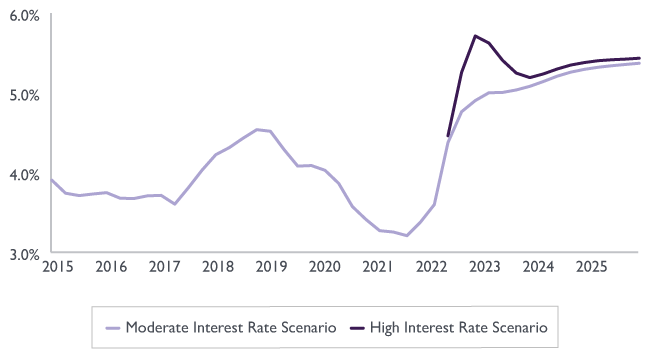

How does CMHC come up with a flat scenario at 5%+ interest rates? Seems crazy to me.

I’d like to know where the people who are now listing are going.

Are they simply people selling a second property?

Or are they moving into condos?

Or ….any ideas on where are they going?

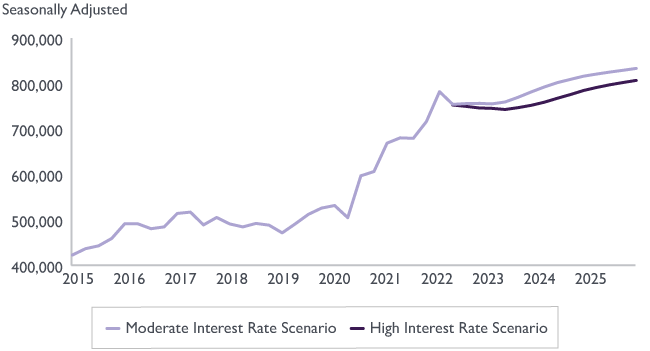

CMHC predicts essentially a flat market

The demographics have changed so much in terms of housing in the GV area since 2015. So while there was more than twice as much inventory between 2010 & 2015 than between 2016 & 2022, a greater percentage of that inventory would have been SFD’s and in the core municipalities.

I don’t know the numbers but before 2016 a huge majority of existing condo’s were built between 1972 and 1992 and most were occupied by seniors and were not rentable. All of that has changed in that much more of the current listings are condo’s compared to the 2010-2015 period. Probably 1/2 of the new condo’s are owned by investors. Marco would know the true numbers for sure.

The population of Langford alone has increased by over 32% between 2016 and now. In turn, Langford has accounted for over 1/3 of new housing over the same period and the West Shore has accounted for 50% of new new housing.

Population in 2010 was 342K as well. Its 394K now which is about a 15% increase (https://www.macrotrends.net/cities/20405/victoria/population) . So Inventory still pretty brutal although it is trending the right way.

No, 2 to 4 mil market is down significantly too. Check on these SFHs close to Uplands border.

My take on construction is that subtrades have been too fat for too long and has effected the quality of work I think workers are just as capable today but have been in the past They have better tools than we ever had but we had better materials

Lots of containers still stuck out at sea, in ports, waiting to be delivered by truck, if your business relies on overseas products, you’re hurting, even the big box retailers are suffering.

From where I’m sitting this is playing out as a typical recession which is a good thing I’m expecting crappy corporate earnings in the fall and a rising labour rate IMO

If we weren’t getting all our crap from China inflation would be a lot worse imo. You would have bidding wars on refrigerators.

Perspective on inventory…

2010 – 4,730

2011 – 5,050

2012 – 5,189

2013 – 4,833

2014 – 4,695

2015 – 4,003

2016 – 2,289

2017 – 1,915

2018 – 2,595

2019 – 3,040

2020 – 2,688

2021 – 1,375

2022 – 2,059 (end of June, now 2090)

I’ve been talking about this on HHV for 10 years now. I remember in 2012 out of 5 siding contractors I phoned for a new home (simple two story all hardie and level grade all around the house) on Shakespeare Street only 2 provided quotes and only 1 was somewhat reasonable. Since then things have become a lot worse. In my opinion people are delusional if they think government will hand out 5/5/5 to office workers while quality trades people are looking for work.

It’s also big in absolute numbers. When was the last time inventory rose >700 in a month? That’ll be a near vertical line on your seasonal adjusted inventory chart, and I don’t see anything like that in the last 10 years.

We have 200 more listings than sales but only 30 more new inventory. Is the re-lists/expired listings causing this discrepancy?

Well it’s an additional 700 listings on the market. The percentage changes are going to be huge for a while coming off such a low base.

We have ways to gomon building up inventory. Not seeing much in the way of price reductions yet on SFH 2 to 4mil.

That’s a big jump. And good to see, approaching something more normal. Looking forward to the post tonight!

Cost of Labor going up in construction has a lot more to do with a generational shift of people being pushed away from the trades. The quality of trades people is also significantly down even the shift in on-site supervision, estimating, etc, is moving towards engineers and not tradespeople. The typical trades person graduating the program is not equipped with the right skills in construction these days.

Monday Numbers for the month to date:

Sales 147 (down 36% from same time last year)

New lists: 346 (up 17%)

Inventory: 2090 (up 50%)

New post tonight.

Right. Nominal GDP could grow at 7%, but if inflation is 8%, that’s -1% real GDP and a recession. That’s interesting, because not many people think like that with their own finances. For example, how many people subtract 6% CPI from their net worth or income to see how they did last year in constant dollars? Your income and net worth may be up 7% and you’re happy about that . But then you read that inflation is 8% and it’s a recession.

It’s human nature to feel good about rising income and stock prices. In the Weimar Germany hyperinflation 1920-23, people felt good about the first 1,000% or so of inflation. There was zero unemployment, generous social programs, Stocks doubling, incomes doubling – felt great. It was in the later stages, after 1,000% of inflation where inflation increased exponentially and the economy fell apart.

I’m not saying we will get hyperinflation here. Just pointing out that many people feel richer in the early stages of inflation – even though technically it’s a recession.

There must be hundreds of thousands of people making money on the internet and therefore don’t need to work 40 hours a week for $15 an hour. Dozens of different selling platforms exist, including eBay which fees have gotten too high, for people to sell almost anything. There is always a constant supply of products from overseas, thrift stores, etc… and if you know what to look for it’s easy to earn at least $500 a week. Not enough to sustain a lifestyle but enough to pay a lot of bills that takes the pressure of the main breadwinner. I believe that’s why people aren’t filling all these job vacancies. These opportunities didn’t exist 25 years ago. Not to mention the money that one can make if they get enough viewers online.

It could be an interesting “recession.” GDP falls for two quarters but you can’t find anyone to work.

The cost of labour is right through the roof as well. Still one cannot be surprised when the Feds have been running the printing presses day and night for the past two years (I know that it is just done electrically theses days which is an interesting issue on its own).

Marko is absolutely right about the cost of materials going through the roof.

If you did a ton of work yourself (flooring, finishing, tiling, painting, landscaping, etc.) you could keep the costs down but the materials have gone through the roof. I use to order these tubs for all our builds off Costco for $399 and now they are double -> https://www.costco.ca/aquatic-eliza-60-in.-%c3%97-32-in.-alcove-bathtub.product.100664472.html

This is why I went to Port Angeles for my fourth shot. If there’s a spike of 50-70 year olds ending up in hospital with Covid over the next few months, Adrian Dix and Bonnie Henry should both resign. As stretched as the healthcare system is right now, this “strategy” is inexcusable. I really don’t know what the hell they’re thinking.

I was a just in Ontario for a couple of days and in Aurora (a bit north of Toronto) I walked by two sandwich boards sitting outside of medical buildings “family Doctor, accepting new patients.” That that was interesting given our crisis here.

Keeping the Model S until 8 year mark and fingers crossed battery dies. If I get a battery replacement under warranty will keep it few more years. If it doesn’t die I’ll sell it at 7 year 11 months and see what is available then.

With the Euro tanking in relation to CND $ I did just order a Model Y Performance in Croatia. Didn’t bother considering anything else, 8 Tesla supercharger stations in an area smaller than Vancouver Island and I can make a 285 km trip between my places at 150 km/h (legal) – 170 km/h (less legal) without charging. Until the other brands can figure out charging waste of my time even taking a look, at least for my purposes in Europe which is all trips.

On CBC NEWS- Farmland is being consumed at a rate of 129 hectares a day, the size of a typical family farm, in Ontario, especially around Toronto. I hope I heard something wrong, but this level of development is scary. Keep them coming in Justin, hope you’ve got property outside of Canada. Save me a bunk.

Yes, that’s what I said “they hope to have a tweaked vaccine available”. But that vaccine is not approved or even finished testing. In test tube, antibody levels were up. But In animals it showed no benefit over the standard one. https://www.nature.com/articles/d41586-022-00003-y The standard 4th vaccine worldwide is to give another standard booster – not “wait for the new tweaked vaccine”. That’s only what BC is doing, and they don’t have science of human trials to back it up,

If it does get approved in the fall, BC wouldn’t get it all right away anyway. So we begin the long waiting process, as so many people would be due for their 4th shot. There are lots people 50-69 age, who are >6 months after their third dose, where studies have shown the vaccine has lost much of its effectiveness. They may get a serious case of Covid and be hospitalized because they couldn’t get the 4th vaccine, which was in stock and sitting on the government shelf. And they won’t get life saving Pfizer Paxlovid therapy either. That’s in stock, sitting in shelves but not available to vaccinated people unless they’re immunocompromised. That’s another “central planning” mistake, to overly restrict medicine that’s not in that short supply. Last I heard there were 15,000 paxlovid treatments sitting unused on BC government shelves, and only 600 had been distributed.

It’s easy to predict what will happen, because it’s happened before. There will be a surge in Covid cases in the fall. Our BC Health will be slow to recognize it, and then declare themselves surprised by it by saying “it’s so sad that very few BCers have had their 4th vaccine, but noone could have predicted this 5th wave”. People will need to pressure them into shortening the time between vaccines, which they will finally do, but too late to help with the current surge. People who aren’t satisfied with this “second world” care will go elsewhere for their Covid shots. People in the USA can just walk into Walmart and get it.

The 4th dose will be different – bivalent with protection for new variants I understand.

Our BC public health department has 200,000 Covid vaccines about to expire by the of July, but won’t budge on their “over 70” requirement for fourth dose. And the vaccines are widely available for them to order more. Instead, we all wait for “the fall”, where they hope to have a tweaked vaccine available. It’s sad to see “central planning” has taken over, and Doctor&patient have typically no say in this for individual cases. As it is, only 2% of BCers are fully vaccinated with 4 doses. Putting us near the bottom in Canada. That number is a disgrace considering the vaccine is available and people want it.

With the vaccine so widely available, and Moderna/Pfizer throwing out expired doses,…Why doesn’t the government just order lots of vaccine and give it to whoever wants it, with their doctors Rx?

https://www.cbc.ca/news/canada/british-columbia/4th-dose-hopefuls-will-have-to-wait-for-booster-shot-says-dr-bonnie-henry-despite-expiring-stock-1.6498038

“4th dose hopefuls will have to wait for booster shot, says Dr. Bonnie Henry, despite expiring stock”

Dr. Brian Conway, medical director of the Vancouver Infectious Diseases Centre, says he hopes provincial health authorities can explain more clearly to the public their rationale for holding back fourth doses.

He says in his own practice, he has done his best to request exceptions for medically vulnerable people who need the added immunity.

We’re all going to get four doses eventually, I really believe that,” Conway told CBC News. “There is a legitimate difference of opinion here; everyone says they’re basing their conclusions on science.

“I’m told there are over 200,000 vaccine doses that are [in] British Columbia — that we have, that we’re ready to give — that are going to expire in the next four to five weeks.”

Henry says if things get worse this fall — and with evidence of waning immunity against Omicron and other new variants of COVID-19 — she may reconsider and make fourth doses available more widely.

With just two per cent of British Columbians fully vaccinated and boosted, the province is near last place among provinces when it comes to uptake for fourth COVID-19 vaccine doses, ahead of only Manitoba, according to most recent federal data from late May.

I am calling 1% hike next week then maybe slow down to 25bps in September if required. Risk reward is better than 75 bps now and having it not be enough.

https://www.theglobeandmail.com/business/article-economists-predict-bank-of-canada-will-hike-key-interest-rate-by-075/

Funny that you say that Dee. I actually tried to get a doctor up island as well and it was just as hard. On a small island or rural community you may get faster emergency service for small issues – although really depends on their doctor situation which can change over time – but then have to go to a larger center for all other more complex needs which are more likely as you age.

I was visiting friends on a small island. One of the kids fell and needed stitches. Kid was gone and back in under an hour. My kid needed stitches here last summer and we waited 4 hours in the ER. Don’t know about you all but when I retire if doctor shortages are still an issue I’m going to a small remote that is prioritized for medical care.

Rarer than rainbow coloured unicorns unfortunately. Our excellent GP retired early due to some health challenges 2 years ago and my family has been without since then. Telehealth plus ER which is not a great solution.

Totoro yes gotta go to van but good stuff u found a doc I know a handful that have quit in the last few years so it’s not looking promising unfortunately

I signed up more than six months ago. At that time they projected August as the enrollment date. Haven’t heard back yet and I was able to get a family doctor. Problem is that the clinic is in Vancouver.

totoro yes there is now a long wait list Where u looking to join

More than a six month wait list now.

I dont believe she has a money near as I can tell but I will look into it but she really needs a doctor that can physically see and examine her regularly. Not too sure that her computer skills are up to handling teleheath but I will see what I can arrange and manage for her.

Umm: I will pass that on but this is ridiculous. Growing up and we were poor but everybody had a GP back then. Why are things worse instead of better. I feel like my generation has somehow failed the generations after mine.

Barrister u can join Telus executive u pay but man it’s great Your doctor will even phone u after dinner just to see how your doing lol

Barrister, that’s tough. After 12 years of trying to find a GP here, I got in with the Nurse Practitioner office. It was only a 6 month wait to get brought on there.

My neighbours GP just told her that he is moving to the US by the end of the summer. Does anybody out there know of a GP that is taking on new patients?

James I don’t know a crew from Calgary would work a whole lot cheaper than locals That looks like a pretty nice Reno to me

“The Reno’s on cresswell would be north of 550 grand”

I could fly in/house a whole crew of top notch tradesmen from Calgary and do it cheaper than that. Maybe if you don’t know how to GC but I imagine most people on this forum didn’t grow up in construction.

Good start to July for listings, at least they didn’t collapse like they did last year.

Hey Marko did you order the BMW i4?

The Creswell is not a typical flip, it’s equivalent to new build. Just like 1257 Hampshire sold earlier this year that sales value is way higher than BC Assessment value.

Not knowing what it looked like before other than Google maps and seeing the after pics now I am guessing 600k+ based on ~$150/sqft. Also depends on how much work is self performed and how that is valued. Maybe GC or Marko can provide better assessment, pretty nice house now though.

https://victoria.evrealestate.com/ListingDetails/1686-Cresswell-Dr-North-Saanich-BC-V8L-4L4/904944

Using this as an example of houses still selling enormously above assessment in an effort to convey that the market is still hot is just plain stupid..

The Reno’s on cresswell would be north of 550 grand

Some manufactured homes are pretty darn nice inside!

‘Manufactured home communities’ come into their own in the midst of an affordability crisis

https://docdro.id/84pjyP9

https://www.theglobeandmail.com/real-estate/vancouver/article-manufactured-home-communities-come-into-their-own-in-the-midst-of-an/

My approach is to not house-hop very much (saving me tens or hundreds of thousands of dollars) and to shop at Costco strategically.

My car insurance dropped 27% ($30/month) after the NDP’s changes to ICBC.

Your kidding right??

“ Looks like pretty much a new build, doubt the assessment reflects that.

I’m amazed they got it for 850k in 2020 even with the dated interior, it’s a large house in a good area…I can’t imagine the renovations costing more than 300k so that is an amazing profit when compared to other properties especially selling after the bubble.

Frank, without getting into specific details they took an old structure tried to meld units into existing plans and a lot of stuff is not lining up. Combine that with inexperienced people running the project and site it has created lots of struggles all round.

Beautiful home, obviously someone saw the potential. Payments are now 8k a month with 500k down. Yikes. What was it before the reno?

I looked at it when it was for sale before the reno. All redone inside and out down to the driveway stones. Some structure changes as well from what I see in the new pics. It was a no expense spared kind of renovation from the appearance compared to when it was for sale not too long ago in it’s original early 80’s shape.

Looks like pretty much a new build, doubt the assessment reflects that.

Google says that there have been about 60 Tesla fires in the last eight years. By the way that is the total extent of my knowledge which depends on three minutes of looking up Google. My wife is on the phone for just a few minutes with her brother for the past hour. Race between canoeing and the sun going down.

up and coming- My Grandfather built this cottage in 1950. There are very few on the market now., but sometimes you can’t give them away. Go figure. Unfortunately the season is very short, especially this year.

Why don’t we just send everyone to Edmonton. I am seeing nice condos on realtor.ca for 200k.

Me, you, Frank, VicRe (and his insiders) at Oak Bay Beach Hotel. I’ll business expense it.

Ha ha 🙂

1686 Cresswell sold for only $640,000 above assessment. Tesla’s are blowing up regularly as well as eScooters. I won’t set foot in an EV. Where’s Ralph Nader when you need him?

My comments were more along the lines of two humans (private seller/private buyer) trying to work out a deal, but regarding seller logic your comment is 100% correct and perfectly summed up. I’ve given up on trying to logic and help people. I stopped doing mere postings, cut back the cash back, etc., and still doing the same amount of deals I was doing 5 years ago but making 2x as much.

I think when I was doing discounts it often worked against me.

Marko: Dont hate condos or density necessarily but endless increases in density for Victoria is not a wise solution to the needs of the next generation in my opinion. Should we approve five or six more thirty floor buildings on the roundhouse lands;; absolutely. But in the long run we need to focus on creating more small town and cities if we are going to continue with a policy of increased immigration. And yes that would also include condos.

If the market totally slows down I will buy you lunch one day and perhaps we can actually have an intelligent discussion where we might find that we differ less than you think. Also it will allow me to practice my limited Croatian with you which should be massive comic relief.

Good on you Frank, just send some of that weather out here to Victoria. Also, I hope you own your cabin there and are not AirBnB’ing one. Was looking on the south and gulf islands for a water/lakefront place and you’re paying $300-$1000 a night depending on how many it sleeps. It’s a license to print money and would imagine renting from May-Sept covers all expenses and turns a profit.

That MLS post takes a lot of motivation. The good thing from the downturn will at least be some better customer service from realtors along with a little more hustle. Also, for the less performing realtors there’s lots of work they might find motivating in hospitality services.

No argument on my part here.

Deals collapsing…lol 🙂 I get more frustrated losing tennis matches. Yes, many RE agents will struggle coming up as 612 sales and 1592 agents doesn’t add up, but I am probably that last person you should worry about when it comes to the market/finances.

I find the level of differing characters on the blog at an all time high. Barrister your clearly hate density and have an agenda against condos. Frank is trying to tell us 1.35 million properties are worth 1.85 and that Tesla batteries blow up regularly, and VicWest coming in strong with inside connections. It is all quite amusing. Other than Leo, there is very little middle ground.

I know what you mean. I tried to talk a friend selling a home into hiring a selling agent to take a $20k commission instead of $30k. And they told me the agent wouldn’t be “motivated” to sell the home. Complete nonsense, but that’s what people believe. And this friend will always drive to CostCo to save $20.

Correct

I might be wrong, but I believe that Ebby did not remove contingency fees but rather limited personal injury rights to a trial. The idea was to reduce costs to ICBC.

You should see a substantial decrease in your car insurance rates (along with flying pigs).

Well yes, it’s great that there are options for lawyers for contingency fees. I’ll keep paying by the hour.

But If “contingency fees” are so bad, why isn’t David Eby “taking that away” from RE agents too?

Ebby should be interesting if he is the next Premier. Someone was suggesting that he has some real strong views on rent control. Does anyone here actually know:

Guess what – some do. It’s called a “contingency fee”. But only for the really big ticket items like personal injury lawsuits. David Eby just took away a big chunk of that business, so I guess he’s not too popular with the personal injury crowd.

Marko: There is actually a reason why an agreed upon gift is advantageous over a reduced commission if you are American. It occurs in LA a little more often than you think natuarally on a handshake basis. But lets not belabor that. I do agree that it is hard to find people that are coldly practical and logical in this world. But if you think that it is just real estate that involves the emotions try negotiating a divorce settlement between parties that really hate each other and both boarder on the psychotic. For that matter try to arrange visitation and custody rights to their poodle (seriously try explaining to a judge why custody of a dog requires an actual hearing and two very experienced council cannot get a settlement on the matter. You dont want to know what her Honour’s suggestion was)

Turning into a beautiful day and my lovely wife wants to go canoeing out on Elk Lake. Cheers to all.

Ouch! In a typical summer, we’d be boasting about the “high pressure area” over Victoria bringing us endless summer sunshine. It’s AWOL this year, and it’s endless clouds.

I’m trying to “Look at clouds from both sides now” like Joni wants, but for me “they only block the sun”!

Barrister, my capital markets insiders are telling me a very different story!!

My point was more along the lines of RE agents will be around forever because people and society in general is just getting more difficult.

That is my takeaway from 12 years in real estate. If you watch my content from 11-12 years ago I was huge into mere postings and the industry going in that for sale by owner type services -> https://www.youtube.com/watch?v=Z4etCA5Chos

I overlooked the human component.

First of all I have absolutely no idea if there are a lot of real estate deals falling apart but it would really surprise me if there were considering the huge potential liability in not closing. Sure more than six months ago but I would be surprised if it was more than just a handful. (Again, I have no actual knowledge and just guessing).

But, for some real estate agents, it might be a very slow summer as buyers wait to see if the market levels out. No ide if we are talking a few months or longer. But one should remember that some people need to sell and other people need to buy. The market cannot stay supper slow forever.

Marko, cheer up the sun is out and my sources in Toronto tell me that summer might be just around the corner.

I wasn’t referencing that. You would be asking for 29 crates of wine in the deal, VicRe would be calling up his insiders, and Frank would be offering you both 300k more than asking price 🙂

I personally thing the SMARTEST thing for people to do is to work out a private deal; however, I know that will never happen in mass. You would need two non-emotional common sense parties which would be difficult to line up.

I agree. RE agents provide a good service and will be around forever. The strange part is the method of compensation. It’s not just RE agents, other professions like financial planners have odd compensation models.

The best model is lawyers. I want to hire a lawyer and it’s $300 per hour. Great. If he/she spends 12 hours it will cost me $3,600 – no surprise there. And I’m not “wasting his time” if I drift into other topics, as he’s happy to talk about whatever for $300 per hour.

Compare that to the strange compensation model of RE agents. They’re getting paid nothing for most of their work they do for me, in the hopes of a huge outsized payment if I buy or list a property with them. Imagine if your lawyer worked like that – everything was free, but he took a % piece out of any transaction he did for you – yukk!

Financial planners payment model is even worse. If I talk to one for 4 hours, they don’t want $300 per hour like the lawyer. They want me to pay them 1% per year of whatever they invest for me. – hopefully forever. Not a % of the profits, they want a % of the whole thing. What a lousy “conflict-of-interest” payment model.

And by the way, I’m not talking about Marko here, he’s a great pioneer in this field with alternate options and transparency for fees.

=====

Q.So why can’t a hire a RE agent like a lawyer, and let them bill me per hour worked? If that’s not possible now, it’s the future I want to see?

Most of my deals have been private, they’re easier than dealing with a desperate agent trying to cover their overhead. Or I have realtor friends that broker a deal with me before the house goes on the market. It pays to have connections.

Off topic, it’s simply an immaculate day at Grand Beach on Lake Winnipeg. 25C., no wind, warm lake water, swam a half mile, next week I’ll be up to a mile. I wonder what the poor people are doing?

Only downside: mosquitoes.

Deals falling apart would be my guess. And yes, I am fully expecting and waiting for Marko to cite me his rock star stats for the current year 🙂

Well if there is one party that is easiest to cut out in a real estate transaction once the property has been selected it would be the realtor.

I’m with you on that, but I agree that for a majority it is about the actual house – especially for those who are retired and at home all the time without childrens’ needs to consider.

Marko: Not sure why you seem to be beating up on me. Two of my friends from Toronto have both bought in Oak Bay and are really happy. A couple of other have found Victoria not tobe their cup of tea but that is a separate issue. Being older and from Toronto is it a surprise that some of my friends and colleagues are looking at retirement homes in Victoria. As for my friends in corporate and finance fields, not a real surprise since I graduated from Osgoode.

But again I am not sure what your point is since I would absolutely recommend that people use both a realtor and a solicitor that specializes in real estate. The exception is that in some small or remote towns the general practitioner is extremely knowledgeable.

I never suggested that it is wise for most people to work out a private deal although I have known a few that have done so. Not my cup of tea for myself since it seems more trouble than it is worth.

But I am wondering why you seem to be on a bit of a rampage. Most sales people usual lean towards a bit more diplomacy.

Well it is happening and I doubt they will be successful.

I never said anything about having Insider real estate contacts (that’s a term someone else sarcastically came up with) or actual contracts not completing in Victoria. I said my lawyer contact told me there has been a significant increase in people inquiring on how to get out of firm deals a couple months ago and whether they complete or not will remain to be seen.

Oh well good thing the lawyer contacts I have aren’t drunks that couldn’t even get into a Canadian law school and had to go abroad to get his law degree. a typical RE conveyancing is a joke and shouldn’t even require a lawyer, I am surprised notaries aren’t more popular in Victoria like they are in the lower mainland, same result for the customer but cheaper. I also don’t have developer friends I do business with whom pleaded guilty to securities fraud previously 😉

+1, for sure. For me the most important thing is walkability, but for a lot of people the actual house takes priority over location/walkability.

A lot of the substance is complete non-sense like contracts not completing. If he actually had “insider real estate contacts” he would know something on the matter of these topics.

I carry out over 100 transactions per year (Leo can verify need be) which means 80 to 90 clients every year ask for lawyer/notary recommendations. I am not going to recommend my clients to a lawyer that dabbles in 10 different things including conveyancing. I recommend them to firms that specialize in real estate conveyancing and when you’ve sent various firms over 100 clients you have a relationship with the owners/partners. Do you see me or anyone else dropping let me check with my “insider real estate contact.” Other than Barrister and his friends in banking.

Up there with Barrister and his “friends” looking for multi-million dollar properties in Victoria.

Someone asked me the other day if the real estate profession is around to stay and I’ve never been so convinced that it not going anywhere in my lifetime. Imagine Barrister, VicRE, and Frank trying to work out a private deal. That would be fun to watch.

lol, this flip sounds as believable as your insider real estate contacts. PTT, real estate fees, legal fees, carry costs (strata fees, etc.), would be in excess of 40k. You can’t add that much value on a newer condo via renos (aka new appliances and some laminate).

The mere fact that the only issue people have is tone instead of actual RE substance indicates to me that I have done what this forum is intended for. With that said, could you let me know the RE substances you do not agree with?

Sold a newly built home on Bear Mountain this past winter. Majority of people interested were out of town buyers. The resort living appeal, biking and hiking trails with close proximity to all consumer needs. The buyer ended being a retired doctor from the Okanagan who wanted to escape the yearly summer fire smoke. He rented downtown first but was put off by the downtown issues.

I think out of towners value the Westshore and bear mountain higher than the local born and raised. Also that is a lot of lights to hit if you want to make a weekend trip up island from downtown or Oak Bay.

VicRE, I actually agree with about half your posts on substance (not this one, to be clear), but you don’t seem to realize just how many of your posts are pretty rude, even just the pretty constant LOL and LMAO mocking. I don’t think you’re very self-aware.

James, it might surprise you as to the number of people whose only interest in Victoria;s core is being far away from it. Being able to take a stroll down Pandora does not appeal to a lot of retired people. Sure if you happen to work downtown then it might be different but for a lot of people there is nothing special about the core.

Record low unemployment rate and declining participation rate for Canada in June. I am going to call 100bps hike next week, BoC has little to loose by front loading.

“ You could also look at it from the perspective of that Bear Mountain homes somewhere on the water in Victoria is around $5 million +/-.

I just have trouble internally reconciling Langford at those prices with a 25 minute drive to the core but rich people who love golf tend to spend a shitload of money on houses in these master planned communities. Crown isle in courtenay has houses going for 1.5-2 on city lots when it’s in the middle of nowhere.

The flooring and appliances are a little dated looking (lots of brown ala the late 2000’s era like the Aria) plus the kitchen is not open concept in some units so a wall could be removed.

GC- Could you please elaborate? Not that I’m interested in purchasing, just curious, thanks.

Speaking of condos on Bear mountain, the latest condo project One Bear Mountain is an absolute disaster. Stay away from that building.

You could also look at it from the perspective of that Bear Mountain homes somewhere on the water in Victoria is around $5 million +/-.

The condos are even newer?

Condo

1432 Pinehurst Pl (Bear Mountain) for $2,782,500

I’ll never understand bear mountain can get a waterfront mansion in lantzville for that price and will likely appreciate much more as well.

Any examples?

1432 Pinehurst Pl (Bear Mountain) for $2,782,500

1686 Cresswell Dr (Dean Park) for $1,925,000

“Some of the recent sales in Dean Park and Bear Mountain surprise me. The prices are still high.“

Any examples?

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-delinquent-debt-expected-to-soon-rise-as-interest-rates-increase-say/

How do you do a flip on Bear Mountain? The homes are too new.

Know someone doing a flip in Bear Mountain right now, curious to see how that one goes.

” good times create weak men, and weak men create hard times”

Some of the recent sales in Dean Park and Bear Mountain surprise me. The prices are still high.

You nailed it. That is exactly the problem with today’s society. Forget inflation, affordability, political polarization, declining trust in institutions, declining fertility, regulatory overreach, homelessness… What we need is a national mobilization to address the defining issue of our generation – butthurt adults on the internet.

We are getting off topic here so this is the last time I will respond to this subject. I am just speaking facts and I don’t think anything I posted is rude. When someone continues to make wrong calls then they should be called out when making further claims. I didn’t resort to any personal attacks, all I am doing is question their credibility on the said subject. I don’t see you coming to my defense when comments about “elite industry contacts” were sarcastically directed at me. For that other point just go look at the posts on here in April and May and you tell me whether the majority of the locals are slow to what is happening in RE or not.

This is the problem with today’s society, adults expecting to be treated with kiddy gloves on a anonymous internet forum none the less.

The froth is gone

The froth is gone away

The froth is gone, baby

The froth is gone away

I know I guessed the market wrong, baby

And I’m so sorry today

The froth is gone

It’s gone away from me

The froth is gone, baby

The froth is gone away from me

Although, I’ll still live on

But so sorry I’ll be

The froth is gone

It’s gone away for good

All the froth is gone

Baby, it’s gone away for good

Someday I know I’ll be ahead baby

Just like I know, I know I should

You know, I’m sorry, sorry now, baby

I’m sorry I listened to the hype

Oh, sorry, sorry, sorry now, baby

I’m sorry I didn’t stop and think

And now that it’s all over

All that I can do is wish for 2% again.

Agree this is basically the same. I thought I’d seen a story with much bigger differences but perhaps I’m mistaken

If the cost to you is so little, then it might be worth considering the reverse – it also costs nothing to treat other people with respect. I don’t see why that basic notion of human courtesy is not required just because you don’t know the person you’re speaking with.

Cutting others down and just being rude in any medium is tactless and really doesn’t actually say anything about the person you’re denigrating. You can do better.

Wouldn’t bother me in the least bit tbh. Facts speak for themselves.

A huge portion of my business is people being bored and creating unnecessary stress for themselves. Life is easy so people often get bored and need to switch homes for no logical reason. Then they are further bored so they go out a buy a pet and then they stress about vet clinics closing because there aren’t enough veterinarians to go around, etc.

Sure, but don’t be surprised if people just start tuning you out or Leo starts removing your posts because you’re being an idiot.

This dreamer is still listing at that price…. makin a mil in a year ain’t that easy unless the timing is impeccable.

https://www.realtor.ca/real-estate/24364088/1647-kenmore-rd-saanich-gordon-head

I’d hold off on the sociological explanations before a good look at the data.

The first question should be”is there a significant difference in life satisfaction between the provinces”? When I look at the numbers (2018 – pre COVID, I ignore the 20-22 numbers as they are skewed by Covid ), I don’t see a significant difference. In fact they are remarkably similar – considering this is a subjective test, conducted in different languages where the questions and culture might have different meanings.

The result was BC 8.01 out of 10

The range was 8.00 (Alberta) to 8.20 (Quebec). Ontario was 8.09

That’s a remarkably narrow range (within 3%). And you can see on the statcan chart below, it was also remarkably similar between male/female, age, education, rural.

(( an aside: To illustrate how small these differences are, what if BC house prices were $801,000 and the range in Canada was $800,000 to $820,000. Would you ask, wow why are house prices so much cheaper in BC, or would you say “wow, house prices are about the same nationwide?”.))

On the life satisfaction numbers … From a sociological perspective, the only significant difference was people living alone (7.66) vs a family (8.21) – but even that’s a small difference.

So my headline would be “Canadians life satisfaction in 2018 is high and remarkably similar between the Provinces and other groups” and leave it at that. That headline wouldn’t be click-bait though.

Good post as always Totoro.

Statscan has lots of data on the distribution of net worth in terms of where it is held and provincial differences. There are lots of stats on small businesses as well. I think it would be a big project to put that all together and come to statistically supportable conclusions.

My brief review seems to indicate that business starts are higher in rural areas of Canada where there are fewer jobs, and that there have been relatively few business starts in the Maritimes where house prices have historically been lower but could be other reasons than lack of equity for this stat.

My view is that the more money you have the faster your net worth increases and the more freedom you have to invest in other things or just stop investing and do something different. Being tied to work income is a significant restriction.

Those who live within their means stand a much better chance of achieving satisfaction in life. Don’t borrow more than necessary or more than one can afford to comfortably repay. Stress will be lowered, joy will be felt. For too many folks in BC there have been too many temptations through readily available and low cost credit. As that cost steadily increases, overstretched borrowers will feel ever more stress.

Perhaps it’s time to heed Mr. Micawber’s advice to young David Copperfield: (advice which he failed to live by himself).

‘My other piece of advice, Copperfield,’ said Mr. Micawber, ‘you know. Annual income twenty pounds, annual expenditure nineteen nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery. The blossom is blighted, the leaf is withered, the god of day goes down upon the dreary scene, and—and in short you are for ever floored. As I am!’ (Charles Dickens)

Sure they do, since there’s been a massive runup in RE prices for decades. What would be interesting is look at house prices versus production of tradable goods and services in a given metro. Or look at non-housing net worth.

It’s been that way for a long time. BC has long attracted people looking for the “good life”, but people who really are satisfied with their lives tend to stay put.

Yeah I can’t say I know of any research on this front. Curious if say rate of business founding or mobility is greater in areas of lower house prices.

Also interested in that recent statscan data on life satisfaction where BC scored lowest. Any good theories on why that is?

I wonder what the penalties are on paying off a 30 year mortgage early? That would deter me from ever taking one out.

If you get offended on an anonymous internet forum then you have bigger problems in your life to worry about.

I don’t think anyone cares whether you do that, they just don’t want to be called an idiot while you’re doing that.

In addition to the normal summer lull of that period, should have clarified that point. Leo’s wonderful graphs should be able to illustrate this clearly once the data is out.

Feel free to prove what I am saying is wrong with some actual backup and I will gladly apologize and admit that I am wrong. Until then I am going to call it as I see it.

Not sure it would be anything different really? If you look at jurisdictions with lower cost housing they also have lower net worth. Home equity fuels a lot of interesting and productive things like small businesses in BC. Greater disposable income might allow some people to work less though.

VicREanalyst. i admire your conviction. but not much else. you dont seem to be able to construct a paragraph without insulting someone. again in this case the “local” people who dont share your great insight.

They drop off normally this time of year.

Cheap rate holds from April comes off this month to coincide with the rate hike next week, I expect sales to dramatically drop further starting in the latter part of July. How many local buyers/sellers and realtors understand this and will act accordingly is the question.

Fair enough, I think I’ve made my point now.

“Section 10(1) of the Canada Interest Act grants borrowers a statutory right to prepay mortgage loans with terms over 5 years at the end of 5 years upon payment of 3 months’ interest, even if the mortgage is expressed to be closed or prepayable only with yield maintenance.”

This is a disincentive for lenders to offer long term mortgages, although they are not prevented from doing so. There are similar prepayment privileges south of the border, but the 30 year term mortgages are financed through the federal agencies which offloads the risk from the originator.

5 year bond yield back up to 3.15%. Still a ways off the peak but probably enough of an increase to keep the banks from dropping the 5 year rates anymore. At least for now. 6 days until Canada interest rate decision. Which also lands on the same day the US inflation numbers come out.

Right. And it’s not just price. It would be nice if they could get US style 30 year fixed mortgages too. Because in Canada they might buy in at a good price, with an affordable mortgage, and then rates rise and mortgage becomes unaffordable. We saw that in the early 80’s.

The federal government comes up with various programs to help FTB – instead they should focus on getting those 30 year fixed mortgages happening. They are higher rates (5.5% in USA now) but that higher interest rate is also one reason USA prices are less than Canada.

The CMHC has been said they want to bring these long term mortgages to Canada. It would require changes to the bank regulations and financing of the mortgages, likely to match what goes on in the US. And likely the government would need to participate and be taking on risk and many would consider it a subsidy to homeowners (which is fine with me).

I would suggest that certain parties should avoid personal attacks and perhaps consider being a bit less personalized in their attacks. Just by way of clarity, dont be a jerk in your comments.

It’s interesting that in some cities house prices are governed so strongly by the maximum people are able to pay.

Would be nice if housing wasn’t that all powerful wealth attracting vacuum. Wonder what interesting and productive things people would invest in if housing didn’t consume most of their money

It is the liquid net worth of the wealthy people arriving, not the value of the house they sold that determines how much cash they can pay for a house here.

Many people are arriving with additional financial assets other than the cash from the house they sold. They aren’t emptying their pockets on the house they buy in Victoria. If you have $5 million assets, and sell your house for $1m (which had fallen from $1.5m), you can still buy here for $1.5m or higher. This applies to all of the recent ROC arrivals on my street.

Hey frank, that house on ascot you thought was worth 1.8M just canceled their listing at $1.35M because they couldn’t get any bites above $1.25M. you really should leave the RE analysis alone, you got zero credibility on this forum. Stick to talking about Hawaii.

As per usual, the way the media is reporting the real estate slow down can lead to misinterpretation of reality. They put up numbers like 35-40% reduction in sales in markets like Vancouver and Toronto. These numbers are 100% accurate but some of the general public may get the impression that prices are down these percentages. People have a unique ability to misinterpret simple data. The reality is prices are down 2% in most locales to maybe 10% in Toronto, Vancouver and other markets that experienced the largest gains. The majority of Canadians are oblivious to the monthly variations in the value of their property. Some are oblivious to the value in general. From a practical point of view, prices may have decreased but thanks to higher interest rates, the cost to acquire a property has increased for those requiring a large mortgage. Who knows what things will be like 6 months from now. Predicting the future nowadays is impossible.

If prices are falling elsewhere in Canada, people selling their houses and moving to Victoria will have less money to buy with.

So obvious it shouldn’t have to be pointed. out.

Thumbs up to Patrick’s Comment

Victoria is seeing ongoing gentrification, which isn’t part of your simple “closed loop” formula above. This is a third group, moving to Victoria from the ROC. Cash rich, and not FTB. About 5,000 people move to Victoria from the ROC per year (Alberta, Ontario).

Victoria is better insulated from the RoC as it is an retirement mecca. Decades ago you had a wide spectrum of people retiring here; now it is an more affluent crowd. Demographics is a large driver IMHO.

Anecdotally, in our older and established Victoria neighbourhood , there has been NO LOCAL families that moved in the last few years. All our new neighbours are from Vancouver, Alberta, and Ontario in that order.

BTW, the newbies are some of nicest people you could meet!

From: https://financialpost.com/real-estate/mortgages/canadians-flocked-to-variable-rate-mortgages-ahead-of-bank-of-canada-rate-hikes-cmhc-report-shows

Looks like it was an overly indulgent debt escalation that really spooked policy makers into finally taking things seriously.

And this….

Oh well, there should be lots of options left in the toolkit to deal with that upcoming recession and the post COVID global sovereign debt crisis that will need to be dealt with as well.

Does it matter at this point? They’re already in power.

Victoria is seeing ongoing gentrification, which isn’t part of your simple “closed loop” formula above. This is a third group, moving to Victoria from the ROC. Cash rich, and not FTB. About 5,000 people move to Victoria from the ROC per year (Alberta, Ontario).

People who don’t understand this become incredulous when they see the sale prices of homes (“who can afford these homes?”), because they assume that their cohorts are the only marginal buyer pool. In reality, they are competing with well-heeled Canadians moving to Victoria with plenty of assets.

Many Victorians have moved here from the ROC – including me. And I wasn’t buying my first home.

up and coming, looks like I owe you an apology. There was a recent sale in Royal Bay for close to $1.5M https://victoria.evrealestate.com/ListingDetails/509-Gurunank-Lane-Colwood-BC-V9C-3R9/904334

To be fair, this is on a elevated 6000+ sqft lot with ocean views so not quite the 4000 sqft ones I was referring to.

The factors I cited weren’t about whether or not prices would ever go down, I think they already are in some places, only about what FTBs do in a very expensive market with rising prices when income isn’t enough It is no longer just about income for FTBs who would like to buy a house in Victoria.

These debates are pointless, the main driver of real-estate are incomes and the availability of credit. Everything else takes a back seat to that.

Falling prices. If the factors you cited were all that mattered prices would never go down.

I think if Eby wins an election as leader of the NDP things could radically shift in housing. Like municipalities might lose the right to regulate some zoning, Airbnbs will be subject to strict regulation, and maybe even some sort of additional tax on housing to pay for low income housing. He has many strong opinions on the subject . The question is whether enough of the 68% of homeowners in BC are going to support that.

I’m not sure what you mean? The economics of housing are pretty straight forward from an investor’s standpoint. Lots of info, free calculators, and when you are dealing with your own money you tend to do the math before you invest. I think the relationship between the cost of borrowing vs. rental income less costs is one of the first things you figure out.

I’m not sure where this notion has been debunked? Do you have a source? I would say your response misses:

– FTBs who have financial help from parents based on their parent’s home equity – extremely common now

– FTBs shrinking their house size, telecommuting, or increasing their commute time to compensate – extremely common now

– the rise of co-ownership

I do agree more people will hesitate to buy in a falling market, including FTBs and consumer confidence is a significant driver of demand. On the other hand there is this stat:

Wouldn’t an out of town buyer be equivalent to a first time buyer? As far as I can tell, most of the participants on this site were once out of towners. An increase in birth rates are definitely not driving the Island real estate market.

I don’t know what you own or what you don’t own and I can care less. I am just saying from a value perspective, paying $1.5M for a house in Royal Bay on a 4000 sqft lot is not a wise thing to do in the current market. Here is something of better value for $1.5M https://www.realtor.ca/real-estate/24626287/1021-st-charles-st-victoria-rockland

Smart choice considering what the rest of Ravi’s family does for a living. Will be in the cross hairs of the liberals.

Sure, whatever makes you feel better.

This is slightly reassuring as most of your contacts were probably asking “is Pepsi okay?” when you ordered a Coke a couple years ago.

I don’t have to justify it, people are paying it, plus more. You just don’t seem to like that people are paying that amount for a house in RB. Is it a wise move to build homes in a giant sandbox? Maybe not, but I simply stated that I see the appeal to young families. You can keep trying to associate me with loving RB despite not living or owning any rentals there if it’s a fun little game for you as I know some people are entertained by simple things.

Ravi Kahlon announced he won’t seek the leadership and is endorsing Eby. Political pundits now saying Eby is almost guaranteed to be premier, if he wants it.

https://www.victoriabuzz.com/2022/07/victoria-ranked-as-canadas-best-small-city-in-2022/?fbclid=IwAR1FF__3mkrRXl57JqvRgsEaMHAKh97H0HjWky2aArgI46fGzAEQNNIZu9s Who doesn’t love a good “Victoria is great” news piece?

This one is my favorite though: https://househuntvictoria.ca/2022/05/16/new-and-active-listings-what-happened-during-the-crash-of-81/#comment-88612

LMAO

Most people don’t understand the relationships between: cap rate, cost of capital and price.

I don’t have any elite RE insider contacts. I have contacts in the industry but they are just useful in getting some on the ground info from and I would not depend on them to provide any actual valuable advice or predictions. I formulate my own conclusions, ones like this: https://househuntvictoria.ca/2022/04/25/dark-sales-revisited/#comment-87529

This is also a good one: https://househuntvictoria.ca/2022/05/16/new-and-active-listings-what-happened-during-the-crash-of-81/#comment-88413

In the meantime you are trying to justify $1.5M+ for a Royal Bay house on a 4000 sqft lot. Lmao, good luck with that.

It doesn’t matter how much this notion is debunked, it seems to persist anyways.

The market is not, and will never be, a closed loop system. You need FTBs at the bottom, and people exiting at the top. For the former, there is not enough out of town buyers to compensate in the event that FTBs are shut out. Generational wealth transfer won’t do it either. With no FTB’s, there simply isn’t a sustainable market.

In fact, FTBs being shut out and high levels of investor activity are stereotypical indicators of a late stage market cycle, for that very reason. I cannot say prices will fall 10%, 20% or 75%, but what I can say is if central banks keep the brakes on and continue, investor activity will drop, money flows will shrink, and after a few years the market will favor FTBs once again.

But many FTB won’t buy then, either. At least not right away. The challenge at that time will be the perception that anyone buying will automatically lose, making the emotional cost of buying high, but the monetary cost low. This is the opposite of what we’ve seen for a while now, and it’s what makes RE markets take so long to recover.

All the CB manipulation is really clouding this basic notion for a lot of people, IMO.

I would guess a lot of young renters are putting out around 50% of their take home pay for a place they are probably sharing with someone. Makes saving for a down payment nearly impossible.

“Totoro actually comes from Mei mispronouncing Tororu, which means troll in Japanese. This comes from a book Mei had read, which turns out to be the traditional Norwegian troll story Billy Goats Gruff.”

Financial fundamentals are ignored by fools.

Just because the cost of borrowing money has essentially doubled, that doesn’t mean prices have to drop in half to compensate. It just means more people are priced out of the market, acquiring a property is even more out of reach for first time buyers. Those with equity will carry on buying and selling, the interest rates aren’t that oppressive, historically they’re still relatively low. The price declines that have been reported are nothing compared to the beating other investments are experiencing. All my friends are crying about the 6 figure losses in their equities, not one is remotely worried about the value of their house.

They don’t and it is nice building, but quite old and in a so so location with very under market rents. The cap rate is only 3.8%. Even worse, heat and hot water are provided through a central service and included in rent at an unlimited rate. You’d have to take over and be an evil landlord looking to raise rents and cut costs for it to really make sense given the probability of high maintenance costs.

Doesn’t work in our market just like the cash flow rules for landlords don’t. We are an expensive market. You should consider moving if that is your benchmark. Otherwise you are are touting trite advice that has no practical value. I’m not sure it ever did given variations in income that are out there and the basic cost of living stats, plus the failure to account for net worth in anything.

Frank – I agree someone will buy 928 Bay basically for the reasons you said, these properties just don’t come along that often.

Are you a GEU member?

From: https://financialpost.com/executive/executive-summary/posthaste-why-this-housing-slump-wont-be-as-bad-as-2008

Wow, that escalated to stage 3 quickly, or have we made it to stage 4 already?

https://youtu.be/rFeVfwDvTyM

Signpost: The operate word is lucky and not in love. This is a house hunting blog and not a spouse hunting blog so I wont bore you with my rule book for picking a spouse. Besides last thing people want is advice.

IF you’re a lucky man, your wife will be your best friend. Conversations with dogs tend to be one-sided and devoid of the lessons which a woman may provide(?).

“I’m a man, but I can change, if I have to, I guess!” (The mans’ prayer from Red Green show).

Maybe you should give him access to your elite insider real estate contacts?

Signpost: After thirty years of practicing matrimonial law I can assure you that marrying for love does not necessarily provide you with a best friend (unless you get a dog as a wedding present). Being in love far too often really clouds one’s judgment. But, I will agree that you thought is far more pleasant at least in terms of providing me with a fine living.

And in meantime continue to exceed that limit by paying 50-60% of your income to rent. I hope all you FTB’s are writing this down.

More than that no? ~33% drop wipes out ~50% gain

Lol Frank I think you need to stop giving RE investment advice, from your post history it is clear that you do not have a clear grasp on the market.

A father’s advice to his son: ” A lucky man, who marries for love, will soon realize that his wife is his best friend.”

Monthly shelter costs should be less than 30% of income. If one can afford homeownership under that guideline, it would be ideal to arrange for a mortgage. If one has to exceed that limit, then it may be time to admit that homeownership is currently unaffordable for oneself: despite what the money lenders may suggest. Proceed with care and do not buy that which is unaffordable. There is always a possibility that one’s future financial circumstances will allow for buying an affordable home.

Gosig: In order to acquire a house without debt I would strongly recommend that one picks ones parents carefully. Failing that marrying money is a proven alternate method.

signpost

i see you are very adverse to debt. what are your recommendations for home ownership without acquiring debt?

or are you recommending (on a blog devoted to home ownership) to not buying a home?

“While real estate is the most important asset held by a majority of Canadian households, the debt incurred to buy that asset is also their biggest liability,” the report said.

“While the value of assets can fluctuate, debt tends to stick around. Inflation does help reduce the relative importance of debt, but because it leads to higher interest rates, there will be more pain ahead.”

https://www.bnnbloomberg.ca/outlook-for-canadian-household-wealth-is-bleak-desjardins-1.1788380

Someone with cash will probably buy 928 Bay St. The property taxes are $10,000, insurance estimate around $10,000, utilities?, Should be generating $12,000 per month (I can’t access that number) leaves around a 4-5% return if no major repairs are needed. I think a true investor sees the potential future increases could be substantial. With zero vacancy rate, the only risk is the condition and life expectancy of the building, it’s 110 years old. $255,000 per unit is a cheap price in that market.

Smoke on the water, dum dum dum, dum dum da dum…..

Home sales and prices in Toronto and Vancouver plunge from last year’s highs

Note that the REBGV does not cover the Fraser Valley, which has seen the largest price declines in the Lower Mainland to date.

Here’s a funny article. Tells a story that anyone reading HHV knows is false. Of course, it’s based on the HPI which we know is badly delayed in reacting to market changes.

https://www.cheknews.ca/victoria-real-estate-sales-drop-as-prices-continue-to-climb-1057057/

So, starts with a 4% wage cut this year, and continue through the next 2. No thanks. + the 25 cent per hour raise which is just going to split the components. They might get liquor store employees to ratify it, but why would technology workers? So some components end up holding out for a better deal. Why even present that to your membership?

Last year’s prices?

I am trying to visual what a 25% drop on house prices would look like in this market. Could be rather interesting.

928 Bay Street – well, their sales brochure gives you all the basic rental income info. More to the point, the brochure guesstimates suites are rented 20-35% below market, and then trumpets that as some kind of ‘yield upside’ on turnover, all while also trumpeting that the building is ‘consistently 100% occupied’ – yeah, no kidding, why would those people move, I’ll bet that turnover will be slow in dribs & drabs over years.

The owners have done themselves a disservice in my view letting the rates slide that far under market. A bit under market is what we used to do on rentals, enough to get a decent tenant who wants to stay, cut him a bit of a break and maybe he cuts you one, but not so much that you’re seriously subsidizing them, which BTW nobody ever thanks you for, and then it impairs the sale price. But as per usual, hey it’s big bad landlord cashing in, hey he got a windfall.

Yes, that’s a rant. I feel ok saying it only because I see lots of rants going completely the other way.

The offer is actually more complicated than this; read this thread if interested:

https://twitter.com/RobShaw_BC/status/1544451078069964800

https://www.theglobeandmail.com/business/article-subprime-lender-fisgard-suspends-residential-construction-loans-in/

Lol rough day on the colwood crawl?

928 Bay St.- if one is a serious investor, an apartment block of this size is ideal. Depending on the age and structural integrity of the building, meaning it doesn’t require a ton of cash to continue operating, this could provide someone and their family and long term cash flow. Let’s say it’s 11 suites (plus one for a supervisor), you are paying $255,000 per unit. Not sure what the current rents are, it could be full of long term tenants paying modest rents, which could be a disincentive. I would expect 25-30% down, would have been a better buy a few months ago when rates were lower. Again, more information is needed, but this is the type of opportunity that could provide generational wealth, especially if it appreciates 3% a year. If you can afford it, buy it.

Maybe a metaphor you’d like for this could be the SFHs being people with above average intelligence from Vancouver/Toronto and the condos being the slow talking knuckle-draggers you seem to think Victorians are. You should check with some of your industry contacts lol.

https://twitter.com/DavidMacCdn/status/1544303676734537730

I am not anticipating any major price adjustments until the fall (if then). I am just not sure about the buyers out there at the moment but it seems a bit slow.

I like 928 Bay Street. Not knowing anything about commercial RE, how much would one need as a downpayment for a property like that? How is a fair price determined, is it a multiple of the annual rents or something?

Rent might be less in those places, just as real estate prices are lower. Either way, no restrictions on leaving.

Hey don’t knock Winnipeg, it’s a great city actually.

You missed the part where you’re moving in with Frank. Also, people would probably have said the same thing about moving to Langford or Esquimalt on this board just a decade ago, or Fernwood in the decade before that, or James Bay in the decade before that.

Not oil prices, or bitcoin, or housing prices, or even bond yields now. In a year someone’s going to post a twitter screencap saying that there exists an absolute legend out there that bought a GIC at 4% in June 2022.

Insurance along with everything else is really going up

Are insurance companies to be trusted, when it comes time to make a claim for earthquake damage? Question, question and question.

https://www.stuff.co.nz/business/122658007/more-than-2000-insurance-claims-still-open-10-years-after-canterbury-quake

If someone is renting a below market rent-controlled unit , they would be subject to market rent at their new place, which is likely higher than their rent-controlled rent. If they’re expecting to pay the same rent, they’d be restricted on choice based on that.

Totoro has been right all along. What’s hopefully new is that you now understand what Totoro is saying.

Thank you, I will rephrase: if you own in Victoria, and have a chunk of equity built up, you aren’t restricted in where you can buy (parts of Vancouver notwithstanding).

Moving to Winnipeg, wow, that’s an amazing life hack!

I don’t know if you guys are trolling me or what.

Selling and moving someplace cheaper has always been an option, nothing new there.

It comes at a price, though. It’s not like the “money in the bank” that Totoro is claiming.

Anyone seeing jumps in insurance? Earthquake amount is getting insane.

Still think they have a hard time not doing it when the Fed just did 75 and inflation rate is still going up. September is a different story.

I don’t own in Victoria and have even less restrictions since I could move tomorrow without having to sell anything.

These choices used to be on the table for anyone with a decent job. You’ve written the epitaph for BC unwittingly.

The way I see it is that if you own in Victoria, and have a chunk of equity built up, you aren’t restricted in where you can move (parts of Vancouver notwithstanding). The Cowichan Valley, Nanaimo, the Comox Valley, Squamish, Kelowna, etc., are all on the table. You have choices — good choices!