Dark sales revisited

Whenever you see any real estate stats on this site, they are from the sales that happened on the Multiple Listing Service (MLS) system. That captures the majority of residential property that changes hands, but not all. Most new construction developments only list a fraction of their units on MLS, and of course private sales and inheritances won’t show up there either for the most part.

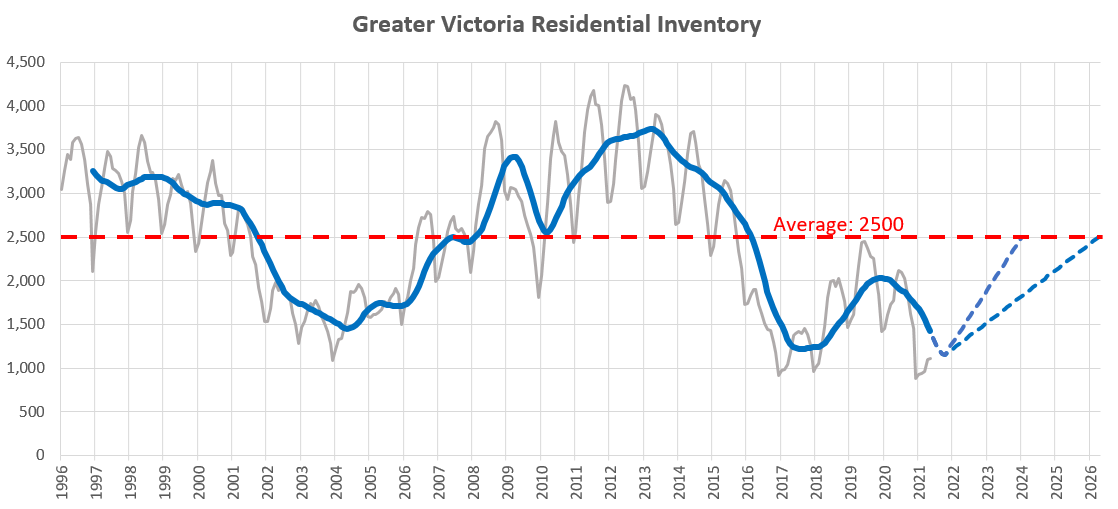

So how much of the market are we missing when we only look at MLS sales? Are the stats reported here an accurate reflection of market activity and prices or do we have a huge blindspot by only looking at publicly listed properties? Five years ago I looked at this topic, finding that about 8 out of 10 residential sales were captured on MLS. That article was published with only limited data available on land transfers, but now we have several years of the same to see if anything has changed. Specifically the boom in construction may have moved more sales off MLS.

When comparing MLS sales to land transfers, I use the BC Open Data property taxation records available here. This is the same source as used for tracking foreign buying (which remains very low). Charting the numbers of MLS sales as a percentage of all property transfers shows us that the ratio has remained very stable over the past five years.

Because MLS stats are by pending date while the land transfer happens a couple months later, I use 12 month rolling periods to compare the percentages. That means that during big shifts in the market this ratio will move somewhat (as you can see when the pandemic hit), but generally we can see that the rule of thumb of 8 out of 10 sales being captured in MLS holds true.

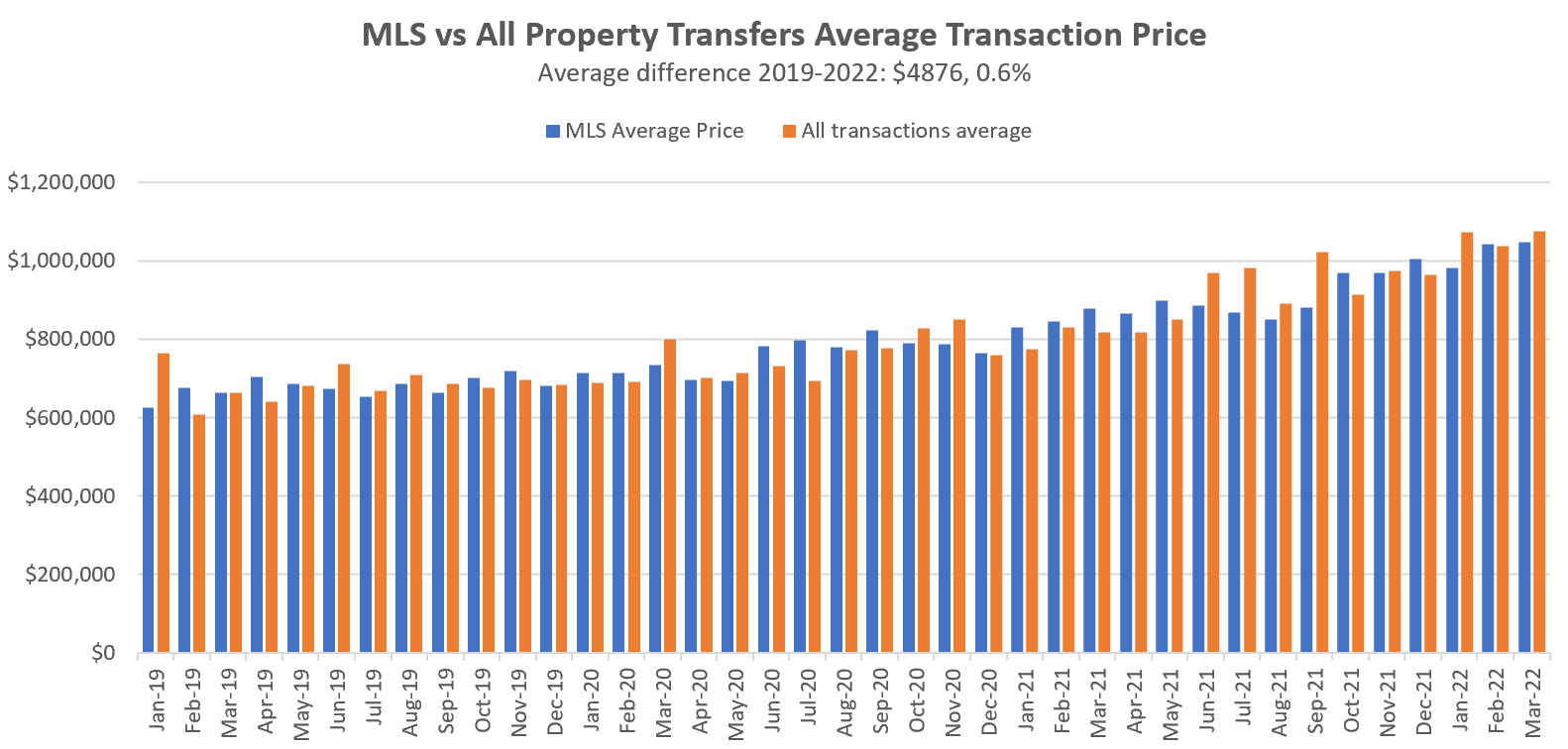

What about prices? Are off-MLS sales substantially different than our on-MLS stats? Though we don’t have seperate data on average prices for sales that aren’t listed on MLS, the BC government does publish the average for all residential transactions, which are compared to the MLS data below.

Though individual months occasionally show differences in the average, over the long run the differences are very small, with an average price difference of only 0.6% over the charted period.

That may not be the most exciting finding, but it does mean we can continue to be confident that despite not being a complete picture of all sales in the market, our MLS stats represent a good and stable picture of market activity and prices.

Also sales courtesy of the VREB.

| April 2022 |

Apr

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 247 | 468 | 637 | 1116 | |

| New Listings | 439 | 732 | 1064 | 1516 | |

| Active Listings | 1175 | 1197 | 1305 | 1454 | |

| Sales to New Listings | 56% | 64% | 60% | 74% | |

| Sales YoY Change | -12% | -22% | -23% | ||

| Months of Inventory | 1.3 | ||||

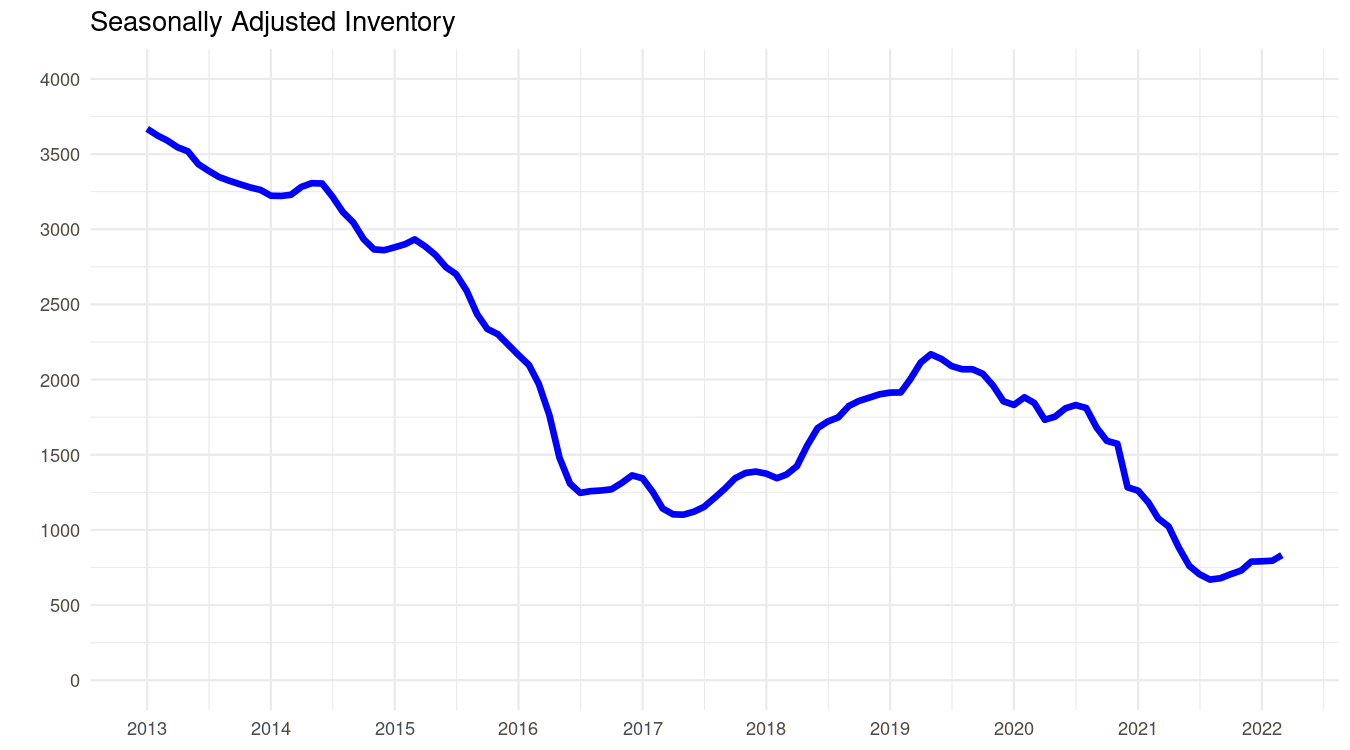

The market continued to slowly cool off last week, adding 100 new listings and closing the gap in inventory from a year ago which is now down to only 10%. With less than a week left in the month we’ll still end down slightly, but this will be the last month of low inventory records for the forseeable future.

Sales are still clearly linked to new listings, indicating that despite the cooling there are still enough buyers out there to snap up the properties that are priced somewhat reasonably. I’m going to be repeating this a lot in the next few months: a cooling market doesn’t mean a cold market. We are cooling off from extreme temperatures, and it’s likely going to take quite some time to move through a normal sellers market to balanced and so on if we keep going.

Last week quite a few attempts at bidding wars fell through, with “only” 41% of properties going over ask. That brought the 14 day average down to under 50% which we haven’t haven’t seen since last fall.

Of course anything over about 10% is still extremely elevated and indicates a hot market, so don’t get too many ideas about being able to throw lowball offers around quite yet. I expect that sellers will continue to shift away from engineered bidding wars as the market cools off and they become less and less reliable. The window for sellers to attract irrational bids is closing quickly, if it hasn’t already closed.

We’re still 5 weeks out from the next variable rate hike, but fixed rates used to buy will keep moving upwards until that point, gradually removing demand out of the market. So far the activity declines in other markets like Vancouver look a lot more dramatic than what we’re seeing here, but I suspect just like the murmurs of a slowdown were in Toronto and Vancouver before they were here, that’s more a lag effect than anything else.

April post: https://househuntvictoria.ca/2022/05/02/april-cooldown-takes-hold-but-were-far-from-a-buyers-market/

Perhaps what you’ve failed to take into consideration is that it’s a lot easier to let people immigrate to Canada than to persuade Canadian women to have more children. Below replacement birthrates are an issue right across developed countries. Various programs have been tried in various countries to increase the birthrate, all expensive, with limited success. $10 a day child care seems to have had some impact in Quebec, we will see how much across Canada.

There are different types of coops. Limited equity coops have low share purchase prices ie. $100-$2000 and higher monthly fees unless they are rent geared to income/subsidized. The share doesn’t appreciate. Market rate coops are 1/3-1/2 of market value (several hundred thousand dollars) which you cannot get a typical mortgage for. Market rate coop shares appreciate, just way more slowly than fee simple, partly due to lack of financing options.

Patrick, how would your proposal work for those that end up giving the 5 year notice? Would they then have to pay the extra $2k per year for 4 years until they could finally evict the tenant?

Right. I’m not picking on you Frank. Things were different back then. Nowadays, renovictions are used as tools to evict some tenants.

There is a problem with growing our population via immigration versus increasing child birth rate. Infants generally do not require a new roof over their head, they stay with their parents for 20+years. This grows the population more naturally, while new immigrants require their own place the day they come to Canada. This creates instant competition for property instead of a more gradual demand. I guess our government has failed to take that into consideration.

Personally I have no real problems with investors. There will always be certain types of rentals that will never exist as purpose built, like a rural property, or ground oriented housing in a specific neighbourhood. Too many investors is a symptom of the housing shortage, but the way to resolve it is to address the shortgage, not get mad at the symptom

What we should work towards is that there is always an option for a purpose built or non-market alternative with secure tenure. If tenants have the option of a secure tenure then they are free to choose to rent from an individual investor if the property is a better fit. Right now most tenants don’t get that choice. They are forced to rent from individual investors and accept the associated higher risk of eviction.

My renoviction was given plenty of time to ease into her new situation, I never pressured the tenant. After the renovations, which were desperately needed, the rent jumped 33%- from $600 to $800 a month. Things were different then.

Right. Under my landlord-spec-tax idea, these are the only two clauses that would change to 5-year-notice, unless landlord-spec tax was paid. These are the two conditions that tenants worry about (“owner moves in”, “Reno-viction”), making them consider their rentals to be insecure, with the only solution being stretching their finances to purchase a home.

Under my idea, you could still get the tenant out at anytime – but they’d need to agree to it. Not every story of eviction is a happy one, so we can’t generalize your “eviction was the best thing that happened to my tenant”.

I did renovict one tenant that came with a property I purchased in Langford. It was the best thing that happened to her. She bought a townhouse for around $180,000 and now has a net worth of at least $500,000. That was 18 years ago, things were different then.

Landlords must give proper notice to tenants if they plan to end a tenancy – there are different notice forms required for different situations:

https://www2.gov.bc.ca/gov/content/housing-tenancy/residential-tenancies/ending-a-tenancy/landlord-notice

Here’s the answer from the BC government:

Interestingly, April stats from VREB show continued price appreciation in the Victoria Core.. Quite interesting. $1,266,200 benchmark for the core single family. which is up from $1,233,700 in March. Anyone on the edge might feel a bit less like selling now.

Landlords can do that now, and it’s fine as long as it doesn’t violate any laws and both parties agree to it. That would be no different if the landlords right to evict tenants was altered with the landlord-spec tax type idea.

To be clear, my idea doesn’t affect the tenant at all, and doesn’t affect the length of tenancy agreed to between landlord and tenant. It just prevent ]so the landlord from evicting or reno-victing the tenant for five years, unless that landlord has paid my proposed “landlord-spec” tax.

As it stands, a BC landlord cannot evict a tenant ever, unless they (owner or immediate family) want to move in, or renovate. So that’s the way it is, and you’re happy with that.

All this adds idea adds is extending the time period for eviction from two months to 5 years. You can sell your property anytime you like, but the new buyer takes over as landlord and is bound to complete the 5 years notice.

If you don’t like that as a landlord, then simply don’t accept it, and pay $2,000 extra property tax per year. Your taxes will go towards building purpose built rentals. “Spec” taxes apply to various groups, vacant homes/vacation homes/ foreign satellite families. They all seem “unfair” to the speculator involved. This would just add a new type of “speculator” – the minority of landlords that buy, rents and evicts a tenant to sell for a quick buck profit. But it doesn’t apply to the majority of landlords, that aren’t planning to sell or move in and evict their tenant -and are willing to commit to that by providing 5 years notice of eviction.

It’s called a landlord-spec tax in recognition of the speculative behavior of the investment. Somebody buying a home, renting it out long term isn’t a speculator. But someone buying it, renting it, flipping it for a sale and evicting the tenant is a speculator. As is the landlord who really bought the home for himself, but speculated that he could make money buying it a few years early, and when he’s ready he would evict his tenant and move in.

From the sounds of it frank, you are the long term landlord that isn’t a speculator.

What if landlords demanded 5 year leases with rent increases built in. I don’t think many tenants would want to commit to such a long term, especially if they are on the hook for the full term if they want to terminate the agreement. What you’re suggesting is similar to a commercial lease, which is a formal business agreement with legal consequences if you default. I’ve signed a couple lease agreements in my day and they are scary. You’re obligated to pay the entire lease and can’t get out of it by giving notice. House rentals are more lenient, the tenant can give a couple months notice and move on, leaving the landlord without any income. In this market it isn’t a concern, but in a market with a high vacancy rate, the landlord is left hanging. It’s a two way street, current conditions favor landlords, but that’s not always the case. If people want the “luxury “ of a long term lease, they better be prepared to accept the responsibility.

Great point! But that could be easily solved. Instead of a grant, all landlords are charged average $2,000 extra on property tax. Except the ones that sign up for the 5-year-“no eviction”-secure-rental-guarantee. Then it is politically sellable. Because no landlord is being subsidized, and the insecure-rental amateur landlords are being charged more. btw) this 5-year-guarantee is renewed each year, so at all times the tenant knows they are secure for at least 5 more years.

Then it’s politically sellable as a three point plan to make rentals more secure

1. increasing taxes on landlords that don’t provide 5-year-no-eviction guarantee. Call it a “spec” tax on short term landlords.

2. Creating secure rentals with guarantee of 5 years no eviction ,and identifying landlords that offer this

3. And the best part, the added revenue from the insecure rentals landlords tax ($2,000) goes towards the long term solution – building more purpose built rentals.

Landlords like Totoro won’t be happy paying $2,000 extra per year if they are unwilling to guarantee no eviction for 5 years. But the money raised is going to help the housing crisis – building purpose built housing – a longer term solution.

Well sure, construction is the long term solution. That’s many years away [I’ve seen estimates in decades!] , whereas my idea is immediate and generates taxes to build purpose built housing . This would help in the first year, as landlords sign up for it, and their rentals are identified and become more secure. And this idea is in addition to constructing purpose built housing, not instead of it.

Put it this way. Let’s say you’re looking for a long term rental house for your family. Assuming a purpose built rental isn’t available… Wouldn’t you like to be able to find one where the landlord offers the secure rental guarantee, and you would get 5 years notice of getting evicted? Or would you be just as happy taking a rental from a landlord like Totoro that refuses to offer that guarantee (and pays $2,000 extra tax per year instead)

Sounds like a solveable problem.

Politically infeasible I would suspect. Or would you like to be the one to design the campaign around subsidizing real estate investors given the current climate on housing?

Well there you’ve stated the reason that many would consider you, as a landlord to be providing an insecure rental. Some people think those types of rentals do more harm than good, since they often end in evictions. And the tenants in the insecure rentals feel ongoing pressure to buy a home, as the only way to get secure housing. (see Garden Suitors post below about that)

Regardless, you are not affected under my plan – just continue as usual, and evict your tenants with as little as two months notice if/when the time comes. But at least with my plan, your prospective tenants will be able to choose before they sign up, between you (who isn’t willing to guarantee that they won’t evict the tenant within 5 years) and a different landlord that is providing the 5- year secure rental (since this information is available publicly, and would likely be advertised by the landlords that are providing them.

This wouldn’t affect long-term affordable purpose built rentals at all. As you know, constructing them would take many years and would likely occur only in certain areas, and typically as apartments only . My idea would apply INSTANLY to any of rental stock, all over Victoria, so for example, someone could advertise a Gordon Head SFH house as a 5-year-secure rental, and families would be happy to find that. You’re not going to see a Gordon Head SFH get constructed as a purpose built rental or co-op housing, yet families need secure rentals exactly like that.

This seems impractical.

For one, rather than put the 10k towards a market rate landlord, it is going to be effective to put into long-term affordable purpose built rentals. Instead of a temporary higher rate solution, you get permanent affordable housing for those who need it most. A lot of tenants don’t stay put for five years – most we’ve had is three. People who will be long-term tenants are often not able to afford market rents to start with.

The next issue is the fact that a private landlord who has, say one rental unit, probably wants to retain the ability to meet their own circumstances so the uptake is going to be limited. I wouldn’t take the 2k/year discount because I can’t predict the future. If someone in the family had ill health, for example, I’d like to be able to retain the flexibility of selling if need be. It would devalue a property more than 10k to be tied in to a five-year term imo. In other words, this program would be likely to have low uptake.

Agreed.

I believe Insecure rentals to be a solvable problem. Most rentals are actually secure but the tenant doesn’t know if their rental is one of the secure ones or not. To solve this, I think there could be government incentives to make existing rentals more secure. This could be done instantly, with existing rental stock, and would be optional for landlords and tenants .

The government could give a “5 year secure rental” grant (e.g. $2,000 per year reduction in property tax) that would lower property taxes for a landlord who has declared their rental to be a “5 year secure rental”. Declaring this would be signing an annual declaration (available publicly) that would, for a period of five years after signing, prevent the landlord from evicting the tenant for landlord use of the property (this would apply to the new owner if the property was sold. It woudl also apply to renovictions. The benefits to the landlord who opts for this would be twofold 1. the grant money would help and 2. landlord would attract more long term stable tenants, and could likely charge a little more as well. The landlord would renew each year, and if he opted out, the clock would start ticking and in 5 years he could evict the tenant as usual for a sale (to a buyer who could evict the tenant) or landlord use of the property. The lease would the usual month to month or 1-year. And the tenant could leave any time (subject to the lease), as they can now. So this secure guarantee doesn’t hurt the tenant.

Many landlords would be horrified by this idea. They are likely the minority of landlords that are providing unsecure rentals where they might evict the tenant for a quick sale or to move a family member in to the home. No problem. These landlords are unaffected – they don’t have to sign up for this program, and can continue to rent and pay taxes as they do now.

But the ones that should benefit are the large majority of landlords that do in fact provide secure rentals, and providing a 5 year guarantee of rental to a tenant wouldn’t be a hardship. Of course the landlord would have all existing remedies like evicting for non-payment of rent or violating the lease. It is only the evictions for landlord use that they would lose for 5 years.

A tenant who found one of these “5 year secure rental” properties would know that they have it secure for at least 5 years. Just pay the rent, follow the rules and you have your secure rental, And they would get 5 years notice if the landlord wanted to move in to evict them or sell it to someone who would evict them.

Of course the added benefit to the “housing crisis” would be that many people would be content with a 5-year-secure rental, and not think that homeownership is the only way to achieve a secure rental. People could find a nice secure rental and be content with that.

Good points, except I disagree that someone should have to make some kind of down payment to get into a co-op. They have no equity interest in their dwelling so I don’t think it’s fair that they should have to buy their way in. I once lived in a co-op in Calgary, nice place close to downtown.

I sure do agree with everything you say Patrick. Governments must get more creative in order to provide affordable housing for those working people who will likely never be able to purchase their own home. And of course we need more controlled institutions for the mentally ill and those with addictions not silly buying up hotels/motels that make it down right scary for many that are given no choice but to live in one of them or to stay on the streets.

We need more co-op apartment buildings and townhomes. Low income retired seniors and lower income working singles and couples without children could live in the one & two bedroom apartment units and couples with children would get the 3 bedroom, 1-1/2 bath townhomes. The couples living in the apartments who eventually have children could transition into a townhome from their apartments. They would get first dibs over new hopefuls.

In order to get into any of these co-ops, everyone would be required to provide a pro-rated cash amount down according to

family income paid out from their proved savings. This would have to be a substantial amount. These places are going to be their home and thus, for their own self respect, they should feel they have sacrificed a tad, just as everyone else has in order to purchase a home. Monthly “rents” or “association fees” would be adjusted yearly again according to income.

I hope I don’t appear like a control freak here.

People are in favour of affordable secure housing. Ownership and purpose built rentals seem to be the two best paths for that. Non-institutionally owned rentals are insecure.

I am getting the impression that inventory is starting to increase over the last few weeks. For the people who follow the stats, what do you see as going on?

Well that’s one way to spin it. Or you could say they have finally surpassed the previous price peak in 2017. More money yes, but it’s nickels and dimes compared to West Coast prices.

People here profess to be in favour of affordable housing. The most affordable housing for low income people are rentals. Yet many of these same affordable housing advocates want less investor (landlord) participation, in favour of higher homeownership. This higher homeownership isn’t affordable housing, it’s just more gentrification (from ROC) that forces lower income people out of the city.

I hope the Victoria homeownership rate falls a bit in the 2021 census. As this would be a sign that there is more affordable housing (rentals) in Victoria than previous. If affordable rentals are available, there isn’t much of a case to be made for a “housing crisis”.

Because it isn’t a “housing crisis” if someone is renting instead of owning. However, it is a crisis if workers here can’t afford to rent, and move away

On BNN- Calgary house prices hit an all time high in April. So much for getting any deals in Alberta. Also means Albertans wanting to move west have more money to spend.

Not only that, it’s a Canada-wide figure which is well out of line with the 2016 census figure for Victoria CMA, 62.6%.

Reputable developers don’t “promise” a 200k discount on completion.

Isn’t that homeownership rate you point to always from 2018 so wouldn’t actually include any recent uptick in investor buying?

From: https://www.cbc.ca/news/canada/toronto/gta-homebuyers-set-to-lose-millions-unprotected-deposits-1.6435599

I’ve had at least 100+ people email me from/around Vernon asking for the owner-builder exam. The government talks about affordability, but there is so much non-sense behind the scenes that is actually making housing unaffordable.

Here is what the latest person emailed me back looking to build a 1,100 sq/ft home in Vernon. Over 5,000 study guides sent out in total now and not one person (literally) has replied with that they took anything away from it that will help after writing the exam.

She moved to B.C.’s interior to find affordable housing. Now, she’s living in a motel

https://www.cbc.ca/news/canada/british-columbia/vernon-motel-affordable-housing-1.6435110

April sales: 824 (down 26% from last year)

New lists: 1368 (down 4%)

Inventory: 1365 (down 6%)

New post tonight.

Is this May a good time to sell an investment property with the idea that you’ll hold cash while looking for a replacement PR? Who knows. It feels like it might be, but last spring felt pretty similar and then the market took off again like a rocket in the fall. Things are different now, but things are always different.

I just don’t really see the big potential upside in trying to rush the sale. The window to attract an irrational bid is closed, so really the only way this turns into a big win is if the market crashes in the meantime. Seems like a pretty low chance of that happening.<

This really is affirming. I just haven't been able to justify pulling the trigger. The ultimate uncertainty says don't sell now. The guestimate of a decline says a moderate one at best. So it just doesn't seem worth the risk to go cash for 6 months. If the market balances, it should be possible to buy subject to sale and go even all else being equal. Strong leanings.

Thank you all who responded.

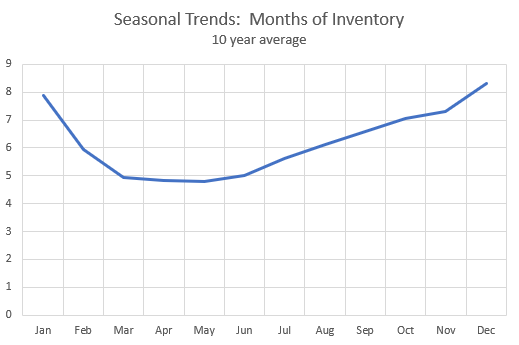

Totally agree and I really don’t think there’s that much to know. There is some seasonality to prices, but that might be more to do with the seasonality in months of inventory which generally is lowest in April/May.

So in that sense May is a good time to sell.

Is this May a good time to sell an investment property with the idea that you’ll hold cash while looking for a replacement PR? Who knows. It feels like it might be, but last spring felt pretty similar and then the market took off again like a rocket in the fall. Things are different now, but things are always different.

I just don’t really see the big potential upside in trying to rush the sale. The window to attract an irrational bid is closed, so really the only way this turns into a big win is if the market crashes in the meantime. Seems like a pretty low chance of that happening.

Marko:

Probably because I was giving you the benefit of the doubt.

In the English language “or” means alternatively.

More succinctly, he wants advice on whether May 2022 is a good time to sell an investment property in Victoria. He acknowledges that markets are “unpredictable” but selling at this time would put cash in his hand.

He states that there aren’t any primary homes available yet and he could be sitting on that cash for 6+ months because of lack of supply.

Then alternatively, would it be better to hold on to the rental if/when the market balances out.

Perhaps, a simpler translation: “I want to sell my rental. Is May a good month to sell in Victoria? I’m looking to buy a primary home but nothing is available right now. OR if you, the professional, think that I should hold on to my rental until the market changes then I’ll consider it.

Market2022

In my case, looking to sell rental to buy new primary residence. There aren’t any primary residences to buy yet due to lack of supply. So could be sitting on cash for 6+months.

Or better to hold on to rental, and sell and buy if/when the market balances out?”

Nope. People that are used to working hard will keep working hard. They’ll grind away and find a way to own a home that maybe isn’t perfect for them right now, but is perfect for now, and eventually they’ll be outbidding all those “smart” people that think they can time the market

This will be a signal to governments and big companies to try to hold back on big multi-year wage increases. That’s part of the expectations genie he’s talking about.

Not sure how you got that from his post, very clear he is looking for market timing advice.

As for May being a good month Leo is 10x more knowledgable on seasonality metrics but my gut feel is seasonality is 5% of the equation, if that, and the state of the market is 95%. For example, much easier to sell in December/January in a hot market versus May/June in a cold market.

Not on here or elsewhere to solicit business, simply interested in real estate so I post. I have more business coming in than I can manage so I decent perctange I have to decline or refer out. I know you’ve never seen me on buses or billboards, but I do okay.

Well we have been hearing increasingly blunt messages from the people who actually have the power to move the bond markets, i.e. the central bankers, that higher interest rates are coming and quickly. Latest is David Dodge, who is retired, but not just speaking for himself IMHO:

Of course it’s not a certainty that the RE market will follow the bond markets down, mirroring the way RE market followed the bond markets up over the last 40 years. We will see.

https://www.theglobeandmail.com/business/commentary/article-rapid-rate-hikes-critical-to-break-rising-inflation-expectations-says/

I could accurately predict the market if only my wife would give me back my crystal ball and stop using it as a paper weight.

Just had a long conversation with an old friend who moved to Kelowna from Winnipeg in Feb. 2020 just before covid. They sold their house in Winnipeg for $700,000 and immediately bought a nice place in West Kelowna for 1.4 mil. He didn’t wait for prices to come down. It’s now worth over 2 million. Empty lots are being sold in a new development for 1 million. 30 storey condos going up one after another to accommodate the people from Vancouver, Alberta and Ontario. Doesn’t seem to be a downturn there, even with the fire situation in the area last year. I guess people have short memories.

Okay, Marko, I guess we’re both looking at different aspects of the post.

I’m presuming that he wants to know whether May is a good month to sell. Sounds like an easy peasy answer.

You’re looking at the “what if” scenario.

I figured that a simple DM would have clarified his needs. C’est la vie.

“

Marco “Look at all the die hard Garth Turner followers and how well they have done over the last 20 years.” I did really well listening to Garth Turner and doing the exact opposite of what he was preaching. Saw him do a talk in Calgary and bought his book then realized he was peddling FUD to sell books. It made me cautious but not fearful kept all debt at zero other than mortgage. bought flipped built and sold my way to being mortgage free in 8 years. The whole time he was preaching the end was months away while paying rent to someone and loving it.

Agreed. I am in the camp that the market cannot be predicted. What is quantifiable is whether or not you have the means to buy at any given time and the motivation to do so.

If I wanted to sell a rental so I could buy a family home I’d be listing now though. The FOMO is dying down but there is still strong demand. At the same time, I’d also be trying to find the home I’m looking for rather than holding the cash and waiting for a downturn. Maybe it happens, maybe it doesn’t. If it does maybe interest rates are higher and you are paying the same each month.

Yes, that’s to be expected. It’s a lot easier for a Mexican to legally immigrate to USA than Canada. In Canada, they need English or French (level 7), have completed high school, one year experience and score 67 on the FSW (skilled worker). And even then it’s only the highest scores that make it in. If you’re a housekeeper speaking Spanish, you’re not going to pass that.

Most Mexican legal immigrants to USA qualify through family sponsorship from an immediate relative in the USA. There are 100X more Mexican born Americans (11 million) than Mexican born Canadians (100K). So not many Mexicans would qualify for family sponsorship to Canada, compared to the USA.

Of course the study I quoted (from remitly) was listing countries that they want to move to, not the easiest ones to move to.

I see, so you suggest I tell him the market is about to crash 50% to sell his investment property while he can so I can grab my commission and run?

He is looking for an answer to a question that I personally don’t think can be answered, or the answer is a coin flip.

I would say one of the biggest reasons in that I’ve been successful financially in life is at a young age I quickly came to the conclusion that no one can predict markets with certainty. For example, when I was in my dorm room at college, I would run BNN in the background and they would have these segments called “Top Picks” where experts would pick three stocks and guess what, after a few months 50% of their picks were up and 50% of their picks were down. The reason this was an important lesson is when I started building my portfolio in 2008, I already knew mutual funds/MERs/etc., were 100% BS. Over 14 years I’ve saved 30% of my portfolio from MERS, but I’ve also been lucky enough to outperform the market. When you compound these savings you can 100% control (cutting out MERS, for example) it makes an insane difference over a lifetime.

Same with the real estate market. CMHC came out with a report in 2020 that the market would drop 9 to 18%. I made a video about it…..you’ll note in the second half of the video I repeat multiple times that no one can predict the market, including CMHC -> https://www.youtube.com/watch?v=h2FMa2OfK6w&t

This is the caption to the video “Personally, I don’t think we will see upwards of an 18% drop in Victoria but no one really knows what the future holds.” and guess what happened, instead of droping 9 to 18% the market exploded.

The problem is if you believe an individual or organization can predict the market you get suckered into bad decisions. Either you think you can predict the market yourself or engage a service or advice from a smooth-talking individual you think can predict the market. Look at all the die hard Garth Turner followers and how well they have done over the last 20 years.

IMO, a large portion of immigrants including myself came to Canada because the application is easier than States, diversity cultures than Europe, and the most important is less racism than other countries (in general speaking). My family is probably paying anywhere between double to triple tax than the average family, so I’d prefer the States health care than the “free” health care quoted by Frank.

If you say so. Over the last decade, over 100,000 Mexicans a year have immigrated legally to the US. Mexico isn’t even in the top 10 source countries for Canada .

Must be Canada’s much stricter immigration laws. 🙂

For those interested, here is the source for the study about popular countries for moving abroad. Canada was easily # 1 destination out of 101 countries, by a lot, with 30 of the 101 countries choosing it as # 1 destination. Including big population countries like India, Pakistan, France, UK, Nigeria. The USA was only chosen by two countries as the # 1 choice (Russia, Norway). The study was based on analysis of Google searches in each country for “ phrases commonly associated with researching a move overseas”

An interesting data point, the # 1 country that people in Mexico want to move to is … Canada!

https://www.remitly.com/gb/en/landing/where-the-world-wants-to-live

Your data point about number of successful immigrants is also irrelevant to the topic under discussion, which is how many immigrants want to come to Canada (not how many have applied or are successful). That said, the USA is always at or near the top destination country for immigrants.

patriotz- Most service sector jobs in the U.S. actually pay very low wages (thanks to the unlimited supply of illegal immigrants). They also only hire part time to avoid providing benefits such as health insurance. I think you’re dead wrong about the better paying jobs new immigrants are flocking to in the U.S. The NFL does pay a helluva lot more than the CFL, maybe that’s what confused you.

Absolutely. They’re also filling a huge gap as pre-Covid hotels are fully booked during tourist season. Plus out in the Westshore with events like Pacific FC, Rugby Canada and other events there is a huge shortage of hotel rooms. I’m considering trying AirBnB, but would give any tenants at least 6 months notice to make sure they’ve found another spot first.

The US gets over twice as many legal immigrants as Canada does. Before anyone says Canada takes more per capita, that’s true, but it’s irrelevant to the question.

There are also countries (including the US but not to a great extent Canada) that get a lot of illegal immigration.

People move to richer countries because the jobs pay better. That’s always been the reason.

Debt Monster: That isn’t relevant unless you have the data from sales of multi-property owners, because they might exceed purchases. A condo flipper might buy and sell 10 condos, you’re only counting his buys and not counting his sells. That’s why the homeownership rate is the data point you should follow.

Regarding immigration- The high cost of housing is hard to avoid in any desirable country, our “free” health care and social safety nets are what people are coming here for.

Does anyone know how many multiple home owners are on Airbnb, providing a short term rental, while taking a property off the market from a permanent resident, either owner or long term renter. They also have the flexibility of selling at any time without compensating tenants or having to give notice. Airbnb started in 2008, and since then prices have done nothing but go up. Leo’s previous article addressing this issue indicated that Airbnb activity dropped dramatically during the pandemic but rebounded when restrictions eased. Lots of flexibility in that business model, short term, long term, buy or sell at any time, that makes it very appealing. What investor wouldn’t go this route. What does a 3 br go for in Victoria? $300.$400 a night? Saw a cottage in Manitoba advertised for $1950 a week in the summer and it’s booked already. I wouldn’t want the hassle but the prospect is enticing. $10,000 a month revenue justifies these high prices. With restrictions finally allowing people to travel more, Victoria will be getting more tourists. We may be underestimating the impact Airbnbs have had on housing supply everywhere.

Nice try umm..really. But the source of the survey wasn’t immigration.ca. As clearly stated in the article, the study was done by “ Remitly, a company that lets users transfer money online from desktops, tablets or mobile phones, unveiled its ‘Where the World Wants to Work’ survey last month. ”

That might be a questionable source because of what it sells (immigration businesses). It would be like referencing the Fraser Institute, Centre for policy alternatives, Broadbent centre and CD Howe institute for unbiased data that affect government policies. Or sourcing Greenpeace, Sierra Club, The Narwal or CAPP for that unbiased environmental research…lol…

Patrick

I wouldn’t characterize them as evil, but if I was a first time home buyer I might have a different opinion.

http://www.canadianmortgagetrends.com/2021/11/influx-of-housing-investors-driving-up-prices-and-adding-to-market-risk-boc/

“A sudden influx of investors in the housing market likely contributed to the rapid price increases we saw earlier this year,” said Deputy Governor Paul Beaudry in a speech this week. “In such a case, expectations of future price increases can become self-fulfilling, at least for a while.”

This, in turn, creates added risk within the market, Beaudry added.

“That can expose the market to a higher chance of a correction. And, if one occurs, the damage can spread far beyond the investors,” he said. “That’s because, for many households, their wealth and access to low–cost credit are tied to the value of their home.”

Well, that wouldn’t be good for any homeowner.

Uh huh

Here’s a question based on some press articles I have seen lately: will high cost of living and housing cost deter potential immigrants from coming to Canada? This could be significant because Canada is rather dependant on immigration for growth and productivity. It’s nice we have these new immigration targets, but what if the immigrants don’t see Canada as a successful option or if recent immigrants decide to leave because of the high costs?

Market2022

Marko

The Greedy, Manipulative Realtor

Doesn’t really sound like he was looking for your analysis of the market over the next 5 yrs. Perhaps, DM the individual and see what his needs are? I think you’ll find that a lot of other “investors” may be asking you a similar question.

This is correct, but the conversation wasn’t about prices, it was about if too many homes are owned by investors/multiple homeowners. Here’s the start of the topic https://househuntvictoria.ca/2022/04/25/dark-sales-revisited/#comment-87719

As an aside, investors build over 90% of new housing supply (the other <10% being built by owner) , and end up owning 32% of it. So investors are huge net sellers of real estate. For example, a developer might keep 5 homes as rentals, but has built 100 and sold 95 of them into the market. That makes him a net seller, not a buyer. And his action of selling 95 homes helps to lower prices in the market, as you’ve pointed out above. Yet in articles like Debt Monster found, this investor will just show up as an evil “multiple home owner, with 5 rental homes”

It’s the parties in the market who determine prices, not the parties who aren’t. The % of properties owned by investors is irrelevant to pricing. What’s relevant is who’s buying.

“ investors made up 21 per cent of the market”…

Debt monster,

With homeownership at 68% in Canada, that puts investor ownership at 32% (if you consider all non homeowner homes as “investors”).

So we need to see 32% of homes being purchased (or newly built and owned) by investors to maintain the status quo. This will be a mix of homes that are built by investors and other homes bought by investors.

The point being, you cannot look at one number, like “ investors made up 21 per cent of the market”, and decide that this is too high. You would need to factor in the constructed homes that are owned by investors. You would also need to know what % of homes were sold by investors.

If you want one number, look at the overall homeownership rate, which was last estimated by statcan in 2019 at 68.55% for Canada , which is near a record. We will get the census number for 2021 within a few months, which will provide more accurate and comparable data for Canada and Victoria. If homeownership has fallen signifcantly, that would be good evidence that investors have risen in the market. If homeownership has risen or stayed flat, it is good evidence that investors are not rising so they aren’t an increasing problem.

The housing crisis is present in both owning and renting, so reducing investors will just worsen the rental situation.

This is explained by HHV’s first law of housing dynamics …. “you can’t solve a housing crisis by redistribution”

Patrick:

bc.ctvnews.ca/investors-and-repeat-buyers-make-up-growing-share-of-canadian-real-estate-market-study-1.5741840

…. but …

If it is build pergolas like that, I approve.

The term “case” is also “BC” for cases of wine.

If one sells positive cash flow rental properties ………..what do you do with the money?

Yes, which reveals your true motivation behind your position – envy. Not a rational concern for the housing crisis. Just another opportunity to “tax the rich”, regardless of the reason.

Oxymoron.

So own a condo in Burnaby instead. Honestly, I can’t understand getting worked up over a situation that hardly anyone could afford in the first place. Even owning a single property in metro Vancouver or Kelowna is difficult enough. Could we shed a few tears for those who deserve it?

Now that I read it again, it does say 29 cases of wine, maybe that’s Ontario for boxes of wine.

I don’t know how one would avoid land transfer taxes when buying a property. After realtor fees, closing costs, capital gains, and land transfer taxes on a new property, trading properties costs hundreds of thousands of dollars, to replace what you already had. Great money losing scheme. Might work in the stock market if your timing is good, replacing a good property is difficult and isn’t going to get much easier. The market might be slowing because the current inventory is low quality, and high priced.

°>You might want to DM Leo or Marco.

No point in DMing me…..I personally don’t believe that anyone can accurately predict markets whether it be real estate or stocks.

If I had any clue what either would do especially in the short term I certainly wouldn’t be spending my time on HHV.

I am more of the approach I buy what I think is quality real estate within the market (verus trying to time market) or companies and collect rent/dividends for 25 years and I’ll sell when I am personally ready to sell versus trying to time what I think is peak.

If Barrister doesn’t specify the wine I think we’re all going to assume it’s $10 bottles of Jackson Triggs

Debt Monster,

The vast majority of multiple homeowners are renting out their homes, so those “multiple homeowner” stats you posted are irrelevant to our discussion about vacant homes tax. Since the Canada homeownership rate is near a record (68%), this means the investors only own 32% which would be near an all time low. There have been always been investors, there are about the same numbers or less now as in the past , so I don’t share your concerns about investors.

I guess it depends how much equity is there at the time of the sale. If you cash out on an investment property and have a decent six-figure down payment ready to go for the next investment property wouldn’t you just avoid land transfer taxes?

Also agree with the good tenants comment, they’re far better than an extra couple hundred per month. The $4000 per month rents being offered for a 1700sq/t 3 bed 2 bath SFHs are desperate and pathetic.

Probably drink most of them, black out for a couple weeks and not be able to opt out your vacancy/speculation tax because you used the notice to wipe up the Dom. Sounds right Leo? 🙂

Market2022

You might want to DM Leo or Marco. They are the only Realtor professionals on this blog that provide their actual names and vocation. All that I’m aware of, anyhow, during my brief time here.

Patrick:

Or are they???

storeys.com/multiple-home-ownership-toronto-vancouver-wealth-gap/

Frank:

Patrick:

The biggest challenge with the upcoming “crash” will be the varying effects on mortgage holders. As pointed out by several posters on this blog, most people will be able to ride it out. You may have a $300,000 mortgage on a $400,000 property afterwards but you won’t be losing your homes .. hopefully.

Those over leveraged homeowners will be up the creek without the proverbial paddle. There simply won’t be enough people country wide losing their homes to interest the banks in collaborating with the government again.

creastats.crea.ca/en-CA/

Absolutely amazing what happens to the national home price average when you take Greater Vancouver and the GTA out of the mix …. probably even more when you take the 3rd highest home priced market out. Clearly, there will be some places that will be affected significantly more than the rest of the country. Just not enough to precipitate any kind of Government intervention.

Uh huh.

200 year chart of interest rates. 20% in 1981, can you say “anomaly”? This will probably never occur again, paying that much to let money sit and rot doesn’t make sense. In fact it’s extremely destructive. I doubt we’ll ever see 10% again. Especially when computers are generating billions of dollars every day in 1000’s of different cryptocurrencies. My limited understanding of currency tells me to put it into something tangible as soon as possible.

What do you even do with 29 bottles of Dom?

Good grief. No one is talking about owning two homes in the City of Vancouver. You pay the tax if you own ONE home in the city of Vancouver, and a second home anywhere else in the world, if your second home is your main home (principle residence, using their definition, and their definition doesn’t allow you to “elect” which one is your principal residence).

For example, a divorced father might have main home in Kelowna, and own a condo in city of Vancouver where he can stay with his kids when he has custody, because “life gets complicated.” This isn’t someone that should be taxed $50,000 extra per year on a $1m condo. Owning a second home isn’t a crime.

Right. For example, if rates rise and mortgage holders are having trouble, the government and banks might step in to help over-indebted people at risk of mortgage defaults/losing their homes by allowing them to switch to interest only payments (like they did during Covid , and they always allow with HELOCS).

For example, imagine a bad scenario where a first time buyer has borrowed $1m at 2.5%/5 year rate and is paying $4,500 per month. Now interest rates rise to 8% and he needs renew, which would be $7,600 per month. He just can’t make that payment. If the bank let him pay interest only, the payment would fall to $6,670 per month. (He needs to make the extra $2,000 somehow so gets an extra job or cuts back elsewhere). So the government let’s him get that 5 year interest only payment. In 5 years, his income is likely 25% higher and he could likely afford the $7,600 if rates were still 8%.

This doesn’t help if rates go to 20%, but could help out in less extreme cases, where someone could survive 8% rates.

In the City of Vancouver? All 44 square miles of it? Yeah sure.

Market 2022 who knows we could go old school where u start getting some return on that savings account sell only if you have plans for the money elsewhere

You sell an investment property, pay closing costs and taxes, and you’re priced out of the market. Buy another property and land transfer taxes are around $30,000. If you have good tenants hold on. Lots of external factors other than interest rates to keep upward pressure on prices. Worst Prairie winter in decades, lots of retired professionals, government workers, war in Europe, etc… This time next year inflation will settle down and rates will stabilize at a rate people can afford. No one wants a meltdown, especially politicians. However, if your property is a dog, now is a good time to unload it.

Market 2022 , I have a couple of professional long term investors lighten up their exposure to rental properties, anytime you sell before buying you take a chance although I like your odds the way this market is shaping up, I expect prices to head south.

Hoping a professional can weigh in with some impartial advice. Is May 2022 a good time to sell an investment property in Victoria? Markets are unpredictable. But selling now puts cash in hand.

In my case, looking to sell rental to buy new primary residence. There aren’t any primary residences to buy yet due to lack of supply. So could be sitting on cash for 6+months.

Or better to hold on to rental, and sell and buy if/when the market balances out?

This seems reasonable. There are several clauses that are specifically marked as “for the sole benefit of the buyer/seller”. Perhaps the BCFSA should identify the clauses that are for the sole benefit of the agent and simply stipulate that they can’t be part of the standard contract. Agent and seller can always negotiate adding them if they want.

What if you drank say 6 cases of wine and blacked out for a couple weeks and used the speculation tax notice to mop up a spill and now you’re a speculator? These are all very important and plausible scenarios we should consider.

The people to blame for a lousy agreement with “incredibly rare scenarios” (with one-sided remedies to benefit the agent) are the people that wrote up and present the agreement – namely the RE agents. They should remove them to begin with, and then there is no problem.

Better still, some lawyer should write up and publish a modified “seller friendly” engagment agreement , and let the RE agent sign it or take it to his lawyer.

Once again, incredibly rare scenario. We are focusing on scenarios that are $5 +/- when you multiple commission amount by odds of scenario.

Guess what the value is when you are able to negotiate $5k off the commission? 5k x 1 = $5,000.

This whole lawyer listing contract review advice is misguided energy imo. Energy would be much better spent on researching mere postings (modified listing contract), lower commission full service options, etc.

Then people complain that commissions are too high. People get caught up on the agents pitch of their magic 99 point marketing plan they put into action the minute the listing contract is signed, and some clauses in the listing contract that occur 1/10000.

If you spend your energy/common sense on finding a comptenent realtor who operates his or her business off referrals the odds of them resorting to fine print in the contract is very low. Pissing off a client can long term cost you 5-10x the value of the commission in terms of lost referrals/repeat business.

As a tradesperson or other business you can piss people off and still have unlimited work due to a huge shortage of that skill. That is not the case in real estate. If you need plumbing work done right now good luck getting two plumbers to your house. If you need your place listed 500+ agents will come by to take a look.

“Barrister gets his 29 cases of wine”, with the details disclosed only as a “scenario”.

The only “wine score” story wilder than that was in an old Sopranos episode, where the wine “fell off a truck” 🙂

https://www.youtube.com/watch?v=VquBcB4i6xM

You literally have to opt out of the speculation and vacancy tax every year. If you don’t opt out then you’re on the hook for the tax by default. Your sick in hospital or have a loved one pass away and neglect it, go on vacation and have your house-sitter recycle the mail, or just plain forget and you’re now a speculator. Even if you’ve claimed not to be for three years prior at the same address.

Marko talks about government waste, but try to show me a more terrible example of administering a program where 99% of the province is exempt from, but it still has to be done every year. How much do you think that costs in staff hours, advertising, mailing materials and everything else associated with the speculation and vacancy tax? It’s a joke, especially with how easy it is to get around.

Just spoke to my agent managing my property in Victoria. Had to get a 3 piece bath completely renovated because of some water damage. Mold remediation was $4400, taking the total cost to 14,000. He mentioned that offers are slowing down, inventory is increasing but still not enough to cause prices to fall. He commented that UpIsland is more active with very limited inventory. That’s his perspective.

Anyone able to tell me what 1110 Reno St sold for?

Marko: You are smart enough to figure out the scenario of how this came about.

Obviously cash was my first preference by way of reduced commission.

You advice to negotiate commission is perfect and hopefully everyone follows it.

City of Vancouver raises the vacancy tax to 5% of the value of the house per year. And they are “investigating” raising it higher to 10% per year. https://globalnews.ca/news/8792837/empty-homes-tax-vancouver-increase/

For me, there are two separate issues.

1. – do they need a vacancy tax?

2. – is 5% per year too high? (About 10X the property tax)

I’m only referring to question 2. I think 5% is too high – and an outrage. It’s an example where politicians will happily raise taxes of non-voters to confiscatory levels, but are too cowardly to raise taxes in general when it affects them or their voters. There are lots of legitimate “life gets complicated” reasons that people own 2 homes (marriage breakup, job in two cities, illness with family member). Or how about if you’re a BC MLA, who gets to own a second home here, and has the government pay their spec tax for them.

These huge taxes are simply designed to “smoke” people out of these homes, and many will end up selling and renting a second home instead, with no net improvement to the housing shortage.

The lawyer wouldn’t be advising on that clause only. There are other clauses worth explaining, like when and how the agreement terminates. And after termination, under what circumstances the commission will still be due (e.g. the ultimate buyer had previous contact with the selling agent about the house).

Most people I’ve spoken to just think of their realtors as really nice people, which is a fair statement. However things change when someone gets stiffed on a commission that they think is due to them, and the contract supports the realtor.

Former Landlord- I fully agree that the agent did his job, went to great lengths on his client’s behalf and met all obligations of the contract. The land owner was being a jerk and deserved what he got for wasting someone’s time.

It is grade 7 math.

Commission ~ $30,000, Probability of outcome ~ 1/5000 to 1/10,000

$30,000 x 1/5000 to 1/10,000 = $6 to $3

For the seller does it make sense to engage a lawyer to advise on the clause?

For the listing agent does it make sense to waste his or her time negotiating the cross-out of the clause? Just cross it out.

Story from Ontario from 15 years ago. In small Victoria alone there are 10,000 transactions per yer. Of course, not everything ends up reported in the news but it gives you an idea of how rare this outcome is.

Couldn’t get him or her to 30?

https://www.thestar.com/life/homes/2014/01/09/court_finds_agent_must_be_paid_for_doing_the_job.html

Here is an example from Ontario of full price offer not being accepted, but commission still due.

So looks like it is definitely enforceable.

Comparing consumer contracts to taxation is bogus. You don’t “opt” in or out of tax obligations.

The reason why you must explicitly declare a lower tax status is that if it were made the default people would “forget” to declare their higher tax status. Requiring a declaration gives the government grounds to prosecute for tax fraud if the declaration is false.

If you want another example, you must explicitly declare your exemption from the foreign buyer’s tax when purchasing RE.

The article concerning Airbnb’s mentioned that 128 rental units were offered by 3 different individuals. Must be very lucrative, even during the pandemic.

Yeah, you declare you’re a homeowner that occupies the property, so you opt in. With the speculation and vacancy tax you’re already in and must opt out. There’s a difference and that’s why it was made illegal for companies to do this to their customers years ago.

I doubt it. Mine is, but from what I’ve experienced so many of them are too busy inflating their own egos and trying to make themselves seem successful in their Instagram stories

This sounds like what I was wondering about. Thanks for taking the time to explain it Leo.

I wrote an article on exactly this topic last year where I looked at the impact of the pandemic on Airbnb .

https://www.capitaldaily.ca/news/victoria-airbnbs-disappearing-covid-rentals

It’s a factor and province should step in to make enforcement easier for municipalities but a tertiary factor at best in housing

Wow, I would have assumed that most sellers would look to negotiate the fee. That is just insane if they don’t. Do most just look at the paper and figure they must pay that 7% on the first $100k and 3% on every $100k after that?

I wonder whether average realtors are as easy-going and common-sensical as Marko when it comes to striking clauses and handling oddball situations.

Change of subject. This article was in the Victoria News, and could explain the housing shortage. AirBnB’s did not exist 20 years ago, in fact the site started in 2008. Some individuals rent several apartments and turn them into short term rentals. If there are 3156 listings, that’s a lot of supply removed from the market. They probably didn’t suffer much during the pandemic as snowbirds that could not enter the U.S. drove to the Island. Also explained the trailer parks being booked solid for the winter. Thanks to the internet, anyone can own a virtual motel with little investment (furnishings).

There was a written agreement and it involved 29 cases of a very specified product. I was not born yesterday. The agent brought me a very specified single deal. I actually had talked with six agents at that point but mostly I reviewed listings on my own and spent over half a year getting to know Victoria.

Marko, I have negotiated countless commission deals in Toronto since the sale of the matrimonial home was often a key asset in many of the divorces I handled.

Let me say that you are actually giving people great advise by and large. As I am sure you have discovered people more often than not ignore great advise. Like me you have probably learned to shrug.

🙂

Did not expect you to be present just to figure out how to tell agents showing to not screw with piano. We will probability rope it off. Dont want you at showing, it is often counter productive.

Don’t have time to be present at showings on my listings. Counterproductive imo. When I show up with my buyers at a listing where listing agent is present they are annoyed 9/10 having to hear the speal.

I wasn’t born yesterday Barrister. You most likely went with an indiviual that brands himself or herself as a luxury agent and you got a gift basket, if that, on completion. Possibly there was a bottle of wine in the gift basket.

Marko. when I bought I got an agreed amount of cash back (actually a specified number of cases of very expensive wine but lets not go into details ). I have negotiated every sales contract or purchase contract with the agent. I will go with the agent that will give me the best commission deal that does not seem like a total morrow. My impression of a number of the luxury agents here and I will not name names is that a number of them are more likely to have an ego that screws a deal rather than be of any help in selling. Just read some of the descriptions on some of their listings, my house painter from Quebec would do a better job.

It is not that I am a lawyer it is that I am a proud Scotsman whose dad taught the value of a dollar. I promise to give you a call when we are ready to sell here and you can give me your best offer on commission. You might be surprised by how easy I am to deal with because there is no emotional attachment to the house.

Your main job will to make sure that no one screws around with my wife’s piano.

+1, in addition an agent that is willing to negotiate his or her fees. Your energy should be spent on this not overanalzying a generic listing contract to death, in my opinion.

Regarding crossing out clauses in contracts whatever the seller wants to cross out I don’t even bother discussing I just grab my pen and start crossing out.

Same with when sellers are concerned about their neighbour or someone they know buying the house they will ask about commission and I’ll reply “give me the names, we will exclude them from the contract and if they buy commission payable is zero.”

It isn’t worth my time discussing any of these points based on life experience. I’ve probably excluded buyers from 25 +/- listing contracts and guess how many bought? Zero. So versus wasting time I just immediately offer zero commission if that buyer buys it and move on. Same with the failure to complete commission clause. I’ve had it happen 1/1000 and I had no intention of going after seller so why would I care if it is crossed out? Makes zero difference to me.

Also sellers getting lawyers to review contracts/cross out clauses I actually don’t mind at all. It means they are not focusing on what actually matters (trying to negotiate the commission) which is the most important thing to me. You could cross out half the listing contract why would I care.

Once again, why are commission so ridiculous high…..people think they are smart but they actually have no common sense.

Barrister, when you bought did you use an agent that gave you back a portion of his or her commission?

And when you sell I know you will use a full commission”luxury” agent to “market” your “luxury house”, but that is okay you’ll cross out the clauses.

+1, standard practice to remove them. I’ve never heard of these clauses being applied in real life thought. It would just be a complete PR nightmare for listing/buyer’s agent. 95% of my business is repeat clients or referral from previous client, why mess with that.

Also, how would the courts interpret “terms.” Let’s say buyer comes in at full price wants an inspection and 2 month close and seller says nope I want unconditional offer and 6 month close.

I would be interested to see a case, if one exists.

As far as commission payable even with failure to complete this is so incredibly rare. First of all failure to complete must be between 1/500 and 1/1000. I’ve had it happen once in my career and I am closing in on 1000 transactions.

Secondly, when I had a failure to complete last year instead of going after my seller for commission we re-listed the property. It sold and I still got paid. Those sellers have also referred me to over $5 million of other real estate transactions.

I would bet only 10% of the time does the agent insist on payment with a failure to complete so do the math 1/500 to 1/1000 x 1/10. If you want to spend your energy on a 1/5000 to 1/10000 probability fill your boots.

And finally as Leo pointed out in that 1/10000 story no victims really.

Frank, I have never had a problem finding an agent to accept alterations to the agreement. Half of them would kill their mother to get a listing these days.

You’re basically signing your life away when you sign any agreement. In order to have any surgical procedure you’re required to sign an agreement that absolves the medical system any responsibility should anything go wrong. Try and take that to a lawyer and have it altered in your favor. In the case of real estate transactions, maybe the sellers/buyers should supply the agreement. Of course agents would refuse to sign it and you’d be left to sell your property yourself, like 20% apparently are doing.

Actually a great topic for this blog, especially for first time sellers or people without a law degree would be to examine the pitfalls of the so called standard agreement with your real estate agent when selling. Focus on which clauses should be modified to benefit the seller instead of the agent. And there is clearly a number of rather one sided clauses in there.

I am pretty confidant that the average seller thinks that commission is only due if the deal actually goes through and the seller gets paid for the house. So this is not only a great topic but one that is really helpful to your readers.

For the real estate agents out there do you tell your clients that this is just the standard agreement AND it is totally written for my benefit and you need to take it to your lawyer because it is completely one sided (which it pretty well is in my opinion.)

But it would be a great article. By the way Leo those two clause you mention should ALWAYS be taken out, they never benefit the seller only the agent. I dont think you meant to mislead but there is absolutely no circumstance where they benefit the owner of the house. In fact a clause needs to be added to make it absolutely clear that the owner has a complete discretion whether or not to accept any offer whatsoever regardless of the terms offered and a further clause making it clear that commission is only due and payable upon a full completion of any accepted offer. No problem getting some agent to accept those terms since there are a lot more agents than houses for sale and truthfully agents dont do much to sell your house in the first place when weighted against the commission they get.

Cut the “guilty” crap. It’s the same way the home owner’s grant has worked for generations. You’re assumed to be a non-owner-occupier unless you declare otherwise.

And in general the tax system works that way for a lot of situations where different taxes may be levied for different scenarios. It’s the only workable way to do it – the onus is on you to declare you qualify for the more favourable treatment. It’s not going to hurt your hand.

You are referring to the clauses 5 a iii and 10 b which state

5 a iii – The seller agrees to pay the listing brokerage a gross commission of X of the sale price of the property if an offer to purchase is obtained from a prospective buyer during the term of this contract who is ready, willing and able to pay the listing price and agrees to other terms of this contract, even if the seller refuses to sign the offer to purchase

10b – The seller agrees to accept an offer made during the term of this contract by a person ready, willing and able to purchase on the terms set out in this contract

These would generally be removed/altered if setting up a list price multiple offer (or in other situations, remember everything is negotiable)

Wasn’t meant to be an answer, just topical on a similar theme..

As much as I trust anyone on commission. I would hope people wouldn’t skip having a lawyer review a contract because they “trust” the other party. I trust that all the clauses that were struck were just standard and weren’t added by the realtor, but was just the standard language the brokerage had their lawyers draft hoping they wouldn’t be reviewed.

Wow, you need to find a real estate agent you trust

So are you aware of this Leo? Or would it have to be a deliberate clause inserted that would allow this?

Big picture, the whole opt out otherwise you’re in is super shady. It was outlawed in BC for cable/phone companies decades ago but brought back a couple years ago with the speculation and vacancy tax. We’re all speculators (and guilty) unless you tick a box saying you’re not.

Umm…really, yeah saw this story but it has nothing to do with what I was asking.

Also Patrick, not asking about commissions. Basically, I read a post about someone who had a rookie RE agent that didn’t know what they were doing and did not protect their client by adding or removing some sort of clause that allowed the buyer a right of refusal or negotiating powers and the property was sold and closed with a full price offer. It’s scary to think that’s possible and it would be out of the sellers hands, so just wanted to ask. Again, could be a RE urban legend.

The real estate agent is not on your side. The so called standard contract is for the agents benefit and is really one sided. Also, and I mean always, have it reviewed and modified by your lawyer. If the agent wont agree just find another agent. Commissions should only be payable if and when the deal actually fully closes. If your agents objects politely tell him that he obviously has his interest put above yours and you will not be needing his services.

The governing body for realtors should be politically forced to change the standard contracts. Personally if I sat on the bench I would have held the commission clause as unenforceable in that it was a fundamental breach of the fiduciary duty owned by the agent to his principle. I would have gone further and awarded serious damages for distress for breaching that fiduciary duty against both the individual realtor and also the real estate firm probably in the amount of six to twelve million as a deterrent against a practice .which is detrimental to the public.

Maybe buyers/sellers should supply their own contracts for the realtor to sign.

In either, I really don’t see the issue. For me, it cost $150 for my lawyer to review the representation contract my realtor wanted me to sign, and my lawyer recommend striking 5 clauses from it for my protection. The realtor was a little indignant about it saying they were all just standard clauses, but they struck them out all the same in order to get me to sign before making my offers. The lesson, don’t cheap out on a $150 bucks if 10s of thousands are on the table.

But what would happen if the housing market went down after the buyer disappeared? What would happen if the buyer disappeared and the deposit amount was not enough to cover the agent commission? The agent was a dual agent for both the seller and the buyer in this case, had the agent any responsibility when the buyer was nowhere to be found to complete the deal? Would the Court still think same then?

$1,703,500

That was a separate issue from the full price offer clause that up-and-coming is referring to.

While bad optics for the agent to sue their client in the CBC story, there aren’t really any victims here. The sellers got $70k from the buyers deposit, they need to pay $54k to the agent, and they kept the properties which have appreciated by hundreds of thousands of dollars after they would have sold them

No, you wouldn’t have to sell the property, if it was a standard offer to purchase. You may have to pay the realtors commission if that’s what it says in the contract (which it often does)

That’ll make you think twice to enlist the services of a realtor.

https://www.cbc.ca/news/canada/british-columbia/bc-commission-real-estate-lawsuit-decision-1.6433370

Question for Leo and/or Marko: is it true there is a clause in a real estate contract that a selling realtor has to either put in place or remove and that if it’s not put in place/removed means that any given property can and must be sold at the listed price if that full price offer is offered by a buyer? So essentially, the property can be purchased with one simple full price offer and the seller cannot reconsider? I’m sure if it exists it’s only a very rookie RE agent that would make this mistake for their sellers, although if it is true I imagine anyone purposely underpricing their home for a bidding war would want to be absolutely certain their realtor knows that. I’ve heard of this, but never knew if it was true, so maybe it’s just a RE urban legend.

These aren’t the people I’d expect to bail, rather the cowboys who got in late and were cash flow negative from the word go, and who will be even worse off with higher rates.

Price/rent in Vancouver was 100.

It depends on how long you held, and what your mortgage rate was. As you can see, prices were flat for 6 years, and mortgage rates remained above 10%. Hard to see how you would do well financially if you’re paying 10%+ interest per year.

Did you manage to hold on until the post 1987, when you would have seen some price appreciation, to help recoup the 10%+ interest you paid per year? Or did you manage to pay it off early, and break even ?

Yes I was shut out of the market at the peak in 1981. Funny thing is, I was able to buy with 40% down not too long after that. And you know, I think I got 18.5% on the last GIC I used for the down payment. So this guy did just fine from those peak interest rates.

NASDAQ had its worst month since 2008. That’s the type of market that can get hit hard fast. Whether housing follows is yet to be determined. As for investors selling their properties, most probably have good long term tenants, and in my case, I’d never toss them out on the street. Well prepared to ride out any downturn as I have in the past. I’d hate to sell now and be sorry 5-10 years from now.

Not what I’m saying

Ya, a lot of what is coming seem to be people looking for a million or over in all areas for types of stock. Hopefully, the increasing inventory allows for a more accurate measure on what the market demand is without it being skewed by such a low inventory. I am still of the mindset that pandemic and the artificially low rates pulled a lot buyers forward and that coming out of the pandemic and rising rates may have the opposite affect now. It will be interesting to see if low demand gap occurs for a period time. A few segments of buyers just might be out of it for a while now: investors because of uncertainty, first timers because of cost, and move up buyers that might want to finally list now that inventory is available, but need max return on their current property to make it work. An interesting thing to watch unfold either way.

In terms of prices, the fall in prices from the 1981 Vancouver peak-to-trough dropped the house prices about 6 months, to levels from June 1980. Houses had doubled in the previous year, See the chart.

Indicating that the problem wasn’t the price drops, the problem was the high mortgage payments to begin with. Any cash buyer (or someone with lots of equity) was fine as all that was lost was the blowout gain of 25% in the 6 months before the crash. Nominal prices were flat for several years, not ideal but not devastating.

That’s why I don’t think everyone gets hurt equally. I think that the people hurt the most will be the first time buyers (who either can’t afford to buy in the first place, or afford the mortgages on homes they’ve bought recently).

>

>

It’s ironic, because many Househunters here seem to be the ones cheering on the rate increases, when they are likely to be among those hurt the most when this happens. As they are either shut out of the market, or face huge mortgage payments after purchase, as happened in 1981 Vancouver

In the Lower Mainland during the 80’s housing crash.

Builder’s we’re offering new cars with the homes they had built. Families were broken up, people lost their homes, and nobody seemed to be benefiting.

It seemed like The Sun ran regular articles on people losing their homes and being forced into bankruptcy.

It wasn’t a time anyone would want to revisit.

So, if there’s no real argument about where inventory and MOI will be during that timeframe, what you’re saying is that the actual returns we’ll experience will be well outside the confidence interval for your MOI graph for three consecutive periods.

Not sure what your intervals are set at, but let’s say they’re at 90% (a commonly used figure). For us to land outside (either above or below) your intervals your graph says that’ll happen one in ten years. For that to happen in three consecutive years, your graph is saying that’ll happen 0.10.10.1 = 0.001 = 0.1% or one in a thousand years. But you’re also saying we’ll be below the interval (not above), so it’s actually one in two thousand years.