April 19th Market Update

After the long weekend it’s worth checking in how the market has been developing so far this month. A small shift has been evident since about mid last month, but if you’re expecting a rapid pullback that hasn’t materialized. Remember that the real estate market usually changes slowly outside of a major shock like the financial crisis or the introduction of the mortgage stress test a few years back. Rather than a sudden event, the market has come under gradually increasing pressure from worsening affordability and increasing rates.

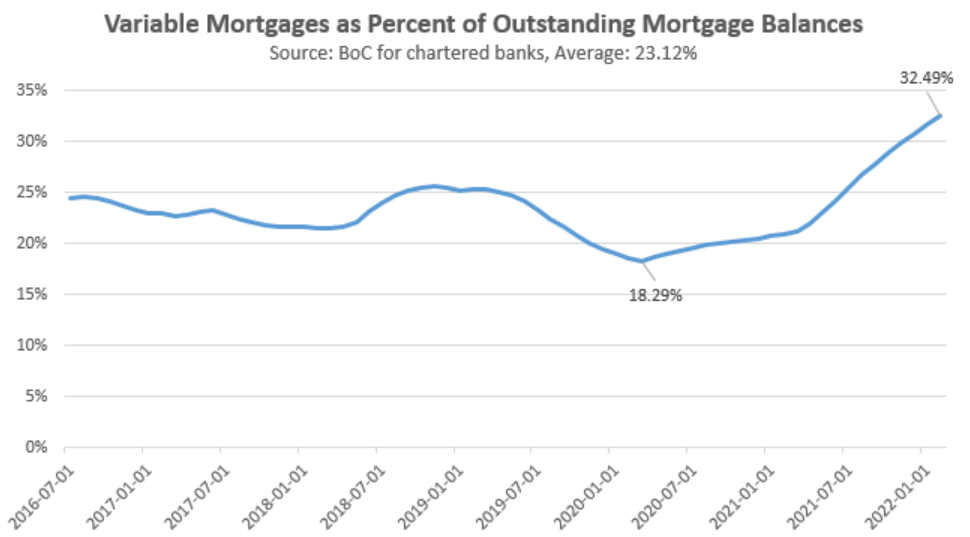

Variable mortgages rose by 0.5% last week, which cuts the mortgage amount by some 5% for a given payment. That rate hike meets the highest proportion of Canadian mortgages on variable rates in a decade. Despite the 0.75% increase in the central bank’s lending rate, those variable mortgage borrowers are still likely ahead of the equivalent fixed-rate borrower, but all indications are the rate hikes are far from over. As I modelled a few weeks ago, the collection of bad outcomes for variable rate borrowers are likely some 4-6 rate hikes away.

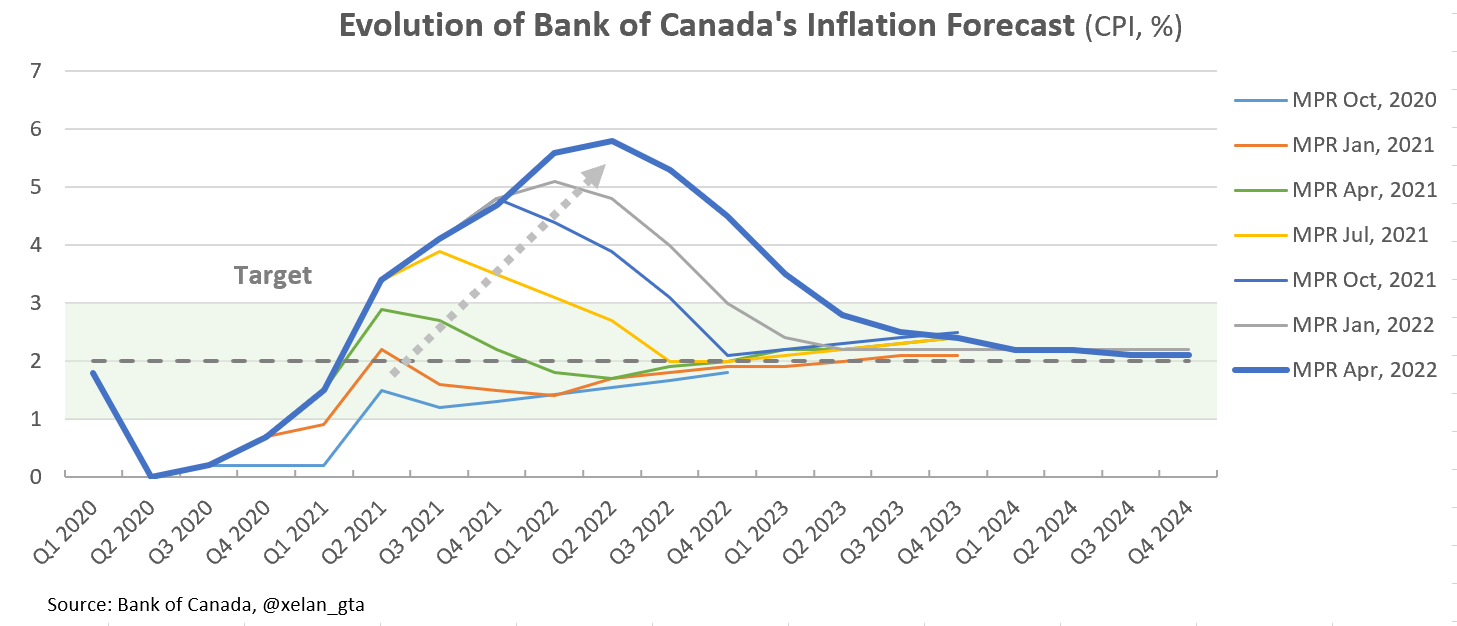

Whether we get there depends a lot on the trajectory of the economy and inflation. Last week’s 0.5% rate hike added about 172 million in monthly interest costs for Canadians. Rising rates will suck more money out of the economy, reducing demand for other goods and services and thus reducing pressure on inflation. No one knows how soon inflation will be tamed, but we do know that the Bank of Canada doesn’t have a great track record in predicting it. At every projection they’ve made in the last two years they’ve pushed their estimate of inflation higher for longer, with the latest predicting a return to the target range by the middle of next year (source).

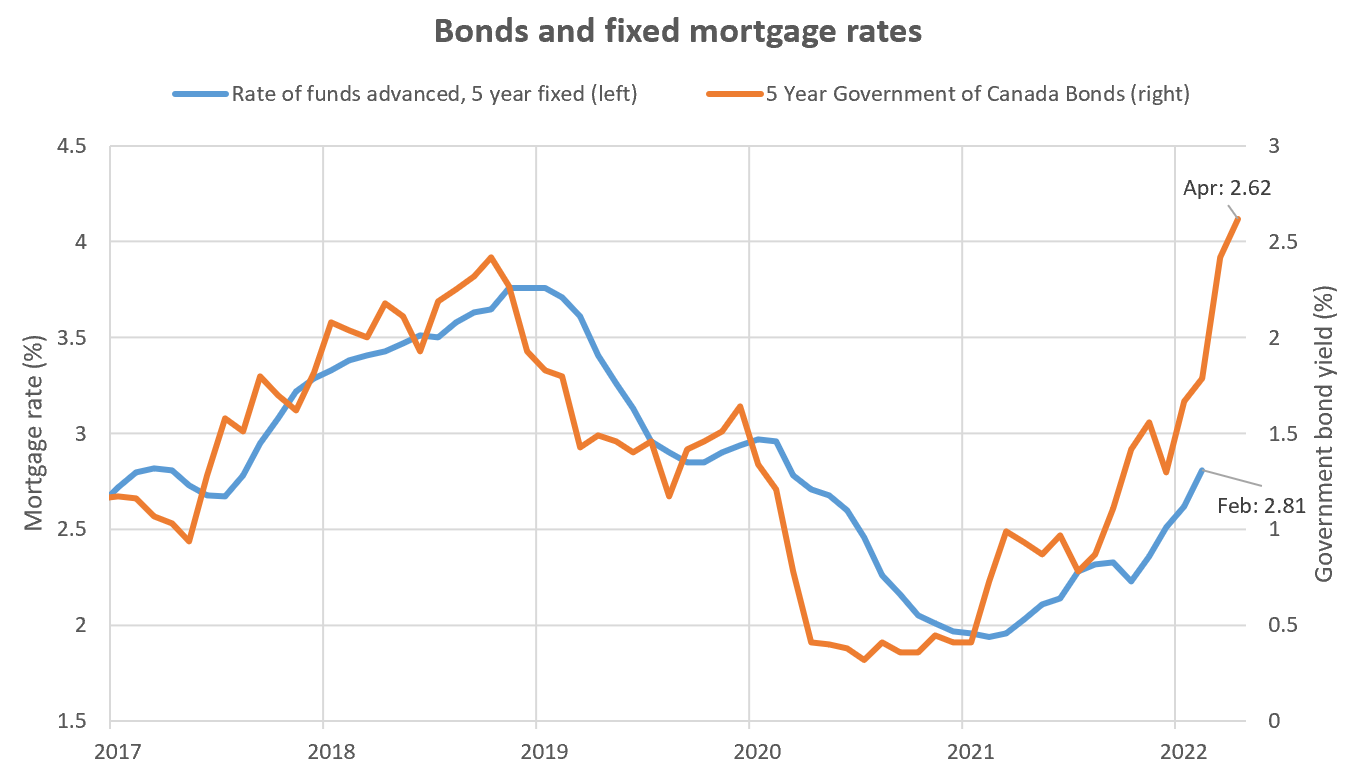

Meanwhile bonds have continued increasing, adding about 1% to fixed rates in the last 6 weeks. Due to rate holds, those higher rates will filter through to actual purchasers in the following ~6 weeks. Current bond yields point to mortgage rates of about 4%. That’s still very low historically speaking, but it’s a doubling in just over 12 months and an extra 24% on the monthly payments on top of the similar increase from increasing prices.

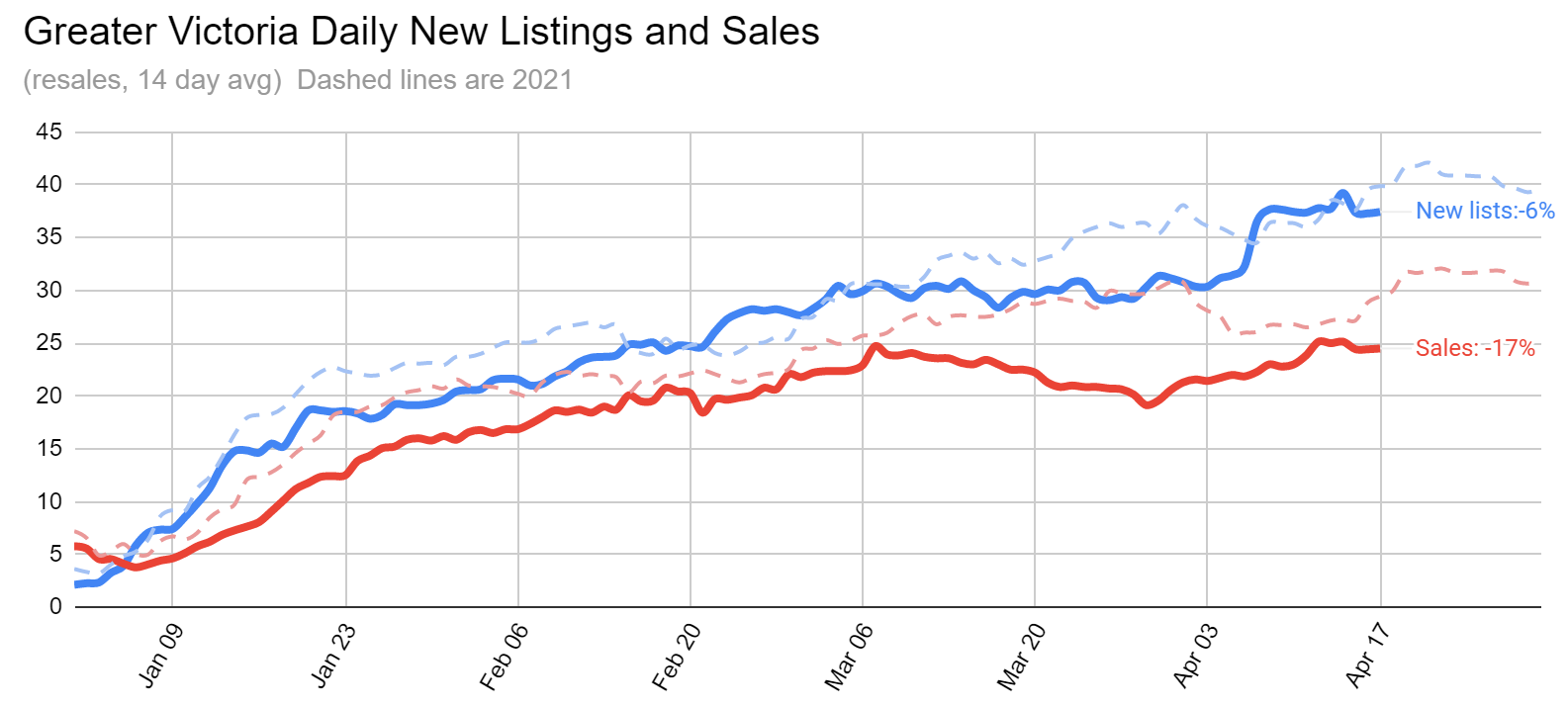

Moving on to market activity, two weeks ago we had a strong increase in new listings and last week quite a number of those new listings were absorbed. Not surprising given we are still at record low inventory for this time of year and are still seeing an unusually high rate of over-ask sales.

| April 2022 |

Apr

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 247 | 468 | 1116 | ||

| New Listings | 439 | 732 | 1516 | ||

| Active Listings | 1175 | 1197 | 1454 | ||

| Sales to New Listings | 56% | 64% | 74% | ||

| Sales YoY Change | -12% | -22% | |||

| Months of Inventory | 1.3 | ||||

However the gap between sales and new listings continues to slowly expand, and this week should be another active one for new listings.

Somewhat surprisingly, there was no drop in the percentage of places going for over the asking price. If buyers were spread thinner, the practice of underlisting was still prevalent enough to keep this above half of all properties. Little difference between condos and detached, with 59% of detached properties going over ask month to date, compared to 54% of condos. There’s also little difference between price bands, with lower valued houses about as likely to go in bidding wars as higher ones.

Construction picks up again

After a minor lull in the number of units under construction in the area, activity has picked up again with February closing in on the all time peak in April 2019. Every contractor and consultant I speak to are run off their feet busy so I would expect this to continue. As supply chain and pricing challenges hopefully get resolved perhaps it might even increase a bit further.

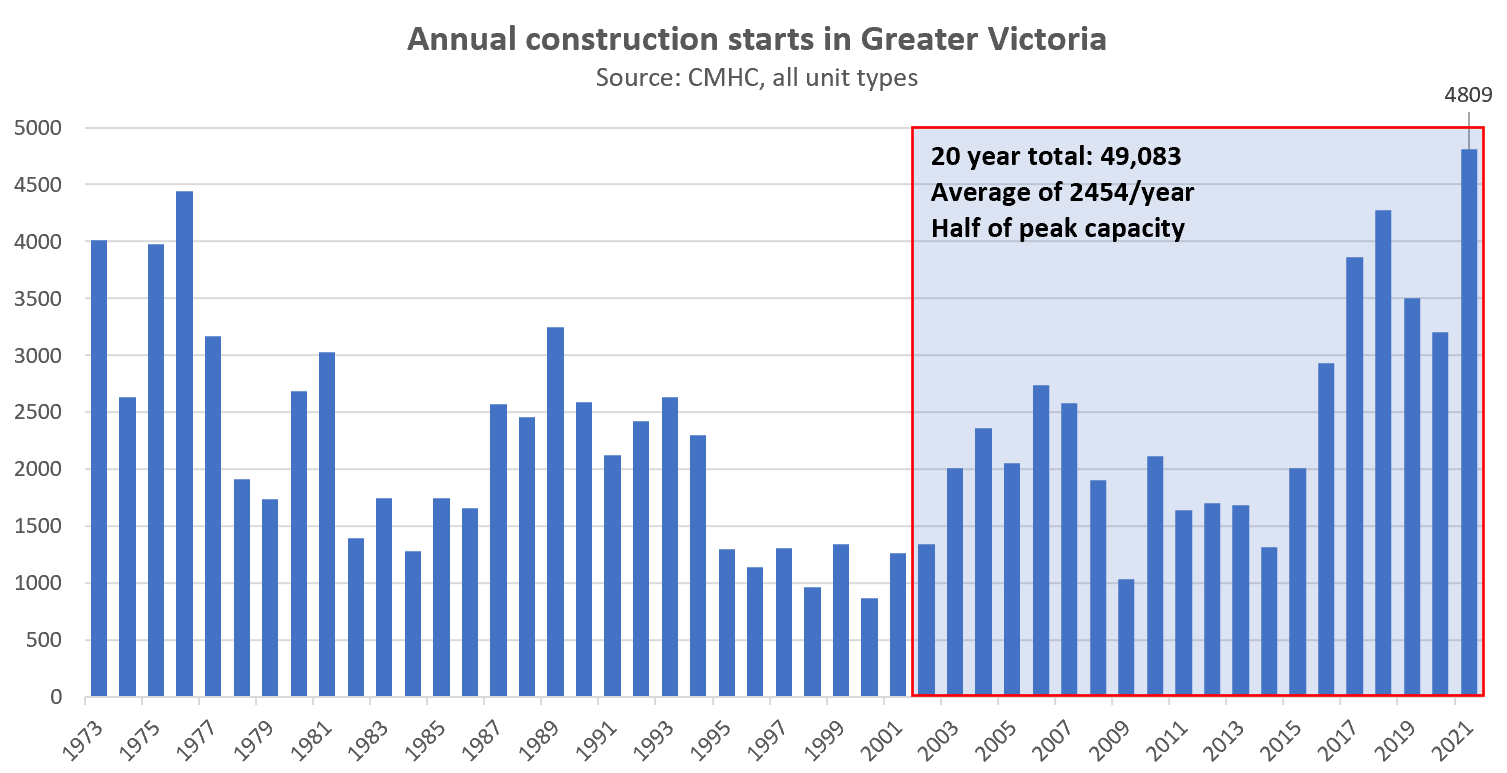

Some people wonder why I bother pushing for more supply when construction is already running at peak capacity. Even if we had the zoning for it, it’s not like we can double the rate of completions overnight. While capacity can be built over time, it’s true that any further gains will be difficult. However this ignores that construction is a boom bust industry. The next recession is inevitable and with it the big developers will become risk adverse and pull back their projects. If you look at the average rate of completions for the last two decades, they are just half of what we know to be our capacity.

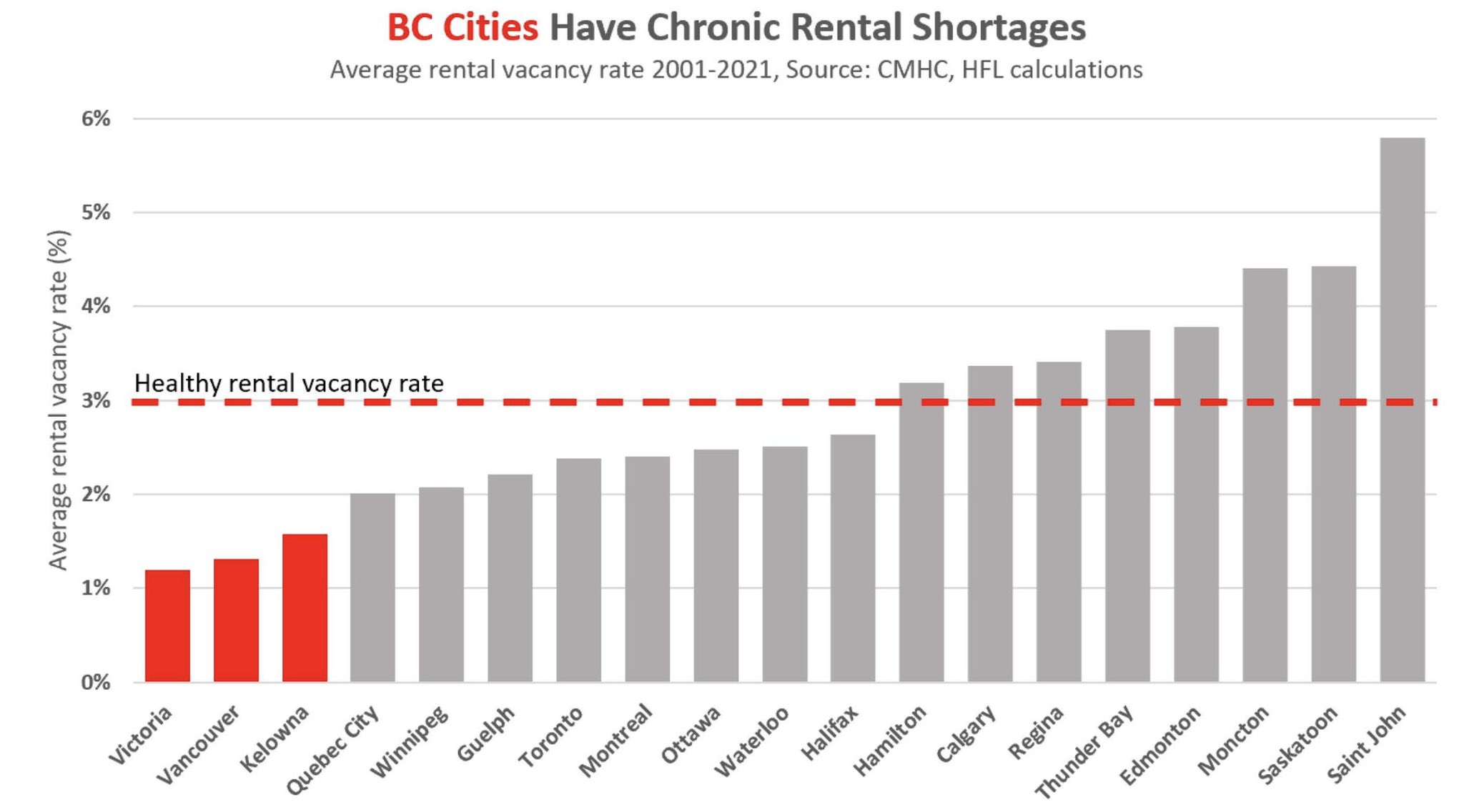

Reducing risk and friction in the process has the potential to keep the smaller builders busy when the larger projects are shelved, while government can fill in the gaps with non-profit housing. The City of Victoria took a big step in that direction last week when it approved a proposal to delegate non-profit and government housing projects to staff. That saves time, reduces risk, and hopefully will lead to substantially increasing the production of affordable housing. Saanich council is already looking into the same changes and I expect other municipalities will enact similar reforms now that there is precedent. This will be followed by votes on upzoning for missing middle and legalizing rental construction in centres in Victoria, which would expand what can be built by right in much of the city. Lots of changes to be made still, but it’s possible that we could build twice as many homes in the next 20 years as the last 20 which would go a long way to alleviating our chronic shortgages.

Sorry to be a broken record here. Nothing anyone says here matters unless it has a QE backdrop.

So we printed 4 X the $ … House prices need to be 4 X what they were in 2019. Is everyone just forgetting about QE?

Please take a look at money printing and asset valuations. They are exactly coordinated.

Grab an M2 Money supply chart. Every comment is trumped by the M2 chart unless your statements involve fractional reserve monetary system,

That trumps QE.

New post: https://househuntvictoria.ca/2022/04/25/dark-sales-revisited

Former Landlord:

“You saw the same happening with doctors and nurses being quoted at the start of the COVID pandemic spreading false information and used to peddle snake oil.”

Which you determined was snake oil by listening to “professionals” or perhaps you listened to the voice of authority in B.C., Dr. Bonny Henry.

I believe the expression is “you can’t suck and blow at the same time”.

Totoro:

“I like how a realtor is in the same category of professional opinion as a doctor. And medical opinions on the same plane as market forecasting.

BTW both Marko and Leo S are licensed realtors. What happens if they disagree with your 40% decline as a certainty? Do you defer to them?”

Lol, I wasn’t listing them in the order of importance. As licensed realtors I have always deferred to them (realtors) when buying or selling property.

Regarding Market Forecasting, I would leave that to someone with a broader scope of knowledge … perhaps Douglas Porter.

This blog has been the first one that I’ve come across where a Realtor has provided useful insight and in-depth analytics into a housing market. Other than utilizing their professional expertise for buying and selling, most realtors slogan is “it’s always a good time to buy”.

Leo doesn’t sell real estate so I certainly appreciate his analysis.

Correct, I am saying arguing something based on their authority is a fallacy (= a manipulative way to try and win an argument).

You saw the same happening with doctors and nurses being quoted at the start of the COVID pandemic spreading false information and used to peddle snake oil.

All could be below ask, and you’d still be right.

Local Fool

“Ergo, I’d argue you’re not going to get to Mr. Monster’s 40% drop with rate hikes alone and almost certainly not in the first year. You’d need a catastrophic rise in unemployment and for a sustained period of time. There is no sign of that yet, in fact it’s still the opposite.”

You’re interesting, Local Fool. My quote was ” I’ll say 40+% in some of the “hottest” markets. I’m saying 20 months and the bank is saying 12 months. If Macklem goes cowboy on June 1st and raises the prime by 3/4%, I might shorten that timeline.”

I like how a realtor is in the same category of professional opinion as a doctor. And medical opinions on the same plane as market forecasting.

BTW both Marko and Leo S are licensed realtors. What happens if they disagree with your 40% decline as a certainty? Do you defer to them?

Yeah, I don’t even necessarily disagree with Douglas here. The big jump in the post pandemic prices was mostly low interest rates + pandemic preference changes. But it hit at a period of low supply which made it doubly impactful. Long term chronic supply shortages + mega demand boost = crazy prices. Of course the usual suspects instead hold it up as proof there’s no housing shortage.

Marko

You should see what’s going on in Lake Cowichan. People now have turned to face book pages looking for properties. Very little desirable properties on MLS. I thought for sure that market would stabilize. Not yet. No inventory still anywhere on the island.

Former Landlord:

“is an argument that relies on the status of the person cited instead of their ideas.”

You do realize that in the context that you are utilizing this strange argument that you would be questioning your doctor, dentist, realtor and pretty much any other professional.

Leo S:

“The founder of Betterdwelling has always had an insufferable “I am very smart” vibe despite writing some absolute nonsense over the years”

Lol, definitely true, but the context of the article was taken directly from Douglas Porter. You can read the same think in the Globe and Mail.

And then there is reality….home I personally thought was priced at market value

“Hi, just an update we have 9 offers in total, thanks”

If a severe downturn in the economy occurs, immigration to Canada will not seem a pleasant prospect. Immigration has dropped notably in previous recessions. I’m not sure how attractive Canada is even now, as the cost of living is so high.

That’s really talking about nominal values. In the end it’ll probably be a wash. I presume inflation isn’t really impactful on the RE market in real terms unless demand is goosed by lots of people seeking to hedge. Plenty of that in the 70s and 80s. Not sure about now, especially in this market.

For now, I just don’t think rates are going to be the issue. Yes, they’ll hike, break something, call it as overshot and drop it back down.

IMO, employment is probably the most fundamental lifeblood of a RE market and as everyone knows, at the moment there’s a labor shortage. The counter there is to doubt whether the existing labor market can support the valuations. While I don’t think they can, some also think they don’t entirely need to.

I’d argue you’re not going to get to Mr. Monster’s 40% drop with rate hikes alone and almost certainly not in the first year. You’d need a catastrophic rise in unemployment and for a sustained period of time. There is no sign of that yet, in fact it’s still the opposite. If the market is truly turning, that will be a net negative for employment and for sure, things could very well snowball. But if they do, we know the CBs are now heavily interventionist, which undermines a lot of the premises for certainty and conventional analysis. There could actually be further price increases related to this interventionist dynamic, terrifying as it is to consider.

But if the market does completely fall off a cliff, think about this: Even a 40% haircut would still leave a extraordinarily expensive RE market. If they fell 60% it would still be higher, in real terms, than what many were paying less than 3 years ago.

Well you’re no fun today, are you. 🙁

I’m curious what the realtors on here are seeing with sales. A Royal Bay house just sold pretty quickly for $15k under ask at $1.535M. Seems good! I’m curious what sellers and buyers are seeing. Is it a mixed bag?

Leo

Just my prediction based on rising interest rates/ building material price increase and large immigration. No one really know. Just guesses like any other period. This period ending with large price increases does not automatically mean prices decreases. That’s where in my view people are incorrect. When we get to 3 to 4 k available homes maybe will change my view. And call for decreases.

The founder of Betterdwelling has always had an insufferable “I am very smart” vibe despite writing some absolute nonsense over the years.

The tried and true fallacy: argument from authority.

Claiming that supply has nothing to do with prices, and the only factor is interest rates, would mean that the price of houses would be the same no matter what the location.

Prices are higher in more desirable locations (think downtown), because there is less supply (relative to demand).

Seems we are too early into a pretty much unprecedented situation (very high prices + rapidly increasing rates) to be overconfident about the outcome one way or another.

Debt dude I tire of you already. Same old stuff.

Enjoy the trip. Later.

“You are just another one that needs to understand the simple economic term of Supply and Demand”

Perhaps, Mr. Heckler, you could address Mr. Porter and explain to him the simplicity of your thesis.

“One of Canada’s most prominent economists really wants you to stop blaming high home prices on supply. BMO chief economist Douglas Porter explained Canada is promoting an incorrect supply narrative.”

betterdwelling.com/canadas-oldest-bank-begs-could-we-please-stop-with-this-supply-myth/

being a murderer been awhile don’t remember that…lol

Oh ok i think I remember now. Not going there. Horrible stuff..

I don’t think “Debt Monster” is “Just Jack”. I found Jack’s posts were easy to identify by his writing style.

He sounds more like Hawk with the dogmatism and certainty. Though I doubt it is Hawk. I think Hawk is gone for good after being pseudo-accused of being a murderer.

Debt dude…. Been on here 11 years dealing with you dreamers. Always the same crap. Interest rates/ 1980 all over,,,,going to crash. You all just disappear under a rock after you buy a house. Some actually stay though. You are just another one that needs to understand the simple economic term of Supply and Demand. Try googling it and there are youtube video also with a nice interactive chart for you.

gwac

“Let me tell ya what is going to happen in Victoria for the next 5 years. plus or minus 5% for the next 2 than a 30% increase from year 3 to 5.”

Lol. Let me guess. You’re the blog heckler. You do have your uses, my friend. I’m not a big believer in schadenfreude, so next year, when this blog is filled with “bears”, come and heckle the odd bull that shows up.

whatever happen to our bear house evaluator. He had about 10 aliases. Could it be……Could it be him back. He was very wordy.

wow has another delusional bear joined the group. Wow maybe i will have to get active again. After Hawk left i loss my reason d’etre.

Don’t worry Leo I will behave. 🙂

Let me tell ya what is going to happen in Victoria for the next 5 years. plus or minus 5% for the next 2 than a 30% increase from year 3 to 5. Enjoy.

Excited to see where those new 1 million Canadians will be squeezed into over the next 2 years. Excited to see how inflation will impact those housing build costs. Excited to see what Canadians do with their inflation raises.

Ahh thanks, you’re just downright adorable. However, I like to consider myself more striking than cute. As for the horror movie, I tend to be the one that’s just fine because like when running from the cops when you’re a kid, you just make sure to bring a fatter slower friend with you that gets caught first. I hope it works the same way for debt….

Congratulations, you must be new to the blog. I don’t believe I have ever stated that debt, over borrowing and being single illiquid assest dependant is not a problem. Yes, many people are over exposed and for some reason don’t see the recession on the horizon in the next 6 months to a year. I hope people don’t get hurt, but any negative consequences are really just self-inflicted.

$1.535M

Offers today @ 5

I miss Hawk as his posts were much shorter. The Debt Monster's posts are so long, I don't even bother to read them.

Former Landlord:

“Maybe you should change your approach and base your conclusions on “accurate information” instead of just any headline ( = information) that supports your seemingly preconceived conclusions.”

I apologize Former Landlord, obviously I should have contacted you for the numbers before believing the actual people that deal with these matters for their livelihood. Unfortunately, Will Dunning CAAMP Chief Economist, didn’t leave a forwarding number so you could correct his assertions.

It would appear that you read headlines and not the actual story … probably better so you don’t lose sight of those rainbows and unicorns.

mortgageproscan.ca/docs/default-source/default-document-library/a-profile-of-home-buying-in-canada.pdf?sfvrsn=e54ef47e_0

“A study done by the Canadian Association of Accredited Mortgage Professionals estimates the average Canadian will own 4.5 to 5.5 homes in their lifetime.”

Of course I mean falling prices and by your own data prices went down. Are you disappointed I didn’t supply a number?

Can anyone tell me what 2750 Belmont sold for?

What did 197 Caspian go for? Tx!

These numbers don’t add up. If the average Canadian will own 5 properties during their lifetime, in any given year on average 20% would be buying their 1st home, 20% their second home, etc.

It probably meant to read “Of the first time buyers, 45% are first-time buyers between the ages of 25 to 34”

Maybe you should change your approach and base your conclusions on “accurate information” instead of just any headline ( = information) that supports your seemingly preconceived conclusions.

No problem. The market has to crack sometime, and you’ll likely be among the first to spot it. Time will tell.

Patrick:

“You might want to put a cork in that bear party you’ve started, based on your excited report of a 2% drop in home prices Canada wide.”

Patrick, Patrick, Patrick, there was no excited report. You asked me for an example of when prices dropped immediately after an increase in interest rates. I supplied it. Who would have thought that prices drop every spring during the hottest selling time of the year? Go figure.

You sure did make a claim about construction costs. You said demand would crash “and thus price for labor, construction”…

What’s your phrase in bold “and thus for price” supposed to mean if you’re not referring to falling prices? That was the phrase you “needed to remind us about one more time”. And now, you want us to forget about it?

Debt Monster,

You might want to put a cork in that bear party you’ve started, based on your breathless report of a 2% drop in home prices Canada wide.

As you can see, that appears to be a seasonal effect, that happens every year. For example, in 2021 Canada average prices dropped 7% but finished the year up 11%. You might want to look at the non-seasonally adjusted MLS HPI benchmark for Canada prices (blue line, on the lower chart), which show that we are at all time highs, with a smooth rise to the present.

There are reportedly seasonal dynamics affecting the mix of sales, that fool people into believing prices are falling, when it is just the seasonal mix of condos vs SFH.

Umm..really

“all of which are a long way off according to the stats that matter”

Those stats that matter indicate what has happened, not what will happen.

“There might be multiple properties for sale in the neighborhood and the seller might have to clean the and mow the lawn before showing! Oh the humanity!!!”

That is so cute. You’re usually the first character killed in a horror movie as you’re laughing about the possibility.

Here’s the reality.

http://www.businessinsider.com/heres-where-those-who-lost-homes-during-the-us-housing-crisis-are-now-2018-8?op=1

“After the real estate bubble burst in 2008, many families living in the US found that the cost of running their homes was no longer affordable, resulting in many of those people losing their homes.

The widespread consequences were that, between 2006 and 2014, nearly 10 million homeowners in America saw the foreclosure sale of their own homes, which entailed having to give up their property to lenders or selling it as quickly as possible via an emergency sale, according to the Süddeutsche Zeitung.

Livelihoods were threatened and the financial damage was colossal — not to mention the emotional damage suffered by victims of the crisis — a 2014 study shows a correlation between the crisis and an increased suicide rate.”

I said that demand for construction labour and materials would crash and that’s exactly what happened in the US circa 2008. New builds dropped off precipitously so the amount of labour and materials used in residential construction dropped off proportionally.

I didn’t make any specific claims about aggregate construction costs, you indicated they did go down so I don’t see a point of contention there.

Great conversation if the market flips I think it will be quickly I’m surprised at all the interest rate chatter would never have thought that they would raise them as quickly as they have househunt got a whole bunch more interesting good to see monster putting up a good fight cheers

It is rather amusing the perceived chaos that will ensue from just the potential of the real estate market normalizing, possibly becoming balanced or the absolute horror of a buyer’s market (all of which are a long way off according to the stats that matter). OMG, how can sellers and the economy survive if there are no offers on offer night?!!!! What do you mean, the only offer has conditions?!!! They want an inspection? It’s conditional on the the sale of their house first? They want a financing condition? Oh nooooo, how will the real estate market, the economy and Canada ever survive interests rates that are still historically low and still will be if they double or triple? There might be multiple properties for sale in the neighborhood and the seller might have to clean the and mow the lawn before showing! Oh the humanity!!!

There is also flow between industries. An electrician currently working on a condo tower in Vancouver may have previously been wiring a potash facility or working at the dockyard. I don’t buy the argument that if completions drop 66% the construction cost would drop a huge amount and there would be an abundance of tradespeople. Too many moving parts. I can think of a lot of strata corporations, for example, that have been putting off large capital expenditures because they can’t find companies to do the work. If oil sustains at around $100 companies will start investing again in the oil sands, etc.

I’m not disagreeing but fact is completions have tripled since then. There is flow between cities and regions in Canada.

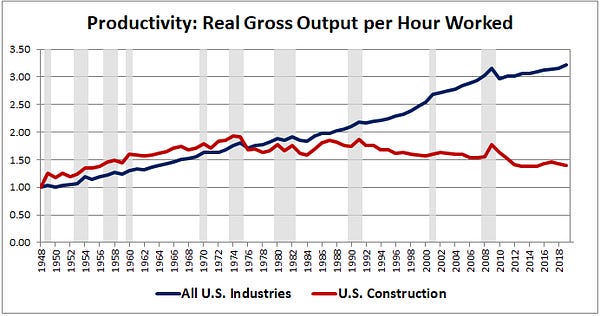

Long run we need big productivity increases in house construction. Big shift to prefab, factory built will be required. The industry is a mess

Monday numbers:

Sales: 637 (down 23% this week last year)

New lists: 1064 (down 8%)

Inventory: 1305 (down 10%)

New post tonight

When we were building in 2011-2014 in a time of 5x inventory, and 1/2 the sales and “slow construction” it was difficult to find tradespeoples. I remember a new house we built in 2011/2012 on Shakespeare Street in Oaklands it was difficult to find framers, siders, etc. Since then things went from very difficult to extremely difficult to the point where last 8 houses we’ve just done our own siding.

There is an absolute shortage of tradespeople that won’t be solved anytime soon. No one wants to work construction in modern day Canadian society. Who on HHV actually works physically in construction? Reality is everyone commenting/reading is government (municipal, provincial, federal), uvic, military, IT, healthcare, or some other large institution and we have a sprinkle of a few business owners and retired people with nothing better to do with their time.

To compound the problem will are bringing in over 400k/immigrants that are highly educated for the most part. We certainly aren’t bringing in drywallers and when we do (I have friend from Croatia that is a drywaller in Victoria currently working on the three Bosa towers in Vic west) they can’t get the paperwork as they don’t have enough points. He has already had to go back to Croatia twice as his permanent residency hasn’t come through. Has already spend $27,000 on an immigration lawyer still no permanent residency in sight.

Friends from in Croatia that are in IT, savvy enough to get in government jobs, etc., of course they already have permanent residency.

In my opinion, I think if the market turns you won’t see construction costs drop much but rather you simply won’t see construction taking place. The true knowledgeable tradespeople will still have plenty of work just servicing existing inventory of homes. If you are a plumber you aren’t going to drop your pants on a new build quote when there are endless hot water tanks to replace.

I’m just happy a true bear is back in the comments.

Totoro

” look at all the specific factors that affect our local markets and get a little closer to understanding why we are not Phoenix and why RE markets are influenced heavily by local factors.”

…. said everyone in Fort Lauderdale in 2006

Patrick:

“For example, construction costs fell 10% during the 2007 US housing/GFC. That is something, but 10% is hardly a “crash”, as it just set the construction costs back to where they were two years previous.”

Patriotz was correct in his assumption except for construction costs and he was still right to a certain extent. In reality, builders absorbed the construction costs of building new homes. In 2007, “nationally”, new home builds cost $247,900. They then dropped in price until 2013.

“Historical Time Series

The following data are for new, single-family houses only. The Survey of Construction does not collect sales information for multifamily buildings or for existing homes.

Note – beginning in November 2019, these tables will be available only in Excel format. PDF versions will no longer be produced.”

http://www.census.gov/construction/nrs/historical_data/index.html

Perhaps, builders are making a fantastic profit right now and are blaming everything and everyone for their prices.

That is a problem. I would urge you to do your own research before making unequivocal statements. It is just… better.

Or we could think of Victoria as Victoria and look at all the specific factors that affect our local markets and get a little closer to understanding why we are not Phoenix and why RE markets are influenced heavily by local factors. This is well covered in past posts here.

Are you at least able to provide a single example where construction costs have crashed during a RE crash, or are we expected to take your word for it?

For example, construction costs fell 10% during the 2007 US housing/GFC. That is something, but 10% is hardly a “crash”, as it just set the construction costs back to where they were two years previous. And inflation was 1% during that time, unlike now ~8%.

The owners who are going to be stretched are already renting out these premises to people who have real money to pay.

If there’s a RE crash demand for labour and materials will crash too.

One more time I have to remind that demand and thus price for labour, construction materials, and yes land, is endogenous to the RE market.

People here are expecting rising rates to drop prices. That might happen. But to state the obvious, this also means that mortgage rates will rise, and the people most hurt will be first time buyers with the highest debt to equity ratios. Those first time buyers are unlikely to see much better affordability, as their mortgage payment (affordability) might be worse with higher payment (despite the price fall)

For example, reportedly Canada house prices have have fallen 2%, because rates rose .25%. And some here believe these lower prices will help first time young buyers.

That .25% rise in mortgage rates has increased monthly mortgage payments 1% for a first time buyer, despite needing to borrow 2% less (and slightly better down payment)

I’m hoping that prices fall too, but not hoping for rate rises, as this won’t help starting affordability for the first time buyers. The beneficiaries of these lower prices from rate rises will be rich cash buyers.

A 3% rise in rates increases mortgage payment about 27%, so a first time buyer would face worse 2% worse affordability even if prices had fallen 20%.(despite them being able to put 25% down instead of 20%)

I think we will see worse affordability if we see rate rises and price drops. Seems to me it will just mean better affordability for cash buyers ( rich people/investors) and not much net improvement in affordability by first time “regular Joe” buyers

Totoro:

“I’d be wary of maligning “investors”

I’m just basing my conclusions on information my friend. Oh, by the way, the RBC worst case scenario was determined by stress testing the market in their quarterly report to stockholders. I’m sure the media version provided a pleasant

http://www.livabl.com/2022/01/investor-appetite-driving-canadas-housing-boom.html

He said it’s become clear that investors are driving demand – offering some key data points.

Totoro:

“At most they are predicting a modest decrease of 2.3% for 2023.”

C’mon the next page tells the story. As Patrick pointed out the USA housing crash resulted in National home prices dropping 19% but … Phoenix – down 54%. Think of British Columbia as Arizona and Victoria as Phoenix.

Outlook varies across the country

“Every buyer across the country will feel the pinch of rising rates. But those in the most expensive markets that will feel it most. We expect downward price pressure to be more intense in Vancouver, Toronto and other pricey markets. This will translate into larger annual price declines in 2023 in British Columbia and Ontario. By comparison, we expect activity and prices to be more resilient in Alberta, where local markets have more catching up to do following a prolonged slump before the pandemic.”

I didn’t forget, the women and children still need a roof over their heads, so it is likely that they will be renting mortgage helper suites or empty rooms. Thus, avoid mass forclosures and steep price drop.

QT:

“Fast forward to the present. We are not seeing anywhere near 20% interest rates, unemployment rate is at 4.9%, and we will see an additional 20-24K of Ukrainians immigrating to BC in the coming months.”

…and you seriously believe that it would take 20% interest rates??? Unemployment doubled during the last crash, my friend and it was only 6.8% prior to the crash.

Make it 40,000 Ukrainians if you want .. they are all single mothers and children. Did you forget that all of the men between 18 and 64 were conscripted for battle.

royal-bank-of-canada-2124.docs.contently.com/v/housing-affordability-spiraling-to-worrisome-levels

Higher sensitivity to interest rates to add stress

Canadian homebuyers are a lot more sensitive to interest rate changes than they were 10 or 15 years ago as today’s sky-high prices

amplify the impact on mortgage payments. A one percentage-point rise in rates currently would boost payments by $315 per month

for a standard home in Canada (valued at $775,000), or roughly double what the increase would have been 10 years ago. Relative to

household income, the impact is two-thirds larger now. Everything else equal, a 150 basis-point rise in rates—our call for the Bank of

Canada—would propel RBC’s composite affordability measure for Canada by more than 7 percentage points (a rise represents a loss

of affordability). While income gains will provide a partial offset, it’s entirely possible RBC’s measure could spike to all-time highs in

the year ahead. A shock of this magnitude would severely stress homebuyers and exert significant downward pressure on demand.

Vancouver, Toronto and Victoria more sensitive to rate hikes

Every buyer across the country will feel the pinch of rising rates. But buyers in the most expensive markets will feel it most. That’s

because interest rate fluctuations affect mortgage payments more in Vancouver, Toronto and Victoria where mortgage sizes signifi-

cantly exceed the national average. RBC’s aggregate affordability measure could easily surpass previous peaks in all three markets.

Buyers in Montreal, Ottawa and, to a lesser extent, Halifax also face further material erosion of affordability. Most of Atlantic Canada

and the Prairies, on the other hand, are relatively less sensitive, containing downward pressure on demand.

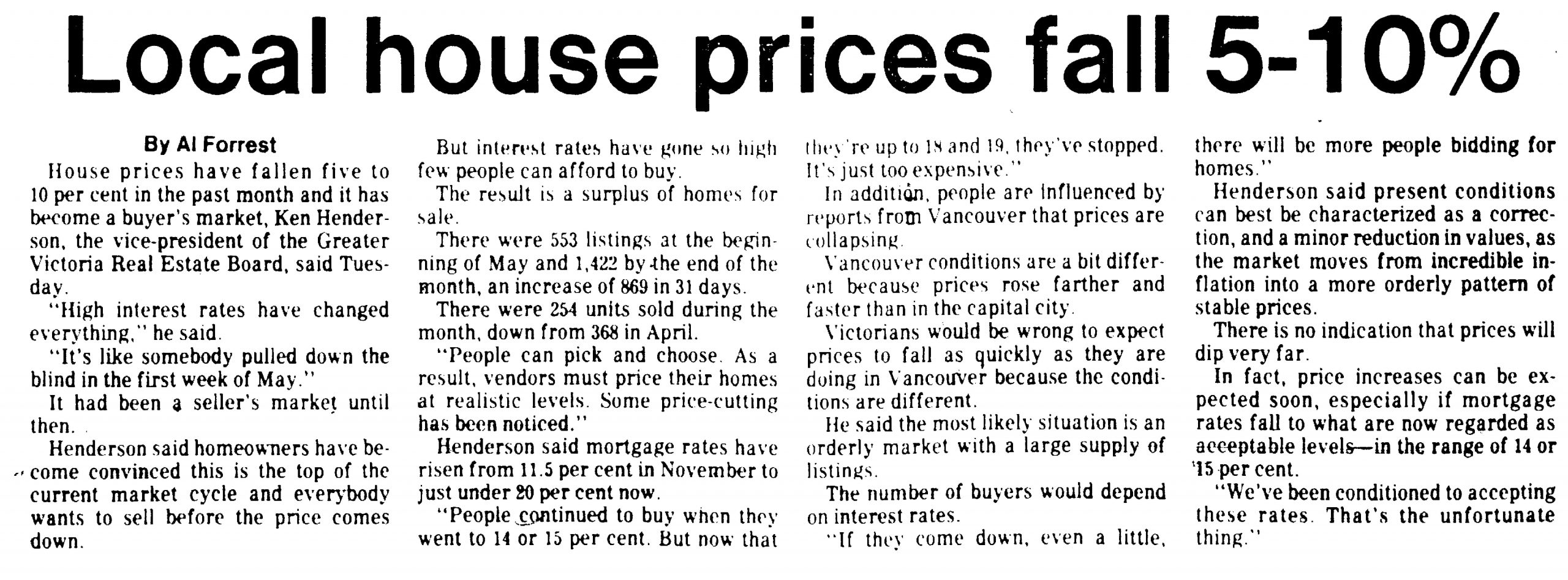

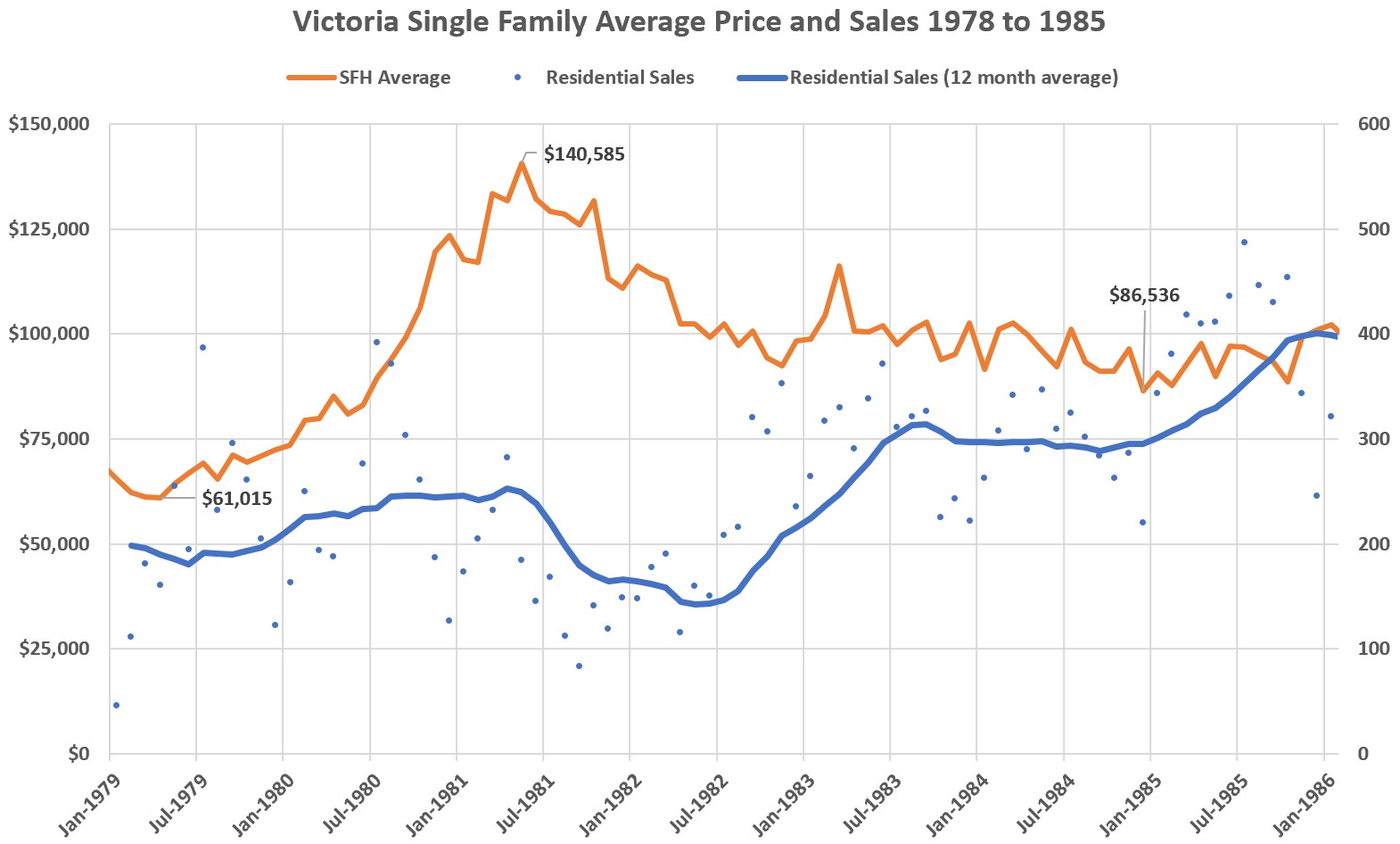

The last time that we saw a 35-45% crash from peaked in the CRD was the early 80s, and it took more than 3 years to bottom out. Interest rates were north of 20%, unemployment rate in BC ran up to 14.7% and if I recalled correctly Victoria unemployment rate peaked at around 18%, and for the first time in Victoria history that there were more people moved out than in.

Fast forward to the present. We are not seeing anywhere near 20% interest rates, unemployment rate is at 4.9%, and we will see an additional 20-24K of Ukrainians immigrating to BC in the coming months.

The conclusion is that we will not going to see the kind of crash that you predicted. IMO if there is a worst case scenario it may drop 20% from current price or roughly 13% lower than December 2021 price. But, I think it is likely that we see a flat line or a 5-15% drop from peak.

Impossible at this point, but man that guy has stamina. Still writing a post basically every day. Not right on real estate and I haven’t kept up with it at all, but I can see that the blog is still a good read. Surprised he never made the leap to Twitter.

“Throughout this astonishing time, a pathetic blog has ground out 4,451 original articles. That’s 3.4 million words (55 books) as a chronicle of daily history. And, below decks, the steerage section has churned out 777,100 comments (which were publishable).”

Usually when governments try to fix a problem in the housing market they do more harm than good.

Garth Turner making a come back! If he lives another 50 years eventually he will be correct.

Lots of fat in sub trades they will be the first ones to take it on the chin

Super dumb headlines in the media aren’t helping.

Headline: “‘Intense’ price drops coming to Vancouver housing market next year: RBC”

Reality of forecast: “That 3.8 per cent drop (in Vancouver) would be the largest decline among all provinces”

Thanks. Interesting. That’s why I think the votes like the rapid affordable & missing middle + villages and corridors upzoning are so important. When the downturn arrives we are going to need low risk projects that builders can work on without a multiyear process.

The somewhat arbitrary number I have heard over the years is a “crash” is a sustained drop in an asset price of at least 20%. Less than that is considered a “correction”.

By that metric, 30% would be a huge crash, regardless of whether it would “only” take us back to recent valuations or not. It would be even more devastating if it occurred all in a 12 month period, and I hardly mean just for homeowners. If the knock-off effects from that also killed off employment, then that will amplify the problem. It’s not like we can do CERB again, at least not if we want to have a functional currency in the next few years.

I believe the worst precedence in Victoria for RE valuation drops is just over 40%, which occurred after a very swift rise in valuations as well as interest rates, and at far smaller real debt levels. We’re not well positioned as a country at the moment to weather such a storm…not that it will matter one way or another when the time comes.

RBC is stating a 40% plus crash within 12 months? Where are you getting your information? Please don’t say Garth Turner…

Here is the RBC prediction for 2022: “We think prices will generally peak this spring before weakening modestly through the remainder of this year. However, stronger-than-expected gains so far this year will result in a higher annual average price for 2022 than we previously anticipated.”

At most they are predicting a modest decrease of 2.3% for 2023.

https://thoughtleadership.rbc.com/rising-interest-rates-a-game-changer-for-canadas-housing-market/

If it is about the future of the real estate market appreciation/depreciation, it is a belief or an opinion – and mostly a guess. Lots and lots of factors affect RE, including those outside of our control or expectation – like a pandemic or war.

The best a person could reasonably say right now is that price increases have been way above average and historically this doesn’t seem reasonable or sustainable. Looking a the past we’d expect a long period of flat or slight decline in prices. Interest rates are a powerful factor in consumer confidence so maybe there will be a bigger dip – not sure. 34% of Canadians are mortgage-free and a lot don’t have that big of a mortgage so rate increases don’t hit everyone the same way.

Also, we need rentals. Our vacancy rate is less than 1%. More than 30% of Canadians rent. We aren’t building enough purpose built and subsidized housing to keep up with the need. Until we address this situation, I’d be wary of maligning “investors” who rent out a home or apartment. I’d be in favour of a capital gains tax on primary residence sales over a certain amount to fund affordable housing.

QT

“What is a crash to you 5%, 10%, 15%, etc… lower than Dec 2021 price?”

If the RBC is seeing a 30% drop worst case scenario, I’ll say 40+% in some of the “hottest” markets. I’m saying 20 months and the bank is saying 12 months. If Macklem goes cowboy on June 1st and raises the prime by 3/4%, I might shorten that timeline.

“In the bank’s downside scenario, they see the potential for a sharp fall — sharper than most expect. In a contraction, their forecast shows prices falling 30% over a 12-month period. This would be large enough to be considered a crash. The following four years are forecast to see an average of 4.2% compound annual growth. RBC’s downside scenario is the biggest of any bank.”

That’s a tough one Leo, right now the margins are so high with some developers and financing soo cheap they have a lot of wiggle room. Costs also vary so drastically from building to building they can do some value engineering to bring things down if needed.

When the condo market softened around 2016 it was the general contractors in town who took a bath. Between Farmer and Campbell they lost hundreds of thousands of dollars on individual projects while developers only left a bit on the table when prices rise shortly after. Historically the GC and the trades are the ones who gets squeezed.

What is a crash to you 5%, 10%, 15%, etc… lower than Dec 2021 price?

And, will you eat your hat if the housing market doesn’t crash within the next 20 months?

Del

I think there’s a difference between bullish and not bearish. I think the supply problems could mitigate a decline in prices. But I don’t think even chronic supply problems can lead to never ending price increases. Demand will still drop off if immigrants have poor prospects and more Canadians leave for greener pastures in the US.

I’d love to have a price floor index for condos that calculates hard costs to build below which devs will start to pull back Can’t find anything great though

Patrick:

” how long have you held the belief that Canadian house prices are overvalued, and about to crash?

Actually Totoro almost answered that for me. I won’t say that I was oblivious to the market but it certainly didn’t preoccupy me, especially after I retired.

I think the first time that the housing market really caught my attention was during the pandemic. What should have been an economic catastrophe turned into another big rise in home prices across Canada and especially so in B.C. and Ontario.

Like everyone, I had a lot of time on my hands and between walks with my wife and meals, I started looking into the reasoning behind this irrational event.

When I discovered that 19% of the home purchases in B.C. were made by “investors” after the BOC crashed interest rates, I started to see the evolution of the USA housing crash in Canada.

There were so many similarities it was scary and the fact that we all of a sudden changed direction on interest rates … wow. Unfortunately, it’s not a belief, it will happen … by the end of next year.

I’m not sure how people predict a crash when construction costs both labour and materials are going through the roof. How much can the land values really fall? And the cost of a home is only going to get more expensive with the step code and other government initiatives. Bureaucracy and red tape is only going to get worse.

The one thing that’s really amazing right now is wages are going up like crazy in the private sector. Never seen such wage growth in my life, it’s finally an employee’s market. Except in the government…

As far as depreciating assets go, houses can go down in price and sometimes do. It is helpful to keep in mind that the general advice is you need to be able to hold through a downturn to mitigate this risk.

As far as being an investor in housing, I”m not sure about that as I have no plans to sell for a profit, but only to transfer to family.

We have more than one house, but we also have four adult children, each of whom will need a place to live. Last year our oldest moved into one place. Next year another one will follow. Gives them options if they’d like to stay on the island – particularly if they want kids/pets.

Debt Monster – you might find it interesting to search through the archives of this site. Admittedly not the best search function, but a lot of debate over the years on debt/credit/cycles/mortgage rates. Some have believed a crash was imminent for years at a time. Those folks didn’t buy as they waited for the drop that never came and eventually were priced out of what they hoped for.

Seems likely that prices will stop escalating soonish, and maybe drop a bit. I don’t really know. Thought that would happen with the pandemic – whoops! What has happened over the past 40 years is that prices have gone up faster than inflation overall. Will it keep going that way long term? Probably, but not certainly, and not likely in a smooth line up.

Debt Monster,

Thanks for the reply. A follow up, how long have you held the belief that Canadian house prices are overvalued, and about to crash? There’s HHVers here that have been predicting (on various boards) a house crash since 2001.

Well no. Since we are not talking about a situation where there is equal selling of homeowners and investors. We talking about the condition that you mentioned, namely that homeowners are not selling and investors are selling. Isn’t that what you meant by saying this?

“Patriotz: Now I’ve said that I expect almost all owner-occupiers to hang in though higher rates, but I’m not sure that investors will have the same motivation to keep a property that’s burning a hole in their pocket.”

In that condition, prices are irrelevant (as is your “think about this” attempt to change the topic) . We simply end up with higher homeownership if homeowners are holding and investors are selling, regardless of prices.

It ought to be pointed out that Totoro is also an investor. Not that there’s anything wrong with that, I used to be one myself.

Patrick

“Just curious, are you taking any action based on your strong belief of the coming housing crash? Like selling your house? I hope not.”

Similar to Totoro and Local Fool, my house is my home. The turning of homes into commodities is just plain wrong.

Well not necessarily. Think about this. Everyone in the stock market is an investor. So in the stock market investors comprise both 0 net buyers and 0 net sellers.

How come stocks have gone down over the past week then?

Debt Monster,

Just curious, are you taking any action based on your strong belief of the coming housing crash? Like selling your house? I hope not.

FYI, I’m not planning to sell regardless of price ups/downs. I hope that prices do fall in Victoria, to allow young families better access to homeownership. At least back to July 2021 which would be a 20% fall in many cases. And it would be nice to see more inventory as well. Essentially a return to the “good old days” of 2019 🙂

Totoro

“It is not like buying a depreciating asset with credit.”

Frankly Totoro, I have no desire for a housing crash. Everyone will be impacted. It will happen, unfortunately and our kids will be the biggest losers in the game. I will hang on to this quote for a while, with your permission, because I believe that it has come at just the right moment as the housing market turns over.

You’re suggesting that investors will be net sellers in a crash. That means homeowners would be net buyers, and the homeownership rate would rise.

Do you have a single example in history where a house price crash had rising homeownership?

Because usually the opposite occurs – ie) homeownership falls and investors buy the homes up cheap.

The most recent examples of this are Ireland (78->70%) and USA(69-63) , as you can see on the chart.

The same would unfortunately happen here in Canada. The reason is the banks tighten lending requirements, which shuts first time buyers with low incomes out of the market. Because they “can’t qualify”, despite the lowered prices.

The self employed people who are incorporated (that I know) usually pay themselves a low wage to avoid paying a lot of tax. They are usually writing off expenses such as their vehicles, gas insurance, repairs, etc.. through their business. Even part of their home for business use. Advantages salaried people do not have. Then when they go for a loan, their declared salaries do not meet the threshold to qualify.

Probably should have set their asking price lower if they wanted to sell.

But it’s true, of the 31 single family properties listed on the 14th, 10 are sold, 19 are active, and 2 are cancelled (failed setups for multiple offers).

up-and-coming:

“You mean they are an anomaly in your experience. I don’t know very many over-leveraged people, so maybe you’re basing your opinion on the not so savvy people you surround yourself with and I’m simply doing the same.”

Being retired, I would think that everything was rosy as all of my friends have paid off mortgages. Confirmation bias for consumers and plausible deniability for banks and governments.

“While over half of those surveyed are concerned about their ability to repay their debts should rates increase, 59 per cent still believe now is a good time to buy things that they otherwise might not be able to afford thanks to those low rates.”

http://www.ctvnews.ca/business/half-of-canadians-within-200-of-not-being-able-to-cover-bills-debt-payments-survey-1.5379871

…. and here’s one from a less followed blog for anyone that is interested in “anecdotal stories”. I’m sure the resident realtors could chime in.

http://www.greaterfool.ca

“This note came on the weekend from a blog dog in Victoria – where the average property in March traded for $1.23 million, a 27% year/year hike. But that was last month. April’s cruel.

Self-employed people who have a decent income are usually incorporated and they can pay themselves a salary and get a T4 to circumvent that.

” You don’t live forever and if you are 55 plus, and particularly if you have RSP room to cover the capital gains taxes, it seems like a pretty good time to sell to me.

This is my situation. I sold some property this year for these reasons as well as to prevent OAS clawback when I have to take OAS at 71. I also cannot use the RRSP deduction after age 70 since my spouse is older even though I have plenty of contribution room. It also makes sense for probate purposes.

13,000 single family lots in CoV

77 garden suites built to date

There is a big difference between choosing to sell and having to sell because you can no longer afford it. Agree that very few will have to sell because they cannot afford to keep the home.

As for second property owners, people sometimes age out of this if it is not a family cottage or bought for a family member’s use.

Someone not wanting to hang on for 7-10 more years might well consider selling right now. There have been two years of startling appreciation and it looks like it is going to slow down. You don’t live forever and if you are 55 plus, and particularly if you have RSP room to cover the capital gains taxes, it seems like a pretty good time to sell to me. I would classify this as a good business decision rather than some sort of hardship.

That’s looking back at 40 years of declining rates of course. Now I’ve said that I expect almost all owner-occupiers to hang in though higher rates, but I’m not sure that investors will have the same motivation to keep a property that’s burning a hole in their pocket.

What is an over-leveraged person btw?

We need a definition for homeowners if you are going to apply it to the data successfully because lenders apply affordability criteria quite thoroughly in my experience and having to qualify at the posted rate means that new buyers have been professionally assessed as not being overleveraged and have some room to weather some variable rate increases.

For buyers who have owned for longer, they are sitting on a lot of equity that provides a big cushion should mortgage rates rise a lot and they then decide to sell. And by longer I guess that is only two years or more in our market given the appreciation over this period of time.

Housing is good debt historically speaking if you can hold through the flat and down and are in a market like Victoria. You need to live somewhere. It is not like buying a depreciating asset with credit.

Research shows that the people who get into trouble with housing purchases in our market are most often those experiencing uninsured illness, that stops them from being able to work, divorce, or addictions issues like gambling/spending.

I can only speak for what is happening in Winnipeg. The auction house I deal with has not had a mortgage sale for months. When they did have one it was aggressively bid on. Foreclosures are occurring all the time, but the current market across the country easily absorbs them. Until buyers go on strike (a term I heard on BNN relating to the stock market), the limited availability of real estate will keep prices stable. I’m basing my outlook on the housing market on this premise: there is more money than real estate. In fact, higher interest rates would put even more money into “money hoarders” bank accounts. Not everyone is hurt by increasing rates.

You mean they are an anomaly in your experience. I don’t know very many over-leveraged people, so maybe you’re basing your opinion on the not so savvy people you surround yourself with and I’m simply doing the same.

More than two undoubtedly. The question, as always, is how much are they willing to pay?

I am guessing currently probably a year +/- to obtain a garden suite permit in COV.

Problem is if they think a window facing a neighbor is too big instead of emailing you back comments in a day or two like a normal private organization it takes three months. Designer makes the change in 10 minutes and then you wait another 3 months for next set of comments.

I’ve become bullish on real estate long term as I don’t believe the beauracy issues will be addressed in my lifetime. It will just get worse and worse and zero appetite to fix.

Makes perfect sense. Spending too much time on garden suites and not getting a lot of results? Raise the fee

https://www.timescolonist.com/local-news/victoria-to-raise-garden-suite-fee-but-faces-bigger-obstacles-in-pushing-small-homes-5294209

Our mortgage is through RBC. I’ve never heard of this but maybe it is a presales product?

I’ve seen lenders partner with the developer and guarantee rates, but usually >2% higher than going rate at the time of contract.

Frank and Patrick. I don’t know whether you’re baiting me or simply myopic. Lol

First of all, Frank, as Barrister pointed out, the mortgages in the USA are amortized over 30yrs – one set rate for 30yrs. The ARM mortgages that you’re referencing seems eerily similar to a Canadian mortgage. You know, where you could get a 5 yr mortgage for 1.95% and then suddenly at renewal it’s at … Bank of Nova Scotia – 4.9%

http://www.cbsnews.com/news/adjustable-rate-mortgages-make-a-comeback/

“Prospective homebuyers, who can’t afford to pay cash, have two basic mortgage options. The first is a fixed-rate loan, usually with a 30-year payback term to spread out the interest and principal payments. The other is an ARM, which comes in many different forms.

A simple ARM allows the buyer to obtain a fixed-rate loan for an initial set number of years, say, five or seven. Then over the rest of the loan term, the mortgage rate is adjusted, say, yearly or every three years, to the prevailing rate — plus a margin — that the mortgage lender pays to borrow the money it then lends out as a mortgage.”

“I believe, for every over-extended home owner, there are two buyers to take their place”

No comment.

Patrick

“The “collapse” referred to in the us housing crash wasn’t a price collapse (since 19% over two years isn’t that big a drop). Select markets (phoenix, Las Vegas) had bigger price drops,and grabbed the headlines, but the overall drop across the US was only 19% spread out over two years.”

Those select markets had the biggest price increases and the biggest drops. Where does Victoria stand. Oh right, in B.C., the highest home priced market in Canada.

http://www.npr.org/2018/04/28/603678259/10-years-after-housing-crisis-a-realtor-a-renter-starting-over-staying-put

“Phoenix felt the housing collapse worse than almost anywhere else. On average, homes in the metro area lost 56 percent of their value — the third worst in the country.”

The meltdown in prices left hundreds of thousands of homeowners underwater on their mortgages, owing more than their houses were worth. Some chose to stay in their homes. Some walked away by choice. Many were forced to leave. Foreclosures swept across the city by the tens of thousands.”

“The point being, for a typical US long term homeowner who paid their mortgage, the “price party” didn’t end, as prices only dipped 19%, regained all time highs 6 years later and have never looked back.”

Patrick, during the USA housing crash home ownership crashed! They had to put a moratorium on foreclosures because there were so many. I guess if you’re mortgage is paid off everything is tickety boo regardless of interest rates.

http://www.investopedia.com/ask/answers/062515/how-was-american-dream-impacted-housing-market-collapse-2008.asp

“The collapse of the housing market during the Great Recession displaced close to 10 million Americans as rising unemployment led to mass foreclosures.1 In 2008 alone, 3.1 million Americans filed for foreclosure, which at the time was one in every 54 homes, according to CNN Money.2 The demise not only ruined the American Dream but increased skepticism among the younger generation that had yet to enter the housing market.

As the housing market stabilized and prices began to climb, skepticism remained. By the second quarter of 2016, the All-Transactions House Price Index had surpassed the pre-crisis high.3 However, homeownership in the United States continued to fall. A combination of growing inequality and the lingering mistrust in the financial system kept many on the sidelines. By 2016, homeownership in the United States had dipped below 63%—a 50 year low. 4 “

Well, we do have a lot of people here that weren’t well qualified that skipped high ratio insurer scrutiny by recieving down payment gifts to reach 20% down. Those folks weren’t even able to manage their money well enough to save a down payment…. So, how much of a rainy day fund will they have in place weather increasing rates and inflation costs? Since their families have already tapped out to help them buy, they might not be able to go back to the well for more cash. Also, if market goes even into a flat state, that HELOC they were counting on probably won’t be there either. Multiple generations of some families in the last few years may have committed fully to a single illiquid asset class in Canada and I hope that people don’t get hurt because of it.

https://househuntvictoria.ca/2022/04/19/april-19th-market-update/#comment-87385

I’ve heard that RBC does a 2 year mortgage commitment and rate hold. So as long as the borrower’s financial situation stays the same, then the formal mortgage approval at time of closing will be straightforward.

Not the case in Vancouver circa 1982 or Toronto circa 1990 either. But we got busts anyway.

Busts are caused by affordability exceeding sustainable limits. Different ways to get there, but that’s why they happen.

And yet OSFI just pointed at loose lending around self employed borrowers as a reason to tighten the rules.

“Recent supervisory reviews identified several common issues around underwriting, specifically income verification in areas that have been raised as being problematic in the past including business for self, rentals, exceptions to income sustainability as well as collateral management,” the report reads.

“Recent growth in such lending has amplified risk for lenders,” OSFI added. “Supervisory review work has revealed that lenders need additional guidance to ensure their underwriting policies align with the principles of Guideline B-20.”

You do the initial qualification at the time of your purchase agreement and deposit. However, the rate is not guaranteed for years down the road for the completion. Once completed, you would need to qualify again and have a mortgage written at the rates available when possession is available to you.

No, you arrange the mortgage when you get the place, not when you buy the presale.

I was wondering on the purchase of a prebuild condo which is very common right now, if one receives a pre-approved mortgage…..is the interest rate guaranteed by the bank? Especially if the completion date is a couple of years away. If it usually is, would the banks still give a guarantee with the rates so uncertain right now?

If the Central banks are successful in controlling inflation they will need to greatly reduce excess demand and the labour shortage. A weaker economy as well as much higher interest rates are likely needed to do this. Both effect housing. If they quickly react to economic problems and ease policy, inflation and ultimately interest rates will probably increase. If inflation is controlled, (like 1994-96) interest rates eventually decrease to “normal” levels which are much higher than rates in 2020/21. Not sure about Victoria but Canadian housing prices would be expected to decline by a moderate amount in the controlled inflation scenario.

The U.S. housing crash was completely avoidable. Greedy financiers lent money to unqualified borrowers at a temporary low rate and then when the real rates kicked in, the were immediately in trouble. They took advantage of some pretty stupid people that did not realize what they were signing, but were lead to believe they could afford a house. It was a scam. That is not the case today in Canada. Not everyone can qualify for these low rates. Self employed people are usually shunned by the banks and have to pay higher rates from secondary lenders. Once rates get to the 5% GIC levels and people start dumping their dividend paying stocks for a guaranteed rate, stocks will plummet, the public will scream and politicians wanting to be re-elected will produce the data that shows inflation slowing (miraculously). That will happen long before house prices decline. I believe, for every over-extended home owner, there are two buyers to take their place. Watch the markets tomorrow, they’re poised for another steep decline, but there will still be bidding wars on properties.

US Fed says peak house prices was early 2007, though that’s close enough to your 2006 price . One remarkable thing about the US “crash” is that median prices from peak to trough only fell 19% (down $48k, from $257k in 2007 to $208k in 2009). They regained that loss in 6 years (2013) and haven’t looked back. If our Victoria SFH market lost 19%, that would bring us back about only 9 months to July 2021 prices.

The “collapse” referred to in the us housing crash wasn’t a price collapse (since 19% over two years isn’t that big a drop). Select markets (phoenix, Las Vegas) had bigger price drops,and grabbed the headlines, but the overall drop across the US was only 19% spread out over two years. The crash referred to was the crash of the subprime mortgage industry, with collapse of the highly leveraged sub-prime players (Lehman, bear sterns), triggering the GFC. https://en.wikipedia.org/wiki/United_States_housing_bubble

The point being, for a typical US long term homeowner who paid their mortgage, the “price party” didn’t end, as prices only dipped 19%, regained all time highs 6 years later and have never looked back.

Chart:

The foreclosures didn’t end the party, the foreclosures took off because the party was already over. Foreclosures aren’t the cause of falling prices but an effect, since foreclosures are rare when almost all owners have equity (i.e. at a market top). That said, when things really get bad, the foreclosures do keep the ball rolling.

US house prices peaked in early 2006. Compare to the foreclosure chart following.

Patrick:

“You’ve run-off-the-rails there Debt Monster.”

Lol. So much for the kiss principle. Even further off the rails – 420.000 people do not have an average $477,0000 mortgage. Clearly that’s per mortgaged household. The last census stated that there were 176,676 private dwellings in Greater Victoria.

The message is still similar though, as pointed out by Local Fool. If 1/3 of those mortgaged households have a balance under $100,000 and another 1/3 has a balance under $300,000 …. yes, Victoria has a mortgage debt problem as highlighted by the headline. The 5th highest in Canada.

I will defer to Local Fool’s analysis.

It look like the rest of Canada would feel the pinch with higher interest rates long before BC, Quebec, and Ontario. And, the rest of BC is going to default before Vancouver and Victoria.

Canada residential mortgages in arrears as of January 2022 — https://cba.ca/mortgages-in-arrears

Mortgage Delinquency Rate: Canada, Provinces and CMAs (2012 to 2021) — https://tinyurl.com/3dnctz44

You’ve run-off-the-rails there Debt Monster. That study you quote that found $477,128 average Victoria mortgage specifically excluded mortgage-free homeowners, and also excluded anyone over the age of 69. So your conclusion about “moving up” the average mortgage for those with mortgages to $715,000 is nonsense.

https://borrowell.com/blog/costs-of-living-canada-homeowners-vs-non-homeowners

“Report findings are based on credit report data of 874,111 Borrowell members in Canada between the ages of 20 and 69 for August 2021. For this study, homeowners are considered to be consumers with active mortgages on their credit reports. For this study, homeowners do not include consumers who have fully paid off their mortgages. “ “Victoria $477,128 mortgage debt”

Agreed!

Local Fool

“I don’t think that’s a fair conclusion. It’s not that simple.”

It’s not my conclusion, Local Fool. “Greater Victoria homeowners hold some of the highest mortgage debt in Canada, according to a credit education company’s new report.” “In Greater Victoria, the average was $477,128, only sitting below Toronto, Vancouver, Burnaby and Surrey.”

Let’s make it simple. If there are 420, 000 people in Greater Victoria and the average mortgage is $477,000. Simply subtract the mortgage free home owners and guess what? If it is 1/3 mortgage free then the rest are picking up that share of the mortgage burden. The average moves up to over $715,000 for those homeowners. IF another 1/3 only owes $300.000, well you know where I’m going here.

Oh, by the way, the BOC is turning off the music. Probably the first sign that the dancing and party is over.

I haven’t been here long enough to know Leo. Lol

I don’t think that’s a fair conclusion. It’s not that simple.

Let’s presume “up to their eyeballs” means owing more than 450% of gross income. Let’s say 2/3 hold a mortgage, with an average amortization period of 25 years. That means that current mortgage holders generally consist of buyers from 1997 up until today.

Across that spectrum, there is a huge variation in leverage used, and balances owing. I think a fairer thing to say is buyers that have purchased at <450% within the last six years, and especially the last two, represent a cohort that is more highly leveraged (and, higher risk). However, it's not clear to me how much of that cohort is at <450%. I do believe there is data that indicates such, although it might exclude private lenders.

You could rebut me by pointing to the US housing bubble in 2008, which had massive foreclosures and nearly brought down the financial system. I raise that point because only a tiny fraction (I think 5-6%) of mortgage holders ran into trouble but it was enough to end the party for everyone. Will that happen now, in Canada?

The comparison isn't really apples to apples, there hasn't been a lot of NINJA loans and B20 will probably have some measure of protection. But in terms of national consumer leverage, the pervasiveness of RE and its related industries in the economy, and its now-grotesque share of GDP, we are IMO much worse off than the US housing market was in 2008. Even so, the reality is it's virtually impossible to know until the party stops and you have the benefit of hindsight. I've been sure myself so often in the past, but here we are and somehow the deck chairs are still getting shifted with buyers getting shafted.

There have been anecdotal reports starting to pop up that some RE markets have gone "lights out", rather than the moderation everyone talks about. Hmmm…

I think Leo is a great moderator!

up-and-coming

“For all the hawks, bears and monsters out there:”

Well friend. the Local Fool is the anomaly and I am happy for him.

As for me, I have been retired for the last 8 yrs and I am sounding the alarm to a whole generation of kids that obviously bought into the shlock about interest rates never rising. It was us boomers, who should have known better, that sold our kids down the real estate river. Perhaps, those $340,000 “gifts” to the kids in Vancouver will bite boomer’s asses as well.

Being retired gives me the time to enjoy blogs like this that are actually filled with interesting characters and an intelligent semi-unbiased moderator.

For all the hawks, bears and monsters out there: this is your average homeowner. Smart, measured and in control. Are there overleveraged people out there that could suffer and have to sell due to rising interest rates? Sure, but you’re not going to benefit from their misfortune because someone with much deeper pockets will, so stop wishing/hoping for “The Crash” so you can get into the market at a price you think you deserve

“Back to the doom and gloom. So many things have to happen for house prices to drop dramatically, other than interest rate increases. I just got out of school in 1982, and unemployment was horrible.”

https://www.stats.gov.nl.ca/Statistics/Topics/labour/PDF/UnempRate.pdf

Frank, similar to Patrick, good example and wrong conclusion. While you were chasing the basketball in school, unemployment was at 6.7 and 6.8% in 1980 and 1981.

Interestingly, in the very same year that mortgages jumped to over 19%, unemployment doubled. Perhaps, they were Real Estate Agents lined up for that receptionist job.

http://www.stats.gov.nl.ca/Statistics/Topics/labour/PDF/UnempRate.pdf

“Banks are reluctant to foreclose on anyone who is employed”

CMHC insurance protects your lender in case you can’t make your payments. Unfortunately, the nice banker has CMHC insurance on a $800,000 mortgage for a house that is worth $500,000. What do you think the nice banker will do? Did anyone naively believe that the insurance was for their benefit?

” Not everyone is in debt up to their eyeballs”

This is absolutely true and it makes things even worse in Victoria. So, presuming that 1/3 of the home owners in Victoria are mortgage free then the other 2/3 are mortgaged up to their eyeballs.

“In Greater Victoria, the average was $477,128, only sitting below Toronto, Vancouver, Burnaby and Surrey.”

https://www.sookenewsmirror.com/news/average-greater-victoria-homeowner-holds-500000-in-debt/

“Most investors have other sources of income to compensate for higher mortgage payments, if they don’t, they shouldn’t be in the game.”

C’mon, Frank. Everyone turned into an investor when interest rates dropped and prices were rising.

“Twenty per cent of homeowners in the City of Vancouver own more than one property. For the wider Census Metropolitan Area, the figure is 16.4 per cent – a number matched in the Toronto CMA.”

http://www.theglobeandmail.com/real-estate/vancouver/article-in-vancouver-and-toronto-as-many-as-1-in-5-homeowners-own-more-than/

I will help you out this much. You are mortgage free but the rental income on your secondary home is probably breaking even or maybe earning you enough to hold on until you can sell for millions of dollars to finance your retirement. DO NOT follow the market down. Drop your price ahead of the market and get out with enough to help your future self enjoy some golf.

Good luck

Can’t wait to be a demonized millennial by the Covid-Kids much like the current crop of whiny millennials like to blame the boomers!

Debt Monster- 1.4 million, that’s so last year. Back to the doom and gloom. So many things have to happen for house prices to drop dramatically, other than interest rate increases. I just got out of school in 1982, and unemployment was horrible. I was looking for a receptionist and they were lined up around the block for $5 an hour. It was depressing, they were desperate. That doesn’t exist today, you need high unemployment to force people to sell their properties. Banks are reluctant to foreclose on anyone who is employed. Vacancy rates would have to rise substantially for investors to get nervous enough to sell. Most investors have other sources of income to compensate for higher mortgage payments, if they don’t, they shouldn’t be in the game. Finally, demand would have to dry up completely. If anything, higher interest rates will cause the stock markets to correct (look at Monday’s futures) and the money people cash out might go to safer tangible investments, like housing. As improbable as it may seem, higher rates might drive prices higher. Houses are simply not that liquid, when the sell orders come in and no one is buying, that’s a knife you don’t want to catch. Not everyone is in debt up to their eyeballs, I would be surprised if the market corrects 10%.

Ha. Not if you’re Hawk it isn’t.

Clearly before your time. But, no worries: Spice up your rhetoric a bit, get a hate-on for Introvert, use that graph with regulatory and there’s at least a few of us that would welcome the nostalgia. I miss the guy, personally. One example for you.

“Hilarious reading the homeowners panicked posts trying slag those who hold zero risk as the bubble starts to leak its noxious fumes. Saw a lot of “new price” signs out there today. All their wives will be screaming “why didn’t you get us out when they were lined up around the block and stuffing our mailbox pleading to sell?” “Because I’m a greedy bastard dear.””

I bought in 2019 with about 15% down. First renewal in 2024. At 2.69% fixed right now, I have zero concerns about renewal time; if it’s 4, 5 or 6% – whatever. We didn’t over-leverage. Like I said I don’t think we’ll get to normalized rates anyways. Not interested in what the prices will be when I retire. We bought this house to live in, not to make money with. I just wish renos weren’t so damn expensive. 🙁

https://youtu.be/RzybAS7zltE

Local Fool

“You’re all doomed. For old times sake.”

Lol, I’m not sure of the reference, but “doomed” is subjective.

As long as your mortgage is under $500,000 and you weren’t planning on using your home equity for retirement, you should be able to ride this one out. Maybe?

You’re all doomed. For old times sake.

.

No one has said that.

I’ve never said that rising rates won’t affect the market. For example, about 5 posts down I thought I made that clear when I said “ Rising rates have a negative effect on prices.”

I summarized my position in the next sentence in that post which is this

“It’s the hot economy that makes the prices go up despite the rate rises”

So I happen to believe that the positive effect of the growing economy and rising incomes will be greater than the negative effect of the rising rates. That may or may not happen, but it is not in the realm of “pure fantasy” as you put it.

Wont you just correct that by redrawing the “carved in stone” constraint lines on your affordability chart like you’ve done in the past?

Wrong question to ask. You are once again ignoring prices and I’m out of different ways to say that prices matter so won’t be commenting further.

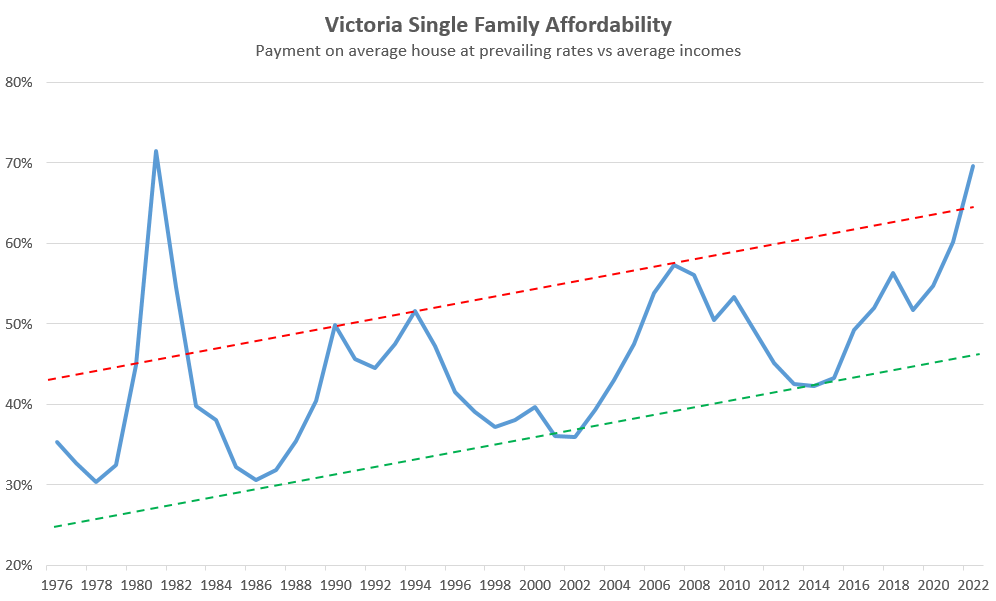

Prices + interest rates = carrying costs which are set against carrying ability of buyers. Irrational exuberance can push that affordability ratio very out of whack for a while as it did in the early 80s in BC and late 80s in Toronto, but eventually it comes back to earth.

We are currently somewhat outside of historical norms for affordability, but not as badly as back then. Rising rates could push us there though. The idea that rapidly rising rates won’t affect the market is pure fantasy.

Patrick:

“So the question is: Can anyone provide their best example, anywhere/anytime in the world, where mortgage rates rose to fight inflation, and house prices quickly fell.”

I take it that Canada doesn’t fit your description. Perhaps, next month you’ll want an example where Victoria’s house prices have fallen and then it will be an example of a home on your block and then finally an example of when your home was affected.

You’re whistling past the graveyard, my friend.

Have we found a new ‘Hawk’?

Frank:

“The sky is falling! The sky is falling! Relax people.”

So says the boomer trying to cash out on his $1,400,000 home next year when he retires. Sorry Frank, very few buyers want to catch a falling knife when price drops start to accelerate.

I appreciate the reply. I don’t want to rain on your “prices fell 2% in March 2022 vs February” parade. But you should be aware that Victoria benchmark SFH prices rose 3% MOM in March 2022 ($11-9k->$1142k), and median SFH rose 1.5% In March 2022 MOM ($1293k->$1312k) https://www.vreb.org/media/attachments/view/doc/stats_release_2022_03_2/pdf/stats_release_2022_03_2.pdf

So I want to confirm, is that 2% price drop that you reference your BEST example of rising rates lowering prices? I say that because you seem to have decades of statistics at your fingertips, as well as google. And your example of price drops is a little underwhelming, since it isn’t being seen in Victoria at all.

If you’ve got a better example, with a bigger price drop, take a mulligan and post it.

The sky is falling! The sky is falling! Relax people.

Patrick

“So if rate rises cause immediate drops on house prices, why did it take ten years of rate rises for prices to fall?”

Okay, my friend, I will explain it to you as simply as possible why today’s jumbo mortgages are so interest rate sensitive.

http://www.superbrokers.ca/tools/mortgage-rate-history

Interest rates on 5yr. fixed mortgages went down from 12% to 10.25% in 1976/77. Let’s use 1978 as the starting point when rates started to actually climb the next year. If you took out an average suburb $60,000 mortgage in 1978 at 10.25%, it would take 2yrs of mortgage hikes before you saw a substantial 4.25% hike in mortgage rates and your mortgage would cost you an additional 24%.

https://tools.td.com/mortgage-payment-calculator/

Today, with a mortgage of $800,000 secured at 2.59% in 2017 …. yes, cheaper mortgage rates were certainly available, a 24% hike in your payments would only require a mortgage rate of 6.4%. (after 5 yrs of principal repayment) Currently, the Bank of Nova Scotia’s 5yr fixed rate is 4.99%. 2 months ago it was 3.99%. Do you have any guesses where that 5 yr rate will be after June’s rate hike … or more scary after what happens this Monday at the end of QE.

Leverage is so much fun going up and not so much so coming down.

Patrick:

“So the question is: Can anyone provide their best example, anywhere/anytime in the world, where mortgage rates rose to fight inflation, and house prices quickly fell.”

How about Canada, last month, when interest rates went up .25%. Yes, there was a whole myriad of reasons, I’m sure. Nobody buys in March, all the good homes sold in February… but a “best” example of interest rates going up and the market responding negatively, immediately.

https://www.crea.ca/news/february-home-sales-rise-as-buyers-scoop-up-first-of-the-2022-spring-listings/