Consumer sentiment revisited

As the market has shifted somewhat lately, I thought it was worth revisiting a topic I wrote about some years ago: the power of consumer sentiment.

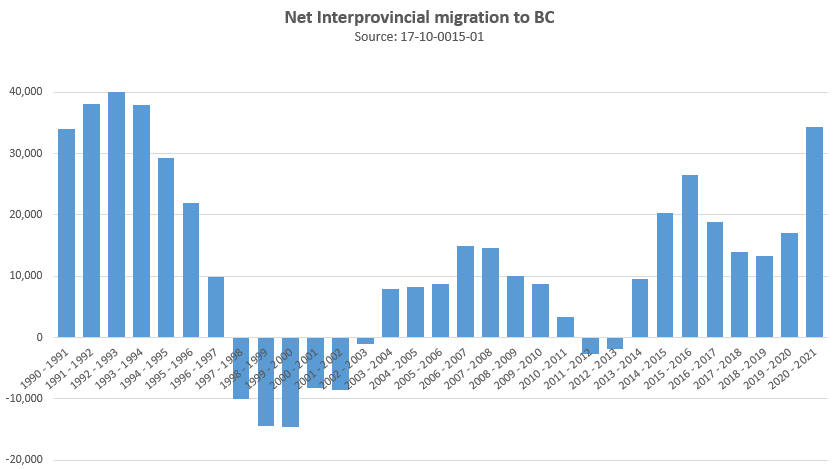

In a hot market when houses are appreciating at thousands or tens of thousands of dollars a month, it’s very hard to understand that anyone wouldn’t be interested in buying real estate. We still have the majority of properties selling in bidding wars, the rental market is super tight, and we just hit a 60 year high in migration to the province. Surely prices will simply keep going up for the forseeable future, even if it is at a slower rate. That could happen, but what’s not to be underestimated is the power of consumer sentiment. When everyone is hot for housing there’s no stopping the market, but when they’re not, real estate can suddenly get really boring for a long time.

Let’s look back to May 2008. The spring real estate market was in full swing in Victoria and the economy was doing well with a record low unemployment rate of 2.6%. We had a rental vacancy rate of 0.5% which was pushing rents up and making buying more attractive. Construction was on fire and thousands of condos were rising around the city while in Langford they were building out Bear Mountain at a rapid pace. Oil was north of $100/barrel and that was causing a flood of Hot Albertan Money to pour into the city. In addition wealthy boomers across the country were approaching retirement, and what better place to come than here?

The median single family home that May sold for $545,000 which worked out to $2865/month with 20% down at prevailing interest rates. While that was getting pretty high for local incomes, prices had doubled in the past 5 years and everyone knew someone that had made a fortune in real estate. 441 buyers came to the conclusion it was a good time to jump in and bought houses that month.

Fast forward 5 years later to May of 2013. The median single family house sold for $525,000, but due to lower rates, the mortgage payment on that had dropped to only $2221/month. And yet, people were cautious, with only 346 people deciding to buy that month while thousands of properties languished on the market. Average Victoria incomes had risen 9% after inflation and required payments had dropped 22%, so why weren’t people pouring into the market? Victoria weather was just as lovely as 5 years earlier, the jobs just as secure, and Canada’s population of retirees bigger than ever. Yet somehow there was little activity.

Back again to May 1994. The real estate market had just come from another frenzied run which saw prices double in Victoria. Though sales were off from the peak in 1991 (those records weren’t broken for 25 years), it was still an active market in Victoria with the median detached house selling for $234,088, or about $1550/month. The rental vacancy rate was 0.8%, which seemed like a relief after the previous year’s 0.2%. Similar to now, people were pouring into BC from other provinces and the city was growing quickly.

Five years later in May 1999, the median house was selling only moderately lower at $220,000. However thanks to dropping mortgage rates, the payment on that came to only $1243/month. Incomes were up and payments were down by 20% but no one was excited about buying. One might think the leaky condo crisis would have driven people to the comparative safety of detached, but if it happened it didn’t do much for the valuations of houses.

In both those situations, real estate had become boring. Stories of outsized appreciation were replaced with stories of difficult sales and stagnant listings. Even though prices had been remarkably stable, many felt that it wasn’t worth jumping into a market that wasn’t making any money.

Hard as it may be to believe now, real estate will become boring again in Victoria. Though the market has no doubt been stronger for longer than I expected, perhaps that period is starting now. Prices in Victoria have shown incredible resilience to slow markets in the past, and whether that continues depends a lot on what happens to interest rates. In the past two cycles lower rates lessened any slowdown and kept prices stable. The market may have been boring, but the continually dropping price of entry kept enough of a buyer flow going to keep everything on the level. This time we don’t have a lot of room to drop rates unless we go into negative territory. On the other hand we really have no precedent for this in ours or any other modern market, so we’ll just have to see how it plays out.

Also weekly numbers courtesy of the VREB.

| April 2022 |

Apr

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 247 | 1116 | |||

| New Listings | 439 | 1516 | |||

| Active Listings | 1175 | 1454 | |||

| Sales to New Listings | 56% | 74% | |||

| Sales YoY Change | -12% | ||||

| Months of Inventory | 1.3 | ||||

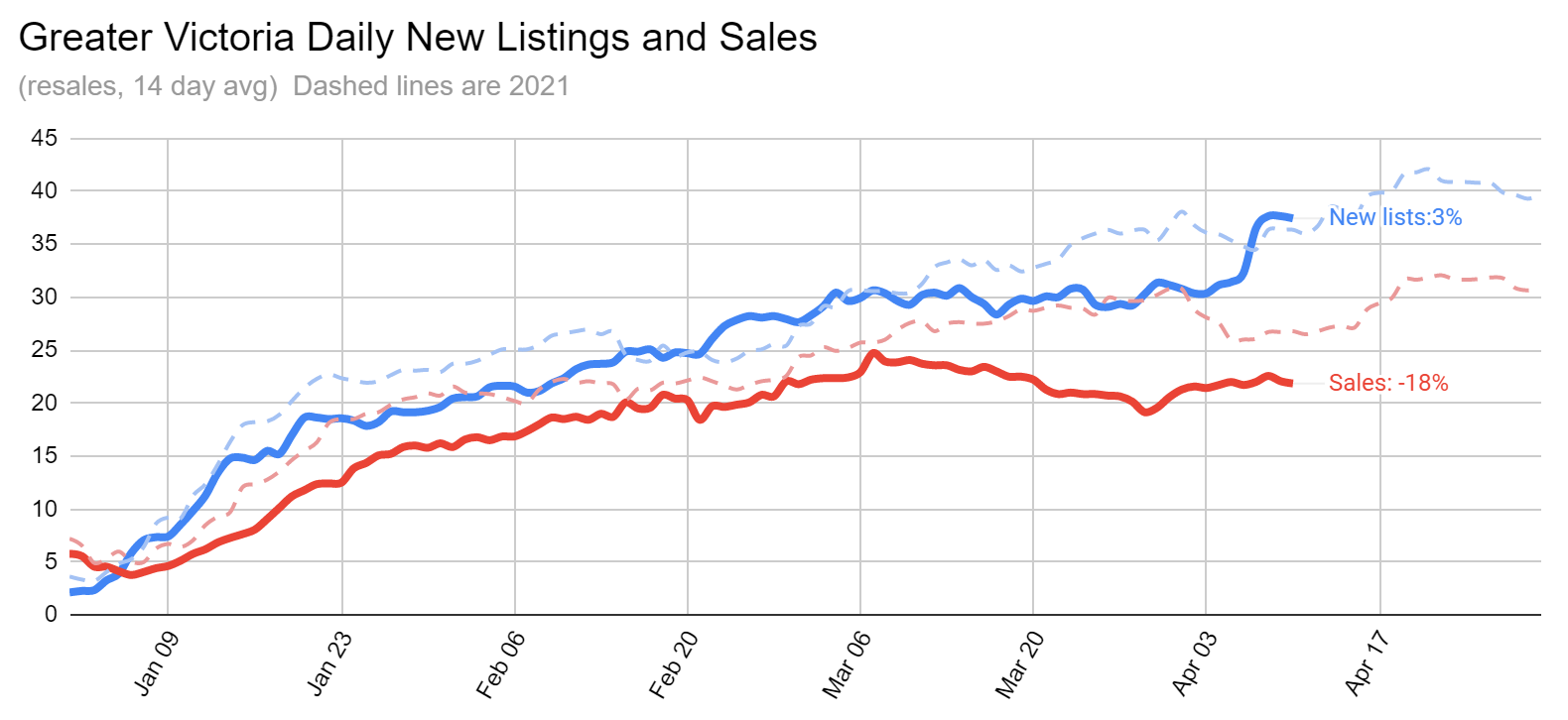

Meanwhile it’s an interesting week ahead in the market. After lagging in March as people went travelling, new listings bounced back last week to the levels of last year. The doubling in listings on Thursday may cause some problems at offer nights this week if the pool of buyers are spread too thin. Watch for properties to be relisted potentially at closer to market price if the offers that do come in just aren’t attractive enough.

Sales meanwhile have stayed pretty stable, ending the slow decline in March as some buyers also returned. The rate of over-asks has also stabilized at around 58% of all properties going over the asking price in the last couple weeks. Expect an increase in sales this week as some of last week’s listings are absorbed. However if the market continues to slowly cool off we should expect the gap between new listings and sales to grow and build up active inventory. Variable rates are going up this week, with the consensus being a 0.5% jump on Wednesday. Strong prints on economic numbers have given the increasingly hawkish Bank of Canada the cover to pull this off ahead of the US.

Another day, another increase in bond yields. Up to 2.7 today…

I feel like anyone who has built has stories. The whole thing is an elaborate dance…from the design process to permitting to inspection and occupancy (and it has been for ages).

Fair enough. Still way ahead of obtaining a HELOC and buying toys with the HELOC funds.

Couldn’t agree more with this.

There needs to be some sort of reasonable expectation/standard. If Langford can process a building permit for a 2,000 sq/ft SFH in two weeks, it shouldn’t be 6 months in the COV/Saanich.

+1, garden suite is a DP (staff can comment on design and other nonsense) plus BP after. The process takes around 9 months right now. I’ve been stuck waiting for a permit for 6 months on new builds and the frustrating part is there isn’t anything tangible that I see come out of it. You wait 2 months than you get feedback like “hose bibs need to be drawn on the plans” (the action of drawing the bibs takes 2 minutes, but you wait 2 months to hear about it) when the previous 20 houses no one has ever asked for location of hose bibs on a SFH. Then you resubmit and wait another two months. Then they are like, ohhh we need an arborist report because the water line you’ve drawn is too close to a tree.

They pay you to be a professional NIMBY? This is the job for me!

About 20 years ago the District of Saanich sent a delegation to the City of Langford to see how Langford had set up their system of issuing building permits. At the time Langford had been around for about 10 years and was issuing a building permit for a house in one to two weeks and beginning to set up a process to issue a new house permit in 48 hours (which is in place and still exists to this day). Saanich arrived with a number of folks including planners, inspectors and administrative staff. The better portion of a day was spent showing the Saanich folks how the process was streamlined to make this happen. To make a long story short at the end of the day Saanich said we can’t do that and left. These days Langford is much bigger and a little slower but still light years ahead of Saanich (and Victoria). Why can’t Saanich (and Victoria) make the changes to speed up their process? Simple, they don’t realize they have to act like a business and give their clients value for their money.

Yup.

You could very well be right that a variable would have been better despite today’s rising rates, but a fixed rate is what makes me the most comfortable.

Similarly, paying my mortgage on schedule and investing surplus cash in Fortis and Telus stocks might also be better mathematically, but I don’t feel comfortable having huge debt hanging around my neck for multiple decades.

You mean to get the building permit takes 9 months?

You should do a story on why a 700 sq/ft garden suite on slab in Saanich takes 9 months to approve in a housing crisis (keep in mind this is once submitted, will take you a few more months beforehand to survey, design, engineer, arborist, etc.)

Anonymized, they’re probably not trolling the HHV comments 🙂 That’s part of the problem too, no one really wants to complain because the fear that it will work against them in the next project.

At 1.50% the variable would have to be under 1% for my >0.50% spread rule to apply. I had a few clients in 2021 get the 0.99% HSBC 5 year fixed, obviously at that point you are going fixed but those were some short lived opportunities.

Probably would be better to get my 25k bond back first 🙂

I suspect the economy will implode well before we could get that high.

You should email me the complete timeline of this. Would make for a good story.

My own suspicion is that the five year rate will stay fairly low at somewhere between six and seven. Eight might be possible as well. Those still seem like both reasonable and also low rates of interest. I suspect that the days of virtually free money are behind us.

I also agree with always going the variable route although when we took out a mortgage early last year we couldn’t pass up 1.50% 5 year fixed rate, we could have paid off the mortgage but why, at 1.50% it’s more like a forced savings plan with over 70% of monthly payments going to principal.

I am not an intellectual, but I have enough common sense to know that no one including myself can predict real estate, stock market, inflation, or anything else with a high degree of certainty so it is not something I include in my personal decision making.

I keep it way way simpler. Irrelevant of what the situation is if the discount is >0.5% I am going variable. Between all my properties I’ve had more than 15 five year terms come and go so far and not one would have been more adventageous with the fixed. IF we see 8 more rate hikes I guess I might have 1 or 2 that would have worked out better had I gone fixed, barely.

My mortgages ran for an extended period at 1.2-1.3% (versus 2.6% 5 year fixed). That means to offset that those variable mortgages have to run at 3.8-3.9% for an equivalent period of time, but I am still at 2.1% even after these rate increases. Also, keep in mind everything resets at the 5 year mark including the 2.6% fixed so if my 5 year variable is ending at 5% you’ll be having to refinance your 2.6% at higher than 5% too.

Would you have selected a variable mortgage 2.5 years ago (vs a 5 year rate of 2.6%), if you knew inflation of 6% was coming in 2 years?

As I mentioned a few weeks ago. COV mini street sweeper machine operator 74k/year. Low skill, low stress, low physical exertion. Why would you actually want to get a real job in construction? If you are a framer, for example, (requires skills) employeed for a contractor/company doubt you are making 100k taking huge risk every day like installing trusses, working in the rain, skin exposed to the sun, no flex fridays, no mental health days, etc.

A lot of my clients are complaining that they can’t even get anyone to provide estimates…..well kind of makes sense to me.

Removing politics, good, but unfortunately bureaucracy is insane and there is no appetite to manage it. There is a reason why a graden suite DP/Permit in Saanich takes nine months and not two weeks which would be reasonable.

If you are making 100k/year as the tree preservation coordinator at COV, you can look up the positions here ->

https://www.victoria.ca/assets/Departments/Finance/Documents/2020%20SOFI_signed%20final.pdf

with flex Fridays, vacation, pension, benefits, etc., where exactly is your incentive to be efficient and reasonable in approving development? Your goal is to reduce liability (i.e. pile on as many useless required consultants as possible which add to housing cost), take your sweet time approving everything, take a few weeks to reply to emails. Maybe expand from two tree preservation coordinators to three. All of a sudden now more managers are needed and so on. In our case the tree preservation coordinator delayed our project 6 months over literally nothing tangible and obviously zero recourse.

I can’t blame the tree preservation coordinators as I would act the same in their shoes. Turn off my email Thursday afternoon and resume work Tuesday after my flex Friday and personal day Monday. The system enables it as there is zero accountability.

Still working on trying to get my bond back for the gold-plated sidewalk….submission to COV last week

“Included you will find

Record Drawing

Construction Completion Certificate

Site Inspection Reports

Geotech Reports”

For a sidewalk!! How did we ever build sidewalks 50 years ago.

Is it thought? 5-year fixed mortgages 2.5 years ago were around 2.6-2.7ish?

All my variables are still well under that (ranging from 1.2 to 1.3 below prime) so around 2.1% (after the recent 0.5% hike) plus 2.5 year head start. Not only do they need to do two more rate increases to bring it up to 2.6%, but then they need to continue increasing rates to offset the 2.5 year head start being well below.

Blind bidding has been around forever, and was blind bidding the culprit for the price crash or ascend in the past?

Or, it is the politicians and the rest of the gullible lemmings are looking for bogeymen to blame, other than the dynamic of the market reaction to supply and demand compounded by the ran away money printing machine?

IMO, the market will correct itself once inflation catch up (as I predicted 2 years ago), and politicians are held accountable for fiscal performance.

Blind bidding has been around forever, and was blind bidding the culprit for the price crash or ascend in the past?

Or, it is the politicians and the rest of the gullible lemmings are looking for bogeymen to blame, other than the dynamic of the market react to supply and demand compounded by the ran away money printing machine?

IMO, the market will correct itself once inflation catch up (as I predicted 2 years ago), and politicians are held accountable for fiscal performance.

https://www.theglobeandmail.com/business/article-canada-real-estate-ban-blind-bidding/

I rarely agree with much of the federal and provincial policies, but bringing in the Ukrainians is a brilliant move that not only help these people in needs, it also provides hardworking workers that we desperately need. However, the housing shortage/costs will continue to rise for the foreseeable future, because BC going to see at least 20,400 to 24,000 people almost immediately, and they will be sponsoring the rest of their family to join them here.

https://globalnews.ca/news/8757706/bc-ukraine-refugees-update-april-13/

https://news.gov.bc.ca/releases/2022MUNI0011-000483

Whole heatedly agree.

We have to revisit our culture to validate the work and risks that Canadian do in our modern environment. For decades we over value paper pushers and sales men, while put little effort to compensate for the hard work and risks of blue collar women and men that build our houses, clean the sewers, and keep the lights on in our homes.

Once blue collar workers compensate properly or at least match the government workers average wage of $29.34/hour (2019 figure) instead of $24.74/hour according to Indeed for Victoria skilled labourer, then perhaps we could increase staff through trades school instead of having youth trip over themselves to go to University for that liberal art degrees. And, then there is the feast or famine factor that doesn’t make the trades attractive as a secured desk job.

https://www.welcomebc.ca/Choose-B-C/Why-Choose-British-Columbia-Canada/Income-and-Wages

https://ca.indeed.com/career/skilled-laborer/salaries/Victoria–BC

patriotz- My point exactly, house hoarders have no impact on the market. Thank you.

Every buyer and seller impacts the market. The question is how much impact a particular group of buyers or sellers has, not whether they have an impact.

Your particular example wouldn’t prove anything, since there are always other factors than investors affecting the market. Like whether you have a global financial crisis or something like that.

In the previous post, the rainbow chart of months of inventory showed on November 2008 moi was a massive 15.7 months. I guess house hoarders were responsible for that scenario also. It would be interesting to know what percentage of houses were owned by owners of multiple properties back then. I would guess it would be similar to today’s number. That would prove to me what impact house hoarders have on the market. None.

Approving stuff is one thing, but there’s not enough labor in the city right now. Farmer, Campbel, Kenetic, knappett are short staffed and turning away projects among a few other companies.

Good news, but don’t anyone think that staff won’t be able to throw sand in the gears, too.

Frank, That’s great to hear that you’ve had good tenants in BC for 33 years – you must be doing something right! As an aside, I grew up in the same long term house rental for over 20 years. My dad always fixed the minor house problems so we never bothered the landlord. Our landlord was a real nice lady and I still think about her fondly to this day. So you really are providing a good service and helping people.

Well yes, that’s was the point. Anyway, I’ll assume that your position is what you wrote on housesforliving.ca (which I agree with) about insecure rentals/evictions resulting from individual investor landlords. And I’ll ignore your recent posts and your “inconvenient truth” chart which seem to be in praise of these same “BC house hoarders.” Perhaps your intended message in that “inconvenient truth” chart wasn’t clear or I misinterpreted it.

And so, as an answer to the question you posed “who should own these rentals”, I’d advise people to ignore your chart and instead read http://www.housesforliving.ca Thanks for the discussion!

Good question. I believe the “housing stock”, (i.e. the denominator) includes all types of housing including purpose built rentals owned by non-individuals. However the numerator only includes those properties owned by individual owners that own multiple properties (so no purpose built rental). See the original chart here: https://www150.statcan.gc.ca/n1/daily-quotidien/220412/cg-a001-eng.htm

I can’t for the life of me reproduce those numbers from their data table though which only has the owners and the average properties owned by each, but it doesn’t add up https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=4610003001

Does “housing stock” in that chart include purpose built rentals? Nova Scotia has much more PBR relative to condos compared to BC or Ontario, and I would suspect the same for NB, since it has seen low population growth in the last 50 years relative to BC or Ontario. Completely different issues compared to individually titled properties or secondary suites.

https://financialpost.com/personal-finance/mortgages-real-estate/the-secret-behind-halifaxs-ability-to-build-purpose-built-rental-housing-at-a-record-pace

Leo- Clearly house hoarders are not responsible for high house prices. According to your chart, B.C. has the lowest percentage of housing owned by owners of multiple properties and the highest prices. While the Maritimes has the highest percentage of owners of multiple properties and the lowest prices. That’s the way I interpret the chart.

Sorry, typo forgot a zero. 1500 sq ft/ 140 sq m

Does the house hoarders chart also includes Properties owned by out of province residents for vacation and kids attending to universities?

sq.m?

150 sqft, for 5 bedrooms, means that they could have been max 5 feet by 6 feet (you could probably squeeze a bed in there?), and that’s if there’s no kitchen/bathroom/living room.

Are you quoting the content I wrote back to me?

There’s also local housing Victoria BC advocacy groups that are saying the same thing as me about these suites and privately owned SFH being lousy rentals.

https://www.homesforliving.ca/about-us

“ More units also mean more alternatives to basements suites and privately owned homes where there is the constant threat of being evicted because the home was sold or renovated”

I thought you were involved in this advocacy group (you’re still listed on their about-us page) . So what gives??… do you stand by that statement of theirs that suites and privately owned SFH are insecure rentals in that there is a “constant threat of being evicted”?’’ And if so, why are you so happy when statscan announces 29% of of BC properties being owned by these individual investors, instead of wing owned for secure primary long term rentals?

Here’s more quotes from the http://www.homesforliving.ca site, where they are saying the exact same thing as me, in that we need more primary (long term rentals) and less insecure rentals where the homeowner plans to (and does) evict the tenant.

“Our failure to build rentals has forced tenants to depend on private investors for their housing. However, that housing is insecure as tenants are often evicted when properties sell. BC has the highest rate of forced moves in Canada due to insecure rental housing. This shortage encourages investors to buy up multiple homes and drive up prices because they know families have no other options for rentals. About 1 in 5 Victoria homes are owned by investors. Current purpose built rental stock is 97% studio, 1, or 2 bed apartments not suitable for families. “

So given the above, for the question you posed “who should own these rentals”, isn’t the correct answer “purpose built and other long term rentals (reit/corporations/non-profits )”? And if you agree with that, why do you get bugged when Andy Yan points out the alarmingly high amount of house hoarding by rich individuals that are providing these insecure rentals, leading to evictions down the road?

Andy Yan has basically made a career of it.

https://vancouversun.com/opinion/columnists/douglas-todd-trudeaus-crackdown-on-house-investors-all-about-posturing-not-fixing

In B.C. and Ontario, an alarming 30 per cent of ‘homes’ are owned by individual investors. What’s worse is the richest 10 per cent of them hold around 25 per cent of the total housing wealth in New Brunswick, Nova Scotia, Ontario and B.C.

“It’s really about hoarding,” Andy Yan, head of SFU’s City Program, said Thursday. “You can grow the housing pie with more supply, but too many people are already on their third and fourth helping.”

I’m not sure why you made this chart, since noone has said multiple home owners are responsible for high prices.

I said some of them are responsible for lousy rentals, but only in the condition that the landlords evict the tenants and move in themselves. And that the solution to that is encouraging more primary rentals, which are long term and less likely to trigger evictions. https://househuntvictoria.ca/2022/04/11/consumer-sentiment-revisited/#comment-87145

Evictions for landlord use of property are common in BC, and BC leads the country in evictions. And that’s why people like the UBC Professor Lauster have said that “ it’s also a concern that so much of B.C.’s rental housing stock is in the secondary rental market — rented condos and basement suites.It’s much easier for landlords to evict tenants for reasons like family use. “. https://thetyee.ca/News/2019/11/26/BC-Eviction-Capital/

Clearly it’s the house hoarders that are responsible for our high prices

Yes, this is definitely true. Average apartment size might be 500 sq ft in Paris, and 1000 sqft in Victoria.

But we shouldn’t compare those prices (ParisVictoria), because the apartments are different sizes. Since there are 500 square foot places for sale in Victoria, we should compare with that. The numbeo site standardizes on 90 sq meters (about 1,000 sq ft) which does seem like a reasonable size to use.

Thanks for the discussion.

Patrick- I’ve never been interested in renting property in Winnipeg. All my life I’ve heard of bad tenants trashing houses causing more trouble than it’s worth. One reason I selected B.C. to invest in, the other being future retirement. I’m always amazed at how little problems I’ve had over the last 33 years. I’ve even had tenants fix damage they caused at their expense. I credit the property managers keeping tabs on the tenants.

I was responding to your assertion that Victoria has average affordability. And questioning if this data set supports that assertion:

Yes, it is interesting that Edmonton is the most affordable city outside of the US, Saudi Arabia and Johannesburg according to this metric.

But I am not surprised Edmonton 1000 sq ft apartments are more affordable than Europe. I grew up in the Netherlands in a 5 bedroom house that was 150 sq ft. Bedrooms and kitchens are much smaller in Europe. The 1000 sq ft Edmonton appartement probably has 2 bedrooms. Comparing that to a for European terms spacious apartment that probably has 3 bedrooms.

I am not familiar with other Australia or NZ so wouldn’t know how they compare. In most of North America spacious dwelling are definitely more affordable than most of the ret of the world.

Yes, that’s the methodology. Affordability = local incomes compared to Prices.

Edmonton has high incomes and relatively cheap homes, so great affordability.

Btw Frank, that numbeo link shows Winnipeg with a very high rental yield (7-8%), does that look accurate to you? https://www.numbeo.com/property-investment/rankings.jsp

My friend’s son (PHD) and his wife (MD) bought a house in Edmonton last year, it was close to $800,000, nothing fancy, just a newer build. Their combined income around $350,000. Lots of government jobs in Edmonton, all high paying, just like Victoria. Maybe it’s affordable compared to the local salaries.

Well no, my point was nothing to do with third world countries – that was your idea.

The affordability data I linked to (numbeo.com) listed 482 main cities around the world. That includes every country relevant to Canada house prices. You’ve focused in your reply for some reason on 3rd world countries in that list. But you can simply ignore those cities in third world countries , and focus on the cities that you do consider relevant, and you’ll still see that Edmonton has the most affordable homes in the world (aside from USA, Saudi Arabia).

For example, look at cities in UK, Australia, New Zealand, Europe, Japan, China etc. – you will see that no city is as affordable as Edmonton (or Winnipeg or Calgary). I find that interesting and relevant – but of course feel free to totally ignore it.

If your point was to point out that it is unaffordable to secure stable housing in a 3rd world country for people living off of a few dollars a day. Yes I agree Canada Is very affordable in comparison due to better job opportunities.

And I agree we are well off in comparison to most of the world.

Thank you for trying to educated me, but I belive that I know a heck of a lot better than you and the bulk of the whiners that constantly belly aching of how expensive and how hard they have it, but forget to look around and appreciates of how good we have it here in Canada.

And, sorry to bust your bubble, because once the Ukrainian refugees get established they will take over the jobs and housing, and the rest of your irks will come into here to complaints about how hard you have and how the DP take yer Jerbs! and homes.

I have to say that comment is in incredibly bad taste and hard to comprehend from someone of your background, who ought to know better.

If the term “affordable” bothers you, you can think of Canada house prices as unaffordable, and most of the rest of the world as “more unaffordable”.

Fact remains that Canada has higher homeownship compared to most countries and Canada is at or near all time highs homeownership. Both of those are signs that lots of Canadians are in fact affording the “unaffordable” homes here.

If they can’t afford a SFH in Victoria, they buy a condo which they can afford. Lots of nice affordable 2 bedroom condos in highly desirable neighbourhoods like James Bay, cook st village etc. for under $500k.

My home city in Vietnam house value has tripled in the last 7 years, and price has gone up over 30X in the last 22 years.

We all can be arm chair economic analysts, but the fact remain is that we are a heck of a lot better off than most place on the planet. If we want affordable and practically free housing, then look no farther than Ukraine, because I hear that the government is giving out free housing with skylights that come with free guns and ammo at the moment. Sorry no free drugs, free daycare, free dental, or free welfare.

I noticed Best in The Netherlands was on that list. This is a suburb of Eindhoven with less than 30,000 population. Hardly one of the main cities in the world. So I would question the methodology of which cities to include.

Also a lot of the more “unaffordable” cities on that list are from 3rd world countries. Saying that the average shanty town dweller will have more trouble affording an apartment downtown is harder in a third world country than a resident of Victoria affording an apartment here is hardly proof that Victoria is affordable.

You seem to really be reaching at straws now to prove your point of affordability

Right.

It looks from your description that Moncton would beat Edmonton for affordability. It looks like Moncton CMA population is 140,000 , so it was likely too small to make it on to the list.

That site does track other data for Moncton, and it looks like rents are about 10% lower there than Edmonton. https://www.numbeo.com/cost-of-living/compare_cities.jsp?country1=Canada&country2=Canada&city1=Edmonton&city2=Moncton&tracking=getDispatchComparison

I couldn’t find Moncton on that long list of houses and where they stand in price compared to other cities. (Maybe I missed it.)

However, I am not so sure that Edmonton is the most affordable place in Canada to own a house.

“The Canadian Real Estate Association released statistics showing that the average price of a home in New Brunswick has risen 24.5 per cent in the last year, going from $203,133 in October 2020 to $252,871 in October 2021.”

It looks like an Edmonto house is somewhere around $400,00.00

New Brunswick “might” be the least expensive in Canada…even with the large increases recently. If anyone has further info on that, I’d like to hear it.

(You can still get a large duplex in Moncton, updated condition, in a nice area, for $350,000. (Both units) (Rents $1,400.00 for each unit plus utilities.)

Well played!

Looks like that dogsled might come in handy today. That, and a snowblower 🙂 …

https://www.google.com/amp/s/globalnews.ca/news/8761362/winter-storm-warning-lifted-winnipeg/amp/

“ Preliminary provincial estimates suggest 15 to 35 centimetres has already fallen in much of southern Manitoba and the Interlake and Parklands regions, while some other areas received up to 50 centimetres.”

Of course Calgary, Edmonton and Winnipeg are the most affordable. In Alberta everyone gets around on horseback and in Winnipeg we all use dogsleds. The price of gas doesn’t affect us. What a pile of crap.

Edmonton is the most affordable city in the world to buy a home (excluding USA and Saudi Arabia)

If we look at affordability of homes in the main 482 cities in the world in 2022, the most affordable are in the USA, by far. Next best are in Saudi Arabia.

But, excluding USA and Saudi Arabia, the most affordable city in the world is …. Edmonton Alberta, with Winnipeg and Calgary close behind them. So three of the four most affordable cities in the world are in Canada (Edmonton, Winnipeg, Calgary) (limerick Ireland is the other one in the top 4).

This is from https://www.numbeo.com/property-investment/rankings.jsp (you need to click on the “affordability” tab to sort by affordability.

Note that this affordability measure (and definition) is to buy a 1000sq ft (90sq m) apartment in the city (average of city center and outside city center), with a median income / https://www.numbeo.com/property-investment/indicators_explained.jsp

Now, I understand that most of the HHV audience here wouldn’t consider living in Edmonton, in a 1,000 sq foot apartment. But the point is, almost any house hunter here could afford that apartment in Edmonton.

btw) Victoria affordability in 2022 is 192nd of 482 cities, which a little better than average affordability of the cities in the world. It ranks with affordability same as Wellington New Zealand and Copenhagen Denmark.

So Canada as a whole doesn’t have unaffordable housing, it has at least three major cities with very affordable housing (Edmonton, Winnipeg, Calgary)

These great options for home affordability is one reason that 400,000 immigrants will choose Canada this year. Because unless they’re coming from USA or Saudi Arabia, they’ll be arriving to a country where some cities have better housing affordability than anywhere in their home country.

Although we flirted hard (for the first time) with a variable, we opted for a fixed at our last renewal (2.5 years ago). At the time, the spread between fixed and variable was small, so we went for a 5-year fixed — third in a row.

Something I’ve lately been fortunate enough to come to understand and appreciate: the smaller the mortgage principal, the less interest rate matters. Paying down your mortgage aggressively is itself a form of interest-rate protection.

Interesting how much the luxury market cooled off after 2018 actually. Wouldn’t expect it to be that influenced by the mortgage stress test, but I guess it coincided with a dropoff in Vancouver buyers.

Hawkish Bank of Canada meets a 15 year high in Canadians on variables

Is Canada’s real estate market headed for a big fall or more gains? The case for both

https://docdro.id/4usbvB2

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-is-canadas-real-estate-market-headed-for-a-big-fall-or-more-gains-the/

566 ledsham is a few hundred feet away from the sooke rd, across the street from a large land assembly, with a neighbour on one side who has had a damaged septic system for years so it smells of constant sewage.

The house itself has one functioning bathroom as well.

And it sold for $1.2m. Undoubtedly a beautiful lot, but damn. It’s not only Royal Bay that has doubled in value the last three years.

I recall some discussion and interest in up island sales time to time on here. I have an acquaintance that just sold their property in Qualicum Beach the day before the BoC announcement. They got their price in selling nearly $100k over ask and bettered their comp sale by about $70k (a neighbour that sold 5 months ago). However, the scenario was very different on the demand and interest side. 5 months ago the neighbour had approximately 100 scheduled showings over a 3-4 day period and had offers from 20 people. The current sale had 7 scheduled viewings over the 3-4 days and 2 offers. One was from a local and the other from Ontario. Both the offers came from people that had failed offers before in the same neighborhood.

Wow indeed. Remember when winning $1m in a lottery would “put you on easy street”? Now it just gets you a healthy deposit and a $1.7m mortgage debt to pay off that tiny house.

Huh? Leo, you’ve written articles on the topic advocating purpose built rentals as sources of long-term secure rentals. But yet now you wonder out loud… “who should own the rentals”??? As a renter, wouldn’t you be more secure in renting from a company (reit) or non-profit owning hundreds of long-term rentals, vs renting from a speculator who plans to evict you so they can let their kid move in?

Why is this a question? If you want more forced evictions – the answer is more individuals (amateur landlords) owning the rental stock. If you want less evictions, then advocate for less individuals owning and more corporate owned (reit) and primary rentals. And also advocate for changes in rental laws to not make it so easy to evict a tenant so landlord or family members can move in. That would create a category of individual owned, yet secure long term rentals, and lower the eviction rate. One way to do this is by taxation, if a “landlord moves in” this currently crystallizes a cap gain – so the idea would be to increase the tax they pay from cap gains to full income on the profit they’ve made.

There are primary rentals (purpose built – very unlikely to get evicted) and secondary rentals (mom n pop … SFH, suites, onesy/twosy – high chance of forced eviction, because they’re held for shorter terms).

So my answer to the question …”who should own the rentals”? … is less ownership of rental stock by individuals (secondary rentals) and more by non-individuals ( primary rentals)

If anyone doesn’t know why this is is important, here’s some StatCan data showing BC as foreclosure capital of Canada, and analysis by UNC professor Lauster pointing out the same concern that the evictions are coming from the secondary market – individual “amateur” landlords. https://thetyee.ca/News/2019/11/26/BC-Eviction-Capital/

——-

“ New data from Statistics Canada shows that British Columbia is the eviction and foreclosure capital of Canada. The province has the highest rate of forced moves compared to the rest of Canada. In fact, B.C. residents are 70% more likely to be forced out of their homes than Canadians in other provinces.”

“ “[UBC Professor] Lauster said it’s also a concern that so much of B.C.’s rental housing stock is in the secondary rental market — rented condos and basement suites.It’s much easier for landlords to evict tenants for reasons like family use. Tenants have more rights when they rent in apartment buildings.”

For those who think Victoria is expensive, this $2.7 + million property in Kitsilano (vancouver) might help put things in perspective.

“WOW! A property like this is a rarity in this market. Don’t miss your chance to own a prime Westside property located in a coveted Kitsilano at a fantastic price point. Meticulously maintained by the current owners, this lovely post war bungalow on a 6,000+ square foot lot consists of 3 bedrooms and 2 bathrooms including a one bedroom suite. A cozy house for those looking to downsize, young families, or work-from-home couples with a dog.”

SP- Check out 411 Walker in Ladysmith. Assessed at $651,000, ask 1.2.mil., sold in a bidding war for 1.375 mil. 1950’s nicely renovated .25 acre.

Well lots of rental properties are owned by an occupant. Remember a house with a suite, or a non-strata duplex or 4plex, is a single property. So the property can be occupied by the owner and by a renter at the same time.

It’s something to keep in mind when looking at statistics. A neighbourhood can have a home ownership rate well below 100% even if every house is owner occupied.

Overwhelming public support too, partially organized by Homes for Living. Sets a good stage for future reforms in Victoria and other municipalities

Leo: that’s great news about the Victoria council tonight!

Good question, that is pretty out there on the distribution.

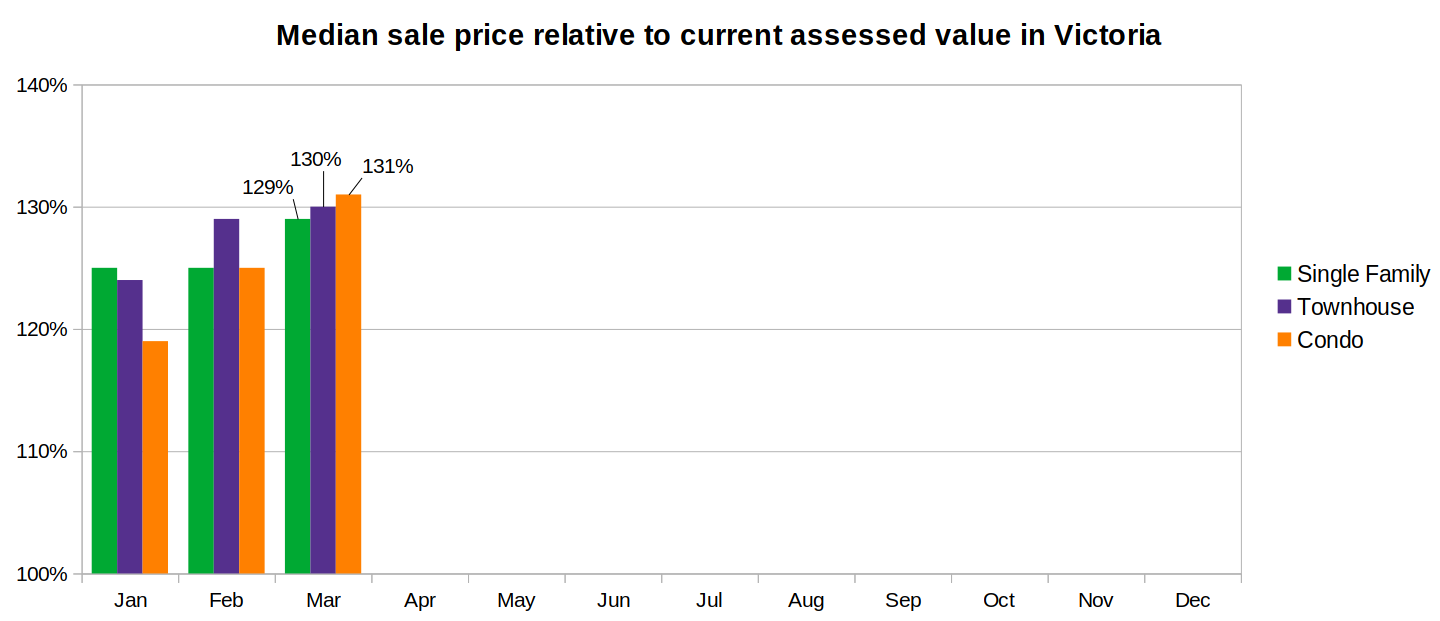

29% over assessment in March

Here is the distribution for the last 250 single family detached sales.

566 Ledsham at 50% over is at the 92nd percentile

Victoria council voted tonight to delegate approval of non-profit & government housing projects to staff. Saves time & money, reduces risk. Leads to more and more affordable housing. More info: https://www.victoria.ca/EN/main/residents/housing-strategy/affordable-housing/proposed-process-changes-for-affordable-housing.html

A bold first step in fixing our broken zoning system. Next up, votes for upzoning for missing middle and villages & corridors in Victoria.

2791 Dewdney is the most irrational sale I’ve been seen this year. Not Sure if a typo on the pending price or some expensive things like couple Porsche 911 included in the offer. By comparison, these 1.4-1.6 Royal Bay sales seem like pretty good deals.

What was the value proposal on 566 Lewisham fetching 50% over assessed on where it is? 1.2mill on 800k???

Leo – what is the over assessed on average for sfd this year so far? Maybe meaningless given some comments recently about very irrational sales prices?

$1.2M

Who knew the housing/homeless crisis was so simple?

No kidding. 32% of the population rents. Who do people imagine they rent from?

No one ever talks about the underlying question though. If not 68%, then what is the optimal ownership rate? And assuming it’s not 100% who should own the rentals?

I have no idea why this would surprise anyone. The truly wealthy people out there (the 1%) have more money/net worth than the bottom 90%, so why is it surprising that 15% of people in BC own 29% of property in a situation where housing is an investment? As frank.the.tank said, he’s not mad at individual realtors for taking advantage of the situation, it’s capitalism, so why is anyone surprised that capitalists out there are doing the same thing?

This is also explicitly calling out property vs homes. Not sure how this takes agricultural land into account. Farms are often spread out over multiple titles.

News Flash: 100% of the rental properties in BC are not owned by the occupant.

The drama around property investment is merely to distract.

Anyone know what’s going on with commercial properties in Langford? Looks like $/sqft double in the last year based on listings but I can’t see what’s actually selling?

Just take any houses where it isn’t clear who the owner is, convert to house the homeless. Problem solved.

Right, foreign ownership is tiny (as you’ve reported many times here). What is big is that 15% of BC owners have multiple homes and own 29% of all property. Most commonly they own two SFH houses. The ones that are renting homes long term help out. But the ones that plan and end up evicting tenants to move family members in are speculators that hurt more than they help imo, and should face higher taxes to discourage them.

https://www150.statcan.gc.ca/n1/daily-quotidien/220412/dq220412a-eng.htm

https://www.canadianmortgagetrends.com/2022/04/nearly-one-third-of-residential-properties-owned-by-multiple-property-owners/

“Roughly three out of every 10 residential homes in Canada are owned by individuals who own multiple properties, according to new data from Statistics Canada.

Multiple-property owners hold properties to receive rental income or for other investment purposes. This can include recreational properties, which may also provide rental income.

“Individual multiple-property owners hold a significant share of the residential property stock, despite accounting for a relatively small number of owners,” StatCan notes.

This is especially true in Nova Scotia, where multiple-property owners made up 22% of all owners in the province in 2020, but held 41% of the province’s property stock. In B.C., they represent 15% of owners and held 29% of property, and in Ontario they represent 15.1% of owners and held 31.1% of property.”

It’s a new deck, no demolition. Already submitted for permits. Pretty basic 250sq/ft vinyl deck, with black aluminum picket railings and stairs.

Can anyone tell me what 566 Ledsham ended up going for?

“It will depend a lot on whether you are talking about replacing the vinyl on an existing deck that is otherwise in good shape or if you are talking about demolishing an existing structure.”

The impression that was given to me is that if you are going to do structural repairs to an existing deck – even relatively minor ones like replacing a compromised post – you are supposed to get a building permit, which then triggers all sorts of stupid shit to bring the deck up to code.

Anyway, that was off topic. I have no idea what it costs to pay someone to build a deck. Hopefully the $65-$125 per sq ft isn’t just to re-deck an existing structure, because that seems crazy.

Re deck costs

It will depend a lot on whether you are talking about replacing the vinyl on an existing deck that is otherwise in good shape or if you are talking about demolishing an existing structure, drawing plans, getting permits, pouring foundations, building the deck, installing the vinyl, getting aluminum railings built and installed along with all the associated inspections. Stairs? And I am sure many combinations in between. Obviously the price will vary widely between those two extremes.

Does anyone know roughly what a price per sq/ft a vinyl deck costs these days? I have received wildly different quotes from $65 sq/ft to $125 sq/ft.

Does anyone know a rough price per sq/ft a vinyl deck should cost these days? I have received wildly different quotes ranging from $65sq/ft to $125/sq ft. $125sq/ft sounds pretty outrageous for a vinyl deck.

A fair point, but you’ve also missed mine. My issue is with the real estate boards, who set the policies that restrict information and prevent transparency, the politicians and government who are charged with oversight but who allow the boards to operate this way, and finally with the public who let both the government and the realty boards ignore their responsibilities when it comes to protecting consumers and serving the public good.

I have no problem with the realtors themselves who see an opportunity and take advantage of it. That’s capitalism.

“About 1.3% of properties in BC are owned by non-individuals.” Seems like a small amount, but probably represents the top end of the market.

The Land Owner Transparency Registry is a good step, but it seems that it will be still based on self declarations and the government does not have the actual ability to uncover complicated obfuscating ownership structures.

As the cbc story says, the ownership trail ends in tax havens where corporate records don’t disclose a company’s shareholders.

Or you can just go online and search for properties yourself. I’ve never noticed the difference a realtor makes except if you are uncomfortable with the process of buying/selling. Not to say there are not differences between individual realtors, or their commissions. Main thing is access to realtor.ca.

About 1.3% of properties in BC are owned by non-individuals. Most (all?) of those will be covered by the beneficial ownership registry when it takes full effect this fall. Not 100% sure if it would cover this ownership structure, but presumably yes.

As a buyer, I have a certain amount of responsibility to do my own inspection, including the neighbourhood. If you have to rely on the realtor to hold your hand through the entire process, you’re probably not ready to get into real estate. I’ve bought properties privately and through realtors. I never depend on anyone to inform me of every detail, that’s up to me. To blame someone else for a mistake you made is childish.

I cannot speak for others but I have always asked the realtor to give me a list of comparables for the neighbourhood. Actually, my practice was to ask three different agents for a list of comparables to make sure the agents where not cherry picking but I am naturally suspicious.

Perhaps in a long distance past before computers Real Estate agents might have buyers that where tied to agents and dependent on the magic book of listings (yes, paper listing before computers even existed) but not these days. These days every listing is on your phone. It would be great if all recent sales where there as well but ask agent to set up a portal to look at sales.

You must be the product of a modern education if you truly believe that the real estate agent is your friend or on your side. Having said that some agents can really give you helpful information but dont be shocked, after you move in, to find that your agent forgot to mention that the house next door is a crack house.

As a business person, I choose to deal with certain realtors to reciprocate for the services they have provided me. Such as managing a property, finding me a good deal, etc… Basically, I feel I owe them because they were partially responsible for my past successes. A diligent realtor can make you rich. A bad realtor can make you poor.

Once again, for anyone who is interested the best GIC rates have gone up again today.

1yr@3.28%, 2yr@3.45%, 30 Mo@3.5, 3yr@3.8%, 4yr@3.9% & 4yr@4.05%.

Because the consumer WILLINGLY chooses to pay for it. I did mere postings for 10 years and simply no mass appetite for it even if you show people all the proof in the world that it works like a charm.

Right now you have ability to mere post, full service lower commission options, etc. Consumer simple chooses not to embrace.

“+1. Yup, truly mind boggling how many sellers fall for this. Even when you ask the seller how they found the home when they bought they still fall for this.”

lol where is Jason Binab when you need him?

https://www.cbc.ca/news/canada/british-columbia/vancouver-island-mansion-harry-meghan-yuri-milner-pandora-1.6419328

Doesn’t this story suggest that we really have no idea about the actual amount of foreign ownership of properties in Canada?

Consumer confidence is on the mandate of every securities commission in the world (except possibly China). For that reason, data is published that allows consumers to pour through every detail to extract every piece of information that could be used to bet on the movement of securities, thereby making $$$$. For this reason, information is currency. It’s the basis of the “efficient markets hypothesis”; the market equilibrium ($price) reflects every piece of publicly available information, and if people have information that isn’t public, and they profit from it, they GO TO JAIL.

Why then, in the real estate industry, have we so little respect for consumer confidence that real estate boards hoard all of the transaction data, restricting access to only realtors who are then allowed to profit from it? And realty is the only sector that operates this way; StatsCan provides comprehensive public information on everything from economics to demographics to sociology.

The entire realtor profession is based on legal insider trading. Why else could someone with a license that it takes only a few months to achieve, be consistently amongst the top earners in the city next to professions such as law, accounting, doctors, etc who each require a decade of training and qualifications to become proficient and publicly trusted?

+1. Yup, truly mind boggling how many sellers fall for this. Even when you ask the seller how they found the home when they bought they still fall for this.

You you clarify exactly what you mean by lack of transparency? All of my buyers are set up on a feed where they see the reported sale prices of properties.

I’d look for you to qualify that claim, specifically, “unjust influence”.

Forgive the pun, but I think you’re giving them a lot of credit. Realtors have always been here, always been sales people, always made money when houses sell and starve when they don’t. Sure they make claims and arguments that are usually in their self interest, but that’s nothing new with either realtors or humans in general.

The best I think you could say is that they are opportunistic like any sales person, more “along for the ride” than anything else. If the RE market was perpetually dead, would you claim that an unjust element of poor realtor sales skills was stifling the market (and by implication, the wider economy)?

If you’re looking for the root cause of this problem, I’d much sooner blame people like Christine Lagarde, Jerome Powell and Tiff Macklem for their policies which are distorting the economy, and perhaps the BOJ for its instrumental role in setting the modern QE precedent.

Realtors aren’t even a footnote in this paradigm, IMO…

What, now realtors are the boogeymen?

Right.

It’s remarkable that much of the public think their selling realtor will find them a buyer or higher price through their special network of contacts and local knowledge. Even more amazing, is that the seller thinks they must pay the realtor full commission or their realtor might not be “motivated” to find them the best buyer. What a bunch of nonsense!

Thanks for telling it like it is Marko!

That’s the canned response of every realtor when pressed about the unjust influence of realtors on market conditions. Ironic, considering the subject of Leo’s post that we’re commenting on now.

Lack of transparency was the subject of my comment, not FOMO. FOMO is the fire that realtors are stoking to increase their commissions. Lack of transparency is what is enabling them to do it.

Yeah as much as I would like to have all market data and bidding fully transparent, I don’t actually think it will change the market by an appreciable amount. It might protect some people against irrational bids, but even that is not clear. A bidding process where you are competing and have the ability to raise your offer in response to another may lead to just as many irrational bids, possibly even more.

Not saying FOMO is not a factor, but how does market data increase supply of SFHs especially in the core areas. In my opinion it comes down to lack of supply, cheap money/printing money, and huge immigration numbers.

Also people blaming realtors for prices is hilarious. We just take orders from people. I’ve never reached out to solicit a buyer, they get in touch with me.

I have a condo in Zagreb, Croatia where the majority of transactions are private…prices have skyrocketed 80% since I bought 5 years ago and income to price ratios make Victoria look like a bargain. Little to zero realtor influence.

That, right there, is the rationale driving the housing crisis. It’s also what every realtor is pushing, and people are forced to accept it because real estate boards restrict access to any market data that could be used as a basis to differ from this mentality. It’s disgusting, and the only exception to the lack of transparency is this blog – thank you Leo and trusted posters (Marko included).

One of the things about waiting for a housing crash, assuming you can get in at x time, forever is given two scenarios would you rather buy and the market drops 20% (you can still afford mortgage payments) or not buy and the market skyrockets and you are priced out?

Hawk really was entertaining: for being so incredibly wrong about absolutely everything.

This was right when I moved to Vic and my boss at the time told me it was a great time to buy. I thought she was batty.

I long for the great return of Hawk and THE GRAPH. It was just so entertaining.

https://theline.substack.com/p/jen-gerson-no-one-is-going-to-fix?s=w

It’s actually hilarious to go back and read the comments from previous years, 2016 and 2018 especially. If you were thinking about buying then, but basing it off the comments section you’d never buy a property, but in hindsight I imagine some wish they had. One of the most telling things I noticed was a poster named “Hawk” who is now probably too embarrassed to continue posting under that name and has changed it, or is still sitting in their nest waiting for the massive housing crash they predicted daily on HHV so they can make a triumphant return to post “I told you so!” almost a decade later.

In fact, they have said just that:

” For the practising politician, then, the sweet spot is to be seen to be doing something to reduce house prices, without actually reducing them.”

This is the perfect definition of the speculation tax.

–

Yes, we were adding housewives to the work force in the 1970s, but we are adding new people now too – bringing in 400,000 immigrants , and many into the work force (average age 29), more than double the immigrant numbers in the 1970s.

Only 25% of workers were unionized in the 1970s. Unemployment was higher in 1970s than now . That doesn’t add up to “better bargaining power” in the 1970s than now. You can see on the chart I posted in message below that US per capita income gains have exceeded inflation by 3-5% in the last two years, indicating some good bargaining power for todays workers.

Right, it’s because there is demand exceeding supply. But , history tells us incomes will typically rise more than inflation by about 2% per year (US data). You can see how income gains exceeded inflation by 2% per year, even during the big inflation of the 1970s.

I’m sure there’s an easy list of them too, Nortel springs to mind.

in terms of stocks, just bought decent amount of AC around $25 last month and ready to load up more if it reaching around $20.

(Next msg)

Cart before the horse.

Inflation isn’t on the uptick because of rising incomes.

James… I said CDN blue chip stocks (BMO, RBC, TD, BNS, Brookfield, Toromont, Telus, Intact, CNR, etc…) With that being said, people should still evaluate sectors and understand risks and exposure. It would be similar to owning a house and never doing any repairs and maintenance.

Those US stocks you suggested are also susceptible to currency exposure and depending on when someone acquired them the losses could be far worse than the decline share price.

In ten years time, Victoria population will have risen about 20% (+70,000 people), so a core SFH home like that would be in higher demand, and less affordable to average incomes. A refugee family in 2031 would hopefully be living in a nice condo, and incomes would be about 2.4X what they are today (if inflation had risen to 2.4X as well). Anyway, all this happened in the 1970s (house price tripled, gdp triples, income up 2.4X) , and you can look it up.

And IMHO, that is exactly what they will continue to do. Central banker’s merely talking about real action in place of actually acting is the new action.

Nearly all of the federal government’s deficit spending has been coming from the central bank purchasing Canadian bonds, and the plans are for continued, outsized deficit spending. I don’t see a scenario where the central bank suddenly says, “there you go, you’re on your own now” and lets the entire edifice collapse.

It’s the same deal with interest rates. They will continue to hike to put on a good show, goose the hike-hike-hike rhetoric to scare markets into rationality, and will do both until something snaps. Given the levels of household, corporate and government debt, hiking rates to even a relatively modest 5% may well result in breadlines and defaults on a scale that we haven’t seen in generations. Given the CB’s 50BP increase on top of their previous one, they may get one or two more in and then I suspect they’ll be going back the other direction as things slip in a hurry. There’s probably some decent investment opportunities coming up in the next year or two.

I also think there’s an argument for saying that despite the CB’s inflation ~2% mandate, elevated inflation is actually a historically preferred way to reduce the burden of debts, because a substantive, voluntary credit reduction in the economy would result in a far worse outcome, at least in the immediate sense.

Regardless, inflation won’t have a chance to get under control unless and until they stop printing money. I suspect inflation will be running hot for a while yet, perhaps many years. But to be honest, I don’t think they have a choice in the matter or a meaningful way to really stop it.

I know, Sears Roebuck and Kodak, American Can, Navistar, U.S. Steel, Westinghouse Electric, Texaco, Bethlehem Steel, F. W. Woolworth Company, Goodyear Tire, Union Carbide, and International Paper. All behemoths of industry today.

Let’s take a modest bugalow on a busy street, $1.2 million, put in a 25% down payment just to make the math easy. At 12% interest rates that puts your monthly payment at only $9287.10 a month. Easily do-able for the vast majority of Ukrainian refugees, wealthy immigrants and the rest of Toronto that plans on retiring here.

Some might say that it is always a good time to buy if you are holding long. Housing, S&P 500 index fund, CDN blue chip stocks all have positive performance over a ten year period and even better over a 25-30 year term.

During the 1970’s the first time buyer cohort transitioned from mostly single income (pre-boomer) to mostly two income (boomers). The impact of this should not be underestimated. Also there were a lot more of the latter than the former.

Bargaining power for workers and the ability to keep ahead of inflation was also much stronger back then.

If we see persistent inflation for the next 10 years (2021-31), such as we saw in the 1970s – I’d expect Victoria nominal house prices in the next decade to at least double (possibly triple) where they are now

This may seem hard to believe for those who didn’t live through it, but here’s what we saw in the ‘70s (1971-81). Nominal GDP tripled. Incomes more than doubled. House prices tripled. Inflation more than doubled (2.4X) the CPI. All this occurred despite mortgage interest rates more than doubling from 5 to 12%.

Here were the inflation values each year for, 71-81 (3%, 5%, 7%, 11%, 11%, 8%, 8%, 9%, 9%, 10%, 12%)

Q. Huh?…How could house prices rise in an environment of rising mortgage rates?

A. Yes, in isolation, rising mortgage rates are BEARISH for housing.

But when rates are rising to cool down inflation and a hot economy, we see inflation, rising incomes, hot economy and rising GDP., all of which are BULLISH for house prices. In the 1971-81 period, the bullish factors won out, and house prices tripled.

If inflation persists during the next ten years (2021-31) like it did in the 1970s the same thing could happen to double or triple house prices here in Victoria

Hey, keen follower of this forum and definitely views posted helped me rationalized my decisions on past buying.

Question, based on prices in current market and future rate increases is there a downside to buy another property based on rent offset of current principal residence ( condo downtown , fixed 5 yr, 1.7%, 3 K monthly rent offsets mortgage and strata fees).

Second home considered is a condo or townhouse ( 625 K mortgage, 2% Variable planned).

Will appreciate view points.

LeoS: So you think 5 year rates will be pretty close to right now, around 4 to 4.5?

They haven’t actually stopped yet. They just keep talking about stopping.

Hypothetical question…market dropping 30% shows the majority didn’t think it was a good time. I re-invested my dividends at that time, but I certainly wasn’t taking funds from my Heloc to move into unregistered accounts to pile in March 2020. I agree, buy and hold quality but to say I wasn’t a little concerned when my portfolio dropped 30%, I don’t know about that.

My point is this blog has been running for 15 years now. When has there been a clear consensus that it is a good time to buy? 2011-2014 was a pretty good time, in hindsight and how many people called it? Leo made good calls a number of times, but the comments sections has not always been in line with his thoughts.

You asked if it was a good time to buy and it clearly was. I had zero concerns about buying equities in March 2020 and was redirecting any spare money into that. Whether the majority realized that is not really my concern. But I also wasn’t trying to time not buying leading up to that point, I just doubled down.

There’s a reason why the average investors badly trails the market. Everyone thinks they’re smarter and can stock pick, but the evidence shows it doesn’t work in the long run for most.

Everything I bought 2009-2015 was cash flow positive at the time of the pre-sale contract and at the time of completion/possession.

For example, $193k purchase the Bayview Promontory in 2011. Rented it out for $1,150 per month to the first tenant (now $1,500 but likely $1,700 with next tenant). At that time of purchase strata fees $150/month, taxes $120/month, mortgage $600ish/month, insurance $20/month. I was defeintively pocketing >$150 each month at the time, obviously a lot more now.

us underlying inf 3.5+.5 to 4% us bonds =4% Cdn bonds (+1.5 from today ) = ? CDN 5 year mortgage

“To me that did seem like a good time, that was when I loaded up on bank stocks and everything else, starting in March 2020”

"Yes. It seemed like a good time to buy every stock. Pretty safe bet to buy after a 30% drop no matter what happens."

Ahhh, I see so you guys also must have bought real estate in Victoria Novemver 2009 when 268 people purchased or April 2020 when 287 people purchased (for context the following April 1,116 purchased)?

Sorry, stats do not support people buying in mass when it is a good time to buy. Quite the opposite.

Individual trying to build a small suite above their garage in a small town in BC just emailed me for owner builder exam and listed some of their costs

“Homeowner Builder authorization – writing an (ridiculous) exam plus – $500

Location and height variance from City of XXXXX – $900

Certificate of Location required for Variance – $900

Consolidation of lot lines required by Variance – Legal – $1 250

Complete Survey required to consolidate lot lines – $2 500

Road Damage Deposit – $500

Building Permit – 1% of cost of build – approx – $2 000

Demolition Fee – $100

Water connection – $2 100

Storm/Sewer connection – $1 000

These are only the costs we have been made aware of so far. Haven’t even hired a designer yet.”

4-4.5%

Where do you think five year rates will be this time next year.

Bought an investment condo and SFH in those years that were both cashflow positive on day one. Those were great times to buy and just goes to show that reading all the HHV comments can be helpful in collecting personal opinions and sometimes facts, but you have to look at your own situation and what you can and are willing to take on or risk.

Poilievre, as PM, would never follow through on all the crap he’s saying in that Twitter video. Do we really think Mr. Pro-Freedom wants to curtail the freedoms of other levels of government?

It is good politics, though. And he wants to gain power.

Now we get to see if the US FED bumps their rates by 1% or more at it’s next announcement. Geez, 8.5% inflation south of the border….

Cadboro, the last paragraph of Rob Carrick’s column today:

Using some of this [extra] cash to reduce debt is smart personal finance. Don’t be troubled by people telling you it’s better to use that money to invest. Investing doesn’t produce guaranteed results, but debt reduction most certainly does.

No one should expect a price decline with 1.x months of inventory.

Yes. It seemed like a good time to buy every stock. Pretty safe bet to buy after a 30% drop no matter what happens.

I’m happy that they’re talking about housing at the federal level.

But PP solution resonates at this point in time but probably not until 2025. Stop money printing? That’s basically done already. Increase building? Basically the 2022 budget.

PP has a good chance at prime minister mostly because the feds have very limited leverage on housing and even if the Liberals copy his platform exactly it won’t do much without the cooperation of lower levels of government

Marko, all I’m saying is, I’d go with your strategy but it’s less suitable for someone in different circumstances.

“Did it seem like a good time to buy CND banks March 2020? (they are up over 100% since then plus dividends) when we thought covid would kill us all.”

To me that did seem like a good time, that was when I loaded up on bank stocks and everything else, starting in March 2020

“Does it seem like a good time to buy now at record highs?”

Much less compelling now in my view.

As expected, BOC target interest rate raised by 50 BP.

Less expected was the announcement that

“Canada’s central bank says it will also stop buying government bonds and begin quantitative tightening (QT), beginning April 25.”

And they promise more hikes to come!

On the bullish side for house prices, the BOC expects real GDP growth of 4.25% and inflation of 5.7%, that’s 10% nominal GDP growth in a year (about 8% per capita). Next year expected to be about 7% nominal GDP growth.

For perspective, that 10% nominal GDP growth is the highest in decades and compares to 3.8% nominal GDP growth in 2019 . Historically, nominal house prices in Canada, USA and around the world have a strong co-relation with nominal GDP growth per capita.

https://ca.finance.yahoo.com/news/bank-of-canada-hikes-interest-rates-50-basis-points-140816248.html

So interest rates are inevitably rising, to 3 maybe 4% at most. How many buyers will be impacted, primarily first time buyers with minimal down payments. What percentage of today’s buyers does that represent? Investors should be flush with cash, flippers should be flushed with cash and current homeowners and established people from other areas are also able to buy without a loan. That will keep house prices from falling no matter how high rates go. First time buyers have only a certain amount of pre-approved money to play with, that’s why they are unable to place ridiculous bids and are priced out of the market. I believe the first time buyers are having little impact on this market. Expect higher prices.

Whatever they may say, no politician actually wants to cut house prices

If PP thinks that big city governments are the problem he’s welcome to run for one. Ottawa, where he lives, has a civic election coming up in the fall. And it’s the provinces, most of them with conservative governments, which have jurisdiction over municipal governance. Ontario has an election coming up too.

All I’ve heard from the guy is finger pointing and nonsense like saying that crypto is the cure for inflation. Not once have I heard him say we need higher interest rates, which has been the known cure since 1982. And how about putting a stop to the financialization of housing through tax policy? Crickets.

https://twitter.com/PierrePoilievre/status/1513493563425714185?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1513493563425714185%7Ctwgr%5E%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Ftwitter.com%2F

He is absolutely on target about the issues. Too much money in the system. Too many rules to build. The anti right are going to piss all over this but what the left has done or not done has created the problem the past 3 years

Good link about FHSA here: https://www.moneywehave.com/what-is-the-first-home-savings-account/

“Once you’ve made a withdrawal to purchase a home, you need to close your FHSA within a year from the first withdrawal.”

So it is a good account for people to buy their (first) primary residences within next 5 to 15 years, but it isn’t really meant for long term investment.

If 4512 Emily Carr drive is any indication, there is no slowdown or price dip.

$2,000,000 is a ton of money to pay for that location and that house I think. A pleasant but modest home (updated but not new one level??) on one of the busier streets in an area that I think one could say is in the upper middle range in terms of Greater Victoria neighbourhoods for price and exclusivity. Nice area but not a top area. Decent size lot but with strong covenants preventing any rental suite development. I guess maybe good value in comparison to Westhills and Royal Bay?

Has anyone found any really detailed rules on the FHSA yet? I keep finding the main points and summeries, but not anything to do with it’s actual functioning yet.

Based on what I could find, it sounds like a person can skip the $8000 a year cap building toward the $40k and just transfer the $40k from a RRSP in one shot without penalty. As well, apparently it can be left there for 15 years and if not used for a down payment, the account is just closed and you can keep the gains without being taxed. What I can’t seem to find out is: can spouses do $40k each? and if a person does buy a house after the account is topped up to $40k and does not use that as a part of the down payment, can the money be left in the FHSA for the remainder of the 15 years? It would be great to buy a house and keep FHSA investment growing tax free.

Does anyone remember if one could have bought an investment condo in those years and been cash flow positive on day one?

It was the math with future normalized interest rates that kept me away from winning some of the offers I made over the last year and a half. I would have needed to push a majority of my liquid assets into a down payment (losing the cushion for illness, job loss or something unforseen) and then not being able to rebuild that financial stability when hit with an escalating interest environment.

It sounds like you have a good plan that provides you with flexibility and you don’t end up growing into an unsustainable lifestyle that you need to cut back on when faced with a higher interest rate on your mortgage renewal.

To Rick: Like I said a black swan can cause a bout of inflation and I imagine it was stay elevated over the next year or so, but there are already some forward looking indicators that seems like inflation is topping out. The Rig counts should start increasing in the US soon and other countries, it may take some time. Deglobalization is a concern, but if manufacturing facilities are brought back to North America they will be capital intensive and I actually think this will be deflationary in the long run. Remember that in the first decade of this century we had a huge boom in demand in commodities from China and inflation averaged 3%. Ultimately the debt levels are too high both privately and publicly to sustain high interest rates and inflation, demand destruction will happen rapidly and recessions are deflationary. Like they say, the cure for higher prices is higher prices.

Marko. Well that is a tad high for such a busy street.

Thanks for the no.

Totally. Didn’t make any sense to wait in those periods unless you were only going to own for a short period. Who knows whether that extends to this time or not.

Condos might be a diff story. I think rather than buying a condo and upgrading it would have made more sense on average to rent and jump straight to a house in those periods. Doesn’t mean there weren’t good condo buys that made a lot of sense, but for the general resale condo that would get sold in 5 years kinda situation.

$2 million on the dot

4512 Emily Carr selling price please. Thanks

If it comes to where financially disciplined (i.e. ones not buying boats/RVs/etc) government employees with 2-3% annual salary increases are losing houses because of interest rates I think you have bigger things to worry about at that point.

If you have extra cash to throw at the mortgage my best guess would be you would make higher interest rates work even if your Fortis stock went to $0 and BMO stopped making dividend payments after 150 years.

To get to a point in life where you can live without buffers you have to take some risks. One thing I’ve noticed since I started buying stocks (2008) and real estate (2009) is it is literally never a good time to buy. There is always some dark cloud ahead, always. Just read HHV 2011-2014….no one would read those three years of comments and think it is a good time to buy and many HHVers didn’t. Did it seem like a good time to buy CND banks March 2020? (they are up over 100% since then plus dividends) when we thought covid would kill us all. Does it seem like a good time to buy now at record highs? Personally, I think you buy quality real estate/companies and hold for the long term. Paying off cheap debt, not my personal strategy. If it becomes expensive, I’ll focus on paying it down then and if rates skyrocket and my CN Rail stock drops to $0 because all of a sudden society doesn’t need anything shipped anymore and I can’t liquidate my stock to pay off the expensive debt such is life.

“You could also get hit by a bus as well, there is risk in life.”

Yes, but your risk of getting hit by the bus is like what, 1 in 2 million? The risk of fed tightening triggering recession and causing some mean reversion on asset prices, houses, stocks, including blue-chips etc. is what, maybe 30-50%?

One can debate whether those risks are really 30-50%, but whatever they are, they’re sure nowhere in the same ballpark as getting hit by a bus. Someone living without a lot of buffers in case of a significant upset would be well-advised to take that into account, and for someone in that position, paying down the mortgage is probably smarter than investing in stocks, even blue-chip dividend stocks.

I say that although I hold lots of those stocks. It just depends on the person’s individual circumstances, but we’re in an environment where battening down the hatches to protect your family’s ability to keep head above water seems pretty prudent. Not a time to strap on a bunch of risk in my view.

Time will tell.

Thanks Marko, much appreciated

$4,460,000….sales surprised me a bit today as well. I thought buyers might take it easy this week with BOC announcement tomorrow, but we will hit 50 sales for the day which I believe will be the highest sales day this year.

To MJ: you say that nothing has changed structurally. Not true.