April: Cooldown takes hold, but we’re far from a buyers market

The slow cooldown in the market that we’ve been talking about for the past 8 weeks continued in April. Many people will confuse “cooling” with “cold”, so I thought it was worth again explaining how market cooldowns work.

As a reminder, here is the rough order of steps that take place during a cooldown from red hot market conditions. Read on for an update of where we are on each step.

- Showings & Offers drop off – This started happening in mid March, but it wasn’t clear if it was temporary due to spring break or the start of a broader slowdown. With more data we know it was the latter.

- Reduced over-ask sales – With overheated markets, it’s beneficial for sellers to list under market value and attract a bidding war. That technique sells homes faster and for more money, so no surprise that at peak we had nearly three quarters of properties selling that way. As the market cools off, some bidding wars don’t attract enough buyers and fall through, which encourages sellers to change strategy and list for market value instead. That’s what has been happening recently, with the proportion of bidding wars dropping from a peak of 74% early March to 45% in the last 14 days. Remember, a normal market has about 5-10% of properties selling for over the asking price, so this is still very elevated.

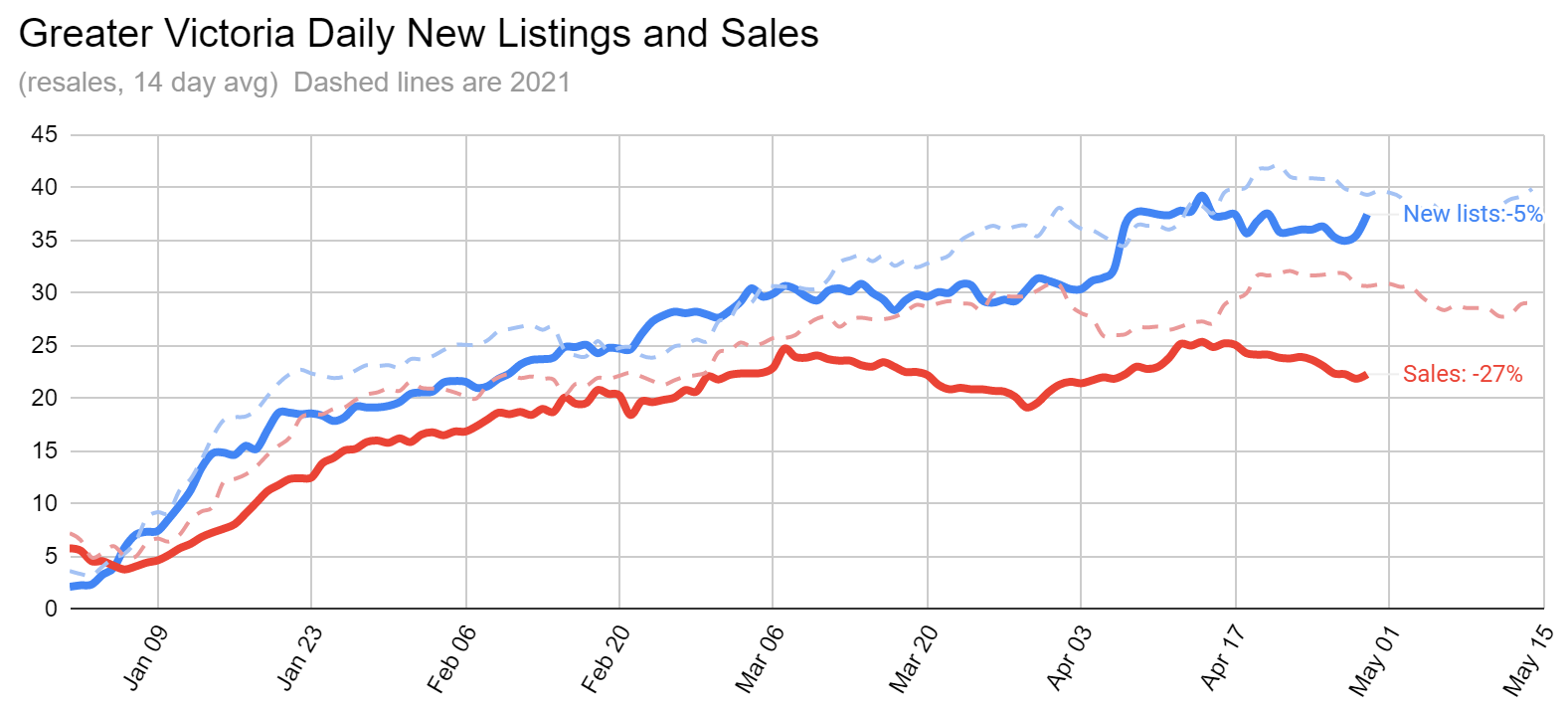

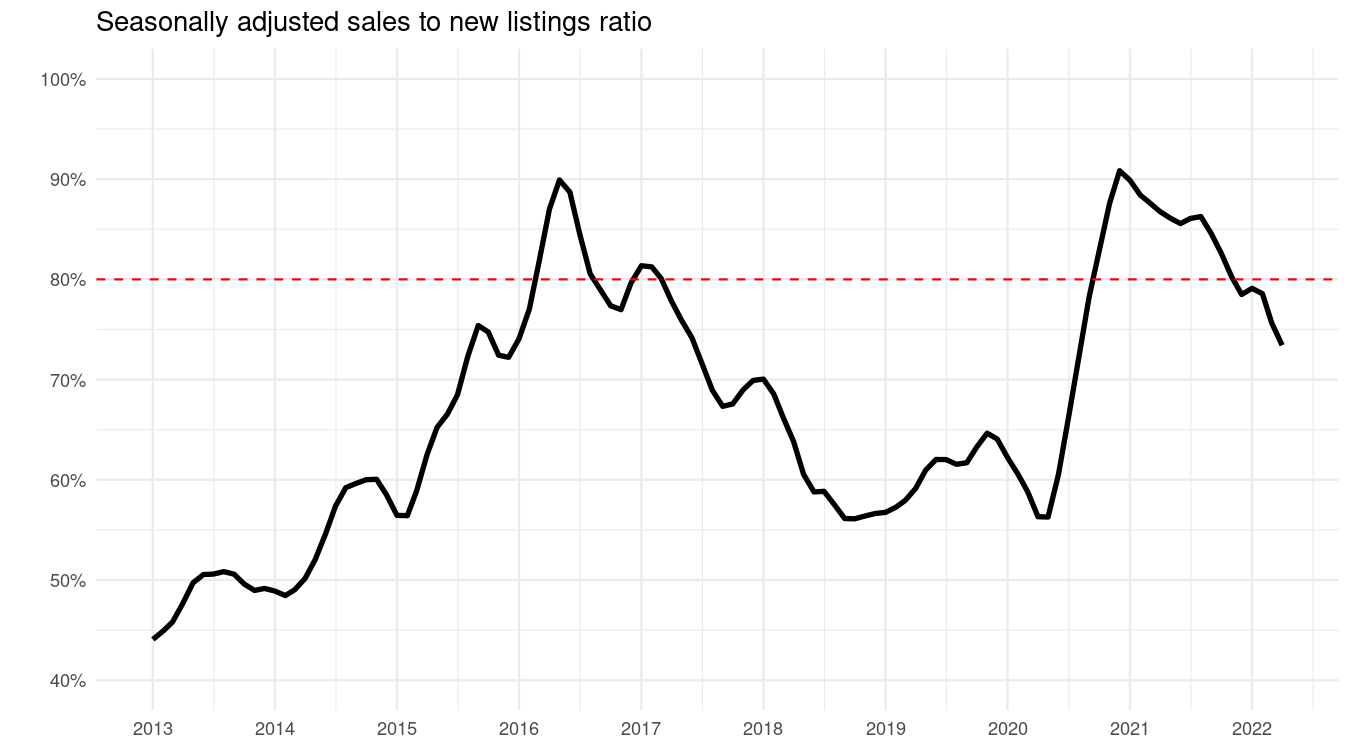

- Reduced sales (to new list ratio) – Sales are dependent on demand, listings available, and seasonality. As the market has slowly cooled the gap between new listings and sales has continued to widen all year. April sales were down 26% from last year, with detached declining 28.5% while condo sales dropped 20.8%.

This is also shown in the sales to new list ratio, which dropped in April. Low inventory has limited sales (and still is to an extent), but recent weakening is more to do with a gradual pullback in demand.

- Price changes – If you have a portal to monitor sales, you will notice a lot more price changes. Some will be re-lists at higher prices when bidding wars fall through, many will be price reductions as sellers list for somewhat above market then adjust downwards. Neither are necessarily indicators of actually falling prices, but they are a precursor.

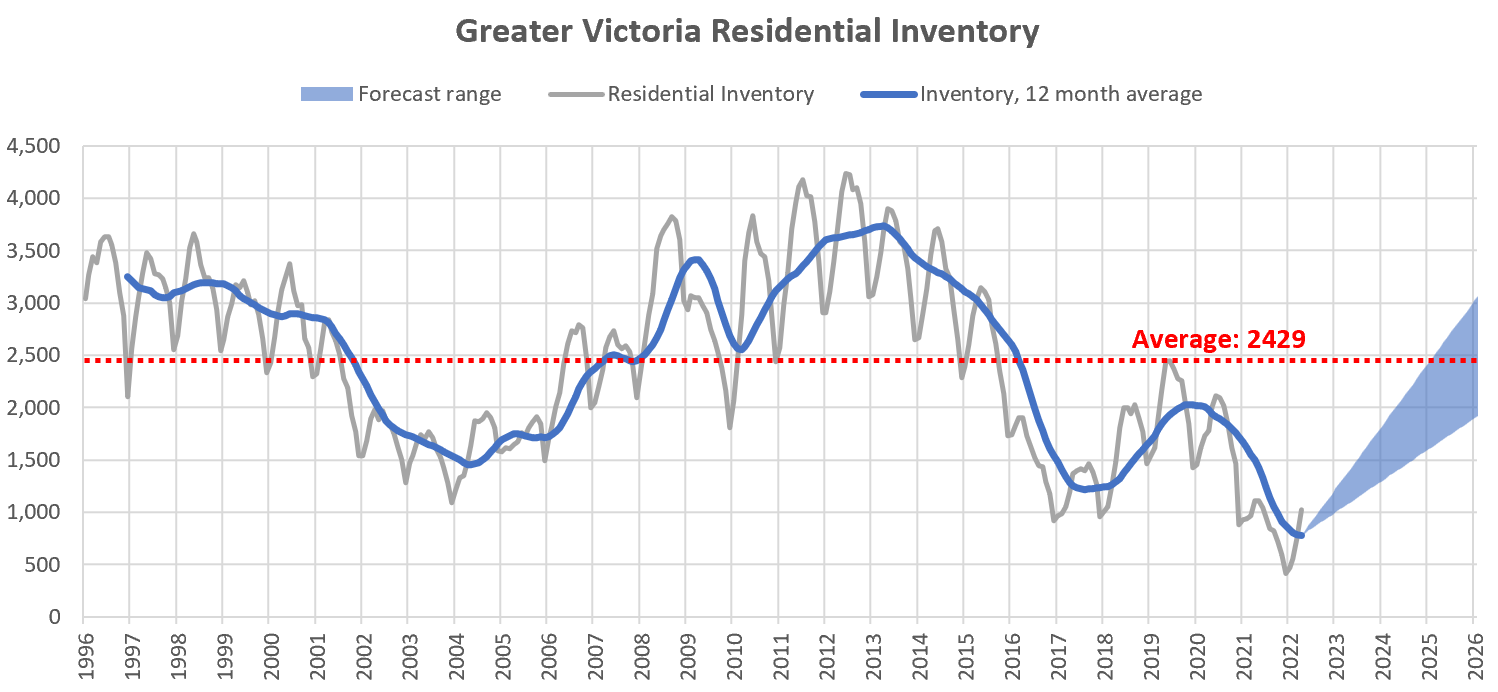

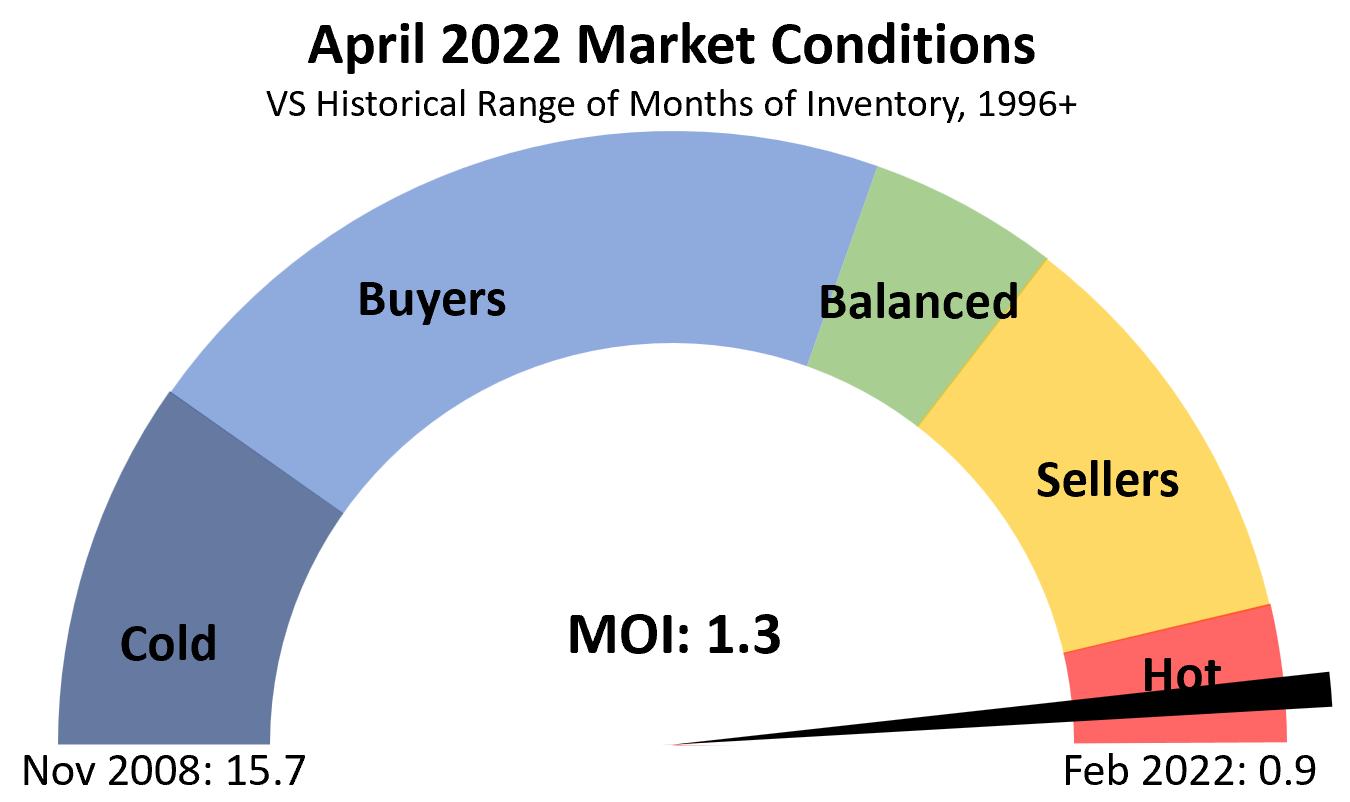

- Months of inventory – Actual inventory remains very low (the 1020 active residential listings at the end of April are still an all time low for this time of year), and it will take a long time to build up. Outside of the great financial crisis, average inventory (seasonality removed) has increased at a pace of between 25 and 50 listings a month in previous cycles. At that pace it would take until 2025 to get back to average levels. It could go faster, but it would take a pretty extraordinary shock to do so. Perhaps at some point I’ll troll through some old newspaper reports to see if I can fill in some inventory data pre-1996 to make this assumption about inventory buildup more robust.

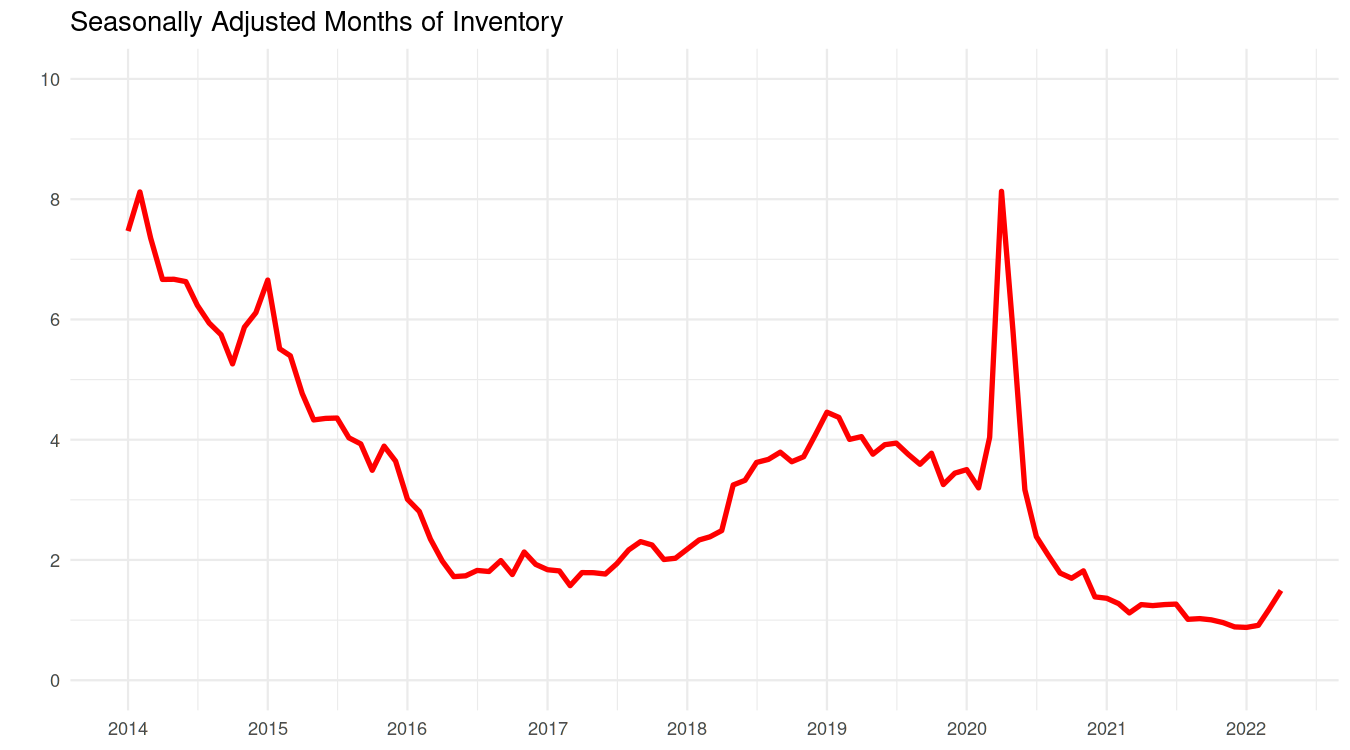

However months of inventory depends on both sales and active listings, so it will generally increase faster as demand wanes (for an extreme example, see April 2020). This April we finally saw a solid leg up in months of inventory as well after many months near 1.

Again the current levels still put us solidly in hot market territory, but at least we’re moving in the right direction and the needle isn’t pinned to the line anymore.

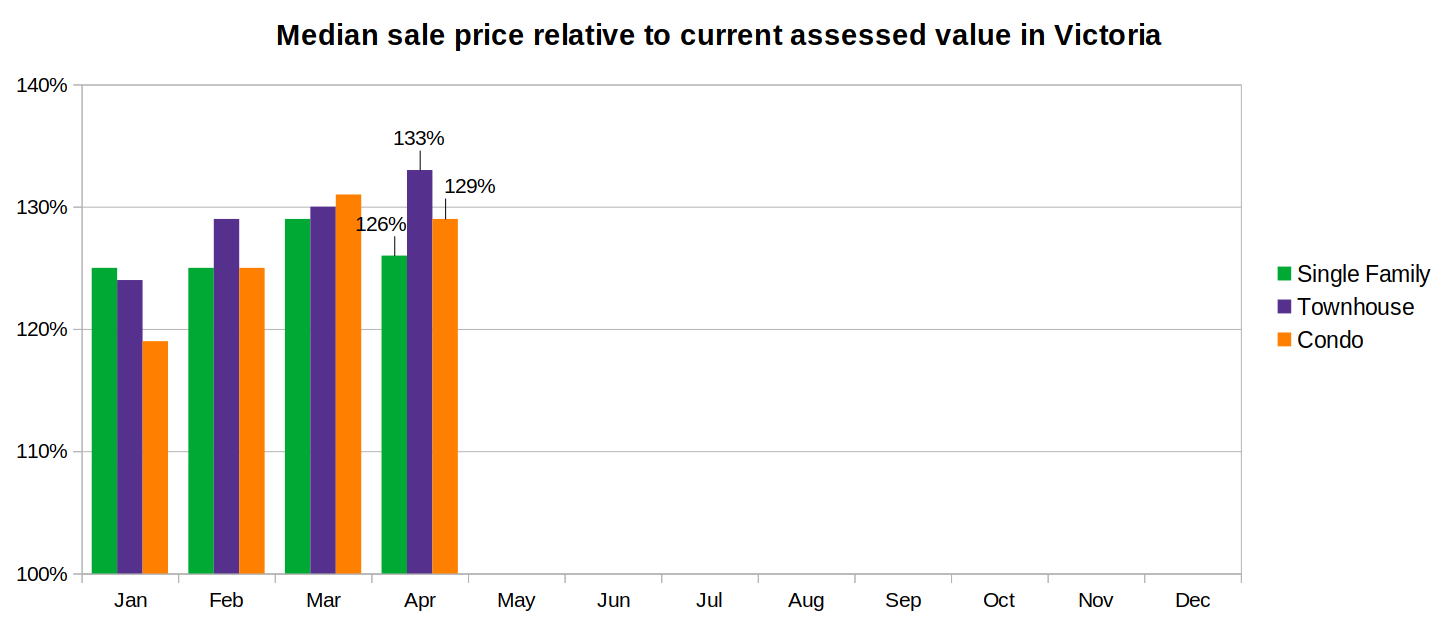

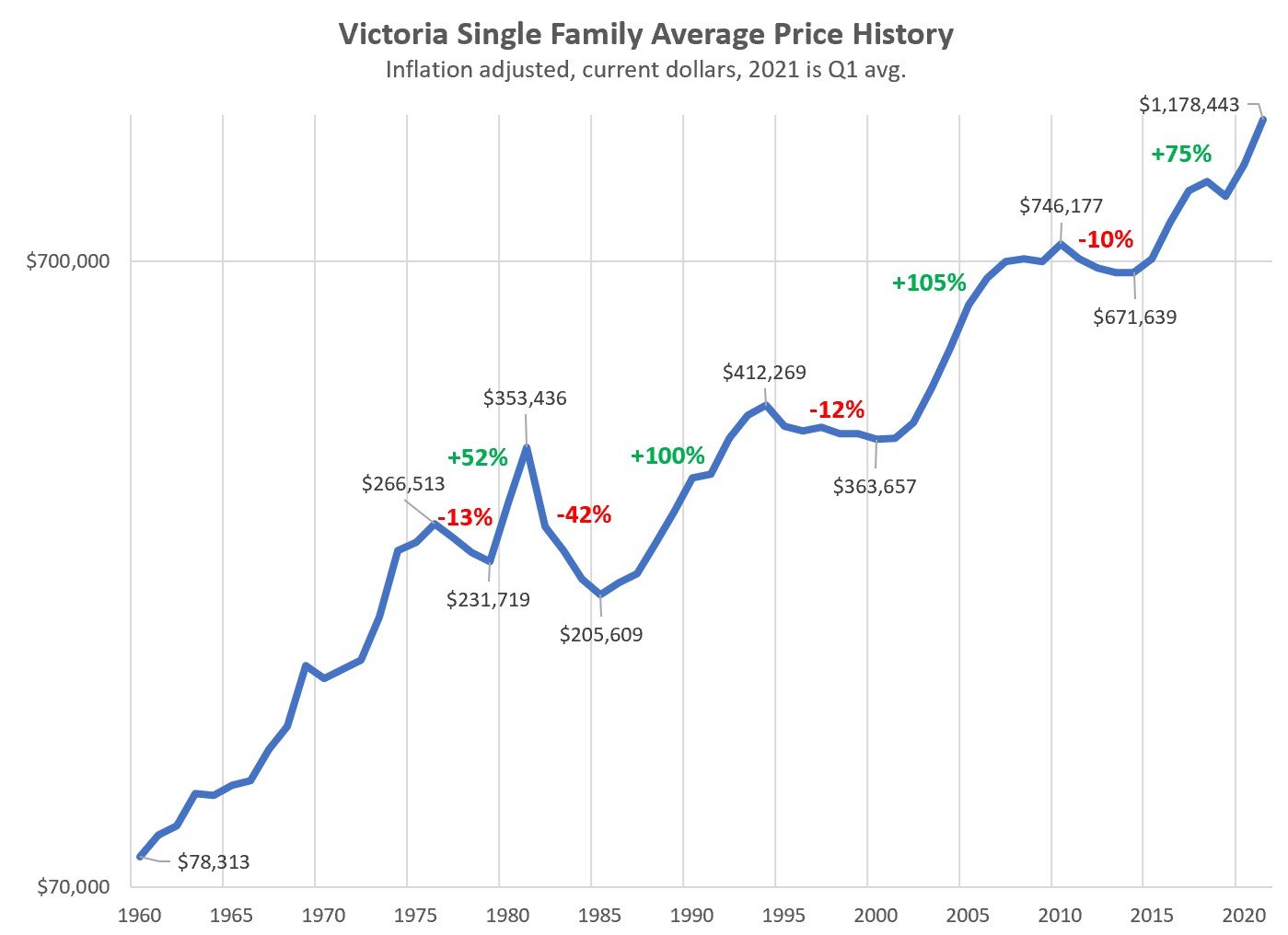

- Prices – We need months of inventory to be over 6 to reliably stop price increases, and about 7 or 8 to start dropping prices. Obviously we are long way from that, but when markets are changing sometimes the trend is more important than the absolute level. In a cooling market we can see prices stop increasing or even decline before we would normally expect them to while in a heating market we can see prices flatline or start increasing before we’ve reached a sellers market. Median prices for detached ($1.25M) and condos ($600k) were down slightly in April while townhouses are at a record high ($890k). A similar small dip is visible for detached and condos in the median sales to assessed value ratios as well while townhouses continued to move up. I wouldn’t read too much into one month of data here, but it’s worth watching going forward. Froth leaving the market could drop this a bit before we get into a true balanced market, but if you are expecting large price declines with current conditions you’ll likely be disappointed.

Something to keep in mind is that no one knows how long the market cooling will go, or how far. Last year the market cooled off very slowly for a few months as well, and there were very good reasons why it should have continued (many of them surely made by me). However rather than continuing to cool the market fired right back up again in August and managed another large price jump.

Many things are different now. Affordability is worse than ever, and rates have been rising at a serious clip, showing no signs of slowing down in the coming months. I’d be willing to bet this year’s slowdown will be more significant and longer lasting than last year’s, but in the end no one has a crystal ball and real estate always surprises. At the very least we can look forward to some more improvement in conditions for buyers. By the time the government’s cooling off period hits sometime in the summer I doubt we’ll have a significant share of over-asks left.

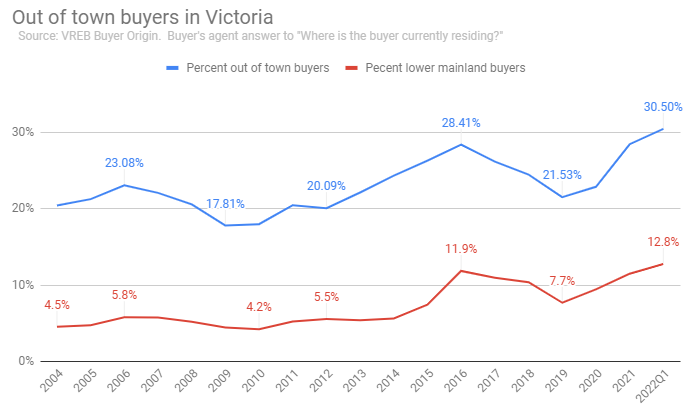

Meanwhile, out of town buying showed no sign of weakness in the first quarter. The share of purchases going ot out of towners reached all time (8 year) highs for both all out of town buyers (30.5%) and buyers from the lower mainland (12.8%). However with the Vancouver market cooling at a faster pace than ours, I wouldn’t be surprised if this percentage had already fallen back a bit in April. We’ll have to wait until the summer for updated figures.

New post: https://househuntvictoria.ca/2022/05/10/months-of-inventory-or-sales-to-list-which-is-better/

It matters to people who are considering going with active management with their 1-2% MER as a service as opposed to a more passive solution.

IMO nothing wrong with picking your own stocks if you have the inclination, time, and risk tolerance for it. Personal finance is personal, after all.

Individual picks are inherently more risky than broad market funds though. Most retail investors looking decades towards retirement would be best served by picking an appropriate index fund (based on their timeline, risk tolerance, financial goals, etc) regularly contributing to it and never selling, regardless of current market conditions. Investing only at peaks ends up doing pretty well over a long timespan if you don’t sell.

Lastly, if anyone is going to pick their own stocks, don’t ascribe lucky outcomes to skill. I’ve seen countless people that hit big on weed stocks or crypto pat themselves on the back about their acumen when really they took a big gamble that happened to pay off. Overconfidence kills.

Short delay. Post tomorrow.

Why would management costs be relevant? I’m investing myself, where costs are close to zero and below the “almost zero” MER of passive ETFs.

The fact that professional investment managers run hot and cold has little relevance to me. They typically have many stocks in their portfolio, which will push their returns towards the mean. I have only a few stocks at a time.

As mentioned, it doesn’t matter to me if I’ve underperformed or outperformed the market. By analogy, are you comparing your house appreciation to the average “market” gain? Or are you just happy that you bought the house YOU chose and you’re happy with it, and it’s appreciated over time. That’s like me with stocks.

I get that you’ve “passed” on the idea of picking your own stocks, maybe because you don’t have the time. Which I think is a shame, because it’s enjoyable to invest in companies that you believe in, and see those investments grow. I wouldn’t get the same feeling seeing VGRO move up 6% each year. But to each his own.

You forget that those people are not the same groups over time. Look up the data on active management. The managers that have outperformed the market in recent years usually go on to underperform in the future. Meanwhile costs of the management or active trading drags on total returns. By all means go on picking stocks, just saying for most it will be a negative yielding proposition.

If that statement is true….

Simple math/logic tells me…

If there is a group that substantially trails the market (“average retail traders”), that means that the rest of the traders (as a group) must outperform the market

For example, if 30% of the market are average retail traders, and they “substantially trail” the market by -10%, that means the other 70% must outperform the market by 4.3%.

If you think you’re one of the underperforming average traders, then you’re better off in a market etf, which will get you market returns.

If you’re not in that group, you should end up outperforming given the underperformers.

You only live once, and I like to find out if I’m an “underperforming retail trader” or not.

Win or lose, it’s more fun to make your own bets. And when you’re done, at least you can croon like Sinatra … “I did it myyyyy way”

Despicable!

Microsoft is up 286% over 5 years even after the 25% drop. My TSFA is down 20k or 9% recently….who cares, it more than doubled since March 2020. Dividends continue to roll in and you use that to buy in at a lower price point, the world is not ending.

It is like real estate. People buy a house for $800k. Five years later it is worth $1.3 million. 5.5 years later it is worth $1.2 million and they are panicking.

Big picture is important.

Other than souring sentiment on the economy which affects every company.

Taking all your jerbs (1), women (1), and buying all the houses (also 1).

LOL, who knew that Leo was a foreign buyer? 🙂

https://twitter.com/LeoSpalteholz/status/1523836665336242176

Buyer sentiment definitely has turned on the stock markets. Microsoft is down 25% for no good reason. Earnings came in strong a few weeks ago and there was no rationale for such a decline. Probably a good buying opportunity. While investors dump their holdings, I wonder if they might turn to something more tangible.

That’s why the average retail trader substantially trails the market. Overconfidence about being able to spot opportunities that somehow the entire rest of the market with 1000x more resources has missed. Even the vast majority of professional fund managers can’t pull it off with any consistency. Meanwhile the ones that have proven they can aren’t interested in your money.

Agree with Vic&Van above.

The idea that the stock market is an efficient machine that reliably and consistently sets fair prices is a complete myth. The stock market is a comedy of errors. Just look at any company’s 52 week high and 52 week low, usually a huge range when very little has changed in the underlying business.

The stock market had been on a 10 year bull run (aside from the COVID blip), it’s time for the pendulum to swing the other way.

“because knowable facts are already reflected in the current price.”

Except the markets overreact all of the time and those are good entry points. Today is a perfect example in the energy space. Why should those companies suddenly be worth 7% less today then yesterday? They are still making tremendous cash flow even if oil prices went down $10 a barrel and their stock prices should be higher.

The top 20 companies in the world by market cap in 1989 is no longer remain in the top 20, therefor buying the index funds is what Warren Buffet suggested.

The top 10% of the world population own 88% of the money, therefore their family are not going to liquidate their portfolio to give to charity, so the market is not going to go down.

Infact we are consuming more now than ever. Case in point 20% more household own pets today when compare to 1988.

We’re reaching that point in boomer demographics when they are essentially becoming net sellers of their RRSPs and most are not adding new money towards retirement. With all the indebtedness the younger generations have invested in their homes, I wonder who is going to absorb the stocks boomers are liquidating. Could get pretty ugly in the next few years.

This could also be applied to real estate, if more boomers were dying off, there would be more inventory, and prices might fall.

And any broad market fund is going to be down right now, as entire markets all seem to be down.

I think the sentiment here is often for whatever all-in-one ETFs that matches one’s asset allocation and risk profile.

VGRO is 80% equities and 20% cdn bonds and gets recommended more for people who have decades of income yet to invest. VBAL is 50/50 so a bit conservative for many.

I’ve still likely got a decade or two of income to invest (unless current or future startup stock units/options pay off in a big exit) so I’m not worried about this blip.

I don’t think any of the main Canadian banks did cut their dividends, no.

If all one cares about is dividends, have a look at HDIV or HDIF also.

I do think it’s a good time to hold dividend-bearing stocks, but then, I always kind of think so, and I guess it’s possible as GIC rates go up & provide real competition, the dividend-bearing stocks will be under some pressure. But no reason in my view to assume bank dividends per se will be cut at all.

True, but did any cut the dividend? (CND that is).

Didn’t know that. I simply figure rail stocks are essentially a monopoly and 100% confident humans won’t change any of their mass consumption habits any time soon and realistically we aren’t transporting dog food via air in my lifetime.

hmm…could not get the quotes to work, sorry. but my comments were on the importance of dividends, or lack thereof

Marko:

Leo:

Couple of comments:

I’m more in Marko’s camp on this. It’s absolutely true what Leo is saying, but the dividend flow does matter, trust me, if you’re retired and have no other income flow. If I knew I had to sell pieces of the portfolio, at highly importune times to boot, I would not be sleeping well in this downturn. I find it very comforting to have cash flow sufficient to fund all our expenses without having to touch the portfolio

That said, we can’t get too complacent about having dividend stocks. The dividends didn’t stop bank stocks and the like cratering 40% or so in the great recession 08/09

Not so sure about that myself but yes I get the point 🙂

Interesting tidbit along the same lines, from 1900 to 2019 rail stocks beat the overall market despite declining from 63% of the market by capitalization to less than 1%. Often the best returns are not in the hot new thing. In fact the value premium comes from companies that in general are cheap for a reason.

That’s why it’s not a part of my investment portfolio. MM fund is a holding position for access and quick deployment. It’s not meant to beat inflation, but to ensure it doesn’t actualize a cash loss in the short term. I hold my long term investment planning separate from what I am committing to housing because I view housing as a lifestyle choice rather than an investment vehicle. So, as with a lifestyle choice, I factor it as what I am willing to pay for it’s enjoyment. Having the DP readily on hand in stable state is just part of that expected cost. As for buying a house, I haven’t been looking for a big price correction, just some breathing space and quality inventory to choose from. What I lose to inflation over a factor of months or even a year or so on the DP will not hasten my process because, it is just short term on money that is accounted separately from actual investments.

100% agree, that is why I don’t do extensive research on any of these companies as much smarter people have done the research and the price is reflected. I do know long term you’ll still be paying a Fortis gas bill in 10 years. I do know people will be driving, curising, flying (don’t like airlines, but they consume) and destroying the environment in 10 years as well. I know they will still be paying outrageous fees to their banks, etc.

Whether the flavour of the day will be Apple or Samsung, Facebook or something else, not 100% confident in that so I personally stay clear of that.

Probably the #1 mistake people make about the stock market is thinking that good companies are good buys. The fact that Fortis is a good company tells you nothing about whether the stock is a good buy, because knowable facts are already reflected in the current price. Not saying change your strategy, just pointing that out.

“Fortunately I am too unsophisticated to invest in complicated things. Fortis, Telus, Cnd Rail, CND banks, etc., dividends just keep rolling in. A bit of a pull back but it is like walking up a hill with a yoyo.”

Add Mullen group to that list.

No. Canadian Banks create money on the fly, by adding an asset and matching liability. The loans are not matched by deposits. The total loans the bank can make is limited by ‘capital constraints”, dependent on the banks equity (capital) relative to assets. (The loans are considered assets). When you get a mortgage the banks creates the money. When you pay it off the money disappears. The bank is free to loan money as long as the equity to assets is high enough. It is typically 4-5% but varies as can be seen here https://data.worldbank.org/indicator/FB.BNK.CAPA.ZS?locations=CA

This is explained here…

https://lop.parl.ca/sites/PublicWebsite/default/en_CA/ResearchPublications/201551E

Money Creation in the Private Banking System

“However, it is important to note that the majority of money in the Canadian economy is created within the private banking system every time banks extend new loans like mortgages, consumer loans and business loans. Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money

One key similarity between money creation in the private banking system and money creation by the Bank of Canada is that both are realized by simultaneously increasing the asset and liability sides of a balance sheet.

One notable difference between the two types of money creation is that there is no external limit to the total amount of money the Bank of Canada may create through its asset purchases, other than the impact the additional money created has on inflation.In contrast, the amount of money that a private commercial bank is permitted to create depends on the amount of the bank’s equity relative to its assets. The limiting rules, known as capital constraints, are established by Canada’s banking regulator in a set of guidelines.“”

Except I don’t know how Shopify’s business model works and how sustainable it is long term. I do know what Fortis and Telus bills look like and I also know that your cat food needs to be shipped to a store and that you aren’t getting rid of your cat anytime soon.

True in itself, but a lot of companies that don’t pay dividends don’t have earnings to pay them from.

No, if you pay off a loan the money goes back to the lender. And if a bank loans you money the ultimate lender is a depositor.

Exception: If you owe money to the Bank of Canada and pay it off (“you” being the government) the money really does disappear. Which is why the BoC is going to stop rolling over GoC debt as it matures.

Wait, I thought you were a buy and hold investor in balanced funds? You’ve told us about 30 years history of what would happen if you’d held a balanced fund, and even gave us a specific example.

Now you’re talking about lots of people “reallocating”. To what?’

‘

‘

I never said I was a balanced investor, I may have been comparing a balanced portfolios rate of return to owing real estate.

I’m not going to go over my portfolio changes here but I had been selling to cash especially in tax sheltered accounts.

In general whether a company pays dividends or not doesn’t matter to the total return. Either they return money to shareholders in terms of dividends, or share buybacks, or growth. What matters is the performance of the company, not how they disburse the value they create.

Of course your money market funds are getting about 1%, so your down payment is falling fast in relation to inflation. It’s so boring/unprofitable to have money in a money market, I predict you’ll get sick of that fast and will buy a house soon. Because you’ll want out of the money market, and the only places to go are back into stocks or buy a house. At least now it’s clear that going forward that nothing’s safe – all asset types have a good chance to lose money against inflation. At least you get to live in and enjoy a house.

Fortunately I am too unsophisticated to invest in complicated things. Fortis, Telus, Cnd Rail, CND banks, etc., dividends just keep rolling in. A bit of a pull back but it is like walking up a hill with a yoyo.

I’m all in on XEQT, and we’re only back to Jan/Feb 2021… not too had here haha eek

Pending now $1,385,000.

You are absolutely correct that we don’t have much in the form of bauxite but will ship it across the ocean to process it into aluminium here, while we have cobalt, rare earth, and lithium that isn’t been mine or process here, or process lumber in this country.

Bananas and mangoes weren’t readily available here in Victoria 40-50 years ago, but we have lumber and affordable housing as you and many here like to think of.

Wait, I thought you were a buy and hold investor in balanced funds? You’ve told us about 30 years history of what would happen if you’d held a balanced fund, and even gave us a specific example.

Now you’re talking about lots of people “reallocating”. To what?

I was trying to shorten the url. Perhaps from now on I will paste the entire url however long it is just for your liking.

Last week of record low inventory.

Sales: 176 (down 24% same week last year)

New listings: 351

Inventory: 1451 (down 3%)

New post tonight.

Yes. Generally land value will increase somewhat but the amount depends on the scale of the upzoning.

If you upzone one lot, the land value rises a lot. Highest and best use increases on that single lot and there are very few lots with the same potential, so scarcity drives up the value.

I had a call with a planner in Kelowna last week and they estimate when they upzoned 800 lots it increased land value by about $100k per lot.

Minneapolis upzoned much of the city and one analysis I read estimated that land values increased about 3% as a result. So the broader the upzoning is, the lower the impact on land values. This is logical, because there’s limited capacity to build something like a multiplex. If there are only a few lots that we can build on, then the value of those gets driven up a lot. If there are thousands, then the value only goes up a little.

Kelowna is now looking at the second phase of their upzoning where they will do up to 6000 lots. They believe that upping the number will substantially decrease the land lift. They are also considering incorporating an affordable housing payment as part of the upzoning right that will capture some of the land lift just in case it ends up being more than expected.

It’s worth noting that land lift accelerates housing development. Part of the reason the original upzoning in Kelowna led to results relatively quickly is because of the land lift. Existing owners saw their increase in land value and sold to builders who put up quadplexes. So they got more housing from the upzoning than if they had tried to capture all the uplift. On the other hand I think it’s reasonable to add a tunable land capture payment in to the upzoning in order to strike a balance between capturing some of the land lift while still getting housing. The city can set the payment and review annually. If there’s little uptake, reduce the payment, if there’s too much speculation, increase the payment.

“HH’ers favorite balanced fund (VBAL) is now trading below where it did pre-pandemic (Feb 2020“

‘

‘

Patrick, I’m not sure that’s a favourite, a lot of people have been reallocating the last 9 months, especially away from portfolios with 50% bonds. Residential real estate is a lagging indicator and it’s best days have past in Canada

I isolated my DP funds away from my general investments in easy access funds for when an opportunity arises. Mostly in money market funds, the good in never really tumbles, the bad it never really gains much, but since the goal of the money is for a DP, I was willing to sacrifice gains for the stability of avoiding losses and ease of access when needed. However, for folks that needed an all in one approach with their DP as a part of their performing investments, I guess it could be hitting them. The ones that are probably really getting hit are the ones that were depending on money being cashed out of their parents HELOCs for gift down payments.

Probably because the vast majority of the world’s bauxite reserves are found in the tropics. If we are trying to be self sufficient in bauxite we might as well try to become self sufficient in bananas and mangoes at the same time.

Good call hiding the url with a tinyurl link. No one would have bothered clicking on a Fraser Institute link.

Patrick, about the homeownership benefits being so much greater in the States than here in Canada. Yet Canada has an almost 70% ownership rate and the US 65%.

The money that was printed during COVID hasn’t disappeared, it still is in circulation hence people that are holding onto cash will at some point jump back into the market. Unless people like Elon Musk and Warren Buffet and their army of minions are going into it blind while amassed hundred of billions in the last couple of years by accident.

Right. Of course if people de-leverage (e.g. reducing a $200K margin loan to $0), the “money” doesn’t get parked anywhere, it just disappears. So everything can go down, nothing needs to go up. Of course it worked the other way on the way up, so we can’t complain!

Good to know, thanks Leo. Do you happen to know if it makes the land values increase once the broad up-zoning has been put in place?

USA is the nation with the cheapest house prices in the world (except Saudi Arabia and South Africa) . ( Price/income https://www.numbeo.com/property-investment/rankings_by_country.jsp )

On top of that, they have 30 year fixed rate mortgages, so inflations isn’t going to raise your mortgage payments. So the payment will never rise, and can actually fall of rates fall and you refinance.

Canadian homeowners have no such advantages with their mortgage. It can rise every term (5 years or less in many cases), unlike the USA.

It is interesting how this will play out as the market is taking a downturn, while people such as Warren Buffet has been siting on cash during the pandemic is out shopping this past quarter.

We will have to wait and see where people will park their money, because everything is down including precious metal and energy (an odd even when inflation is running wild and perhaps a correction is a round the corner.)

Upzoning for missing middle is actually a critically important measure to take. Like it or not the days of an affordable single detached home for most families is behind us (and for many it’s been behind us for 15 years). That’s true even if we see a 20% drop in prices. So it makes no sense to reserve the large majority of our land exclusively for that housing type.

Broad upzoning is critical because if we upzone lot by lot there are not enough hours in the year to go through the process.

Kelowna did this with success in 2017 when they upzoned 800 lots to 4-plexes and attracted 300 building permits in 5 years. The key is it’s a game changer for small builders who can start putting up these small projects that right now are basically only done by developers

A sign of the times…

HH’ers favorite balanced fund (VBAL) is now trading below where it did pre-pandemic (Feb 2020).

All the “sugar-rush” $trillions of stimulus, money printing, low rates and we’re back to where we started. The stock market sure knows how to blow off the “froth” quickly.

Wonder if the house market will follow soon. At least to blow off the 20% price “froth” that occurred since the July 2021 assessments.

Has this even worked elsewhere? It really just seems like a last ditch effort by Victoria council to be seen to take action on housing affordability. Together Victoria campaigned in rental buildings promising affordable housing to renters and have done nothing but delayed developments from being built, so now they’re desperate.

DuranDuran, DP payouts are not impacted by the market. That is way it is so attractive/secure.

There is no specification of tenure. So someone could build a *plex, live in one and rent out the others, or they could stratify them and sell them off. I’m not 100% sure if subdividing and something like freehold townhouses would be allowed.

Speaking of markets, there seems to be a nice little tumble going on in the markets the past few weeks. I don’t know that anyone has solved the ‘down payment investment dilemma’. Are prospective buyers seeing their DP investments going up in smoke right now, based on collapsing Shopify / Facebook / crypto etc. prices?

My sense is that high oil and interest rates will shift the focus from the housing crisis to a brutal recession very shortly.

I am relying on someone’s expertise here . The missing middle proposal by Victoria city council is it all rental six plexes or is it also condos? Thanks in advance.

No to the latter. Increasing incomes while leaving other factors unchanged will simply increase housing prices in turn. It will not make housing more affordable.

What other nations have figured this part out?

In any case, there’s no mystery what the causes are and how to solve them. The biggest problem is that there are too many interest groups who have a stake in high housing prices and don’t want them to go down. In short, the financialization of housing. And the largest such group is not corporations or hedge funds, but the ordinary owners who view their house as a piggy bank and don’t want lower housing prices upsetting their goals. And they vote.

Ontario tried a speculation tax on property, and the market ‘collapsed overnight’

Froth starting to be blown off house prices. I think anything higher than July 2021 assessment is pure froth and that’s 20%+.

https://ca.finance.yahoo.com/news/toronto-home-prices-drop-most-090000164.html

“ The average price of a home in Canada’s largest city declined 6.4% in April from the month before on a seasonally-adjusted basis, to C$1.2 million (about $936,000), according to the Toronto Regional Real Estate Board. That was the biggest monthly drop since April 2020, when the market was largely frozen because of Covid-19 lockdowns.”

I’d install one just to drown out my neighbor’s yappy little dog. The thing is possessed.

Sometimes when I read HHV comments I imagine that everyone is talking with a mouth full of unsalted dry roasted peanuts. Try it….it’s fun!

Have fun cleaning your screens.

FEW understand this.

Right. We’ve likely all read about the noise and strange health issues surrounding wind turbines. I can’t imagine installing one in a city and I expect the neighbors would hate it too.

The building is in Winnipeg.

Sounds like you haven’t looked. Tons of professional solar installers in Victoria

I would franchise it if I could see one in action. I can’t even find a properly installed and working solar panel system to inspect. I’ve heard some of the installations are a nightmare. I looked into getting a system on my commercial building but did not have any confidence in the young men that came around to sell me a grossly overpriced system.

Typical political solution, instead of paying a premium to go to remote communities, they piss them off and they go to the U.S. Misguided government policy is the cause of most of our problems.

Even better would be the Canadian innovation known as the Slowpoke 2 reactor. Just get a mini one in your basement. Support Canadian innovation and all the resources are here to do it domestically. You can power your neighborhood and be a true anti-carbon warrior, while making money back at the same time! We need to get Marko on getting permits passed through city council, but I’m sure that will be easy enough.

More seriously though, no one is hiding clean energy sources out there. If something is viable, I am sure there is ample investment for it and business looking to sell it into any market. At this point for the clean energy model to work, it really needs government to get out of the way more than anything else. Come on Frank, you sound sold on it, the BC or Victoria territories probably need a franchiser. Put up the cash and get on selling those systems.

In the 1980s BC refused to allow new medical doctors, unless they worked in underpriced areas (up north). It was based on the idea that bc had too many doctors in cities. They wouldn’t give out billing numbers, until they lost a charter of rights case from a BC doctor.

Is anyone familiar with the Kohilo vertical axis wind turbine. They are manufactured in New York and could be mounted on a flat roof or on the ground. They are advertised as being quiet and efficient. I never hear anyone bringing up this technology, we all know there’s a lot of wind. Why nobody is demonstrating this machine is a mystery. We should be testing this unit to determine its viability. Added to some solar panels, this system could solve a lot of problems. Instead we are kept in the dark. A clean self sustainable energy source is worth $100,000 to me.

“ And that sort of defines the issue in a nutshell. If you have open trade in with a country where the middle class starts at US $7,250 a year, there are a lot of sectors a country like Canada won’t be competitive with. It doesn’t mean there’s anything wrong with us”

So everything is good then. I thought our middle class was having an issue affording housing?

To make housing more affordable you can reduce the cost. Or increase your income.

While other nations have figured this part out, we seem to be stuck in neutral. The idea of adding value to create wealth is something we no longer speak of (capitalism). Sorry. can we still use that word?

Our solutions seem limited to demanding that our greedy employers pay us more or buying lottery tickets

Doesn’t have to be nuclear. Point is countries made decisions in favour of environmental concerns, but didn’t change any of their energy consumption habits and now they are depending on Russia.

If we can’t process the lumber here in BC vs shipping it across the ocean and back, when we have cheap energy and the know how, then there is definitely wrong with the system with labour cost consist of only 15% of the overall operational cost.

We’ll see how the Blondin act works out.

https://www.theglobeandmail.com/business/article-recession-worries-widespread-as-interest-rates-rise-poll/

The Chinese government defines incomes ranging from US $7,250 to $62,500 (RMB 60,000 to 500,000) per year as middle class.

And that sort of defines the issue in a nutshell. If you have open trade in with a country where the middle class starts at US $7,250 a year, there are a lot of sectors a country like Canada won’t be competitive with. It doesn’t mean there’s anything wrong with us.

I’m not a big fan of nuclear power, Ontario went into it intensively and it cost them a fortune. Some of the highest hydro bills in the country. As much as we think bringing more people into the country is a positive, we simply don’t have the infrastructure to support more than 40 million people. Especially all the social programs they think grow on trees.

Same story in many countries in Europe and now Putin has them by the balls. Love how is everyone is “we condemn the killings of innocent civilians” but keep the gas flowing please.

If you weren’t dumb enough to shut down safe nuclear power you wouldn’t be in this situation.

Telsa factory delayed a year in Germany over some water usage regulation BS but you keep pumping gas from Russia for ICE cars. Makes sense.

Still active

What did the house on Whimbrel that sold recently go for? Tx!

Now it costs quadruple to ship the goods we need to produce the houses we are in dire need of. Looks like we shot ourselves in the foot. Don’t expect any affordable houses anytime soon.

“ They closed because the owners weren’t making enough profit.”

Yes I think that is the case. Our costs of doing business are too high in this country. Whether it is poor management, high labour costs , taxes or regulation or ? Sad to think that we can transport raw logs to Asia and bring them back processed cheaper than we can do locally. Illustrates the massive gap in competitiveness. Not surprising that investment in Canada has greatly shrunk. And along with it loss of good paying jobs and the disappearance of our middle class.

On a totally unrelated note. China’s middle class seems to have boomed.

Listening to CBC Radio’s Cross Country Checkup — today’s topic: housing affordability — and I keep hearing in my head Leo’s salient observations and informed explanations in response to many points being raised.

This blog spoils us with information and knowledge. Kudos, Leo.

The numerous lumber and plywood mills that have closed in BC didn’t do so because of “greenies”. In fact I think you will find that the real greenies advocate more processing of timber locally. They closed because the owners weren’t making enough profit.

Oh, yes plus 13 days stat leave.

With a little maneuvering and creative manipulating the average BC government employee who have been employed for over 5 years could you know work about 192-195 days per year. Considering: Annual Leave, Sick Leave, Bereavement Leave. Special Leave, Household Emergency Leave, Moving Leave (yes moving leave), Education Leave. Not bad.

And yet so many of them seem to be totally upset when someone has worked for themselves, scrimped and saved and then purchased a condo to rent out so they can perhaps get a decent pension at retirement.

NIMBism would be considered as a minor issue and new facilities actually receive taxes benefit from all levels of government. The most challenge is the regulatory approvals – environmental assessment will take minimum 2 years, industrial rezoning permits, BC Hydro and natural gas connections, and good luck to get permits under the waste discharge and water regulations.

I’m glad that you asked Talentedkehole.

Here is a 2015 full on report — https://tinyurl.com/ytsy7j32

True that we can’t compete in some sectors, but IMO we definitely can compete in mineral refining, oil & gas, and lumber if the backward greenies and the government don’t convolute the approval process and tax it to death.

For and example, we import plywood that requires very little human processing from the US, and Asia who buys our lumber and turn it into plywood to resell it to us. Similarly we import bauxite from South America and Africa to refine it into aluminium instead of mining it locally due to NIMBism and taxes.

“Comparing Government and Private Sector Compensation in Canada, 2020”

Curious – what’s the private sector equivalent to a director who manages a program that delivers critical benefits to hundreds of thousands of BC residents? Or perhaps the private sector equivalent to a government employee who works to take down money launderers or terrorists? I always find studies from the Fraser institute to be weak because often there are no comparable jobs to the private sector.

Up and Coming – Spot On!

Actually there are very good reasons whey we shouldn’t be self sufficient – we’re a fairly small economy over a very large territory with some large natural resource based sectors. That means it would be very inefficient to try to make everything ourselves. We gave up making cars just for the Canadian market almost 60 years ago, well before globalization. What would have happened if we’d tried to continue with that – well Australia has stopped making cars altogether.

In the last 30 years many government IT tasks are outsource to private companies that outsource the work to oversea entities.

Comparing Government and Private Sector Compensation in Canada, 2020 — https://tinyurl.com/yss9zdk8

The majority of government employees earn more than a living wage, so yes, whining for more is entitlement.

Another theme that showed up in 81. The province had just increased payments to doctors by 40% and people in the TC comments were complaining about greedy doctors and realtors

All the big Canadian banks, some clothing companies, software co.’s and more are currently outsourcing to equally skilled workers in India, Mexico, Philippines etc. paying a fraction of the cost of hiring Canadians. Maybe someday, our governments will be thinking of doing the same?

“Governments are afraid of excessive inflation as it’s destabilizing and ultimately ruinous.”

I wish governments were as concerned with asset inflation as they are with wage inflation.

“ Governments are afraid of excessive inflation as it’s destabilizing and ultimately ruinous. Being a huge employer, and a government no less, offering a wage hike to that degree to that many workers would go a significant way in solidifying the inflation and sending a signal to the population that it expects inflation (and all the strife it causes) to continue.”

The provincial government has no control over inflation.

“ Hello class, welcome to Entitlement 101”

Give me a break – earning a living wage while working in a professional capacity is now entitlement? Seems like we are sliding backwards and people like you are ok with it.

Garden- That started decades ago when the government allowed most of our manufacturing to be shipped overseas. The working class lost their careers to slave labor. Now we have supply issues driving up prices of everything in one of the few countries in the world that should be 100% self sufficient. It boggles the mind. At least the rich got richer.

The issue with this is that the market is quite cruel to many in the working class.

Productivity and profits have risen much faster than avg incomes over the past 50 years. Wealth inequality has been following suit. Seems unjust not having employees share in that success proportionally.

https://www.theglobeandmail.com/canada/british-columbia/article-bcs-beneficial-ownership-registry-being-used-in-tax-cases-visa/

Do note this is the total workforce of the department. They do other things than process immigrant applications, e.g. process refugee claims , temporary foreign workers, and citizenship applications.

If an individual feels their skills and qualifications are not being appreciated, then they are free to offer their services to an employer who will compensate them adequately. That is, if they have any unique skills or qualifications. No one is forcing anyone to stay at their current place of employment. You are free to seek out a better paying job whenever you wish. It is that simple. Unfortunately, it is very difficult to find any other employer that offers a better package than the government. Private employers also expect a certain level of productivity.

Fees for M.D.s are also too low to live anywhere on the South Island.

Hello class, welcome to Entitlement 101

Every government is addicted to any tax otherwise they would have nothing to bribe us with.

Personally I’m glad the housing boom came with the NDP government otherwise other insane taxes (hi introvert) would be implemented to deliver on their half-baked promises.

And if you think any government employee has a gold-plated anything you’re mistaken. Stable, sure (minus 2001 and it could happen again), pension, sure, but those are even more modest than salaries. No one with a government job is getting rich off their salary, it’s just a convenient scapegoat at times

Yeah I get it’s a good size for a condo, especially these days so that’s why the per sq/ft is lower. Are you saying there are 10-15 year old buildings with units going for more per sq/ft or going for a higher selling price? I see a couple of the units overlooking Florence Lake are in the 800s too. Wild to see that for a condo in Langford, but maybe that’s just the way everything is going, especially with the way people in the CRD seem to be turning their backs on the city of Victoria proper.

Also, on the per sq/ft price, I’ve noticed that realtors and others in the RE business refer to that measurement more frequently these days. I get that in a place like New York where almost everything is built out that’s kind of a go to reference, but is that a fair measurement of properties on the lower island? Not a criticism, just a question

I would like to know how many people the government employs to approve 1500 immigrant applications a day.

https://twitter.com/trevortombe/status/1523091008929423360

If wages went up, prices would also go up, resulting in less affordability and even more overpaid government workers. Nothing is simple.

“The problem is that wages are too low”.

The wages should be what the market will bear. If you can’t find someone competent to do the job for the wage then then the wage is too low. Just like in the private sector (the real world)

The salaries for government workers to live anywhere on the southern island are too low. They should be about 25% higher than they are now. The problem isn’t that house prices and rents are too high. The problem is that wages are too low.

I don’t know how the BC government gets anyone to work there at least on the it side. Even an IS 30 is basically being paid half the going rate and in the private sector you get RSUs that beat the pension. I could see getting an IS 30 job out of university would be ok but then you’re tapped out.

Bravo!

It’s nice to see that common sense in government sometimes prevails. Nova Scotia is scrapping the proposed non-resident tax. They looked at the tax, and realized that it wouldn’t make a difference to home affordability, so they scrapped it. Maybe some day politicians here will “put personal pride to the side” and “look for another tool” to help the housing problem, as the Nova Scotia Premier has done.

https://www.theglobeandmail.com/canada/article-nova-scotia-non-president-property-tax/

Nova Scotia reverses course, scraps non-resident property tax

“[Nova Scotia premier] So today I will put my personal pride to the side. This policy was an effort to find a solution. It was always meant to be a tool to support housing. But when you realize that the tool you have in your hand might not get the job done, you look for another tool. I commit to finding a tool to make home affordability, particularly for first-time home buyers, a reality in this province.”

A lot of head scratchers out there, but not sure about this one. $595 per square foot for a new build isn’t outrageous. 10-15 year old buildigs in Langford are going for more.

As far as the bedrooms back to back bedrooms are like 1/2 the condo layouts.

To a GEU member it probably feels that way, but I don’t think BCGOV is coming from that angle. They know there’s inflation in goods and services, which is why they are offering 1.75% on the wage side. Theoretically, if you meet goods and services inflation with higher wages, it locks in that inflation. If you don’t, I think the thought is it inhibits upward pressure on goods and services (and ultimately debt servicing) costs as the market will not bear the increases.

Governments are afraid of excessive inflation as it’s destabilizing and ultimately ruinous. Being a huge employer, and a government no less, offering a wage hike to that degree to that many workers would go a significant way in solidifying the inflation and sending a signal to the population that it expects inflation (and all the strife it causes) to continue.

Whether it’s fair or unfair, the theory right or wrong…that’s my little armchair guess on it.

Heading into a recession and likely delcining government revenues in the coming year and higher debt servicing costs, no one is going to be getting inflation protection in a contract. As well, BC government revenues have become addicted to land transfer tax and if they are forecasting any slow down on real estate, there isn’t much around to dole out to government workers that the general public views as already having a pretty gold-plated set up for the expected output to compensation model that is currently in place.

Looking at the deal on offer, the B.C. government is pretending there is no inflation right now:

BCGEU to hold strike vote for 33,000 public sector employees

https://www.timescolonist.com/local-news/bcgeu-sets-strike-vote-for-may-16-5341756

Langford reaches for the sky: 18- and 24-storey condo towers being built, more are planned

https://www.timescolonist.com/local-news/langford-reaches-for-the-sky-18-and-24-storey-condo-towers-being-built-more-are-planned-5342002

This mid-floor 2bed unit that couldn’t even separate the bedrooms in the layout has to be one of the biggest head scratchers out there. Are these actually selling at this price? https://www.realtor.ca/real-estate/24368373/403-842-orono-ave-langford-langford-proper

i/ Often you can get a much better unit for the same dollar amount

ii/ You don’t have to come up with the full funds/mortgage for 2-3 years

iii/ Warranty and you buy yourself more years before the first special assessment. Even thought a five year building may look new a lot of components such as elevator have a shelf life and I prefer to start at zero.

The biggest factor for me is deferring full payment for years and or in a much better position to qualify for a mortgage in three years versus now. Rental income for two years in a not a huge factor imo. You have to remember you also have expenses (mortgage interest, taxes, strata fees, insurance) associated with that rental income.

I guess by renting the pre-sale you would get today’s price and tomorrow’s rents. Whether that’s better depends on tomorrow’s price and tomorrow’s interest rates, of course.

I fail to see the rationale in putting money on a pre-sale if you intend to rent it at completion when you can buy an existing unit and get rental income immediately. Let’s face it, the only reason most people buy a pre-sale would be to sell the paper for a tidy profit prior to completion. You’re probably the exception Marko. I still think that pre-sales should be limited to 2 per person. It’s the whales that buy several units I have issue with.

I’ve only ever assigned one as someone approached me about it and offered me 175k for a piece of paper so that was a no brainer. Beyond that the studio/one bedrooms I always keep and rent out long term (would have no issues signing a 5 year lease on any of them). The plan there is if I run them cashflow neutral they will be mortgage free in 15-20 years. A couple of two bedrooms I’ve sold on completion/possession. I’ve stopped buying two beds, you have to deal with bigger mortgage etcs. I like studios and small one beds as smaller absolute downside risk, smaller capital investment, small strata fees, less to worry about in general.

I’ve made videos over the years as to why I like my condos small as possible in Victoria -> https://www.youtube.com/watch?v=DAz_1KGS-hY

+1, exactly

If a pre-sale buyer plans to sell upon completion of the project, it makes no difference to the market price whether there were pre-sales or not. It’s the same number of units on the market. If the pre-sale buyer plans to hold the unit, then in a situation with no pre-sales they would be competing for the finished units.

Bottom line its the supply and demand at time of completion that matter. Here’s what happens when things don’t to the pre-sale buyers’ way:

https://www.theglobeandmail.com/news/british-columbia/reluctant-condo-buyers-sued-for-backing-out-of-village-purchases/article567310/

Everything is negotiable, though I would say it’s a lot more common for brokers to buy down the rate

Marko- I was enlightened by your example of the project designed to keep prices down for the end user, ie. affordable housing, but could not get off the ground. That’s the point I was trying to make, the system is stacked against the little guy, and affordable housing is a myth.

Just curious as to how many pre- sales you’ve seen to completion and how long you usually have to hold onto a one before selling it. Sounds like a good way to leverage a small amount of money into a potentially substantial gain with little work. I wasn’t implying it was evil, I’m a capitalist also, but I can’t help but think it plays a role in driving prices higher in certain markets.

I would look outside Victoria for mortgage brokers. Got one out of Alberta that was .25% lower than anyone here with 5K cashback(even higher if I went variable). No one locally would touch it. Mortgage is with TD.

That would be GST, as BC has no HST. Appears to be charged on the assignment premium, not the total price of the property.

https://www.bcrea.bc.ca/legally-speaking/federal-budget-2022-taxation-of-property-flipping-gst-and-assignment-sales-548/

As someone who buys pre-sales on a regular basis I don’t view it an evil endeavour. Everyone has an opportunity to purchase a pre-sale (at least in Victoria they take months or years to sell out unlike Vancouver/Toronto where it can happen overnight); however, the vast majority of people don’t want to wait three years for it to get built so they pass on it. I and other investors fill that void. I take the risk that the market tanks during construction. On completion, I rent it out.

It would decrease overall inventory as many projects would simply not get off the ground. Here is a local Victoria example. BC Housing partnered with Chard Development on a development called Haven on Johnson Street. Since Chard is receiving financing to build the project from BC Housing they have criteria on who can buy the pre-sales and invenstors are not allowed to purchase, high-income earners not allowed to purchase, you need to be a BC resident for at least 1 year, etc. It is truly meant as a product for end-users.

Currently at Haven (https://www.havenbychard.com/) you have 375 sq/ft studios offered at $325,000+GST = $335,400 (after GST Rebate)

Literally ACROSS the street on Johnson YESTERDAY a 388 sq/ft studio in a 1 year old building sold for $420,000.

Why is the pre-sale suppressed so much? Simple, investors cannot buy it and the average end-user is not patient enough to wait two years to move into a studio even thought it is an amazing deal.

How can the developer make the project work? Simple, BC Housing is giving him interest free cash to build it. You remove the interest free cash and restrict to owner-occupiers the numbers don’t work. The development does not get built.

I assume you’re talking about Toronto and not here based on the $1800 1bed/1bath 45 inquiries scenario.

> That sounds like the market rent is higher than $1,800, and the landlord is looking for a good tenant at a good price.

I like that strategy, but 45 emails is too many to deal with and make time for. I don’t even know how I would find people if any of my rentals become available. There are some online groups where tenants are putting their best foot forward to try and secure a rental by sharing info about themselves and I will probably try that next time as I don’t feel like 45 emails/phone calls. Although, with the 2bed/1bath I have rented at $1500 and all utilities included I doubt they’re going anywhere.

Frank

Well, starting tomorrow (May 7) all assignment sales are subject to HST. This applies to the sale of the unit from the builder to the original buyer (13%) and additional tax (another 13%) on the price paid by the second buyers. So, a 26% tax should resolve that problem, Frank.

That sounds like the market rent is higher than $1,800, and the landlord is looking for a good tenant at a good price. Rents are likely headed higher.

Is it possible to negotiate cash back from the mortgage brokers commission?

We’re talking about presales, so these condos don’t exist yet.

If 10 people buy 10 existing condos, then that drives up the price of condos but adds to the rental supply, reducing upward rent pressure. Net zero for housing from a 10,000 foot view, though of course that depends on your perspective.

A recent tweet from Curtis Lindsay: “I don’t think anyone fully grasps the rental crisis here in #VictoriaBC. A client listed their 1bed/1bath condo for rent at $1,800 and received 45 applications in half a day. They were completely overwhelmed with personal stories/situations.”

Clearly we’re not exactly suffering from an abundance of investor owned rental condos.

I’d say the exception where it turns harmful is flippers who only hold for a year to grab some market gains and then sell. They can avoid the vacancy tax, and they don’t provide secure rental housing. At the same time they add market volatility and increase the risk of crashes. Anti-speculation legislation that targetted that behaviour would be good.

$1.58, full asking. 8 DOM

Options I can recommend:

– Mike Grace (Disclosure: he advertises on this site)

– Matt Imhoff

– Tyler McTaggart

Not following you there? Taken literally, that means supply meeting demand. That’s what’s supposed to happen, is it not?

As far as artificial demand (I presume you mean speculative demand), that’s really only a function what stage the market is in. Investors are present in all stages, but the kind of rabid, speculative demand that can result in a blow-off-top increases and peaks towards the end of the market cycle. Eventually it moves back to favor first time buyers and what some people call “smart money” investors.

Can’t say that neat and tidy little cycle hasn’t been corrupted recently and made almost any investor look brilliant, but that’s another topic.

Ten people buying 10 condos, taking the supply off the market creates an instant shortage that produces an increased, possibility artificial demand, pumping up the price. Something like the diamond market, millions of diamonds are held in vaults by the big dealers who release them slowly into the market, creating an artificial shortage that drives up consumer prices. In the end, the end user gets screwed.

I thought people were concerned about affordable housing, evidently not.

What was the sale price on this duplex at 1841-1843 Laval Ave? And DOM? Thanks.

Our family has been dealing with Denise Webster. (She is a mortgage broker in UpTown).

Super nice person. Great for follow up support. Always found us financing even on difficult ones.

If you google her you should find her contact number.

G oo d L uc k.

Isn’t that what the pre-con buyers are? Private investors that are helping finance the project?

I don’t know a lot about this, but I think this is par for the course for the capital stack to be assembled with a mix of private and bank money

Some turmoil in the construction community as the great resignation hits the construction sector… just heard Campbell Construction had their CFO and senior estimator/PM of 20+ years resign. Now the company has no staff with any education and more than a couple years experience. While Farmer is also losing staff and having conflicts with ownership pulling the company in different directions. Tough times ahead.

The developer should have private investors in on the entire project who reap the benefits if public demand is high and when the units sell quickly, the prices go up. Public investors should be limited to 2-3 units. Fairer distribution. But I guess everyone likes a quick buck, just don’t complain if you lose your shirt. I should have said it creates a shortage of affordable housing.

How does flipping an assignment create a shortage of housing? It’s not housing, it’s just a slip of paper.

I get that people hate these assignment flippers but I don’t actually think they drive up house prices. All they’re doing is assuming some risk and gambling on future appreciation. Just buying condo futures.

Arguably we should do a better job qualifying them so they don’t cause a crash when they get overextended, but otherwise I don’t see a huge issue

Frank, having trouble following your logic. Investors taking on the risk makes it easier for developers to actually build and hence more is actually built. If the developer is going to take on all the risk he will sell the final product for at least the same price as the speculator would and perhaps for more since less units are likely being built.

patriotz- I know that, but it creates a shortage of housing. If they get stuck holding something they can’t unload, too bad. These players must have deep pockets, and a lot of them were from foreign countries. Just look at all the empty buildings, even cities, in China. It’s basically a pyramid scheme in some cases.

That’s the purpose actually. It offloads risk from the developer to the pre-sale buyer. Without pre-sales developers would find it much more difficult to get financing.

“Yes. Provincially regulated lenders and even the big banks if you are otherwise very well qualified. I’d talk to a mortgage broker”

Any recommendations on names, companies providing services in Victoria ?

Buyers of pre-construction properties should be forced to own the property for a minimum 2 years before they can sell. That would probably take the froth out of some of the market. I heard years ago of foreign buyers scooping up entire floors of condominium towers, then selling them off for huge profits before taking possession. That should have been addressed years ago but someone turned a blind eye.

Buying pre-construction is pure speculation. If “investors “ get burned, boo hoo.

Lots of examples from a RE lawyer about buyer remorse due to the market turning and worried they’ll lose more than their deposit, pre-con buyers intending to flip assignments with no ability to actually take possession, how private lending equity tends to dry up fast in a downturn, and how much has been flowing from parents which could indicate few reserves to weather a decline.

Their market is a lot weaker right now than it is here. But the first murmurs of a slowdown also started in Toronto before there was any sign of it here

Yes. Provincially regulated lenders and even the big banks if you are otherwise very well qualified. I’d talk to a mortgage broker

Not really, aiming for fall right now but of course will keep an eye on the market and might delay a bit further depending on what has happened by then. I do think if not a decent price pullback at the very least buyers will have a lot more power

Bit off topic requiring guidance, can one still bypass mortgage stress requirements off 5.25% by opting for non federally regulated credit unions like Coastal Community, Island Savings etc. ? Any one can share their experience ?

Any other guidance on bypassing mortgage stress test ?

Thanks

Leo, you’ve said a few times your parents are interested in downsizing to a townhouse, but that you’re waiting for the market to settle before you encourage them to proceed. Have your thoughts changed at all?

@leo able to share more re: Toronto call?

Also mayor helps asking if they could change zoning to disallow building new SFH without a suite… Any thoughts on that?

I’m pondering the question that we need six months of inventory before prices decline. If demand at the current prices of say around 1.2 to 1.5 million is in balance, since price are not increasing, then adding more homes for sale at at different price levels might show gaps in demand.

I’m thinking of the small houses in the Gateway and Tillicum neighborhoods that seem to be selling below vacant land costs. There may be strong demand for homes in the 1.2 to 1.5 million dollar range but homes for first time house buyers in the $750,000 to $850,000 could be a lot weaker since condominiums are strong competition for that price range of prospective buyers and that market could easily be satiated. Builders should be snapping up these low price homes but construction costs are high and they might not get the price they need after sinking a ton of cash and time in building to turn a profit. As a new home in this area is only selling at around 1.4 million.

In otherwords demand for housing in different price ranges may not be uniformly strong. Lower prices in these ranges might not bring more first time starter home buyers forward. That being said, six months of inventory in the lower starter home price range might not be necessary.

Things that make you go hmmmm.

I’m probably showing a bit of confirmation bias by posting this one, but it is really just too hilarious.

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-rate-hikes-landlords-toronto-vancouver-rent-increase/

Some highlights:

If landlords really need tenants, it might be difficult to raise rents. It’s probably a better time for tenants to push for discount because if the landlord is already losing money they probably can’t afford it to be vacant.

Ahh, looking for ways to stop that increasing cost….

I guess all that money had to come from somewhere.

Sucks to be them.

Postponed until next thursday @ 9AM.

Centres and villages going to public hearing though.

Listened in on a twitter space with Toronto realtors, lawyers, and devs. Amazingly negative sentiment.

The oil and gas growth was halted was due to our government taxed it to the wazoo. And, it’s still functioning very well at the moment.

It’s not just tech but the entire market that is crashing.

Inflation is goosed by many factors, but mainly from the fact that all governments over printed money during COVID, Russia/Ukraine war, blind support of unpractical green energy, and destruction of nuclear/fossil fuel energy investment.

Everything is going to be expensive going forward because of poor energy polices. In 6 months price of everything will be out of control when the EU completely detach from Russia oil supply.

Looks like high tech is revisiting the crash of 2000. People aren’t shopping on line as much, Uber and lyft can’t get drivers same with skip and all the other delivery services. Funny what high gas prices do, I’ve even heard truckers parking their trucks, doesn’t pay to pull a load. Cut the price of gas in half and inflation would disappear.

Missing Middle live at council -> https://pub-victoria.escribemeetings.com/Players/ISIStandAlonePlayer.aspx?Id=fa871a02-81d5-42b1-94b8-4ad3b2a666ec

“…personally I prefer sprawl to density as I don’t think it’s healthy having huge amounts of people crammed tightly together.”

I also prefer low density living for myself, but wouldn’t object to zoning changes to permit other types of low density structures in existing low density neighborhoods. I doubt I would suffer much if the structure next door with two dwelling units is replaced by a structure containing four. Tall fences and hedges are pretty good barriers against unwanted neighborly contact.

I still remember the letters to the editor back in the day when downtown was starting to densify, complaining about how it would ruin the character and charm of Victoria. Nothing screams character and charm like bombed out parking lots and random street fighting I guess.

You live in the suburbs of an un-amalgamated city.

Local Fool, many people who live in the more rural areas want/need all of the services that cities provide but then don’t pay for them and complain about them.

Right it’s not a “city”. Nor is metro Victoria’s most populous municipality, Saanich. 🙂

North Saanich.

Where are you? Gold River? Why do you care whether the city densifies then?

I don’t.

patriotz- Low gas prices led to the collapse of our oil industry, now we have high prices because we lack adequate production and shipping facilities (pipelines). Lack of demand caused the shortage, not low interest rates.

High interest rates are the result of a low supply of money, today it’s the other way around. The current over supply of money will not disappear if rates go up, unless you’re taking a beating in the stock market today, High rates will only shift money around to other asset classes as investors look for safety. Easier to dump your portfolio than sell your house and live in the street. I would bet that houses actually increase in value in the next year,. We’ll just wait and see. In the mean time I’m paying 1.89% on a relatively small line of credit and have great tenants, and great properties.

Certainly healthier than sitting in a car for hours every day.

Why do you live in a city then?

Sarcasm aside, I think that’s debatable. Environmental and efficiency arguments aside, personally I prefer sprawl to density as I don’t think it’s healthy having huge amounts of people crammed tightly together. Some will like it for sure, but for the rest of us – no, I want some space and a bit of privacy.

Never bought those “lively”, “happening” or “energetic” euphemisms that proponents use to label community characteristics with high populations in small areas, or the argument that more density always controls housing costs.

Seems like they missed step 0 on that cartoon. Or was suburban sprawl the paradise that God created?

Hmmm, doesn’t seem like a lot of concern for the over leveraged.

“Right now, interest rates will hurt borrowers, but inflation is hurting everyone,” Rogers said. “So, the best thing we can do — even for people who have high levels of debt — is just get inflation down.”

https://www.msn.com/en-ca/money/topstories/bank-of-canada-s-carolyn-rogers-says-supply-is-the-key-to-solving-housing-problem/ar-AAWX3lc?ocid=finance-verthp-feeds&cvid=09d1df37b87f458c87ee797797a2cfd4

That was a short lived hiccup.

@introvert, that was probably right around the time Gordon Head was built.

Guess you missed the collapse in gas prices that accompanied the first lockdowns in spring 2020.

The current inflation is the result of two factors: too much money (demand side) and too little product (supply chain problems, Russia war, China lockdowns).

Wrong in both theory and practice. Low interest rates mean more money supply and higher prices. Higher interest rates mean less money supply and lower prices. We got away with low interest rates without high consumer price inflation (but with high asset inflation) for a bit more than a decade but that party is over.

Barrister- And government policy had nothing to do with creating shortages (by shutting down the economy over a virus) and raising gas prices, which increases the price of everything. In my opinion both policies are failures, but succeeded in creating the inflation we are currently experiencing. No pandemic lockdowns, no artificially high gas prices, no inflation. Our current inflation rate is due to shortages not rampant demand. House prices would be a lot lower if there was more supply. Raising interest rates will only make everything more expensive, the demand is not going away.

https://www.cbc.ca/news/thenational/toronto-vancouver-home-sales-plunge-in-april-1.6441987

Just need more of these stories out there to get in the minds of the general public and not just housing blog readers. Can the fear of financial losses become a contagion like the fear of missing out did during the last couple years?

Frank seems to have never grasped finance 101

For every person that is affected negatively by high interest rates, there are probably 2 or 3 people (money hoarders) that are licking their chops over higher rates. They have been suffering for decades with 1-2% return on their savings. They never contribute to the economy by investing in productive endeavours, just sit on their money forever. Now they’ll be sitting on more, but not for long.

95% of B.C. MLAs own a home, nearly half have a second property

https://www.burnabynow.com/real-estate-news/95-of-bc-mlas-own-a-home-nearly-half-have-a-second-property-5314806

Marco:

…. and this!

Real Love:

https://apnews.com/article/russia-ukraine-business-seoul-economy-europe-2aa3a3315649570b7e2f391c7e4f9a21

In terms of the Canadian dollar .. follow the money. The dollar is tied to the economy. If the economy goes south, well …

1980-1981: Canadian short-term interest rates rise sharply, and the Canadian dollar comes under significant downward pressure.

February 4, 1986: The loonie hits a record low of 69.13 U.S. cents based on significantly higher interest rates …

globalnews.ca/news/66674/timeline-the-rise-and-fall-of-the-canadian-loonie/

Sounds about right.

I think it was more the fact he said they weren’t actively considering doing 3/4% rate increase at future meetings.

Politicians aren’t stupid, just useless. Why wouldn’t they own multiple properties, banks must love their high incomes and employment prospects. Even if they lose an election, they manage to find some manufactured government position. Can’t see them that interested in making housing affordable, all they have to do is sound sympathetic to the plight of people priced out of the market. There really is no such thing as affordable housing and little motivation to create it out of thin air.

Although by the looks of things, NDP, Liberal, or Green they all have something in common besides being politicians. They are almost all property owners and many own multiple properties. No wonder the government just passed a piece of housing legislation that was practically a blank page. Many said it was so they could make decisions in secret, but now you have to wonder if it’s so they don’t have to make any decisions at all.

https://www.timescolonist.com/local-news/95-of-bc-mlas-own-a-home-nearly-half-have-a-second-property-5314806

Probably about 10 cents higher than it will be within a year. That will make our exports more desirable but push inflation higher.

rush4life:

Sorry rush, but the markets were reacting to the fact that Powell didn’t raise rates by 3/4%. The increases will continue along with Quantitative Tightening

“The economy is strong and well positioned to handle tighter monetary policy,” he said, though he cautioned “it’s not going to be easy.”

Investors are worrying about whether the Fed can pull off the delicate dance to slow the economy enough to halt high inflation but not so much as to cause a downturn. Still, the market cheered the Fed’s latest moves.”

Macklem and Powell seem to be singing from the same song sheet, don’t they?

And where is the CAD $ at currently?

BC’s biggest exports, coal and lumber are at all time highs by big margins. We have $107 oil right now, wheat is over a grand a bushel, cattle is also at an all time high. Milk futures are also, though not as drastic as Cattle/coal/lumber. Basically every major export from every province is booming.

Local Fool:

As noted by Leo, this is a National problem but there are only two provinces that went way off the rails. Those being B.C. #1 and Ontario #2. The third highest, Quebec, has an average home price of $472,800 for March 2022.

wowa.ca/reports/canada-housing-market

More importantly, in those provinces, where are the highest prices? The impact of a housing crash will be demonstrably higher on these provinces but, will it tip the scales? That CPI basket may be quite slow to change.

The BoC Governor is well aware of the impact of higher rates on highly leveraged home owners. He is also keenly aware that we will be headed for a recession within 2yrs but if he doesn’t put the brakes on inflation ….

^This^.

It’s true that the BOC doesn’t have a mandate to protect housing values. However, national and local GDP is now so tightly and extensively intertwined with the performance of the housing market and is so top heavy with debt that the sensitivity to rising rates can hardly be overstated.

In the United States, much of the liquidity and effects of low rates has been dumped into the stock market. In Canada, it’s houses (do people under 30 even know what the TSX is?)

So, the Fed is essentially saying they are going to smash stock market valuations to rein in inflation. In Canada, that same message from the BOC means the same thing, but in the context of housing valuations.

They won’t have to go far to tip the RE market south, and my guess is, come the expected hikes in June they are going to be at or just past the limit of what the economy will be able to tolerate in terms of rate levels. If housing goes down in a significant way, the entire economy sinks with it full stop. There are few other nations in the world where this is more true than here.

Given the illiquid nature of housing compared to the stock market, I suspect that dims the Canadian prospects of a fast recovery if they end up hiking too far. In that case, there would be a silver lining though: The revelation that perhaps we need another economic driver in our country beyond selling dirt and boxes back and forth to each other at ever higher prices.

I think the point is that rates are still low by historical norms, which only look high relative to post-2008 rates. Given high debt levels I don’t think they’ll have to go beyond those norms. And I think rates will remain near those norms for some time, because the environment that allowed rates to go to unprecedented lows without generating consumer price inflation is no longer with us.

“The next 3 months will flush out the Specuvestors from the true investors. The majority of “investors” over the last 3 – 5 years were counting on appreciation as opposed to income. They may very well be the first in the downward trend in prices …. well passed neutrality.”