June 27th Market Update

A quick update as we approach the end of the month, here are the weekly numbers courtesy of the VREB.

| June 2022 |

June

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 111 | 234 | 393 | 522 | 942 |

| New Listings | 224 | 547 | 873 | 1191 | 1208 |

| Active Listings | 1789 | 1878 | 1935 | 2031 | 1375 |

| Sales to New Listings | 50% | 43% | 45% | 44% | 78% |

| Sales YoY Change | -20% | -36% | -33% | -33% | |

| Months of Inventory | 1.5 | ||||

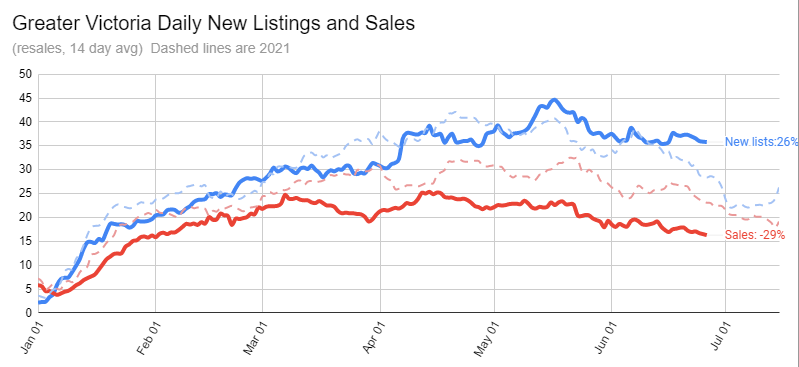

Sales have continued to drift downward steadily, consistently off by about a third from last June’s pace. Meanwhile new listings have held up well towards the end of the month and look to be on track for a more or less normal pace for the time of year.

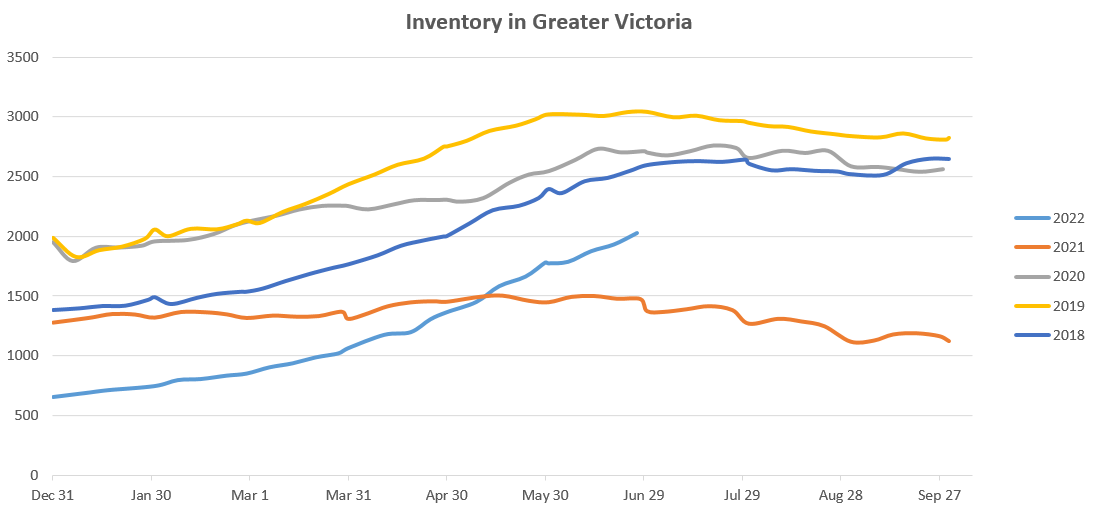

Though inventory remains very low (the 10 year June average is 3263), we have now cracked 2000 listings for the first time since November of 2020.

More important is where it goes next. Inventory nearly always increases from January to June but it also usually tops out around that point. So far we haven’t seen signs of the increases slowing down, but it’ll be interesting to see if the pace of the slowdown is enough to overcome seasonal trends, or if sellers are about to take their usual summer break and keep inventory stable.

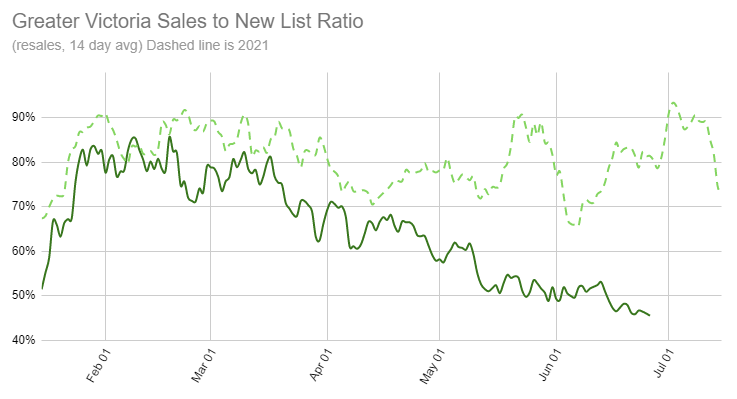

The sales to list ratio continues to drop slowly, now moving below the balanced market trend of around 50% and moving towards buyers market levels. Month to date, the condo market remains somewhat stronger with a sales to list ratio of 50% compared to 43% for single family detached.

Bidding wars also continue to decline, down to 17% of sales in the last two weeks. This measure will quickly become uninteresting as it stabilizes at roughly normal levels.

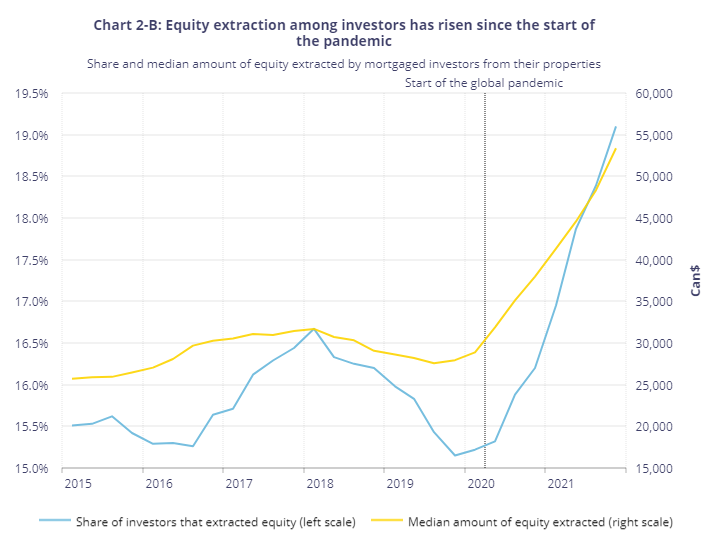

Expect the cooling trend to continue as long as rates keep rising. In addition, OSFI looks set to announce changes likely related to the use of HELOCs for real estate investing tomorrow (UPDATE: nothingburger changes). Similar to most of their changes I doubt this will have a huge impact on the market, but it may reign in some investors that have been increasingly extracting equity from their existing real estate to finance further purchases.

With credit tightening at the same time as house prices fall, I would expect the share of investor purchases to drop back to pre-pandemic levels. High rents may protect most investors from rising carrying costs, but highly leveraged investors without the ability to raise rents may opt to sell and add to resale inventory. Theoretically this all adds up to increasingly favourable buying conditions, but of course the reason is that deteriorating affordability has pushed more buyers out of the competition entirely. We won’t truly see improved conditions for most buyers until affordability returns to the market in some form.

Anyone know what the scoop is on 185 Olive St which has been on the market since early June? Is it overpriced or are buyers just becoming more wary with interest rate hikes?

New post: https://househuntvictoria.ca/2022/07/03/june-the-froth-is-gone/

While that seems logical if you actually look at incomes they are higher than Victoria, and they increased by the same amount since 2000. It’s not that they can’t pay much higher prices for real estate, it’s that they don’t have to.

Nice. At the peak with 2 kids we were paying north of $20k/year.

Would tend to agree. Also many up island municipalities are not as supply constrained as Victoria. More room to sprawl.

Didn’t Thoreau, after leaving Walden Pond spend eight months in a brothel?

It’s fortune-cookie time on HHV!

Was just at some Canada Day celebrations and the Triple-O’s food truck was charging $15 for a single burger. The bill for my family of 4 (with a 7yo and 2yo) was $75 just for food (no drinks). Whether we can afford it or not, the sticker shock still gives us pause to consider if it is worth it.

I’ve seen my portfolio drop almost $200K in this most recent sell-down, and I’ve never experienced wealth destruction like this before. Maybe it’s just me, but costs are always there, simmering in the background of my head as I am paying for gas, groceries, parking, etc etc. It’s made me adjust how I approach spending. Maybe because RE wealth hasn’t been as impacted, most people are still doing ok and the psychology of loss aversion hasn’t kicked in?

One can learn much from the wisdom of those who have gone before. Those who can sit quietly alone and form their own beliefs may reach a state of contentment with what they can afford without resorting to borrowing money from lenders: thus avoiding the stress of debt obligations.

Jibber jabber confirmed. Thoreau quotes only get you so far.

“…for a man is rich in proportion to the number of things which he can afford to let alone.” Thoreau

What kind of jibber jabber is this? Are you referencing a mortgage?

We had a way bigger increase up island for our farm than we did in town. I think up Island will have a bigger drop though. Covid caused some early retirement and relocation to more remote areas which caused rapid price escalation, but I don’t think that trend will continue. You can see a bigger drop in the Fraser Valley now too so it seems likely that up island will reverse a bit.

Ladysmith prices are close to Victoria prices on streets with a great view. Watch what 419-B Walker st. goes for this week. Priced at $800,000, 2 properties on the same street sold for over 1.2 mil and 1.3 mil. I think there is less homelessness in some of these smaller cities and possibly less crime, I’m not certain however. Smaller communities with a less overwhelmed police service might be able to deal with crime more efficiently, again, not certain.

Quite possibly there is an endless supply of fools who are willing to rent from money lenders, and assume all responsibility for the maintenance and care of the lenders’ properties(?). Permanent debt will fail to offer a stress-free life.

“…and the cost of a thing is the amount of what I will call life which is required to be exchanged for it, immediately or in the long run.” Henry David Thoreau

Condo in a middle of the road area in Zagreb ($600,000 CND and you need to install your own kitchen, etc.) -> https://www.njuskalo.hr/nekretnine/stan-zagreb-donje-svetice-109.00-m2-novogradnja-oglas-37656821

Same condo in a nicer area of Zagreb would be around $800,000 CND but there is almost no inventory in nicer areas (people keep attractive real estate through generations).

In a town that is a 40 minute easy straight nice highway drive from Zagreb with a population of 55,000 (has hospital and everything else you would need) you can buy a SFH on a 1/2 acre for $150,000 CND or less -> https://www.njuskalo.hr/nekretnine/kuca-zagradci-246.00-m2-oglas-37613549

If you go 2 hrs out you can buy a solid house $75,000 or less.

It would be like Duncan being 1/4 the price of Victoria, Port Alberni 1/8 the price and Gold River you can buy a house for the price of a used Honda Civic.

Ours got approved in Saanich. They are approving non-profits first so the savings are not as much as you suggest. Our costs prior to approval were $775 a month. Now it’s $200. Nice savings but not $1000 a month.

“Based on what I’ve seen around the world, for example, in Croatia you could sell a 1,000 sq/ft condo in the equivalent of Victoria and buy 5 SFHs in the equivalent of Edmonton but Edmonton is only a 2 hr drive and the weather is similar.”

It’s interesting how Courtenay area is so close in prices for Vic for how much less it has to offer with no ferry service and not much to do with a ton of flat land available in the area in many directions . The same could be said with Nanaimo. Am I the only one questioning why housing up island has gotten so expensive without the government jobs to support it ?

I think if you were to plot crude oil vs. Edmonton real estate you would have a definite positive correlation. It does affect employment levels and pay levels – even government raises in Alberta are positively correlated to energy prices.

I never understood this reasoning. It would make sense if the city wasn’t growing or unemployment was high but that’s not the case so I don’t see how oil affects their real estate directly

Edmonton real estate is strongly affected by the price of oil. For the last 9 years before 2021, oil was trending downwards hence flat real estate prices. Now, though, looking at those charts, Edmonton might be the better buy for the investor with a 2-7 year timeline. Victoria looks almost too hot to handle at this point although for the 10-20 year timeline it most likely would be the superior investment. The choice from a purely investment point of view would be akin to buying a “growth” tech stock like Amazon vs. a “value” somewhat cyclical oil stock like Suncor.

Can someone tell me why all the $10 a day daycares are located in Fairfield, Fernwood and Oak Bay. Again the government pumping real estate in the most affluent areas. For two kids that is an approx. 2k savings a month.

Solar is still so rare in Victoria that I can see many buyers shying away from it, or at least hesitating.

What RE markets did those studies use, and what was the solar market penetration in those RE markets?

I’ve never seen a study that showed a negative resale impact

Yes, I’m in no huge rush, but once the old roof is dead it’s metal

A long time ago you were toying with the idea of a metal roof. Is that still your plan?

🙂

en masse

tracts

Installing 25-year solar is a tough sell to people who move on average every 7 years. And it’s not at all clear whether solar is an asset or a liability on resale.

At current interest rates no.

From a climate and natural beauty perspective, Edmonton and Victoria are apples and oranges. Dozens of other factors at play, but this is a big chunk of it, IMO.

I wonder why this doesn’t work in Ontario. Lots of tracks of flat land where they are putting up thousands and thousands of houses that all look the same. Simply more demand than Edmonton despite the same concept of sprawl?

My new math takeaway is that income only grows (doesn’t appear that it has ever flatlined). Therefore, if you are in a house for 30 yrs while rates bounce up and down one metric (income) that is associated with higher prices will essentially go up pretty much every year for those 30 years.

It is kind of like having a yoyo (interest rates) in your hand but walking uphill (incomes). Elevation of the yoyo keeps increasing. Add lack of new construction supply, immigration, and a bunch of other factors to the walking uphill part.

5 year growth rate of 8.3%, substantially higher than Victoria so seems like there is no shortage of demand.

I think it’s mostly a supply story. They have more sprawl and more permissive infill zoning.

For housing prices in the short term it’s all about demand. In the long term it’s all about supply.

You can buy a solid condo in Edmonton for 200k. Is there just no demand or are they building enough to keep flat prices via supply? A lot of people make the argument we should build new cities for people to move to but here with have Edmonton with healthcare, education, infrastructure and unless I am missing something (they are building like crazy) it would appear people are not moving there in mass.

Based on what I’ve seen around the world, for example, in Croatia you could sell a 1,000 sq/ft condo in the equivalent of Victoria and buy 5 SFHs in the equivalent of Edmonton but Edmonton is only a 2 hr drive and the weather is similar.

My “new math” is people want to live in attractive places at the end of the day. I know personally I’ll take a 1,000 sq/ft middle of the road condo in Vic over a 5,000 luxury mansion in Edmonton.

Definitely. Income growth has actually been pretty solid in Victoria the last 20 years. Will be interesting to see how the high inflation impacts this.

Or the folks not working at home. I do think our relative price VS other cities is important. Alberta will do well with in-migration unless prices drop in other provinces.

These same people then lecture me on the environment 🙂

It is my rough eyeball test. Maybe Leo can give you a number down to the dollar to show it is actually $83,591.55.

https://www.victoria.ca/assets/City~Hall/Documents/2021%20Statement%20of%20Financial%20Information.pdf

https://www.islandhealth.ca/sites/default/files/accountability/documents/employee-remuneration-2020-2021.pdf

When I worked at VIHA that list was less than 40 pages, now it is 160. Pretty sure salaries have gone up and will continue to do with inflation.

Not saying wages are keeping up with housing prices, they are not as per Leo’s affordability charts, but they are certainly raising the low end affordability threshold. Houses aren’t dropping to 500k when the cleaning supervisor is pulling in over 6 figures with the City of Victoria. No slight to cleaning supervisors as my mom is a cleaning supervisor at UVIC but it isn’t exactly a back-breaking high education rocket science position.

Is this “new math”?

With everyone working from home why aren’t people moving to Edmonton?

Yeah we are doing roof first before panels because the roof is near end of life. But it’s not the end of the world to remove them either to re-roof halfway through.

Sounds like it’s time to update your knowledge

Solar panels would work best on a metal roof, shingles only last a certain length of time and might deteriorate faster due to condensation under the panels. The panels only last approximately 25 years and need replacing. Solar panel systems work best on a farm where they can be mounted in an open field. These installations are for commercial use and cost over $200,000. They do pay for themselves eventually. The weight of the panels have to be taken into consideration, especially on a flat roof. I looked into it a few years ago for my commercial building and opted not to proceed. I didn’t have a lot of confidence in the people I was dealing with here. An old fashion clothes line might save more money.

Brother in law signed up to be a distributor for Charge Solar to do his install + a few others hence the good price. Another guy I know got it through a commercial electrical supply place through work.

Not sure if there’s any normal places for parts other than Wego Solar.

No PEng for the racking design.

Can you post where you sourced your parts? I’ve found HESPV to be pretty useless…

I’m assuming you did not need a P.Eng for your racking.

I wonder if a roof full of old solar panels actually might detract from the value of the house. Personally when we were house hunting I looked at two houses with solar panels and both my wife and I immediately agreed that they would have to go. The other thought that hit me is that when you remove the panels to you also have to redo the roof.

But that is me personally (and my wife for that matter). Lots of other people would see it as a positive. But it just seems to be one more thing to maintain and if you are buying a resale I doubt if the warranty covers a second owner in all cases. But again I suspect that a lot of people would find it a positive.

Yeah that is definitely a risk worth considering. I think its mitigiated by the interest free loan. If I stay in this house for 10 years I won’t really be out any cash (assuming it does indeed end up being cashflow neutral or better).

Nice. Hard to beat for a nearly guaranteed and after tax return. Of course if you sell your house before 25 years then you’re gambling on the solar being reflected in resale, but the few studies I’ve read indicate that solar does lead to higher resale prices. Not sure how robust they are.

Got two quotes for 9.1kW solar install so far, one at 20.5k, the other at 23k (both before rebate), return of about 8%-9% annually in my case. Easy decision, especially with the interest free loan. The yearly cost of the loan should be entirely covered (plus a bit extra) by energy bill savings. Hard to see a downside.

Left without comment.

13.5kW for $18k in parts + ~$4k in electrical work.

10.64% IRR over 25 years, close to 14% after the $5k incentive.

Payback in years is the wrong way to think about it IMO. Think of it like a GIC that yields 10%. Would you buy that?

A fully installed system will be lower for sure, but around 8% return is still good.

Would love more info on this Leo. Warrants a whole post imo.

That’s a stunning decline in the Canadian average over just one year, with even greater declines in the priciest markets, and a comparable annual decline to what Vancouver saw in the 1980’s bust. I don’t see that turning around after a year in places like BC, where the economy is so dependent on RE. Too many knockoff effects. I’m not saying that we will necessarily see a bust as bad as that, just if we do I don’t see a quick turnaround.

Approx cost on this DIY set up? Neighbor just paid 20k for a 10kw system after a 5k rebate. Still seems like a long pay off. Heard CMHC is offering 0% loans now for homeowners to have these installed.

Weather is being felt now.

Not too sure about certain categories’ of restaurants being packing. Younger families with kids might really be cutting down.

Helping my brother with a solar install.

DIY mounting + electrician hookup on a 13.5kW install has north of 10% IRR before incentives.

No brainer on suitable roofs.

Scotiabank just recently published a report stating that if the Canadian government just spent 2.3% less than they currently are this would be equivalent to a 75bps rate hike. But no days ago they announce a 8.9 Billion dollar plan to fight inflation and affordability. Just printing more money to into the system that created this mess.

Agreed so much news, and yes the Malahat is packed. I have never seen so many new trucks, rvs and boats on the road. Or did everyone just tap into their HELOC!

A lot of posts will be interesting to revisit in the fall as we are all reading the news and the data differently

TD’s updated housing market forecast

https://economics.td.com/ca-provincial-housing-outlook

Travel, sure but long term I think we will break records depsite the climate change concerns. Resturants my bet is packed next year, packed the year after and so on while everyone complains about tough times. Same concept when it comes to gas…..complain about price of gas but buy F150. When I am not surrounded by F150s/Rams on Veterans Memorial on a Sunday afternoon I’ll know gas is too expensive.

Marko: I suspect that there is a bit of a positive Covid bounce that is keeping restaurants and travel really busy. People want to just get out after two years of feeling trapped. At some point increased mortgages and inflation are going to slow things down and hopefully not bring things to a screeching halt.

I agree, that is why the market has slowed and prices have come off peaks but the baseline for the low-end of a correction is higher than it was 3-6-9 years ago in my opinion. Effect of inflation also means the basement rental suite is now $1,800 and not $1,200/month. You can buy a lot of bannans, rice, and large packages of chicken from Costco with $600 that you can then take home in your Toyota Yaris. If you buy cherries at $8/lb and drive a V6 or V8 SUV than yes inflation is a bit more of an issue.

Interest thing is with all this inflation two meals + two drinks + tip is $80-90 at restaurants. Restaurants still packed. Go figure out these tough times.

I would argue that given the effect of inflation, interest rates and taxes, that government worker had more disposable income 3 years ago making 75k a year.

I think we are completely ****ed on climate change and I think we are already seeing the impacts of it; however, as a dual passport holder it doesn’t bother me, I can move around to avoid the natural disasters until I die. I sleep really well at night because nothing will change so why bother worrying about it. Best selling vehicles in Canada

Someone let me know when those two gas guzzlers aren’t that top selling vehicles in Canada. Someone also fill me in when three massive cruisers aren’t pulling into James Bay. Let me know when passport linesup/airports aren’t in chaos.

As far as life, in my opinion by far the easiest times in history. Problem is in North America people are so incredibly spoiled and the average North American does little traveling beyond Hawaii/Mexico/Western Europe so they have zero perspective on how the rest of the world actually lives.

Even within North America life has to be the easiest it has every been. We’ve lost a bit on square footage of living accommodation affordability but look at everything else from health care (aside from Doctor shortage average life expectancy is trending up minus covid) to cars to electronics, etc. Even the cheapest cars today has like 10 airbags, appleplay, A/C. The cheapest car has more tech than a 200k car for the late 90s. Would love to know what the ratio of humans to pets is in North America and a bunch of other metrics in these “tough times.” Must be super tough in society when we are paying basketball players $250 million dollar contracts to throw a ball through a round cylinder.

Yeah something worth keeping in mind for buyers is that sometimes you buy at future market value.

If the market is really hot and you want to buy you gotta be the one bidding above what anyone else thinks is market value. Prices are generally rising in those times though so market value will usually catch up to your sale in a few months.

On the downside it can be the same. Some percentage of sellers need to sell in every market, and if you find one with a place that’s a bit hard to sell you might be able to get it lower than market and get ahead of future declines. Market may stabilize lower but once prices are clearly stable sellers are less anxious to get out as well

I don’t believe that one can time the market with any sort of consistency so personally my trigger point is when is the market slow enough that I can get a below market deal within whatever the market is. For example, if the market is weak and you have sellers sitting on market 6 months then you can always find a seller that panics after they’ve been sitting on market 6 months, they get an offer, it collapses, and then you hit them with a low unconditional offer, $500k deposit, 10 business day completion (or whatever they want). The unconditional component is crucial to getting an exceptional deal, it definitively makes a desperate seller think twice about countering anything on the contract even if the price is below what they want and as noted works extremely well if they are coming off an offer collapse. If you are conditional then they know it isn’t really real until you remove conditions so they are much more likely to counter the price.

We aren’t there yet. Maybe in 6 to 12 months, maybe not.

On a side note I don’t think SFHs are ever going down to that price range unless government starts reducing salaries (when has that happened). Reality is someone 3 years ago that was making 75k is now making 85k and looking at 3/3/3 renegotiation which will put them over 100k. Rates will go up, but then they will stabilize or go down but the salary won’t. If you can ride out the interest rates I don’t think real estate is the worst place to be in times of inflation long term.

Price and interest rates are interdependent. you would be a fool to pay $800k for a SFH in those areas if interest rates are 10% plus. But if rates are 5% then it would be a decent buy.

You sure about that? Most people i know are hesitant to gamble with their down payments.

Perhaps, if you were at a large university or some research centre.

If I remember correctly we didn’t have internet till perhaps late 1991~1992 at Uvic, and we were playing with 300 & 1200 baud, and Victoria Free-Net went up on-line soon after Uvic.

Does anyone have any price triggers before they buy more property? I’m thinking if sfds go for around 7-800 in fernwood /Gordon head I’ll buy but I am patient until then . One issue is that stocks are also in the gutter and many people have their down payments in the stock market so I don’t quite see a flood of money swooping in .

It was around in the 1980s actually, but just for nerds like me.

“ In terms of stupid statements, it’s hard to beat this one.”

Ok somewhat stupid statement was made but my point is that climate change will likely not be life altering during the next 20-50 years and the most dramatic changes are still generations away

Climate change is more intricate than most people are lead to believe.

It is not purely CO2 that is causing the change, but perhaps CO2 is somewhat mitigating the speed of change. CO2 encourage plant growth, and the heat also increase water evaporation that in turn increase rain and snowfall. What more of a concern is that over the last 100 years human has reduced the planet forest and grassland by 1/3 for animal grazing, crops, and urban buildup, with rivers and underground water reservoirs that takes thousands of years to fill are drained to feed 8 billions people.

Perhaps, climate change will not affect Canadians so much in our lifetime, because we are bless with large amount of land, water and natural resources, but it is being felt by billions of people before you and I are born. Hence, many including our founding forefather who had he need to migrates to the new world.

Temperature record of the last 2,000 years — https://en.wikipedia.org/wiki/Temperature_record_of_the_last_2,000_years

https://phys.org/news/2021-11-deforestation-local-temperatures-degrees-celsius.html

I think that is very likely. Seems like over the past month Victoria folks have finally become aware of the slowing market and higher interest rates. IMO very possible for a significant portion of investors who are in the money to cash out. Lock in anywhere between $200k to over $500k of cold hard gains by selling versus playing landlord while watching those paper gains dissipate.

I am pretty sure that climate change will not have a major impact on my lifestyle during my lifetime. That should be enough word salad to be accurate.

Let’s see if we can break 2500 by August and 3000 by September. Just to mess with the historical seasonal trends.

Last year everyone went on vacation in July and August and we had very low listings. Will be interesting to see if we have the same issue this year.

No worries

Ohhh got it, thanks for the explanation – and for the chart!!

James – you are right, I do read way too much news, I need to cut down I also hope you’re right about the rest of it. I imagine my apocalyptic scenario and your idyllic one will meet somewhere in the middle in reality.

Actually you know what, my bad it was up and coming that was pumping royal bay. Lol pls disregard.

And where do you see a 360 by me? Because your examples that contrdict that post come from different poster… Or am I missing how that is confusing you?

Nope, lmao go have a look at that link.

https://househuntvictoria.ca/2020/12/07/1981-anatomy-of-victorias-housing-crash/#comment-74721

In the link above you posted the following:

In terms of stupid statements, it’s hard to beat this one.

Please don’t confuse me with up-and-coming. My posts have been quite consistent here over the years. Your pretty sure on that attribution is absolutely wrong. Or are you just having a moment? You can go back and take a look…

It’s being felt now.

“I am a millennial and my life is soft. I am scared of the next… well the rest of my life actually economy, climate change, war… I think the golden years of carefree life for humanity are behind us. “

I think we are living in one of the easiest times in modern history and life will get even easier and more convenient with social programs and amenities. Housing for the homeless, general increase in compassion, deflationary pressure of efficiency. I think you need to watch less tv / internet. Climate change won’t be felt in our lifetimes, but perhaps future generations. A majority of canadas population is coming from countries with far more hardship so we are fairly set up for resilience

BC Assessment shows the pending date for sales (though they aren’t actually entered into their system until completion).

Redfin is showing the date that it actually changed hands.

VREB reports median prices by when a sale was reported which is slightly different again. For example a house could have sold June 30th but not been reported as sold until July, so it would count in the July numbers even though it sold in June. Usually reporting is within days (that’s the board rule) but sometimes you get sales from months ago reported.

The chart I made below is based on pending sales, so whenever the contract goes unconditional. That also means the June figures are missing a few sales that haven’t been reported yet. This is the most accurate method in terms of prices reflecting market conditions, as it gives the price on the day the buyer and seller agreed to the transaction.

Prices still up substantially from last year. The median house sold for 15% over its detached value in June.

Varies, but most will just be people looking to cash in big but they kinda missed the boat on the market now.

Never said I lived in Oak Bay, only own property there since 1994. Currently rented as it has been since purchasing. Very happy tenants, excellent property management.

I actually have another question for the experts We got possession of our home in March 2021, but we made the offer in November 2020. BCAssessment shows the “last sold” date as in November 2020. Whereas Redfin shows it as March 2021. Which date is accurate in terms of contributing to “median family home” price? Are we in the November 2020 or March 2021 cohort? I would have assumed March but BCAssessment has me doubting myself.

LMAO, wait a minute. I am pretty sure that “umm really” is claiming that he/she is in the market for additional rental properties in royal bay should prices crash. Sounds like he/she picked up at least 2 properties after making that post in Dec 2020, lol quite the 360 or is it a “ummm really” moment?

Can you also look at that Frank guy’s post history, this guy claimed on one post that he lives in Oak Bay but I think I recall in another post that he says he doesn’t even live here.

I am a millennial and my life is soft. I am scared of the next… well the rest of my life actually economy, climate change, war… I think the golden years of carefree life for humanity are behind us. (I realize not every human on earth had such a free ride in the last 70 years, I’m mostly speaking from the north American point of view. Feels like from 1950 until now life has been pretty fantastic – barring some cold war nerves – for the majority of people in the western world. Not sure how much longer that will continue for.)

On another note –

Does anyone know what the deal is with houses that were purchased in 2021 and are re-listed now for WAY more? Not a flip job where someone buys an old house and gives it a facelift.

Examples:

– 5064 cordova bay road. Purchased July 30, 2021 for $2,288,000. Listed now for $2,885,000. Seems to be in the exact same condition as when it was purchased. Lots of expensive cars in the driveway.

Why do people do this? Kentwood has been sitting for quite some time so I don’t think they’ll get what they want for it. Cordova bay I’m not sure.

Am I to believe these people are being forced to sell? Or they actually think flipping these particular houses is a good idea? Are they trying to time the market? It’s very confusing. I’m wondering if people with more knowledge on how real estate works might have a better idea.

Thanks for the good advice. Will do!

Patrick: I never said that my generation faced real hardship because by and large we didn’t, not even close (and most certainly I did not). I find it telling that you think that Covid produced real hardship except for a few cases but not overall for most people. My dad’s generation is a different matter with suffering both through the depression and WW2. His first full time job was at age 14 for twelve hours a day six days a week in a Welsh Coal mine. My life was soft.

I am not trying to pit one group against another but I was wondering if we have really prepared and equipped people to deal with a major economic reversal.

But lets leave it and hope for the best.

Patrick: I thoroughly enjoy most all of your post. I know you know better than to egg him on. Just let it be. Every single generation has had their own hardships. To pit one against the other doesn’t help anything or anybody. Stick to all of your well thought out and informative posts.

I think recent history shows you to be very wrong.

Many in society faced real hardship in 2020-21 with Covid. Shutting the economy down, lockdowns, border closings. Nothing was worse than that in my lifetime. And young people were the hardest hit economically, with sudden loss of income, businesses and careers in many cases. The old people shut themselves in their homes. The younger generation stepped up to the front lines and kept society functioning. For low pay, lousy working conditions and risk to their personal health.

I’m guessing that you, like most old folks, spent Covid locked inside the safety of your house, accepting deliveries from Thrifty’s , Amazon and Skip the dishes. If you ever peeked out your front window to witness one of your requested “contactless deliveries”, or spent time in a hospital during Covid, you would have seen many young people dealing with real hardship.

Totoro: People on the internet seem to be both often delusional and also easily annoyed. But you should be pleased that your children see reality the same way that you do. That should be comforting to you. Equally, I am sure that you have provided for your own children to make sure that they dont have to worry about their cost of housing which in no way takes away from the general issue of housing costs.

My children and their friends who are late teens and early 20s seem to understand reality. Generational judgements are as annoying to them as they would be to me I’d expect. One of the biggest differences I see is they have the heavy weight of climate change hanging over them, and unaffordable housing.

Totoro: Hope you are right but I sometimes wonder if the internet has also made people more delusional. But in any event it is going to be interesting times.

The same way any other generation did. Assess, adapt and carry on.

I see no point in speculating on a downturn and how people will cope. The world has changed a lot since the 1980s when there was no internet. Access to information gives subsequent generations a huge advantage.

Caveat: Actually I dont believe anyone has really seen real hardship since my fathers generation. An economic shock is just less relevant to my generation since most of us will just continue staring out the nursing home windows. If (and notice the if since it is a rather large one) things get really bad as I fear they might, then it is the younger generations that will need to cope.

Barrister and Caveat- Make that 20 millennials. The younger generations will simply retreat to the safety of curmudgeonly old codger’s basements. Free food, laundry service, free internet, cable or streaming services, maybe even an allowance. A safe haven to pursue their careers in video games and internet surfing.

If things get bad in B.C., things will be a lot worse elsewhere. B.C. is one of the richest regions in the world. All coastal areas benefit from the business activity that shipping and gigantic ports generate. Land locked regions are generally the poorest regions, take Afghanistan for example. If the Alberta oil sands were located in B.C., I’m sure the products would find their way to ports and shipped around the world. Not to mention the resources such as forestry, mining, agriculture, etc… that provide unlimited opportunity. Seems that the one thing that is in short supply are people willing to get their hands dirty (heaven forbid they soil their iPhones). Don’t feel sorry for anyone not being able to take care of themselves, in today’s demand for skilled labor, being unemployed is the result of being unemployable.

Spare a thought also for the curmudgeonly old codgers who are tired out from commuting uphill both ways through snow drifts and working harder than 10 millennials all their life.

There is a real potential for a major economic shock that will transcend more than just real estate in this province. I really hope that I am wrong because I am unsure of how the younger generations will deal with any real hardship.

Seems like the last price drop was only $50k so the write up is misleading/douchey.

I believe they started that one at $1.35 before dropping to 1.25 and now 1.1. Yes, it is nice to see expectations starting to adjust. Also, nice reading that Wollaston description… “Huge price drop…no delayed offers”…lol

“$150,000 below assessment” and they’re right – $1,100,000 versus $1,250,000.

This reminds me of the price slump in Vancouver West Side a few years back, where lot value properties were affected most.

Pretty good drop in median prices again. These are for pending sales, so a little different than what is reported by the board (which is based on reported sales)

This SFH in Oak bay just dropped in price $150k – https://www.rew.ca/properties/4137702/2140-fair-street-oak-bay-bc

And this SFH in Esquimalt dropped $200k – https://www.rew.ca/properties/3880438/1044-wollaston-street-esquimalt-bc

I know they were probably overpriced initially, but still, big drops!

The +1.75% on the variable side would basically be catchup to where fixed rates are currently.

Official number won’t be out until Monday. It’s impossible to accurately reproduce their calculations but it’ll be approximately 624 sales, 1381 new listings, and 2071 active listings (the last one is the least precise, could be a bit less)

Fair enough.

Well no. I didn’t actually consider Vancouver prices a bubble until 2005. By the “beginning of the bubble” I was referring to prices starting to go up again in 2001 after the price declines of the late 1990’s. I mean, who would call a market bottom a “bubble”.

But I’ll give you a gold star for your thorough research.

https://twitter.com/RobMcLister/status/1542946276517548032

RRSP is also a freebie, although a surprising number of people don’t understand this.

So where did we end up for June sales? Of greater import, what are the active listing number?

+1, long term I don’t think you can go wrong even with lower returns. Odds are your salary will increase over time, but the absolute amount of your mortgage won’t, the rental suite in your home will rent for more in 15 years than it rents for now, principal will be paid down, you don’t have to worry about receiving two months’ notice to move, no capital gains.

The government gives you only two freebies. Principal residence exemption and TFSA, would be foolish not to use both.

No just had never seen data back that far.

Seems remarkably stable. Is there a concern?

Yes, good advice.

Those homebuyers that are worried that rates are headed much higher could still get a

10 year fixed mortgage as low as 5.23% https://www.ratehub.ca/best-mortgage-rates/10-year/fixed

Then they can forget about rates, and have a fixed payment for 10 years. Each year, their income is likely to rise and it will be easier to pay the mortgage. After ten years of inflation and population growth, Victoria house prices will likely be higher.

People make their own decisions and realtors are not to blame for this. It is market conditions outside the control of realtors or buyers or sellers that create a sellers market. And, quite likely, the vast majority of these buyers will come out ahead of renting in the end, although in some cases with stress costs.

Why ascribe some weird winner/loser mentality with a scapegoat to these transactions?

I am sure that even if interest rates rise further access to credit will be the key way to build financial security for most people who live in Victoria, and generally through a primary residence. I understand you lived through the 80s housing crash. Planning to hold through a drop and rise in interest rates is important, and part of risk management.

In terms of options, if you are just starting out in life and of median income what is your alternative? Rent? Rents are high and not ideal. For most, the only reasonable alternatives are a mortgage or perhaps coop, but coop availability is limited and does not build equity.

I would still be looking to buy a primary residence with a mortgage even at a higher rate.

When was the last time you had an accurate forecast of the direction of future house prices? Haven’t you been calling Vancouver house prices a bubble “ since the beginning of the bubble in 2001.”? http://vancouvercondo.info/2008/10/lower-mainland-home-prices-drop-below-2007-levels.html

Might have something to do with a 40 year decline in interest rates. I’m not so sure the strategy will work as well with that trend reversed.

The poster is talking about buyers two years ago “ They might not get their property ladder leap they were hoping for in the next couple of years now” The date he “gave up” on debating homeowners is not relevant.

You can read about these same debates on HHV from Dec 2020 e.g. https://househuntvictoria.ca/2020/12/07/1981-anatomy-of-victorias-housing-crash/#comment-74721 when he says “ Separately, I am always amused by folks in my social cohort that have purchased properties in Victoria almost express hostility at me for not buying.”

And the Victoria SFH median was $909K in dec 2020 when that HHV post was made, and it is $1,250K now… up 37%.

Borrowing to buy appreciating assets or generate business income has been the way most wealth is generated during my lifetime. One of the lower risk ways to use credit is through a primary residence mortgage.

I have no idea what a balanced low debt approach is in your view.

I’m a fan of responsible credit use. This means avoiding bad debt – credit cards you don’t pay off each month and amounts borrowed to purchase depreciating assets like cars or experiences like expensive vacations, while using good debt to build financial security by investing in a home, researched business, or education. In all of it you need to weigh risk vs. reward and have a plan to mitigate risk.

“Half way through the pandemic I gave up on those folks ” That would be people buying around mid 2021, about a year ago. Two years ago, i.e. mid 2020 prices had been flat for the previous two years and the pandemic price boom had yet to start.

Why would those homeowners be hurt at all? If they bought two years ago, they paid 30% less than todays prices, and have also paid off 6% of their loan. And they have 3 years left of low rates if they got a 5 year rate. For the savers/renters to be an equal or better position, they would need to see prices fall 30% from today’s prices, and then sign up for a mortgage at a high rate. If the “savers” had invested in a growth ETF like VGRO in Feb 2020 (pre-pandemic) , they’d have seen no capital growth, as VGRO ($27.35) is down 1% from Feb 2020($27.71)

The question going forward for “those who wait”… Are you planning to wait for drops of 30%+ that may never come? Or would you pull the trigger sooner, and buy in at higher prices than the people you “gave up on” that bought two years ago?

Pretty sure developers and realtors very aware of interest rate increases, current economic conditions, and the potential effects of continued rising rates on credit availability and consumer confidence. As are most Canadians. Continually covered in the news for starters.

Or are you referencing something else?

Talked to quite a few local realtors and small time developers tonight at a gathering, none of them have any remote concept of of the businesses/credit cycle. I think it will be quite messy should BoC continue with the rate hikes.

Half way through the pandemic I gave up on those folks. I believe some of the quotes were: “borrowing is the new way of wealth generation” and a balanced low debt approach ensuring not to over extend yourself was referred to as “saving like a psychopath”. So, more power to them. They might not get their property ladder leap they were hoping for in the next couple of years now, but if they can stick it out for 10 to 15 years in their places, they shouldn’t be hurt too much.

Of course, but many people that bought unconditional first had to hit a number on their subsequent sale to make the financing work and if you don’t leave a huge buffer, it can be stressful.

Leo, did you include the sub-areas of Lambrick Park, Arbutus, and Mt. Doug? They're in Gordon Head too.

Investor ownership in BC back to 1976

I know this is a US example, but take a look. RE market peak was in early 2006, but no appreciable increase in rental vacancy rate until the financial crisis and recession in late 2008.

https://fred.stlouisfed.org/series/RRVRUSQ156N

Toronto market peak was 1988, but vacancy rate remained under 1% until recession of 1991 and never got above 2%. That was Canada’s biggest RE bust post-WWII.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3410012701&cubeTimeFrame.startYear=1980&cubeTimeFrame.endYear=2000&referencePeriods=19800101%2C20000101

Can’t wait to hear your thoughts on the Westshore VicREanalyst. Eyeroll. And for the ridiculous comparison of the Westshore to Toronto commuter neighbourhood a, it took me 22 mins to get from Royal Bay to work downtown this morning leaving at 8am.

“ Forestry being the first of course. And today here we are:”

This is my line of thought. Although many buyers might be government workers, business owners and healthcare workers, our economy relies on the value creation of tangible goods and knowledge based industries to support all the bloat at the top . Construction/finance goes hand in hand with real estate .

Let me know when the rental vacancy rate increases dramatically. Then real estate might be in trouble. Until then, it’s business as usual.

Patriotz Yep very different economy also remember Bennett running on austerity see if those days are revisited lol

So is realestate considered a luxury? Because people have stopped dead in their tracks in acquiring those.

On CBS News- American Airlines is offering their pilots TRIPLE PAY for extra shifts. Talk about wage inflation. Yep, the economy sure is hurting, 2 million passengers are flying every day in the U.S., the airlines can’t handle the volume. It’s not like air fares are a bargain either. Seems like some people are immune to inflation, high gas prices, etc… Go figure. Similar scenario here in Canada. High prices of basic needs doesn’t seem to stop people’s appetite for some luxuries.

Anyone else remember the bumper stickers that said “Mining – BC’s second industry”? Forestry being the first of course. And today here we are:

https://www.statista.com/statistics/608359/gdp-distribution-of-british-columbia-canada-by-industry/

Everyone’s able to sell. However when things slow down some people think they deserve more than what the market offers.

I have my own views about the westshore, but I will park it for now and revisit the actual data come September.

That’s a fairly academic point which I can’t argue without having my own facts. I will leave it to the realtors on here to chime in as to what line of work most of their buyers are in.

“ I don’t see any catalyst for this to be breached unless actual mortgage defaults happen on a significant scale, I see 2019 prices as a current worst case scenario unless we actually go into stagflation with high interest rates and high unemployment.”

Sorry I should elaborate. So much of the economic engine of the island and BC is driven by real estate that we could very well enter stagflation and high unemployment. More diversified economies are more resistant to this phenomenon.

What, no condolences for those poor souls who got suckered into bidding wars with no conditions by their realtors up to the end of March?

Doubt it, prices are always sticky on the way down until it gets to the point of a fire sale where it may overshoot a fundamental floor. IMO the fundamental price floor for a SFH is when rent pays the mortgage at current rates with 20% down. I don’t see any catalyst for this to be breached unless actual mortgage defaults happen on a significant scale, I see 2019 prices as a current worst case scenario unless we actually go into stagflation with high interest rates and high unemployment.

Real estate soon to be dead money We will

be talking about how well we are doing on our Gic

We are in for pre pandemic price drops. Hold on to your shekels it’s about to get really ugly here.

Panic selling exists on the same plane as panic buying. The shift in magnitude coupled with a recession and a stall in real estate demand (Renos, construction costs, flippers) means I think we will return to 2017 prices . I’m not forecasting total gloom but the latest jumps are not sustainable.

Congratulations to the folks that sold at peak price through the first half of the year. It’s always good to see people do well.

Will be for sure. Based on my eyeball test we will clear 618 from 2011 but not 637 from 2012. Difference is back then we have over 5000 listings.

My house was built in 14 and is extremely solid and they used a lot of good materials. Whether it is attractive is a matter of taste. The important thing is to keep up the maintence on a regular basis.

I’m not convinced the same factors are at work between Fraser Valley and Westshore. I can see the commuter towns around Toronto and fraser valley getting hammered with return to work and gas prices, but commuting 1-2 hours is quite different than westshore. Maybe some people commuting from Mill Bay or Duncan are reconsidering though.

But sales might be at a 10 year low for June either way.

Wow, a lot of new listings this week for an end month rollover combined with a long weekend.

Looks like Saretsky is tweeting that Fraser Valley just experienced the lowest home sales for June in 20 years. Curious to see how the Westshore fares in August/September.

I don’t think he actually knows or understands any actual construction issues with these 70s houses, he’s just trying to find ways to cope with the price of the sale as it doesn’t fit his narrative.

Our house is 48 years old (1974). No substantial issues in the 9 years we’ve owned it.

Only weird thing I’ve seen on a 70s house was stucco over fiberboard sheathing. But I don’t think that was a common building practice around here. Probably just a very cheaply built house, which exist in every era.

Biggest thing with 70s houses would seem to be aluminum wiring, which isn’t the end of the world. GH boxes seem alright. Not much style, but solid.

70s houses are not too bad I would own one Pre 50s get a little more interesting

LMAO, what a clown.

Obviously people are aware of how poorly constructed those 70’s houses are in the first place.

Bad news travels fast, good luck with those Gordon Head boxes. They’re lucky they unloaded them on someone. Maybe they were purchased for land value, putting any money into them is a waste. Not much worthwhile material to get out of a deconstruction.

I don’t get most people, why get a realtor if you are not going to listen to their advice. The most ridiculous part is that when their house won’t sell for what they want they will switch agents. Lol do they really think couple Instagram videos will now suddenly encourage people to pay couple hundred k more? In the mean time they still have zero concept of the difference between Bank of Canada and Royal Bank of Canada.

I would say most people list higher than what is suggested.

Are those the ones that list via a price you suggested or a price that they wanted?

Really depends on the client. I’ve already had a few listing cancellations and have a number more coming up. Some sellers go into it “if I can get this number, great, and if not I’ll stay put or will continue renting the property.”

Those that really want to sell I guess my advice is stay ahead of the market. If no action in the first week and you really want to sell the market has probably spoken.

I don’t have anyone left that has bought something (but hasn’t sold) so pressure is off. A few properties that I have sitting not moving the sellers need to buy after they sell so if their property drops whatever they are buying drops too, not a big deal. Critical zone was all those that bought unconditionally and had to sell but all my clients involved in that were able to sell.

So far this year, I’d say Marko’s best advise as seller agent was on 1655 Hampshire, $170K below asking, 6 DOM sounds crazy in May but no doubt his client is happy now. Good job!

I don’t know if I’m more shocked that this 7 bedroom concrete bunker is assessed at 2 bills, or that it went for $1.85.

Glad atleast you can get something right 😉

Do you have those other ones handy to share?

There have been 5 sales of detached houses under assessed value in Gordon head this year. Torrington at 93% is the second lowest (lowest is 1639 Ash at 92%)

Looks like couple other similar 70’s houses for sale in that neighborhood that are less renoed and on smaller lots, lets see if those go below $1M.

Cancelled.

12 days on market. Possibly an estate sale, so they might have had go with the best offer they had on offer day. Someone with the realtor view might be able to fill in the exact details.

I don’t have time to read every post, I really hope you don’t either. Though, I am guessing that you are being facetious.

My guess is that their agent and also the one for 3711 Stamboul advised the sellers to transact before the July rate hike to lock in some profits before further declines. Curious to see how Marko is advising his clients?

Interest rate direction during that 33 years notwithstanding this is an annoymous internet forum, nobody knows nor cares what you claim to have or what you don’t have . Only thing that really holds any weight here are the contents of your prior posts. You know the ones from couple months ago where you thought that house on ascot was priced for a bidding war while I am saying people in Victoria are slow and the decline from peak is couple months behind Toronto and Vancouver.

If you are going to quote my prior posts, at least acknowledge it.

PM at local construction firm: they’re busy for the next year but after that the pipeline looks “a bit grim”

Diff industry folks saying diff things but costs and rates are definitely biting

Hello all – anyone know if 2320 Arbutus Rd sold and what for?

I’m sure the neighbors at Torrington are thrilled.

While 1.08mill would see a low anomaly even now it still speaks to the direction of the market.

Curious how the sellers agent advised them on that sale and why they bit on the offer. Must have been very motivated. How many days on market? Anyone know?

Thurston: Agree that if you are older than we have been there before but for a lot of younger people this is new. I wonder how many are badly positioned to weather any storm?

Barrister Read the article wasn’t too bothered by it Agree with the hard landing and recession But we have been there before

What we are experiencing now is stagflation, due to supply shocks since 2020 we have not recovered in productivity while prices have rocketed. If anyone if crazy enough to try to time the market do yourself a favour and dont take what you read/see on the news at face value.

At one point there was a bit of discussion about condo investments that were either cash neutral or mildly cash negative. I am wondering in this environment (a likely rental increase limited to 2% or much less than inflation) with mortgage costs perhaps doubling or even tripling and inflation costs running rampant with declining real estate prices whether the sales pressure will be unavoidable.

Foreign Buyer: Excellent article and one that should be read carefully by everyone here. It is what our people have been telling us for the past two years. But most people will just ignore this type of article since people generally prefer good news.

Interesting times. I would encourage people to really read the article carefully and thoughtfully. There are strong implications for the housing market contained within its premises.

$122,000, I think I was paying my receptionist $6-7 an hour for some perspective. It was still a risky endeavour, no one I knew was following my footsteps.

What was the price? Remember – interest rates can change, but your purchase price doesn’t.

Foreign Buyer- Great article, kind of doom and gloomy. I wonder if our policy makers have taken some of the scenarios presented in the article into consideration. As we introduce more demand into our system we put more stress on our ability to house, feed, and provide economical energy supply to the public and business sectors. One thing not touched on in the article was the low unemployment levels and fairly decent salaries that people in demand receive. So long as businesses can find ways to stay afloat and continue providing for their employees, I don’t think things will get too dire. The problem is the economic feasibility of businesses. They are the canary in the coal mine. If costs get too high and it is no longer profitable, they simply stop functioning and unemployment rises. That’s when things go really bad.

Well, this makes for cheerful reading:

https://www.theguardian.com/business/2022/jun/30/stagflationary-debt-crisis-us-recession

An interesting one in Gordon Head – 4429 Torrington Rd

Listed $1.2

Sold $1.08

A large, livable condition house, on a large lot, in a desirable part of town that would have sold for well over ask just a few short months ago. Things seem to be quickly changing.

“None of them can overcome high interest rates or market psychology”. – Glad no one told me that 33 years ago when I took out a 12.25% mortgage for my first investment property . Population in Canada in 1989 was 27.25 million, today, 38.25 million, an increase of 40%. What’s the population going to be 10 years from now? If prices aren’t conducive to investment in Victoria, investors will simply look elsewhere.

That’s kind of my point, with all these theories of low inventory, hong kongers/Ukrainians, people from else where in Canada, rich locals etc. ready to pounce on any weakness in the market, none of them can overcome high interest rates or market psychology…

This can’t be going anywhere good.

I see what you are saying now Marko, point taken. I could potentially be in a cash for keys position with the under market tenants to get an investor on board to purchase.

It doesn’t matter which, what matter is every politician, and politician wannabe contribute to the fallout.

Perhaps it wasn’t Horgan or the NDP original idea, but they ride the coat tails of WEF/Soros, etc… that contributes to the problem we are now facing.

Exactly my point. If you are a seller investor you could lose value in your property by not keeping up with max rent increases especially with a “rent stabilization law” in place. Therefore, even sellers focused on value versus cashflow/rental income would be smart to apply the max increase every year. If buyer investor is skipping your property because they can choose what they want to buy and there isn’t enough of a owner-occupier market for your product you could end up selling for less.

But I thought it was the World Economic Forum that ran the world. Or was it George Soros?

Is it really John Horgan and the BC NDP?

Horgan added fuel to the fire, because it was a trendy thing to do without any critical thinking and forethought, and the action encourage copycats.

It was a detrimental action that is now playing out today in Ukraine, Egypt, Pakistan, Sri Lanka, Afganistan, and much of Africa (war and famine).

Well that’s one way of looking at it. Another way is that they simply could not buy without the cash flow from a suite.

The problem with rent stabilization is that it might take some units off the market entirely. If someone moves out and I can only increase 10% but I can wait a year for stabilization to time out then the money might make it worth it to keep it empty. So what if rent stabilization is 2, 3, 4 years? Still might make sense for someone to not resist the unit and just wait until there’s a new government that reverses stabilization. Or, if renting a new suite for the first time, Jack up the rent as high as possible knowing about rent stabilization. I think it’s dangerous tinkering that could really worsen the scenario. What is needed is more rentals – period. We can’t legislate our way around that.

Just looked up the details on 4429 Torrington. $1.08M for nicely kept house on a 10,000 sqft lot in GH (none busy road), IMO that is much better value than the sale on Stamboul street for $1.05M on a lot that is half the size but suited up and down. Very interesting as lots of people say the value in RE is the land yet people got no problem paying up for cash flow.

As a buyer investor I get to choose what I want to buy.

As a buyer investor you have the option of removing the existing tenants?

As a buyer yes you do, but as a seller, an empty property is easier than trying to deal with existing tenants in a sale. Point I am trying to make is that not everyone out there is trying to maximize rental income.

As an investor you have no choice if the property is tenanted?

Do investors prefer taking over existing tenants? I personally don’t unless I have the opportunity to interact with them and judge for myself. Definitely won’t be taking a seller’s word for it on whether or not they are good tenants.

Something I find crazy is when you search Victoria core, condo strata/freehold (not leasehold), under 350k there are two search results and both are studios. One has an accepted offer.

You could impact the value too if the property was something were a large portion of the potential buyers were investors.

+1 if we just built enough all of these discussions would be irrelevant.

Big lot but no suite, that’s the problem. Suits aren’t properly valued in bc assessment, none the less this would have sold for over $1.3M (probably mid $1.4M) in Feb, March.

Which arguably would be better and keep occupied unit rents closer to market rents. But that only works if the allowed increases are reasonable. Inflation + 2% or whatever the old system was was a decent system. Would prevent rent increase shocks while still allowing rent to increase if necessary. Of course the underlying problem is the scarcity of rental units. If we didn’t have a 1% vacancy rate we wouldn’t be in this mess.

is 4429 Torrington the first one sells below assessed value in GH this year?

I think that depends on one’s financial, cashflow situation and willingness to deal with annoyances. Some people use RE mainly as a store of value and don’t really care about rental income as they don’t need the cashflow. But yes overall this would absolutely increase the likelihood of landlord upping rents on current tenants.

Yes I understand that, leverage works the other way in a decline. Also once you buy a house, then the only thing you can do to get more leverage is taking out a HELOC/refinance, the more the property becomes paid off the less leverage you have until it is all paid off then it’s just a pure asset, at which point cash is more valuable because it is much more liquid. I agree with the tax advantages with owning a rental, many people include maintenance on their primary residence on their tax write offs for their rental property.

if one were to have a bearish view on the market then the move would be to cash out now, put the money into the GIC then go back in for two additional houses when the time is right.

So my calculations are off by a magnitude? Huh. 330,000 applications received in 4 months since the start of the war. 330,000×3=990,000. Sure they won’t all be showing up in the next 6 months but they’re waiting in the wings. Every day the war goes on, the more people will be fleeing. Once the capital starts to destabilize, the exodus will ramp up. Don’t think for one minute that Putin is going to spontaneously become sane.

Problem is you can’t leverage GICs and you have to pay capital gains on the profit if you sell real estate to move into GICs. While I love my dividend portfolio (I agree, 100% stress free and you can be anywhere in the world and the money just drops into your account) but when I crunch the numbers my real estate investments have absolutely crushed my portfolio on the basis of leverage.

There are condos I put down 40k on that are up almost 300k in value + cash flow positive every month + mortgage has been paid down.

If you are worried about “rent stabilization” then your current tenant is below market; therefore, the maximum increase every year won’t exceed market. Otherwise, you wouldn’t be would about “rent stabilization.” If the rent is below market than the odds of them leaving early on the basis of the yearly increases is reduced.

As much as I love quality tenants giving them a rent increase would achieve two things

i/ Higher revenue during course of tenancy

ii/ Won’t get screwed over by rent stabilization on re-rent

While I am willing to forgo i/ there is no way I would be willing to do i/ and ii/. At that point I am applying the max rent increase every year even if it increases the chances of a good tenant leaving.

I don’t know what the stats are but I would think even without rent stabilization a lot of owners give a yearly increase. With rent stabilization you would force pretty much all landlords to do the max even those that normally wouldn’t have. If the the landlord isn’t super smart someone would fill them in on it….”hey if you continue renting to this person for $1,000/month for 10 years and rent stabilization is max 10% that means if they move out you’ll only be able to rent it for $1,100 and market will be $2,000/month.”

That tenant might have also left early if you did that. So in reality I think you will probably still consider the quality of your current tenant when deciding how much rent to raise.

Sell now, take ~500k profit and get a stress free ~20k a year from the GIC. Or keep rental and cashflow ~20k a year as a landlord assuming nothing goes wrong.

1 year GIC rate now 4.22 with GIC Direct… keeps creeping up eh.

Some of the ideas politicians come up with just off imo.

I rented one of my condos downtown Victoria in 2011 for $1,075. Turned out to be the perfect tenant, rent on time every month for 10 years, I went into the unit only once in 10 years to replace the refrigerator. Tenant moves out last year in 2021 and his rent was still $1,075 which I was content with as it covered all my costs (mortgage, strata fees, insurance, taxes). I re-rented the unit for $1,500 or slightly below market.

If there was a “rent stabilization law” I would have given the excellent tenant the max 2-4% increase EVERY single year so I wouldn’t get caught in a trap on the re-rent; therefore, the excellent tenant would have been penalized because of such a law.

Just let the market do its thing and let it be efficient.

Yes. Since the discussion is based on macroeconomics (inflation, interest rate) effects on rent, it makes sense to me to refer to average rent nationwide, since those macro factors affect all rents.

If you believe inflation and rising rates will significantly lower rents (I don’t). you should expect that to happen in a nationwide average of rents. And it never has happened in previous 80 years in USA , and I don’t I’ll expect that to happen in Canada either.

And of course this doesn’t apply to each city, due to local factors. If anything, I’d expect local factors (gentrification from ROC ) to raise Victoria rents more than Canadian average.

As you can see, the Ontario NDP occupies a different political space than its BC counterpart.

You’re correct that the BCA values the property based on the market conditions as at July 1 of the previous year, however I would add that they are based on the physical and legal condition of the property as at October 31 of the previous year. Any rezoning, subdivision, construction, etc on the property should be accounted for up until October 31 (as well as any substantial damage occurring after October 31, like if the home burned down). Minor distinction but I thought it was worth noting.

https://info.bcassessment.ca/Services-products/Understanding-the-assessment-process/key-dates

No, that is specific for Ontario.

Doubt we will have that here? I haven’t seen it come up in discussion anywhere.

Unless your build is after 2018

New residential apartment buildings, condos or houses that were occupied for the first time as of November 15, 2018 are not rent controlled. Landlords can increase the rent year-to-year to whatever they want and they are not required to follow any guideline. (https://settlement.org/ontario/housing/rent-a-home/tenant-rights-and-responsibilities/how-often-can-a-landlord-increase-the-rent/). Copied that from Reddit.

Ontario caps rent increases at 2.5% -> https://ca.finance.yahoo.com/news/ontario-caps-2023-rent-increase-161058654.html

Will be interesting to see what happens here.

Yes and that is why I haven’t bought another rental yet, I think with variable rates having still at least 1.5% more to go, there’s more downside. I will jump in again once I get some comfort that rates have peaked and are likely dropping. But long term if I am holding a cashflow neutral or better property in the core with 6000+ sqft, then that is an attractive proposition.

Assuming interest rates have peaked, of course.

And that is why I have been saying the bottom for SFH is where the mortgage is equal to the rent assuming 20% down-payment.

But that’s the US average. That can obscure a lot of variation in individual markets.

Hard to imagine rents falling much in price. With landlord costs going up (inflation, rising rates) and increasing population, rents will likely rise or flatline regardless.

As you can see, Rents in US over the last 80 years haven’t ever fallen much , despite WWII, 12 recessions, 9/11, 2007 housing crash, Covid etc. Average rent is remarkably stable, without bubbles or crashes.

Will be interesting to see if fertility rate rebounds somewhat post Covid. Of all wealthy western democracies France has done the “best” at maintaining their birthrate, but even there the birthrate is sub-replacement. I’m fine with population declining gradually, but places where the fertility rates have fallen off a cliff (Korea, Japan, Italy, Ukraine) are going to have some serious economic issues.

Among all the many social and economic factors influencing fertility it would be interesting to know how important housing is. Anecdotally I know people who have reduced their desired number of kids due to housing. In some cases (IMO) this reflected inflated housing expectations. Is it really impossible to have 3 kids in a 3 bedroom house? In others it was a pretty genuine lack of space and lack of means to buy or rent more space. Do you really want more than 1 kid if you are in a 1 bedroom apartment?

Canada will eventually like Ukraine without immigrations.

https://www.statcan.gc.ca/o1/en/plus/960-fewer-babies-born-canadas-fertility-rate-hits-record-low-2020

VicRE- I’ll save you an upper bunk, you’ll be sharing the room with 5 other people, it’ll be real cozy.

Trust me, they’ll all be here permanently. The population of Ukraine was on the decline, most won’t go back, there will be nothing to go back to. Demand for rental is going to be insane, unless our government starts building a million apartments. That’s not going to happen, they are so short sighted, they think problems solve themselves. This massive influx could be disastrous. Trudeau’s not worried, he’s oblivious.

It should be noted that they are neither immigrants nor refugees, but temporary visitors. Of course some may enter one of the former categories in the future, but we don’t know how many or when.

I am not seeing any reductions

I would gladly rent off him if his rent is significantly cheaper than what I can get for rent in my principal residence provided it is similar in both location and quality. I am a cashflow guy and have zero shame in that.

looks like some Victoria realtors are advising their clients to reduce prices and try to get a sale prior to the July hike.

Your numbers are off by an order of magnitude.

https://www.canada.ca/en/immigration-refugees-citizenship/services/immigrate-canada/ukraine-measures/key-figures.html

I assume you are referring to the Trans Mountain Pipeline expansion. I’m in favour of that project (and other oil/gas projects). And the TMX pipeline is getting built, as of April 2022 is 50% completed..

And yes, all levels of government opposed it at times. Including the The BC Liberals (2016 – http://www.cbc.ca/news/canada/british-columbia/transmountain-b-c-government-kindermorgan-1.3398689) “ Trans Mountain pipeline expansion not supported by B.C. [Liberal] government”

The BC NDP grudgingly accepted its inevitability when their court challenge was lost in 2020 “[Horgan]… This [TMX] is a legitimate project that has massive benefits to B.C., particularly to Indigenous communities, and through dialogue we’ll find a way forward.”

It was always up to the Feds to approve it or not. And they approved it in 2019.

– The legal opposition that is still occurring (lawsuits ) are coming from indigenous groups, not the BC government.

– And there are eco-protesters delaying the construction. For example, BC professors have been living in trees in Burnaby, at times with a bicycle u-lock around their neck .(https://www.burnabynow.com/local-news/trans-mountain-says-expansion-project-is-now-50-complete-5278696

You should be nicer to Frank, you might have to rent off him one day.

Sales for the month seem slow?

That 6bd house on ascot is still for sale Frank. I think you can be successful with an offer of 1.25M now.

Heard on the radio- 40-60 Ukrainians are coming to Winnipeg every day, almost 3% population increase in one year just from that country. Extrapolate that across the country, one million new immigrants from the Ukraine alone in a year. I think I’ll invest in bunkbeds.

Sounds like the plot for a James Bond movie. In real life, Horgan’s government opposed the TMX expansion, and was ultimately unsuccessful. I assure you that if the TMX expansion had been completed a few years earlier, it would have changed nothing globally. It’s just not that big.

It should also be noted that opposition to the TMX expansion was part of the NDP’s 2017 election platform and had nothing to do with their subsequent deal with the Greens.

I think his government deserves a great deal of credit for its position of approving LNG development on environmentally and socially responsible terms. That was also part their 2017 election platform.

I would do the right thing by stepping down and leave politic indefinately, instead of sold my soul to the devil.

Or, at the very least find original mandates/goals that the majority of the populous can stand behind, and find/backup a greater leader that listen and work with the populous.

David Eby has a young family, which may give him pause.

I believe the headline with a photo of Dix the day before the election was “This man could kick a puppy and still become Premier” and we all know how that went lol. They’re in trouble without Horgan. He’s done a good job but is probably worn out from holding a political party of activists and social justice warriors together. I don’t blame him for stepping away from that circus of fools and clowns while he’s on top.

“destroy the Canadian oil & gas pipeline”

That’s the only way to keep Greens. Otherwise, we were still under the Clark government. If you were the minority NDP leader, what would you do?

https://thenarwhal.ca/what-b-c-s-new-ndp-minority-government-means-environment/

In terms of showings and accepted offers seeing a bit more traffic on SFHs vs condos right now.

Seems like this is the political flavour of the day and I just can’t wrap my head around it. Demand for oil is global and will continue to hit record peaks for next 10 to 20 years globally and in Canada as well. Just look at the passport lineups (people want to travel). Look at the massive cruisers in James Bay. When the Coho sails past them it looks like a spec. Most new cars are SUVS or pickups. People want huge houses. Etc.

With demand for oil going up someone is going to pump it and not sure how Russia and others pumping gas and making profits is better than Canada pumping and making profits. If the environment is the concern take the profits and give massive incentives on EVs, etc. rather than restricting supply, benefiting Russia, which probably isn’t using profits for EV incentives.

Yup he does a great job at using every tool in his toolbox to destroy the Canadian oil & gas pipeline, and by doing so give Russia fuel to wipe out Ukrainians, and give dictatorship China the thumb up for doing a great job at controlling global energy security.

Dix also got thumped in an election where the NDP was leading in the polls. Measured and thoughtful have their place, but they seldom work for leaders.

No official stats but very rare.

Dix is more measured and thoughtful.