Will high rents and migration prevent price declines?

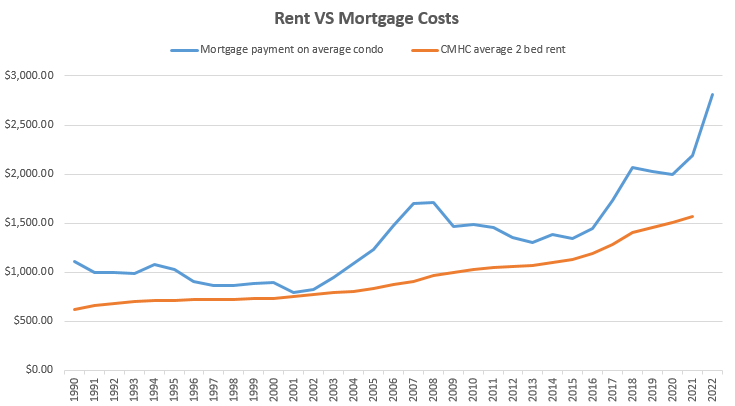

The housing market has been cooling for several months now and prices have likely dropped a few percent from peak as the froth has left the market. However rents have shown no sign of the same weakness, with CMHC reporting that vacancy rates in the region dropped back down to 1% at the end of last year. Anytime the vacancy rate is below about 3% rents will increase, and the average rent for an occupied 1 bed unit rose to $1213/month while two beds were at $1570. If that seems extremely low it’s because CMHC measures the average rent paid in occupied units, which due to rent control is usually far below the rate for vacant advertised units. CMHC data from 2020 shows that the rent for advertised vacant units was 28% higher than the average occupied unit, and that gap has likely only grown. Though it’s not quite apples to apples, the rentals.ca report for June indicated that the average 1 bed rent in Victoria was $1870/month, 54% higher than the CMHC figure.

Rents in some ways are a superior measure of housing demand compared to prices. House prices are influenced by the cost of credit and vulnerable to speculation, while rents are simply a product of how many people are chasing the available homes. Given rents are high and a purchased condo is essentially interchangeable with a rental, will that support condo prices? One way to look at this is comparing rent to mortgage payments. Unfortunately here we are let down by a lack of data. CMHC rents are only measured once a year and are lower than the market, while there is no series for average asking rents. However the CMHC rent series does have a consistent methodology over time and if we look at the historical pattern, condo prices usually jumped once mortgage payments got close to the average rents, and conversely stagnated when mortgage payments were substantially higher than rents. Currently we are at a time when mortgage payments are much higher than rents, but it’s unclear if the gap between occupied and vacant rents is currently higher than it has been in the past. On the other hand we also have rising mortgage rates pushing up payments. In the chart below the 2022 figure is based on the year to date average fixed rate of 3.92%, while today’s fixed rates are about 5%.

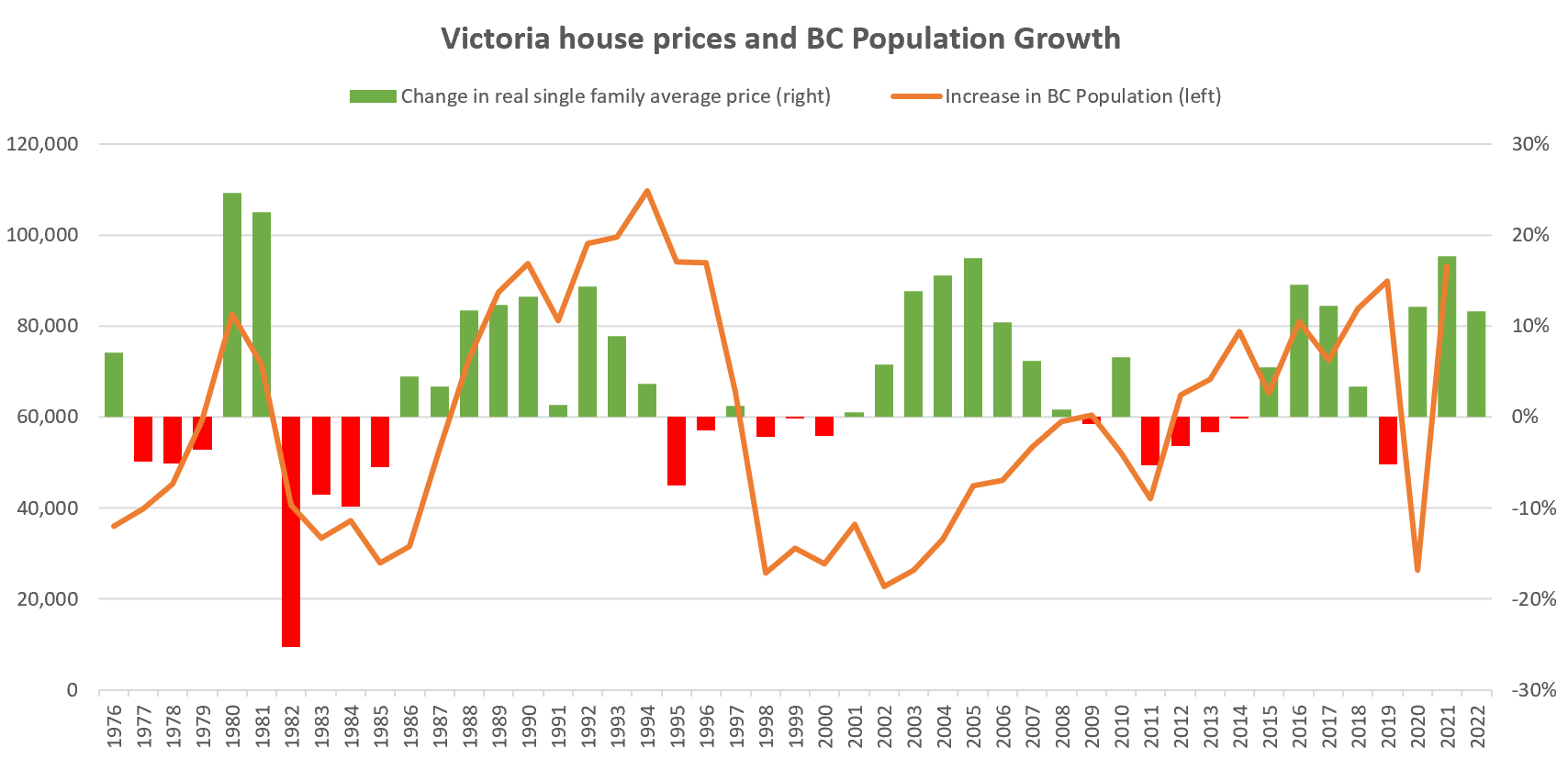

Migration to BC too has been extremely strong, hitting a 60 year high with over 100,000 people coming to the province. That puts immense pressure on housing as all those people need a place to live. Many people are wondering if prices can decline when there are so many people coming to the province needing places to live.

There is a connection between Victoria housing prices and migration to the province. In 1980 and 81 when prices were exploding there was also a rush of migration to BC. After 1982 when the real estate bubble burst, BC population growth also slowed down substantially. It picked up again in the late 80s along with house prices. In the mid 90s house prices dipped a couple years before migration also dropped down. Then in the early 2000s the real estate market picked up somewhat ahead of when migration started trending upwards. There was a dip in growth in 2009 after which the market flatlined for a few years, while both prices and growth trended higher in the last 7 years.

Though sometimes the market tops out before population growth and vice versa, I think the connection is strong enough that we can say real estate slumps are accompanied by growth slumps. Whether one causes the other, or if both are reflective of a third variable like the unemployment rate is somewhat tangential. I think if we are going to see a slump in real estate it will have to come along with a decline in our growth rate. Or stated the other way, I doubt it is possible to have substantial price pullbacks combined with sustained high population growth rates. However I also don’t believe that our high growth rate can be maintained without improvement in housing affordability. Affordability is already dragging on the resale market, and when asking rents are many hundreds of dollars above what most renters are currently paying, any forced move runs the risk of pushing people right out of the city. As the saying goes, the cure for high prices is high prices, and I think we are going to see a reduction in growth figures in the coming quarters.

Unfortunately the dual risks of rising rates and rising construction costs will make dealing with the housing shortage more difficult than ever as costs for new homes are driven higher. Cities will need to grapple with some serious reforms just to counter the impact of rising costs, let alone correct the systemic issues that brought us here in the first place.

Also the weekly numbers courtesy of the VREB.

| June 2022 |

June

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 111 | 234 | 393 | 942 | |

| New Listings | 224 | 547 | 873 | 1208 | |

| Active Listings | 1789 | 1878 | 1935 | 1375 | |

| Sales to New Listings | 50% | 43% | 45% | 78% | |

| Sales YoY Change | -20% | -36% | -33% | ||

| Months of Inventory | 1.5 | ||||

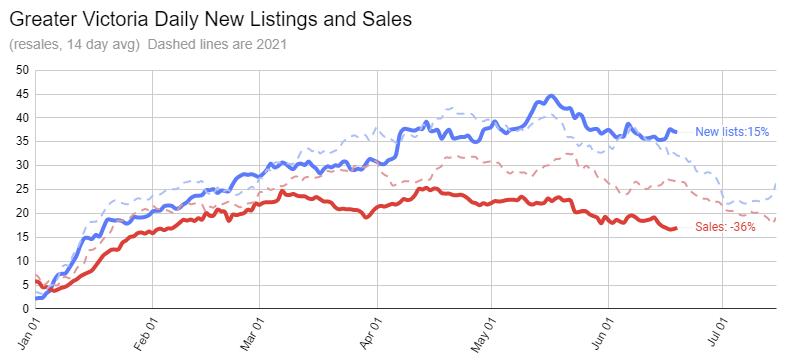

Inventory continues to build fairly steadily as the rate of new listings is approximately normal while sales run a third below last year’s rate. We will still end the month with substantially less inventory than the 10 year average of 3200, but at least we’re moving in the right direction at a reasonable pace.

Continued cooling in the market has caused the over-ask sales to take another step down, dropping to one in 5 properties for the past 14 day period. We should end the month at about 3 months of inventory, which should bring a normal rate of over-asks (5-10%).

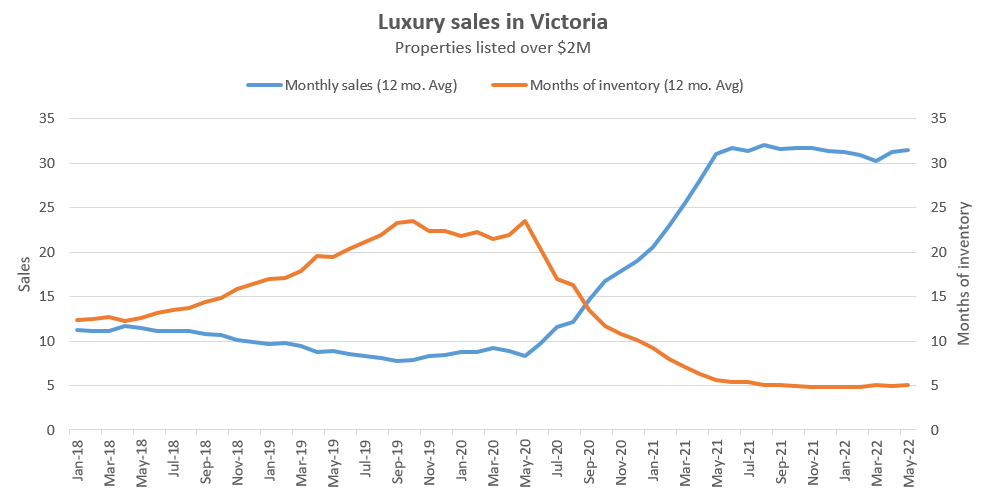

Meanwhile the rate of luxury sales has not shown much if any sign of slowing down. This is a proxy for the number of out of town buyers, and activity remains high, at an average of just over 30 sales a month, while months of inventory is at a steady 5 where it has been ever since the pandemic hit. Just as with population growth numbers, I suspect we will have to see a pullback in out of town buyers before we see a lot of sustained weakness especially in the detached market.

Why would households “buckle” because housing is getting cheaper? Oh right – they might be financing current expenses by borrowing against equity.

From: https://financialpost.com/news/economy/inflation-drives-canadian-consumer-confidence-to-crisis-era-lows

I guess we get to see how contagious panic can be in the very near future.

I changed my mind, Lombok it is!

Lombok Island would be my first pick. Nowhere else that you can be alone on a pink beach or a soft white coral sand beach.

For 2 months of the year I’m a beach bum, I can do 12 months.

Maui nō ka ‘oi … which translates to “Maui is the best!”

You haven’t even been to them Frank…

“Probably nicer outside of Greater LA though.”

LA is a terrible place. I felt like San Diego would be a nice place to call home though.

I’m just grateful that my kids can walk or bike to their not-overcrowded neighbourhood school and buses aren’t necessary.

If money was no object, I think my first pick would be one of the Hawaiian islands. Not sure which one, I’ve read there are some strange climate patterns affecting certain areas differently. Probably great health care (expensive though), great weather if you like heat, not as many natural disasters but it really is a big volcano. Never been there, haven’t heard many complaints from people who have.

Funny, someone on here guessed I live in Royal Bay and now someone guessed I live in Langford. I own rentals in the Westshore, but never said I live there. But thanks for caring enough to guess James. Also, I’ve looked at buying on Pandora in The Union as it allows Air BnB’s, so who knows…

iPads work outdoors. And yes, it’s a beautiful day. Thanks for the discussion.

Southern California is pretty nice.

Meh. My main impression was traffic, overcrowding, pollution, and huge income disparities. Probably nicer outside of Greater LA though.

Kind of an odd list in some ways as some of those cities are very different. For instance if the Calgary lifestyle suits you perfectly you’d probably be happier moving to Edmonton than you would be moving to Geneva, Zurich or Vienna despite their high rankings.

On the other hand countries like Switzerland, Canada, Netherlands rate highly on many international measures so not a shocker that they are going to rank high in liveability too

And for some reason the portal still doesn’t allow clients to see the listing price history or the transaction sale history the realtor view has on it.

“Does that make you happy (or at least less angry)?”

I’m not the one hammering away on a keyboard on one of the most beautiful days of the year so far.

I went to public schools in both systems because they were closest to my house. One is just funded better and says a prayer during the morning announcements along with singing “Oh Canada”. You could opt out of any other religious undertakings.

This happened to a friend of mine here, except they had to drive them there.

Unfortunately Alberta still retains the 19th century “separate” school system, which often results in kids being unable to attend the school nearest them. I don’t know if it’s directly to blame for the situation below, but it is for a lot of kids.

I don’t like Calgary, I’m just being objective about it. If you’re going to rank cities on something, it wouldn’t be very objective to base it upon how you feel about the city.

That’s another thing, zero kid autonomy since the majority need to be driven to school. It’s crazy that they don’t have bus service in SD61 (they do in SD63).

Immediate family of ours bought a place a few years ago in the “core” of Calgary (i.e., not in one of the farthest-flung newer communities). Their house is located approx. 25 houses away from the local neighbourhood elementary school. They have a kid who’s going into kindergarten in a few years.

The school is currently at capacity. With the CBE projecting an increase in enrollment, they’re facing the substantial likelihood that, even though they live a 2-minute walk away from their neighbourhood school, their kid will have to be bussed to a much farther away elementary.

No it doesn’t scream rich white guy. Because if you learn to fact-check that superficial screaming in your head about race that you use to define issues, and spent the time to research, you’d find that for “The Economist”…

—- only 4/9 economist board members are white guys, the majority are women and people of color. https://www.economistgroup.com/esg/board

—- the editor and both chief economist executives (ceo, cfo) are all women https://en.wikipedia.org/wiki/The_Economist_Group

— regarding the specific study, done by the economist eiu.com group, only 25% of the analysts are white men. http://www.eiu.com/analysts

Does that make you happy (or at least less angry)?

I don’t think they will post the actual sale price of the listing though when it sells, just the previous sales of active listings.

Yes and I personally knew a couple smaller developers that were getting real nervous with unsold inventory. But yes, it will depend on what BoC ultimately does.

Funny, I’ve talked to people from Calgary and they seem to hate Calgary.

Exactly what people were saying in 2018, then the Fed flopped on interest rate hikes. I think I might actually be in Marko’s camp here, they’re hoping that they can front load it hard and flop in September. Even after announcing QT in the US, they’ve continued to inject money into the system. At the end of the day, they’re hoping to tough talk their way out of this, not actually tighten as much as they need to.

Why do you live in Langford?

Why not right on Pandora?

“No need to bring race into it. Especially when you’re just making that statement up, with nothing to back it up.”

It’s a ranking of cities for people who can move anywhere in the world, in an English language publication based in the UK. That doesn’t scream rich white guy?

No need to bring race into it. Especially when you’re just making that statement up, with nothing to back it up.

Wow inventory jacking that will help to lower prices Some good deals to be had maybe in the fall

fyi, not sure if anyone has noticed but some sales history is being posted now on realtor.ca! For example -> https://www.realtor.ca/real-estate/24548080/305-989-johnson-st-victoria-downtown

A step in the right direction imo.

Face it, the suburban parts of all big cities look pretty much the same. Victoria like Vancouver does have its character areas, but they are well out of reach of the ordinary family.

“I’ve noticed that every one of them is criticized and dismissed by many of the “ resident experts” here, who apparently know more about what criteria are important.”

It’s a survey taken by rich white guys for the benefit of rich expat white guys.

If I was a rich white guy, neither Victoria, Vancouver or anywhere in Canada for that

matter would be on the top of my list. I’d head for warmth. Southern California is pretty nice.

Yes I did read the post. They are university fellows/professors, and that site is open to phd students and university professors to submit articles. The article isn’t peer reviewed and doesn’t contain comments from anyone other than the authors. Moreover, much of their complaint is questions about things they don’t know about , such as what crimes are being measured, or what the qualifications of the economist experts is. They only comment on information that was “freely available” about the study, so it isn’t clear if they even bothered to contact the study authors to get the missing information. So no, that alone didn’t convince me (as it did you) that the study was “quite flawed”. And in fact I don’t think the study is flawed, as they are quite transparent as to what is being measured, and have been consistent in doing it for over 20 years.

Did you read the link? It is not a blog post. It is an article by the following people:

Julianna Rozek

Research Officer, Healthy Liveable Cities Group, Centre for Urban Research, RMIT University

Billie Giles-Corti

Director, Urban Futures Enabling Capability Platform and Director, Healthy Liveable Cities Group, RMIT University

Lucy Gunn

Research Fellow, Healthy Liveable Cities Group, Centre for Urban Research, RMIT University, RMIT University

They have valid points I think if you read their critique. I do think Victoria is a very good city to live in and I deliberately chose it for its livability.

Why would anyone want to travel outside a city to witness beauty rather than live in a beautiful city? Also, with all the “tailgated by a Dodge Ram” comments I would imagine Calgary isn’t for many people in this chat.

Canada, Vancouver and Victoria finish near the top of many world surveys – happiness, liveability, desirability etc.

I’ve noticed that every one of them is criticized and dismissed by many of the “ resident experts” here, who apparently know more about what criteria are important. Apparently it is to try to convince us that Canada has no business being highly rated for anything. In this case, we are told that the Economist’s annual, well regarded liveability survey is “quite flawed”, because someone said so on a blog post four years ago.

While this can be true for one survey, when you add them all up, it appears that Victoria, Vancouver and Canada are indeed special places, as seen by objective analyses from the rest of the world.

Much to the disappointment of some incredulous people here.

I think the average Victorian will finally be “woke” after the minimum 75bps in July. I was at a bbq this past weekend and still very few people were talking about interest rates, lots of chatter about inflation but pretty much nothing on interest rates. Most people still haven’t realized that the market has changed significantly since March. There will be a reality check for these small time developers and those are trying to do flips shortly (those who haven’t been through a cycle), especially those doing them in the westshore.

I don’t disagree, that just wasn’t in what you posted.

Lots of beauty just outside Calgary too.

Access to education is going to be better in Calgary. No one sleeping outside their elementary schools to get a spot.

Maybe. I personally consider weather, natural environment/aesthetics, and access to education key livability factors. These seem really good in Victoria.

Public transport is pretty good in the core areas in Victoria, and bike paths are improving – don’t know about other areas. Number of bike paths and walkability vs. practical usage year-round would need to be evaluated. Victoria likely comes out ahead.

There is a reason many retirees choose to relocate from Alberta to BC and very few choose the reverse.

almost 100 more mls active listings than last week.

@Totoro, from your article, I think Victoria would probably win over Calgary on walkability (which still isn’t great) and that’s about it.

Broke 2000… Woohoo.

Monday month to date numbers:

Sales: 522 (down 33% from same week last year)

New lists: 1191 (up 10%)

Inventory: 2031 (up 38%)

New post tonight

It may not be a fluke, but the survey itself seems quite flawed to me. Here is a critique of it: https://theconversation.com/the-worlds-most-liveable-city-title-isnt-a-measure-of-the-things-most-of-us-actually-care-about-101525#:~:text=The%20Economist%E2%80%99s%20Global%20Liveability%20Index%20uses%2030%20indicators,and%20a%20field%20correspondent%20based%20in%20each%20city%E2%80%9D.

I’d say Victoria is way better than Calgary based on most objective criteria except housing. Victoria really doesn’t do well on affordable housing or housing supply. If you have a stable place to live or bought a while ago you are probably not feeling stressed by this, but if not it is a big concern and a reason to choose another location.

Yes, it is a surprise. And not a fluke, as Calgary regularly finishes in the top 10 in this annual survey.

They measure 30 variables of “liveability”…. “ Each city is assigned a score for over 30 qualitative and quantitative factors across five broad categories”

Right, they don’t include prices because they release a “cost of living” survey separately. Which, as you say is even more surprising, because Calgary would do well against European cities for cost of living.

Here’s a list of the cities in the survey (Victoria is not included) https://store.eiu.com/product/global-liveability-survey/

While the real estate market has cooled rental market still seems nuts -> https://www.reddit.com/r/VictoriaBC/comments/vkyuwe/answered_a_post_for_a_2br_for_2100this_was_the/

Wonder if some large downtown rental projects will even move the needle but certain can’t be finished soon enough (Hudson Place II, Wedge, Dockside Tower 3, etc.).

I’ve been to 9/10 on the list and not sure about Toronto, Calgary and Frankfurt. Not sure how Frankfurt even beats out Munich. Agree with Vienna thought!

@alexandracdn It depends what time one works. We know someone that works a normal 9-5 and moved out to the west shore and was stuck in the crawl every day. They couldn’t stand it and eventually moved back.

We bought a triplex in Esquimalt a couple years ago and both suites pretty much pay our mortgage ($150 short). I really like Esquimalt. This past weekend we walked home from downtown, it was only 25 minutes. It takes all of us 10 minutes to get to where we have to go. Neighbors are nice but it’s Esquimalt so they mind their business. It all depends on what people want. For us top priority is NOT spending hours every week or day in a car that’s spewing out gas into the atmosphere and eating up time that would otherwise be spent together.

More townhouses is good. Cities need families to thrive and not everyone with kids want to live in Langford (though I know it is cute and has lots to offer).

As noted on page 6 this survey does not take into account local cost of living, nor does it look at local salaries or job opportunities, as it’s done for the benefit of corporate executives.

Quite striking then that Calgary ranks so high, as its housing costs and general cost of living relative to local salaries are quite reasonable.

Canada has three cities in top 10 livable cities worldwide out of 173 cities… Calgary, Vancouver and Toronto. No US cities made the top 10. I don’t think Victoria is big enough to be included in this list.

“ Considering a big move this year? You may want to think about Canada or western Europe. The Economist, ranked 173 cities around the world on a variety of factors, including health care, crime rates, political stability, infrastructure and access to green space.”

https://www.cnn.com/travel/article/economist-world-most-liveable-cities-2022/index.html methodology; https://pages.eiu.com/rs/753-RIQ-438/images/liveability-index-2022.pdf

Hi gang, just catching up on the comments after not looking for a few days, and I have to chime in to correct one comment from Barrister on June 24, 2022 at 9:14 am. Sorry, I forgot how to quote properly again, but he wrote “Downzoning property means that the city would be liable to pay compensation which could run into the hundreds of millions. Theoretically yes but actually it will be next to impossible to down zone. But you already know this which makes me wonder why the disingenuous remark by you.”

Barrister, I just have to correct the record here: compensation is not owed to property owners as a result of any change to a zoning bylaw or Official Community Plan, per Section 458 of the Local Government Act (https://www.bclaws.gov.bc.ca/civix/document/id/complete/statreg/r15001_14#section458)

So… down/upzone away!

Yes., and that’s one reason we should expect more remote workers from ROC arriving in Victoria. To escape the cold winters. Instead of waiting to retire in Victoria – they’ll move now and keep working.

For example, here’s someone from Ottawa looking to move to Victoria.

https://www.reddit.com/r/VictoriaBC/comments/sxgvzf/moving_to_victoria_from_ottawa/

“I’m curious as to what everyone thinks about a move from Ottawa to Victoria . From what I gather:

* Idyllic weather (I guess ideal weather is different for each person but it seems pretty decent year round in comparison to Ottawa which goes from -30 to +30 and is mad humid at all times)

* Real estate seems to be more considerably expensive in Victoria, do housing costs go down reasonably in nearby cities in Vancouver island? Cost of living seems to be decent overall

* Ample job opportunities in a lot of growing fields, both private and public

* Proximate to Vancouver and Seattle, I assume taking the ferry may be a hassle though?

* Faces reasonable natural risk due to the effects of climate change, a point to consider for the long-term

* Heard many people calling Victoria boring but I don’t think they’ve visited Ottawa

* City with a lot to offer for those who like nature and like to be active{

With much less hassle they can also live in the San Juans or similar areas, get cheaper housing, work remotely, earn US dollars and pay much less income tax (lower federal tax, no state income tax in WA). Decisions, decisions.

Those people were not immigrants to Canada, they had simply entered as visitors with the goal of illegally entering the US.

Rush- That’s what I’ve been saying all along, reduce immigration for a while. Catch up on infrastructure, housing inventory, etc… Unfortunately, that won’t get you re-elected. Should buying investment properties be restricted, maybe, but since everyone has the same opportunity, I see going down that path a step closer to communism. Some people simply won’t make the sacrifices necessary (or work hard enough) to acquire even a primary residence and are forever going to be renters. Something as simple as being a non-smoker can greatly increase one’s chance of being better off financially.

Owning multiple properties is no picnic, I’m probably going to spend close to$100,000 on repairs and improvements this year. I don’t see it as an expense, I see it as an investment, that helps ease the pain. All I know is that my tenants (not university students) are extremely glad to have a place to rent in a good neighbourhood, they deserve that right also. And they never have to pay to get anything fixed, I do. I know lots of people that tried buying rental properties and bailed early, it’s not for everyone.

nan-I haven’t any research to back this but I would surmise that a lot of the Canadians emigrating to the U.S. are recent immigrants. They use Canada as a stepping stone. They know that their economic future is potentially better in the U.S. They might not know the dangers and racism they could be encountering. One family from India froze to death trying to walk into the U.S. in the middle of the winter this year in Manitoba. It was a botched smuggling attempt, they were supposed to be picked up on the other side but something went terribly wrong.

An industrious individual can make more money in the U.S. it’s the wealthiest country in the world. What we don’t see is the massive poverty that exists throughout impoverished communities. I lived in the U.S. when I went to school in the early 1980’s. You could tell people were wealthier than Canadians. They drove better cars, were involved in more business enterprises (instead of taking government jobs), its a totally different business atmosphere. At some point however, people start to consider the safety of their family and choose that over financial gain, or they have plenty of money and don’t need anymore.

Per capita, Canada still takes in a higher percentage of new immigrants than the U.S., and many of them eventually make their way across the border or B.C.

@Frank: “According to one source, Canada has 1.7 million millionaires, the U.S., 20 million.”

The US probably has a better case for Canadian millionaires moving the the US with Trudeau at the helm.

Not only that thousands of Canadian future millionaires are moving to the states because their families aren’t already rich and they actually need to make the money they spend on housing. Expect more of this:

https://betterdwelling.com/canadians-permanently-leaving-was-unusually-high-for-the-first-quarter/

Watch that number skyrocket. People can always fly home for an abortion but living in substandard housing while making 1/3 of what you can make in the US is pervasive for anyone with a choice.

How dare the university students live near by their university, and drives up the price of NIMBYs houses due to proximity. Perhaps, it would be better for NIMBYs to live where there are no partying university students like Langford.

Odd that people keeps on coming here to Victoria instead of other places where the housing are cheaper with higher salary?

Ahhh yes. First it was the Hong Kong people who were gonna move here in droves and spike prices higher then ever – we are cheap compared to Hong Kong don’t you know? Then it was the Ukranian refugees, now it’s back to the Americans (last time it was when Trump got elected). Fact of the matter Frank is it’s the Canadians who are making this place the most expensive by not building enough homes. Even if we drop 20% that gets us back what, a year? I’d be surprised if we even see that. If you want real long term change: reduce immigration numbers for now then follow new Zealand on both increased down payments (40% on investment properties) and get rid of SFH zoning – and for the cherry on top stop allowing equity takeout for down payments on other homes. Then maybe we see some real long lasting impact on affordability.

Frank just accept the current downturn. Probably 20% decline then increases after that.

According to one source, Canada has 1.7 million millionaires, the U.S., 20 million. If 5 % of them feel uncomfortable with the way things are going- political instability, social upheaval, gun violence, you name it, they will look for a more stable place to live. I don’t think we have enough room for another 1 mil millionaires.

Every major city in the U.S. would have areas that are comparable to prices in Victoria. Winnipeg has a lot of million dollar+ properties. There is also 10 times the population in the U.S. No shortage of people with the means of locating to wherever they want. Even wealthy Ukrainians can afford properties in the millions. A lot of wealth has been created around the world in the last 40 years, that’s why real estate is so expensive.

Other than San Fran and New York City, I’m pretty sure every other city in the US has cheaper housing than Victoria.

I’d also get paid about 3 times more in San Fran in USD if I worked there doing the same thing.

I’m pretty sure that’s the one we’re looking at! Could be neighbours!

A house often rented to a cadre of partying UVic students near me is up for sale. Here’s hoping a nice family buys it, and not another investor.

There’s a few more houses in the vicinity that I’d love to see go the same way.

Americans can live in Canada, work remotely and still earn U.S. dollars. I’m sure houses in California (which has the same population as Canada) are comparable to our prices. There are very affordable regions of the U.S., mostly low density areas. High density regions have high prices, just like Canada.

Now that’s a laugh. True their dollar is 30% higher, but the average Canadian house price (in CAD) is almost twice the average US house price (in USD).

Not to mention, of course, that if they moved to Canada and got a job they would be making CAD.

Realest. Didn’t mean to disparage Cadillac Avenue at all. I biked down there a couple weeks ago and It looks fine to me. Just far enough from the highway Unlike some neighbouring streets.

Doctors don’t like working in a dysfunctional government run system, plus the monetary compensation is intoxicating. They can afford to live in gated communities.

Thanks for the info. I didn’t know that.

You are right Frank, explains why so many of our doctors are heading south.

Barrister- Maybe the cost of real estate, fires, air quality, gun violence, shall I continue? Plus Canadian real estate is 30% on sale for them. Canada is also more tolerant of racial and sexual differences. U.S. is regressing 100 years into the past. Soon they’ll take away a woman’s right to vote. I forgot lack of water.

The housing stories making it into the media every day are just beyond wtf. There is no hope for housing.

https://www.richmond-news.com/local-news/richmond-strata-surprised-they-have-to-share-driveway-5515382

Buyers buy into newer development (which obviously didn’t inconvenience anyone and no neighbours were against it). Just like all existing housing stock required no trees to be cut down, etc.

Right of way REGISTERED on title at BC Land Title office (i.e. clearly visibly when purchasing). So the buyers hired completely useless realtors/lawyers.

That all aside what is happening would be a net benefit for me.

10 townhomes sharing a 4-meter lane (i.e. you pass by another car maybe once a couple of weeks) versus 35 townhomes sharing a 5.5 meter lane (i.e. you pass by a car maybe once a week). Personally, I’ll take the wider lane please. Certainly isn’t end of world sharing a wider lane with a few more townhomes (residential creates very little traffic).

Somehow this is a new story and the owners are being hard done?

This 12 minute travel from Langford to Uptown is true off peak hours. But in the context of a work commute into town it would waaaay longer.

My first house was just off Cadillac in 2012. Not our desired area but it was literally the cheapest core SFH on the market at the time and what we could afford. It’s cleaned up a lot now but back then it was a pretty dumpy neighbourhood. It turned out to be a very convenient location as everything seemed to be 10 mins away – downtown, costco, central saanich, etc. Uptown is a useful landmark in terms of relating proximity to other areas.

Caveat: I was simply responding to Dee’s comment of She would rather live in the core as she does not have the patience or desire to spend a couple of hours commuting every day. So it was just an example of travel time by car (or bus) from one location to another. If you live in Gonzales area and you work at UVIC, it is going to take awhile to get there and back each day Admittedly most people would rather live in one of the core municipalities of Victoria versus non-core if they could afford to do so. I do know however of many couples/singles who purchased in Colwood, Langford and even Sooke when it was by far not their first choice, but have ended up loving where they are. Ask anyone just a few years back what people thought of their choice to move to Esquimalt.

Is travel time to Uptown a useful measure of anything in Victoria real estate? Is Cadillac Avenue now the most coveted location in Greater Victoria?

Frank: Why would the recent Roe decision make Americans want to move to Canada? Maybe relocate to California or Washington state but not Canada.

Well it’s one floor above 301 610 Johnson St, which sold for $849,000 just last February and is bigger. Maybe the altitude is giving the owner delusions. 🙂

Still too little dwelling for too much land. That’s why they’re not built, the numbers wouldn’t work. What would work is individually titled townhouses.

Like Germany, Switzerland has a large stock of secure purpose built rentals. Home ownership rate is just 36%. This has to be taken into account when looking at affordability of properties for sale. It’s not the same buyer cohort as here.

What is so special about 401 610 Johnson St? It is 765 sq feet (finished area) and listed at 1.37, which is more than 100% above its 2021 assessed value.

With the recent Supreme Court decision I’m sure more Americans are considering moving to Canada.

I’ve been to Switzerland x3 and whenever I’ve looked up real estate prices they are insane. A decent condo in Zurich in a decent location is like $2 million Swiss Francs.

Canada: 10,000,000 km2, Switzerland: 41,000 km2. Why is this being discussed?

“Perhaps, but it doesn’t look like being “a lot more thoughtful” has resulted in more detached homes in Switzerland than Canada.”

I wonder if there is more “middle” housing though. Here it seems to be condos, extremely tall townhomes or very large houses. I wish we had a bunch of new “wartime” like homes – small 2 or 3 bdrm bungalows on small plots. Would be good for both young families and older people looking to downsize.

Early 80s I believe…. Someone had hunted down the newspaper announcements for it

I recall Leo pointing out that most of the residential part of Victoria was downzoned to SFH some decades ago.

Perhaps, but it doesn’t look like being “a lot more thoughtful” has resulted in more detached homes in Switzerland than Canada.

Canada 53% of dwellings are detached houses https://www12.statcan.gc.ca/census-recensement/2021/ref/98-500/001/98-500-x2021001-eng.cfm

Switzerland, 22% of dwellings are detached houses. https://www.statista.com/statistics/536550/distribution-of-the-population-in-switzerland-by-dwelling-type/

Malton: $1,235,000

Beam: $1,250,000

Sorry ‘recent’

Would anyone be able to provide rent sale prices for:

4020 Malton

4096 Beam

Thank you

Hopefully summer is arriving…..

Enjoy the weekend folks!

Really the only thing we should be able to complain about is immigrants right Frank?

It’s great that people can live wherever they want, just stop complaining about high house prices and lack of affordable housing. We let Canadian trained doctors, whose education is subsidized by Canadian taxes, practice wherever they want, like in the U.S., just don’t complain about a doctor shortage.

I live near Ash, and can get to uptown in less than 20 minutes biking.

Whoops, highest 2yr GIC is 4.55% & 3yr is 4.65%. Both with EQ bank.

If you live close to highway access in Langford or Colwood and many do, you can get to Uptown Centre in about 12 minutes. If you live in South Fairfield, it could easily take you 20 minutes to get to the Uptown Mall. If you live out towards Ash Road in Gordon Head, probably will take you 20 minutes as well. Oak Bay, ditto.

Number of families in Canada in 2019 by number of children:

No Children: 4,419,650,

One Child: 2,655,810,

Two Children: 2,209,080

Three or more children: 1,014,310

The 1yr GIC @ 4.18% is through GIC Wealth Management, but you can get a 1yr @4.17% through GIC direct located on Fort St. downtown. The 2-5 years are all through Oaken Financial, i.e. Home Bank and Home Trust.

Dang, who is offering that one year rate?

Best GIC rates today:

1yr@4.18%

2yr@4.5%

3yr@4.6%

4yr@4.65% &

5yr@5.0%

Caveat, love to chat with you about the million dollar cows and everything Swiss but totally off topic? Anyway, off to my lab tests so need to leave it for another day. Hope you all enjoy the sunshine.

No, we elect councillors to lead. If people don’t like it they can make their voice heard this fall. But I feel like people are done with the status quo approach, it’s clearly not working

Was there a referendum when it was put in place 40 years ago?

Actually, it is not something that you can undo from a practical point of view. Downzoning property means that the city would be liable to pay compensation which could run into the hundreds of millions. Theoretically yes but actually it will be next to impossible to down zone. But you already know this which makes me wonder why the disingenuous remark by you.

Actually a massive rezoning of the city is the ideal matter for a referendum.

Since Switzerland is Balkanized into 26 cantons and countless communes all with very different visions generalizations like that are fairly useless. The development attitudes ranging from Oak Bay to Langford are all represented and more in different communes. In most of the tourist area strict rules preserve a lot of the postcard nature of the towns and countryside. Outside of those areas you can find lots of hodgepodge development and ugly concrete multi-family blocks.

We have representative democracy so there is no particular need for a referendum for most issues and certainly not this one. If a council adopted missing middle and people don’t approve a future council can undo it.

If it was put to referendum it might do better with the public than with our NIMBY councillors.

Caveat: Unlike Victoria planning in Switzerland is a lot more thoughtful but thanks for tossing more mud on the issue.

James, it absolutely should be decided by the citizens of Victoria. They are the people that City Council is elected by and responsible to. I love how the development people all pop out of the woodwork on this one.

How much does it truly help if only the city of Victoria does it?

Barrister. Lugano is chock full of apartments and other multi-family. Another s – – thole?

James. the zoning is for the city of Victoria as you well know so obviously the referendum should be by the citizens of Victoria. But go ahead and obscure the matter.

Would it include future residents? homeless people? which city are you talking about, Victoria, Saanich, Esquimalt, Oak Bay, View Royal, Colwood, Langford, Highlands, Metchosin, Sooke, Central Saanich, North Saanich, Sidney?

I have an idea Leo maybe you are right and you should let people chose what they want without your efforts to social engineer what you want people to have. You have to admit that you are pushing your developer ideas as hard as possible so I think perhaps saying that people should chose may not exactly sit well.

But I am in favour of letting people chose so considering that this whole missing middle is a major and probability irreversible decision I strongly support having a referendum in the city to let people chose what they believe is best for their city.

Would you support a referendum?

Kelowna for as long as I can remember = beautiful location, ugly town. Has that changed?

Yes it’s probably because they allowed a few quadplexes. It’s not that it’s always been a congested car centric place like it was 15 years ago when I worked there.

Oh and one of the fastest growing cities in Canada, which is a telltale sign that no one wants to live there

I’ve got a novel idea, how about we let people chose where they want to live. You know, like now.

@Frank younger people move to cities for work. We relocated to Victoria from a smaller place because we got jobs here. If not for needing a job I’d probably be living on Cortes island. Living close to work/school is a top priority for us because I do not have the patience/desire to spend a couple of hours every day commuting. I’d rather live in a 900sqft 2 bed shoebox (with both kids sharing a room) in the core than have a SFH in Langford. But, that’s just me.

I was in Kelowna just a few weeks ago. The place is turning into an absolute shithole which I have heard from a number of people who live there and trying to get out. God help Victoria if that is the model that people Like Leo think is the ideal way of moving forward. But it is great for developers who can knock up cheap crap boxes to cram more people into.

Can someone put up pictures of what most of the Kelowna sixplexes look like especially when you start getting a whole street of them. Nothing like what the advocates of this plan say it is going to be like. But would people like Lisa Helps ever do anything bad to your city?

If a family of 3 swaps their townhouse with a family of two in a SFH (by sales at market rates)… that doesn’t improve the housing problems of prices, vacancy rates or affordability. I’m in favour of more tax incentives to help families with kids, but let them decide how they want to use that extra money – maybe they prefer to live in a townhouse downtown than a SFH in the suburbs.

Why is the concept of life in a rural community considered punishment? People will have to be shackled, loaded onto the back of a truck and dropped off in the wilderness to fend for themselves. I’m sure there are people who would prefer to live somewhere they could afford. Where homelessness, squalor, crime, and the constant wail of sirens is almost nonexistent. Maybe the punishment is forcing people into congested cities where the price of housing is out of reach. I guess it depends on one’s perspective.

But over 50% of households in metro Vancouver (and even more so in metro Victoria) have only 1 or 2 persons. What really matters is the stock of SFH versus larger households. In fact metro Vancouver has more SFH than households of 4 or more, and almost as many SFH as households of 3 or more. Greater Victoria has more SFH than households of 3 or more.

Which brings back the question: is the problem really a shortage of housing stock, or inequitable distribution?

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CMACA&Code1=933&Geo2=PR&Code2=59&Data=Count&SearchText=vancouver&SearchType=Begins&SearchPR=01&B1=All&TABID=1

3849 Merriman sale at 969k. Pretty much assessed value for a sfh with renos in cedar hill

Yeah the economic analysis done by the city’s consultant shows there’s very little land lift under the current proposal.

I had an interesting call with a Kelowna planner on this topic. They upzoned 800 lots to quadplexes in 2017 with very few restrictions and fast-tracked pre-approved designs that allowed small builders to easily participate. He estimated the land lift in their case was about $100k for owners of those lots. Partially this is because of the small area which focused development capacity, and partially because the program was very permissive. They are now looking to upzone thousands of lots for phase 2 and add some flexible value capture to reduce the land lift.

While it’s true that we don’t want to give away all the land value to existing owners, we also don’t want the land lift to be zero because then there’s no incentive for owners to sell to builders or build themselves. Some land lift is desireable, and in Kelownas case it lead to 300 building permits in 5 years which is a lot for only 800 lots. We also want to make sure there is incentive for redeveloping into 4 homes vs just replacing a house with a house

He’s clearly stating that forcing people in trucks into the country side should be handled by private industry.

San Francisco says whaaaaat.

The NIMBYs Made $6.9 Trillion Last Year — https://www.strongtowns.org/journal/2022/4/19/the-nimbys-made-6-trillion-last-year

It is still happening, but people will find reasons to complaint.

Why Tiny Towns are Giving Away Land in Canada — https://www.immigration.ca/why-tiny-towns-are-giving-away-land-in-canada

They’re talking about affordability of a benchmark single-family detached house, as if everyone should be able to own that in Vancouver.

That’s not realistic. In large cities, detached houses are a luxury and most people live in townhouses or apartments.

That’s a trade-off you make for living in a large city, less space but more services etc.

Affordability discussions should be about satisfactory housing, not luxury housing.

Value lift has been discussed at multiple city council meetings for extended periods of time even thought staff have evidence to suggest otherwise (there won’t be a big lift).

“Because the upzoning will make homeowners rich and greedy developers will profit.”

I see you’ve been spending time on the Victoria subreddit.

Because the upzoning will make homeowners rich and greedy developers will profit.

Seems to me that this kind of opposition would come from homeowners, not renters. Why would a renter who doesn’t have secure tenure in a neighbourhood care about change in housing stock in the first place?

+1, I know two young Croatian couples that ended up in Moose Jaw under the immigrant nominee program. The minute they received their PR, packed their cars and came to Victoria.

The exact same individual that complains about housing affordability and teardowns being replaced by SFH mansions will also NOT be in support of missing middle. That is what drives me nuts, just pick a position and stick to it but people seem to pick positions that are totally counter one another.

Immigrants, aka permanent residents have a constitutional right to live and work anywhere in Canada. You’re mixing them up with people on work visas who are a different group altogether. Also, most of the farm workers are on farms that are rather close to big cities, not in remote areas at all. That’s simply because most of the farms that use such labour are relatively near big cities, e.g. Fraser Valley or Southern Ontario.

The government, I believe, already directs new immigrants to different parts of the country. For an example I already mentioned, look at the men from the Phillippenes that are coming into Canada on work visas and are going to work on farms in remote communities. The families that they leave behind can join them in 4 years. They live in cramped quarters and do work most Canadians wouldn’t dream of doing. This type of control exists today.

I think the point was that you stated “The less government involvement, the better the chances for success.” while at same time proposing things that would require government involvement.

The government would need to get involved to incentivise them to move to remote places like “giving them land”. Without government involvement they would most likely stay in large population areas where there are more opportunities and support networks.

Trucking people to a community that offers freedom is better than having the doors of your high rise apartment being welded shut. Or your entire city bombed into rubble.

I can get behind that.

Give people land, that’s how it was done 100+ years ago.

So should we move them there in trucks or what are you thinking?

Less government other than the part where we force people to live where the state decides they should?

The only solution I see for the masses of people moving to Canada is not densification. It’s evident that the most expensive cities are also the densest populated: New York, Mississauga, Vancouver, Toronto and Hamilton. Spreading people out to smaller communities where some sort of infrastructure already exists and land readily available is the only way to accommodate millions of new immigrants. They can start new businesses, support each other and grow the community into a thriving, self supporting place to live, instead of piling on top of each other. Take advantage of the natural resources that are nearby, which takes ingenuity, something a lot of immigrants have. To concentrate more people into heavily populated southern Ontario and southwest B.C. is definitely not the answer. The less government involvement, the better the chances for success.

We have a huge amount of investment going into housing, yet we have a housing crisis. How is this possible? Answer is is because so much new investment is going to people who are already adequately housed, and that’s because the falling rates have given them an advantage in the market. Both in terms of bigger properties and second properties.

If housing loses its attraction as a wealth generator, people should be more motivated to buy housing simply as a place to live. Some cooperation from municipalities to build more smaller units would help of course.

Higher rates will disincent owners from holding for speculative purposes, whether it be small households with big houses or owners of vacant land.

Speaking of land doing nothing.

How the hell is it that the old Mayfair lanes lot has had nothing happen to it in nearly 2 decades?

40 years. When a trend has been around that long, a lot of people just don’t consider the effects of what would happen if the trend reverses.

Yes, returns decreasing over time. And that’s with still decreasing rates. I still think people aren’t factoring in how much of a tailwind that was to the market in the last 40 years. Real estate returns could disappoint for a generation if people are expecting the same as in the past. That doesn’t mean there won’t be good buys out there with positive returns, but I think the era of outsized returns where basically any real estate was a ticket to substantial wealth is over.

Problem is that doesn’t do a damn thing to solve our housing problems

New data released by RBC Economics Thursday suggests it’s essentially impossible for many Vancouver residents to carry the cost of a home without going into debt.

According to analysis by RBC Assistant Chief Economist Robert Hogue, mortgage payments, property taxes, and utility bills for a benchmark single-family detached home in the Vancouver area would have chewed up 111.1 per cent of median pre-tax household income in the first quarter. That was up 21.9 per cent from a year earlier, and a nearly 10 per cent surge from the fourth quarter of last year.

At a national level, RBC estimates 54 per cent of pre-tax household income would have been needed to cover the cost of home ownership across all property types in the first quarter. Hogue said that’s the worst affordability in about 30 years, and warned it’s only going to get worse. In the country’s largest housing market, RBC estimates 74.9 per cent of income was needed in the Toronto area. That was up 5.5 points from the previous quarter and 16.7 from a year earlier.

“The Bank of Canada’s ‘forceful’ interest rate hiking campaign will further inflate ownership costs in the near term, putting RBC’s national affordability measure on a path to worst-ever levels,” he wrote in the report.

Hogue said rate hikes will be particularly painful for homeowners in the country’s priciest markets. “Affordability to get even uglier in Vancouver, Toronto and Victoria,” he wrote; for example, he estimates a one-point rate increase would cause RBC’s gauge of housing affordability to deteriorate by 8.8 percentage points in Vancouver, compared to a worsening of 5.5 percentage points for the national average.

Hogue said he thinks recent wage gains will help improve affordability, “but we think the factor most likely to move the needed is a price correction.” And on that front, he said RBC expects the national benchmark home price will drop more than 10 per cent from peak to trough this year.

St. John’s can lay claim to being Canada’s most affordable housing market. RBC estimates 23.1 per cent of median pre-tax household income was needed to cover home ownership costs in that city during the first quarter. Regina wasn’t far behind at 24.6 per cent.

Buckle up, it is here……………….

Interest rates have been falling for 30 years. Here is something to keep in mind: since 2000, the benchmark home price in the USA has appreciated 60%; however, the benchmark home price in Canada has tripled over that same time. Housing in Canada has been shown to be the most sensitive to interest rate fluctuations. The rate of sensitively as rates rise, will create a painful correction. We are likely in a recession now and the data will reflect that as unemployment rises over the next 4 quarters. The places to watch are the most unaffordable: Vancouver, Toronto and Victoria.

In oak bay 1.4 comes down and 3.5 goes up so not affordable for a lot of folks

Huge part of the reason for that is that the only thing legal to build on the vast majority of our land is single family homes. So that’s a 1:1 replacement (or best case 1:2 if the new place has a suite built in). Legalizing missing middle like townhouses will be a key reform.

Unfortunately a lot of the new homes being built in the next decade will only be replacing houses that are torn down, or should I say “deconstructed”.

179,150 to 251,398 SFH average or 40% increase

which isn’t too far off

2010 to 2020 (I used 2022 in my example below that would have the same impact as using 1988 on above).

629,925 to 992,247 SFH average or 57% increase

1990-2000 was pretty flat actually. What got the juice flowing was the subsequent interest rate cuts in response to the dot-com bust, the global financial crisis, and Covid.

Those who thought flat prices were a bad thing blamed the NDP government of the day.

Lovely, another report that will lead to municipalities requiring deconstruction by toothpicks, after you wait 12 months to get a permit to deconstruct by toothpick.

Fair enough but you could make the exact same argument going back every 10 years for last 50 years. There was a bigger SFH run up 2000 – 2010 than 2010 – 2022

2000 – 2010; 150%

2010 – 2022; 120%

5 year bond yield getting beat up today – 3.17% – could soften fixed rates a bit if it stays for more than a day haha.

Only difference is their mortgage was for 300k, not 1MM.

Huge CMHC report out this morning identifying the need to build an extra 3.5 million homes in Canada by 2030 to address affordability.

https://www.cmhc-schl.gc.ca/en/blog/2022/canadas-housing-supply-shortage-restoring-affordability-2030?utm_medium=email&utm_source=e-blast&utm_campaign=2022-06-Estimating_Supply_Gaps

Current deal that’s expiring (2019-2022) had no impact on students. Horgan was premier.

Previous deal (2013-2019) involved a strike that affected graduation and college admissions because teachers had been working under an expired contract for 11 months. Christy Clark was premier.

Quite right, Barrister. I was being hypocritical, so I deleted my comment.

How do the strikes have anything to do with housing?

.

BCTF usually waits to strike until they can have the most negative impact on students in order to interfere with graduation and college admissions.

Correct.

That would be clever, so they probably won’t do that.

Interesting, I think couple people were calling for 1.3m minimum so that’s pretty close. I do remember frank calling for 1.5m min and then over 2m after a reno.

And where was this from? ALT lenders will have lower rates but higher fees. Devil is in the details.

Marko, was that for a five year fixed?

Patriotz: Absolutely right about conditional on financing and thanks for the reminder. Time to go back to the good old days and maybe some more realistic pricing at the same time. Hope the real estate agents can get up to speed and protect their buyers situation properly.

I had buyers yesterday obtain a 4 month rate hold into October for 4.34% so highest we’ve seen in 10 years but not quite disastrous. I remember working with several buyers end of 2010 and they were very excifed with a 3.49% BMO offer back then so rates must have been in the high 3s.

Most buyers closing today still have the cheaper rate holds. Different story in a month.

” It does not solve the problem of people defaulting their deal because of declining house appraisals. ”

There also used to be something called “conditional on financing”.

For most of my life, RE sales were conditional upon the sale of your existing home. I suspect that we will go back to this model. It does not solve the problem of people defaulting their deal because of declining house appraisals.

The next six months should be an interesting time for anyone buying. Lets see where inventory stands by the end of the summer.

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-as-the-housing-market-slows-costly-bridge-mortgages-are-an/

Canada (that’s us) is opening an embassy in Rwanda to counter Russian and Chinese influence. First, it will have zero influence on two superpowers’ dominance in several African nations. Second, I cannot fathom how much that will cost to establish and maintain. But what the heck, we’re already a trillion dollars in debt. I fail to see the need and can think of dozens of internal uses for the money. Like infrastructure, schools, health care, etc….

They’ll strike at the same time for maximum leverage.

BCGEU is not the BCTF? Or am I missing something?

2955 Westdowne sold at $1,318,500

I think that’s wrong. School will start as normal as negotiations continue.

Re: Luxury house sales chart over $3 million. Are there really 100 houses over $3 million for sale? 10 sales a month x 10 months inventory.

lots of media coverage about the high rent increases and housing shortage in certain areas across the country and globally.

But, but… what about rents? What about immigration?

https://www.theglobeandmail.com/real-estate/toronto/article-in-toronto-real-estate-buyers-gain-the-upper-hand

This is clearly what the Government wanted. 1.75%, 2%, 2% raises are untenable. Since that was all they were willing to offer when the last contract was better, it’s only possible to conclude that they want a strike. Likelyhood of kids going back to school in Sept is pretty much zero.

yes I agree, this was the only move to make that made sense.

Great decision. Whatever the reason, it’s nice to see common sense win out once in awhile. .

just heard 95% of BCGEU voted TO strike and 92% of PEA. So now they go back to the table with PSA to see if they can make a deal with the new found negotiating card in their hand. Curious to see what PSA does.

I think they are way over budget on their royal bay research building already and that will come out soon so they are trying to get ahead of it by pausing the main museum to minimize some damage. Given what I see in the current market, every large scale construction budget done prior to Feb 2022 are short by a wide margin, the normal contingencies carried are not nearly enough to over come this. This applies to everyone from the Jawls, to Quardreal to Brookfield, Suncor, Enbridge, federal, provincial and municipal public sectors.

“Royal bc museum project paused. Wonder how big the actual price tag got for them to make this decision”

Interesting. Given the near universal negative reaction, this seems more like a political decision than a financial one. Could prove to be a smart decision to not double down and just admit they made a mistake.

Royal bc museum project paused. Wonder how big the actual price tag got for them to make this decision

Yes, though I would argue if you look at the sales distribution, picking a cap that is sufficiently far away from the bulk of the housing stock is a good enough approximation (and a lot less work!). It also reflects what we know happened (luxury market took off after the pandemic well before widespread price gains). If we set a cap based on price we’re mostly measuring turnover of the same housing stock and I’m not sure how useful that is. I guess months of inventory in that dynamic range should give us similar info

Right. To account for rising home prices, perhaps the ideal definition of luxury would be something like “properties listed over 3X median home price”. So if median home price was $800k in 2019, that would be over $2.4m for 2019, and if it was $1.2m in 2022, then luxury would be over $3.6m.

Another 4.5 mill sale today.

Not on your level in terms of stats Leo but the “Luxury Sales” chart wouldn’t it be off on the basis of the huge run up in prices. For example, the home that sold today for 4.5 million was purchased for $2.145 in 2015 so all of a sudden that home is on the over 3 million chart but it wasn’t 7 years ago. The actually home hasn’t changed but now it is under the luxury home umbrella.

Very similar.

I never said RB houses would be above $2m before they’re below $1m, but please don’t let the truth or reality get in the way of your narrative/hopes/dreams/etc. It would actually be great if they go under $1m so I can buy another rental property as many agree, it’s a desirable place to live.

Just because the health care doctor thing comes up here from time to time.

From: https://bc.ctvnews.ca/anger-and-frustration-talks-stall-as-health-minister-blindsides-b-c-doctors-1.5957616

I guess if you’re going to crap the bed at work, you might as well really crap the bed big time..lol…

Leo, any chance you can create a luxury sales in Victoria chart, with properties listed over 3 million instead of 2M?

Yes, broad based. No easy solutions here.

Wonder if boc will move up with an emergency 1% hike before end of June. I would have said yes if not for falling oil prices.

Yes, for May vs April. But overall, still plenty of inflation ex-gasoline.

https://globalnews.ca/news/8938704/inflation-canada-may-2022/

“Excluding gasoline, the annual inflation rate in May rose to 6.3 per cent compared with 5.8 per cent in April. Statistics Canada said the price for food bought at stores rose 9.7 per cent compared with a year ago, matching the April increase, as the cost of nearly everything in the grocery cart went higher.“

True. For those bank economists to keep their jobs I think they need to stick with conservative and positive-sounding predictions

Mostly a gasoline story. Turns out that the addition of used vehicle prices made no difference, it would be 7.7% even without that new factor

Lots of economists are calling for a recession. Now it includes the ECRI (Lakshman Achuthan), which focuses on economic cycles and has a great track record at predicting recessions https://www.businesscycle.com/ecri-news-events/news-details/economic-cycle-research-ecri-lakshman-achuthan-business-cycle-yahoo-finance-interview-u-s-inflation-the-fed-and-recession-risk

Predictions are hard, especially about the future

About a quarter of the cost of each litter of gasoline is taxes. Maybe it might be time to lower that to modify the inflation factor. The price of gas is build into the cost of almost everything else.

“Canada’s inflation rate now at 7.7% — its highest point since 1983” – https://www.cbc.ca/news/business/inflation-rate-canada-1.6497189.

Canada’s inflation rate rose at its fastest pace in almost 40 years in the year up to May, as the price of just about everything continues to go up fast.

Statistics Canada reported Wednesday that an uptick in the price of gasoline was a major factor causing the overall inflation rate to hit 7.7 per cent. Gas prices rose by 12 per cent in the month of May alone, and are up by 48 per cent compared to where they were a year ago.

Food prices were also a major factor to the upside, with grocery bills increasing by 9.7 per cent over the past year. Within the food category, the cost of edible fats and oils skyrocketed 30 per cent, the fastest increase on record.

Economists has been expecting the rate to increase from a 30-year high of 6.8 per cent in April, but the numbers for May blew past those expectations. Prices increased by 1.4 per cent in the month of May alone. Seasonally adjusted, May saw the biggest one-month jump in the inflation rate since 1992.

“If you aren’t over 40, you have never lived through inflation like this, and unfortunately, we are not expecting much of a reprieve going forward,” TD Bank economist Leslie Preston said. “Inflation is expected to remain elevated through 2022.”

Yes, rates that high or higher are definitely possible. Though the Bay Street 6 big banks are still sticking with more modest forecasts, where 5-year bond rates max out at 3%, and the target rate maxes out at 2.75% by Q4 2023. fwiw) they’ve increased these forecasts by 25 basis points over the last month. https://www.canadianmortgagetrends.com/2022/05/the-latest-in-mortgage-news-boc-rate-hike-expectations-grow/

But I’m with you Barrister, in that I think the rates will be higher than that.

Who just spent over three mil for a new build in Fairfield? That borders on the insane for me.

Correction: Those $5 and $7 million dollar properties actually sold for $3.85 and 5.4 million U.S. dollars. I wonder what country that money came from. Canada is still on sale to the world of the wealthy.

Should be an interesting watch. There is the possibility that 5 and 10 year bond markets might have peaked now. However, the overnight rates have yet to peak, so, there is a chance that the variable might actually rise to the level of the fixed rate or possibly higher. There’s still the assumption that fixed rates will increase, but it would be something to see variables at 5-7% and fixed in at 4.5 to 6% during the same period. I guess more of a shock then a something in that scenario.

Umm… Wait for a few months and those rates might look great. I remember a few weeks back getting slammed for passing on what my Bay Street friends were saying so I wont do it again. But does anyone here think that a six or seven percent rate for a five year is still impossible? Not saying it will happen but a six looks more likely than not to me.

Ewwww….

A bit all over the place right now. I booked into showing out in the West Shore on the weekend and only about 3 of the 30 showing slots had been booked. More desirable locations will still get the interest. However, I am not quite sure if open houses actually have a lot of potential/serious buyers or not.

Just drove by one of the houses for sale in the Oaklands. They were having an open house and it was a zoo. People everywhere waiting to get. It looked very busy… My thoughts of a big drop in the market may be premature.

785 Island Rd Oak Bay BC

Nothing quite like a cancel and relist with $500k price drop.

We can re-visit this assessment when royal bay houses go below $1M or above $2M.

I think in the luxury market people are more inclined to pay up for lifestyle, would you rather hold off your lifestyle for a year in what is a finite life time to save a million if you are worth $20M plus?

No he had a problem with both what I was saying and how I was saying it.

I don’t think he has a problem with what you’re saying, but with how you’re saying it.

And those people would be the dullest blades in the HHV knife block

$5 and $7 million sales just today. I guess the luxury market isn’t as sensitive to high interest rates?

Its completly fine, this is the purpose of an anonymous forum. One is able to express themselves in a manner they may not be able to in real life.

I’d like to point out that my comments to “VicREanalyst” were rude and totally uncalled for.

I put it down to getting extremely frustrated and grumpy.

Sorry about that. The comments I made were not fair at all and should be interpreted as someone who is just upset at how our world is having serious problems that seem insurmountable at times.

BC has low property taxes. I don’t just mean the rates, I mean the taxes paid for a comparable property (size not assessed value) compared to other Canadian cities. A cursory look at property taxes versus rents is all that’s needed to show your premise simply isn’t true.

That is fine, not everyone can accept reality. I also work very closely with apartment owners and do so in a transactional capacity, I can tell you when it comes to money no one is trying to make less of it.

To “VicREanalyst”…. In my opinion, it is people like you on House Hunt Victoria that spoil the whole experience.

In my opinion you are a self absorbed, arrogant person who just has to be right.

I stated my thoughts which were based on my experiences over fifty years with some people I value very much.

I do not value your opinion on the subject.

Still in the early innings to be claiming victory there bears. Bearish scenario requires sustained high interest rates in conjunction with a recession, certainly far from a guarantee currently. Market is changing quickly though, just as you saw in Ontario in the April/May time frame.

tomtom- Actually Hawaii is mostly owned by the Japanese. They’re passing on Canada.

Read what I wrote, I included consideration for tenant stability. Do you think landlords will pass the savings to renters if property taxes goes down or if they get a deal on maintenance?

Try a city with high taxes but 8% vacancy rates and see how much rents go up. Vacancy rates dictate rent prices, lol this is a basic principle and you are saying I am in the wrong business….

Sorry James…I must be missing something.

I believe in always charge “less” than the market value.

I could ask more if I based it on market value.

What I hear him say is that he bases his rents on market value…what the market will bare.

So I must be missing something.

@Marko, your favourite low housing indicator is showing an massive increase. There are now 5! FIVE! houses for sale in Oaklands.

You’re agreeing, they’re not charging less because the property is worth less, they’re charging based on market value.

Actually…I do not agree that “most landlords charge the most that the market will bare”.

I’ve talked to major owners of multiple apartment buildings and they often say…”Good God…Property taxes are up again and that’s like taking away one of the units in each building”.

We always rent slightly below market value because when you do that, you get a tenant who will take care of the place, not complain about minor things, etc. That is worth gold.

If you don’t believe that high city taxes influence the price of rents then you might be in the wrong business:)

“Canada is not hooked on real estate, the people immigrating to Canada are. ”

Meanwhile, Hawaiian complained Hawaii is not hooked on real estate, Manitobans immigrating to Hawaii are.

Any mortgage brokers on here? I believe we are coming to the end of the last rate holds from March so everything financing deal going forward shortly should carry significantly higher rates.

Frank, that house on ascot is still for sale, I am pretty sure they will take 1.3M at this point which is 500k less than what you thought it was worth a month ago!. If you truly believe that then you should be jumping on this asap.

lol some people may argue this sketchy slumlord is providing much needed affordable hostel style housing to new immigrants and students.

It’s always immigrants with you Frank.

They’re Canadian Frank.

Canada is not hooked on real estate, the people immigrating to Canada are. While walking along the beach of Lake Winnipeg on Sunday (37C or 98.6F) I struck up a conversation with a friendly couple originally from India. They have lived here for over 10 years. We discussed the economy, inflation, interest rates, all which was of no concern for them. Turns out they had recently purchased a 200 unit rental complex in a small community northeast of Winnipeg for $29 million dollars. Maybe it was B.S., I doubt it, but that is serious money and supposedly not their only investment. Real estate will soon be controlled by the wealthy and the average person will be completely priced out of the market. In some ways we are already there, in 10-20 years, it will be irreversible. I seriously doubt any government intervention can stop this from happening.

That is an interesting article Signpost. Some good side-bar articles as well.

Owner? I think you spelled sketchy slumlord wrong…

“Canada is hooked on Real Estate. It needs a de-tox.” from Mark Morris

https://www.cbc.ca/news/opinion/opinion-canada-real-estate-addiction-morris-1.6492967

Barrister, you be shocked to know how many people are doing cash rentals in Victoria without going through the proper paperwork. I know of one owner with ~15 people living in a 6 bed room house, all cash at 400-500 bucks per person.

That is absolutely incorrect. Almost all landlords will charge the highest rent the market will bare (with some consideration to rental stability) without regard for what their own cost is. That is like you getting a great deal on a car from a family member and then selling it for below market because your own cost was lower. I can cashflow neutral my rental house at 2,500 a month, I can tell you the only way I am charging that is if that’s what the market price is.

Flip side is also true, I don’t expect tenants to pay above market to rent from me if my costs somehow dramatically increases (major repairs etc.)

“People in households that spend 30% or more of total household income on shelter expenses are defined as having a “housing affordability” problem. Shelter expenses include electricity, oil, gas, coal, wood or other fuels, water and other municipal services, monthly mortgage payments, property taxes, condominium fees, and rent. ” Statscanada

It struck me that the difference between average rents and present market rents being so dramatic perhaps should be a red light for anyone considering a rental investment. It may be an indication of what your rental is going to bring in under rent control ten years from now.

How good is an investment when its cash flow is limited to less than the cost of inflation? It may require one to look past todays rent to figure out how attractive is it for someone to buy ten years from now when you want to divest. Exactly how much mortgage is carried by the unit with an average tenant who might not leave for years.

That’s a great overview of the situation. Much appreciated Leo.

Makes one feel terribly sorry for young people or anyone who is paying rent etc. Very tough.

I believe that house taxes are “one” of the causes of high rents. It doesn’t get talked about much but I know, for us at least, that it is always one of the key things that influences whether a decision is made to increase rents or not and by how much.

I am an artist and I am often astonished how many sculpture opportunities are called for in various cities. The range of money for these sculptures is often $150,000.00 and sometimes much higher.

Even as an artist, I’m always shocked at this kind of luxury spending. Art is super important of course, but so is housing and I am always left with the feeling that our governments do not fully evaluate the costs to society when they go on a spending spree with luxury items at the same time that people are homeless. (One hand does not know what the other hand is doing.) (Close to a billion dollar for a museum. )

It’s never the one strand of straw of course that breaks the camels back.

I feel we are on the verge of something awful happening and there is real chance of society breaking apart in a civil war. (The USA is getting close to that already and Canada usually follows them)

Young people (and old) are being asked to live under horrible conditions. (Super high rents, cramped living conditions where they have to share space with no privacy, several people in a house. Low wages and high taxes.)

The truck convoy was just a hint at the hidden anger and society will pay the price in ways we have never seen.

Our governments need to listen and make major changes and fix this immediately.

We count our blessings every day. We have worked hard…… but no doubt about it, we have been lucky as well.

Leo, can’t you just look at toronto or vancouver right now to see that low vacancy rates arent stopping prices from from dropping?

I find the luxury home sales chart intriguing and perplexing at the same time. Today there are approximately 30 sales per month with a 5 month inventory. Some simple math tells me there are 150 available properties in this price range. When this graph changed direction in September 20, there were 15 sales and 15 months inventory indicating 225 properties available over 2 million at that time. Given the rampant prices increases in the last 2 years, and the number of 1+ million dollar properties that are now $2 million, you would think that there should be more $2+ million properties available. Not exactly sure what to make of this data. The one year plateau is interesting and indicates a slowing of price increases. Possibly $2+million properties are becoming the norm, and not a luxury in this market. Scary.