Poor affordability continues to drag on the market

Just a few months ago, I observed that affordability, especially for single family homes, was outside of historical ranges, somewhere beyond the level where we have seen prices flatten out in the past, but not at levels where we’ve seen major price declines. A little later we looked at various scenarios for affordability in the future.

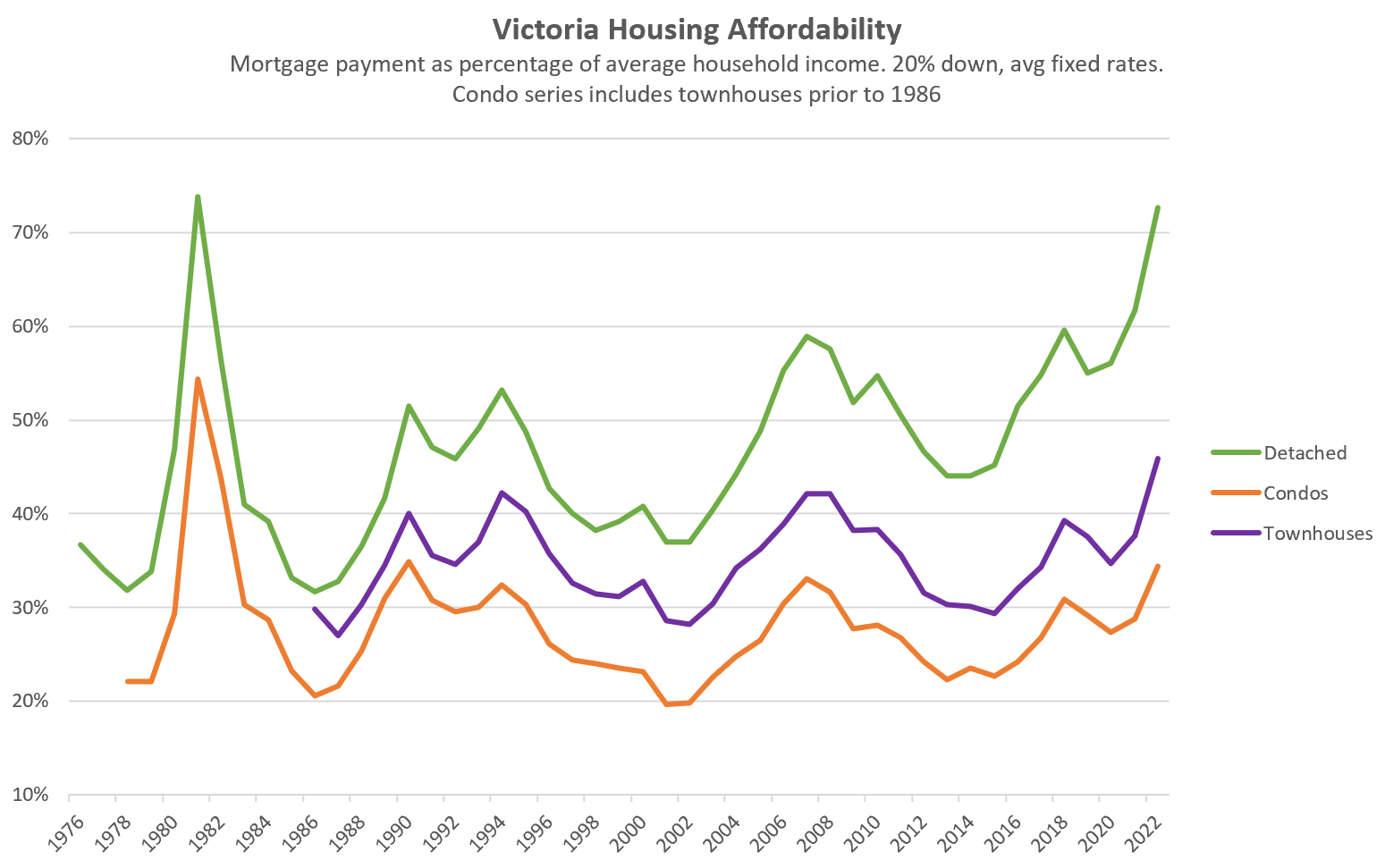

Prices have since responded to the poor affordability levels, flattening out and even declining slightly in recent weeks. It’s safe to say that fixed rates have been rising faster than most expected, so it’s worth taking another look at how affordability has changed since then. The below chart includes not only updated rates and prices up to May, but I’ve also reconstructed condo prices from monthly data back nearly as far as the single family series, and added townhouses to as far back as we have data for those (1986).

Remember these are affordability levels at year to date average fixed rates (3.85% is used for the 2022 data point), so on the one hand that is less than current fixed rates, but higher than variable rates.

There’s a few takeaways here worth noting:

- Though year to date prices have pulled back a bit since our last look in March, affordability has only deteriorated as rates have risen to more than offset the slightly lower prices.

- The condo data shows that even back to 1978, we can see that condo payments usually stay between ~20% and about 33% of average incomes (the 1981 bubble being an obvious exception)

- Townhouse affordability also looks to be pretty constant as between ~30 and ~43% of average incomes, but we don’t have as much data to be as certain about it. Given townhouses sit on substantially more land than condos, we might expect some long run deterioration in affordability there too.

- Detached houses are the only ones with a clear trend of deteriorating affordability over the long run. It’s clear why this happens, and there is absolutely no reason to believe this trend will reverse. Though prices may drop and houses likely will get more affordable again in the short or medium term, in the long run the average detached house (or rather the lot it sits on) will continue to get less and less attainable to the average household.

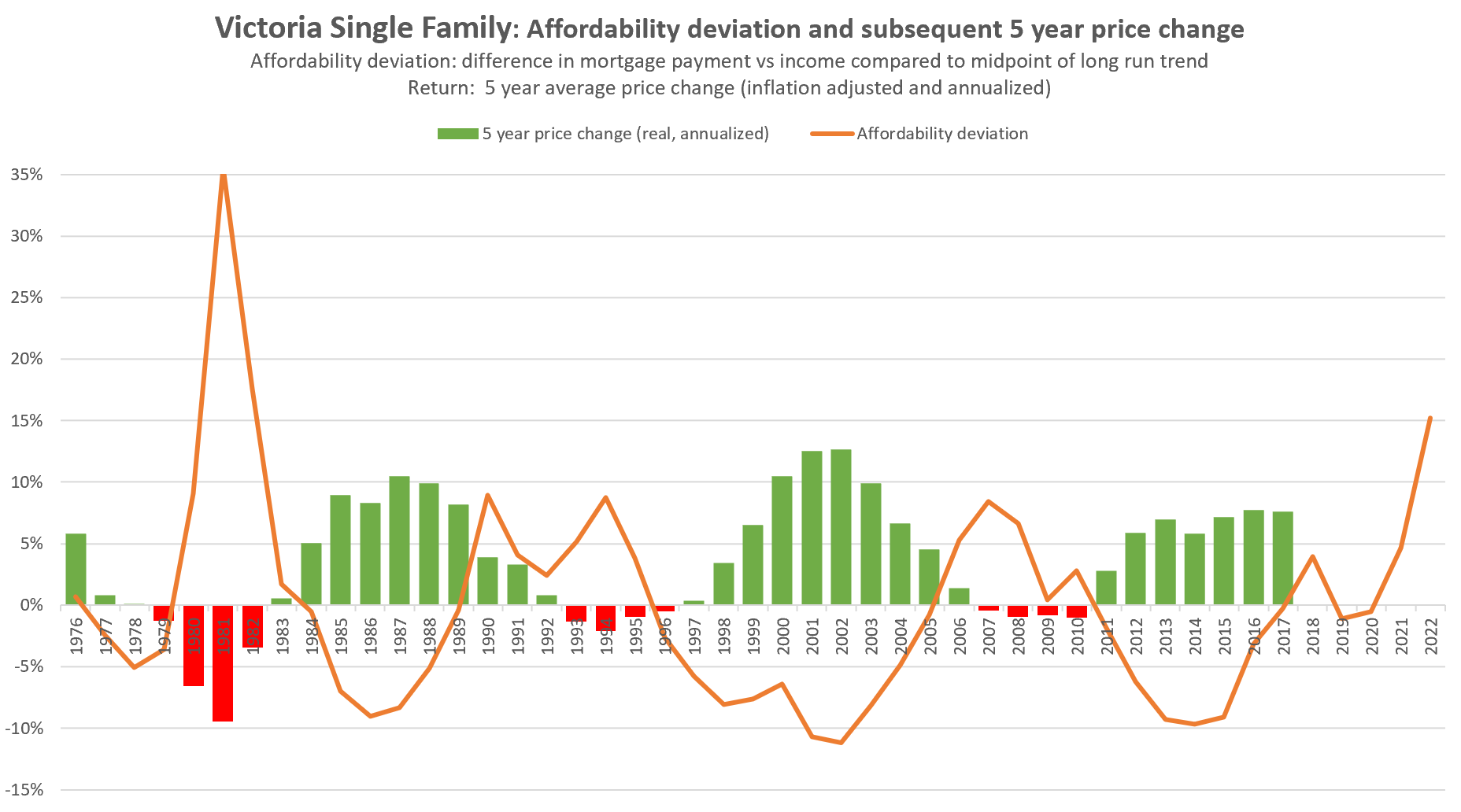

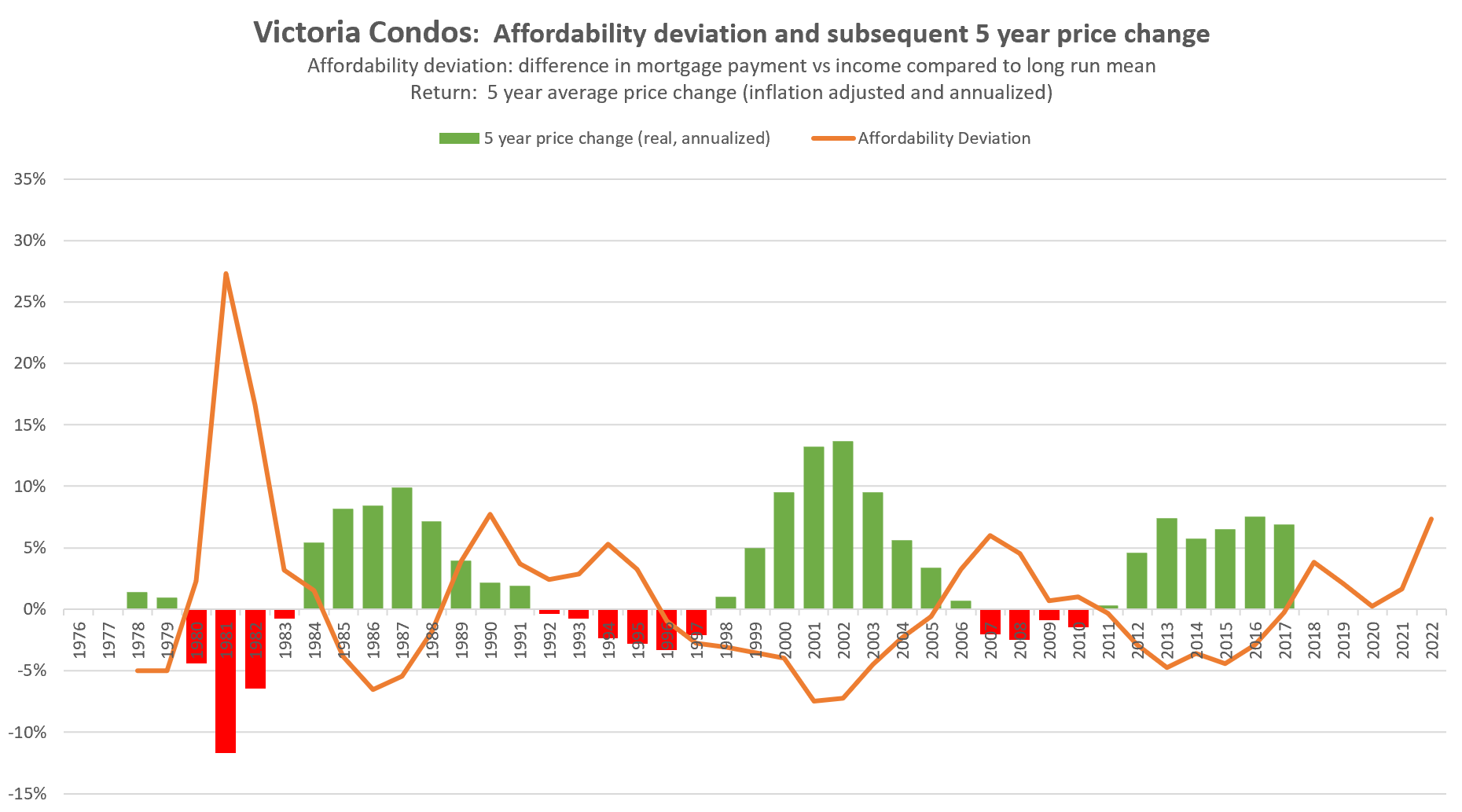

What does it mean for prices that affordability is currently so stretched? Well to make the picture more clear, we can plot affordability relative to its long term trend along with subsequent price changes. For condos affordability doesn’t change much in the long run, so we just subtract the mean from the current level. For single family we expect a long run deterioration of affordability so we subtract that rising trend to get the residual. Those charts are below.

As you can see, when affordability was about 5-10 percentage points worse than normal in the 90s and late 2000s, prices flattened out or declined a bit. When affordability was much worse (25 to 35 percentage points) than normal in the early 80s, prices crashed.

Where are we now? With year to date prices and rates, condo affordability seems to be at about the same level as where we were when prices flatlined and pulled back a bit in the last two cycles. Single family affordability meanwhile is worse now than it was then, possibly pointing to a larger price correction. How high would rates have to rise to get to the level of unaffordability that caused the 80s crash? By my calculations the average yearly rate would have to be 2.5-3% higher than now.

Note that because this is a long run analysis it gets a little difficult to relate the average yearly figures to current rate reality. In addition the lower variable rate currently provides an escape hatch from rising fixed rates (unless the Bank of Canada catches up). In a future post I’ll look at creating a more comprehensive rate series that folds in variable rates and shows monthly affordability which will be more useful as the market unfolds this year. Stay tuned.

Also the weekly numbers courtesy of the VREB.

| June 2022 |

June

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 111 | 234 | 942 | ||

| New Listings | 224 | 547 | 1208 | ||

| Active Listings | 1789 | 1878 | 1375 | ||

| Sales to New Listings | 50% | 43% | 78% | ||

| Sales YoY Change | -20% | -36% | |||

| Months of Inventory | 1.5 | ||||

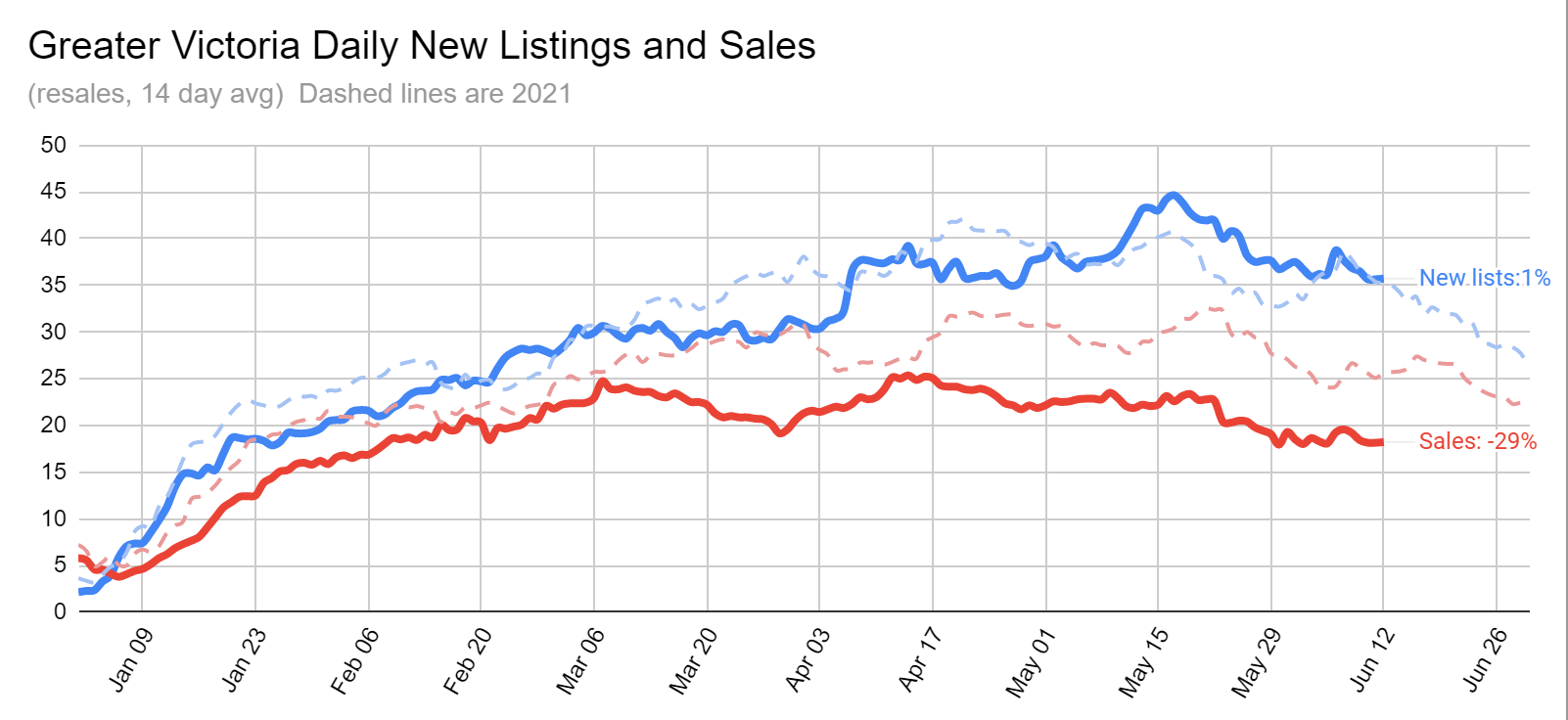

New listings are coming in at exactly the same pace as last year: no sign of any nervous sellers trying to bail out of the market. However sales continue to drift downwards, which is leading to a continued healthy build of inventory, now up 25% from this week last year. A 43% sales to new list ratio is approaching the bottom end of balanced market territory, though this can creep up during the month as new listings are generally frontloaded. For the last two weeks we still had 30% of listings go over the asking price though, so some sellers are still able to successfully underlist and sell quickly.

Last week I posted about a 3.1% bond yield, this week it’s already over 3.5%, which is continuing to drive fixed rates up sharply. No way to predict where it will top out, but I suspect we will need to see signs the inflation fight is being won first.

New post: https://househuntvictoria.ca/2022/06/20/will-high-rents-and-migration-prevent-price-declines/

Before Leo throws up the new post, give me your thoughts on this Manulife One thing, people.

I personally can’t see how it could be much better than a traditional mortgage, because you’re borrowing money at a higher interest rate. Am I missing something?

Average increase in house prices between 2019 and 2021, by distance from downtown.

Analyzing the house price boom in the suburbs of Canada’s major cities during the pandemic — https://www.bankofcanada.ca/2022/06/staff-analytical-note-2022-7/

According to the BOC, the price gap between city center and suburb in 2016 was 33% different, and by 2021 the different has narrowed to 10% spread. So the conclusion is that in a pandemic and possibly post pandemic environment houses in the suburb will appreciates quicker than city center.

Yes, that’s true.

Even though I’m in my late 30s, I’m essentially a grumpy, get-off-my-lawn 80-year-old NIMBY at heart, so Oak Bay is my kind of place vs. Royal Bay.

How dreadful! Just kidding, we are two adults and two kids sharing one bathroom and it’s fine. But the second bathroom will be nice to have once we take the suite back.

This is also where I stand on the RB vs. OB debate, even though I’ve defended RB and poked fun at some of Oak Bay residents being old and pretentious. I don’t live in RB or have properties there, but I recognize it’s appeal.

Agreed on the investment component, but I personally live in a super crap long term investment because I prefer it over a good investment (SFH with a suite in the core). There are reasons why people would choose 1.5 in Royal Bay over Oak Bay that do not matter to me, but matter to them. For example, a livable home in Oak Bay for 1.5 is not going to have an ensuite so the parents + kids for all intents and purposes have to share the main bath up. In Royal Bay you’ll get an ensuite plus a main bath on the bedroom level, etc.

Thank you for the HHVer that emailed me a month ago to let me know “for all intensive purposes” is considered a fairly common eggcorn 🙂

“$1.25M of that $1.5M home in Oak Bay is land value. In Royal Bay, the building accounts for the majority of the overall value. Land appreciates; buildings don’t. So if I had to choose between the two, I’d buy a $1.5M place in Oak Bay all day long. And that’s not even factoring in such things as less crowded schools; leafy, mature tree-lined streets; less density; a better commute; and fewer Dodge Rams.”

Agree with you in the long term – definitely land value will trump building appreciation so best to get a home with a higher land to building value ratio. In the short term, though, the rapidly escalating cost of construction labour and materials has recently put a premium on new construction which may explain why the new homes at Royal Bay have closed the gap with the older Oak Bay homes. Also, just finding construction trades to build your new home will be a huge challenge along with the delays. A recession, too, will kibosh construction labour costs, again, an argument in favour of allocating more dollars to land vs. buildings if you are buying now.

$1.25M of that $1.5M home in Oak Bay is land value. In Royal Bay, the building accounts for the majority of the overall value.

Land appreciates; buildings don’t. So if I had to choose between the two, I’d buy a $1.5M place in Oak Bay all day long. And that’s not even factoring in such things as less crowded schools; leafy, mature tree-lined streets; less density; a better commute; and fewer Dodge Rams.

Family members in Calgary bought a $650K duplex a few years ago. $300K down payment and HELOC for the rest.

From the way they described it, I’m pretty sure they opted for a product called Manulife One:

At the time, they were telling us how great it is. They made it seem like they’d discovered some sort of financial secret weapon.

Good point. Though there are practical considerations of limits to both what you can put in a TFSA and how much you can pay down your mortgage . If you stick it all in an TFSA, and decide one day to withdraw $100K from TFSA to pay down your mortgage, you may find out from your bank that you can’t pay down that much all at once.

An exception being if you happen to have a mortgage rate lower than the current GIC rates – which is a possibility today – you would be better off putting the money in the TFSA and buying GIC’s with the appropriate maturity. Then pay down the mortgage at end of term.

Yes, that strategy makes sense. One point, you’re comparing paying off investment loans to investing in a TFSA – so there’s a clear tax advantage to investing in a TFSA, since the investment loan interest is tax deductible.

I’m just pointing that out because a typical homeowner gets no tax break on the mortgage interest they pay, so they wouldn’t be better off tax-wise putting the money in a TFSA.

I’m sure someone will pay dearly for Westdowne just to get the knotty pine panelling lining the basement walls. Must be a fortune there, I’m sure the city councillors will line up to pay top dollar for it so they can retrofit it into their own property. I hear the late 1950’s decor is hot now. Throw in a couple stuffed fish, some illegal taxidermy, hang a disco ball and you’ll be the envy of the neighborhood.

Yes, buying dividend stock like Telus or Fortis, WITHIN TSFA. My TSFA/RRSPs are maxed out. If I could buy Telus or Fortis in my TSFA today I would do it and leave my mortgages as is. Current variable 2.55 + 0.75 (anticipated hike) + 0.5 (anticipated hike?) is 3.8%….at that point I am still going TSFA. Over 4% then I give it a bit more thought.

My TSFA dropped 12.7% in the last couple of months. That sucks. Big picture, the 12.7% drop resulted in a balance as of 1 pm today of 192k which means long term it has paid off. If you think you can time when to get in, good luck, but long term the numbers are pretty clear.

My philosophy of always going variable mortgage , buying quality real estate, buying quality dividend paying companies, etc., will never change, but as I said you can’t live in a complete vacuum (for example, if variable discount is 1% and there is a 90% chance of a 3/4 rate hike in two weeks plus more). At this time I am not super confident dumping my cash into more real estate or non-registered stocks. At the same time I am not selling any of my real estate assests or stocks either. I didn’t reduce my exposure in the last few months like Kenny G 🙂

Plan is perhaps pay down some debt but for the most part sit on the sidelines with cash and see how things unfold. If Telus/Fortis drop to the point where dividend is 7-8% I want to have ammo and same with real estate. I am not counting on either otherwise I would sell my Telus/Forits today, but never hurts to be ready. Certainly re-investing all my dividend payouts every month into more shares.

Just can’t get excited about GICs.

My two cents on Royal Bay vs Oak Bay.

First of all, huge fan of Royal Bay. Convinced many clients over the years to buy pre-sale in Royal Bay over Westhills. The minute anyone ever mentioned Westhills my next sentence was let’s go check out the sale center in Royal Bay. Also, with a friend bought 5 lots off Gablecraft in Royal Bay when no other builders would touch it. To me long term Royal Bay was always a no brainer. For what it is it is awesome.

Second of all, having grown up in the Oaklands area I always felt Oak Bay was way overvalued. 5 minutes drive and you pay 200-300k more and you are actually in a less convenient location.

However, these were my thoughts when a new house in Royal Bay was 600k and change and an older house in Oak Bay was 900k and change. What happened earlier this year is Royal Bay home 1.5 million and older Oak Bay house with some renos (totally livable) 1.5 million.

At that point Royal Bay starts to lose its value IMO. As much as I like Royal Bay it isn’t the same as walking with your kids in South Oak Bay, grabbing some ice creaming and taking the dog up to Anderson Hill Park and then going to one of many beaches. If commuting from South Oak Bay to somewhere in town unlikely to have a Dodge Ram tailgating you, versus high possibility if going somewhere from Royal Bay 🙂

You have to be willing to live in an older home. You aren’t getting into a newer home in Oak Bay under 2 million and in terms of affordability quite a big difference between 1.5 and over 2.

As I recall, about two months ago your opinion on the HHV topic of using spare cash to pay down a mortgage was that your money was better put to use buying dividend stocks like Telus and Fortis.

So assuming I’ve understood your post, it’s nice to hear that you’ve changed that to paying down a mortgage. Hopefully other HHVers will do the same,

seen this around the twittersphere today

[img [/img]

[/img]

But the COV makes you replace perfectly functional sidewalk under a different bylaw. Having an excavator come and remove sidewalk, doing all the prep work/trucking, pouring new concrete, million consultants involved, that must be environmentally friendly right?

Every new house we’ve built in the COV we’ve had to replace old perfectly functioning sidewalk with new perfectly functioning sidewalk.

For example, this house we built on Shakespeare -> https://goo.gl/maps/moXCSPPVkpdxwvdx9

50′ of new sidewalk that was 100% serviceable before.

There is no hope for housing, if you can afford it and there is a dip in the next 12 months get in while you can. Long term we are royally screwed.

My prediction is within 5 yrs we are in another lack of inventory crisis.

But substantially down for 2020. Higher interest rates aren’t bringing more properties to market which is interesting imo.

I did a few open house this weekend and it was slow. Quite a few comments along the lines “sold our condo, will rent until prices come down.”

What I found shocking over the weekend was the traffic. I had to make a few trips Sidney to Langford, etc., and I know yesterday was father’s day but the volume in both directions on Pat Bay/Trans Canada was insane. I’ve never seen anything like it on a Sunday. You would think $2.3L/gas and all the media coverage re potential recession that people would change their habits a bit, nope.

100% I will always go variable given appropriate discount; however, I am not switching to fixed mortgages but rather paying off debt. The reason I have cash on hand is my entire life I’ve gone variables mortgages which has resulted in 100s of thousands saved. That being said you can’t operate in a vacuum. If I have cash on hand and my variable is 5% time to consider paying some debt down. As I said I’ll only consider doing such as each mortgage comes up for a new term. Would prefer to have cash on hand if real estate softens, stock market crashes, or some other opportunity.

If you went benefited from extremely low variable rates last 15 years to buy boats/RVs/etc., have fun.

Didn’t someone call $1.5M last week?

Nah, banks love it. think about it, they make a spread on the variable rate mortgage and in a rate increasing environment, the buyer would have paid off minimal principal so the banks effectively just increased the duration on their loan, plus the buyer will likely have a hard time switching lenders after the term now so they can make even more money. They start to care if the LTV goes the other way though.

Aren’t you a huge advocate or going variable as it works out better over the duration of the loan? Seems interesting that you are switching camps given what happened only in the last 3 months. Why not put money in a GIC instead, they roughly have the same yield as the variable rate mortgage.

On fixed payment mortgages you are usually paying much more to principal than variable payment. The payment is higher at the start so you usually end up paying of quicker than official amortization.

Banks cover their risk in increasing rate environment by having triggers to increase payments.

have good chunk of cash on hand during a recession is smart

This ^^

We won’t be making any additional payments to principle until rates go significantly higher than where they were when we signed (4-5% and up). Our variable is prime -1%, so we are only at about 2.5 right now for our mortgage. I won’t start thinking about it until we are at 4% (for our mortgage). But our monthly payments to principle stay the same regardless of what the interest rate is.

I have one variable coming up October 1st, 2022. If they do a 3/4 followed by a 1/2 I am considering paying it off completely. The rest I would just wait for them to come up and then decide what to do.

If it wasn’t super difficult/complicated to qualify for mortgages, I would pay more off but worried about paying down debt then not being able to get the debt back if opportunities arise.

No offense taken, but what I meant was that seems risky not only to homeowners but to banks (to be essentially paying so much interest and not much principle on such a large loan — it’s basically like a huge HELOC almost). We have a home with a variable rate and payment and a home with a fixed rate and locked in fixed HELOCs and I understand them all very well – it’s just not the same type that you are talking about.

I do think people who bought in the last few years understand their mortgages well because how could you not with such a massive price tag. If you don’t read the fine print on the biggest purchase of your life, then you’ve likely got a lot of other financial issues too….which makes me wonder how can some people purchase homes at these prices in the first place.

I’ve been voluntarily increasing my mortgage payment in response to the rate hikes. Is anyone else with a variable rate mortgage doing this?

Re – Anyone been to any open houses recently?

Went to 2955 Westdowne open house, saw at least five groups people from young families to boomers. Oil tank just removed last week and no major structure issues. The only minor issue is a bit traffic noise from Foul Bay Rd, but still think this one will sell at least around $1.3M.

A really good variable right now would be P-1.25 (depending on a few factors) – and really good Heloc rate might be Prime. Those numbers a bit old but probably a good starting point – basically 1.25% difference.

Would need a engineer to sign off on any old wood that is going to take a structural load Lots of other uses that are decorative

Higher, lots of them are a premium to prime instead of a discount like variable rate mortgages. So yes, the cost of funds from the bank of mom and dad are getting higher too with each rate hike.

How do HELOC rates compare to variable rates?

Anyone been to any open houses recently? I went to two this weekend as I knew the realtors hosting them, both were pretty dead. One was a condo and had a total of 4 groups show up and 3 of them were just curious neighbors wanting to see the floorplan. The house faired a little better with I think 6 groups and only 1 of which was a neighbor.

I have to agree that the market for old studs, sheathing, lathe, subfloor etc. must be very close to zero or negative. If you take old fir and mix in a small amount of rat pee (most old houses in Victoria) you end up with a product that is only of use for compost heaps and that is if it is not close to where you might sit. It is even worse when it gets wet. I have had some outside in a separate deck for 10 years and it is just as foul now as when I built it. Floor joists might be worth a bit. The real value would be in any trim, copper pipe, maybe electrical wire, brass plumbing fittings etc. Maybe some pristine oak flooring. Maybe a small market for vintage siding for other restorations. Fir flooring usually splits when you pull it up. I wonder how much weight you get if you drive through with an excavator and then pay a couple of day labor types to pull out anything that looks like wood. Sorry, no 8′ 2X4’s but I have lots of 18″ ones….. I wonder what just the floor joists and other salvageable stuff listed would weigh for a typical 1200 square foot house. Maybe you could lift off the top of the house with an excavator and salvage from the deck down. There are creative people out there that will figure out how to “optimize” the regulations.

I think the bottom line is that when most people buy houses, they solely focus on monthly payments without looking at the entire picture. In reality, when you take out a mortgage to buy a 1.5m house in royal bay you are stuck with that mortgage regardless of whatever else happens until you either pay it off or declare bankruptcy.

Don’t take this the wrong way Millenialhomeownerx2, but Looks like my suspicion is correct not many homeowners understand mortgage structures. There could be some surprises for owners in a few years at renewal time where they have essentially paid down no principal. Trigger rate is typically 2% above the prime rate from when the financing was closed.

You can always budget and put the difference in payments away in a GIC. Of course the majority of people will not do this.

It seems to me that some people opt for a “open variable rate mortgage”? I believe with this type, you pay a higher interest rate but you are able to slap down extra payments which goes directly off the principle. Also, I think you can lock in to a fixed rate mortgage at any time without penalty. I had one like this many years ago, knowing I was going to pay the mortgage down very quickly say within 18 months.

I guess people are worried about monthly payments changing. I would be more worried in the fixed payment scenario when rates are rising than I would be on a variable payment.

Yes! Under a mortgage structured that way, where the payment remains the same.

Wow – that’s crazy to me. But when interest rates go down, you pay the same amount monthly but more goes to the principal?

Ya, that was over generalized by VicRE. It really depends on individual mortgage agreements for folks. Some may fall under the following:

From: https://stories.td.com/ca/en/article/mortgage-process-101#:~:text=If%20the%20TD%20Mortgage%20Prime%20Rate%20goes%20up%2C%20more%20will,is%20called%20the%20Trigger%20Rate.

The idea is that the mechanism is in place in case the point is reached where the payment either applies zero against the principal (interest only) or that the interest rate has increased enough where it adds debt to the principal each month. So, the risk in a delcining market folks in this type of agreement may need to refinance possibly after losing equity and needing bring an additional lump some payment or insurance to the table.

There’s two kinds of variable rates:

1. Variable payment variables – When the prime rate increases, your payments increase

2. Fixed payment variables – This is about 80% of all variable mortgages outstanding (recent data from the BoC). When the prime rate increases, your payment stays the same, but less of your payment goes to principal, so your amortization increases. If the prime rate increases too much eventually it hit a trigger and your payments will increase. The trigger rate will vary depending on your loan agreement.

What do you mean trigger rate. We have a variable mortgage and our payment amount changes with the rate. So we pay more interest when rates go up and less interest when rates go down. Our principal repayment amount stays the same each month. We are not even back to the amount we paid pre-covid interest rate drops yet. After July hike we will be.

Month to date numbers:

Sales: 393 (down 33% from same week last year)

New lists: 873 (up 7%)

Inventory: 1935 (up 31%)

New post tonight.

Some people are going to start to feel the increases by the end of summer but I dont expect the number who are actually in trouble to be large. Still we will see a pullback on discretionary spending as inflation continues its rip through the economy.

Yes that’s what I meant, corrected now thanks.

Perhaps you mean fixed payment variable rate?

Looks like with a 75bps hike in July most fixed payment variable rate mortgages taken out at the covid lows will hit their trigger rates. Wonder how many owners are actually aware of this.

I recall going to an antique/salvage business in Victoria years ago, it was owned by a fellow named Paul. He had recently purchased 35,000 board feet of mahogany that was reclaimed from a ship that was being scrapped. I can’t remember the thickness but he said it was heavily painted to preserve it. I have no idea what he did with it but I’m sure he eventually sold it. There definitely is a market for reclaimed wood, certain species are simply not available anymore. I know a violin maker who is having a difficult time sourcing ebony and other rare woods. I don’t know what demand there is for lumber that has been sitting behind asbestos laden plaster for decades. The thousands of feet of lath would be unusable.

I’ve made tons of stuff with reclaimed/used lumber. There are people who’s sole job is brokering old timbers. Not me, but some local examples:

New Uses for Old Wood Part 1 (https://stretchdeveloper.com/?p=2217)

Part 2 (https://stretchdeveloper.com/?p=2506)

Thanks all for responses. I agree that anytime can be a good time to buy or sell depending on one’s time frame and investment objectives. In my case, I am considering raising capital for other investments in Victoria so may sell this house. Also agree it is never a bad time to take profits!

They can increase the rate whenever they want. Doesn’t have to be done at the scheduled meeting, could always call a special meeting.

But yes i think 75bps is the minimum they will do.

Victoria realtors have officially started talking about interest rates now. How do I know? The young ones who’s more interested in looking pretty on social media than studying the markets and doesn’t know the difference between Royal Bank and Bank of Canada are talking about it now.

From: https://www.reuters.com/business/finance/feds-waller-wants-another-75-basis-point-hike-all-in-inflation-fight-2022-06-18/

Maybe the BoC will feel the need to get ahead since they will not have a rate announcement in August and go with 1.0 or more increase for it’s July announcement.

Nobody ever went broke from taking profits

Market: I would be concerned about my assumptions as to both interest rates and price appreciation. Don’t have a crystal ball but your assumptions are extremely optimistic.

Re Apologies Your analysis assumes very low interest rates and solid house price appreciation. Possible but seems optimistic to me.

One way of analyzing a possible sale, is to ask yourself hypothetically. if you would NOW take the opposite side of this transaction. Ie) if you didn’t own any investment property, and didn’t have any debt, would you buy this investment property now, using all your savings, and go into debt as you are now?

As I read your situation, ($780K debt on a $1m property, at variable interest rates, with rental income limited by rent controls)….I’m thinking “hell no, I wouldn’t want to put myself in this mess”. But that’s me. You know the whole situation, would you do it again today?

Put simply… If you wouldn’t buy it today, the same logic would say you should sell it today.

In the end, a person can only really know what best for themself in their own circumstances. A few more factors that you might want to weigh in your process is your age, earning potential, cash flow after debt servicing and what is needed for a safety net in case of an unforseen circumstances (such as illness, divorce or death). Hope you find the best path for your needs.

I don’t see prices going back to peak within a year unless interest rates go back to bottom in the same time frame. I don’t think rates are going back, period.

Apologies if this question is a bit out of the blue.

Question: I have a one million dollar property and am thinking of selling. If I keep it for ten years, by my math, one scenerio is:

Anything wildly wrong about these assumptions?

Old 2×4 dimension of yesteryear are the same as current 2×4 dimension unless they are rough sawn, however old lumber has been time hardened and are too dried so it is easily split when nailed.

IMHO, politicians have no place in making construction policies, because they are untrained and have no field experience. Therefore, they should leave the engineering to engineers, construction to trades people, urban planing to urban planners/engineers, and economy to economists/financial analyst.

Site rubbish burial was banned due to ecological concern, then ban construction waste to save dump space, and now you must salvage/reuse.

What next, ban demolition of old SFH?

You could reuse the 2×4’s out of an old house, only problem is they are actual 2×4”. Today’s 2×4’s are 1.5×3.5”. Only other problem, they would cost $100 each to be economically feasible to recycle. Do these elected officials have any education at all?

“Nothing easier than pulling nails out of 100 year old Doug fir”

Probably easier than trying to drive a nail into it. Other than making hgtv Shiplap feature walls, is there any use for 100 year old fir? You couldn’t reuse it as structural timber. Only practical use I can think of is firewood.

Maybe there is an opportunity. Once someone has salvaged a few flatbeds full of full of rough cut old doug fir then maybe they can rent those loads out to other builders to help them meet their salvage targets.

Nothing easier than pulling nails out of 100 year old Doug fir 🙂

You could go to the zoning map at City of Vic and count the SFH zoned lots if you wanted an “exact” number. By area about half of Vic West is mainly SFH while the other half is condo, commercial etc

Victoria bylaw will make builders pay for not salvaging material

https://www.timescolonist.com/local-news/victoria-bylaw-will-make-builders-pay-for-not-salvaging-material-5494907

Other than condos exactly how many SFH are there in Vic West at this point?

Exactly how much demand do they think there is for most of this old wood filed with nails paint and screws? End up paying someone to burn it.

These politicians dreaming up deconstructions regulations must be insane. That means salvaging 10,000-20,000 lbs. of lumber from a house built entirely with thousands of nails, large, difficult to remove nails. Who is going to remove all those nails to make the lumber reusable? Obviously politicians have never had a blister on their hands.

A good bonfire might be a cheaper way of demolishing that North Vancouver house.

https://www.cbc.ca/news/canada/british-columbia/north-vancouver-wood-salvage-demolition-bylaw-1.6493461

GC, your description of Vic West sounds just like the people who buy in Royal Bay. Minus the caring about the commute.

From: https://financialpost.com/executive/executive-summary/posthaste-canadas-housing-correction-has-started-whats-surprising-is-its-speed

Thank you re: 2861 Tudor.

$2.475M

Could anyone tell me the selling price for 2861 Tudor Ave. please? Thank you.

Could be worse. One spouse could have already bought out the other at the top.

From: https://www.ctvnews.ca/business/divorcing-couples-challenged-by-declining-home-prices-rising-interest-rates-experts-1.5953023

I already posted below, $1.628 pending.

I would greatly appreciate knowing the sales price of 3845 Ascot Drive, thanks……

Another leg down for the over-asks.

Gc you nailed it

Interesting note, there seems to be a lot of young families in Vic West. Most young families I know buying in the core tend to be high net worth educated professional couples who want to be close to work and have amenities within walking distance. Really depends on what circles people roll in

Looks like 3845 ascot went pending for 1.63, asking was 1.75. 2800 sqft house on a 21,000 sqft lot.

I can see both points of view. Someone recently pointed out to me that for a lot of people their jobs are actually not in the core and often in the West Shore. There is simply not much draw or allure to downtown for young families. The West shore may no be my cup of tea but I can see why the core, especially considering prices, is not many peoples first choice.

I agree, I think Maplewood is the most undervalued neighborhood in the core. There are some elevated properties there offering great views of the city.

“This is exactly why most people are short sighted. From an ROI perspective I think one is much better off buying a $1.1M older house on a 7000+ sqft lot in Maplewood and do a 400k reno than buying a $1.5M new house in royal bay on a 4000 sqft lot.”

Now that would be a smart move. As I’ve mentioned before, I think Maplewood is a hidden gem of an area. It has so many of the attributes of Oak Bay – character homes, charm, lovely trees, nice parks, established area, winding roads, far enough from the problems of downtown but close enough for convenience – and some advantages – easier access to the ferries/airport/more direct commute to Downtown than say South Oak Bay. And less expensive for sure.

Slightly larger lots, slightly newer and larger homes for the same price, I think, than Oak Bay. None of the commuting/traffic problems of the Westshore. It is not as upscale as fellow Saanich areas Broadmead or Cordova Ridge but it’s definitely more central and more established. Not known as a “rich” area but I do personally know a few doctors, lawyers and university profs who have quietly lived there for years and love it.

You’re the only one stating “everything else being the same” and “for the same money” which is not the reality of the current RE market.

What I actually said was “The people buying $1.8 million homes in Royal Bay could buy a $1.8 million home in Oak Bay if they wanted to”, which is true.

I’ve deleted several comments. Please folks, just move past it.

What is even happening in this comment section. Seriously, refer to communities in a respectful way.

Also what people don’t seem to understand is that Royal Bay is an awesome place to live in an awesome location. There’s no reason to go downtown for anything. I have zero interest in moving to Oak Bay or Fairfield or any other place that uppity people think is better, despite being able to afford a nice home there.

And to the person who said it will look like lower Bear Mountain, that’s still nicer than most of the low grade, asbestos ridden, severely dated homes in Victoria and Saanich.

For a couple of you on here, and you must know who you are: Don’t you ever tire of listening to yourselves talk?

I think it is you that need a reasoning tune up. You are implying that everything else being the same a young family would prefer to live in Royal Bay compared to Oak Bay. I think what you meant to say is that FOR THE SAME MONEY a young family would rather live in a new house in Royal Bay compared to an hold house in Oak Bay.

There you go, leveraged investment with positive cashflow. Not sure if there is anything else to debate.

Up and coming i get it u bought a place in royal bay It’s a good a good fit for some people but it’s more sooke than oak bay

Kenny- Unfortunately no one I know takes that great advice. They watch it daily as it is going up because it gives them a high. Then when it starts dropping they keep on watching until it becomes too painful to watch. Then they take a pill.

Huh? I think your reasoning could use a tune up. That or you should take the time to write coherently as most of your posts read like an MLS ad.

Royal Bay would be guaranteed to have more children, I haven’t been there but I am willing to bet that given how small the lots are that in 10 years it will start to look rundown like the lower portions of Bear Mountain.

Frank, the best advice for people who own a hands off diversified portfolio is don’t look at it when its down, just follow the market indexes and this will give you a general idea on where things are going without the need to look at your bottom line, then get on with your day.

The seller might need to close on another property themselves. Remember a great many sellers are buying another property, and if so they probably would have removed conditions, if they had made any in the first place.

Well a new build in oak bay is going to cost u 3.5 same place in royal bay not so much dumb comparison too funny

Nominally no. But it did go down in real terms, which means prices were positive cashflow for a few years before real prices went up.

From: https://www.bnnbloomberg.ca/distressed-deals-pile-up-in-canada-s-once-booming-housing-market-1.1780269

Wow, I can’t believe the seller negotiated down? You’d think they would just relist, sell and then have lawyers go after the difference for the breach. Or maybe Ontario has gone so cold on the sale side, they figure the just should take the money they could get and not risk the place failing to sell delaying the lawsuit.

One of the dumbest comments I’ve seen on here. The people buying $1.8 million homes in Royal Bay could buy a $1.8 million home in Oak Bay if they wanted to. Or is there a pretentious tax I’m not aware of in OB?

Multiple homeowners didn’t get into the market in the last few years. If they did they would have to have been very wealthy to begin with. They also have accumulated a lot of equity over the last decade. They should have secure renters and no problem replacing them. Multiple homeowners are not sweating it like their peers getting slaughtered in the markets and are glad they chose real estate over volatile equities. The one group that can be hurt in the near term are the highly leveraged first time buyers who overpaid for a property with problems. Plus they thought a variable mortgage was a smart idea. That’s a very small percentage of homeowners and if they have to liquidate I doubt it will move the market much.

When you can see your equities tanking in front of your eyes every day one might panic and decide to bail out. Not many homeowners feel like packing up their lives and find another place to live. Real estate, especially given today’s demand, is far more stable.

Oh man Introvert, look at those progressive Saskatchewan voters.

9-0 vote, Regina is way ahead of Victoria on infill even they don’t have housing shortage issues at all.

https://www.cbc.ca/news/canada/saskatchewan/regina-backyard-suites-1.6488102

If its the only house they have and live in it of course not. If they are multiple property Owners I am pretty sure they have started to clue in on the current headwinds facing RE.

You sure about that? Some are saying Royal Bay is a more attractive neighborhood to a young family compared to Oak Bay.

The boomer friends I’ve talked to lately are all crying the blues over their stock market losses. None of them mention the potential decline in the value of their homes. Most of them were probably not aware of the peak value their property reached in the last few months/year. If you told them what their property was worth today, they probably wouldn’t believe you. The percentage of people looking to sell in the next year represent a small segment of the population. I would say most home owners have substantial savings in the stock market, or they did have.

A Yorkshire man who had fathered 15 children, gave the following advice to his 13th. child (6th. son): “Don’t be like me son, don’t let your prick put you in the poor house!”

That’s advice which may have saved many men (some of whom are in prominent positions) from financial stress…

The Royal bay buyer cannot afford to buy in Oak bay probably never will cheers

I may wrong but I believe a large portion of people who bought in Royal Bay are short of budget on large renovations. For people who bought original conditions in Henderson/North Oak Bay for $1.3M are willing to spend $200k+ on large renovations or who bought original conditions in Estevan/South Oak Bay are willing to spend $1M+ to build new. We all know the cons of Royal Bay is the location but the pros are less maintenance cost in the next 10 to 15 years and live in a SFH. I don’t see anything wrong with these two locations, they just attract different groups of buyers.

Ok but did it go down much after it reached cashflow neutrality? I said cashflow neutrality is the floor.

I am shocked that people need to have this explained to them…. But I guess that is why people are paying $1.5 for royal bay…

VicREanalyst – the issue is that during the prior decade we had both falling rates and rising prices which increased the availability of capital to investors and – importantly – influenced buyer attitudes that RE investing was a “can’t lose” proposition. We’re not going to see that going forward.

Vancouver got to cash flow neutral investing quite quickly after the early 1980’s bust but prices didn’t go up appreciably until the late 1980’s. Same sort of thing with the Toronto bust a decade later, and the US bust a decade after that. People get spooked.

In the process right now. Been very slow and they appear quite disorganized, but I’m now approved for up to 5kW PV. Next step (for me) is to get the engineering done.

This is exactly why most people are short sighted. From an ROI perspective I think one is much better off buying a $1.1M older house on a 7000+ sqft lot in Maplewood and do a 400k reno than buying a $1.5M new house in royal bay on a 4000 sqft lot.

It does because when you are cashflow neutral that actually means your CAP rate is higher than your cost of debt. RE investors do not invest based on where they think interest rates will go in 5 years, that is too big of a prediction. CAP rate versus cost of capital and location are the main drivers and this applies to institutional investors.

Sure because that’s a choice between a teardown and a new house. You seem to be getting it backwards – the inferior house for the same price in Oak Bay means that Oak Bay is the preferred location.

Sure, if we’re assuming the same price and comparing what ex. $1MM buys in those neighbourhoods. Seems like a lot of families are picking the Westshore.

Comparisons ignoring price are a useless exercise IMO.

We don’t have to remember, posts are all there for people to see still. I went back and looked, doesn’t look like anyone was calling for a major drop, especially when interest rates dove and cerb came into effect.

True, but that period encompassed mortgage rates that were both historically low and declining. We are now seeing an sharp rise in rates after a long period of very low rates – an unprecedented situation, and I don’t think the prior decade tells us much.

Sure it’s attainable, the question is how much collateral damage are you willing to tolerate.

No one said the sky is falling. But if I had to make a bet, I would bet that Royal Bay SFH goes below $1M before it goes above $2M.

I wouldn’t say I am a bear, I definitely believe if you were going to invest in RE then Victoria is one of the best places in the country. But blindly thinking it will defy macro economic forces is foolish. I have already posted before that the price floor for SFH is the when it is cashflow neutural as a rental with 20% down. If you look back over the past 10 years, whenever that has happened the prices have gone up shortly thereafter.

Not going to be that quick to bring down inflation I wonder if the boc can live with 4/5 points 2 percent just seems so unattainable

Yeah, the sky is falling crew (charlatans) that are now brave enough to say “I could see this coming, I knew all of this was going to happen”. I also agree things will come down in the short and then my guess is a plateau for the medium. Like I said, we’ll see…

I miss Debt Monster too. Hope he/she comes back soon.

How is the Federal government going to know who to give this one time $500 amount to certain low income renters? How do they know who is renting and who isn’t? That stat isn’t reported on income tax returns. Just wondering.

“It’s nice to see the bears and “experts” so confident and getting their time to shine. We’ll just have to wait and see how it all turns out, but somehow I don’t think it’s going to end up quite as they hoped…”

By experts do you mean charlatans? Remember what people were saying about housing at the beginning of the pandemic? Didn’t quite go the way folks expected. I’m bearish on the market short to medium term, but we’ll see if I guess right. Nothing worse than an over-confident prick.

It’s nice to see the bears and “experts” so confident and getting their time to shine. We’ll just have to wait and see how it all turns out, but somehow I don’t think it’s going to end up quite as they hoped…

“No, the writing was on the wall in April on interest rate increases but look at the comments here compared to what folks were saying in Toronto/Vancouver.”

What was clear is that interest rates would rise. What wasn’t clear/still isn’t clear is how quickly and by how much.

No, the writing was on the wall in April on interest rate increases but look at the comments here compared to what folks were saying in Toronto/Vancouver. People were still pumping royal bay this week lol

I just received an email stating the Canada Greener Homes Loan (as part of the grant program) is now available.

Has anyone here had solar panels installed? Any recommended installers?

3 month rolling average and based on completions. So reflective of about February which basically lines up with the peak

Common sense in choosing a subset of seniors should be based on need (GIS, as you suggested). The governments decision to instead pick a subset of “really old” seniors (75+) regardless of income is arbitrary and silly.

Stopping inflation requires “demand destruction,” which means people cutting back on spending. And the government should be cutting back too.

It was actually announced back in April 2021 in the federal budget, and just coming into effect now. And I agree, the money would have been much better spent increasing GIS which goes to people who really need it. But there’s nothing new about handouts to seniors who don’t need them (seniors’ HOG, property tax deferral anyone?)

Yes it appears to be permanent. It’s just for 75+ though.

Teranet (remember that?) is up 2.49% MOM for Victoria in May, and 23% YOY. Of course it’s a 3 month rolling average so lags changes in the market. But that’s likely a good measure of what was happening in March-April in Victoria – ? Peak insanity ?

https://housepriceindex.ca/2022/06/may2022/

10% increase in OAS not well thought out as usual. This is the easy way, but a percentage of OAS is clawed back from high income pensioners anyway. That money could have been better distributed to low income pensioners. I guess that would have created more work. Also an excellent re-election tactic. I wonder if that increase is permanent?

Lol is it a cold evening in royal bay or something?

I didn’t say a renovation and a sale, but it sounds like you’re a RE analyst AND a house flipper? Whoa, cool! How many houses have you bought and flipped in Greater Victoria just so we all know?

Oh good, so we’re dealing in assumptions and free houses? Now this is top notch analysis right here

Good point Dad

And let’s not forget the BOCs guidance they gave indicating rates would remain low for longer – i think it was 2023 rates were previously indicated to rise.

Nothing is ever certain.

True true. Things are evolving quickly. There is also the fact that for 10+ years economists were predicting rising rates and impeding implosion of the housing bubble neither of which ever happened. No surprise people grew tone deaf to the warning signs.

“Now, yes for sure. But go back 1-3 months and the bears were generally being ruled out as fear mongers…”

Fair enough, but go back a bit further and central banks were still on about transitory inflation. Things have evolved quickly.

Now, yes for sure. But go back 1-3 months and the bears were generally being ruled out as fear mongers while the majority in the comments believed shortage of stock and never ending demand would prevent a significant price drop of any kind in Victoria. People have short memories. Now there are full discussions about if the govt will do a bail out. LoL

From: https://www.ctvnews.ca/business/recession-concerns-have-older-canadians-worried-about-retirement-pension-plans-1.5950096

They can always just get reverse mortgage, or maybe draw more off their HELOCs or even better buy an additional house. Oh wait, that is all just more debt….. Maybe some will just have to sell some assets or that one asset they have.

“Meh, lots of people on this forum believe victoria is special and will be immune from macro economic factors.”

Why would you say that? Sentiment seems to be quite bearish these days.

Meh, lots of people on this forum believe victoria is special and will be immune from macro economic factors. Just look at the comments on this thread.

So far that seems to be the pattern elsewhere so no reason it wouldn’t happen here too

lol from a local Victoria realtor at the start of the month, roughly 3 month after some Toronto realtors noticed the shift. Hopefully those that bought in the last couple month in Royal Bay doesn’t experience what’s currently happening in those Toronto suburbs.

Nor would I. Try reading it again to understand what I said.

Well the bad news is that the government deficit-funded giveaways of $500 billion + in the last two years have already “moved the inflation needle” a lot, and created much of this inflation mess in the first place. So I wouldn’t consider $9 billion more of giveaways to “address inflation” as good news of any kind. Seems like a case of “good money after bad”.

You are correct, but note that the tax cuts or subsidies advocated by the other federal parties (and implemented by Ontario provincially for example) are also inflationary.

The good news is that the amount spent is not going to move the needle anywhere near as much as the interest rate hikes.

B.C. handled covid a lot differently than other Provinces. In Manitoba, one restaurant that refused to close and follow the mandates was eventually fined one million dollars. Poorly trained by- law officers, many of them recently hired, patrolled businesses on a weekly basis just to see if they could write a ticket for some obscure restriction. Costco was fined $5000 for having too many customers in their store. The same fine could be levied on a small sole proprietor business, talk about unfair. The pandemic definitely deepened my level of mistrust and apathy that I already had for the bozos we have in government.

Honestly, Olympics took a bigger toll on downtown.

Liberal Finance Minister Freeland announces measures to combat effects of inflation, by introducing giveaways sure to worsen inflation. All with borrowed money of course.

e.g.

– Increasing Old Age Security (OAS) by 10 per cent, providing up to $766 in new support in the first year starting in July.

https://ca.finance.yahoo.com/news/chrystia-freeland-deliver-major-speech-080000296.html

“ $8.9 billion in financial supports her government has introduced to help Canadians deal with rising inflation.

“We know that Canadians are worried about inflation and that they’re asking what their government is going to do about it,” Freeland said in a media statement.

“That’s why we have a new Affordability Plan — $8.9 billion in new support this year — that is going to put more money in the pockets of Canadians at a time when they need it most.”

Freeland said her plan to address inflation and the affordability crisis has five parts: respecting the role of the Bank of Canada, investing in workers, managing the debt, creating good jobs and funding the suite of programs that make up the Affordability Plan.”

Very true and there is no denying that COViD took a toll on downtown

Correct. So for example the travel I did was allowed under the rules. The point of my example was that there was no effort at enforcement. We could just as well have been going to a family reunion. While the prohibition had force of law, without enforcement it amounted to little more than a “very strong recommendation”. Which in the end was probably OK. For the measures to be effective 100% enforced compliance wasn’t necessary, 95% voluntary compliance was perhaps good enough.

Caveat: Why do you feel a need for an organized counter? This is not a sales blog after all. At the end of the day you will get a variety of opinions and ultimately people vote with their dollar as to where they buy. I have heard a whole range of opinions and mostly it reflects that people are different.

BMO: “The frothy psychology in Canada’s housing market has been broken”

https://twitter.com/SBarlow_ROB/status/1537397843870220288

Actually the article notes the prohibition was on “non-essential” travel which had a number of exemptions, including traveling for medical treatment.

Well you certainly did better on school closures. Ontario had the most school closure days in Canada, if not the world. Priorities.

“they think downtown is quickly losing its charm.”

Leo could we please get a counter for every reference to “downtown losing its charm” on HHV

https://news.gov.bc.ca/releases/2021PSSG0029-000758

Under the restriction you were prohibited from traveling off of Vancouver Island. You were discouraged from travelling within Vancouver Island.

Enforcement minimal. For instance I brought my mom to a medical appointment in Vancouver. BC ferries never asked our reason for travel.

With walks all over my neighborhood and 100 km bike loops through the CRD I never felt that restricted. But of course these prohibitions suck and are only justified for a short period of time in extreme circumstances.

My personal opinion: BC did a pretty good job. Perhaps erring slightly on the side of too restrictive for too long.

Ok….

2757 Dufferin Ave. interesting property but too small for my friends and they definitely dont want the hassle of building. You can wait a few years to even get a good contractor to start. But thanks for the suggestion. Actually, they are starting to rethink Victoria as a good location. They were here a few months back and they think downtown is quickly losing its charm. Combined with the lack of doctors they are having thoughts.

“I have been following the 2 to 4 million market for Toronto friends of mine. ”

If I were your friend and a serious buyer at today’s market, I’d put an offer on 2757 Dufferin Ave. Either reno the existing house or just move in or tear down for a mansion on this super rare 100 ft frontage lot in the neighborhood, or just rezoning to two small lots build a downsize house on one then hold or sell another one. In that neighborhood, your friends will quickly make new friends with similar backgrounds and ages.

Doesn’t take a rocket scientist to see this, yet some don’t…

Estate sale offers Wednesday

“Like I said in my other posts, people in victoria are slow so what your seeing in Toronto and Vancouver suburbs now are likely come to Victoria by August.”

lol, love the underlying tone of contempt here.

West shore will be the first to take it on the chin and the most Just like suburbs in van and toronto the core will hold up better

Here’s a strange one: 769 Kanaca Pl. Asking 799k assessed 932k built in 1988 on a 9200 sq ft lot.

Lol i think you are rhe one out off touch….Give any young family the choice of a free house (assuming they are the same) between oakbay, Fernwood, James Bay, Fairfield versus the Westshore and see what they pick.

Lol that’s precisely the reason why I am not buying it. Why would anyone want to try to do a flip in a interest rising environment in a market where prices are over 10x the median income? Like I said in my other posts, people in victoria are slow so what your seeing in Toronto and Vancouver suburbs now are likely come to Victoria by August. People paying 1.5m for house on a 4000 sqft lot in royal bay are going to be bag holders.

I have been following the 2 to 4 million market for Toronto friends of mine. There seems to be eight houses coming up for every one that sells the last three weeks. There definitely seems to be a lull in the market right now. The asking prices still seem really high to me.

Oak Bay and downtown are two different municipalities with different living conditions, including, safety/crime. For example, downtown has a very high crime rate, Oak Bay has an extremely low crime rate. The biggest drawback for OB is the price of houses.

2955 Westdowne is objectively a very good location for walkability, proximity to all levels of schools, transit, parks, and beaches. I think a young family would benefit from being in this location for many reasons, including access to higher education later on, but Royal Bay probably does have more young families.

1.2 million seems low for this property. It will be interesting to see what it goes for.

2955 Westdowne is in my hood. I’ve owned an investment property there since 1994. Never had any problems with crime, always got renters quickly. The materials used in construction of homes of that era would be superior to some of the crap they use today. No OSB in those walls. We discussed this before, newer houses go up in flames a lot quicker in a fire. This house will give a family more time to react. If safety of your family is a primary concern, this is a wise choice. 2955 Westdowne is larger than most of the homes in that area and has great potential after a few hundred grand is thrown at it. The area is also very close to Uplands. You’ve gotta love the knotty pine in the basement. Priced at assessed value because it is dated, probably go close to 1.5 mil. After it’s done 2 mil+. This house is a gem. Too bad it’s not in Hawaii (that’s where I would invest to live now).

Well somebody is paying those higher prices in the core. Objectively the most desirable market segments are the most expensive ones.

Location location location VREanalyst.

If you’re such a good analyst why don’t you buy it? I’m sure you’re approved for a $1.5-8 million mortgage so you can bring that bummer of a house up to current standards with a couple hundred in renos. That your plan? Ouch

If you were in touch with anything in this market you’d know most young families are sick of the Oak Bay/downtown core BS. Sure, all the time the market clever people and cop hating crew will disagree because they’re in love with an idea, but most real families are living in and moving to the Westshore where they can afford a home, because they’re actually building them there.

I recall the restriction being to the health service area. That is, the south island.

The Vancouver Island Health Authority that we were supposed to stay in covered all of Vancouver Island and even some of the mainland.

Also it was a restriction on non-essential travel, so “prohibited” is a stretch.

I suspect that there will be at least three more rate hikes of about 50 points before the year is donr by the US FED. This is just starting.

Exactly. That’s what makes a single 75 basis point move more impactful now (raising rates by 75/175= 40%) than at 17.5% (raising rates by 75/1750= 4%).

Current rate is 1.75%, not 17.5%.

Oh man, I walked to Cape Scott and back every day. Luckily didn’t get caught.

If you care to take a look, you’ll see I didn’t use the term. But do find the article, all that comes up for me on a search is someone fined for using a park.

Hopefully the 75 basis point increase is a “Volcker” moment that halts inflation. It will likely causing a recession, but that’s the lesser of two evils.

A lockdown is a restriction policy for people or community to stay where they are, usually due to specific risks to themselves or to others if they can move and interact freely. The term “stay-at-home” or “shelter-in-place” is often used for lockdowns that affect an area, rather than specific locations. Wikipedia

I hope you stayed within the south island, as we were prohibited from leaving our local health area for a time.

If you want, I can find the report of the man fined $880 for walking his dog on the apartment property. Does that meet your definition of “lockdown”, or must the apartment door be TIG welded shut?

On a lot that is half the size? ouch.

No reason other than income data I was using was annual and before I had monthly data into the 80s I only had annual data on prices. I will switch to a monthly averaged series for a future post.

Why are you using year to date average instead of a 12 month (or 6 month) rolling average?

I bet 2955 Westdowne will sell at least around $1.3M if no oil leaking or foundation issues.

$1.2 million for a postal code and a “local status” that’s getting stale as fast as the seniors that live there. I’d rather pay the extra 100k for a house 73 years newer in Royal Bay.

What is a proper market price for this listing?

Yeah nothing like political lobby based think tanks. Fraser holds the same credibility as the Centre for Policy Alternatives, Broadbent Institute or the CD Howe institute. But the news likes them. The best is when something like modelling gets presented from the Sierra Club or Greenpeace, I give that the same weight as something I see from the Canadian Association of Petroleum producers.

Or probably trying to get ahead of the group.

From: https://financialpost.com/news/economy/federal-reserve-system-bank-of-canada-inflation

The masters of motivated reasoning. Other useful conclusions from the Fraser Institute over the years: Climate change is a hoax, No health impacts from air pollution

Immigrants will save the market 😉 just watch and learn

They will be vulnerable in 3 years, but for the time being I think they will be okay. 5 year fixed interest rates were so low last year that very few of my buyers went into variable mortgages. The vulnerable group imo is those who bought Jan-March and went into variable mortgages as the fixed started to rise.

For example, I remember last April I had two first time buyers lock into the HSBC 0.99% 5 year fixed. They are good for another 4 years, then who knows.

Assuming we don’t head into a recession and then they cut rates again.

Can we stay off the vaccine theories since they are really off topic at this point.

When the vaccines were first being rolled out to the public, the CDC advised the U.S. government to vaccinate the smokers first as they were the primary group getting seriously ill and dying from covid. Nobody followed their advice.

Back on topic, any indication of how many out of town buyers are actively looking for property and what parts of Canada they’re primarily from. Thanks.

I personally don’t trust any advice on the subject of covid that comes out of the mouth of an economist.

I smell the foul stench of the Fraser institute in Mr. Douglas W. Allen’s work.

I’m glad that our politicians, (mostly world wide), listened to the doctors who worked for the centers for disease control. These professionals sole focus was to protect the public from a virus that no one had enough information yet …. to understand what the dangers and threats were. I’m glad they were extra cautious.

What is going to happen when the next… much more fatal virus comes along.

In my opinion, God help our children if Douglas W. Allen has any say on what we should do.

US Fed announced 75 basis point hike in overnight lending rate given inflation at 8.6% The USA had a similar run up in prices due to the Pandemic shift to the suburbs and need for more space. BOC will surely follow with a 75 basis point hike [I think that is next month]. Tiff should be fired. I see 5 year fixed mortgage rates nearing 4.5%. Those that bought over the last 2 years are vulnerable. Inventory is still really tight and unemployment is really low. Interesting times indeed. I always said that the run up in housing prices over the last decade [plus] has been a function of the falling cost of credit [falling interest rates] – now, my thesis will be put to the test. Affordability depends on two main factors: incomes and interest rates. As interest rates rise, and incomes do not keep up, sales fall [which is exactly what Leo’s data shows – this is consistent with what we see across the country – and we should see inventories rise [I see a lot more “For Sale” signs in my area]. The press reports that housing prices rose 50% during the pandemic as Tiff drove down interest rates [0-25 basis points overnight lending rate] and bought bonds to fund the Liberal-NDP spending spree – flooding the financial sector with liquidity. The end result is inflation we have not seen since the 1980’s. Friday’s USA inflation at 8.6% [and we are running close to 7%] tells you what we need to know – central banks will now not be focused on employment – the target is as clear as day [inflation] and housing is one of the culprits. Shelter costs are not supportive of growth – they are the opposite – unproductive assets. The next 24 months will show a significant adjustment in prices. As mortgage rates rise, affordability falls and falls and falls. Even the bank of Mom and Dad can’t keep up. Those Helocs are getting expensive. Leo says prices have flattened to slightly being down – let’s keep in mind that we are just at the starting gate for tightening – no serious student of this RE market can cling to the greater fool theory that has driven crypto [worthless] as being applicable to RE now – the main foundation for the RE is dissolving. Neutral for the BOC is going to be 3.5%

Looks like bidding war strategy is not end yet.

https://www.realtor.ca/real-estate/24544148/2955-westdowne-rd-oak-bay-henderson

I will say that I am a fan of the floorplan. checks all the boxes family friendly, WFH and mortgage helper.

For $1.8M you can be in cordova by with ocean views on a lot more than twice the size albeit an older house. https://www.realtor.ca/real-estate/24466012/811-sea-ridge-pl-saanich-cordova-bay. Must be really bullish on the neighborhood going forward, maybe it will turn into the Kits of Victoria…

Currently at least three pre-sales have A/O in excess of 1.7 million. There is demand for larger homes (>3,000 sq/ft) in Royal Bay.

This one has one extra bathroom and states it has an accepted offer for over $1.8 million, so maybe that price doesn’t look so bad to some…

https://www.realtor.ca/real-estate/24494620/3423-trumpeter-st-colwood-royal-bay

Postal code: L0L0L0

VicREanalyst

lol, some one tell me this is a joke!

It was the Gablecraft staged house, it also includes all the furnishings.

But ya, good luck on the price.

Key finding from the Cullen commission. Another silver bullet solution dashed

lol, some one tell me this is a joke!

https://www.realtor.ca/real-estate/24391237/3335-curlew-st-colwood-royal-bay

There have been other studies that analyzed severity of lockdown restrictions vs outcome on a per country basis. The assertion you’re making does not align with their findings. The SFU report itself is a study of 80 different studies. It’s worth a read.

Cullen commission report into money laundering is out https://cullencommission.ca/com-rep/

Now do “With lockdowns”

Dumb report is dumb. Without lockdowns we get the Delta variant well before we had vaccines, and we’re all in big fucking shit, hospitals completely overrun and anyone in a car accident is basically DOA.

lol $117 dollar oil and CAD/USD is at 0.77 and that is with a July 75bps BoC hike pretty much baked in. Looks like Tiff has cornered himself.

According to a report from SFU, the cost of “lockdown measures” was significantly worse than not having the measures.

I agree that legally there weren’t technically limitations in going out, but a majority of people were tricked into thinking they were locked down by purposefully (IMO) obfuscated and confusing rules and press releases . I flew across Canada and internationally in 2020 and most of my friends were in disbelief that it was even possible.

The definition of lockdown typically includes things like school closures, business closures and hospital restrictions etc, and those things happened and had a large deleterious effect obviously.

The idea that lockdown measures were somehow benign, or even desirable, is pretty perverse IMO. Enough data was available in April/May 2020 to know this.

https://www.sfu.ca/~allen/LockdownReport.pdf

Off topic I know, but I’m just responding to some comments.

Fed hike done at 75bps, will BoC goto 1% in July is the question, 75bps is already a foregone conclusion imo. Once that happens I would expect the slow Victoria folks (realtors and amature developers included) to finally figure out what is happening.

https://www.bloomberg.com/news/articles/2022-06-15/fed-hikes-rates-75-basis-points-intensifying-inflation-fight?srnd=premium-canada

If the full $500,000 were harvested from the sale, over the coming years, a careful corporate investor may expect to experience an average return of between 7% and 12% each year from such a sizeable portfolio of shares in 25 diversified corporations: i.e. $35,000 to $60,000

That will provide for the costs of shelter (hopefully with a non-prison ambience) and a larder stuffed with nutritious victuals!

People were never confined to their residences in Ontario. There were some periods where you weren’t supposed to go out except for necessary shopping, employment if on site, things like medical care, and exercise – including walking your dog.

Public parks were indeed closed for some periods in Ottawa and other cities and signposted as such.

At one point Ford wanted to authorize the police to stop people for no reason but he backed off after a storm of criticism, including from the police themselves.

But you stayed within the health district, right? We were prohibited from leaving the south island for a time.

I guess I don’t really, since it has and had zero bearing on my life. Went for walks and bike rides daily.

That was one report, you can find others if you care to look.

Based on that story you were still allowed to walk your dog, big difference from not being able to leave your apartment.

I went to Europe 4x during the pandemic and what you saw in the media and reality on the ground were two different things. Everything is “locked” down then you show up in that country and parties everywhere no one wearing masks etc.

People or person? Also doesn’t seem like they were just walking their dog.

Biking at that time was phenomenal.

https://ottawacitizen.com/news/local-news/britannia-man-fined-880-while-walking-dog-through-britannia-park

Pity the poor folks who suffer imaginary lockdowns and who perceive apartments as prisons. Does the man own the house, or does the house own the man?

“Pity the poor fellow who inherits the farm and all its implements, for these things are more easily acquired than gotten rid of.” (Henry David Thoreau in Walden)

That was in Ontario. People were fined $880 for taking their dog for a walk.

Certainly didn’t happen in BC. Lots of people didn’t understand the guidance though.

What province was that? Don’t remember that here I was out and about literally every single day.

I really enjoyed the “lockdowns.” Less traffic, no cruisers, what was really locked down? You wanted to go for a hike you went for a hike. I went to Europe in October 2020 best travel experience. No waits at airport. 22 passagers on a widebody airbus. I hated shaking peoples hands before covid so that was awesome as well getting to skip that nonsense.

Back in 2020. At times, people couldn’t leave their apartment to walk their dog.

When were Canadians in “lockdowns”?

Typically well under 10% of us mortgages have been variable rate (ARM). For example, it was 3% in January 2022. This has risen in the last few months to 11% of mortgages.

https://www.bloomberg.com/news/articles/2022-05-11/adjustable-loans-form-largest-share-of-us-mortgages-since-2008

“ ARMs — which carry variable interest rates that reset based on the market at predetermined times — accounted for 10.8% of total home-loan applications in the week ended May 6, data from the Mortgage Bankers Association showed Wednesday. That’s up from 3.1% of activity at the start of the year and is the largest share since 2008.”

=====

Contrast that to Canada, where about 50% of mortgages are variable (near all time high). https://financialpost.com/real-estate/mortgages/canadian-home-buyers-pile-into-variable-loans-blunting-impact-of-rising-fixed-rates

Bank of America mortgage rate chart below. Since when are all U.S. mortgages 30 year fixed? Looks like lots of borrowers could be in trouble.

Thanks Leo, I find your analysis very helpful and look forward to your new posts.

Bluesman- They got a 2 bedroom apartment, probably very nice, still an apartment. During the lockdowns, would you rather stay couped up in a house with a yard or an apartment with a hallway. It would feel like prison to me. I can’t help but think we’re not through with lockdowns and other behaviour controlling restrictions. Monkey pox is sure getting a lot of publicity.

Interesting to see what the next Fed bump will be, if it is 75 that would be a real message.

What can u rent in the peg for 2 grand Frank? Im too Lazy to look online. I am guessing a pretty nice place?

There definitely are seniors liquidating their primary residence and banking a lot of money while moving into apartments. Good friends of mine recently did that in Winnipeg. Sold their place for $500,000, but they wouldn’t tell me their new rent, I think it’s over $2000 a month. In their home their monthly expenses would have been under $1000 a month. Plus they won’t enjoy any future appreciation on their home. They are in their late 60’s, I think they bailed too early. They are both very healthy and active, I wouldn’t doubt at least one of them lives into their 90’s. His mother stayed in her home well into her 80’s. They weren’t strapped financially it was just a life style choice. I think they should have waited 10 years before downsizing or when health becomes an issue. At least they get to enjoy apartment living for the rest of their lives (sarcasm).

So far so good.

two boomers….two boomers that are single sounds like? Yeah might be a good life entering the second chapter, freedom to travel, no ties, options to go any where, maybe even take a portion of that mill and buy a really nice place abroad, seasonal crash pad…..could definitely appeal to some!

Mortgage rates in the US have risen from 3.25% in January to 6.28%. They were 5.5% a week ago. In the US, rates are set by the market (MBS). That’s resulted in a typical new monthly payment on a mortgage going up 41% since January!

https://www.cnbc.com/2022/06/14/30-year-mortgage-rate-surges-to-6point28percent-up-from-5point5percent-just-a-week-ago.html

“Higher home prices and rates have crushed home affordability.

That caused the rise in rates that began in January, with the average rate starting the year at around 3.25% and pushing higher each month. There was a brief reprieve in May, but it was short-lived.”

“For instance, on a $400,000 home, with a 20% down payment, the monthly mortgage payment went from $1,399 at the start of January to $1,976 today, a difference of $577. That does not include homeowners insurance nor property taxes.“

Not a lot of people are going to be happy renting a bachelor suite as they age. Renting would be way to precarious for me.

Why must they buy? I know two boomers: one sold March and the other in April (smiled all the way to the bank). One of them is renting a condo and the other is renting back the house into July and then going traveling for 4 months. The latter said they are likely just looking to rent a bachelor suite when their travels are done. They both cleared a million after all was done and they have pensions and other investments. So, they are comfortable to rent and figure it’s a coin flip if they ever buy again.

If large institutional investors were really in control of prices, why would they sell in the first place? Why wouldn’t they just hold and keep their asset prices high?

“The time to buy is when there’s blood in the streets.” — N. Rothschild

Warren Buffet war chest is north of $120 billions at the moment, and the rest of the whales and institutions are holding cash waiting to pounce.