New and active listings: what happened during the crash of ’81?

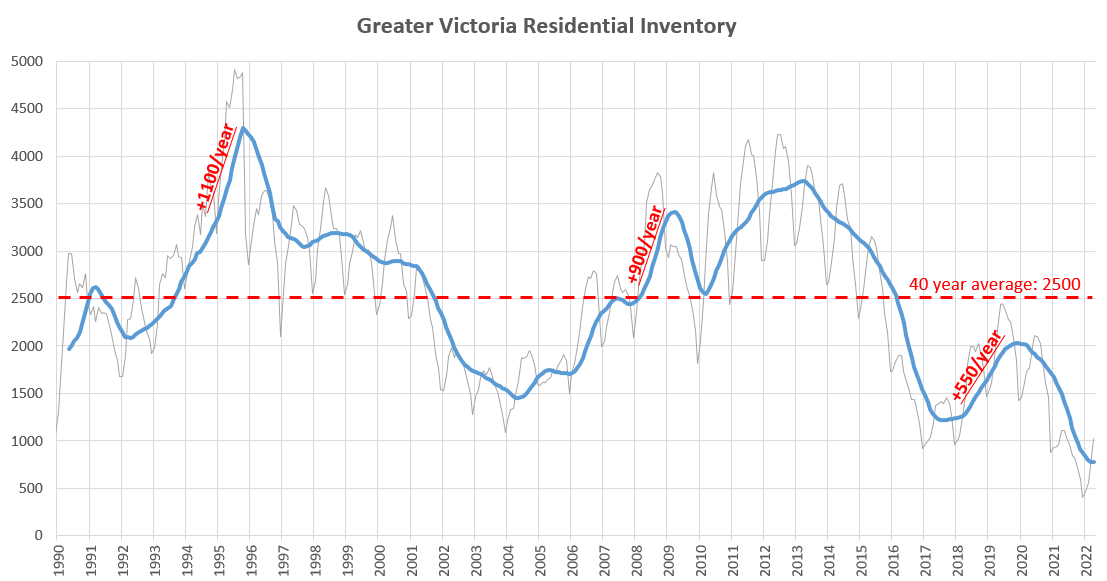

I recently found some more data on active listings in Victoria, bringing us back to 1990 for active residential listings data. It doesn’t change the picture too much though, with the average inventory remaining at 2500 listings. Again we can see that inventory usually builds quite slowly during normal corrections. Marked on the chart are some of the most rapid builds of inventory we’ve seen, and it’s generally not that quick. If we matched the absolute fastest gain in inventory from 1994 now, it would still take until the end of 2023 just to get back to average levels. At more typical rates of inventory growth we are into 2025 or beyond.

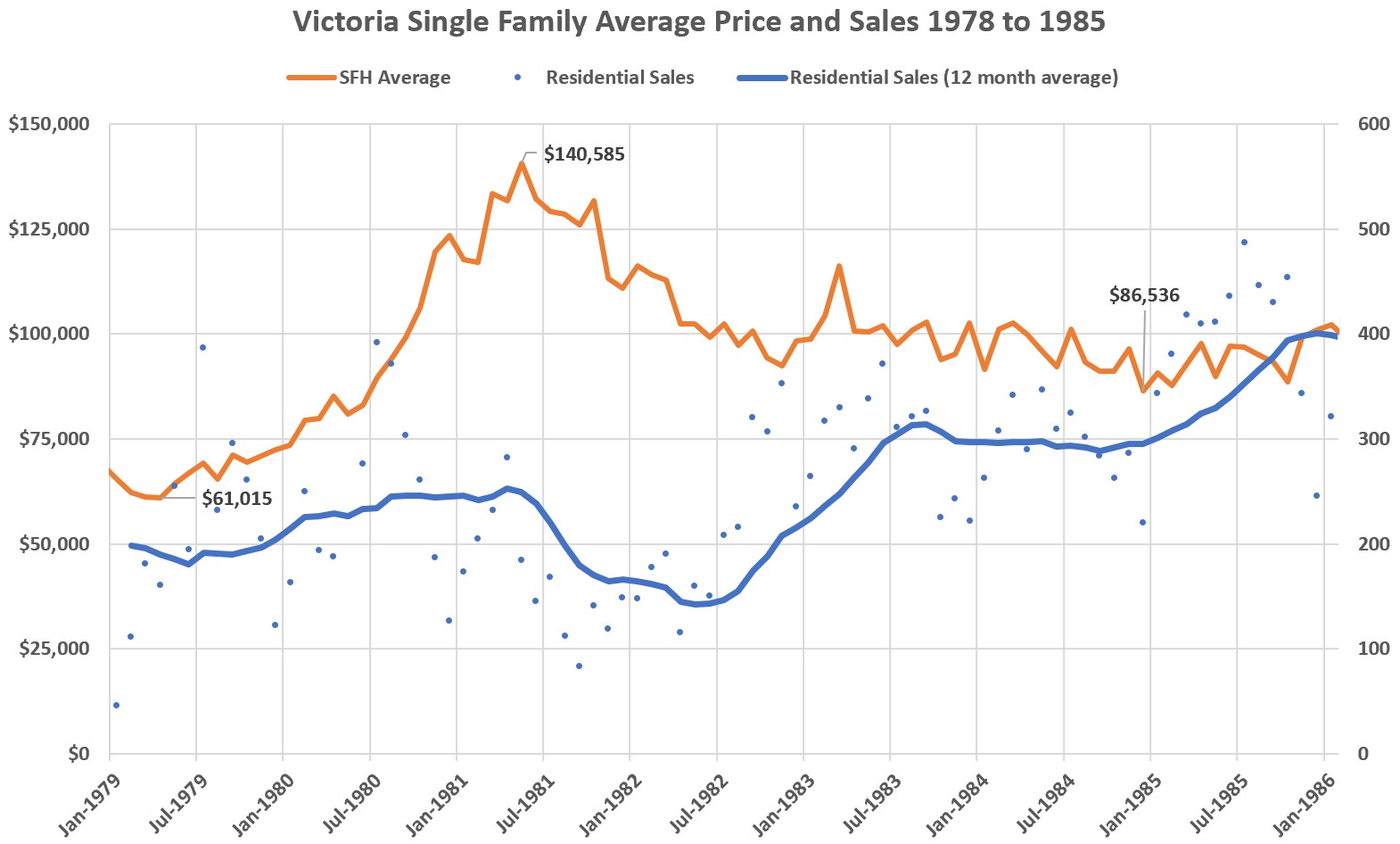

However that’s not to say that inventory always has to behave this way. I’ve previously written about what happened with prices and sales during the 1981 crash. Take a look at the article for the full discussion, but in short prices crashed about 35% after more than doubling in two years, followed by a long period of flat prices as inflation reduced their real value. Nominal prices didn’t regain the peak until 7 years later, and inflation adjusted it took 10.

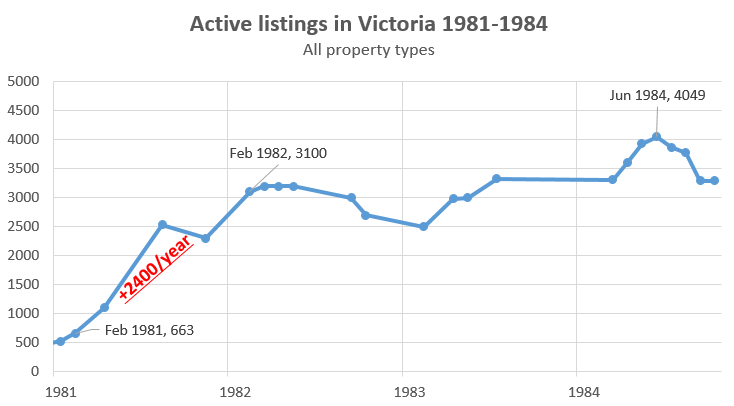

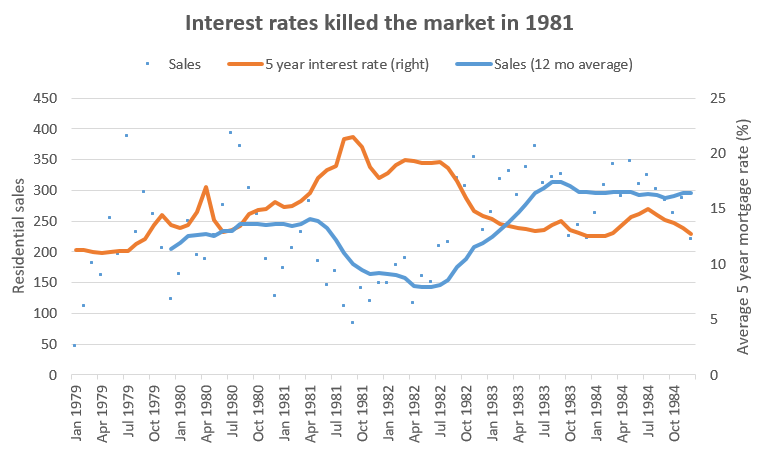

However at the time I wrote that article I didn’t have any data on active or new listings for that period. To fill in some of the gaps, I’ve been trolling through archives of the Times Colonist, trying to find reports from the Victoria Real Estate Board which were periodically published in the paper. Though we can’t fill in every month, there is enough there to paint a striking picture of how quickly the inventory piled on. Between February 1981 and 1982, more than 2400 listings were added to inventory, bringing the market from way below average to above average in just a year.

Inventory decreased a bit towards the end of 1982, while a sales recovery brought hope to the real estate industry and projections of a return to price gains. However a continued high rate of new listings drove inventory back up, staying high and peaking over 4000 as prices continued to slowly drop to the bottom in 1984.

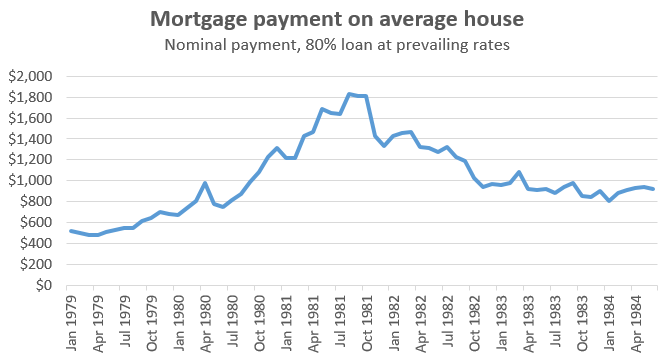

Why did inventory pile on so quickly back then? The major reason was a collapse in sales. From May 1980 to April 1981 there were 3035 residential sales in the region, despite record low inventory levels that made it difficult to find property to buy. In the following 12 months there were only 1733 sales, a drop of 43% despite an explosion of selection for buyers. As the real estate board president reflected in the paper: “You could almost pinpoint the time to the minute when the collapse occurred. It was on an afternoon in May of 1981”. Just days before buyers stepped back the paper puzzled over why activity was still as high as it was given the high mortgage rates and prices. FOMO kept the party going longer than seemed reasonable, but it couldn’t go on forever.

Another reason for the rapid inventory build was an increase in new listings. Speculators were forced out by rising rates, and some owners lost their homes from the grinding stress of high rates and job losses. That didn’t happen until after sales dropped, and in fact new listings were very depressed in the two years leading up to the crash as sellers held out for a better price later. Data is very spotty here, but in 1978 new listings were pretty unremarkable, then dropped extremely low for much of 1979, 1980, and the start of 1981 before rising strongly when prices started falling. For example in June 1981 there were 983 new listings, an increase of 80% from the 545 new listings the year before. The following June there were still 847 new listings, well above the pre-crash rate.

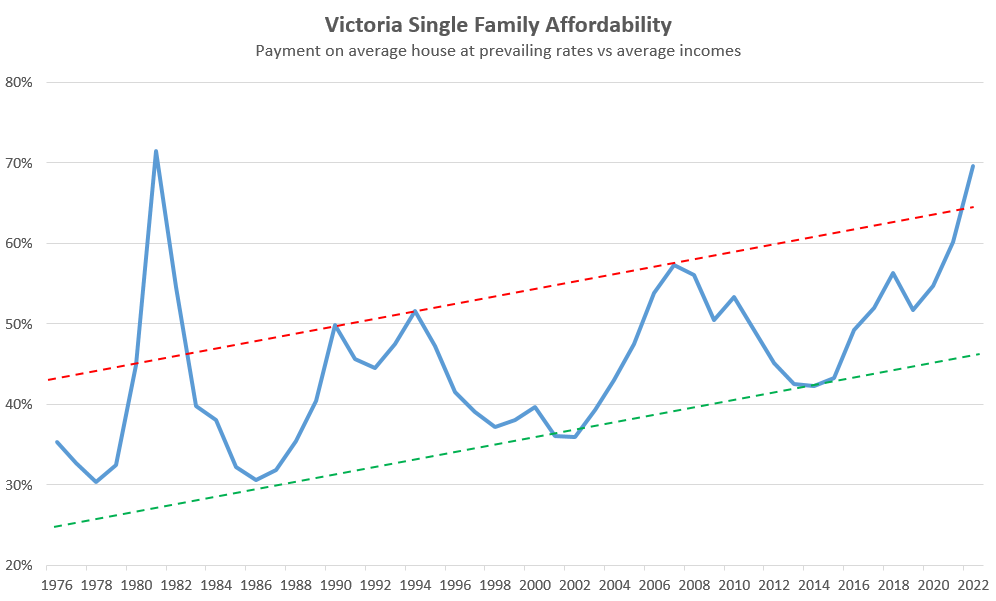

The question is, could this be repeated today? Overall I doubt it, but it all depends on the trajectory of rates. Firstly we need to appreciate how extreme that runup in prices really was. Though the average house is close to that level of unaffordability today, back then it was a much bigger departure from where it started. We can see this on the yearly affordability chart, where the carrying cost of an average house went from a relatively affordable 30% of the average income in 1978 to over 70% in just 3 years. Our recent 3 year price increase has only driven the same measure up by about 18 percentage points. Of course that’s before rising rates really started to bite so it’s too early to draw any conclusions there.

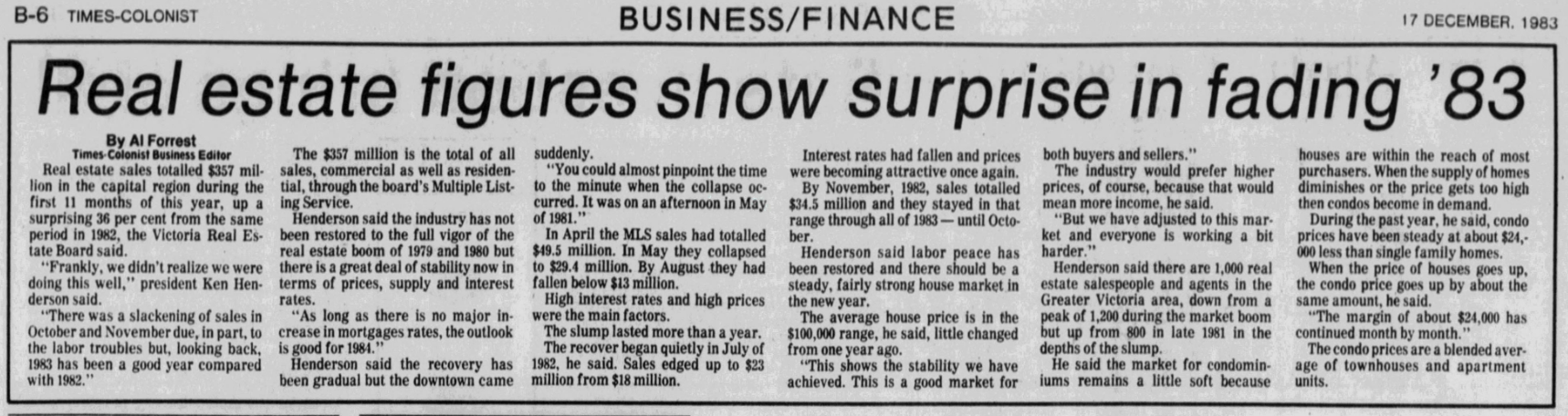

On the monthly chart of average payments we can also see how quickly payments for the average new house increased: tripling in 2 years. We’re nowhere close to that with “only” a 57% increase in the last two years, but again we also haven’t had a lot of rate increases yet. The fact that our market is slowing after just a few increases seems to indicate we may be more sensitive to rates now, or we burned out most of the FOMO and are out of irrational exuberance to drive the market along as far as it went back then. Interestingly enough, before the crash BC and Victoria also saw an influx of Canadians coming to the province but it didn’t stop the listings from appearing.

Having seen how quickly things can change, I think there is a reasonable chance that we could build inventory faster than we have seen in recent market cooling cycles back to the 90s. I don’t think it will happen as quickly as it did during our 80s crash, but it’s possible that relief for buyers might come faster than many think. It all hinges on the path for interest rates, which is what really pushed the situation in 1981 from a more gradual correction (prices were simply too high) to a true crash. Based on my estimates we would need another 3% rise in interest rates to get to a similar impact today.

Also the weekly numbers courtesy of the VREB.

| May 2022 |

May

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 176 | 364 | 1049 | ||

| New Listings | 351 | 752 | 1333 | ||

| Active Listings | 1451 | 1584 | 1450 | ||

| Sales to New Listings | 50% | 48% | 79% | ||

| Sales YoY Change | -24% | -27% | |||

| Months of Inventory | 1.4 | ||||

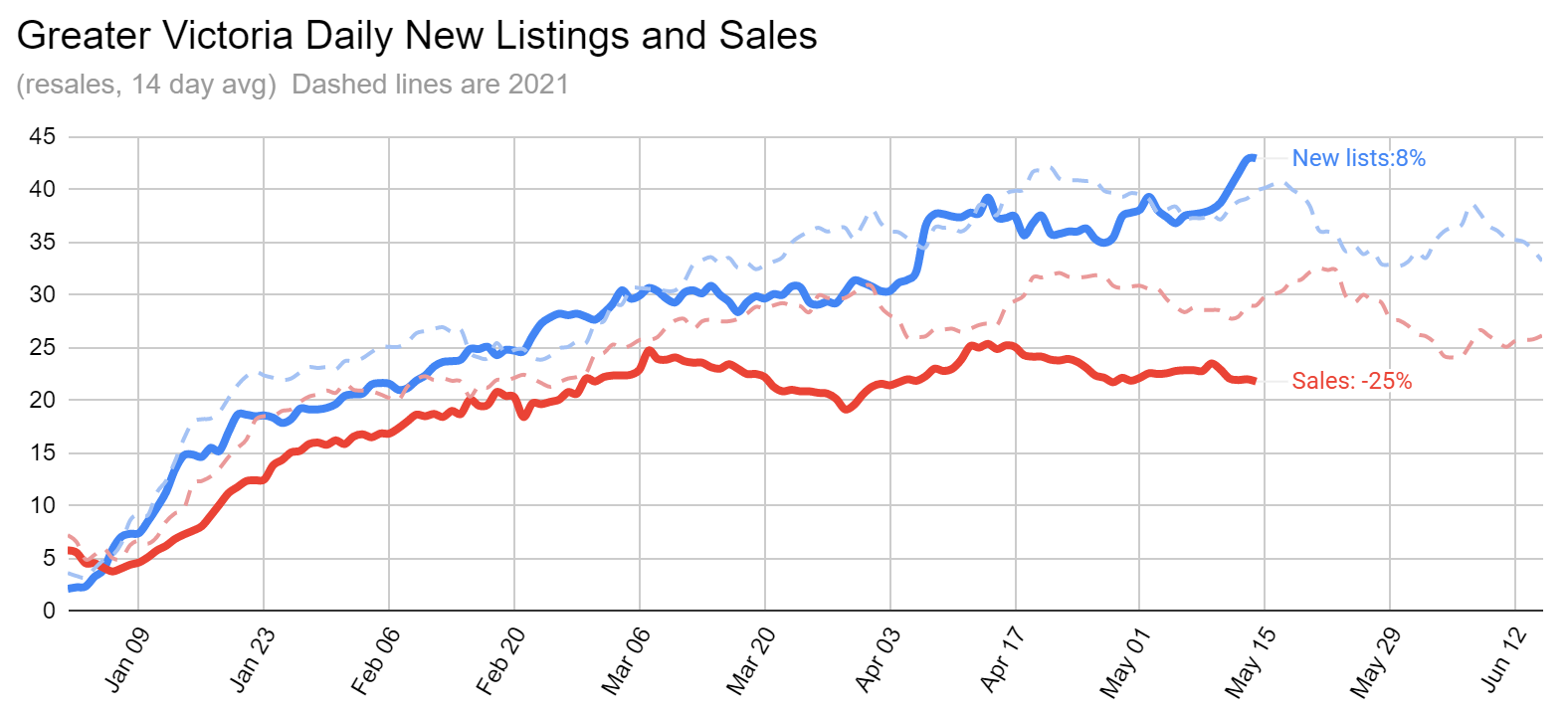

Strong week for new listings and after what seemed like endless months of record low inventory we finally exceeded the year ago inventory levels. New listings month to date are up 12% from the pace of a year ago, while inventory is up 5% from the same week last year.

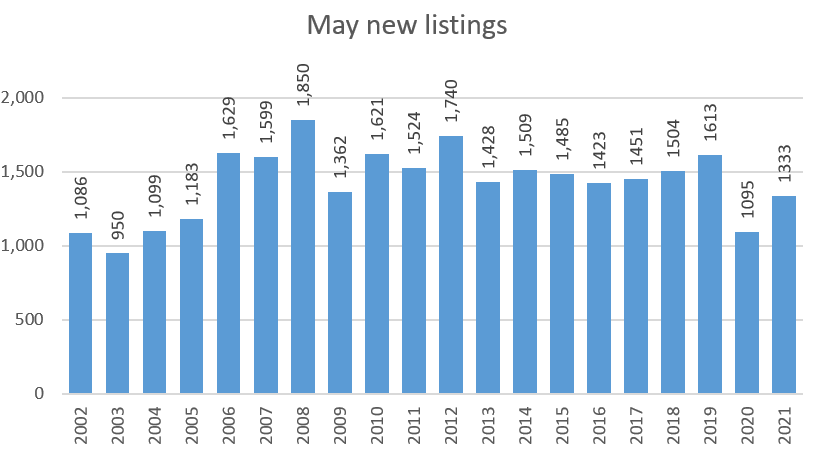

It would take about a 12% increase in new listings for the month to get back to the level of new listings that we saw pre-covid, so we may be getting back to at least normal levels in May.

Despite the increased listings and stagnant sales, there was no change in the percent of properties going over ask, remaining at around 45%. It’s inevitable that this will keep drifting down, but again we need a sustained 2 months of inventory or higher to really bring it down.

So far the slowdown has been orderly and gradual, driving much of the froth out of the market without really bringing us out of what remains a very tight market. That’s a striking difference from what has happened in Toronto, where activity has subsided a lot faster with seemingly more sellers caught in difficult situations and driving down prices somewhat from the peak in February. We’ve seen a few of those transactions in Victoria but not yet a flood. Agents, lawyers, buyers, and sellers will want to be extra careful with what they say and their due diligence in times like these. A rising market hides nearly any amount of incompetence, but when the market turns the lawsuits come out.

New post: https://househuntvictoria.ca/2022/05/24/regions-and-property-types-whats-doing-the-best/

A mass murder I believe is 3 or more victims. The U.S. averages more than one a day

Mr monster don’t leave things are just getting started us bears need a voice

Still doesn’t stop almost all immigrants trying to use Canada as a stepping stone to get to the USA.

No, wrong, its 14 little kids and one teacher.

Another mass shooting in the states…in Texas. 10 children killed at elementary school and one teacher.

Man, you can have that country.

Go down to your local fire department and see if anyone there own an EV. The process to put out an EV fire effectively is enormous. Most of them, hopefully, have undergone training to deal with these mini- Chernobyl’s. If you want an educated opinion, ask a fire specialist.

I believe most people take out extra medical insurance here before travelling to Mexico. Anyone can visit a doctor though. You pay so much per visit. I believe it is pretty reasonable. Maybe $50? If you run out of some meds while you are there such as metformin or Lipitor, you can pick them up cheap at any of their many, many pharmacies. Others you would need a doctor’s prescription. Some will fill it if you happen to have the correct bottle with you, or even your own doctor’s prescription.

Lol no. The only real problem the EV industry has for the next 5 years is figuring out how to build enough EVs to meet demand.

However this fact has exactly zero bearing on the stock price of any of the EV makers.

Bad week for the EV industry. Several Tesla’s went up in flames across North America. Vancouver, California, Illinois and a Miami dealership. I’d sell any Tesla shares, Elon could soon go from the richest person in the world to flat broke. We’re just one Hindenburg event (a ferry going up in flames) before the technology is deemed too dangerous. I’ve heard all the stats that EVs have the lowest percentage of fires compared to gas and hybrid vehicles, so don’t bother repeating them. I would never set foot in an EV, it’s comparable to swimming off the coast of Australia, it’s just too potentially dangerous.

This place used to be a middle class paradise before 2005.

I wonder what the family doctor situation in those other places are? is it better than in Victoria?

A quick check of realtor.ca shows that “homes” includes condos. Edmonton is full of sketchy condos that are conversions from PBR. There are indeed a few SFH under $200K but they are essentially teardowns. For example:

https://www.realtor.ca/real-estate/24424822/11149-97-st-nw-edmonton-alberta-avenue

“I wouldn’t care if I was happy or miserable if I was in Hawaii. Probably happy most of the time.”

“

“

“

Frank, you may be joking but if you’re miserable in Winnipeg it won’t take you long until you’re miserable in Hawaii, unhappiness has a way of following you, that’s the way mental health works. That’s what I was getting at earlier when I said Victoria is one of the most unhappy places in Canada despite the weather and pleasant scenery.

Here is something from Yahoo Canada:

List of Homes in Canada that you can still buy for less than $200K

Cape Breton 44.2 % of homes less than $200K

REGINA 36.5%

St. John N.B. 26.72%

LETHBRIDGE 26.1%

EDMONTON 24.63 %

SASKATOON 23.47%

Winnipeg 23.45%

Red Deer 22.8%

St. Johns Nfld 13.46% &

Quebec City 9.85%

With these savings, and if I were in a different boat, I would seriously consider moving to a few of these places,

live there is the summer “with air conditioning”, rent it out in the winter months, and buy a condo in Puerto Vallarta to live in from October through to April each year. Maybe.

I have actually heard recently that immigrants are now leaving Victoria/Vancouver due to the cost of living. As for the wealthy immigrants, you have to understand that capital is mobile and people will try to seek out the best risk adjusted returns on their investment. If you got $5M cash, would you want to plunge that down on Victoria Real estate right now?

Actually no, you are sounding like that Bill guy who runs that Vancouver Housing Collapse fb group. That guy has been dead wrong for 5 years and everyone who followed his advice is now most likely priced out. I do actually think prices will correct by 20%-30% depending on interest rates but it’s too soon to start calling people out on that.

If you want to be credible then put your money where your mouth is and buy $25k of HCG puts expiring later this year and put up the screenshots.

Thank goodness Debt Meister was around to warn me . Guess I’ll toss out my renters, sell my properties, pay a ton of capital gains taxes and invest what’s left into some GIC. Heaven forbid my 1.89% mortgage for the next 2 years doesn’t sink me. No thanks, I’ll ride things out and let the demographics do their own thing. Wealthy baby boomers are aging well, their children, if well educated are making 6 figure salaries and they both want their own place to live. Add to that record high immigration levels, our real estate market will have a hiccup or two, but the carnage some are predicting simply won’t happen. No matter how bad things get there are always people with money. I just worry if they’re happy.

For those of you who are interested, I see CWB is now offering a 27 Month GIC @4.25%. One can get paid interest annually as well @ the same rate. It will most likely go up again 1st of June.

VicREanalyst, you’re right, my friend. It’s very apparent that I’ve touched a few nerves here. Nobody likes to have financial mistakes rubbed in their faces.

There’s a point where “warning” turns into “I told you so” and I already stated that I’m not going to do that. Quite frankly, if you’re in trouble already or you know that you’re going to be in trouble as the market starts to crumble, then you should have listed by now. The market visibly shifts in June.

Leo, Marco, Patriotz, James and Local Fool (despite his protestations) know where this market is headed. Leo and Marco are professionals and diplomatic enough not to write it down (yet) but, at least, read between the lines. It’s not really that difficult.

Frank, Patrick and Up-and-coming, you might have a small window between the rate increases to help yourself.

This is my last post. Thank you all for welcoming me to this blog. It has been engaging and fun. Take care and good luck.

Debt Monster

Patrick- At least someone doesn’t take everything seriously. I wouldn’t care if I was happy or miserable if I was in Hawaii. Probably happy most of the time.

Debt Monster, why don’t you just chill out on the doom and gloom for 2 months until there is hard data available for Victoria supporting your thesis. You can then come back and give Frank a run for his money.

Monday:

Sales: 568 (down 25% same week last year)

New listings: 1117 (up 18%)

Inventory: 1664 (up 14%)

New post tonight.

I think it was a joke, not a “truly bizarre statement”. And it’s funny, typical Yiddish style humour.

Similar to these two…

“ I’d rather be happy than rich, but I definitely wouldn’t mind being both!”

“Rich or poor, it’s always nice to have money”

Honestly, if you have kids (especially if you have more than 4 people in your family), it’s better because the kids get a room with a door(can go to sleep at a decent hour). If you have more than 2 kids you usually have to book 2 hotel rooms, right away it makes way more sense.

A couple of the reasons are that they are way better and cheaper for people travelling in a group, or people travelling for extended periods of time. Renting a hotel without facilities for a month gets old fast. I have stayed in Japan with six people in a four bedroom house with laundry for $2500/month – a hotel would have been min. $9000 with two per cramped room and no kitchen/laundry. Plus hotels in north America are always carpeted, which seems unsanitary with the traffic they get.

Why don’t you post some October, November, December, January, February, March nightly rates.

Haven’t used Airbnb in Canada but elsewhere usually cheaper than hotels. I get to meet someone local that may or may not give me free dinner and I hate the annoyance of room service at hotels.

From: https://www.cbc.ca/news/canada/canadian-military-habitat-for-humanity-suggestion-1.6463424

The military getting in on the housing prognostication in Canada now..

Del .

This is a truly bizarre statement.

I think you’re out of date with your Airbnb rates. More like $250-300/night. I really don’t know why people bother with renting these though. I’d rather stay in a hotel and it’s cheaper.

As for valuing your own time I think you have to consider that most people have no way to make money in their spare time. An activity that pays $30/hr or whatever that they can do on top of their job is attractive. I can definitely see why people do it. I think the other munis should copy Victoria’s AirBnB restrictions and the province should step in and force AirBnB to cooperate with municipalities. Crazy that Victoria needs to pay full time staff to chase AirBnB when it should be as simple as uploading a list of licensed units and the platform should refuse to host anything that’s not licensed/

I’d rather be miserable in Hawaii than happy in Winnipeg, especially after this last winter.

How do you know how happy your clients are?

From: https://www.forbes.com/sites/ywang/2022/05/12/billionaire-sun-hongbins-sunac-defaults-on-dollar-bond-payments/?sh=393c8d127258

Victoria will never be more expensive that Vancouver so yes if Vancouver tanks we are tanking here as well.

It will remain relatively expensive for a city its size. However, if you think Victoria will remain unaffected if prices fall in Vancouver or across Canada, I disagree.

One of the best places to live and happiness are different things imo. You could have a 15 million south facing waterfront property in Oak Bay and still be unhappy.

I spend a lot of time in Croatia with a cousin that works at a warehouse for $480 euros per month with a networth of $0 to $480 depending on time of month and he is way happier than all of my clients with a networth in the millions.

“Victoria has to be one of the best places in the world to live and work in“

“

“

Well you wouldn’t know it by the happiness index which had Victoria near the very bottom of 33 cities in Canada when done a few years ago. My theory is that people move to Victoria but they may leave their friends and families and end up unhappy here despite the nice scenery. Some of the happiest places are some of the poorest, like smaller cities in Quebec and Nfld where family is more important then money. I have worked with lots of clients who moved here from other places in Canada and after a few years quite a few of them end up moving elsewhere.

“To me it seems more a side gig for retired people, part time employees.”

“

“

Many people don’t think about the value of their time and or perhaps as you mentioned they have nothing better to do.

“ Victoria has to be one of the best places in the world to live and work in” Well put Marko, and that is why you and the majority of the people posting here have relocated over the last few decades. That’s why I bought property on the Island almost 30 years ago. If all of us had not, prices wouldn’t be so high. We all helped caused the high prices we constantly complain about. So either move to a less desirable city or stop complaining. The influx of people thinking the same way will not stop either. Victoria is simply an expensive place for housing and nothing is going to change that. I doubt many home owners want to see any change.

I don’t understand the Airbnb business model personally. I looked into it once with one of my units at the Era (allows airbnb) but when I factored in using my assistant at the time to run it for me and her per hour wage it made no sense.

A one bedroom with parking at Era you can rent for $2000 a month or $67/day 365 days a year. That is zero work involved. Zero licencing/airbnb/etc fees involved. 0% vacancy. Etc.

Even if you are pulling in $150/night on a one bed airbnb I don’t see how it makes sense, if you place a value on your time of $30/hour, for example.

To me it seems more a side gig for retired people, part time employeed, or you have a suite (outside of COV) that you need for family members visiting so you airbnb it inbetween.

If anyone had some real life numbers to post I would be interested to see! I just don’t see much upside versus long term rental.

It’s an incredibly beautiful country but 2x doctor salaries cannot afford SFH (in a desirable place even like Zagreb which is non-tourist area).

That is what makes Victoria so special as a package in my opinion. I’ve travelled to more beautiful places and other superior attributes but in Victoria when you combine mild climate, low natural disaster risk, within one of the best countries in the world, plenty of water, no smog, above average natural beauty, you can buy a place on 2x professional incomes, etc., it has to be one of the best places in the world to live and work in.

Looks like those that entered into a 5 year term in 2016/early 2017 would have been the most exposed to a large increases in interest rates, but they have already re-financed.

The next 18 months of refinancing coming up those owners had rates on purchase that were trending up (mid 2017 to end of 2018) so owners will be looking at refinancing from 2.6 to 3.2% to 4.2% +/-.

Those with 1.5% mortgages (early 2021) +/- won’t be re-financing until early 2026. I agree, they could be in trouble if refinancing at 4.5% but they have 4 years to get their crap together. Maybe sell the SUV and get a used Honda Fit, etc.

I commented a lot on this similar topic in HHV in 2013/2014 when the crash was around the corner any day. The 2007 peak purchase buyers had already re-financed in 2012 at much lower rates and paid down principal. I didn’t feel that many people out there were in “trouble” unless bad luck (health, etc.) or just dumb with money.

QT

Yes, I was there, but the real point of that chart was the $790 increase in mortgage payments that happened over the last 6 months and it’s just going to get worse. People just don’t budget for that kind of thing when they bought 5 yrs ago when you could get mortgage rates for 3% and under. It also takes demand out of the market as evidenced by the drop in sales and sales/new listing.

They couldn’t except prices won’t be that high.

Very unlikely to happen with oil, commodities and food going for today’s historically high prices. If they crash it’s the early 1980’s over again.

The very highest 5 year rate in 1983 (January) was 14.05%. Take a $100K house with $5K down, your payments would have been $1,163 a month. The only way you could have paid $2K was with unconventional (ahem) financing. Mortgage calculator says 25%.

In any case, the crash had already been underway for almost 2 years at the start of 1983, and the province was already into a severe recession.

I’m sorry but $3000 in 2022 is not thing near what my parents, and many others has to endured during the 80s. My parents mortgage payment was $2000/month in 1983 on our modest 3bed/2bath home here in Victoria.

So it is highly unlikely that we see a repeat of the 80s crash so that you and the bears can buy a home at 30-35% off in the core.

And, what make you think the bears can afford a $850K house next year when they couldn’t afford it 3 years ago at much lower than 6% rates?

Meanwhile, this chart, gives you a very good idea of the train coming down the tracks.

twitter.com/BenRabidoux/status/1528768057178476544

There is also an extreme shortage in qualified workers willing to work. Is nobody paying attention to the news? Everything is in short supply. This inflation is caused by high energy prices, just like in 1980. Only difference now is our energy shortage was self inflicted.

Wage adjustment did happen in a few isolated sectors, but most were wage freeze with no overtime during the 80s crash. So, worst case it would be like the 80s and the CAD drop to 2/3 of the USD, and during that time lumber price didn’t really drop even those fuel price drop significantly.

House price did drop on the Island in the 80s, because of population out flow, and places like Port Alberni, Duncan, Sidney, Sooke, Coolwood, Langford, Esquimalt, Fernwood, Fairfield, etc… fall into dilapidation because noone could afford lumber/paint to keep up their homes.

Absolutely, but warehouses are not going to import products to sell at a lost, and unlike government private companies would cut production and layoff employees instead of running a deficit.

Hence automation and send manufacturing overseas. A win win for the manufacture and a death sentence for Canadian workers.

If new developments are no longer feasible, then that puts more demand on existing housing, driving prices higher. We need more products at cheaper prices to bring down inflation. Just had a conversation with a neighbor at the cottage. Where he works, what used to cost $5000 for a container is now $20,000. Higher interest rates aren’t going to fix that. Higher interest rates are only making things more expensive. Our economy has suffered enough with the pandemic lockdowns (that helped create these shortages), to inflict more pain could be catastrophic to our economy. Then there’s the war in Europe.

SFH Hunter

Well, it would appear that Victoria is following Toronto’s lead regarding sales. Interestingly, it was the perimeter areas of Toronto that started to drop first. Signs of things to come.

https://www.movesmartly.com/monthly-report-may-2022

But this year, the opposite is happening.

Home sales in the Toronto area were down 26% in April over last month and lower than sales in February as well.”

If the CAD rise against the USD, but the CAD could find it self worth $0.65 USD or less like the late 90s to early 2K.

That’s the thing about inflation being an economic killer. The costs escalate past what the market will bear. Then the wages and material cost is not economically feasible. Then the wage and material needs to adjust accordingly. So, if that high wage worker needs a paycheck, they need to consider working for a lower rate, if they don’t and want to hold on to the high wage, the work will not be there and they are sitting at home (maybe doing cash jobs, but still lower). Same with materials, if those imported materials are simply gathering in a warehouse, the value of that material decreases. The owners of that material need to recover costs and they start selling at a discount. The manufacturers of that material then need to find a way to lower the cost of that product if they want to keep operating.

If the RE market slows down in the US, which is where our material prices are really determined (whether imported or not), the prices will go down.

https://time.com/6178366/house-prices-us/

https://twitter.com/i/status/1528746046582673408

I don’t think there will be a downward pressure on costs, because employers are jacking up wages to keep employees and minimum wage is rising. And, materials prices are not going to drop because most are imported.

Neither.

IMO, it is over priced to begin with, because of poor location (right next to busy North Dairy Rd.) and possibly a dozer bait.

That’s the fun part of economics. That costly developments that are no longer economically feasible that have been completed simply go into receivership. Followed by a slow down in construction leading to surplus labour and materials (putting downard pressure on costs). However, there is still demand for new construction and housing at a lower cost and there is an ability to cater to that with delcining costs and increased competition for the less available funds (thus driving down costs). It simply comes down to the cost the market will bear.

Lol. It seems I’ve struck a chord. Also, Jack Daniels is a boomer drink, so it sounds like you’re projecting on the boozing and posting and that would explain how you would think this response is somehow clever and not completely childish. Hope you have a better day today, cheers.

With rising interest rates, large mortgage payments are a new hurdle for homebuyers

Note “late 2021”. The affordability measure cited appears to be a Canada-wide average, hence the peak in 1990 which reflects the outsized contribution of the Toronto market.

we were in Croatia a couple of years ago and it was beautiful, whether up in Rovijn, driving through the countryside, in Dubrovnik, or on the islands (like Hvar). Just beautiful. Super good roads in the countryside, too, as I imagine many of them had to be upgraded. But when driving in the countryside, you still see the outward effects of the war, the occasional burnt-out or shot-up building, so it’s sort of “there” as one might expect. And people talk about it if you engage.

As many or most houses in Dubrovnik had to be rebuilt, the airbnb’s there seem to be a super-cool mix of old and new, beautiful old exterior walls and some very modern interiors, very attractive. If it weren’t for the long flight, it would be tempting to buy an airbnb there, even at current prices I’ll bet it’s a good investment.

And to bring it back to Victoria, the legit airbnbs in the core also can be a pretty good investment even at current prices, I don’t think the cash flow on these is going to dry up any time soon, even in some measure of downturn. Which I do believe is coming for real estate everywhere, probably more muted effect in Victoria, but still coming. You simply can’t go from central banks inflating everything like crazy & all assets including real estate popping, to removing all that stimulus and not expecting a reaction, even if it’s just a muted reversion to the mean.

Every claim you made is spot on! My parents weren’t part of the communist party so no free condo for them. As a naval architect (lead of an entire department at a shipyard) and an accountant at Renault Croatia they couldn’t afford to purchase a one bedroom condo after the collapse. That is literally the only reason we ended up in Canada. If they had the means to buy a one bed we would have never left. Other than that life was pretty good in terms of health care (free dental work etc.), education (free including university), food, etc. A lot of new immigrants from Croatia are increasingly more disappointed with Canada. Real estate prices being the main reason as that is kind of why you come here. You certainly don’t come for the health care these days.

As far as people sending money back home absolutely correct as well. A lot of people work in Germany and send money or buy property back in Croatia. I also have a friend in Victoria who is a family physician that works in a small northern community as he makes 2-3x what he would running a family practice in Victoria. Owns a 2.5 mill +/- home in Victoria so that is a practice that occurs here too. May see more of it again if the oil sands fire up investment again.

That being said I have two cousins in Nancy, France. One of them owns a car dealership and is a business person in general. When I get the numbers out of him on how much he pays his employees and what the rents/real estate prices are in Nancy it is another situation that is far worse than Victoria.

patriotz- Huh? It appears there is no shortage of money out there, unless you tank the stock markets making people poorer. What a great idea, let’s make everyone poorer, thanks a lot. I can’t see a government whose policies are making people poorer sticking around for long. Just because Justie and Jaggie formed an alliance from hell, doesn’t mean a citizens revolt couldn’t take them down. All that has to happen is all the truckers park their rigs for one week and our economy collapses. Maybe we should form a Truckers Party and have them run the country. They’d probably do a better job. At least they have real life experience, not like the privileged brat we have now.

It works because if you decrease the supply of money things get cheaper. It’s the money supply that’s the metric that matters, higher interest rates are just a result of lower money supply.

I suppose the rationale in raising interest rates is to decrease demand thereby causing prices to fall. I don’t see how that will work in an environment of extreme shortages of materials, energy (in Europe), housing, food, computer chips, you name it. Higher rates are only making things worse. In the early 80’s, high inflation was created by a supposed energy crisis and the concept of peak oil, causing gas prices to soar. Today we have self- imposed high gas prices by the carbon taxes and strangling of the oil sands due to pipeline shortages. High energy costs affect the prices of everything. Today’s high prices are the result of tripling of shipping costs and transportation of goods. High interest rates won’t decrease demand in a market of shortages, we still need more housing to accommodate all our newcomers. This inflationary environment has been created by escalating energy prices and can only be resolved with lower energy costs. Take your pick: global warming ( which I don’t deny, just don’t think our carbon taxes are going to make any difference) or a severe depression that will starve millions of people. We created this problem, I don’t think high interest rates are the solution.

But it’s close to “the new upcoming Wallmart store”. Who could resist that? Just the thing to add a few extra walls.

Last I heard housing starts were still at an all time high. That’s a pretty long way from freezing up.

I think you’d find that in the carnage of Vancouver circa 1984 or Toronto 1992 there were still starts. Even in the legendary US bust they didn’t go al the way to zero. Having said that I think the condo sector would be more affected by a downturn due to the more complicated nature of the projects and financing. You’d see a bigger proportion of work on smaller properties, suites, etc. People have to work.

Wonder what happens when the cost of building a new condo exceeds the markets ability to buy a unit because of mortgage costs. Obviously, the developers stop building so my real question is roughly at what point in higher mortgage rates does the building sector freeze up.

I know that there is no magic number but are we close to the thresshold?

From: https://bc.ctvnews.ca/average-detached-home-prices-in-surrey-langley-seeing-double-digit-drop-1.5914648

I guess for an Island context, this doesn’t bode well for those that spent a million to live in Sooke or Coble Hill in the last year or so. It has to bite a bit to have a down payment wiped out especially if it was borrowed off a family member’s HELOC. Hopefully, the plan wasn’t to pay back the gift down payments from equity growth when it could be drawn from a HELOC on the new property.

Well, I’m starting to understand your name … up-and-cumming. You’re a dick.

Tell you what, put away the Jack Daniels, step away from the keyboard and tomorrow come back and try again.

This place dropped their price $100k – interesting! A sign of things to come or just a one off??

https://www.rew.ca/properties/4095301/3202-kenya-place-saanich-bc?search_params%5Bquery%5D=Cedar+Hill%2C+Saanich%2C+BC&searchable_id=846&searchable_type=Geography

Actually for years it’s been a place where people come to discuss the local RE market and learn from others. The title is literally called House Hunt Victoria, which would indicate people come here for analysis and market trends in order to help them navigate the purchase of a property in Victoria. The fact that you think you can swoop in from Vancouver or whatever rock you live under and respond to “bull rhetoric” on a blog just shows how ignorant you are about Victoria RE, how miserable you are in your current situation and how desperate you are to be paid attention to.

Thanks introvert – I did mean bulls – I’ve updated my post. Cheers.

Monster I for one can see your very wise I enjoy your posts cheers

I’ve always been pretty bullish on Victoria RE. Maybe less obnoxiously so, lately.

I just got back from Lake Louise and spent a delightful half hour catching up on HHV. I love reading about competing crystal balls.

Keep it coming Debt Monster. It used to be Introvert and Patrick were two of the only bulls on the forum and personally I liked having their posts as it brought a balance. It has been very bearish lately and I agree it’s nice having some bulls here.

But interest rates aren’t following the previous pattern. Try to convince us that doesn’t matter.

Yes that’s true, I think it’s around 30%. It’s also been true for every bust.

I won’t make a specific claim about Croatia, but I know that it was commonplace in East European countries for tenants to be given their rental apartments after the end of Communism. Combine that with a static or declining population and apartments passed on within families.

I do know that since Croatia is now a member of the EU a lot of its citizens work in higher wage countries and send money back home. In fact that was common even back in the days of Yugoslavia.

If Debt Monster follows the pattern set by previous HHV super-bears, he will be around for quite a while (years).

Just until it was too late.

Lolol, I’ll be letting Patrick take over for me at the end of July.

Patrick

This must have been quite the echo chamber of backslapping and high fives prior to last month. You will note, of course, that I don’t start these conversations. I simply respond to “bull” rhetoric trying to convince each other that everything is going to be okay.

Leo S

April 25, 2022 9:07 am

I’m just happy a true bear is back in the comments.

19

omg Mr. Monster, what will you do with your time not spent obsessively posting comments and links on this blog come summer? While it occurs to me to ask, what did you do with your time before your discovered HHV? And are you obsessively posting and sharing all your original advise to Ontarians? Is there a blog there you are on sharing all your prophesy and advice?

I do enjoy a balanced view on things including some of the contents of your posts.

But, hmmm, yeah, maybe take breather? Its a bit much.

I’m already looking forward to it and Patrick is also doing a fine job of picking apart your posts, so maybe take a break? Take your boomer ass outside and maybe go for a walk? You could go take some photos with your iPad.

Believe me, up-and-coming, you will not be looking forward to that time.

Yes, I certainly do appreciate that, Patrick and I’m not concerned for the average Canadian. Only those Canadians that reside in Ontario and B.C.

You also understand “that with a price crash some people’s equity would be negative or well below 46%. Mainly recent FTB, and hopefully many of them have locked in low 5 year rates.”

Well, that’s where the rubber hits the road, isn’t it, because when sales do happen and they always do, new price points will develop and a lot of that equity is going to dissolve quickly.

At least you’re giving us something to look forward to

Great. You’re now back-on-the-rails posting things that are correct, and not “hiding behind headlines that you didn’t write”. Yes, Victoria residents have some of the highest mortgages in the country, as one would expect in any city with expensive houses. They also have some of the highest home equity and non-RE assets in the country. And 43% of Canadian homeowners have no mortgage at all,

Moreover, the average Canadian homeowner has 73% equity in their home, with 27% mortgage. https://cba.ca/household-borrowing-in-canada

This means, if prices fell by half (50%), Canadian homeowners would still have average equity of 46%. (Because their mortgage owing is now 27%/0.50= 54%, leaving 46% equity. Eg. $1m house with $730k equity, $270k owing… becomes a $500k house with $270k owing and $230k equity, and 230/500=46%

And yes, I know that with a price crash some people’s equity would be negative or well below 46%. Mainly recent FTB, and hopefully many of them have locked in low 5 year rates. But someone who calls himself “Debt Monster” should appreciate that a starting average position for Canada homeowners of 73% equity and 27% mortgage in a house is a great position to start if there is going to be a crash.

Patrick, okay, what I meant to say was I didn’t write the headline. Sheesh.

The facts speak for themselves and for those “mortgaged” Victoria residents, they carry some of the highest mortgages in the country..

I presumed that it would be self evident that they were writing about residents with mortgages but ….

As the Prairies slowly crawl out of the worst winter in decades, more people have decided to retire and look for milder climes. May has even been frigid and very wet. Hopefully farmers will get a crop in, or we’ll all be paying dearly for food. I’m sure some have been exploring the Island to relocate to, prices of property and cottages have also risen considerably but fall well short of B.C. prices. Might as well spend your kids’ inheritance and enjoy your golden years without the harsh winters. Migration to the Island should remain steady for a few more years at least.

Excuse me, but it is “your headline”. You posted the same thing a month ago, and I pointed out how it was nonsense back then too, which you acknowledged. https://househuntvictoria.ca/2022/04/19/april-19th-market-update/#comment-87376

So then you post the same nonsense today as fact. You should spend more time reading the whole article, and only post articles here that you consider to be factual because they make sense. And that would stop you reposting the same news that you knew was false from last month.

I’ve posted articles here with facts that people have pointed out were false. But I learned something from that, felt a “little stupid”, and didn’t repost the same nonsense. You should do the same.

https://www.sookenewsmirror.com/news/average-greater-victoria-homeowner-holds-500000-in-debt/

Not my headline, Patrick, but it doesn’t change the fact that for every mortgage in Victoria under $200,000 there is one over $700,000. That’s just the way averages work.

Debt Monster,

No, the average Victoria homeowner doesn’t have $477,128 mortgage debt. That data you posted is only for homeowners with mortgages and excludes homeowners over age 69 and homeowners with no mortgage. The average mortgage debt of all homeowners is much less, because 43% of Canadian homeowners have no mortgage. (2016 census) https://www150.statcan.gc.ca/n1/pub/75-006-x/2019001/article/00012-eng.htm

https://borrowell.com/blog/costs-of-living-canada-homeowners-vs-non-homeowners

“Report findings are based on credit report data of 874,111 Borrowell members in Canada between the ages of 20 and 69 for August 2021. For this study, homeowners are considered to be consumers with active mortgages on their credit reports. For this study, homeowners do not include consumers who have fully paid off their mortgages. “

The ‘froth’ in house prices since July 2021 assessments could easily disappear (within 6 months). That’s a drop of about 20%, and gets prices back to where they were 11 months ago. That would mean a HPI benchmark SFH would fall from $1.18m (April 2022) to $978k (July 1, 2021). The 20% down buyer won’t see much improvement in affordabiiity ( monthly mortgage payment) because they’ll be signing up at higher mortgage rates (@ 6% rate), but they are borrowing less which is important. The all-cash buyer would “save” 20% in that case. Typically sales numbers would be very low during a crash like that, so I’d expect a greater proportion of cash buyers (including wealthy out-of-towners). If rates stay there (6%) I wouldn’t expect price drops to worsen unless there’s an economic downturn as well.

Fraser Valley

up-and-coming

Actually, my friend, after this summer I will have no reason to post anymore. This is all about warning people. Once the Bank of Canada raises rates the next 2 times it will be too late to sound the alarm any further.

Escalating prices on food seem like nothing compared to the price increases I’ve been getting on materials in the construction industry. A few union companies in town are paying above the agreed wages just to keep guys. Fire private contractors it’s getting hard to keep guys on the bottom.

There have been periodic shortages of a lot of things over the past year. And sharply escalating prices on a lot of food items. I have very large gardens, but they have never made sense financially. Maybe this is the year.

It’s nice that you lay out timelines for your ridiculous claims so we have something to reference when you’re wrong. Although you’ll probably have some sort of excuse or just kick your prediction further down the road hoping one day you’ll eventually be right.

DM

For gods sake will you give it a rest. Put the computer away and go outside. Do something else. Anything. Please. You are getting me depressed. I’m sure that’s what gives you pleasure. But take a break.

Marco

Bingo!! That has been the biggest problem! Everyone can service that debt when mortgage rates are under 3%.

These kids bought as much house as they could “afford “ with super low rates and the assurances of realtors, mortgage brokers and the BOC governor that those rates would be around for a long time.

Now, mix in those new “investors” using their HELOCS to purchase more properties at those emergency rates. I believe in the States they call them “teaser” rates because they renewed in just 5 years.

By the end of Summer you’ll be able to count the “bulls” on this blog on one hand.

I had a hard time finding soap at Wal-Mart today. Soap. The shelves were almost empty.

Frank

Consensus is a little off the mark. Just 11 more sleeps and you will see 6%+ rates.

Posted Rate

Scotia Ultimate Variable Rate Mortgage-Closed 3 Year Term 4.100%1

Scotia Flex Value Mortgage-Closed 5 Year Term 3.400%2

Scotia Flex Value Mortgage-Open 5 Year Term 6.500%3

Closed Term Fixed Rate Mortgages

Term Rate

1 year 3.840%

2 years 4.490%

3 years 4.590%

4 years 4.790%

5 years 4.990%

7 years 5.490%

10 years 5.890%

Of course poor countries are hit first in that scenario. It is just a condridiction to think food security will become a thing at the same time having interest rate growth somehow restricted. Unless Canada is going on a steak and grain diet, in a food security circumstance, the country will need to maintain a strong currency so that we can starve those poorer parts of the world by buying up their food. Hence the increasing interest rate to support the currency against the competition for food supplies. Not saying that the food security thing will happen, it just doesn’t support a low inflation scenario. Your fresh fruit and veg during the majority of the year does come from those poorer countries.

The poorer nations are going to face food insecurity long before us, and we are a long way away from pensioners that have to eat pet foods for survival in the 80s. And it possible that we will see higher than 5-6% rates, but at the moment it doesn’t look like so.

Crazy price for an 1800 sqf 3br house.

$1,135,000

If food security becomes an issue then inflation will continue to escalate and there goes your stop at 5% – 6% for interest rates.

How much did 724 Bondi Close sold for?

Thanks

There are people that are down sizing and that makes it easier for them to buy all cash. They aren’t the ones that are going to have problems with a higher interest rate. It’s those buying that are putting every nickel and dime into their mortgage payments that are going to feel the brunt of an interest rate hike at renewal time or having their suite go vacant for a month or two or three. They can put 50% down but if they are only just making the payments they are in the same situation as someone that went high ratio. And isn’t just the vacancy rate either. Tenants can skip out on you without paying their rent which increases your bad debts.

If you own an apartment block then you will likely have to carry a much higher vacancy rate than a home owner with a suite. Once you lower the rent on one of your suites, the other tenants in the building are going to want a reduction too or you will experience an increase in the turn over rate of tenants which will add to your expenses of cleaning and painting the suite before the next tenant moves in.

Apartment buildings in Victoria are selling in the range of 21 to 23 times there gross income assuming that the rents are at current market rates. That’s really quite high by historical standards. I’ve seen that rate drop to 10 to 12 in bad real estate markets.

Interest rates are going up, from historically low levels (in some cases negative interest) but I think consensus sees rates going no further than 5-6%. That will hurt some people, benefit others. I don’t think rates are going through the roof . I would worry more about food security in the next year instead.

That poor schmuck could own 2 rental properties worth over 2 mil and have $6000 rent coming in every month. The $700,000 mortgage is making him rich.

Wouldn’t the ability to service the debt be more important than the actual debt? I would think on average someone buying a house in Winnipeg would be more likely to buy close to their max qualification than someone in Victoria where 25% of our transactions are cash and <25% are high ratio.

Yes, that has been the mantra, right up until this year.

Debt is never your friend when interest rates are going up!!

Problem is they are in places no one wants to live/buy and owners don’t want to sell them for next to nothing so they let them go vacant.

As for construction, very difficult. Croatia is part of the EU so hardworking tradespeople just go work in Germany so you end up with a labor shortage. We have more and more workers from Nepal, etc. Even in a poor country people don’t want to work anymore so you bring in people from a really poor country.

Frank

Frank, you are making my argument for me. You’re right, it is an average. Therefore, if your mortgage is only $250,000, then some other poor schmuck will be carrying a mortgage over $700,000.

That $700,000 mortgage at 1.89% could be coming up for renewal at vastly higher rates.

You’re looking at an amber light. It will be turning red by the end of summer.

A good way of looking at the demand for housing is the days-on-market (DoM). The lower the DoM the greater the demand. In this way it is possible to determine which segments of the market are weaker or stronger by looking at the different DoMs for each segment. It should be a fairly easy thing to create a scatter graph showing sale price against DoM.

As for reaching a 5% vacancy rate. All that has to happen is for the economy to go into a prolonged recession. That would put construction companies out of work, the trades, and all those that have jobs that support the construction industry.

The difference between the early 1980’s and today is that a lot of the trades are now subcontractors and not salaried. As a subcontractor they have the option of paying into employment insurance but I suspect most do not. Without that social safety net those trades have to find lesser paid jobs immediately or leave Victoria for employment in places like the tar sands.

What will never happen is that you can build enough rental housing to increase the vacancy rates. Contractors will just stop building rental properties when the vacancy rate increases. As isn’t economically feasible to construct rentals when the vacancy rate is just a few percentages higher and coupled with soft rental rates.

And it doesn’t matter how many multi-millionaires live in Victoria. Market prices are set by those buying and those selling. If you are neither one of them then you have absolutely no influence on prices. You are not part of the marketplace.

DM- How many homeowners have no mortgage debt? Not every owner is carrying debt. I don’t know what percentage they represent. My property was fully paid for in the 1990’s. I’ve had a mortgage on it since 2002 when I bought a dump in Langford, which I financed to by a Hawthorne equivalent in Ladysmith, and so on. I’m currently carrying a $250,000 mortgage (of a $350,000 line of credit) at 1.89%. I’m paying (at least my renters are paying) almost $700 a week to pay down the principal so when I need more credit it’s there. How many other homeowners have mortgaged their property to buy additional properties? How much revenue are they getting from that mortgage? They’re not paying the mortgage, someone else is. That’s the beautiful thing about real estate, debt is your friend, it allows you to acquire more assets. Maybe you missed out on that opportunity, having someone else paying off money you borrowed from someone else, at ridiculously low rates. Hope you can follow that.

Frank

The Island has some of the highest mortgage debt in the country.

What is it about that problem that you don’t see?

https://www.sookenewsmirror.com/news/average-greater-victoria-homeowner-holds-500000-in-debt/

Well there ya go. It’s like the opposite of Georgism

“There were two recent properties on Dewdney sold well above asking and assessment value, but now 3020 Devon stuck on the market for over two weeks. Even compared to 2777 Dover sold last year, it sounds Devon’s asking is reasonable. Although there were some blow out sales but I would say the market is cooling down, at least for the $2M+ market.”

3020 Devon is much closer to Uplands proper than Dewdney which clearly is not even Uplands border. Devon and Dover are clearly Uplands border whereas Dewdney is not. Devon is not Uplands proper but getting close. Devon, therefore, is the superior location to Dewdney.

In terms of the high end market, there is a very good selection of rather stunning Ten Mile Point waterfront properties available right now. In fact, it’s the highest I have seen for inventory in perhaps 10 years for Ten Mile Point waterfront. The only catch is the cheapest property is priced at just under $4,000,000 and the most expensive is $10,000,000.

Doesn’t explain the capital Zagreb where 25% of the population of the country lives. No one buys a vacation property in Zagreb. You buy that in Dubrovnik, etc.

A ton of vacant properties as there is no property tax in Croatia so when people inherit they often don’t sell and just let it sit.

The thing is the vacant properties aren’t where people want to live. We sold my grandfather’s farm on 10 acres private pond/lake with house and barn for 35,000 euros and that was an exceptional sale as the neighbor bought it otherwise would have probably sold for 20,000 euros. Thing is people don’t want to live in smaller towns/cities, at least in Croatia.

Everyone wants to be in the attractive cities and not 60 minutes away, at least in Croatia.

Yes, seriously. Industries that were world leaders are now worthless. Look at GE, a fraction of what it was worth. The entire banking industry almost collapsed in 2008. Target looses 25% in one day. Sears is gone, the list is endless. Skyrocketing shipping costs could destroy Wal-Mart and other major retailers. High gas prices are killing Uber, Lyft, skip the dishes and any business relying on delivery, including Amazon. There are no guarantees. People have to live somewhere.

Frank

>” Those were paper gains, crypto is an illusion, stocks had the greatest run in history. That’s what you bail out of at the peak,”

Seriously????

You’re reaching here, Frank

Those were paper gains, crypto is an illusion, stocks had the greatest run in history. That’s what you bail out of at the peak, and hold tangible assets that don’t evaporate on bad news. Houses can’t be dumped in a few minutes, not while people are living in them. When you go to the bank for financing, the only assets they are interested in taking for collateral are primary residences. Or any other property that is rented in desirable areas. They know how stable real estate is compared to paper assets. Probably the most stable asset in the developed world. Especially if your neighbor is the most powerful country in the world. Canada is in a sweet spot and people around the world know it.

I think almost everyone living in Greater Victoria SFH is now living in a $1m+ home

Frank

Uh huh

https://stevesaretsky.com/the-rout-is-on/

Debt Monster- You’re dreaming if you believe rising interest rates are going to tank the housing market on the Island. Financially secure seniors and professionals across the country and overseas can easily support current and escalating prices. This is not 1980, trillions of dollars of wealth has been created in the last 40 years. Some people didn’t benefit from the opportunities that were available over the last 40 years, they should have applied themselves more. Most people who diligently worked their way up the ladder now enjoy the fruits of their labor. I know some of my friends that only got a high school education are living in $1-2 million homes. Opportunities were endless, you just had to work hard and not waste your money.

Patrick

…. or they could simply sit on the sidelines and watch as prices deteriorate.

Apparently, the Spring market is a bust. Let’s see what the next best market time will bring.

September should be inspiring.

Right, though ownership is 90% in Singapore as well, but it’s more like leaseholds of public housing. Sounds like Croatia hasa different system but also has a pretty extensive system of subsidized loans that allows people to buy even if they otherwise wouldn’t have.

Sounds like they need to put in some demand measures. If population is declining but there’s still so little supply that prices are being bid up then there must be lots of empty places. One article says 10% of purchases are foreign buyers. Perhaps lots of empty vacation homes? Not sure if they can crack down on that if they’re in the EU.

Wonder what the construction costs are. With low wages must be pretty cheap, so again why aren’t they building anything?

Looking forward to it.

Home ownership is over 90% -> https://www.croatiaweek.com/croatia-second-highest-homeownership-rate-in-europe-despite-global-decline/

Population

1995 – $4,620,000

2022 – 3,888,529

Population decline (many who have no hope of every buying anything leave the country). Economy sucks. Wages sucks. Higher interest rates. Literally every single housing metric is poor, prices continue to go upwards.

This summer I am going to do a YouTube series interviewing my cousins across Europe that have kids and their living accomodation (as the common arguement in Canada is you can’t have kids in a condo). I’ll do a quick video tour of their condo and then I’ll sit down with them for an interview in English. Some pretty crazy living setups!

For example, this is one of my cousins I’ll interview -> https://www.linkedin.com/in/jure-murgic-03b89097/?originalSubdomain=hr

As you can see quite the extensive oncology resume including Princess Margaret Cancer Centre in Toronto. Wife also a doctor + PHD. They live in a 1000 sq/ft condo (that is like 50 yrs old) with 5 kids and one euro style minivan. The 10+ yrs old kids already speak three languages, accomplished in sports, etc. You don’t need a SFH for kids to thrive and be successful. Our standard of living in Canada in incredibly high and now it is pulling back unfortunately and this has many upset.

Ciena

The media drives the herd. Similarly, as prices were skyrocketing, the odd bear may have pointed out a sale under asking. It doesn’t matter.

If the media says sentiment is changing and prices are dropping then the herd will respond accordingly. Just wait for the June headlines.

By the way, this hasn’t been gradual.

February Market Summary

BY LEO S · MARCH 1, 2022

The market in February continued on much the same trajectory as January, with a frantic sales pace constrained by low inventory, rising prices in every property type, and an extremely high proportion of sales going in bidding wars. Inventory remained at record lows for the time of year, down another 36% from last February’s already very low level, while sales remained 20% above the 10 year average.

Condos are available everywhere. So that’s why numbeo.com uses a standard condo, making their data comparable in any country.

You seem fixed on the idea of measuring affordability by comparing to the “good old days”, when typical families could afford Victoria SFH. And ignoring what is happening with worsening affordability around the world. With your belief that a “Victoria SFH affordability cycle” will “save the day”, and return us to decent affordability. I just don’t think that’s ever going to happen, and data from other countries supports my belief. I don’t see a future of improved SFH affordability in Victoria. I see affordability worsening, approaching what Marko describes in Croatia. It’s important for a HHer to recognize this trend, before they get pushed out further from their dream of home ownership.

The important thing to remember is that the CREA states very clearly that national home prices are skewed by over $130,000 by home prices in Toronto and Vancouver.

Therefore, as national home prices start to drop, those minimal declines nationwide will be much bigger declines regionally …. B.C and Ontario.

So far, nationally, the average price has dropped by just over $70,000 but as noted by our resident bulls “not in my Victoria “.

The brunt of the decline is obviously in parts of Ontario and the mainland of B.C.

You better build a bigger moat. June is approaching.

Gee, I don’t know, Patrick. It does look somewhat worrisome.

Bad analogy. Teslas and Camrys are both similar other than price. But population density in different cities make different housing forms impossible. You don’t get a townhouse in Singapore no matter what you pay.

You’ve told that story a few times but there must be more to it. Clearly no one earning $16k is buying a $500k condo. So there must be something else at play such as a much more prevalent social housing system or something else. For example, Singapore prices are sky high but 80% of the population lives in public housing on fixed leases. The price of a market house is basically immaterial to the average person.

There were two recent properties on Dewdney sold well above asking and assessment value, but now 3020 Devon stuck on the market for over two weeks. Even compared to 2777 Dover sold last year, it sounds Devon’s asking is reasonable. Although there were some blow out sales but I would say the market is cooling down, at least for the $2M+ market.

I am with Patrick on this topic. Whether I am visiting family in various countries in Europe or friends in Taiwan I try to figure out what the salary is for staple professions (nurse, engineer, teacher, etc) and then I look at the price of real estate somewhere attractive where would want to live, not 60 minutes away from where I would want to live.

For example, nurse here makes $90k/year and decent condo can be purchased in the core for 700k CND in Victoria. In Croatia nurse makes $16k/year and the same decent condo in the core of cities I would want to live in in Croatia is $500k CND and interest rates are way higher.

Situation here is bad but at least there is hope on two professional salaries. In most countries zero hope. That is why people have immigrate here. Few very immigrants are hungry in their respective countries.

The fact that the norm here is SFHs just means we have a way higher standard of living.

Listed Thursday, so probably holding offers off until Tuesday (if they’re sticking to the formula) So, it would Wednesday or Thursday next week when a deposit cheque would most likely be in hand (if it sells). Then the pending price is usually available and posted.

Instead of homes, use an analogy of cars…

If most people in San Fransisco drives $100K teslas, the “norm” is $100k car prices.

And if most people in Winnipeg drives $30K Toyota Camry, the “norm” price for cars in Winnipeg is $30k.

By your logic (median car prices) we would conclude that car prices are cheaper in Winnipeg than San Francisco.

But I would claim that the car prices are identical. And so would numbeo.com using their standardized methodology that you reject.

Because the dealers actually sell the cars for the same price in both cities. People in San Fransisco could buy Camrys, but are rich enough to buy more expensive Teslas..

Similarly, if people in Hong Kong live in 700 sq foot apartments, if we want to compare prices, we should compare that to the price of someone in Victoria buying a 700 sq foot apartment. Not to the 2,000 sq ft SFH that people in Victoria think they deserve.

If you don’t standardize on home size/type, you’ll be comparing SFH (“Teslas”)with condos (“Camrys”) in different countries. On a “condo to condo” comparison, Canada homes are more affordable than most countries.

Whenever bidding wars are involved, highly leveraged buyers can only bid up to the amount they have been pre-approved for. Banks require appraisals to validate the property is actually worth what the buyer offered. That’s difficult to do in hot markets when no one can predict the value of a property. That’s why most highly leveraged buyers have probably not been significant participants in the recent escalation in prices. Therefore, higher interest rates won’t affect Victoria and other areas of the Island for a while. B.C.=Bring Cash.

Disagree. Norms are different between countries and cities. We can say that a 2000sqft detached house is cheap here compared to Hongkong. Apples to apples and 100% meaningless

If a 500 sq ft Vancouver condo sells for less than a 1,500 sq foot condo in Langford, it doesn’t mean that home prices are cheaper in Vancouver than Langford. Because we need to standardize to a benchmark home of similar size. So you can’t use median prices when comparing countries (as you did comparing Seoul to Victoria), because you may be comparing apples to oranges in terms of home size and type (SFH vs condo)

The numbeo site standardizes the home type (condo), size (1,000 sq ft) and location (city center, and city suburb). This allows a valid comparison, which would work for Langford vs Vancouver as well as it works for your example of Victoria vs Seoul South Korea.

The most important point of the story was not the data. It was the perils of unconditional offers combined with long closing periods that led to a bunch of knobs not having the cash to complete transactions exposing them to breach of contract liabilities. Not to mention, to close they might need to use higher risk lenders, that would also up their costs.

Has 3809 Ascot sold yet?

Generally the HPI is pretty good, but during fast market swings it seems to get out of whack. It was way understating the increase for quite some time on the way up. Not saying that’s the case now, just pointing out that no measure is perfect.

Initial proposal in 2013 I believe? Only took 9 years 🙂

Still confused why people think we can get meaningful price declines with 1.x months of inventory. We can’t. Maybe we’ll be at 2 months of inventory in May which should be enough to kill most of the bidding wars. Yes there are temporary swings in sentiment but true buyers markets are over 6 months of inventory.

Shawinigan Lake appreciation is wild. Shows how much money is sloshing around in the system as I would think most people don’t spend 2-3 million on Shawnigan for a primary residence but rather for 2-3 months of use.

Home sold this morning for $2,680,000

Previous sale on the home $1,300,000 in 2019

Previous to that advertised and expired after 363 days in 2014 (then purchased privately off market in 2017 for 860,000).

So 2017 to 2022 $860,000 to $2,680,000.

They approved Doral Forest park, which was outside the village and less walkable. I’ll be calling in to support if this makes it to PH.

You really glossed over the key part there which is that these figures are based on condos only. Not sensible to compare just the condo market in a country with 100x our population density IMO.

Also not convinced about the accuracy of Numbeo’s data, they have a lot of low-effort stuff. Seems like in Seoul the house price is 12 times the average income (http://www.koreaherald.com/view.php?ud=20200803000755). Pretty much the same as in Victoria (2022 median price is 11 times median family income assuming some pretty strong income gains the last two years)

Debt Monster,

You’re getting fooled (again) by average prices, by thinking that if average prices fall 6.26%, this means a typical home would have seen its value fall by 6.26%. The Home Price Index tracked by CREA actually fell only 0.6% in April, which would mean that a typical homes value would have fallen 0.6%.

https://creastats.crea.ca/en-CA/

“MLS® Home Price Index (HPI) edged down 0.6% month-over-month [March to April 2022] but was still up 23.8% year-over-year.”

Frank, I don’t have a tiger to sell, but I can sell you my rock that keeps tigers away for $1.8 million (it might keep them in the wild as well).

Whenever properties, no matter how many, sell for hundreds of thousands over list, it indicates supply does not meet demand. Weak demand would never produce these sales results. Tigers are my favourite, I’d like to own a couple but would rather they live in the wild.

Too funny, showing singular data points on properties selling over or for high prices is just about as valid as showing singular data points of properties selling under or for low prices. Reminds me when some folks here would post the one or two listings of Langford townhomes for around $750k and argue there were still ample affordable options. I have a rock that keeps tigers away, because whenever I hold that particular rock, I have never seen a tiger.

I wonder what part of the Island they’re moving to? Anywhere they want.

Proposal in Saanich -> https://www.timescolonist.com/local-news/developer-proposes-19-storey-mainly-residential-tower-on-med-grill-site-5394892

Kind of a perfect location for this type of density. Right next to transit, amenities including groceries a couple of minute walk. No need for a car essentially.

Classic NIMBY opposition comments online, doubt it gets approved.

“Terrible idea… that is way to high- will be an eyesore to the area. We need to keep Med Grill as there are not many restaurants in this area. Please reconsider”

And so on! I like when something isn’t convenient for people the housing crisis, environmental crisis and everything else gets thrown out the window.

21 yr old house on a 33′ wide lot for 4.2 million.

Ciena- Thank you, finally some real world examples. 200k-400k over ask for top end of the market properties. Obviously interest rates are not an issue for some. Yes, number of offers has decreased, even over ask percentage has also decreased. That’s because first time buyers with 10-20% down can no longer afford anything out there because a slight increase in mortgage rates has lowered what they can borrow. Other than pumping up the number of offers coming in (making the market look hotter) they probably weren’t big buyers. In B.C., if you haven’t acquired substantial equity in a property, you probably will never afford a mortgage with minimum down payment. That’s the reality out there. Prices will not adjust to accommodate people requiring a large mortgage that few can afford to carry. Unfortunately, housing is getting out of reach for more and more people. It’s like that in many countries around the world and is now a Canadian problem. Why? One reason is our high immigration rate. Population growth through immigration instead of child birth rate isn’t natural and creates imbalances in our society.

My main point is it doesn’t feel like Armageddon as the media would have you believe. Its not clear to me prices are on the decline in a meaningful way. I see some softening, but I also see competition and aggressive buyers.

There is quite a bit of doom and gloom here but as someone closely watching key Victoria & Vancouver markets, still seeing some blow out sales last 2 weeks. While I know sales have slowed still seeing most over ask or close. Some examples:

Victoria

5671 Batu

Listed 4.99M, sold 5.4M

851 hampshire rd

Listed 2.199; Sold 2.424M

4521 Cheeseman

Listed 1.625; Sold 2.1M

Vancouver

Listed 2.199;sold 2.447M

https://www.bccondosandhomes.com/listing/r2683251-1050-w-19th-street

Listed 3.9; Sold 4.2m

https://www.bccondosandhomes.com/listing/r2685283-3016-w-19th-avenue

Listed 1.99M; Sold 2.225M

https://www.bccondosandhomes.com/listing/r2687323-3664-mcewen-avenue

Really? This is false.

Ask Marko and Leo how long they think it would realistically take Victoria to build enough rental stock or housing to reach a 5% vacancy rate given the current stories they’ve shared around restrictive zoning and sidewalks that cost tens of thousands of dollars.

But, but, but that was only a 1/4% interest rate hike until the middle of April.

How can that be?

“It’s only a flesh wound.”

From: https://www.ctvnews.ca/business/what-to-do-when-your-home-appraisal-falls-short-as-the-housing-market-cools-1.5912304

THIS IS SPARTA!!!!

I believe that the rate of inflation in Canada is less than in America but that will not stop the Bank of Canada from raising interest rates. We have to have slightly higher interest rates in Canada relative to America to attract foreign investment.

If a recession happens what you may find is that the bank will want an appraisal performed on your property (s) to reset your home equity limit. Access to equity, if you have any left, will be a problem for people.

And you just might hear your lender saying that you own too much real estate and are now considered to be a high risk. Contractors and real estate agents that depend on real estate to make their living will find difficulty in getting loans in a recession as they are at higher risk of default. They may also cut back on the percentage of income from your investment housing that can be used to qualify for the loan.

A 10 percent drop in the value of one property is far less risky to a bank, than a 10 percent drop over 5 or 10 homes that you might own. And if the vacancy rate goes to 5% and your investment properties start to go vacant then you’re going to have to sell some off to cover your negative cash flow.

During a recession, it’s the bean counters that make policy.

No one was talking about average prices paid. The price to income chart I posted was in reply to Ted’s post comparing prices to income in Canada vs USA. Ted’s chart was all indexed to 100 so had no info regarding average prices paid either.

That numbeo chart has many tabs. One of them is mortgage payment to income, which is the exact metric you use for your affordabiiity chart. Click on that numbeo link , and you’ll see Canada has 19th most affordable housing out of 112 countries. For example, South Korea affordabiiity is very bad at 200%, compared to Canada at 50% (for a 1,000 sq ft condo). Croatia 100%, Portugal 75%, UK 60% also have much worse affordability than Canada. Affordability in these countries isn’t bounded by the same lines you use to imply extremes of Victoria “affordability cycles”.. https://www.numbeo.com/property-investment/rankings_by_country.jsp

These numbers are basically worthless. Has nothing to do with average prices paid

$1.15M

What did 4391 elnido sell for? That one you can actually reno into something decent for ~$100k.

Don’t forget credit spread.

A buyers market would be great for me to tap into my HELOC and buy another property so I guess I’ll just wait until this summer and make it happen, thanks for the heads up DM.

lol what is this BC Ferries or core government?

Question for the realtors in this forum: Have you seen successful offers that have financing conditions attached happening a little more these last few weeks?

Marco Juras

Only for those that are actually paying attention.

The interesting thing is that nobody pays attention until they have to face it. Perhaps, they want to combine some other credit products into their mortgage, perhaps renewal is coming up, maybe you want to take money out of your heloc.

The crunch is coming.

newhomeowner

Perhaps, my friend, you haven’t been paying attention to Leo’s charts. After a 1/4% and 1/2% rate increase :

Wk1. Wk2

Sales to New Listings 50% 48%

Sales YoY Change -24% -27%

The next 2 rate increases will effectively freeze the Victoria housing market or, more subtly, turn it into a buyers market. Lol

Both you and Marco, boots on the ground, have demonstrated via employment opportunities and consumer spending why the BOC will continue hiking rates.

The falling home prices in Ontario and B.C. Will simply bring them in line with the national average and Macklem will continue his rate hikes past September.

My opinion is that we will not see a significant decline in prices until the vacancy rate increases. It’s when basement suites become vacant and the home owner is not able to lease them for the same rent things start to get ugly. A higher vacancy rate has an immediate impact on house prices as the home owners are not able to make their mortgage payments.

Higher interest rates take longer to impact home owners and only become a problem at renewal time. If they are just making the payments today when it comes time to renew they have to either pay down the mortgage or sell. If they are under water by $500 a month a month then they would have to pay down the mortgage by some $100,000 to lower their mortgage payment by $500. I don’t think many people will be able to do that.

If vacancy rates are rising and their suite goes vacant then they will have to the same in just a few months and not at renewal time in a couple of years. A higher vacancy rate impacts everyone that overly relies on that suite income at the same time. That could cause a market crash as a ton of listings hit the market at the same time.