Months of inventory or sales to list: which is better?

Both months of inventory and the sales to new listings ratio are indicators of market balance correlated with subsequent price movements. But which one is more reliable? And how do they behave when the market changes? Let’s take a look.

First the definitions and a brief overview of how to interpret the values.

Months of inventory (MOI) is simply how many months it would take to (theoretically) sell every property on the market at the current sales rate.

MOI = sales / active listings.

Generally 6 months of inventory is seen as a balanced market, with prices increasing roughly at the rate of inflation, with lower numbers indicating a sellers market with prices rising, and numbers higher indicating a buyers market with prices falling.

The sales to new listings ratio (SNLR) is also a measure of market balance, but instead of showing sales relative to all listings on the market, it is relative to new listings that came online that month. In other words

SNLR = sales / new listings

Around 50% is a balanced market, with higher values showing a tilt towards sellers and vice versa.

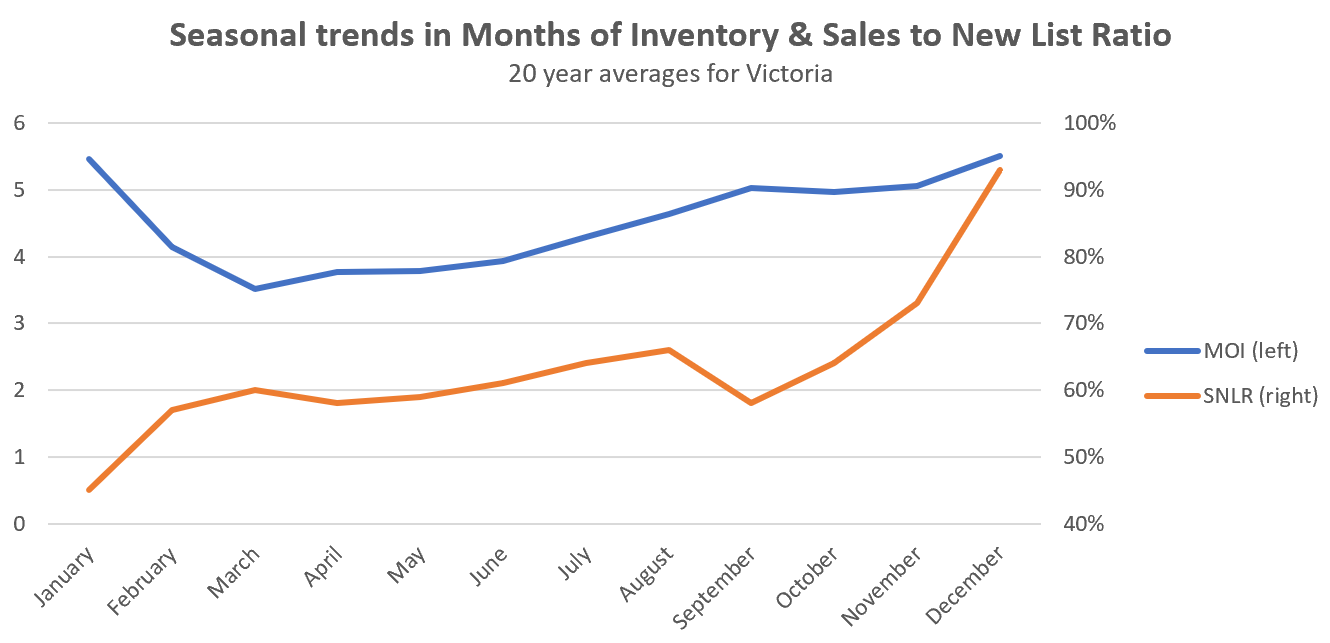

Before we get into discussing how these indicators behave, we need to acknowledge that both of them exhibit seasonality, with especially the sales to new listings ratio varying drastically over the year.

There is absolutely no point in relating the sales to new list ratio to prices without removing seasonality. If we naively looked at the raw data we would have to conclude that every year swings from a buyers market in January to an extreme sellers market in December which of course is not true. On months of inventory I am less convinced that seasonal adjustment is strictly necessary as changes may actually reflect some true weakening in the market into the winter, but the patterns are regular enough that adjusting for it gives a smoother signal.

How have they behaved in the past?

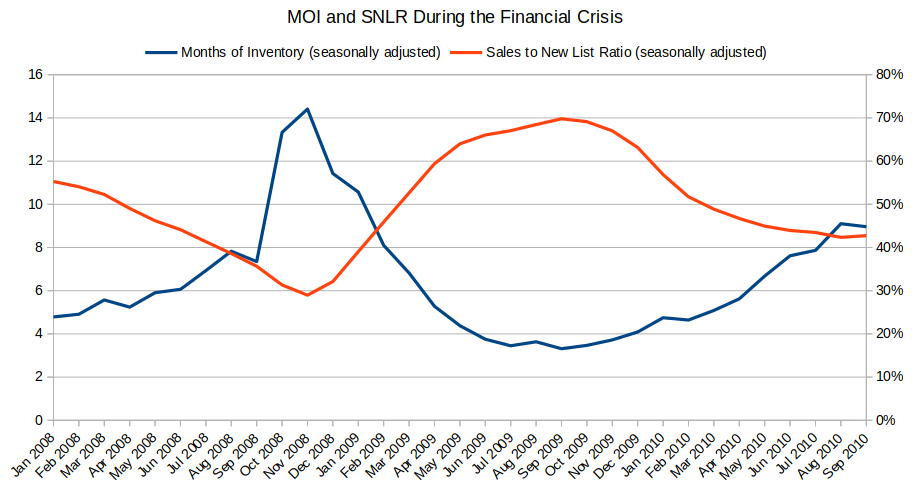

To see how these metrics have reflected market changes in the past, let’s look back at a time when there were several changes in rapid succession: the Great Financial Crisis. Throughout 2008, the market was slowly weakening, with months of inventory moving upward while the sales to new listings ratio gradually declined. When sales absolutely collapsed in October, months of inventory more accurately captured the magnitude of the market change. In that case everyone stopped listing properties at the same time so the SNLR looked somewhat innocuous in comparison. After that, both measures moved roughly in tandem, starting to recover at the end of 2008, then reaching peak heat during mid 2009, and gradually cooling again into the market peak in 2010. There wasn’t any compelling reason to prefer one over the other as an indicator of the market, as both signalled similar things.

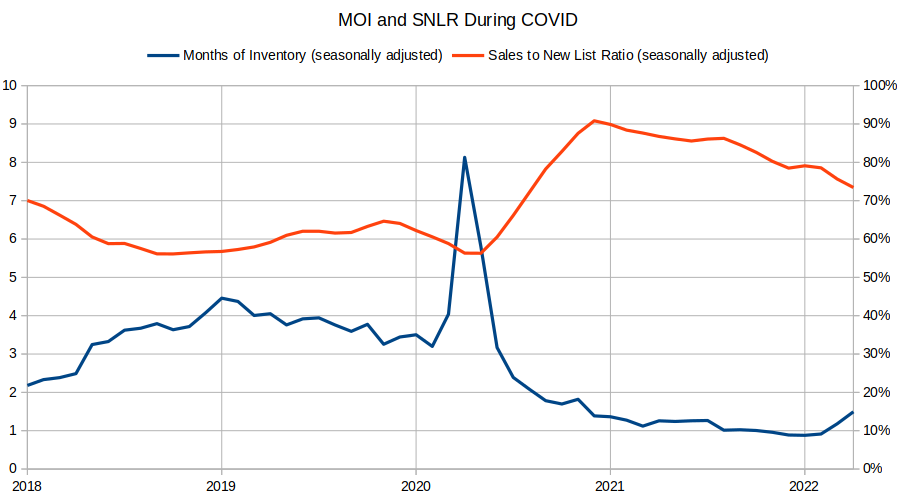

Looking at the same metrics during the COVID period is also interesting. After the mortgage stress test hit, prices were knocked flat for about 18 months, but neither measure served as a great indicator there, remaining in sellers market territory for most of the period. During the acute lockdown in April 2020, we saw another example where MOI was conveying the real market disruption and the following whip-back more accurately than the SNLR, which hardly budged at all as sales and new listings moved in concert. After 2021 the SNLR again become somewhat misleading, continually dropping more due to extremely low inventory that constrained sales rather than any weakening in the market.

How do these metrics correlate with prices?

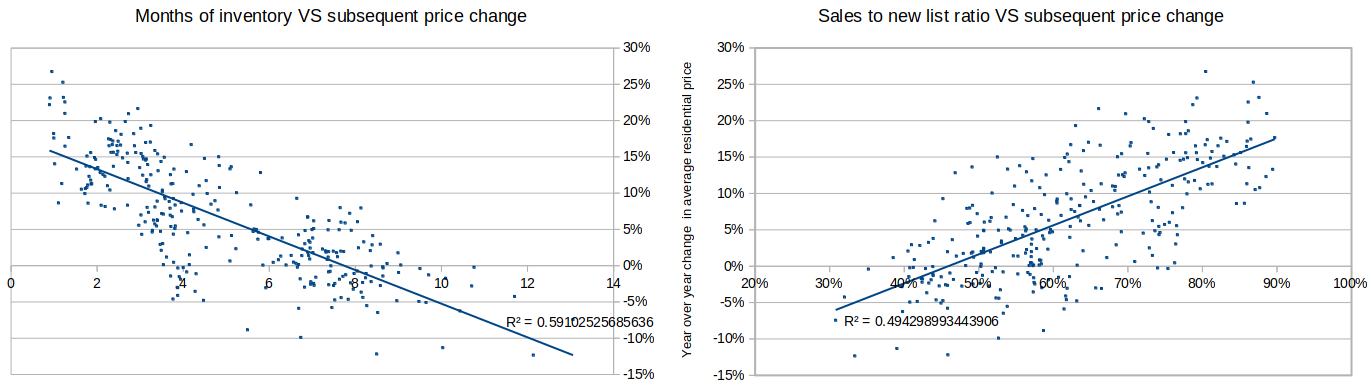

What’s interesting about these metrics is not the values themselves, but how they reflect market balance, and thus price changes. Charting the last 25 years of data and subsequent price changes, we can see that both are correlated with prices, though as always the relationship is noisy. Reflecting the observation that MOI seems to reflect market conditions more accurately, the fit on the months of inventory chart is somewhat better. However it’s worth noting that we are lacking data at high months of inventory, simply because we haven’t had a lot of extended periods with strong buyers markets in that time. I suspect if we had more data the slope of the best fit lines in both charts would be somewhat steeper. Measuring price change using the year over year change in the smoothed average is another source of noise, as the market often changes more rapidly during the year.

Overall then it seems that though it isn’t perfect, months of inventory provides a more accurate view of the market than the sales to new listings ratio. The sales to new listings ratio is prone to distortion during crashes and when there is so little inventory that it constrains sales. Also important but more difficult to take into account is the trend in the metric. We still have extremely low months of inventory, but the cooling trend makes me think we aren’t going to be looking at big price gains 12 months from now.

Also the weekly numbers courtesy of the VREB.

| May 2022 |

May

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 176 | 1049 | |||

| New Listings | 351 | 1333 | |||

| Active Listings | 1451 | 1450 | |||

| Sales to New Listings | 50% | 79% | |||

| Sales YoY Change | -24% | ||||

| Months of Inventory | 1.4 | ||||

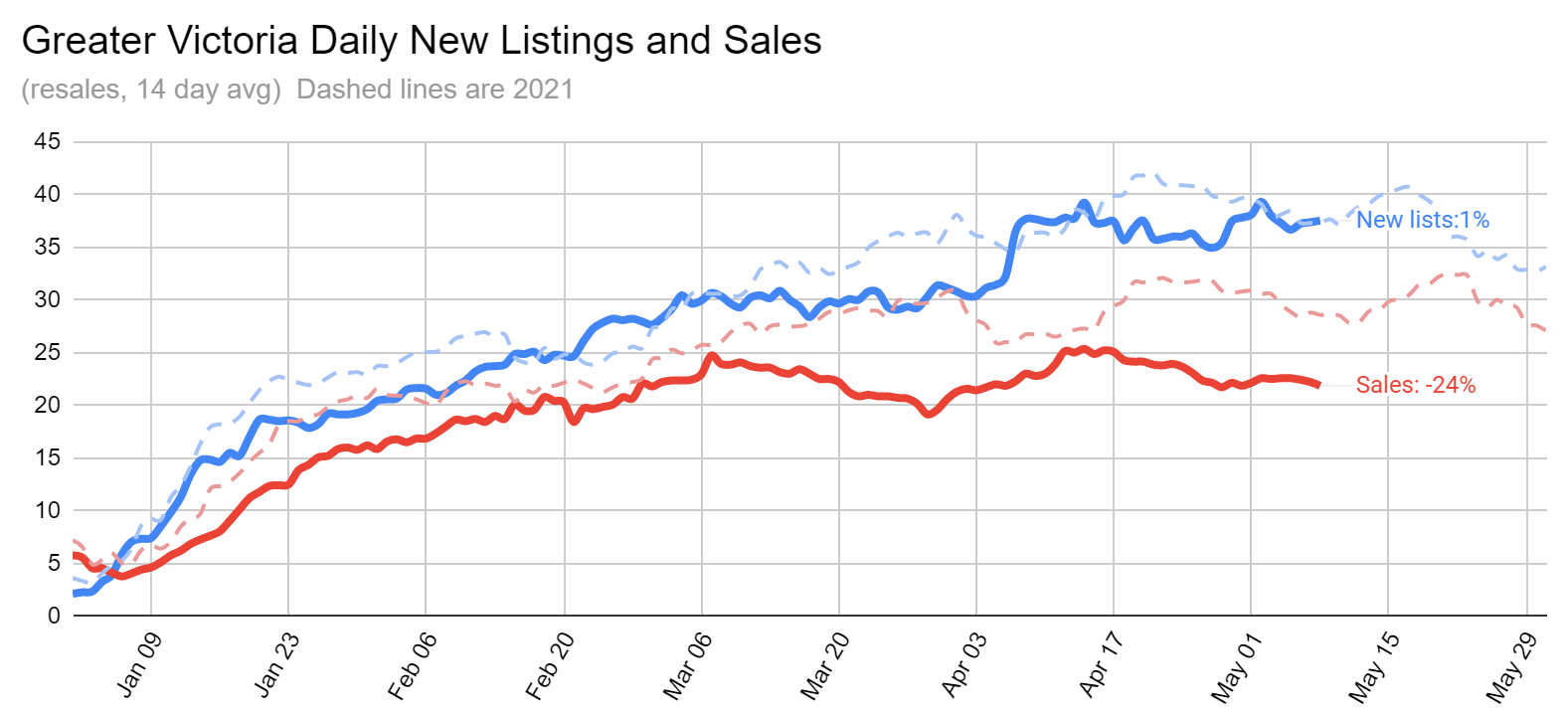

Not too much change in the market from the end of the month, with new listings coming in at the same pace as this week last year, while sales are lagging substantially. The gap between new listings and sales continues to widen, as it has been all year.

Inventory continues to build, with this week coming in down only 3% from the same week last year. This will very likely be the last week of record low inventory, and I’m looking forward to a long period of increasing selection for buyers.

I’ve talked before about how inventory usually builds very slowly, but I’ve been working through old newspapers from the 80s to fill in the inventory data gaps, and I should have more to write on how inventory behaved back during our only real estate crash pretty soon. Stay tuned.

Frank, if you had 300k for a rental/investment property today, where would you put it? Take a look on realtor.ca and tell me where you think there are workable properties for that. Pretend I just got divorced and netted that from my house sale + don’t know where to put it… 🙂

New post: https://househuntvictoria.ca/2022/05/16/new-and-active-listings-what-happened-during-the-crash-of-81/

I guess if Vancouver prices collapse, Victoria and the Island would follow. Have Vancouver prices collapsed? All the new immigrants who have moved to Canada in the last 30 years have suddenly gotten the urge to move back to China so they can be locked up in an apartment for months. Millions of people want to come to Canada, few are planning to return to the oppressive regimes they fled.

Noticed you left out the part of my reply pointing out how ridiculous your logic in your previous post was (you refer to this as trolling), but glad you’re having a chuckle

I run houselovevictoria.ca but it doesn’t get nearly as much traffic.

The articles take less time to write though.

March update: who cares hug your spouse

April sales: immaterial, just be glad you have a roof over your head.

“Whatever happened to people just loving their house because it is their home with memories of friends and familly?”

“

“

TV home shows for one thing made people feel that their current homes were inadequate. Then people stated looking at their homes as an investment rather then a place to live. I for one would welcome a very large correction in home prices or a capital gains tax on peoples PR to reduce our obsession with real estate.

Ahh, always back to your semi-hostile different way of knowing in trying to interpret things that aren’t actually written to fit a your view of what must be. However, your not so vague trolling attempts are always worth a chuckle… I hope your day is going well.

Household sizes are flexible and can respond to market conditions. Demand can come out of the woodwork if prices are rising and everyone is buying, but can also collapse again when things go south.

Whatever happened to people just loving their house because it is their home with memories of friends and familly?

Someone that bought within the past decade has been building equity in their home and is most likely also saving and investing. Buying in the last couple months, sure there are probably some people desperate to hold onto the home they live in so I would imagine they’ll do anything to keep it, not sell. I can’t say I understand the moral high ground you seem to be standing on recently because you have down payment and some investments (again, who doesn’t?) as interest rates rise. You seem to be one of those people that thinks they can time the market, so good luck I guess. Looking forward to the triumphant update this summer that you’ve bought a home and are only a decade behind those that “sacrificed” saving and investing…

I’m just curious where all these sellers are going to live, what their alternative is. Or is everyone moving to Moncton.

There are a few contradictions in that one. So, if 60% won’t be selling, you don’t think a number up to 40% selling would be significant? (I am not saying either number is accurate) Not sure the where the point was going on the 30% of renters staying put? Do you mean rents stay consistent for the investors or that 70% of renters are looking to buy to take up any listings? As for properties not being equities, that factor results in the opposite of what you asert, the illiquid asset (a house) stagnates on market as other listings join it because the cash strapped person has no choice due to increasing costs. This building listings and inventory. Since a lot of people in the last decade sacrificed saving and investing in order to obtain a house, selling becomes their only option when hit with hardship.

Yep I do question how much luv there is when things go south When it comes to money people can be fickle

Disagree, you don’t know what people would do when things don’t go their way. Victoria market hasn’t experienced a meaningful sustained rate increase in a very long time. It’s like the stock market when people say “I love this stock, if it goes down then its on sale and I just buy more”, when it actually goes down for real then more time than not people would just sell.

For people that bought say 10 years ago and and can cash out with close to a million dollar gain now, if they see prices start to trend lower with no end in sight, do you think they will all hold tight and not cash out to pocket the gain now?

In a softening market, this would set the price ceiling for the neighborhood. Lets see if that rings true or not.

I find that Victoria prices are slow to adjust both ways, we were behind the 8 ball compared to Vancouver, Toronto when prices were increasing in 2016-2017 and 2020/21, we were also slow with the price declines in 2018/19 so I bet we are just slow to the current decline too. Toronto market experienced what we are currently experiencing in late Feb/March. I bet if all things staying the same and we get the next 50 bps hike in June then we are going to see some serious build in inventory.

I would say 60+% of homeowners have no intention to sell their properties because rates are going up. 30+% of the renters are content with their accommodations, which leaves a small percentage of investors, flippers, etc.. that may want out. I don’t think they represent a large enough contingent of owners that can move the market significantly. Maybe for a few months at best. Property is not like equities that can be dumped onto the market in one day. Unlike property, equities have little use, especially when they are out of favor.

Folks that were planning on selling see the potential for flattening or declining declining values bring their sales forward. Investors planning flips see carrying costs increasing, but their potential end sale price dropping. Folks that planned to rent properties that factored their costs on 1 year variables that were below 1%. People that maxed out their HELOCs and now are in a debt trap and need to sell to hold off a default. And more…..

Caught my eye as those were about the numbers in Vancouver when I got into the market.

With 25% down your mortgage would be $960 a month. But in Vancouver you could rent the house for about $1200 a month.

Millenialhomeownerx2

Sorry, I added $1000. for a flat fee commission service and didn’t factor in the other costs. You’re right … ouch.

Frank

That’s what the real investors are thinking and/or hoping I’m sure. See Patriotz post.

patriotz

May 13, 2022 5:53 am

https://www.theglobeandmail.com/investing/personal-finance/young-money/article-helocs-have-us-complacent-and-greedy-about-debt-theyre-now-a-defining/

The loss would have been far greater than 191k when you factor in property transfer tax, realtor fees, legal fees.

Frank

That’s all it takes Frank. This person took a $191,000 loss in 84 days. Regardless of the reasoning, I couldn’t imagine that the sellers were wanting to liquidate the property at a loss. They were hoping for a bidding war and apparently the market didn’t recognize the value.

I’m sure that the realtor advised his clients of the change in the market. Sell for $1.81 M now or sell for $1.6M next month.

997 Amblewood sounds like a relationship problem necessitating the property to be liquidated. This is one of the ways properties come up for sale. My current tenant recently sold her property due to marital problems and was thankful my property became available in her neighbourhood.

Any investor playing in a seven figure market like Victoria should be well capitalized. If they have been in the market for several years, they would have made a pile of money and have some sort of a cushion. I don’t think many novice investors are running to the bank and getting a pile of money to gamble on a million dollar property, banks aren’t that easy to deal with. And who has $300,000 lying around for a down payment. They can easily get substantial rental revenue to ride out this current “high” interest rate environment. When I started, with a $120,000 house at 12.25%, I fully expected to be cash flow negative. Given the difficulty in buying a property, an investor would be foolish to liquidate a solid future investment. You have to weather downturns if you want to make future gains.

997 Amblewood sold for 1.81 M in 4 days.

As Leo stated:

“Listed February 16th at $1,595,000

Sold feb 22 for $2,000,000

Listed May 12 for $1,788,800. Offers on the 16th”

So those sellers took a loss from a few months ago. I wonder what happened to make them sell so quickly.

$1.251M

Hello, Thanks for the interesting read.

Would someone be able to tell me what 679 Vanalman Ave sold for? Thank you!

Maybe some of those cash flow negative investors want to get out before they have to renew?

Why would increasing interest rates induce an increase in new listings?

I am not referring to active listings but new listings.

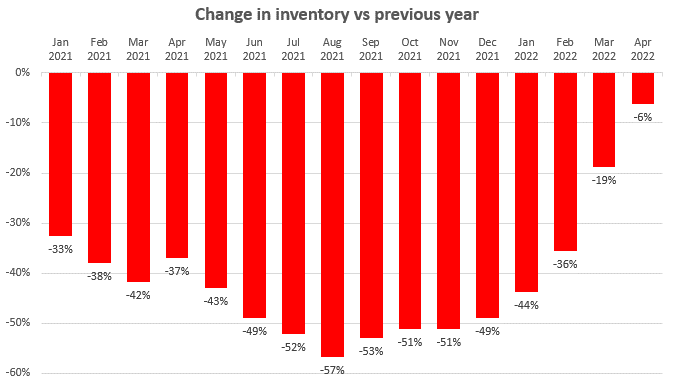

We were still losing listings 2 months ago. A reversal is news.

Keep in mind last year at 1,333 other than 2020 (covid lockdown) was the lowest new listings in 15 years so we are 12% higher than a very low baseline, aka new listings not flooding the market as one would suspect with interest rates going up.

Month to date numbers:

Sales: 364 (down 27% from same week last year)

New listings: 752 (up 12%)

Inventory: 1584 (up 5%)

New post tonight.

None of this is new, but below are a few salient snippets I liked from this article.

Don’t worry, no HHVers exhibit any of these characteristics or tendencies 😉

The human flaws that fuelled this market crash – and why they keep failing us when investing

https://docdro.id/knzLzEm

https://www.theglobeandmail.com/business/article-the-human-flaws-that-fuelled-this-market-crash-and-why-they-keep/

I think we once played the game “What does lumber cost at different Home Depots across Canada?” and learned that the price is uniform.

Kenny- Their decision to take out a large mortgage I agree was unusual. The point I was making was they had the financial resources to move to Kelowna. I hope their plan doesn’t backfire on them. At least the property has appreciated 50% so they have a lot of cushion.

As I understand it, the definition of the benchmark home changes over time, including size of home and land size.

They review the model each year. https://www.crea.ca/wp-content/uploads/2016/07/HPI_Methodology.pdf

Do you have any data on if/how the benchmark home parameters have changed over time? People assume the benchmark compares apples to apples but maybe the benchmark home is getting smaller w/less land, but might have some better features too?

Frank, you friend is atypical of most seniors moving to BC, or seniors in general. Most people of their age at almost 70 would generally be uncomfortable with a large mortgage or mortgage debt in general, even in situations where debt may make financial sense. There are of course exceptions to this but this is definitely unusual. I deal with older clients like your friend all the time, hopefully he has gotten outside advice and deals with an experienced advisor. The other issue is both spouses may not see things the same way and if one spouse is uncomfortable with debt it may place tremendous stress on the marriage. It’s quite normal at their age for the decision making spouse or both spouses to want to make sure that the other spouse will be financially ok in the event of their early death, this doesn’t seem the case here.

The MLS HPI benchmark would not be affected by sales mix changes so look at that

https://www.theglobeandmail.com/business/article-pandemic-housing-boom-winding-down-as-canadian-home-prices-drop-for/

Right. It would still be a good move – looks like 10 years are about 4.75%. https://www.ratehub.ca/best-mortgage-rates/10-year/fixed

There are lots of people who prefer variable rates. but they are (hopefully) financially able to withstand high rates. If rates higher than 6% would mean that you’d be unable to pay your mortgage, and losing your home would be a big deal, I think it’s a smarter move to lock in the rates for 10 years.

I’ve been saying for a long time that anyone buying needs to account for the possibility of more normal interest rates, and 6% is anything but abnormal. I think most owner-occupiers would be able to hang on at that rate but I don’t have a lot of sympathy for those who wouldn’t.

As has been pointed out on this forum, buyers had the option of getting a 10 year term at historically low rates which would have virtually eliminated interest rate risk. Such a great deal yet so few took it up.

Barrister,

Yes, I don’t think there’s any good news in interest rate hikes above the “neutral range” of 2-3%. I don’t think many people would be happy to see homes opening up because others are losing them to foreclosure. Thanks for the discussion.

There is one thing that comes to mind when I think about the new museum plans and the crazy timing of it.

I have always felt that governments should build big projects when times are tough. Not when the construction is booming and it’s hard to get workers and material costs are at all time highs.

So… it leaves me wondering if our governments are aware that a major crash is coming?

Is this a sign?

(I’m not sure any government has that kind of foresight and are that smart though:)

But it does run through my mind.

Otherwise…. making plans for such an expensive, massive project like this…… at this time when construction companies are frantic trying to get enough workers ……..does not make any sense.

Just a thought.

What appears to be falling prices may be due to a slow down in sales of expensive homes. Without the multimillion $ homes sales, overall averages appear much lower. If the average drops from 1.5 million down to 1.2 million, that doesn’t mean areas where the houses were selling in the 1.5 m range, are all of a sudden selling for 1.2 m. A more in-depth analysis needs to be done by neighborhood. It depends what kind of spin one wants to put on raw data. Expensive homes don’t even have to sell for less money, just at a much lower number of sales, which would also skew an average downward. Averages can be deceiving.

Corporate political contributions are no longer allowed in BC. Back when they were, guess who got the big contributions from construction companies.

https://www.nytimes.com/2017/01/13/world/canada/british-columbia-christy-clark.html

I don’t think it’s any cheaper in Toronto. So why are prices falling there?

My friend and his wife moved to Kelowna in February 2020, just before covid. They had sold a property in Arizona a few years ago and did “well”. They sold their property in Winnipeg for $700,000, and bought a place in West Kelowna for 1.4 million, which shocked me. He told me they had the cash to pay off the house but decided to take out a 1 million mortgage at 2.5% and keep their money invested. At 66, I didn’t think banks would lend that much to someone that age. My friend works, his wife is retired. One would think that he is a prime candidate to get hit in this situation. His investments have lost value after a good run but his mortgage is set for a few more years. Plus his $1.4 million home is now worth $2 million. I don’t think they are too worried, in fact, depending how much they have in cash, the increased rates would make them more money. They are probably a prime example of the type of people coming to B.C. from across Canada.

Ha. Banks take a haircut? Unlikely. More likely they increase amortizations so to reduce payments but actually earn more interest over the life of the loan.

I’ve never seen this – most ‘rule of thumbs’ say 1% increase in rate and a 10% drop in price. But that rule was around when mortgages were 4 or 5% percent so a 1% increase was a 25% percent increase in interest payment on a smaller loan. Now we have million dollar loans at 1.50% so a 1% increase is a 66% increase in interest. Could make an argument it’s more than 10% now imo (if u believed that rule in the first place.). These things get even more difficult to predict once you add in things like qualifying rates.

Just my 2 cents:

1) 100% rates are going up

2) 100% that there are 2 differing views from “economists” and “analysts”; take it with a grain of salt what the experts say

3) 100% banks are corporations which primary motive is to make profits which means they make the difference what what they pay to savers and what they charge borrowers.

The only way they would raise rates is they are “forced to” by the BoC. They are not going to want to write a big part of their book off because of declining asset prices and will do everything they can to mitigate that risk. So what does that mean for the average borrower:

a) they’ll give you a % at their cost or slightly above it as not to risk their portfolio (e.g. prime is 3.5%, you’ll get somewhere close to that). So unless that prime rate goes to like 7.5%, no one is seeing an 8% mortgage.

b) as RE prices are sticky and only a small amount of it comes for sale at any time, there will be “some” bargains, but don’t expect a system wide meltdown.

c) if % go up, and pmt amounts go up, guess what? Are you going to sell your house? Maybe. Are you going to ask your boss for a raise or a look for a job that pays more? Definitely. This will have more pressure on core wage inflation.

d) a simple rule of thumb, very rudimentary, is for every 1% mortgage rate increase, expect a 3.0%-3.5% decrease in RE values.

So for values to plummet by 35%, you need +10% increase in rates.

Yes, it is an over simplification, but is something that is used by asset managers. So you can use this tool to size up the probability and the size of a correction that could occur in the near term. Good luck everyone.

@Debt Monster

I’m starting to think Debt Monster is Hawk after all.

What the banks post and what you pay is usually less, around a point lower. All this prognosticating about mortgage rates and the housing market is like predicting who’s going to win the Stanley Cup. We’ll find out in June when it happens. In the last couple years if you didn’t lock in the lowest rates ever, well, you deserve to lose your shirt. I’m certain Victoria’s property will remain flat, worst case scenario.

Patrick, I spent over thirty years working on Bay Street and it is not a catch phrase for just the banks (although it includes the banks). it is the markets and the corporate law firms and the private finance as well as major corp headquaters. There are major investment houses involved as well. Sorry, but you are absolutely mistaken if you think the term refers to just the banks.

Nobody, and especially me can predict 5yr mortgage rates but you must appreciate that the banks projections are somewhat tailored to create perceptions. Some of my friends are extremely knowledgeable but nevertheless it is still guesswork.

But I honestly hope that we dont see 6 much less 8, but since Scotia is already past 4.5 then I cannot honestly say that six is out of the question.

Patrick

We’re at 4.5% and there is no housing crash.

Here is the way this is going to play out …

After the next 1/2 % rate increase, housing supply will increase, noticeably. Then after a similar increase in rates in July, inventory will be considerably higher and prices will be dropping.

Come September, Macklem will continue to raise rates while acknowledging a pronounced slowdown in the housing market. Vancouver and Toronto markets will be down by 15%. Victoria always lags … and it will follow.

Come October and November, with inventory at very high levels everywhere, the Real Estate Boards will have to acknowledge “a much needed correction in prices”.

By the end of next year … Ontario and B.C. will be entrenched in a very big crash.

Thanks for the reply DM.

We have actually found “common ground”. If your prediction of 8% mortgages comes to pass, I share your view of a crash coming to house prices. And if we get 4.5% mortgages, there’ll be no housing crash.

fwiw,

—- An 8% mortgage costs 70% more per month than a 2.5% mortgage.

— An 8% mortgage costs 40% more per month than a 4.5% mortgage.

Winnipeg has the Human Rights Museum which cost around $400 million several years ago. Plus $20,000,000 a year to run. Less than a mile away, there are people living in squalor, tent cities all over, crime like crazy, it goes on and on. Some construction companies are going to get rich, I guess that’s the payback for hefty political contributions. The system is so corrupt.

Guessing the actual costs will be 30 to 50% higher by the time it’s done, and it will take several years longer than they anticipate. I also wonder what kind of museum they are going to make – one that shows representative aspects of history in a interesting and factual manner while having a little fun, or one that’s primarily focused on “the message”.

In any case, I think health care is a greater, almost emergency priority at the moment…

I haven’t seen any mention on HHV about the BC government’s plans for a new museum and the $800million dollar price tag for that. (Maybe I missed comments)

Besides the “horrendous” costs for such a building, I am left wondering what will happen when the projected two thousand construction workers are pulled out of the housing sector. (That is the number of workers that the government mentions.)

I am shocked that they would spend this much on a building when we have so many homeless people on our streets without housing. I’m also shocked at the price when I’m told that in general, it costs around $20million dollars for each floor for a New York skyscraper. I realise that a museum might have special needs but the numbers seem completely out of whack…especially when you look at similar museum projects Nationally and internationally.

The cost seems odd and I smell a rat somewhere.

Have we all gone crazy?

Went to Home Depot today. 2x4s $13.00+. Sheet of OSB $43+, there ain’t no way housing is dropping in any significant way. It probably costs double to build a house from a few years ago, if you can source some of the necessary fixtures. I’d put money on it. With today’s shortage of inventory and plenty of affluent buyers, if anything, prices will rise.

Patrick

http://www.scotiabank.com/ca/en/personal/rates-prices/mortgages-rates.html

Term Rate

1 year 3.840%

2 years 4.490%

3 years 4.590%

4 years 4.790%

5 years 4.990%

7 years 5.490%

10 years 5.890%

Well, considering Scotiabank’s mortgages are already over 4.5%, I would have to suggest that the market won’t crash at that rate but they are certainly starting to turn over.

Well, here’s what you said

“For the moment, the talk on Bay Street is to expect six to eight by the beginning of next year. That is what I am hearing from TO.”

… and as we know, the term “Bay Street” is the catch word term for the Financial District with the 5 banks

https://www.investopedia.com/terms/b/baystreet.asp#:~:text=What%20Is%20Bay%20Street%3F,the%20U.S.%20financial%20services%20industry.

What Is Bay Street?

—Bay Street lies at the heart of Toronto’s downtown business district and is often used as a catchword for Canada’s financial industry, just as Wall Street has come to be a shorthand for the U.S. financial services industry

—The area around Bay Street houses five of Canada’s main banks: the Bank of Montreal, Scotiabank, Canadian Imperial Bank of Commerce (CIBC), Toronto-Dominion Bank (TD Bank), and the Royal Bank.

—- When individuals refer to Bay Street, they are typically referring to economic and financial topics in Canada.

Patrick, I absolutely never said that the banks were predicting rates of 6 to 8%. Perhaps you might want to read my post more carefully.

Debt Monster,

Thanks for the reply, but you didn’t answer my question.

My question was

– if you are wrong about MORTGAGE rates rising (to say 8%), and instead they only rise to 4.5% (as some others are predicting)…

Q. Are you still predicting a house price crash?

Patriotz

Absolutely does. The builder that I bought my first home from bought down the mortgage rate by 3%. He had already dropped his price by 45%.

Patrick

Honestly, the only one that I pay any attention to is the BOC Governor, especially when he is trying to deal with an inflation problem that he is admittedly behind the curve on. As “Umm..really” has already pointed out, even in the event that the BOC could put the brakes on rising rates, the bond market is the animal you have to tame.

If Canada puts the brakes on rates while the US Fed continues, then the depreciated dollar will simply import more inflation and the Bond Vigilantes will simply force Canada’s hand in raising yields on their bonds. Either scenario will include higher mortgage rates. Macklem is well aware of this and he will be moving in tandem with the USA.

Come June 1st, Macklem will raise rates another 1/2 percent and on July 13th he will announce the same kind of “outsized” increase in rates.

At that point he will have until September to determine whether the rate increases are having the desired effect. We have only seen a 3/4% increase in interest rates and already the major markets are starting to roll over. Market sentiment works both ways and it has already changed.

You certainly are consistent, sir. “You’re wrong,” or, “You’re right, except you’re actually wrong,” or in the case above, “you’re wrong, except you’re right”.

You do like to simply contradict people, haha. Reminds me of one of my favorite Monty Python skits, “Argument Clinic”…

Increased prices increase demand. In other words the more expensive housing gets, the more people expect prices to go up and the more they are willing to pay. Until they simply aren’t able to pay.

People were resorting to increasingly desperate measures to compensate for the higher rates – e. g. financing from parents, buying with a partner (which I almost got into). Housing was considered to be the only safe haven from inflation. Eventually they ran out of tricks. Sound familiar?

The point is just because higher rates didn’t sink the market immediately it doesn’t mean that higher rates didn’t sink the market. It’s always about affordability.

Increased prices and interest rates do decrease demand, but increasing prices and interest rates can overpower that due to the “fear of missing out” factor. It is an unstable dynamic.

The music always stops, though.

This one, May 7, 1981. Ironically the collapse was literally days away.

I think it’s a difference between short term and long term. Short term they weren’t needed. If it’s a bubble it will burst by itself.

But long term even the 30-40% crash in prices did essentially nothing to solve the housing problems we have today. We need those reforms to change the long term trajectory

When we were looking for those articles, one of the things that stuck me was the range of debate there was on policy solutions to high housing prices. A lot of very clever people with all kinds of ideas – build supply, reduction of red tape, rent controls, new taxes, you name it. It wasn’t really different than the discussion we have today, other than this time around it’s been going on quite a bit longer.

The point is, in the end, the market died of its own volition. Few of those policies were implemented in the end, and they weren’t needed either. We have the same conversation every market top, like we’re experiencing it for the first time.

I might be alone in believing that it wasn’t really interest rates that killed the housing market then, because prices were exploding upwards as rates got higher; even soaring past 17% it showed no sign of slowing down. There’s several articles I recall finding (you might even have them still) that specifically mention, with apparent bewilderment, that despite steeply climbing rates the housing market appeared to be unstoppable. Until one day, the lights just went out.

Market exhaustion is a powerful thing…

October 1981 arguing for a cap in the tax free gains on a house.

To be clear, my post of the 6 banks projections was only in response to a poster saying that the Bay Street banks are predicting rates of 6-8% in a year. Because that is just factually wrong, as they are predicting 3% BOC rate as I showed.

Yes of course noone knows the future, and that is especially true for rates and inflation. So feel free to accept 8% rate projections from Debt Monster, and ignore the consensus of 4.5% 5-year rates from the 6 big banks.

But our discussion of rates and housing should at least not accept the false statement that the 6 banks are predicting rates of 6-8% in a year.

Good post Local Fool. No one knows the future. If you think there is a chance with the situation you are in that your mortgage payments will be increasing substantially within the next couple of years, and you are unable or don’t wish to sell your home, then immediately start to live a little cleaner if you can. If you don’t have a budget then sit down and make one out. Then eliminate or reduce things that you don’t need or rarely use. For instance, you don’t need NETFLIX. Get a GVPL membership. You can Access your account from phone or computer. There are literally thousands of movies, mini series, & TV series there for you and they are FREE. Try it. If you have much of your debt in credit cards, start paying down those debts as fast as possible starting with the ones charging the highest rates. After you have paid them off, rip them up all except one for emergency use only. Then pay only by debit card or cash. If you have two cars, sell one and buy a bus pass if need be (or maybe walk or ride your bike?) If the price of groceries are getting to you, get creative. Never only purchase at one grocery store like Thrifty’s. Not the thrifty thing to do for sure. Watch all your flyers. Grocery stores put the same stuff on sale all the time. They rotate their sales items. Lots of times say the Market Stores will have beef, pork & chicken cuts at almost 1/2 their regular price. That’s when you pick up those nice steaks for a treat. Always make up a grocery list and don’t waiver from it. Be aware of points, rewards & coupons. Buy only what you need. For instance if you use your CIBC debit card (or credit card) at Save-on Foods; you always get double the points.

Learn how to make great stews, soups & casseroles. Its creative, its fun, its something two or three people can do together and you get a wonderful meal out of it.

Pack a tasty lunch and take the kids to Goldstream park or to the beach on weekends In turn, cancel the $5K holidays until you really can afford it. My Dad used to put up a little pup tent in the back yard and my girlfriend and I would lie there in our sleeping bags with a little battery light and talk until 2 o’clock in the morning, then fall asleep and wake up to the fresh air. We had a ball. (So did the dog).

Anyway, I am sure most of you know all of what I have said. But sometimes I really wonder…….

Exactly. Krugman is 100x smarter than I am but it doesn’t change that the majority of the outcome is dependent on unknown unknowns.

Debt Monster,

You are calling for big rate increases so that people will be paying 8% mortgages, and house prices may fall 50%. I’m willing to accept that this is possible,

But are you willing to accept that rate forecasts can easily be wrong, and that this must also include the possibility that yours is wrong too, and the banks may turn out to be right (even from a lucky guess), and that the highest mortgage rates will be only 4.5%.

I ask because I’m curious as to what you think will happen to house prices under that 4.5% mortgage rate scenario? Does your housing crash still happen without the big rates?

The even bigger issue is almost no interest rate forecast from any major Canadian think-tank in the last 15 years has turned out to be remotely close to accurate. There’s no reason I can see to suspect that anything has changed.

Those projections that are being posted are worthless IMO, and going back and forth on it is debating in a vacuum. Expect uncertainty. Expect market manipulation by central banks. Pay down debt. Don’t use your house as an ATM. It’ll be what it’ll be, regardless.

The issue with any projections right now will be accuracy because of the current state of uncertainty driven by inflation. Many of the forecast for bonds and rates were predicated on the so called “transitory inflation”. If inflation remains out of control, those bond rates will need to increase on order to find a market to want to buy the bonds. It’s a really interesting policy watch right now, because it all ends with increasing rates. Trying to tackle inflation? Well, interest rates set by central banks will increase… Oh wait, what if central banks don’t increase rates and inflation continues to rip unchecked? Well, in order to sell the bonds that back lending, the lenders need to increase the return to investors by increasing rates because they have falling too far behind inflation. Either way, it ends up in the same place of escalating rates without any real reasonable guess on where it might stop at this point.

I’m kinda believing the Bay St whisperer as the Big 6 predictions for interest rate projections from just over 4 months ago seem to be well off target. Let’s call it fluid.

http://www.canadianmortgagetrends.com/2021/12/2022-housing-and-interest-rate-forecasts/

2022 real estate and interest rate forecasts

Steve Huebl·Real Estate

·December 29, 2021

2022 Housing and Interest Rate Forecasts

Interest Rate Forecasts

Below are the latest rate forecasts from the Big 6 banks. Averaging the forecasts, the Big 6 banks expect the overnight rate to rise about 1% by the end of 2022, meaning four quarter-point rate hikes by the Bank of Canada.

Looking ahead to the end of 2023, analysts from the big banks are calling for an additional three rate hikes, bringing the overnight rate to 1.75%.

Target Rate:

Year-end ’21 Target Rate:

Year-end ’22 Target Rate:

Year-end ’23 5-Year BoC Bond Yield:

Year-end ’21 5-Year BoC Bond Yiel

Year-end ’22

BMO 0.25% 1.25% NA 1.45% 1.80%

CIBC 0.25% 1.00% 1.75% NA NA

NBC 0.25% 1.50% 1.75% 1.40% 1.90%

RBC 0.25% 1.00% 1.75% 1.25% 1.65%

Scotiabank 0.25% 1.25% 2.25% 1.50% 2.05%

TD Bank 0.25% 1.00% 1.75% 1.35% 1.90%

Meanwhile, the bond market is maintaining its forecast for more aggressive rate tightening by the Bank of Canada.

As of Tuesday, it is still fully priced in for five quarter-point rate hikes by the end of 2022, which would bring the overnight target rate to 1.50%.

Patrick, I really hope you are right but you are suggesting that the five year rate, which sits a hair above 4 has almost peaked already. With good fortune I hope that is accurate.

I am just passing on what I hear from a few sources but no one has a crystal ball.

No, “Bay Street” isn’t “expecting six to eight by the beginning of next year”.

The six big Canadian banks (“Bay Street”) all provide detailed, current projections of where they expect rates to be for the next two years. All of the banks project the BofC target rate maxing out at about 3% (it is currently 1%), with the 5year bond around 2.8% (it is 2.78% now) . That would put 5 year mortgage rates around 4.5% max

Here’s a link to the projections of all the banks, if you click on a bank, it goes to the bank’s web page, where the economics department provide more details. https://www.canadianmortgagetrends.com/2022/05/the-latest-in-mortgage-news-boc-rate-hike-expectations-grow/

For example, here’s RBC (current May 2022 projections for 2022 and 2023) , with 2.5% BOC rate by Dec 2022 and then staying flat “pausing” until at least December 2023. http://www.rbc.com/economics/economic-reports/pdf/financial-markets/rates.pdf

While we’d love to have a “Bay St whisperer” here on the board, how’se about something more credible next time?

The unemployment on the Island and elsewhere in BC wasn’t just about RE, by a long shot. There was a commodities bust in the 1980’s with severe impact on the forest industry, which never regained its previous employment levels. And speaking of Victoria, let’s not forget Bill Bennett’s “restraint” program.

As I’ve said, if commodities remain strong that’s cover for the BoC to raise rates without severely boosting unemployment Canada wide. And if some regions have become unduly dependent on RE, that’s just collateral damage.

Let hope it doesn’t happnen, because that translate to many SFH will face $5K/mo or more payment when renew in 1-2 year from now, north of $6K/mo in 3-4 years, and well north of $7K/mo in 4-5 years.

IMO, the melt down would drop your house value 35-50%, and unemployment run between 12% and 18% on the island like the 80s.

For the moment, the talk on Bay Street is to expect six to eight by the beginning of next year. There is an expectation that some people will be hurt but that most will manage. The housing market is simply one of a number of component’s and to many on the street, not the most important one. That is what I am hearing from TO.

Getting rid of the stress test wouldn’t help someone that cannot pay their current mortgage. Unless you are implying that the stress test is preventing existing homeowners from refinancing and consolidating their non-mortgage debt and that would help them keep their house…

COVID was a crisis and interest rates rising a bit isn’t. The program for defferels during Covid was more to do with protecting financial institutions then it was exposed borrowers that had lost employment due to shutdowns. Unless there’s a risk to lending institutions (possibly going under), there really won’t be a coordinated bail out. You might see existing mechanisms such as bankruptcy, loan modifications and debt renegotiations used, but nothing to extent of the COVID program. As well,CMHC will not be involving themselves with anyone they are not insuring. So, those 20% down folks that skipped CMHC scrutiny will be on their own to deal with their lenders. For the ones with CMHC coverage, guess how CMHC will cover losses that come from defaults that they insured? HIGHER CMHC PREMIUMS for every other CMHC covered loan… It is hard to believe we are seeing so much panic and calamity from just a .5% rate increase and the possibility of rates going up by a possible 3 more percentage points. No matter what rules people thought they were following, they should have checked themselves on their costs and not over spent. If people are going to be underwater soon with increasing rates, there is a simple solution: time to sell and cut their losses before that happens. In the end, it’s a them problem and no one else is responsible.

If a mortgage is insured the bank will renew. As long as the payments keep coming they’ll be happy, that what they loaned the money for.

If the owner can’t make the payments that’s another story, but I think most will cut everything else first. However walkaways do happen when a property is underwater and the owner doesn’t see the point in continuing payments. But that happens a couple of years into a bust at which time the decline is baked in the cake. For example the US market peaked in 2006, but things didn’t get really nasty until 2008.

VicREanalyst

I could see the banks negotiating with homeowners that are slightly underwater but when things really start going south the banks will take care of their shareholders.

OSFI oversees the banks and they have made damned sure that the banks are fully capitalized to withstand what is coming down the pipeline.

Longer amortizations and dropping the stress test will be incentives for new buyers and will do nothing for underwater homeowners.

Rush4life is correct. That once in a lifetime shutdown of the economy for Covid was just that and the government had to “ask” OSFI and the banks for their support.

I agree the likelihood of government stepping in to help by getting rid of the stress test or increasing AM is likely if ppl start losing homes like 2008 in the US; however the one difference in your comparison is during the pandemic the government told people they couldn’t work. If it wasn’t for government people would have continued working and would have been able to make their mortgage payments but government forced them to shut down for the greater good. They were obligated to help in that scenario IMO. They MAY not feel that way if they have to increase rates due to inflation – then it’s more indirect. Pandemic was (hopefully) a once in a lifetime scenario.

If rates go above the stress test levels and primary residence home owners starts to lose their homes you don’t think there would be a bailout for them? These are the responsible people who played by the rules, I will guarantee those folks will be bailed out via extended amortization or something to that effect, lol look at the mortgage deferrals that was introduced during COVID. But maybe if enough investors bail then that would be enough to crack the market.

BoC rates will be tied to the Fed, look at our our weak Loonie currently with $100+ oil, we have no choice but to hike rates with the Fed or else no one can afford to live in Canada anymore.

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-cooling-housing-market-gives-some-leverage-back-to-homebuyers/

One big difference for existing homeowners , between the Canadian and USA housing markets going forward.

vs

So for existing homeowners, I’d expect to see more Canadians struggling with the higher rates than Americans.

People on shoestring budgets shouldn’t be getting mortgages, let alone substantial ones…. I guess that’s the problem with the gift down payments, folks that weren’t able to demonstrate a financial capability to save ended with mortgages that they shouldn’t have gotten. Fixed mortgage rates are now in the mid 4% range of so 8% isn’t that far fetched by the end of summer or fall now especially for the higher risk shoestring types.

Signpost,

Good post. Thanks for the info.

The BOC speech didn’t say they would abandon the inflation target. What they did introduce as new policy (they referred to it as a “nuance” in their policy) was the idea of a “pause” in the rate rises when they get to the 2-3% range, if the housing sector is slowing.

I expect that they’ll find some excuse to do this “pause” at 2-3% , if it isn’t a housing slowdown it will be the economy slowing. It is disappointing that they are thinking like this, because most central banks (like the USA) are saying that the rates need to rise fast until inflation is stopped and they certainly don’t mention pausing if the housing market slows.

Frank

C’mon Frank, we all know that those jumbo (substantial) mortgages are only in 2 provinces.

The third highest market has an average home price under $500,000.

That was a direct result of securitization of risky mortgage loans, as is well known. It’s also well known how mortgage debt in Canada is handled, namely that risky loans are backstopped by CMHC and the “private” insurers. Financial institutions just don’t have the kind of exposure that would get them into trouble as the result of a bust. Didn’t happen in the Toronto bust of late 1980’s-early 1990’s which was huge. Serious recession in Ontario, but no financial crisis.

Certainly there would be a knock-off effect from a housing decline on other sectors, but as has been discussed that appears to be part of BoC’s calibrations. I do not believe that BoC is going to abandon its CPI inflation target just to keep the RE market from taking a hit. Whatever it takes will happen.

Wrong, wrong, wrong. 8% mortgage rates would hurt everyone with substantial mortgages. Most are getting by on a shoestring budget. It’s all relative.

Local Fool

Okay, my friend let’s try this differently.

Mortgage rates at 8% would be a huge problem for B.C. and Ontario. It wouldn’t be the same problem in any other province by any stretch of the imagination.

Therefore, the upcoming housing crash in Ontario and B.C. will not result in a national crash.

From: https://financialpost.com/real-estate/mortgages/reverse-mortgages-take-off-canada

Geez, I know it’s morally wrong to let a sucker keep their money, but reverse mortgages really should be categorized as preditory lending. There are so many other ways to borrow against a house that doesn’t end up giving away the vast majority of it’s value to the ones selling these reverse mortgage schemes.

About $400k in current dollars. but have to take into account that real incomes are up by about a third since then.

I don’t interpret that as them saying they will let inflation run rampant if housing activity drops a lot. My interpretation is that they will watch housing carefully to see if there’s a big crash in activity that could cause an overshoot from rate increases. Housing works on a lag, so they don’t want to be in the situation where they keep raising rates too quickly, housing crashes, and we get swept into a deeper recession than they wanted due to the knock-down effects. Unless I hear them specifically say that if housing activity crashes we will abandon our inflation targetting mandate, then I think this is more likely.

No, I wasn’t. That’s like supposing that in 2008, because homes in Los Angles, Phoenix and New York were overpriced but homes in North Dakota, Delaware and North Carolina (you can insert most other states) were not, the housing crash in the US only mattered for New York, Arizona and California. The reality was only a few percent of folks in some states ran into trouble, but the effects nationwide on the credit market were almost globally catastrophic.

What actually matters is how much housing activity in aggregate, and its supporting industries, comprise the national GDP. Right now, RE selling, buying and leasing is a double digit percentage of GDP, and that doesn’t even count those peripheral, supporting industries. Therefore, a reduction in that sector of the economy means an outsized effect on the national economy including less credit nationwide, fewer job opportunities, less wealth generating activity, and less taxation revenue. This, is on top of what could become crippling debt levels for a relatively small but still potent segment of the population. Like in the US, it won’t matter for the country whether those folks live in BC, Ontario, Manitoba or PEI, although RE values will not correct to the same degree from one region to another, just as has happened in the past. BC and Ontario historically bear the brunt of RE price escalation and retrenchment.

…. or is it your sensitivity to my translation of OSFI’s position. Hence “basically, let it burn” describing their apparent lack of concern for certain markets.

It is observations like these that make it sound like you are hoping for a crash and will enjoy watching it.

If you are here to just warn people as you you would not be using rhetoric like that.

Also if a correction is to come in these high priced markets of 20-40% from peak prices bringing them more in line to the rest of Canada, this would just bring us back to price levels from about 4 years ago. Hardly a bonfire.

The problem with this rhetoric, Local Fool, is that you are projecting the sky high prices and speculative fever that was rampant in B.C. and Ontario as nationwide and if that were true, then a nationwide collapse in housing would be extremely problematic for the BOC.

wowa.ca/reports/canada-housing-market

The reality though is that only B.C. and Ontario saw the kind of ridiculous price growth that is way out of line with the rest of Canada. The average home price in every other province is under half of what these two outliers sit at today. Apparently, the head of OSFI sees it the same way. Basically, let them burn!

http://www.bnnbloomberg.ca/home-prices-could-sink-20-when-speculative-fever-breaks-osfi-1.1717632

From earlier: “But that’s not going to happen to a company like Telus. Telus has earned about $1 USD/share forever (2010-2022). It’s share price has tripled, yet it’s earnings have stayed the same.

The shares have tripled ($8 – $24 USD) because people are seeking high dividend stocks, and Telus fits the bill.”

Shares purchased near the beginning of the above time frame at an actual cost of C$37.36 were subsequently split twice. So the number of shares held were quadrupled and the apparent cost per share was reduced to C$9.34 The current annual dividend is C$1.3544 which produces a dividend yield of 14.5% against that original cost, and a current dividend yield, for a present day purchase, of 4%.

The reported current profit per share can also be quadrupled when compared to the profit per share at the beginning of the above time frame. Patience can be a profitable virtue…

numbers hack- Interesting article, bottom line: Governments spend too much money..

Lots of good points being shared about RE (asset) prices and interest rates. But cause and effect of this occurred way BEFORE the pandemic and alarms bells were being raised in World economic/finance circles!

This article from 2018 sheds light of how society as a whole, especially our neighbours down south have created a mess…that IMO will be IMPOSSIBLE to get out of – short of a revolution. There are no conclusions, but mere warnings from 4 years ago.

https://indepthnews.net/index.php/sustainability/peace-justice/1811-g7-fiscal-monetary-policies-are-ticking-time-bombs

Since 1971, when President Richard Nixon ended unilaterally the direct international convertibility of the American dollar to gold, the US, which continues to enjoy the “exorbitant privilege” (of printing its currency and paying other nations for goods and services bought from them), has become the epicentre for the unsustainable monetary policies without any concern for its ballooning twin deficits.

Thus, the G7 monetary policies “are a common factor to most of the speculative excesses observed in bonds, stocks, and real estate.”

The flawed monetary and fiscal policies being implemented by the G7 countries are contributing to the twin dangers of “the global warming time bomb” and “war,” Hannoun and Dittus said.

HOW TRUE the author’s last point from the Secretary General of Bank of Int’l Settlements (BIS)

The BOC is hardly independent. I wouldn’t consider the BOC to be independent of the government, since the board controls everything, and the board is appointed by the minister of finance (three year terms) , with appointees subject to approval of the governor in council. The Governor in council are also selected by the government. Since the libs have been in for more than 3 years, this means all board members have been picked by the liberal government. This government handpicked board then decides who to hire as BOC governor.

https://www.bankofcanada.ca/about/

The Board of Directors is appointed by the Minister of Finance for a three-year term, subject to the approval of the Governor in Council. It is composed of the Governor, the Senior Deputy Governor, 12 outside directors and the Deputy Minister of Finance (who has no vote). Their responsibilities include:

providing general oversight of the management and administration of the Bank

reviewing the Bank’s general policies (on matters other than monetary policy and for approving the Bank’s corporate objectives, plans and annual budget)

keeping the Bank informed about prevailing economic conditions in their respective regions

appointing the Governor and Senior Deputy Governor

The economy is bigger than the housing market and inflation is bigger threat to the economy than the housing market giving back 2 years artificial gains that arose from a crisis intervention. The anomaly was the pandemic gains and not a new norm because it came from the public subsidizing private debt. Guess what! Even if the BoC stops it’s rate increases (which it won’t) mortgage rates will continue to climb across the board because BoC and CMHC are no longer purchasing billions in bonds from lenders to subsidize low lending rates. At this point, the BoC rate is more symbolic and psychological for the public. If it doesn’t increase, lenders will just change how the peg their prime rates and their variable rate formulas to account for what they need to sell their bonds for on the market. Someone has to want to buy your mortgage, and look at what returns you can get on bonds now. So, why would someone want to invest in low yeild mortgage debt? The solution, increase the yeild (mortgage rates) to get investors to buy it…. So, unless there’s going to be new rounds of QE, just get use to paying more on all debt.

Long time lurker first time commenter

Came to comment about 997 amblewood but I see it’s already being discussed. Super weird, seems like it was re listed a day or two after possession for less than the selling price?

That’s exactly why the BoC is independent of the government. They don’t have to worry about votes.

I am, because society and the real economy would function much better with lower house prices. I don’t care what my house would sell for since I’m not depending on it for anything but a place to live. If I move, the next house will be cheaper too.

VicREanalyst:

You are very right and very hopeful. CMHC won’t be bailing anyone out simply because they are providing insurance to the banks. Let’s see, do we bail out Joe Blow who has an $800,000 mortgage on a $600,000 home or do we simply let nature take it’s course and make sure the bank is made whole. Uh huh.

Thurston

There are only 2 provinces in Canada that are way out of whack on home prices. British Columbia doesn’t count and never will, in terms of getting attention from the Federal Agencies and Ontario, which seems to be sliding downhill first.

Just maybe, the BOC recognizes that the majority of those jumbo mortgages reside within those 2 provinces and they are not too concerned about cutting those markets out at the knees.

You’re right Thurston. If the BOC has heard the pleas out of Toronto then it will be a quarter point hike. Lololol

http://www.bloomberg.com/news/articles/2022-05-04/toronto-home-prices-drop-most-in-two-years-as-rates-slam-market

Toronto Home Prices Drop Most in Two Years as Rates Slam Market.

…. and I’m retired, don’t use my home as an ATM and other than a “dick measuring contest”, what does the value of my home mean?

See above, but you have not seen me “cheering” on this blog. I’m simply warning anyone that wants to listen what’s coming down the road.

So given the ground breaking news today If there is a quarter point hike or no hike in June Could I assume the housing market is far more important than inflation

Or, dole bailouts again to juice the housing market if they trip up and went overboard with rates.

Merry-go-round has to stop at some point, it always does.

RIght. And if you read the BoC speech, they might pause the rate hikes at 2-3% with just a slowdown in the housing sector – irrespective of house prices. I think it will be easy for them to spot and declare a “slowdown in the housing sector”, and they will be done with the rate hikes, despite ongoing inflation. With 68% of voters owning homes, and the other 32% wanting to own homes, this would be just a case of cynically giving the voters the interest rates they want

Completely illogical. It is both if you own a home in Victoria – or most of Canada for that matter. Primary residences are Canadian homeowners biggest single asset and component of their net worth.

Do you seriously expect people to believe that you are cheering for the home you own to lose its value by 50%?

Unfortunately we are tied to the Fed, I can see BoC raise rates while CMHC bails out existing primary residence mortgages in trouble so people don’t lose their homes.

Lol It’s not an asset. It’s a home, my friend. Thinking of your home as an asset has led to the Heloc revolution.

Lol if you are mortgage free then why are you cheering for an event that will see your asset depreciate by 50%?

Well no, it wasn’t some random speech – that’s not how the BoC works. And he’s mainly talking about slowdown in the housing sector, which is a much broader category than house prices. It was from Gravelle (Deputy Govenor). And transcript was released on the BoC site as an official release 11:35 pm Thursday night. And he leads off his speech by telling you that this will describe the BoC policy response to rising rates when he says “Finally, I want to talk about what our policy response might look like going forward. But here’s where I want to discuss some of the nuances of the future path of interest rates.”

He is clearly speaking on behalf of the BoC, as he refers to “we” and “us” throughout. Then he talks about the “neutral range” where the BoC rate is 2-3%. And then he says that if there is a big slowdown in “housing activity” they might pause the rate hikes. If anything stops inflation, of course he would stop the rate hikes. But that’s not what he’s saying. He specifically specifically singled out slowing housing activity as a separate reason to stop (pause) rate hikes, and that this would be a separate reason than inflation stopping. He describes the BoC policy response that if inflation is still high, but “housing activity” is way down, then the BoC could pause their rate hikes in the neutral range, which is 2-3% Note that all his references are to “housing activity” – which, although related to house prices, is a term describing a bunch of factors like housing sales, construction, employment, building permits, new mortgage activity etc

The transcript is here….

https://www.bankofcanada.ca/2022/05/the-perfect-storm/

“First, what might lead us to pause our policy rate increases as the rate enters our estimated range for neutral of 2% to 3%? One reason would be if price increases reversed course. Commodity prices could start to decline, especially if the war in Ukraine is resolved. Another reason is related to the bullwhip effect. Spending habits shifted dramatically into goods and out of services at the outset of the pandemic. But now the economy is almost fully open. Because of this, spending on goods could decline faster than we expect, just as goods supply and inventories finally expand. Faced with excess supply, retailers and manufacturers could put large discounts on goods. This too could reverse observed price increases.

Another factor that might lead us to pause is that many households have taken on more debt to get into the housing market. At the end of 2021, the household debt-to-income ratio was 186%, above the pre-pandemic level of 181%. And rising interest rates are designed to slow the economy by making borrowing more expensive. That tends to slow sectors like housing. But this slowing might be amplified this time around because highly indebted households will face high debt-servicing costs and will likely reduce household spending more than they would have otherwise. Our base-case scenario includes a slowdown in housing activity. But we could see a larger-than-expected slowdown due to higher indebtedness and unsustainably high housing prices.”

If we don’t follow interest rate increases by the Fed that will lead to a lower CAD and even higher food prices.

It appears that rising interest rates have also solved global warming. The weather has been horrible across Western Canada. April was entirely a winter month, complete with blizzards, freezing temperatures and record snowfall in Saskatchewan and Manitoba. Now we’re flooded out with no relief in sight. If farmers can’t plant soon, food costs are going to skyrocket (they already are). Raising interest rates isn’t going to help with food shortage price increases.

Somebody’s always buying, and somebody always has to sell. 1930’s, WWII, etc. Only question is at what price.

But I don’t think we’ll get to 8% rates.

No harm in waiting a few months to buy in Victoria right now. Market conditions (for buyers) are bound to improve somewhat. But I hope no one is deluded enough to think that a median SFH in Victoria will be available at $500 K in “several months”.

Outside a massive nuclear or radiological attack on Canadian cities, or perhaps an asteroid strike at least 1/4 the size of the Chicxulub impactor, you are not going to have 500k homes within the time span of several months – certainly not anywhere near here (presuming detached, VicRE). The RE market rarely works like a stock market. Actual affordability does not immediately occur in a downturn and I think that’s especially true this cycle.

Even if downward pressures grew to a degree to take homes to 500k , that would take years to occur and the resulting interim damage to the economy would almost certainly mean the population in general won’t be in a position or confident enough to take advantage of the lower prices (that’s why in downturns, prices tend to fall over a long period of time, not overnight). The anecdotes of 100k a month coming off prices today isn’t any more sustainable than the 100k a month being added in February.

So, for people that are thinking homes are going to be affordable in the next few months, I suspect they are going to be very disappointed. But, affordability will hopefully be able to at least start moving in the right direction.

Like I’ve been repeating on this board over and over – central banks are not going to get far with their quaint little pretense of back-to-normal, regardless of the forcefulness of their rhetoric or the moves they’ve made to date. In Canada, it’s not very complicated: You trip up housing, you bust the economy – and they know that. That will have an outsized, cascading effect throughout the economy, and I suspect you’ll find all those help wanted signs disappear along with most of the inflation. At this point, I’m not even sure they will do a 50BPS hike come June. We’ll soon see.

I have my first renewal in 2024, and I can’t tell you how unconcerned I am with what the overnight or 5 year bond rate will be then. It may be higher than my current 2.69%, but it ain’t going to 8%. If by some miracle it did, we’ll have far bigger problems like wide scale and sovereign defaults, accelerating social and political tensions, and even war. No one will be buying houses at that point…

What were house prices the last time rates were 8%? Not $800K I think. I’m pretty sure 8% would crater the RE market – and consumer spending – coast to coast. Which is why I don’t think we’ll see rates that high – I think inflation can be brought under control before that. We could well see 6% though.

I went a similar route, and did high yield stocks in my non-registered, then move some into TFSA in the first 5 years then took all of the money out and dumped it into my house, because I got burned by tech (AMD & Nvidia) and green (lithium, batteries) stocks in the 2008 aftermath crashed (overall I still made money).

After a few hiatus years from the stock market, I got back in with a dividend concentrated TFSA, balanced dividend/growth non-registered and RSP accounts.

Since December to now. I have changed my strategy to growth weighted TFSA and RSP, while non-registered is a mixed between dividend/growth (the dividend is more than enough at paying any interests that incurred by HELOC.)

VicREa analyst, I’m mortgage free but if I was a new buyer, I would much prefer to buy a home for $500,000 @ 8%.

They will have to wait several months for that.

Im not sure if they’re actually saying anything different. Fact is if house prices fall consumer spending will fall and inflation too. I think they might just be saying that elevated house prices mean the economy might react more quickly than otherwise to rising rates so they won’t have to raise as far.

I don’t think the BoC is in the habit of casually deciding to abandon their mandate in a random speech

Curious indeed

Listed February 16th at $1,595,000

Sold feb 22 for $2,000,000

Listed May 12 for $1,788,800. Offers on the 16th

Hmmm

Debt Monster, would you be able to afford a house if they were now $800k instead of $1.6M but mortgage rates are at 8%?

Interesting contrast to the Fed, Jerome Powell said yesterday that the mandate is to get inflation under control and they cannot guarantee a soft landing. I wonder if Canada will pause once housing corrects while the U.S. pushes ahead with rate hikes. The CAD is still so weak with oil above $100, seems like USD is the currency to be in. Weak CAD is good for foreign buyers though or “domestic buyers” with lots of foreign assets.

This is only news if you’ve been living under a rock for last 20 years. He just stated the obvious.

Bought post covid around $11ish….I figured government threats against the industry are all non-sense posturing to give the impression to the public like they are doing something. Government can’t find staffing for desirable clean hospital jobs let alone to privatize and staff retirement residences. Then culturally, in Canada, I figure no way people don’t stop stuff their 85-year-old parents in these places. Swings are wild on Sienna, but the dividend comes every month. Not the safest dividend but they’ve weathered a decent storm.

As long as you don’t lose any sleep when it goes from $18 to $9 then back up to $17 and now down to $13.7 then its all gravy. Seems like you got ~50k worth in your TFSA, pretty solid position.

millenialhomeownerx2

… or maybe no payments at all. Not so pretty.

+1, could not agree more. The first 5 years I did high risk growth stocks and got lucky but I’ve become obsessed with passive income so it is now all dividend paying stocks (would be smarter to have growth stocks in TSFA but whatever). I’ve had much better returns on real estate; however, there is something appealing just knowning that my TSFA dividend paying stock will never call me at 3 am that the unit above them leaked and they are flooded out 🙂

Sienna Senior Living just paid me $282 dollars this morning and they do a monthly dividend. That is like three solid dinners out every month, for doing literally nothing, on just one position.

The Deputy Governor would be remiss not to suggest that they aren’t looking at all aspects of the economy during their discussions.

Introvert and Local Fool are absolutely correct in their assertion that the BOC will reverse course but ….well after the bubbliest cities crash.

I’m sure that the BOC has heard all of the blathering from the Toronto Real Estate Board. Prices are dropping $100,000/ month. If Macklem is concerned about that kind of

affect on the housing market then you’ll see him raise interest rates by only 1/4%. Lolol.

There is no doubt that another 1/2% rate increase will be coming on June 01.

https://www.bankofcanada.ca/2022/05/the-perfect-storm/

I agree 100%. I know of at least a few friends who shove 1K into their TFSA every month. Now the question is whether they invest it. A lot of people seem to think a TFSA is an investment.

A TFSA is such a powerful tool. I am setting my 19 year old cousin up with hers and buying her a value dividend ETF. She has 18K of room! And she has so many years to let those dividends reinvest themselves. Compound interest is so powerful when you start young. I only wish someone did this for me when I was 20.

That’s not really putting it properly, the annual contribution started at $5K and is now up to $6K, with a blip at $10K for a year. If you have a normal income and can’t save that kind of money saving just isn’t your priority. Only a little more than 1/2 of eligible Canadians have a TSFA at all, and of those under 10% are fully contributed.

Curious – was 997 Amblewood sold in the last few years? It looks very familiar

As for variable rates and how much people are affected. I just wanted to give our own personal example. We payed 3300 for our mortgage pre-covid. This went down to 2800 during covid. It is now around 3000 and I expect it will go up more. Seems to me that someone who bought pre-2020 and has a variable is still sitting pretty and enjoyed 2 years of lower payments due to covid, and are now just getting back to ‘normal’.

I would say a lot of homeowners at least. My husband and I have maxed out our TFSAs and they each now sit at 100+K. However we only did this in the last 2 years using large lump sums. The earlier you max out, buy those dividend value stocks, and turn on the DRIP, the more opportunity your TFSA will swell far beyond the contribution limits. I’ve always though that DRIP in an RRSP or TFSA was a cheat code to wealth generation.

GIC interest rates up a bit again, best rates:

1yr@3.71%,

2yr@3.95%,

3yr@4.10%,

4yr@4.15%,

&

5yr@4.25%

That policy to limit rate increases if house prices fall too much is absurd. They pretend they care about inflation, but reveal that preserving high house prices is more important.

In the USA the “fed put” refers to the fed history of protecting stock prices by rate policy. Looks like we have a canadian “housing put” version of this, but to protect housing prices.

Interest rate trajectory will depend heavily on housing market, Bank of Canada deputy governor says

https://docdro.id/Z1StCk1

https://www.theglobeandmail.com/business/article-interest-rate-trajectory-will-depend-heavily-on-housing-market-boc/

https://www.theglobeandmail.com/investing/personal-finance/young-money/article-helocs-have-us-complacent-and-greedy-about-debt-theyre-now-a-defining/

Honestly, I was surprised that there wasn’t more.

I thought for sure that when Iran was getting hit early on that Saudi was going to do something.

Inflation was exacerbated by the war, but this is mostly on the central banks. Oil was already at $95 before the war started. We only have one month of data since the war started in Canada since they haven’t released April numbers yet.

Looks like Bitcoin has gone up nearly 20% since 7am today?

Get rich quick scheme has been exposed so the rats are abandoning ship. Similarly ESG greenwashing could be next. As for the traditional energy sector that have been prudent by paying back debt and share buy back is siting pretty especially as an inflation hedge.

Cryptocurrencies seem to be getting hit hardest with rising interest rates. Why? They don’t earn any interest. The conspiracy theorist in me wonders if this is a method to destabilize that market. I’m positive governments hate cryptocurrencies, something they can’t control, even if they think they can. Several have already been near ruin and that will only destroy confidence in all crypto. Talk about heading for the exits.

Who minds paying tax on money you make with zero effort. I resent paying taxes on my hard earned money.

The first $1000 of interest income annually used to be exempt.

“ In my opinion gas is incredibly cheap in Canada but we’ve been conditioned to it being cheap for decades”

$2/L gas doesn’t seem to have deterred the people who like to use drive through windows. Still seeing long lines of idling morons.

I think we will have to hit ~$4/L before these motoring enthusiasts will get up on their hind legs and out of their vehicles

I have the same magnolious portrait enshrined atop my mantlepiece.

Every Wednesday evening, we have mass to celebrate our Dear Leader. A substantial and revolving floral arrangement adorns the tribute, on either side numerous books describe and celebrate his glorious achievements, including the time he scored 14 holes-in-one his first time playing golf (the next closest record is 11).