Cooling off period: what’s the impact?

Just a brief update before our end of the month summary in a few days. The BC NDP passed the legislation to bring in a cooling off period to real estate sales in the province a couple months ago, but at that time they had little idea how it might work, preferring to leave the details up to the real estate regulator. Well the BC Financial Services Authority has now released a report with the recommended details of that change, so let’s take a quick look at what impact it might have.

The real estate industry reacted negatively to the proposed changes, but it’s worth remembering that there already is a cooling off period for new construction purchases introduced by the Liberals in 2005 as part of the Real Estate Development Marketing Act. Presumably this was done with the acknowledgement that there can be significant information asymmetries between big developers and new home buyers, with the rescission period allowing buyers additional time for due diligence and to back out of the deal within 7 days. Though the volume of new construction sales is much lower, it certainly hasn’t been the end of the world for new construction sales.

The motivation to bring in the resale cooling off period seems similar. During the super-heated market the majority of sales went for over-asking and without conditions, putting buyers at a substantial information disadvantage. Not only were buyers sometimes going without building inspections (or eating the cost of multiple pre-inspections on failed offers), but the lack of financing conditions laid the groundwork for failed appraisals when the market started to cool. The government identified the risk of buyers ending up with properties with major problems, but in my opinion equally dangerous was that it’s impossible to tell whether properties are trading hands at market value and may be going for substantially above. For a sale price to be at market value, both the buyer and seller must be well informed and the price not affected by undue stimulus. The idea that both conditions can be satisfied in a blind bidding war with unconditional offers is dubious at best.

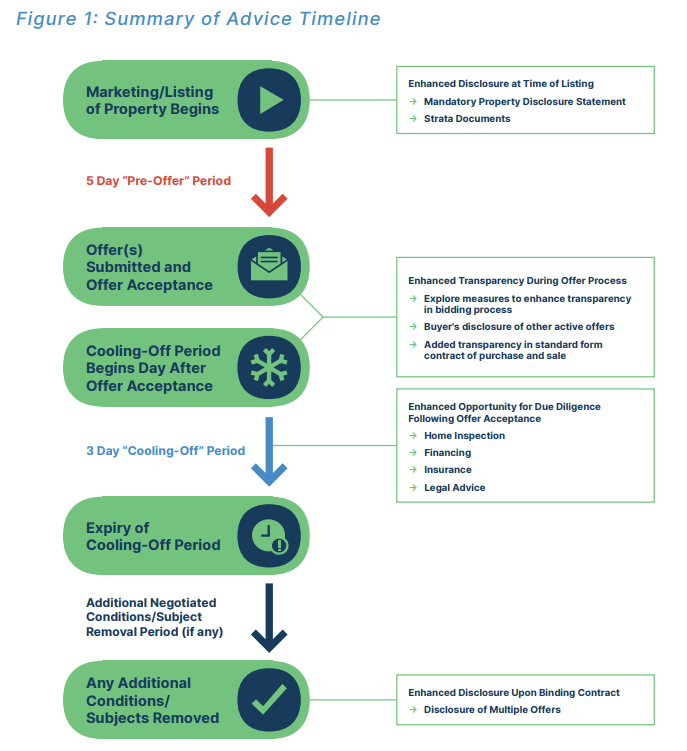

The BCFSA then is recommending a number of changes to be made. I’ve summarized some of the most interesting ones below:

- A non-waivable 3 business day cooling off period. This would allow a buyer to do some due diligence after an accepted offer (like getting an inspection or verifying financing). If they decided to back out, they would pay a penalty of between 0.1% to 0.5% of the purchase price to the seller. For an average house at $1.4M that would be a penalty of between $1400 and $7000. Nothing to sneeze at, and very likely sufficient in order to discourage people from tying up multiple properties and backing out of the ones they don’t want which was a major concern from the industry. There is an unclear provision for exemption from these fees which we’ll have to see the details of before we can evaluate those. See also point 5 for another measure against this kind of abuse.

- Consider requiring disclosure of other active offers to the buyer and other bidders. We’ve all heard of cases where the winning bid was many tens of thousands of dollars above the second highest. While most have suggested moving to open bidding to avoid this situation, this proposal is a different approach to avoid the same situation. While the BCFSA have watered it down with the word “consider”, disclosure of other offers would allow a buyer that submitted an irrational bid a chance to save themselves from the mistake before committing. My only concern is that the disclosure could be abused, with buyers submitting extremely high bids to win without intending to follow through, then using the information about the other bids to renegotiate the sale at a lower price. There is also a suggestion to disclose information about other bids to non-winning bidders to increase confidence in the process.

- Require a 5 day pre-offer period. This is essentially banning bully offers and was a suggestion from the BCREA (though they wanted it instead of the cooling off period, not in addition to).

- Provide key forms like strata docs at the time of listing. This includes Form B, the strata’s bylaws, and two years of minutes. Makes perfect sense and will make due diligence on condos easier.

- Improve transparency in offers. The BCFSA recommends pursuing models for open bidding including notifying buyers of the number and value of existing offers to improve transparency. Interestingly enough, they are also considering requiring buyers to disclose any other active offers they have to avoid the problem of buyers tying up multiple properties. This all sounds good at first glance, but I can imagine the communication nightmare of the notification requirements going both ways (agents already regularly get themselves into trouble with the current rules). I think we need some technology here to handle open auctions. They do caution that moving to open auctions could increase prices due to “auction fever” and recommend investigating a hybrid approach of disclosure without going to fully public auctions like Australia has.

See the timeline overview of the proposed measures below.

What’s unclear at this point is whether these changes would apply to private sales or mere postings. If they don’t then on the one hand it gives private sellers an advantage of flexibility, however on the other hand it might drive buyers away from those listings as they don’t have the same protections.

There are still a pile of “coulds” and “mays” and “considers” in this report, which makes me think we’re still some way from finalizing these rules. By the time these changes are finalized and take effect the stated problem of 70% of properties going in unconditional offers will be history. In a month or two we will be at normal levels of bidding wars. However we know that the next hot market will come, so that alone is not a reason not to proceed with the changes.

If anyone is hoping the cooling off period will reduce prices then they will be disappointed. There is absolutely no reason to believe they will, but that is also not the point. The purpose of the legislation is consumer protection, and I think there’s a good argument to be made that the changes will be at least somewhat effective to protect people against poorly considered purchases in overheated markets. It puts a bit more control back into the hands of buyers during times when everything is stacked against them. It will be interesting to see if during the next hot market these changes will prevent the prevalence of bidding wars, and sellers will move to more accurately pricing their properties instead.

Also the weekly numbers courtesy of the VREB.

| May 2022 |

May

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 176 | 364 | 568 | 694 | 1049 |

| New Listings | 351 | 752 | 1117 | 1440 | 1333 |

| Active Listings | 1451 | 1584 | 1664 | 1782 | 1450 |

| Sales to New Listings | 50% | 48% | 51% | 48% | 79% |

| Sales YoY Change | -24% | -27% | -25% | -29% | |

| Months of Inventory | 1.4 | ||||

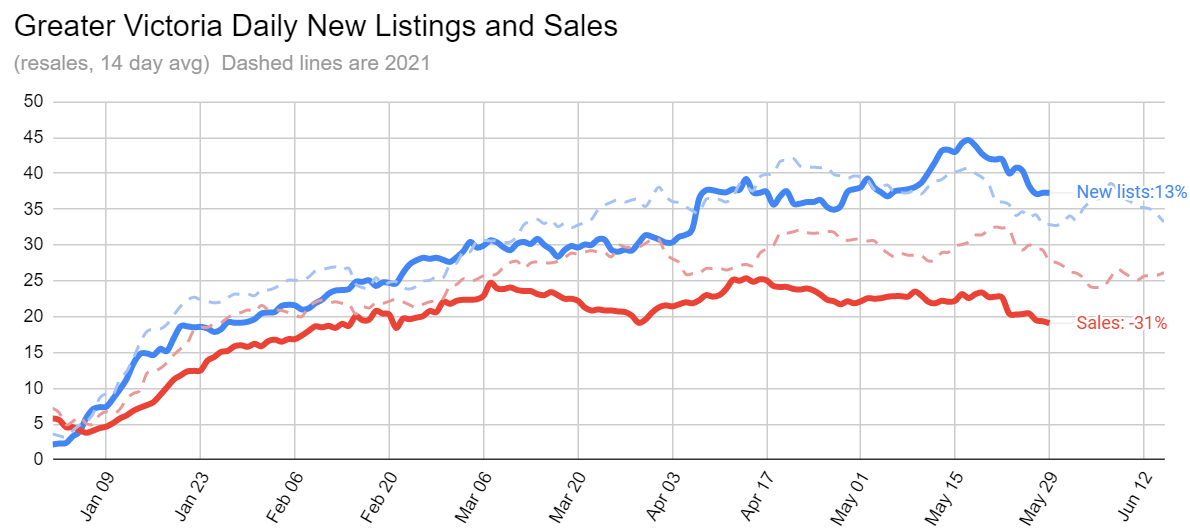

More of the same trend last week, with sales down nearly 30% from this time last year (note the table above is all sales including commercial, while the chart below is resales in Greater Victoria only). New lists should be about at the historically normal level for May. Inventory is now 23% above the same period last year which is a huge change from big double digit decreases from just a few months ago. However keep in mind that off an extremely low base any increase will look big on a percentage basis.

Stay tuned for the month’s review in a couple days.

Monthly charts https://househuntvictoria.ca/2022/06/01/may-prices-pull-back-somewhat-as-cooldown-continues/

In the morning with my bowl of captain crunch I read online the following: BBC world, CBC, times communist and for fun NP. And of course HHV!

Comments are infuriating but have to keep in mind that most are bots or spiteful trolls. I get suspicious if a commentator has more than 90,000 posts! I do dislike CBCs decision making on which articles can have comments. There is a very clear pattern. Any article with the word “Alberta” in it though is assuredly open for combat

Occasionally I pick up a globe and mail. Good to be reminded of what real journalism is.

I have a few acquaintances in these fields and they have been complaining about a lack of staff or keeping current staff. I asked them if their fee scales have gone up? They all said yes. Then I said, “that makes it simple for raises, the employees just the equivalent to the percentage of the fee scale as the raise”. They seemed shocked by the suggestion that wage increases would help retain employees and doing it automatically when fee scales went up was nuts.

My question to all the govey union members – in a small city like Victoria, are there really all lot of options for you to go to? I’m likely ignorant to opportunities within the public sector and associated employers, municipalities etc.

First under the BC Liberals and continuing under the BC NDP, the government has inserted “me-too” clauses in all major public-sector agreements, which functionally results in every union receiving the same pay increase. But things like signing bonuses, benefits, working conditions, etc., can differ quite a bit.

Last round, all the unions got 2% a year for 3 years.

Things may get ugly on that front in the coming months, especially in the public sector.

The BCGEU is still assessing whether they have a strike mandate (I’m guessing they will get it). However, the BCTF’s contract is also coming up for renewal, and they apparently have concerns with the wage offer (my understanding is it’s also 1.75%/y). The problem is, the discontent is now spreading to the BC Nurse’s Union as well as the Hospital Employees Union.

There has been increasing talk amongst those bodies that at the beginning of September, all of those unions may go on strike and at the same time. I guess it depends how strong the mandate is from the members, but the potential for significant labor and school disruption appears to be very real and escalating.

“Client: this is SOCIALIST CRAP! It’s all Justin Trudeau’s fault.”

‘

‘

‘

Love it! This is like reading the comment section from every article on the National Post web site, where their comments section is like an echo chamber filled with bigots.

Electrician also seems to be the one trade that it is the least critical in terms of a shortage.

Large firm is a different story. If you factor in the pensions and flexibility, the pay is well above $35/hr. I bet their firm must has a large turnover rate or their boss is just amazing.

https://www.cbsnews.com/news/retail-price-gouging-lowes-amazon-target-accountable-us/

This is related:

So falling prices in Fraser valley and outskirts of Toronto with super low inventory never saw that one coming

My friend is a journeyman electrician with a large firm in town and they pay $33 an hour – so i don’t think that is the case across the board.

Infrequent poster: I have an accounting practice (I work with small/med sized businesses in BC and AB) and EVERYONE is having issues with hiring and retaining people. The amount of discussions I have with clients that goes like this is nuts:

Client: I just had 25% of my staff leave for an extra $2-5/hr. I’ve put out job ads but “no one wants to work”.

Me: well, it’s a free market for labour, can you blame a person making $20/hr for leaving for a 10 – 25% pay raise? Also, what are you offering in the new job ad.

Client: the same wage as before, I can’t afford to pay them more.

Me: [checks client income statement] well it says here that you made $400k profit last year, up from 100k profit three years ago. Are you sure you can’t afford to pay your 5 – 10 employees an extra $5/hr ($5/hr x 10 employees x 2000 hrs/year = $100,000).

Client: this is SOCIALIST CRAP! It’s all Justin Trudeau’s fault.

Me: well, it’s a debate for the ages what’s more important to a business – clients or staff. The reality is, you don’t have business without both.

Wage inflation is here, and lots of workers are demanding it. Most of my professional colleagues (lawyers, CPA’s, dentists, etc) have received 5%+ raises in EACH the last 3 years.

The reality is, as the cost of living rises, any decent worker is going to demand a raise, or they leave.

Fixed and yes I meant thirty

But the CPI measures consumer prices, so if it’s going up inflation is being passed on to consumers.

IMO, these are the jobs most sensitive to the rate increases, Higher rates = more expensive financing = higher hurdle rate = less projects = more labour available = less pressure on wages. That is a certainty.

They don’t go that long. Try 30 years. 🙂

But what’s significant is that the Fed can increase interest rates with less impact on homeowners because their rates are locked in. However the BoC has to follow the Fed to keep inflation under control. Result bigger impact on homeowners here.

That’s what I do every month.

I would still like to see commercial properties excluded from the data and only provide residential properties. Commercial is a different animal, businesses seem to be throwing in the towel now that the pandemic restrictions have eased and the new reality of doing business is settling in. Inflation is difficult to pass on to consumers at the best of times, even more so under current conditions.

Most US mortgages are for a 30 year term (and do mean TERM )

Did you read this? https://househuntvictoria.ca/2022/05/24/regions-and-property-types-whats-doing-the-best/

Can anyone comment on the significant discrepancy between US and Canadian mortgage products? I have friends in Seattle that have 30 year fixed mortgages at 2.5%. The 30 year product doesn’t seem to exist in Canada and even our 10 year fixed mortgages are rate prohibitive. Considering the risks that come with house purchases, removing rate uncertainty from the equation would make assessing individual affordability a lot easier. What would it take to see these products in the north?

The May numbers do look like things are getting weak, but in what category? Since inventory includes every type of property, excluding gazebos and dog houses, a breakdown would paint a better picture. I would like to know the number of SFHs in the inventory and sales figures. That would give a better indication of the activity in the most sought after type of housing. I always remind myself that commercial properties are included in the inventory and wouldn’t be surprised if they were responsible for an increase in inventory. Sales figures do seem to be dismal, but is it due to a lack of the type of property people are looking for. Commercial properties should be excluded from these figures for our purposes.

Only for the first 6 to 8 months before they got certificates or can work independently, then pays will increase to the high $30s or easily more than doubled depend on the trades.

what your binoculars didn’t tell you was that prices are downward sticky, so it really becomes a game of buying on the way up but not the peak. Like I said before, people in Victoria are slow and behind the folks in Toronto where they actually peaked prior to the first rate rise. Paying $1.5M for a royal bay house in March 2022 is probably not a prudent move in the short term.

Well I saw this in my binoculars:

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-how-real-estate-investors-and-speculators-helped-trigger-the-onslaught/

Most big bank employees got a mid year 3% raise on top of their annual raises, big 4 accounting firms have raised their pay by about 10% over the past 2 years for entry level cpa students, min wage is $15.65 as of today. I believe even the most basic job in construction pays $25 an hour now.

True – In Canada it was hardly a downturn at all. A run of the mill downturn would be worse in terms of things like job losses.

Interesting survey data

https://www.ctvnews.ca/business/study-finds-non-homeowners-are-pessimistic-about-buying-homes-despite-cooling-prices-1.5927764

Also thanks Leo for the reminder on how to do quotes. I will have an extra cookie today to congratulate myself for doing that correctly for the first time.

Salmonhunter:

Can you say more about this? I haven’t heard that from anyone else and I’d love to have more insight. What is the mechanism that could cause this to happen at rapid pace? I’m thinking of the looming strike with BC government workers (who seem to make up 50% of the workforce in Victoria from what I can see)… these folks are being offered, effectively, a 5%+ wage cut by the employer. It’s hard for me to see how wages can go up with anything approaching parity with inflation – specifically RE inflation rather than CPI.

Please tell me more!

Don’t know what is on the horizon but 2008/9 is definitely not your average run of the mill economic downturn.

Good thing we don’t have global events any more. 🙂

That was during 2008/9 so was more of a global event. HSBC was the main lender and they wrote off losses in the 9 figure range.

Anyone know what is wrong with this house? https://www.realtor.ca/real-estate/24459416/4069-livingstone-ave-n-saanich-mt-doug

Seems to be good value but unsure if it is set up for a bidding war or not as the market value is changing fairly fast these days.

Bear Mountain also went bankrupt about a decade ago. So much for RE being a no-lose proposition.

https://www.mediacoop.ca/story/vancouver-islands-most-racist-developer-plead-guil/19099

May numbers:

Sales: 761 (down 27%)

New lists: 1531 (up 15%)

Inventory: 1776 (up 22%)

New post tonight.

Another 50bps rate hike in the books today per expectations. As expected, the concerns related to interest rates has finally started to appear in the Vic RE community that I know (realtors, small time developers and landlords). I would expect the average person to catch on when the July hike goes down.

Your reply goes here. Note the full space between the quote and your reply. See picture for what you type.

you need to put a “>” (without the quotations) in front of the words. So, for example “>can someone tell me how to do the quote things” without the quotations and it will work.

Bear mountain is populated by a lot of people in the RE industry in Victoria (Realtors, small time developers etc.) It is pretty cliquey and I would personally avoid.

I noticed that a number of houses on Bear Mountain are asking in the two and even three million price range. A neighbour was actually wondering if living in the City of Victoria was becoming less desirable over the last few years.

I might add, for what it is worth, that I don’t believe that Victoria is going to tank unless the world goes into a serious depression. Prices here, in the inner core, are still much much less than the inner core of Vancouver. (Within a simple bike ride to work downtown for example)

I would only buy a place in Victoria if I was moving to Victoria and not worry about a dip.

By the way…. Moncton had one of the highest percentage returns for real estate in Canada last year. (Forgive me…I can’t resist:)

I live in Sooke.

Salmonhunter- I think the thanks goes to Deryk, he’s Moncton Man.

Can someone tell me how to do the quote things on another comment please?

Kenny G: the issues in the 80’s were pretty different from what we have now. Oil embargo, high unemployment and the US changing how they tackled interest rates. In my opinion, we have learned a lot from the 80’s and hopefully won’t make the same mistakes.

Here’s a good article about how the US fed was making decisions: https://www.federalreservehistory.org/essays/recession-of-1981-82

Since we’re on the topic of high prices in Victoria – a question that is very much on my mind is – So where do prices go from here?

A few things I see (I’m an accountant in Kelowna, soon to be moving to Victoria and I think Vic and Kelowna have very similar markets):

– NIMBY is real and isn’t going anywhere fast (or ever)…no one wants THEIR neighbourhood to become affordable

– Politicians are not incented to make any changes, and change is hard

– You can still sell a house in Vancouver/GTA and buy in Vic at a “discount” although this is changing (I have many new clients that fit this demographic)

– With a suite in your basement, many can afford the prices in Vic…albeit you’ll need 100k ish down and good income(s)

– Everyone wants a SFH but we are not producing them in line with demand (and it’s been this way for 20+ years)

I’ve seen calls on this board for drastic price reductions, but I just don’t see how it all adds up. My guess – prices stay flat or go up a little (I think Van/GTA come down a bit and Vic moves up a bit until they are a little closer to each other).

The real truth I see:

1. Owning a SFH in BC has become a luxury, only high income earners or kids who are given large down payments will get them.

2. Wage inflation is coming at 100 km/hr

3. Over 20 years, as baby boomers actually leave their homes, affordability will recover, but through wage increases, not price reductions.

Lastly, Frank: thanks for sharing the moncton house – moving across Canada is what thousands of people do to try and get ahead. I would never be able to afford BC had I not moved to where the opportunity was to get ahead.

Spoke with someone who was bringing in immigrants from the Philippines to work on Manitoba farms. It takes 2 years to go through the process (supposed to be 6 months) to bring one worker over. Their family can follow 4 years later. That is the type of sacrifice immigrants have to make to come to Canada to do back breaking work that most Canadians would refuse to do. And they are moving to remote communities (have you heard of Fisher Branch?) for the opportunity. Gives some perspective to our expectations that we should be able to afford to live anywhere we want. How many Canadians would leave their family to work in a foreign country? I’m not even going to discuss the cramped living conditions they are provided. We just don’t understand how difficult it is in other countries.

Do people really go into politics to help needy people or do they go in to help themselves? I think we know the answer to that.

Ontario tried a speculation tax on property, and the market ‘collapsed overnight’. The province announced a 50 per cent land speculation tax on April 9, 1974, a date the Ontario real estate industry will always remember

As I’ve said, there are solutions and they’re not hard to figure out. What’s missing is the will to implement them.

Whatever they may say, no politician actually wants to cut house prices

Bubble or no bubble, housing is and will be: unaffordable in Victoria. Whether your cheer lead up or cheer lead down, it won’t make any difference.

The cost of constructing new housing is exorbitantly high. Labour is tight, materials are expensive, and you cannot force someone to give away their land. Sure there are going to be a few deals here and there; but prices will IMO not reach affordable levels.

For people who have been in Victoria for a long time, say 40+ years… has our infrastructure and roads seen added capacity or improvements? NOPE Are there “more” people living in your neighbourhood? NOPE

The point is Victoria is setup to be a sleepy town with limited land and infrastructure. The noble vision of creating affordable housing and social housing for all who want to call it home is disingenuous and an unattainable goal.

Don’t forget the real estate bubble in Ontario in the late 80’s. if you bought at the peak prices fell almost 50%, and if you had a child the same time that you bought your house they would have finished University before you broke even after adjusting for inflation or they would have been a teenager before the nominal price reached your purchase price

I heard about the B.C. 1980’s price collapse but I was a poor student with no interest in real estate because I was broke. Didn’t get into it until 1986. When you don’t have any money, real estate isn’t very interesting. I did own a mobile home on the outskirts of Marietta Ga., that’s right, I was white trailer trash for 3.5 years, best time of my life. I was really happy then. Paid $10,000 for it and broke even.

He already said why in his previous comment on the last post:

The 2008 financial meltdown in the US was the result of the RE bubble that started to collapse two years earlier.

Anyway, I certainly got the impression that you were old enough to remember the early 80’s bubble and bust in Vancouver and Victoria. There were others further afield in Canada and elsewhere later, but I’ll excuse your lack of curiosity.

Who’s “everyone”? Try paying attention to the facts, you might like it.

From time to time i post about Moncton because NB is one of the cheapest places to buy a house in Canada and I thought others might find it interesting also. If it was just a few dollars difference I wouldn’t mention it. But the difference is gobsmacking.

I posted the information because I feel very sad for people who haven’t much hope of owning a home here in Victoria and yet want the security of home ownership and a life where they can raise their kids in peace.

I am an immigrant. We moved half way around the world to find a place where there were better opportunities.

Many people don’t know about NB and how cheap it is. There are new people joining HHV and that’s why I believe that the subject is very relevant to people on this forum and from time to time and so I mention it.

Thanks for the positive comments from some House Hunt Victoria people:)

Then why aren’t you buying the place on Ascot Frank?

This is the type of suggestion that you can either choose to be insulted by or not. For instance, I’m not the least bit insulted by this suggestion.

The only real estate bubble that I’m aware of in my lifetime was the 2008 financial meltdown that occurred in the U.S. Why did it occur? Financial fraud by unscrupulous bankers allowing mortgages to be handed out like candy to people they knew could not afford the real payments hidden in their mortgages. From what I recall very few Canadians, if any, were affected by this scam. In fact, thousands of Canadians took advantage of the distressed prices and bought investment properties south of the border. I couldn’t believe how many of my friends, most with slightly above average incomes, rushed down and bought in Arizona. I don’t remember many foreclosures in our country, mainly because most mortgage holders weren’t sold a product they couldn’t afford. I believe those same conditions exist today with even more safety nets like the stress test regulations. Why is everyone expecting massive defaults here. If there are going to be defaults, I guarantee there will be buyers waiting in the wings with cash. That’s the reality I see.

Is it really? People move across continents and oceans to earn a living, sometimes leaving family behind. People regularly retire to places with lower cost of living, including relocating to other countries.

I don’t like that prices are stupidly high here, but they are and don’t look set to change. If your income here doesn’t buy you the lifestyle you want here then moving somewhere cheaper could make sense.

Which is what? Bubbles burst all the time.

“There is no inherent reason why housing in BC can’t be made affordable”, and then there is reality.

Suggesting that someone literally move across the continent to afford a place to live is insulting IMHO.

There is no inherent reason why housing in BC can’t be made affordable, except that there are too many interest groups opposed to it.

It’s a bit quirky, but it’s not like Deryk is spamming us with excessive Moncton posts. Looking at what your money buys you elsewhere is not so far off target?

3903 Persimmon Dr – $2.45M

Bought 2015 – 800K

Substantial reno but not my style. Beautiful piece of property but we’ll see where they end up in this market.

Can you stop posting about Moncton? Maybe setup a website called househuntmoncton and keep your posts all concentrated there.

paint a house cost $5,000 five years ago, now $10,000. The house price doubled as well.

https://www.kijiji.ca/v-house-for-sale/moncton/56-elm-st-moncton-new-brunswick/1612981420

I’m posting this simply to make people be aware that there are opportunities for anyone who wants to reconsider living somewhere else than Victoria. This duplex in Moncton is under $300,00.00 for example.

In Moncton …they think prices are crazy and out of line. (Much like some people stated on House Hunt Victoria back when Victoria houses were $500,000.00)

How much did that answer from the lawyer cost you? 🙂

Answer from lawyer: We don’t know yet because the regulation isn’t there yet, but because it’s an amendment to the property law act, he expects the cooling off period to apply to all transactions, including private sales and mere postings.

Not likely:

As a buyer in a hot market you could use this strategy. However you have no assurance that other bidders won’t do the same. Then you have the choice of backing out and paying a penalty or trying to negotiate down to the next highest inflated bid (and thus still potentially overpaying).

Bottom line I don’t think many people will be making frivolous offers and backing out. Most people, even quite well to do people, have a severe aversion to several thousand dollar penalties. Psychologically it is probably easier for most people to overpay for a house by several thousand dollars than it is to pay several thousand dollars in penalties for backing out.

Wow… Canada nominal GDP in Q1 2021 is up 10% YOY. That’s 9% nominal GDP growth per capita YOY. You won’t see that in any headlines, because statCan and everyone else loves to adjust the data by inflation. If you understand/believe the strong correlation between house prices and nominal gdp per capita, it’s not a surprise that Canada house prices are up 11% YOY

Nominal GDP values are important to real estate, because people care about nominal house prices, and nominal house prices are strongly correlated with nominal GDP per capitaThis is not only true in Canada, but in studies done in USA, Europe and Asia. This is a long term co-relation, and since correlation is less than 100% it’s obviously not true in every year.

https://www.asiagreen.com/en/news-insights/the-link-between-gdp-growth-and-the-real-estate-market

“Studies in Asia, Europe, and the US reveal that median home prices correlate by as much as 60% to 95% with GDP per capita. “

Anyway, for the “number crunchers”, here’s a link to actual GDP numbers for Canada, where you can see all of the components of GDP and how they add up to Canada’s current gdp, which is $1.94 trillion CAD/year.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610010401&pickMembers%5B0%5D=2.2&pickMembers%5B1%5D=3.2&cubeTimeFrame.startMonth=01&cubeTimeFrame.startYear=2019&cubeTimeFrame.endMonth=01&cubeTimeFrame.endYear=2022&referencePeriods=20190101%2C20220101

You can add conditions to a pre-sale, non-issue. A lot of the time I do add a condition for my client so that my client needs to sign an amendment to remove conditions firming up the sale. The recession period comes and goes without any paperwork so could lead to buyer who actually wants to back out forgetting or similar.

sorry meant to say individual seller, not private seller.

Both. I added the timeline graphic to the article. I also don’t really see the point of requiring both. I mean what’s the harm if a seller wants to accept a bully offer? The buyer still has recourse through the cooling off period.

Think about how dumb this is though. To essentially download a PDF of minutes and some forms should not cost $300. Seems like this can and should be easily solved with technology or regulation to stop the gouging by strata management corps.

Here’s what they say about that: “Require sellers of resale strata units to provide prospective buyers with an updated disclosure of strata documents if there is a material change between listing or marketing their property for sale and the date on which the contract for purchase and sale becomes firm or binding.”

Definitely curious about this and private sales. I’ll ask a lawyer but I presume no one knows yet.

How is that different than a market like we’ve had where seller has 20 bids and if the first one bails they take one of the three backup offers they secured? Or just relist.

In a slow market I really don’t think we’re going to see a lot of people using the cooling off period. Why bother if they can make a conditional offer and back out for free?

I don’t understand this. Why would it add stress or hurt a private seller more?

Thanks for sharing this. Agree this is a huge part of the problem.

Prices for new apartments used to increase more slowly but when Starlight started buying apartments the new prices started going up at much steeper increases, then other buildings copied the new price. In the last few years prices seem to have doubled.

Thanks for the info, I hadn’t heard about this one. Agree new builds are a positive!

Btw, the whole 7 day recession period in pre-sales comparison is complete non-sense on many levels imo. Developer has maybe 20 to 200 units so someone rescinds it just goes back into the pool and developer sells to someone else at a later date, no big deal.

Private seller might be trying to move their family into a smaller/larger home, etc. and a rescission can actually impact them quite a bit especially on the stress level aspect.

That is why I am not feeling the mandatory 5 day delay plus 3 day cooling off period combined if that is the case. It could make moving where a sale is required very tricky in terms of timelines.

Also, no mention of how to address mere postings. Adding a bunch of regulations to the marketplace will not improve competition in terms of services offered, imo. More complicated you make it the better grasp agents have over fees.

This is enough to eliminate true tire kickers. Hopefully needs to be paid within 24 hrs of accepted offer and immediately released to seller if the buyer does not proceed.

Is this in conjuction with the cooling off period? Should be one or the other. Both seems too much.

There are many real life problems with some of these suggestions including multiple points with this one alone.

Strata documents can sometimes be upwards of $300 (property management company has a legal right to charge for them). In the last 24 months I always ordered them before listing because I knew there was a 95% chance a listing would sell. 2011-2014 I wouldn’t order them without an accepted offer first as listings wouldn’t sell or by the time it sold a year later you would have to reorder.

In a slower market documents such as the Form B are time sensitive. For example, lenders will not accept a Form B older than 60 days so you’ll be ordering expensive forms 2x which seems like a waste.

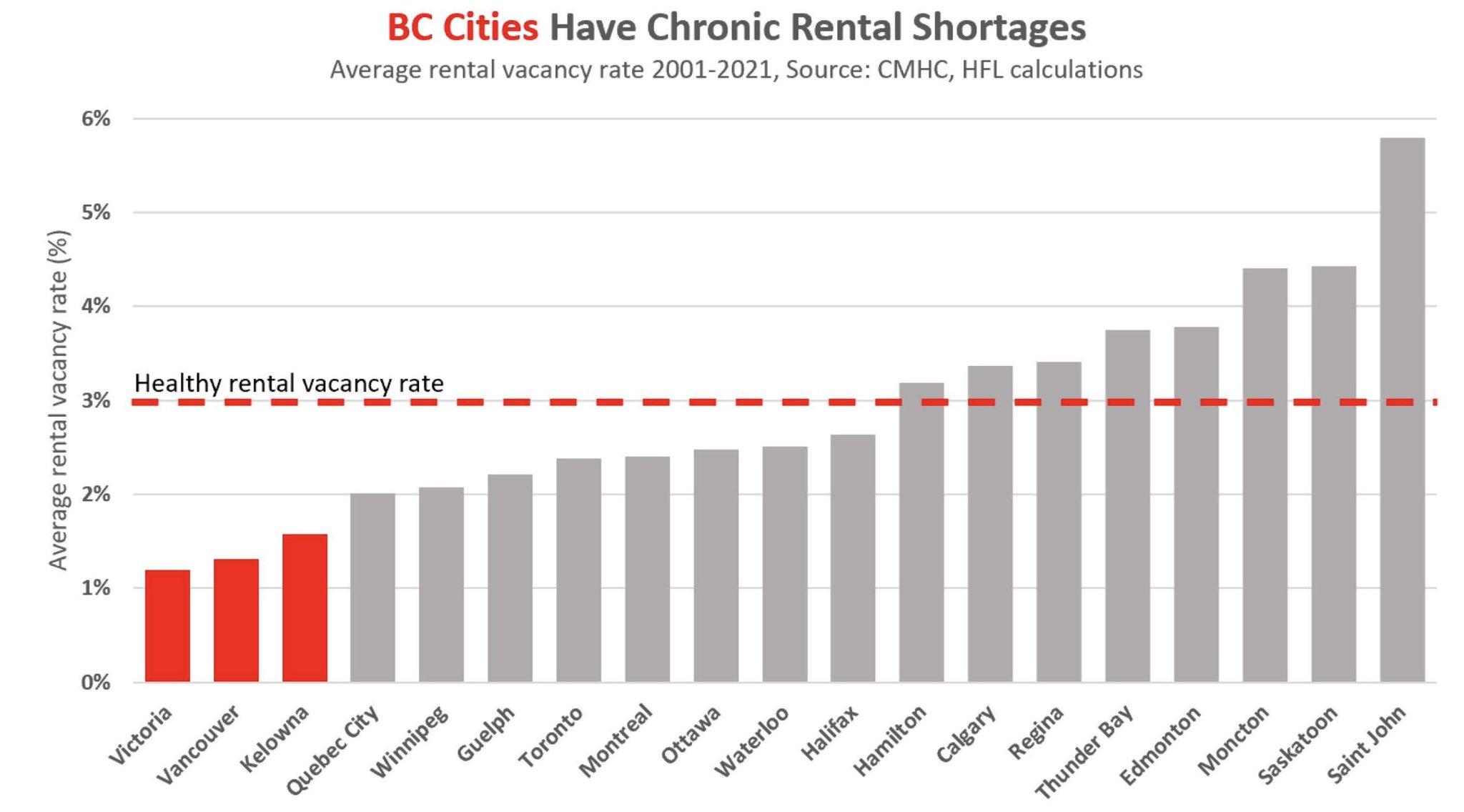

The unfortunate direct result of our chronically low vacancy rate. Lowest in the country.

Why didn’t the previous owner jack up the rent? Were they just benevolent landlords?

Before we bought we lived in a rental apartment on Quadra St. The owner said he never raises the rent, and he had a lady living in one of his buildings that moved in 40 years ago and still paid the same rent.

While that attitude was endearing, relying on the benevolence of landlords is not a housing strategy.

I’m not entirely familiar with their projects, but they are building 235 rentals in Central Saanich.

https://www.timescolonist.com/local-news/central-saanich-approves-235-unit-rental-development-at-former-nursery-5087643

Sellers have no ability to influence prices

No, rents increase when vacancy rates are below about 3%. At 1% vacancy the results are predictable.

Think about it. If landlords had the ability to recoup losses (aka charge higher rent) at will, then rational actors would do this at all times. They don’t do this because they can’t. They can only charge what the market will bear.

If costs go up but rents are frozen, then some landlords may sell their rentals when it’s no longer profitable. That does drive rents up as rental supply migrates to the resale market.

I got the “auction fever” once, was laid out for a week and wound up with a 1965 Jaguar E-type and three palettes of off brand maple candy in my garage. Those were the good ole days eh?

My problem with them is they buy up existing rental buildings and then jack the rents up, often all in one area so it sets a new price level. Rents have gone up astronomically since they moved into Victoria. I’ve heard recently that they are building a few new buildings. I also know they are not the only reason rents are going up, but they are a big part of the problem, imo. It seems very exploitive.

The higher the regulation, risk, and uncertainty for sellers, the higher price they will ask to offset the increased risk. That is fine in a balanced market that can absorb it, but when inventory is low it will drive prices up even further.

Look at rental prices in the last year of evidence of this – government prevented evictions for non payment, closed all post secondary schools to international students, and limited rent increases while inflation is the highest in years. The results are predictable – landlords are recouping those losses.

Note that condo pre-sales are always unconditional, so in practical terms their cooling off period brings them more in line with the usual practice of conditional offers for RE sales.

Not wholly of course. Once that cooling off period is over you’re at the mercy of whatever happens to RE and money markets in the next 2-3 years. Up to now that’s usually gone the buyer’s way. If not, well check out what happened when the Olympic Village got to closing date.

Not sure why the 5 day pre-period would be there, if a seller sees the offer they want and gets it early, they should be able just to accept it. So, the realtor might not get to try to organize a bidding war on an offer day? I don’t see this needing to be a rule because the seller and realtor can just agree to have an offer day.

I’ve heard some horror stories about renters in Starlight buildings but generally we want a lot more purpose built rentals and it’s gonna be companies like Starlight that owns those. Generally they will provide a lot more secure tenure than individual landlords. No issue with that.

If there’s a problem with them abusing tenants then that should be solved by strengthening tenant protection laws.

First!