May: prices pull back somewhat as cooldown continues

May brought a continued cooldown to the market, with the sales to list ratio actually approaching balanced market territory for the month, a sharp change from the extreme sellers market we saw this month last year. While Victoria remains far stronger than the Fraser Valley or the commuter towns of Ontario, it’s a significant pullback from where we were just a couple months ago.

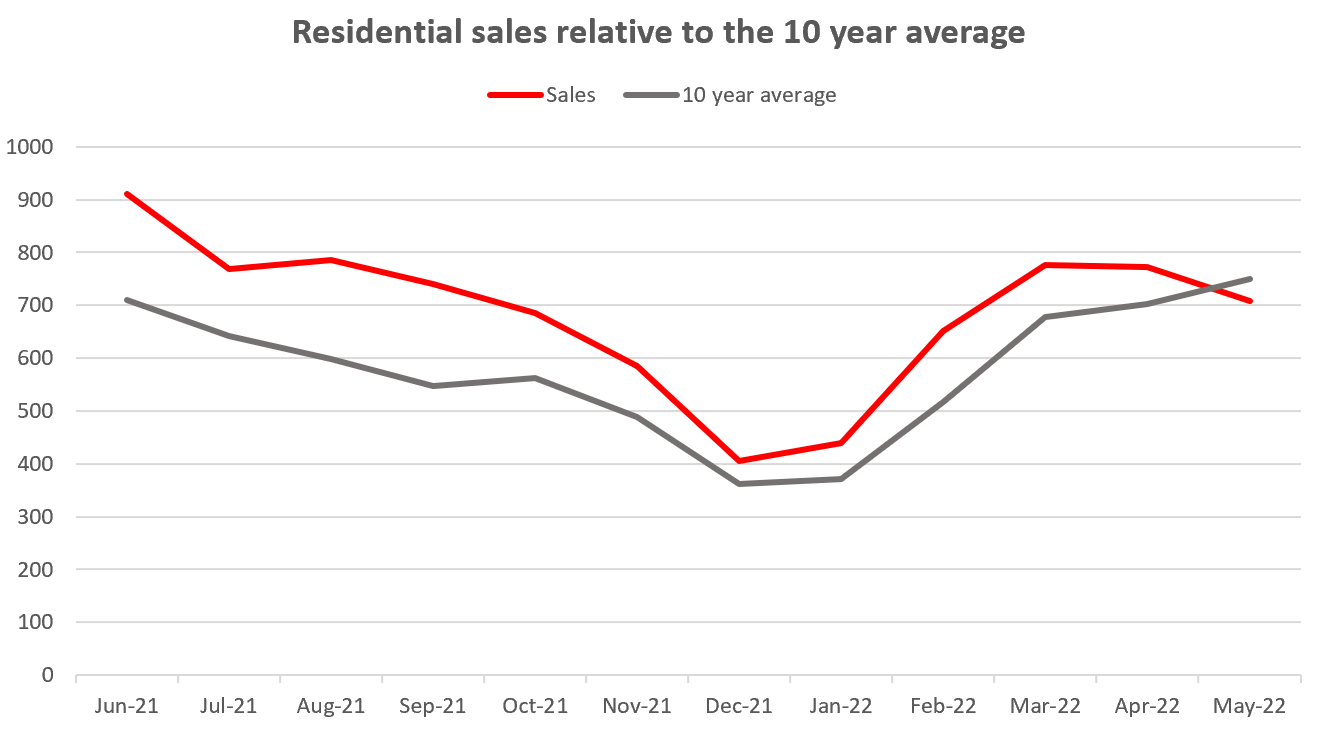

Looking at sales, the drop from well above the 10 year average to somewhat below is clear in May. However keep in mind we’re still not that much below the 10 year average, while residential inventory at 1371 units remains 45% below the 10 year average level for May.

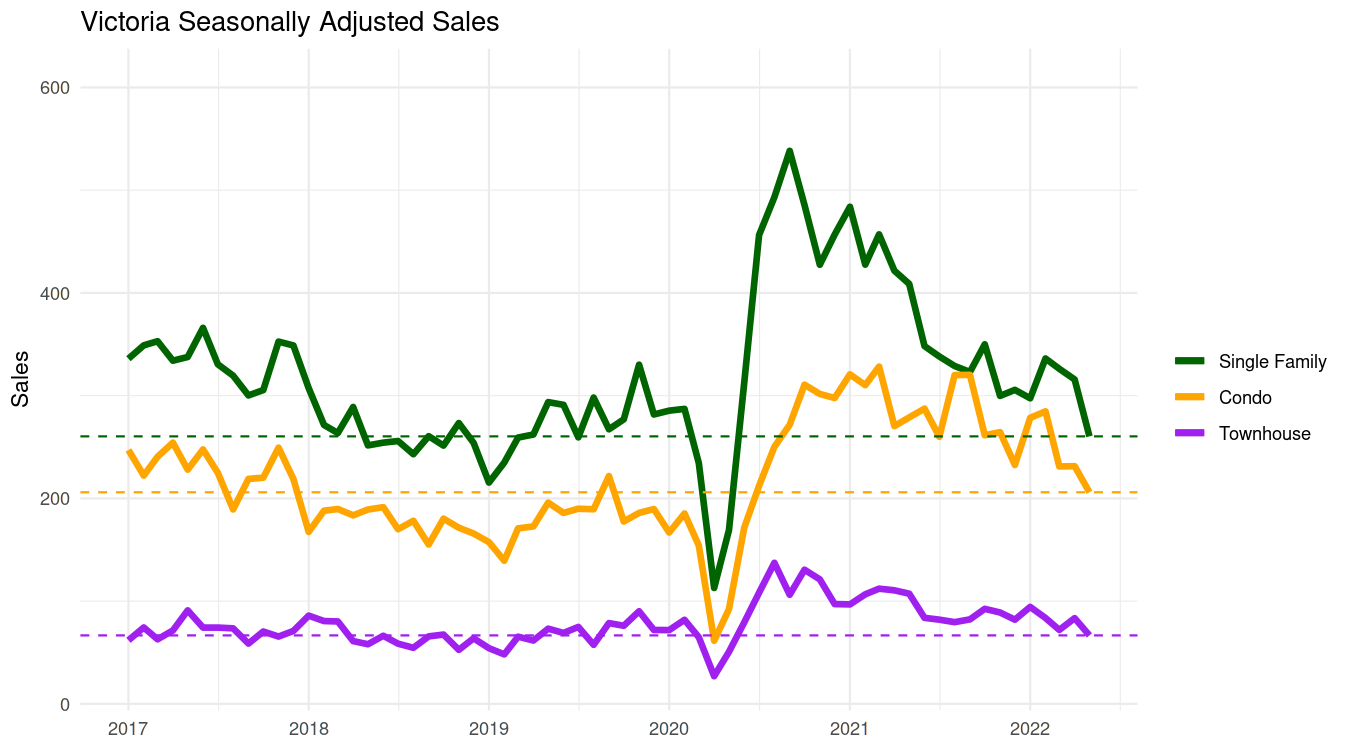

On a seasonally adjusted basis, single family and townhouse sales are at or somewhat below pre-pandemic levels, while condo sales remain somewhat above.

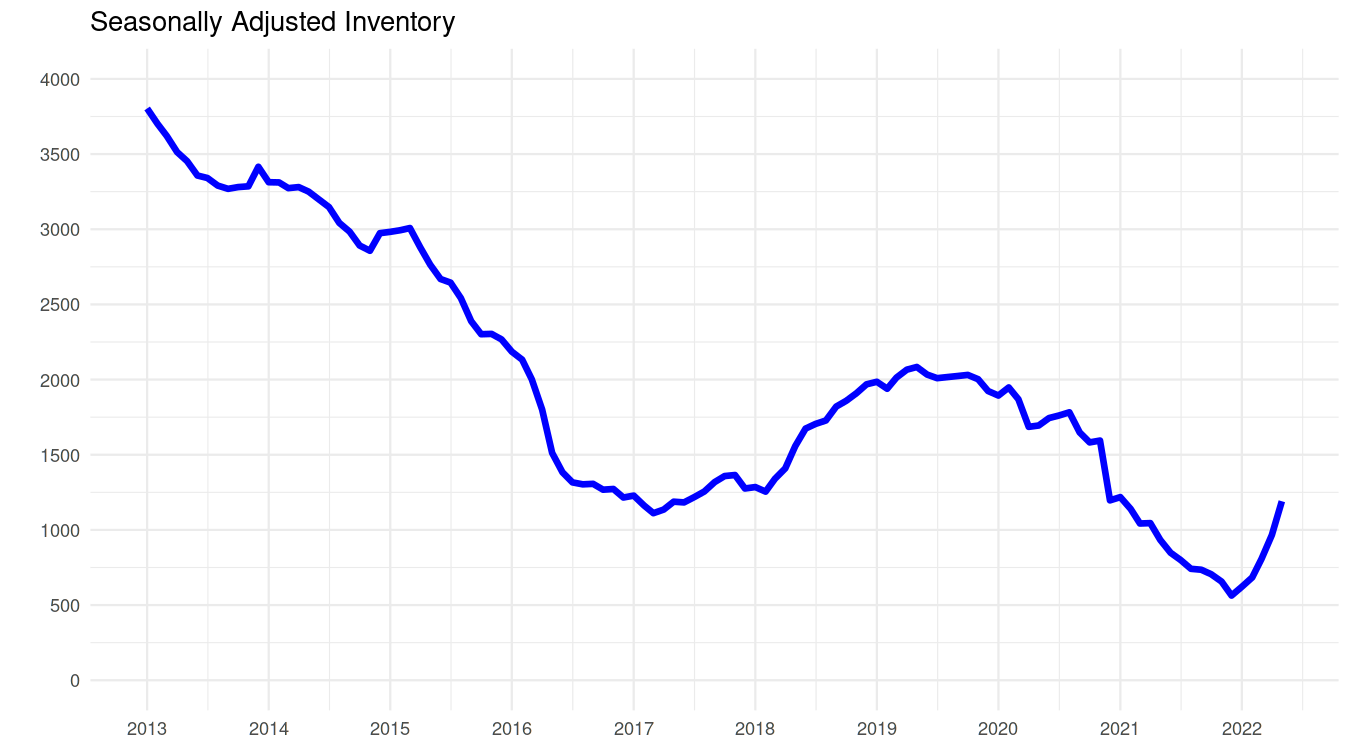

Inventory growth is now looking pretty strong. Inventory usually peaks in June so we should expect the selection to continue to grow month. Past that it usually starts declining for the year, but our seasonally adjusted chart will tell us whether the underlying trend continues upward.

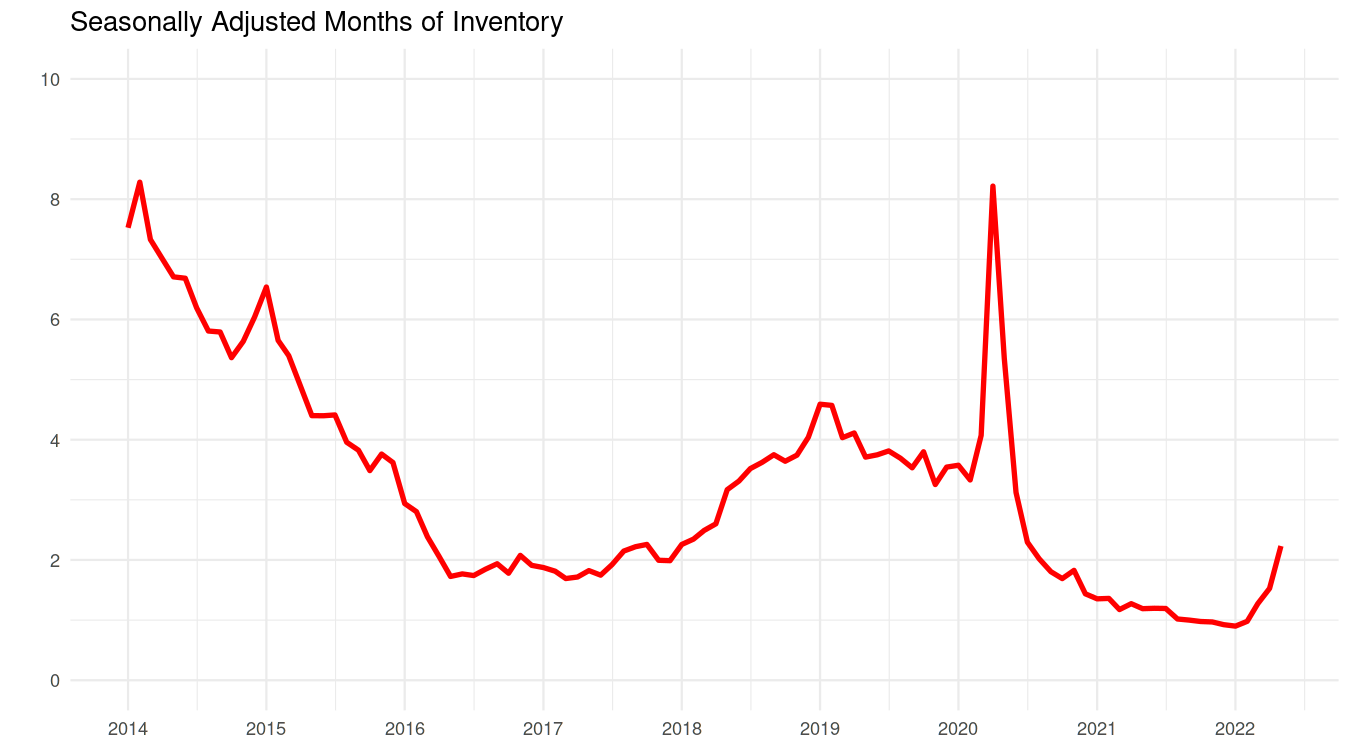

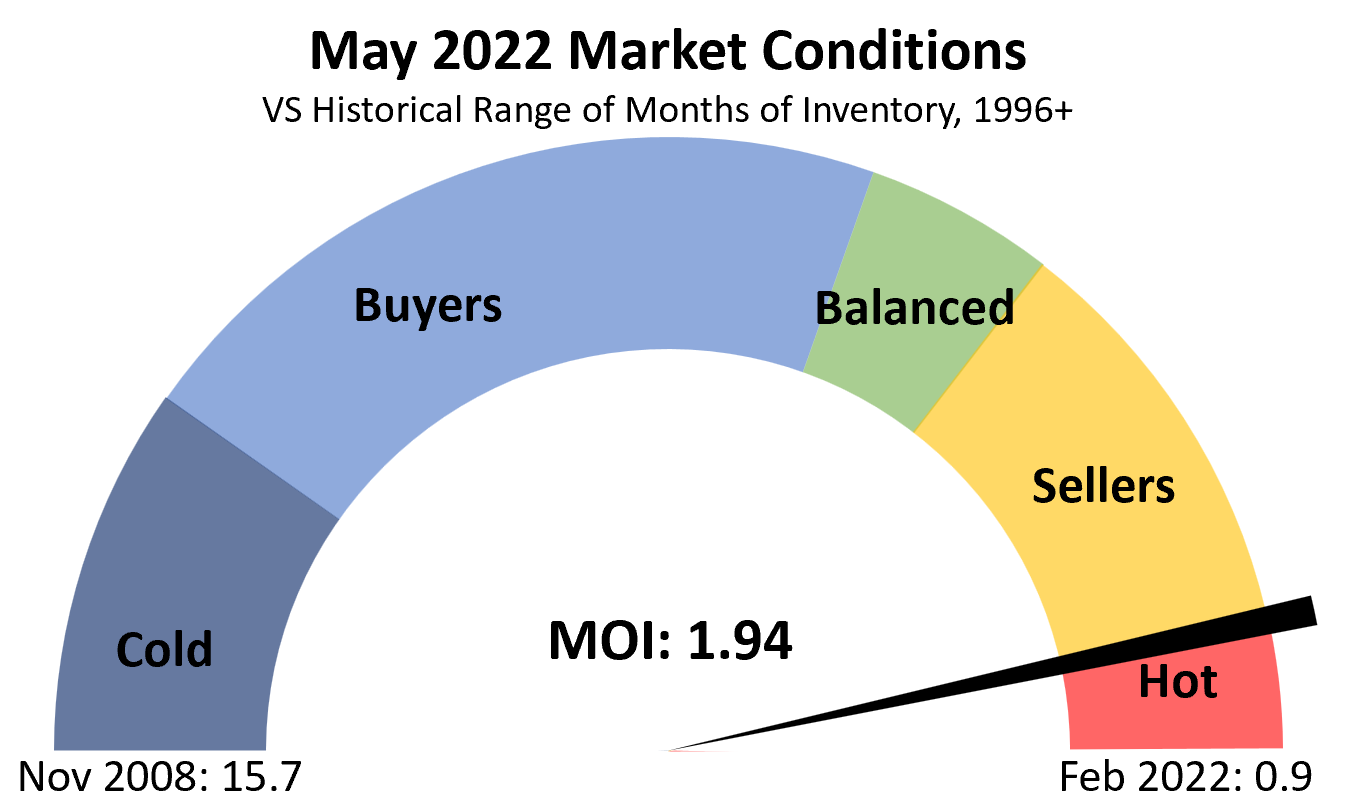

Months of inventory is also on an upward path. When we seasonally adjust to remove effects of the spring market (where months of inventory usually goes down) we can see we have finally risen above the 2 months of inventory level that we’ve been in since mid-2020. Widespread bidding wars can only be sustained below about 2 months of inventory, and sure enough we’ve seen a dramatic drop in the prevalence of those.

Looking at our market guage, we can see that though we have pulled back from the ultra-hot market conditions, we are still at the border between a hot and sellers market as measured by months of inventory (unadjusted).

However it’s important to look at this indicator in concert with the sales to new list ratio, which reacts a bit more quickly to changing conditions. Here we see that it has dropped pretty quickly from the levels of just a few months ago. We’re now around the levels of 2018/19 when prices flatlined for a while, while remaining substantially higher than a true buyers market like 2011-2013.

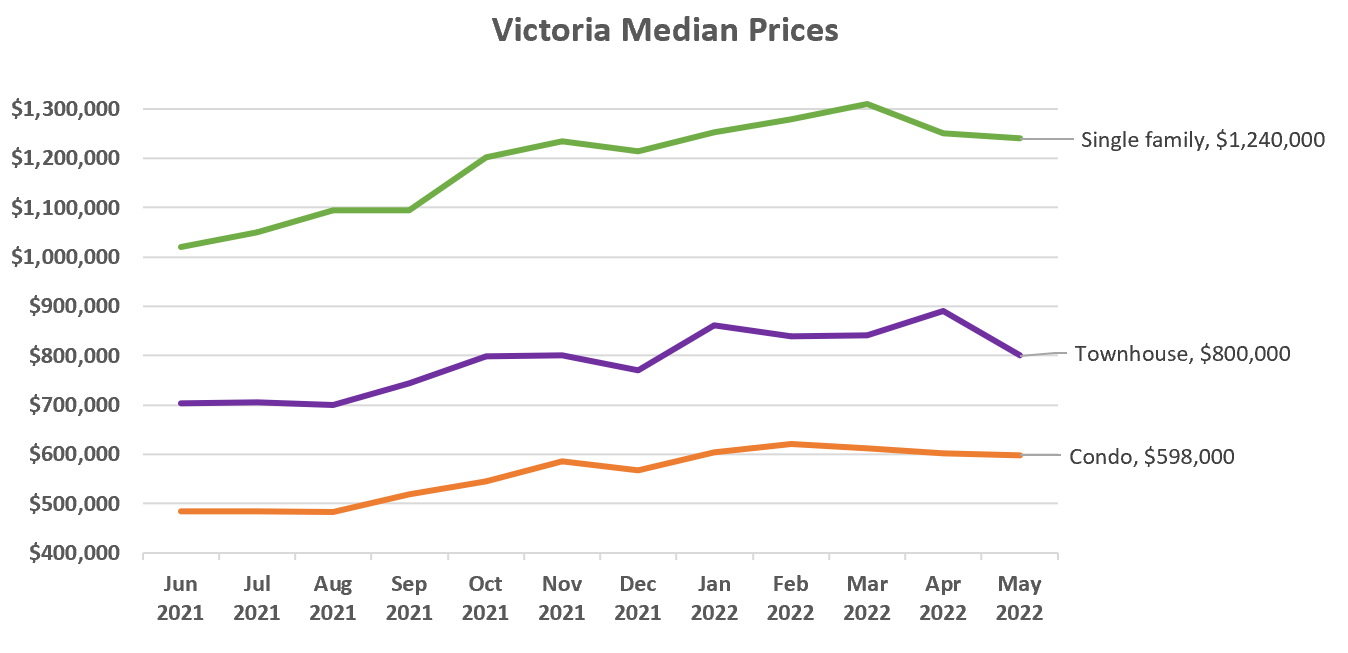

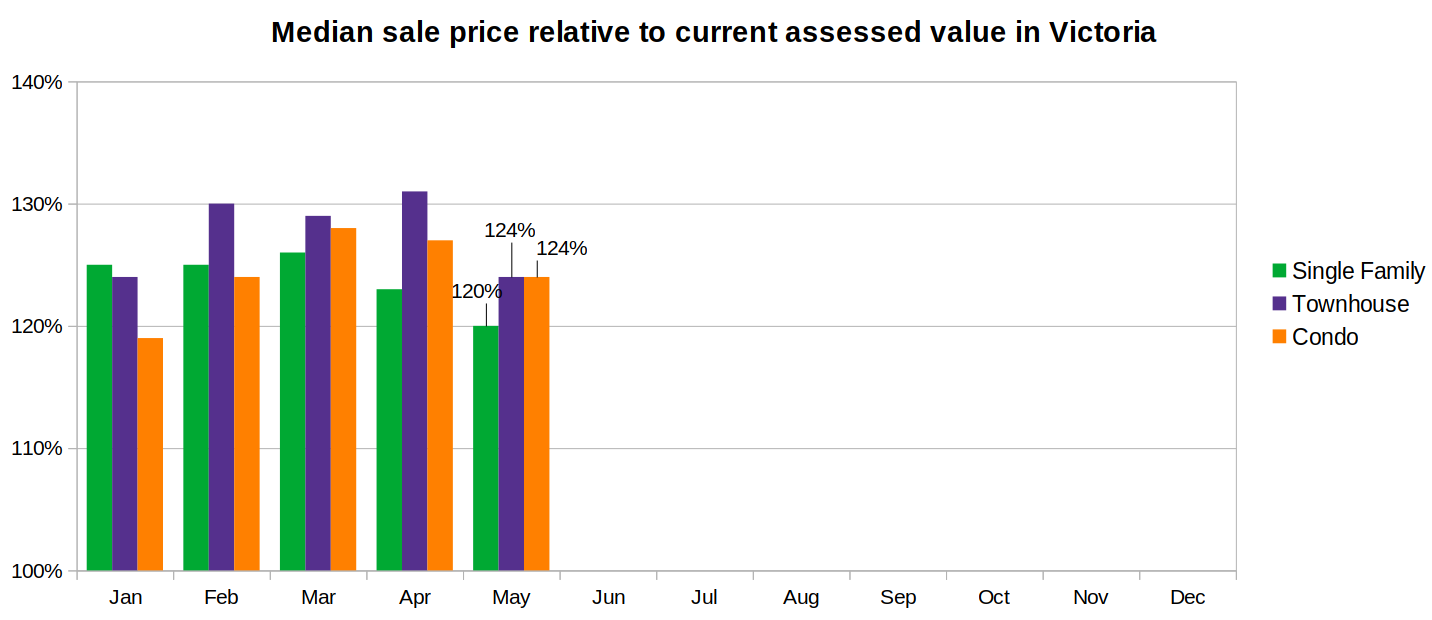

That assessment of conditions also matches prices, which have indeed stalled out for the time being, with median sales prices below peak for all property types.

However medians are noisy and generally a poor short term measure of price movements, while benchmark prices have been lagging badly and not reflecting conditions. Median sales to assessed value ratios are generally more reliable indicators of trends and in this case show a similar picture as the medians with prices down somewhat in every category in May. As I’ve mentioned before I believe this is mostly due to the reduction in bidding wars and with it a reduction in sales at above market prices. I’d want to see a lot weaker conditions before calling a significant decline in market prices, but perhaps we’re moving towards that point.

No one knows how far or how long the cooling will go, but with today’s rate hike for variables and a near guarantee from the Bank of Canada that more are coming, I don’t see any reason to believe that the trend will change within the next couple months. For those who think that the Bank of Canada will soften their stance in response to a weakening housing market, so far they show no sign of it. Despite acknowledging that the housing market is moderating, they have but one hammer, and they intend to use it. “The Bank will use its monetary policy tools to return inflation to target and keep inflation expectations well anchored”.

In some ways it’s good news for the stability of our market that the much bigger markets in the lower mainland and Ontario are weakening faster than ours. A price crash in those areas might cause consumers to pull back and moderate inflation before it fully filters through to us. Personally I think a true price crash requires rates around the 6% mark which I doubt we’re going to hit. However the rapid turnaround in the market in other areas has certainly been surprising. Though real estate has never been very predictable, after the unprecedented jump in debt during the pandemic it’s only gotten less so. We’ll just need to stay tuned and see what happens.

Make them high enough and they will. But that’s not the job at hand – it’s raise them enough to take CPI inflation down, whether or not it raises the CAD.

New post: https://househuntvictoria.ca/2022/06/07/busted-benchmark/

First off, they have a inflation rate of about 78% in Turkey, secondly they dropped rates to 14%. Thirdly, you guys are comparing CAD to USD only, when we import from more than just the US. The CAD has gone up 87% against the Turkish Lira in the last year for instance, or 23% against the Argentinian peso, almost 17% against the yen, 7.5% against NZD…

Higher rates may make the CAD fall less. But it won’t raise the CAD by itself. If you think otherwise, buy some cad futures, those “know nothings” are expecting the CAD to fall against the USD. https://www.cmegroup.com/markets/fx/g10/canadian-dollar.quotes.html Or invest in the Turkish lira – they rose rates to 14%.

“The Toronto Real Estate Board’s monthly numbers dropped on Friday, and they now officially show what we have been shouting for a while—the housing market has weakened considerably on a dime. The reason? A simple nudge in interest rates by the Bank of Canada was enough to chill rampant demand, and continued aggressive tightening will weigh through the rest of the year. Consider that we’ve gone from a world where housing was priced at roughly 1.5% mortgage rates, to one later this year where both variable- and five-year fixed-rate mortgages could be in the 4-to-5% range (fixed already are). Prices are already under heavy pressure as valuations adjust to this new reality. It could be a long, cold, summer for housing.”

https://twitter.com/SBarlow_ROB/status/1534140027042676736?s=20&t=n2S2IkNGDIE4wxQKoth2KA

Can you imagine what CAD would be if we go back to what seems like a normal range bound of 80 usd oil?

You mean to last year’s levels? I don’t ever expect to see that. We’ve seen the results and once bitten twice shy for the central banks.

There’s a whole basket of issues – conflict with Russia, detachment from China, labour shortages, and of course climate change which will continue to exert pressure on consumer prices going forward. This isn’t 2008 when you could dramatically drop interest rates and get away with it (except for asset price inflation which the CB’s don’t care about). The new normal will probably look more like the pre-2008 old normal.

Increased interest rates will result in a higher CAD, thus lower CAD price for globally priced products than otherwise.

Sure the CAD price may go up anyway but the target is the whole market basket of goods and services, many of which are locally priced. Higher prices for globally priced products mean less to spend on locally priced products.

Since house prices are pulling back — and probably will for some time to come — how fast will be the recovery? Is it likely that once interest rates are brought back down that prices will come back fairly quickly?

First, great article. Second, when you say that “it will require rates above 6%”, what are you referring to? BofC rates, bond market rates or five year mortgage rate. Articles and discussions seem to throw out rate numbers without a term of reference all the time for some reason.

Curious if there is any increase in asking prices in the last few months, and if any data exists.

Coal & Forestry are still the top exports.

A reference never hurts…

Largest exports for Canada.., oil dwarfs everything else . This Wikipedia list looks a little suspect though, since Forestry is only mentioned under pulp.

.

Problem with some of the crops, its been so wet in parts of the Prairies, certain crops cannot be planted because it’s so late in the season. Some food shortages are certain later in the year. Then prices are going to go up and increased interest rates won’t have any affect on the rising prices.

The forest industry was devastated. I lost my own job – I was working for a major forest company at the time. Mining did badly too. Those were the top two industries in BC at the time.

As far as the macro situation in Canada today goes, I would say the top commodities are oil and grain. Don’t need a reference to know how they are doing.

Doesn’t really matter what the prices are when you’re forced to sell it to Ontario for pennies on the dollar.

He probably has more experience with immigrants than me too.

Lol, okay James. You mean making fun of Frank, cause that’s what you and Umm really did when he shared his opinion. Besides I’d take Frank’s opinion over yours, he clearly has more RE experience than both of you.

Not sure what you’re calling a “commodities bust” in 1982. Here’s commodity prices, for all commodities, and oil specifically – no bust in ‘82. There was an oil shock price rise 3 years earlier 79-80, and oil prices crashed in 1986.

Most people would say the 1982 recession was caused by the tight monetary policies (20% interest rates and high unemployment). https://en.wikipedia.org/wiki/Early_1980s_recession_in_the_United_States

May ’21 vs ’22 price comparisons:

Copper: -6%

Lumber: -49%

Palladium: -30%

Iron: -32%

Steel: -8%

Silver: -15%

Patriotz keep in mind killing inflation is killing demand so it will hit at the commodities market I think we will find out if we are going south sooner than later the latest move in interest rates won’t show up for a few weeks yet I’m sure marko will let us know when it gets frosty on the ground

When that government bond hits 3.123% I’ll start to worry 🙂

As long as commodities remain strong I don’t see the economy getting that bad. Unfortunately that means the BoC won’t have to worry as much about the RE market.

Remember the recession of 1982 was a commodities bust.

In other news: Canada 5 Year Government Bond 3.122%.

Barrister I’m of the feeling they will keep going I think we are closer to the beginning with inflation and it will still be debated a year from now I can’t see the economy coming out of this alive Recessions do come and go and life still goes on

I dont think it will be too bad as long as The BofC stops at three, anything past three might be a rather bad story.

Basically flat from last week after a few weeks of a hundred or so inventory gains. Leo does inventory normally drop over the summer?

Sounds like it’ll be around the same as current (8.3/8.4). Wonder if they’ll actually let it surprise to the upside this time to make up for suppression in the last one. It would allow them to try to pretend that they’ve got a handle on it by September.

Updated sales list

Monday numbers:

Sales: 111 (down 20% same week last year)

New list: 224 (down 4%)

Inventory: 1789 (Up 20%)

New post probably tonight (folks in town)

Whoosh.

I understand that being petty is something you’re intimately familiar with, but pointing out that Frank missed the opportunity to buy his dream $1.8 million flip and is now priced out forever isn’t it.

Yikes, saw this on twitter – talk about updating your expectations:

[img

Was sitting for 2.5 months apparently.

Couldn’t be more wrong JS, again. For the first time in a decade I switched from variable to fixed last year, so all my properties have interest rates under 2%. The payments are low, the properties are cash positive and the debt is being paid by other people, so I’m fine. I was simply pointing out how there are a few clever people that aren’t even homeowners that seem to enjoy pointing out that some are going through buyer regret right now or struggling with higher interest payments and I think it’s petty.

Wow! finally broke through 3 (3.11% now). Should see 5 year mtg rates go up again if it can hold this. See what US inflation brings this week as well as our own next week.

5 Year Canadian Bond yield today: 3.079

House prices must be going up bonkers like they did in the 70s…

Anyone else notice that Debt Monster actually hasn’t posted anything since saying he would stop. Wonder how long it will last.

It’s okay U&C, we get it, you’re having trouble with rising interest rates.

Everyone cherry picks things to fit their narrative. Remember when you made this “interesting” post last week?

“Interesting survey data”

https://www.ctvnews.ca/business/study-finds-non-homeowners-are-pessimistic-about-buying-homes-despite-cooling-prices-1.5927764

“CPA Canada says that 60 per cent of homeowners find that affording necessary renovations is challenging, 40 per cent say its hard to keep up with mortgage payments and taxes, while 35 per cent struggle to pay utilities”

The entire article was about non-homeowners buying homes and you cherry picked a quote about current homeowners finding rising interest rates and costs challenging. Most of your posts seem to find some joy in attacking those currently in the market (see your Frank posts about what he should offer on a Saanich property that wasn’t even the one in question earlier in the thread, lol, you and JS look like the fools now) or your posts that are upset about someone getting help from a parent or loved one for a down payment, which has also been happening for a long time prior to the past couple of years, so maybe relax on that one too because it just looks like envy/jealousy/whining.

Benchmark prices have been screwy since the pandemic. Last spring they were saying prices were only up 10% when in fact prices were up more like 20%. Now they haven’t caught up to the fact market has changed again

I’m confused. If prices are pulling back in Victoria, why does the VREB now publish that the benchmark value for a home in Victoria

“in May 2022 increased by 23.8 per cent to $1,446,400, up from April’s value of $1,424,900”

And, why has VREB now changed their calculus for benchmark value now that prices are changing??

As a social science major yah I know you can cook the books to show up stats however you like but this is just getting unclear. VREB is looking at benchmark not medians but still results should not vary too much.

Leo, can you help out with understanding why your stats differ from VREB on such a fundamental issue of prices going up or down last two months?

Your Sunday morning long-read!

Twilight of the NIMBY

https://www.nytimes.com/2022/06/05/business/economy/california-housing-crisis-nimby.html

Pretty sure part of downtown Victoria and downtown Vancouver would be worse.

Let’s start with realtors and make our way down…

You laugh, but I’m sure it is more authentic than Tuscany Village.

Lol wtf

Look Marko: Croatia in Texas https://twitter.com/gmoult/status/1533135523417575426?s=21&t=LaWPnsqRly2IGT1zyEq25A

Lol they are getting paid complaining how unaffordable houses are on hhv.

“It would be great if public servants WERE paid by the hours they actually work rather than annually paid.”

They’re not working in a sawmill man.

I always loved living in London. While housing is expensive, it is not outrageous given local salaries and the depth of job opportunities. I agree that in many ways cost of living is cheaper and there is simply more to do. Terraced houses are extremely common for middle class residents, with semi-detached and detached dwellings more common in the suburbs. Even in very expensive areas (Kensington, Chelsea), it is highly unlikely that you would find a detached house. Affordability for working class residents was also good in the post-war era, until Thatcher made significant changes to council housing. That said, even with austerity programs and the erosion of the welfare state, the UK generally has better funded and broader social programs than Canada, which also makes life easier.

Also, as for why some people left London/the UK for Victoria, there are many complex personal factors surrounding the decision to emigrate and it is far too reductive to say that people left their home country because it is unlivable, etc. Also, some people emigrate simply to have new experiences and gain a broader perspective on life. This is something that I highly recommend for everyone!

Employee compensation is actually highest in Q4, because of Christmas/end year bonuses and other annual payments. StatCan data is seasonally adjusted for that reason. To be clear -I’m not predicting or expecting the 4.2% increase in Q1 to repeat and annualize to 17%. Just pointing out how big an increase of 4.2% in 3 months is.

To avoid seasonal effects, and compare apples to year-old-apples, we can simply look back to the YOY comparison for q1 2022 vs q1 2021 to see that total employee “pay-stubs” compensation has increased 11% (10% per capita). That’s an increase of $130 billion, from CAD $1.221 trillion to $1.351 trillion ( a record increase for a year). This amount is a huge part of the Canadian economy (for comparison, the number is about 65% of our $2 trillion GDP) That’s $130 billion more cash sloshing around, and it’s one reason why Canadian homes rose 12% in price last year. btw) that $1.351 trillion works out to about $35,000 per person, and the 11% increase was $3,700 per person (that’s including every person- working or not).

What more of a concern is the amount of productivity in a work day.

I lived in London 20 years ago, and I don’t recall having any complaints about livability. Housing aside, it was cheaper than Victoria or Vancouver (a bit like living in the US where salaries are higher and goods are cheaper), had excellent public transit (had no car), and no shortage of things to do. A surprisingly decent amount of green space (would walk through Greenwich park to Canary Wharf regularly). Proximity to other countries and cultures was a huge plus.

Lots of housing for the middle class, although it was almost all flats/apartments. I don’t recall SFH except for the super expensive older areas.

How would I rate rate the livability of London, I’ve never been there. Why not ask all the English people that live in Victoria? They had their reasons for moving. I believe people from the U.K. represent the largest percentage of immigrants in Victoria. Can anyone verify that? I read it somewhere.

Greater London has a homicide rate of 1.4 per 100,000. Calgary has a homicide rate of 2.53 per 100,000. Crime has very little to do with density, and a lot to do with socioeconomic factors.

The major livability problem for London is – surprise – cost of housing.

Most employees receive their pay raise effective Jan 1st. Annualizing pay increase based on first 3 months does not make sense if that holds true for most employees.

It would be great if public servants WERE paid by the hours they actually work rather than annually paid.

I’d clap for a 5% raise for them if they had to clock in and clock out.

How is everyone finding their insurance rates lately? With the soaring costs of getting anything done construction wise, rates must be soaring also. I’ve been fortunate with my rates, they go up an acceptable amount every year. I’ve heard some horrendous increases from some people. High inflation gives them a good excuse to charge whatever they want.

At what point does tying up a couple million dollars in a property plus high taxes, insurance, and maintenance costs, not make any sense financially. In a few years most Canadians will be priced out of the market completely. Where are people going to live? Is Canada becoming a country with an elite upper class and a struggling lower class.

How would you rate the livability of London for the middle class?

Say, 0 is over-crowded, crime-ridden squalor, and 10 is paradise. Where would you put London?

Income gains matching inflation have always been sustainable in Canada – look at the long term chart since 1981/ This is not cherry picking. You should expect hourly wages to slightly exceed inflation, because they’ve been doing that since 1981 in Canada. Total compensation was higher than inflation in last 12 months, likely because of increase in total hours worked from increasing labour participation as we recover from Covid.

So if inflation stays around 6.5%, you should expect about 7% hourly wage growth. That would double income in 10 years. I think we are just getting started with the inflation generated wage growth, and the Q1 2022 total compensation from income pay stubs is a good indicator of what’s to come.

“1/3 of an acre in Maplewood for 1.125mill?

I don’t think that’s exactly a bad deal seen worse in the last year. Would have sold for land value only.”

Maplewood has always been an underappreciated neighbourhood in my opinion. What is not to like about it? It has lovely, established streetscapes, some reminiscent of South Oak Bay. Some of the houses I think are even heritage and look that way. The homes in general seem larger than say Oaklands or even many South Oak Bay homes. It’s not a raw, spanking new subdivision but gracefully aging with lots of mature trees and flowering bushes. Playfair Park is spectacular when the flowers are in bloom. You are close to an interesting golf course. It’s closer in to town than higher end suburban areas like Broadmead or Cordova Bay and much, much closer in to town than the Westshore areas. At the same time, it’s far enough away from the street life and social ills of the inner city. Ok- it’s not on the oceanside but neither is Broadmead, Fernwood or Bear Mountain. Prices in Maplewood always seem lower than what they should be in comparison to other Victoria areas.

That is some interesting cherry picking wage data points and extrapolations from it. Let’s just wait and see if those actualize over term along with the other assumptions. Chances are inflation will hamper productivity and drag on the economy. Yes, in a panic some wages have shown growth, however, it is more likely that those are not sustainable in the business model where they occured. Now that correction will shock some folks when the goods or production behind those wages decline because they have surpassed the cost of what the market will bear.

you sure it won’t find its way into filling the belly and gas tank first?

This looks reasonable for $1.8M: https://www.realtor.ca/real-estate/24423782/1724-algoa-pl-victoria-rockland. Frank would probably bully offer $3M though.

it is a great deal if you think the market will stabilize from now on out.

1/3 of an acre in Maplewood for 1.125mill?

I don’t think that’s exactly a bad deal seen worse in the last year. Would have sold for land value only.

I’m buying in Eastern Europe, lots of fixer-uppers there. No renters though.

What’s their budget Leo?

That’s a different house, 3809 Ascot Dr is the one Frank thought was $1.8M and is still on the market for $1.4M. Lol I don’t think even Frank would think 3730 Ascot Dr is worth $1.8M.

Sorry Leo, you misspelled $1.8M

Inflation is running at 6.8%, so you could ask for that as a minimum. https://tradingeconomics.com/canada/inflation-cpi

But if you want to keep up with other house hunters, you should raise your income by about 11%.

Because when StatCan measures what Canadians are getting paid total on their pay stubs, compensation rose 11% YOY. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610011401 and these wages are up 14% from pre-pandemic (Q4 2019) numbers.

And relevant to house prices, the 11% growth in total wages paid to Canadians is going to find its way into housing prices. Maybe a one income family has become a two income family. Or someone works overtime. But the overall effect is 11% more total income (10% per capita) sloshing around in the economy, despite wages per hour not rising 11%.

As mentioned, in the first 3 months of 2022, total BC wages paid on pay stubs went up 4.2% (annualized 17%). That will find its way into house prices.

Frank, another you would of won at your valuation. You need to start making bids. Can we start making the price decline percentage graphics based on Frank’s expected sale prices to the actual sale prices?

They are being paid the market wage. Objectively they are not being underpaid . The problem is that in resort cities, which is what Victoria is becoming de facto, some sectors cannot competitively pay their employees wages that allow for decent housing.

You might not care about getting a Big Mac, but medical care is another matter.

$1.125M

Would a kind soul post the sale price of 3730 Ascot Drive, please…..

LeoS : Lets see if there is perhaps one point of agreement or compromise. I would be more liable to be convinced if your proposal was to have townhouses with small gardens built which would be family friendly and could be blended both in terms of height and structure into existing street scapes. Some architectural controls to preserve the feel of neighbourhoods like Fernwood. Restrict sixplexes to a limited number of zones. Approve some thirty and forty story towers in VicWest and that would more than balance out the units difference between sixplex and townhouses.

As for young workers in the city, maybe it is time to pay them better, a lot better. I dont think we need to subside housing just so Walmart and McDonalds can continue underpaying their workers.

You were saying that people should be asking for 9% raises.

I thought it was 5% on the first 500k, 10% on the next 500k, and 20% on anything above that? Which would be in the $115000 range for a $1.2 million house.

A lot of the “single family homes” in Victoria haven’t been single family for decades and are actually apartments that are just shaped like single family homes because that’s how they were originally built.

I lived in one of them in Rockland and it was a nice big house on the outside and inside it was a bunch of ugly weird little apartments where I got to listen to the upstairs neighbors fighting and smell the downstairs neighbor every time he lit a cigarette.

That’s why there was no parking on my street either and only one car at a time could drive up or down the road.

But yeah I guess if you’re just driving through the neighborhood in your car it looked like a bunch of single family homes so that was nice to look at I suppose.

I do remember when I lived there too that at least two of these structures burned down and the residents inside burned to death because of course they didn’t have proper fire escapes and these were just 100-year-old dumps that had never been intended to have four to six families living in them in the first place.

So tearing down some of these nasty dangerous apartments and replacing it with a modern structure that doesn’t have leaded pipes, asbestos and proper exits in case there’s a fire etc. would be an improvement in those neighborhoods even if the shape of the structure is different and it doesn’t look like something that was built in a previous century.

Those neighborhoods are already absorbing the density that people are trying to avoid, they’ve just got tenants packed in like sardines in crappy apartment buildings disguised like houses.

From George Gammon, one of the most informative and important videos

https://www.youtube.com/watch?v=IdQJK4xhEJ0

Granted they could fix this gap by raising the CMHC cap, but still. Right now there’s a massive difference in minimum down payments between houses and townhouses.

“The provincial government won’t even…”

An easier solution than moving ministries around would be to give assurances that people in paper pusher roles can work from home full time. That would seemingly allow folks to move out of Victoria, while countervailing the pay cut the employer is offering. Government could then begin offloading leased office space.

But of course nothing really ever changes.

My parents are old and they are looking for a townhouse in Victoria. They don’t want the maintenance of a house, but they also don’t want to live in a condo. They want a small spot they can put a bit of a garden in, and otherwise not have to worry about it. Missing middle could greatly expand those kinds of options.

I’m old, and I have an opinion, and I’m not really concerned whether anyone thinks I should have it. That opinion is that young people need housing, and we old people need young people to work in service jobs, particularly health care. If that means condos and townhouses go up around my single family home, which I’m very grateful to own, then I’m fine with that. I think the entire city should be upzoned, and the NIMBY brigade should be told to go pound sand.

A Vancouver roller coaster ride: Fasten your seatbelt please.

https://www.youtube.com/watch?v=hqOn5XEm86A

Langford offered a property tax break for 10 years to incentivize the provincial government to build offices in their municipality. That would seem to be a tax break received by the government.

https://www.timescolonist.com/local-news/langford-aims-to-lure-major-employers-with-possible-tax-breaks-4642402

No, because I’m referring to wage compensation per employee, not per hour. Total Employee compensation affects inflation. And If it goes up 12% in a year, employers need to raise prices on goods.

“My clients that work completely from home (even before covid) want to buy in nice core areas, not Duncan.”

Makes sense. If they wanted to live in Duncan, they wouldn’t be your clients.

That’s fine. A lot of people come to government from out of town (or country).

At a certain point towns take a life of their own. If you had a major employer like government, put in a post secondary institution and suddenly you need a hospital, police, fire dept, elementary and secondary schools, and everything around that. Until you have a hospital though I think you’ve limited the number of people that will move there.

Something is garbled here, governments offer tax breaks, they don’t receive them.

You are neglecting the possibility of the same employee working more hours.

My clients that work completely from home (even before covid) want to buy in nice core areas, not Duncan.

The point wasn’t that they would. The point was that it doesn’t take Soviet style central planning.

The provincial government won’t even move offices from Victoria to Langford despite being offered tax break incentives so good luck with those Interior BC ministries. I think they opened one remote office out in Langford, but not a ministry. They should do it, but they won’t.

When I was growing up, the James Bay area, particularly the Outer Wharf part of it, had nothing but a bunch of old and run down “shacks”. So now yes, there are huge multiplexes there and for the most part, I think compliment the entire area.

This is not going to happen in the Rockland part of Fairfield. At least not as long as I am alive.

Yes, but employed workforce (Canada) only grew 0.9% and Canada total wages grew 3.8% % in Q1. So wage growth per employee is 3.8-0.9= 2.9% per employee in Q1, annualized to 12% for a year.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410028701&pickMembers%5B0%5D=1.1&pickMembers%5B1%5D=3.1&pickMembers%5B2%5D=4.1&pickMembers%5B3%5D=5.1&cubeTimeFrame.startMonth=12&cubeTimeFrame.startYear=2021&cubeTimeFrame.endMonth=03&cubeTimeFrame.endYear=2022&referencePeriods=20211201%2C20220301

Again, best GIC rates:

1yr@4.02%

2yr@4.20%

3yr@4.3%

4yr@4.3%

5yr@4.35%

What a great illustration – Imagine that same number of homes pictured, except each person is in a SFD on a 5000ft2 lot. 80% of the trees gone, landscape destroyed, miles of extra asphalt, etc.

We know what works, we just don’t seem to want to do it here.

Sure you can move BC government employees out of Victoria, but the discussion was about distribution of population Canada-wide. That’s been determined by market forces and that’s going to continue.

New towns such as Kitimat have been built specifically for resource-related industries. Some like Kitimat are still around, a lot aren’t. But for the government to build a new town just in the hope people and jobs would move to it would be just nuts.

Not really, as Barrister has said, they do similar things in Switzerland. All it would take is moving some of the ministries to Duncan and Nanaimo, or the Interior of BC, or build a new town entirely. You can even transition it gradually, get a second office and just make all new hires from there.

That’s total employee compensation, not wages. It reflects increase in the workforce as well as wage increases. You can see from the source table.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610020501

Most? Lol try 50 to 80 years.

Barrister you have no clue what you are talking about. This very nice Rockland fourplex has been sitting on the market not going anywhere -> https://www.realtor.ca/real-estate/24159748/1064-beverley-pl-victoria-rockland

You will not see any fourplexes replace livable Rockland SFHs for decades. The economics don’t make any sense if you knew anything about construction or development.

As for teardowns, do we want brand new 6,000 sqft mansions replacing teardowns for the ultra rich or a fourplex with four units for the rich?

Feel free to correct me of how the economics of a fourplex in Rockland would work and how you and your neighborhours will make millions. Actual numbers please.

In my opinion yes. Victoria is not a suburb, it’s the core of a growing city. Note that actual heritage buildings are already protected.

Medium density is best density, both from a climate perspective and financial sustainability perspective, but also from a livability perspective. It supports walkable 15 minute neighbourhourhoods and good transit service, while still remaining green and leafy. Note this is higher than the missing middle allows. If it was up to me I’d legalize 3-4 story small apartments as part of the missing middle, just like they used to be legal (and you see quite a few in victoria dotted around random areas). They were all downzoned 40 years ago.

I think people fundamentally mistake what makes a city lovely. It’s not single family suburbs. Think about cook street village. What makes that such a great stretch is the street trees and the fact that you can get most of what you need by walking. The buildings could be at least twice or three times as tall and it would be just as nice (and allow a lot more people to enjoy it). We can prioritize trees on all the boulevards and keep and expand those kinds of areas. Walking around the suburbs where we live is boring. Much more interesting to walk around areas where there is a mix of housing available.

Barrister: you want to move to Lugano, you tell me does this look like single family zoning? Would cities in Europe be better or worse if they sprawled more?

Canada inflation rages on, and it’s home grown now with employee compensation way up…especially in BC

https://www150.statcan.gc.ca/n1/daily-quotidien/220531/mc-b001-eng.htm

— People looking for a raise should be asking for at least 9%, since that’s the per capita compensation increase for the last 12 months in Canada. More if they live in BC.

I love the fact that people seem to argue that old people should not have an opinion.

On the one hand people argue that it will be years before much of anything is built but at the same time they argue that this will have a major impact on the housing crisis.

The real question in my mind is whether it takes five years or fifteen years is converting most of the single family homes into multiplexes (generally it will not be townhouses since multiplexes are more profitable) really what we want Victoria to become. The argument that it will only be a few properties is rather disingenuous. If we only looking to have a comparatively few properties converted this can easily be accomplished by regularly and more limited zoning changes to specific areas. If you are going to argue for a total city blanket change then you better work on the assumption that most of the city will convert and the speed of that conversion will likely be faster than the advocates suggest.

My neighbours (and myself included) stand to make millions as SFH rentals that we own are converted to multiplexes and not ten years from now but in the next few years at most. It will create more housing units but it will have a major impact on the character and history of Victoria.

If you are going to rezone the whole city for multiplexes then you really need to envisage what the city will look like when most of the city including Fernwood and James Bay are converted to multiplexes. If you think we are going to build charming little complexes you are deceiving yourself. We will build as cheap as we can since that is the sweet point for profit. The hundred year old house I am in will be removed and replaced with stark boxes. My kids will inherit a bit more but the city will be poorer.

But I am old so perhaps it all should not matter. Still you might ask why it matters to many of the supporters of this

idea. I am sure that a few really are altruistic but for many of my neighbours who have investment properties it is pure greed.

Yes, that slow timeline looks right. 5 years before anything built, and then gradual. I’m not sure why people are worked up about it either hurting or helping. James Bay population is already 95% living in multi-dwelling housing – and that doesn’t bother anyone.

Bank of Canada open to hiking interest rates past 3% in bid to bridle inflation

https://www.thestar.com/business/2022/06/02/bank-of-canada-could-hike-interest-rates-past-3-in-bid-to-bridle-inflation.html

Engineer behind evacuated Langford highrise fined, stripped of licence

https://www.timescolonist.com/local-news/engineer-behind-evacuated-langford-building-fined-stripped-of-licence-5437102

Not sure what is going on in Ukranine but in Croatia everyone wants to live in a few select cities. The disparity in price is insane once you start leaving core areas. In Croatia a SFH in Sooke would be like half the price of a condo in the core of Victoria. Gas is super expensive but I think more of it is cultural, people want to be close to the city center as all the action happens there.

Which London? Greater London has a density of 5,666/km2. The City of London is just one square mile.

Realistic comparison is metro Vancouver versus Greater London. Former has a density of 900 people/km2, although some of it is non-urban, i.e. mountains or farmland.

Canadian cities aren’t that dense, they’re just unaffordable.

Canadian cities are not that dense. Vancouver, the country’s most dense city, has 5,493 people per km2. This is half the density of London. Also, we are not the Ukraine. To make a case for redistribution based on what happens in the Ukraine is ludicrous. To make the case for redistribution at all ignores climate, geography, transportation, immigration, health care, economics, free will, and the Charter.

As far as Leo’s position on the missing middle goes, I’m in favour of blanket rezoning, particularly in areas like Rockland, Fairfield, Gonzales and Fernwood – sorry Barrister. These areas are all walkable and located in the core. If we can promote home conversions to multiple units that is going to help in the near term. Tear downs and rebuilds to townhouses are going to be a lot slower I’d think. I wish the Province would step in on rezoning so we don’t have the municipal quagmire playing out everywhere.

The problem with Canada is the more effort we put into densification, it’s never going to be enough. As for Germany, what percentage of the population live in a sfh and what do they cost?

People live where they do in Canada because of economic forces. To try to alter that would require, shall we say, Soviet-style central planning. It wouldn’t work here any better than it worked there.

Germany has 83 million people. Netherlands 17 million – that’s half the population of Canada – in an area a bit bigger than Vancouver Island.

The main problem we need to address in Canada is inefficient land use in cities and beside the usual suspect of detached houses I would put equal blame on the car culture.

Canada is 10 million square kilometres, Ukraine is 600,000 square kilometres. From what this map shows, Canada’s 37 million people are already crammed into the most temperate areas of the country. Canadians insist on congregating in 2 small regions of one of the largest countries in the world. One might conclude densification has already occurred. Now millions of those evenly distributed Ukrainians want to move to Canada. I don’t see any more cities being created, or even talked about. I also don’t see real estate dropping in value.

Take a look at the map of Ukrainian cities with populations over 250,000. In the next post I’ll show the map for Canada. Notice the even distribution of the 40+ million people. Compare it to the distribution of Canada’s 37 million people. Over half of the major cities are in southern Ontario, most of the remainder of major cities- southwest B.C. and 2 cities in Alberta. I would say densification has already occurred. Ukraine is almost half the size of Ontario. The solution to our housing crisis is not densification, it’s redistribution. Obviously most Canadians want to live in the minute areas of our large country where the climate is most favorable. I’ll post the Canada map in the next post.

@Barrister I don’t think it’s a personal attack to suggest you may under appreciate housing insecurity when you are not experiencing it.

Someone who lives in a 6,000 sq/ft SFH is opposed to the missing middle. Go figure.

Missing middle is exactly what we need in my opinion. I also don’t understand all the fear mongering. My parents live a few houses from this 5 plex (split into two old homes on a lot where they use to be one old house) -> https://goo.gl/maps/Ef9ztX3h5nsyEz2f8

In 6 years I’ve never seen one person coming or going from the complex even thought all the units are occupied according to the neighbor. No parking issues (I am guessing probably a couple of units don’t even have cars due to an incredibly convenient location), etc.

A few multiplexes built out on your street in the next 20-30 years it is not going to change your life.

I know it is kind of harsh but some of the people opposing missing middle are in their 70s. The first one won’t be built for 5 years +/- plus add another 10 to 15 years to actually have a few where they are even somewhat noticeable. 30 years before there is a trace of parking issues (assuming autonomous driving still isn’t a thing by then). 70+30 = 100….not that many people live that long.

If I was in my 70s I would put the focus on my health versus worrying about development that I won’t outlive.

Also love how the environment gets completely thrown out the window when there is mention of something that could potentially be even minutely inconvenient for people.

LeoS: Yes Leo, we live in a very comfortable city and it would be nice to actually try to keep it that way. So maybe before you come up with your lets make developers rich plan (and this would make me richer as well, but I still think it is bad for the city) why dont you give so thought to a more balenced plan for the city and actually give some thought to whether there is an optimum size to a city for quality of life.

You want to create more housing In BC perhaps ask the question whether there are better places to do it rather than just the two big cities in BC. I suspect that you are emotionally married to this plan so I suspect that its is past reasonable discussion judging that your first retort is some sort of personal attack. I have to admit that I am disappointed in you. Be that as it may, my neighbours on two sides are thrilled with the idea since they both own a number of rental houses that will be destroyed by your bulldozer at great profit. What is going to be built is not going to be pretty but I guess that is not important since density and profit seem to be the only criteria.

Tell me you’re comfortably housed without telling me you’re comfortably housed. 🙂

The missing middle seems to have as its sole value increased density (along with some pretty decent profits for developers and owners of second homes). Development will follow zoning over a shorter time frame than people think. The vision of these missing middle proponents will eradicate areas like James Bay and Fernwood with a architectural form that eventually will resemble British council housing.

No one is arguing that the city could well do with some more townhouse projects but this is a far more radical proposal that will convert over time almost the whole city into small tenement blocks of sixplexes with the occasional townhouses. The sixplexs will dominate because they are the most profitable for developers.

This is not a vision of a balanced city or one that preserves it heritage neighbourhoods. For that matter is this a proposal that really benefits the people who actually live in the city today?

A BoC deputy governor gave a speech

From: https://www.cbc.ca/news/politics/bank-of-canada-inflation-poilievre-1.6475515

Cool, maybe we will get a 1% increase in July instead of just a 0.5%

Fraser valley average sale price is nutty. Some of this is likely change in sales mix but still, pretty dramatic

I also think it could be a great area, I just couldn’t live in the west shore as there’s far to much traffic and it’s far to car dependant.

.

Me on Missing Middle https://www.vicnews.com/news/coming-victoria-motion-looks-to-reverse-missing-middle-timeline-delays/

Thanks for the tips everyone, it’s way easier to make a decision with a sounding board. Cheers

Rural areas are happier because they have lower population turnover and people are more rooted. That doesn’t mean you’ll be happier if you move to one.

This is the right take. I toured the south phase of the Royal Bay development a few weeks ago (aka big piles of aggregate and fill). It’s going to be a lovely neighborhood when it’s done. That whole area with the developed waterfront is going to be great

The studies on neighborhood happiness show you are probably going to be happy wherever land are if the crime rate isn’t too high, your commute isn’t too long, you can afford it, and you like your neighbors. People get attached to their neighborhood whether it is Royal Bay or Oak Bay. You might be slightly happier in a more rural location than a city.

https://news.ubc.ca/2018/05/24/the-happiest-and-least-happy-places-in-canada/

https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0210091

Yes Royal bay full of shitty built new houses and get your groceries in sooke lol

Totally agree. You’ll want to know why Royal Bay is one of most popular, fastest growing communities in Greater Victoria and is full of young families, playgrounds, new schools and has people lining up to live there because their council is committed to building housing versus Oak Bay, where the latest bylaw their council passed was to ban gas powered leaf blowers because it distracts from the fact that they don’t build any new housing and want nothing to change in their community that resembles the real life equivalent of an erectile dysfunction ad you’d find in a golf magazine.

Aim for the first, fall back to the second.

Are you sure? I don’t see that.

https://www.marketwatch.com/investing/bond/tmbmkca-05y/charts?countrycode=bx&mod=mw_quote_advanced

“The aggressive Bank of Canada rhetoric and a further back-up in U.S. yields put pressure on the entire GoC curve. Focusing on arguably the most important term for the domestic housing market, five-year yields probed the 2.9% threshold. These yields have not been above that mark since early 2010. Five-year yields are now up almost precisely 2 percentage points from one short year ago. There was only one other episode in the past 30 years when 5-years moved so quickly, in 1994- 95. Suffice it to say that this rapid climb in rates bodes ill for housing. Note that the weakest year for housing starts in the past 60 years just happens to have been in 1995 (at just 110,900 units). True, that was at the tail end of a deep slide in home prices, with the 1994/95 tightening the final slap for the sector.”

“BMO: “Suffice it to say that this rapid climb in rates bodes ill for housing””

https://twitter.com/SBarlow_ROB/status/1532332860379734019?s=20&t=SViAfJ6jEmBXCWrCmsgLug

Option 2.1- before we moved to Victoria, we sold our house and pretty much everything because the shipping cost didn’t make sense plus furniture may not match the new house, and storage fees were not cheap. Then we rented about two years at two locations to learn the neighborhoods. Never regretted my decision because after two years live in Victoria at two opposite locations, I knew exactly which streets I wanted to buy and which school I wanted my kids to go. I don’t suggest you buy a new home here before you moved unless you know why Royal Bay vs Oak Bay is not even a comparison.

Seriously limits the buyer pool.

Salmonhunter

You can sell your current home but with a rent-back (for 6 or 10 month) clause/condition/request, so your family can continue to live in the house after selling it and take the time to shop for your new home in Victoria.

Salmonhunter: If you are really intent on doing this, I would choose “Option 3” for sure.

Salmonhunter- If you’ve got a 3 year old and 10 month old, I’m sure you haven’t invested much money in your furnishings. They might not be worth storing or shipping, especially if you shop at IKEA. If you move to the west side of the Island instead, you’ll find things wash up on the shore daily from Fukushima. If you’re lucky you might find a couple 40 ft. containers and make a shelter out of them. People aren’t as resourceful as they used to be. Just thought you could use a little levity, if you get into a jam, I’m sure Barrister could put you and your family up for a couple years. Hope you’ve got a sense of humor. If you do take my advice, look out for the container people, I hear they’re quite ruthless.

Personally this is one of the few times in the past couple of years where I feel like i could comfortably sell a home and wait a couple months to buy another without having to worry about prices jumping up crazily. If anything you might save a few bucks though not a good reason to do it. We still have some buyers left today that are buying with much better rates – they will all be gone in two months. Anything could happen of course but i just don’t see a scenario where prices suddenly spike over the next couple of months.

Would the market conditions graph be a bit more precise if Leo flipped the pointer so the sharp end is pointed outward?

I don’t think a subject-to-sale condition is going to be appealing to the seller in a falling market. Sale falls though and you might be looking at next try a couple months later.

Then again maybe the market isn’t falling, or people don’t think so yet.

Are we not yet at a point where a buyer can have a subject-to-sale condition and have the offer accepted? Perhaps Marko can advise.

The math might say people on a variable are still ahead, but man it’s fun to watch interest rates rise steeply and not bat an eyelash.

Off-topic EV news:

B.C. electric vehicle sales tops in North America

https://www.timescolonist.com/local-news/bc-electric-vehicle-sales-tops-in-north-america-5434076

In B.C., the government will now pay for 75% of an EV charging station

https://www.timescolonist.com/bc-news/in-bc-the-government-will-now-pay-for-75-of-an-ev-charging-station-5382583

I’m curious to get some opinions on the best way to move a family from Kelowna to Victoria (Mom, dad, 3 year old, 10 month old). From what I can see, we essentially have two options

Option 1: sell our current house, put the possession date as far into the future as I can, and then hope to hell that I can buy a house that closes on the exact same date in Victoria. We would put our stuff into storage with a company that drops off a bin at the current house and then stores it for future delivery to the new house. This option seems super risky and could easily end up with us homeless.

Option 2: sell our kelowna house, put everything in storage, live like gypsies for a month or two or four (Air Bnb makes this easy, but expensive), and then buy a home in Victoria at our leisure.

If you can think of another option, please suggest it!

Yes, but people need to take into account the risk premium and hedging costs when trying to draw parallels between the 5 year yield and mortgage rates. May inflation will have sticker shock as used car prices are in there, 50bps in July is a certainty at this point, the question is will it be 75bps and what s to come after. I wonder if the people who bought in Feb on variable rates budgeted for this.

They had but after the hawkish outlook yesterday we at near peak. In two weeks our inflation comes out – that could put us over 3% if it’s higher then expected.

https://m.ca.investing.com/rates-bonds/canada-5-year-bond-yield

CAD 5 year yields have actually pulled back a little after touching 3% in the past month. However the risk premium and cost of hedging has increased which is why there hasn’t been a decrease in the 5 year fixed rate mortgage.

Crazy time looks good maybe an investor bailing now while he can put some money in his pocket Going forward I’m sure we will see more of this I would think real estate investors would be the first to jump before they’re profits shrink

What is wrong with this house? It was not sold back in 2019, but sold for 940k last year. Now it is back on the market.

I was looking at the discounters, who are currently offering a bit under 4%. Posted rate at the big banks would likely approach 6%.

I’m assuming you mean variable? Since 5 year fixed at TD is already 4.59%.

That would take the 5 year mortgage rate over 5% I think.

And keep in mind that the US housing market is less vulnerable to rate increases, first because their price/income is a lot lower than ours, and second because so many owners have 30 year term mortgages.

Agreed, I think they have to, because they dropped the ball in leaving them last year.

It’s the proverbial “rock and a hard place. They can’t afford to raise rates, and they can’t afford to keep them as low as they are. They are still deeply negative in real terms. Canada will follow the Fed, more or less.

I expect they will overshoot on the hikes though, possibly by a fair bit. Far too early to declare the present rate hikes as not being enough, as some are doing.

I don’t think it’s an “if” at this point. It’s whether or not they’ve let it go on too long that they have to slam on the brakes. I don’t see the US Fed giving a shit about our housing market though, and I don’t see how we get the inflationary spiral under control if we stop raising rates when the US Fed hasn’t and the CAD goes into the tank.

In October 2018, we got to 1.75% before the tipping point started becoming visible, especially in the US. This occurred at considerably lower debt levels than today.

We are now at 1.5% with no realistic chance of upping rates to match, let alone exceed, present levels of inflation. Hopefully the outsized sensitivity to rate hikes will be enough to get it under control, but that remains to be seen. If the economy completely pukes and they pull another QE stunt, containing inflation will become that much harder and things like RE could actually start to rise again.

Long story short, the central bank is not your friend…

I’m not sure if I totally agree that we need 6% rates for a crash – sentiment is almost impossible to predict as is evidenced by a 30% increase during a global pandemic. Nobody wants to be the last fool.

I would say though that the chances of a crash increase with every rate increase. Who knows what the tipping point is?

Great article. Yes, the median sales to assessed ratio is helpful for showing these trends.

Well written I think u nailed it I do think we are just getting started and this will end up as some variation of 82 Cheers

The TC has a piece on the struggles of buyers this morning: https://www.timescolonist.com/business/victoria-real-estate-market-finally-cooling-off-but-too-late-for-some-5434066

Another good article. I suspect that we will have a good summer of people spending after two years of covid confinement but as inflation really starts to bite into budgets there will be a real tightening of spending.

“The next few months are going to be interesting “. -And the last couple years weren’t?

The next few months are going to be interesting!

Great writeup Leo. It’s my first time reading the blog in ages.