Triggered

We’re in a unique moment in the housing and mortgage markets. Not only had prices shot up post pandemic, but the rise of inflation has radically accelerated the path of rising rates. Back in February when I pointed out the risk of taking a variable rate, the markets were projecting an increase in the overnight rate of only 1.5% by year end. Instead the bank already raised 2.25% and markets are expecting another percent before the end of the year. The rate increases that we’ve had so far have already boosted payments on new variable mortgages by some 25% and there’s more to come. No surprise then that we’ve got all time low sales and falling prices. More proof that even though we likely have more wealthy buyers than most cities, income-based affordability remains crucial to our housing market.

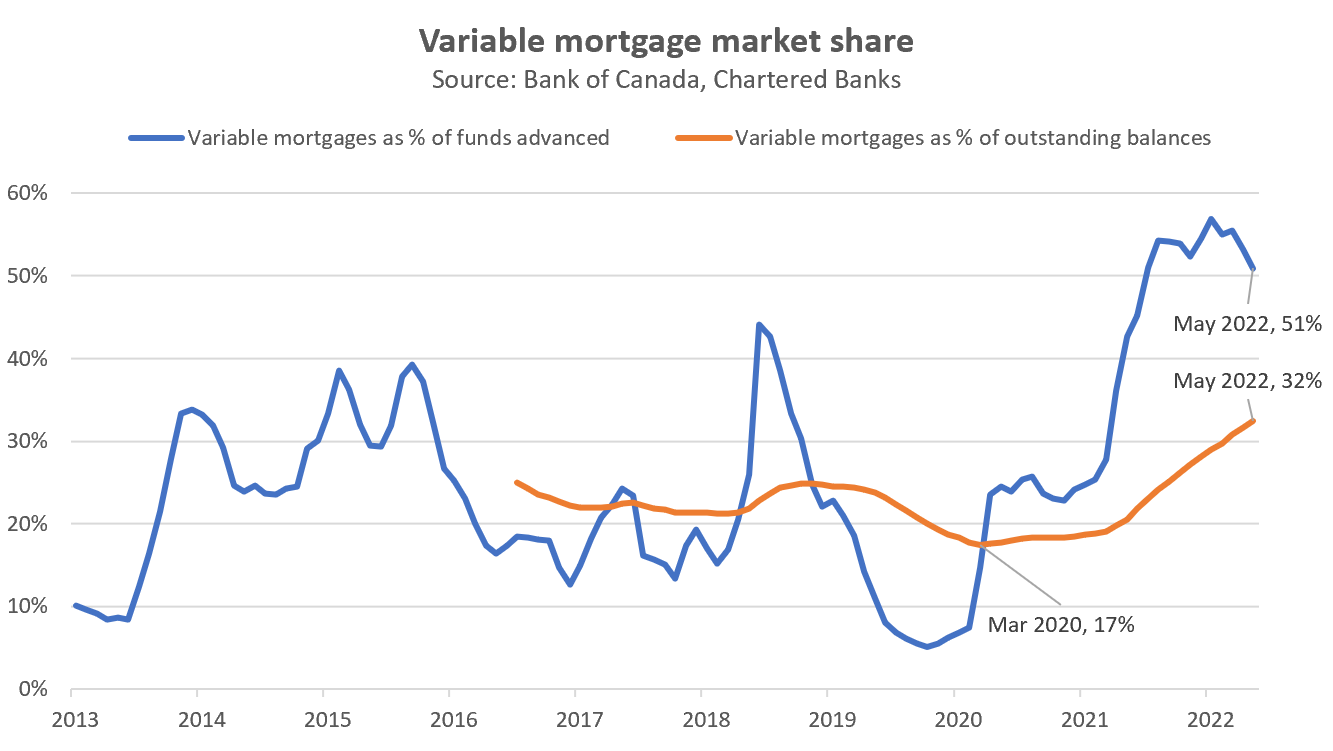

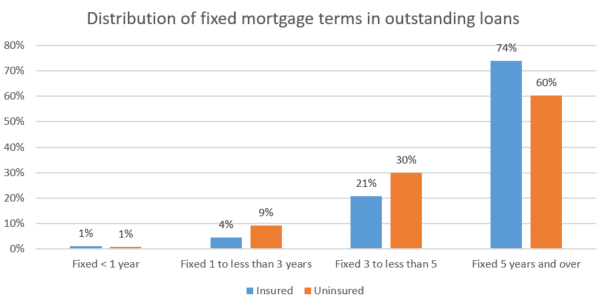

On top of buyers being sidelined, we also have the problem of an unprecedented rush into variable rates by existing buyers. Normally Canadian buyers strongly prefer fixed rates, with about three quarters of buyers choosing those products pre-pandemic despite the fact that variable are usually a better deal. However the large discounts were simply too much to resist, and over half of buyers opted for variable rates in the last 12 months. That rush has increased the proportion of mortgage holders on variable rates to 32%.

There are two types of variable rates: adjustable and fixed. For adjustable rate variable mortgages, every time the lender’s prime rate increases – which happens generally in lock step with the Bank of Canada’s overnight rate – the borrower’s payment goes up. For example let’s say borrower Sam has a 1.5% adjustable variable rate in January and was paying $2000/month on a $500,000 mortgage. After the rate hikes they would now be paying $2560/month.

However most people with variable rate mortgages are not in this situation. In fact recent Bank of Canada data showed that 80% of variable rate holders have a fixed payment, which means that in general when the Bank of Canada raises their overnight rate their monthly payments will not change. What happens instead is that more of the payment goes towards interest, effectively extending the amortization of the mortgage. Sam – now on a fixed payment variable – would still have a $2000/month mortgage payment today, but instead of a 25 year amortization it would now be pushed to 40 years.

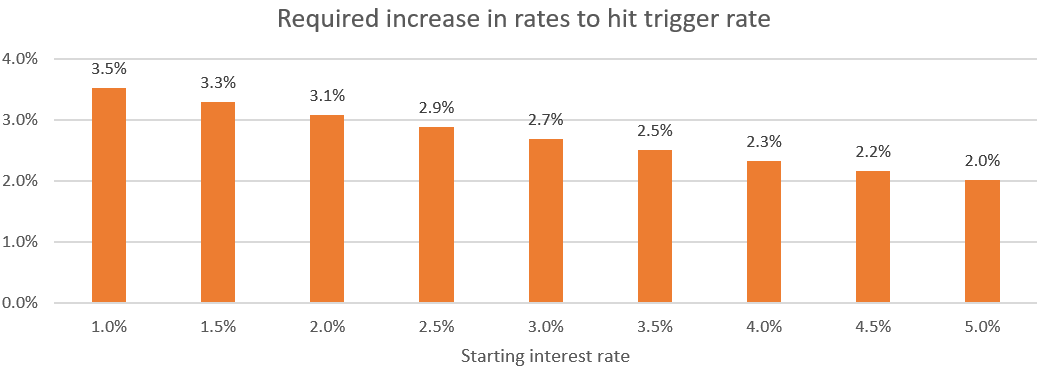

Eventually if rates rise too much, the $2000/month payment is no longer sufficient even to cover the interest portion of the loan. Then you are paying nothing towards principal and are ending in negative amortization (i.e. you will never pay the mortgage back and in fact are growing it). That rate is called the trigger rate, and if you have a fixed payment variable mortgage you will find the trigger rate specified in your mortgage agreement. If you start with a lower rate, a large part of your payment will be going to principal, which means that rates can go up more before hitting the trigger rate compared to if you had started with a higher rate. For example, someone starting with a 1.5% variable rate would need to see a 3.5% increase in the prime rate to hit their trigger, while someone starting at 4% would only need a 2.3% increase for the same as illustrated below.

When you hit the trigger rate, expect a letter from your lender with a warning and options to get back on track (increasing your payments, making a lump sum, or converting to a fixed rate). Some lenders will force you to raise payments at this point (for example our lender CIBC does this) while others will let you ignore the situation for the time being.

What happens if you do nothing after you hit that trigger rate? Well that depends on the lender, but it’s not hard to understand that lenders are not particularly keen to lend you money that you will never repay and you aren’t even covering the interest payment on. For a while they may let you continue your usual payments and your mortgage balance will grow every month instead of shrink, but eventually you will hit what they call a trigger point. Here’s how one lender describes that in their mortgage agreement:

Trigger Point – If at any time the outstanding principal amount (including any deferred interest) exceeds the original principal amount, then your term portion has passed what we call the trigger point.

At that point you should expect another letter and a phone call from the lender. Generally you will be forced to either pay them a lump sum payment to bring your principal back under the original amount and increase your payments to get back to the original amortization, or convert to a fixed rate for the remainder of the term. Some may allow you to exceed the original principal amount if they are satisfied the value of the house is sufficient to remain above maximum loan to value thresholds. However some action will be required, and if you can’t come to an arrangement you may be liable to pay back the entire mortgage amount plus penalties.

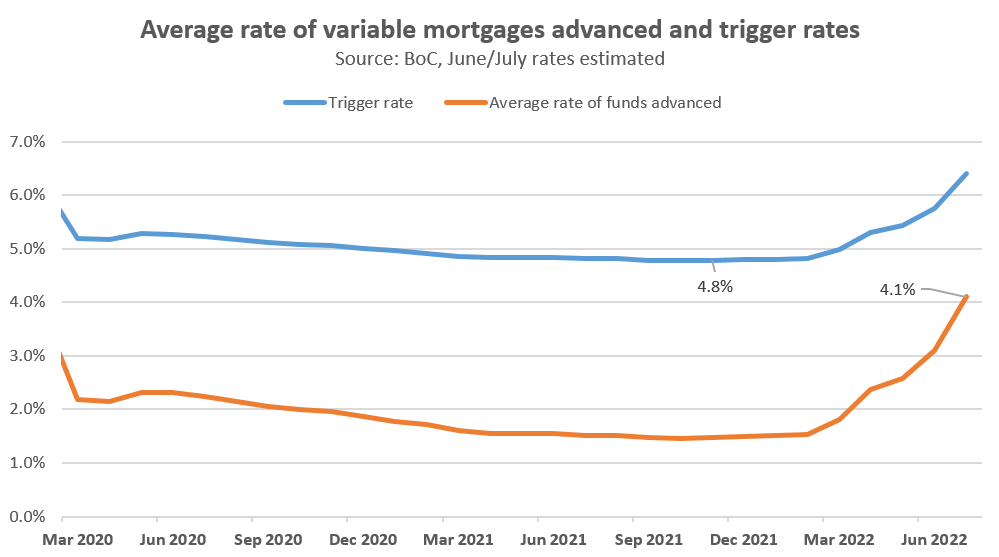

The central bank has not raised rates enough for variable mortgage holders to hit their trigger points, but we’re getting closer. Markets expect the central bank to hike another 1% before the end of the year, and if that happens a lot of variable rate borrowers are going to be getting an unpleasant letter from the bank asking for more money.

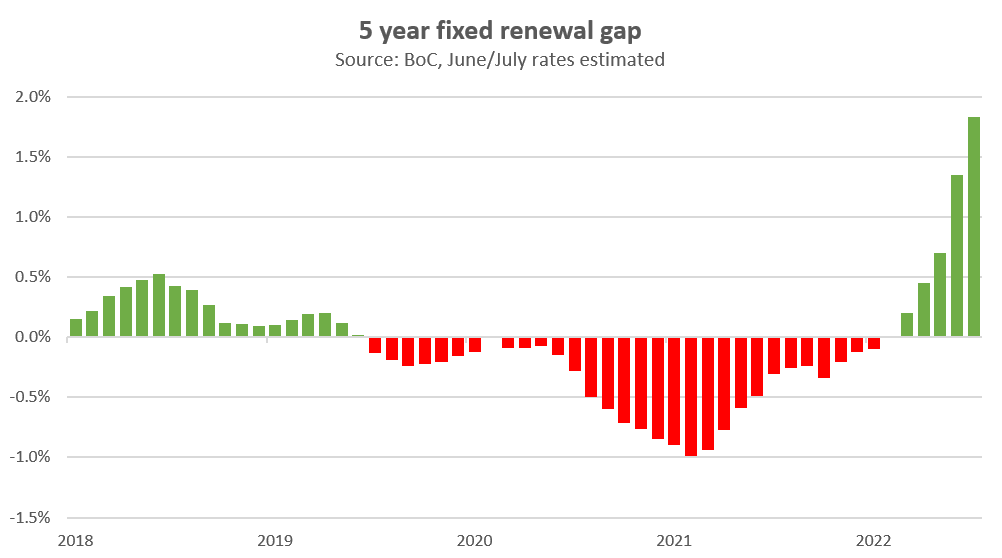

Meanwhile borrowers on fixed payments – especially those that locked in last year – are laughing right now. However our relatively short terms also don’t insulate from rate hikes forever. Folks renewing now are seeing rate hikes of over 1.5% which will also crimp budgets.

Remember that while it’s not in the lender’s interest to force regularly paying borrowers to sell into a down market, the lender is not your friend and will be primarily concerned with their own return, as well as complying with strict regulatory constraints regarding loan to value of their mortgage book. Nothing in this article constitutes mortgage advice, so please consult with your lender or broker to discuss specific options available if the rising rates are impacting your situation.

Thanks to Matt Imhoff for providing information and background for this post.

Also the weekly numbers courtesy of the VREB.

| July2022 |

July

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 147 | 285 | 835 | ||

| New Listings | 346 | 631 | 971 | ||

| Active Listings | 2090 | 2141 | 1270 | ||

| Sales to New Listings | 42% | 45% | 86% | ||

| Sales YoY Change | -36% | -31% | |||

| Months of Inventory | 1.5 | ||||

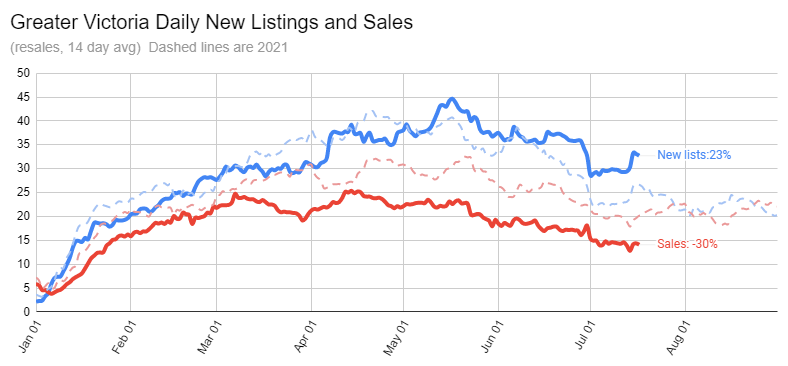

No great change in the market last week. Inventory continues to build gradually, sales are sluggish, and new listings are about normal for the time of year. Sales are generally pretty flat for the summer, with August only a few percent slower for sales than July on average. I wouldn’t expect anything too dramatic during the summer but with an average of 20 more listings per day than sales, it will be interesting to see how long we keep building inventory.

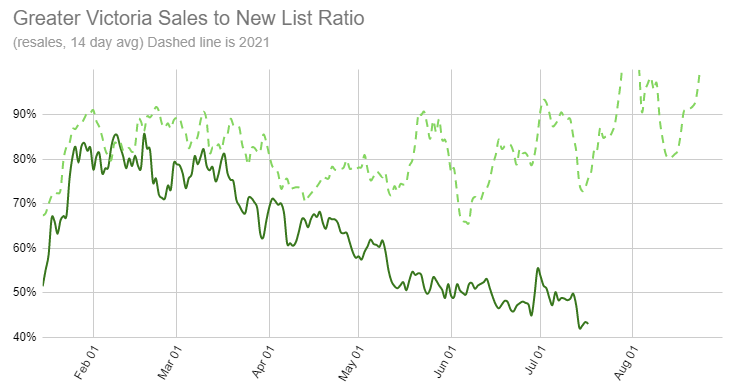

The sales to list ratio continues to gradually deteriorate, though we’ll have to wait for the month end numbers to see whether the trend continues on a seasonally adjusted basis.

The current level is enough to keep prices sliding though, with the median sales to assessment ratio down a few percent further from the June figures. There should continue to be enough buyers not dependent on credit availability to keep the market from locking up, but it’s clear that there aren’t enough of those to sustain prices by themselves. I expect we won’t see a recovery in sales and prices until affordability improves for local buyers.

New post: https://househuntvictoria.ca/2022/07/25/whats-holding-up-the-best/

Lol lets just cut to the chase here, interest rates will almost certainly keep going up for the rest of the year and it will be a headwind for house prices.

If food and energy goes down wage inflation pressure would lessen.

Wage push Inflation is what central bankers are worried about frank, and that’s what they are targeting with the rate hikes. That and the weak CAD/USD

I’ve recently noticed gas prices coming down, 10-15%. Grocery store shelves are full again and there are more items on sale. Maybe the supply issues have been resolved, and prices will moderate. Food and energy contribute the most to inflation as they are felt by almost everyone. This could be the beginning of the end of rampant inflation. I don’t think increasing interest rates had much impact on increasing supply shortages.

Thanks for the info on rental rates.

I suspect that we might be in for a rough ride here in BC.

“ What’s the average rent for a two bedroom apartment? Thanks

Newish 2 bedroom under 700ft2 in Langford is 2,400-2,800.

“ What’s the average rent for a two bedroom apartment? Thanks”

Renovated/new in the core is $2,500

What’s the average rent for a two bedroom apartment? Thanks.

It is looking more and more likely for a recession in the states. Fed. Reserve rate expected to be raised .75 basis points later this week. As consumer confidence erodes, things can change drastically and very quickly.

I never really pay attention to sell side reports other than getting some hard data. Much better off seeing what developers and investors are actually doing to make a better judgement of market direction.

Who hasn’t seen these before, but still interesting…

https://financialpost.com/executive/executive-summary/posthaste-canadas-housing-market-headed-for-historic-correction-says-rbc?_ga=2.200533998.1725841579.1658771191-684692664.1658771191

Month to date numbers:

Sales: 398 (down 32%)

New lists: 870 (up 14%)

Inventory: 2164 (up 56%)

New post tonight.

Well the vancouver plan really only exists on paper. No actual change to zoning which is crucial. But I guess they’re going to make subsequent 3 year action plans?

https://www.theglobeandmail.com/canada/british-columbia/article-new-plan-cements-vision-for-vancouver/

Only one title according to BC Assessment. Street addresses generally correspond to titled properties but not necessarily so.

Does that mean you can’t sell them separately?

Sold as a single family, but the legal suite has its own address. Not really sure what the implications of that are (other than making it harder to claim that you get the entire principal residence exemption on the capital gain when you sell).

Sounds good to me

Thanks, I didn’t realize that. Here’s an interesting article about starlight:

https://breachmedia.ca/a-public-pension-fund-is-canadas-newest-mega-landlord/

From the article:

“The business model of companies like Starlight consists of buying poorly maintained buildings occupied by low-income renters in neighborhoods that are close to more upscale locations. They then do cosmetic upgrades to buildings and increase rents, waiting for lower income tenants to leave or be evicted. Eventually, the original tenants are replaced by higher income renters. In the industry, this is called “repositioning.“

The name jogged my memory, I was actually bought out by them. That is, I was a shareholder of Northview Apartment REIT which was taken over by Starlight. Starlight isn’t a REIT by the way, it’s a private corporation.

They’re hasn’t been a rise in BC investor ownership by families . Maybe family investors are selling more than they’re buying

For example, here you can see that family investor ownership actually fell in BC during 2012-2019. That doesn’t the support the “surge” you’re talking about. Moreover, family investor ownership in BC has been remarkably stable since 1976, including the present.

Lol, such has happened in the past. Literally, grocery bags full of cash.

I think they have to work a little harder these days, though.

Was 2940 blackwood a full duplex?

I think that’s called rent control.

I read that the Ontario Greens proposed a 20% tax on buying 3rd or more properties. This seems like a sensible solution to house hoarding. I’d start with 2nd properties but starting at 3rd might make the introduction of this tax more feasible. Either way it seems like a good idea and would work similar to the foreign buyers tax but apply to Canadian investors.

Would also like to see some way to regulate REITs like Starlight that buy up existing affordable buildings and then raise rents astronomically (not talking about them building new apartments).

1 In 6 BC Real Estate Owners Have Multiple Properties

British Columbia (BC) real estate has also seen 1 in 6 (15.6%) owners scoop at least a second property. BC has seen 293,300 homeowners acquire more than one property as of 2020, and 22,100 of those have at least 4 homes. The surge of investor-driven purchasing over the past decade certainly drove that much higher. Unfortunately historical data going back a decade isn’t publicly available.

$1.2M

Can anyone tell me what 2940 Blackwood sold for? Thanks in advance

Right. A typical money launderer isn’t going to be dumb enough to walk in with $200,000 cash for a deposit. That would freak out a RE agent, and his local bank if they tried to deposit it.

According to reports…. Money launderers have lots of better options.Usually they want the money out of Canada as quickly as possible. And so they break it up into small amounts and get it sent offshore. Bitcoin ATM/ gift cards/ eBay sales/ casino/ Western Union etc. …

I’ve sold 2 listings in 3 days, market is crazy busy 🙂

In my 12 years I’ve never heard of a real estate brokerage taking cash for a deposit. That is not the type of money laundering I am referring to. There are many layers/steps to money laundering not involving cash.

We have to fill out FINTRAC forms, but I’ve filled out a couple of thousand and last time I checked with my brokerage no one has actually examined any of them other than a spot “audit” every 10 years to make sure we are filling them out “correctly.” The feedback I received last time is I have to be more specific on the profession. For example, if I fill out the FINTRAC as “doctor,” it should be more specific such as “family doctor.” So we fill out these form correctly and then they literally go no where. They just sit at the brokerage.

Deposits right now are made payable after condition removal. The reason behind that is once in a while you get a crazy seller that refuses to sign a release when conditions are not removed and then the deposit is stuck in the trust account and the matter may need to go to court to have the deposit released. Deposits after condition removal avoids this potential hassle, but they also create for more tire kickers.

With the cool off period deposits will be asked for upfront as no one will want to chase the buyer for the 0.25% if they bail.

Penalty is calculated on purchase price, not deposit amount. I was using a $1 million purchase for simplicity.

2006:

https://millersamuel.com/buy-this-its-a-great-time-to-buy-or-sell-a-home/

Darren Days billboard outside of town: “what slow market? 3 homes sold in 8 days”

Re: Money laundering

I never really understood this. I would have thought that somebody walking into a car dealership or real estate firm with a suitcase full of grubby $20 bills would cause even the dimmest bulb to think that there might be something suspicious about the transaction. Assuming the car dealership has to deposit the bills in a bank you would think even more questions would arise. I can believe that there is a lot of very willful blindness going on but I don’t understand why a few even slightly restrictive laws enforced mildly wouldn’t put an end to it.

Always good to demonstrate to folks that interest rates are still super low and there’s lots room to still keep raising them.

Marko: How is the money laundering any different then having a conditional on financing or inspection, giving deposit to broker and then not having it pass the conditions? Still get a deposit refund from the brokerage.

Am I missing something?

It’s a % of the contracted sale price, not of the deposit.

I don’t get how you have to give away $2,500 at 0.25%?

$200,000 * 0.0025 = $500

+1. It would make zero sense to have a conditional period followed by a cooling off period. You can cool off during the conditional period.

Also, you are only responsible for the 0.25% if you go in unconditional. If you go conditional and collapse the 0.25% penalty does not apply.

Also, starting hear a lot of concerns about it on a number of different fronts. For example, money laundry. With the penalty deposits will be payable upfront. You give 200k to brokerage, collapse deal, give $2,500 away to seller and get a bank draft back from the brokerage trust account.

This is more of a curiosity question. If you look at the BC assessment site along with the property ownership layer in the CRD mapping site you sometimes see one house on two legal lots. In many cases there seems to be a legal house with a second adjacent lot but the owner has treated it as one large lot. In others, the house appears to actually straddle the two lots (sorry, I can’t find an example right now but I am pretty sure I have seen it). Any idea how or if the empty home tax is applied in these two cases? Google implies yes in the former case and is unclear on the second case but I did not come across a definitive answer for either. For bonus points, what if the house is on one lot but so close to the boundary it would not be legal if there had been a house on the second lot. Fortunately neither case applies to me but I would be pretty bent out of shape if it did and I had to pay the tax.

Nothing like a new policy that brings clarity…..

I thought it was just for unconditional sales.

Same in most countries.

Maybe something to do with this:

Exactly when does the three day cooling off period start. Is it after all conditions are removed?

I’m seeing lots of significant price reductions on one of my portals (Peninsula SFH over 1.5M). Especially premium waterfront type listings.

Interesting chart

RBCs outlook of the housing market, dated yesterday July 22.

An interesting read….

https://thoughtleadership.rbc.com/downgrading-our-forecast-for-canadas-housing-market/

995

A leg up in house costs recently

Hmm…. Things getting weird at BC Ferries..

https://vancouverisland.ctvnews.ca/bc-ferries-ousts-ceo-amid-staff-shortages-cancellations-1.5998450

Hopefully, we are not going back to 90s with the ferries where the boat would be turned around after departure because MLA missed it, or you would sit looking at the terminal from the boat for 4 hours because of a wildcat strike or the person that operated the ramp decided not to come to work that day and the rest of the staff would work to rule.

I wonder if the people who rushed down to buy their mindless “Ducknana” at London Drugs, before they all sold out, if they drove down through Pandora Street.

Land appreciates and the structure depreciates, but maintaining the structure should be a priority for current use and enjoyment reasons by whomever occupies it. You’ll enjoy it more and you’ll get tenants who like to maintain a nice space.

In a really hot market it might not matter so much for value when you go to sell, but in a normal, flat or declining market it really does.

…Martin jokes that Ducknanas could hold a key to the region’s affordability crisis.

“If everyone had a Ducknana on their lawn, we may finally see property values go down,” he said.

https://www.timescolonist.com/local-news/what-the-duck-people-going-bananas-for-the-fruit-fowl-hybrid-ducknana-5609983

The point was raised about the value of land (“Improvements depreciate, land appreciates over time”) and I agree with that very much.

However, I also believe in keeping a property in good shape and reasonably up to date.

The value of that idea is that if things change (Prices drop etc.) you are in a stronger position to hold on until things spring back. (No one knows the future. No one.)

Your chances to sell in a tough market or to rent are always better if your property has been impeccably managed and shows well.

I’m not a fan of slum landlords for a number of reasons.

Curious- is there a way to see average mortgage balances in Victoria? I wonder how much debt people are carrying who bought in the last two years.

I prefer the current format, for all the reasons mentioned.

I like the current format. Threaded makes sense when there are totally disparate issues being discussed. Here the conversation is pretty linear with usually only a few side topics at any point so easy to keep track of.

Marco we upped it 10%, probably why less applicants, or time of year

Yep

Let’s see what happens after the long weekend.

I like the current format. Easier to follow chronologically and the chat is usually pretty linear on this forum. Not too much jumping around topics.

Temperature check: simple linear comment system still OK? I can also move to threaded comments (so you can reply to a comment and the replies are organized beneath/indented with that comment), but it’s harder to read all the comments in order that way.

Relatively sluggish week for new listings. I don’t think we’ll see much dramatic change through July and August.

Another article that talks about the cost of “homes” without explaining just what a “home” is supposed to be.

It’s been something watching the price drops on that group of houses in that Estevan to Uplands in between stretch.

Yes

From: https://www.ctvnews.ca/business/you-need-an-income-of-over-220k-to-buy-a-home-in-toronto-vancouver-new-data-shows-1.5997247

3246 Doncaster is also already sold, just waiting for the price to be reported.

Yeah, 6 DOM according to MLS listing. Assessed value closer to 900k. Suited houses in Victoria proper potentially selling under 1m and interest rate increases still don’t seem to have been fully priced in yet..

VicREanalyst – I think it’s only been up for a week. I went to the open house last weekend. It’s a nice place. Well maintained with a move in ready suite. It’s just one house in from the main road though (Cedar Hill Road), so could definitely have some noise from that.

Be interesting to see what this one goes for, has been on the market for couple weeks.

https://www.realtor.ca/real-estate/24669901/3246-doncaster-dr-saanich-cedar-hill

Completely agree with this too as I’ve looked into subdividing in the future. However, if you’re holding long-term with the goal of sub-dividing or thinking the province could possibly blanket zone for missing middle housing to increase density, having a large lot works right now for the tenant-focused reasons I listed and long-term for the potential gains in value you’re referencing.

That really depends on how you view it, my perspective is that owning the land provides more flexibility and options both for the owner/seller and potential buyers

When RE markets fall most of the drop is in land value.

Yes, I view having land as a put option on the RE. Even if all else goes down the drain there is atleast land value.

Are you asking the same price as last year?

We’re currently vetting tenants for our suite I’ll do an update once we’re done. So far vs. last fall, slightly less applicants I think we had around 70 last time, still probably around 50 now. By applicants I mean messages via Facebook, we’re only showing to a handful and will pick from them after reference and credit checks. About half of the messages are from International students + family. Of the rest, half are from out of town and relocating to Victoria which we didn’t have a lot of last time, so doing virtual showings and meetings.

Not where I was going with the larger lot comment. For purposes of rental income personally I would prefer the smaller the better im terms of yard. Overall, the reason you would want a huge lot on a rental property has nothing to do with tenants but rather long term appreciation. Improvements depreciate, land appreciates over time. Over 10-20 years the larger the lot the likelihood hood the return is better especially with density down the pipeline.

In 2017 they promised 114,000 new housing units and delivered less than 10% of those units in 5 years.

They ran on providing a $400 renters rebate in 2017 and then again in 2020 and still haven’t delivered on that promise, meanwhile in just a few short months they’ve found the ability to send out $110 gas rebates to people driving EVs across the province.

It’s no wonder many have zero faith in their ability to deliver on any of their housing related promises.

You’ve been thinking about that one for a while now. It was good timing, but it came about as a result of entering a renewal period for one rental. Because I had to go to the bank anyways I figured I’d ask the question about rates for other properties switching from variable to 5-year fixed as I’m not interested in selling anything in the near future. The rate was comparable to the current variable and was assured for 5 years, so weighed the pros and cons and decided to lock in. 2020 showed us all that nothing is certain, so when 5 years of financial certainty is presented you tend to think hard about it. Not sure why that’s so hard for you to believe. And I never claimed it was a genius financial move that was impeccably timed, I simply said it’s the move I made.

+1. Providing space for tenants to be outside is huge in my experience. Having large yards with some privacy, trees, fenced in and with room to host has always attracted the right kind of tenants and they’re often ones that want to do the yard work and make it their own, which saves time from having to do it yourself or hiring someone to take care of it. I also appreciate the simplicity of renting condos out. Far fewer calls and way less hassle.

I am ok with this.

From the Ministry of Finance announcement:

A new homebuyer protection period will protect people in B.C. looking to buy a home from being pressured into high-risk sales.The period is the first of its kind in Canada and marks the first key action the Province is taking based on the B.C. Financial Services Authority’s (BCFSA) report on ways to offer homebuyers better consumer protection in the real estate market. The mandatory three-day period will give homebuyers an opportunity to take important steps, such as securing financing or arranging home inspections, as they prepare to make one of their biggest financial decisions.

The homebuyer protection period will come into effect on Jan. 1, 2023. It includes a recission (cancellation) fee of 0.25% of the purchase price, or $250 for every $100,000, for those who choose to back out of a deal. For example, if the purchaser exercises the right of rescission on a $1-million home, they would be required to pay $2,500 to the seller.

Buyers still may make offers conditional on home inspections or financing at any time. The protection period will offer homebuyers the opportunity for due diligence at times when conditions are not in place.

The homebuyer protection period is informed by the results of consultations that the BCFSA completed this year with a wide range of real estate industry stakeholders, including home inspectors, appraisers, realtors and academics, as well as representatives from the legal and financial services sectors.

The Province will continue studying the BCFSA’s advice and its potential effects to further strengthen public confidence in the real estate market.

I’m in favour of building purpose built rental housing, specifically townhouses and condos, on public land and have been for years. And doing so on a massive scale. One of my favourite places to live was UVic family housing. Good spaces and great common amenities with good aesthetics.

The fact that the land does not need to be purchased should reduce costs to the point where reasonable rental income should cover expenses (three bed townhouse at Uvic is 1600/month).

I would think that coops with share transfers are even better given that the sense of ownership and responsibility is enhanced and there is a board of directors on site.

NDP have had two election platforms and 5 years of governing full of similar promises. With little result.

What I am hearing from property managers is prices at all time peaks; however, number of applicants dropping. One property manager I talked to last week had a house in Colwood she rented for $5,000/month but there was just the one applicant.

Hopefully some huge projects nearing completion like Hudson 2 alleviate some of the pressure. Tough picturing where all the people come from. Hudson 2 has over 200 units and it will probably be fully rented out within 2-3 months.

Any anecdotes on the rental market lately?

You didn’t see Eby promising that government will build middle class housing on government land? I wonder how many they can build with the museum money….

One of my projects in the COV…..lol we are screwed on housing long term! The person I am dealing with is actually really nice and a huge upgrade from the previous person but the system is so broken, more than a month to get a reply to schedule a 5 minute inspection of grass.

If the missing middle is approved I am thinking 5 years before the keys are handed over to the first houseplex occupant.

From: Marko Juras

Sent: June 15, 2022 10:26 AM

To: xxxxxx@victoria.ca

Hi xxxxxxx,

Hope you are doing well. Would it be possible to call for an inspection of the boulevard grass?

Thanks, Marko

Reply July 21, 2022 10:57 AM

Good morning Marko,

Thanks for your patience awaiting a response. We are even further short staffed since last we met. I will schedule time to review your boulevard and return your deposit next week unless I hear otherwise from you in the interim. Assuming all is correct following inspection, I will submit the deposit for refund immediately after.

Best regards,

Agreed.

We are not selling but instead transferring to adult children when they are at that stage of life but I would be concerned with this otherwise. If I knew I was going to sell I’d rent to students who will vacate at some point and then list.

Saying you got couple hundred K ready to go on an anonymous internet forum is quite different than going to the bank and coming up with that cash for real.

With your location in Ucluelet (?) a better plan might be to do home exchanges which are permitted in residential zones. We do this and it worked very well before covid. Stayed in Amsterdam, Isreal, and France so far. If you put a suite in your house you could start collecting points now for travels later.

Also, in the last 2 years I’ve come to the realization that when it comes to selling SFH tenants are far far more difficult to work with and can often hold up the selling process. If you tell a single individual hey your studio is going up for sale most of the time they are like this sucks but whatever I’ll rent another studio in one of the many new towers. If you tell a family of 5 hey your home is going up for sale they aren’t super receptive to showings, etc. They know almost impossible to find another rental and probably looking at $1,000 to $1,500 more. For the landlord it can be quite stressful.

Affordability/being able to qualify isn’t the only factor. If prices in Feb are down another 10-20% from here that means we are 400 sales and 4000 active listings. If a great opportunity presents itself the buyer is looking at 3 other homes on the same street and every day in their PCS account they are seeing 3x the price drops than sales.

The vast majority of potential buyers freeze up in this situation even if they are approved. They hope that instead of a nice million dollar house in Maplewood maybe in 6 months they will be able to buy a nicer SFH in Oak Bay.

If you look at buying opportunities (Jan-March 2009, March-April 2020 and to some extent 2011-2014) the number of sales is very low. When prices are skyrocketing sales numbers are very high.

I bought a condo now so I have a place to move when I have had enough of living in a remote tourist town with nothing to do but surf and watch storms. Looking at 8 years from now. It made sense for me to get an investment condo that will turn into my residence when I retire in 2030 and use the sale of my SF home to travel half the year until I die. Someone else is paying the mortgage while I pay the strata fees and property taxes. If it goes up or down in value doesn’t matter to me. Its my primary detached house value that I worry about. Its the difference between travelling to Bali or Nanaimo for vacations.

Right. I have my hands full maintaining a personal property, and can’t imagine taking on extra work with a rental of any kind. My hat’s off to those who do.

I have also only owned SFH for a rental. Much more flexibility on what you can do as far as generating revenue.

Yes, there are always those cases. I’m just saying there are large numbers of house hunters (indicated by large numbers of HHVers here), and they do have down payments and financing.

You bring up a good point about financing though. The financing can dry up in a market downturn, as the banks tighten lending standards. So if that happens, you’re right and a mostly cash buyer is in a great position.

We have only purchased SFHs or multi-family residential. But for Marko’s posts I would never even considered a condo as an investment property as the numbers don’t provide the best return and there is little option to add value through improvements.

We have always been willing to put the work and time in to improve properties – it is a hobby for me that I enjoy. That won’t be the case forever though. I also have the skill set to manage tenancies, but I recognize that this can be a very challenging part of rentals. A bad tenant can create a huge headache and financial losses.

A lot of people would experience more stress than it is worth for them to own a SFH and if they want to own a rental a small condo would probably be a better choice.

I think he is saying why wouldn’t one of the renters buy it and rent out the suite.

There isn’t one renter, there are two. Upstairs and downstairs.

Lack of down payment and or can’t get financing. This senario has happened many times before here.

Oh and waiting for the market to drop further lol

Leo – thanks for this post. It’s very informative and well put together. I didn’t fully understand the trigger rate before, so it’s good to get clarity on it. I also shared the post with a bunch of friends, who also found it very useful.

I’ve learned a lot from this blog, keep up the good work!

That would be great to see. But if they are cash flow neutral with 20% down, your renter is paying your mortgage. Why wouldn’t the main renter buy it instead (and rent out the suite) ?

Anyway, it would be great to see under $1m SFH, as that would work for many HHVers.

In relation to other condos. Long term you will always do much better with a good SFH rental property was good condo rental property.

Catch is a good SFH rental property has to be old and ideally on a large lot. With an old property comes a lot of headache especially with multiple tenants on the property.

I prefer to sacrifice return and go with the best condo option as it is much less involved. Elevator not working? Tenant knows not to phone me. Garage gate broken and tenant can’t get out of parkade? Knows not to phone me. My 11 year old condo rental I’ve replaced a $600 refrigator. My 8 year old condo and newer ones I’ve literally done nothing in terms of maintenance to this point.

SFH investment property, imo, is better suited for tradespeople or hands on, semi-retired or retired where you can go putter around the property to carry out repairs etc.

That is what I posted multiple times in the last 2 months. I expect 60-70s livable suited houses in the core to dip below $1m in Feb 2023 should the current interest rate path continue.

Metrics I am looking for is either cashflow neutrality with 20% down, and or cap rate approaching 6%. This is subject to change pending market conditions.

In Victoria, It was only a bust if you bought in one year -> 1981 ($126k) and sold within 7 years. Buying in any other year, you saw prices flat (+/- 10%) or up.

Yes, if you can get a decent one below $1m that would be a good buy. It’s nice to imagine a future where nice Maplewood homes are under $1m.

looking to get one more in Maplewood as I had previously indicated.

Yields on condos need to be higher because they have little land value which means the depreciable part of your investment is much larger. And yes they do depreciate, like any structure they require capital inflows over time to be habitable.

25 years ago was 1997. The bust of the early 80’s was only a little more than a decade in the past. Housing was affordable and people just bought. Trying to project attitudes of today into that time just doesn’t work.

Being a bit older than VicRE I bought a SFH on one income in the mid 80’s. Because I could.

OK. And so the idea you’re pursuing is to buy Victoria SFH homes and rent them out? Marko has some good videos pointing out that rental returns are best on low priced (smaller) condos. How do the numbers make sense for SFH rentals? What’s the theory there… Are you expecting big rises in SFH prices after you buy?

Sure if you are buying your primary residence and can afford it and like the place. When looking at rental investments I am looking at cashflow, cap rates and ROE.

Lol I was 10 years old then, so no definitely not buying anything then.

Maybe they’re smarter than you, and think that buying now is better than hoping to buy “cheaper” later.

25 years ago, you would have been pointing out that it’s better to wait for a $250k average Victoria SFH to fall to $220k so you can buy, even at a higher rate. Now SFH are over $1 million. Both people who bought made smart moves. The only one that lost out was someone waiting for house price falls that never came and has been renting ever since.

https://www.vreb.org/media/attachments/view/doc/3_2021_historic_summary_of_single_family_detached_sales_by_year/pdf/3_2021_historic_summary_of_single_family_detached_sales_by_year.pdf

Not surprising to be honest as most people can’t do basic math. I am sure there are still people who think buying a expensive house at a cheaper interest rate (that renews in 5 years) is the same as buying a cheaper house at a higher interest rates because the payments are the same for the first term…..

Well some of you newbies (not you) probably don’t even know what to do in this market…

Yea pretty much. They blame the first REALTOR® for not doing enough “marketing,” etc. Then the second agent comes in most often at a lower list price to start and potentially a third. Once I was a the 4th listing agent on a house in North Saanich; however, the 5th agent sold it 🙂

For the most part people have no common sense either. My assistant at the time and I approx. 10 years ago looked at cancelled listing of a local lower commission company (let’s say they charge 1%, commissions may vary). We took a sample size of 100 cancellations from this company that were re-listed with a different brokerage and 99/100 were re-listed with a full commission company (let’s say 6%100k+3%balance, commissions may vary) at the same or lower price. We found 1/100 that was relisted for 10k more but the seller had taken a month to carry out some renos/cleanup.

So people increase commission and cut the list price versus in my opinion the common sense would be to cut the price and reduce the commission you are paying. Example, 99/100 people list property for $529,900 with lower commission company and then they cancel and re-list with a higher commission company for $499,900. I think it should be the other way around or just stick with the lower commission company at a lower price.

Only a few months ago people were blaming REALTORS® for bidding wars, what happened? Did we all stop doing our job?

Basically people don’t understand how markets function; this is in part why commissions are so high. When you don’t understand how a market functions (whether it be housing or other) you fall for non-sense. i.e., you pay more commission somehow it will lead to an offer.

Where is he going to build these houses? Lytton?

It will be interesting how the government handle things this time around.

My feeling is that the BoC will chicken out, and drop rates in the next 24~36 months after a few quarters of poor economy.

Vote buying and be damn with the future generation.

Government have gone out of their way to tie the private sector the ability to meet demand, and now they are going to waste public monies for the inefficiencies.

Wow, Eby is about to go in hot on housing!

https://vancouversun.com/news/local-news/eby-says-top-priority-bc-premier-housing

People need to stop trying to scare all the variable rate mortgage holders!! Did people on this forum try to scare those who didn’t have a house during the run-up?

Interest rates have jumped, but old rules of monetary policy suggest they still have much further to go

https://docdro.id/XRkdGFa

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-inflation-interest-rates-canada/

marko yes hard to talk people down from they’re perch Would u say 80 percent of the time it’s the homeowners that set the price

Disagree, short sellers seldom move the market except for some illiquid low volume/capitalization names. Most of the flows are people going long or existing a long position. Besides, why would anyone short the housing market when it is guaranteed to go up in the long run, your timing has to be impeccable kinda like locking in all your RE holding mortgages (atleast 3) at all-time low rates last year.

IMHO the biggest reason is the illiquidity of RE compared to stock or commodities markets, particularly the inability to short sell.

Didn’t continue in 1981 did it? Yes you get a bump in the interest component of CPI but then you get a reduction in aggregate demand which leads to reduced price growth and quite possibly a recession which reduces demand further. For everything.

So basically the first realtor would suggest lowering the price but the client won’t listen then when they get to the second or third realtor the client will listen?

Key is going to be the second or third listing REALTOR® in at a lower price.

Chasing the market down means not pricing properly, it is different than putting it on the market in the first place.

Yes it will be chase the market down hard for people to get ahead of it is always too painful Going to be a tough to be a realtor soon as they will be getting a lot of the blame

This is something I was asking about in February:

https://househuntvictoria.ca/2022/02/14/the-dispersion-of-risk/#comment-85491 and

https://househuntvictoria.ca/2022/02/14/the-dispersion-of-risk/#comment-85495

Don’t see how it doesn’t continue.

The correct answer should be available shortly.

Obviously not meant entirely seriously but the feedback loop is pretty interesting

I think sellers that can wait are probably more inclined to do so. Most people aren’t tracking the market and its history as a whole.

For many sellers, this slowdown may be viewed as buyers just being temporarily skittish until the market roars back in a few months – where they will hopefully get full pop and maybe a bit more.

Most sellers don’t front-run the market; in fact it tends to be the opposite in that they chase the market down. It’s one of the reasons prices are always sticky and declines take several years to play out.

To get back on topic, I foresee an above average amount of listings to come on after this long weekend compared to prior years as sellers try to front run the Sep rate hike.

Sorry Leo!

Hey Totoro:

Agreed in part, actually, like that it isn’t purely hard science problem (solutions have to be employed by people after all; they should be politically feasible; etc.). I hear what you’re saying about individual choices; hopefully you’re hearing me too. And probably let’s leave it at that and return to topic.. 🙂

What are you guys talking about. Is someone contemplating buying RE on Venus?

Hopefully this will help – and I suggest you find a highland region. Air’s a bit thick in the lower elevations, unless “density” is your thing.

https://lunarembassy.com/product/buy-land-planet-venus/

Maybe a solution to our housing crisis is to dig down instead of building up.

Venus is hot precisely because of the greenhouse gases in its atmosphere. Compressing a gas makes it hot but ongoing “pressure” does not generate any heat.

I agree. While there are some individual actions that are just window dressing, others actually have the potential to make a difference especially if taken up more broadly.

Doing without a car or without a second car

Changing a portion of your transportation to active transportation

Traveling locally and thus avoiding some air travel

Picking the low hanging fruit for your home energy efficiency

Most of these actions also have co-benefits. Save money. Better health. Less resource use.

James- Venus has incredibly high atmospheric pressure that generates an enormous amount of heat, even hotter than Mercury which is closer to the sun. Sorry Leo. Climate change factors are far more complex than an increase in greenhouse gases. Maybe do some research into Iceland.

The other day I came home and the lava tubes must have blocked up. Wouldn’t you know it, my whole basement was full of molten rock.

Peter: Motive’s (Home Bank/Home Trust) HISA is paying 3% right now. Maybe look at that for holding funds.

Unless you’re planning to buy an underground house heated by magma ima say this is offtopic…

Maggie- Try going into a mine a kilometre under the surface. You have to dig deeper, that’s how geothermal works. What’s your dog’s name? Einstein?

anyone have insight into this leasehold building?

104 – 909 Pendergast St

MLS:908473

i am strictly concerned whether it is a decent place to “own” and live in. 6 months/year for a snow bird family member.

as opposed to renting.

normally not interested in leaseholds but …

1) the math works as total cost per month.

probably cheaper than rent.

$270k + $480 “strata” fees. no taxes heat or hot water.

not concerned about the greater difficultly with financing a leasehold

2) almost nothing else on the market under $450k. looking for a studio or 1 BR. james bay, fairfield oak bay. but NOT downtown

a few of the available listings have outrageous asking prices 30-55% over assessed. i guess lack of supply.

3) i know a leasehold is a dud re: appreciation. but even if it was a freehold i think it will be a awhile before there will be significant capital appreciation

4) nice location across from beacon hill park.

i dont know the building or owner or management – but i have heard dire things about the “other” major leasehold building – orchard house (647 michigan)

any thoughts appreciated

Ah, yes. There is the place you’ve gotten off track imo.

Bottom line is that it is a people problem so the solution needs to take into account hard science and social science. If it was just a hard science solution it would be much simpler.

That is the thing with solutions, they need work in real life too and so please rethink your inclination to discount individual efforts to address climate change.

Wrong approach imo.

Incremental change has a huge cumulative effect when replicated over time and number of people and leads to more change and acceptance of additional steps.

As hot as the earth’s core is, it’s surprising that my dog digs a hole to lie down in on hot days. He must be getting bad information off of Facebook or something.

Oh, there’s a formal definition which lines up with what you’ve seen, where one uses the big O to bound the size of something (like the number of steps in an algorithm, or the difference between two quantities, like sin(x) = x + O(x^2) for small x). I’m being a bit colloquial, a consequence of habit, describing how it’s used in practice in discussions.

[D’oh. I thought you were asking me instead of Frank.. but since the science is interesting..]

https://www.acs.org/content/acs/en/climatescience/energybalance/predictedplanetarytemperatures.html

A similar estimate for Venus is off by an O(1) amount, whereas estimates for Mercury and Mars are pretty good. What do people make of this?

Well, it’s like the grade school picture for how the scientific method works. You make a hypothesis (in this case an extremely oversimplified model for energy balance where energy in = solar radiation), test it, see if it works, and if it doesn’t, revise it.

In practice what people have learned from this (and here I’m condensing decades of planetary science, where people investigated precisely this discrepancy) is that greenhouse trapping on Venus is, unlike on Earth, an effect of approximately equal importance as incoming solar radiation. In other words, for Venus, the two most important effects that determine its temperature are (i) incident solar radiation and (ii) greenhouse trapping. Whereas, for the other inner planets, solar radiation is the most important factor. To verify that idea, what people have done is to model Venus’ atmosphere, compare it with observations (e.g. spectroscopic data, which tells you about the relative composition of different elements), and then estimate trapping once you know the model gets other things right.

That is my inclination, but I was careful to not say that. What I was trying to argue there was more conservative in nature (in the sense of advancing a weaker claim that I have stronger confidence in). To rephrase, if you are going to say that climate change is a scientific problem, one should then address it in a scientific fashion. In basic science you make progress by being quantitative, and in particular comparing the importance of what you’re proposing/modeling with the size of the effect you want to understand or the problem you want to solve. What I’m saying is something very basic, namely that should be done when discussing responses to climate change as well.

From what I’ve seen of the numbers involved, yes, those personal/family-level decisions are negligible in the face of it, and so I’m inclined to regard them as a matter of personal discretion rather than the basis for coherent and effective policy. But I haven’t seen enough data-driven discussion to have full confidence in that claim, which is why I’m not advancing it.

I’ve seen that only as big O notation in Computer Science (https://en.wikipedia.org/wiki/Big_O_notation) to classify algorithms. Never seen it used the way you’re using it.

How do you correlate this world view with Venus having a solid metal core and having temperatures well above ours? There’s also trillions of planets in our galaxy and billions of galaxies in the universe… do you actually think none of them would have a molten core and oceans?

So you’re arguing that since personal-level / family-level changes are relatively small, they’re neither important nor worthwhile?

Hey Frank:

Well, the moon has a molten core, but no oceans and no atmosphere and no active volcanoes. Temperatures there wildly fluctuate between day and night, but if you take the time average you get ~ 250 K, which is close to the 278 K I advertised from the back-of-the-envelope computation that only accounts for incident light from the sun.

You can think about it though in terms of power = energy/time. Both the sun’s light and the molten core are sources for energy into the Earth’s surface, which heat it up, until the rate at which energy is emitted from the surface (by virtue of being at its temperature) is equal to the rate at which energy comes in. Solar radiation can be measured directly, and people estimate how much comes from the interior of the Earth. I don’t do those sorts of estimates myself (that’s the province of geophysicists) but apparently the latter is expected to be O(10^{-4}) compared to solar radiation.

I’ve always been under the impression that the primary factor keeping our planet in a livable range of -40-+40C, is the heat generated by our molten core that heats our oceans which distributes it in a complex system of currents. Undersea volcanic activity also contributes to increased oceanic temperatures. Without our molten core and the oceans, that do not exist on many (if any) planets, this world be one cold, dead rock.

Some houses in Ladysmith were going for double assessed value a few months ago. I doubt they were due to speculators. That market has also slowed recently, it’s summer.

Just start layering some in and then put the rest in a cashable or something until sep. Never going to bottom/top tick unless you get lucky.

Hey Totoro:

I specifically had him in mind wrt energy production; I’d have to see what is going on with the Snopes article you referenced. (Although, regrettably, Snopes has kept with the times and become more and more into ideology and advocacy, and thus less reliable, so I admit my prior there is to suspend judgment..) I do know that he has some recent comments about renewables that seem overly strong in their criticism, whereas their proponents oversell their benefit and underemphasize their flaws.

I learned about him through his wildly unsuccessful primary campaign for CA state governor, but don’t know much about him otherwise. He distinguished himself to me by at once taking climate change seriously while emphasizing the role of energy production. People in policy that do that in the States are whatever the opposite of a dime a dozen is, and so he caught my eye.

Hey Introvert:

Sorry; what it means, in English, is “of order 1,” but the way it is often used is to describe an effect that is as important as the thing you’re discussing.

Here’s an example. Suppose you wanted to predict the global mean temperature of the Earth, ~ 290 K. Well, in physics a standard problem we give undergraduate students is to estimate that temperature under the simple assumption that the Earth is in thermal equilibrium with the incident radiation from the Sun, the latter of which can be inferred from its surface temperature which in turn can be inferred from the frequency distribution of light it emits. If the student computes correctly, they come up with an estimate of ~ 278 K.

That estimate is not right of course, because there’s other factors not accounted for in that simple “back-of-the-envelope” computation. The Earth doesn’t perfectly absorb all incident radiation; there’s trapping of energy which we’re talking about when we discuss climate change; etc.

But the estimate is nevertheless correct at O(1), since 278/290 = 0.96. The other effects are much smaller than the one the students consider in this problem, e.g. non-perfect absorption is responsible for about a ~ 25 K shift down, which is an O(10^{-1}) effect (25/290 ~ 10^{-1}), and trapping is of a similar size.

So the lesson for that particular problem is that the dominant effect in determining the temperature of the Earth is light from the sun.

If you wanted to know the next most important effects, what you would then do is to compare the observed temperature of the Earth (290 K) with your estimate (278 K) and then determine the effects that contribute to global mean temperature with that sort of size (~10 K).

I’m blabbing about this because I think it’s a good organizing principle for thinking about scientific problems that lack an exact solution. It’s one of the very effective modes of thinking that physicists bring to bear on problems, one that most people do intuitively, but which is often lacking in these discussions, where instead somehow just doing something, anything!, is assumed to be important and worthwhile.

(It’s also why I pushed back on the phys.org article that Totoro posted earlier; nothing wrong with the article of course on its own terms, but I would say that as a piece of physics it is unenlightening insofar as it doesn’t quantitatively discuss the implications of the proposals made especially in comparison with the goals of carbon reduction. Yes, those are potentially effective changes, but how much benefit do you get for how much cost and how does that compare with the scope of the problem and in comparison with other society-wide changes?)

Hey Dee:

Well, to put on the scientist hat, the honest answer is that I’m not an expert in these matters; it’s the usual thing where it takes less training to be able to identify problems, much more to be constructive. I do know some things, enough to be able to confidently identify flaws in proposals/arguments and have a few judgments I think will survive the test of time, but not enough to be able to lay out a roadmap for the future. Very few can do that.

Two more objective things I can pass on are:

Good grief. Ladysmith population 8,000. Victoria has found 900 spec tax homes, so proportional to population, we should expect about 18 spec tax homes to be found in Ladysmith. If the average spec tax is $4,000 that will be a meaningless $72,000 that will get sent to Ladysmith municipality to help solve their affordability problem. That’ll probably end up barely paying for consultant reports on affordability/vacancy problems.

And maybe we will smoke a few foreigners out of their Ladysmith homes, as they’ll be unable to pay 2% spec tax per year. So they’ll rent instead.

That will do nothing for the housing problems. At O(1) anyway . (Thanks Kristan) 🙂

The high rates by themselves aren’t expected to stop inflation. Recessions stop inflation, not high rates. I think the BOC rate will need to exceed inflation, and then we will get a recession. Hopefully the recession stops inflation, unlike the 70s-80s when we had stagflation (recession, unemployment and ongoing inflation)

Imo inflation goes higher than lower in the coming months and so goes interest rates

I’ve been pretty tempted to buy some medium-term GICs or even a longer-term bond ETF, but have decided to wait until we see what happens in September. It’s an arbitrary decision made with imperfect information, but as you say, lots can happen in the interim

I’m guessing next (this) month comes in a bit lower if only due to gas prices falling?

Yes, with that said though I will take the under on 2.5%. Too early to make a call on the September hike, lots can happen between now and then.

BoC is more worried about wage push Inflation and the CAD as opposed to commodity prices and supply chains.

VicRE: Real inflation is raging at a higher number than the officially reported one. The official number is scary enough. Frankly, a lot depends on were the Fed goes.

Another 2 -2.5% from now till end of the year??

CPI is 8.1%, up from 7.7% last month. Expectations were 8.4%.

https://www.google.ca/amp/s/www.thestar.com/amp/business/2022/07/20/how-bad-is-inflation-getting-statistics-canada-is-about-to-tell-us.html

Some of the countries with the lowest gas prices may appear to have low prices in U.S. dollars, but in local currencies the prices are still very high. At one time the Venezuelan currency was so devalued when gas was 1 cent a litre, one U.S. dollar could buy 900,000 litres of gas. That didn’t last long.

Realistically we could be looking at two to two and a half points increase by the New Year. Not a prediction but not a number that would surprise me.

The reason fuel prices have jumped in some of those countries has everything to do with Putin’s stupid war and essentially nothing to do with “eco” policies. Some of the other countries you list are dictatorships with some of the cheapest gas prices in the world due to government subsidies, but running out of money to bribe their people into submission.

Some of the countries with the world’s lowest gas prices:

Venezuela, Libya, Iran, Syria, Algeria

Some of the countries with the world’s highest gas prices:

Iceland, Israel, Norway, Finland, Central African Republic

I know which list I’d like to choose from.

I wonder how much food and produce would cost since farmers, truckers, and everything else need fossil fuel to give us the comfort of modern life.

And, would the bottom half of the population tolerates the insanity or they would burn down all legislative buildings and the parliament?

Perhaps one might want to take a look at the protests that has cropped up like mushrooms due to fuel/food price in the last few months, such as UK, Belgium, Netherlands, Greece, Cyprus, Indonesia, Sri Lanka, Ecuador, Peru, Argentina, Iran, Pakistan, Zimbabwe, Kenya, Sudan, Tunisia, Guinea, Egypt, Lebanon, Palestinian, etc…, before jumping on the destructive eco bandwagon fad.

Right that is why the streets/highways are packed with pickups on Sunday afternoons.

$4/ litre gas won’t stop tradespeople from driving pickup trucks and towing trailers when they travel to job sites, they’ll just charge more for their services.

I dont have any prediction but another one percent raise is with the range of the very possible. I am not fear mongering here and would agree that the US Fed might provide at least some signal where rates might be going.

When we hike carbon taxes we get less carbon

When we hike cigarette taxes we get less smoking

When we hike new housing taxes we get…

Stop fear mongering!! Clearly that’s what you are doing right after Leo drops the piece on trigger rates/points

I don’t think another 100bps is on the table if the fed doesn’t go 100bps later this month.

What does this mean?

The case building for another 100 points to be added to the BoC rate in September…

From: https://financialpost.com/news/economy/inflation-expected-to-top-8-heralding-another-supersized-rate-hike

Lol no,I have walked past him couple times downtown.

He looks about 8′ tall here

Yes, he is like 6’8

Granted it doesn’t help that his wife seems to be crouching a bit but this guy is freaking huge. ?1658105573

?1658105573

Here’s one right into wheelhouse for Leo and Marko….

From: https://nationalpost.com/opinion/adam-zivo-is-the-city-of-toronto-giving-young-homebuyers-the-middle-finger

By my estimate/calculation about 2.2% of the fixed mortgage volume renews every month.

If you want to do that, consider taking out a HELOC, paying down the mortgage, and then taking the same amount from the HELOC to buy the investments. The interest would be tax deductible.

If you have spare room in your TFSA you should just put the money in it directly though. Also goes for RRSP in most circumstances. Interest on money borrowed to make contributions to these is not deductible.

Ash I split mine between variable and fixed couldn’t make up my mind what I wanted to do lol Investment wise I think at this time everything is a loser but I’m okay with that

Ash? You have committed to a mortgage, but you aren’t sure of how it works? I presume right now, because the prime rate is probably higher than when you signed up, that less is going towards the principal and you are paying more interest.

I have a variable rate, and was surprised when I found out my payment wouldn’t go up with the rise in rates (at least not until if/when rates go up substantially). I had always assumed the payment would rise immediately and planned accordingly. With the stock market down, and as one who (generally) prefers to invest vs pay down the mortgage, I’m still putting any extra $ into investments rather than the mortgage, for now. So count me as one of those homeowners ‘kicking the can’. Will shift back to the mortgage before my term is up so as not to fall too far behind/ require a longer amort. Curious what others are doing.

Michael Schellenberger doesn’t seem to be a scientist. He has an MA in Anthropology.

Are you specifically referring to his views on nuclear energy? It seems like many of his other ideas are subject to some valid critique: https://www.snopes.com/news/2020/08/04/shellenberger-climate-change/

@Kristan what proposals are reasonable and effective (in your view)? I’m genuinely curious.

Hey Totoro:

Well, I guess it depends on how one deals with numbers. I’m a physicist, and so for me a 6% change is effectively zero when compared with the reduction required, which is something in the 50-90% range IIRC. (My phrasing also comes from conversations I had with physicist-turned-climate scientists in mid-2020, who described the carbon reductions as quite small.) It’s a small perturbation, in other words, rather than an effective strategy, to say nothing of being viable in the long-term.

To me this all underscores the magnitude of the problem and the importance of serious and politically viable attempts to address it. If individual people feel so led to make O(1) changes to their lives, good for them. But..

FWIW, the most reasonable person I’ve seen in the States making specific proposals on these matters is Michael Shellenberger. There are reasonable such people out there, but unfortunately we get a lot more of denialism from the right or what is effectively “Jesus is coming! Look busy!” from the left on these points..

Agreed on all counts..

Sure. And I’m not a climate scientist. Just a person who reads up on things I’m interested in and willing to change my mind if I’ve missed something.

So far my approach has been to limit my footprint, and it works partly because I like it that way anyway.

If you came to me with a solution for the problem with individual climate change measures you are pointing out, I’d research it and if it seems logical you’d get my vote/backing.

Pointing to a problem without a solution is disempowering. Science backs reducing your carbon footprint as far as I can tell because this does not mean that government is precluded from taking action too.

Ukee dude. I truly appreciate your recent “man on the street” comments. You are a real person addressing realistic and valid concerns. Good for you for recognizing how one unfortunate turn of event right now could be life altering for you and your family. You have a mature outlook on what is happening and have taken some positive steps in the right direction. I really wish you the best. No matter what happens, I can tell you are one

who will land your feet. Keep us posted.

Great. Also outside of the sphere of immediate influence and control for almost all individuals.

I think a lot of people get frustrated with what they perceive as virtue signaling that is ineffective and inane, and worse, like fiddling when Rome burns.

Sure, me too.

But then I think that is part of the change cycle. At least it is trendy now and given the social changes that are coming, buy in is possibly the most important factor. The fires, floods. and heat domes have given a big boost to this as well.

That seems possibly misleading given the data I read? In 2020, carbon dioxide emissions fell by 6.4% or 2.3 billion tonnes globally, but then businesses and travel started again and the numbers went up. It was a temporary measure with a temporary effect. We did also get a bit warmer in many areas as the pollution that was blocking sunlight cleared.

https://usafacts.org/articles/carbon-emissions-dropped-in-2020-much-of-the-decrease-was-due-to-less-driving-and-fewer-flights/

@Marko No Im not going to spend my time advocating for sprawl.

So you are going to start an advocacy group to slowdown construction of density yet let sprawl continue to run wild?

Yea because nature and building envelopes work perfectly in harmony in our climate. Even if you found some very smart consultants to design perfection who is going to build it? It is great to design a cool design with plenty of podiums/terraces overflowing with green nature but reality is the man or woman installing the torch on membrane on that podium/terrace above a living space is often poorly trained and may or may not have had a bit too much to drink the night before.

Based on having represented hundreds of condos buyers and read hundreds of strata document package I cringe whenever I see a design that isn’t a vertical box in terms of long term maintenance/problems with the amount of rain/wind we get here.

Be careful, people on here with a narrative to push (or protect) will jump all over you for anecdotal observations!

A father’s advice: “Remember this son: nobody is indispensable, they may think they are, but in any graveyard lie the dead bodies of many indispensable folks.”

Umm really Just wow that’s a real haircut I was of the feeling mid island was getting overpriced for what it is

An anecdotal up island update. I mentioned the two acquaintances up in Qualicum before, each sold in their neighborhood 1 and 1.1 mil respectively in April separated by two weeks in between, that made them the only listings in the neighborhood for sale at the time. One had an extended closing where the buyer waivered on closing the deal (unconditional offer) and looked to escape the deal and when that failed asked for a re-negotiation. That ended with a litigators letter from the seller to the buyer that brought everything back to the original agreement and close. Since those two sales, there has been 5 or 6 listings in the same block (basically the same rancher style built over the span of 15 years) and all have had price drops. A day after the the 100 point BoC bump, one listing that is an estate sale moved it’s asking below $700k and still no buyers. Basically, the same house that sold back in April for around the million mark.

@Marko funny you should say that because I am chatting with a couple knowledgeable people about forming an advocacy group. It seems insane to me (and I’m not the only one) that we still don’t understand the value of trees given the current climate crises – and that we seem to revert to binary thinking of earth vs people. Also, 100% replacement doesn’t indicate that a building is biophilic. Truly biophilic put nature at the heart of building and try to achieve way more than 100% replacement. 100% replacement is only the bare minimum that we should do to be somewhat environmentally responsible with our building practices.

Hey Totoro:

Agreed. However, there are partial (and effective!) solutions on the table which don’t require reordering society or imposing significant burdens on the poor. Carbon emissions in the States went down by just over 20% from 2005-2020, largely due to changes in energy production/infrastructure, going away from coal to LNG. It’s possible to knock that down further by a factor of ~1/2 by switching to a combination of hydro/nuclear/LNG, which is what I was alluding to earlier.

(By the by, people vastly overestimate the contribution of individual transportation to climate change relative to power generation. Again, carbon emission in the West during the “lockdown” phase of the pandemic when air and personal travel were severely curtailed was nearly identical to before and after.)

Unfortunately, pricing things like air travel, fuel, borrowing costs, etc… to curb usage in an attempt to impact climate change, will destroy the economy around the world. In order to achieve some of the climate goals governments have set will create an economic catastrophe plunging the world into a deep depression. What is really needed is a massive reduction in world population. Not sure how that will ever be implemented, maybe another ice age?

+1, for sure. Just compare cars in Europe (gas $$$) vs North America (gas $).

I have a feeling at $4 dollars/litre f150 and dodge ram would not be best and second best selling vehicles in Canada.

Get some friends together. Raise some capital. Try to rezone and build a small biophilic building and report back to me as to how it went.

It is good to identify problems and barriers based on science. It is even better to understand solutions and focus on them because analysis paralysis is a kind of purgatory that also won’t stop climate change.

Incremental and partial solutions are better than saying “what’s the point” and discouraging any momentum.

Science based solutions are critical, but so is reaching the level of voter support to get to the hard line legislative changes and enforcement needed.

I believe the science and yet I am still contemplating taking a flight in January for the first time in three years. I’ve cut back on flights overall, but I’d probably stop flying if they were taxed they way they might need to be to compensate for climate impact. I would support this government action, but I only moderate my behaviour and don’t stop it without this. At least not yet.

Change is hard and the economics need to be part of the incentive for change.

@Marko well I’d really like to discuss this more and hear more about why this is completely and utterly impossible and not feasible. Anyway, we might agree that change tends to happen when we have no choice left.

At this point and time what you want is not even remotely close to being feasible on so many different levels from economics to everything else such as municipal approvals, etc. I am sure envelope consultants would be rushing to sign off on these designs in our climate asap. You can’t find labour to nail 2×6″ together but biophilic you’ll have expert trades lining up to build.

I guess society could also collapse and you’ll be guarding your cabbage patch with a semi auto.

More realistically government does some symbolic nonsesne like a “hiring freeze” or goes after low laying fruit like privatizing hopsital cleaning stuff like they did in 2001.

@Marko The earth doesn’t care about our duelling crises and our failures of imagination or will . Who do you think will be suffering in the future when shade is a top asset that people need to survive? It won’t be the rich – it will be those with limited resources who live in green deserts. It’s a complete failure to not understand the interconnectedness of these two crises – and to fail to come up with solutions that address both as opposed to embracing courses of action that prioritize one over the other (i.e. preserving greenspace over density vs massive density and no greenspace). I want all development to at least replace the greenspace that would be there naturally.

Saw on the news yesterday, I believe it was in Alberta, there is a shortage of concrete. Builders were told they would be lucky to get half what they order. What’s going on? Even concrete is becoming a precious commodity.

Speaking of inflation I’ve never had lower transportation costs in my life. The basic insurance ICBC insurance on my 7 year old Tesla is $643/year. Free supercharging. Out of pocket costs last 24 months one door handle replacement $400…will need new tires this fall thought.

Sorry to say but this is complete fantasy land. We can’t find enough consultants/tradespeople to build simple crappy houses in a gravel pit let alone biophilic design.

Let’s get the housing shortage under control first and no better way to do that than massive concrete buildings on 1/2 acre lots accommodating 300 people walking distance to amenities or we can continue to blast apart entire hillsides on the Westshore to accommodate 300 people that have to drive to every single amenity.

We can’t even get the ultra basic concept of having people amendable to living in a non-SFH.

Solar panels work great in California, if the sun can get through the smoke.

One last comment before jumping off the soap box. Not sure if you’ve heard about it, but Sri Lanka is a great recent example of what can go wrong when trying to reorder society according to the good intentions of wealthy Westerners. For a primer, before the recent collapse of their government, see:

https://foreignpolicy.com/2022/03/05/sri-lanka-organic-farming-crisis/

There is an imperfect (and perhaps very imperfect) analogy with the modern climate movement, in that most of the proposals put forward are palatable and virtuous to the wealthy but disproportionately impact the poor, whose buy-in and political support is required to pull the thing off. A recent absurd example in the West is the state of California mandating that new builds come with solar panels (most likely built with Uyghur slave labor) while shutting down nuclear power generation.

Again, this isn’t directed at anyone here, just voicing a perspective that doesn’t seem to be heard that much round these parts.

Looking at national EV-adoption curves, Canada (and others) may be approaching a tipping point:

https://www.bloomberg.com/news/articles/2022-07-09/us-electric-car-sales-reach-key-milestone

Surely change has to start somewhere and people can control their own sphere? The more individuals do things based on climate impact the greater their knock off impact on people they know and the increase in support for governmental change which will lead to a lot more participation.

I agree that we need large structural changes and enforceable incentives and disincentives to make a difference in a significant way, but individual action is part of the process that gets you there. Along with, unfortunately, visible evidence of the negative impacts of climate change.

Buy in is a big thing in change and if we don’t work on this simultaneously with science based recommendations then it may take that much longer to implement and enforce the unpalatable changes that impact lifestyle and economies.