Are we building too many condos in Langford?

The median condo went for $540,500 in January, which is down from a very short-lived peak of around $600k in the spring of 2022. Outside of that market mania, prices haven’t really moved since late 2021. But if you look at the number of cranes in the city, it’s clear that there’s a ton of new housing coming, with units under construction at an all time high.

From a total housing perspective, that’s a good thing, but for anyone that remembers the Bear Mountain situation, a lot of supply in the face of limited demand can tank some segments of the condo market even during a time when overall prices are pretty stable. We also know that the last time when prices were relatively flat, prices in the core held up better than in the westshore, likely because buyers in the bedroom communities are younger and more dependent on credit. With a spike in interest rates cratering affordability, it’s a key factor in the westshore market being weaker today. So is there a risk of over-supply, especially in Langford?

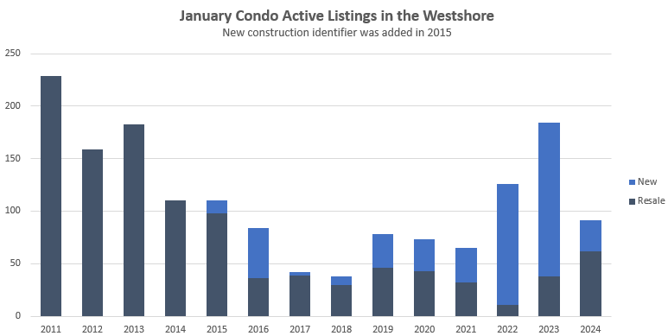

First, let’s take a look at current condo listings on the westshore, which surprisingly dropped substantially year over year. Resale inventory is actually up, but new construction condo listings dropped drastically compared to a year ago. It’s no secret that new construction sales have been struggling, so those are more likely to have been pulled from the system rather than being sold. New inventory on MLS is extremely volatile since developers use it as a marketing tool and may choose to list nothing there, just a couple units, or nearly every unit they have. Generally I exclude new inventory from analysis for that reason, but for the time being we’re not at concerning levels of listings.

Some developers are hanging on to units they can’t sell and renting them out while they wait for better market conditions. That removes them from the market temporarily and reduces downward price pressure, but it also creates a buffer of potential resale inventory that – when trickled back onto the market – can keep the market stagnant for a longer period.

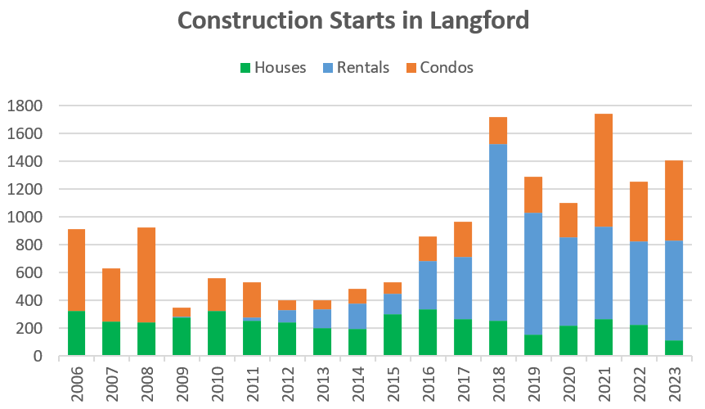

Meanwhile, on the new construction side, there’s a lot of supply being built, but much of that is destined for the rental market. There were actually fewer condos started in 2023 in Langford than there were in 2008 while the remainder were all rentals.

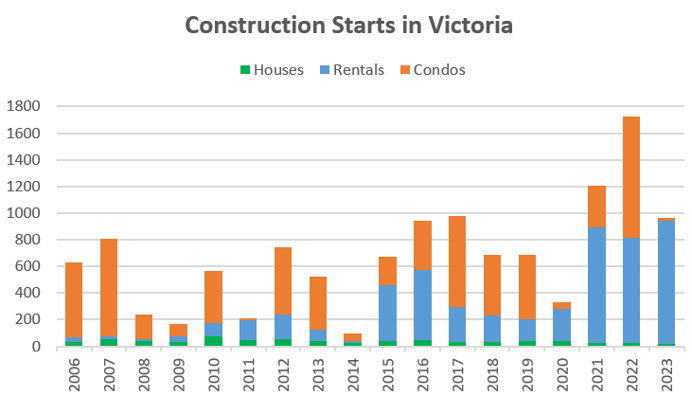

Still, there are a fair number of condos being built as well, so is there enough to cause a potential oversupply when mixed with a weak resale market? Perhaps, but we have to also look at what is happening in Victoria, which is the next most productive city for new housing construction. Condos in Victoria and condos further out will generally be substitutes in the minds of buyers, if imperfectly. The Victoria market too has shifted strongly towards building rentals, and in fact in 2023, 96% of all housing starts were for rental apartments. That’s primarily due to various rental incentives and an overly restrictive inclusionary zoning policy brought in by the previous council and only partially rectified by the current one. Perhaps that balance will change, but for now there is very little condo supply coming in Victoria.

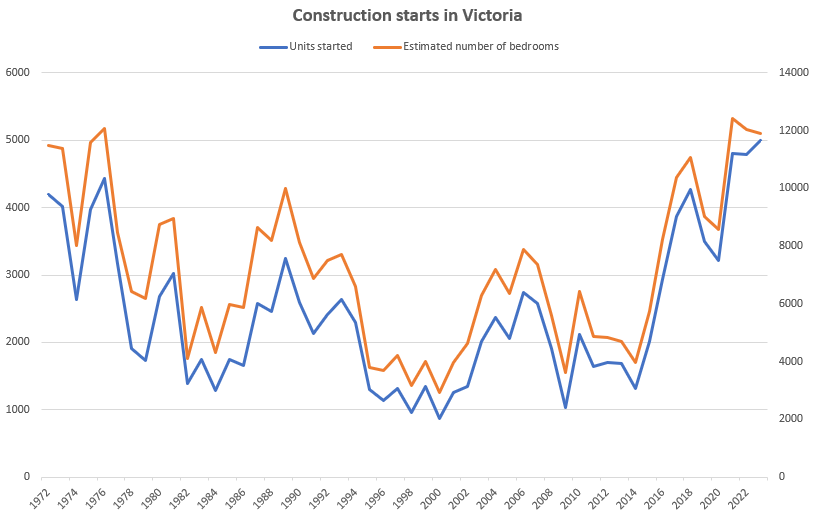

But isn’t that still a ton of housing under construction? Yes, though the units under construction chart is a little misleading because it’s taking longer and longer to get those buildings completed. When we look at actual units starting construction, activity is also at record highs, though due to a shift from detached to condos, the number of bedrooms built is around the same as in the 70s (when Victoria was half the size).

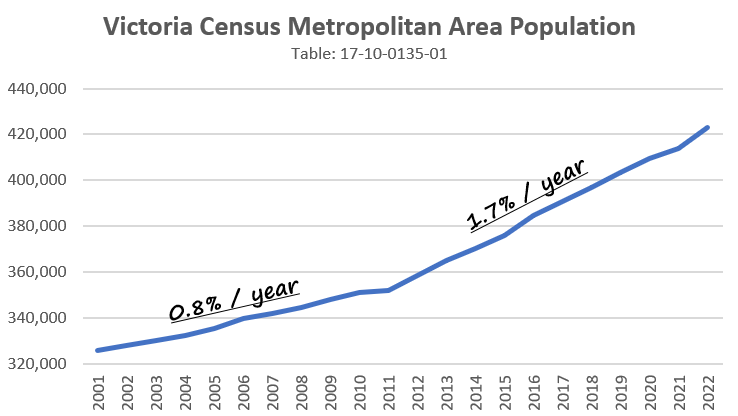

It’s also worth remembering that in 2008 at the top of the last market, Victoria’s population was growing at about 8 people per day. Today we’re averaging 18 new people in the region every day, a 125% increase in the growth rate. One might think that increase was coincident with the increase in immigration in 2015/16 or the increase in non-permanent residents in 2021/2022, but that’s not the case. 2011 seemed to be the inflection point between the two growth periods.

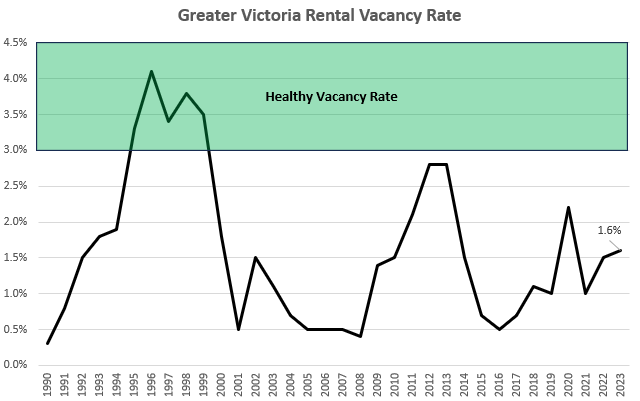

So generally I don’t think we are at risk of condo oversupply. Poor affordability and sufficient supply should keep a lid on prices, possibly for quite a long time, but I doubt we will have too many on our hands anytime soon. What I do think will happen is that the rental market will be in much better shape. The higher rate of rental construction has been helping there for the last few years, but high growth rate has absorbed the supply to date. That’s likely about to change with the renewed federal focus on controlling non-permanent resident growth, and continued high rates of construction. I expect in a couple years we may even hit a healthy rental market with stable rents for the first time since the late 90s.

Also the weekly numbers

| February 2024 |

Feb

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 54 | 154 | 274 | 460 | |

| New Listings | 160 | 400 | 678 | 811 | |

| Active Listings | 2129 | 2186 | 2258 | 1809 | |

| Sales to New Listings | 34% | 39% | 40% | 57% | |

| Sales YoY Change | — | -9% | -2% | -36% | |

| New Lists YoY Change | — | +14% | +26% | -13% | |

| Inventory YoY Change | +22% | 22% | +25% | +113% | |

| Months of Inventory | |||||

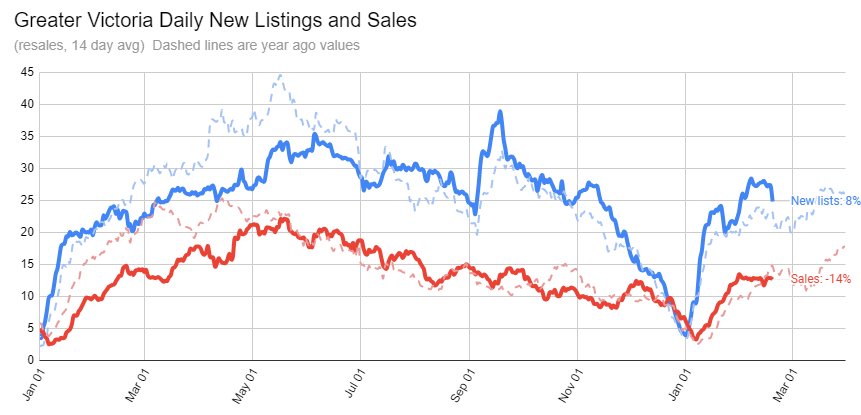

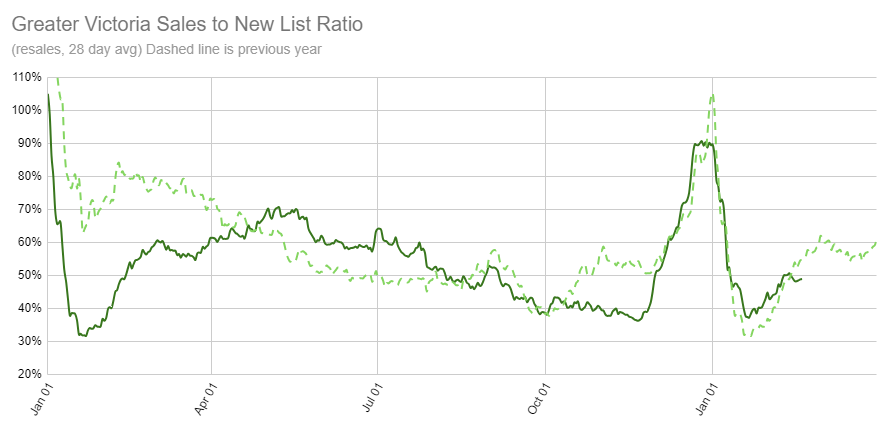

Sales have stalled out for the time being, failing to increase as they usually do in February and roughly pacing last year’s low levels of activity. Meanwhile new lists are coming on at a healthy clip for this time of the year, which has driven inventory back up to +25% compared to a year ago. However even if we don’t outdo last February in sales, months of inventory will drop from about 6 to around 5 by the end of the month. A tightening towards a seller’s market is inevitable in the spring, even if it doesn’t get as active as a year ago.

For now, market conditions are a touch cooler than they were a year ago after running a bit hotter to start. We’ll probably swing back and forth a little throughout the year, but I don’t expect a lot to happen until rates come down, and perhaps not even then. The market expects that will happen by year end, but we’re going to need to see some more negative economic news before then, which of course counters some of the positive impact of dropping rates.

Remember that absent a major shock (1981 bubble, 2008 financial crisis, 2022 rate shock), Victoria real estate tends to correct by being boring, and that could go on for years. I suspect we may be only in the first innings here.

New post: https://househuntvictoria.ca/2024/02/26/property-tax-breaks-and-new-inventory-arrives

Governments are petrified of cryptocurrencies.

Removing land mines is good, actually

No Joke, Ottawa is giving Ukraine 4 million dollars to have a gender inclusive program of land mine removal.

Made two offers and had two others prepped that we didn’t proceed with when we got the number of other offers on the table. The two offers submitted came in second, so, horseshoes and hand grenades there… I would say they were value offers and not necessarily low balls because they would have taken it, if not for the one better offer on each of those attempts.

SFD in the core-ish areas (with some restrictions), also keeping an eye on value and quality a bit beyond those areas if a value option really pops where I just can’t say no. Mostly, it seems that there are still a few buyers that share the same targets on the value and location view with me. I will keep neighbourhoods, price and more granular considerations to myself. I will say those are on a sliding scale on how I view the value in a particular property.

Both my kids are right Into bitcoin, for any commerce they use these things…

Mycelium Bitcoin Wallet.

https://wallet.mycelium.com/

https://www.cnet.com/personal-finance/investing/crypto/the-best-bitcoin-and-crypto-wallets/

It’s strictly bitcoin now, get with the times.

Frank goes all cash, no need for banks.

And the bank Is going to accept your bully offer?

Yes, some of these agents have clients that discussed their plans of when to list. You got people on HHV seeking advice on when and if to list their house for sale so I think it’s completely normal that agents get into those conversations with clients.

Then you are making the assumption that these agents’ clients get in touch with them to let them know that they will try to time the spring market. Doesn’t work like that.

Sounds like it’s time to make another bully offer 😉

Has properly priced homes always been snapped up within days under multiple offers? When it’s slow even those priced properly would take 2 weeks to sell. Like Marko said previously, some stuff that has been sitting for months are now getting sold at around asking without price reductions.

Yes, the assumption here is that a sample of ~30 agents with various client groups would reasonably represent the population as a whole.

As it stands where do you approximate we peak at for 2024? I guessed 3,100 @ peak two months ago but wasn’t so sure two weeks ago but now it looks like 3,100 +/- is possibility.

My extended family deals with land acquisition, rentals, sales. Some of these properties are “end of life” It costs $100k to remove the asbestos, demo, hauling, grading…To bring an average lot back to saleable condition.

When did improperly priced homes ever get snapped up?

As an insider myself (I had 77 MLS transactions myself last year which is more than 1% of total transactions in the VREB) there is no aggregate of insider contacts that would have information available at hand to draw such a conclusion, reliably. A guess at best.

If trades are slow prices sure aren’t coming down. Just reviewing strata docs for clients on a condo purchase and the strata levied a special assessment last year for a new roof based on early 2023 quotes, but the new roof was delayed and early 2024 quotes are now higher so they need to do a second special assessment to raise the funds.

A couple of builder/developer friends also sending me quotes on their projects and I am not seeing any downward pressure. Well over 200k for electrical on a 10 townhome development. Should be 150k tops.

Friends that work for large construction companies have noted layoffs but the laid off people would have never ever been employed under any remotely normal labour market conditions in the first place.

Its not just construction. Hospitality, retail, service work, consulting, sales. If you are an over leveraged Individual, may god be with you.

If the trades are slow, so is housing construction, creating a greater shortage. Not good for affordability.

Thank you very much 😉

https://househuntvictoria.ca/2024/02/03/january-teetering/#comment-111498

Depends on the property.

Where are you hunting?

How many offers are you making? Are you trying to lowball price, or just running into bad luck where you came close and almost got it. SFH are still selling a little under assessment, so if you’re offering around there you should have success soon.

If you want to know If construction Is slowing down, ask any excavation/ trucking contractor. They are the first In line.

Yes, BC construction jobs down 10% in 2023.

StatsCan reports….

——BC construction 2023 employment has been falling steadily. Jan 2024 YOY down from 253k to 226k . That includes trades and general construction workers.

—— Bright spots in rising BC employment are rising employment numbers for (university educated) professional/science/tech workers. Up 9% (23k) YOY from 266k to 289k working in BC.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410035501&pickMembers%5B0%5D=1.11&pickMembers%5B1%5D=3.1&pickMembers%5B2%5D=4.1&cubeTimeFrame.startMonth=01&cubeTimeFrame.startYear=2023&cubeTimeFrame.endMonth=01&cubeTimeFrame.endYear=2024&referencePeriods=20230101%2C20240101

Have heard from a number of trades that it’s definitely slower.

Not a scientific opinion, nor a meaningful sample, but I just spoke to my painter that said two of his friends in the trades (who are usually backed up) have phoned him to see if he knows of work. This does not mean that the trades overall are slowing down but some developers might be getting a bit slower.

Note, my painter is not an inside contact and in point of fact most summers he is painting outside.

Umm… “What sayst thou to me now? Speak once again”

Leo ” Beware the ides of March”

Umm…. “He is a dreamer. Let us leave him. Pass.”

LMAO, you need insider contacts to tell you that?

Looks like my insider contacts were right about sellers trying to time the spring market, should be a big March coming up. Properly priced nice homes are still being snapped up!

Swing-and-a-miss there Xa. I’ve never been a teacher, or worked anything else in education system. Haven’t even heard of that school.

I am expecting a slow week for new lists until the 1st of March and think we’ll get a nice surge to kick off the spring. Curious to see when that inventory comes on, if more buyers start to appear. I find with the offers I have been making lately, there are still a number of competitors, I imagine that’s mostly because of where I am hunting. However, I do think those like me that are in a strong position to buy, have jumped on the opportunities that came up the last few months. The question is how many of those buyers remain rolling into the spring with interest rates and costs remaining steady…. I guess we will start to see in the next couple of weeks.

Month to date activity

Sales: 386 (down 4% vs same time last year)

New lists: 929 (up 30%)

Inventory: 2344 (up 30%)

Inventory piling on these days. Wonder if borrower stress is finally starting to be reflected in seller behaviour

This started happening a year ago with white collar and IT jobs at my work. I think the only sector holding the fort down now is trades according to Marko. I know the larger national level GCs are chasing jobs they wouldn’t have otherwise chased a year ago but don’t have much visibility to the local market.

Have you had a look at the restaurants for sale In the Victoria core.

I’m 50, I know a recession.

A lot of those may be recent arrivals to Victoria, either from ROC or foreign countries.

Statcan reported a huge population increase in workforce age between December and January, up 0.4%

https://www.timescolonist.com/business/victoria-unemployment-rate-inched-up-last-month-but-still-well-below-national-rate-8284281

“ Canada’s population of people aged 15 and older grew 0.4 per cent between December and January”

Totoro: Monterey middle school in English was better … Perhaps Patrick, as a recently retired teacher from that school, has something to add about this topic.

We are In the first phase…

-separate the wheat from the chaff.

-distinguish valuable people or things from worthless ones.

I was talking to a friend who owns a large landscaping business in town, 2 years ago it was hard to fill positions. Now he’s received over 60 applications for 2 recent openings.

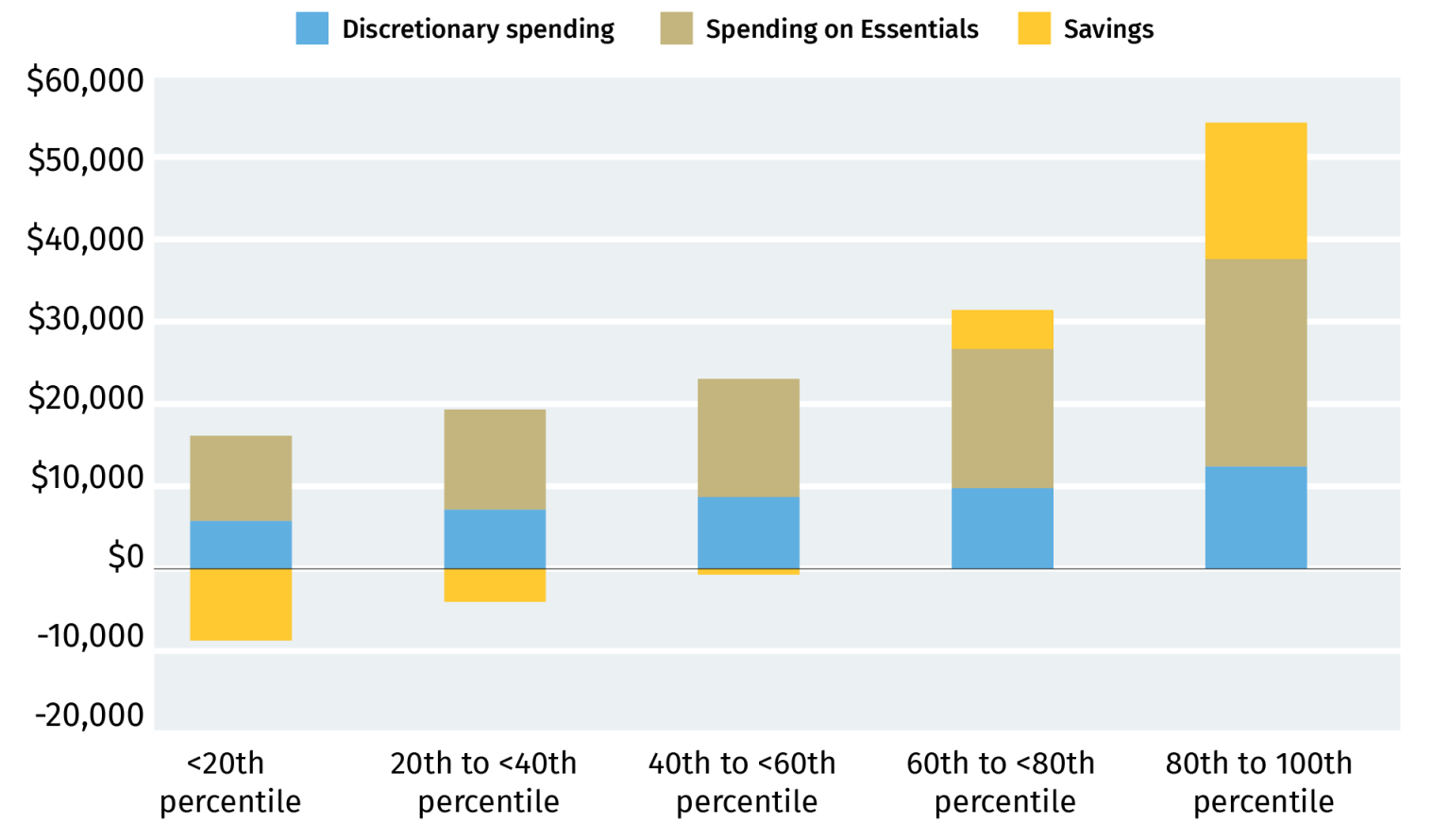

Another chart to show you how the savings rates have changed the over the last 2 years.

From RBC

While per capita household income rose by 2.8% from Q4 2022 to Q3 2023, debt payments (including interest on mortgage and consumer credit and obligated principal payments) rose by a much higher 6.4% in the same period.

Not a great sign given that we’re heading into an obvious recession.

It has always been hard, If It was easy everyone would be doing It.

You have to make big time sacrifices…Your family and the house Is your life…Nothing else.

I am an average guy, I’m not a hot shot Realtor or Developer or anything, I’m just a guy that worked 7 days a week just to make the wheels turn. I am well over the bell curve of the 25 year amortization period and I am still happily married with two happy teen aged boys.

This has been the case for most of the last 40 years. As you can see in a side-by-side comparison.

But they never come, that’s the thing.

The latest delinquency rate on mortgages remains near all time low, and are lowest in the regions with the highest house prices (Ontario and BC). In BC only 1 out of 750 mortgages is delinquent. That’s a story of incredibly good mortgage affordability for existing homeowners. . You’re saying problems will be coming “in the coming months”. That’s your prediction, but that isn’t describing the present or the past.

There’s a reason that delinquencies won’t be a problem. People’s incomes have risen on average 10%+ since they bought, giving them $10k+ more income. On top of that, rates are expected to fall this year. We’d need a recession with unemployment to see a spike in mortgage delinquencies and lower house prices.

In my experience Its best to have two kids with a four spread In between them, They become friends…Like super tight friends.

I agree with you that people shouldn’t have kids If they can’t afford them. The nest should be planned and built first.

As far as doctors, have you tried reaching out of the city? My family doctor Is In Metchosin…Out of his house.

That can be a big advantage.

Yes typo on my part, meant to say Nov 2021

Ah, yeah, that’s not true.

From my own experience, condo-living is fine for the first few years after you’ve had a kid. When the second kid comes along, it starts to feel a bit more cramped, but most siblings will share a bedroom for a few years.

It’s when they hit the ‘floor is lava’ phase that the downstairs neighbours start to get annoyed, and tensions in general start to rise.

I live in a 2 bedder with my wife and 2 elementary-age kids, and whilst it’s not ideal, we have limited options. There are plenty of other families in our building, and lots of families in my kids’ classes living in similar situations, so it’s not all that uncommon these days.

But if I have failed to convince you, and you’re still of the opinion that you can’t have kids without having a house first, why not consider not having kids? Especially if any 2 of these also apply to you:

* you don’t have 1 very high (>200k) very stable income in your household

* you don’t have a family doctor

* you don’t have family in town who will gladly do school pick-up and/or drop-off most days of the week, and/or look after your kids when they’re sick and have to stay home from school

We did Willows to Lansdowne French Immersion. Didn’t love Lansdowne — the experience at Monterey middle school in English was better imo.

This is another option to rapidly improve French: https://englishfrench.ca/ I did it twice. My kids did it. Fun and subsidized – tuition, lodging and meals are included.

Can’t or do not want to? There are no more age restrictions (other than 55+) so market is wide open now for picking up older large condos in established neighborhoods close to parks, etc.

Maybe not a quantifiable advantage (in my case it is as I generate an extra 5 +/- transactions per year because clients prefer that I can navigate them through a sale/purchase in their native language) but much like travelling, playing an instrument, practicing and playing spots (even if not professional), etc., overall I think it can give people an advantage in life. Especially, if you have a non-sense BS career like I do. People prefer to do business with people they like/can relate to and if you are well rounded you can relate to more people. In fact, my interest in basketball lead to a professional connection with an individual that has been more valuable than 3 PHDs.

I went down this path and graduated from Vic High back in 2004. Two of my closest friends from Vic High that I randomly become friends with for non-socioeconomic reasons are far more successful than I am. One owns a 400+ employee company. I really enjoyed my time at Vic High. There were kids scoring 99 or 100% on the standardized provincial exams. I clearly remember one kid received 100% on the math 12 provincial and 98% on the English 12 provincial. There were also kids smoking outside all day skipping class, but the education provided if you wanted it was just fine imo.

I imagine with Vic High catching James Bay, Rockland, Fairfield and real estate prices in those areas over the last 20 years the socioeconomic status is different?

I think mortgages rates at this time in 2019 were over 3% and now that we mortgages trending down a tad a lot of people will be re-financing at less than a 2% increase (aka stress test). Later in the year if rates start dropping it is going to be an even smaller spread.

Price peak was not November 2022. It occurred between Dec 2021 and Feb 2022.

And prices were inflated for most of 2021, it’s just rates were still low.

A majority of mortgages in the latter half of 2021 were variable so they have all rolled over. The switch from majority fixed to variable was in mid-2021.

Most analysts agree that a majority of Canadian homeowners will be on higher rates this year, we’re already pretty close to that threshold now.

Further, homebuyer stats are skewed due to difference house types bought at different ages. People in their thirties mostly own too-small condos, not townhomes or houses. That increases the “homeownership rate” to levels comparable to older generations, but it’s fundamentally different because people in small condos can’t have kids without moving, which requires them to upsize to a larger property which is now marked up at an inflated price.

Just see the national bank link to posted to compare apartment versus non apartment homeownership rates. In Victoria for all ages, homeownership of non-condos is <50%, and I suspect that’s driven by younger folks mostly buying condos.

Hard to believe but Victoria is now equally unaffordable for local incomes as Toronto.

Just stop to think about that for a second.

Data is here: https://www.nbc.ca/content/dam/bnc/taux-analyses/analyse-eco/logement/housing-affordability.pdf

Not sure about that, you can easily count how many home sales there were between November 2022 and now. So only a small

subset of those could arguably be underwater without financial resources to withstand the rate increase.

I Introduced mine to both guitar and piano…They love It, and they are very good at It.

We are a multi-lingual household. Maybe a nice to have once in a while when we travel, but generally not an advantage here. Having English as your first language is a huge advantage.

French Immersion is good for some kids, and a possible future plus, but nothing beats a stable home with invested parent(s) overall. Kids with this tend to have an easier go based on my observations over the years. Counselling and therapy for parents seems like a more important thing than French Immersion.

Yeah, I admit, that was a poor effort by me. I retract that statement.

But I still think the smugness around French immersion is unjustified.

A majority of people in their 30s today bought at inflated prices, and in the coming months, a majority of all mortgage holders will have had their rates rise to 5% or higher.

Owning a home, bought at an inflated price, and paying off a mortgage at untenable rates just to avoid paying super high rents is not “overcoming a divide”. It’s being stuck between a rock and a hard place.

Seriously? That’s the only advantage you can come up with? How hard did you try?

If I had kids I would seriously look at home schooling, and enter them in community sports programs. I would also insist on learning a musical instrument or two. Most of their work would involve a pencil and lots of paper. I would limit computer time to one hour a day, primarily for research only.

I grew up in a small town with only one high school and the best lesson I learned is that it’s not about the school, it’s about you. Kids from my high school went on to every conceivable life path from prison to international success.

Now having said that I do think I’d avoid the worst areas in any large city, too many disadvantaged kids create a burden. But beyond that I don’t think it matters.

As a kid…It does become a bit distracting from the early spring Into the late summer months.

UBC = GBI moving forward.

https://www.wbhrb.in/canada-new-guaranteed-basic-income/

Small sample size but 3 of the 4 folks I knew who went to Shawnigan failed out in 1st year UBC.

…And that Is the biggest quality of anything that matters.

I guess the question could be the quality of life of being mortgage free vs. having a more costly longer mortgage? Would moving up into another neighbourhood require more time at work and more stress that could impact on the amount of time and the quality of that time with the children? In the end, housing does come down to lifestyle choice. Where and what circumstances would you and your family be happier? If it’s a push on all the factors, it’s simply where you might prefer or want to be.

Understood.

Leave the culture war somewhere else please.

Well, having french for an Anglo, only really helps if you’re looking for a government job in Ottawa, not really a BC thing. However, most of the real high end universities south of the border do require a second language. As for Steve Jobs, l believe he spoke Armenian and Arabic in addition to English; and Elon Musk apparently speaks Afrikaans, French, Mandarin and Spanish in addition to English. Likely not a determinant of success, but probably falls into that doesn’t hurt category.

Move to Shawnigan Lake. You would be mortgage free, with the best school ever…

https://shawnigan.myschoolapp.com/page/admissions/tuition–payments?siteId=1021&ssl=1

What are your thoughts on the LGBTQIA2S+ Immersion schools?

“ A lot of it likely comes down to how much time, effort and caring a parent has to put into their children. So, looking at it on scale, particular catchments will have more families with greater resources, that allows them to be more involved likely leading more overall better outcomes for the entire cohort where their child is emersed.”

Yep. I guess I’ve basically just been wondering if it’s worth it to move up to a catchment where my kids will be surrounded by more kids who do well academically. But I agree that there are good and bad seeds in all walks of life. No guarantees. I guess we just have to decide if we think we’d ultimately be happier being mortgage-free in our current neighbourhood in 10 years or if we want to take on many more years of mortgage to live in a fancier neighbourhood.

French Immersion is a lottery but it’s a lottery that you have to opt into. And to want to bother to opt into it you also have to want to bother to deal with helping your kid learn to read and write in two languages. So it’s not even necessarily about wanting your kid to learn French specifically but about wanting your kid to be in a class with other kids whose parents have chosen to take on something more than the minimum.

GNS rules with an Iron fist. What you might think Is reasonable behaviour, they would consider grounds for expulsion.

There Is no refund.

I thought the stats were pretty clear on private v public schools: kids from the same socioeconomic background perform similarly at both. Kids at private schools tend to perform better, on average, because, on average, they enjoy better socioeconomic environments at home.

And WTF is up with French immersion snobbery in this city? It’s a friggin’ lottery FFS. You’re lucky if your kid gets in, but it’s not the end of the world if they don’t. Does Elon Musk speak French? Jeff Bezos? Steve Jobs?

Pretty much the only advantage I can see from learning French is that you’re better placed to get a government job. But if that’s your goal for your kid — that they end up working for the government — isn’t that just a bit sad?

The equivalent catchment route if lived in vicinity of GNS would take the path of Margaret Jenkins-Monterey-Oak Bay High (Lansdowne for emersion middle). So, yes, not likely a big difference. The difference between catchments apparently in SD61 is the involvement of the PAC at the school. Also, some have said, the teachers being able to have their own kids attend the school they work in if they live outside the catchment, has brought in more vested educators to some schools in certain areas. I spoke with a few teachers that say Lansdowne is a “tale of two worlds” split between the emersion campus and the English campus, with the English campus being the noticable underdog across many factors. I don’t know much about Quadra elementary, but I heard some narratives about Vic High as pretty easy to find trouble. However, at that age, you can find trouble at any school if you really want. A lot of it likely comes down to how much time, effort and caring a parent has to put into their children. So, looking at it on scale, particular catchments will have more families with greater resources, that allows them to be more involved likely leading more overall better outcomes for the entire cohort where their child is emersed. There are good and bad seeds across all socioeconomic classes, but it’s hard to argue with the probability of outcomes for those with a scale of advantage. That said, I have had teachers tell that the “french emersion lotto” basically provides a kid with a “private school within public school” advantage, no matter the catchment. However, that just might be that parents who are trying to get their kids to be multi-lingual, likely have the time to invest more focus on their children’s education.

I know someone who teaches at GNS who thinks that it’s only better than public schools in terms of extracurriculars. They tell me that anyone who has a kid with any kind of issues who can afford the tuition gets their kid out of public school and into GNS or SMU, so it actually ends up being the case that teachers and EAs there are dealing with quite a few behavioural and learning issues. Not sure how much stock to put in that but it is coming from an insider.

The catchment path that I mentioned (Quadra –> Lansdowne –> Vic High) is for French Immersion. Any thoughts on those schools?

Looks like Oxford sold for 300K less then asking last year. If your looking for sold prices of properties try house sigma.

I wonder how much profit was made by the builder given lot for bought 2 years ago for 1.3MM and after realtor fees etc. ?

https://housesigma.com/bc/victoria-real-estate/1141-oxford-st/home/2Z5BX32OQoQYDar0?id_listing=9w8o3m4Q5wV7GKjm

About half (52%) of millennials in their thirties in Canada own homes. The divide is between those millennials and the other half of them that don’t. You should talk to the millennials that own homes and ask them how they overcame the “large generational divide” you are referring to.

1141 Oxford 2.6

Thanks Leo I don’t receive duplexes on my pcs.

Can someone tell me what the new house on Oxford (near Cook) just went for? Sorry I don’t have the address but it was on for quite a while. TIA.

129 Ontario- How much work does that beast need? Built in 1911.

Marko- If you rented your place for the summer, where did you stay? Teslas don’t look that comfortable.

Full ask 1.499

Anyone got the sold price on 129 Ontario St? Please and thank you.

Its not just you bro…Gen X Is just as pissed.

My vote as well as my Wife’s vote are going to PP.

The Boomers took It all, and they will keep on taking until this country Is bk.

1.94M

I’ve been thinking about this statement. But you’ve got it wrong.

No one’s being played by the conservatives.

Liberals under Trudeau have actively pushed policies which have screwed over a generation, and many of us are so fed up that we’re willing to sacrifice some of the things we care about a lot to vote him out.

The fact that some people don’t understand that shows me just how large the generational divide in this country is.

Long time reader could someone tell me what 2506 wotton cresent sold for?

Child Indoctrination Is not a bad thing. Just let “they or them” follow the narrative as they see fit. Its for the greater good.

School catchment does matter. If the catchment is bad enough, I am looking for a discount on the house enough to offset a bit of the private school costs. However, I am probably footing the bill for private middle school during those really formative years and keeping my kids away from the BCTF nutters during that time period.

Government: we’re raising the exemption thresholds to save first time buyers some taxes

Marko: 835k instead of $850k? This PDF at the bottom of the site isn’t updated? That’s it I’m leaving the country!

-> GNS…

https://www.mygns.ca/

“If the catchment school really sucks but you like everything else about where you are”

Quadra –> Lansdowne –> Vic High. Not the worst but not Willows –> Lansdowne –> Oak Bay High.

The only reason I come here Is to read what you have to say.

If the catchment school really sucks but you like everything else about where you are, private school is another option. In my experience some kids thrive in that environment and others don’t. Only you know your child well enough to make the call.

“Smartest route one can take, no one takes it as too inconvenient with kids/pets. In a slow market with more inventory there is also a reasonable probability you don’t have to rent if you go this route (you find something to buy after sale where the dates line up).”

Moving with small kids seems painful, I’m no going to lie.

Someone in my neighbourhood just sold a comparable house to mine in something like 10 days for $300,000ish over assessment, which got me feeling optimistic about a move up. But selling/buying sounds like a giant ass pain, as does more debt. (The scenario that Marko outlines of still carrying a mortgage and then taking on more mortgage at a higher rate is my scenario. We can afford it but it doesn’t sound fun.) It’s almost enough to make me not bother, honestly. Maybe schools aren’t actually that big a deal…

Usually if you get caught in this situation you need a place for months, not weeks, and a market for such will continue to exist.

I rented my personal place to a couple waiting to complete/possession on a house in North Saanich this summer.

I agree that’s what the probably did, but they don’t have basic common sense and logic to realize that the median price in the sales distribution will be outdated within a few months and the PTT exemption is updated every 5+ years.

They can’t even update the site properly -> https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/exemptions/first-time-home-buyers

Click on the “Guide to the First Time Home Buyers’ Program (PDF, 215KB)” at bottom, lol. Beyond sad how useless government is becoming. Just thankful I have dual citizenship as I don’t see a bright long term future in Canada. Standard of living will just continue to sink.

Yeah what is up with those numbers lol. I’m going to guess they looked at a sales distribution and said let’s set it to the median price or something

It all sounds so easy, just move into a rental for a short period of time. How does that happen now that airbnbs are about to be banned? What landlord wants a temporary tenant? I once had someone rent my place while they were having a house built in Uplands. My property manager said they would be there for 6 months, I knew better, they were there for 2 years.

Smartest route one can take, no one takes it as too inconvenient with kids/pets. In a slow market with more inventory there is also a reasonable probability you don’t have to rent if you go this route (you find something to buy after sale where the dates line up).

I was being sarcastic. One could sell first, move into a rental and then buy.

This development has finally hit the market -> https://www.realtor.ca/real-estate/26545407/12-909-redfern-st-victoria-fairfield-east

Interesting “lower level” townhome concept -> https://aryze.ca/projects/wisteriarow

I was a little confused until I saw the window well label on the floorplans.

Maybe when interest rates were low but most people upgrading still have a mortgage on the current home, so you are potentially looking at carrying the new more expensive home at a high interest rate plus whatever is left over on your existing one. It could easily be well over 10k/month in additional carrying costs on top of current.

Then if you get an offer on your current place and it collapses for whatever reason the stress builds extremely quickly. If your current property is paid for and you are paying for the purchase in cash without having to sell, I agree then offer away but not many people are in such a situation, otherwise talk to a bank/mortgage broker. I had clients forgo an offer on a million dollar property even thought they have a property worth north of $1.5 mill free and clear, it was simply going to be too much interest cost for their liking.

My best strategy is to make sure you can close on both and then offer away 😉

On a separate note, it is quite entertaining to see muted people continue to try and post but get zero interaction. That is a real LMAO

As far as a bridge, depends on the scenario. If you are bridging and you do not have an unconditional contract in place for the sale of your current place then that is expensive and very stressful. If you are bridging and you do have an unconditional contract in place for the sale of your current place then that is just expensive.

Best strategy depends on the individual and how one values monetary gain vs inconvience vs stress. In general three ways to go about it.

i. Buy first with a long completion and then sell. Works well in 2016 or 2021 when homes are listed on a Thursday and offers reviewed Monday or Tuesday evening. However, would not recommend in the current market as it is a good way to die from stress, especially if you can’t qualify for a bridge. Even if you can it is ultra stressful.

ii. Sell first with a long completion and then buy. From a monetary perspective this makes the most sense, imo. You aren’t under pressure to sell your home whatsoever. When you do sell you know exactly how much you sold for and you can make clean offers on whatever you want to purchase subsequently; therefore, increases the chances of securing a desirable property and or getting a better purchase price on it. The problem with this approach, especially with kids, is the potential of inconvenience if you cannot secure a subsequent purchase. At that point you are looking at renting while you continue to search and that means two moves. That being said, in a slow market there is more inventory typically so it is easier to secure something in relation to 2016/2021 after you’ve sold your place.

iii. Subject to sale offers, this seems to what the majority of people want to do but several problems with this. If a desirable property in a good neighbourhood comes up that is reasonably priced good luck with a subject to sale offer, the seller will have non-subject to sale offers. Even if you find a property that has been sitting for some time where the seller is willing to accept a subject to offer they can bump you with 24 to 72 hrs’ notice if they receive another offer. If you don’t get bumped while you are trying to sell yours well guess what, the market doesn’t really think the property is worth what you’ve agreed upon which makes sense as sellers are far less motivated to negotiate on the price when they are dealing with a subject to offer. Then, if you have a secured subject to sale on the purchase you are under more pressure to sell your home and typically will be more motivated (take less) versus if you weren’t underpressure.

Then you have a bunch of other methods which can involve a degree of deception and not acting in good faith which I am not a fan of. For example, you can make an offer subject to financing/inspection/etc., for 10 business days and the immediately put your home on the market and aim to go unconditional in less than 10 business days. In this scenario you are making an offer that is not subject to sale, but it really is. Also, doesn’t work well in a slow market.

Decreases the transaction costs for those looking to downsize down to a townhome or a large condo. On a $1,000,000 brand new condo that is a savings of $18,000. It may help move a few of the brand new unsold 2 bed 2 bath 1,000 sq/ft+ units at Dockside. Also, puts the brand new re-sale units at a near 2% disadvantage.

Friendly tip, a number of legal avenues to increase $1,100,000 full exemption and up to $1,150,000 partial exemption. One of them is appliances, for example. 99% of developments are sold with appliances INCLUDED (appliances are chattels, PTT should not apply). If the builder won’t go below $1,110,000+GST, for example, have your real estate agent re-write the contract as $1,100,000+GST and the buyer will credit the developer $10,000 (or value of appliances). This way you get the deal done (developer is receiving $1,110,000) and the buyer is savings thousands of dollars on the PPT. The appliance exclusion you can also do for the FTHB exemption, but I believe then you have to pay 5% GST on the value of the used appliances (at least that is what I was told by someone at the minisitry when I looked into making sure all of this stuff I was doing was legal). Either way 5% GST on value of the appliances is very small compared to savings in PTT (when in exemption/partial exemption cutoffs).

A number of small market nuances I can think of here, but nothing major. For example, those looking to sell their 400-500k and upgrade to a 800ish townhome are now facing more competition and it becomes as little more difficult to execute as it will drive prices up a bit.

Re FTHB exemption, what idiot in the government came up with $835,000 full exemption and up to $860,000 partial? Just set it to 800/850 or 850/900.

Are millennials ready to rule Canada? The transition will be anything but smooth

https://www.thestar.com/opinion/star-columnists/are-millennials-ready-to-rule-canada-the-transition-will-be-anything-but-smooth/article_d7f96472-d1ae-11ee-8bcd-afda9486f760.html

Pretty interesting how they have upped the new home PTT exemption. With other policies to get a ton more new homes built it makes sense to also make them easier to buy.

Same with the FTHB exemption, while it’s a demand subsidy and basically just drives up prices a bit, it makes more sense to target that subsidy at first time buyers.

Oh goody, they are reopening Tiny Town containers. North Park should be thrilled to once again help to re-elect this council. “This time will be different”.

I wonder how much energy is consumed producing the materials used to run a nuclear plant. Then there is the problem of disposing of the spent radioactive rods. In case you’re not aware, nuclear plants are essentially a sophisticated steam plant. Ever wonder what happens to the contaminated water pumped through them. Yummy. Talk to anyone from Ontario about their electricity bills.

By the way, Germany has completely shut down all of their nuclear plants.

“the strategy you go with is likely more important (a factor you can actually control) like do you make offers subject to sale of your property or you sell with a long completion and then purchase, etc.”

Thanks for your reply, Marko. What do you generally deem to be the best strategy for selling a current house and buying a new one? Is bridge financing unwise?

(I bought in 2016 when all offers had to be submitted at X time on Y day without subjects. I’ll never do that again. And I can’t imagine that any market like that is one in which it would be wise to try to move up.)

I wish I didn’t even have a cell phone, I hate them, It Is nothing more than a leash…It nags me all the time. Its usually never anything good. Someone always wants something out of me from somewhere that I could really give a shit about.

Each and every day that passes, looking around at this upside down world that we all as a whole have created. I’m thinking about going back to reading books, pulling out the old battery powered ham radio, throwing a couple logs In the wood stove, lighting a few candles…tobacco pipe In one hand, with the finest bourbon In the other.

“People use ham radio to talk across town, around the world, or even into space, all without the Internet or cell phones”.

http://www.arrl.org/what-is-ham-radio

I have the complete hard copy of the 2010 Encyclopedia Britannica Print Set, I also have the Merriam-Webster’s Collegiate Dictionary.

https://canadiangeographic.ca/articles/ham-radio-and-the-world-of-amateur-radio-operators/

Cautionary tale…Computers were the start of our demise.

☮

Yes, and so apparently would you.

https://www.ertyu.org/steven_nikkel/cancellsites.html

Just shut down the smart meters remotely for two months mid winter due to lack of supply…Then It will go over really well.

Don’t worry, southern BC got more radioactive exposure than anyone living near the nuclear plant in Canada because of the tests they use to run at Hanford. As well, I believe some nuclear ramjets were tested over BC a few times.

I’m sure a nuclear plant would go over really well on Paradise Island. For fun, put it on the Pacific Ocean coast.

“Would you buy a home within 10 miles of a nuclear plant? If not, how far would you want to be from the nearest one.”

Yes, literally anything is more likely to kill you than nuclear energy generation.

Would you buy a home within 10 miles of a cell tower? Or the much more powerful 5G towers?

Its not like Its anything new.

Hundreds of thousands, if not a million people live within 10 miles of Pickering, and many houses go for a million or more, so someone obviously does. It’s not my back yard though.

Thanks didn’t know about NB, Gentilly has been shut down for some years now, there is talk about restarting it but nothing definitive as far as I know, it’s not that far from here and it would be newsworthy if so. There is plenty in the news about a proposed waste dump up river.

Would you buy a home within 10 miles of a nuclear plant? If not, how far would you want to be from the nearest one.

…And there are 8 billion of us.

Coast to coast passenger/cargo /freight trains.

“Russia has claimed to have become the lead innovators in developing and completing nuclear powered trains.”

“Fitting a small reactor in a locomotive is technically feasible, as it has been done on submarines”.

http://large.stanford.edu/courses/2015/ph241/sanders1/

Point Lapreau is producing in New Brunswick and I think Quebec Hydro announced a plan to restart Gentilly.

On nuclear, it’s the safest reliable (not weather dependent) power source out there and it isn’t even close. 35 seasons of the Simpsons might have you believing otherwise but it’s true

https://ourworldindata.org/grapher/death-rates-from-energy-production-per-twh

https://en.wikipedia.org/wiki/List_of_nuclear_and_radiation_accidents_by_death_toll

Cumulative deaths since the advent of nuclear tech is literally in the hundreds.

On Nuclear waste, the other frequent Nuclear scare tactic,

https://whatisnuclear.com/calcs/how-much-waste.html#:~:text=To%20fit%20all%209.35%20billion,field%20in%20spent%20fuel%20pellets.

The entirety of human generated nuclear waste can fit on a football field about 10 feet high. Literally nothing.

Conversely about 1,000,000 people die every year at the hands of pollution caused COPD.

It might be taboo but it is the only realistic near term option for sufficient amounts of clean energy.

We don’t get a federal carbon tax rebate In BC. Its only eight Provinces. I have never received a carbon rebate.

And.

Now why Is that? Seriously…I want to know why that Is? They want net zero by 2050.

“It produces zero carbon emissions and doesn’t produce other noxious greenhouse gases through its operation. The lifecycle emissions of nuclear energy (emissions resulting from every stage of the production process) are also significantly lower than in fossil fuel-based generation”.

https://www.nationalgrid.com/stories/energy-explained/what-nuclear-energy-and-why-it-considered-clean-energy

Ironically most people are better off paying the federal carbon tax and receiving the rebate, but they don’t understand this. Getting rid of it will hurt the most those who are struggling to get by, who aren’t likely to be driving a $100K gas burning vehicle or living in a mega house.

Ontario, which is the only province currently using nuclear power, has announced a major expansion. Not claiming that’s the best option – the current government has a grudge against wind and solar – but it’s happening.

Not sure I’m seeing this. Strip the carbon tax off natural gas, and eliminate the subsidies for installing a heat pump, and natural gas heating probably wins out. EVs have disadvantages compared to gas-powered vehicles when it comes to driving long distances, which seems to bother North Americans. Sales are slowing in the US, even with the available subsidies. For bulk shipment of goods over long distances, it doesn’t really seem like there is an obvious successor to the diesel engine. Coal fired power is being replaced by natural gas; nuclear still seems to be taboo.

I probably don’t know enough about the subject, but it doesn’t feel like the pace of transition will be epic, or, for that matter, complete.

Anything that is not: “the low carbon option is the no brainer choice because it’s better” is not a durable solution.

People will accept carbon taxes and incentives when economic times are good (and they are both effective in driving the transition more quickly) but when things turn bad they don’t survive

Luckily for the planet, we are now at the time where the low carbon option is the obvious choice completely outside of any environmental benefits for many soon most use cases. The pace of the transition is going to be epic. We’ll probably still need to do some geoengineering though

Tend to agree but will never happen

Variable rates are > 6%, and that’s 70K of after tax dollars, so closer to 100K of income.

On immigration, new housing needs more labour than it currently has. More generally, the reason for Canada needing increased immigration from 10 years ago is our aging demographics where the fraction of people over age 65 is increasing and puts more strains on pensions, healthcare.

See, for example,

https://financialpost.com/news/economy/all-the-reasons-why-canada-needs-immigration-and-more-of-it

Last year, Canada admitted 470K permanent residents and 800K temporary ones. Our permanent numbers are not high for where we will need to be and the feds are targeting some necessary areas, like medical specialists and construction workers.

On the other hand, there are problems with both foreign students and temporary workers. Provinces should be setting the standards for foreign students and workers, but since they aren’t (e.g. Ontario has shady private colleges set up to make money off foreign students) the feds need to look at the specifics of colleges/employers of foreign students/workers (duplicating what provinces already do or should be doing) and make deep cuts to temporary visa approvals.

Try the math again?

If the B.C. government (or the federal government for that matter) had any sense or courage, they’d axe the PTT on all properties. Plus the vacancy / foreign buyer / spec taxes. Plus GST, HST, and income tax.

They could replace all of those with one tax: a broad-based unimproved land value tax.

Absolutely, giving someone sitting on an asset worth 100s of thousands 10k to add value to it, is nuts. It’s a vote buy, not an environmental policy. Electric vehicles are the same, giving someone thousands to buy a new car? Do you want heat pumps and electric vehicles to actually be cheaper? The way to do it would be to drop the incentives and subsidies. The irony is that it kind of creates a reverse Robinhood tax; taxing folks that are lower income and disproportionately dependent carbon intensive energy to heat where they live and drive older vehicles to get to work, just to hand it over to folks buying 80k cars and million dollar homes is hilarious. Guess what, those folks are buying those cars and updating their heating system anyways……

Great, another policy aimed at helping people who don’t live in Victoria or DINKs who just need a small condo.

No way of timing the market from a price perspective. We do see number of sales/listings increase until about June, then a slow down, then increase in a bit September/October so from a timing perspective of most options you may consider that. That being said, the strategy you go with is likely more important (a factor you can actually control) like do you make offers subject to sale of your property or you sell with a long completion and then purchase, etc.

Big picture if prices were to go up that 300-500k spread would get bigger most likely in conjunction with lower interest rates; however, better to have a smaller mortgage over the long run.

My buyers purchased 1063 Hyacinth back in 2015 for $543,000 and sold a few years later (they are not the current sellers). House back in 2015 was on the market for 6 months! Started at $579,000 and made its way down to $559,000 and then we were able to negotiate down to $543,000.

Or they already made an offer on another place.

I don’t FTB are their target audience. Move-up buyers only, please.

250k wouldn’t pass the stress test at that price, 20% down, 25y amortization, 7% interest rate, according to https://itools-ioutils.fcac-acfc.gc.ca/MQ-HQ/MQCalc-EAPHCalc-eng.aspx

Umm…really, it’s not like the property tax doesn’t get eventually paid, it’s just deferred until when people either want to sell or their estate does. I never get why people object to it.

Offers to have closing dates post April’s fools day now. Anyways, does it operate like old one, where once you over the exemption, you need to pay the full amount tax? If they want to make it an actual working benefit: for 1st time buyers, only the amount over the 835k should be calculated for the tax. Making the first 835k exempt. To keep consistency, I am against demand side incentives. They add an artificiality to the market. These types of incentives should be done away with along with property tax deferrals on the other end of life. Let the actual cost of housing be reflected.

How would they know that part?

10k on 835k. Is supposed to be a big deal?

So your thinking Is because grandma Is deferring her property taxes, which allows her to stay In the home, Is artificially adding to the market value, since she Is still able to afford to live In the home, therefore reducing available housing stock?

Its 10k on 835k. My mother inlaw received a 10k rebate grant for having a heatpump Installed In her house, Electric vehicles…Are you also against those demand side Incentives?

What does 835k buy one in Vancouver? One bedroom or a two bedroom?

Shocking how many outlets picked up this complete non-story as the headline versus the actual story the increase in PTT exemption.

Flipping tax is just politics, but pretty interesting that if you add a housing unit, you are exempt.

First time homebuyer exemption raised to $835,000 as of April 1, 2024 https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/exemptions/first-time-home-buyers#qualify

First time buyers PTT exemption up to 835k from 500k.

Surprised to see some asking price adjustments on some SFD I was watching this week. Thought they would hold on to their asks at least into March.

…While eating an apple.

But I want my ponies now.

Stew has reduced annual property taxes by 10% more than once In his thirty years at the helm.

When he gets back In power we’ll probably have both the lions and the caps as home teams at starlight stadium.

He has visions. He knows how to generate money. He Is a businessman…Look at the private empire he built.

Look at the city of Langford that he built.

He doesn’t need any money, that’s not what he was In It for.

He has so many millions of dollars and he still gets out there In the community where he lives and talks to everyone…And he’s not even the mayor yet.

Stew doesn’t need a motorcade to get back and forth to work everyday like the current mayor does. Everyone just loves Stew. He doesn’t even have to try.

Canadians seem to have a “time’s up” moment for all long serving PM’s, we saw it for Harper, Chrétien, Mulroney, PET etc.

PP likely needs to just talk about “time for a change” and the specifics won’t matter too much.

Barrister- There are multiple ways to immigrate to Canada. I don’t know all of them, but family sponsorship, skilled worker, provincial nominee, refugee, it goes on and on. As long as the current world turmoil continues, I doubt there will ever be a noticeable reduction. If it did happen, some parts of the country would definitely be more affected than other regions. The Island would not feel much of an impact and prices would remain high. The only scenario that would reduce prices significantly would be if Canadians left the country in droves. But where would they go? Most countries are cutting back on immigration.

Just for the sake of analysis, what is the impact if immigration is cut back to about 200k a year and student permits are seriously reduced to be a maximum of five per cent of students at any one institution.

If this was done over a five period what impact would it have on housing?

I am not inviting people to tell me why this will not happen. Lets at least look at what would happen to the housing market if it does.

Question from a long-time lurker:

I’ve owned a home in the core that I’m happy with for 8 years but would like to move to a nicer neighbourhood (partly for kid/ school catchment reasons). I don’t necessarily need more house but I would like generally to live somewhere nicer. So far as I can tell, an upgrade to Oak Bay, say, would cost me $300,000ish. For a bigger house it would be $500,000ish. Any opinions as to when it makes sense to try to pull off an upgrade? There’s no huge rush. I have a ridiculously low mortgage rate until 2026 but then I’ll obviously be at the mercy of considerably higher rates.

Real estate investors won’t be disappointed.

The surge in population over the last couple of years was mostly due to international students and TFWs. The Liberals have already put a cap on new student visas and we may see action from the Liberals, or Conservatives, on TFW numbers. What I will guarantee you will hear is a lot of talk from the Conservatives about getting tough on unsponsored refugee claimants and those with expired visas, indeed we already have. But as for permanent residents, as I said elections are won or lost in the immigrant ridings:

Seems to me somebody is going to be disappointed by a Conservative government on this issue. We’ll find out who.

I think that is quite doable for couple earning 250k a year?

“1063 hyacinth definitely looks like some interest rate pressure –”

imagine having an $880k mortgage at 5.86% over 25 years at $5,780/month or $70k/year without even an in law suite or basement suite to rent. You’re sharing the laundry and kitchen w a room mate while dumping $300k into the downpayment. No thanks man.

Don’t despair Max. They’ll probably shave a few decimal points off the proposed increase before finalizing it. Then next year the increase will only be 10%. The following year will be the election year so they will probably try to minimize the tax increase. Then after that Stewie is going to ride to the rescue and ponies will once again be free!

I don’t think Aug 2021 was peak, if memory serves me correct there were some deals that summer after some ridiculous bidding in the spring.

1063 hyacinth definitely looks like some interest rate pressure – bought at peak in 2021, already a price drop after 6 days on market

Unless the knives come out, I don’t see it happening. And no signs of that yet.

PP and the cons can basically sleepwalk to victory at this point, unless PP does something really stupid, which isn’t out of the question.

Meh , not much difference between all political parties , it will be more of the same

I’ve learned not to listen to the words of politicians but to look at their actions and implied actions.

Trudeau didn’t promise 1.3 million new Canadians a year did he, and yet it happened, and it’s clear from both the rhetoric and inaction from the current government that they want this to continue. Like many observers this is clearly due to the liberal party being in thrall to the ideas of the century initiative, which demands ongoing massive immigration to Canada.

The conservatives have no such allegiance to these ideas and they can clearly read the room and shift gears.

I can promise you that even if Poillievre didn’t make a vague promise to reduce immigration that he will do so, and substantially, compared to this past year and this coming year. This is simple political reality: people expect the conservatives to fix this situation if they get voted in.

If the liberals or the NDP are willing to remove their current leadership and clean house in the next year to allow them to build a convincing alternate policy platform, then absolutely they will regain votes. But with the current leadership and ideology that they are following it is evident that we need to shift to a different party.

This is actually one reason why we see cycles between parties in bipolar and tripolar political systems: when one party is in power for too long they grow numb to the expectations of the electorate and can drive people to vote them out.

No matter which government comes in next, what we need is less of it. Forcing automakers to produce a product that the majority of the market does not want is economic suicide. Cramming people into boxes they don’t want is political suicide.

Mine too!

You should try living In a communist Municipality that just had taxes jacked 25% In 12 months.

All we can do Is wait this guy out…It sucks.

Yes, I agree there. I would assume the first thing he’ll do would be to announce plans to increase housing and then wait years to see the results before touching immigration. Then reassess things, which might be 2-3 years from now. He wouldn’t have broken any promises with that plan.

No he didn’t. He just said he’d bring in an unknown “formula”. Means nothing unless he gives you the answer – a hard number.

So what does that mean exactly? More homes or less immigration? Well whatever you want to think. He’s playing you and it’s working, just like he’s playing the immigrant communities by telling them he wants to make immigration easier.

And he has my vote, as it’s clear no other political parties are willing to do it.

I think it’s hard to explain just how far out the current government is when centre left, millennial liberals like myself are ready to vote in poilievre for offering to basically reinstate the immigration policies of 10 years ago.

Anyone who doesn’t believe him hasn’t been paying attention. Liberals have drunk their own cool-aid and they’re unwilling to slow down population growth to within historically normal rates.

Why do we need 100 million Canadians by 2100, anyway?

Poilievre announced he would slash immigration levels

“A Poilievre government would apply a “mathematical formula” that links population growth to the growth in the supply of housing. “It’s the only way to eliminate the housing shortage — adding homes faster than we add population,” he said.”

May not happen but at least it sounds like a sensible policy that gives hope to the younger generations.

That is a shrewd political position to take. Because he can still promise lots of houses and lots of immigrants, while also promising to reduce immigration if we don’t have the available housing. So a promise for everyone.

Of course I’m too cynical to believe that these are more than empty promises, but it may help him get elected.

A while back, didn’t Marko say he was going to trade in his S when he buys his Y because he doesn’t want to go through the hassle of what he’s describing above?

Poilievre announced he would slash immigration levels

“A Poilievre government would apply a “mathematical formula” that links population growth to the growth in the supply of housing. “It’s the only way to eliminate the housing shortage — adding homes faster than we add population,” he said.”

Impressive! In this case, a $5K flat fee commission when acting as buyer or seller agent. Well done Marko. More agents should publicize deals like that!

MillenialhomebuyerX2, when selling my last place, the realtor gave a $3,000 cut on the seller’s agent commission, although I think they forgot we were the buyers, and they were the sellers agents the last time as we purchased without an agent, but they considered us “repeat customers.” It was on the sale of a home worth roughly $925K. Commissions were like 30K so it was maybe 10%. I asked my current realtor (a different one) if selling and buying at the same time with him if he offered a cut on commission and he said no, so I guess it depends.

Don’t they have to be represented now that I think about it?

It is common, the OP’s close friend either really needs the $ and only thinking short-term or just isn’t interested in giving discounts period

Could be easily mitigated by the seller encouraging mortgage pre approval paperwork attached to the offer if there is a financing subject. But I take your point

A neighbour of mine sold his house about 2 years ago and said the listing agent only charged half their commision on the sale side. They know they will get the 1/2 commission when they buy another hosue. I would think this is or should be pretty common.

I didn’t say anything about cold feet, literally financing. Comes up in a million and one scenarios. A week ago clients I worked with 12 years ago called me up wanting to view a condo as they want to downsize. We look at the condo and they are like great “let’s write up an offer.” I asked them how they planned to finance it (as they are not ready to sell their SFH quite yet so subject to not an option) and they replied with “we have no mortgage on our home [SFH]” and right away I was like hmmmm, strong probability this won’t work as they are retired and banks don’t just give you money like that. This was on a Saturday and I suggested they talk to a mortgage broker + their bank on Monday and guess what….it wasn’t going to work how they imagined it (private $ was their only option) and they opted not to write an offer and are now considering putting their home on the market first later in the year.

If they were unrepresented they would have written an offer, probably got it accepted, and then pulled the plug afterwards. Buyers’ agents don’t have an incentive to spend their time with a buyer who is not in a position to buy.

How does having a realtor representation prevent this? Are you banking on the other realtor to talk the client out of bailing due to getting cold feet because it is in their best interest to also have the sale go through?

I would ask for their buyer’s agent to get in touch with me to make sure he or she is okay with me showing his or her clients the property. Reality is this doesn’t happen often as comptent agents have systems in place when they leave town.

Btw, the unrepresented party that I showed the condo to last Saturday….first question they asked me was “can we look at the parking first” and of course the unit did not have parking which they would have known if they had a buyer’s agent.

I also had a couple of mere postings accept offers from unrepresented parties recently only to email me a week later that the deals fell apart due to financing which I admit happens with represented parties too, but at a far lower frequency.

Literally anyone can click “book a showing” on realtor.ca and as a consumer I can’t say I am totally cool with unknown unrepresented parties coming through my home. I recently sold my Model S and wow, people are weird. After the first five complete waste of time testdrives (“can you hold it for me for 2 months while I try to sell my car”) I started screening people. You can look at it, but if you want to test drive it I need a $500 refundable bankdraft made out to me and I’ll give it back to you at the end of the testdrive. Cut all the tire kickers out and the person that bought it wanted the car so they took the time to get the bankdraft and the transaction went smoothly.

In real estate, the forms are a great way of eliminating unrepresented tire kickers, from my experience. I was excited when the government brought the forms in. The majority of agents were not (it cut down on double-ending).

lol don’t ask me, I am with you on that. But I bet majority of people thinks that the porsche realtor is somehow “smarter” or “better” than the civic realtor and will yield better results.

I think the OP don’t want to be too aggressive with the ask given it is a friend, so if there is a 30% brokerage fee then asking for 50% on the remaining might be too much.

So if a buyer approaches you to show them your listing because their agent is out of town or whatever they still have to sign this form?

That’s literally a government mandated thing! I showed a condo I have listed downtown to someone without a buyer’s agent last Saturday. I sent them the forms, they initialled the forms, we met a the condo and that was that. Problem is buyers without an agent don’t want to deal with the same forms over and over again for each showing. When I send buyers the forms it isn’t that I don’t want to show them the property, but rather I don’t want to be fined by the BCSFA.

https://www.bcfsa.ca/industry-resources/real-estate-professional-resources/knowledge-base/toolkits/guide-disclosure-risks-unrepresented-parties-form

btw, read the forms. The government scaring people from purchasing without a buyer’s agent and keep in mind agents didn’t lobby for this whatsoever.

If a listing agent won’t show a property to someone without a buyer’s agent that amounts to commission fixing IMHO, and acting against the seller’s interest as well.

Yes I understand, was just providing an example of a site where most people are familiar with to demonstrate there is equity made on zoning.

Slightly different concept. What I am talking about is how you walk away with every dollar you put in when the CMHC LTV is 95% (not 100%). A better anology would be developer buys a Mazda dealership for $5 million, re-zones it with the city to increase the value to $10 million, spends $90 million on construction and then the CMHC financing kicks in.

I still don’t understand how this plays into the equation. I pay $250/transaction (less than 2%), how does it matter if an agent pays 10, 20, or 30% to his or her brokerage?

Would you justify paying an agent a larger commission because they drive a Porsche and the competitor drives a Civic? The Porsche is not going to yield better results in terms of your home sale and neither is the % cut to the brokerage.

Jawls did this at the old mazda dealership, they did the city firehall project with affordable rentals, in exchange the city gave them more density for the Mazda site and then they sold it to Chard.

Some brokerages can go as high as 30% (in exchange for office space, marketing, leads), some will have a fixed fee for the year and if you have a good year then part of the year would be pure commission. I think you should send out a few feeler emails to different realtors and see what discounts are offered. $10k back in your pocket is not insignificant for most people.

If you have cash, the math makes no sense imo. However, if you have limited cash resources you can pull off projects where you extract every single dollar of equity (i.e. you leave nothing behind at end of project) and with a 50 yr CMHC amort the property will cash flow, just barely. You move onto the next rental project and you see the result in 10 to 25 years (rents appreciate, principal paydown, property appreciation, etc.).

The reason you can potentially pull off leaving nothing behind is 95% LTV with CMHC and you can create equity via increased density on the re-zoning.

However, if you have 10 mill in cash the return is poor. At that point I would just buy a pipeline,bank, telecom, railroad, etc., and count my dividends every month.

I keep preaching this everywhere….there isn’t a problem with commission fixing in the industry, the problem is the consumer. I can explain a million times on HHV how to mere post and successful sell a home (which I have in the past including how to set up an offer delay) and at the end of the day people will pay full pop because “Bob” spends money on marketing (aka billboard of his or her face), is the “neighbourhood expert,” kids play hocket with “Suzy’s kid,” “Jim is the expert for 100 year old mansions and knows how to market them,” or he or she is a family friend/acquaintance, etc.

That’s all great, but stop complaining about commissions then 🙂

I don’t understand why people complain and then take zero action, it makes no sense to me. It would be like me complaining about a 2% MER but not pulling the money out of the mutual fund.

Ughh it’s so shitty asking for kickback. But since Sept 2023, we will have made him 55K in realtor commissions from our 3 transactions. Again I don’t know what amount goes to his brokerage. I don’t think he has a ton of volume either.

Brand new home sale in Oak Bay for $1,905,000 this morning. The building lot alone was $975,000. Good value there for the buyer imo.

I pay my brokerage $250/transaction just to give you an idea, so that is less than 2% on the average commission. If someone is at a brokerage that takes 10, 20, 30% from their agents that is the agent’s problem; not yours as the consumer.

I have a close friend from highschool. We graduated together from Vic High in 2004 and have been close since then. I’ve done 10+ transaction with him and when he bought his most recent home I took 5k and wrote him a cheque for over 20k. Right now he is selling his home for $2.5 million and I am doing that for 5k on the listing side (approx. 34k discount). After that he will buy something more expensive, I’ll again take 5k and I’ll cut him a cheque for 50k+.

I am happy with the arrangement and he is always insisting I take a bigger cut so he is happy too.

The one thing the helps is I know the 5k commission is essentially guaranteed in that he would never replace me with another agent and when there is near zero uncertainty it makes sense to take less from a business perspective, in addition to him being a close friend.

Right now, especially in the luxury market, every day properties being re-listed with different listing agents.

On the flip side I have a friend that works at a large investment firm and he is always like “honestly we rip people off with the MERs, just do your own thing and this is some free advice I can give you.” If he tried to convice me to move my money over to his firm for his monetary benefit I would no longer be friends with him.

Close friend, that is your problem… there is fee which the realtor would need to pay to their brokerage, and once they finish paying that fee then they get to pocket the entire commission. Up to 50% cash back for buyer’s commission although rare is not unheard of if it is limited to one or two showings with offers and limit on counters. For sellers, I would honestly just work something out with Marko or someone offering a similar direct listing service with a little bit of hand holding, since you have already bought and sold multiple homes you should know the general process and this should be adequate.

Just to provide some perspective, lots of realtors advertise $1k to $2k cash back for buyers without any negotiation. The fact your “close friend” didn’t even offer that to you kind of shows you where his priorities are…

Can someone give me an idea of what to expect in terms of a friends and family / repeat business discount from a realtor’s commission? For background, we have used him to buy SFHs in 2016, 2017, and to sell SFHs in 2023 and 2024, and buy an SFH in 2024.

We have never had any reductions in commission to date. For our sale in 2024, we want either a kickback or reduced commission. Is this unreasonable? What would be a reasonable amount?

Our realtor is a very close friend so it’s been a bit awkward.

Town houses tend to be multi-level designs and that allows every bedroom with a fire escape window. Although there are two-level condominiums as well.

What is or what is not a townhouse can get a bit fuzzy.

One type of two-storey condominium that I’ve seen had an internal stairway in the unit as well as two sets of doors that opened onto the interior hallways on both levels. That would be a design that would allow home owners to rent one of the levels as the tenant would have their own entrance on a different floor. A flexible floor plan.

But there isn’t many ways to configure such a small living space.

Federal government relieves GST on new rental construction: https://www.grantthornton.ca/insights/federal-government-relieves-gst-on-new-rental-construction/#:~:text=The%20use%20of%20the%20residential%20units%20in%20the,GST%2FHST%20forms%20a%20cost%20on%20completion%20for%20landlords. “In addition, the British Columbia government committed to removing the PST from certain construction costs for purpose-built rentals. ” (I’m not sure if this has been implemented yet or not.)

Difficult to build because of the building code requiring every bedroom to have a window, which makes 3 bed floorplans tricky to fit into a building. Then limited demand because the prices start to approach townhouse prices and people would rather have those.