Why more people paid the vacancy tax in 2023

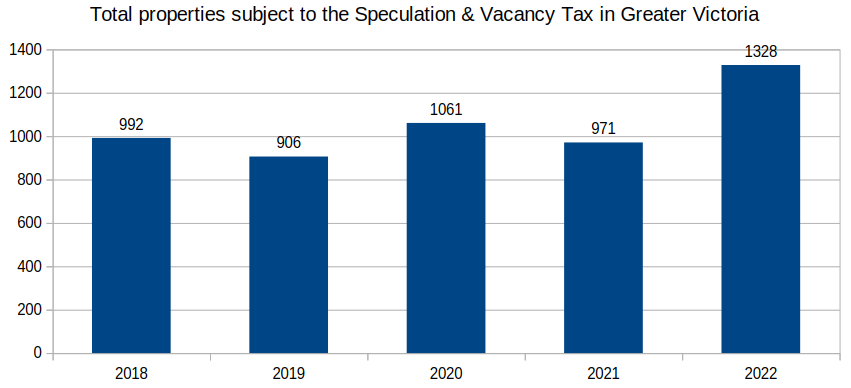

The province recently released new data on the Speculation and Vacancy Tax, and it showed that 1328 people in the CRD paid it last year (for the 2022 tax year), up from 971 the year before. What gives? Isn’t the vacancy tax supposed to reduce vacancies? Do we suddenly have hundreds more vacancies in the region?

The short answer is no, but let’s take a closer look. After 4 years of about 1000 properties subject to the tax in the region, it suddenly jumped last year.

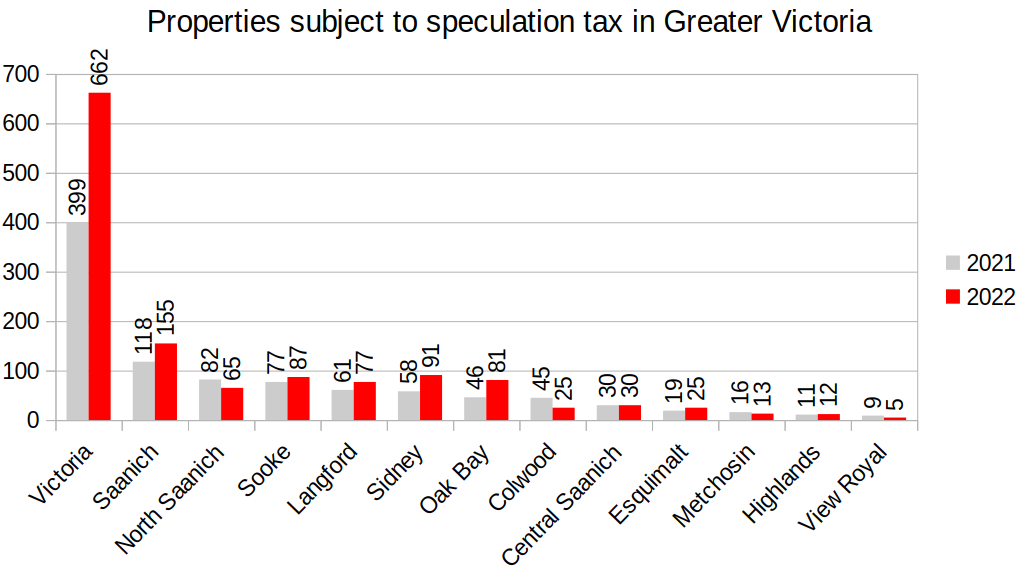

Breaking that down by region, we can see that it’s really the City of Victoria that saw the biggest jump, with 263 more properties taxable in 2022 than a year before, a 66% increase. Saanich, Sidney, and Oak Bay also saw sizeable increases on a percentage basis, but the absolute numbers are small. The rest of the local municipalities were mixed.

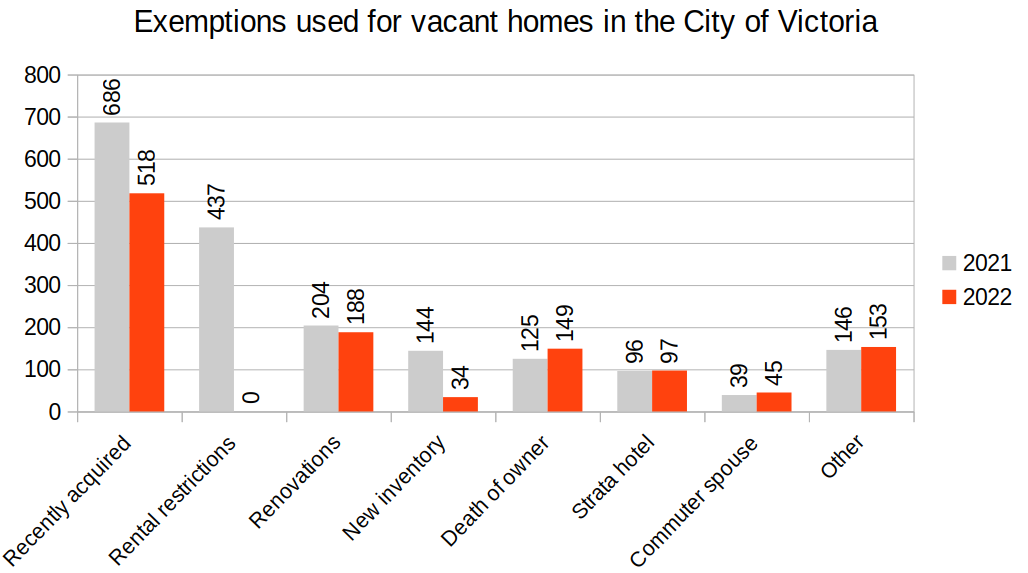

Why did the numbers jump in Victoria specifically? The clue is in the tax exemptions that were used for vacant homes in previous years. Specifically the exemption for a vacant condo with rental restrictions was phased out after the 2021 tax year, which means it was no longer available as a reason to maintain an empty apartment. Rental restrictions were most common in older condos, which were more common in Victoria. Saanich, Sidney and Oak Bay also had a few which explains their increases in 2022 tax year. At the end of 2022, stratas were prohibited from enacting rental restrictions entirely which means those units would have been hit either way if they remained empty. The other categories didn’t see much change, though there were drops in exemptions for recently aquired and vacant new inventory potentially due to relatively low sales and inventory levels that year.

So what happened to those 437 empty condos that were previously exempt from the tax? Well if we assume vacancies otherwise didn’t change, it means that some 60% of owners decided to pay the tax after their exemption expired. Remember that rental-restricted condos are generally older, and BC residents get a tax credit sufficient to cover the spec tax on a $400k condo, meaning the actual tax paid was likely quite small. The other 40% may have either moved into their units or sold them to avoid paying the tax (the intended effect). In other words, despite a jump in the number of spec tax payers, we likely ended up with a couple hundred fewer actual vacancies in the region than in the year before. This year expect the total number of tax payers to drop further as some owners get tired of paying it and sell or use their new ability to rent out their vacant units.

In total, 1.04% of properties in the region paid the speculation and vacancy tax in 2023. About 100 of those are occupied by so called “satellite families” so not actually vacant, while the rest may slowly be chipped away over time. While there were certainly some properties brought back to the market via this tax, it’s also pretty clear there’s not much blood left in the stone.

Also the weekly numbers

| February 2024 |

Feb

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 54 | 154 | 460 | ||

| New Listings | 160 | 400 | 811 | ||

| Active Listings | 2129 | 2186 | 1809 | ||

| Sales to New Listings | 34% | 39% | 57% | ||

| Sales YoY Change | — | -9% | -36% | ||

| New Lists YoY Change | — | +14% | -13% | ||

| Inventory YoY Change | +22% | 22% | +113% | ||

| Months of Inventory | |||||

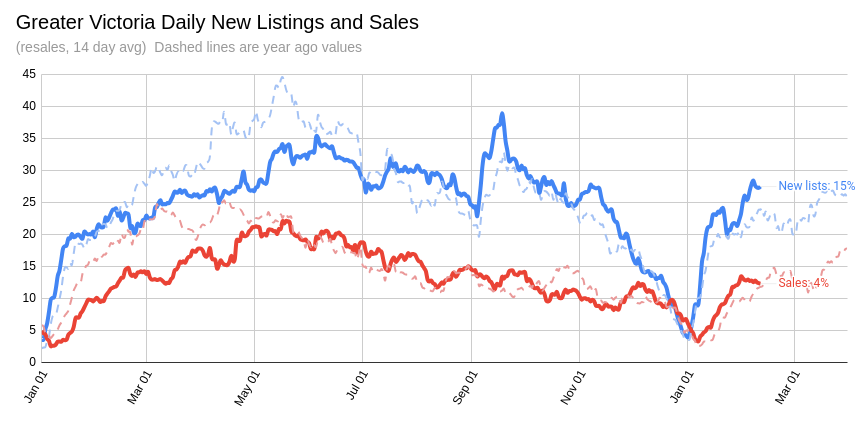

It was a somewhat slow week for sales last week, bringing reported activity below the year ago pace. Looking at the last two weeks of residential resales in the areas most people are looking in (core, westshore, peninsula), we are now about even with the year ago sales activity for the first time in about 6 weeks.

I wouldn’t read too much into a week’s numbers though. When you’re comparing against times when sales are increasing, a few days delay or advance in the next ramp of sales can push around the percentages pretty quickly. However it’s something to keep an eye on for the rest of February. We do have an extra day this month (and it’s a business day) which should help to outdo the year ago figures. 7% of properties went for over the asking price in the last two weeks, compared to 15% on the same day last February. It’s another indication that though the market is likely to tilt towards sellers in the spring, I don’t think it will get as warm as it did a year ago.

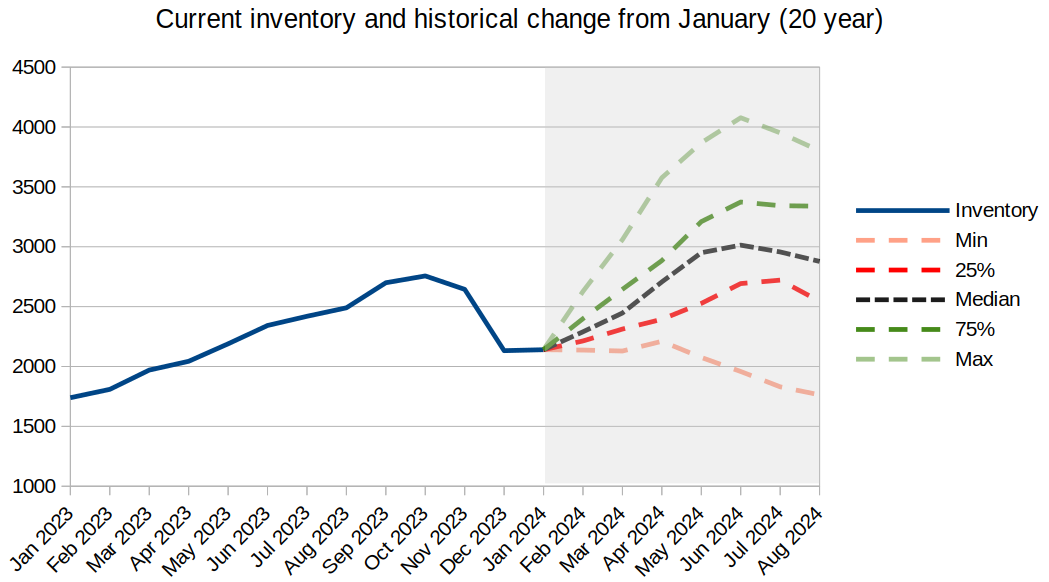

Right now we are at 2186 properties on the market, about 1600 of which are residential properties, and we’re just at the start of the spring market when inventory usually grows. So how much inventory will we get to this year? To estimate, we can look at how inventory has evolved in the the past from January to the inventory peak (which usually happens in early to late summer). From the last 20 years of data, there’s a big range in how inventory has changed from January, with some years inventory actually dropping as the market heats up (2016 for example) and others where it piles up under rapid cooling (2010). The average increase is just under 1000 new listings while the median is 873, which would let us just scrape 3000 listings by around June. Given that rates aren’t moving much, I think that’s probably a reasonable bet for peak inventory in 2024. Where do you think we’ll end up?

New post: https://househuntvictoria.ca/2024/02/20/are-we-building-too-many-condos-in-langford/

That would seem like a good plan.

The licensed builder doing this is assuming the warranty and it is their assets on the line which is a minimum of $250,000 if things turn south. I have been involved in such a project as the designer and it is currently going through the courts. It’s shady as all f***. I don’t understand it because I also have a few clients with no construction experience breeze through the home builder course and get their homeowner builder license in a matter of weeks.

This happens all the time, right here In Victoria. There are builders all over town That aren’t licensed and just use someone else’s HPO# for a fee of around 15-20k. Obviously the one with the HPO# trusts the individual who does not have the HPO#.

Its a good way to make money for doing virtually nothing.

Looks like JT is adding another $2 billion to construction financing for rental apartments in BC.

Who’s that? You and your “kids”?

Some people here have been “gun shy” for 6+ years 🙂

LMAO, did you google what happened last June after the 2.8% print? No one knows where it’s going, 5 year bond yield still around 3.6% people are currently gun shy.

The Scotiabank info you posted is remarkable. Good find. Especially the ability to use 70% of RSP as qualifying assets.

A related question…

Are some banks more flexible than others for loaning using owned real estate as collateral? For example, a second home with no mortgage. Can that be a qualifying asset to borrow against, and not be subject to standard income testing?

Yes, I thought the same thing. Scotiabank may become the preferred “bank for mum and dad” buying homes for family based on RSP assets.

Interesting given that RRSP assets cannot be pledged as security for a loan, and they are protected in bankrutpcy. Just going on faith that the borrower will raid the RRSP when push comes to shove.

Well they certainly haven’t been saying so. Keep in mind that the election will be won or lost in the Vancouver suburbs and 905.

Marko, would the rules allow for a licensed residential builder to be prime on otherwise self-build projects? i.e. A company that works with all of these folks that email you in frustration to allow them to go build for themselves.

I would imagine it would be a lot of paperwork and liability, but do the rules allow for something like that? Say you charge the home-builder $20k or something, take care of the paperwork and you have someone skilled swing by to check on progress every once in a while. You could have your own set of criteria for which clients to accept, like the clearly skilled guy you just posted about.

Just a thought as it seems to be an ongoing issue with no resolution in sight.

Looks like the same inflation trend over 3,6,9 and 12 months…

“ This is the first time that CPI inflation rates at all horizons 12 months and less have fallen into the Bank of Canada’s target zone since mid-2021, and the 3-month rate has been bumping around the 2% target since November.”

https://twitter.com/stephenfgordon/status/1759943344552112566?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Etweet

That sounds like a feasible strategy. The list of qualifying assets is in their explainer sheet:

https://assets-powerstores-com.s3.amazonaws.com/data/org/17209/media/doc/5c12f3_a97cdc94a89c40aca2ef50141ad3d582-94d1c6777647df1d622645216466bc1c.pdf

If wishes were horses…”market over-reaction is not particularly surprising…It’s just one month folks. Chill…

The BoC’s two preferred core gauges of inflation landed sharply softer than the recent trend…But they come on the heels of the prior month’s 4.7% and 4.8% readings….The Bank of Canada is searching for a more convincing trend. One month doesn’t cut it; call it mean reversion off of a hot prior reading for now and wait for more evidence.” -Deek Holt, BNS

I would consider median prices falling around 15% (from VREB site) from mid 2021 to Jan 2024 as significant. When you include inflation rising at a cumuative total of 15% over the last 3 years prices are off close to 30% from peak prices since mid 2021.

The next few years should be interesting, for many items the pandemic premiums is being fully unwound. Take a look at bikes, electric cars, rv’s etc… there is a large surplus and price drops happenning right now.

I feel like the housing market is just going to drift sideways for a few years and wages may rise and make housing more affordable, unless interest rates drop dramatically, if this happens of course this means we have entered a recession.

I can remember reading an article on US housing in 2006, before the melt down, and Robert Shiller predicted that US house prices would fall to levels consistent with long term trend growth rates, of course prices usually overshoot and go too far down but they tend to revert back to the long term rate of return.

Canada has a wild card with immigration levels, but given that the Cons will get in the next election, immigration will fall and there may be a building boom and prices may drift sideways for longer.

I also predict that property taxes will rise by 2x inflation into the future, which will affect housing prices.

A shortage of listings led to a rapid increase in prices during the first quarter of 2022 with multiple offers presented over the asking prices. Market prices stabilized during the second quarter of 2022 due to quantitative tightening increases in mortgage interest rates. The third quarter of 2022 has had further interest rate increases, resulting in some softening of market prices as the number of sales declined, the average days-on-market increased, and the months of inventory increased. This resulted in the market place transitioning from a market heavily in favor of sellers to a more balanced position between buyers and sellers. The fourth quarter (Q4) of 2022 and Q1 & Q2 of 2023 had further interest increases, however a decline in listings caused a return to a sellers market and prices rebounded from levels in the last half of 2021 to price levels in Q2 of 2022. Interest rates have remained unchanged since July 2023.

Personally, I have not seen the effects of the higher interest rates on housing in Victoria. Sales may be down and inventory higher but that has yet to lead to any significant price declines. Those that have been caught with a higher renewal rate have been able to sell or restructure their mortgages. Most of those that bought during Covid at the lower interest rates have yet to renew.

I was anticipating, that by now, there would be a trickle of court ordered sales but that has not emerged. It is astonishing how resilient the market has been to a downturn since June 2023.

Welcome back to HHV, Leo!

Month to date activity

Sales: 274 (down 2% over same time last year)

New lists: 678 (up 26%)

Inventory: 2258 (up 25%)

April BOC rate cut now likely.

https://www.reuters.com/world/americas/canadas-inflation-rate-drops-more-than-expected-29-january-2024-02-20/

…to moderate or chide.

Oops cpi was today, came in lower!

No one is asking you to “debate” with anyone. You are free to scroll and move to the next post.

What I don’t like to see is simply “attacking the messenger”. I would hope that you’re not setting out to do that, but if you look at your post, it sure looks like you’re just attacking the messenger (Max), instead of referring to something he actually said.

You wouldn’t like it if someone took a cheap shot and said “don’t try to debate with longTimeObserver, it goes nowhere”, so how about you extend the same courtesy to Max. And all this means is scrolling to the next post…

500k off the table plus 14 months of carrying costs…Times two? Sucks to be that guy.

My family used to build spec houses here In Victoria way back In the day. It can be really good…Or It can be really bad.

Feast or famine.

Fair enough, to tell you the truth I could really give a shit…I have no Interest In the development anyway.

Thanks for reminding me Its February 19th though…I have something very Important to do tomorrow that I totally forgot about.

Max it’s not May. Calendar says it’s February 19th so whatever regulations pertain to that zoning in Colwood apply and/or any other rules Colwood might have about short-term stays or rentals or whatever you want to call it.

If someone needs to stay for a month or two for business, what are their options now?

Ah gotcha, i just guessed the 30 day minimum based off monthly rates – what does Colwood Corners website show for minimum stay?

” Short-Term Rental Accommodations Act defines a short-term rental as an accommodation provided to members of the public in a host’s property, in exchange for money, for a period of less than 90 consecutive days”.

https://www2.gov.bc.ca/gov/content/housing-tenancy/short-term-rentals/straa-definitions

I think they would have to be 90 day leases to be a legal. Maybe even 120 day lease to play It safe.

I personally think the developers were blindsided by these new STR regulations and are about to eat crow.

$3300 per/month for a 1 bedroom In Colwood. $3800 for a 2 bedroom!

I could however see these units being very lucrative In the black market area. Just pay the rent…Do what you do.

I would Imagine you would be allowed guests…Just rotate them. Create your very own counterfeit air bnb operation.

I am not saying that’s what I am going to do, I have family values…It was just a joke.

Max aren’t those furnished rentals at Colwood Corner minimum 30 days leases, i don’t invest in condos so haven’t kept up with the STR rules outside of airbnbs. Maybe i’m missing something

Not my part of town.

4333 and 4335 Shelbourne St are interesting new builds. Both started off listed at 2.3MM in January and now down to 1.8MM 14 months later. There’s also a 9 year old home for sale at 4365 Shelbourne bought new in 2017 for 1.25MM now asking 1.65MM.

Marko has a listing at 4113 Alberg that appears to be priced at least 300K over current market conditions.

I understand Its Colwood, I get that part. What I don’t understand Is the “Short Term Stays” part. Is Colwood now exempt from the STR regulations? Perhaps that’s the new loop hole, they’re not STR… They are STS.

https://www2.gov.bc.ca/gov/content/housing-tenancy/short-term-rentals/principal-residence-requirement#exemptland

Look at It again.

don’t bother trying to debate with Max, it goes nowhere 🙂

It was the STR part, Look at It again, I even underlined It In red. STR would make total sense considering…

Royal Roads University Is right beside It.

https://www.royalroads.ca/

CFB Esquimalt Facilities in Colwood Is directly behind It.

https://www.colwood.ca/discover-colwood/points-of-interest/canadian-forces-base-esquimalt

Elements Casino Is also beside It.

https://greatcanadian.com/destinations/britishcolumbia/elements-casinos/

With a Save On Foods Integrated In It.

$2200 for a one plus den condo in langford…standard. but anyway moving on

I would say Its competitive. Also It has street access to the unit via the patio with street parking.

Lol that place is a mess. Thr old ceo was giving direct award contracts to a non-profit ran by his wife, but the non-profit also had a for profit subsidiary… when eby asked the board to fire him the board refused and eby had to fire the whole board.

The only more frequent email than the one below is people complaining that there isn’t a licenced residential builder in their area and they are forced to take the owner-builder exam. Hmmm, wonder why there aren’t licensed builders around! Some director/manager at BC Housing that has never set foot on a construction site introducing more and more barriers every year so you end up with situations where people lose their homes in wildfires and can’t legally rebuild without writing a very difficult exam.

“Hi Marko

I am a licensed electrician, and I worked as a carpenter for over a decade prior to becoming and electrician. I would like to become a licensed residential builder, and with around 25 years of experience in residential construction I feel I have a great deal to offer someone who would like to build a new home. Sadly, my experience doesn’t count for much in the eyes of the government as I’m sure you already know…the process to become licensed for residential construction in B.C. is extremely difficult now.

My first building project will be for myself. A simple carriage house, here in XXXXXXX, on top of the existing garage that I built myself (with permits) a little over 20 years ago. However, because I haven’t held a building permit for over 5 years I am starting over at square one as if I had zero prior experience. So I no longer qualify to get my own permit. Extremely frustrating.

I’m very much interested in obtaining an owner builder permit for my own home while I work on the becoming a licensed builder over the next few years. Can you help me with some reference material or a study guide of some kind?

Thank you, xxxxxxxx”

Canada CPI print on Wednesday, the spring market RE market could very well hinge on this. All the tick tock realtors here (you know who you are), go ahead and start making that content now 😉

Max, the flyer says they’re introducing the City of Langford to Colwood Corners, not that it’s in Langford. Clearly uses the word Colwood twice.

Sideliner, as it was explained to me if you have funds in an RRSP, that counts and then if you sell your house/property you have cash in hand, the high net worth minimum of $250k can be made up from those two alone and when you go to purchase you just get a mortgage that means you have that much “in the bank” so maybe you hold back 100 grand, and get a mortgage that is $100k higher, then after you close you then use your prepayment option to put that on the mortgage and then ask for a recalculation of payment. So you’re using your home equity to qualify to upgrade. Haven’t done it, but a mortgage broker explained it to me in that way. I forget the other qualifying details but it would have enabled me to buy a higher priced townhome with strata fees where ordinarily I wouldn’t qualify. Not able to downsize which is funny; going from a house to a townhome otherwise.

Different insurers’ policies may vary, so better to check with your own. We did a 3 months house-swap before, notified our insurer and they said no extra charge for one time thing.

Max, take a closer look at that condo you posted in Langford – it’s a junior 2 bed (700 sq feet one bed plus den)

$2200 with one parking spot.

looks good and convenient location but not exactly a game changer for landlords

Just Curious, depending on your policy it might be prudent to notify your insurer to make sure you are still covered during a commercial rental.

We are Airbnb-ing (verb?) our primary residence while on vacation. Its too hard to turn down the easy money, especially with the reduced competition from the Airbnb ban for short term. Marko you mentioned you’ve done this….have others as well? Specifically, my question is do you add additional home insurance for short term rentals? Any other precautions you take (insurance wise)?

Brand new building, Thrifty foods flag ship super store directly below, and you can walk to anything you could possibly ever Imagine within 5 minuets, for $2200 per/month all In…No strata fees. 2 bedroom, secure underground parking with ev charger, storage locker, bike storage. Now I would say that’s not too shabby. So any landlords out there had better sharpen their pencil. Ask this guy…

https://www.usedvictoria.com/apartment-rentals/40555842

Patrick, that house you linked In kettle creek for 700k Is the bottom for SFH.

After looking at that thing, now I want 2m for mine, I’m not even looking to sell…ever!

What I’m saying Is, people who already own a SFH, will just stay there.

With that comes a very competitive rental market. Banks might pull the reigns even tighter for those relying on basement suite rental Income.

More apartment rentals and less condos likely means a lower homeownership rate. This is contrary to the HHV narrative that investors flee (are net sellers) during downturns, which would mean that home ownership would rise. I don’t expect that to happen.

In the US housing crash, a lot of new condo buildings couldn’t find buyers, and became rental apartments. Seattle is full of them and they are filled with thousands of long term renters .

US home ownership rate fell from 69% to 63.5% during the 2007-2011 bust.

Resale SFH are a relative good bargain right now…while you can still get them.

These 8′ wide builds for only $224 CAD might work somewhere In the CRD. It seems like a waste of land use.

https://www.zillow.com/community/elm-trails/29900265_plid/

I don’t think they have EV chargers though.

Pre-sales in general 20 years ago were cheaper than re-sale options (let’s define re-sale options as similar quality of construction, same location, 1 to 5 years old) by 5 to 8%. That started changing in Vancouver approximately 12-14 years ago where that discount erroded and then eventually switched to a premium for pre-sales upwards of 15% which makes zero sense, but I think it was driven by speculation. Concept being you buy a pre-sale condo downtown Vancouver at higher than equivalent re-sales and then you hope there is huge market appreciation during the 3 year build-out (large buildings, takes forever to excavate/build) and you get a large return on your deposit. Basically gambling.

In Victoria pre-sales where cheaper up until approximately 2016 I would say. The Encore was the last building I remember clearly being cheaper during pre-sales versus re-sale market. I bought one pre-sale unit at the Encore, then I listed a unit at the Promontory (across the street) which ended up with 5 offers on it, and I remember the following morning I went to the Encore showroom and bought a second pre-sale unit as the price was very clearly cheaper than re-sales.

Since then pre-sales in Victoria have been priced in-line with the market, but unlike Vancouver we never saw a premium above re-sale market for pre-sales (for the most part). Some buyers have still done really well, but on the basis of market appreciation during construction, not because the pre-sale were below re-sale market at time of purchase. For example, the Pearl took forever to build and during the buildout there was significant market appreciation.

Who knows what happens going forward with developers having gone to building apartments versus condos.

Would It be safe to say the ones back In 2014 with fomo and bought, were right? And those that chose to wait It out…Were wrong?

Suspect ~$2k at low end, $4k at high end. Can’t see a 1200sqft 3 bed go for much over 4k unless there’s a massive balcony with views.

Market rents are nuts these days.

https://www.goldstreamgazette.com/news/canadas-rental-vacancy-lowest-its-been-since-chmc-started-tracking-7312459

.

I was wondering about the math mostly based on the Kelowna number. And then wondering why someone would pay 1200 a square foot for new based on the many much lower priced alternative resale options which were built pre current inflation/fast escalation of construction costs.

Are these all market rentals?

You can do $300sqft all in for hard and soft, a little lower if you have multiple builds and can get grunts from the lower mainland. So you can do the math and see if it’s worthwhile.

I don’t know what’s not to understand. There is no money to be made buying and selling condos unless you are taking a pure speculative position and thats not what a developer does. Chard isn’t going to all of a sudden stop developing/building and start buying existing product instead to flip.

Yes, for condos as well. I didn’t understand your comment for them either.

Uhhh that sounds way too high

The wedge? Ya they had some issues, funny enough that the developer actually lives right across the street.

Uhhh you were talking about high rises not SFH….

Over 100 rental units about to hit the market shortly -> https://rentatdocksidegreen.com/floorplans they have a proper three bed floorplan, wonder what that will rent for.

The large rental on the corner of Johnson and Vancouver is so delayed they’ll be finishing as Bosa approaching full occupancy. It would have been a little more interesting if they both hit the market at the same time.

I think that is part of the reason why SFH starts last year are at an all time low. If you look at the purchase price of the building lot ($925,000) on that Windsor home there is not a ton of margin there whatsoever.

It is also the reason why a lot of multi-unit builders/developers have shifted to rentals. Just add up all the unsold inventory in this newly completed building on Cook Street -> https://www.modvictoria.com/floor-plans

Totoro , they really missed the mark on those 2 homes . I think aesthetics’s have done them in

Yes, good points. I was doing the math for myself as someone who would build under missing middle and wondering why anyone would build new to sell right now unless they are in a big project like Royal Bay. Seems like you end up with a cost that is hard to recover.

For example, this home in OB has been listed for 81 days: https://www.realtor.ca/real-estate/26319108/2266-windsor-rd-oak-bay-south-oak-bay It was a lot that was split into two.

Not sure what to make of this. Unlike cars, 10 year old homes don’t sell at a big discount to brand new. New homes also don’t sell at building cost escalation + set xx% margin. They sell at whatever the market will bear and often there is good value imo. Reason being is the 800-1200k SFH re-sale market is so competitive right now that I do find you get better value (assuming you can afford it) north of $1.5 million and north of $1.5 can get you into newer builds.

We don’t have major home builders in Victoria. Maybe Gablecraft? but there is no way their actually margin is 30% if today’s market value of the lot was assessed to the calculations.

I’m not sure what you mean. To me the cost of a new build SFH is not good value vs. buying something that is slightly older even. Not just the 7% GST issue but also the escalation in build costs means that resale homes are a relative bargain.

Look at the major home builders, margins remain high.

Last few houses I’ve sold for builders have been 8 and 9% margins. One of those builders sold a ready to go building lot with duplex plans included in Sooke yesterday. Couldn’t pencil a 10% profit margin and none of his long time trades would agree to lowering their quotes 10% (his idea was if everyone lowers their price 10% he starts construction).

Carrying costs are also crushing people, a lot of builds are being financed in double digits. Even a construction mortgage through a credit union like CCCU is 9.2% +/-.

GC margins? Sounds too high, maybe isolated cases. There are duplexes built in langford that costs less than 800k all in for hard and soft. Too much variability in these smaller scale builds as the barrier to entry is very low.

At some point u would think climate change will effect or even limit building materials such as lumber and materials being mined . I believe there’s a push for green cement . All of this would not make building materials any cheaper

At some point, home builders profit margins may need to shrink – still hovering near a healthy 30%. I do think the elevated cost of materials and labor during the last few years will keep SFH prices from falling too much, with the usual demand outpacing supply SFH inventory problems likely persist keeping a floor on pricing.

At the very least, land values should help offset some pain with a longer term view on ownership.

Not if the density is much lower, plus older units sell for a discount. Also that is not what a developer does. You have to think both in terms margin% and absolute notional dollars. 10% on $50M is still lot better than 25% on $10M.

Sorry, should have been clearer. Not sure how building more new market inventory will happen. For market inventory it makes more sense for a home purchaser to buy slightly older housing stock given what new housing that does not qualify for grants has to sell for to make a profit.

I’m confused about the math of this.

Why would you be using a % against your current assets income to compare anything? Unless you are establishing baseline cash flow needs for affordability purposes I don’t see the relevance. Once this is established the math is whether it is better to invest in a home or something else with the cash flow and the measure is ROI over time.

If you bought a house five years ago in Victoria prices were, on average, 300k less for a SFH. If you bought an average home and paid 20% down you need to compare the after tax ROI on the ex. 180k down in 2019 in the market vs. invested in the home adjusted for the differential in rent vs. buy and add back principal paydown. I certainly did not come out ahead with my market investments.

Another consideration is that you could get a five year fixed discount mortgage for 2.7% in 2019, vs. 5% today. I agree that buying is up to the individual and prices are down from the very peak in 2022, plus there is way more inventory to choose from.

https://www.vreb.org/media/attachments/view/doc/2023_historic_summary_of_single_family_detached_sales_by_year/pdf/2023_historic_summary_of_single_family_detached_sales_by_year.pdf

Government has programs for grants and cheaper financing if affordable housing. Wood frame is cheaper in the 300s

Then all the other costs like permitting, servicing, and land and seems a tough go to get to affordable new housing. Buying older renovated housing seems like a bargain relatively.

Buying is easy when it’s imaginary buying like how you supposedly just did for your kid. Get a life

That’s great. Sounds like a solid plan. Good luck!

Yes, I am very happy. The percentages have consistently improved for me. My savings rate combined with my return on investments that would not have occurred with a purchase, have well outpaced real estate gains. Now, more desirable locations are available to me at a lower opportunity and carrying costs percentage wise (against my assets and income) than anytime in the last 5 years. People tend to forget that real estate gains are theoretical until it is turned into cash on sale. People mistakenly think that drawing debt against the asset is paying themselves; it is actually adding a liability and a debt servicing costs and not taking out profit. But hey, each to their own. I think Paul McCartney did a song for a Bond movie that sums it up…..

Buying the house is the hard part. Once bought, paying for it is easy and gets easier each year (99.9% pay for it without defaulting)

– and so those 99.9% that are paying for it can then move to their other goals, namely other investments towards retirement planning and the “lifestyle choices”. Most have money left over after paying mortgage and house expenses, and they can go on trips etc. instead of pouring it all into a bigger down payment.

You’ve taken the route where you don’t want to stretch to buy the house in the first place. From an outside observer, waiting 6 years paying rent and watching prices move up 40% doesn’t sound like much fun , but if you’re happy with it and enjoying “lifestyle choices” that’s all that matters.

Please, when have I ever been on the vacant homes or foreigners? I have never been against AirBnBs….. Not being a perpetual bull, doesn’t make a person a bear either…. Simply because I am not on your wagon of always buy, anytime, no matter what and sacrifice all other financial sense to so, does not make a person a bear. My view has been consistent, a house is a lifestyle choice; it is not is not a financial plan, it is not forced savings and it does not solely give a person retirement stability. As a lifestyle choice, a person then should buy what they want, where they want and enjoy it. Instead of buying whatever they can get, wherever they can get it, and for all they can pay.

Yes, a “trend” called the Canada census, only measured every five years. But the trend continues to the present.

Kelowna is the # 1 fastest growing city in Canada. +14% in 5 years. This is from the most recent census 2016-21. And its growth rate continues to present, likely faster given immigration surge.

I know you’re a long-term bear (despite my years of HHV advice), but do you really ignore stats that like, and substitute them with nothingburger bearish themes like the end of “vacant homes”, “foreigners” and now “airbnbs”?

This “Kelowna” discussion thread wasn’t even aware that Kelowna is fastest growing city. Now you know.

Feel free to completely ignore it. The same way you’ve ignored other bullish housing stats for the last 6+ years on HHV.

But regardless of what is said on HHV, I’m sure you’re keenly aware that you’ll be paying a lot more for the house that you finally buy.

LMAO, The man is the google king. Earlier he posted some article from 6 years ago replying to me. Clown show for real.

Well, Garth says Interest rates are gonna drop faster than a pair of hookers panties come late fall, so I wouldn’t fret.

With his solid abbs, proven wisdom, outstanding track record, always speaking with the voice of reason…Just saying.

An article from last year about a trend from 2 years ago? I guess those screams right now asking Kelowna to be exempt from AirBnB rules are just overblown and can ignored since they all should be bought up without issue.

From: https://www.cbc.ca/news/canada/presales-construction-contracts-real-estate-canada-buyer-beware-1.7076994

The BC condo wave should be something to see post May…..

This leaflet came In my mail box yesterday and It says City of Langford…Which Its not, Its In Colwood. It says both short and long term stays.

Picture quality sucks, I used my old ipad…I under lined In red. Is this a hotel now? Hover over the Image to enlarge.

https://colwoodcorners.com/

Forget about those small, irrelevant boogeymen factors (foreigners, str, vacant homes).

The biggest factor in Kelowna has been huge population growth, more than double the ROC, almost 2X BC’s growth rate, and all this is adding demand beyond supply.

Kelowna population grew 13.5% in five years and its getting younger (highest growth is age 20-44).

https://www.kelownacapnews.com/news/kelownas-population-growing-quickly-and-getting-younger-report-3241841#

Depends on the land and density. Construction costs will be around $400/sqft for basic concrete towers of around 15 stories.

The message behind that quote is that absentee owners, foreign buyers, and short-term operators have been largely responsible for Kelowna’s inflated RE prices, which in turn have allowed the RE industry to make inflated profits. Condos are built and sold at a profit for a lot less in other markets, and there’s no inherent reason why they can’t be in Kelowna, once the players get real.

It seems that they are now growing coffee just outside Santa Barbara. Who would have ever guessed. Off to the Getty Museum tomorrow. Coffee in California, what a wonder.

New condos need to sell for $1200 per square foot with 60-70% presales to make a profit in Kelowna… wonder what it is in Victoria?https://www.castanet.net/news/Kelowna/472824/Government-regulations-sour-investors-in-Kelowna-s-housing-market-says-real-estate-executive

Were these supposed to be str?

https://evefurnishedapartments.com/destinations/colwood/furnished-apartments/

$3800 per/month In Colwood. I think we are going to have a lot of rental stock available.

I don’t see a housing crisis. Moving forward I think the rental market will be very competitive…especially for basement suites.

If we are going to see any price reductions anywhere In the region…Its going to be In the rental market. They’re everywhere.

Despite the efforts to supply more “hotdogs” (shoebox multi units), a recent study (may 2023) confirms that most (62%) Canadians are still looking for “steak” (single family houses, away from downtown).

The recent dismal numbers of SFH construction in BC likely mean that net SFH construction in core Victoria is now very close to zero. (It was only 95 per year during 2016-21 according to StatCan so that’s already close to zero. With 7,000 population increase per year and most wanting SFH.

These Are the Top Features Canadian Buyers Want in a Home – Toronto Storeys

Marko, Actually, I completely understand why someone would pay 3 million for a condo downtown. It is a reasonable price for a luxury unit right downtown. Initially the units seemed to sell really well, most have sold I believe. A friend of mine bought a unit there.

What I dont understand is why they dont seem to be selling now. Is this just an indication of a general slowdown in the luxury condo market or is it more site specific. Maybe someone other than Marko actually has an answer as to the state of this segment of the market.

I really like this design. Nice sunny south facing basement suite. 500 block Niagara.

Yuu should learn how to read.

Wrong. For example, the Customs House developer (Magnum) reported publicly that all units sold had a connection to Victoria, and were bought by owner occupiers.

https://www.vicnews.com/business/highest-condo-sale-in-victoria-fetches-10-79m-46887

“We’ve not seen any investors in this project,” he said. “Of the 57 units planned for Customs House, only nine have not yet been sold. One thing I find quite interesting is everybody who’s bought into this [Customs House] project has a connection to Victoria, whether they went to Brentwood or they went to UVic or they had business interests in Victoria.”

The removal of the transparency registry search fee is a good and obvious “why did it take them so long” step. It also is another example of BC government hypocrisy. This is because the BC government have also introduced (fall 2021) a $10 fee for people requesting government information from them, under the freedom of information legislation. This $10 fee has been blasted by people like the BC privacy commissioner as something that stifles access requests. Since they added the $10 search fee, requests for BC government information under freedom of information have fallen more than 50%.

https://www.richmond-news.com/highlights/bc-lifts-fee-on-beneficial-land-ownership-data-8319339

“Lifting LOTR fee runs counter to B.C. government trend

The lifting of the [transparency reigsitry] search fee comes in the wake of the provincial B.C. NDP government imposing $10 search fees on all freedom of information requests and allowing sub-provincial government entities such as municipalities and health authorities to do the same. Since implementation “general requests, to which the application fee applied, declined by more than 50 per cent (mostly by political parties, media, and individual applicants).”

https://ifunny.co/video/my-emotional-support-dog-after-one-day-with-me-DerUV0Y8B?s=cl

IMO most of these buyers are from bigger cities where it is quite common for wealthy people to live in luxury condos (even in Vancouver, one of the Aquilini brothers live in harbour 3 green). Not many native Victorians are buying these and if they do buy them then usually there is a connection with the developer. If you are not raising a family, aren’t fixated on having SFH to boost your net worth or other financial benefits then buying and living in a SFH makes little sense.

Barrister question sounds like the questions I get from my relative when I visit them in their nursing home and they ask me the same questions multiple times.

You’ve already asked me about Custom House multiple times and I’ve answered multiple times. I get it, you hate condos and can’t phantom that someone would pay $3 million for a condo over your impeccably built 100 yr old Rockland mansion but asking me the same question over and over again is not going to change the preferences of the marketplace.

I assume that the Land Owner Transparency Registry is run by Hobbits and Elfs?

Hey HHV,

Long time lurker, first time poster here. Thank you Leo for a top notch blog that was a great reference when we were house shopping a few years ago.

I am a 33 year old industrial electrician and am happy to field questions.

I started my apprenticeship in Victoria 11 years ago doing residential/ commercial and then moved to North Eastern BC part way through and started working in the natural gas sector (industrial) where I acquired my Red Seal. I worked camp jobs here and there but for the most part was home every night (up North). I didn’t work on any mega projects like Site C or Kitimat’s LNG plant but a lot of my coworkers did. I was up there for 6 years and then moved back to be closer to family and the ocean.

It was an excellent way for my now wife and I to build our careers, pay off her student debt, and save up for a house down here.

A few things just on the few comments I’ve read:

– there were lots of guys like me from down south working in these industries to get a head start and not blowing all of our money on trucks and hard drugs.

-it’s not uncommon for electricians to switch industries, if it was then Site C would have no workers. If a career industrial electrician comes to Victoria to find residential or commercial work, he will not be making the wage of the top journeyman in that industry. After he proves himself/ learns the intricacies he will though.

-overall, the oil and gas/ camp work construction sector is a young man’s game. Generally when people get into committed relationships they would take less money to not be away 2/3 of the time. Older guys were usually a few divorces in. If guys stay in the industrial sector they usually transition to industrial maintenance after they’ve made their good money.

Fun!

Patriots , will be interesting to see which way interest rates and the economy will go with Canada and the U.S on seemingly different economic paths

But we have to follow the Fed, if not we will likely get a falling CAD which will fuel inflation, regardless of a weak local economy.

Well shite economic news is good for interest rates cuts and with the States doing well , it should drag us up

Grocers are feeling It too. Perishables are being repurposed , discounted until they reach the last bite level, donated, then finally trashed.

https://www.thestar.com/business/tip-of-the-iceberg-experts-warn-plunge-in-canadian-tire-profits-point-to-economic-storm/article_43d805b0-cc1c-11ee-8bab-b76ea78ad666.html

Listing prices just seem weird right now (they seem all over the place). Also, it seems to the same with some sales right now: where something looks like it should sell for a lot, doesn’t, and something you’d expect to linger and drop, sells for more…

I saw one of those with a co worker last summer, for the price it is very bad value.

1940 Sq/Ft SFH on a 10760 Sq/Ft lot for 190k…

https://moscowestates.com/property/very-cheap-house-near-the-forest-55-km-from-moscow/

We are obviously doing something very wrong here. Just wfh.

My dental hygienist Is from there and Is really considering moving back.

Marko, do you think the Custom House condos are moving slow and if so why? They seem to have seven of them for sale for the longest time.

Slow and steady I would say and not really seeing upward or downward price pressure.

Will this effect Canada’s action plan to lower emissions to zero on a net basis by 2050?

https://www.reuters.com/sustainability/sustainable-finance-reporting/jpmorgan-fund-arm-quits-climate-action-100-investor-group-2024-02-15/

https://www.reuters.com/markets/us/bond-manager-pimco-withdraws-climate-action-100-investor-coalition-2024-02-16/

Agreed.

Just a difference in interpretation of terms I think. ‘Ultra high wealth’ means >$30m USD to me according to the generally accepted definitions outlined here (https://en.wikipedia.org/wiki/High-net-worth_individual). Maybe it’s a US thing and not used in Canada.

I was surprised that the Scotiabank net worth mortgage applied to people with a minimum of $250k liquid assets which is much less than even the ‘high net worth individual’ definition of ~$1m). Since on average Canadians have the bulk of their net worth in real estate, this mortgage may not be useful in most cases, but it can be for small business owners with holding companies like I said.

Well it wouldn’t be feasible to have a different rent increase apply in between tenancies because that would create a stronger incentivize for landlords to try and turn rental units over than currently exists under the decontrol model. If you’re curious about how vacancy control might work, you can check out Manitoba’s swiss cheese model. It does a decent job of mitigating the negative effects of vacancy control through a patchwork of exemptions and above guideline rent increases.

Which is?

(btw, industrial camp electricians do take work on residential projects when they get tired of the shitty life camp-work offers, and if they want to create a relationship with their children.

A tidbit of information in the weekly newsletter I receive from BC Land TItle

“Effective April 1, 2024, Land Owner Transparency Registry (LOTR) search fees will be removed making it easier for law enforcement agencies, journalists and researchers to expose money laundering and hidden ownership in B.C.”

Between gambling and drugs, little is saved from workers up in the oil sands or wherever. Plus buying $100,000 trucks and other expensive toys. Easy come easy go.

Marko, what are you seeing on the ground this week? Has the demand tapered off somewhat?

Dad, I suspect that you might be confusing the 7% increase control between tenants and the regular annaul rent increases.

The forced savings during the 2 weeks at camp can be substantial if you don’t blow it all during the 1 week off.

Five years of working on the LNG should give a young person a pretty good down payment on a house.

I don’t think you can actually do this for M&E (Houle would not put a residential electrician on industrial, that would be a huge liability) but general grunts sure. I just had another look at the proformas based on actual bid contracts and looks like journeyman carpenters would be around $55 to $60/hour (apprentices would be $35sh). Industrial M&E Foreman would be around $80.

I am being told that there is a difference between Vacancy Controls were units cannot be increased between tenants (limited to annual increases) and a Vacancy Cap where the maximum increase between tenants is regulated (I have heard different names for this depending on who is speaking while being assured that a Vacancy Cap is not a Vacancy Control.) If you want to rely on what a politician has said a long time ago before the current RENTAL CRISIS go ahead but this seems to be coming up a lot in certain circles.

It does not seem like a logical response to me, and very counterproductive in the long run, but a lot of government policy makes little to no sense to me.

https://www.thebureau.news/p/bankers-verified-fake-chinese-income

I chatted to him for an hr as I find this stuff quite interesting and he was saying, for example, there is a crew from Italy working on the LNG compressors as that is quite specialized but he said a number of guys from Victoria from the dockyard, previous residential jobs, etc.

I agree, you probably aren’t getting a lifelong oilpatch electrician to upgrade your residential electrical panel in Victoria; however, due to the massive scale of these projects I do think it is easier to throw a residential electrician into a commercial application and have him or her do the same task every day for a couple of years.

Obviously not everyone is going to be okay with the working conditions and being away from home 2/3s of the year, but my point is tradespeople have substitute opportunities.

LMAO, thanks for cherry picking what is probably the most specialized trade at LNG Canada.

Like I said, you don’t decide to stop showing up on site at your 6 story stick frame apartment job here one day and then go straight to O&G for 3x the pay

Thanks for making my point.

7% is higher than the long term compound annual growth rate of rent, so in a way, the example you are proposing would be better for landlords than the current system. A 7% cap on rent increases would allow rents to keep up with the market price over the long run, without requiring the rental unit to turnover. The main impact would be that landlords would be forced to increase the rent each year by the maximum amount, or an amount that puts rent up to the market price. For tenants, this system would be worse than the current one.

Have to point out that this has a strong straw man aroma, given Eby himself has consistently opposed vacancy control.

The total net worth mortgage only counts liquid assets – ie. cash that is easy to access in a bank account, gic, mutual fund… If you own other real estate, for example, this is not considered in their criteria. You have to have one dollar of liquid assets for every dollar of mortgage that is above your income based qualification.

Good info. Thanks.

I am aware that some lenders will consider total net worth but it is not offered by every lender. Thanks for posting the link.

As I said:

Like I said, the Oil & Gas industry really messes with a worker’s expectation of worth.

—— Journeyman steamfitter at LNG Kitimat wouldn’t need to work much if any overtime to make $200k. And wouldn’t need to work anywhere near 3,000 hours. More like 2,400.

——- They work shifts of 10 hours per day (by contract, no overtime unless >10 hours), and it’s 14 on/7 off so that’s 240 days work per year x 10 hours per day = 2,400 hours.

——- To make $200k for 2,400 hours work he’d need to make $83.33 per hour.

——— Posted salaries for journeyman steamfitter is $76.27/hour (including vac. Pay) + extra pay for stat holidays. That should put him around $83.33. (Esp. If does any night shift work at premium if $6/hour) . Which means he wouldn’t need to work much if any overtime to make $200k.

——- Total compensation is $93.89/hour and as above T4 income could easily be $200k without much if any overtime.

https://ualocal170.com/lngc-kitimat-information/

Weak example as industrial & residential electricians follow two separate training paths….ever seen an O&G electrician show up on a residential job?

My “insider contact” tells me all they know how to do is hang cable trays.

Most of the M&E trades working on condos here will not be able to get a job in O&G if they wanted to (Houle electric for example has different electricians for industrial jobs vs residential jobs). Residential outside of certain niche pockets are generally the bottom of the barrel for both skilled and unskilled labour, especially true in the bigger cities.

I’m of the opinion that the Oil & Gas industry really messes with a worker’s expectation of worth and their concept of work ethic.

Hiring someone from The Patch is usually a mistake as far as productivity is concerned, and they want O&G wages even when going home to their family every night.

Majority of LNG Canada trades are different than the typical residential construction here in Victoria. Even for the same trades like M&E, there is a significant difference between those who can work on residential vs industrial. Anyways good on him for possibly working 3000 hours a year, respect that more than the lazy ppl complaining about the cost of living on their flexday.

It looks as though the Vacancy Tax doubles as a Foreign Buyers Tax outside of the specified FBT areas:

“The couple bought their detached home two years ago and live in it year-round, but because they are not Canadian citizens or permanent residents, they can not apply for an exemption from the [vacancy] tax. This is the first year the vacancy tax has applied to Ladysmith…The Becerras plan to file an appeal but have been told that because they are not permanent residents, they do not qualify for an exemption.”

https://www.cbc.ca/news/canada/british-columbia/couple-hit-with-b-c-vacancy-tax-despite-living-in-home-1.7116908

It will crash investment in building rental stock and the existing rental stock will see less maintenance and remediation causing decline in the quality and the number of the rentals available. The irony is that it would end up with more expensive rentals that are in poorer condition .

Entirely depends on the trade and the work hours. Putting in 3000 hours on a LNG site in a year and he’d only need to average just over $60/hour. That’s quite doable for some skilled trades working on-site in remote locations.

I think people also forget just how much our currency has been devalued. Sure “inflation has been low for years”, but base living costs have risen way above the official inflation rate.

We might have an official minimum wage now at 15/hour, but the real minimum is higher.

In Victoria there’s almost no job paid at such a low wage. Even students won’t take so little. Many low-medium skill jobs with maybe 6 months of training, zero university and maybe a year or 2 of experience earn around 25/hour.

What’s stopping him from getting two jobs in victoria then?

Drink is likely the most common answer.

The government is free to apply vacancy control to any building they build and operate if they think its a good idea.

The impact on renters from vacancy control would be immediately felt from mom n pop landlords as rent increases would be guaranteed every year. My tenant hasn’t seen an increase since they moved in 5 years ago and is paying much less than market rent now. I planned to adjust to market rent if they moved out because while I accepted the fact that it is cash flow negative by a lot now (my lack of foresight is not my tenants problem) but figured it would average out over the long term as the principle is paid down and adjusted rents at turnover time. Im not an investor I just wanted to secure my retirement residence before I couldn’t afford it in the future. Im sure Im not the only one.

I think it would kill new purpose built rentals. That’s what happened the last time we had them in the 1970’s.

Maybe Leo can provide a chart of real estate (SFH and condos) appreciation over the last 10 years and indicate when certain initiatives were implemented. Foreign buyers ban, stress test, spec tax, Airbnb ban, interest rate increases, etc… Rent increases could also be included. Thanks Leo.

Does anyone know whether there would be a major or minor impact if the so called Vacancy controls where passed in BC? If there was a cap of a 7% increase put on units would that have any real impact?

Recently discovered this isn’t true. As an accountant you’ll know that lots of small business owners set up a hold-co / op-co structure for investments to defer taxable personal income until later in life when you need less income (house paid off etc) and you’re in a lower personal tax bracket.

Scotiabank offer the ‘Total net worth’ mortgage which allows such people to secure a larger mortgage based on their net worth (including qualifying liquid assets in an incorporated holding company) rather than just their personal income.

Link to mortgage details: https://assets-powerstores-com.s3.amazonaws.com/data/org/17209/media/doc/5c12f3_a97cdc94a89c40aca2ef50141ad3d582-94d1c6777647df1d622645216466bc1c.pdf

Stick frame or concrete?

He has a trade and what else would you do in a camp other than pick up as much overtime as possible?

I have very recent detailed budgets from multiple contractors for an apartment building and hard costs are so high it’s difficult to pencil a project even with CMHC financing.

I call b.s. on that unless he worked a shit ton of OT. We have investments in the industrial and energy sector where I have seen detailed proforma financials and I can guarantee you the typical blue-collar grunt is no where close to 200k a year.

Prices aren’t jumping, but they certainly aren’t coming down either. Labour shortage still an ongoing issue.

I ran into a tradesperson friend today I haven’t seen in a while and he went from working on construction sites in Victoria to taking a job in Kitimat at the LNG facility. Two weeks in a camp there and one week back in Victoria. Says he just cleared $200,000 last year but recently promoted to foreman and says hopes to clear $250,000 this year.

I am guessing he would probably take a job in Victoria for $120,000-$130,000, but he isn’t going to be working in Victoria for 70k/year if construction slows down and he is forgoing over $200k/year.

With CHMC pretty much financing every apartment building in the country there isn’t going to be a huge slowdown in housing starts. What is lost in SFHs and condos will be made up by purpose built rentals.

This problem could be solved by focusing on bringing in construction workers via immigration, but such is not happening. Ottawa prefers a high level of English + university degree and that demographic of immigrant is unlikely to hit the construction sites anytime soon.

It is not just inflation that makes construction extremely expensive but a bunch of other factors as well. One of them is bureaucracy. 100 years ago when the grid was laid out in the Oaklands area, for example, a crew came out and framed the sidewalks and concrete was poured. Those 100 year old sidewalks still function. However, today you need 8 consultants and 8 reports before the concrete is poured for the exact same utility and function sidewalk. Just imagine if the tree root of a tree 20 feet away is impacted! Also, back in the day immigrants came and worked on construction sites, in logging, and other manual labor sectors. Today we import immigrants that work in-front of laptops.

Vic, no relief on custom homes and the small stuff . Going forward we will c just more red tape and building code changes and that will continue to pile on the costs

Not seeing that currently on big jobs Thurston.

Barrister , unfortunately we are far passed that time , never to comeback again . We are going to continue to see construction costs climb way past inflation . People throwing around affordability do not know what they are talking about , it’s just b. s

Wave the stupid consults and just preapprove the lots. We managed to build whole cities in the recent past without them and we could do it again. House were built in quantity after WW2. Follow the model.

Please share some factual data on costs and put an end to these philosophical discussions on how to make housing affordable.

Patrick,

LOL. Knowing your communication style, I won’t take your bait.

10k wouldn’t cover the consultants. Do you guys have any idea how much it costs to prep/service a lot these days?

Then why are you making references to what the median income family in BC can afford? These discussions are pointless, someone get back on topic with current market conditions (sales/rents), construction costs etc. please.

Wages are never a true measure of “wealth”. Inheritance and other assets are not counted. They are related to your ability to handle monthly expenses like a mortgage. An inheritance may increase your down payment by a lot, but most young people don’t inherit at the time they are looking to buy a first home.

Net worth is also not related to mortgage qualification unless you are ultra high wealth and your lender has a separate policy provision for this. Very few people, especially younger people, have median incomes and ultra high wealth so seems like it would not throw off the median at all.

In terms of affordability, the same applies as above when it comes to qualifying for a mortgage personally. It is possible to buy with retained earnings in a corporation but that also would not be something that would impact medians imo as it is both rare and not the best tax move in many cases.

How about if you wake up to find that a few homeless people have pitched a tent on the boulevard in front of your house.

Will this mean another round of warm messages and Swiss chocolates? 🙂

Something vaguely similar was happening in an Alberta county when I was living there.

Lots sold to members of the public (NOT developers) at sub market prices. Came with lots of conditions, including: (1) Lots reverted to county if no residence built within 5 years. (2) Lots could not be resold until a residence was built. (3) Lots (even with a completed residence) could not be sold for a period of time (which I don’t recall). (4) Lottery system to allocate – they were oversubscribed

Still a subsidy to the well off. But not as egregious as giving land basically for free to developers. The conditions attached were directly intended to make it difficult/unprofitable as a speculation and more attractive for people that wanted to reside there.

With a 20% downpayment, that would allow the two average workers to buy this nice small 2bdr $699k freehold SFH, built in 2010.

https://www.realtor.ca/real-estate/26470077/2954-golden-spike-pl-langford-langford-lake?view=imagelist

This is an example supporting my “homes are affordable to average incomes” narrative (that few HHVers accept).

Not indicative of wealth and throws affordability off.

You want to give a taxpayer asset worth well over a 100k to a developer and homeowner to build houses on the free market that can then be sold for a windfall profit. These would be people who can already afford to buy a townhouse but want a house and you think owning a SFH is worth the taxpayer subsidy?

Why on earth would I as a taxpayer ever vote for anyone to do this when we cannot house low income people and they are in crisis and cannot find a secure apartment for their families. If you are going to invest taxpayer money the priority would be to lease government land at low cost for social housing imo.

Ludicrous.

Totoro. there is a lot of government held land available near or close to small communities. Sell lots to developers for 10K, caveat that houses have to be built and sold to the public, no GST, no land transfer, two thousand square foot houses on 6k lots and you can definitely build for a thousand a square foot. Allow owners to expand and add to the houses as required.

There is something in the Canadian mindset that seems to always look for failure.

The average full-time worker earns 70k/year. Not sure about median.

Two average full-time workers get to 140k. This allows you to qualify for a home valued at 665k with 100k down and no other debt.

You’re assuming two full time wage earners. Keep in mind there are plenty of families that have only one wage earner – and that includes single parent families. Or one full time and one part time. Or retirees who are also included in census families.

No doubt the median income of two full time wage earner families is a good deal higher.

How so? Your personal income is your personal income for mortgage qualification purposes whether you are incorporated or unincorporated.

That’s pretty wild considering two minimum wage workers will be around ~$66k, so the median family income is only 50% above minimum wage? Self employment etc. also throw these stats off, a good example would be Marko qualifying for the full EV incentive LMAO.

The BC government already permits workers in service jobs to work in “any B.C. community where the hiring ministry has an existing office,” and flexible work arrangements and remote work are also offered.

The median family income in BC is around 99k. If you have saved 100k and have zero other debt you will qualify to buy a home worth max 500k today.

Where in BC can you buy a SFH for 500k that is in good livable condition for a family (ie. doesn’t need 100k in repairs asap)?

Existing “small cities” like Prince George and Ft. St. John. On the island possibly Port Alberni, Port McNeil, or Port Hardy, but the houses will need some work.

The list is really short and there are already jobs in these areas for remote and provincial government employees who want to relocate for cheaper housing.

Don’t see people beating down the doors now, so why would they move to some magical new small city in BC when they aren’t going to the existing ones. Your solution to offer SFHs to “young people” in these new towns doesn’t work because the houses will not be affordable there either because the houses will be new and well above 500k when add building costs to land costs – and then there is the lack of amenities and infrastructure.

Totoro, I was obviously being sarcastic about moving BC ferries headquarters to Mill Bay but upon reflection moving them out of Victoria might be sensible. Nanaimo or Sidney would help move some population and be a boast to those cities,

My point, which you seem to ignore, is that governments can do a lot to create small cities both in the way of infrastructure and economic opportunities that would draw people to other locations rather than cramming them into the same small handful of cities. The Swiss, being a practical people, seemed to have successfully managed this so there is no reason that we cant.

Yes, it happened in our neighborhood when they used an old hospital/care home as a shelter for about two years. There were lots of objections from lots of people then. Our feedback then was: “Homeless people became homeless for a reason, but most not by choice, those who were moving to our neighbourhood “have been carefully assessed and are not just off the street”. We normally can’t choose who will be our new neighbour, but we can choose to do something positive to show our respect and kindness. When we do so, the new neighbour would more likely feel welcome and want to be a good member of the neighbourhood in return. Thus helping them also helps ourselves and the neighborhood. ”

So we bought cards, wrote short warm messages on them, and brought them to the shelter with a big bag of swiss chocolate. Not sure how much they helped, but we were sure that they didn’t hurt. 😉

Thank you Arrow, that was excellent. I will pass it on.

That was one of the more extreme comments I saw on reddit. But definitely he seems to evoke some strong reactions. Seems to happen when politicians pass thei best before date.

I just reviewed my comments and there was no mention of hate.

Disagreements perhaps with recent links to credible sources.

Why so much hate?

Another Stewie supporter on reddit

A heritage-designated property is protected by a municipal heritage designation bylaw. These properties may not be altered or demolished without the approval of City Council.

By itself, listing a property on the Heritage Register does not restrict any future actions proposed by an owner. Alterations to properties on the register only need Council approval if they are protected by a heritage designation bylaw or are within a heritage conservation area.

One may request the designation for a number of reasons, including an ideal of protecting old houses (a noble cause, I suppose), or seeking a grant for restoration & repair of an old house (a deal with the devil, in that the deal can not be exited if more than 20% of the building is standing).

Reddit? These guys whine about working three jobs to make the rent. They were the founders of “don’t pay the rent”.

Huge audience of 13 posts btw, The member “Cokeinmynostrel” Is exactly what we don’t want out here.

Try this…

https://twitter.com/OurLangford

And this…

https://www.facebook.com/groups/413680104007064/

These are the residents of Langford…Not basement dwellers pissed off at the world.

Dude…We will roll out the red carpet.

He Is only 63 years old, I hope Stew Young Jr continues his old mans legacy and becomes the future mayor of Langford.

Stu Young is certainly not a fan favorite on reddit given the number of negative posts about him. Here as an example.

https://www.reddit.com/r/VictoriaBC/comments/17qyw7o/after_a_year_on_the_sidelines_stew_young/?rdt=58275

I guess voters will decide in 3 years time whether to welcome him back or not.

Update from Stew Young 4 hours ago…

https://www.goldstreamgazette.com/news/langford-mayor-and-council-concerned-with-aggressive-public-behaviour-7318196

what???

Your point? Data?

Japan doesn’t want a shrinking population. It just doesn’t want to allow immigration and the culture does not encourage children at anywhere close to replacement level.

Because a head office should be next to a remote ferry terminal unlikely to increase in use rather than services and schools that many employees wish to be near? And have you looked at the prices of SFHs in Mill Bay? One under a million right now – 950k… And you want BC Ferries to build a building there at taxpayer expense to encourage lower sfh prices?

The world is a big place and Canada happens to be a desirable immigration target for some. This number is probably going to increase over the years with climate change. We are not increasing our population with our birth rate – that is for sure.

I’m not sure what the immigration target should or should not be, but the Canadian government has published a report on why it should continue to increase. I’m in favour of requiring a reasonable plan for housing and medical services for this – in advance – as we don’t have adequate levels for our existing population.

https://www.canada.ca/en/immigration-refugees-citizenship/news/2022/11/an-immigration-plan-to-grow-the-economy.html

Does anyone know if there is a distinction between registered and designated heritage houses? Marko?

Patriotz, absolutely agree that people choose where to live because of economic and social reasons. Since Government is one of the biggest and often best employers in Canada, along with controlling tax and economic incentives such as infrastructure projects they have a lot of input as to the economic magnets of towns and cities.

Financing a battery plant in Duncan or building a Medical school and hospital in Cowichan Bay would certainly entice the development of those communities. Convincing BC ferries to move its head office to Mill Bay were there is actually a ferry would certainly have a impact to were people see their economic future.

People move to jobs as often as not and the government controls a lot of those jobs and where they are located. Put another way, how many people have moved to Victoria because of government jobs?

Incorrect. Adam Stirling CFAX 1070…

Part 1:

https://omny.fm/shows/cfax-1070/adam-stirling-hour-two-april-3-2023

Part 2:

https://omny.fm/shows/cfax-1070/adam-stirling-hour-2-november-7-2023

Part 3:

https://omny.fm/shows/cfax-1070/adam-stirling-hour-3-november-7-2023

Investment capital Is leaving…That’s why.

These guys are clearly Incompetent…Its beyond obvious.

Unless we are going to believe in magic, I think logic dictates that you cannot have infinite growth in a finite world. Whether you believe that is a few billion more people or that we are already past the carrying capacity, sooner or later population growth is going to stop whether we choose to do it or nature does it for us.

It wasn’t that long ago that a replacement birthrate was viewed as a good thing until society realized that also meant an aging population. Canada is postponing things with immigration but it is not a long term solution and, as we are now discovering, comes with its own set of disadvantages. As someone once said, “only economists believe in infinite growth.

Most of Canada wealth is actually produced by a comparatively small part of its population. Unlike Japan we do not need a shrinking population but should aim at a stable population. Our manufacturing sector production is about the same as ten years ago but with half the labour force and this has been duplicated in most of our productive areas such as energy and agriculture. Yes, the big box stores and franchises love to have cheap labour but having to pay a living wage is not going to bankrupt Home Depot or MacDonalds.

While our population is aging it also is healthier for longer. Again, we can afford a small population growth but we are not likely to experience major labour issues especially since over time we should be able to reduce the parts of our labour force that is building endless housing.

Earth to Langford, Earth to Langford……

yes your taxes are going to go up when there has been cumulative inflation of 14% (+ or -) over the last three years.

Langford…New mayor wants help from former mayor.

https://www.timescolonist.com/local-news/langford-councillor-harassed-at-home-by-disgruntled-member-of-the-public-mayor-8308455

This isn’t the USSR where the government decides where people can live or creates new cities from scratch. People live where they do for economic and social reasons, and people move to the big cities because that’s where the economic activity and social amenities are. Economic reasons include both the availability of jobs and cost of living. We have been seeing shifts of population to more affordable big cities (e.g. Edmonton and Calgary) and smaller centres, and the result has been a serious loss of affordability in some of them.

The answer is to facilitate the creation of more housing everywhere.

We have a below replacement birth rate and an aging population. Immigration accounts for almost 100% of Canada’s labour force growth, and, by 2032, it’s projected to account for 100% of Canada’s population growth. Canada’s aging population means that the worker-to-retiree ratio is expected to shift from 7 to 1 50 years ago, to 2 to 1 by 2035.

If you are going to dramatically cut immigration please let us know what the plan is for the economic and other social system impacts are as a result of dramatically lower productivity and tax revenues.

In terms of building a bunch of small cities, how are you proposing to fund this? Especially if done in conjunction with lower immigration which will lead to lower productivity and lower tax revenues. Canada has no overall plan to maintain its current infrastructure never mind develop infrastructure for a whole bunch of small cities. You can see the costing here: https://futurecitiescanada.ca/portal/resources/building-our-urban-futures-inside-canadas-infrastructure-and-real-estate-needs/

I suppose you can look to Japan to see some of the potential consequences of low immigration plus many small cities. With fewer workers paying taxes to support a growing silver population in need of pensions and healthcare services, Japan’s economy is facing a potential collapse in future and, within 8 years, the population decline will likely be irreversible. Already, there is a call for seniors to return to work or work longer because of the labour shortage and young people are extremely pessimistic about the future.

In terms of small towns in Japan, they are shrinking at a greater rate as people move to the larger cities.

To me, the math of “reducing immigration and building a bunch of new cities” does not translate to overall better quality of life for young Canadians and I don’t think it is affordable for taxpayers.

I agree with you Marko that we simply have too much bureaucracy that gets in the way. My dad built most our homes along with a couple of my uncles and I think the permits where gotten with a hand sketch done in the kitchen. When your family ends up being nine kids a few additions where really needed.

I still don’t understand why we need new small cities when we have affordable big cities like Edmonton where all the infrastructure is already in place. It takes years to build a small bridge or expand Sooke Rd a bit let alone the infrastructure for a new city. Just the environmental impact studies would take 20 years. People can’t even rebuild after a fire in BC let alone a new city. These are the types of emails I get every day

“I have recently been watching your u-tube videos on BC Housing’s Owner Builder exam. I lost my house due to the xxxxxxxx Fire that occurred the summer of 2023, (maybe you saw the footage of the ‘rare fire tornado’, well that was in front of my place at xxxxxx). Due to the remoteness of this area, there is indeed NO licensed contractor’s available…none…in fact closest it 120km’s away, and that is in xxxxxx BC. So…clearly this puts me in a place where I have to become the Home-Owner Builder if I want to ever have a House again.