January: Teetering

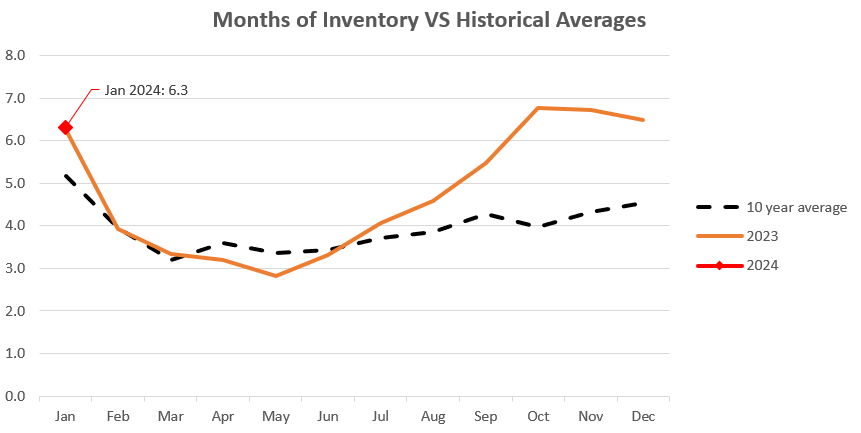

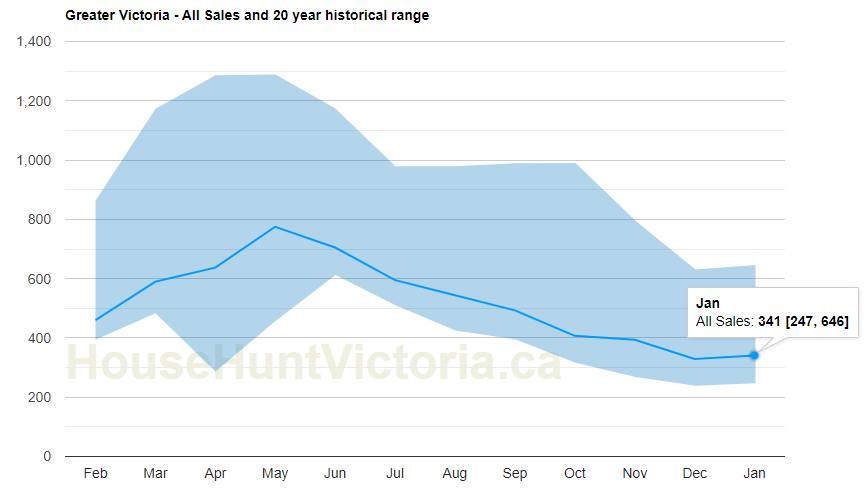

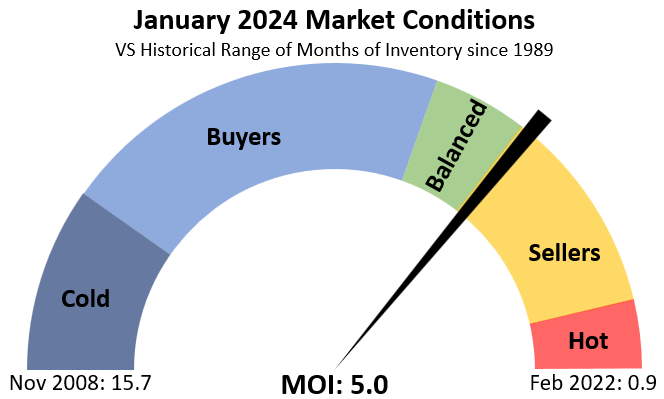

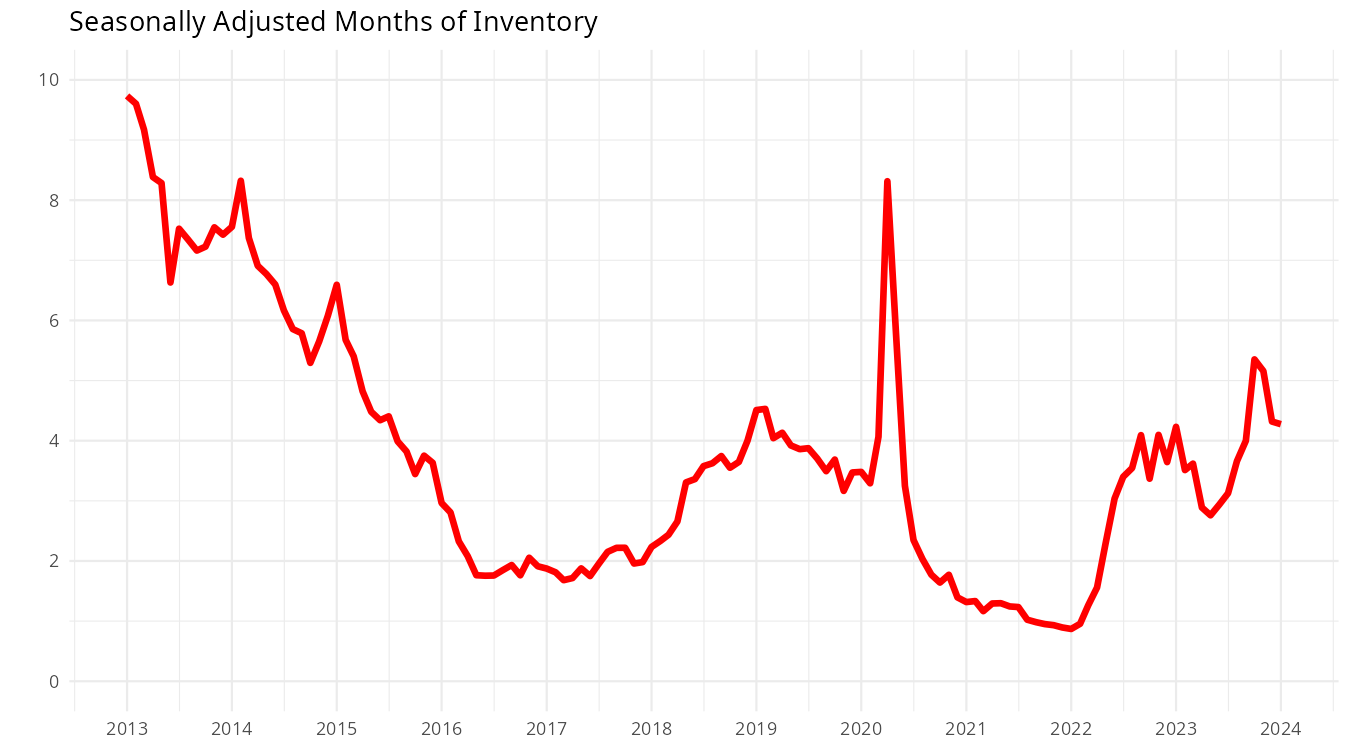

January was in some ways fairly unremarkable, with market conditions coming in essentially identical to this time a year ago. With 6.3 months of inventory (for all property types) we are in a balanced market, precisely where we were last January. However while we are perched in that roughly balanced market, this is when we saw a sharp tightening in market conditions last year, and prices experienced a bump. More importantly, it’s something that happens nearly every spring. If we look at the 10 year average for months of inventory, market conditions usually heat up substantially from the winter into the spring. In the short term, count on a sellers market and at the very least a stabilization of prices, if not increases in the coming months.

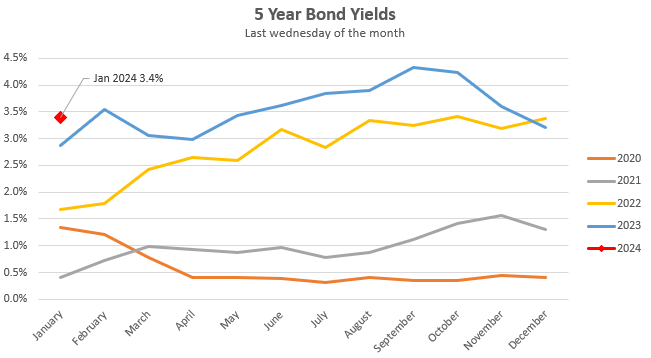

The bond market has been volatile as always, but is generally at similar levels as it was a year ago.

That means fixed rates are also pretty similar to what they were a year ago, which is down significantly from where they were in the fall. Prices are roughly unchanged, with the single family median at $1,047,450 ($1,065,000 last January) and the condo median at $540,500 ($530,000 last year). That means affordability is in a similar position: still very strained but slightly better due to income gains, which are running at about 5% per year.

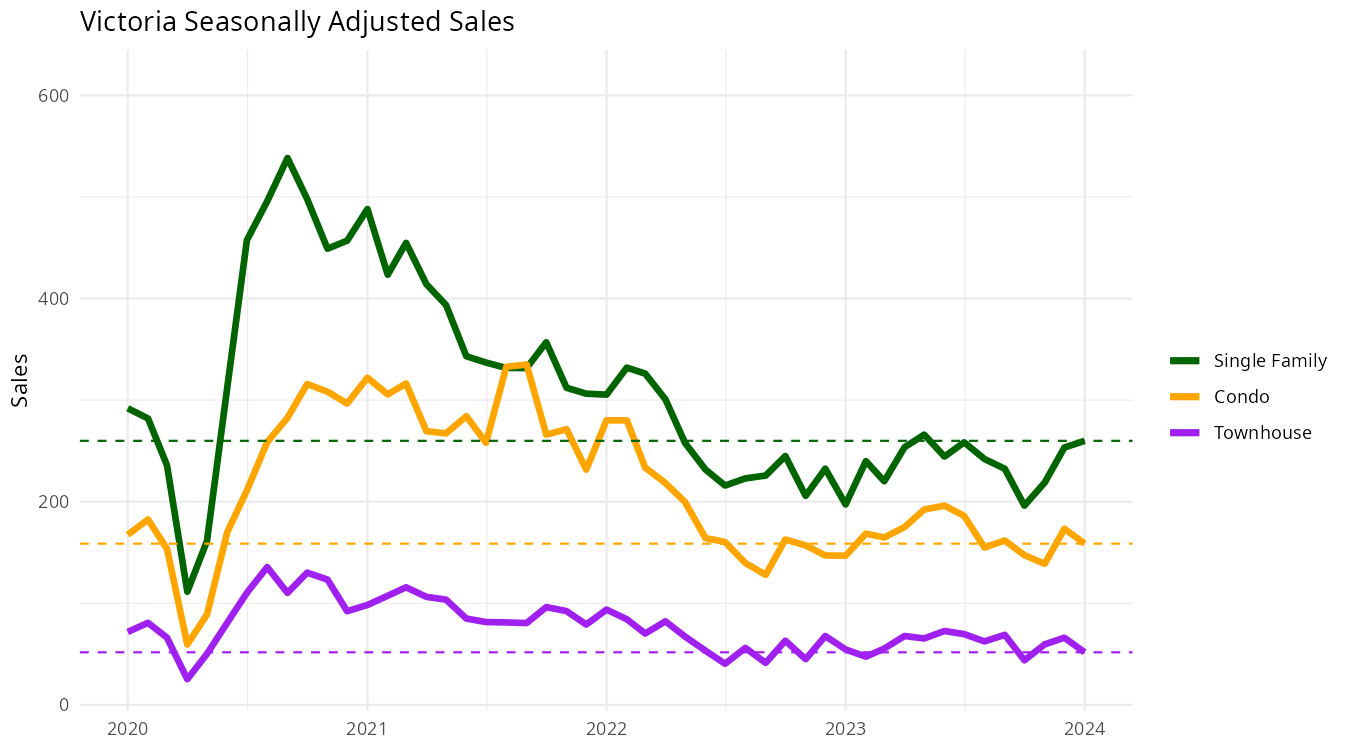

Sales are mixed, with single family strengthening somewhat in recent months, but all property types generally bouncing around at very low levels compared to what we saw in the post-covid years.

If we look at all sales, we’ve been pretty consistent since June relative to the historical range for the time of year with no huge moves up or down. I’ll have to adjust this chart in the future to remove the covid outliers to get a slightly better picture of normal activity in April and May as well.

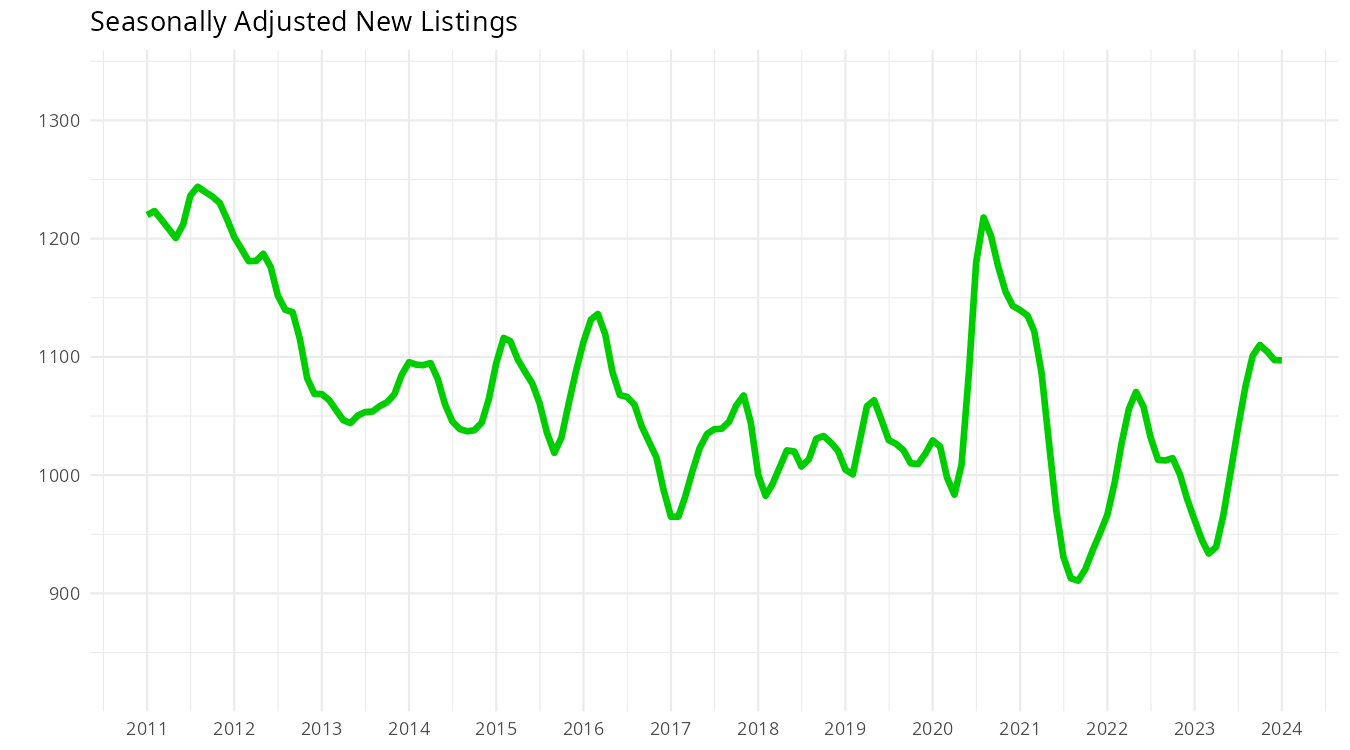

New listings are relatively healthy (higher than they’ve been for most of the past decade), but still well within normal ranges. I’ve never found new listings to correlate to much else in the market, they tend to move around more or less randomly. The reduction in mobility in recent years may explain why they’ve been generally lackluster as owners are simply moving somewhat less often than they used to. Still no evidence of many distressed sales, and though some of the steepest increases in mortgage payments are happening this year, it seems unlikely that those will lead to a lot of forced selling unless we have a spike in unemployment at the same time. Whether it’s via extended amortizations, payment flexibility, or owners getting creative with redirecting money from other areas, somehow consumers are able to absorb those higher payments for the most part.

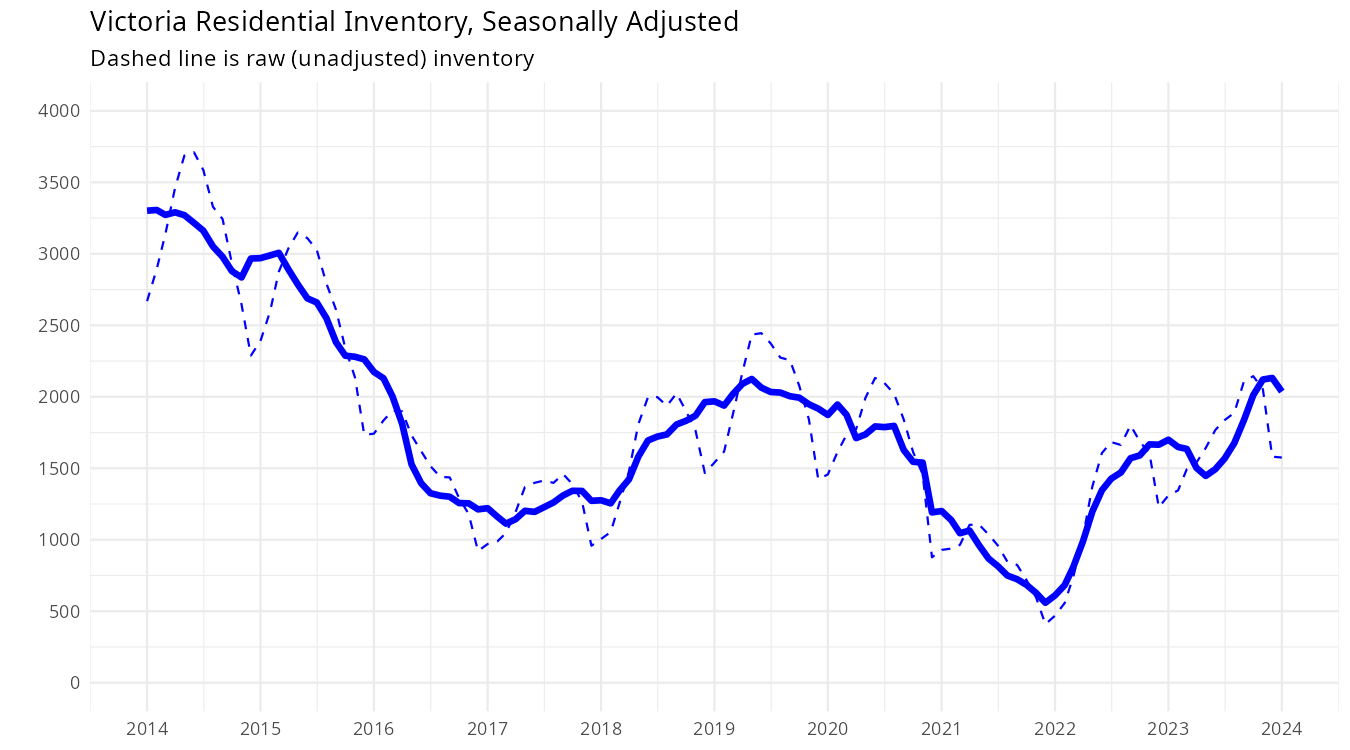

Inventory was essentially unchanged from December to January, but normally we see a bit more of an increase. It’s starting to look quite similar to this time a year ago, when we also saw inventory start to turn down on a seasonally adjusted basis.

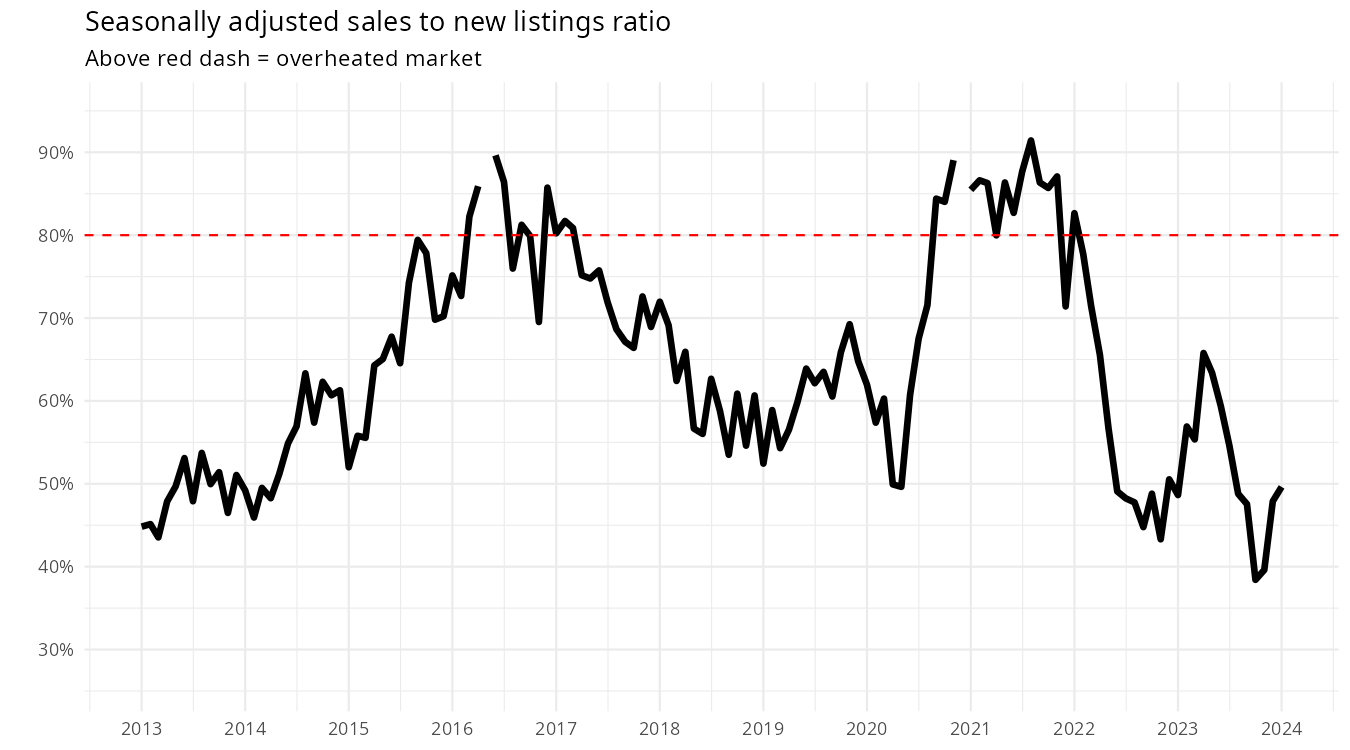

There’s two generally accepted measures of market balance: the sales to new listings ratio (SNLR), and months of inventory (MOI). Generally I prefer months of inventory as it correlates a little better with price movements and doesn’t necessarily need seasonal adjustment to be useable. However the sales to new list ratio is a little more sensitive, and tends to reflect the on-the-ground conditions a little better than months of inventory which moves more slowly. Right now the SNLR still indicates a buyers market, though improved from where we were in the fall.

Total months of inventory was 6.3 in January, down a bit from 6.5 in December and identical to a year ago. However that includes all property types, not just residential properties. Looking at just residential months of inventory, the current reading of 4.97 is actually a smidge lower than the 5.06 we had last January. That puts us just below what is traditionally called a balanced market.

And as mentioned at the top, months of inventory usually decreases going into the spring. And if we seasonally adjust this series, we see the improvement in market conditions since the fall.

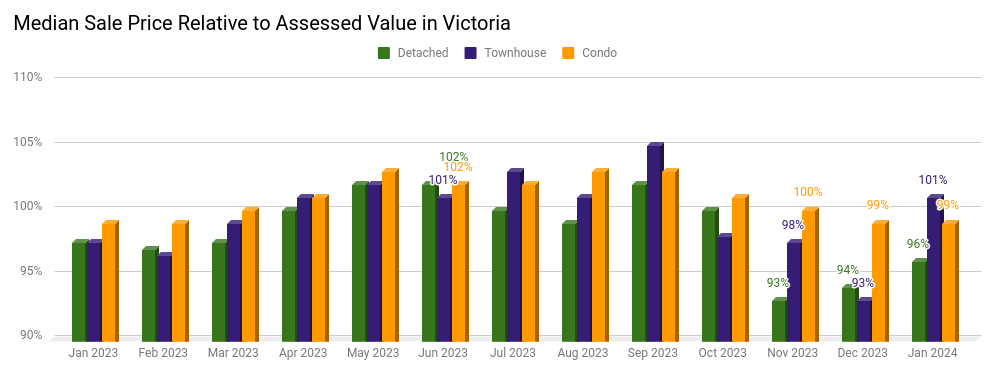

Despite volatility last year, prices went nowhere in 12 months. While the market should heat up into the spring, the 20% more inventory on the market should keep it a little cooler than a year ago. However that’s not a large buffer, and it’s too early to tell which way we’ll go this year. Note the chart below shows 3 month rolling averages.

Sales relative to assessed value are mixed. Townhouses have been all over the place, but I wouldn’t read too much into it because there’s just a few sales. It only takes a couple more sales on either side to move the median by several percent. The ratio for houses and condos is more reliable, and houses have been strengthening for a couple months now. Most properties are still selling below their assessed value, but I wouldn’t be surprised if we see these continue to move upward. That’s partially from improving quality of the sales mix (houses in better condition selling quickly in the spring) and partially due to a tightening market. Condos are roughly unchanged and are still down from where values were in the latter half of last year.

I had paid off my mortgage before these things were online, but I can tell you I simply received a renewal notice at end of term in the mail, and signed it along with the desired term going forward and mailed it back.

New post: https://househuntvictoria.ca/2024/02/12/why-more-people-paid-the-vacancy-tax-in-2023/

I think It had to do with the blending. My wife Is very tech savvy and very familiar with docusign.

I didn’t want to be there…I remember that part.

Ditto. Everything done electronically including identity verification.

My guess is that there was either an anomaly triggering extra steps in your renewal, or your wife booked an in-person appointment. Had nothing to do with any new generalized requirements and my guess is your wife booked an in person appointment.

I don’t know why. This was at coast capital Colwood corners branch. In late 2020 In the middle of the pandemic. I have been carrying this mortgage at this Institution for 20+ years. I am still married to the same woman who works for the provincial government with a very solid t-4 with pay that gets direct deposited Into the above Institution bi-weekly.

Maybe they just enjoy my company.

I never had to physically meet anybody on a new mortgage…all electronically done after negotiations including docusign. why would a renewal need in-person meetings?

My most recent renewal with Coast Capital was done over the phone.

Correct, and I knew that going In. It was a blend deal…My previous term hadn’t yet expired. I am already receiving paper mail now about blending with 22 months still left to go on my current term, 2.9% discount rate If I blend now…I am going to wait It out. This Is a credit union I’m dealing with, not one of the big five.

A 2.9% discount rate tells me the forecast In their opinion Is that rates will be trending down.

Perhaps I’m getting a little too cozy with my financial Institution, I’ve been with them since I was a kid, when we had a passport style book they would stamp for each deposit/withdrawal.

Max, the interest rate you received seems a bit high for that time, which was the low of the rate cycle where the 5 year bond rate was at aprox. 0.40% . As I remember the 5 year fixed mortage rate was as low as 1.40% at that time.

This was a 1.86% five year fix rate for a 1/2 hour of my time.

He was a loans officer…Of coarse he was.

I’ve renewed a lot of mortgages, have never had to go physically in person.

For the third time, this is an incorrect generalization.

I can say for certain that this is not my experience with a recent RBC mortgage renewal. And there have been zero credit inquiries by any lenders – I check my report monthly. A second poster has also confirmed that this was not their renewal experience with BMO.

What we can say with a degree of certainty is that the renewal requirements applied to you are as a result of either your personal factors such as a specific request for term/rates, Coast Capital specific practices, or some combination of the two.

We can also say with a degree of certainty that if you did not go in to renew your mortgage it would have atomically renewed for a one-year term if you were in good standing because:

https://www.coastcapitalsavings.com/mortgages/renewing-your-mortgage

Was the banker packing a Glock?

That would have been post covid. This was through coast capital. Our last renewal was late 2020 (In the heat of covid) when the economy was Is In limbo. We had never had to do this before either. My wife always dealt with the renewal, I never had to do anything.

I think he’s Dasmo too.

Ahh witch-hunt again I see. I am pretty sure I been more right than wrong on hhv thank you very much :). The only advice I can give you is to call Marko and start making some offers before your kids get priced out 😉

Case closed.

Market seems fairly steady to me although some of the places seem rather optimistically priced.

1017

You forgot to add the advice to, after you’ve been bearish and wrong for 5 years, change your HHV ID to a new one (from ks112 to VicREAnalyst) and pretend you’re someone new. 🙂

Zach, I think you should use this blog as a source for information and analysis you may not easily find elsewhere as it pertains to the local market (e.g. Leo’s analysis, Marko and other realtors’ boots on the ground real time observations, what other landlords/developers/appraisers/ builders/trades people are seeing etc.). Content outside of that are mostly irrelevant with zero value add and engaging with them should be done only for pure entertainment.

What was it last year?

This is so interesting, seems like most buyers are looking at the 5 CAD year bond yield. Social media at its best!

Marko, I doubt that either given there is an extra day.

I think we probably will. Average increase between end of January inventory and max inventory for the year in the past 15 was 968.

That would put us at 3108.

I just renewed six months ago. I did everything over the phone (discussing terms, negotiating rates, etc.) Did not have to sign anything, provide any documentation or go in person. The lady on the phone confirmed everything I agreed to verbally on the phone (call is recorded) and then they sent the renewal package in the mail. They didn’t even need to speak with my husband even though he’s on the mortgage/title. This is with BMO. I can’t recall the last time I went to the branch in person, as the renewal prior to this one was also over the phone. I’m sure it helps that our paycheques get auto deposited to our BMO chequing account so they can see that nothing has changed with our employment.

Looks like we won’t hit 3,000 this year yet again?

Doubt we end the month lower than last year but we will see.

Month to date activity:

Sales: 154 (down 9% over same time last year.. interesting switch there…)

New lists: 400 (up 14%)

Inventory: 2186 (up 22%)

I’m pretty sure that the vast majority of people who were truly ready to buy a home in 2018 already bought during the large improvement in affordability that occurred when interest rates dropped in 2020. That’s what bid up the housing prices after all.

Patrick, I think with your obsession on this topic (and obvious attempts to stoke fear of another speculative market boom) you’re now the official HHV mascot for FOMO and house market speculation boosterism.

You remind me of Dasmo. Please take no offence to the comment…I liked Dasmo.

Throwing shit at Patrick Is counter productive.

Just as much as all the shit that rolls off my tongue would be considered counter productive by many.

Life’s a tough gig.

Who actually makes any sense on this blog?

Leo brings this all together for us.

Can we all collectively agree on that?

You need to get a life, go call marko and put an offer on a house for your kids

In 2024 time…Even If you have a million dollars In an account with the financial Institution you have been using for 20+ years…They still want a soft scrape of your credit score, T-4, two pieces of picture Identification, In person Interview… Just for renewing a mortgage balance of $183k On an asset valued at 1,093,000.

I could move that million dollars tomorrow…And they know that.

I’ve never had to do anything to renew any of the mortgages I’ve had. Happens automatically in fact if you don’t contact them first.

Not on the Island…Too much old money on the Island.

I know guys that buy property and let the house go absolutely derelict. Now I don’t know how that makes any finical sense…They seem to.

Black berry bushes thriving Inside the house… People have deep pockets here and don’t give a shit about a house with black berry bushes thriving Inside the house.

Acreages In North Saanich. Christmas trees, juniper…Whatever It takes for farm status.

I bought In 1998…Timing the market Is a fools game.

Well I don’t want to embarrass any HHvers that didn’t buy in 2018 and are still here waiting. So let me instead point out one person who did buy. I recall it being around 2018, and this fellow’s name was “LocalFool”. We had endless HHV debates, where he showed off an encyclopedic knowledge of economist opinions and latest YouTube “heroes’” videos, all of which were telling him prices were absurdly high, and the crash is around the corner. He was thrilled when we named him “king of the bears”.

Anyway, he shocked the board by announcing one day in 2018-19 that he’d found an underpriced SFH and bought. And good for him, a wise move indeed, and I don’t think he’s looked back since.

This Is precisely why the financial Institutions make you physically come In for the mortgage renewal.

The loans officer checks you out…Your age, T-4, physical ability, credit score, doesn’t hurt to have the wife there as well.

My wife and I had to each bring two pieces of picture Identification…For a renewal.

Actually I messed up that calculation as it’s not counting the 23k in interest earned on the 100k downpayment (50% in RRSP, 50% taxable account taxed at 32% marginal rate, invested in cash.to at 5%). So actually the property needs to gain 170k gain or 17-18% over 5 years, but hey now we’re just splitting hairs.

I’ll point out again Patrick: all of us who had the money for a downpayment before the peak in prices and rise in rates already did so. The rest of us are just waiting for the right time. But prices don’t rise 30% every 2-3 years, that’s just not how market economics work.

I’m not planning on waiting another 5 years from today, personally. But I’m also not going to buy a temporary place today just because of FOMO.

We’re less than 2 years from the peak and I’m pretty sure I’ve got 1-2 years more before another speculative frenzy is going to start. And, it wouldn’t surprise me that if Trudeau gets the boot and immigration rates crash to 2015 levels then believe me that we might see the opposite: a cold market for a decade.

I bought in Victoria in 1994, likely within hours of the housing peak. I wasn’t aware of that until decades later looking at stats. The point being, the day after you buy your home, you forget about home prices, as (unfortunately) there are lots of other things to worry about in life.

There is only ever the deal of the day. We don’t know the future, only a best guess based on past performance.

If you can afford to buy and won’t be forced to sell within 7-10 years you are probably at extremely low risk of not coming far ahead of renting. Even if future appreciation is less than the past (I think it has been 7% averaged per year not adjusted for inflation?) you will likely outpace inflation – leverage is on your side.

What you want to avoid at all costs is having to sell in a down market. Divorce, addiction, job loss, and disability can happen. Divorce and addiction can be hard to control for. If there is a risk be very careful about buying. Job loss you can move short-term and rent the place out. Disability you can insure against.

Zach, I’m sure you’ll make the best choice you can but be careful of analysis paralysis. Many people have held out for the big crash that never came and time keeps passing as you and your family age.

The best thing about houses is that they are not stocks and you can live in them and they have a market rental value and if it is your primary residence any gain is tax free.

What would be Ideal. Scrap the capital gains exception on the sale of the house. Make Interest payments towards the mortgage principle on the primary residence 100% tax deductible. This would encourage mortgage pay down. Once the principle on the mortgage Is paid down to a certain level …They could Invest that equity Into a tax sheltered account (RRSP, TFSA, FHSA). This would stimulate everything.

How many years have you already waited with this strategy? That’s a relevant question, because some people have a “forever waiting” strategy, where they are waiting for conditions that never come.

For example. I’ve had this exact debate in 2019 with HHVers that are in this same conversation now. They were waiting then, with a similar argument to yours, and are still here waiting. I won’t mention their names, they know who they are.

Some have even changed their ID’s in a (failed) attempt to wipe the slate clean. And they know “whom” they are 🙂

Maybe we’ll hear from one of these HHvers, about what’s it’s been like paying 5 more years of rent and watching prices move up 30%+ and mortgage rates move up more than that. Has it been worth the wait? Do you wish you’d “held your nose, and bought” 5 years ago?

And to be clear on my position: I wouldn’t advise anyone who can afford to buy a home to rent for 25 years when you could escape the risks of being a forever renter. I actually think that over 25 years buying is almost always better than renting.

The main disagreement here is about the medium term. Patrick has argued that people should “get on the housing ladder” asap. But that’s flawed to my mind. The housing ladder concept is overused and really only applies if you’re looking to stay in a home for at least 5 years, preferably 10, before upsizing.

Let me give you an example a little closer to my own as I can give more exact numbers. I’m higher income than Patrick’s example person who’s just barely getting the oldest, most run down townhome in the entire city at 500k.

Let’s say I could ditch my rent today for a temporary place I could buy, and maybe I could get it for 950k. It wouldn’t be as good as my current rental, but that’s something I can find on the market nearby. But the place I really want costs 1.5-1.6 million. I’ve got 100k in downpayment money available, and it will take me 5 years to save the additional 200k to buy the 1.5 million dollar home.

Should I “get on the housing ladder now” or keep saving?

My monthly payment with CMHC insurance is $5,249 and I’ll be paying 3,700 per month in non-recoverable mortgage costs, + $400 monthly taxes and $400 monthly maintenance fees or $4,500 in non-recoverable costs per month. That amount will drop by $75 per month each year until the end of year 5 at which time my non-recoverable costs will be 4,050 per month.

I could also keep renting at $3,500 per month. It’s a nicer place and I also won’t have to pay the moving costs. It would cost be 1-2 days of labour and at least $2k to pack up and move all of my stuff, or 5-6k if I hire out the entire process. Plus 17k land transfer tax plus 31,500 in realtor fees (technically the seller pays, so you’ll actually pay this when you sell, which is going to be higher than when you buy).

So when I sell this place in 5 years, I need to recoup at least 55k in property transfer expenses plus 500-1000 per month in non-recoverable costs over my rent, plus I lose FHSA, let’s say that 2 people, 8k per year at 32% tax or 5k per year / $425 per month in tax reduction over that 5 years.

Compound that out at 5% and you’ve got around $91k after 5 years + 55k more money for your downpayment.

To beat this you need to see your home price rise by at least 16% over those 5 years.

This is a bet on a rising housing market. Sure, during the covid boom, you’d have seen a 35% price increase in your home over 5 years. That said, from the last housing market peak in summer 2016, it took a full 5 years until summer 2021 to see any price appreciation whatsoever in homes.

A lot of people made bank if they timed things right and others got screwed if they didn’t.

I think it’s fair to say that on timelines of <5 years, there's a benefit to waiting on a downpayment for the house that you want, and not jumping into the housing ladder at the the first opportunity to cash in one the "housing ladder".

Its not supposed to be a return…Its supposed to be a family home. You have to live somewhere anyway.

It was the best thing I ever did…Its a tangible asset that I can leverage If I want. Its solid, Its real, and Its mine.

I tend to agree that in the long run it’s always better to buy than to rent.

Where I think the buy over rent argument goes wrong is to assume that in short periods of major stress on new home buyers that it’s always better to buy.

This is often biased as well by the recent history of falling interest rates and double digit house price returns in this province.

Generally overpriced markets see worse future expected returns, not better returns.

Renting for 25 years would suck. You would probably end up divorced, losing half of that accumulated wealth. And your kids would think you were a loser. You want to be young when you buy your first house…Happy Wife happy life, kids are playing In the back yard with the dog…Before you know It…Its paid off. And that time goes by very fast.

The “Ignorance Is bliss” approach Is by far easier In this upside down world where nothing makes any sense anymore anyway.

https://financialpost.com/real-estate/housing-market-headed-another-soft-patch-desjardins

Peter , agree I bought my first home cause I wanted a house , never really cared if it made financial sense or not . I just like to own my shite

have to agree with Patrick on this one. While that rent vs. buy calculation is right so far as it goes, these cold equations almost never seem to work out in real life. In real life, over 25 long years, (a) sorry, but most people will not have the discipline to save & invest scrupulously as one might think they could, (b) the calculation kind of ignores the real-life impact of leverage, which probably translates into the “$500k house” being even more than the $1 million in 25 years, and (c) the calculation completely ignores the real-life sacrifices that come with being a renter over the course of the best years of your life & that of your family.

It’s the only calculation that matters to you. What about your spouse and kids? Chances are they have different variables in the calculation. And they can outvote you 🙂

Lets take the amount that you suggested someone should be forced to save: Ie 50% of 3300 is 1650.

Over 25 years, that 500k mortgage can be paid off through 12*25 equal payments of 1650 per month.

Let’s take that amount and invest it instead of using it to pay down principal.

Set aside 1650 monthly and invest in a tax sheltered account (RRSP, TFSA, FHSA). (Everyone employed has at least this much room in their tax sheltered accounts monthly.)

Compounded at 6% (ie less than simply buying the S and p 500 and holding) after 25 years you have $1.1 million.

Does someone need to be a “saavy investor” to achieve this? Hardly this is finance 101.

The real question is whether buying the home actually gives more cash flow for investment purposes than renting and what is the expected rate of return on each asset class over time. That’s the only calculation that matters.

There’s lots of reasons I’m on HHV.

pretty sure you said the only reason you are on HHV is because you are trying to help your kids look for a house. Regardless, if that is your view then isn’t the best time to buy yesterday? Why not give Marko a call this afternoon, negotiate a $5K cash back on the purchase commission and go buy something?

There is recent progress.

So why haven’t you gotten your kids houses yet after all these years posting on HHV?

Not sure how many people actually stay in the same house for 25 years….

Nice work.

And what did it tell you about your rent vs buy decision?

Who cares if “disciplined, clever” renters could be a little better off financially than homeowners..

Here’s what awaits “dumb” homeowners……

—— In 25 years, the $500k home is likely worth $1 million, and the owner owes nothing . There is a name for people like that … millionaire.

—— In addition, they have enjoyed providing a stable home environment for their family for 25 years.

—— Where their kids grow up in the same neighbourhood, not at risk of eviction where they unexpectedly scramble to move somewhere else and switch schools.

I wrote a JSFiddle a few weeks back, to try to help me make the rent vs buy decision.

Might be useful to others: Rent vs buy

Note:

* best viewed on Chrome, on a screen bigger than your phone

* you may need to click “Run this fiddle” to run it

* it’s a work in progress

* calculations are approximate

* it only indicates the equity you would acquire by investing the difference between owning expenses and renting expenses

* don’t make a house purchase / rent / investment decision based solely on the results!

* feedback welcome

quite interesting as this price is essentially the same as a partially renoed house in the mt doug area.

Forced savings concept is only applicable if prices don’t go down, cashflow is always king.

Was there ever a more condescending term than “forced savings”? As if homeowners / renters wouldn’t have the discipline to save in the appropriate tax-sheltered vehicles, if house prices / rents weren’t making it so difficult / impossible.

This topic has been beaten to death over and over again. Right now, on a cashflow basis the delta between renting a SFH and buying that same SFH is about $2.5k to $3k a month using a fixed 5 year mortgage. People should do the math themselves and see what is best for them and their family. Forced savings is a great concept if you want to forego enjoyment and financial flexibility in your younger years in order to potentially capitalize on it when you are older.

I think you’re missing my point. “Forced savings” is not the same as “the proportion of principal paid over 25 years of a mortgage”.

These aren’t even close to the same concept. The forced savings in year 1 are about 20% of 3300, with non recoverable costs of 3300*80% + maintenance + taxes.

Those forced savings will continue to underperform what a renter could easily save for at least half the lifetime of that mortgage.

If you think “forcing” savings is important, ignoring the vast differential in opportunity cost over the initial 10-15 years of the mortgage, then perhaps this is a good thing.

But I’ll tell you that the absolute amount of interest that first time buyers new to pay right now is obscene and in no way does the paltry forced savings that one can achieve on a tiny apartment or aging townhome at 500k mortgage at 6.3% counterbalance the loss of other investible income that one forgoes over that first decade.

Perhaps in a few years with lower prices or lower rates the trade off will be better.

Peter- Using taxes to create affordable housing is a pipe dream. The government is incompetent on all levels. Waiting for them to fix a problem they created is a waste of time and money. What we need is less government, especially one led by someone who didn’t grow up in fairy land.

Ukedude, in fairness to Max, your statement above in a Langford tax discussion made it sound like you were on Langford council, not Tofino. Noone knows where “on council here” is if you don’t say so. Thanks for clarifying it.

Maybe I’m the only one, but I don’t think this is a bad idea. What I like about it is that instead of demonizing the mom & pop landlord, it recognizes that the housing crisis is a societal problem and the costs should be shared across society, ie. through our progressive tax system. (Or using tax revenues to create housing, or whatever, just not all landing on some poor slob trying to eke out a retirement by renting out something)

Of course, but no one said differently,

If you re-read my statement, you’ll see clearly I am referring to 50% forced savings over 25 years of the mortgage

this is what I said…

Patrick: “ That would allow to borrow $500k for $3,300/month. (Half of that $3,300 is forced savings over the 25 years, compared to rent payments which have no forced savings ).”

That 50% forced savings is easy to calculate, 25 years x 12 payments = 300 payments x $3,300 = $990k to pay off $500k principal so $490k interest which is ~50% principal pay down of $990k total payment.

If you’re insisting on big “forced savings” in year 1, you likely have that as well if you consider inflation as forced savings. Because (on the $500k home) if the house value rises by 3% inflation, that’s $15k more equity you have , added to the $10k forced savings from the mortgage in year 1. That’s $25k equity you have at the end of year 1 after paying $40k mortgage payments, which is MORE than 50% forced savings in year 1.

If you’re like some of the HHV bears here, I expect you reject some/all these ideas about considering mortgage payments and inflation as forced savings, and of course you’re free to do that. Someone who isn’t rejecting the “forced savings” idea is your landlord. You are paying off his mortgage, inflation is his friend (and will raise your rent) and there is absolutely no forced savings for you going on for the rental payments you make.

A feckin’ townhome! On feckin’ Shelbourne! Once again, Victoria flips the bird at “missing middle”.

I don’t think there’s much chance of the People’s Party winning.

I do think that temporary residents are going to be cut regardless of who wins. It would have the least blowback from the immigrant communities which all major parties are courting, and you can already see it happening. But permanent residents much less likely.

I agree that the stress test is redundant for 10 year fixed mortgages and could be safely eliminated.

However, I disagree with the above statement you made about “forced saving” compared to renting. About 80% of that hypothetical mortgage payment you describe goes to interest (not half), with only 20% as forced saving. And there are further non-recoverable costs that you ignore including maintenance and property taxes.

The principal payment won’t make up “half” of the overall mortgage payment until 12 years in, which is after the original term of the 10 year fixed mortgage that you describe.

I was talking with a Toronto banker who said that they are doing some interesting modelling of the real estate model in case there is a change of Federal government that results in much lower immigration numbers moving forward. I found it a rather interesting conversation with nuanced impacts over multiply parts of the economy.

Lock-off suites (a “suite within a suite”) aren’t new, but may become more popular for rental income including str/airbnb (if allowed in the building)

https://vancouversun.com/business/real-estate/metro-vancouver-developers-lock-off-suites

Too much time, not enough reading comprehension.

Well, some valid reasoning for it summed up in this YouTube clip…

https://youtu.be/4JbEDvtqAqg?feature=shared

I have absolutely nothing In life to be bitter about. I can’t even think of one thing to be bitter about right now.

Now this Is a communication network…correct? I’m pretty sure this blog was created for people to communicate. Its Saturday, okay people have time on their hands on Saturdays. So I would suggest you just turn that frown upside down…Get out there and enjoy the day.

Now just look at that quote of yours up there. If anything, you were trolling me for a reply.

This Is a discussion forum…People discuss things.

With that said, what exactly did you add to the discussion to justify your negative/hateful comment towards me?

Having a debate with a council member who Is destroying the community In which I reside Is not trolling.

Sales history of a 2014 townhome on Shelbourne

Feb-2024 $1,144,000

Jun-2021 $970,000

Sep-2019 $830,000

Nov-2017 $789,000

Aug-2014 $579,000+GST

I took a break from this site and came back to see Max is still trolling hard. Think he has too much time on his hands, sounding increasingly bitter/hostile

“As a general rule, it is considered undesirable to build over cemeteries. It’s considered disrespectful to the dead and any still-living relatives they might have. Also, superstitions about cemeteries are such that many wouldn’t want to live or work in a building that they knew was built over a cemetery”.

https://canada.constructconnect.com/dcn/news/others/2020/10/you-built-it-on-a-cemetery-where-you-build-is-just-as-important-as-what-youre-building

As long as your nice and move them upstairs…You should be good to go. The commercial retail space at street level alone would make It very lucrative. In fact I think It would actually be a better way to view the dead…Take the elevator up, look at the nice shiny coffin that probably cost $25k , say what ever It Is you need to say. You can come back anytime to view It. Humans and pets.

I think Its a better way to handle It. Its better than looking at the expensive ground that could be repurposed for better land use.

Hoping to raise the quality of the recent comment stream, I offer this gem of NIMBY reasoning:

“A Surrey, B.C., city councillor says she is opposed to plans to turn a local pet cemetery into a housing development.”

(Unlike human cemeteries, pet cemeteries are not regulated, which means a developer could remove the headstones and use the property for whatever purpose it is zoned for.)

ukeedude, I’m sorry.

Threats? Nonsense.

“A statement of an intention to inflict pain, injury, damage, or other hostile action on someone”.

https://www.merriam-webster.com/dictionary/threat

Well that Is very obvious.

I am not Stew but anyway Im out of here. Its gone way off topic and the threats are concerning.

“I serve Ucluelet and Tofino… All over the world from Abu Dhabi to Las Vegas”.

I don’t even know where Langford is to be honest

Not really

The position Is already filled (Stew Young)…Why don’t you just resign? You know your days are numbered anyway.

So you have no Interest In Langford other than your pay cheque?

in all seriousness though the best way to make change is to run for the position. It’s a thankless job but has its moments.

No I do not. But fun fact you do not need to live in the city you are a councillor for.

Do you even live In Langford? You don’t seem like a very good fit.

no

Are you suggesting you are above the average person?

Ok perfectly average person

That’s discriminatory…

“making or showing an unjust or prejudicial distinction between different categories of people”.

https://www.merriam-webster.com/dictionary/discriminatory

LOL. Ok big guy

Start looking for a new job.

The peanut gallery has spoken

Okay, you guys are doing a tremendous job…Everyone Is just thrilled by these tax Increases, keep up the good work.

You can not complain about inadequate snow removal and complain about tax increases in the same day lol

Let them go bk…Don’t keep spoon feeding them…They will figure It out.

Im not sure what you are talking about and neither are you. Run for council you will see for yourself. FYI I never said I was on Langford council

Hoping someday Langford drops YMCA and they turn it into a more broad based rec centre for families. Unless you’re a member, it is far more expensive for a drop in swim than places like Juan De Fuca rec centre. I don’t know much about the funding model or how much Langford is involved but it’d be great to see a change there eventually. I’ve heard good things of the spot like childcare for an hour while you workout so maybe we’re missing out not being members but anyway

You guys had to hire security guards to remedy any push back. Outstanding work on the snow removal this year by the way.

The sands of time for this mayor and his council are running low. They don’t stand a chance for re election.

From experience people complain more about a lack of services and potholes than their property tax bill.

I don’t think $279 property tax increase is going to phase anyone. I am on council here and we get little to no pushback on tax increases of this size. We have to balance the budget by law and there is virtually no “nice to haves” in the budgets. Infrastructure costs and new legislation on everything from housing to fire protection services, disaster mitigation, and insurance requirements are setting the floor on the tax burden. Not raising taxes today means raising them exponentially more tomorrow.

Embrace Investment Into the community …Don’t scare It away.

not really sure how people expect property taxes to stay the same with inflation the way it was the past couple of years…..

This guy Is so done.

Are you a landlord?

A lot of home owners never do sell… The games rigged.

Langford expected to increase property taxes by 11.79%

https://www.timescolonist.com/local-news/langford-expected-to-increase-property-taxes-by-1179-8286574

Major film studio envisioned for Mill Bay

https://www.timescolonist.com/local-news/malahat-nation-production-company-announce-plans-for-film-studios-8286403

Lake Cowichan residents win $10.5M in assessment reductions after appeals

https://www.timescolonist.com/local-news/lake-cowichan-residents-win-105m-in-assessment-reductions-after-appeals-8286400

Again, this preposterous idea that eliminating rentals will fix the housing crisis. Here’s something that might help renters. Since homeowners eventually get a tax break when they sell, why not set standard rent levels, for example $1000 per month for a one bedroom apartment, anything over that is tax deductible. The level would vary from region to region. This could be implemented immediately and make rents more affordable.

I agree with Max. I also think you tax gains on rental properties as income rather than capital gains as investors compete with first time home buyers for low priced properties with suites.

He’s obviously looking for a solution. Best solution I can come up with Is… scrap the capital gains exemption on the sale of the principle residence, scrap cmhc Insurance, scrap the stress test. Make Interest on mortgages 100% tax deductible for primary residence.

As It Is right now… A homeowner can sell and walk away with 100% tax free cash. Why not pull that forward for these young people? cmhc Insurance Is a joke, the stress test Is a joke…All designed to protect the financial Institutions. The financial Institution already owns the asset as collateral… Wtf does It need cmhc Insurance for? Or the stress test?

Just like Bell media…Shit Is going to start to change…Rapidly.

We will witness the long term rentals die…Along side the short term rentals.

What’s the point of this post?

Scientists say new glowing plants could replace artificial yard lighting…

https://www.homesandgardens.com/gardens/glowing-plants

Thanks!!!

Nope, OSFI only makes some of the decisions. . OSFI controls the stress test rules for non-insured mortgages, but the federal government determines the stress test rules for insured mortgages.

That’s why the feds were able to recently announce changes to the stress test for insured mortgages as described here…

https://nationalpost.com/news/canada-mortgage-stress-test

“One of the proposals would see homeowners with an insured mortgage up for renewal not have to requalify at the minimum qualifying rate — colloquially called the stress test — if they’re switching lenders at the end of their term.

Ottawa is proposing to introduce a Canadian Mortgage Charter that will set expectations for how lenders interact with homeowners throughout the mortgage process.”

—-=====

If your theory that the stress test is only to preserve the health of financial institutions, why would the feds be introducing these new changes in a “Canadian mortgage charter” specifically to give rights to homeowners to be able to AVOID the stress test on renewal.

The replacement cost of the home Is the value of the home (plus the land) and they are very expensive to replace…I don’t think that will ever change. Blame the material suppliers. My house was built In 1981 for probably around $50k for 2600 sq/ft just for the build. Today Its 2600 x $200 = $520k (If you were to manage It yourself…No general contractor) plus the land equals the value for a well maintained home.

In a nutshell. In 1981, It would have been 50k for the build, 50k for the lot, And the builder would be lucky to make 15k profit…Live In It for a year for the capital gains exemption. My Father did this, we moved all the time.

Thankfully it’s OFSI making the decision on the stress test with a mandate that has nothing to with housing and is only concerned with the stability and viability of financial institutions. It’s not the inability to take on more debt that is preventing Canadians from buying homes, it’s the price of the homes.

Government should eliminate the stress test for 10 year fixed rate / 25 year mortgages. This would help the “first home out of reach” problem, which is the biggest part of the housing crisis.

The stress test is a big part of the problem that is making homes out of reach for Canadians. For example, a few times on HHV, I’ve provided examples of homes for sale that are affordable, and then a HHVer replies saying that yes they could afford that, but couldn’t qualify because of the stress test.

Stress test qualification rate is 2% above the 5 year rate.

There is a simple solution to this.

1. The stress test shouldn’t apply to 10 year mortgage term

2. Interest Rate of 10 year mortgages could be lowered by about 0.3% if government removed the law that allows borrower to refinance a 10 year after 5 years. With this change, that would put a 10 year rate at about 1% higher than a 5 year rate. This is much lower than the 2% stress test.

Someone with a ten year mortgage doesn’t need to pass a stress test, because they are already being income tested to qualify for the 10 year mortgage rate, which is fixed. And after ten years, they’ll have the same mortgage payment, but have a lower mortgage outstanding, and higher income from inflation so no problem with renewal.

A current 10 year is about 6.3%. That would allow to borrow $500k for $3,300/month. (Half of that $3,300 is forced savings over the 25 years, compared to rent payments which have no forced savings )

1.599

Current US 30 year mortgage rate is just under 7%, down from almost 8% last Oct. this is one of the reasons why US home sales have been so slow.

BoC expected to take its time with interest rate cuts after January’s job gain

https://ca.finance.yahoo.com/news/statistics-canada-release-january-jobs-090000504.html

Guess what – you can get a 25 year term mortgage in Canada right now. But few people are willing to pay the premium to get a 10 year term, never mind 25 years.

The US has a low premium for 30 year terms because the federal agencies (Fannie Mae etc.) buy the mortgages. I’m not sure how wise it would be for our federal government to take on the added risk, we know what happened in the US in 2008.

Scroll down and click on “Fixed Mortgage Rates”

https://www.rbcroyalbank.com/mortgages/mortgage-rates.html#posted-rates

What one should consider is developing 30 year terms like they have here in the US. One of the grandkids has a thirty year term at about 3%. He is not exactly sweating the interest rate hikes.

What a surprise. Going to a 30 year amortization would simply result in higher prices since buyers could get a larger mortgage with the same monthly payment.

Homebuilders group pushing for 30-year mortgages to boost construction in Canada

https://www.timescolonist.com/the-mix/homebuilders-group-pushing-for-30-year-mortgages-to-boost-construction-in-canada-8277376

Economic climate ‘extremely challenging,’ rental-project developers say

https://www.timescolonist.com/business/economic-climate-extremely-challenging-rental-project-developers-say-8281052

Insider contacts tells me that all tenders received recently for institutional jobs in town have come in below estimate with competitive bidding from multiple GCs. These are reno jobs with significant M&E components.

“It’s not unheard of for copper plumbing in favourable conditions to last even longer than 70 years”.

As Dad mentioned Its thicker walled, and acidic water Is not a problem here…Its the king of water lines.

https://www.squareone.ca/resource-centres/getting-to-know-your-home/guide-copper-pipes-plumbing

“The average lifespan of Poly B pipes is between 15 and 25 years”.

https://yourguydrainage.ca/what-is-poly-b-plumbing/

“PEX pipes are known to last up to 25 years under warranty permit”.

https://proskillservices.com/hvac-plumbing-heating-blog/2023/01/05/how-long-do-pex-pipes-last/

I’ve heard that in areas with acidic water, it can shorten the lifespan, but that’s not a problem here. Not something I would worry about, and 60 year old copper will be the thicker wall type.

Never had a problem with copper , not used much anymore . It’s all poly now , cheaper and faster . I trust copper more

I was at my brother’s last week and he was doing a bathroom remodel and replacing the copper pipe. I was surprised but he said the life expectancy of copper can be low considering the age of the house. Just wondering what people’s take is on copper? We live in a 1960’s and I was thinking our copper was a good thing and would outlast us. Do people worry about 60+ year old copper pipe? It would be a gonghsow replacing it in our place.

Any particular reason we don’t use tidal turbines to generate electricity for the Island?

Carbon fiber is chemically stable, corrosion-resistant, and won’t rust. That’s why it works well in harsh environments.

https://www.innovativecomposite.com/what-is-carbon-fiber/

There are cages that can be constructed to protect the ocean/wild life. Noise to marine life is minimal.

https://www.comsol.com/blogs/designing-tidal-turbines-that-are-safe-for-marine-life/

It’s has to be less harmful environmentally than a hydroelectric dam.

“Water is hundreds of times denser than air, which makes tidal energy more powerful than wind. It is more efficient than wind or solar energy due to its relative density and produces no greenhouse gases or other waste, making it an attractive renewable energy source to pursue”.

https://www.pnnl.gov/explainer-articles/tidal-energy

“The early history of tidal energy dates back centuries, beginning in the 7th century with the use of tide mills to primarily grind grain”.

https://impactful.ninja/the-history-of-tidal-energy/

Interesting I would rate Humboldt valley at a min. on par compared to vic west and definitely better than Chinatown area.

Holy shit…Thanks for that. I knew they made mistakes with Site C…I didn’t know It was that bad.

Max

https://www.theglobeandmail.com/amp/canada/article-after-year-of-record-breaking-imports-bc-hydro-rolls-out-new-spending/

They say imports of about 10000 GWh. That’s actually about two Site C dam. They don’t get specific on amounts from the US vs amounts from Alberta. Lots of other stories on this too.

A cryptocurrency mining company has lost a bid to force BC Hydro to provide the vast amounts of power needed for its operations…would have consumed 2.5 million megawatt-hours of electricity each year (enough to power and heat more than 570,000 apartments).

Just out of curiosity…Did anyone watch the Tucker Interview tonight?

If you don’t know who Tucker Is …Disregard.

I think you are very wrong.

Speaking with a neighbor who moved up to Nanaimo in November and rented his house out to a nice couple with good references, paid the first month rent and deposit. And then never paid rent again. They were evicted last month and he has spent the last two weeks cleaning and repairing damages. If you have new tenants and they have two new model Mercedes that are black and white -beware.

Anyway, he loves Nanaimo and isn’t coming back as he dislikes the politics, higher living costs and traffic in Victoria. He will be putting his Victoria home up for sale in the next two months. In his words he is done with Victoria.

Link? I would just like to know where we are Importing from. Thx

Fact Check: We just came off a year where we imported more power than Site C will generate in a year.

Most aren’t. There’s no need to “convince the provincial Government to move more jobs out of Victoria “. They are convinced. They aren’t moving current employees because that would just be a waste of money paying relocation, but new hires for most positions can be anywhere in the province.

Everyone should do their homework when buying real estate.

Check everything. Do not count on the listing agent or even the seller knowing.

It’s that simple.

In case folks missed it…

https://financialpost.com/real-estate/mortgages/mortgage-rates/spillover-effect-u-s-economy-could-lift-canadian-mortgage-rates

First, everyone protests the construction of Site C. Then everyone freaks out about EV demand and grids collapsing, and now we have unsellable excess power 🙂

This is where I point out, as I have before, that the demand for the electricity that Site C will produce isn’t there. Like the article says, it’s being used to power LNG ambitions. Another hope was to sell it wholesale to Washington and if I recall correctly, they’ve said they don’t have a need for it either. The story worldwide is that despite population increases, electricity demand has been flat. It’s only developing countries that have a need for expansion.

Interesting claim Patriotz, something I will have to think about. My first thought was that houses and condos are not equivalent substitutes as houses have a higher barrier of entry such as the down payment and PPT; and condos are typically marketed to first time buyers. An apples to apples comparison would be to compare similar prospective purchasers. I’ve not yet seen a study that has considered the effect of SFH versus condos in months of inventory. They are generally considered distinct markets from each other.

This is already (sort of) happening. Many positions are no longer geographically restricted to Victoria.

1970’s actually, thus the infamous “Ford to City, Drop Dead” headline.

Simple. If condos are selling slowly but SFH are selling quickly in both areas, Langford will have the lower MOI on the ratio alone.

Sometimes it seems like everybody assumes that all the jobs are in the City of Victoria. I suspect that a lot of people live and work in the West Shore. Now if we could convince the provincial Government to move more jobs out of Victoria that would certainly take a lot of pressure off.

My opinion, is that Langford and Colwood are no longer bedroom communities they have grown to a population that has a vibrant commercial, industrial, and business base separate from Victoria. It is no longer necessary to travel into Victoria, except for those that are still chained to a government work space. The big box stores now draw people that live in Victoria to spend their money in the Westshore.

The doughnut effect is nothing new it just has a new name. The pendulum swing of moving in and out of downtown areas has happened many times in the past as people left the downtown areas and moved to the suburbs. For the last few decades the population in rural area BC has been declining as people moved to the cities for better jobs and opportunities. Covid and remote working may have caused the pendulum to swing back to the suburbs and other remote areas. Whether people are moving to Langford, or Courtney the effect on the downtown core is the same.

The economics behind this is geospatial. Property values are not uniformly concentric circles emanating from the down town core but are effected by roads and perhaps now by remote work.

New York City was on the verge of bankruptcy in the 1980’s as people left the city due to crime and congestion.

(Thank-you Patriotz, the 1970’s.)

The doughnut effect has been a thing since the 1960’s (or the donut effect if you are American). Pre-Covid there was a reverse doughnut effect where money and people were coming back into Canadian downtowns. Since Covid and the rise of remote work the doughnut effect is definitely back in action.

But I think it is an open question which communities will benefit most from remote work. Is it going to be traditional bedroom communities like Langford or smaller cities like Courtenay/Comox.

Patriotz, you would have to explain to me why you think the ratio of SFH to Condos is relevant?

But Langford would have much bigger proportion of SFH versus condos in the inventory wouldn’t it? Are you comparing apples and apples?

In January the downtown core had 8.2 months of inventory with 20 sales while Langford had 4.0 MOI with 17 sales. It’s difficult to read into this data what is the cause, although in the USA the economists are referencing the doughnut effect on downtown centers.

To live in Langford and work distantly may be appealing to more people.

Pre-regulation value likely around $400k so a ~14% STR premium.

Parksville & Sidney are at the top of Canada’s grey ladder:

“Parksville, B.C., where older people make up just over 46 per cent of the population, has the country’s highest concentration of residents 65 or older…In second-place Sidney, 43 per cent of residents are 65 or older, also 14 per cent of its residents are at least 80, the highest proportion in the country ”

Parksville city councillor Sylvia Martin said younger retired people are drawn to the Vancouver Island community because of its mild weather, outdoor activities and beautiful surroundings. But when they get really old, they move back to be closer to where they’re from, for family support and more accessible health care….”

https://biv.com/article/2024/02/canada-now-has-more-100-urban-centres-where-least-quarter-population-65-or-older

Some good value in Humboldt Valley as well, imo, -> https://www.realtor.ca/real-estate/26485912/704-788-humboldt-st-victoria-downtown?view=imagelist

Keep in mind that a wood-framed 2 bed on Orono Ave (in Langford) sold yesterday for $639,000. The spread between a wood-framed in Langford and concrete downtown Victoria is becoming non-existent.

In Vancouver. There is no province-wide ban…yet.

It Is housing related, everyone else Is talking about EV’s…It plugs Into the house…That you might want to buy.

You can actually supply electricity Into the house with this electric car…In case the power ever goes out.

https://aerreva.com/

Made me smile Barrister 🙂

Totoro, you just did a housing question, are you sure you are on the right site?

Would anyone know what 2724 Thompson Ave sold for? TIA

Cut over all consumption? So exporting our LNG Is good when we are going to need even more energy consumption protocols In place? By 2025, all new and replacement heating and hot water systems must be zero emissions. Well Isn’t that a coincidence.

https://www.cbc.ca/news/science/bans-fossil-fuel-heating-homes-1.6327113

Lol…

https://aerreva.com/

Ahhhh… the return of Site C as an HHV discussion item.

There’s is no such thing as a free lunch and no energy source free of any impacts. Unless and until we cut overall consumption we are going to need more energy. The beauty of hydro is that it is instantly dispatchable (can be turned on and off in seconds) and highly storable. Basically the perfect energy source to have in the mix to offset intermittent renewables like solar and wind.

As far as big hydro goes you can’t get much lower impact than Site C as a lot of the downstream impacts on the Peace Athabasca delta already happened when the WAC Bennett dam was built.

University of Victoria…

https://www.timescolonist.com/local-news/uvic-student-wants-university-to-allow-living-in-vans-on-campus-7678345

not sure you need to be competitive in a the current rental market. People are sleeping in vans. Maybe in the far off utopian future where renters have EVs and and a vacancy rate of 3%+. Make no mistake Im hoping this is true. My strata did a poll of owners to see if we wanted to have charger ready outlets installed in every spot. the estimate came in at $4k per stall and it was voted down. I voted in favour but that is dumbocracy for you.

The explosion has been mainly in the second tier universities (UCW, UFV, VIU, etc.) and community colleges like Camosun.

All of this to export our LNG…

“The publicly funded Site C dam on B.C.’s Peace River will help power the province’s new LNG export industry. The dam will flood 128 kilometres of the Peace River and its tributaries, destroying some of Canada’s best agricultural land, habitat for more than 100 at-risk species, Indigenous burial sites and traditional hunting, trapping and fishing grounds. Aug. 30, 2023.

Photo: BC Hydro”.

https://thenarwhal.ca/bc-hydro-site-c-data-error/

Until everyone has one, and everyone has a heatpump…And the demand for electricity Is so high with the supply of electricity too low to handle It…Well yeah.

120 is a painfully slow and expensive way to charge a car , like dribbling gas into a tank at the service station . Even with a 100 amp panel u most likely have a spot for a double breaker even if your maxing out , just charge on the off hours when the load is down

Keep in mind a lot of cars offer a nema 5-20 adapter which can increase charging speed just enough to make a 120v outlet work.

But BC has more international students per capita than Ontario. Appears to me that private colleges account for a lot of that. And get a load of this for-profit “university”.

https://www.ucanwest.ca

New renters across the street from me own two EVs and just charge them with Level 1 (120V) chargers. Essentially two hefty extension cords. One to a car in their driveway. One across the sidewalk to a car in the street. Don’t think it is ideal, but they make it work. I think they can occasionally charge at work too.

All that talk about international student explosion, and UVic says their international student enrollment is expected to be 11%, the lowest level in 10 years. More budget cuts as a result this year.

Data shows the explosion was mostly in Ontario universities and colleges.

I don’t think the 120v outlet is going to work for all tenants but it might for some. Over time I think almost everyone is going to have a charger installed.

I like the idea of having a hook-up installed and tenants installing their own chargers and taking them with them when they go.

Does a 120v outlet and an extension cord count?

So really it’s not all of downtown, seems to be a specific pocket. How’s humboldt valley holding up?

Going to have to provide ev charging for rental properties soon to be competitive.

If you charge your car at home it costs between $2-4 per 100km you drive and you can do it while you sleep. For public charging you’ll likely pay twice as much and you have to wait around for access as ev adoption increases plus waiting out the charging time. And public charging is not well regulated currently making it annoying and inconsistent.

https://www.cbc.ca/news/business/electric-car-charging-network-canada-marketplace-1.7094656

Foreign trained doctors (IMG) living in Canada are an obvious and huge potential source to help with the family doctor shortage.

The government should be pouring more money into training for unlicensed foreign doctors (IMG) in Canada so they can be licensed and practice as Family Doctors here. There are thousands of them, they pass all of the Canadian exams, but there are minimal training spots for them so they can’t get licensed and practice. The training setup would be foreign doctors working family practice clinics under supervision, so this would immediately help with the family doctor shortage. The BC government only has small numbers of training spots under their existing IMG program https://www2.gov.bc.ca/gov/content/health/practitioner-professional-resources/physician-compensation/return-service-programs/pgme-img-program

BC spec tax also doesn’t apply on treaty/reserve land.

UBC student commutes from Calgary — cheaper than paying Vancouver rent

https://bc.ctvnews.ca/ubc-student-commutes-from-calgary-cheaper-than-paying-vancouver-rent-1.6759116

Legato is 6 years old, Yates on Yates is 4 years old, it’s not a huge difference. Yates on Yates even has A/C whereas Dockside doesn’t. The vast bulk of the factor is the location.

That one is brand new though

Do you have a gas pump there now?

The $349,000 Janion microloft has sold this morning for $344,000 ($1,158 per square foot); the first sale in the building since the STR legislation announcement. All the housing problems are solved.

2019 sale of same unit – $307,500

2017 sale of same unit – $321,000

Also, another sale in Vic West this morning of a one bedroom at $612,000 for 611 sq/ft or $1,002 per foot. For not too much more ($650kish) you can buy a two bed two bath downtown. The discrepancy right now is just insane.

1994 woodframed on Topaz listed for 600k goes for 609k in multiples. Everyone avoiding downtown.

It applies. Reserves are under federal jurisdiction and some provincial jurisdiction applies if not occupied by FN or Federal laws.

Yes, but the ownership is of a lease not the lands itself. Lease terms are frequently 99 years and have similar value as off-Reserve lands of the same quality. As the lease term ticks down below 50 years the valuation is affected.

https://pub-victoria.escribemeetings.com/Meeting.aspx?Id=350f9c65-6f3e-4dc3-bc43-fa3f881b35d9&Agenda=Merged&lang=English

Go to G1 of the presentation and download Attachment D and E, interesting!

I had a tour of a brand new townhome rental project in Sooke a few months ago and the developer did a really clever cheap setup. The townhomes have surface parking so he ran a conduit from the electrical panel of each unit to metal black powder coated posts he had fabricated that are bolted in-front of the parking spots for each townhome.

When a tenant shows up with an EV they install their own charger of their choice and secure it to this metal post and the usage is billed directly to their meter. When they leave they take their charger with them.

Kind of brilliant as the landlord doesn’t have to maintain/worry about the charger itself.

He finished another rental project in Sooke a couple of years ago and he said with turnover of tenants more and more asking for charging so he knew he had to setup every unit for charging with this new project.

Are non first nations people able to own STR properties on first nations land?

So when my tenants move out and the new tenants own an EV, will they expect me to install a charger for them? Any examples of this happening?

Hows the private sector job stats for BC. How much growth?

At whose expense: where would those surgeons, nurses, and anesthesiologists come from, and who would care for their current wait list patients?

“B.C.’s Short-Term Rental Accommodation Act does not apply to reserve land or treaty land”

Can we dream of another headline? “The Canada Health Act does not apply to reserve land or treaty land”

Overnight we would have direct and prompt access to CATs, MRIs, ENTs, ophthalmologists, hip replacements, knee replacements….. And a beleaguered and under-engaged native population would reap the rewards.

Works for me.

Maybe an unpopular opinion. I think we have seen the bottom in terms of prices as of now. Just because inflation is lower, does not mean prices are going to come down in response – they just aren’t going to continue their climb (or at least not as quickly – e.g. runaway inflation which is what the BoC was scared of). As for whether the market moves back into sellers territory – I think it may for a bit, but whether that continues will depend on when and the magnitude of rate cuts. However, I do not see prices falling further for Victoria / Saanich. Maybe Langford.

Most big companies will avoid layoffs and will be happy to just break-even and keep all their workforce intact. Not sure about the mom and pops though

That’s awesome! I am guessing chances for the First Nation opt in are low? Hope they can capitalize on this to increase their profits.

Where there is a will (and a need), there is a way:

Investors flock to First Nation land as Kelowna home, condo values slump

B.C.’s Short-Term Rental Accommodation Act does not apply to reserve land or treaty land unless a First Nation chooses to opt in through an agreement with the province

“When these restrictions came out it was actually a blessing for us. It made the development that much more desirable, especially from an investor standpoint” said Westrich Bay sales manager Cole Killeen. “Even for the people who bought this as a vacation home, they have that option that they can rent it out now.”

https://biv.com/article/2024/02/investors-flock-first-nation-land-kelowna-home-condo-values-slump

In a slow down , company’s don’t really let anyone go . It’s the trades people that leave for greener pasture because they are not getting in enough days .

Things haven’t slowed down that much thought….still substandard non-capable tradespeople that are busy.

If things do slow down further yes there might come a day where your construction company might lay you off if you show up hungover to work everyday. If you show up ready to work and know your trade doubt you’ll be unemployed in my lifetime.

Just look at the stats Leo posted a few days ago….the % of workerforce in administration in Victoria went from 11 to 16% in last 10 years.

More and more people flipping paper and less and less swinging hammers. I think trades will be an awesome career opportunity for many going forward. Doubt robots will be replacing hot water tanks anytime soon.

So only the ones you know that’s busy are capable? That’s a little rich….

It’s becoming less of a thing lately as most developers are now just automatically roughing in each spot with power so there is nothing to ask for. The apartment building I am working on level two in each spot and also a plug for each bicycle storage spot.

I did give my clients some really poor advice regarding EV charging upgrades in the last 10 years and now some of them including myself are getting burned, explained in this video -> https://youtu.be/QTcaFtOycys?si=6e1ebBEMpch-WRfj

Live and learn, another experience to notch so I can give people better advice in the future.

Right now more than half my buyers are showing up to showings in EVs. Yesterday I was at an inspection in Gordon Head, clients drive an electric Kona. Today I am doing showing with a couple from Vancouver, electric Ioniq5.

Pretty much any house after 1990 has a 200 amp panel. Problem solved. A lot of houses pre 1990 have already had their service upgraded for other reasons (suite, hottub, heatpump, etc.). If you really need an upgrade I would say 5k for new panel + service (as long as overhead). If underground that sucks, add costs for trenching. Then add another 1k for wiring to the charger depending on where the panel is.

Thing is 200 amp service upgrade increases the value of the home if you have to do it.

As for availability of electricians that is the one trade I’ve never had an issue getting a hold off so I am sure you could organize that within a month.

On a side note, a ton of people can also level 1 charge no problem without any upgrades.

Marko- What are your pre-sale buyers offered for parking/charging stations? What are they asking for? Thank you for providing actual information instead of the mindless speculation one has to plow through.

Spoke to a woman about her brand new Bronco and asked her if she considered an EV. Her main deterrent was the expense of upgrading her panel and installation of the charger. Any idea of the upfront cost and how quickly that can be done given the availability of electricians. Thanks.

Odd that builders are sitting on vacant lots if trades are readily available. You would think that pre-sales my clients are buying wouldn’t be delayed within more availability of trades. Right now I have multiple pre-sale buyers in Royal Bay, two in the Westhills, etc., and it is all moving slowly and I don’t think lack of materials is a major issue anymore.

I am getting quotes for my apartment building and everything coming in so far is at peak construction cost pricing.

I have a friend that owns a custom exterior door company and I thought he would be struggling but they are at full production capacity.

I call South Island Mechanical to service heat pumps in my rental condos and it’s like a month wait for an appointment.

Today I was at an inspection in Gordon Head and the inspector, a smart guy with contacts in construction, was complaining about how slow his personal basement suite project is taking due to trades. He was hoping to have it rented out for Jan 1st and now it has been pushed back to April 1st.

One of my tenants does drywall repairs/painting and he is booked solid a month out, I had to ask for a favor for him to come fix up a condo at night I am listing next week.

Problem is there is an absolute shortage of trades; therefore, when things slow down there is still plenty of work for people that are capable. It’s the non-capable ones that are sidelined. Yes, the person wearing a toolbelt calling themselves a “carpenter” is SOL. A true carpenter that doesn’t have to think twice about how to frame an eyebrow dormer….doubt they will be struggling to find work anytime soon.

This reminds me of HHV 15 years ago when many hoped building lots/teardowns in Oak Bay would fall to 350k and tradespeople would be begging for work and they would be able to build for another 350k construction cost or 700k all in financed by their middle manager jobs at the BC Government. A truly skilled tradesperson is not coming to work at your home for $30/hr anytime soon.

A handshake deal Is more bad than a promissory note. I watched the second half as well, he reminds me of garth turner.

Here’s a great summary of what’s happenning to real estate prices across the country including Victoria. Watch the second half for the performance of each major city across Canada, truly shocking especially Ontario where prices are down 22 -30% from the pandemic high. Victoria shows up at only down 16% from the high. Author of video predicting more pain in 2024.

https://www.youtube.com/watch?v=HTLGsM4NvKI

I am seeing weakness across the board too. This month and next will cement the trend and then it will be fact rather than opinion.

Not as frequent as you’d think? It’s Edmonton. Winter is 50% of the year. Having spent a few years in Calgary (a warmer, southerly city with chinooks to boot), I can confidently tell you that winter in Alberta lasts from October to the end of April. And it is cold. My wife spent a few years and Edmonton and quite consistently assured me it’s colder.

Anyways, we’re agreed that you’d need a strong economic incentive, or family incentive, to move from Victoria to Edmonton.

Oh yes, pictures or video!

3965 Bow Road, asking 975, went for 997

He’s too busy firing ministers.

https://www.timescolonist.com/local-news/jewish-community-offended-hurt-by-robinsons-removal-from-bc-cabinet-advocate-8218228

That youtube link that you posted was all you and had nothing to do with me.

I’m not looking for any trouble here.

If Oak Bay can not make its housing targets but Langford can surpass theirs then an increase Oak Bay property taxes could be used by Langford to increase housing.

Oak Bay resident’s property taxes spent in Langford. Similar to a carbon tax.

Should I send an email to Eby?

He will put the brakes on.

Pretty big chunk of property…Fair swack of ocean front property as well.

” Money can’t buy you happiness, but it can buy you a yacht big enough to pull up right alongside it. ”

-David Lee Roth.

https://youtu.be/eich-EN4gdQ?si=ZrLusOCooFJKRwxG

These guys…

https://vancouverisland.ctvnews.ca/massive-superyacht-with-helicopter-pad-docks-in-victoria-1.6419450

Possibly but don’t get your hopes up for Stewie cutting your taxes even if he does get back in. The model of artificially low taxes based on brand new infrastructure paid for by new developments only lasts so long. I’d look for Langford to have some more above average tax increases. It’s a story that has played out elsewhere before.

The luxury market for homes in Oak Bay in the top 5 percentile of sales during 2023 started at 4.2 million. While a luxury Oak Bay condo sold to the top 5 percent of buyers would start at $2,500,000. Both of these type of properties would be and are described as luxury.

It’s hard to make an apples to apples comparison using price as your only measure of luxury given that prices are constantly changing and the term luxury isn’t defined. There are uber rich people that have no interest in Oak Bay waterfront and prefer a hi-rise condo with a panoramic view.

Before we can measure luxury – we first have to define luxury without introducing personal bias. I chose to define luxury as the top five percent of buyers. Is that right? Maybe, maybe not. But by doing so, I can now measure one year against another year.

Patrick, didn’t you say your children cant get into the market?

Based on your long term outlook did you happen to pick up a rental or two in the last 20 years?

I guess if we look out at the long term based on birth rates we may face the same fate of several european countries whos populations and real estate prices are falling such as in Italy where average prices are down over 30% since 2008 (adjusing for inflation). Obviously not if the Liberals stay in power but immigration numbers will be interested when the Conservatives get back into power.

Nope. Never been working in RE or a related field directly or indirectly. I’ve just been long term bullish on RE from a buy and hold perspective.

Pat, well you cherry picked one year number using the bottom of the market in late 2022, so a larger perspective is needed. Prices are also down around 5% from last summer. You certainly sound like someone who works in real estate.

I think inflation will stick around and prices will be flat to down this year. I am hearing that the lower end of the market is active below 1 to 1.2MM and higher end is still weak. When you adjust for inflation prices are down around 20% in Toronto and 15% in Vancouver and Victoria over the last 18 – 24 months. So I think prices may rise over the next few years but only keeping up with inflation.

I agree with you that Its always good to have a positive attitude. Good for you!

I’m not about to comment on one month “average” prices. I’ve stated my bullish prediction for 2024 Victoria , and I’ve been bullish for a long time.

How about you Bobby? Where do you think SFH prices are headed in Victoria?

Numbers of ultra-wealthy people in Canada are rising faster than the supply of luxury SFH that they want to buy. And recent trends have been favouring SFH over condos for ultra-wealthy to purchase.

This is just a variation of saying “the rich are getting richer”, and assuming that you believe that, realize that they will have a lot of wealth in the primary residence. There’s a close to fixed number of oceanfront houses in Victoria, and there are lots more rich ROCers moving here each year.

Patrick, to put Vancouver house prices in perspectives, prices were down sharply in Jan and average price now back to mid 2021 levels.

Property taxes reflect rent. There are a lot more residential owners and business owners. Scott and his council are done.

Are you looking to buy or sell In the luxury market?

People who rent dont really care about taxes. Lots of Langford renters.

Tough to measure the luxury market by using price alone as prices are always changing. What one could buy in 2022 for 4 million isn’t necessarily what one could buy in 2023.

Disagree, people don’t like property tax Increases. Scott and his council have already sealed their fate.

https://househuntvictoria.ca/2024/02/03/january-teetering/#comment-111468

Maybe your builder friends are the problem 😉

https://househuntvictoria.ca/2024/02/03/january-teetering/#comment-111468

I can assure you they are not!

Yes, sales numbers over $10m are always going to be small numbers. 20 in 2023. ( vs.15 in 2022)

Other bullish SFH numbers from Vancouver 2023

Vancouver Detached homes benchmark prices up 7.7% YOY (benchmark now $1,964k) That’s a rise of $141k in 2023 for benchmark Vancouver house

vancouver Sales luxury homes (over $4m) up by 8% (328 sales)

——==

– Calgary luxury sales (over $4m) up 50% in 2023

Max , ya doesn’t seem too bad , but I havnt lived in Van since 2010 yikes

Patrick, I see that a 40% increase in homes sold over 10MM is 4 or 5 more homes sold in 2023 then in 2022. This sounds like an exagerated headline from a real estate press release.

This one 😉