The market impact of lifting rental restrictions

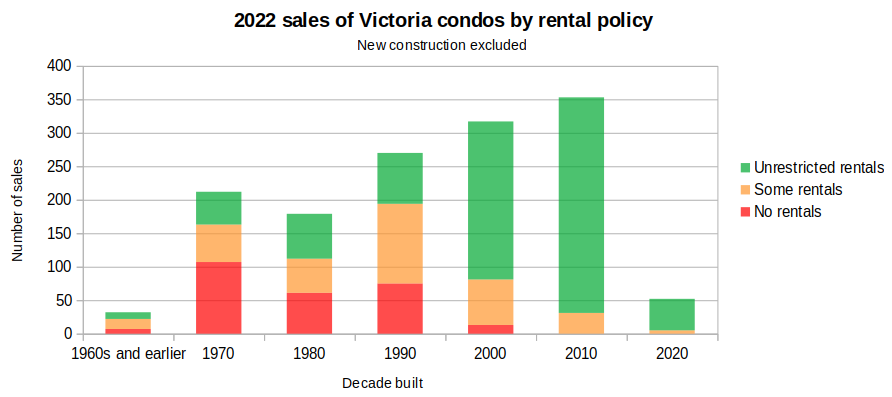

Last week we discussed the changes coming from the first part of Eby’s new housing platform. One of the biggest immediate changes was the removal of the ability of strata councils to restrict owners renting out their units. As a fraction of sales, about 2 in 10 condos sold prohibit all rentals, another 2 have limits on how many units can be rented, while the remaining 6 have no restrictions on rentals. What happens when all rental restrictions become unenforceable overnight? Let’s take a look.

First we have to acknowledge that we don’t actually have data on the condo stock by rental policy, so we don’t know exactly how many condos there are with restrictions in Victoria. The province says there are 300,000 condos with rental restrictions BC-wide. As a proxy we can use sales data from this year to see what kinds of condos typically have rental restrictions.

It’s clear that there are two eras in condos built in Victoria: before the 2000s when full or partial rental restrictions were common, and after 2000 when they were rare.

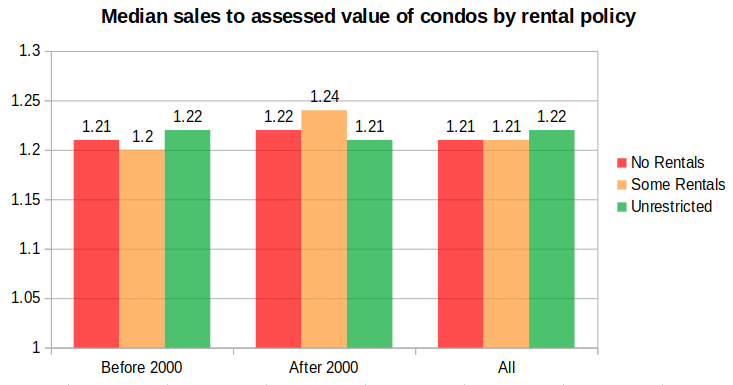

If we looked at sales price relative to assessed value, there is actually no substantial difference by rental policy. There are two possible reasons for this:

- Rental policy does not influence value which seems unlikely OR

- BC Assessment is taking into account rental policy when valuing condos.

By median prices there are differences. This year condos without rental restrictions sold for $35,000 more than those that banned rentals ($585,000 VS $550,000). However we already know that the average rental-restricted condo is older than the average unrestricted condo so we’re not comparing apples and oranges. Older condos are also larger than newer ones and those with rental restrictions are the largest of all.

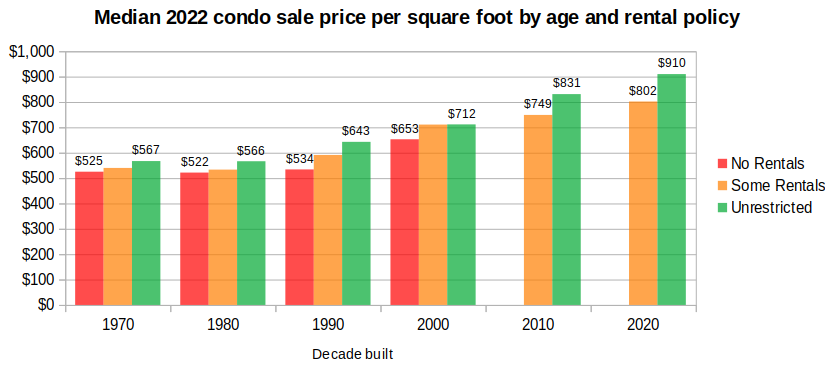

To correct for the differences in size, we can compare prices by area and age.

Prices per square foot for condos without rental restrictions are consistently higher than those with restrictions. On average, unrestricted condos sold for 11% higher per square foot than those that banned rentals. The premium was stronger for 1 bed condos, which sold for an average of 19% higher without restrictions, compared to only a 9% premium for 2 bed condos. This makes sense given smaller condos generally yield better rental returns and would attract more investors. Now that rental restrictions are history, we should expect this differential to disappear and prices to meet somewhere in the middle.

In conclusion then, what impacts are we likely to see from this provincial change?

- Investors will be spread across the entire condo stock. That should reduce the concentration of rentals in newer buildings and increase it in older ones.

- More older rentals will enter the rental pool. Just like older condos are cheaper than newer ones, older rentals are cheaper than newer ones as well.

- More larger rentals will enter the rental pool. Not only were older condos larger, but the condos that were previously rental restricted tended to be larger than average.

- Previously rental restricted condos will have increased price pressure. In other words prices will rise relative to the counterfactual if no changes had been made. By how much? That will depend on whether the investment case makes sense for any given condo, but given an overall premium of around 10% for unrestricted condos, we might expect an average bump on the order of half that (5%). Some will see a bigger increase (likely the smallest units) while others will not be affected at all if there is no investment case for it.

- Previously unrestricted rentals will have reduced price pressure. As investors are spread over more condos there will be fewer investor buyers competing for each unit. That will reduce prices relative to the base case to counter the positive price pressure on previously restricted units. Net impact should be zero, but as with positive price pressure the impact by unit will vary, with a reduction in demand most likely to be felt in marginally rentable units where there are now better alternatives.

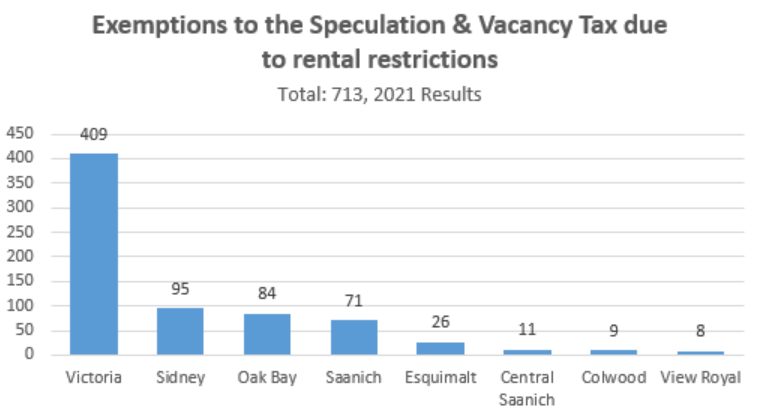

- Some vacant units will be rented out. Based on 2021 results of the speculation & vacancy tax, there were 713 exemptions in the region for vacant units that could not be rented out due to rental restrictions. That exemption expired this year so those owners would have had to sell or pay the tax for 2022, but now they have a third option to rent it out instead. I suspect most of those units will be either sold or rented by next year, with only a minority choosing to pay the spec tax instead.

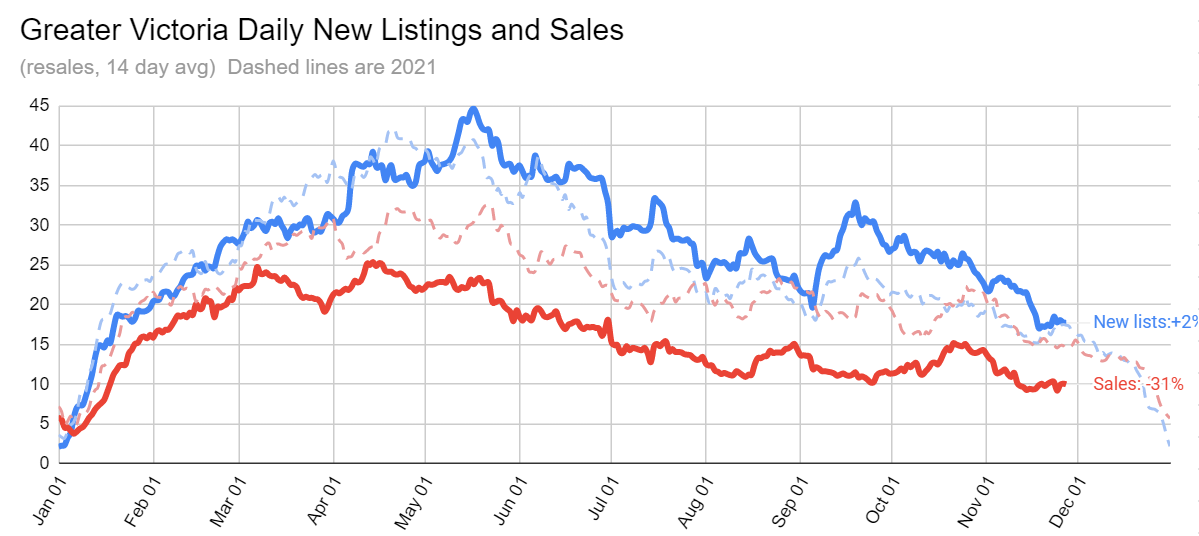

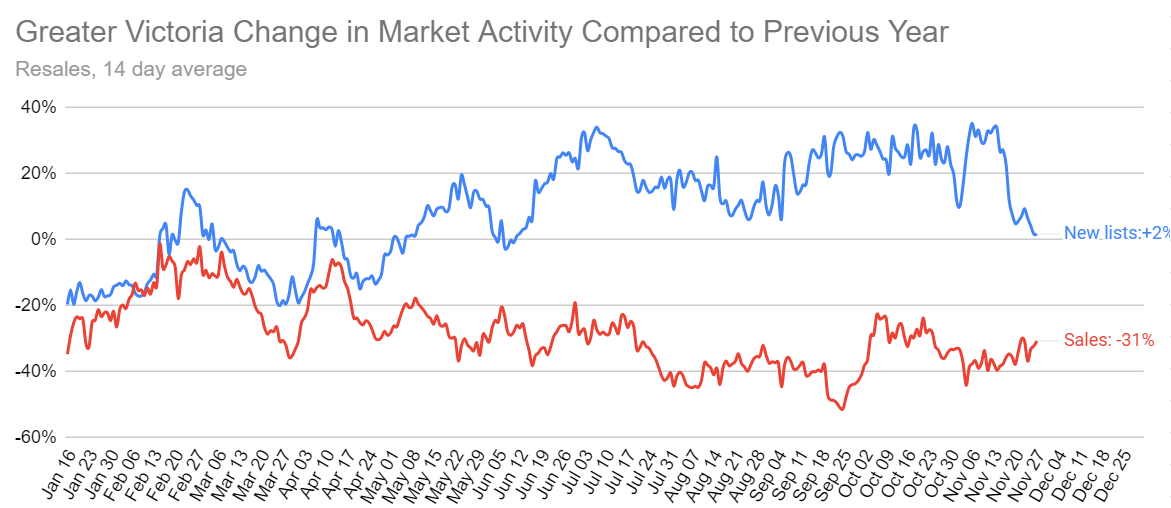

Also here are the weekly numbers courtesy of the VREB.

| November 2022 |

Nov

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 83 | 156 | 249 | 339 | 653 |

| New Listings | 205 | 375 | 541 | 713 | 696 |

| Active Listings | 2161 | 2186 | 2147 | 2129 | 887 |

| Sales to New Listings | 40% | 42% | 46% | 48% | 94% |

| Sales YoY Change | -41% | -46% | -41% | -42% | |

| Months of Inventory | 1.4 | ||||

No great change in the market last week, with new lists remaining lower than they have been, roughly tracking the year ago pace rather than being substantially above as we’ve seen for the last few months.

Too early to tell if that’s just noise or a trend change away from an increased pace of new listings. However given that most variable rate holders have now been triggered by their lenders, it seems that so far owners are able to weather the higher payments without much distress. That said it seems many lenders are only increasing payments by enough to cover the interest, rather than forcing borrowers to get back to their original amortization. The Bank of Canada says “Of the mortgages that have already reached their trigger rate, we estimate that the median payment increase would have been at most about 5%” which is surprisingly low. Good news for borrowers now, but that’s kicking the can down the road rather than solving the problem. If rates haven’t dropped by renewal time, those lenders and borrowers will have to choose between drastically higher payments or accepting very long amortizations.

Stay tuned for a review of the month’s stats later this week. I recently migrated to a new server so if you encounter any glitches leave a comment or email me at leo.spalteholz@gmail.com

New post: https://househuntvictoria.ca/2022/12/04/november-detached-prices-dip-under-a-million/

In greater Victoria, the YOY price drop occured in 1982

End of 1979 $67k

End of 1980 , $92k

end of 1981 $126k

End of 1982 $105k

1983 , 101k

1984 , 95k

1985, 93k

1986,102 k

Of interest, the $126k to $105k SFH drop in 1982 closely mirrors our 2022 drop from 126% to 105% (SFH price/assessment). In the 1980s, there was only a slow burn down after that, losing another 11% over 3 years. Of course there was almost continuous recessions in BC throughout 1981-86, worse than the ROC. That has a lot to do with price falls, in fact rates were falling during the entire 82-86 period.

The only buyers that (on average) lost more than 10% would have been the 1981-1982 buyer , with the worst loss YOY being 26% ($126k (1981) to $93k (1985) ). Of course these are year end snapshot stats, there might have been more or less loss depending on timing.

https://www.vreb.org/media/attachments/view/doc/3_2021_historic_summary_of_single_family_detached_sales_by_year/pdf/3_2021_historic_summary_of_single_family_detached_sales_by_year.pdf

Sure doesn’t feel like the sharpest decline in 40 years. Unless you are following the market regularly I don’t think most people even realize the market has gone down…. that to me indicates there isn’t enough blood on the streets yet for deep value buys.

Seem to recall there was a recession ~1980-83. Cheaply put together homes that were built in that period too.

Sure Dad, lets do everything we can to make thinks look and be as ugly and cheap as possible. Your grandkids will love you for it.

Those quintessential 50s and 60s wood frame apartments and stucco bungalows were also built as cheaply as possible. Same with 70s boxes in Gordon head.

I’m not seeing what the problem is with building cheaply.

Not necessarily for detached or even some condo locations, but you are right this will follow the Westhills model. Zoning controls did force builders to come up with higher quality units in order to win density approval and that is exactly what is being removed.

Is this specific only to MMH? Wouldn’t it be the same for SFHs/condos/apartments that are built by developers/builders for sale/rent? There is no reason to use building quality as an excuse against MMH.

Freedom, agree that it is not affordable housing, but it will be cheaply built to maximize profit.

Barrister,

Again, MMH ≠ affordable nor low cost.

Freedom: With the cost of construction exactly what do you think is going to get built? Throwing a granite countertop in does not make it a luxury unit. I dont think you are going to see a lot of condo units by and large.

MMH ≠ affordable nor low cost. I doubt much of the coming MMH buildings would be cheaply built rentals by REIT funds. Time will tell and it won’t be too long.

Adam Stirling noted it. Council made a decision in a closed meeting to push ahead with it without any public meetings. Personally, while extremely profitable for some of my friends I am not sure that slowly converting most of the city into cheaply built low rise rentals owned by Reits really benefits Victoria. It should keep the contractors busy for the next decade though.

Great news but where did you see this?

No, it doesn’t make any sense at all, as the “for it” crowd is getting bigger now than before the election.

https://www.theglobeandmail.com/business/commentary/article-bank-of-canada-wage-class-war/

Peaked at $1.3M in March. Granted medians are volatile so month to month is a bit of cherrypicking, but still we haven’t seen a decline like that in 40 years.

Funny. The complaint previously was that the old council couldn’t vote on it because they were about to leave. They don’t need to sit on the public hearing, they very clearly supported missing middle during the campaign and they were voted in. Doesn’t make any sense to have another public hearing when nothing has changed.

Looks like missing middle is about to be passed by this council and without any more public hearings. The majority of this council is newly elected and are about to vote on a major zoning change that effects every part of the city without ever sitting on the public hearings.

Welp I give up. We’ll just have to wait and see what happens when step 5 comes into effect.

Median detached price under a million for the first time since February 2021

I suspect that Colwood has thought of a politically correct way to stop more density. We are just moving into the land of stupid these days. And it is a really ugly house by almost any measure.

What I have come across when dealing with gold and platinum LEED construction is that this is a small boutique market. The initial sales from the developer will sell at a premium as they are extensively marketed to target specific buyers that want something different. The developer also has complete control over all of the sales. But the amount of prospective purchasers for solar passive buildings is small and the market can be satiated quickly. The next project may therefore not get that premium. That premium is also lost upon re-sale as these buildings have to compete against other homes. Without the extensive marketing and control over the development that premium evaporates.

Examples that come to mind are Dockside Green, Care-o-minimums, and fractural interest condominiums. After the initial purchase, they got butchered in the re-sale market.

I had a chance to listen to this during a hike, overall meh. I learned a few things but my overall opinion didn’t budge. When he claimed that a step code 5 home in Courtney sold for more than $100k compared to neighboring homes that lead me to do some investigating as I’ve never come across such a scenario in my career. I’ve sold passive-solar-etc. style houses such as this one – https://markojuras.com/2013/05/619000-2882-dysart-gorge/

and it has always been a hard sell. Certainly no premium over same square footage without the passive features; therefore, no way someone would pay substantially extra for step code 5 vs step code 3 imo.

While I appreciate that he gives a true real life case study of a simple home step code 5 in Courtney here is what I took away

56:40s – The house is really ugly. He says it looks like any other spec house on the street. I looked up the houses on the street in my MLS database and this one is by far the ugliest. Here are the photos of the house – https://www.coastalcustomhomes.ca/home/3385-marygrove-crescent/

57:45s – Acknowledges the envelope contractor didn’t know what they were talking about when they said “exterior vapor barrier” and that incorrect tape was used.

103:56s – You understand why the home is ugly when he explaines the design philosophy, basically building a square box helps you get to step code 5.

Earlier in the lecture he notes that it is very easy to hit step code 5 facing south (rear yard) and guess which way this case study points? Due south. It can’t be any more south.

Then he goes on to say that this house sold for $100k than other homes in the neighborhood so I did some research.

The subject house (3385 Marygrove) sold June 2021 for $975,000. BC Assessments has it listed as 2,660 sq.ft

The month before 3401 Marygrove sold May 2021 for $1,050,000. BC Assessments has it listed as 1,710 sq.ft.

If you google image 3401 Marygrove you will see it is a much more attractive house with articulations, etc., as it wasn’t designed to hit step code 5.

How about a case study of a typical spec build by GableCraft in Royal Bay, yard facing north, and the exterior design doesn’t change (leave the articulations), windows don’t shrink, etc.

One thing I started thinking about with all of this is Colwood voted to go to step code 5 by this summer, but I doubt the new counselors are aware that there is a bylaw for lots under 550m2 (6000 sqft) where they have to go through a DP for character and form. How on earth is that going to work? Staff want an interesting looking house to pass the DP and step code 5 calls for a box (if you don’t want costs out of control).

Van life grows in housing-stressed Vancouver

https://www.theglobeandmail.com/real-estate/vancouver/article-van-life-grows-in-housing-stressed-vancouver/

https://docdro.id/Not4J1h

If they do, … “t’was the hike before Christmas”

If I had to guess maybe 25 bps next week since they dont like to hike right before Christmas.

House prices do not seem to really be dropping from what I see.

House prices are all over the map, some house prices in Oak Bay, are now less then a starter home in the Westshore. Spring market is going to be interesting.

General consensus that I’ve been hearing is 50bps next Wednesday, followed by 25bps in January.

“Upper crust of society”

In Victoria?

Entry into oak bay is going to cost you It’s only for the upper crust of society

You can get mansions on the river in Montreal for that price.

You can easily get a mansions in Winnipeg for 3 million, but nearly impossible for any new build over 3K finished sq ft on 7K+ sq ft lot on Windsor rd.

The shelter component makes up almost a third of Canada’s CPI and half of CPI excluding energy and food. Rent is almost 7% of total CPI, mortgage interest is a little over 3, and homeowner replacement cost is a little over 6.

US CPI calculates ownership costs using imputed rent or “owners equivalent rent,” which is supposed to represent the rent paid if a homeowner rented their own home. For rented accommodation, rent is calculated by looking at what current tenants are actually paying rather than the market price. Since most tenants have one year leases, there is a significant lag between current rent and market rent which is evident when you compare CPI rent to one of the indexes (e.g., Zillow) in America that attempts to measure the market price of rent. Those measures indicate that market prices peaked some time ago but because of the lag, will continue to show up in US CPI, especially core CPI, long after they have abated. JPow spoke about this earlier in the week.

I think 25 bps is more likely in December, and maybe one more in January. The latest jobs report was middle of the road.

Right – they’re bumping rates to try and reduce inflation, but it seems like some items in CPI may not be directly correlated to interest rates (like food and fuel). Mtg interest definitely is directly correlated to rates. Consumable goods probably see price increases with rate increases (to try and cover the extra costs of higher rates) until an inflection point is hit and everyone stops buying (at which point I assume we hit recession). I really should spend some time learning more about this stuff.

I think Rodger is referring to the strong jobs numbers coming out (more leeway to further increase rates).

Isn’t a decent chunk of inflation in food, fuel, and mtg interest? Are these items even affected by interest rates? People still have to eat…

I don’t follow this much so looking for an explanation.

It appears to be a 1/2-point increase in interest rates next week.

Re: 2314 Windsor- looks like a new build with land runs $1000 per sq. ft. in south Oak Bay. 3.85 million should get a mansion on a sizeable estate, not a residential lot. I wonder who bought that place?

Sounds like we’ll have to pry Patrick’s private health care from his cold dead hands

3.85M

Anyone able to share what 2314 WINDSOR RD VICTORIA BC sold for? Thanks.

Sounds good. Thanks for the discussion.

You know absolutely nothing about me, but so long as the private services aren’t subterfuge for queue-jumping on issues covered by provincial Medicare, I have no problem with people paying for uncovered services.

Oh please. You probably spend that much ($3,600/year) on your cat or dog, home renos, or “stretching” to buy more house than you need. The people that put higher priority on their health care than you go for these private health care services. Leave them alone.

Sounds good. Wish I could afford it.

Does Telus give priority to patients who pay for the “extra” services over those who don’t, even when the matter at hand is billed to provincial Medicare? If so, that might be why “my government” is trying to stop it. And if so, I wish them luck.

No. I’ve had my same doctor for ten years at Telus Health (and its predecessor). And will continue to have the same doctor with Telus Health, as the government lawsuit is expected to take many years to play out. FYI, they have a holistic service, with nutritionists, kinesthiologists, and nurses, whose services are not covered by Medicare. And these are the services that are charged for, so I expect the government to lose their case, if it ever gets to a verdict in court. And if you’re thinking, “wow that holistic approach sounds great” , you’re right it is, which is why you shouldn’t be so happy to see your government trying to stop it.

From the article: “Vancouver-resident Mark Winston, 72, said he received a letter from his family doctor late last year telling him he’s relocating to Telus Health. ”

So do you think you should have this guy’s doctor because you can afford to pay and he can’t?

Now our NDP government, which can’t find enough family doctors for BC, has decided to file an injunction against doctors like Telus “LifePlus”, who provide family doctors services to people like me. https://www.cbc.ca/news/canada/british-columbia/telus-health-lifeplus-injunction-1.6671327

Other than Canada, about the only other countries that outlaw private medicine are Cuba and North Korea.

No no wasn’t referring to your comments at all, just been playing with chat.openai.com and just blown away by the quality of the AI.

Looking into it, I am seeing the same. Caches are my enemy

These are just condos.

Just wondering if others are experiencing the same…I’m having some trouble getting the blog to update with the latest comments. Need to try a few times and alternate between newest and oldest comments and eventually get there, but not very consistently.

Thanks for the link. Mark gave a great presentation which contradicts your thoughts (with some evidence) Marko: https://boabc.org/using-data-to-cut-through-noise-on-codes/

The previous presentation also talks about why building your condo to a higher standard is important – specifically the ‘locked in’ aspect of buildings (once it’s built, you pay the price for the life of the building).

I try to limit my PH-related comments to debunking, as opposed to soap-boxing the benefits. But, swing by sometime and I’ll give you a tour…

If there were no transfer tax properties would simply sell for more, since people buy at the limits of affordability.

Interestingly, the local RE industry and the C.D. Howe institute, no less, blamed Toronto’s new property transfer tax for falling prices in 2008.

https://www.theglobeandmail.com/news/national/mayors-land-transfer-tax-helped-sink-toronto-real-estate-market-study-says/article20390874/

Triple glaze windows because of the months of sub artic weather that we experience in Victoria. I am beginning to understand why the average working person is starting to be priced out of a house. What with the stupid land transfer tax on houses as well.

Welp I’ve been replaced by a robot.

Me to OpenAI chatbot: “Write me a blog comment discussing the pros and cons of a municipality adopting a Passive House standard for new construction”

OpenAI: One benefit of a Passive House standard is that it can help to reduce the energy consumption of new buildings. Passive House buildings are designed to be highly energy efficient, using advanced insulation, airtight construction, and efficient heating and cooling systems to minimize energy use. This can help to reduce greenhouse gas emissions and save money on energy bills for building occupants.

Another benefit of a Passive House standard is that it can promote healthy indoor air quality. Passive House buildings are designed to provide a constant supply of fresh air, which can help to reduce the concentration of indoor pollutants and improve air quality. This can be particularly important in areas with poor outdoor air quality, as it can provide a healthier indoor environment for building occupants.

However, there are also some potential drawbacks to a municipality adopting a Passive House standard for new construction. One potential drawback is that it can increase the cost of construction. Passive House buildings require a higher level of insulation and other energy-saving measures, which can add to the cost of construction. This may make it more difficult for some developers to build affordable housing, or may result in higher prices for new homes. This could potentially impact the housing supply in the municipality, as developers may be less willing to build new homes if they are not financially viable.

Looking at the latest numbers despite the huge slowdown in sales this year 2022 will be the second highest ever for Total Sale $ with around $6.8 billion, only lower than 2021. Don’t feel too sorry for real estate agents.

Agreed, the policies we are bringing in will make SFHs for the rich upper class long term. I wish politicians would just tell it like it is.

Marko couldn’t agree more but as you know as a builder u pass all of this along and owning a home will be for those with deep enough pockets Nothing is free and if people can’t afford to buy they can always rent

We have had to shave down 2/10 last 10 builds and I don’t know about “quality” but we are typically buying doors/windows from the typical suspects…Plygem, Milgard, etc. These are huge companies you have to buy from to make a profit on a spec.

I also don’t buy your 20% premium for triple-pane based on the quotes I’ve seen. Also, what will happens to demand for triple-pane when the code comes. I can’t see increased demand causing a decrease in prices in the short term.

I think your experience may be heavily slated towards your custom owner builds. Building spec where you have to turn a profit is a whole different story. I am not just basing my experience on the homes I am involved in the construction but also all the walk-throughs I attend with my clients on a regular basis. When you’ve had 10 clients buy a gablecraft home you can a pretty solid idea of how they build as well and the issues they are facing with tradespeople, etc.

You have to adapt to the marketplace/surroundings. My condos in Croatia have concrete walls INBETWEEN the units, exceptional windows and parkades that are finished nicer than a lot of finished living space in Canada. This is one of my parkades in Croatia -> https://www.youtube.com/watch?v=IY8KIGMGhCA (keep in mind this is 6 year old, this developer has upped his game even further recently on parkade finishing).

If you tried to build this in Victoria/Canada first of all the knowhow wouldn’t be there and it would cost a fortune. In Croatia the developer brings in some poor souls from Nepal and they spend months installing tiling in the parkade and he or she pays them $1,000 cnd/month. In Victoria you can’t tile a parkade as the tile person would be $7,000-$8,000/month.

Same with a lot of other features. For example, at the front door of my condos I have one hardwired switch that cuts the power to all the lights in the entire unit so you don’t have to run around turning off lights. I imagine this feature is cost prohibitive in terms of labour cost in Victoria.

Only very recently (because of the fed incentives coming in 2023 they’re shipping cars up here). Too bad they didn’t go for an e-tron.

No need to be when you’re not holding the bag.

I don’t buy it. There is no shaving down a quality door (ie, one which would be used on a step 5 house). High-efficiency houses should all be using service cavities, which protect the plywood AB/VB or high-quality (not poly) AB/VB (and mean easy air sealing and no drilling for trades). Euro tilt-turn windows all adjust easily with an allen key, with most coming with 25 year warranties.

I find it hard to reconcile your acknowledgement of the higher quality craftsmanship and products in Croatia, but think those things have no place in Canada.

All the banks also increasing their dividends so they can’t be too concerned about a meltdown.

Mostly true but Tesla has a pile of Model Ys and 3s sitting in inventory in Vancouver and I just had friends buy an ICE Audi SUV that was the same price as a Model Y….they might be reading HHV 🙂 Why weren’t they forced to absorb ready to go EV inventory at the same price they paid for their ICE? The same comment Sidekick made re stepcode 5 applies to Tesla Y over Audi SUV….”They are also healthier, longer lasting, more comfortable, less polluting etc.”

https://www.tesla.com/en_CA/inventory/new/my?arrangeby=plh&zip=v8r4j2&range=200

https://www.theglobeandmail.com/business/article-banks-growing-mortgage-amortizations-higher-interest-rates/

Supply shortages. We are rounding month 13 on the waitlist for a VW ID4. It might arrive sometime next spring. Adoption rate would double or triple overnight if there was enough supply.

I can tell you the bureaucracy from all sides from licensing to municipalities to code is forcing out a decent chunk of middle-older 1 to 2 home/year builders. GableCraft, Westhills, and Verity will eventually be 90% market share of SFHs.

Could care less about the blower test, I’ve seen it play out in real life. As the builder you sweat about the blower test than a month into selling the home the owner wants you to shave down the front door because it is tight to close, they miss a stud putting up their flat screen TV and puncture the vapour barrier, a window doesn’t seal anymore and you can’t get anyone to come service it as there is a labour shortage, etc., etc.

Give me a well built (framing, plywood, etc.) house and whatever I’ll spend $800 a year heating it instead of $600.

So why are there so many Porsche Macans, Audi SQ5s, various Benzes, around Victoria etc. when there is the model Y? Same applies with 3-series, etc., vs Model 3.

At the end of the day I don’t fundamentally have an issue with step code 5 but I don’t think the timing could be worse. Construction costs are facing inflationary pressures, massive shortage of trades, housing crisis. They should have delayed this 2-3 years, much like they are delaying the switch to ICE but a few decades.

Nobody is forcing anyone out, and you’re right – it isn’t rocket science.

You probably don’t though. Without a blower door test, you have no idea. The general population has no idea what a well-built home is…to them it’s granite countertops.

Well this only really affects a small subset of trades, but I’m all for incentivizing skilled trade immigration.

I had to deal with the environmental and abatement in 2008, so that’s not new (at least for Victoria). On the fence for hand de-construction…

We are. Isn’t there also legislation to stop the sale of ICE passenger vehicles after some date? I don’t see this as apples-to-apples as some minor tweaks to construction can have a major impact today. We have all the parts/knowledge to build step 5 today, at a relatively small premium. If the car-buying population could buy an EV equivalent to ICE today for 5% more, it would be a no-brainer.

Third lowest on record. Only in front of 2012 (366) and 2008 (268).

Buyer can only afford so much. More likely is costs for the builder/developer go up and they simply won’t build and housing starts will suffer which is not what we need right now. Once interest rates stabilizie + 500k immigrants per year the housing problems will be back in full force again with 18 to 36 months.

The upside on the step code and other code changes is that the end buyer pays for it so it’s a win win for everyone

Sorry, the link to the energy step code presentations didn’t attach for some reason. It is: https://boabc.org/energy-step-code-presentations/. If that doesn’t work just search BOABC, hit the dropdown “2022 Conference”, then go down to the bottom of the page to the link “Energy Step Code presentations”.

We already have a massive shortage of skilled trades. Why force out someone that knows how to do an older method really really well to be replaced with someone who knows the new methods poorly. We aren’t building rockets here and a revolutionary technology has come out. I much rather have a well built classic 2×6” home than a 2×6”+poorly installed exterior insulation that is going to give me grief as the envelope contractor wasn’t 100% familiar.

In conclusion, I think Step Code 5 would have been better to delay 2 to 3 years while we try to stabilize the housing crisis, imo. We can’t build enough non-step code homes, how does going to step code 5 help?

But it isn’t just that. It starts from having the hand de-construct the home to everything else that has been piled on. I remember tearing down a home in Langford 2008 and I literally called Don Mann excavating. They dropped off the excavator and the home was gone the next day.

Now you need an environmental report. Then you have to deal with the abatement. Then you have to “hand de-construct it.” Report is a four figure cost, abatement and hand de-construct are each five figures costs. This is all before you even start construction.

This is why I think long term we are completely ****ed on housing. The politics might improve a bit, might, but the bureaucracy never will. Immigration seems to be a shoe in for 500k/year long term.

It will be great! All the homes with be Step Code 5, but the majority of people won’t have a place to live.

Why aren’t we forcing everyone to buy EVs?

I still don’t quite understand the numbers. I had a huge SFH where I put zero effort into efficiency (mini split heat pump) and if I removed my Tesla charging, lights, appliances, etc., I was well under $1,000/year for heating. Real life I still don’t understand how I pay back triple-pane windows. By the time you pay back the triple-pane windows they are 10-20 years old and who knows if they are performing as well as day one. For example, we built and sold a brand new home in March. Simple two-pane windows but one has an issue already and we’ve been waiting for months for a service tech from this company to come and repair as they only have one service tech on the island but they are selling thousands of windows. It is like heatpump vs electrical baseboard. Yes, obviously heatpump is way better but I’ve never seen anyone account for heatpump servicing/replacements versus I regularly go into 1970s homes and the baseboards and thermostats are 50 years old and working (i.e. no maintenance over the years).

My current condo is very inefficient. Corner unit with huge glass on all sides, wrap around balcony (really bad for energy) as the cold outside slab transfers cold into the interior slab (no thermal break), etc. Heatpump heating. Looks like for the entire year this year I’ll be under $300/hydro, that’s right for the entire year. Seems to me like there are bigger fish to fry than to try to make a $300/year condo more efficient, in my opinion.

I would think affordable housing CURRENTLY would be more important than trying to squeeze out more efficiency out of already pretty efficient products.

Great! I misinterpreted your post then. Lots of anti-step-code sentiment out there.

100% you must have the energy advisor (or similar) on-board at the start of the project. Lots of proven, simple assemblies out there.

Can you re-attach? Would like to see the vid.

You’re not wrong, but it’s a pretty small percentage of overall costs. Not sure what the going rate is but I suspect ~5k for energy advisor and blower door testing. There are operational savings to help offset that, plus a much smaller heat plant. I would like to see the municipalities give concessions for Step 5 to help even it out.

and energy advisor wasn’t around 5+ years ago. Someone has to pay for the energy reports, various blower tests, etc.

If that was the only piece of added bureaucracy sure, but multiply something that wasn’t around 5-15 years ago by a number of factors.

Good discussion on the energy requirements in the building code. I am in the business and know the reluctance of some builders to make changes to the way they have done things in the past. But I also see new builders coming into the market and making those changes. The smart ones bring in the energy advisor at the building design stage. Their advice can save a lot of money and can minimize the cost to buyers while still getting up to step 5. I have attached a link to the building official’s website which has videos of presentations (energy step code) done at their conference earlier this year. They are quite informative and have been made available to the public through the courtesy of BC Hydro.

Final November Sales: 384 (down 41% from last November)

New lists: 785 (up 13%)

Inventory: 2111 (up 138%)

I don’t disagree with any of that Sidekick. I am working on step 5 buildings already and have both construction and architecture background.

I don’t think this has anything to do with income or NIMBYism. Building better products generally costs a bit more, but the good news is the operation costs of these buildings is much lower. They are also healthier, longer lasting, more comfortable, less polluting etc.

Perhaps. It’s a one week course, and it’s an ‘a-ha’ moment for most people in the industry.

True, but it’s the execution that matters more in my opinion.

Good. If you consider yourself a professional and you can’t learn some simple new methods, then it’s time to retire.

Adding more insulation is really, really easy and cheap. If you can slap one 2×4 stud wall together, you can slap two 2×4 stud walls together (as a double stud wall), or 2x8s together (as a thicker wall). Exterior insulation can be a little more challenging but really…

Triple-pane glass is a 20% premium over double-pane, but with R-values available above 10 (or check out lite-zone glass for crazy R-values). Windows and doors are where the majority of the extra cost will be.

Define minimal. Lots of high-efficiency houses out there with lots of glass and articulation. Can’t defy physics though, you’re losing/gaining a significant portion of your heat through glazing, so be smart about it. High-efficiency houses of all shapes and sizes out there, but simpler shapes are cheaper and more efficient.

Basements aside, you don’t find a lot of ICF in the high-efficiency world. Concrete is extremely expensive, non-renewable, extremely high environmental impact, and a poor insulator. It’s not possible to get away from it (yet), but as soon as carbon restrictions hit the industry, folks will have to limit the amount of concrete in their buildings.

UkeeDude, happy to take this discussion ‘offline’ (Leo has my email). I think Colwood made the right choice here. Home builders should be creating a better ‘core’ product and sacrificing the ‘bling’ if that’s what it takes to make the numbers work.

It borders on discriminatory pricing out lower income families. Rich NIMBYs are going to love it. Getting up to speed on this is challenging but not impossible. Most of it is in the hands of the architect and energy advisor to specify the products and installation details. The problem is a lot of contractors are of the “Im too old for this sh*t” category and may just retire rather than spend the time learning the new methods. I ordered all the envelope/roof assembly binders from BC Housing that show all the methods and details to reach the required effective RSI values to meet the codes. Most of it is layering up more insulation and walls are getting thicker (pricier). Triple pain windows are about to become the norm and we will see more houses that have minimal glazings and minimal articulation (boring square box no windows) Im designing more ICF houses lately as its so much easier for builders to wrap their heads around since ICF basements have been the norm for over a decade. ICF manufacturers are keeping up with the code and designing products to comply so builders once familiar with installations need only use the current product.

“More and more new buildings have charging in every stall. For example, Town Square in Esquimalt has a charger already installed in every single spot.”

Excellent!

It is important to have one at each stall because you would want to plug in and retire for the evening.

It must also mean that there has been ample power installed into the building.

Does anyone know if the charge for the power is the regular cost of electricity, or do they charge you a premium for the use? (Is each unit on the same electric circuit as your suite is what I guess I am asking.)

Two pieces of good news:

#1 Last night Saanich Council voted (9-0) to approve a 9-unit car-free townhouse on Richmond at Allenby.

See: https://twitter.com/ColinPlant2022/status/1597862522220314624

We listened in until 10pm. It felt very encourage to hear that most speakers were for it, and the positive inputs from multiple car-free families.

#2 From 2021 Census: Greater Victoria had by far the highest share of commuters who walked or cycled among all Canadian metropolitan areas. Note this was for the week of May 2-8, 2021 and for the whole YYJ

See: https://www.reddit.com/r/VictoriaBC/comments/z8u996/2021_census_greater_victoria_had_by_far_the/

Way to go YYJ!!!

Is this a wood mass building at Town Center?

Looked into the Town Square in Esquimalt and it looks well thought out and an appealing place to live. Having mixed commercial and residential makes a development less impersonal. Tenants can access businesses and interact with the local community. Something I think is lacking in some large complexes. The geothermal system is interesting, I wonder how well it works. I have a friend in Minneapolis who moved into a retrofitted old building and freezes during the winter. I would like to know what the footprint of the development is and price range of the units, also condo fees. Thanks

Thanks. Where are the stalls located, in an outdoor parking lot or underground? Or both.

More and more new buildings have charging in every stall. For example, Town Square in Esquimalt has a charger already installed in every single spot.

I guess the answer is no.

Yes, most condos being built today would be in a city that mandates some kind of EV charging provision. See list: https://pluginbc.ca/policy/

Are any of the new apartments/condos that are being built providing charging stations for all the electric vehicles everyone is going to be buying in the near future? Not sure what installation of a outdoor charging station costs but it can’t be cheap. Are they going to add that to the cost of each unit?

True, but people do change their life plans. And on that topic, people change spouses and partners too. But wouldn’t only the person resident at the time of the 55+ restriction be grandfathered? Another reason for under 55’s not to go for it.

This isn’t positive for the marketplace. Makes mere postings, etc., less appealing for the consumer.

They should have added something re reasonable access in my opinion, respecting tenants rights, etc.

Sure. But at that price, they would expect to have their own bedrooms each, Not 4 people share two bedrooms.

Yeah maybe not I would just be careful if a seller was thinking of actively contravening the spirit of the regulation. I’m thinking about this sentence in the BCFSA report “Consideration could also be given to creating exemptions from the termination fee where buyers who exercise their right to cool off can demonstrate that they have completed due-diligence activities during the cooling-off period. ”

I don’t think this made it into the regulations (which is good), but to me it speaks to the intent of the rescission period and the ability for a buyer to back out if their DD doesn’t check out.

Then again the BFSA also said “Access to Property – Establish an explicit requirement for sellers to provide reasonable access to the property for professionals engaged by or on behalf of the buyer to perform due diligence inspections”

I wonder what their reason was for leaving that out.

Most of the recent BCFSA changes seem almost designed to guarantee the role of realtors in BC.

Spenser Castle and The Rockland were 16 and older.

UVIC students are paying around $800 to $1,200 per month for accommodation.

Cooling off period is built into conditional offers as well, you can’t get around it. Obviously when you get along with people everything is fine.

The issue will be navigating the 0.25% penalty when a private buyer backs out from private seller and then they will end up in small claims court. The paperwork of when the cooling off period started, etc., will be a mess. Most private sellers and private buyers just want to buy and sell. They aren’t going to be filling out proper cooling off period forms imo.

A lot of these older complexes are self managed. Gives the old timers something to do. Management companies fees add several hundred dollars a month to each unit.

The seller THINKS they sold it for way too little is different from the seller actually sold it for too low. I’ve had sellers regret a sale re price when in my professional opinion it was at or above market value.

Nothing malicious about “sorry, you made an unconditional offer, recession period does not grant any access as per legislation, you are more than welcome to rescind at the 0.25% penalty”

Not sure how that is legally risky.

But you a right, this recession period won’t be in play for years.

Wouldn’t these older 55+ buildings be rented out only to 55+ renters? How could you “have four tenants paying a thousand bucks each every month”? hmm …

I’m not a fan of the cooling off period. A fool and their money should always be parted.

ie Elon Musk

Huge condos also mean huge strata fees and huge special assessments/unit; therefore, you won’t see a massive uptake from investors. I predict, on average, 1/10 sell to investors and 9/10 go to owner occupiers. A newer building downtown with a small unit mix would be approx. 3 to 4/10 investors and 6 to 7/10 owner occupiers.

Factor in turnover it will be years before previously no rentals no kids buildings see dramatic changes in the make-up of the residents.

We have sold three houses ourselves before, just take buyers with conditional offers. We had nothing to hide, and happy buyer results in a good and solid contract. We even became friends with one buyer family afterwards.

We’ll see but I don’t see this as a real world concern. If the seller thinks they sold for way too little then the buyer just closes on the deal to snag it.

My bet is on the rare occasion the rescission period is even relevant most sellers will be typically motivated to get through the rescission period to complete the sale and will make reasonable accommodations to allow buyer to access property. Malicious attempts to prevent due diligence during the rescission period are also likely to be legally risky for the seller.

The condo can’t screen tenants. That’s up to the owner. But the strata can levy fines against the owner for not following the bylaws.

The older 55 and over buildings can be a lot bigger than 1,200 square feet. Some are as big as 1,700 square feet. They are 1,300; 1,400; 1,500; 1,600 Square feet in James Bay, Oak Bay, and Fairfield.

When you go into them they don’t feel like a condo at all. That much space makes them feel like living in a house. And they are all located in the very best locations in the city. Many of them are along Dallas Road and Beach Drive. Some of my other favorites are Spenser Castle in Mayfair and The Rockland on Belmont they can be up to 2,600 to 2,700 square feet.

That’s a lot different than living in a 500 square foot downtown condo which comes with your own homeless tent at the front entry.

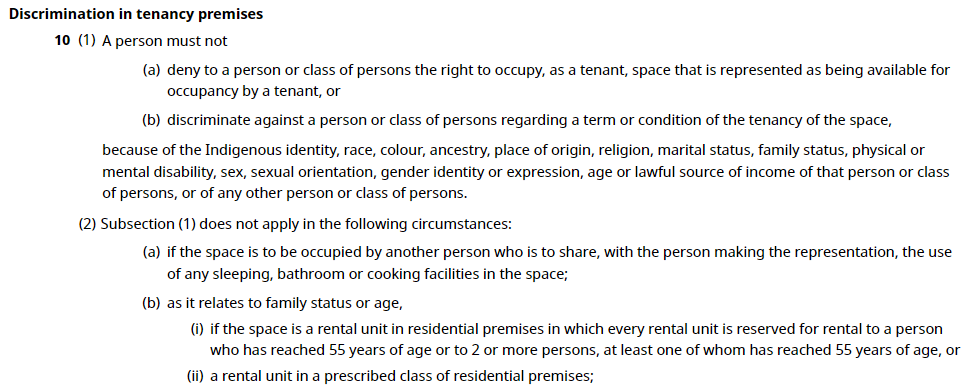

From reading:

Age restrictions bylaws are allowed for any occupants 55 or greater. So may restrict at age 55, 60 or 65 etc.

Age restrictions bylaws can require all persons or one or more persons residing in the unit to be the minimum age.

The Strata Corp. can’t screen tenants or establish screening criteria or require the insertion of terms in the tenancy agreements or restrict the rental of the strata lot.

Your comment is far fetched 🙂 Subject to inspection doesn’t grant any of the above ridiculous scenarios, but it does grant reasonable access to the property for an inspection.

You would be shocked how much time I spend on the phone every year negotiating access to properties…..”why do they need to see the property again? They saw it at the viewing” (this is from sellers that have nothing to hide, just being emotional/difficult). Even if the contract of purchase and sale has a clause that the buyer can view the property 3x prior to completion with 24 hrs notice or similar it is always some sort of struggle. People are super super weird.

Lots of motivation. Residential real estate is very emotional. The next day seller could be “you know what we sold this for way too little, we aren’t letting them in,” or a million other scenarios.

My understanding was that lack of due diligence purchases was the main reason the cooling off period was brought in. It doesn’t address that really, it really just gives the buyer and option to change their mind for no particular reason.

btw, also applies to for sale by owners. That should be fun.

BC Human Rights code specifically exempts 55+ properties.

No. Age discrimination specifically allowed in 55+ buildings.

That doesn’t sound unreasonable. I can see that granting a blanket right to access the property would be problematic (can the buyer show up at midnight? Can they squat there for the entire 3 days? If not how many hours total? How many individual accesses?) Best to leave this to the buyer and seller to work out.

What’s the motivation of the seller here? They are trying to scam the buyer out of the rescission fee? Or they have a material defect that they have failed to disclose? This seems pretty far-fetched.

More details coming out on the cooling off period and it is bad on many fronts. If you make a subject free offer the buyer does not have an automatic right to access the property during the 3 day cooling off period. However, if the offer is conditional subject to inspection then they can access the property.

Wasn’t the biggest concern about unconditional offers lack of due diligence specifically inspections? Turns out you can’t do it with cooling off period either unless you write a conditional offer which you have always been able to do.

What a joke imo. 5 day delay before reviewing or accepting any offers would have been 10x better avenue to go. Then the seller would be motivated to provide access for due diligence during those 5 days. With this system the seller is going to know the buyer doesn’t want to give up the 0.25% fee and may choose not to allow access to property once unconditional offer is signed.

Exactly what happened with a friend that moved from Calgary to Victoria. Sold his newer condo in Calgary and bought an older condo in Cook Street Village that he then renovated.

That is my understanding as well. I guess in 55 plus buildings you have to rent to 55 plus tenants but doesn’t that contravene the Tenancy Act re age discrimination?

There are max occupancy limits in a number of buildings including mine. My particular building is max 3 for a one-bedroom and max 4 for a two-bedroom. The strata proposed max 2 for a one bedroom but I fought that and we got it up to 3.

That being said, what is there to prevent a strata from doing max 2 people for a 2 bedroom?

My building is mostly downsizers and because it is only three years old there were no rental restrictions and no age restrictions to begin with, didn’t seem to deter anyone? As I’ve said many times before people want to sell a dated 70s home and buy a newer ocean view condo. No one goes dated 70s home to dated 70s condo.

Of course they have to vote on changing the bylaws. And according to the Condominium Act if you are under 55 then you are grandfathered. If you’re say 45 the bylaw change would not have an effect on your ownership.

These complexes already had an age restriction. That may have been the reason why they bought them in the first place. They are most likely all empty nestors. So what makes you think that they would not wat that to continue?

-Maybe money?

But a few percentage drop in the condos value may mean less to them than living in a non adult orientated complex. And who knows, the 55 and older buildings might become more attractive to senior buyers that don’t want to be around children and lots of 20 and 30 year old renters. These condos could go up in value as they now appeal to a boutique market of purchasers that desire a quieter building with less rental turn overs at the end of each month.

There are advantages to living in a 55 and over complex.

A lot of discussion in the previous thread about Royal Bay prices, I’ve represented 10 or so buyers in Royal Bay and here are some of the best pre-sales deals I was involved in. After mid 2020 prices skyrocketed. In part due to the market but in part to people actually wanting to live in Royal Bay. When I was trying to sell clients on Royal Bay 2015-2019 it was a tough go and it was reflected in prices (cheaper than Westhills at the time for comparable home).

October 2016 – 1,700 sq.ft. plus unfinished basement home on 8,000 sq.ft. lot – $599,900 GST INCLUDED

March 2019 – 1,600 sq.f.t plus unfinished basement on 3,800 sq.ft. lot – $665,000 GST INCLUDED

Who knows what the market does but will all the amenities planned I can only see the community being more and more attractive for families.

Colwood voted unanimously last night for step code 5 by summer 2023! 30-40k more per house and trades aren’t up to speed on the technical details, fund times ahead on that front. So much for “affordable” housing.

Right, don’t we have enough discussion of “people want to pay $4000/m rent for a 2bed 1200 sqft old wood frame condo unit, so they can listen to every footstep of their neighbours”? What is new now, put two adults in one bedroom or sleeping in the living room? 😉

Shouldn’t/ Wouldn’t there be a owner vote for a strata to change the age limit, like for any other major strata rule change? I don’t see how those buildings with 19+/45+ age limit currently (or before) could vote to change it to 55+, unless the majority owners there right now are 55+ (fat chance) .

Owners of some of these age restricted complexes won’t be happy with double or triple water bills when families with kids move in. Probably result in higher condo fees.

These older buildings do have HUGE suites. A suite that use to have one or two senior owners could now have four tenants paying a thousand bucks each every month. Some of these suites are bigger than the main floor of a Gordon Head house. That’s more parking problems and increased wear and tear on the building.

If the complex went to 55 and older and a suite was rented to four students then the strata council could impose fines on the owner for breaking the bylaws. Now there is a conflict between the tenancy act and the condominium act as the owner can not evict them without just cause.

My take is that people get upset when a government unilaterally imposes its will on the people. I suspect that previous restrictions on purchasers and renters being 19 and over will have a backlash of a few going to seniors communities with restrictions of 55 and older for both purchasers and renters.

Condominium complexes and their strata councils are like mini empires. Anyone that has ever lived in one and have been to the strata council meetings know exactly what I am speaking about. Common sense does not always rule.

There were a few 70’s & 80’s condo’s that at one time had a restriction of age 55 and up but changed it to ages 40/45/50 etc. Some of them may opt to bring it back up to 55.

You can bet a huge issue with the apartment style condo’s built in the 70’s is that most of those buildings have between 17 & 20 suites and so the shared laundry usually have no more than 2 washers and dryers. Now some these suites will have 3 or more people residing in them so the usage is going to be far greater.

If they wanted children then they would have been aware of the 19 and older restriction in the first place.

The Province is making amendments to the Strata Property Act to end all strata rental-restriction bylaws and to limit age-restriction bylaws so that the only permitted age restriction is to preserve and promote seniors’ housing through the “55 and over” rule in strata housing.

On Monday, David Eby announced an amendment to the Strata Act to remove almost all rental restrictions that had dictated only a certain percentage of buildings’ units could be rented over owned.

The only exception will be for buildings meant for those 55 years old or older, with in-home care allowed.

Unlikely to pass imo given that 19 plus owners may want to have children, and no buildings are able to retain rental restrictions, including 55 plus.

If you live in a building that was 19 and older with rental restrictions, you could do the Poison Pill approach to keep the mature adult and rent restrictions. Just move the age restriction from 19 to 55.

The general consensus on this blog is that 55 and older buildings sell for slightly less than unrestricted buildings. But to keep control and enjoyment of the complex the slightly lower price might be worth it to the current owners.

Just to be sure Leo, you are including all strata’s and not just “apartment” style condo’s? The Strata Act was amended which includes apartment style condo’s, townhomes, strata semi-detatched, & bare land strata homes.

I doubt it. Downsize ≠ down living standard. Not many old people want to trade their (updated or not) SFH with a 20+ years old condo, rental restricted or not, unless that condo is very special or they are forced to (free up money). I would rather pay the same value of our SFH to live in a new build codno with a good view but half or less the size when we downsize. I am sure that is pretty common per past posts by Marko.

Good analysis Leo. WRT “sales price relative to assessed value”, assessment should be based on the market/sold price regardless of rental policy. So I think, the assessed value is low for rental restricted condos just because their resale price is low compared to those that don’t, up until now.

That is an interesting point Barrister. I think some will avoid strata now that the restrictions have been lifted, but the impact on 55 plus buildings, where most retirees could buy, or now rent, is minimal.

Interesting analysis although, moving ahead in time, I wonder if the rental premium may well disappear as the prospect of increasing condo prices is removed. With declining prices as a real possibility exactly how attractive is buying a condo rental with a negative cash flow?

I suspect that between removing age restrictions and rental restrictions a small hidden impact will be to increase the desirability of SFH or at least increase th reluctance of some people to downsize.